(To Prospectus dated December 18, 2009)

Filed pursuant to Rule 424(b)(5)

No. 333-163869

5,000,000 Shares of Common Stock

Warrants to Purchase up to 4,000,000 Shares of Common Stock

Pacific Asia Petroleum, Inc.

Pursuant to this prospectus supplement and the accompanying prospectus, we are offering (1) up to 5,000,000 shares of our common stock, at a price of $4.00 per share for aggregate gross proceeds of $20 million, (2) warrants to purchase up to 2 million shares of our common stock (and the shares of common stock issuable from time to time upon exercise of these warrants), with an exercise price of $4.50 per share, exercisable beginning on the six month anniversary of the closing day until the 36 month anniversary of such exercise date (the “Series A Warrants”), and (3) warrants to purchase up to 2 million shares of our common stock (and the shares of common stock issuable from time to time upon exercise of these warrants), with an exercise price of $4.00 per share, exercisable immediately until November 1, 2010 (the “Series B Warrants;” together with the Series A Warrants, the “Warrants”), to selected institutional investors under a securities purchase agreements, each dated February 10, 2010, between us and each of the investors. The common stock and the warrants will be issued separately but will be purchased together in the offering. If fully exercised, the Series A Warrants and Series B Warrant would result in additional gross proceeds to the Company of $17 million.

Our common stock is listed on the NYSE Amex Equities under the symbol “PAP.” On February 10, 2010, the last reported per share sale price of our common stock was $3.87. You are urged to obtain current market quotations of our common stock before purchasing any of the shares being offered for sale pursuant to this prospectus.

You should carefully consider the risk factors beginning on page S-4 of this prospectus supplement and set forth in the documents incorporated by reference herein before making any decision to invest in our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus or any prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

| | Per Common Share/Total for Common Shares | Per Series A Warrant Share/Total for Warrant Shares | Per Series B Warrant Share/Total for Warrant Shares | Total Offering |

| Offering Price | $4.00/$20,000,000 | $4.50/$9,000,000(1) | $4.00/$8,000,000(1) | $37,000,000(1) |

| Placement Agent Fees | $0.24/$1,200,000 | -- | -- | $1,200,000 |

| Proceeds before expenses to us | $3.76/$18,800,000 | $4.50/$9,000,000(1) | $4.00/$8,000,000(1) | $35,800,000(1)( |

____________________

(1) Assumes the valid exercise of the warrants received by the purchasers pursuant to this offering.

______________________________________

Rodman & Renshaw, LLC, a wholly owned subsidiary of Rodman & Renshaw Capital Group, Inc. (Nasdaq: RODM), is acting as the exclusive placement agent for the sale of the shares of our common stock and the warrants to purchase shares of common stock. We estimate the total expenses of this offering, excluding the placement agent fees, will be approximately $37,580. They will also receive warrants to purchase up to 150,000 shares of our common stock (and the shares of common stock issuable from time to time upon exercise of these warrants), with an exercise price of $5.00 per share (125% of the public offering price), exercisable beginning on the six month anniversary of the closing day, with an expiration date of February 3, 2015. Because there is no minimum offering amount required as a condition to closing in this offering, the actual offering amounts, placement agent fees and net proceeds to us, if any, in this offering are not presently determinable and may be substantially less than the total maximum offering amounts set forth above. The placement agent is not required to sell any specific number or dollar amount of the securities offered in this offering, but will use its best efforts to sell the securities offered. It is anticipated that the shares of common stock and the warrants will be delivered against payment thereon on or before February 13, 2010.

______________________________________

Rodman & Renshaw, LLC

The date of this prospectus supplement is February 11, 2010

Prospectus Supplement

| ABOUT THIS PROSPECTUS SUPPLEMENT | S-i |

| FORWARD-LOOKING STATEMENTS | S-i |

| SUMMARY | S-1 |

| THE OFFERING | S-3 |

| RISK FACTORS | S-3 |

| USE OF PROCEEDS | S-16 |

| PRICE RANGE OF COMMON STOCK | S-16 |

| DIVIDEND POLICY | S-16 |

| DESCRIPTION OF SECURITIES WE ARE OFFERING | S-17 |

| PLAN OF DISTRIBUTION | S-18 |

| LEGAL MATTERS | S-20 |

| EXPERTS | S-20 |

| INCORPORATION BY REFERENCE | S-20 |

| WHERE YOU CAN FIND MORE INFORMATION | S-21 |

Prospectus

| INFORMATION CONTAINED IN THIS PROSPECTUS | 1 | |

| SUMMARY | 2 | |

| RISK FACTORS | 3 | |

| FORWARD-LOOKING STATEMENTS | 3 | |

| USE OF PROCEEDS | 3 | |

| RATIO OF EARNINGS TO COMBINED FIXED CHARGES | 4 | |

| DESCRIPTION OF CAPITAL STOCK | 4 | |

| DESCRIPTION OF WARRANTS | 6 | |

| DESCRIPTION OF DEBT SECURITIES | 7 | |

| DESCRIPTION OF UNITS | 14 | |

| PLAN OF DISTRIBUTION | 15 | |

| LEGAL MATTERS | 16 | |

| EXPERTS | 17 | |

| INCORPORATION BY REFERENCE | 17 | |

| AVAILABLE INFORMATION | 17 | |

| INDEMNIFICATION | 18 | |

This prospectus supplement and the accompanying prospectus, dated December 18, 2009, are part of a registration statement on Form S-3 (File No. 333-163869) that we filed with the Securities and Exchange Commission using a “shelf” registration process. Under this “shelf” registration process, we, and the selling stockholder may from time to time sell any combination of securities described in the accompanying prospectus in one or more offerings. In this prospectus supplement, we provide you with specific information about the terms of this offering.

As permitted under the rules of the SEC, this prospectus incorporates by reference important information about us that is contained in documents that we file with the SEC, but that are not attached to or delivered with this prospectus. You may obtain copies of these documents, without charge, from the website maintained by the SEC at www.sec.gov, as well as other sources. See “Incorporation of Certain Information by Reference” for further information.

This document comprises two parts. The first part is this prospectus supplement, which describes the specific terms of this offering of common stock and warrants and also adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference into the prospectus. The second part, the accompanying prospectus, gives more general information, some of which may not apply to this offering. If the description of the offering varies between this prospectus supplement and the accompanying prospectus, you should rely on the information contained in this prospectus supplement. However, if any statement in one of these documents is inconsistent with a statement in another document having a later date — for example, a document incorporated by reference in the accompanying prospectus — the statement in the document having the later date modifies or supersedes the earlier statement.

