Houston Headquarters

1330 Post Oak Blvd, Suite 2250, Houston, TX 77056

Tel: 713-797-2940 Fax: 713-797-2990

April 4, 2013

VIA EDGAR CORRESPONDENCE

Mr. Brad Skinner

Senior Assistant Chief Accountant

United States Securities and Exchange Commission

Division of Corporation Finance

101 F Street N.E.

Washington, D.C. 20549

Re: CAMAC Energy, Inc.

Form 10-K for Fiscal Year Ended December 31, 2011

Filed March 15, 2012

Definitive Proxy Statement on Schedule 14A

Filed April 30, 2012

Dear Mr. Skinner:

We have received your letter dated April 3, 2013 (the “Comment Letter”), addressed to Dr. Kase Lukman Lawal, Chief Executive Officer of CAMAC Energy, Inc. (the “Company”), pursuant to which you provided comments from the staff (the “Staff”) of the United States Securities and Exchange Commission (“SEC”) pertaining to our Annual Report on Form 10-K for the fiscal year ended December 31, 2011 (File No. 1-34525) filed with the SEC on March 15, 2012 (“Form 10-K”) and our Definitive Proxy Statement on Schedule 14A (File No. 1-34525) filed with the SEC on April 30, 2012 (the “Proxy Statement”).

We have set forth below the responses of the Company to the Staff’s comments dated April 3, 2013. For your convenience, the comments contained in your Comment Letter are set forth below verbatim in italicized text.

Form 10-K for Fiscal Year Ended December 31, 2011

Financial Statements

Note 3: Significant Accounting Policies, page 66

Impairment of Long-Lived Assets, page 67

| | 1. | Please describe for us the methodology, data and analysis used to determine the year end 2012 and 2011 estimated quantities of proved, probable and possible reserves and the risk factors of 81% and 53% and 45% and 28%, respectively, related to probable and possible reserves for each year end. |

Response:

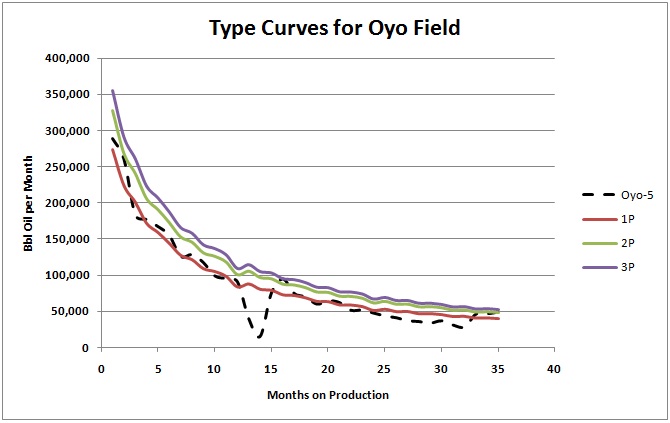

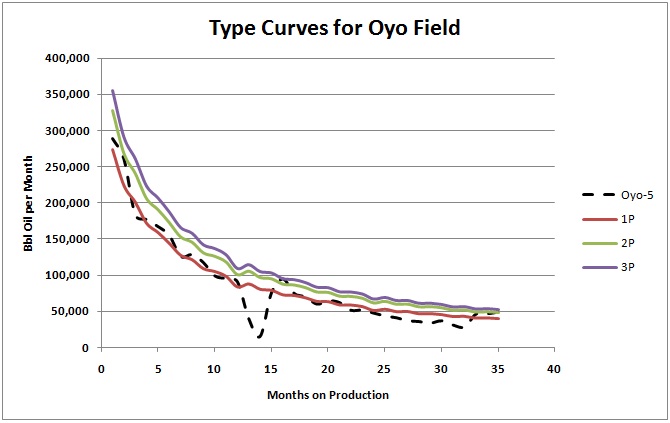

The methodologies used to determine the proved, probable and possible reserves for year-end 2011 and 2012 were different. For 2011, the previous independent reserves evaluator had used a combination of methodologies, consisting of DCA type curve, application of reservoir simulation and volumetric approach (recovery factors) (see Exhibit A). However in 2012, the new independent reserves evaluator used only DCA type curve approach for the reserves evaluation. A set of type curves were generated from an existing producing well to create 1P, 2P and 3P profiles (see Exhibit B). These type curves were applied to both an existing and planned wells.

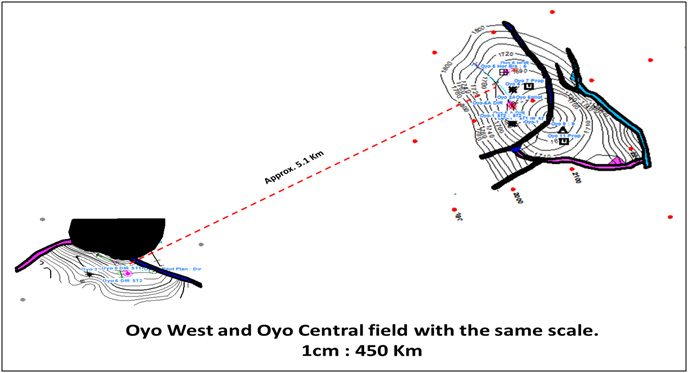

The T1A reservoir has both the Central (east and west fault blocks) and the West culminations. Oyo-5 is producing from the western fault block of the central culmination while the only other producing well, Oyo-6 is completed on the western culmination. Both wells are producing from T1A reservoir. In the Central culmination, a minor fault separates the reservoir into east and west fault block (see Exhibit C).

