Filed by Zimmer Holdings, Inc.

(Commission File No. 001-16407)

Pursuant to Rule 425 under the Securities Act of 1933

Subject Company: LVB Acquisition, Inc.

Commission File No. for Registration Statement

on Form S-4 filed by Zimmer Holdings, Inc.: 333-198380

33rd Annual J.P. Morgan Healthcare Conference

January 13, 2015

David Dvorak President and CEO

Focus on Musculoskeletal Healthcare Leadership

Cautionary Statement Regarding Forward-Looking Statements

This communication contains forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of forward-looking terms such as “may,” “will,” “expects,” “believes,” “anticipates,” “plans,” “estimates,” “projects,” “assumes,” “guides,” “targets,” “forecasts,” and “seeks” or the negative of such terms or other variations on such terms or comparable terminology. Such forward-looking statements include, but are not limited to, statements about the benefits of the proposed merger between Zimmer and LVB

Acquisition, Inc. (“LVB”), the parent company of Biomet, including future financial and operating results, the combined company’s plans, objectives, expectations and intentions, the expected timing of completion of the transaction and other statements that are not historical facts. Such statements are based upon the current beliefs and expectations of Zimmer’s management and are subject to significant risks and uncertainties that could cause actual outcomes and results to differ materially. These risks and uncertainties include, but are not limited to: the possibility that the anticipated synergies and other benefits from the proposed merger of Zimmer and LVB will not be realized, or will not be realized within the expected time periods; the inability to obtain regulatory approvals of the merger (including the approval of antitrust authorities necessary to complete the transaction) on the terms desired or anticipated; the timing of such approvals and the risk that such approvals may result in the imposition of conditions that could adversely affect the combined company or the expected benefits of the transaction; the risk that a condition to closing the transaction may not be satisfied on a timely basis or at all; the risk that the proposed transaction fails to close for any other reason; the risks and uncertainties related to Zimmer’s ability to successfully integrate the operations, products and employees of Zimmer and Biomet; the effect of the potential disruption of management’s attention from ongoing business operations due to the pending merger; the effect of the announcement of the proposed merger on Zimmer’s and Biomet’s relationships with their respective customers, vendors and lenders and on their respective operating results and businesses generally; risks relating to the value of the Zimmer shares to be issued in the transaction; access to available financing (including financing for the acquisition or refinancing of Zimmer’s or Biomet’s debt) reasonable terms, including the risk that any condition to the closing of the financing committed for the proposed merger and refinancing of Zimmer’s debt is not satisfied; the outcome of any legal proceedings related to the proposed merger; the risks and uncertainties normally incidental to the orthopaedic industry, including price and product competition; the success of the companies’ quality and operational excellence initiatives; changes in customer demand for Zimmer’s or Biomet’s products and services caused by demographic changes or other factors; the impact of healthcare reform measures, including the impact of the U.S. excise tax on medical devices; reductions in reimbursement levels by third-party payors and cost containment efforts of healthcare purchasing organizations; dependence on new product development, technological advances and innovation; shifts in the product category or regional sales mix of Zimmer’s or Biomet’s products and services; supply and prices of raw materials and products; control of costs and expenses; the ability to obtain and maintain adequate intellectual property protection; the ability to form and implement alliances; challenges relating to changes in and compliance with governmental laws and regulations, including regulations of the U.S. Food and

Drug Administration (the “FDA”) and foreign government regulators, such as more stringent requirements for regulatory clearance of products; the ability to remediate matters identified in any inspectional observations or warning letters issued by the FDA; changes in tax obligations arising from tax reform measures or examinations by tax authorities; product liability and intellectual property litigation losses; the ability to retain the independent agents and distributors who market Zimmer’s and Biomet’s products; dependence on a limited number of suppliers for key raw materials and outsourced activities; changes in general industry and market conditions, including domestic and international growth rates and general domestic and international economic conditions, including interest rate and currency exchange rate fluctuations; and the impact of the ongoing economic uncertainty affecting countries in the Euro zone on the ability to collect accounts receivable in affected countries. For a further list and description of such risks and uncertainties, see Zimmer’s periodic reports filed with the

U.S. Securities and Exchange Commission (the “SEC”). Copies of these filings, as well as subsequent filings, are available online at www.sec.gov, www.zimmer.com or on request from Zimmer. Zimmer disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be set forth in its periodic reports. Readers of this communication are cautioned not to place undue reliance on these forward-looking statements, since, while management believes the assumptions on which the forward-looking statements are based are reasonable, there can be no assurance that these forward-looking statements will prove to be accurate. This cautionary statement is applicable to all forward-looking statements contained in this communication. on