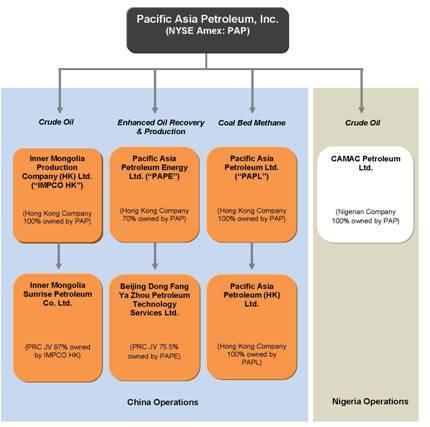

In this prospectus supplement, unless otherwise indicated, references in this prospectus to “China” and “PRC” are references to the People's Republic of China, references to “Hong Kong” are to the Hong Kong Special Administrative Region of China, and references to “PAP”, “we,” “us,” or “our” and the “Company” are references to the combined business of Pacific Asia Petroleum, Inc. and its wholly-owned subsidiaries and joint venture companies, including, (i) Pacific Asia Petroleum, Limited, a Hong Kong company (“PAPL”), (ii) Inner Mongolia Production Company (HK) Limited, a Hong Kong company (“IMPCO HK”), (iii) Pacific Asia Petroleum (HK) Limited, a Hong Kong company, (iv) Inner Mongolia Sunrise Petroleum Co. Ltd, a PRC joint venture company 97% owned by IMPCO HK and 3% owned by Beijing Jinrun Hongda Technology Co., Ltd., an unaffiliated PRC corporation, (v) Pacific Asia Petroleum Energy, Limited (“PAPE”), a Hong Kong company 70% owned by PAP and 30% owned by Best Source Group Holdings Limited, an unaffiliated Hong Kong company, (vi) Beijing Dong Fang Ya Zhou Petroleum Technology Service Company Limited (“Dong Fang”), a PRC joint venture company 75.5% by PAPE and 24.5% by Mr. Li Xiangdong, and (vii) CAMAC Petroleum Limited (“CPL”), a Nigerian company (collectively, the “Company”).

You should rely only on the information contained in or incorporated by reference into this prospectus supplement and the accompanying prospectus to which it relates. No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus. You must not rely on any unauthorized information or representations. The information contained in this prospectus supplement and contained, or incorporated by reference, in the accompanying prospectus is accurate only as of the respective dates thereof, regardless of the time of delivery of this prospectus supplement and the accompanying prospectus or of any sale of common stock. This prospectus is an offer to sell only the shares and warrants offered hereby by us, but only under circumstances and in jurisdictions where it is lawful to do so.

FORWARD-LOOKING STATEMENTS

This prospectus contains and incorporates “forward-looking statements” within the meaning of Section 27A of the United States Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the United States Securities Exchange Act of 1934, as amended, or the Exchange Act. Any statements about our expectations, beliefs, plans, objectives, assumptions or future events or performance are not historical facts and may be forward-looking. These statements are often, but not always, made through the use of words or phrases like “anticipate,” “estimate,” “plans,” “projects,” “continuing,” “ongoing,” “target,” “expects,” “management believes,” “we believe,” “we intend,” “we may,” “we will,” “we should,” “we seek,” “we plan,” the negative of those terms, and similar words or phrases. We base these forward-looking statements on our expectations, assumptions, estimates and projections about our business and the industry in which we operate as of the date of this prospectus. These forward-looking statements are subject to a number of risks and uncertainties that cannot be predicted, quantified or controlled and that could cause actual results to differ materially from those set forth in, contemplated by, or underlying the forward-looking statements. Statements in this prospectus and in documents incorporated into this prospectus, including those set forth below in “Risk Factors,” describe factors, among others, that could contribute to or cause these differences.

Because the factors discussed in this prospectus or incorporated by reference could cause actual results or outcomes to differ materially from those expressed in any forward-looking statements made by us or on our behalf, you should not place undue reliance on any such forward-looking statements. Further, any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update any forward-looking statement or statements to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for us to predict which will arise. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

PROSPECTUS SUPPLEMENT SUMMARY

The following information supplements, and should be read together with, the information contained or incorporated by reference in other parts of this prospectus supplement and in the accompanying prospectus. This summary highlights selected information contained elsewhere in this prospectus supplement or the documents incorporated by reference herein. Because the following is only a summary, it does not contain all of the information that you should consider before investing in our common stock. You should carefully read this entire prospectus supplement and the accompanying prospectus, including the factors described under the heading “Risk Factors” included in this prospectus supplement and the financial statements and other information incorporated by reference in this prospectus supplement and the accompanying prospectus before making an investment decision.

PACIFIC ASIA PETROLEUM, INC.

General

We are a development stage company formed to develop new energy ventures, directly and through joint ventures and other partnerships in which it may participate. Members of the Company’s senior management team have experience in the fields of petroleum engineering, geology, field development and production, operations, international business development and finance. Several members of the Company’s management team have held management and executive positions with Texaco Inc. and other energy companies and have managed energy projects in the People’s Republic of China (the “PRC” or “China”) and elsewhere in Asia and other parts of the world. Members of the Company’s management team also have experience in oil drilling, operations, geology, engineering and sales in China’s energy sector. The Company considers itself currently to be engaged in a single business segment--oil and gas exploration, development and production.

History

The Company was incorporated in the State of Delaware in 1979 under the name “Gemini Marketing Associates, Inc.” In 1994, the Company changed its name from “Gemini Marketing Associates, Inc.” to “Big Smith Brands, Inc.,” in 2006 it again changed its name to “Pacific East Advisors, Inc.,” and in 2007 it again changed its name to “Pacific Asia Petroleum, Inc.” As Big Smith Brands, Inc., the Company operated as an apparel company engaged primarily in the manufacture and sale of work apparel, and was listed on the Nasdaq Stock Market’s Small-Cap Market from 1995 until December 4, 1997, and the Pacific Stock Exchange from 1995 until April 1, 1999. In 1999, the Company sold all of its assets related to its workwear business to Walls Industries, Inc., and in 1999 filed for voluntary bankruptcy under Chapter 11 of the United States Bankruptcy Code. The final bankruptcy decree was entered on August 8, 2001, and thereafter the Company existed as a “shell company,” but not a “blank check” company, under regulations promulgated by the SEC and had no business operations and only nominal assets until May 2007, when it consummated the mergers of Inner Mongolia Production Company LLC (“IMPCO”) and Advanced Drilling Services, LLC (“ADS”) into wholly-owned subsidiaries of the Company. In December 2007, the Company merged these wholly-owned subsidiaries into the parent company, resulting in the cessation of the separate corporate existence of each of IMPCO and ADS and the assumption by the Company of the businesses of IMPCO and ADS. In connection with the mergers, the Company changed its name from “Pacific East Advisors, Inc.” to “Pacific Asia Petroleum, Inc.” In July 2008, the Company consummated the merger of Navitas Corporation, a Nevada corporation whose sole assets were comprised of Company Common Stock and certain deferred tax assets, with and into the Company, and the separate corporate existence of Navitas Corporation ceased upon effectiveness of the merger. On November 5, 2009, the Company’s common stock became listed on the NYSE Amex under the symbol “PAP.”

CAMAC Transaction

On November 18, 2009, we announced our entry into a Purchase and Sale Agreement (the “Purchase Agreement”) with CAMAC Energy Holdings Limited and certain of its affiliates (“CAMAC”), pursuant to which we agreed to acquire all of CAMAC’s interest in a Production Sharing Contract (the “Oyo Field PSC”) with respect to that certain oilfield asset known as the Oyo Field (the “Contract Rights” and the transaction, the “CAMAC Transaction”). The PSC sets out the terms of agreement in relation to petroleum operations in the area covered by the Oil Mining Lease 120 and Oil Mining Lease 121 granted on August 28, 2002 by the Federal Republic of Nigeria to affiliates of CAMAC with respect to Oil Prospecting License Block 210 awarded to Allied on June 3, 1992 by the Federal Republic of Nigeria. In exchange for the Contract Rights, the Company has agreed to pay $38.84 million in cash, and issue common stock to CAMAC equal to 62.74% of the Company’s issued and outstanding common stock.

