UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________

FORM 10-K

____________________________

x ANNUAL REPORT UNDER SECTION 13 OR 15(D) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2009

Commission File # 000-52727

ELRAY RESOURCES, INC.

(Exact name of small business issuer as specified in its charter)

Nevada

(State or other jurisdiction of incorporation or organization)

98-0526438

(IRS Employer Identification Number)

#15, 291 Street, Sangkat Boeng Kok 1, Tourl Kok District, Phnom Penh

Cambodia

(Address of principal offices)

01161407313942

(Issuer’s telephone number)

Securities registered pursuant to section 12(b) of the Act:

None

Securities registered pursuant to section 12(g) of the Act:

Common Stock, Par Value $0.001 per share

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. [ ] Yes [√] No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act: [ ] Yes [√] No

Indicate by check mark whether the registrant(1) has filed all reports required by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 day. [√] Yes [ ] No

1

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulations S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| |

Large accelerated filer [ ] | Accelerated filer [ ] |

Non-accelerated filer [ ] (Do not check if a smaller reporting company) | Smaller reporting company [√] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

[ ] Yes [√ ] No

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed fourth fiscal quarter. $10,801,025.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date. The issuer had 56,847,500 shares of common stock issued and outstanding as of March 31, 2010.

Documents incorporated by reference:None.

2

Table of Contents

Item

Page

Item 1.

Business

4

Item 1A.

Risk Factors

15

Item 1B.

Unresolved Staff Comments

15

Item 2.

Properties

15

Item 3.

Legal Proceedings

15

Item 4.

Submission of Matters to a Vote of Security Holders

15

Item 5.

Market for Registrant’s Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities. 15

Item 6.

Selected Financial Data.

16

Item 7.

Management’s Discussion and Analysis of Financial Condition and Results of Operations. 17

Item 7A.

Quantative and Qualitative Disclosures About Market Risk.

19

Item 8.

Financial Statements and Supplementary Data.

19

Item 9.

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure. 31

Item 9A.

Controls and Procedures.

32

Item 9B.

Other Information.

32

Item 10.

Directors, Executive Officers and Corporate Governance.

32

Item 11.

Executive Compensation.

35

Item 12.

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. 35

Item 13.

Certain Relationships and Related Transactions, and Director Independence.

37

Item 14.

Principal Accounting Fees and Services.

37

Item 15.

Exhibits, Financial Statement Schedules.

38

SIGNATURES

40

3

PART I

Item 1

Business

DESCRIPTION OF BUSINESS

In General

Elray Resources, Inc. (the “Company” or “we”) was incorporated in Nevada on December 13, 2006. Angkor Wat Minerals Ltd. (“Angkor Wat”), the wholly owned subsidiary of the Company, was incorporated in Cambodia on June 26, 2006. We are an exploration stage company (i.e. a company engaged in the search for mineral deposits (reserves) which are not in either the development or production stage). We are engaged in the acquisition and exploration of mineral properties with a view to exploiting any mineral deposits we discover.

We currently own a 100% interest in Porphyry Creek, a 90 sq km gold and copper claim located in Cambodia, and also have entered into a Letter of Intent to acquire 99% of Minera Monteverde SA, comprising a 99% interest in the assets of Monteverde’s “Picacho” gold property code 300869 located in the El Oro Province, Canton Atahualpa, Ecuador.

The Indonesian zircon sands /gold Joint Venture in Central Kalimantan was terminated on December 30, 2009 due to changes to partner, PT. Indo Imperial Resource’s business direction and conflicting priorities for the application of resources. In addition, terminations of the Senator and Rom Dey claim projects resulted from available resources being applied to bring forward exploitation and drilling of the Porphyry Creek gold and copper project and the planned settlement of the Picacho gold property.

The Company conducts due diligence on other mineral prospects in the normal course of its business and may enter into additional joint ventures in the near future.

