PACIFIC ASIA PETROLEUM, INC.

PURCHASE AND SALE AGREEMENT

THIS PURCHASE AND SALE AGREEMENT, dated as of November 18, 2009 (this “Agreement”), by and among PACIFIC ASIA PETROLEUM, INC., a corporation incorporated in the State of Delaware, USA (“PAPI” and together with the new entity to be formed by PAPI pursuant to Section 7.12 hereof (“PAPI Newco”), the “PAPI Parties”); CAMAC ENERGY HOLDINGS LIMITED, a Cayman Islands company (“CEHL”); CAMAC INTERNATIONAL (NIGERIA) LIMITED, a company incorporated in the Federal Republic of Nigeria (“CINL”) and a wholly-owned subsidiary of CEHL; and ALLIED ENERGY PLC (formerly, Allied Energy Resources Nigeria Limited, a company incorporated in the Federal Republic of Nigeria and a wholly-owned subsidiary of CEHL (“Allied,” and together with CEHL, and CINL, the “CAMAC Parties”). Each of the Parties to this Agreement is individually referred to herein as a “Party” and collectively as the “Parties.” Capitalized terms used herein that are not otherwise defined herein shall have the meanings ascribed to them in Annex A hereto.

BACKGROUND

A. PAPI and its subsidiary companies are engaged in the business of oil and gas development, production and distribution.

B. On June 3, 1992, Allied was awarded Oil Prospecting License 210 (“OPL 210”) by the Federal Republic of Nigeria, 2.5% of the interest in which Allied subsequently assigned to CINL, on September 30, 1992 pursuant to an assignment agreement by and between Allied and CINL (the “Allied Assignment”).

C. On August 28, 2002, Allied and CINL were granted Oil Mining Lease 120 and Oil Mining Lease 121 (the “OMLs”) by the Federal Republic of Nigeria, with respect to OPL 210, for a term of 20 years commencing on February 27, 2001. Pursuant to a Deed of Assignment, dated July 22, 2005, Allied and CINL assigned to the Nigerian AGIP Exploration Limited (the “NAE”), a 40% participating interest in the OMLs, with the remaining 60% participating interest in the OMLs being retained by Allied and CINL (the “NAE Assignment”).

D. On July 22, 2005, Allied, CINL and the NAE entered into a Production Sharing Contract (the “PSC”) setting out the terms of agreement in relation to petroleum operations in the area covered by the OMLs.

E. PAPI desires to acquire from Allied and CINL, through PAPI Newco, all of the CAMAC Parties’ interest in the PSC with respect to that certain oilfield asset known as the Oyo Field (as such term is defined herein), that is the subject of Oil Mining Lease 120 (“OML 120”), as well as the joint and several obligations of CINL and Allied to the NAE under the PSC in connection with the Oyo Field (such interest in the PSC with respect to the Oyo Field, subject to the rights and obligations set forth in the PSC and the Oyo Field Supplemental Agreement (as defined herein), is referred to herein as the “Contract Rights”), for stock consideration consisting of shares of PAPI’s common stock, par value $0.001 per share (the “Common Stock”), representing 62.74% of the issued and outstanding Common Stock of the Company, and cash in the amount of USD $38.84 million. Allied and CINL shall retain all right, title and interest in

and to the PSC with respect to the OMLs, other than with respect to the Oyo Field, that is subject to OML 120.

F. Concurrently with the Closing (as described below), the Parties hereto will enter into, or cause their affiliates to enter into, certain other agreements contemplated by this Agreement (together, the “Transaction Documents”), including but not limited to the Novation Agreement by and among Allied, CINL, PAPI Newco and NAE (the “Novation Agreement”); the right of first refusal agreement between the CAMAC Parties and the PAPI Parties (the “ROFR Agreement”); the technical services agreement between PAPI Newco and Allied (the “Technical Services Agreement”); the cost allocation and management agreement between PAPI Newco and Allied (the “Oyo Field Supplemental Agreement”); and the registration rights agreement with respect to the Consideration Shares between PAPI and the CAMAC Parties (the “Registration Rights Agreement”).

G. As a condition precedent to the Closing, PAPI will consummate an equity financing with certain qualified investors, on terms reasonably acceptable to the CAMAC Parties and the PAPI Parties, resulting in gross proceeds of at least Forty-Five Million Dollars ($45,000,000) (the “Financing”).

H. The boards of directors of each of PAPI, CINL, Allied and PAPI Newco have considered and have declared advisable this Agreement and the other transactions contemplated hereby (together, the “Transactions”).

AGREEMENT

NOW, THEREFORE, in consideration of the foregoing and the respective representations, warranties, covenants and agreements set forth herein, and intending to be legally bound hereby, the Parties agree as follows:

ARTICLE I

Transfer of Contract Rights; Related Transactions

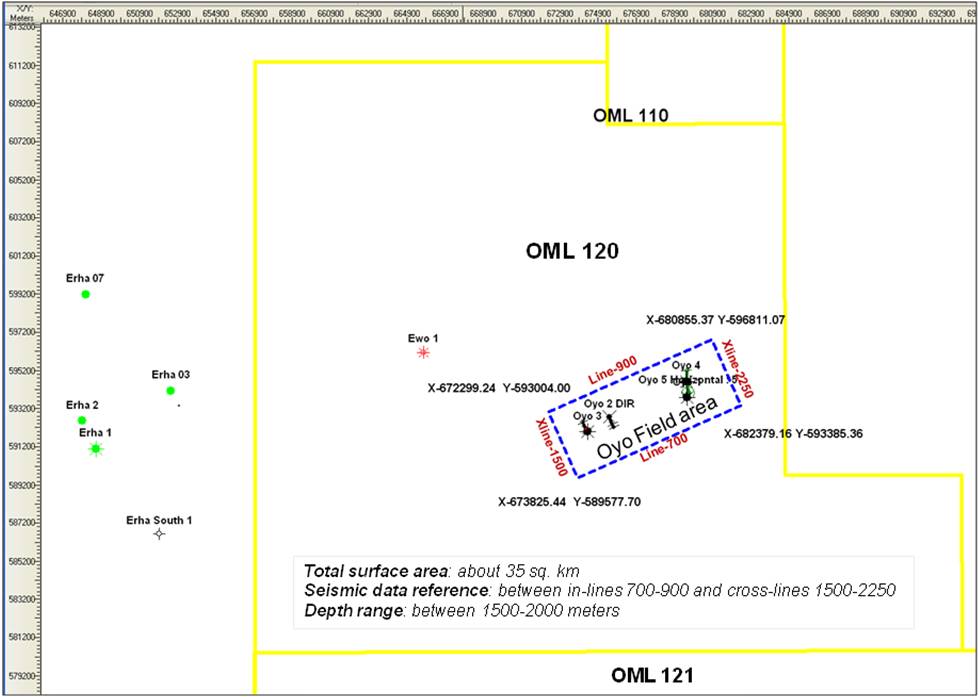

Section 1.1 Oyo Field. The Parties agree and acknowledge that the description set forth in Schedule A attached hereto is the “Oyo Field” for purposes of this Agreement, the Transaction Documents, and the transactions contemplated hereby and thereby and the CAMAC Parties further acknowledge and agree that the Oyo Field is an oil field subject to the provisions of the Oyo Related Agreements.

Section 1.2 Transfer of Contract Rights. Subject to the terms and conditions contained herein, each of the PAPI Parties agrees to acquire, and the CAMAC Parties agree to transfer, all of the rights, title and interest of the CAMAC Parties’ in and to the Contract Rights. The transfer of the Contract Rights related to the PSC shall be made by novation of all of Allied’s and CINL’s right, title and interest in and to the PSC with respect to the Oyo Field, together with all of Allied’s and CINL’s liabilities and obligations to the NAE under the PSC in relation to the Oyo Field. Such novation shall be subject to the terms of a Novation Agreement in form and

substance satisfactory to the Parties, which shall be effective on the effective date set forth in the Novation Agreement (the “Novation Date”).

Section 1.3 Complete Transfer. Each of the CAMAC Parties expressly agrees that the transfer of the Contract Rights pursuant to the Novation Agreement and this Agreement, constitutes a complete transfer of all of the Contract Rights, free and clear of (a) all Liens on the Contract Rights or the Oyo Field, and (b) any material adverse contractual obligations other than the Oyo Related Agreements, and the CAMAC Parties reserve no rights to market or otherwise transfer any interest in and to the Contract Rights. For the avoidance of doubt, upon the consummation of the Transactions neither PAPI nor PAPI Newco shall have any obligation to any of the CAMAC Parties to support, maintain, offer, or do any other act relating to the OMLs or the PSC other than as set forth herein or in the Transaction Documents.