The CAMAC Transaction is expected to close during the first quarter of 2010, and is subject to the satisfaction of customary conditions to closing, including, without limitation: (i) the negotiation and entry by the parties into certain other agreements as set forth in the Purchase Agreement in forms reasonably satisfactory to the parties; (ii) our consummation of a financing on terms reasonably acceptable to CAMAC resulting in gross proceeds of at least USD $45 million to the Company; and (iii) the approval of our stockholders of the Purchase Agreement and the transactions contemplated thereby. In addition, for a period commencing on the closing and ending the date that is one (1) year following the closing, the parties agree that our Board of Directors will consist of seven (7) members, four (4) of whom will be nominated by CAMAC, and three (3) of whom shall be current Company directors. The Purchase Agreement also contains other customary terms, including, but not limited to, representations and warranties, indemnification and limitation of liability provisions, termination rights, and break-up fees if either party terminates under certain circumstances. The offering to which this prospectus supplement relates is a part of the required financing. For details regarding the Purchase Agreement see the Company’s Form 8-K filed with the SEC on November 23, 2009, and the exhibits thereto. For a detailed summary of the CAMAC transaction and the risk factors associated with the transaction, please see our Preliminary Proxy Statement on Schedule 14A, filed with the SEC on December 31, 2009.

The following chart reflects our current corporate organizational structure:

The Company’s executive offices are located at 250 East Hartsdale Ave., Suite 47, Hartsdale, New York 10530. The Company also has an office located in Beijing, China. PAP may be contacted by telephone at (914) 472-6070. We maintain a website at www.papetroleum.com that contains information about us, but that information is not a part of this prospectus.

THE OFFERING

| Common stock offered by us | 5,000,000 shares directly. |

| | |

| Warrants offered by us | Two series with an aggregate of 4,000,000 shares issuable upon exercise of warrants. |

| | |

| Common stock outstanding immediately following the offering | 49,232,952 shares, based on 44,232,952 shares of common stock outstanding as of February 10, 2010 and excluding any shares of our common stock issuable upon exercise of outstanding warrants (including warrants issued in this offering), options or other rights to purchase shares of our common stock, including the warrants. |

| | |

| Use of proceeds | We currently intend to use the net proceeds from this offering for working capital requirements, and we may also use the net proceeds from this offering to fund (i) the Company’s acquisition from CAMAC of the Contract Rights, and (ii) other asset acquisitions and ventures. |

| | |

| Risk factors | You should carefully consider the risk factors contained and incorporated by reference in this prospectus supplement before making an investment decision. The specific risks are set forth under the caption “Risk Factors” section beginning on page S-6 of this prospectus supplement. |

| | |

| NYSE Amex symbol | “PAP” |

| |

| |

| | |

RISK FACTORS

Investing in our common stock involves a high degree of risk. In addition to the other information contained in this prospectus supplement, the accompanying prospectus and in documents that we incorporate by reference, you should carefully consider the risks discussed below, before making a decision about investing in our securities. If any of these risks occur, our business, financial condition and results of operations could be harmed, the trading price of our common stock could decline and you could lose part or all of your investment.

Risk Related to the Company’s Business

The Company’s limited operating history makes it difficult to predict future results and raises substantial doubt as to its ability to successfully develop profitable business operations.

The Company’s limited operating history makes it difficult to evaluate its current business and prospects or to accurately predict its future revenue or results of operations, and raises substantial doubt as to its ability to successfully develop profitable business operations. The Company’s revenue and income potential are unproven. As a result of its early stage of development, and to keep up with the frequent changes in the energy industry, it is necessary for the Company to analyze and revise its business strategy on an ongoing basis. Companies in early stages of development, particularly companies in new and rapidly evolving energy industry segments, are generally more vulnerable to risks, uncertainties, expenses and difficulties than more established companies.

The Company’s ability to diversify risks by participating in multiple projects and joint ventures depends upon its ability to raise capital and the availability of suitable prospects, and any failure to raise needed capital and secure suitable projects would negatively affect the Company’s ability to operate.

The Company’s business strategy includes spreading the risk of oil and natural gas exploration, development and drilling, and ownership of interests in oil and natural gas properties, by participating in multiple projects and joint ventures, in particular with major Chinese government-owned oil and gas companies as joint venture partners. If the Company is unable to secure sufficient attractive projects as a result of its inability to raise sufficient capital or otherwise, the average quality of the projects and joint venture opportunities may decline and the risk of the Company’s overall operations could increase.

The loss of key employees could adversely affect the Company’s ability to operate.

The Company believes that its success depends on the continued service of its key employees, as well as the Company’s ability to hire additional key employees, when and as needed. Each of Frank C. Ingriselli, the Company’s President and Chief Executive Officer, Stephen F. Groth, its Vice President and Chief Financial Officer, and Richard Grigg, the Company’s Senior Vice President and Managing Director, has the right to terminate his employment at any time without penalty under his employment agreement. The unexpected loss of the services of either Mr. Ingriselli, Mr. Groth, Mr. Grigg, or any other key employee, or the Company’s failure to find suitable replacements within a reasonable period of time thereafter, could have a material adverse effect on the Company’s ability to execute its business plan and therefore, on its financial condition and results of operations.

The Company may not be able to raise the additional capital necessary to execute its business strategy, which could result in the curtailment or cessation of the Company’s operations.

The Company will need to raise substantial additional funds to fully fund its existing operations, consummate all of its current asset transfer and acquisition opportunities currently contemplated and for the development, production, trading and expansion of its business. On December 31, 2009 (unaudited), the Company had positive working capital of approximately $3.9 million (including $3.6 million in cash and cash equivalents). Other than the financing transaction disclosed in this prospectus supplement, the Company has no current arrangements with respect to sources of additional financing and the needed additional financing may not be available on commercially reasonable terms on a timely basis, or at all. The inability to obtain additional financing, when needed, would have a negative effect on the Company, including possibly requiring it to curtail or cease operations. If any future financing involves the sale of the Company’s equity securities, the shares of Common Stock held by its stockholders could be substantially diluted. If the Company borrows money or issues debt securities, it will be subject to the risks associated with indebtedness, including the risk that interest rates may fluctuate and the possibility that it may not be able to pay principal and interest on the indebtedness when due.

Insufficient funds will prevent the Company from implementing its business plan and will require it to delay, scale back, or eliminate certain of its programs or to license to third parties rights to commercialize rights in fields that it would otherwise seek to develop itself.

Failure by the Company to generate sufficient cash flow from operations could eventually result in the cessation of the Company’s operations and require the Company to seek outside financing or discontinue operations.

The Company’s business activities require substantial capital from outside sources as well as from internally-generated sources. The Company’s ability to finance a portion of its working capital and capital expenditure requirements with cash flow from operations will be subject to a number of variables, such as:

| · | the level of production of existing wells; |

| · | prices of oil and natural gas; |

| · | the success and timing of development of proved undeveloped reserves; |

| · | remedial work to improve a well’s producing capability; |

| · | direct costs and general and administrative expenses of operations; |

| · | reserves, including a reserve for the estimated costs of eventually plugging and abandoning the wells; |

| · | indemnification obligations of the Company for losses or liabilities incurred in connection with the Company’s activities; and |

| · | general economic, financial, competitive, legislative, regulatory and other factors beyond the Company’s control. |

The Company might not generate or sustain cash flow at sufficient levels to finance its business activities. When and if the Company generates revenues, if such revenues were to decrease due to lower oil and natural gas prices, decreased production or other factors, and if the Company were unable to obtain capital through reasonable financing arrangements, such as a credit line, or otherwise, its ability to execute its business plan would be limited and it could be required to discontinue operations.

The Company’s failure to capitalize on its two existing definitive production agreements, to fully consummate the transactions contemplated by the Letter of Understanding related to its enhanced oil recovery and production opportunities and/or enter into additional agreements, would likely result in its inability to generate sufficient revenues and continue operations even if the CAMAC Transaction is consummated.

