Filed by Zimmer Holdings, Inc.

(Commission File No. 001-16407)

Pursuant to Rule 425 of the Securities Act of 1933

Subject Company: LVB Acquisition, Inc.

Commission File No. for Registration Statement

on Form S-4 filed by Zimmer Holdings, Inc.:333-198380

MESSAGE FROM THE INTEGRATION MANAGEMENT OFFICE

Zimmer and Biomet Colleagues:

It has been a busy, but an exciting few weeks. We continued to make great strides in the integration planning process by announcing two important milestones: the combined company will be named Zimmer Biomet, and we announced CEO David Dvorak’s executive leadership team, also known as the Operating Committee. Both of these changes will be implemented after the closing of the transaction.

We are fortunate to have extraordinary talent across all levels at Zimmer and Biomet, and we believe that our future is bright. Over the coming weeks and months, we will have opportunities to get to know the recently named executives who will form Zimmer Biomet’s Operating Committee, beginning with this edition of Coming Together.

We also want to provide an update on the fourth integration summit, which was held on October 14 and 15 in Fort Wayne. Up until now, much of the integration planning work has been focused on each group’s needs. Now the teams are spending more time working together, given the many interdependencies across the organization. As we did after the last summit, we wanted to share a few themes that emerged over the two days together and provide the Pulse Check Survey feedback on our integration planning efforts.

| | — | Creating a Compelling Culture is a Priority: The Summit kicked off with a discussion about “gratitude.” A pediatric oncology nurse spoke to the integration planning team leaders about keeping perspective and giving back. To bring this to life, attendees created stuffed animals that will be delivered to children at two local Indiana hospitals. While the integration planning process can be challenging at times, it is important to recognize our ultimate goal of helping patients. See the group photo, below. |

| | — | Collaborating to Identify Opportunities: Our goal is to create the leading musculoskeletal healthcare innovator. To make that a reality, our integration planning teams participated in nearly 60 detailed breakout sessions where representatives of both companies reviewed current practices at Zimmer and Biomet to determine the most effective approach for our new company. After thoughtful discussions (and some pointed questions!), the teams came together to identify some best practices for the new company. |

| | — | Integration Planning on Track and Will Continue Beyond Day One: The integration planning teams are doing an excellent job with their submissions. Some of the teams, including IT and HR, identified additional work that will be done in 2015 and 2016, after we have begun operating as one company. In short, integrating our two companies is a complex process that will continue for some time. |

Expressions of Gratitude at the October Summit. Integration planning team leaders and the bears to be donated to pediatric oncology patients at two local Indiana hospitals.

