UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| x | QUARTERLY REPORT UNDER TO SECTION 13 OR 15(d) OF THE SECURITIES |

| | EXCHANGE ACT OF 1934 FOR THE QUARTERLY PERIOD ENDED DECEMBER 31, 2008 |

Commission file number 000-53291

LAKE VICTORIA MINING COMPANY, INC.

(Exact name of registrant as specified in its charter)

NEVADA

(State or other jurisdiction of incorporation or organization)

1781 Larkspur Drive

Golden, CO 80401

(Address of principal executive offices, including zip code.)

(303) 526-5100

(telephone number, including area code)

Check whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the last 90 days.YESx NO¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer, “accelerated filer,” “non-accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer | ¨ | Accelerated Filer | ¨ |

| Non-accelerated Filer | ¨ | Smaller Reporting Company | x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

YES¨ NOx

State the number of shares outstanding of each of the issuer’s classes of common equity, as of the latest practicable date: 24,478,300 as of February 16, 2009.

PART I – FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

| LAKE VICTORIA MINING, INC. | | | | | |

| (AN EXPLORATION STAGE COMPANY) | | | | | |

| BALANCE SHEETS | | | | | |

| |

| |

| | | December 31, | | | March 31 |

| | | 2008 | | | 2008 |

| | | (UNAUDITED) | | | |

| ASSETS | | | | | |

| |

| Current assets | | | | | |

| Cash | $ | 860,970 | | $ | 101,925 |

| Advances and Accounts receivable | | 60,000 | | | - |

| Total Current Assets | | 920,970 | | | 101,925 |

| |

| PROPERTY AND EQUIPMENT, NET | | - | | | - |

| |

| TOTAL ASSETS | $ | 920,970 | | $ | 101,925 |

| |

| |

| LIABILITIES AND SHAREHOLDERS' DEFICIT | | | | | |

| |

| CURRENT LIABILITIES | | | | | |

| Accounts payable | $ | 87,741 | | $ | 2,580 |

| Accrued expenses | | - | | | 1,290 |

| Advances payable - related party | | 53,500 | | | 53,920 |

| Other Payables | | - | | | 79 |

| Total Current Liabilities | | 141,241 | | | 57,869 |

| |

| COMMITMENTS AND CONTINGENCIES | | - | | | - |

| |

| STOCKHOLDERS' DEFICIT | | | | | |

| Preferred stock, $0.00001 par value: 100,000,000 | | - | | | - |

| authorized, no shares outstanding | | | | | |

| Common stock, $0.00001 par value; | | | | | |

| 100,000,000 shares authorized, 24,478,300 and 5,003,000) | | | | | |

| shares issued and outstanding, respectively | | 245 | | | 50 |

| Additional paid-in capital | | 3,950,395 | | | 100,290 |

| Subscription receivable | | (35) | | | (35) |

| Accumulated deficit during exploration stage | | (3,170,876) | | | (56,249) |

| Total stockholders' Deficit | | 779,729 | | | 44,056 |

| |

| TOTAL LIABILITIES AND | | | | | |

| STOCKHOLDERS DEFICIT | $ | 920,970 | | $ | 101,925 |

The accompanying condensed notes are an integral part of these interim financial statements

F-1

-2-

| LAKE VICTORIA MINING, INC. | | | | | | | | | | | | | | |

| (AN EXPLORATION STAGE COMPANY) | | | | | | | | | | | | |

| STATEMENT OF OPERATIONS | | | | | | | | | | | | | | |

| (UNAUDITED) | | | | | | | | | | | | | | |

| |

| | | For the Three | | | For the Three | | | For the Nine | | | For the Nine | | | Period from |

| | | Month Period | | | Month Period | | | Month Period | | | Month Period | | | March 14, 2007 |

| | | Ended | | | Ended | | | Ended | | | Ended | | | (Inception) to |

| | | December 31, | | | December 31, | | | December 31, | | | December 31, | | | December 31, |

| | | 2008 | | | 2007 | | | 2008 | | | 2007 | | | 2008 |

| |

| REVENUE | $ | - | | $ | - | | $ | - | | $ | - | | $ | - |

| |

| OPERATING EXPENSES | | | | | | | | | | | | | | |

| General and administrative expenses | | 44,769 | | | 4,444 | | | 106,351 | | | 17,149 | | | 162,707 |

| |

| Acquisition Costs | | 2,510,300 | | | | | | 2,585,300 | | | | | | 2,585,300 |

| Exploration Costs | | 352,408 | | | - | | | 425,748 | | | - | | | 425,748 |

| |

| Total operating expense | | 2,907,477 | | | 4,444 | | | 3,117,399 | | | 17,149 | | | 3,173,755 |

| |

| LOSS FROM OPERATIONS | | (2,907,477) | | | (4,444) | | | (3,117,399) | | | (17,149) | | | (3,173,755) |

| |

| OTHER INCOME(EXPENSES) | | | | | | | | | | | | | | |

| Interest income | | 2,327 | | | 51 | | | 2,772 | | | 53 | | | 2,879 |

| Total other income | | 2,327 | | | 51 | | | 2,772 | | | 53 | | | 2,879 |

| |

| LOSS BEFORE TAXES | | (2,905,150) | | | (4,392) | | | (3,114,627) | | | (17,096) | | | (3,170,876) |

| |

| INCOME TAX EXPENSE | | - | | | - | | | - | | | - | | | - |

| |

| NET LOSS | $ | (2,905,150) | | $ | (4,392) | | $ | (3,114,627) | | $ | (17,096) | | $ | (3,170,876) |

| |

| NET LOSS PER COMMON SHARE, | | | | | | | | | | | | | | |

| BASIC AND DILUTED | $ | nil | | $ | nil | | $ | nil | | $ | nil | | $ | (0.34) |

| |

| WEIGHTED AVERAGE NUMBER | | | | | | | | | | | | | | |

| OF COMMON SHARES OUTSTANDING, | | | | | | | | | | | | | | |

| BASIC AND DILUTED | | 20,107,971 | | | 4,036,467 | | | 15,767,790 | | | 4,018,333 | | | 9,412,148 |

The accompanying condensed notes are an integral part of these interim financial statements

F-2

-3-

| LAKE VICTORIA MINING, INC. | | | | | | | | |

| (AN EXPLORATION STAGE COMPANY) | | | | | | | | |

| STATEMENT OF CASH FLOWS | | | | | | | | |

| (UNAUDITED) | | | | | | | | |

| |

| |

| | | For the Nine | | | For the Nine | | | Period from |

| | | Month Period | | | Month Period | | | March 14, 2007 |

| | | Ended | | | Ended | | | (Inception) to |

| | | December 31, 2008 | | | December 31, 2007 | | | December 31, 2008 |

| |

| CASH FLOWS FROM OPERATING ACTIVITIES | | | | | | | | |

| Net loss | $ | (3,114,627) | | $ | (17,096) | | $ | (3,170,876) |

| Adjustments to reconcile net loss to net cash | | | | | | | | |

| provided (used) by operating activities: | | | | | | | | |

| Increase in Advance and Accounts receivable | | (60,000) | | | | | | (60,000) |

| Increase in Accounts payable | | 85,161 | | | 4,441 | | | 87,741 |

| Increase in accrued expenses | | (1,290) | | | (9,000) | | | - |

| Increase in other payables | | (79) | | | 79 | | | - |

| Net cash used by operating activities | | (3,090,835) | | | (21,576) | | | (3,143,135) |

| |

| |

| CASH FLOWS PROVIDED BY INVESTING ACTIVITIES: | | - | | | - | | | - |

| |

| CASH FLOWS PROVIDED BY FINANCING ACTIVITIES: | | | | | | | | |

| Proceeds from issuance of stock | | 3,850,300 | | | 100,300 | | | 3,950,605 |

| Related party payable proceeds | | (420) | | | 33,500 | | | 53,500 |

| Net cash provided by financing activities | | 3,849,880 | | | 133,800 | | | 4,004,105 |

| |

| Net increase in cash and cash equivalents | | 759,045 | | | 112,224 | | | 860,970 |

| |

| Cash at beginning of period | | 101,925 | | | 300 | | | - |

| |

| Cash at end of period | $ | 860,970 | | $ | 112,524 | | $ | 860,970 |

| |

| |

| SUPPLEMENTAL CASH DISCLOSURES: | | | | | | | | |

| Income taxes paid | $ | - | | $ | - | | $ | - |

| Interest paid | $ | - | | $ | - | | $ | - |

| |

| NON-CASH INVESTING AND FINANCING ACTIVITIES: | | | | | | | | |

| Stock issued for subscription receivable | $ | (35) | | $ | (35) | | $ | (35) |

| Issuance of share capital for acquisition of mineral property | $ | 2,350,300 | | | - | | $ | 2,350,300 |

The accompanying condensed notes are an integral part of these interim financial statements

F-3

-4-

| LAKE VICTORIA MINING COMPANY, INC. |

| CONDENSED NOTES TO THE FINANCIAL STATEMENTS |

| December 31, 2008 |

| (Unaudited) |

| |

| |

NOTE 1 DESCRIPTION OF BUSINESS

Lake Victoria Mining Company, Inc. (hereinafter he Company was incorporated March 14, 2007 under the laws of the State of Nevada.