The Company’s only definitive production contracts that have been secured to date are (i) the Contract for Cooperation and Joint Development with Chifeng Zhongtong Oil and Natural Gas Co. (“Chifeng”) covering an oil field in Inner Mongolia, and (ii) the Production Sharing Contract entered into with China United Coalbed Methane Co., Ltd. (“CUCBM”) granting the Company exclusive rights to a large contract area located in the Shanxi Province of China ( the “CUCBM Contract Area”), for the exploitation of coalbed methane (“CBM”) and tight gas sand resources (the "Zijinshan PSC"). The Company has not entered into definitive agreements with respect to any other ventures that it is currently pursuing other than (i) the Letter of Understanding, dated May 13, 2009, as amended (the “LOU”), entered into with Mr. Li Xiangdong (“LXD”) and Mr. Ho Chi Kong (“HCK”), related to the Company’s current enhanced oil recovery and production (“EORP”) operations, and (ii) the proposed CAMAC Transaction. The Company’s ability to consummate the CAMAC Transaction and secure one or more additional ventures is subject to, among other things, (i) the amount of capital the Company raises in the future; (ii) the availability of land for exploration and development in the geographical regions in which the Company’s business is focused; (iii) the nature and number of competitive offers for the same projects on which the Company is bidding; and (iv) approval by government and industry officials. The Company may not be successful in executing definitive agreements in connection with any other ventures, or otherwise be able to secure any additional ventures it pursues in the future. Failure of the Company to capitalize on its existing contracts and/or to secure one or more additional business opportunities would have a material adverse effect on the Company’s business and results of operations, and could result in the cessation of the Company’s business operations, even if the CAMAC Transaction is consummated.

The Company’s oil and gas operations will involve many operating risks that can cause substantial losses.

The Company expects to produce, transport and market potentially toxic materials, and purchase, handle and dispose of other potentially toxic materials in the course of its business. The Company’s operations will produce byproducts, which may be considered pollutants. Any of these activities could result in liability, either as a result of an accidental, unlawful discharge or as a result of new findings on the effects the Company’s operations on human health or the environment. Additionally, the Company’s oil and gas operations may also involve one or more of the following risks:

| · | uncontrollable flows of oil, gas, formation water, or drilling fluids; |

| · | pipe or cement failures; |

| · | embedded oilfield drilling and service tools; |

| · | abnormally pressured formations; |

| · | damages caused by vandalism and terrorist acts; and |

| · | environmental hazards such as oil spills, natural gas leaks, pipeline ruptures and discharges of toxic gases. |

In the event that any of the foregoing events occur, the Company could incur substantial losses as a result of (i) injury or loss of life; (ii) severe damage or destruction of property, natural resources or equipment; (iii) pollution and other environmental damage; (iv) investigatory and clean-up responsibilities; (v) regulatory investigation and penalties; (vi) suspension of its operations; or (vii) repairs to resume operations. If the Company experiences any of these problems, its ability to conduct operations could be adversely affected. Additionally, offshore operations are subject to a variety of operating risks, such as capsizing, collisions and damage or loss from typhoons or other adverse weather conditions. These conditions can cause substantial damage to facilities and interrupt production.

The Company is a development-stage company and expects to continue to incur losses for a significant period of time.

The Company is a development-stage company with minimal revenues to date. As of September 30, 2009 (unaudited), the Company had an accumulated deficit of approximately $16.7 million. The Company expects to continue to incur significant expenses relating to its identification of new ventures and investment costs relating to these ventures. Additionally, fixed commitments, including salaries and fees for employees and consultants, rent and other contractual commitments may be substantial and are likely to increase as additional ventures are entered into and personnel are retained prior to the generation of significant revenue. Energy ventures, such as oil well drilling projects, generally require significant periods of time before they produce resources and in turn generate profits. The Company may not achieve or sustain profitability on a quarterly or annual basis, or at all.

The Company will be dependent upon others for the storage and transportation of oil and gas, which could result in significant operational costs to the Company and depletion of capital.

The Company does not own storage or transportation facilities and, therefore, will depend upon third parties to store and transport all of its oil and gas resources when and if produced. The Company will likely be subject to price changes and termination provisions in any contracts it may enter into with these third-party service providers. The Company may not be able to identify such third-parties for any particular project. Even if such sources are initially identified, the Company may not be able to identify alternative storage and transportation providers in the event of contract price increases or termination. In the event the Company is unable to find acceptable third-party service providers, it would be required to contract for its own storage facilities and employees to transport the Company’s resources. The Company may not have sufficient capital available to assume these obligations, and its inability to do so could result in the cessation of its business.

The Company may not be able to manage its anticipated growth, which could result in the disruption of the Company’s operations and prevent the Company from generating meaningful revenue.

Subject to its receipt of additional capital, the Company plans to significantly expand operations to accommodate additional development projects and other opportunities. This expansion will likely strain its management, operations, systems and financial resources. To manage its recent growth and any future growth of its operations and personnel, the Company must improve and effectively utilize its existing operational, management and financial systems and successfully recruit, hire, train and manage personnel and maintain close coordination among its technical, finance, development and production staffs. The Company may need to hire additional personnel in certain operational and other areas during 2010. In addition, the Company may also need to increase the capacity of its software, hardware and telecommunications systems on short notice, and will need to manage an increasing number of complex relationships with strategic partners and other third parties. The failure to manage this growth could disrupt the Company’s operations and ultimately prevent the Company from generating meaningful revenue.

An interruption in the supply of materials, resources and services the Company plans to obtain from third party sources could limit the Company’s operations and cause unprofitability.

Once it has identified, financed, and acquired projects, the Company will need to obtain other materials, resources and services, including, but not limited to, specialized chemicals and specialty muds and drilling fluids, pipe, drill-string, geological and geophysical mapping and interruption services. There may be only a limited number of manufacturers and suppliers of these materials, resources and services. These manufacturers and suppliers may experience difficulty in supplying such materials, resources and services to the Company sufficient to meet its needs or may terminate or fail to renew contracts for supplying these materials, resources or services on terms the Company finds acceptable including, without limitation, acceptable pricing terms. Any significant interruption in the supply of any of these materials, resources or services, or significant increases in the amounts the Company is required to pay for these materials, resources or services, could result in a lack of profitability, or the cessation of operations, if unable to replace any material sources in a reasonable period of time.

The Company does not have a plan to carry insurance policies in China and will be at risk of incurring personal injury claims for its employees and subcontractors, and incurring loss of business due to theft, accidents or natural disasters.

The Company does not carry, and does not plan to carry, any policies of insurance to cover any type of risk to its business in China, including, without limitation, the risks discussed above. In the event that the Company were to incur substantial liabilities with respect to one or more incidents, this could adversely affect its operations and it may not have the necessary capital to pay its portion of such costs and maintain business operations.

The Company is exposed to concentration of credit risk, which may result in losses in the future.

The Company is exposed to concentration of credit risk with respect to cash, cash equivalents, short-term investments, long-term investments, and long-term advances. At December 31, 2009 (unaudited), 65% ($1,291,455) of the Company’s total cash was on deposit at HSBC in China and Hong Kong. Also at that date (unaudited), 64% ($1,028,762) of the Company’s total cash equivalents was invested in a single money market fund in the U.S. At December 31, 2008, 78% ($975,681) of the Company’s total cash was on deposit in China at the Bank of China. Also at that date, 48.7% ($4,514,167) of the Company’s total cash equivalents was invested in a single money market fund in the U.S.