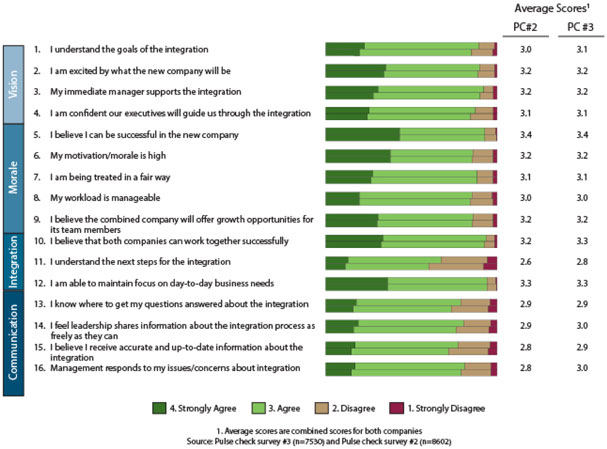

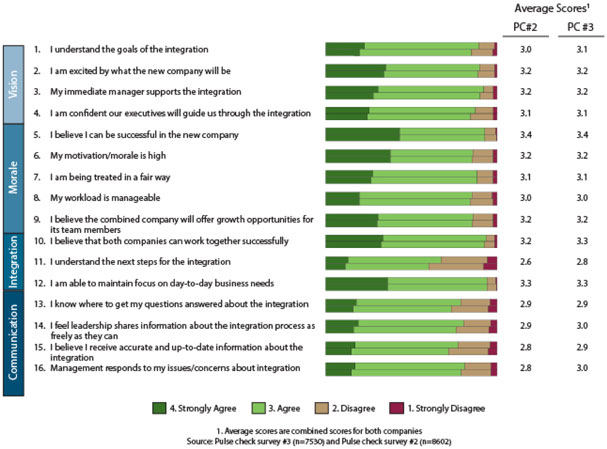

Results of the latest Pulse Check Survey. Overall, the most recent Pulse Check results were consistent with prior pulse checks. Importantly, scores around understanding next steps of the integration and communications continue to improve. You can see the detailed results below. One area that we would like to focus on improving is participation. The number of employees and Team Members who participated in Pulse Check Survey #3 was 7,520 or approximately 40 percent of the combined total, which is down about 10 percent from the prior survey. Your feedback is very helpful as we move through the planning process, and we hope you will take the time to participate in the next survey.

While the integration planning process is interesting, we also need to remember what allowed us to achieve this important opportunity – hard work and focus. Please continue to stay focused on your day-to-day work, so that we can continue serving our customers in the manner they deserve and are accustomed. All organizations continue to operate under their current leadership structure, and it is business as usual.

We will continue to keep you updated through the close of the transaction, and while we don’t have all the answers yet, we are in a great position to hit the ground running on Day One – thanks to all of you.

Sincerely,

Derek Davis

IMO Integration Lead (Zimmer)

VP Finance, Corporate Controller

and Chief Accounting Officer

Peggy Taylor

IMO Integration Lead (Biomet)

SVP, Human Resources

INTRODUCING THE FUTURE OPERATING COMMITTEE: FOCUSING ON BUSINESS UNIT EXECUTIVE LEADERSHIP

The future Operating Committee will be organized around three business units, three geographic regions and six functional areas. In this issue, we will introduce the business unit leadership.

| | |

| | Adam Johnson Group President with responsibility for the Spine, Microfixation, Bone Healing and Dental businesses. Adam Johnson has been Senior Vice President, Biomet, and President of Biomet Spine, Bone Healing and Microfixation since June 2012. Before he took on this expanded role, he was President of Microfixation from 2007 to 2012, and was Vice President of Global Marketing for Biomet Microfixation from 2006. Prior to that, Adam was the Director of Global Marketing for Regeneration Technologies, Inc. (RTI), where he built an internal marketing department and worked with leadership to build a direct sales force. He also worked for Biomet for five years previously, starting his career with Biomet in 1999. Adam holds a Bachelor of Arts degree in marketing and a Master of Business Administration from Jacksonville University. |

| |

| | Dave Nolan Group President with responsibility for the Sports Medicine, Extremities, Trauma, Biologics and Surgical businesses. Dave has 18 years of experience in commercial leadership roles in orthopaedics and currently leads Zimmer’s Advanced Solutions portfolio. He came to Zimmer as the Senior Vice President of Sales for Gel-One® Cross-linked Hyaluronate product. Prior to joining Zimmer, he served as the President of Biomet Sports Medicine, Extremities and Trauma; prior to that he served as the President of Biomet Sports Medicine. He has also held additional marketing and sales leadership positions at Biomet and at Summit Medical Supplies. Dave has a Bachelor of Arts degree in Psychology from Wabash College. |

| | |

| | Dan Williamson Group President with responsibility for the Knee, Hip and Bone Cement businesses. Dan has been Senior Vice President, Biomet, Inc. and President, Global Reconstructive Joints since February 2014. Dan began his career with Biomet in July of 1990 as a Product Development Engineer and has held various other positions of increasing responsibility in Product Development, Marketing and Business Development. These positions include VP of Business Development, Corporate VP, Global Biologics & Biomaterials, and most recently, VP and General Manager, Global Bone Cement and Biomaterials Research. Dan has a Bachelor of Science degree in Bioengineering from Syracuse University and a Master of Science degree in Biomedical Engineering from the University of Kentucky. |

In the next issue of Coming Together, we’ll introduce more members of the executive leadership team.

SPOTLIGHT ON: PRODUCT EDUCATION EVENTS

As part of the integration planning, product education events are being held throughout the regions. In October, education events took place in Zurich, Switzerland (Oct. 6-7), Sydney, Australia (Oct. 16-17) and Chicago, USA (Oct. 16-17). Representatives from both organizations attended.