The principal business of the Company is to search for mineral deposits or reserves which are not in either the development or production stage. The Company is an exploration stage corporation that is conducting exploration activities on a gold property located in Tanzania. This property consists of one mining license for an area of approximately 70.72 square kilometers. We are no longer a Shell Company. We are exploring our property by conducting an extensive program of mapping geology, sampling soils and rocks and having the samples assayed for gold, and by conducting a detailed magnetic survey to identify faults and other geologic structures that might be helping to control the location of important gold values.

The Company’s administrative office is located in Golden, Colorado. The Company’s year-end is March 31.

The foregoing unaudited interim financial statements have been prepared in accordance with generally accepted accounting principles for interim financial information and with the instructions to Form 10-Q and Regulation S-K as promulgated by the Securities and Exchange Commission (SEC). Accordingly, these financial statements do not include all of the disclosures required by generally accepted accounting principles in the United States of America for complete financial statements. These unaudited interim financial statements should be read in conjunction with the Company audited financial statements for the year ended March 31, 2008, included in the Company annual reports on Form 10K which was filed with the SEC on June 24, 2008. In the opinion of management, the unaudited interim financial statements furnished herein include all adjustments, all of which are of a normal recurring nature, necessary for a fair statement of the results for the interim period presented. Operating results for the nine month period ended December 31, 2008 are not necessarily indicative of the results that may be expected for the full year.

The preparation of financial statements in accordance with generally accepted accounting principles in the United States of America requires the use of estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities known to exist as of the date the financial statements are published, and the reported amounts of revenues and expenses during the period. Uncertainties with respect to such estimates and assumptions are inherent in the preparation of the Company’s financial statements; accordingly, it is possible that the actual results could differ from the estimates and assumptions and could have a material effect on the reported amounts of the Company’s financial position and results of operations.

F-4

-5-

| LAKE VICTORIA MINING COMPANY, INC. |

| CONDENSED NOTES TO THE FINANCIAL STATEMENTS |

| December 31, 2008 |

| (Unaudited) |

| |

| |

NOTE 2 SUMMARY OF SIGNIFICANT ACCOUNTING PRINCIPLES

This summary of significant accounting policies of Lake Victoria Mining Company, Inc. are presented to assist in understanding the Company financial statements. The financial statements and notes are representations of the Company management, which is responsible for their integrity and objectivity.

These accounting policies conform to accounting principles generally accepted in the United States of America, and have been consistently applied in the preparation of the financial statements.

Accounting Method

The Company financial statements are prepared using the accrual basis of accounting in accordance with accounting principles generally accepted in the United States of America.

Cash and Cash Equivalents

For purposes of the statement of cash flows, the Company considers all short-term investments with original maturities of three months or less to be equivalent.

Derivative Instruments

The Financial Accounting Standards Board issued Statement of Financial Accounting Standards No. 133, ccounting for Derivative Instruments and Hedging Activities (hereinafter FAS No. 133 , as amended by SFAS No. 137, ccounting for Derivative Instruments and Hedging Activities Deferral of the Effective Date of FASB No. 133 and SFAS No. 138, ccounting for Certain Derivative Instruments and Certain Hedging Activities and SFAS No. 149, mendment of Statement 133 on Derivative Instruments and Hedging Activities These statements establish accounting and reporting standards for derivative instruments, including certain derivative instruments embedded in other contracts, and for hedging activities.

If certain conditions are met, a derivative may be specifically designated as a hedge, the objective of which is to match the timing of gain or loss recognition on the hedging derivative with the recognition of (i) the changes in the fair value of the hedged asset or liability that are attributable to the hedged risk or (ii) the earnings effect of the hedged forecasted transaction. For a derivative not designated as a hedging instrument, the gain or loss is recognized in income in the period of change.

At December 31, 2008, the Company has not engaged in any transactions that would be considered derivative instruments or hedging activities.

F-5

-6-

| LAKE VICTORIA MINING COMPANY, INC. |

| CONDENSED NOTES TO THE FINANCIAL STATEMENTS |

| December 31, 2008 |

| (Unaudited) |

| |

Earnings Per Share

The Company has adopted Statement of Financial Accounting Standards No. 128, which provides for calculation of "basic" and "diluted" earnings per share. Basic earnings per share includes no dilution and is computed by dividing net income (loss) available to common shareholders by the weighted average common shares outstanding for the period. Diluted earnings per share reflect the potential dilution of securities that could share in the earnings of an entity similar to fully diluted earnings per share. Basic and diluted losses per share were the same, at the reporting dates, as the common stock equivalents outstanding would be considered antidilutive.

Exploration Stage

The Company has been in an exploration stage since its formation and has not realized any revenues from operations. It is primarily engaged in searching for mineral deposits or reserves which are not in either the development or production stage.

Fair Value of Financial Instruments

SFAS No. 157,Fair Value Measurements("SFAS 157"), defies fair value, establishes a framework for measuring fair value in accordance with generally accepted accounting principles, and expands disclosures about fair value measurements.

SFAS 157 establishes a three-tier fair value hierarchy which prioritizes the inputs used in measuring fair value as follows:

Level1. Observable inputs such as quoted prices in active markets;

Level2. Inputs, other than the quoted prices in active markets, that are observable either directly or indirectly; and

Level3. Unobservable inputs in which there is little or no market data, which require the reporting entity to develop its own assumptions.

The Company does not have any assets or liabilities measured at fair value on a recurring basis at December 31, 2008. The Company did not have any fair value adjustments for assets and liabilities measured at fair value on a nonrecurring basis during the Nine months ended December 31,2008.

F-6

-7-

| LAKE VICTORIA MINING COMPANY, INC. |

| CONDENSED NOTES TO THE FINANCIAL STATEMENTS |

| December 31, 2008 |

| (Unaudited) |

| |

Income Taxes

Income taxes are provided based upon the liability method of accounting pursuant to Statement of Financial Accounting Standards No. 109, ccounting for Income Taxes (hereinafter SFAS No.109 . Under this approach, deferred income taxes are recorded to reflect the tax consequences in future years of differences between the tax basis of assets and liabilities and their financial reporting amounts at each year-end. A valuation allowance is recorded against deferred tax assets if management does not believe the Company has met the mre likely than not standard imposed by SFAS No. 109 to allow recognition of such an asset.

Use of Estimates

The process of preparing financial statements in conformity with accounting principles generally accepted in the United States of America requires the use of estimates and assumptions regarding certain types of assets, liabilities, revenues, and expenses. Such estimates primarily relate to unsettled transactions and events as of the date of the financial statements. Accordingly, upon settlement, actual results may differ from estimated amounts.

Going Concern

As shown in the accompanying financial statements, the Company has an accumulated deficit of $3,170,876 incurred through December 31, 2008. The Company has no revenues, limited cash and losses from operations. Management intends to seek additional capital from new equity securities offerings that will provide funds needed begin the exploration for gold. These plans, if successful, will mitigate the factors which raise substantial doubt about the Company ability to continue as a going concern. The financial statements do not include any adjustments relating to the recoverability and classification of recorded assets, or the amounts and classification of liabilities that might be necessary in the event the Company cannot continue in existence. The Company expects to be able to control its cash outflows based upon funds received.

Mineral Properties

Costs of acquiring mineral properties are capitalized by project area upon purchase of the associated claims. Costs to maintain the mineral rights and leases are expensed as incurred. When a property reaches the production stage, the related capitalized costs will be amortized, using the units of production method on the basis of periodic estimates of ore reserves.