In the T1B reservoir, six meters of oil were penetrated in Oyo-1 well, but PVT data indicate the reservoir to be under-saturated.

Year-end 2011 and 2012 risk factors varied as a result of the change in reserve evaluation methodology. The approach taken in assessing the risk factors was to identify the type of risks associated with each evaluation method. In doing this, a team of geoscientists and engineers were assembled in risking sessions to estimate the appropriate risks factors for both 2011 and 2012 reserves estimates.

Year end 2012 risk factors of 81% for Probable reserves and 53% for Possible reserves were derived using two risk elements: risk associated with the in-place volume calculation and risk associated with achieving the expected production well performance. The in-place volume risk relates to uncertainty in rock and fluid parameters while the well performance risk relates principally to the ability of future wells to achieve the expected production performance. In the Possible category, as there are no penetrations east of the fault, the in-place volume risk is deemed to be much higher.

Details of these risk factors as estimated are presented in Exhibit D.

For year-end 2011, due to the different methodology used by the reserves estimator, five risk elements were considered for Probable and Possible reserves. These are, risk associated with expected well performance, risk associated with in-place volume calculation, risk associated with reservoir simulation results, risk associated with finding estimated T1B volumes, and risk associated with the recovery factors applied in the 3P case.

Three risk elements were used for the Probable (P2) category: well performance risk, reservoir simulation results risk, finding estimated T1B volumes risk. The following three risk elements were used for the Possible (P3) category: finding estimated T1B volumes risk, in-place volume calculation, and recovery factor risk.

The calculation and resulting composite risk factors are presented in Exhibit E.

2. | Please provide us a reasonably detailed summary of the cash flow recoverability analyses related to the year ended 2012. The summary should clearly indicate how estimated revenues have been determined and how variable and fixed costs have been taken into consideration. |

Response:

The cash flow recoverability analysis for 2012 was derived from the Oyo Field economic model used by Gaffney Cline & Associates (“GCA”) to calculate its estimate of the Company’s Net Cash Flows from 3P (Proved + Probable + Possible) Reserves as of December 31, 2012 (see Exhibit F). The Company applied internally generated risk factors to the gross reserve volumes estimated by GCA as follows: 100% to Gross Proved Reserves (1P), 81% to Gross Probable Reserves (P2), and 53% to Gross Possible Reserves (P3) (see Exhibit G). These risk factors reflect the Company’s internal technical analysis of the recoverability risk associated with each category of reserve volumes. The details of this risking analysis are explained in our response to the Staff’s comment 1 above.

The Risked Gross 3P Reserve volumes are then flowed through GCA’s Oyo Field economic model to calculate the Risked 3P Reserve volumes net to the Company (see Exhibit H). The Risked 3P Reserve volumes net to the Company are used to calculate expected net cash flows using the same price, tax, net capital investment, and net operating expense assumptions as used in GCA’s calculation. The net capital investment and net operating expenses are not assumed to be a variable of reserve volumes due to the fixed nature of offshore oil and gas operating costs. The Company excluded resulting negative net cash flows from fiscal years 2023 and 2024 from its total net cash flows, under the assumption that it would discontinue operations rather than produce in those years. Negative net cash flows from fiscal year 2022 are included however, since those net cash flows include the Company’s share of abandonment costs which are assumed to be paid in the final year of producing operations.

| 3. | Please tell us why the risk factors in your 2012 recoverability analysis have been revised upward, as compared to those used for 2011, representing greater certainty of attaining the estimated volumes. |

Response:

The risk factors in the 2012 recoverability analysis have been revised upward to reflect the difference in the reserve evaluation methodology that was used in 2012 compared to 2011.

The 2012 approach does represent a higher degree of certainty, and is supported by the 2013 production performance - since the beginning of 2013, the actual monthly production performance have exceeded the 2P type curve predicted production (see Exhibit I).

| 4. | Please tell us why the risk factors of 45% for probable and 28% for possible are more appropriate than the 50% and 10% factors used in your prior recoverability analysis for 2011. |

Response:

The 45% for probable and 28% for possible are consistent with the more rigorous approach we adopted in 2012.

| 5. | We note you state the independent reserves evaluator based the type curves for all the planned future wells on the decline curve from an existing well. Furthermore, you state that you believe the existing well on which the type curves were based is not representative of future wells because the well was damaged from the start due to operational issues. |

| | ● | Please clarify if the subject decline type curve was the basis of the reserve estimates as of December 31, 2011 or December 31, 2012. |

Response:

The decline type curve shown in Exhibit B was the basis of the reserves estimates for December 31, 2012 for both existing and planned new wells for all categories of reserves. The independent reserves evaluator used the actual performance from Oyo-5 to generate 1P, 2P and 3P type curves. A similar approach was used to generate type curves for Oyo-6. For December 31, 2011, a combination of methodologies, consisting of decline curve, simulation and volumetric approach was used. The methodology for each well used for 2011 and 2012 are set forth in Exhibit A.

| | ● | Please provide the technical data and analysis that supports that the subject well was damaged. |

Response:

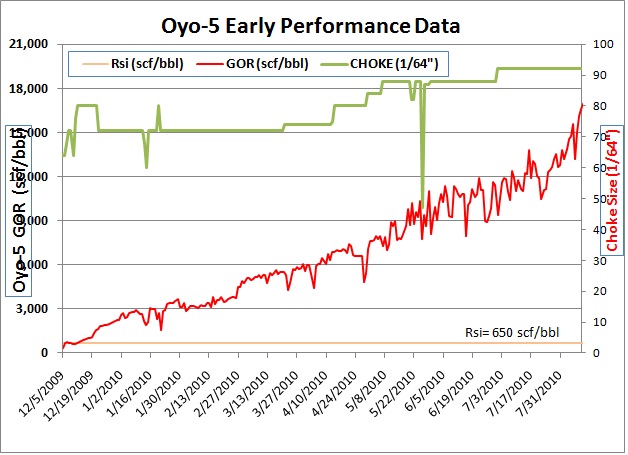

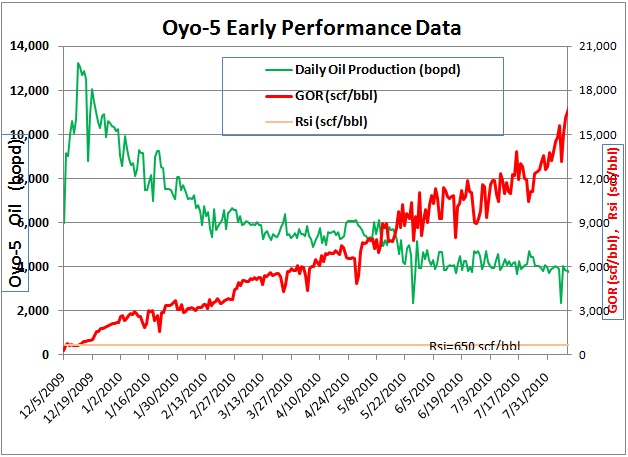

Well-5, on which the type curves were based, is completed horizontally and produces in the middle of a 40 meter oil column in a saturated reservoir. The initial solution GOR based on PVT analysis is 650 scf/bbl. This well started producing at about solution GOR and within a few days the producing GOR rapidly increased and far exceeded 10,000 scf/bbl. The high GOR is believed to be a result of poor cement bond at the 9 5/8” casing shoe, excessive initial production rate and aggressive bean up during well clean-up/production which resulted in gas cusping. The two charts in Exhibit J show the increasing GOR from start of production (12/05/09) and the choke trends for Oyo-5.

| | ● | Please tell us why the subject well’s performance will not be representative of future wells and why. |

Response:

In the planning for the future wells, actions will be taken to ensure that early breakthrough is prevented. Such measures include rotation of the casing prior to cementing, use of gas-block cement slurry and more gentle bean up, all of which were absent in Oyo-5. In addition, while Oyo-5 was produced at maximum rate in excess of 13,000 bopd, the new wells are planned to be produced at maximum 7,000 bopd. Well clean-up will also be based on less aggressive choke operation.

In Connection with its response, CAMAC Energy Inc. acknowledges that:

| | ● | CAMAC Energy Inc. is responsible for the adequacy and accuracy of the disclosures in the filings; |

| | ● | Staff comments or changes to disclosure in response to Staff comments do not foreclose the Commission from taking any action with respect to the filings; and |

| | ● | CAMAC Energy Inc. may not assert Staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

If you have any questions or comments regarding this letter, please contact the undersigned at 713 797 2940.

| | Very truly yours | |

| | | |

| | CAMAC Energy Inc. | |

| | | | |

| | By: | /s/ Earl W. McNiel | |

| | | Earl W. McNiel | |

| | | Senior Vice President & Chief Financial Officer | |

| | | | |

| Year | Reserves Category | Reservoirs | Fault Block | Wells | Methodology | Remarks | |

2011 | PDP | T1A Central | West | Oyo-5H | DCA | Based on Oyo-5 DCA | |

| T1A West | | Oyo-6H | DCA | Based on Oyo-6 DCA | |

| PUD | T1A Central | West | Oyo7V, 8V & 9H | Simulation | History matched for well-5 and generated production rates for the PUD wells | |

| Probable | T1A Central | West | Oyo-5H, 7V, 8 V& 9H | Simulation | History matched for well-5 and made more slightly optimistic assumption for well initial rate | |

| T1B Central | | Oyo-7V & Oyo8V | Estimation | Using new wells in L1A central as analogue | |

| T1A West | | Oyo-6H | DCA | Based on Oyo-6 DCA | |

| Possible | T1A Central | West | Oyo-5H, 7V, 8 V& 9H | Volumetric | Assumed 35% recovery for L1A Central and T1B reservoirs and 26% for the L1A west reservoir | |

| T1A Central | East | Oyo-10H, 11H & 12H | |

| T1B Central | | Oyo-7V & Oyo8V | |

| T1A West | | Oyo-6H | |

| | | | | | | | |

| 2012 | PDP | T1A Central | West | Oyo-5H | DCA | Based on Oyo-5 DCA | |

| | T1A West | | Oyo-6H | DCA | Based on Oyo-6 DCA | |

| PUD | T1A Central | West | Oyo7H, 8H & 9H | DCA | Used well-5 1P DCA type curve | |

| Probable | T1A Central | West | Oyo 5H,7H, 8H & 9H | DCA | Used well-5 2P DCA type curve | |

| | T1A West | | Oyo-6H | DCA | Based on Oyo-6 DCA | |

| Possible | T1A Central | West | Oyo 5H,7H, 8H & 9H | DCA | Used well-5 3P DCA type curve | |