About Our Mineral Claims

·

During April, 2009 an Independent Technical Report on Cambodian and Indonesian Projects was prepared in fulfillment of the requirements for a Canadian National Instrument 43-101, Standard of Disclosure for Mineral Projects. The Technical Report describes the essential features of the Company’s exploration and program recommendations.

·

On the Porphyry Creek Test Pitting Program, the program involved the completion of 2 exploration trenches. Trench 1 was cut on a line perpendicular to Porphyry Creek, and commenced in the area where mineralized outcrop has been observed in the past, and around the bed of Porphyry Creek. Trench 2 was located immediately adjacent to the area known as “the French Pit”. The success of the exploration has geologists pressing the Company to move forward on current and planned works and to move immediately to commence a drilling program for the copper and gold Porphyry Creek project.

·

A Prospecting and Geological Report by Geologist Wilmer C Vaca, a Consultant Mining Auditor, on the Picacho gold property in Ecuador, supported the Company’s decision to sign a Letter of Intent on November 3, 2009 to acquire the shares of Minerva Monteverde S.A. comprising a 99% interest in the assets of Monteverde’s Picacho property located in the El Oro Province, Canton Atahualpa. The Company must have completed its due diligence and finalized the acquisition of shares of Monteverde by June 14, 2010.

4

Mineral Exploration Licenses

The Company is registered with the Cambodian Ministry of Industry, Mines and Energy (“MIME”) to conduct exploration and mining activities in Cambodia. The Company is also scheduled to visit officials in Ecuador and Indonesia on completion of its due diligence program to ensure it can comply with new mining laws and procedures being introduced.

Mineral Exploration Licenses in Cambodia are normally granted for initial periods of two years, renewable twice for additional two year periods. At the end of the six year exploration period, a license holder can apply to MIME for an extension to carry out feasibility studies on any potential mining project located within the license area. Land rental costs for exploration licenses are $20 per sq km for the first two years, rising to $30 for years 3 and 4 and $40 for years 5 and 6. Relinquishment of 30% of the license area is required at the end of Year 2, however the Company may decide on which 30% may be relinquished.

On completion of a feasibility study, the license holder can apply to the Council for the Development of Cambodia (“CDC”) for an Industrial Mining License (“IML”) which can be granted for a period of up to 30 years. Mineral royalties, tax rates and other conditions relating to a mining operation in Cambodia are normally negotiated with the Government at the time of the application for an IML.

The mineral exploration license for the Porphyry Creek project has been renewed as a result of the company having completed its committed works program which met MIME’s requirements, with the project being recorded as ‘in good standing’.

Porphyry Creek Project

The Porphyry Creek project is the company’s immediate development priority. Results from the current works program continue to confirm the potential of the copper and gold project and will greatly assist the Company as it actively seeks the necessary funding to advance development.

This is project is located approximately 290 km north of Phnom Penh in an area considered to have potential to host a copper porphyry system with copper and gold mineralization, based upon reconnaissance geological mapping and sampling.

The Company was granted a mineral exploration license for gold and other metallic minerals over the Porphyry lands on January 29, 2007. The 100% owned license area is 90 sq km (9,000 hectares).

Geology

5

The Porphyry Creek Project is a multiple style mineralization project. The NI 43-101 reported on samples and observed an interesting new style of mineralization for Cambodia on the SW edge of the ground that suggests there is a copper porphyry that underlies the project, either directly beneath the sampled outcrop or in a really close sense.