Additional Information and Where to Find It

Zimmer filed with the SEC, and the SEC declared effective on September 29, 2014, a registration statement on Form S-4 that includes a consent solicitation statement of LVB that also constitutes a prospectus of Zimmer. INVESTORS AND SECURITYHOLDERS OF LVB ARE URGED TO READ THE CONSENT SOLICITATION/PROSPECTUS AND OTHER FILINGS MADE WITH THE SEC IN CONNECTION WITH THE MERGER CAREFULLY AND IN THEIR ENTIRETY, BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE MERGER. The registration statement and consent solicitation statement/prospectus and other documents filed by Zimmer with the SEC may be obtained free of charge at the SEC’s website at www.sec.gov or from Zimmer at www.zimmer.com. You may also read and copy any reports, statements and other information filed by Zimmer, LVB and Biomet with the SEC at the SEC public reference room at 100 F Street N.E., Room 1580, Washington, D.C. 20549. Please call the SEC at (800) 732-

0330 or visit the SEC’s website for further information on its public reference room. Certain executive officers and directors of LVB have interests in the proposed transaction that may differ from the interests of stockholders generally, including benefits conferred under retention, severance and change in control arrangements and continuation of director and officer insurance and indemnification.

This communication shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to appropriate registration or qualification under the securities laws of such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Industry Innovator. Strong Performance Profile.

Annual

Global Impact of EPS(1) growth operating reconstructive Biomet – last five years cash flow market (2) acquisition on 2009–2013 – average last position future EPS(1) five years

10% ~$1.1B #1 Double Digit CAGR Accretive

(1): Adjusted EPS

(2): Reconstructive market of ~$16B includes knees, hips and extremities. Determined based on competitor annual filings, Wall Street equity research and Company estimates.

A G E N D A

Innovation Driving Growth

Built a global leader

Executing consistent, successful strategy

Pending acquisition – an ideal fit

An exciting future – extending our strategy

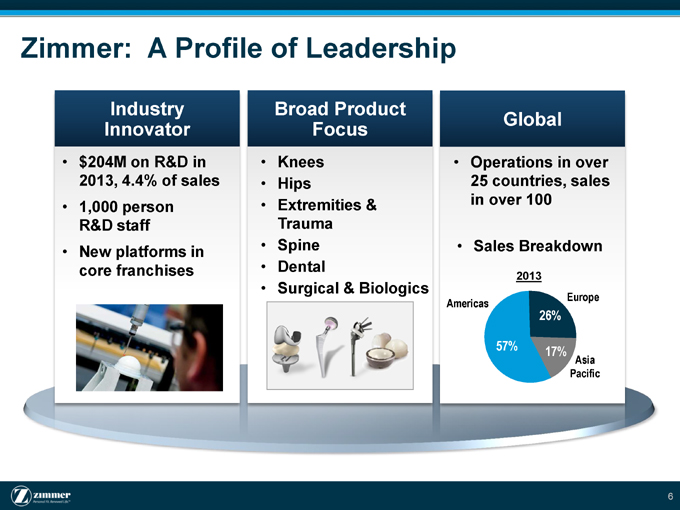

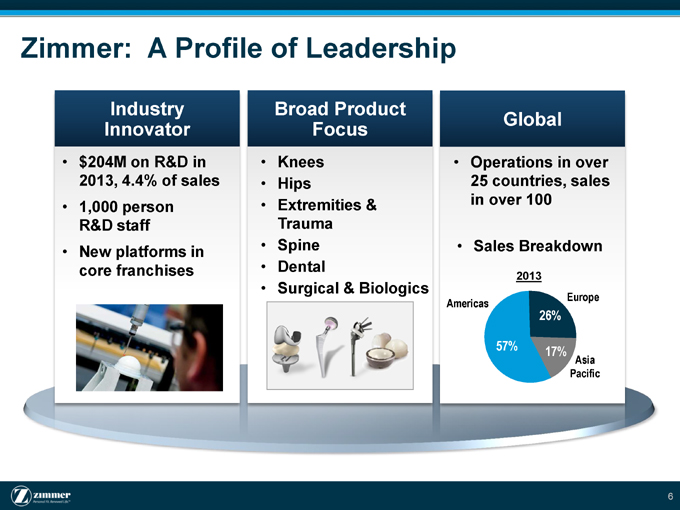

Zimmer: A Profile of Leadership

Industry Broad Product

Global Innovator Focus

$204M on R&D in Knees Operations in over 2013, 4.4% of sales Hips 25 countries, sales

