Filed by: LVB Acquisition, Inc.

Pursuant to Rule 425 under the Securities Act of 1933

Subject Company: LVB Acquisition, Inc.

Subject Company’s Commission File No.: 000-54505

Zimmer and Biomet colleagues:

Welcome to the first edition of theComing Together newsletter. This newsletter will provide you with regular updates on the integration planning process, including updates from the integration planning teams and answers to your questions. It is our goal to provide you with timely and transparent information regarding our progress. TheComing Together newsletter is your ‘go-to’ resource for information related to integration planning.

In this edition, we are sharing video highlights from David Dvorak and Jeff Binder’s discussion with the integration planning teams at their kick-off meeting a few weeks ago. David and Jeff shared their combined vision for the new organization, providing a framework and focus for the teams as they began their planning work. Their message is just as relevant for the larger team as we all continue to stay focused on our day-to-day work with an eye to the future of our combined organization. To view the video, click here.

Since the kick-off meeting, the integration planning teams have presented their draft team charters to the Integration Steering Committee (ISC) and most are well along in detailing the integration planning work to be done. This newsletter will serve as your source of information on the teams and their progress, as well as the activities of the Integration Management Office (IMO) and ISC.

If you have questions for the IMO or integration planning teams, continue to send them toteammemberquestions@biomet.com. While we would like to be able to respond to all of the questions, at this point, it may be too early in the integration planning process to be able to answer many of your questions right away. Please be aware that answers will emerge and be shared as the integration planning teams continue their work. We will answer as many questions as possible in future editions of theComing Together newsletter

Sincerely,

| | |

| Derek Davis | | Peggy Taylor |

| IMO Integration Lead (Zimmer) | | IMO Integration Lead (Biomet) |

| VP Finance, Corporate Controller | | SVP, Human Resources |

| and Chief Accounting Officer | | |

David Dvorak and Jeff Binder Outline Vision and Priorities for Combined Company

At the Integration Planning Team Kick-Off Meeting on July 15 and 16 in Warsaw, David Dvorak and Jeff Binder outlined the vision and priorities for the new company. As you will see in the video, both CEOs expressed excitement about the possibilities of the combined companies, as well as their appreciation to the integration planning teams for their dedication and spirit of cooperation.

In future issues, we’ll provide additional updates on the activities of the various integration teams.

David Dvorak / Jeffrey Binder Transcript(13:39)

Coming Together

Zimmer-Biomet Integration Kick Off

July 15-16, 2014 Opening Remarks

David Dvorak(6:02)

It’s a beautiful day for musculoskeletal health. Right? Little bit of a mouthful, but it is in fact. I think that we’re about, together, to embark upon a journey that offers incredible opportunity for these organizations. And the work that all of you have done to bring the companies to this point to make them successful enough to create this opportunity should be commended. And you’ve been selected as representatives of these organizations among some eighteen thousand team members to take these leadership roles. And with that comes a big responsibility. We’re going to talk to you a bit about that. Even from a vision and a direction standpoint as to how you communicate the opportunity and the work ahead to your broader teams. And how we embed that in the specific plans that we’re about to begin to develop.

If you look at some of the benefits of the combination on the next slide. These are ones that we’ve talked about in front of all the stakeholders that we’ve had a chance to discuss this combination. Some of these are pretty straightforward. Jeff will elaborate a little bit on the thinking of the integration steering committee. But you start with the products and systems that will come together. There won’t be another company that can match the combined companies’ assets in that regard. Think about the bearing surface technologies, the systems and bone ingrowth technologies across all the anatomical sites and up and down the continuum of care. No one will be out there with a more comprehensive and complete set of solutions for customers.

But if you look beyond that, I think what’s even more exciting—and consider the market in which we’re going to be operating—is no company is going to have the dedicated resources across internal research and development with complementary external development opportunities through licensing or further acquisitions than this combined entity.

And our opportunity to innovate, again, early intervention, joint preservation, biological solutions through joint replacement, revision, salvage systems, intelligent instruments, you name it, is going to be unmatched in the industry.

But beyond that, we’re going to be able to develop integrated services, comprehensive solutions that help these customers develop and deliver the right solution for a particular patient in an increasingly personalized way. I don’t know that anyone can look at a company that’s going to have broader resources and yet be focused exclusively on this musculoskeletal space.