| | T1A Central | East | Oyo-10H, 11H & 12H | DCA | Used well-5 3P DCA type curve | |

| | T1A West | | Oyo-6H | DCA | Based on Oyo-6 DCA | |

****** H – horizontal well and V- Vertical Well

Exhibit B

Exhibit D

YE 2012 P2 and P3 Risk Factors

| | | P2 | | | P3 | | | |

| | | (probable) | | | (possible) | | | |

| | | 3.5 mmbo* | | | 16.8 mmbo* | | | |

| | | | | | | | | | | |

| Risk elements | | Risk Factors | | Comments |

| | | | | | | | | | | |

| 1. In -place volume | | | 0.95 | | | | 0.72 | | P2 (0.95): risk factor accounts for uncertainty in rock and fluid input parameters |

| | | | | | | | | | P3 (0.72): volumes lie east of the fault where no wells have been drilled; |

| | | | | | | | | | - principal risk is geologic |

| | | | | | | | | | - geologic risking: seal = 1, trap = 1, charge = 0.9, reservoir quality

& presence = 0.8 |

| | | | | | | | | | - carries higher in-place volume risk |

| 2. Expected Well performance | | | 0.85 | | | | 0.74 | | P2 (0.85) rationale/considerations: |

| | | | | | | | | | | 1. Oyo -5 type well was sub-optimally completed and produced, |

| | | | | | | | | | | hence performance of future wells should be better |

| | | | | | | | | | | 2. Risked volume is small (3.5 mmbo) |

| | | | | | | | | | P3 (0.74) rationale: uncertainty in reservoir quality across the fault, hence performance |

| | | | | | | | | | | |

| Composite Risk Factor | | | 0.81 | | | | 0.53 | | Assumes equal weighting of both risk elements |

Only TIA included in YE 2012 assessment (both TIA and TIB were included in 2011).

Exhibit E

YE 2011 P2 and P3 Risk Factors

| | | (Probable) | | | (Possible) | |

| | | | | | | |

| Well 5 | | 0.2 | | | n/a | |

| Well 6 | | 0.2 | | | n/a | |

| Well 7 | | 7.9 | | | n/a | |

| Well 8 | | 7.9 | | | n/a | |

| Well 9 | | 3.4 | | | n/a | |

| TOTAL | | 19.7 mmbo | | | 41.4 mmbo | |

| | | P2 | | | P3 | | |

| | | (Probable) | | | (Possible) | | Comments |

| | | | | | | | |

| 1. DCA | | 0.85 | | | n/a | | P2 DCA as in 2012 |

| | | | | | | | |

| 2. Confidence in simulation | | 0.7 | | | n/a | | |

| | | | | | | | |

| 2. Confidence in T1B volumes | | 0.2 | | | 0.2 | | Uncertainty in GRV relating to mapping uncertainty |

| | | | | | | | |

| 3. STOOIP Volume | | n/a | | | 0.72 | | STOOIP risking: seal = 1, trap = 1, charge = 0.9, reservoir quality & presence = 0.8 |

| | | | | | | | |

| 4. Recovey Factor | | n/a | | | 0.45 | | Low probability that the simulated EUR/well (10 mmbo) will be achieved |

| | | | | | | | when compared with the Oyo-7 4.5 mmbo EUR expectation |

| | | | | | | | |

P2 Composite Risk Factor calculation

| | | | | | | | | | |

| | | | | | | | | | |

| | | Unrisked Volume | | | | | | Risked volume | |

| | | (mmbo) | | | Risk | | | (mmbo) | |

| | | | | | | | | | |

| T1A wells 5,6 | | | 0.4 | | | | 0.85 | | | | 0.34 | |

| T1A wells 7,8,9 | | | 9.2 | | | | 0.7 | | | | 6.44 | |

| T1B wells 7 & 8 | | | 10 | | | | 0.2 | | | | 2 | |

| | | | | | | | | | | | | |

| Total risked volume | | | | | | | | | | | 8.78 | |

| Total unrisked volume | | | | | | | | | | | 19.7 | |

| | | | | | | | | | | | | |

| Composite Risk Factor (total risked volume/total unrisked volume) | | 0.45 | |

P3 Composite Risk Factor calculation

| | | Unrisked Volume | | | | | | Risked volume | |

| | | (mmbo) | | | Risk | | | (mmbo) | |

| | | | | | | | | | |

| T1A wells 10,11,12 | | | 29 | | | | 0.45 | | | | 13.05 | |

| T1A wells 5,6,7,8,9 | | | 2.4 | | | | 0.45 | | | | 1.08 | |

| T1B wells 7 & 8 | | | 10 | | | | 0.2 | | | | 2 | |

| | | | | | | | | | | | | |

| Total risked volume | | | | | | | | | | | 16.13 | |

| Total unrisked volume | | | | | | | | | | | 41.4 | |

| | | | | | | | | | | | | |

| Recovery risk factor (total risked volume/total unrisked volume) | | | | 0.39 | |

| STOOIP risk factor | | | | 0.72 | |

| Composite Risk Factor | | | | 0.28 | |

Exhibit F

| SUMMARY PROJECTION OF RESERVES AND REVENUECAMAC ENERGY INC. INTERESTOYO FIELD, OIL MINING LEASE 120, OFFSHORE NIGERIAAS OF DECEMBER 31, 2012 PROVED (1P) RESERVES |