Extremities & in over 100

1,000 person

R&D staff Trauma

New platforms in Spine Sales Breakdown core franchises Dental

Surgical & Biologics 2013

Europe Americas 26%

57% 17%

Asia Pacific

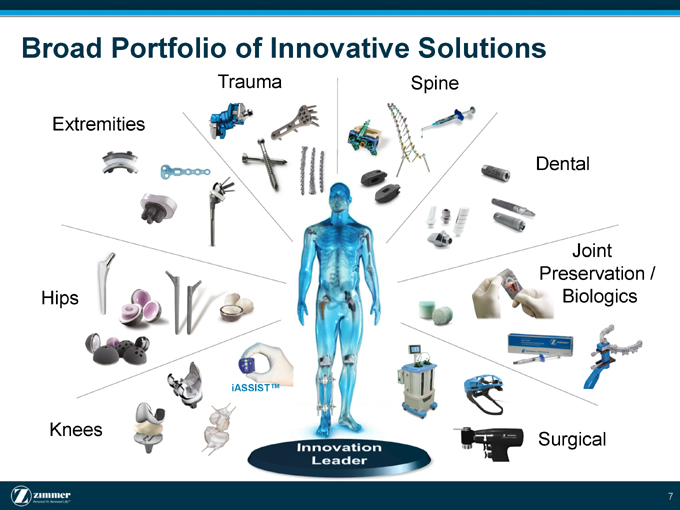

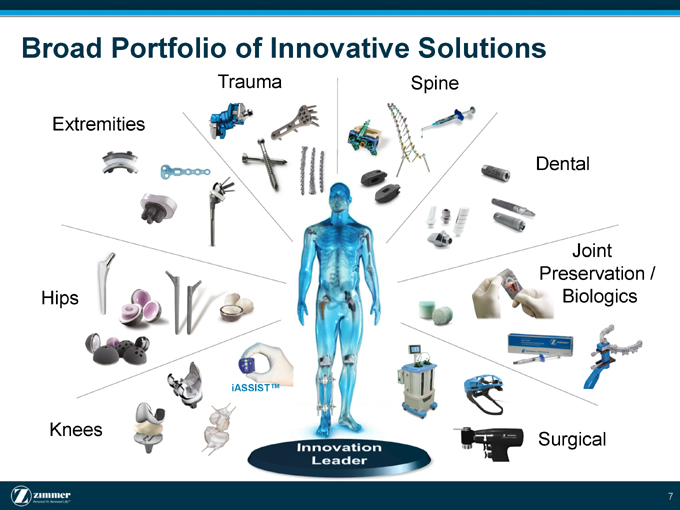

Broad Portfolio of Innovative Solutions

Trauma Spine

Extremities

Dental

Joint Preservation / Hips Biologics

iASSIST™

Knees

Surgical

A G E N D A

Innovation Driving Growth

Built a global leader

Executing consistent, successful strategy

Pending acquisition – an ideal fit

An exciting future – extending our strategy

Executing Consistent Strategy

Driving Operating Margin Expansion and Accelerated EPS