Section 1.4 Release and Discharge. At the Novation Date, except as otherwise provided for herein, or in the Transaction Documents, the CAMAC Parties and PAPI Newco hereby release and discharge from further obligations to each other with respect to the Contract Rights (other than as shareholders of PAPI) and their respective rights against each other with respect to the Contract Rights are cancelled; provided that such release and discharge shall not affect any rights, liabilities or obligations of any of them with respect to claims, causes of actions, payments or other obligations due and payable or due to be performed on or prior to the Novation Date or related to the facts or events occurring prior to the Novation Date.

Section 1.5 No Assumption of Liabilities. Except as otherwise provided for herein, in the Novation Agreement or in any of the other Transaction Documents, this Agreement does not transfer, the PAPI Parties do not assume, and the PAPI Parties expressly disclaim any and all liabilities, costs, debts, claims and obligations of the CAMAC Parties relating to the Contract Rights or otherwise. Except as otherwise provided for herein or the Transaction Documents, neither PAPI nor PAPI Newco shall have any obligation with respect to the CAMAC Parties arising prior to the Closing Date.

ARTICLE II

Consideration

Section 2.1 Consideration Shares. At the Closing, PAPI shall issue to CEHL or its designee(s), shares of Common Stock equal to 62.74% of the issued and outstanding Common Stock after giving effect to the Transactions and the Financing, excluding shares issued in the Excluded Transaction (as defined below) (the “Consideration Shares”). The Parties agree and acknowledge that any issuances of Equity Interests by PAPI prior to the Closing (or pursuant to any existing agreement or arrangement, or any agreement or arrangement entered into after the date of this Agreement but before Closing, to issue Equity Interests before or after the Closing) shall not reduce the 62.74% post-Closing Equity Interest in PAPI to be issued to CEHL or its designee(s) at Closing, except with respect to: (i) the reservation or issuance of up to one million (1,000,000) shares of the Common Stock in connection with awards granted under PAPI’s employee stock incentive plan after the date of this Agreement and prior to Closing; or (ii) the issuance of shares of Common Stock in connection with the exercise of existing awards granted under PAPI’s employee stock incentive plan prior to the date of this Agreement (the “Excluded

Transactions”). Other than the Excluded Transactions, the Parties further agree that no other existing agreements or arrangements, or any agreement or arrangement entered into after the date of this Agreement but before Closing, for the issuance of any Equity Interests in PAPI before or after Closing shall reduce the CAMAC Parties’ 62.74% Equity Interest in PAPI, and PAPI shall issue such additional shares Common Stock to the CAMAC Parties at the Closing (or within five (5) business days of issuance if any such shares of PAPI Common Stock are issues following the Closing ) as is required to preserve CAMAC’s 62.74% post-Closing Equity Interest in PAPI.

Section 2.2 Cash Consideration. At the Closing PAPI shall pay to CEHL, cash in the amount of thirty eight million eight hundred forty thousand dollars ($38,840,000) in immediately available funds to an account designated by CEHL at least two (2) business days prior to Closing (the “Cash Consideration”).

ARTICLE III

The Closing

Section 3.1 Closing. The Closing (the “Closing”) of the Transactions, shall take place at the offices of Pillsbury Winthrop Shaw Pittman LLP in Houston, TX, commencing at 9:00 a.m. local time on the third business day following the satisfaction or waiver of all conditions and obligations of the Parties to consummate the Transactions contemplated hereby (other than conditions and obligations with respect to actions that the respective Parties will take at Closing), or on such other date and at such other time as the Parties may mutually determine (the “Closing Date”).

Section 3.2 Deliveries of the Parties. At the Closing, (i) the CAMAC Parties shall deliver or cause to be delivered to the PAPI Parties, the certificates, opinions, instruments, agreements and documents required by Article IX hereof and (ii) the PAPI Parties shall deliver or cause to be delivered to the CAMAC Parties, the Cash Consideration, the Consideration Shares and the certificates, opinions, instruments, agreements and documents required by Article IX hereof.

ARTICLE IV

Representations and Warranties of the CAMAC Parties

Subject to the exceptions set forth in the schedule of exceptions, which shall state the specific subsection of this Article IV to which each disclosure or exception is made by the CAMAC Parties and attached hereto as Schedule B, each of the CAMAC Parties jointly and severally represents and warrants to the PAPI Parties as of the date hereof and as of the Closing as follows:

Section 4.1 Organization and Standing. Each of the CAMAC Parties is duly organized, validly existing and in good standing under the laws of its respective jurisdiction of incorporation or organization. Each of the CAMAC Parties is duly qualified to do business in each of the jurisdictions in which the property owned, leased or operated by it or the nature of the business which it conducts requires qualification, except where the failure to so qualify

would not reasonably be expected, individually or in the aggregate, to result in a CAMAC Material Adverse Effect. Each of the CAMAC Parties has all requisite power and authority to own, lease and operate the Oyo Field and to carry on its business as now being conducted pursuant to the Oyo Related Agreements. The CAMAC Parties have made available to PAPI true and complete copies of the CAMAC Constituent Instruments.

Section 4.2 Power and Authority. Each of the CAMAC Parties has all requisite corporate power and authority to execute and deliver this Agreement and the Transaction Documents to which it is a party and to consummate the Transactions contemplated hereby and thereby. The execution and delivery by the CAMAC Parties of this Agreement and the Transaction Documents and the consummation by them of the Transactions have been duly authorized and approved by the boards of directors or other governing body of each of the CAMAC Parties (if an entity), such authorization and approval remains in effect and has not been rescinded or qualified in any respect, and no other proceedings on the part of any such entities are necessary to authorize this Agreement, the Transaction Documents or the consummation of the Transactions contemplated hereby and thereby. Each of this Agreement and the Transaction Documents to which any CAMAC Party is a party has been duly executed and delivered by such party and constitutes the valid and binding obligation of each of the CAMAC Parties, enforceable against the CAMAC Parties in accordance with its terms, except as enforceability may be limited by applicable bankruptcy, insolvency, reorganization, moratorium, fraudulent transfer or similar laws of general application now or hereafter in effect affecting the rights and remedies of creditors and by general principles of equity (regardless of whether enforcement is sought in a proceeding at law or in equity).

Section 4.3 No Conflicts. The execution and delivery of this Agreement or any of the Transaction Documents contemplated hereby by each of the CAMAC Parties and the consummation of the Transactions and compliance with the terms hereof and thereof will not, (a) conflict with, or result in any violation of or Default (with or without notice or lapse of time, or both) under, or give rise to a right of termination, cancellation or acceleration of any obligation or to loss of a material benefit under, or result in the creation of any Lien upon any of the Contract Rights under any provision of: (i) any CAMAC Constituent Instrument; (ii) any material contract to which any of the CAMAC Parties is a party or to or by which it (or any of its assets and properties) is subject or bound; (iii) any applicable Law or Legal requirement of and Governmental Authority; or (iv) any Material Permit of any of the CAMAC Parties; (b) result in any material Judgment applicable to any of the Contract Rights or (c) terminate or modify, or give any third party the right to terminate or modify, the provisions or terms of any of the Oyo Related Agreements.

Section 4.4 Representations Related to the Oyo Field and Oyo Related Agreements..

(a) Oyo Related Agreements. Each of the OMLs, the Allied Assignment, the NAE Assignment and the PSC (the “Oyo Related Agreements”) are valid, binding and in full force and effect in all material respects and enforceable by and against the CAMAC Parties, as applicable, in accordance with its terms. None of the CAMAC Parties is in violation of, or in Default under (nor does there exist any condition which upon the passage of time or the giving of notice would cause such a violation of, or Default under), any of the Oyo Related Agreements to which any CAMAC Party is a party, except for violations or Defaults that would not,

individually or in the aggregate, reasonably be expected to result in a CAMAC Material Adverse Effect; and, except as set forth on Schedule 4.4, to the CAMAC Parties’ Knowledge, no other Person has violated or breached, or committed any Default under, any Oyo Related Agreement, except for violations, breaches and Defaults that, individually or in the aggregate, have not had and would not reasonably be expected to have a CAMAC Material Adverse Effect. No party to an Oyo Related Agreement has terminated or, the CAMAC Parties’ Knowledge, threatened termination of any such agreement with any of the CAMAC Parties. To the CAMAC Parties’ Knowledge, no other party to any of the Oyo Related Agreements is in material Default thereunder and none of the CAMAC Parties has received any written notice regarding any actual or possible violation or breach of, or Default under, any Oyo Related Agreement, except in each such case for Defaults, acceleration rights, termination rights and other rights that have not had and would not reasonably be expected to have a CAMAC Material Adverse Effect. No event or claim of force majeure has occurred under any of the Oyo Related Agreements. There have been no written claims by any Governmental Authority to terminate the Oyo Related Agreements. To the CAMAC Parties’ Knowledge, the Oyo Related Agreements do not infringe upon the rights of any third party.