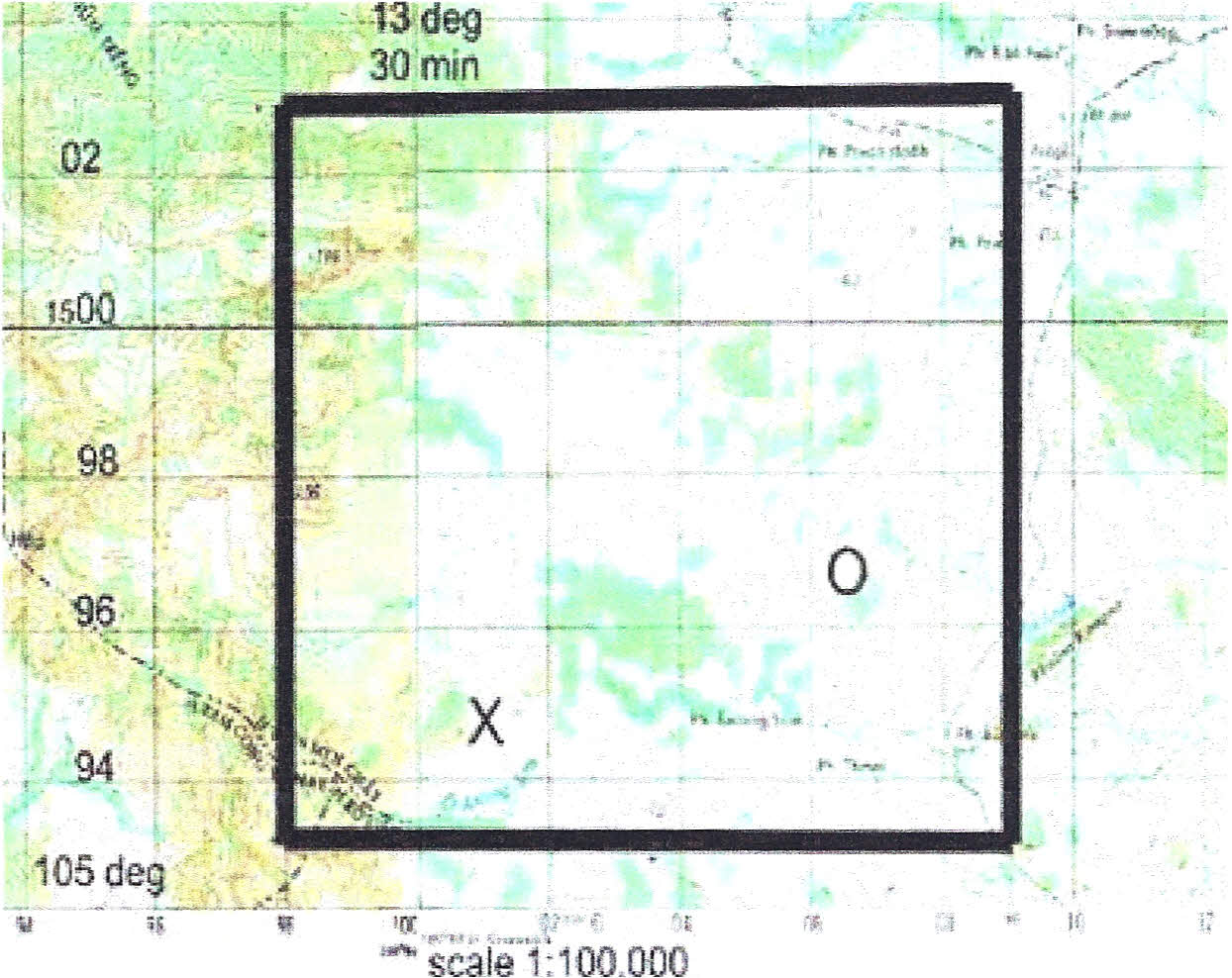

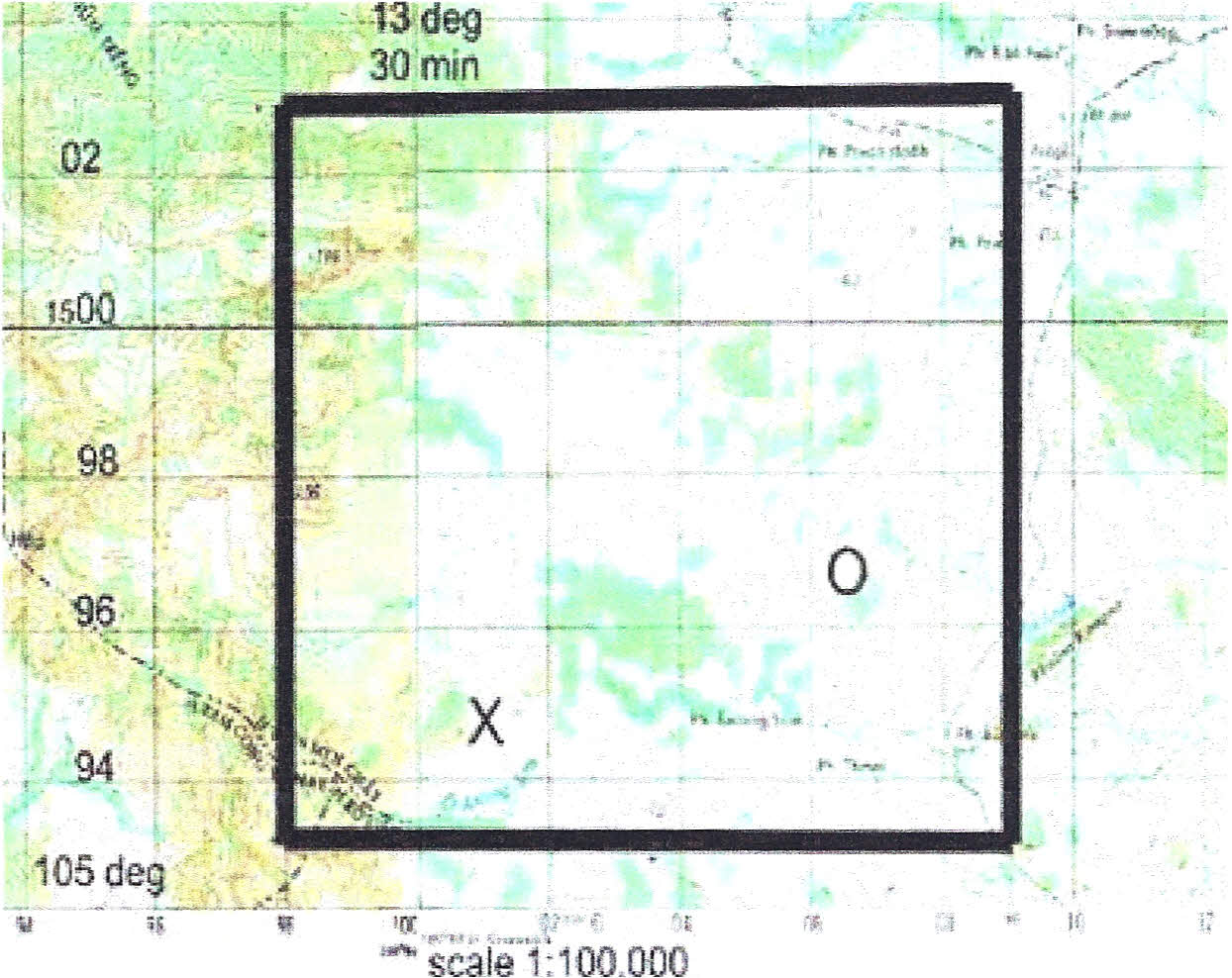

The ground falls across 2 topographic and 2 geological map sheets with the south-western corner near the junction of the map sheets at 105 degrees and 13 degrees 30 minutes. The ground is variably hilly rising from about 60 meters to 190 meters elevation. It is crossed by a number of small streams with a major stream, the Stung Sen, which is approximately 5km to the East. There is limited population on the ground in the area and towards the northeast some villages are seen.