Mineral properties are periodically assessed for impairment of value and any diminution in value. (See Note 3)

F-7

-8-

| LAKE VICTORIA MINING COMPANY, INC. | | | | | | | | | |

| CONDENSED NOTES TO THE FINANCIAL STATEMENTS | | | | | | |

| December 31, 2008 | | | | | | | | | | | | |

| (Unaudited) | | | | | | | | | | | | |

| |

| |

| |

| NOTE 3 - MINERAL PROPERTY AND EXPLORATION COSTS |

| |

| The continuity of mineral properties acquisition cost |

| | | Kalemela Gold Project | | State Mining Project | | |

| | | PL2747/2005 | | PL2910/2004 | | PL3006/2005 | | PL2702/2004 | | PL4339/2006 | | Total |

| | | (a) | | (b) | | (c) | | (d) | | (e) | | |

| Balance, June 30, 2008 | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - |

| |

| |

| Option related payments: | | | | | | | | | | | | |

| Cash Consideration | | 75,000 | | | | | | | | | | 75,000 |

| Share issued for Mining properties | | | | | | | | | | | | |

| | | 75,000 | | - | | - | | - | | - | | 75,000 |

| |

| Balance, September 30, 2008 | | 75,000 | | - | | - | | - | | - | | 75,000 |

| |

| |

| Option related payments: | | | | | | | | | | | | |

| Cash Consideration | | - | | 50,000 | | 50,000 | | 30,000 | | 30,000 | | 160,000 |

| Share issued for Mining properties | | 1,750,300 | | 300,000 | | 300,000 | | | | | | 2,350,300 |

| | | 1,750,300 | | 350,000 | | 350,000 | | 30,000 | | 30,000 | | 2,510,300 |

| |

| Balance, December 31, 2008 | $ | 1,825,300 | $ | 350,000 | $ | 350,000 | $ | 30,000 | $ | 30,000 | $ | 2,585,300 |

| The continuity of mineral properties exploration expenditures |

| | | Kalemela Gold Project | | State Mining Project | | |

| | | PL2747/2005 | | PL2910/2004 | | PL3006/2005 | | PL2702/2004 | | PL4339/2006 | | Total |

| | | (a) | | (b) | | (c) | | (d) | | (e) | | |

| Balance, June 30, 2008 | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - |

| |

| Exploration expenditures: | | | | | | | | | | | | |

| Camp, Field Supplies and Travel | | 19,085 | | | | | | | | | | 19,085 |

| Exploration and field overhead | | 1,200 | | | | | | | | | | 1,200 |

| Geological consulting and Wages | | 31,119 | | | | | | | | | | 31,119 |

| Geophysical and Geochemical | | 21,186 | | | | | | | | | | 21,186 |

| Parts and equipment | | 750 | | | | | | | | | | 750 |

| Project Administration fee | | - | | | | | | | | | | - |

| Vehicle and Fuel expenses | | - | | | | | | | | | | - |

| | | 73,340 | | - | | - | | | - | - | | 73,340 |

| |

| Balance, September 30, 2008 | $ | 73,340 | $ | - | $ | - | $ | - | $ | - | $ | 73,340 |

| |

| Exploration expenditures: | | | | | | | | | | | | |

| Camp, Field Supplies and Travel | | 32,915 | | | | 30,000 | | | | | | 62,915 |

| Exploration and field overhead | | (1,200) | | | | - | | | | | | (1,200) |

| Geological consulting and Wages | | 38,561 | | | | 29,700 | | | | | | 68,261 |

| Geophysical and Geochemical | | 54,338 | | | | 41,000 | | | | | | 95,338 |

| Parts and equipment | | 3,250 | | | | 4,000 | | | | | | 7,250 |

| Project Administration fee | | 33,800 | | | | 19,500 | | | | | | 53,300 |

| Vehicle and Fuel expenses | | 32,284 | | | | 34,260 | | | | | | 66,544 |

| | | 193,948 | | - | | 158,460 | | | - | - | | 352,408 |

| |

| Balance, December 31, 2008 | $ | 267,288 | $ | - | $ | 158,460 | $ | - | $ | - | $ | 425,748 |

F-8

-9

| LAKE VICTORIA MINING COMPANY, INC. |

| CONDENSED NOTES TO THE FINANCIAL STATEMENTS |

| December 31, 2008 |

| (Unaudited) |

| |

(a) Kalemela Gold Project: PL2747/2004

On May 25, 2007, license 2747/2004 was granted by the Ministry of Energy and Minerals to Uyowa Gold Mining and Exploration Company Limited for the period of seven years with the intention of conducting exploration.

The license is owned 100% by Uyowa Gold Mining and Exploration Company Limited and with the present agreement the license will be optioned 80% interest to Lake Victoria Mining Company, Inc. No royalties or other encumbrances exist with respect to this property.

On April 1, 2008, the Company signed mineral property purchase/option agreement to acquire a license to explore the property from Uyowa Gold Mining and Exploration Company Limited, Dar es Salaam, Tanzania. The Company acquires a 100% interest in the property by contracting its own geologist, making a $20,000 (Initial Payment Date) within a maximum of 100 days of the Initial Signing Date and issuing 10% of Company's share capital on the Initial Payment Date.

On June 3, 2008, Lake Victoria Mining Company, Inc. agreed to a fourth amendment to the Mineral Property Purchase/Option Agreement dated April 1, 2007 between Lake Victoria Mining Company and Uyowa Gold Mining and Exploration Limited.

The parties have mutually agreed to a Fourth Amendment Agreement that in summary contains the following material changes:

| | 1. | The number of days or the date for the cash and shares payment (Initial Payment Date) has been amended and must occur no later than August 31, 2008. |

| |

| 2. | The payment amount has been increased from $20,000 USD to $75,000 USD. |

| |

| 3. | The option to acquire a 100% interest in and to the property has been amended to an option to acquire an 80% interest in and to the property. |

| |

| 4. | Schedule C "Production and Pre Production Agreement" has be amended to a new Schedule C "Exploration Commitments" and commits Lake Victoria to perform a total of $1,600,000 in exploration work over a forty-eight month period from the "Initial Payment Date". |

On July 14, 2008, the Company made cash payment of $75,000 to acquire 80% interest of Kalemela licenses PL2747/2004.

F-9

-10-

| LAKE VICTORIA MINING COMPANY, INC. |

| CONDENSED NOTES TO THE FINANCIAL STATEMENTS |

| December 31, 2008 |

| (Unaudited) |

| |

On July 23, 2008, the Company signed an exploration services agreement with Geo Can Resources Company Limited, Tanzania, to provide the initial exploration program on Kalemela license. According to the agreement, the Company shall pay Geo Can security deposit of US$60,000. Upon receipt of the Company payment of the final invoice, the $60,000 deposit will be returned. On August 1st, 2008, the Company paid deposit of $60,000 to Geo Can Resources Company Ltd. The Company has an obligation, according to the Uyowa Fourth Amendment Agreement, to complete $750,000 of mineral exploration on PL2747/2004 within 48 months of the nitial Payment Date

(b) & (c)

On November 18, 2008, the Company entered into an Option To Purchase Prospecting Licenses Agreement (the greement with Geo Can wherein the Company was granted the right to acquire an undivided 60% interest in and to certain property comprised of prospecting licenses, by carrying out a series of exploration programs on the property and by making certain payments to Geo Can in the form of shares of our common stock and cash as follows:

| | 1. | Reimburse Geo Can for the costs related to annual fees and registration fees in the amount of US$4,222.20. |

| |

| 2. | Pay Geo Can US$250,000 as follows: US$100,000 at closing and US$150,000 on the first anniversary of closing. |

| |

| 3. | Allot and issue to Geo Can a total 1,500,000 shares of common stock as follows: 600,000 shares within 10 days of closing and 900,000 shares on or before the first anniversary of closing. |

| |

| 4. | Incur exploration expenses of US$1,200,000 not later than the third anniversary of closing as follows: |

US$200,000 on or before the one year anniversary of closing; an additional $400,000 on or before the two year anniversary of closing; and, an additional US$600,000 on or before the three year anniversary of closing.

In addition, the Company can acquire the remaining 40% under additional options by the payment of money and issuance of additional shares of common stock. The exercise of these additional options will cause the Company and Geo Can to associate in a joint venture, the terms of which will be contained in a joint venture agreement.

F-10

-11-

| LAKE VICTORIA MINING COMPANY, INC. |

| CONDENSED NOTES TO THE FINANCIAL STATEMENTS |

| December 31, 2008 |

| (Unaudited) |

| |

Further, upon any part of the property being placed into commercial production, the Company will pay Geo Can a royalty of 2% of net smelter returns.

Together the three licenses cover an area of about 260 square kilometers. The Company has expanded Exploration Services Agreement with Geo Can to include mineral exploration of all three licenses. Therefore, on December 9, 2008 the Company advanced an additional $225,000 to continue mineral exploration activities on PL2747/2004, PL2910/2004 and PL3006/2005. This exploration is being conducted after reviewing and agreeing on a budget for the initial mineral exploration on PL3006/2005 and PL2910/2004.

(d) & (e)

On December 22, 2008 the Company completed an ption to Purchase Prospecting Licenses Agreement with Geo Can for PL4339/2006 and PL2702/2004. Under the terms of the agreement the Company will acquire all the right, title and interest of Geo Can, in and to the exclusive option that Geo Can has ( eo Can Option through the ineral Property Option to Purchase Agreement dated May 20, 2008 between Geo Can and State Mining Corporation, Tanzania. The Company will have the exclusive and irrevocable option to acquire from State Mining Corporation a 90% undivided interest in PL4339/2006 and PL2702/2004 through the Geo Can Option, pursuant to the terms and conditions of the agreement.