Risks Related to the CAMAC Transaction

We cannot be sure if or when the CAMAC Transaction will be completed, if at all.

The consummation of the CAMAC Transaction is subject to the satisfaction of various conditions, many of which are beyond our control, including, but not limited to, the approval of the CAMAC Transaction by the Company’s stockholders, the Company’s ability to raise the minimum $45 million in financing (the “Minimum Financing”) required on terms and conditions acceptable to the Company, and a termination right by either party if the CAMAC Transaction is not completed by March 31, 2010. The Company successfully raised approximately $20 million through the offering and issuance of 5 million shares of its Common Stock in the financing described in this prospectus supplement, in addition to warrants exercisable for an aggregate of 4 million shares of Common Stock, but there is no assurance that it will be able to raise the remaining $25 million required to meet the Minimum Financing closing condition. We cannot guarantee that we will be able to satisfy the closing conditions set forth in the Purchase Agreement. If we are unable to satisfy the closing conditions in the Purchase Agreement, CAMAC will not be obligated to complete the CAMAC Transaction and we may still incur the significant transaction costs described below.

We will incur significant costs in connection with the CAMAC Transaction, whether or not it is completed.

We currently expect to incur approximately $500,000 in costs related to the CAMAC Transaction. These expenses include, but are not limited to, financial advisory, legal and accounting fees and expenses, employee expenses, filing fees, printing expenses, proxy solicitation and other related charges. We may also incur additional unanticipated expenses in connection with the CAMAC Transaction. Approximately $400,000 of the costs related to the CAMAC Transaction, such as legal fees and due diligence fees, will be incurred regardless of whether the CAMAC Transaction is completed. The incurrence of these expenses will reduce the amount of cash available to be used for other corporate purposes, including for use in our ongoing operations.

The Purchase Agreement will expose the Company to contingent liabilities.

Under the Purchase Agreement, we have agreed to indemnify CAMAC for a number of matters including the breach of our representations, warranties and covenants contained in the Purchase Agreement, which indemnification obligations could result in significant cash payments by the Company that could materially and negatively impact its results of operations.

We may not realize the intended benefits of the CAMAC Transaction if revenues from the Oyo Field Production Sharing Contract are not as projected.

The Company conducted extensive legal, financial and technical due diligence on the Oyo Field Production Sharing Contract (“Oyo PSC”) and the Oyo Field, reviewed and analyzed the Estimate of Reserves and Future Revenue report prepared for Allied Energy Corporation by Netherland, Sewell & Associates, Inc., dated May 1, 2008 (the “NSAI Report”), and commissioned Somerley Limited to prepare a valuation of the Contract Rights based, in part, on the anticipated future revenues to be derived through its interests in the Oyo Field. If any of the assumptions underlying the Company’s valuation models, including, but not limited to, actual quantities of oil produced from the Oyo Field, projected oil prices, anticipated tax rates, and historic and future operating expenses allocable to the Oyo Field, or if the reserve information provided in the NSAI Report has changed materially since the NSAI Report’s creation in May 2008, then the Company’s interests in the Oyo Field and Oyo Field PSC may ultimately prove to be worth less than the total consideration the Company will be paying to CAMAC for the Contract Rights under the Purchase Agreement, and the Company may not realize the intended benefits of the CAMAC Transaction.

Applicable Nigerian income tax rates could adversely affect the value of the Oyo Field asset.

The Oyo Field, income derived therefrom, and CAMAC Petroleum Limited as our acquiring subsidiary in the CAMAC Transaction (“CPL”), will be subject to the jurisdiction of the Nigerian taxing authorities. The Nigerian government applies different tax rates upon income derived from Nigerian oil operations ranging from 50% to 85%, based on a number of factors. The final determination of the tax liabilities with respect to the Oyo Field involves the interpretation of local tax laws and related authorities. In addition, changes in the operating environment, including changes in tax law and currency/repatriation controls, could impact the determination of tax liabilities with respect to the Oyo Field for a tax year. While CAMAC believes the tax rate applicable to the Oyo Field and the Oyo Field PSC is 50%, the actual applicable rate could be higher, which could result in a material decrease in the profits allocable to the Company under the Oyo Field PSC.

Failure to complete the CAMAC Transaction could cause our stock price to decline.

If the CAMAC Transaction is not completed for any reason, our stock price may decline because costs related to the CAMAC Transaction, such as legal and accounting, must be paid even if the CAMAC Transaction is not completed. In addition, if the CAMAC Transaction is not completed, our stock price may decline to the extent that the current market price reflects a market assumption that the CAMAC Transaction will be completed.

The Company and CAMAC may waive one or more of the conditions to the CAMAC Transaction without re-soliciting stockholder approval for the CAMAC Transaction.

Each of the conditions to the Company’s and CAMAC’s obligations to complete the CAMAC Transaction may be waived, in whole or in part, to the extent permitted by applicable laws, by agreement of the Company and CAMAC. The Board of Directors of the Company will evaluate the materiality of any such waiver to determine whether amendment of this proxy statement and resolicitation of proxies is warranted. However, the Company generally does not expect any such waiver to be sufficiently material to warrant resolicitation of the stockholders. In the event that the Board of Directors of the Company determines any such waiver is not sufficiently material to warrant resolicitation of stockholders, the Company may determine to complete the CAMAC Transaction without seeking further stockholder approval.

The issuance of the consideration shares to CAMAC and the contemplated issuance of additional securities to satisfy the Minimum Financing closing condition may dilute our earnings per share, could lower our stock price and adversely affect our ability to raise additional capital in a subsequent financing. If we are unable to obtain additional capital in future years, we may be unable to proceed with our plans and we may be forced to curtail our operations.

We will require additional working capital to support our long-term growth strategies and we may not be able to obtain adequate levels of additional financing, whether through equity financing, debt financing or other sources. Under the terms of the Purchase Agreement, the Company is obligated to raise at least $45 million of additional equity and to consummate the Purchase Agreement, and the Company is obligated to issue shares equaling 62.74% of the Company’s issued and outstanding Common Stock, after giving effect to the CAMAC Transaction and the Minimum Financing. The Company successfully raised approximately $20 million through the offering and issuance of 5 million shares of its Common Stock in the financing described in this prospectus supplement, in addition to warrants exercisable for an aggregate of 4 million shares of Common Stock, but there is no assurance that it will be able to raise the remaining $25 million required to meet the Minimum Financing closing condition. Shares issued in connection with the Purchase Agreement and Minimum Financing combined may result in dilution to our earnings per share and could lead to the issuance of securities with rights superior to our current outstanding securities.

Following completion of the CAMAC Transaction and the Minimum Financing, any additional financing that involves the issuance of Company Common Stock or other securities that are convertible into or exercisable for the Company’s Common Stock may result in dilution to the Company’s stockholders, including CAMAC following the CAMAC Transaction. In addition, we may grant registration rights to investors purchasing our equity or debt securities in the future. If we are unable to raise additional financing, we may be unable to implement our long-term growth strategies, develop or enhance our products and services, take advantage of future opportunities or respond to competitive pressures on a timely basis, if at all. In addition, a lack of additional financing could force us to substantially curtail operations.

The passage into law of the Nigerian Petroleum Industry Bill could create additional fiscal and regulatory burdens on the parties to the Oyo Field PSC, which could have a material adverse effect on the profitability of the production.