| | |

| | | | | | | | | | | | | | | Net | | | Net | | | | | | | |

| | | Oil Reserves | | | Gross | | | | | | Capital | | | Operating | | | Net | | | Cumulative PWAT | |

| Period | | Gross | | | Net | | | Revenue | | | Taxes | | | Investment | | | Expense | | | Cash Flow | | | | 10.0% | |

| Ending | | (MBBL) | | | (MBBL) | | | $(M) | | | $(M) | | | $(M) | | | $(M) | | | $(M) | | | $(M) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 12/31/2013 | | | 1,544.2 | | | | 111.1 | | | | 12,531.8 | | | | 267.7 | | | | 0.0 | | | | 0.0 | | | | 12,264.1 | | | | 11,693.3 | |

| 12/31/2014 | | | 3,497.9 | | | | 771.4 | | | | 86,985.2 | | | | 4,044.6 | | | | 58,500.0 | | | | 26,557.7 | | | | - 2,117.1 | | | | 9,858.2 | |

| 12/31/2015 | | | 3,841.2 | | | | 585.8 | | | | 66,060.4 | | | | 7,906.1 | | | | 0.0 | | | | 26,737.4 | | | | 31,416.9 | | | | 34,614.3 | |

| 12/31/2016 | | | 2,224.0 | | | | 418.8 | | | | 47,226.2 | | | | 3,718.9 | | | | 0.0 | | | | 25,890.8 | | | | 17,616.4 | | | | 47,233.8 | |

| 12/31/2017 | | | 1,624.4 | | | | 359.7 | | | | 40,559.6 | | | | 2,114.8 | | | | 300.0 | | | | 25,577.0 | | | | 12,567.9 | | | | 55,418.4 | |

| 12/31/2018 | | | 1,286.6 | | | | 322.6 | | | | 36,379.9 | | | | 1,234.8 | | | | 0.0 | | | | 25,400.1 | | | | 9,744.9 | | | | 61,187.6 | |

| 12/31/2019 | | | 1,045.4 | | | | 290.6 | | | | 32,766.5 | | | | 568.5 | | | | 0.0 | | | | 25,273.9 | | | | 6,924.2 | | | | 64,914.2 | |

| 12/31/2020 | | | 856.0 | | | | 238.0 | | | | 26,835.5 | | | | 30.6 | | | | 0.0 | | | | 25,174.7 | | | | 1,630.1 | | | | 65,711.8 | |

| 12/31/2021 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 12/31/2022 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 12/31/2023 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 12/31/2024 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total | | | 15,919.7 | | | | 3,097.9 | | | | 349,345.0 | | | | 19,886.0 | | | | 58,800.0 | | | | 180,611.7 | | | | 90,047.3 | | | | 65,711.8 | |

PROBABLE UNDEVELOPED RESERVES (P2)

| | | | | | | | | Future | | | | | | Net | | | Net | | | Future | | | Cumulative | |

| | | Oil Reserves | | | Gross | | | | | | Capital | | | Operating | | | Net | | | PW at | |

| Period | | Gross | | | Net | | | Revenue | | | Taxes | | | Costs | | | Expense | | | Revenue | | | | 10.0% | |

| Ending | | (MBBL) | | | (MBBL) | | | $(M) | | | $(M) | | | $(M) | | | $(M) | | | $(M) | | | $(M) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 12/31/2013 | | | 166.3 | | | | 15.2 | | | | 1,709.6 | | | | 411.5 | | | | 0.0 | | | | 0.0 | | | | 1,298.1 | | | | 1,237.7 | |

| 12/31/2014 | | | 605.2 | | | | 61.4 | | | | 6,924.3 | | | | 1,589.2 | | | | 0.0 | | | | - 56.7 | | | | 5,391.7 | | | | 5,911.1 | |

| 12/31/2015 | | | 700.5 | | | | 68.1 | | | | 7,674.8 | | | | 1,885.2 | | | | 0.0 | | | | - 46.7 | | | | 5,836.2 | | | | 10,510.0 | |

| 12/31/2016 | | | 393.4 | | | | 40.0 | | | | 4,513.1 | | | | 1,082.9 | | | | 0.0 | | | | - 32.3 | | | | 3,462.5 | | | | 12,990.4 | |

| 12/31/2017 | | | 284.7 | | | | 29.4 | | | | 3,319.4 | | | | 799.2 | | | | 0.0 | | | | - 24.8 | | | | 2,545.0 | | | | 14,647.8 | |

| 12/31/2018 | | | 224.6 | | | | 202.9 | | | | 22,879.5 | | | | 641.7 | | | | 0.0 | | | | - 20.0 | | | | 22,257.8 | | | | 27,824.9 | |

| 12/31/2019 | | | 181.7 | | | | 58.0 | | | | 6,538.3 | | | | 527.2 | | | | 0.0 | | | | - 16.6 | | | | 6,027.6 | | | | 95,983.2 | |

| 12/31/2020 | | | 148.0 | | | | 41.9 | | | | 4,727.6 | | | | 435.5 | | | | 0.0 | | | | - 13.9 | | | | 4,306.0 | | | | 33,175.8 | |

| 12/31/2021 | | | 120.1 | | | | 33.5 | | | | 3,775.8 | | | | 0.0 | | | | 0.0 | | | | - 11.7 | | | | 3,787.6 | | | | 34,860.5 | |

| 12/31/2022 | | | 98.1 | | | | 27.4 | | | | 3,092.1 | | | | 0.0 | | | | 0.0 | | | | 291.3 | | | | 2,800.8 | | | | 35,993.1 | |

| 12/31/2023 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 12/31/2024 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total | | | 2,824.5 | | | | 550.3 | | | | 62,062.4 | | | | 7,372.5 | | | | 0.0 | | | | - 222.6 | | | | 54,912.5 | | | | 34,860.5 | |