In consideration for the 90% undivided interest Option in PL4339/2006 and PL2702/2004 the Company agreed that:

| | (i) | With respect to the Option and within 15 Business Days of our Board of Directors acceptance of the transactions contemplated we will: |

| |

| (ii) | issue 50,000 Shares per license to Geo Can or its assignee; and |

| |

| (iii) | pay $10,000 per license to Geo Can or its assignee within 180 days of the Approval Date; and |

| |

| (iv) | assume all payments and obligations under the Geo Can Option; and |

| |

| (v) | pay Geo Can the 2.5% Net Smelter Royalty as contained in Schedule C of the agreement. |

Under the terms of the ineral Property Option to Purchase Agreement dated May 20, 2008 between Geo Can and State Mining Corporation, Tanzania that the Company is assuming the Company shall:

| | (i) | pay State Mining Company $30,000 per license listed; that is PL4339/2006 and PL2702/2004 and |

F-11

-12-

| LAKE VICTORIA MINING COMPANY, INC. |

| CONDENSED NOTES TO THE FINANCIAL STATEMENTS |

| December 31, 2008 |

| (Unaudited) |

| |

| | (ii) | Thirty thousand dollars (US$30,000) per license annually on subsequent anniversary dates of issuance of confirmation from the Commissioner of Minerals of registration of the Mineral Property Option to Purchase Agreement up to the date of completing a Bankable Feasibility Study and |

Complete the following minimum exploration expenditures

| | (i) | The OPTION HOLDER shall spend a minimum of US$ 100,000 per license per annum on exploration up to completion of Bankable Feasibility Study and announcement of Production Decision. |

| |

| (ii) | In addition the OPTION HOLDER will maintain a free 10% carried interest to the benefit of the OWNER through to mining production. |

| |

NOTE 4 CAPITAL STOCK

Preferred Stock

The Company is authorized to issue 100,000,000 shares of preferred stock with a par value of $0.00001. As of December 31, 2008, the Company has not issued any preferred stock.

Common Stock

The Company is authorized to issue 100,000,000 shares of common stock. All shares have equal voting rights, are non-assessable and have one vote per share. Voting rights are not cumulative and, therefore, the holders of more than 50% of the common stock could, if they choose to do so, elect all of the directors of the Company.

On December 23, 2008 the Company issued 10% of share Capital, 1,750,300 shares of common stock at a fair value of $1,750,300 to satisfy share obligations of the Fourth Amendment Agreement with Uyowa Gold Mining and Exploration Company Ltd for the acquisition of 80% of PL2747/2004.

On November 24, 2008 a treasury order was requested to issue 10% of our share capital as of the nitial Payment Date The Company thereby satisfied our cash and share obligations of the Fourth Amendment Agreement with Uyowa for the acquisition of 80% of PL2747/2004. On December 23, 2008, the Company issued 1,750,300 shares of common stock at a fair value of $1,750,300.

On November 18, 2008, the Company entered into an Option Purchase Prospecting Licenses Agreement with Geo Can Resources Company Ltd to acquire 60% interest of two Prospecting Licenses, PL2910/2004 and PL3006/2005 in Tanzania. The total consideration includes an aggregate cash payment of $250,000 and issuance of 1,500,000 shares of common stock. On December 23, 2008 the Company issued 600,000 shares of common stock at a fair value of $600,000.

F-12

-13-

| LAKE VICTORIA MINING COMPANY, INC. |

| CONDENSED NOTES TO THE FINANCIAL STATEMENTS |

| December 31, 2008 |

| (Unaudited) |

| |

On November 18, 2008 the Company sold 4,000,000 shares of common stock to three individuals in consideration of $1,000,000 and granted the three individuals the right to acquire an additional 4,000,000 shares of common stock at an exercise price of $1.00 per share.

On November 10, 2008, the Company sold 125,000 shares of common stock to one individual in consideration of $50,000 and granted the individual the right to acquire an additional 62,500 shares of common stock at an exercise price of $1.10 per share.

On October 19, 2008, the Company sold 125,000 shares of common stock to three individuals in consideration of $50,000 and granted the three individuals the right to acquire an additional 62,500 shares of common stock at an exercise price of $1.10 per share.

On October 10, 2008, the Company sold 375,000 shares of common stock to one individual in consideration of $150,000 and granted the individual the right to acquire an additional 187,500 shares of common stock at an exercise price of $1.10 per share.

On May 28, 2008, the company completed a non-brokered Regulation S private placement of 12,500,000 shares of the company restricted common stock at $0.02 per share for cash of $250,000.

The fair value of the 4,312,500 stock options was estimated using the Black-Scholes pricing model based on the following assumptions: dividend yield of 0%; risk-free interest rate of 0.39%; expected life of one year and five months; and volatility of 93%. A fair value of $332,000 was estimated.

NOTE 5 RELATED PARTY TRANSACTIONS

The Company president and director received a management fee of $5,000 in October, November and December, 2008 for a total of $15,000 for the last three months of 2008.

As of December 31, 2008 the Company majority shareholder Kilimanjaro Mining Company Inc. loaned the Company in the total amount of $53,500. This loan is noncollateralized and due on demand.

NOTE 6 SUBSEQUENT EVENTS

On January 21, 2009 the Company entered into an option to purchase prospecting license agreement with Geo Can Resources Ltd. to acquire prospecting license PL2806/2004 at Geita area in Geita District.

F-13

-14-

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OR PLAN OF OPERATIONS.

This section of our quarterly report includes a number of forward-looking statements that reflect our current views with respect to future events and financial performance. Forward-looking statements are often identified by words like: believe, expect, estimate, anticipate, intend, project and similar expressions, or words which, by their nature, refer to future events. You should not place undue certainty on these forward-looking statements, which apply only as of the date of this report. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from historical results or our predictions.

Our auditors have issued a going concern opinion. This means that there is substantial doubt that we can continue as an on-going business for the next twelve months unless we obtain additional capital to pay for our expenditures. This is because we have not generated any revenues. Accordingly, cash must be raised from other sources. Our only other source for cash at this time is investments by others. We must raise cash to implement our project and stay in business. We believe the money we raised in the public offering will last twelve months.

We have conducted research in the form of mineral exploration of our property. Our exploration program is explained in as much detail as possible in the business section of this report.

Effective September 30, 2008, we are no longer a shell company. During the quarter ended December 31, 2008, we had more than nominal operations.

Business

We acquired a prospecting license in Tanzania, PL2747/2004, to conduct mineral exploration, from Uyowa Gold Mining and Exploration Company Limited, P.O. Box 3167, Dar es Salaam, Tanzania (The “Property”). On June 3, 2008, we agreed to a fourth amendment to the Mineral Property Purchase/Option Agreement dated April 1, 2007, between us and Uyowa Gold Mining and Exploration Limited (“Uyowa”).

We mutually agreed with Uyowa to a Fourth Amendment Agreement that in summary contains the following material changes:

| 1. | The number of days or the date for the cash and shares payment (Initial Payment Date) has been amended and must occur no later than August 31, 2008. |

| |

| 2. | The payment amount has been increased from $20,000 USD to $75,000 USD. |

| |

| 3. | The option to acquire a 100% interest in and to the property has been amended to an option to acquire an 80% interest in and to the property. |

| |

| 4. | Schedule C "Production and Pre Production Agreement" has be amended to a new Schedule C "Exploration Commitments" and commits us to perform a total of $750,000 in exploration work over a forty-eight month period from the "Initial Payment Date". |

-15-

Additionally we must complete the issuance of 10% of our share capital on the Initial Payment Date and perform on a best efforts basis and if necessary items of Schedule B.

On July 8, 2008 we announced that we were proceeding with the acquisition of an 80% interest in the Kalemela property, PL2747/2004.

On July 14, 2008 we completed a payment of $75,000 (”Initial Payment Date”) in accordance with the Fourth Amendment Agreement.

On November 24, 2008 a treasury order was requested to issue 10% of our share capital as of the “Initial Payment Date”. We thereby satisfied our cash and share obligations of the Fourth Amendment Agreement with Uyowa for the acquisition of 80% of PL2747/2004.

We have an obligation, according to the Uyowa Fourth Amendment Agreement, to complete $750,000 of mineral exploration on PL2747/2004 within 48 months of the “Initial Payment Date”. Therefore, on July 23, 2008 we entered into an Exploration Services Agreement with Geo Can Resources Company Limited, Dar es Salaam, Tanzania (“Geo Can”) to provide mineral exploration services on PL2747/2004. In accordance with the Exploration Services Agreement we advanced a USD$60,000T deposit against exploration work to be conducted in accordance with approved budgets. The initial exploration services commenced in July and included, but was not limited to: soil sampling on a grid, grab sampling, trenching and rock chip sampling, geologic, regolith and artisanal mapping, ground magnetic survey and report writing. To the date we have spent $267,288 on mineral exploration on PL2747/2004.