While the companies continue to operate separately until closing, these meetings were an opportunity for our teams to learn about each company’s respective marketed products. At these events, the teams heard high-level product presentations, followed by breakout sessions with product segment leaders. Information was shared in the same way representatives educate physicians in the field. Publicly-available fact sheets and existing brochures were also used. Each event focused on a specific set of products. For example, the Sydney event for APAC focused on Knees and Hips, Extremities, Intelligent Instruments and Bone Cement.

By creating an atmosphere of education and open dialogue, our teams have the opportunity to take a step back and learn about what each company has to offer the new Zimmer Biomet. As the teams gain a deeper understanding of what could be in their “product bag” after the close, they can start to map out – at a high level – opportunities for growth, cross selling and synergies. For now, however, it is business as usual.

“We believe this product education meeting is beneficial for employees because we had strong attendance and positive collaboration. It is also beneficial from the perspective of our clients. By understanding the suite of products that will be available after closing, we will be better prepared to provide more complete musculoskeletal solutions to our customers after closing. Feedback from the participants has been positive as the opportunities that exist on a combined basis are exciting.”

– PeiSi Oh, Senior Director, Strategic Marketing, Zimmer Asia Pacific.

FREQUENTLY ASKED QUESTIONS

| | 1. | Are temporary workers going to be phased out and let go? |

We recognize the value temporary workers bring and have no plans at this time to change how we utilize temporary workers. If a different approach is developed in the future, we will communicate that as early as possible.

| | 2. | Will we maintain shift premiums? |

Yes, we expect to continue to pay shift premiums. The amount of those premiums is currently under review and we will let you know of any changes, including the timing of any changes, as those decisions are made.

| | 3. | Will we harmonize shift hours between Biomet and Zimmer? |

There are no immediate plans to change shift scheduling. As we gain experience in the new company, it may make sense to revise or harmonize shift hours. If that happens, we will communicate with employees in advance regarding any shift changes.

This edition’s Frequently Asked Questions are for U.S. employees and Team Members only.

| | | | |

| | |

| | STAY IN THE KNOW | | |

| | |

| | We’ll continue sending you updates to keep you informed. | | |

| | |

| | In the meantime, if you have questions for the IMO or integration planning teams, we’ll do our best to answer them. Please submit your questions to one of the following: | | |

| | |

| | Zimmer Employees comingtogether@zimmer.com Biomet Team Members teammemberquestions@biomet.com | | |