POSSIBLE UNDEVELOPED RESERVES (P3)

| | | | | | | | | Future | | | | | | Net | | | Net | | | Future | | | Cumulative | |

| | | Oil Reserves | | | Gross | | | | | | Capital | | | Operating | | | Net | | | PW at | |

| Period | | Gross | | | Net | | | Revenue | | | Taxes | | | Costs | | | Expense | | | Revenue | | | | 10.0% | |

| Ending | | (MBBL) | | | (MBBL) | | | $(M) | | | $(M) | | | $(M) | | | $(M) | | | $(M) | | | $(M) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 12/31/2013 | | | 86.4 | | | | 8.0 | | | | 904.2 | | | | 223.9 | | | | 0.0 | | | | 0.0 | | | | 680.3 | | | | 648.6 | |

| 12/31/2014 | | | 308.7 | | | | 27.9 | | | | 3,142.1 | | | | 836.8 | | | | 0.0 | | | | - 350.6 | | | | 2,655.9 | | | | 2,950.7 | |

| 12/31/2015 | | | 357.2 | | | | 171.5 | | | | 19,343.4 | | | | - 246.4 | | | | 27,900.0 | | | | - 383.1 | | | | - 7,927.1 | | | | - 3,295.8 | |

| 12/31/2016 | | | 2,025.4 | | | | 373.6 | | | | 42,129.6 | | | | 4,340.3 | | | | 27,900.0 | | | | 366.5 | | | | 9,522.9 | | | | 3,525.9 | |

| 12/31/2017 | | | 2,783.3 | | | | 489.1 | | | | 55,154.8 | | | | 6,590.1 | | | | 27,600.0 | | | | 688.8 | | | | 20,275.9 | | | | 16,730.2 | |

| 12/31/2018 | | | 3,288.8 | | | | 1,186.9 | | | | 133,847.9 | | | | 9,593.1 | | | | 0.0 | | | | 895.6 | | | | 123,359.2 | | | | 89,761.9 | |

| 12/31/2019 | | | 1,847.7 | | | | 625.3 | | | | 70,511.2 | | | | 5,463.9 | | | | 0.0 | | | | 461.6 | | | | 64,585.7 | | | | 124,522.3 | |

| 12/31/2020 | | | 1,338.4 | | | | 453.6 | | | | 82,710.3 | | | | 4,463.8 | | | | 0.0 | | | | 25,482.6 | | | | 52,764.0 | | | | 246,321.7 | |

| 12/31/2021 | | | 1,043.7 | | | | 345.6 | | | | 64,740.8 | | | | 3,074.2 | | | | 0.0 | | | | 25,328.0 | | | | 36,338.7 | | | | 262,485.1 | |

| 12/31/2022 | | | 834.4 | | | | 265.8 | | | | 51,201.5 | | | | 6,810.8 | | | | 0.0 | | | | 25,213.2 | | | | 19,177.4 | | | | 270,239.7 | |

| 12/31/2023 | | | 1,223.8 | | | | 362.0 | | | | 40,821.0 | | | | 7,842.2 | | | | 0.0 | | | | 25,121.6 | | | | 7,857.2 | | | | 278,096.9 | |

| 12/31/2024 | | | 997.9 | | | | 289.0 | | | | 32,591.4 | | | | 3,258.5 | | | | 0.0 | | | | 25,048.7 | | | | 4,284.3 | | | | 282,381.2 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total | | | 13,914.0 | | | | 3,947.2 | | | | 523,685.9 | | | | 41,150.5 | | | | 83,400.0 | | | | 77,702.5 | | | | 321,432.8 | | | | 183,188.9 | |

| PRELIMINARY ESTIMATES | BASED ON SEC PRICE AND COST PARAMETERS |

KBbls

| | | | 2013 | | | 2014 | | | 2015 | | | 2016 | | | 2017 | | | 2018 | | | 2019 | | | 2020 | | | 2021 | | | 2022 | | | 2023 | | | 2024 | | | Total | |

| PDP | | | | 752.1 | | | | 548.0 | | | | 428.2 | | | | 350.5 | | | | 294.1 | | | | 253.0 | | | | 220.6 | | | | 194.5 | | | | 171.8 | | | | 153.2 | | | | 137.4 | | | | 124.3 | | | | |

| PUD | | | | 792.1 | | | | 2,949.9 | | | | 3,413.0 | | | | 1,873.5 | | | | 1,330.3 | | | | 1,033.6 | | | | 824.8 | | | | 661.5 | | | | 527.7 | | | | 422.2 | | | | 337.8 | | | | 271.0 | | | | |

| Proved (1P) | | | | 1,544.2 | | | | 3,497.9 | | | | 3,841.2 | | | | 2,224.0 | | | | 1,624.4 | | | | 1,286.6 | | | | 1,045.4 | | | | 856.0 | | | | 699.5 | (a) | | | 575.4 | (a) | | | 475.2 | (a) | | | 395.2 | (a) | | | 18,065.1 | |

| Probable Undeveloped (P2) | | | | 166.3 | | | | 605.2 | | | | 700.5 | | | | 393.4 | | | | 284.7 | | | | 224.6 | | | | 181.7 | | | | 148.0 | | | | 120.1 | | | | 98.1 | | | | 80.4 | (a) | | | 66.3 | (a) | | | | |