On November 10, 2008 we entered into a non-binding letter of intent with Geo Can to acquire two additional mineral licenses contiguous with the existing Kalemela Gold Project license, PL2747/2004.

On November 18, 2008, we entered into an Option To Purchase Prospecting Licenses Agreement (the “Agreement”) with Geo Can wherein we were granted the right to acquire an undivided 60% interest in and to certain property comprised of prospecting licenses, by carrying out a series of exploration programs on the property and by making certain payments to Geo Can in the form of shares of our common stock and cash as follows:

| 1. | Reimburse Geo Can for the costs related to annual fees and registration fees in the amount of US$4,222.20. |

| |

| 2. | Pay Geo Can US$250,000 as follows: US$100,000 at closing and US$150,000 on the first anniversary of closing. |

| |

| 3. | Allot and issue to Geo Can a total 1,500,000 shares of common stock as follows: 600,000 shares within 10 days of closing and 900,000 shares on or before the first anniversary of closing. |

| |

| 4. | Incur exploration expenses of US$1,200,000 not later than the third anniversary of closing as follows: US$200,000 on or before the one year anniversary of closing; an additional $400,000 on or before the two year anniversary of closing; and, an additional US$600,000 on or before the three year anniversary of closing. |

-16-

In addition, we can acquire the remaining 40% under additional options by the payment of money and issuance of additional shares of common stock. The exercise of these additional options will cause us and Geo Can to associate in a joint venture, the terms of which will be contained in a joint venture agreement.

Further, upon any part of the property being placed into commercial production, we will pay Geo Can a royalty of 2% of net smelter returns.

Together the three licenses cover an area of about 260 square kilometers. We have expanded our Exploration Services Agreement with Geo Can to include mineral exploration of all three licenses. Therefore, on December 9, 2008 we advanced an additional $225,000 to continue mineral exploration activities on PL2747/2004, PL2910/2004 and PL3006/2005. This exploration is being conducted after reviewing and agreeing on a budget for the initial mineral exploration on PL3006/2005 and PL2910/2004.

Additionally, on December 22, 2008 we completed an “Option to Purchase Prospecting Licenses Agreement” with Geo Can for PL4339/2006 and PL2702/2004. Under the terms of the agreement we will acquire all the right, title and interest of Geo Can, in and to the exclusive option that Geo Can has (“Geo Can Option”) through the “Mineral Property Option to Purchase Agreement” dated May 20, 2008 between Geo Can and State Mining Corporation, Tanzania. For the consideration, summarized below, we will have the exclusive and irrevocable option to acquire from State Mining Corporation a 90% undivided interest in PL4339/2006 and PL2702/2004 through the Geo Can Option, pursuant to the terms and conditions of the agreement.

In consideration for the 90% undivided interest Option in PL4339/2006 and PL2702/2004 we agreed that:

| (a) | With respect to the Option and within 15 Business Days of our Board of Directors acceptance of the transactions contemplated we will: |

| | (i) | issue 50,000 Shares per license to Geo Can or its assignee; and |

| | (ii) | pay $10,000 per license to Geo Can or its assignee within 180 days of the Approval Date; and |

| | (iii) | assume all payments and obligations under the Geo Can Option; and |

| | (iv) | pay Geo Can the 2.5% Net Smelter Royalty as contained in Schedule C of the agreement. |

Under the terms of the “Mineral Property Option to Purchase Agreement” dated May 20, 2008 between Geo Can and State Mining Corporation, Tanzania that we are assuming we will:

| (a) | | |

| | (i) | pay State Mining Company $30,000 per license listed in Schedule A; that is PL4339/2006 and PL2702/2004 and |

| (ii) | Thirty thousand dollars (US$30,000) per license annually on subsequent anniversary dates of issuance of confirmation from the Commissioner of Minerals of registration of the Mineral Property Option to Purchase Agreement up to the date of completing a Bankable Feasibility Study and |

-17-

| (b) | Complete the following minimum exploration expenditures |

| | (i) | The OPTION HOLDER shall spend a minimum of US$ 100,000 per license per annum on exploration up to completion of Bankable Feasibility Study and announcement of Production Decision. |

| | (ii) | In addition the OPTION HOLDER will maintain a free 10% carried interest to the benefit of the OWNER through to mining production. |

We have no revenues, have incurred losses since inception, have been issued a going concern opinion and have relied upon the sale of our securities and loans from our officers and directors to fund operations.

We have no plans to change our business activities or to combine with another business, and are not currently aware of any imminent events or circumstances that might cause us to change our plans. The properties are unencumbered and there are no competitive conditions which affect the properties. Further, there is no insurance covering the properties and we believe that no insurance is necessary since the properties are unimproved.

We initiated exploration operations on PL2747/2004 in the second fiscal quarter of 2008. To date, we have not discovered a commercially viable mineral deposit, a reserve, on the property and will be unable to do so until further exploration is done and a comprehensive evaluation concludes economic and legal feasibility.

There are no native land licenses that affect title to our Properties. At this time, we have no plans to interest other companies in the properties if mineralization is found.

Licenses

The following chart is a complete list of each license that we own by license number, the area, district and QDS of its location along with the date of issue, transfer and expiration for each. We own no property other than the following licenses:

| License | Area and District | Issue Date | Transfer Date | Expiry Date |

| |

| PL2747/2004 | Magu, Magu QDS/23/4 | 08-10-04 | 25-05-07 | 07-10-11 |

| PL2910/2004 | Bunda South, Bunda QDS/32/3 | 30-11-04 | 25-05-07 | 29-11-11 |

| PL3006/2005 | Bunda, Bunda QDS23/4 | 28-01-05 | 22-03-07 | 27-01-12 |

| PL4339/2006 | Makutupora, Dodoma QDS 162/2 | 09-05-07 | 24-09-08 | 08-05-10 |

| PL2702/2004 | Igusule, Nzega QDS 63/3 | 02-10-04 | 24-09-08 | 01-10-11 |

-18-

Kalemela Gold Project – PL2747/2004, PL3006/2005 and PL2910/2004

Location and Access

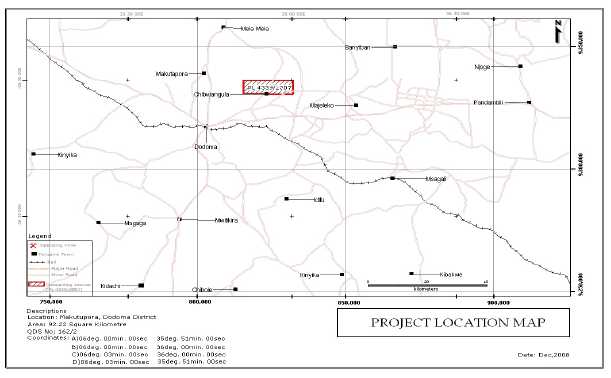

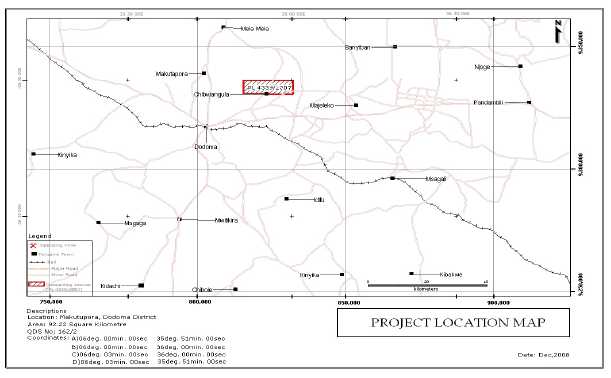

The license PL2747/2004 was granted by the Ministry of Energy and Minerals to Uyowa Gold Mining and Exploration Company Limited on May 25, 2007 for a period of four years with the intention of doing exploration. The license is owned 100% by Uyowa Gold Mining and Exploration Company Limited, which is 100% owned by Geo Can Resources Company Limited, and with the present agreement an 80% interest in and to the license is owned by us upon completing the exploration commitments. No royalties or other encumbrances exist with respect to this property. On November 18th, 2008, Lake Victoria optioned a 60% interest in two additional contiguous licenses PL2910/2004 granted by the Ministry of Energy and Minerals to Uyowa Gold Mining and Exploration Company Limited on May 25, 200 7 for a period of approximately four and one half years and PL3006/2005 granted by the Ministry of Energy and Minerals to Geo Can Resources Company Limited on March 22, 2007 for a period of approximately five years from Geo Can Resources Company Limited. Together the three licenses cover about 260 square kilometers. Map 1, “The Kalemela Gold Property Location Map, Tanzania” illustrates the location of these three licenses relative to Lake Victoria, the Serengeti National Park and each of the other licenses.