A draft Petroleum Industry Bill (“PIB”) is currently undergoing legislative process at the Nigerian National Assembly. The draft PIB seeks to introduce significant changes to legislation governing the oil and gas sector in Nigeria, including new fiscal regulatory and tax obligations and expanded fiscal and regulatory oversight that may impose additional operational and regulatory burdens on the operating contractor under the Oyo Field PSC and impact the economic benefits anticipated by the parties to the Oyo Field PSC. Any such fiscal and regulatory changes could have a negative impact on the profits allocable to the Company under the Oyo Field PSC.

The Oyo Field is subject to the instability of the Nigerian Government.

The government of Nigeria originally granted the rights to the Oyo Field to CAMAC. The government of Nigeria has historically experienced instability, which is out of management’s control. The Company’s ability to exploit its interests in this area pursuant to the Oyo Field PSC may be adversely impacted by unanticipated governmental action. The future success of the Company’s Oyo Field interest may also be adversely affected by risks associated with international activities, including economic and labor conditions, political instability, risk of war, expropriation, repatriation, termination, renegotiation or modification of existing contracts, tax laws (including host-country import-export, excise and income taxes and United States taxes on foreign subsidiaries) and changes in the value of the U.S. dollar versus the local currencies in which future oil and gas producing activities may be denominated. Changes in exchange rates may also adversely affect the Company’s future results of operations and financial condition. Realization of any of these factors could materially and adversely affect our financial position, results of operations and cash flows.

The Oyo Field is located in an area where there are high security risks, which could result in harm to the Oyo Field operations and our interest in the Oyo Field.

The Oyo Field is located approximately 75 miles off the Southern Nigerian coast in deep-water. There are some risks inherent to oil production in Nigeria. In June 2008, Shell’s Bonga Oilfield, which is near the Oyo Field, was attacked by Nigerian militants, causing Shell to shut down the operation of the field. In June 2009, another Nigerian offshore oilfield operated by Shell, the Ofirma Field, and a flow station operated by Chevron were attacked by Nigerian Militants. Subsequently, Shell was forced to shut down some of its oil production in the region. In addition, an attack like that of September 11, 2001 or longer-lasting wars or international hostilities, including those currently in Afghanistan and Iraq could damage the world economy and adversely affect the availability of and demand for crude oil and petroleum products and negatively affect our investment and our customers’ investment decisions over an extended period of time. Despite undertaking various security measures and being situated 75 miles offshore the Nigerian coast, the Floating Production Storage and Offloading (“FPSO”) vessel currently being used for petroleum production in the Oyo Field may become subject to terrorist acts and other acts of hostility like piracy. Such actions could adversely impact our overall business, financial condition and operations. In addition, the Oyo Field’s financial viability may also be negatively affected by changing economic, political and governmental conditions in Nigeria. Moreover, we operate in a sector of the economy that is likely to be adversely impacted by the effects of political instability, terrorist or other attacks, war or international hostilities.

The FPSO vessel may be requisitioned by the Nigerian without adequate compensation.

The Nigerian government could requisition or seize the FPSO vessel. Under requisition for title, a government takes control of a vessel and becomes its owner. Under requisition for hire, a government takes control of a vessel and effectively becomes its charterer at dictated charter rates. Generally, requisitions occur during periods of war or emergency. Although we would be entitled to compensation in the event of a requisition, the amount and timing of payment would be uncertain.

Maritime disasters and other operational risks may adversely impact our reputation, financial condition and results of operations.

The operation of the FPSO vessel has an inherent risk of maritime disaster, environmental mishaps, cargo and property losses or damage and business interruptions caused by, among others:

| · | damages requiring dry-dock repairs; |

| · | adverse weather conditions; |

| · | vessel off hire periods; |

| · | political action, civil conflicts, terrorism and piracy in countries where vessel operations are conducted, vessels are registered or from which spare parts and provisions are sourced and purchased. |

Any of these circumstances could adversely affect the operation of the FPSO vessel, and result in loss of revenues or increased costs and adversely affect our profitability. Terrorist acts and regional hostilities around the world in recent years have led to increase in insurance premium rates and the implementation of special “war risk” premiums for certain areas. Such increases in insurance rates may adversely affect our profitability with respect to the Oyo Field asset.

We will depend on NAE as the operating contractor under the Oyo Field PSC, which may result in operating costs, methods and timing of operations and expenditures beyond the Company’s control, and potential delay or discontinuation of operations and production.

As operating contractor of the Oyo Field under the Oyo Field PSC, Nigerian Agip Exploration Ltd (“NAE”), a subsidiary of Italy's ENI SpA (one of the world’s largest international energy companies), will manage all of the physical development and operations with respect to the Oyo Field under the Oyo Field PSC, including, but not limited to, the timing of drilling, production and related operations, the timing and amount of operational costs, the technology and service providers employed. We would be materially adversely affected if NAE does not properly and efficiently manage operational and production matters, or becomes unable or unwilling to continue acting as the operating contractor under the Oyo Field PSC.

Stock sales following the issuance of the consideration shares to CAMAC in the CAMAC Transaction or issuance of shares to satisfy the Minimum Financing closing condition may affect the stock price of the Company’s Common Stock.

After the issuance of the consideration shares (as defined in the Purchase Agreement) to CAMAC in the CAMAC Transaction and issuance of shares to satisfy the Minimum Financing closing condition, the recipients of such shares may sell all or a substantial portion of their shares in the public market, which could result in downward pressure on the stock price of all the Company’s capital stock. Moreover, in connection with the issuance of the Consideration Shares to CAMAC, the Company will enter into a registration rights agreement with CAMAC, which agreement will provide CAMAC with rights to request that the Company file a registration statement to register the sale of Company capital stock held by CAMAC to the public, which registration could also result in downward pressure on the stock price of all the Company’s capital stock.

Following the Closing of the CAMAC Transaction, CAMAC will be our controlling stockholder, and CAMAC may take actions that conflict with the interests of the other stockholders.

Following the Closing of the CAMAC Transaction, CAMAC will beneficially own 62.74% of our outstanding shares of Common Stock. Accordingly, subject to the voting agreement described above pursuant to which CAMAC has agreed to elect or remove the three directors designated by a PAPI Representative (as defined in the Purchase Agreement) for one year following the Closing, CAMAC will control the power to elect our directors, to appoint members of management and to approve all actions requiring the approval of the holders of our Common Stock, including adopting amendments to our Certificate of Incorporation and approving mergers, acquisitions or sales of all or substantially all of our assets, subject to certain restrictive covenants. The interests of CAMAC as our controlling stockholder could conflict with your interests as a holder of Company Common Stock. For example, CAMAC as our controlling stockholder may have an interest in pursuing acquisitions, divestitures, financings or other transactions that, in its judgment, could enhance its equity investment, even though such transactions might involve risks to you, as minority holders of the Company.

A substantial or extended decline in oil and natural gas prices may adversely affect our business, financial condition or results of operations.

The price NAE as operating contractor under the Oyo Field PSC may receives for production with respect to the Oyo Field will heavily influence our revenue, profitability, access to capital and future rate of growth. Oil is a commodity and, therefore, its price is subject to wide fluctuations in response to relatively minor changes in supply and demand. Historically, the market for oil has been volatile. This market will likely continue to be volatile in the future. The prices NAE will receive for its production under the Oyo Field PSC with respect to the Oyo Field, and the levels of its production, depend on numerous factors beyond our and NAE’s control. These factors include the following:

| · | changes in global supply and demand for oil; |

| · | the actions of the Organization of Petroleum Exporting Countries; |

| · | the price and quantity of imports of foreign oil; |

| · | political and economic conditions, including embargoes, in oil producing countries or affecting other oil-producing activity; |

| · | the level of global oil exploration and production activity; |

| · | the level of global oil inventories; |

| · | technological advances affecting energy consumption; |

| · | domestic and foreign governmental regulations; |

| · | proximity and capacity of oil pipelines and other transportation facilities; and |

| · | the price and availability of alternative fuels. |

Lower oil prices may not only decrease our revenues on a per unit basis but also may reduce the amount of oil that NAE can produce economically under the Oyo Field PSC with respect to the Oyo Field. A substantial or extended decline in oil prices may materially and adversely affect our future business, financial condition, results of operations, liquidity or ability to finance planned capital expenditures.