When you do these combinations, it happens very rapidly. Decisions have to get made rapidly. The organization is expecting clarity and momentum, and a lot of acceleration will take place. From the point of putting this leadership team together, things will start to move pretty fast at this point. I know the people have been pining to get together and get questions answered, and access to information, and conversations with our counterparts on each side. And that’s healthy and natural. It’s going to happen pretty quickly from here. And you think about this: Everything that you were responsible for doing continues on and now we’ve got a multi-billion dollar integration to plan. But boy that’s really exciting because some of the things that we might have been caught up in or feeling like they were extraordinarily hard on an isolated basis, get put in a different context when you take a different perspective with some of those issues. And the team members across these entities can do the same thing. You can start to step out of the confines of your existence prior to this announcement—prior to this opportunity—and start to think big about what we can do together and how we can innovate in a way that’s going to positively affect individuals and patients across the globe.

And I don’t know that we get another chance to do this in as profound a way in our professional lives than what we’re going to have before us. It’s really special, and we ought to treat it that way. I know—because I’ve seen it in the past, and I can already feel it in a context of this combination—the people step up. People that might have been kind of bogged down and grinding their way through some of the challenges they were facing. They do step back and look at this, and they’re really inspired by the opportunity of the combined entity. And I’ve already seen that in the conversations that I’ve had with individuals from both organizations. People are anxious and ready to get after it, and see this as being a unique opportunity for them as individuals, and their teams, and the broad group of people that rely on us to get this right. So take advantage of that. Have fun and leverage this learning opportunity in a way that redowns to your benefit and to your team’s benefit because I do think it’s really going to be a unique chance for us to create something great together.

So I look forward to working with all of you, starting in these couple days, but in the weeks and months to come, to fully realize the potential of this combination. I’m excited about it for myself and for all of us. I’m most excited about it because of what I think we can uniquely do for patients.

*****************************************************

Jeffrey Binder(7:31)

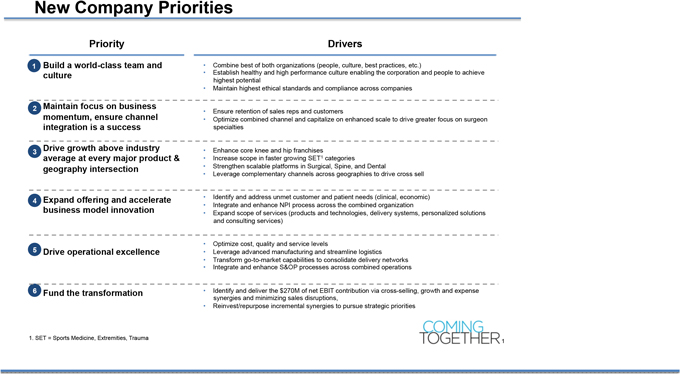

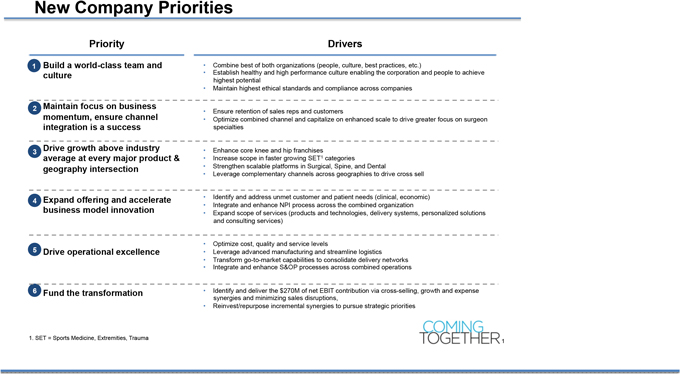

And in terms of one of our first assignments, which was setting the priorities for the business, I’d have to say that was a very easy collaboration in the sense that it wasn’t really all that difficult to set the priorities for the business because they stem from what I think are a common set of priorities that each of us have on our own. And our priorities that were—we did a little wordsmithing, but at the end of the day I can’t remember one time where we thought, “I don’t agree with that.” It was much more of a process of, “Hey, it’s pretty clear. It’s pretty clear what we need to accomplish here. And it’s pretty clear what the priorities for the organization will be.” And I’ll talk about those—though not in excruciating detail—at the end of my remarks. Because there’s going to be a lot of conversation about those priorities and how they apply to the work of the integration teams. And I don’t think we need to get into detail here.

The first priority that we all talked about was building a world-class culture and a world-class team. David talked about doing some formal work with Senn Delaney about understanding the two cultures and then consciously building together the culture that we want to have. That’s a very important part of that. Another really important part of that is the idea of creating a high-performance culture—both a culture that provides opportunities for people to perform at their best, but also a culture that gives a platform for the company to succeed.