Sustainable Operational Disciplined Growth Excellence Capital Allocation

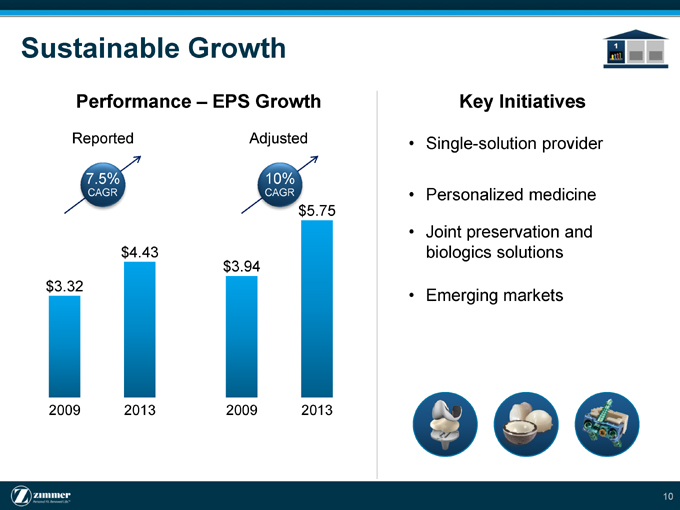

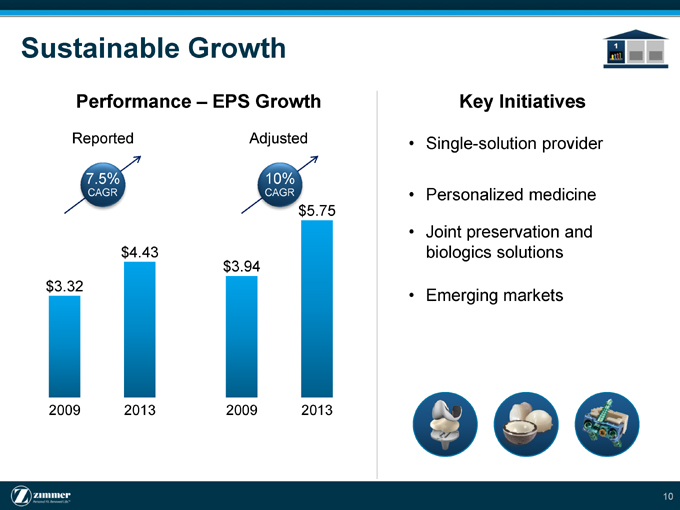

Sustainable Growth

Performance – EPS Growth Key Initiatives

Reported Adjusted • Single-solution provider

7.5% 10%

CAGR CAGR • Personalized medicine

5.75

Joint preservation and $4.43 biologics solutions

$3.94 $3.32

Emerging markets

2009 2013 2009 2013

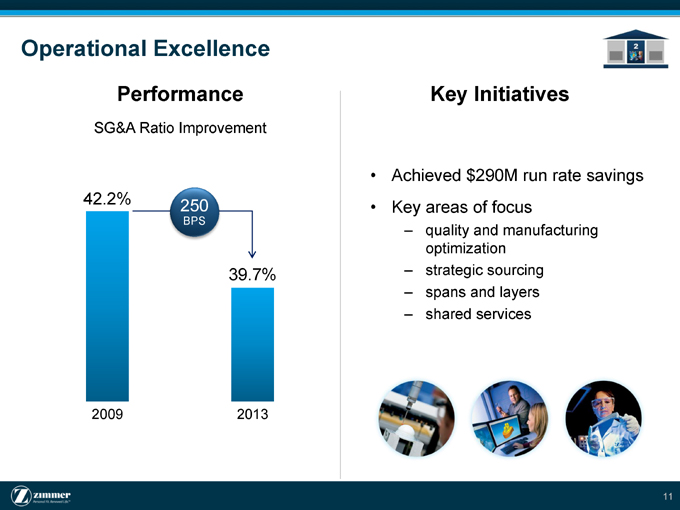

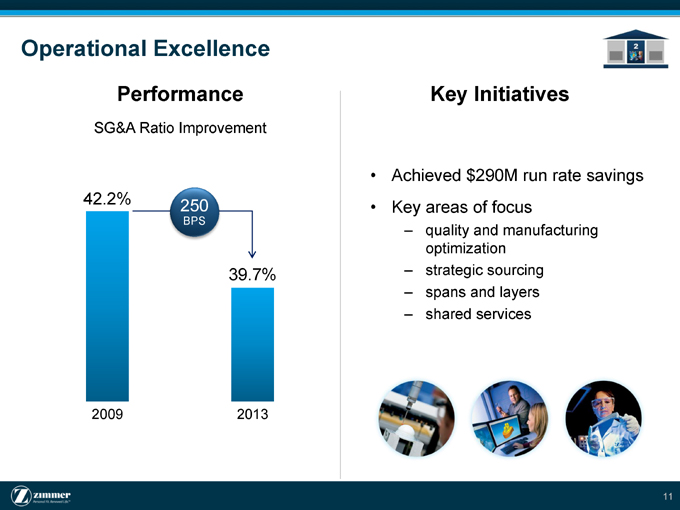

Operational Excellence

Performance Key Initiatives

SG&A Ratio Improvement

Achieved $290M run rate savings 42.2% 250

Key areas of focus

BPS

– quality and manufacturing optimization 39.7% – strategic sourcing – spans and layers – shared services