(b) Completeness of Oyo Related Agreements. The OMLs contain the entirety of the obligation of the CAMAC Parties to the Government of Nigeria with respect to the Oyo Field and the interests thereon that are subject to the PSC. No CAMAC Party is a party to any Contract relating to or affecting the Oyo Field or Contract Rights other than the Oyo Related Agreements.

(c) No Claims. There are no claims, actions, suits, audits, demands, arbitrations, mediations, formal investigations or proceedings pending, or, to the CAMAC Parties’ Knowledge, threatened, before any Governmental Authority, mediator or arbitrator with respect to the Oyo Field or the Oyo Related Agreements.

(d) Funding and Other Obligations. No work program or operations or funding commitment exists or has been proposed by the CAMAC Parties or any other party to any of the Oyo Related Agreements under such agreements, except as has been disclosed to the PAPI Parties in writing or as set forth in the PSC. Upon the consummation of the Transactions, neither PAPI nor PAPI Newco will be subject to any obligation to pay any other party any net profits interests, production payments, royalties or other fixed or contingent amounts based upon the sale, license, distribution or other use or exploitation of the Oyo Field, except as set forth in the PSC or applicable Law. There are no bonds, letters of credit, guarantees, deposits or other security furnished by the CAMAC Parties or any Affiliate of CAMAC Parties relating to the Oyo Field or the Oyo Related Agreements that will require expenditures in excess of $100,000, other than the Oyo Debt. The interests of the CAMAC Parties in the PSC and the OMLs are not subject to any preferential rights to purchase, rights of first opportunity or similar rights, or any required third party consents to assignment that may be applicable to the Transactions other than as may be specified in the Oyo Related Agreements.

(e) No Limitations on Transfer. PAPI Newco shall not be subject to any limitations, obligations or restrictions with regard to the sale, license, distribution or other transfer or exploitation of the Contract Rights, except as set forth in the Oyo Related Agreements, applicable stock exchange rules or applicable Law.

(f) The transfer of the Contract Rights pursuant to the Novation Agreement constitutes a complete transfer of all of the CAMAC Parties’ rights, title and interest in and to the Oyo Field, and the CAMAC Parties reserve no rights to market or otherwise transfer any interest in the Oyo Field. For the avoidance of doubt, neither PAPI nor PAPI Newco shall have any obligation to any of the CAMAC Parties to support, maintain, offer, or do any other act relating to the OMLs or the PSC other than as set forth in the Transaction Documents, and the PAPI Parties may dispose of the Contract Rights, at their sole discretion, subject only to any approval rights maintained by NAE, the Nigerian government, applicable stock exchange rules, and applicable shareholder and board approval requirements.

Section 4.5 Litigation. As of the date of this Agreement, there is no private or governmental action, suit, inquiry, notice of violation, claim, arbitration, audit, proceeding or investigation (“Action”) pending or threatened in writing against any of the CAMAC Parties or, to the CAMAC Parties’ Knowledge, any of the other parties to the Oyo Related Agreements, before or by any Governmental Authority which (a) adversely affects or challenges the legality, validity or enforceability of this Agreement or the Oyo Related Agreements (b) could, if there were an unfavorable decision, individually or in the aggregate, have or would reasonably be expected to result in a CAMAC Material Adverse Effect. As of the date of this Agreement, there is no judgment imposed upon any of the CAMAC Parties or, to the CAMAC Parties’ Knowledge, any of the parties to the Oyo Related Agreements, that would prevent, enjoin, alter or materially delay any of the Transactions contemplated by this Agreement, or that would reasonably be expected to have a CAMAC Material Adverse Effect.

Section 4.6 Consents and Approvals. Except as disclosed on Schedule 4.6, no consent, approval, license, permit, order or authorization of, or registration, declaration or filing with any Governmental Authority (“Consent”) to which any of the Oyo Related Agreements or the Oyo Field are subject is required to be obtained or made by any of the CAMAC Parties, in connection with the execution, delivery and performance of this Agreement or the consummation of the Transactions, except for (a) such Consents as may be required under applicable state securities laws and the securities laws of any foreign country; and (b) such other Consents which, if not obtained or made, would not have a CAMAC Material Adverse Effect.

Section 4.7 Licenses, Permits, Etc. The CAMAC Parties possesses or will possess prior to the Closing all licenses, franchises, permits and other governmental authorizations held by them that are material in connection with business related to the Oyo Related Agreements and the Oyo Field (the “Material Permits”). As of the date of this Agreement, all such Material Permits are in full force and effect.

Section 4.8 Material Contracts and Commitments. Other than the Oyo Related Agreements and the Transaction Documents, there are no material contracts, agreements or other instruments to which any CAMAC Party or any affiliate of a CAMAC Party is a party that will be binding on PAPI and PAPI Newco after the consummation of the Transactions.

Section 4.9 Taxes. Each of the CAMAC Parties have timely, or have caused to be timely filed on their behalf, all Tax Returns required by any law or regulation to be filed by or with respect to it in connection with the Contract Rights, the Oyo Related Agreements or the Oyo Field, either separately or as a member of group of corporations, pursuant to applicable

Legal Requirements. All such Tax Returns filed by (or that include on a consolidated basis) any of the CAMAC Parties were (and, as to a Tax Return not filed as of the date hereof, will be) in all respects true, complete and accurate, except to the extent any failure to file or any inaccuracies in any filed Tax returns, individually or in the aggregate, have not and would not reasonably be expected to have a CAMAC Material Adverse Effect. There are no unpaid Taxes in respect to the Contract Rights, the Oyo Related Agreements or the Oyo Field claimed to be due by any Governmental Authority in charge of taxation of any jurisdiction, nor any claim for additional Taxes in respect to the Contract Rights, the Oyo Related Agreements or the Oyo Field for any period for which Tax Returns have been filed, except to the extent any failure to file or any inaccuracies in any filed Tax returns, individually or in the aggregate, have not and would not reasonably be expected to have a CAMAC Material Adverse Effect. Any deficiencies proposed as a result of any governmental audits or such Tax Returns have been paid or settled, and there are no present disputes as to Taxes in respect to the Contract Rights, the Oyo Related Agreements or the Oyo Field payable by any of the CAMAC Parties. There are no tax liens against any of the Contract Rights and, to the CAMAC Parties’ Knowledge, there is no basis for any such lien.

Section 4.10 Brokers; Schedule of Fees and Expenses. No broker, investment banker, financial advisor or other Person is entitled to any broker’s, finder’s, financial advisor’s or other similar fee or commission in connection with this Agreement or the Transactions based upon arrangements made by or on behalf of the CAMAC Parties.

Section 4.11 Foreign Corrupt Practices. Neither the CAMAC Parties, nor to the CAMAC Parties’ Knowledge, any of their respective Representatives, has, in the course of its actions for, or on behalf of, the CAMAC Parties, directly or indirectly, (a) used any corporate funds for any unlawful contribution, gift, entertainment or other unlawful expenses relating to political activity; (b) made any direct or indirect unlawful payment to any Governmental Authority or any foreign or domestic government official or employee from corporate funds; (c) violated or is in violation of any provision of the U.S. Foreign Corrupt Practices Act of 1977, as amended, and the rules and regulations thereunder (the “FCPA”); or (d) made any unlawful bribe, rebate, payoff, influence payment, kickback or other unlawful payment in connection with the operations of CAMAC Parties to any foreign or domestic government official or employee, except, in the case of clauses (a) and (b) above, any such items that, individually or in the aggregate, have not had and would not reasonably be expected to have a CAMAC Material Adverse Effect.

Section 4.12 Money Laundering Laws. To the CAMAC Parties’ Knowledge, none of the CAMAC Parties has violated any money laundering statute or any rules and regulations relating to money laundering statutes (collectively, the “Money Laundering Laws”) and no proceeding involving any CAMAC Parties with respect to the Money Laundering Laws is pending or, to the Knowledge of the officers of the CAMAC Parties, is threatened.