The second priority is around maintaining focus on business momentum or business continuity. And ensuring especially that the integration of our channels is a success. That involves, of course, retaining our sales reps and our customers. And, in general, just configuring our channels appropriately to mirror the needs of our customers. And I would say as we think about again the spirit of this idea of one surgeon and one patient, making sure that this integration at the very beginning is for them and not for us. And one of the things that we’ve talked about a lot is that Zimmer’s customers have chosen to be Zimmer customers. They didn’t just kind of fall into it. There’s something that they really like about Zimmer. They like the products. They like their rep. They like the company. Same thing on the Biomet side, which is why I think this branding is so important. They chose Biomet. They chose to be part of Biomet product, service—all the same things. As we go through this transition and we think about maintaining business momentum, I think it’s very important. One surgeon. What are we doing for that one surgeon. Does that one surgeon feel at home? Does that one customer feel at home in the combined company? Do they have an emotional connection to the company? Do they feel like they still belong? I think very important for that one surgeon in business continuity.

I talked about winning attitude. The third priority is about driving above-market growth. It was really interesting. We have something that we call “Excellence at Every Intersection.” I think Zimmer, I heard, during the conversation, has something called a “Stoplight Report”—the green and red arrows. Pretty simple. Are we growing ahead of the market in every geography, in every product line. It’s that winning spirit. It’s that “you can’t control the world, you can’t control the market, but you can darn well control how you compete.” And so I think that’s an ethos that we both bring to the table. Obviously, that gets built one surgeon at a time.

And I think, as David talked about, you can almost think about a few different sets of businesses. But the same goal across all of them to win. In hips and knees, where clearly it’s about enhancing leadership. In segments like sports, extremities, and trauma where it’s about increasing our critical mass even further, and winning in those segments. And then in places like surgical, spine, and dental, creating scalable platforms. I think people in those businesses have all been thinking, “Boy, it would be nice to get a little bit bigger and little bit more powerful, and to have a little bit more resource.” And we have the capability of doing that through this integration.

The fourth priority is around innovation, and around expanding the offering. Incredible opportunity through resource as we talked about to be able to do that. I think a particular opportunity, given that there will be some overlap in the portfolios, a particular opportunity to focus resources on the greatest needs. And the biggest clinical needs out there. And making sure that projects that have the biggest impact on surgeons and patients are well funded. Certainly, developing new business models, and some of the nuts and bolts of making sure that our processes integrate.

The fifth priority is around driving operational excellence. You can think about this triangle that we all try to manage of cost and quality and delivery. I think in the old days, people used to think you can kind of give up one of them for the others. In the modern world, I think we recognize very, very clearly that it’s not a trade-off. It’s a mutually enforcing virtuous circle where we need to do well on cost, quality, and delivery. All three of them incredibly important to our customers. Maybe cost used to not be as important, but we know that for many of our stakeholders it’s sometimes the most important now. But coming up with, not only the cost-effective solutions, but being able to deliver them in a cost-effective way. And using some of our latest, modern, advanced manufacturing techniques is critically important.

And then finally, what we call “Fund the Transformation.” And David has spoken a lot about this. Didn’t speak about it as much today, but I know he’ll be speaking a lot about it. This whole idea that we need to meet our financial commitments and we need to be able to deliver synergies. But those synergies are not exclusively cost synergies by any means. Those synergies are about creating value that can come in all sorts of ways. And a lot of that value comes from being able to take advantage of cross-selling, being able to take advantage of some of the opportunities that we’re going to start to identify in this room today. And using the proceeds of those opportunities to fund the business, and to fund even more explosive growth in the future. And using them to pursue our strategic priorities.

Can’t say enough about how much I’ve enjoyed getting to know you, David. I’ve told our people at every event that I think David’s going to be just a fabulous CEO of this combined company. I’m really looking forward to continuing to work with him on this journey, and hope we’ll set a good example for all of you in how fruitful our collaboration can be.

Update on Integration Process

The second Integration Team Summit took place in Warsaw on August 12 and 13. The participants were employees from both companies who were divided into 25 joint teams representing all of our business units, regions and functions.

Over the course of the two-day meeting, each team presented a status update on their integration plans. It is a large undertaking to bring together two global organizations like Zimmer and Biomet. The integration teams had the opportunity to share ideas about how we will work together once the transaction closes. We are making significant progress and everything is moving ahead right on schedule. In the coming months, these teams will meet at additional Summits until the transaction closes.