Proved + Probable (2P) | | | | 1,710.4 | | | | 4,103.1 | | | | 4,541.7 | | | | 2,617.4 | | | | 1,909.1 | | | | 1,511.3 | | | | 1,227.1 | | | | 1,004.0 | | | | 819.6 | | | | 673.5 | | | | 555.6 | | | | 461.5 | | | | 21,134.3 | |

| Possible Undeveloped (P3) | | | | 86.4 | | | | 308.7 | | | | 357.2 | | | | 2,025.4 | | | | 2,783.3 | | | | 3,288.8 | | | | 1,847.7 | | | | 1,338.4 | | | | 1,043.7 | | | | 834.4 | | | | 668.2 | | | | 536.4 | | | | | |

Proved + Probable + Possible (3P) | | | | 1,796.8 | | | | 4,411.8 | | | | 4,898.9 | | | | 4,642.8 | | | | 4,692.4 | | | | 4,800.0 | | | | 3,074.8 | | | | 2,342.5 | | | | 1,863.3 | | | | 1,507.9 | | | | 1,223.8 | | | | 997.9 | | | | 36,252.9 | |

| | | | | 2013 | | | | 2014 | | | | 2015 | | | | 2016 | | | | 2017 | | | | 2018 | | | | 2019 | | | | 2020 | | | | 2021 | | | | 2022 | | | | 2023 | | | | 2024 | | | Total | |

| | P2 | | | | 166.3 | | | | 605.2 | | | | 700.5 | | | | 393.4 | | | | 284.7 | | | | 224.6 | | | | 181.7 | | | | 148.0 | | | | 120.1 | | | | 98.1 | | | | 80.4 | | | | 66.3 | | | | 3,069.2 | |

| | P3 | | | | 86.4 | | | | 308.7 | | | | 357.2 | | | | 2,025.4 | | | | 2,783.3 | | | | 3,288.8 | | | | 1,847.7 | | | | 1,338.4 | | | | 1,043.7 | | | | 834.4 | | | | 668.2 | | | | 536.4 | | | | 15,118.6 | |

| | | | | | 2013 | | | | 2014 | | | | 2015 | | | | 2016 | | | | 2017 | | | | 2018 | | | | 2019 | | | | 2020 | | | | 2021 | | | | 2022 | | | | 2023 | | | | 2024 | | | Total | |

| Risked P2 (81%) | | | | 134.3 | | | | 488.7 | | | | 565.6 | | | | 317.7 | | | | 229.9 | | | | 181.4 | | | | 146.7 | | | | 119.5 | | | | 97.0 | | | | 79.2 | | | | 64.9 | | | | 53.5 | | | | 2,478.4 | |

| Risked P3 (53%) | | | | 45.4 | | | | 162.2 | | | | 187.7 | | | | 1,064.2 | | | | 1,462.4 | | | | 1,727.9 | | | | 970.8 | | | | 703.2 | | | | 548.4 | | | | 438.4 | | | | 351.1 | | | | 281.8 | | | | 7,943.3 | |

| | | | | | 2013 | | | | 2014 | | | | 2015 | | | | 2016 | | | | 2017 | | | | 2018 | | | | 2019 | | | | 2020 | | | | 2021 | | | | 2022 | | | | 2023 | | | | 2024 | | | Total | |

| Risked 1P | | | | 1,544.2 | | | | 3,497.9 | | | | 3,841.2 | | | | 2,224.0 | | | | 1,624.4 | | | | 1,286.6 | | | | 1,045.4 | | | | 856.0 | | | | 699.5 | | | | 575.4 | | | | 475.2 | | | | 395.2 | | | | 18,065.1 | |

| Delta to 1P | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | |

| Risked 2P | | | | 1,678.4 | | | | 3,986.6 | | | | 4,406.8 | | | | 2,541.6 | | | | 1,854.3 | | | | 1,468.0 | | | | 1,192.1 | | | | 975.5 | | | | 796.5 | | | | 654.6 | | | | 540.1 | | | | 448.7 | | | | 20,543.5 | |

| Delta to 2P | | | | (32 | ) | | | (116 | ) | | | (135 | ) | | | (76 | ) | | | (55 | ) | | | (43 | ) | | | (35 | ) | | | (28 | ) | | | (23 | ) | | | (19 | ) | | | (15 | ) | | | (13 | ) | | | (591 | ) |

| Risked 3P | | | | 1,723.8 | | | | 4,148.8 | | | | 4,594.5 | | | | 3,605.8 | | | | 3,316.7 | | | | 3,195.9 | | | | 2,162.9 | | | | 1,678.7 | | | | 1,344.9 | | | | 1,093.0 | | | | 891.2 | | | | 730.6 | | | | 28,486.8 | |

| Delta to 3P | | | | (73 | ) | | | (263 | ) | | | (304 | ) | | | (1,037 | ) | | | (1,376 | ) | | | (1,604 | ) | | | (912 | ) | | | (664 | ) | | | (518 | ) | | | (415 | ) | | | (333 | ) | | | (267 | ) | | | (7,766 | ) |