| | |

| | | | |

Cautionary Statement Regarding Forward-Looking Statements

This communication contains forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of forward-looking terms such as “may,” “will,” “expects,” “believes,” “anticipates,” “plans,” “estimates,” “projects,” “assumes,” “guides,” “targets,” “forecasts,” and “seeks” or the negative of such terms or other variations on such terms or comparable terminology. Such forward-looking statements include, but are not limited to, statements about the benefits of the proposed merger between Zimmer and LVB Acquisition, Inc. (“LVB”), the parent company of Biomet, including future financial and operating results, the combined company’s plans, objectives, expectations and intentions, the expected timing of completion of the transaction and other statements that are not historical facts. Such statements are based upon the current beliefs and expectations of Zimmer’s and LVB’s management and are subject to significant risks and uncertainties that could cause actual outcomes and results to differ materially. These risks and uncertainties include, but are not limited to: the possibility that the anticipated synergies and other benefits from the proposed merger of Zimmer and LVB will not be realized, or will not be realized within the expected time periods; the inability to obtain regulatory approvals of the merger (including the approval of antitrust authorities necessary to complete the transaction) on the terms desired or anticipated; the timing of such approvals and the risk that such approvals may result in the imposition of conditions that could adversely affect the combined company or the expected benefits of the transaction; the risk that a condition to closing the transaction may not be satisfied on a timely basis or at all; the risk that the proposed transaction fails to close for any other reason; the risks and uncertainties related to Zimmer’s ability to successfully integrate the operations, products and employees of Zimmer and Biomet; the effect of the potential disruption of management’s attention from ongoing business operations due to the pending merger; the effect of the announcement of the proposed merger on Zimmer’s and Biomet’s relationships with their respective customers, vendors and lenders and on their respective operating results and businesses generally; risks relating to the value of the Zimmer shares to be issued in the transaction; access to available financing (including financing for the acquisition or refinancing of Zimmer’s or Biomet’s debt) on reasonable terms, including the risk that any condition to the closing of the financing committed for the proposed merger and refinancing of Zimmer’s debt is not satisfied; the outcome of any legal proceedings related to the proposed merger; the risks and uncertainties normally incidental to the orthopaedic industry, including price and product competition; the success of the companies’ quality and operational excellence initiatives; changes in customer demand for Zimmer’s or Biomet’s products and services caused by demographic changes or other factors; the impact of healthcare reform measures, including the impact of the U.S. excise tax on medical devices; reductions in reimbursement levels by third-party payors and cost containment efforts of healthcare purchasing organizations; dependence on new product development, technological advances and innovation; shifts in the product category or regional sales mix of Zimmer’s or Biomet’s products and services; supply and prices of raw materials and products; control of costs and expenses; the ability to obtain and maintain adequate intellectual property protection; the ability to form and implement alliances; challenges relating to changes in and compliance with governmental laws and regulations, including regulations of the U.S. Food and Drug Administration (the “FDA”) and foreign government regulators, such as more stringent requirements for regulatory clearance of products; the ability to remediate matters identified in any inspectional observations or warning letters issued by the FDA; changes in tax obligations arising from tax reform measures or examinations by tax authorities; product liability and intellectual property litigation losses; the ability to retain the independent agents and distributors who market Zimmer’s and Biomet’s products; dependence on a limited number of suppliers for key raw materials and outsourced activities; changes in general industry and market conditions, including domestic and international growth rates and general domestic and international economic conditions, including interest rate and currency exchange rate fluctuations; and the impact of the ongoing economic uncertainty affecting countries in the Euro zone on the ability to collect accounts receivable in affected countries. For a further list and description of such risks and uncertainties, see Zimmer’s, LVB’s and Biomet’s periodic reports filed with the U.S. Securities and Exchange Commission (the “SEC”). Copies of these filings, as well as subsequent filings, are available online atwww.sec.gov,www.zimmer.com,www.biomet.com or on request from Zimmer or Biomet, as applicable. Zimmer, Biomet and LVB disclaim any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be set forth in the companies’ respective periodic reports. Readers of this communication are cautioned not to place undue reliance on these forward-looking statements, since, while management believes the assumptions on which the forward-looking statements are based are reasonable, there can be no assurance that these forward-looking statements will prove to be accurate. This cautionary statement is applicable to all forward-looking statements contained in this communication.

Additional Information and Where to Find It

Zimmer filed with the U.S. Securities and Exchange Commission (the “SEC”), and the SEC declared effective on September 29, 2014, a registration statement on Form S-4 that includes a consent solicitation statement of LVB that also constitutes a prospectus of Zimmer. INVESTORS AND SECURITYHOLDERS OF LVB ARE URGED TO READ THE CONSENT SOLICITATION/PROSPECTUS AND OTHER FILINGS MADE WITH THE SEC IN CONNECTION WITH THE MERGER CAREFULLY AND IN THEIR ENTIRETY, BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE MERGER. The registration statement and consent solicitation statement/prospectus and other documents filed by Zimmer with the SEC may be obtained free of charge at the SEC’s website atwww.sec.gov or from Zimmer atwww.zimmer.com. You may also read and copy any reports, statements and other information filed by Zimmer, LVB and Biomet with the SEC at the SEC public reference room at 100 F Street N.E., Room 1580, Washington, D.C. 20549. Please call the SEC at (800) 732-0330 or visit the SEC’s website for further information on its public reference room. Certain executive officers and directors of LVB have interests in the proposed transaction that may differ from the interests of stockholders generally, including benefits conferred under retention, severance and change in control arrangements and continuation of director and officer insurance and indemnification.

This communication shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to appropriate registration or qualification under the securities laws of such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

|

This newsletter will provide you with regular updates on the integration planning process, including updates from the integration planning teams and answers to your questions. It is our goal to provide you with timely and transparent information regarding our progress. The Coming Together newsletter is your ‘go-to’ resource for information related to integration planning. |