Fluctuations in exchange rates could result in foreign currency exchange losses.

Because some or all of our revenues arising under the Oyo Field PSC may be denominated in foreign currencies, including the Nigerian Naira, European Union euro and British pound sterling, and our cash is denominated in U.S. dollars, fluctuations in the exchange rates between the U.S. dollar and foreign currencies will affect our balance sheet and earnings per share in U.S. dollars. In addition, we will report our financial results in U.S. dollars, and appreciation or depreciation in the value of such foreign currencies relative to the U.S. dollar would affect our financial results reported in U.S. dollars terms without giving effect to any underlying change in our business or results of operations. Fluctuations in the exchange rates will also affect the relative value of earnings from and the value of any U.S. dollar-denominated investments we make in the future.

Very limited hedging transactions are available in the Federal Republic of Nigeria to reduce our exposure to exchange rate fluctuations with respect to the Nigerian Naira, although there are many hedging transactions available with respect to the European Union euro and the British pound sterling. We have not entered into any hedging transactions in an effort to reduce our exposure to foreign currency exchange risk. While we may decide to enter into hedging transactions in the future, the availability and effectiveness of these hedging transactions may be limited and we may not be able to successfully hedge our subsidiaries' exposure at all. In addition, our currency exchange losses with respect to the Nigerian Naira may be magnified by Nigerian exchange control regulations that restrict our ability to convert Nigerian Naira into foreign currency.

Risks Related to the Company’s Industry

The Company may not be successful in finding petroleum resources or developing resources, and if it fails to do so, the Company will likely cease operations.

The Company will be operating primarily in the petroleum extractive business; therefore, if it is not successful in finding crude oil and natural gas sources with good prospects for future production, and exploiting such sources, its business will not be profitable and it may be forced to terminate its operations. Exploring and exploiting oil and gas or other sources of energy entails significant risks, which risks can only be partially mitigated by technology and experienced personnel. The Company or any ventures it acquires or participates in may not be successful in finding petroleum or other energy sources; or, if it is successful in doing so, the Company may not be successful in developing such resources and producing quantities that will be sufficient to permit the Company to conduct profitable operations. The Company’s future success will depend in large part on the success of its drilling programs and creating and maintaining an inventory of projects. Creating and maintaining an inventory of projects depends on many factors, including, among other things, obtaining rights to explore, develop and produce hydrocarbons in promising areas, drilling success, ability to bring long lead-time, capital intensive projects to completion on budget and schedule, and efficient and profitable operation of mature properties. The Company’s inability to successfully identify and exploit crude oil and natural gas sources would have a material adverse effect on its business and results of operations and would, in all likelihood, result in the cessation of its business operations.

In addition to the numerous operating risks described in more detail in this report, exploring and exploitation of energy sources involve the risk that no commercially productive oil or gas reservoirs will be discovered or, if discovered, that the cost or timing of drilling, completing and producing wells will not result in profitable operations. The Company’s drilling operations may be curtailed, delayed or abandoned as a result of a variety of factors, including:

| · | adverse weather conditions; |

| · | unexpected drilling conditions; |

| · | pressure or irregularities in formations; |

| · | equipment failures or accidents; |

| · | inability to comply with governmental requirements; |

| · | shortages or delays in the availability of drilling rigs and the delivery of equipment; and |

| · | shortages or unavailability of qualified labor to complete the drilling programs according to the business plan schedule. |

The energy market in which the Company operates is highly competitive and the Company may not be able to compete successfully against its current and future competitors, which could seriously harm the Company’s business.

Competition in the oil and gas industry is intense, particularly with respect to access to drilling rigs and other services, the acquisition of properties and the hiring and retention of technical personnel. The Company expects competition in the market to remain intense because of the increasing global demand for energy, and that competition will increase significantly as new companies enter the market and current competitors continue to seek new sources of energy and leverage existing sources. Recently, higher commodity prices and stiff competition for acquisitions have significantly increased the cost of available properties. Many of the Company’s competitors, including large oil companies, have an established presence in Asia and the Pacific Rim countries and have longer operating histories, significantly greater financial, technical, marketing, development, extraction and other resources and greater name recognition than the Company does. As a result, they may be able to respond more quickly to new or emerging technologies, changes in regulations affecting the industry, newly discovered resources and exploration opportunities, as well as to large swings in oil and natural gas prices. In addition, increased competition could result in lower energy prices, and reduced margins and loss of market share, any of which could harm the Company’s business. Furthermore, increased competition may harm the Company’s ability to secure ventures on terms favorable to it and may lead to higher costs and reduced profitability, which may seriously harm its business.

The Company’s business depends on the level of activity in the oil and gas industry, which is significantly affected by volatile energy prices, which volatility could adversely affect its ability to operate profitably.

The Company’s business depends on the level of activity in the oil and gas exploration, development and production in markets worldwide. Oil and gas prices, market expectations of potential changes in these prices and a variety of political and economic and weather-related factors significantly affect this level of activity. Oil and gas prices are extremely volatile and are affected by numerous factors, including:

| · | the domestic and foreign supply of oil and natural gas; |

| · | the ability of the Organization of Petroleum Exporting Countries, commonly called “OPEC,” to set and maintain production levels and pricing; |

| · | the price and availability of alternative fuels; |

| · | the level of consumer demand; |

| · | global economic conditions; |

| · | political conditions in oil and gas producing regions; and |

| · | government regulations. |

Within the past 12 months, light crude oil futures have ranged from below $35 per barrel to over $80 per barrel, and may continue to fluctuate significantly in the future. With respect to ventures in China, the prices the Company will receive for oil and gas, in connection with any of its production ventures, will likely be regulated and set by the government. As a result, these prices may be well below the market price established in world markets. Therefore, the Company may be subject to arbitrary changes in prices that may adversely affect its ability to operate profitably.

If the Company does not hedge its exposure to reductions in oil and gas prices, it may be subject to the risk of significant reductions in prices; alternatively, use by the Company of oil and gas price hedging contracts could limit future revenues from price increases.

To date, the Company has not entered into any hedging transactions but may do so in the future. In the event that the Company chooses not to hedge its exposure to reductions in oil and gas prices by purchasing futures and by using other hedging strategies, it could be subject to significant reduction in prices which could have a material negative impact on its profitability. Alternatively, the Company may elect to use hedging transactions with respect to a portion of its oil and gas production to achieve more predictable cash flow and to reduce its exposure to price fluctuations. The use of hedging transactions could limit future revenues from price increases and could also expose the Company to adverse changes in basis risk, the relationship between the price of the specific oil or gas being hedged and the price of the commodity underlying the futures contracts or other instruments used in the hedging transaction. Hedging transactions also involve the risk that the counterparty does not satisfy its obligations.

The Company may be required to take non-cash asset write-downs if oil and natural gas prices decline, which could have a negative impact on the Company’s earnings.