2009 2013

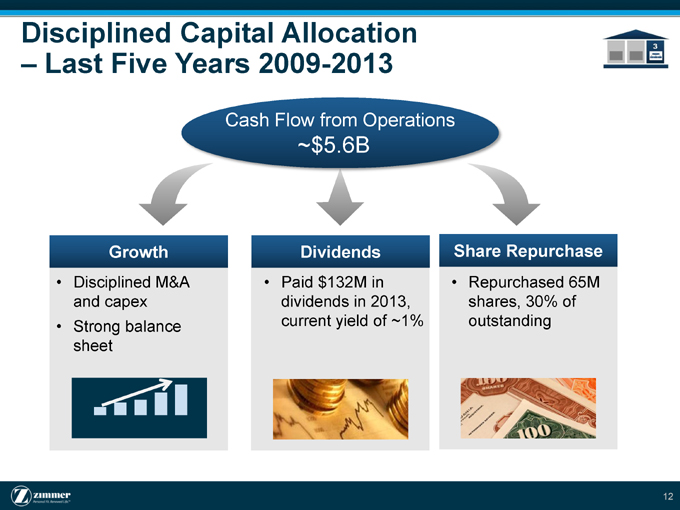

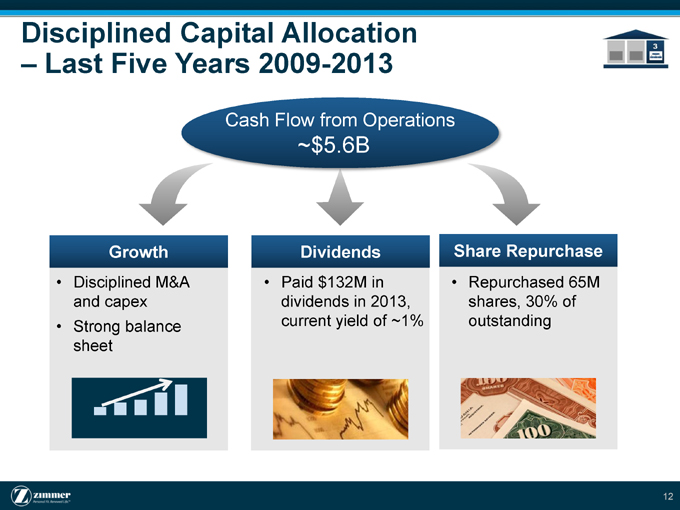

Disciplined Capital Allocation

– Last Five Years 2009-2013

Cash Flow from Operations

~$5.6B

Growth Dividends Share Repurchase

Disciplined M&A Paid $132M in Repurchased 65M and capex dividends in 2013, shares, 30% of

Strong balance current yield of ~1% outstanding sheet

A G E N D A

Innovation Driving Growth

Built a global leader

Executing consistent, successful strategy

Pending acquisition – an ideal fit

An exciting future – extending our strategy

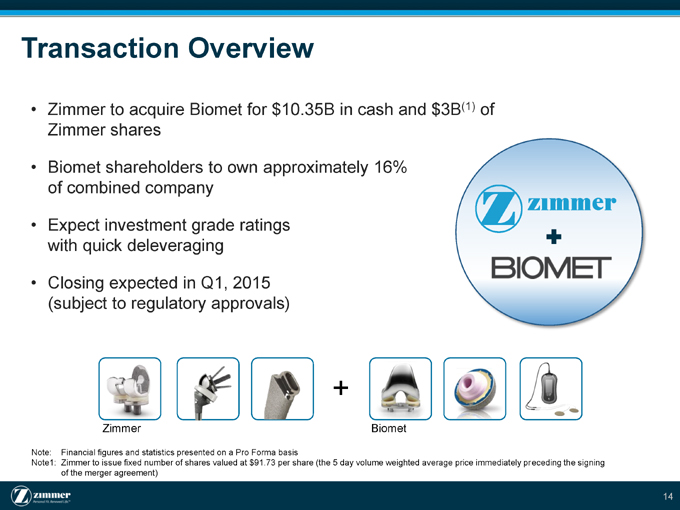

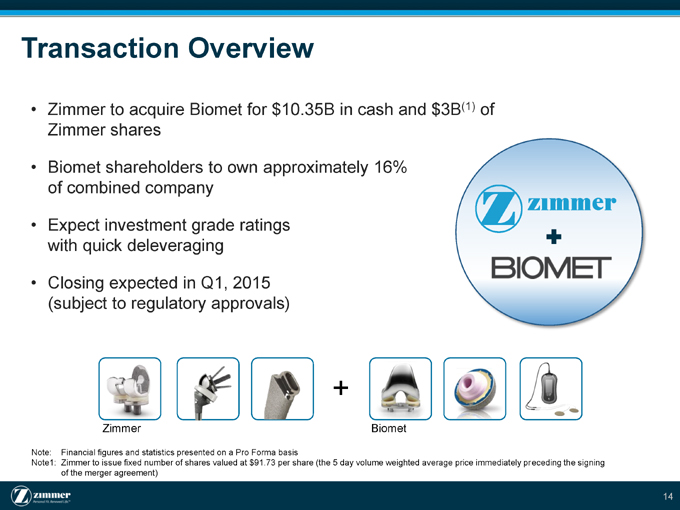

Transaction Overview

Zimmer to acquire Biomet for $10.35B in cash and $3B(1) of Zimmer shares

Biomet shareholders to own approximately 16% of combined company

Expect investment grade ratings with quick deleveraging

Closing expected in Q1, 2015 (subject to regulatory approvals)