Section 4.13 OFAC. None of the CAMAC Parties, any director or officer of the CAMAC Parties, or, to the CAMAC Parties’ Knowledge, any agent, employee, affiliate or Person acting on behalf of the CAMAC Parties is currently identified on the specially designated nationals or other blocked person list or otherwise currently subject to any U.S. sanctions administered by the Office of Foreign Asset Control of the U.S. Treasury Department

(“OFAC”); and the CAMAC Parties have not, directly or indirectly, used any funds, or loaned, contributed or otherwise made available such funds to any Subsidiary, joint venture partner or other Person, in connection with any sales or operations in Cuba, Iran, Syria, Sudan, Myanmar or any other country sanctioned by OFAC or for the purpose of financing the activities of any Person currently subject to, or otherwise in violation of, any U.S. sanctions administered by OFAC.

Section 4.14 Environmental Matters. Except as set forth on Schedule 4.14, with respect to the Oyo Field:

(a) The CAMAC Parties and all associated operations are and, during the relevant time periods specified in all applicable statutes of limitations, have been in compliance with Environmental Laws in all material respects;

(b) The CAMAC Parties have all Environmental Authorizations required for their operations as presently conducted, all such Environmental Authorizations are in the name of the proper entity and in full force and effect, and the CAMAC Parties are in compliance in all material respects with such Environmental Authorizations;

(c) The CAMAC Parties are not subject to any pending or, to the CAMAC Parties’ Knowledge, threatened Action pursuant to Environmental Laws, nor has any CAMAC Party received any written notice of violation, noncompliance, or enforcement or any written notice of investigation or remediation from any Governmental Authority pursuant to Environmental Laws;

(d) There has been no Release of Hazardous Materials at, on, under or from the assets or in connection with the operations of the Acquired Entities in violation of any Environmental Laws or in a manner that could give rise to any Environmental Liabilities or any other remedial or corrective action obligations pursuant to Environmental Laws;

(e) To the CAMAC Parties’ Knowledge, there has been no exposure of any Person or property to any Hazardous Materials that could reasonably be expected to form the basis for any Environmental Liabilities or any Action for other Damages or compensation; and

(f) The CAMAC Parties have made available for inspection by the PAPI Parties complete and correct copies of all environmental assessment and audit reports and studies and all correspondence addressing environmental obligations that are in the possession or control of the CAMAC Parties.

(g) Notwithstanding any other provision of this Agreement, the representations and warranties made in this Section 4.14 are the sole and exclusive representations and warranties made in this Agreement by the CAMAC Parties with respect to environmental matters.

Section 4.15 Bankruptcy. The CAMAC Parties do not contemplate filing for relief under the provision of any applicable bankruptcy code. The Contract Rights are not the proceeds of, nor are they intended for, or being transferred in, the furtherance of any concealment of assets or any effort by conspiracy or otherwise to defeat, defraud or otherwise evade, any party or the

court in any bankruptcy proceeding, a receiver, a custodian, a trustee, a marshall, or any other officer of the court or government or regulatory official of any kind.

ARTICLE V

Representations and Warranties of PAPI

Subject to the exceptions set forth in the schedule of exceptions, which shall state the specific subsection of this Article V to which each disclosure or exception is made by the PAPI Parties with respect to themselves and their respective Subsidiaries, and attached hereto as Schedule C (the “PAPI Disclosure Schedule”), each of the PAPI Parties jointly and severally represents and warrants to the CAMAC Parties as of the date hereof and as of the Closing Date as follows:

Section 5.1 Organization and Standing. Each of the PAPI Parties and their respective Subsidiaries is duly organized, validly existing and in good standing under the laws of its respective jurisdiction of incorporation. Each of the PAPI Parties and their respective Subsidiaries is duly qualified to do business in each of the jurisdictions in which the property owned, leased or operated by it or the nature of the business which it conducts requires qualification, except where the failure to so qualify would not reasonably be expected, individually or in the aggregate, to result in a PAPI Material Adverse Effect. Each of the PAPI Parties and their respective Subsidiaries has all requisite power and authority to own, lease and operate its tangible assets and properties and to carry on its business as now being conducted. The PAPI Parties have delivered to the CAMAC Parties true and complete copies of the PAPI Constituent Instruments.

Section 5.2 Organizational Documents. The PAPI Parties have made available to the CAMAC Parties true, complete and correct copies of the PAPI Constituent Instruments, in each case as amended or restated to date and presently in effect. Except as set forth on Schedule 5.2, neither PAPI nor any of its Subsidiaries is in violation of any of the provisions of its PAPI Constituent Instruments. The minute books and stock records of PAPI heretofore made available to the CAMAC Parties correctly and completely reflect in all material respects all actions taken at all meetings of, or by written consents of, directors, managers and holders of equity interests of PAPI (including any analogous governing bodies thereof or committees of governing bodies thereof).

Section 5.3 Power and Authority. Each of the PAPI Parties and their respective Subsidiaries (and their respective nominees) has all requisite corporate power and authority to execute and deliver this Agreement and the Transaction Documents to which it is a party and to consummate the Transactions contemplated hereby and thereby. The execution and delivery by the PAPI Parties of this Agreement and the consummation by them of the Transactions have been duly authorized and approved by the boards of directors or other governing body of each of the PAPI Parties and their respective Subsidiaries (if an entity), such authorization and approval remains in effect and has not been rescinded or qualified in any way, and no other proceedings on the part of any such entities are necessary to authorize this Agreement and the Transactions. Each of this Agreement and the Transaction Documents to which any PAPI Party is a party has been duly executed and delivered by such party and constitutes the valid, binding, and

enforceable obligation of each of them, enforceable in accordance with its terms, except as enforceability may be limited by applicable bankruptcy, insolvency, reorganization, moratorium, fraudulent transfer or similar laws of general application now or hereafter in effect affecting the rights and remedies of creditors and by general principles of equity (regardless of whether enforcement is sought in a proceeding at law or in equity).

Section 5.4 No Conflicts. Neither the execution nor delivery by the PAPI Parties of this Agreement nor compliance by any of them with the terms and provisions hereof will conflict with, or result in a breach of (a) the terms, conditions or provisions of, or constitute a Default under, or result in any violation of, any PAPI Constituent Instrument or any Material Contract to which any PAPI Party or their respective Subsidiaries is a party, which would prevent any of the transactions contemplated under this Agreement or any of the Transaction Documents contemplated hereby and thereby, or (b) any regulation, law, judgment, order or the like to which any such PAPI Party or their respective Subsidiaries is subject, the Default or violation of which would prevent any of the transactions contemplated under this Agreement or any of the Transaction Documents contemplated hereby and thereby.

Section 5.5 Material Contracts. Except as set forth in the SEC Reports and on Schedule 5.5, none of the PAPI Parties or their respective Subsidiaries is a party to any of the following (each such Contract, a “Material Contract”):

(a) any Contract involving payments by or to a PAPI Party or any of their respective Subsidiaries in excess of $100,000;

(b) any Contract that constitutes a purchase order or other Contract relating to the sale, purchase, lease or provision by a PAPI Party or any of their respective Subsidiaries of goods or services in excess of $100,000 in any 12 month period;

(c) any Contract pursuant to which any party is required to purchase or sell a stated portion of its requirements or output from or to another party;

(d) any Contract under which a PAPI Party or any of their respective Subsidiaries has agreed to indemnify any third Person in any manner, other than such Contracts that were made in the ordinary course of business consistent with past practice, or to share the Tax liability of any third Person;

(e) any Contract pursuant to which a PAPI Party or any of their respective Subsidiaries is required to make on or after the date of the Latest Balance Sheet a capital expenditure, capital addition or betterment in excess of $100,000 in the aggregate;

(f) any power of attorney (other than powers of attorney given in the ordinary course of business with respect to routine export, Tax or securities matters);

(g) any Contract in respect of Intellectual Property involving a license granted, title conveyed or royalty payment to or by a PAPI Party or any of their respective Subsidiaries;

(h) any bond, indenture, note, loan or credit agreement or other Contract relating to indebtedness for borrowed money, any Contract creating a capital lease obligation, any Contract for the sale of accounts receivable, any Contract relating to the direct or indirect guarantee or assumption of the obligations of any other Person or any Contract requiring a PAPI Party or any of their respective Subsidiaries to maintain the financial position of any other Person;

(i) any outstanding loan or advance by a PAPI Party or any of their respective Subsidiaries to, or investment by such Person in, any Person, or any Contract or commitment relating to the making of any such loan, advance or investment (excluding trade receivables and advances to employees for normally incurred business expenses each arising in the ordinary course of business consistent with past practice);