The Kalemela Gold Project consisting of PL2747/2004, PL2910/2004 and PL3006/2005 is located in the Kilimafedha greenstone belt of the Lake Victoria Gold Field in the Magu and Bunda Districts, Mwanza Region of northern Tanzania. The properties can be reached by traveling northeastwards from Mwanza city on the all-weather Mwanza-Magu-Bunda sealed road that continues northwards to Musoma.PL2747/2004 covers a total area of 70.72 square kilometers in quadrangle QDS 23/4. PL2910/2004 covers a total area of 77.20 square kilometers in quadrangle QDS 32/3. PL3006/2005 covers a total area of 113.90 square kilometers in quadrangle QDS 23/4.

The properties are near the eastern tip of the Speke Gulf and close to the southern shoreline of Lake Victoria. The nearest airport with regularly scheduled flights is in Musoma although the Mwanza airport is preferred where there are daily flights to and from Dar es Salaam and Kilimanjaro international airports.

MAP 1

-19-

Musoma has a population of about 1.5 million and a well-developed social and commercial infrastructure including: transportation, telecommunications, educational institutes, hospitals, hotels, and recreational facilities. The licenses are approximately 86km south of Musoma, and are within the Magu District of the Mwanza Region. Bunda, a closer, smaller commercial center than Musoma, is only about 36km’s north of the project area.

Access to the licenses are from Musoma, the nearest large town, then to Lamadi village over a well maintained tarmac road, and then by dirt roads to all parts of the project. Two wheel vehicles are satisfactory in the dry season, but four wheel drive vehicles are required during the wet season.

Physiography and Climate

Topographically, the license consists of sweeping terrain, with several low hills in the southern and eastern parts; flat stretches of grass and dark colored clay rich mbuga soils dominate the central and northern parts of the license. The most conspicuous topographic features in the area surrounding the project are two large hills known as Ngasamo Hill and Wamangola Hill. These two hills lie south of the project and are formed by iron and magnesium rich intrusive rocks.

The project is located at the western fringe of the Kilimafedha greenstone belt. Granitoid and greenstone rocks extend northward to the Ndabaka Plains and to the Serengeti Game Reserve. The license constitutes the northern extremity of a large and physiographically mature area known as Sukumaland.The area is adequately drained by the NW-SE flowing Lutubiga stream together with various other tributaries to the generally E-W flowing Ramadi River. All rivers in the area flow into the Duma River that eventually empties into Lake Victoria. The drainage channels are structurally controlled and follow joints, shear zones and other internal structures in the underlying bedrock. Outcrops are generally scarce as much of the area is covered with extensive amounts of recent clay rich soils.

The climate at the area is tropically humid with alternating wet and dry seasons. The dry season usually starts in June, and the wet season typically begins in October and extends into May with a short interruption towards the end of December. Maximum rainfall occurs in March and April. Daytime temperatures in the dry season vary from 20-32ºC and the nights are often 5-7oC cooler. Climatic conditions are not expected to unduly hinder exploration program.The flora consists open grass land, that is extensively cultivated for cotton and grazed for cattle. Most of the primary vegetation has been cleared from areas of granitic bedrock leaving only thick bush on the steeper hillsides.

Geology

Greenstone volcanic rocks and granite rocks are the major lithologies present on the Kalemela licenses. The greenstones have planar flow structures in the SW, central and SE parts of the property. A major NE-trending linear feature, present in the Lutubiga area, coincides with greenstone outcrops in the central part of the property. Minor NW-trending fault and fracture features are also present, and a greenstone dike is present in the central south part of the license that might help control some elevated metal values.

Regionally, the most significant structural feature is the northwest trending Suguti Shear Zone, which is located about 25 kilometers to the northeast. This structure lies within a broad, 2-3 kilometer wide depression; smaller faults within our properties are believed to represent offshoots from the larger Suguti structure. It may be possible that these small faults have helped to control the location of elevated metal values.

-20-

Local (Deposit) Geology

The local (prospect) geology of the license area is as shown in Map 2.

Dark Greyish Green Volcanic Rocks (Amphibolites)

The greenstone rocks form isolated outcrops and extend E-W through the center of the property. These are believed to be the main host rock for any metals that might be discovered on the Properties.

Grey Granitic Rocks (Syn-tectonic granites)

These granitic rocks are generally grey colored and coarse-to medium-grained. They are present in the southern half of the Properties.

Late Pink Granite Rocks (Late orogenic granites)

Late pink granites are pink, and coarse- to fine-grained. These granites appear to be distinct from the grey granites whose outcrops tend to form rugged prominent topographical features.

Minor Intrusive Rocks

Small occurrences of generally dark green to greenish gray basaltic rocks often are present in areas of low topographic relief, and rock exposures are generally rare.

Clay Rich Dark Gray to Black Soil (Mbuga)

The northern half of the properties consists of heavy, dark colored , clay rich soils. These soils cover important geologic features in the underlying bedrock, and mineral exploration programs are designed to identify prospective areas below the generally 2 to 3 meter thick soil cover.

History

There are no historical large mines or developed gold mineralization bodies within the license; limited reconnaissance exploration has been conducted on the property and within the region.

MAP 2

-21-

Our Proposed Exploration Program

Our exploration target is to find an ore body containing gold. Our success depends upon finding mineralized material. This includes a determination by our consultant if the Properties contain reserves. Mineralized material is a mineralized body, which has been delineated by appropriate spaced drilling or underground sampling to support sufficient tonnage and average grade of metals to justify removal. If we don’t find mineralized material or we cannot remove mineralized material, either because we do not have the money to do it or because it is not economically feasible to do it, we may suspend active business operations and you may lose part or all of your investment in the Company.

In addition, we may not have enough money to complete our exploration of the Properties. If it turns out that we have not raised enough money to complete our exploration program, we will try to raise additional funds from additional offerings of our securities or via debt financing. At the present time, there is no assurance that we would be able to raise additional money in the future. If we need additional money and can't raise it, we may have to suspend active business operations.

We must conduct exploration to determine what amount of minerals, if any, exist on our Properties and if any minerals which are found can be economically extracted and profitably processed.

The Properties are undeveloped raw land. To our knowledge, the Properties have never been mined except for shallow artisanal pits. We are exploring the properties at the present time and have been doing so, starting with PL2747/2004, since July 23, 2008. Before mineral recovery can begin, we must explore for and find mineralized material. After that has occurred, we have to determine if it is economically feasible to remove the mineralized material. Economically feasible means that the costs associated with the removal of the mineralized material will not exceed the price at which we can sell the mineralized material. We can’t predict what that will be until we find mineralized material.

We do not know if we will find mineralized material. We believe that activities occurring on adjoining properties are not material to our activities. The reason is that whatever is located under adjoining property may or may not be located under our Properties.

We have implemented an initial exploration program which consists of geochemical surveys such as rockchip/soil sampling, trenching, geological mapping which has be undertaken across faults inferred from the aeromagnetic lineaments and geophysical surveying. Based on results from these initial exploration programs our consultants and management will determine where drilling will occur on the Properties. Our consultant will receive fees for his services.

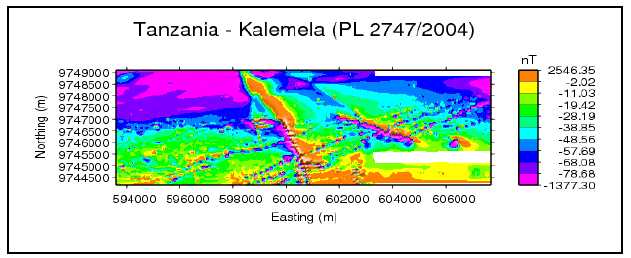

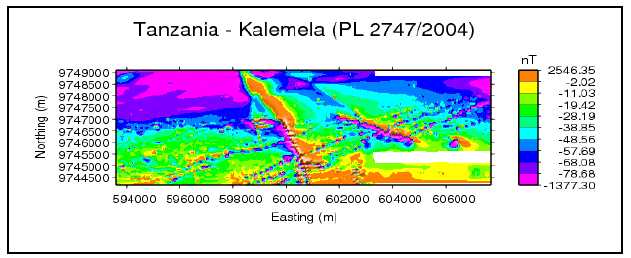

Work done on PL2747/2004 through our exploration services agreement with Geo Can to date includes: geological mapping at a scale of 1:10,000; 62 rock chips samples; 1,789 soil samples, the soil sampling grid was 200m x 50m; ten trenches were dug at 156m, 1-2m depth; 50 samples were collected on rock chip and soil anomalies to define the width of mineralization within the target area; three pits were dug and a detailed ground magnetic survey has been completed that covered the entire license. This survey will define the structural setting and rock types present underlying below the mbuga soils.

All of these samples have been tested to determine if mineralized material is located on the Property. We take our soil, grab and rock chip samples to analytical chemists, geochemists and registered assayers located in Mwanza, United Republic of Tanzania. Based upon the initial exploration program, we are continuing our exploration operations on the continguous licenses, PL3006 and PL2910 and will proceed with additional exploration of the initial Kalemela Property, PL2747.