+

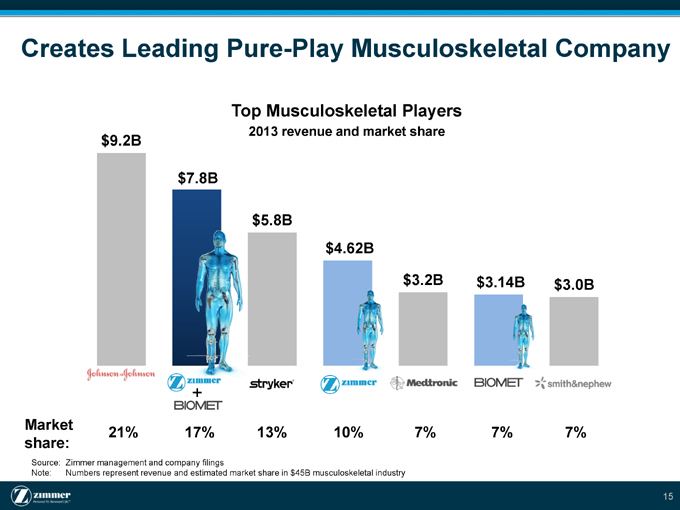

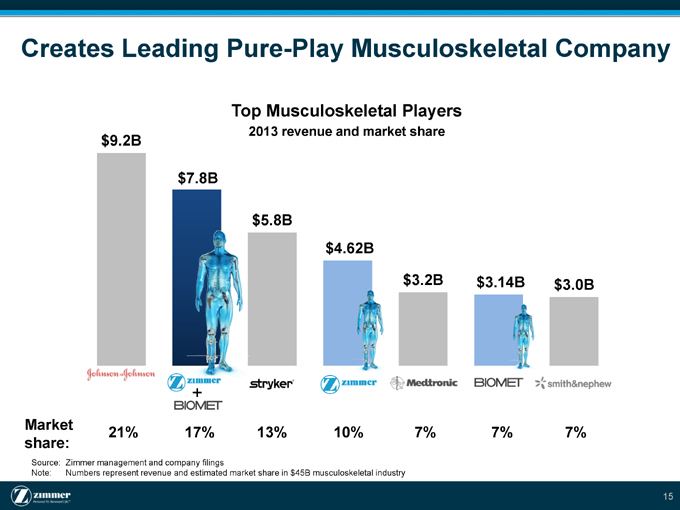

Creates Leading Pure-Play Musculoskeletal Company

Top Musculoskeletal Players

2013 revenue and market share $9.2B

$7.8B

$5.8B $4.62B

$3.2B $3.14B $3.0B

+

Market

21% 17% 13% 10% 7% 7% 7% share:

Source: Zimmer management and company filings

Note: Numbers represent revenue and estimated market share in $45B musculoskeletal industry