There were a number of key takeaways to share with you.

| | • | | Our Communications are Critical:Nearly all of the integration teams said that the communication of plans to employees, customers and other key stakeholders is a top priority. The IMO and integration teams are committed to keeping all employees and stakeholders informed as the integration planning continues. We will update you after each Summit and please be on the lookout for regular newsletters from the Integration Management Office (IMO). We understand that employees want more information and we will provide that information when it is available. |

| | • | | We Have More Similarities than Differences:The integration teams have been working together for more than a month, and each of them found that they have much in common, from customer focus to collaboration to culture. There was a lot of laughter during the meeting and positive dialogue. We are all working closely together and sharing our ideas to create an even better, stronger combined company. |

| | • | | We are Stronger Together:As we review our businesses, it is clear that there are significant opportunities for growth that will make us even more competitive in the global marketplace. Teams are already identifying areas for innovation and efficiency. |

We Need Your Input on the Integration Process

The IMO asks that you provide your opinion on the integration planning process. Your feedback is an important gauge of how we’re doing so far, and it will help ensure we are effectively communicating. This week you received a brief online “Pulse Check” survey—16 questions that should take less than 10 minutes to complete. We ask that you take a few minutes to share your opinions with us. We will ask you to participate in this survey several times over the coming months to help us continually improve. Your responses will be collected by an outside resource and will remain anonymous.

Please submit all questions toteammemberquestions@biomet.com

I understand that Zimmer requires a college education for many jobs. Will that policy remain in place after closing?

We have received a number of questions about Zimmer’s degree requirement for professional positions. We understand that you are anxious to know how that policy will affect Biomet Team Members as the companies combine.

Biomet Team Members without college degrees will not be subject to degree requirements to remain in their current jobs when the combination occurs.

As a new combined company, we will begin to establish job descriptions and minimum job qualifications that can substitute for a four-year degree requirement where appropriate. Until the merger closes, the current education requirements remain in place at both respective companies.

We are committed to provide growth opportunities for employees in the new combined company. We will share more information with you as it becomes available.

What will be the dress code of the new company?

The dress code of the new company has been a topic of much discussion since the announcement of the combination. It is the goal of the Integration Steering Committee to take a thoughtful approach to decisions that will help shape the new culture. As we consider the company’s various facilities around the world, we recognize they each have their own practices and cultural considerations that we wish to respect.

At the close of the combination, a location-based dress code will be implemented to allow for varying practices and we will look to local teams to guide the decision at their location.

Recently, Zimmer announced that for Warsaw-based employees, a blended approach will be taken and the Company has implemented a new casual dress code. Employees who work at Zimmer’s Warsaw headquarters (Building 3) now have the opportunity to wear jeans throughout the work week. All other Warsaw-based sites now have the opportunity to wear jeans or shorts.

Safety is always our number one priority and we will continue to require all employees to adhere to local safety requirements, including closed-toe shoes and other protective gear as necessary.

What should I be doing differently?

For now, the best thing that we can all do is to keep doing what we’re doing and focus on our day jobs and responsibilities. The talent of our people is what makes both companies so successful. We can’t be distracted or lose sight of that. Thank you for your commitment and all of your hard work.

When will we have more information about headcount, compensation, job title, etc.?

We understand that these are the most important questions for many of us. At this time, we do not have further information, but decisions on these topics will be communicated as early as possible.

Cautionary Statement Regarding Forward-Looking Statements

This communication contains forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of forward-looking terms such as “may,” “will,” “expects,” “believes,” “anticipates,” “plans,” “estimates,” “projects,” “assumes,” “guides,” “targets,” “forecasts,” and “seeks” or the negative of such terms or other variations on such terms or comparable terminology. Such forward-looking statements include, but are not limited to, statements about the benefits of the proposed merger between Zimmer and LVB Acquisition, Inc. (“LVB”), the parent company of Biomet, including future financial and operating results, the combined company’s plans, objectives, expectations and intentions, the expected timing of completion of the transaction and other statements that are not historical facts. Such statements are based upon the current beliefs and expectations of Zimmer’s and LVB’s management and are subject to significant