(j) any Contract involving interest rate swaps, cap or collar agreements, commodity or financial future or option contracts or similar derivative or hedging Contracts;

(k) any Contract providing for the deferred payment of any purchase price (other than trade payables incurred in the ordinary course of business consistent with past practice) including any “earn out” or other contingent fee arrangement;

(l) any Contract creating a Lien, other than any Permitted Lien, on any of the PAPI Parties or any of their respective Subsidiaries that will not be discharged at or prior to the Closing;

(m) any Contract purporting to limit or restrict the freedom of a PAPI Party or any of their respective Subsidiaries or, to the PAPI Parties’ Knowledge, any of their respective officers, directors or key employees (A) to engage in any line of business, (B) to own, operate, sell, transfer, pledge or otherwise dispose of or encumber any asset, (C) to compete with any Person or (D) to engage in any business or activity in any geographic region;

(n) any (A) distributorship agreement or (B) Contract that grants any Person the exclusive right to sell products or provide services within any geographical region other than a Contract that (1) is terminable by any party thereto giving notice of termination to the other party thereto not more than 30 days in advance of the proposed termination date and (2) even if so terminable, contains no post-termination obligations (other than payment obligations for pre-termination sales or services), termination penalties, buy-back obligations or similar obligations;

(o) any Contract under which a PAPI Party or any of their respective Subsidiaries is the lessor of, or makes available for use by any third Person, any tangible personal property owned by a PAPI Party or any of their respective Subsidiaries, in each case for an annual rent in excess of $100,000;

(p) any Contract constituting a partnership, joint venture or other similar Contract;

(q) any Contract that contains restrictions with respect to the payment of any dividends in respect of a PAPI Party or any of their respective Subsidiaries or the purchase, redemption or other acquisition of any such Equity Interests;

(r) any Contract relating to the acquisition or divestiture by a PAPI Party or any of their respective Subsidiaries of Equity Interests, assets or business of any Person, which provides for consideration or payments in excess of $100,000 and is not made in the ordinary course of business;

(s) any Contract between a PAPI Party or any of their respective Subsidiaries, on the one hand, and the present or former officers, directors, stockholders, other equity holders of a PAPI or other Affiliates of a PAPI Party or any of their respective Subsidiaries on the other hand;

(t) any Contract containing provisions applicable upon a change of control of a PAPI Party or any of their respective Subsidiaries;

(u) any Contract granting to any Person a right of first refusal, first offer or other right to purchase any of the assets of a PAPI Party or any of their respective Subsidiaries;

(v) any Contract requiring a PAPI Party or any of their respective Subsidiaries to make a payment as a result of the consummation of the Transactions contemplated hereby; and

(w) any other agreement which is material to the PAPI Parties or any of their respective Subsidiaries taken as a whole.

True and complete copies (including all amendments) of each Material Contract have been made available to the CAMAC Parties. Each Material Contract is the legal, valid obligation of each PAPI Party or any of their respective Subsidiaries, as the case may be, and to the PAPI Parties’ Knowledge, any other Person party thereto, binding and enforceable against each such PAPI Party or any of their respective Subsidiaries, as the case may be and, to the PAPI Parties’ Knowledge, any other Person party thereto, in accordance with its terms subject to, except as enforcement may be limited by applicable bankruptcy, insolvency, fraudulent transfer, reorganization, moratorium or other similar Laws relating to or affecting the enforcement of creditors’ rights generally and subject, as to enforceability, to legal principles of general applicability governing the availability of equitable remedies (whether enforcement is sought in a proceeding in equity or at law); (ii) no Material Contract has been terminated, and neither a PAPI Party or any of their respective Subsidiaries, nor, to the PAPI Parties’ Knowledge, any other Person is in material breach or Default thereunder, and to the PAPI Parties’ Knowledge no event has occurred that with notice or lapse of time, or both, would constitute a material breach or Default, or permit termination, modification in any manner materially adverse to a PAPI Party or any of their respective Subsidiaries, as the case may be, or acceleration thereunder; (iii) no party has asserted or has any right to offset, discount or otherwise abate any amount owing under any Material Contract; and (iv) there are no material waivers regarding any Material Contract that have not been disclosed in writing to the CAMAC Parties.

Section 5.6 Capitalization. Schedule 5.6 sets forth a correct and complete description of the following: (i) all of the authorized Equity Interests of the PAPI Parties and each of its Subsidiaries and (ii) the amount of outstanding Equity Interests of the PAPI Parties and each of

its Subsidiaries. Except as described in Schedule 5.6 no Equity Interests of any PAPI Party or any of its Subsidiaries are issued or outstanding or reserved for any purpose.

All of the outstanding Equity Interests of the PAPI Parties and their respective Subsidiaries are duly authorized, validly issued and fully paid and nonassessable, and have not been issued in violation of (nor are any of the authorized Equity Interests of a PAPI Party or any of their respective Subsidiaries is subject to) any preemptive or similar rights created by the PAPI Constituent Instruments or any Contract to which a PAPI Party or their respective Subsidiary is a party or bound.

There are no outstanding securities, options, warrants or other rights (including registration rights), agreements, arrangements or other Contracts to which a PAPI Party or any of their respective Subsidiaries is a party or is bound relating to the issued or unissued Equity Interests of a PAPI Party or any of their respective Subsidiaries or obligating a PAPI Party or any of their respective Subsidiaries to grant, issue, deliver or sell, or cause to be granted, issued, delivered or sold, any Equity Interests of a PAPI Party or any of their respective Subsidiaries, by sale, lease, license or otherwise. Except as set forth on Schedule 5.6, there are no obligations, contingent or otherwise, of a PAPI Party or any of their respective Subsidiaries to (i) repurchase, redeem or otherwise acquire any Equity Interests of a PAPI Party or any of their respective Subsidiaries, (ii) dispose of any Equity Interests of a PAPI Party or any of their respective Subsidiaries or (iii) provide funds to, or make any investment in (in the form of a loan, capital contribution or purchase of Equity Interests or otherwise), or provide any guarantee with respect to the obligations of, any other Person. No PAPI Party or any of their respective Subsidiaries directly or indirectly owns, has agreed to purchase or otherwise acquire or holds any interest convertible into or exchangeable or exercisable for, Equity Interests of any Person. There are no agreements, arrangements or other Contracts (contingent or otherwise) to which a PAPI Party or any of their respective Subsidiaries is a party or otherwise bound pursuant to which any Person is or may be entitled to receive any payment based on the revenues or earnings, or calculated in accordance therewith, of a PAPI Party or any of their respective Subsidiaries. Except as set forth on Schedule 5.6, are no voting trusts, proxies or other agreements or understandings with respect to the voting of any Equity Interests of a PAPI Party or any of their respective Subsidiaries. There are no bonds, debentures, notes or other indebtedness of a PAPI Party or any of their respective Subsidiaries having the right to vote (or convertible into, or exchangeable for, securities having the right to vote) on any matters on which holders of Equity Interests of a PAPI Party or any of their respective Subsidiaries may vote.

(a) Rights; Liens; Encumbrances. Except as disclosed in Schedule 5.6 of the PAPI Disclosure Schedule, (i) none of the capital stock of the PAPI Parties or their Subsidiaries is subject to preemptive rights or any other similar rights or any liens or encumbrances suffered or permitted by any of them; (ii) there are no outstanding options, warrants, scrip, rights to subscribe to, calls or commitments of any character whatsoever relating to, or securities or rights convertible into, or exercisable or exchangeable for, any capital stock of any of the PAPI Parties or their Subsidiaries, or contracts, commitments, understandings or arrangements by which any of the PAPI Parties or their Subsidiaries is or may become bound to issue additional capital stock of any of the PAPI Parties or their Subsidiaries or options, warrants, scrip, rights to subscribe to, calls or commitments of any character whatsoever relating to, or securities or rights convertible into, or exercisable or exchangeable for, any capital stock of any of the PAPI Parties or their

Subsidiaries; (iii) there are no outstanding debt securities, notes, credit agreements, credit facilities or other agreements, documents or instruments evidencing indebtedness of any of the PAPI Parties or their Subsidiaries or by which any of them is or may become bound which are required to be disclosed in any SEC Report (as defined below) but not so disclosed in the SEC Reports, (iv) there are no agreements or arrangements under which any of the PAPI Parties or their Subsidiaries is obligated to register the sale of any of their securities under the Securities Act; (v) there are no outstanding securities or instruments of any of the PAPI Parties or their Subsidiaries which contain any redemption or similar provisions, and there are no contracts, commitments, understandings or arrangements by which any of them is or may become bound to redeem a security of any of the PAPI Parties or their Subsidiaries; (vi) there are no securities or instruments containing anti-dilution or similar provisions that will be triggered by the issuance or reservation of the Consideration Shares; (vii) PAPI does not have any stock appreciation rights or “phantom stock” plans or agreements or any similar plan or agreement; (viii) none of the PAPI Parties or their Subsidiaries have any liabilities or obligations required to be disclosed in the SEC Reports but not so disclosed in the SEC Reports, other than those incurred in the ordinary course of the their respective businesses and which, individually or in the aggregate, do not or would not have a PAPI Material Adverse Effect; and (ix) there are no financing statements securing obligations in any material amounts, either singly or in the aggregate, filed in connection with any of the PAPI Parties or their Subsidiaries. PAPI has filed in its SEC Reports with the SEC true, correct and complete copies of its Certificate of Incorporation and its Bylaws, both as amended and as in effect on the date hereof, and the form of all securities convertible into, or exercisable or exchangeable for, shares of Common Stock.