Leverage Global Distribution Channels and Cross-Selling Opportunities

Leverage complementary Cross-Sell Example sales channels

– Cross-selling opportunities

Benefit from enhanced scale

– Focus on surgeon specialties Gel-One®

Transform go-to-market capabilities

– Address needs of consolidating delivery networks

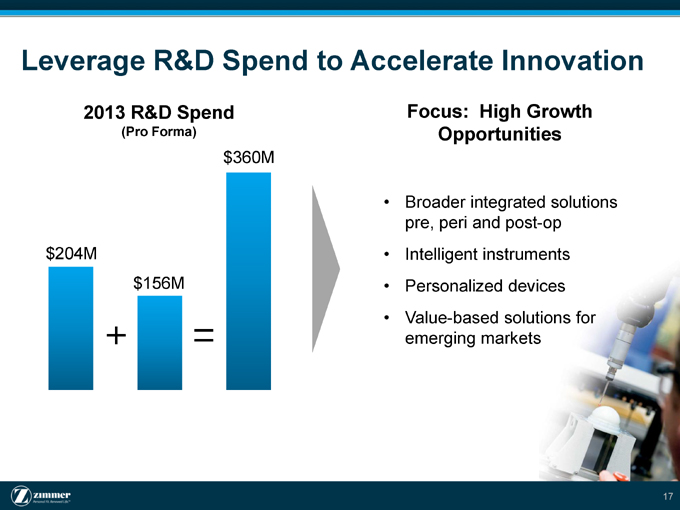

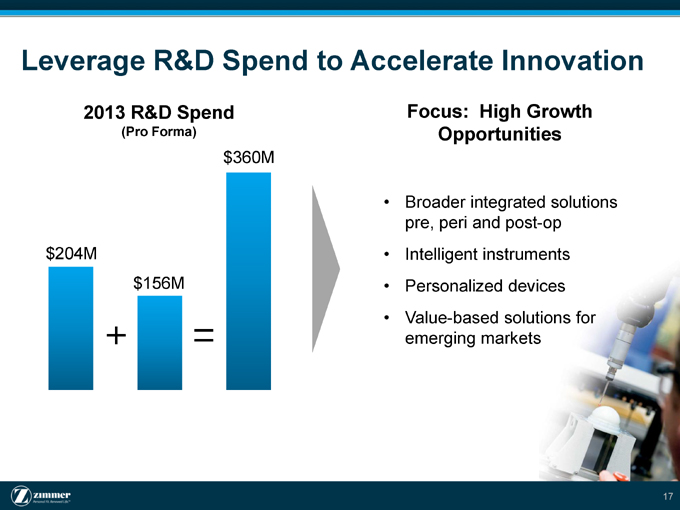

Leverage R&D Spend to Accelerate Innovation

2013 R&D Spend Focus: High Growth (Pro Forma) Opportunities

$360M

Broader integrated solutions pre, peri and post-op $204M Intelligent instruments $156M Personalized devices