risks and uncertainties that could cause actual outcomes and results to differ materially. These risks and uncertainties include, but are not limited to: the possibility that the anticipated synergies and other benefits from the proposed merger of Zimmer and LVB will not be realized, or will not be realized within the expected time periods; the inability to obtain regulatory approvals of the merger (including the approval of antitrust authorities necessary to complete the transaction) on the terms desired or anticipated; the timing of such approvals and the risk that such approvals may result in the imposition of conditions that could adversely affect the combined company or the expected benefits of the transaction; the risk that a condition to closing the transaction may not be satisfied on a timely basis or at all; the risk that the proposed transaction fails to close for any other reason; the risks and uncertainties related to Zimmer’s ability to successfully integrate the operations, products and employees of Zimmer and Biomet; the effect of the potential disruption of management’s attention from ongoing business operations due to the pending merger; the effect of the announcement of the proposed merger on Zimmer’s and Biomet’s relationships with their respective customers, vendors and lenders and on their respective operating results and businesses generally; risks relating to the value of the Zimmer shares to be issued in the transaction; access to available financing (including financing for the acquisition or refinancing of Zimmer’s or Biomet’s debt) on reasonable terms, including the risk that any condition to the closing of the financing committed for the proposed merger and refinancing of Zimmer’s debt is not satisfied; the outcome of any legal proceedings related to the proposed merger; the risks and uncertainties normally incidental to the orthopaedic industry, including price and product competition; the success of the companies’ quality and operational excellence initiatives; changes in customer demand for Zimmer’s or Biomet’s products and services caused by demographic changes or other factors; the impact of healthcare reform measures, including the impact of the U.S. excise tax on medical devices; reductions in reimbursement levels by third-party payors and cost containment efforts of healthcare purchasing organizations; dependence on new product development, technological advances and innovation; shifts in the product category or regional sales mix of Zimmer’s or Biomet’s products and services; supply and prices of raw materials and products; control of costs and expenses; the ability to obtain and maintain adequate intellectual property protection; the ability to form and implement alliances; challenges relating to changes in and compliance with governmental laws and regulations, including regulations of the U.S. Food and Drug Administration (the “FDA”) and foreign government regulators, such as more stringent requirements for regulatory clearance of products; the ability to remediate matters identified in any inspectional observations or warning letters issued by the FDA; changes in tax obligations arising from tax reform measures or examinations by tax authorities; product liability and intellectual property litigation losses; the ability to retain the independent agents and distributors who market Zimmer’s and Biomet’s products; dependence on a limited number of suppliers for key raw materials and outsourced activities; changes in general industry and market conditions, including domestic and international growth rates and general domestic and international economic conditions, including interest rate and currency exchange rate fluctuations; and the impact of the ongoing economic uncertainty affecting countries in the Euro zone on the ability to collect accounts receivable in affected countries. For a further list and description of such risks and uncertainties, see Zimmer’s, LVB’s and Biomet’s periodic reports filed with the U.S. Securities and Exchange Commission (the “SEC”). Copies of these filings, as well as subsequent filings, are available online at www.sec.gov, www.zimmer.com,www.biomet.com or on request from Zimmer or Biomet, as applicable. Zimmer, Biomet and LVB disclaim any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be set forth in the companies’ respective periodic reports. Readers of this communication are cautioned not to place undue reliance on these forward-looking statements, since, while management believes the assumptions on which the forward-looking statements are based are reasonable, there can be no assurance that these forward-looking statements will prove to be accurate. This cautionary statement is applicable to all forward-looking statements contained in this communication.

Additional Information and Where to Find It

Zimmer will file with the SEC a registration statement on Form S-4, in which a consent solicitation statement will be included as a prospectus, and other documents in connection with the proposed acquisition of LVB. The consent solicitation statement/prospectus will be sent to the stockholders of LVB. INVESTORS AND SECURITYHOLDERS OF LVB ARE URGED TO READ THE CONSENT SOLICITATION/PROSPECTUS, AND ANY OTHER FILINGS THAT MAY BE MADE WITH THE SEC IN CONNECTION WITH THE MERGER WHEN THEY BECOME AVAILABLE, AS THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE MERGER. The registration statement and consent solicitation statement/prospectus and other documents which will be filed by Zimmer with the SEC, when filed, will be available free of charge at the SEC’s website at www.sec.gov or from Zimmer at www.zimmer.com. Such documents are not currently available. You may also read and copy any reports, statements and other information filed by Zimmer, LVB and Biomet with the SEC at the SEC public reference room at 100 F Street N.E., Room 1580, Washington, D.C. 20549. Please call the SEC at (800) 732-0330 or visit the SEC’s website for further information on its public reference room. Certain executive officers and directors of LVB have interests in the proposed transaction that may differ from the interests of stockholders generally, including benefits conferred under retention, severance and change in control arrangements and continuation of director and officer insurance and indemnification.

This communication shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to appropriate registration or qualification under the securities laws of such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.