Under applicable accounting rules, the Company may be required to write down the carrying value of oil and natural gas properties if oil and natural gas prices decline or if there are substantial downward adjustments to its estimated proved reserves, increases in its estimates of development costs or deterioration in its exploration results. Accounting standards require the Company to review its long-lived assets for possible impairment whenever changes in circumstances indicate that the carrying amount of an asset may not be fully recoverable over time. In such cases, if the asset’s estimated undiscounted future cash flows are less than its carrying amount, impairment exists. Any impairment write-down, which would equal the excess of the carrying amount of the assets being written down over their fair value, would have a negative impact on the Company’s earnings, which could be material.

Risks Related to Chinese and Other International Operations

The Company’s Chinese and other international operations will subject it to certain risks inherent in conducting business operations in China and other foreign countries, including political instability and foreign government regulation, which could significantly impact the Company’s ability to operate in such countries and impact the Company’s results of operations.

The Company conducts substantially all of its business in China. The Company’s Chinese operations and anticipated operations in other foreign countries are, and will be, subject to risks generally associated with conducting businesses in foreign countries, such as:

| · | foreign laws and regulations that may be materially different from those of the United States; |

| · | changes in applicable laws and regulations; |

| · | challenges to, or failure of, title; |

| · | labor and political unrest; |

| · | foreign currency fluctuations; |

| · | changes in foreign economic and political conditions; |

| · | export and import restrictions; |

| · | tariffs, customs, duties and other trade barriers; |

| · | difficulties in staffing and managing foreign operations; |

| · | longer time periods in collecting revenues; |

| · | difficulties in collecting accounts receivable and enforcing agreements; |

| · | possible loss of properties due to nationalization or expropriation; and |

| · | limitations on repatriation of income or capital. |

Specifically, foreign governments may enact and enforce laws and regulations requiring increased ownership by businesses and/or state agencies in energy producing businesses and the facilities used by these businesses, which could adversely affect the Company’s ownership interests in then existing ventures. The Company’s ownership structure may not be adequate to accomplish the Company’s business objectives in China or in any other foreign jurisdiction where the Company may operate. Foreign governments also may impose additional taxes and/or royalties on the Company’s business, which would adversely affect the Company’s profitability. In certain locations, governments have imposed restrictions, controls and taxes, and in others, political conditions have existed that may threaten the safety of employees and the Company’s continued presence in those countries. Internal unrest, acts of violence or strained relations between a foreign government and the Company or other governments may adversely affect its operations. These developments may, at times, significantly affect the Company’s results of operations, and must be carefully considered by its management when evaluating the level of current and future activity in such countries.

Compliance and enforcement of environmental laws and regulations, including those related to climate change, may cause the Company to incur significant expenditures and require resources, which it may not have.

Extensive national, regional and local environmental laws and regulations in China and other Pacific Rim countries are expected to have a significant impact on the Company’s operations. These laws and regulations set various standards regulating certain aspects of health and environmental quality, which provide for user fees, penalties and other liabilities for the violation of these standards. As new environmental laws and regulations are enacted and existing laws are repealed, interpretation, application and enforcement of the laws may become inconsistent. Compliance with applicable local laws in the future could require significant expenditures, which may adversely affect the Company’s operations. The enactment of any such laws, rules or regulations in the future may have a negative impact on the Company’s projected growth, which could in turn decrease its projected revenues or increase its cost of doing business.

A foreign government could change its policies toward private enterprise or even nationalize or expropriate private enterprises, which could result in the total loss of the Company’s investment in that country.

The Company’s business is subject to significant political and economic uncertainties and may be adversely affected by political, economic and social developments in China or in any other foreign jurisdiction in which it operates. Over the past several years, the Chinese government has pursued economic reform policies including the encouragement of private economic activity, foreign investment and greater economic decentralization. The Chinese government may not continue to pursue these policies or may significantly alter them to the Company’s detriment from time to time with little, if any, prior notice.

Changes in policies, laws and regulations or in their interpretation or the imposition of confiscatory taxation, restrictions on currency conversion, restrictions or prohibitions on dividend payments to stockholders, devaluations of currency or the nationalization or other expropriation of private enterprises could have a material adverse effect on the Company’s business. Nationalization or expropriation could even result in the loss of all or substantially all of the Company’s assets and in the total loss of your investment in the Company.

Because the Company plans to conduct substantial business in China, fluctuations in exchange rates and restrictions on currency conversions could adversely affect the Company’s results of operations and financial condition.

The Company expects that it will conduct substantial business in China, and its financial performance and condition there will be measured in terms of the RMB. It is difficult to assess whether a devaluation or revaluation (upwards valuation) of the RMB against the U.S. dollar would have an adverse effect on the Company’s financial performance and asset values when measured in terms of U.S. dollars. An increase in the RMB would raise the Company’s costs incurred in RMB; however, it is not clear whether the underlying cause of the revaluation would also cause an increase in the Company’s price received for oil or gas which would have the opposite effect of increasing the Company’s margins and improving its financial performance.

The Company’s financial condition could also be adversely affected as a result of its inability to obtain the governmental approvals necessary for the conversion of RMB into U.S. dollars in certain transactions of capital, such as direct capital investments in Chinese companies by foreign investors.

Currently, there are few means and/or financial tools available in the open market for the Company to hedge its exchange risk against any possible revaluation or devaluation of RMB. Because the Company does not currently intend to engage in hedging activities to protect against foreign currency risks, future movements in the exchange rate of the RMB could have an adverse effect on its results of operations and financial condition.

If relations between the United States and China were to deteriorate, investors might be unwilling to hold or buy the Company’s stock and its stock price may decrease.

At various times during recent years, the United States and China have had significant disagreements over political, economic and security issues. Additional controversies may arise in the future between these two countries. Any political or trade controversies between these two countries, whether or not directly related to the Company’s business, could adversely affect the market price of the Company’s Common Stock.

If the United States imposes trade sanctions on China due to its current currency policies, the Company’s operations could be materially and adversely affected.

Trade groups in the United States have blamed the cheap value of the Chinese currency for causing job losses in American factories, giving exporters an unfair advantage and making its imports expensive. Congress from time to time has been considering the enactment of legislation with the view of imposing new tariffs on Chinese imports. In 2005, the People’s Bank of China decided to strengthen the exchange rate of the Chinese currency to the U.S. dollar, revaluing the Chinese currency by 2.1% and introducing a “managed floating exchange rate regime.” Since that time, the exchange rate of the Chinese currency has been allowed to float against a basket of currencies.

If Congress deems that China is still gaining a trade advantage from its exchange currency policy and an additional tariff is imposed, it is possible that China-based companies will no longer maintain significant price advantages over U.S. and other foreign companies on their goods and services, and the rapid growth of China’s economy would slow as a result. If the United States or other countries enact laws to penalize China for its currency policies, the Company’s business could be materially and adversely affected.

A lack of adequate remedies and impartiality under the Chinese legal system may adversely impact the Company’s ability to do business and to enforce the agreements to which it is a party.

The Company anticipates that it will be entering into numerous agreements governed by Chinese law. The Company’s business would be materially and adversely affected if these agreements were not enforced. In the event of a dispute, enforcement of these agreements in China could be extremely difficult. Unlike the United States, China has a civil law system based on written statutes in which judicial decisions have little precedential value. The government’s experience in implementing, interpreting and enforcing certain recently enacted laws and regulations is limited, and the Company’s ability to enforce commercial claims or to resolve commercial disputes is uncertain. Furthermore, enforcement of the laws and regulations may be subject to the exercise of considerable discretion by agencies of the Chinese government, and forces unrelated to the legal merits of a particular matter or dispute may influence their determination. These uncertainties could limit the protections that are available to the Company.

The Company’s stockholders may not be able to enforce United States civil liabilities claims.