(b) Effect of Consideration Shares. The Consideration Shares shall equal 62.74% of PAPI’s issued and outstanding Common Stock after giving effect to the consummation of the Transactions and the Financing, excluding shares issued in the Excluded Transaction.

Section 5.7 Shares Validly Issued. When issued in compliance with the provisions of this Agreement, the Consideration Shares will be validly issued, fully paid and nonassessable, and will be free of any liens or encumbrances; provided, however, that the Consideration Shares may be subject to restrictions on transfer under state and/or federal securities laws as set forth herein or as otherwise required by such laws.

Section 5.8 Litigation. As of the date of this Agreement, there is no private or governmental Action pending or threatened in writing against any of the PAPI Parties or their respective Subsidiaries, or, to the PAPI Parties’ Knowledge, any of their respective executive officers or directors (in their capacities as such) or any of their respective properties before or by any Governmental Authority. As of the date of this Agreement, there is no Judgment imposed upon any of the PAPI Parties or their respective Subsidiaries or any of their respective properties, that would prevent, enjoin, alter or materially delay any of the Transactions contemplated by this Agreement. Neither the PAPI Parties, nor any director or executive officer of any of them (in his or her capacity as such), is or has been the subject of any Action involving a material claim or material violation of or material liability under the securities laws of any Governmental Authority or a material claim of breach of fiduciary duty.

Section 5.9 Consents and Approvals. Except as disclosed on Schedule 5.9 of the PAPI Disclosure Schedule, no Consent to which any of the PAPI Parties or any of their respective Subsidiaries are subject is required to be obtained or made by or with respect to any of the PAPI Parties or any of their respective Subsidiaries, in connection with the execution, delivery and performance of this Agreement or the consummation of the Transactions, except for (a) such Consents as may be required under applicable state securities laws and the securities laws of any foreign country; and (b) such other Consents which, if not obtained or made, would not have a PAPI Material Adverse Effect and would not prevent or materially alter or delay any of the Transactions.

Section 5.10 Brokers; Schedule of Fees and Expenses. There are no broker, investment banker, financial advisor or other Person is entitled to any broker’s, finder’s, financial advisor’s or other similar fee or commission in connection with this Agreement or the Transactions based upon arrangements made by or on behalf of PAPI Parties.

Section 5.11 Financial Statements; Undisclosed Liabilities.

(a) The SEC Reports contain true and complete copies of the combined financial statements of PAPI consisting of (i) audited combined balance sheets of PAPI as of December 31, 2007 and 2008, and the related audited combined statements of income and stockholder’s equity and cash flows for the years then ended (including the notes or other supplementary information thereto) (collectively, the “Year-End Financial Statements”) and (ii) an unaudited balance sheet of PAPI as of September 30, 2009 (the “Latest Balance Sheet”), and the related unaudited combined statements of income and stockholders’ equity and cash flows for the nine-month period then ended (the “Interim Financial Statements,” and, collectively with the Year-End Financial Statements, the “Financial Statements”).

(b) Each of the Financial Statements (including the notes or other supplementary information thereto) (i) has been prepared in accordance with GAAP applied on a consistent basis throughout the periods involved and (ii) present fairly, in all material respects, the financial position of PAPI as of the respective dates thereof and the results of each such entity’s operations and cash flows for the periods indicated, subject, however, in the case of the Interim Financial Statements, to normal year-end audit adjustments and to the absence of notes and other textual disclosure required by GAAP. The books and records of PAPI have been and are being maintained in all material respects in accordance with applicable legal and accounting requirements to permit preparation of the financial statements in accordance with GAAP and to maintain asset accountability.

(c) No PAPI Party has any liability (and, to the PAPI Parties’ Knowledge, there is no reasonable basis for any action, suit, proceeding, hearing, investigation, charge, complaint, claim or demand against a PAPI Party or any of their respective Subsidiaries giving rise to any liability), other than (i) liabilities reserved or disclosed on the face of the Latest Balance Sheet, (ii) liabilities which have arisen after the date of Latest Balance Sheet in the ordinary course of business of the PAPI (none of which results from, arises out of, relates to, is in the nature of or was caused by any breach of contract, breach of warranty, tort, infringement or violation of Laws), (iii) liabilities which have been discharged or paid in full after the date of the Latest Balance Sheet in the ordinary course of business of PAPI (none of which results from,

arises out of, relates to, is in the nature of or was caused by any breach of contract, breach of warranty, tort, infringement or violation of Laws) or (iv) liabilities that are obligations to perform pursuant to the terms of any Contract binding on the PAPI Parties or any of their respective Subsidiaries.

Section 5.12 Absence of Certain Changes or Events. Except as set forth in the SEC Reports or on Schedule 5.12, since December 31, 2008, PAPI has conducted its businesses only in the ordinary course and in a manner consistent with past practice and there has not been:

(a) any PAPI Material Adverse Effect;

(b) any damage, destruction or loss (whether or not covered by insurance) with respect to a PAPI Party or any of their respective Subsidiaries, having a replacement cost of more than $50,000 for any single loss or $200,000 for all such losses;

(c) except as required by changes in GAAP or any Law regarding Taxes, any material change by a PAPI Party or any of their respective Subsidiaries in their accounting or Tax reporting methods, principles or practices;

(d) any declaration, setting aside or payment of any dividends on or dividends in respect of any Equity Interests of a PAPI Party;

(e) any (A) issuance of any Equity Interests in a PAPI Party or any of their respective Subsidiaries, (B) redemption, purchase or other acquisition by a PAPI Party or any of their respective Subsidiaries of any Equity Interests of a PAPI Party or any of their respective Subsidiaries or (C) any split, combination or reclassification of any Equity Interests of a PAPI Party or any of their respective Subsidiaries;

(f) any entry into, or amendment of, any employment, consulting, severance, change in control or indemnification agreement or any agreement with respect to any retention bonus with any employee of a PAPI Party or any of their respective Subsidiaries or any other Person, or any incurrence of, entry into or amendment of any collective bargaining agreement or obligation to any labor organization;

(g) any increase or acceleration of the benefits under, or the establishment or amendment of, any bonus, insurance, severance, deferred compensation, pension, retirement, profit sharing, option (including the granting of equity options, equity appreciation rights, performance awards or restricted equity awards), equity purchase or other employee benefit plan, or any increase in the compensation payable or to become payable to partners, members, directors, officers, employees or contractors of a PAPI Party or any of their respective Subsidiaries, except for (A) increases in salaries or wages payable or to become payable in the ordinary course of business and consistent with past practice;

(h) any making by a PAPI Party or any of their respective Subsidiaries of any material election relating to Taxes, the rescission by a PAPI Party or any of their respective Subsidiaries of any material election relating to Taxes or the settlement or compromise of any material claim relating to Taxes;

(i) any entry by a PAPI Party or any of their respective Subsidiaries into any commitment, arrangement or transaction with any director, officer, member, partner or holder of any Equity Interest in a PAPI Party or any of their respective Subsidiaries;

(j) any revaluation by a PAPI Party or any of their respective Subsidiaries of any of its assets or properties, including the writing down of the value of inventory or the writing down or off of notes or accounts receivable, other than in the ordinary course of business and consistent with past practices;

(k) any material acquisition of any assets, business or Person (other than the purchase of assets from suppliers or vendors in the ordinary course of business consistent with past practice);