-22-

We estimate the cost of initial exploration programs on all three Kalemela Gold Project licenses consisting of: gridding, soil sampling, geophysical surveying, trenching, geological mapping, soil and rock assays, report writing, accommodations and travel to be approximately $500,000.

The breakdowns were made in consultation with our consultants and management.

Hombolo Village PL4339/2006 and Igusule PL2702/2004

On December 22, 2008 we completed an “Option to Purchase Prospecting Licenses Agreement” with Geo Can for PL4339/2006 at Makutupora Area in Dodoma District which covers a total area of 92.22 square kilometers in QDS 162/2, Tanzania and PL2702/2004 at Igusule Area in Kahama District which covers a total area of 46.25 square kilometers in QDS 63/3, 63/4, Tanzania.

Under the terms of the agreement we will acquire all the right, title and interest of Geo Can, in and to the exclusive option that Geo Can has (“Geo Can Option”) through the “Mineral Property Option to Purchase Agreement” dated May 20, 2008 between Geo Can and State Mining Corporation, Tanzania. For the consideration we will have the exclusive and irrevocable option to acquire from State Mining Corporation a 90% undivided interest in PL4339/2006 and PL2702/2004 through the Geo Can Option, pursuant to the terms and conditions of the agreement.

Hombolo Village PL4339/2006

Location and Access

The Hombolo Prospect is under PL 4339/2006 issued to the State Mining Corporation (STAMICO) on May 9, 2007 and is valid for 36 months from the date of grant. It was transferred to Geo Can on September 24, 2008. The total area is 92.22 km2and lies within QDS 162/2 (Dodoma East) at Hombolo village. Access is generally easy as the properties are traversed by a number of roads that connect nearby villages (MAP 3).

Physiography

The environment for which Hombolo prospect may fall is that of “calcrete related environment in quaternary deposits”. The Hombolo prospect is in QDS 162/2 (Dodoma East). The Hombolo area is covered by mbuga and seasonal swamps. It forms an internal drainage basin. The prospect is being highly selected for uranium investigations. There has been no previous detailed investigations in the area except for the general regional mapping campaign by the Geological Survey of Tanzania.

Geology

Geological Enviroments for Uranium Mineralization in Tanzania

There are four known environments for uranium mineralization in Tanzania: -

-23-

In sandstones, especially of the Karron Super Group and Bukoba Super Group

In carbonatite complexes of Mesozoic to Recent age.

In calcretes related secondary environment in quaternary deposits.

In unconformities between Karagwe – Ankolean and Bukoba Super Group for vein-typeuranium mineralization.

The environment for which Hombolo prospect may fall is that of “calcrete related environment in quaternary deposits”. The Hombolo area is covered by mbuga and seasonal swamps. It forms an internal drainage basin. On the basis of one of the geological environments for uranium mineralization in Tanzania -In calcretes related secondary environment in quaternary deposits, the Hombolo prospect is being highly selected for uranium investigations. There has been no previous detailed investigations in the area except for the general regional mapping campaign by the Geological Survey of Tanzania.

MAP 3 Location map of PL4339/2006

-24-

MAP 4 – Geology and Location Map PL4339/2006

Local (Deposit) Geology

The Hombolo area is covered by mbuga and seasonal swamps. It forms an internal drainage basin. On the basis of one of the geological environments for uranium mineralization in Tanzania - In calcretes related secondary environment in quaternary deposits, the Hombolo prospect is being highly selected for uranium investigations. The Hombolo lake is dischargeless drainage basin. The surface material consists of black, sandy, clay like material. Beneath the clays, there are clayey sediments which are calcerous and also gypsiferous. The sediments have are yet to be tested for uranium.

History

Uranium anomalies were selected from the airborne geophysical survey results for ground follow up in the 1980/81 field season. With the exception of the anomaly detected over the Ngualla Carbonatite (QDS 209), these anomalies originated from outcropping granitic/gneiss rocks and mbugas (seasonal swamps). Granitic/gneiss rocks were found to contain very low concentrations of syngenetic Uranium. Mbuga anomalies were found to be caused by secondary Uranium which has been precipitated from water drainage into these Mbugas during the wet season.

The areas that were investigated during the airborne geophysical survey comprised QDS 121, 122, 123, 124, 140, 141, 142, 143, 158, 159, 161, 162, 176, 177, 178, 179 and 209.

-25-

Aside from the countrywide Radiometric Airborne survey, there has been no previous detailed investigations on PL4339 except for the general regional mapping campaign by the Geological Survey of Tanzania.

Our Proposed Exploration Program

Plan for Hombolo PL4339

Detailed ground radiometric survey at 100m grid will be completed on the anomalous block indicated during country wide Airborne geophysics survey. Trenches and pitting will be done to validate the previous anomaly. The survey will be followed up by shallow RAB or Auger drilling.

Igusule PL2702/2004

Location and Access

The Igusule tenement, PL 2702/04, is situated within the Kahama District, Shinyanga region, about 100km SE of Bulyanhulu mine and approximately 20km SE of the Buzwagi deposit. It is located within the Nzega – Iramba greenstone belt, in the Lake Victoria Goldfields of northwestern Tanzania.

Physiography and Climate

The Igusule, PL2702/2004 is underlain by both lower Nyanzian basalts and Upper Nyanzian volcaniclastic sediments. Felsic dykes, granite and ultramafic rocks have intruded the Nyanzian lithologies in the area. Most of the area has outcropping lithologies (mainly greywacke to the east and basalt on the western boundary). Granitic sand has been mapped on the NE corner of the tenement. The area is located on the gravity high and is characterized by crustal scale structural intersections of WNW, NE, EW and NS- trending magnetic lineaments.

Geology

MAP 5 Geology and Location Map of PL2702/2004

-26-

History

The Igusule, PL2702/2004 had exploration work completed by Barrick Exploration Africa Limited (BEAL) in the tenement that included; Airborne magnetic survey, Gravity survey, Geological mapping (1:20,000), soil geochemical sampling (1054) and RAB (1,905m) drilling programs.

Soil geochemical sampling program (1054 samples) has been conducted over the tenement in February and March 2006. The program started with 800m x 100m grid followed by an infill sampling at 400m x 100m spacing over the area with in-situ soils. All soil samples were analyzed for Au and multi-element -ME-ICP41. Wide-spaced RAB was used to investigate the Au-in-soil anomalies.

Three wide-spaced RAB fences (approx 100m between holes) were drilled at the tenement (PL 2702) area. A total of 1,905m of RAB drilling (23 holes) were completed in the tenement. The main lithological units encountered include, mafic volcanic (fine to medium grained), ultra-mafic intrusive and felsic dykes, which crosscuts all lithologies.

Our Proposed Exploration Program

Plan for Igusule PL2702 – By combining the Mag-Gravity superimposed image with RAB drilling results we see that there are 2 or 3 prospective targets. One just east of the Artisanal mining and the RAB drilling fence area with significant structural intersections that may be the extension of Artisanal mining and RAB drilling program area, The other target is south of the RAB drilling fence where there is another structural intersection .The third target is located east of the major fault and just in the contact between the Gravity high and low and containing several structural intersections.

Based on the interpretation work of the regional data and of the work done by BEAL the following is recommended:

| 1. | Soil sampling at a grid of 200 by 50m conducted over the whole license. |

| 2. | Detailed mapping at a scale of 1;20000. |

| 3. | Ground magnetic conducted over the whole license at a 100m grid. |

| 4. | Grab sampling on Artisanal mining area and in some targeted pits and trenches at various locations on the license. |

We have just completed the Option Agreement at the time of this writing and will now develop specific plans and budgets for the mineral exploration program on these additional properties to be conducted during the first two quarters of 2009.

At this time, we may or may not attempt to interest other companies in the Properties if we find mineralized materials. We may or may not try to develop the reserves ourselves through the use of consultants. We have no plans to interest other companies in the Properties if we do not find mineralized material.

If we are unable to complete exploration because we do not have enough money, we will suspend active operations until we locate and secure additional sources of funding. If we cannot or do not locate and secure additional funding, we may be forced to suspend active business operations.

-27-

Competitive Factors

The gold mining industry is fragmented, that is there are many gold prospectors and producers, small and large. We are a small exploration stage mining company and we do not have the financial, personnel or equipment resources that many competitors possess. Because of our lack of resources we may not be able to adequately withstand the competitive forces that exist in the mining industry generally and specifically with respect to gold mining.

Regulations

Mineral rights in the United Republic of Tanzania are governed by the Mining Act of 1998, and control over minerals are vested in the United Republic of Tanzania. Prospecting for the mining of minerals may only be conducted under authority of a mineral right granted by the Ministry of Energy and Minerals under this Act.