Value-based solutions for emerging markets

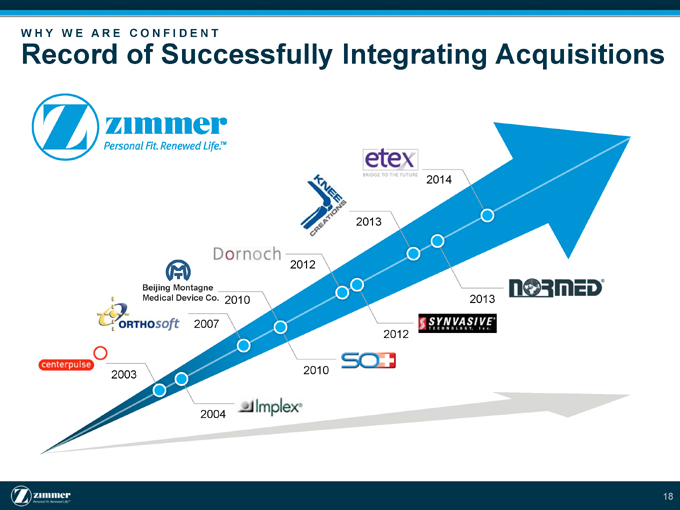

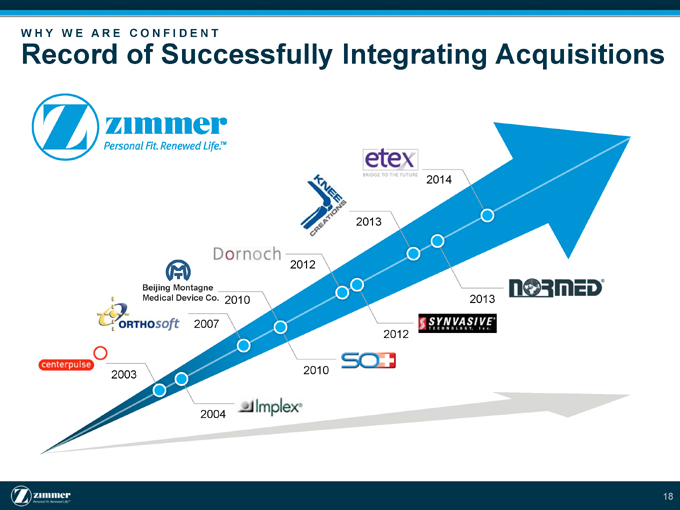

W H Y W E A R E C O N F I D E N T

Record of Successfully Integrating Acquisitions

2014

2013

2012

Beijing Montagne

Medical Device Co. 2010 2013

2007

2012 2003 2010 2004

A G E N D A

Innovation Driving Growth

Built a global leader

Executing consistent, successful strategy

Pending acquisition – an ideal fit

An exciting future – extending our strategy

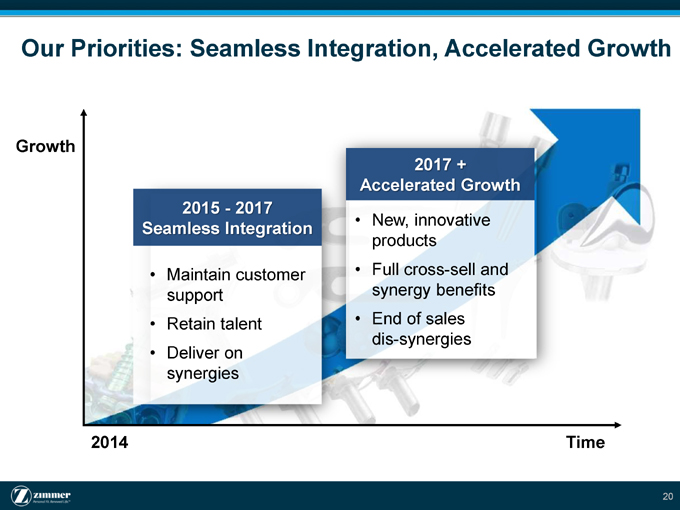

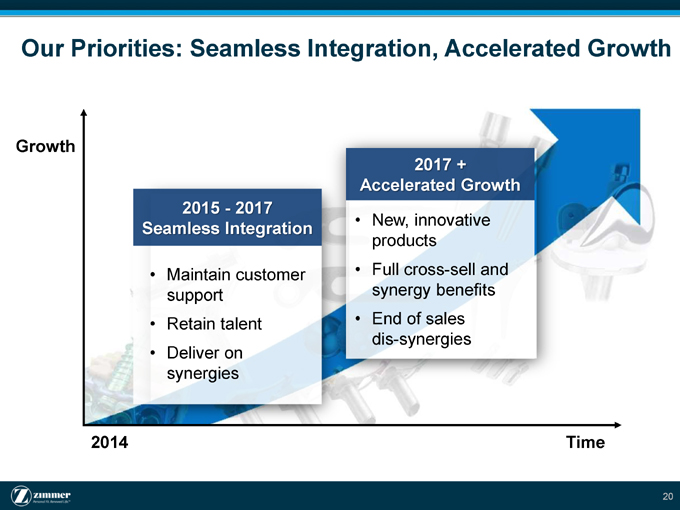

Our Priorities: Seamless Integration, Accelerated Growth

Growth

2017 + Accelerated Growth 2015—2017

New, innovative

Seamless Integration products

Maintain customer Full cross-sell and support synergy benefits

Retain talent End of sales dis-synergies

Deliver on synergies

2014 Time

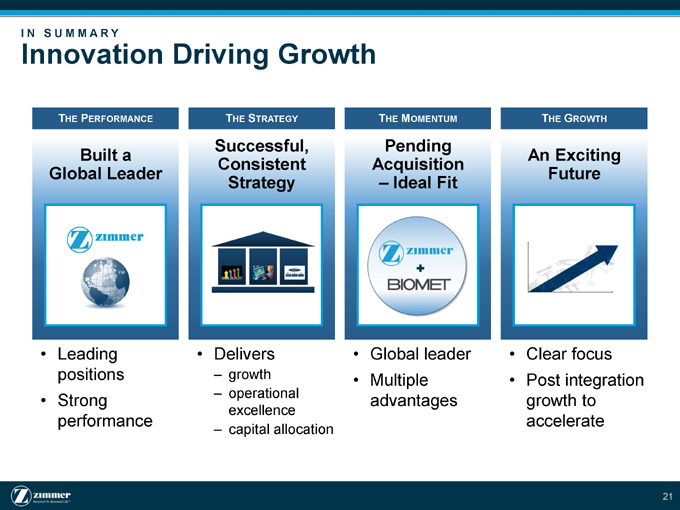

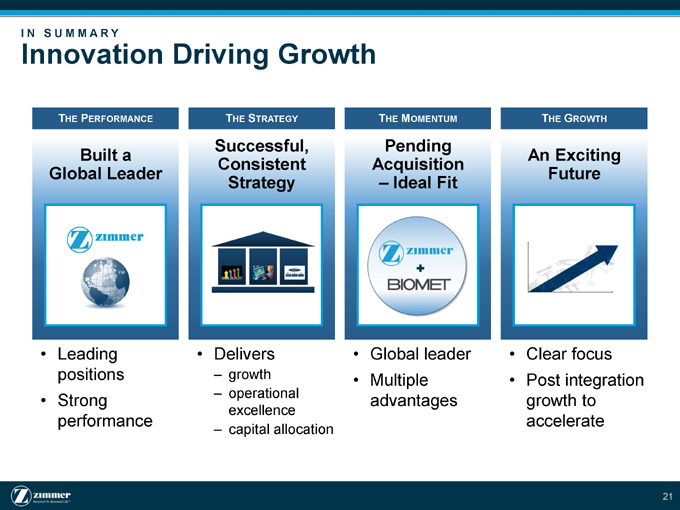

I N S U M M A R Y

Innovation Driving Growth

THE PERFORMANCE THE STRATEGY THE MOMENTUM THE GROWTH

Successful, Pending

Built a An Exciting Consistent Acquisition Global Leader Future Strategy – Ideal Fit

Leading Delivers Global leader Clear focus positions – growth Multiple Post integration

Strong – operational advantages growth to

excellence

performance accelerate

– capital allocation

Zimmer

Personal fit renewed life