(l) any sale, transfer, lease, exchange or other disposition of any material assets or properties owned or leased by a PAPI Party or any of their respective Subsidiaries (other than in the ordinary course of business consistent with past practice);

(m) any pending order for, any capital expenditures, or capital additions or betterments made by or on behalf of a PAPI Party or any of their respective Subsidiaries in excess of $100,000 in the aggregate;

(n) any waiver, release, discharge, transfer or cancellation by a PAPI Party or any of their respective Subsidiaries of any debt or claim or the amendment, cancellation, termination, relinquishment, waiver or release of any Contract or right, other than such actions in the ordinary course of business consistent with past practice and, in the aggregate, not material to a PAPI Party and their respective Subsidiaries;

(o) any commencement or settlement of any material legal actions, suits or other legal proceedings;

(p) the creation of any Lien, other than Permitted Liens, on any assets or properties owned or leased by a PAPI Party or any of their respective Subsidiaries;

(q) any discharge or satisfaction of any Lien, or payment of any obligation or liability (fixed or contingent), except as is in the ordinary course of business consistent with past practice and not material to a PAPI Party or any of their respective Subsidiaries;

(r) any entry by a PAPI Party or any of their respective Subsidiaries into any commitment, arrangement or transaction material to the PAPI Parties and their respective Subsidiaries, taken as a whole;

(s) any material increase (including by way of guaranteeing or assuming the obligations of third Persons to repay indebtedness for borrowed money) in the PAPI Parties indebtedness for borrowed money;

(t) any failure by the PAPI Parties or any of their respective Subsidiaries to pay trade accounts payable or any other liability of a PAPI Party or any of their respective Subsidiaries when due (other than trade accounts payable that are subject to dispute in the

ordinary course of business and are, individually and in the aggregate, not material to the PAPI Parties and their respective Subsidiaries);

(u) any loan to or from any PAPI Party to or from any partner, member, director, officer, employee or contractor of such PAPI Party; or

(v) any Contract to do any of the foregoing, except as expressly permitted by this Agreement.

Section 5.13 Foreign Corrupt Practices. Neither the PAPI Parties and their respective Subsidiaries, nor to the PAPI Parties’ Knowledge, any of their respective Representatives, has, in the course of its actions for, or on behalf of, the PAPI Parties or their respective Subsidiaries, directly or indirectly, (a) used any corporate funds for any unlawful contribution, gift, entertainment or other unlawful expenses relating to political activity; (b) made any direct or indirect unlawful payment to any Governmental Authority or any foreign or domestic government official or employee from corporate funds; (c) violated or is in violation of any provision of the FCPA; or (d) made any unlawful bribe, rebate, payoff, influence payment, kickback or other unlawful payment in connection with the operations of PAPI Parties or any of their respective Subsidiaries to any foreign or domestic government official or employee, except, in the case of clauses (a) and (b) above, any such items that, individually or in the aggregate, have not had and would not reasonably be expected to have a PAPI Material Adverse Effect.

Section 5.14 Money Laundering Laws. To the PAPI Parties’ Knowledge, none of the PAPI Parties or their respective Subsidiaries has violated any Money Laundering Laws, and no proceeding involving any PAPI Parties or any of their respective Subsidiaries with respect to the Money Laundering Laws is pending or, to the Knowledge of the officers of the PAPI Parties, is threatened.

Section 5.15 OFAC. None of the PAPI Parties or their respective Subsidiaries, any director or officer of the PAPI Parties, or, to the PAPI Parties’ Knowledge, any agent, employee, affiliate or Person acting on behalf of the PAPI Parties is currently identified on the specially designated nationals or other blocked person list or otherwise currently subject to any U.S. sanctions administered by OFAC; and none of the PAPI Parties nor any of their respective Subsidiaries have, directly or indirectly, used any funds, or loaned, contributed or otherwise made available such funds to any Subsidiary, joint venture partner or other Person, in connection with any sales or operations in Cuba, Iran, Syria, Sudan, Myanmar or any other country sanctioned by OFAC or for the purpose of financing the activities of any Person currently subject to, or otherwise in violation of, any U.S. sanctions administered by OFAC.

Section 5.16 Environmental Matters. Except as set forth on Schedule 5.16:

(a) The PAPI Parties and their respective Subsidiaries and all associated operations are and, during the relevant time periods specified in all applicable statutes of limitations, have been in compliance with Environmental Laws in all material respects;

(b) The PAPI Parties and their respective Subsidiaries all Environmental Authorizations required for their operations as presently conducted, all such Environmental

Authorizations are in the name of the proper entity and in full force and effect, and the PAPI Parties are in compliance in all material respects with such Environmental Authorizations;

(c) The PAPI Parties and their respective Subsidiaries are not subject to any pending or, to the PAPI Parties’ Knowledge, threatened Action pursuant to Environmental Laws, nor has any PAPI Party received any written notice of violation, noncompliance, or enforcement or any written notice of investigation or remediation from any Governmental Authority pursuant to Environmental Laws;

(d) There has been no Release of Hazardous Materials at, on, under or from the assets or in connection with the operations of the PAPI Parties in violation of any Environmental Laws or in a manner that could give rise to any Environmental Liabilities or any other remedial or corrective action obligations pursuant to Environmental Laws;

(e) To the PAPI Parties’ Knowledge and their respective Subsidiaries, there has been no exposure of any Person or property to any Hazardous Materials in connection with the Acquired Assets or the operations of the PAPI Parties that could reasonably be expected to form the basis for any Environmental Liabilities or any Action for other Damages or compensation; and

(f) The PAPI Parties and their respective Subsidiaries have made available for inspection complete and correct copies of all environmental assessment and audit reports and studies and all correspondence addressing environmental obligations relating to the PAPI Parties that are in the possession or control of the PAPI Parties.

(g) Notwithstanding any other provision of this Agreement, the representations and warranties made in this Section 5.16 are the sole and exclusive representations and warranties made in this Agreement by the PAPI Parties with respect to environmental matters.

Section 5.17 Taxes. Each of the PAPI Parties and their Subsidiaries have timely, or have caused to be timely filed on their behalf, all Tax Returns required by any law or regulation to be filed by or with respect to it, either separately or as a member of group of corporations, pursuant to applicable Legal Requirements. All Tax Returns filed by (or that include on a consolidated basis) any of the PAPI Parties and their Subsidiaries were (and, as to a Tax Return not filed as of the date hereof, will be) in all respects true, complete and accurate, except to the extent any failure to file or any inaccuracies in any filed Tax returns, individually or in the aggregate, have not and would not reasonably be expected to have a PAPI Material Adverse Effect. There are no unpaid Taxes claimed to be due by any Governmental Authority in charge of taxation of any jurisdiction, nor any claim for additional Taxes for any period for which Tax Returns have been filed, except to the extent any failure to file or any inaccuracies in any filed Tax returns, individually or in the aggregate, have not and would not reasonably be expected to have a PAPI Material Adverse Effect. Each of the PAPI Parties and their Subsidiaries has set aside on its books provision reasonably adequate for the payment of all taxes for periods subsequent to the periods to which such returns, reports or declarations apply. Any deficiencies proposed as a result of any governmental audits or such Tax Returns have been paid or settled, and there are no present disputes as to such Taxes payable by any of the PAPI Parties or their

Subsidiaries. There are no tax liens against any property for assets of the PAPI Parties or their Subsidiaries and, to the PAPI Parties’ Knowledge, there is no basis for any such lien.

Section 5.18 Title. Each of PAPI and its Subsidiaries has good and marketable title to all real property and good and marketable title to all personal property owned by them which is material to their respective businesses, in each case free and clear of all liens, encumbrances and defects except (i) such as are described in Schedule 5.18 of the PAPI Disclosure Schedule, or (ii) such as do not materially affect the value of such property and do not interfere with the use made and proposed to be made of such property by any of them. Any real property (including mineral, mining or similar rights) and facilities held under lease by PAPI or any of its Subsidiaries are held by them under valid, subsisting and enforceable leases with such exceptions as are not material and do not interfere with the use made and proposed to be made of such property and buildings by any of them.