The three types of mineral rights most often encountered, which are applicable to us include: prospecting licenses; retention licenses; and mining licenses. A prospecting license grants the holder thereof the exclusive right to prospect in the area covered by the license for all minerals, other than building and gemstones, for a period of three years. Thereafter, the license is renewable for two further periods of two years each. On each renewal of a prospecting license, 50 percent of the area covered by the license must be relinquished. Before application is made for a prospecting license, a prospecting reconnaissance for a maximum area of 5,000 square kilometers is issued for a period of two years after which a three-year prospecting license is applied for. A company applying for a prospecting license must, inter alia, state the financial and technical resources available to it. A retention license can al so be requested from the Minister, after the expiry of the 3-2-2-year prospecting license period, for reasons ranging from funds to technical considerations.

Mining is carried out through either a mining license or a special mining license, both of which confer on the holder thereof the exclusive right to conduct mining operations in or on the area covered by the license. A mining license is granted for a period of 10 years and is renewable for a further period of 10 years. A special mining license is granted for a period of 25 years and is renewable for a further period of 25 years. If the holder of a prospecting license has identified a mineral deposit within the prospecting area which is potentially of commercial significance, but it cannot be developed immediately by reason of technical constraints, adverse market conditions or other economic factors of a temporary character, it can apply for a retention license which will entitle the holder thereof to apply for a special mining license when it sees fit to proceed with mining operations.

A retention license is valid for a period of five years and is thereafter renewable for a single period of five years. A mineral right may be freely assigned by the holder thereof to another person, except for a mining license, which must have the approval of the Ministry to be assigned.

However, this approval requirement for the assignment of a mining license will not apply if the mining license is assigned to an affiliate company of the holder or to a financial institution or bank as security for any loan or guarantee in respect of mining operations.

A holder of a mineral right may enter into a development agreement with the Ministry to guarantee the fiscal stability of a long-term mining project and make special provision for the payment of royalties, taxes, fees and other fiscal imposts.

-28-

We have complied with all applicable requirements and the relevant licenses have been issued.

Environmental Law

We are also subject to laws dealing with environmental matters relating to the exploration and development of mining properties. The goals are to protect the environment through a series of regulations affecting:

| 1. | Health and Safety |

| 2. | Archaeological Sites |

| 3. | Exploration Access |

We have complied.

Results of Operations

In the second fiscal quarter of 2008, we started exploration, but have not discovered mineralized material and therefore we have not generated any revenue. Accordingly, as of the second fiscal quarter of 2008, we were no longer a “shell company.” We explored our property by conducting an extensive program of mapping geology, sampling soils and rocks and having the samples assayed for gold, and by conducting a detailed ground magnetic survey to identify faults and other geologic structures that might be helping to control the location of important gold values. In the second fiscal quarter, the cost of exploration activities was $2,862,708. In addition to these exploration activities, we desired to acquire additional property, and on November 10, 2008 we entered into a non-binding letter of intent to acquire two additional mineral licenses contiguous with the existing Kalemela license PL2747/2004. O n November 18, 2008, we entered into an Option To Purchase Prospecting Licenses Agreement (the “Agreement”) with Geo Can wherein we were granted the right to acquire an undivided 60% interest in and to certain property comprised of prospecting licenses, by carrying out a series of exploration programs on the property and by making certain payments to Geo Can in the form of shares of our common stock and cash as follows:

1. Reimburse Geo Can for the costs related to annual fees and registration fees in the amount of US$4,222.20.

2. Pay Geo Can US$250,000 as follows: US$100,000 at closing and US$150,000 on the first anniversary of closing.

3. Allot and issue to Geo Can a total 1,500,000 shares of common stock as follows: 600,000 shares within 10 days of closing and 900,000 shares on or before the first anniversary of closing.

4. Incur exploration expenses of US$1,200,000 not later than the third anniversary of closing as follows: US$200,000 on or before the one year anniversary of closing; an additional $400,000 on or before the two year anniversary of closing; and, an additional US$600,000 on or before the three year anniversary of closing.

In addition, we can acquire the remaining 40% under additional options by the payment of money and issuance of additional shares of common stock. The exercise of these additional options will cause us and Geo Can to associate in a joint venture, the terms of which will be contained in a joint venture agreement.

-29-

Further, upon any part of the property being placed into commercial production, we will pay Geo Can a royalty of 2% of net smelter returns.

Together the three licenses cover an area of about 260 square kilometers. We have expanded our Exploration Services Agreement with Geo Can Resources Company Limited to include mineral exploration of all three licenses. On December 9, 2008 we advanced an additional $225,000 to continue mineral exploration activities on PL2747/2004, PL2910/2004 and PL3006/2005.

PL2747/2004 - 2008 Exploration Work

Geo Can Resources Company Limited conducted reconnaissance Phase One exploration that included the following: geological mapping, soil sampling with grid lines spaced at 200m and samples spaced at 50m (Figure 2). Based on prior experience, soil samples were not collected from clay rich mbuga soil areas. Ten trenches were placed to define nature and source of the soil anomalies, ground magnetic profiles began in early October and have further defined structures in the higher gold areas. The work conducted to date is summarized below in Table 2:

| Table 2: Summary of Completed Exploration |

| | | | | Ground | |

| | Area | Soil | Rock | Magnetic | |

| Project | Mapped | Samples | Samples | Survey | |

| License No. | (km2) | Collected | Collected | (line km) | Trenches |

| Kalemela, | | | | | |

| PL2747/2004 | 70.72 | 1,789 | 62 | 800 | 10 |

Geologic Mapping

The main lithologies observed during geological mapping are as follows: In the northern part of the license wide areas are covered by superficial clay rich mbuga soils that overlie Nyanzian greenstones rocks similar to the ones in the middle or central part of the license. In the central part of the license granites and greenstone with moderate magnetic properties occur with felsic dykes and quartz feldspar porphyry dykes. Quartz veins are present and tend to follow dilational zones of weakness in the greenstone and granitoid host rocks.

-30-

Note: Soil samples are displayed as Part per Billion and not as Parts per Million

Figure 1: Geological and gold assay map. Anomalous gold in soils define north-south and northeast structural trends on PL2747. Ground magnetic results define similar trends. The large gold anomaly overlies granite and a contact zone with greenstone rocks. Samples were not collected in the mbuga clay rich area (colored yellow on map) as the gold cannot penetrate the clay area. This map covers about 21 sq kms and is located near the center of PL2747 license. Note: All soil samples are displayed in ppb and not as ppm.

Structural Controls

Two main structural controls are present. The northeast direction is dominant in the western part of the license. This northwest direction becomes more east-southeast in the central part of the license, and also extends into the eastern part. Dip directions are to the north. This pattern setting is also reflected in the soil anomalies that have northeast and northwest trends in the central part of the license(Figure 2).

-31-

Note: Soil samples are displayed as Part per Billion and not as Parts per Million

Figure 2: Gold assay values in soil samples at the Kalemela project, PL2747 Note: All soil samples are displayed in ppb and not as ppm.

Ground Magnetic Survey Results

-32-

Figure 3: Map image of ground magnetic survey, with UTM Coordinates, PL2747The detailed magnetic survey identified previously unknown prominent intersecting northwest and northeast trending structures that lie beneath shallow soil cover. The areas of intersection partially correspond to areas of elevated gold values in soil samples and provide locations for induced polarization surveys to further define possible drill targets.

Picture 1 and 2: Ground magnetic surveying on the Kalemela Gold Project PL2747

conducted by Geo Can Resources Company field crew.

Sampling Method and Approach

Soil samples were collected from shallow hand dug holes that reached the B-soil horizon; sample size was between one and two kilograms.

Sample Preparation, Analysis and Security

Geo Can Resources Company Limited sent the collected samples to the registered and certified SGS Analytical Laboratories in Mwanza for gold assay analysis.

Adjacent Properties

To the west, and contingent with PL 2747/2004, are licenses PL 2910/2004 and PL 3006/2005 (Map 2). The three properties have known gold occurrences due to artisanal mining and similar geology; an option agreement was signed with us on November 18th, 2008 for these two additional licenses.

-33-

Mineral Resource and Mineral Reserve Estimates

There is not an established mineral resource or a mineral reserve on the property; no attempt is made in this report to indicate, calculate or otherwise estimate a resource or reserve.

Interpretation and Conclusions

Soil sample results, along with the geologic setting, magnetic survey results and the presence of sulphide minerals suggest the area has exploration potential. Positive exploration criteria include: Presence of Nyanzian greenstone rocks including basalts and several felsic and mafic dykes.

Initial rock assays from mafic and felsic dykes that include anomalous values.

Detailed soil sampling indicates anomalous portions of the license; these values lie along structural trends that may or may not host a mineable gold deposit.

Recommendations For Future Work

The Kalemela gold project is at the western edge of the Kilimafedha greenstone belt, and the potential is due to the presence of strong granite – basalt lithological and several associated dykes which define possible feeder channels for gold mineralization.