(a) Volumes excluded from GCA standalone 1P and P2 cases as expected net cash flows are negative beginning in 2021 and 2023, in the respective cases

PROPERTIES LOCATED IN OYO FIELD, NIGERIA

CAMAC HOLDINGS, INC. INTEREST

PROVED + PROBABLE + POSSIBLE (3P) RESERVES

| | | | | | | | | | | | | | | | | | Net | | | Net | | | | | | | |

| | | Oil Reserves | | | Average | | | Gross | | | | | | Capital | | | Operating | | | Net | | | Cumulative PWAT | |

| Period | | Gross | | | Net | | | Oil Price | | | Revenue | | | Taxes | | | Investment | | | Expense | | | Cash Flow | | | | 10.0% | |

| Ending | | (MBBL) | | | (MBBL) | | | ($/BBL) | | | | (M$) | | | | (M$) | | | | (M$) | | | | (M$) | | | | (M$) | | | | (M$) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 12/31/2013 | | | 1,724 | | | | 128 | | | | 113 | | | | 14,382 | | | | 714 | | | | 0 | | | | 0 | | | | 13,668 | | | | 13,032 | |

| 12/31/2014 | | | 4,149 | | | | 837 | | | | 113 | | | | 94,359 | | | | 5,759 | | | | 58,500 | | | | 26,431 | | | | 3,669 | | | | 16,212 | |

| 12/31/2015 | | | 4,595 | | | | 794 | | | | 113 | | | | 89,559 | | | | 8,693 | | | | 27,900 | | | | 26,614 | | | | 26,353 | | | | 36,977 | |

| 12/31/2016 | | | 3,606 | | | | 707 | | | | 113 | | | | 79,753 | | | | 6,234 | | | | 27,900 | | | | 26,208 | | | | 19,412 | | | | 50,883 | |

| 12/31/2017 | | | 3,317 | | | | 693 | | | | 113 | | | | 78,199 | | | | 5,552 | | | | 27,900 | | | | 26,089 | | | | 18,658 | | | | 63,034 | |

| 12/31/2018 | | | 3,196 | | | | 1,244 | | | | 113 | | | | 140,285 | | | | 6,797 | | | | 0 | | | | 26,039 | | | | 107,449 | | | | 126,646 | |

| 12/31/2019 | | | 2,163 | | | | 666 | | | | 113 | | | | 75,159 | | | | 3,864 | | | | 0 | | | | 25,615 | | | | 45,680 | | | | 151,231 | |

| 12/31/2020 | | | 1,679 | | | | 507 | | | | 113 | | | | 57,177 | | | | 2,477 | | | | 0 | | | | 25,416 | | | | 29,284 | | | | 165,559 | |

| 12/31/2021 | | | 1,345 | | | | 395 | | | | 113 | | | | 44,574 | | | | 1,505 | | | | 0 | | | | 25,279 | | | | 17,790 | | | | 173,472 | |

| 12/31/2022 | | | 1,093 | | | | 374 | | | | 113 | | | | 42,156 | | | | 765 | | | | 11,700 | | | | 25,176 | | | | 4,516 | | | | 175,298 | |

| 12/31/2023 | | | 891 | | | | 258 | | | | 113 | | | | 29,081 | | | | 151 | | | | 0 | | | | 25,093 | | | | 3,838 | | | | 179,136 | |

| 12/31/2024 | | | 731 | | | | 208 | | | | 113 | | | | 23,420 | | | | 0 | | | | 0 | | | | 25,027 | | | | -1,607 | | | | 177,529 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total 2013-2024 | | | 28,487 | | | | 6,811 | | | | | | | | 768,106 | | | | 42,512 | | | | 153,900 | | | | 282,985 | | | | 288,709 | | | | 177,529 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total 2013-2022 | | | 26,865 | | | | 6,346 | | | | | | | | 715,604 | | | | 42,361 | | | | 153,900 | | | | 232,865 | | | | 286,478 | | | | 175,298 | |

Exhibit I

| | | | | | | | | | | | | | |

| | | Predicted Average Field 1P Oil Rate (b/d) | | | Predicted Average Field 2P Oil Rate (b/d) | | | Predicted Average Field 3P Oil Rate (b/d) | | | | Actual Field Oil Rate (b/d) | |

| | | | | | | | | | | | | | |

| 1/1/2013 | | 2437 | | | 2442 | | | 2447 | | | | | 2432 | |

| 2/1/2013 | | 2356 | | | 2365 | | | 2374 | | | | | 2359 | |

| 3/1/2013 | | 2281 | | | 2293 | | | 2304 | | | | | 2360 | |

| 4/1/2013 | | 2207 | | | 2223 | | | 2237 | | To date | | | 2362 | |

| 5/1/2013 | | 2138 | | | 2157 | | | 2174 | | | | | | |

| 6/1/2013 | | 2073 | | | 2094 | | | 2114 | | | | | | |

| 7/1/2013 | | 2012 | | | 2036 | | | 2057 | | | | | | |

| 8/1/2013 | | 1953 | | | 1979 | | | 2003 | | | | | | |

| 9/1/2013 | | 1898 | | | 1926 | | | 1952 | | | | | | |

| 10/1/2013 | | 1846 | | | 1876 | | | 1904 | | | | | | |

| 11/1/2013 | | 1796 | | | 1828 | | | 1858 | | | | | | |

| 12/1/2013 | | 1749 | | | 1783 | | | 1814 | | | | | | |