Section 5.19 Accounts Receivable. Except as set forth on Schedule 5.19, all accounts receivable reflected on the Latest Balance Sheet or accrued after the date thereof and existing as of the Closing are due and valid claims against account debtors for goods or services delivered or rendered, collectible and subject to no defenses, offsets or counterclaims, except to the extent reserved against on the Latest Balance Sheet, as would be adjusted for operations and transactions during the period after the date of the Latest Balance Sheet through the Closing Date in accordance with the past custom and practice of the PAPI. PAPI good and valid title to such accounts receivable free and clear of all Liens except Permitted Liens. No PAPI Party has any obligation pursuant to any rule or regulation of any Governmental Authority (whether in bankruptcy or insolvency proceedings or otherwise) to repay, return, refund or forfeit any accounts receivable previously collected. All accounts receivable of PAPI reflected on the Latest Balance Sheet or accrued after the date thereof arose in the ordinary course of business. None of the obligors of such receivables have refused or given written notice that it refuses to pay the full amount thereof and none of the obligors of such accounts receivable is an affiliate of any PAPI Party or, to the PAPI Parties’ Knowledge, is involved in a bankruptcy or insolvency proceeding. Except as set forth in Schedule 5.19, no accounts receivable are subject to prior assignment or Lien. Except as reflected on the Latest Balance Sheet as would be adjusted for operations and transactions during the period after the date of the Latest Balance Sheet through the Closing Date in accordance with the past custom and practice of PAPI, no PAPI Party has incurred any liabilities to customers for discounts, returns, promotional allowances or otherwise.

Section 5.20 SEC Reports. The Company has filed all reports, schedules, forms, statements and other documents required to be filed by it under the Securities Act and the Exchange Act, including pursuant to Section 13(a) or 15(d) thereof (the foregoing materials including all exhibits and schedules thereto, being collectively referred to herein as the “SEC Reports” and, together with the Schedules to this Agreement, and any other materials prepared by the Company and delivered to the CAMAC Parties in writing, the “Disclosure Materials”). The Company has delivered to the CAMAC Parties or their representatives, true, correct and complete copies of the SEC Reports not available on the EDGAR system. As of their respective dates, the SEC Reports complied in all material respects with the requirements of the Securities Act and the Exchange Act and the rules and regulations of the Commission promulgated thereunder, none of the SEC Reports or the other Disclosure Materials, when filed or prepared, as applicable, contained any untrue statement of a material fact or omitted to state a material fact

required to be stated therein or necessary in order to make the statements therein, in the light of the circumstances under which they were made, not misleading.

Section 5.21 Investment Company. None of the PAPI Parties, nor any of their subsidiaries, is, and after giving effect to this Agreement, the Transaction Documents, and the transactions contemplated hereby and thereby, none of them will be, (i) an “investment company” within the meaning of such term under the Investment Company Act of 1940, as amended (the “Investment Company Act”), and the rules and regulations of the SEC thereunder or (ii) a “business development company” (as defined in Section 2(a)(48) of the Investment Company Act).

ARTICLE VI

Covenants of the CAMAC Parties

Section 6.1 General Conduct of Business. During the period from the date of this Agreement and continuing until the earlier of the termination of this Agreement or the Closing Date, each of the CAMAC Parties agree, unless consented to in writing by the PAPI Parties, it will (x) operate its business with respect to the Contract Rights and the Oyo Related Agreements in the usual and ordinary course consistent with past practices and (y) with respect to the Contract Rights and the Oyo Related Agreements, preserve substantially intact its business organization, maintain its rights and franchises and maintain its relationships and goodwill with its suppliers, customers, distributors, licensors, licensees and other Persons doing business with it. Without limiting the generality of the foregoing, except as otherwise consented to in writing by the PAPI Parties, from the date of this Agreement until the earlier of the Closing or the termination of this Agreement, the CAMAC Parties will not, and will prevent their respective Subsidiaries from doing any of the following:

(a) sell, transfer, lease, exchange or otherwise dispose of, whether by merging, consolidating or in any other manner, or grant any Lien with respect to the Contract Rights or the Oyo Field;

(b) incur, create, assume, guarantee or otherwise become liable for any obligation for borrowed money, purchase money indebtedness or any obligation of any other Person, that is secured by the Contract Rights or the Oyo Field;

(c) take or cause to be taken any action (including inaction) that could reasonably be expected to delay or adversely affect the consummation of the transactions contemplated hereby or that could reasonably be expected to result in any of the representations and warranties contained in Article IV becoming untrue or inaccurate in any material respect; or

(d) agree in writing or otherwise to do any of the foregoing.

Section 6.2 Notice of CAMAC Material Adverse Effect. Each of the CAMAC Parties agree to promptly notify the PAPI Parties of any material event or occurrence not in the ordinary course of its business that would have or reasonably be expected to have a CAMAC Material Adverse Effect, including but not limited to: (i) any written notice of Default or termination received or given by any of the CAMAC Parties with respect to any of the Oyo Related

Agreements, Oyo Debt Documents or the Oyo Field; (ii) any written notice of any pending or threatened claim, demand, action, suit, inquiry or proceeding relating to any of the Oyo Related Agreements, Oyo Debt Documents or the Oyo Field; (iii) any material damage, destruction or loss to all or any part of the Oyo Field or any assets used in connection with the Oyo Field or any of the Oyo Related Agreements or (iv) any event or condition occurring or arising on or after the date hereof that (A) would render unenforceable, the PAPI Parties’ rights under this Agreement, or, after giving effect to this Agreement, under any of the Oyo Related Agreements or (B) would require any amendment or supplement to the Proxy Statement (as defined below).

Section 6.3 Consultation; Compliance. The CAMAC Parties agree to (i) consult with the PAPI Parties before voting on material decisions under any of the Oyo Related Agreements; (ii) continue to pay all amounts due and owing under each of the Oyo Related Agreements; and (iii) comply in all material respects with all covenants, agreements and other provisions of each of the Oyo Related Agreements required to be complied with by the CAMAC Parties.

Section 6.4 PAPI Consent Required. Without limiting the generality of the forgoing, during the period from the date of this Agreement and continuing until the earlier of the termination of this Agreement or the Closing Date, except as listed on Schedule 6.4 of the CAMAC Disclosure Schedule or as otherwise expressly permitted by or provided for in this Agreement, none of the CAMAC Parties shall do, allow, cause or permit any of the following actions to occur with respect to any of the Contract Rights without the prior written consent of the PAPI Parties, which shall not be unreasonably delayed or withheld:

(a) Material Contracts. Except as set forth in Schedule 6.4(a), enter into any new material contract relating to the PSC or the Oyo Field, or violate, amend or otherwise materially modify or waive any of the terms of any existing Oyo Related Agreement or waive or fail to enforce any material right thereunder, other than (x) in the ordinary course of business consistent with past practice or (y) upon prior consultation with, and prior written consent of the PAPI Parties;

(b) Dispositions. Sell, lease, license or otherwise dispose of or encumber all or part of the Contract Rights, except in the ordinary course of business consistent with past practice;

(c) Litigation. Compromise or settle any material litigation or arbitration proceedings related to the PSC or the Oyo Field; or

(d) Capital Commitments. Enter into any capital commitment in excess of $100,000 relating to the Oyo Field.

Section 6.5 Related Tax. From the date of this Agreement and continuing until the earlier of the termination of this Agreement or the Closing Date, each of the CAMAC Parties, consistent with past practice, shall (i) duly and timely file all Tax Returns and other documents, with respect to the Oyo Related Agreements or the Oyo Field, required to be filed by it with applicable Governmental Authorities, the failure to file of which could have a CAMAC Material Adverse Effect, subject to extensions permitted by law and properly granted by the appropriate authority; and (ii) pay all Taxes shown as due on such Tax Returns (subject to good faith

disputes over such Taxes). The CAMAC Parties shall be jointly and severally responsible for any and all sales or other transaction taxes, duties and other similar charges payable in connection with the sale and transfer of the interest in the Contract Rights.

Section 6.6 Access to Information. Except as required pursuant to any confidentiality agreement or similar agreement or arrangement to which any CAMAC Party is subject, between the date of this Agreement and the Closing Date, subject to the PAPI Parties’ undertaking to use commercially reasonable efforts to keep confidential and protect the Intellectual Property of CAMAC Parties against any disclosure, the CAMAC Parties will permit the PAPI Parties and its Representatives reasonable access at dates and times agreed upon by the applicable CAMAC Party and the PAPI Parties, to all of their books and records and other data with respect to the Oyo Related Agreements and the Oyo Field, including, but not limited to, exploration operations, oil screening assessments and drilling and reconnaissance programs, which the PAPI Parties determine are necessary for the preparation and amendment of the Proxy Statement and such other filings or submissions required by SEC rules and regulations as are necessary to consummate the Transactions and as are necessary to respond to requests of the SEC’s staff, the PAPI Parties’ accountants and relevant Governmental Authorities.