With the help of geological maps, known sites were plotted according to the geological settings with sampled projects. This showed the presence of mapped intrusives that could be centrally located or proximal enough to drive a hydrothermal system to create some of the observed metal occurrences. The intrusions have been mapped even showing segredation and possible complex emplacement late into a pre-existing mixed assemblage of rocks. The suggested structural setting is complex and extensive and the timing of the intrusives is similar to other porphyry deposits in Asia.

Work completed to date

Equipment used in the trenching program were D8 bulldozers and 12 tonne excavators.

Trench 1, located at 5000858E, 1494233 (Indian – Thailand datum) was started near the outcrop previously discovered in the bed of Porphyry Creek and was cut directly north from that location for a distance 60m. On completion, the trench was approximately 5m wide and 3m deep.

Trench 2, located at 500914E, 1494233 (Indian – Thailand datum) immediately south of the French Pit was 30m long by 5m wide and 4.5m deep. Most of the work was completed by the bulldozer with the excavator used to bed down to fresh rock.

Three mineralized zones were intercepted as follows (from South to North):

i)

Located at the site of the original outcrop in the bed of Porphyry Creek. This zone was traced for a distance of approximately 10m along strikes to the North West. The zone is approximately 1.5m wide and comprises a series of steeply dipping joints in Diorite that trend slightly West of North. The joint spacing ranges 50-250 mm, with thickness ranging 1-3 mm. all joints observed are filled with weathered clays. Slickensides and striations are observable on numerous joint surfaces. These indicate sub-vertical upward displacement along the joint planes. Most of the joint surfaces display thick veneers of Malachite and Azurite. Some minor occurrences of Chalcopyrite were observed, usually immediately beneath the Azurite veneers. Highly oxidized pyrite was also present in some hand samples. It might be expected that the occurrence of sulphides will increase with increasing depth down dip.

ii)

Located approximately 17m North of site 1 and occupying a zone 2.5m wide. Again, the mineralization is centred on a series of steeply dipping joints spaced between 100 and 280 mm. Abundant Malachite and Azurite occur on the joint surfaces, with the veneers sometimes up to 1 mm thick. The joint sets have the

6

same general trend as those observed at site 1. The mineralization is again intimately associated with the geological structure.

iii)

Site 3 is located approximately 12m immediately North of site 2. The un-weathered outcrop was exposed revealing a similar pattern of mineralization to that observed at the other sites. One sample collected contained a 1 cm thick band of sulphide. The host rock was unusal in that it comprised a diorite brecca. This rock was formed in a zone of intense deformation where pathways have been opened for the passage of the hydrothermal solutions and ultimately, precipitation of the observed minerals. Exposing more of this third site is recommended as being a priority. The mineralized outcrop appears to line up well with the trend of the French Pit and it may transpire that the zone intercepted in that pit continues through site 3. This would demonstrate continuity along strike of 100m.

iv)

The “French Pit” and surrounding area was examined in detail and strong evidence was gathered to demonstrate the occurrence of a 4th mineralized zone in the area. A drainage ditch was excavated at the eastern end of the pit to enable future investigations.

The trenching works and sampling were conducted under the supervision of an independent geologist and on three separate occasions, Mines Department geologists and mapping specialists.

A pioneer road was cut through to the works area.

Current state of exploration and/or development

Reconnaissance geological, mapping and trenching work continues to meet the Ministry of Industry, Mines and Energy Department ‘works’ requirements.

Plant and equipment

There is no infrastructure or electricity on the Porphyry Creek Project property. Electrical power, required to conduct exploration activities is provided by diesel generators brought to the site.

Adequate water supplies for the early stage exploration camp and drilling equipment is readily available.

Additionally, strong relationships exist with well equipped Australian and Vietnamese drilling contractors operating on nearby projects.

License

The Porphyry Creek license in the Rovieng area covers host rocks that probably represent the lower (Triassic) parts of the Khorat Basin.

All of the mineralization reviewed on site appears to be closely associated with Jurassic intrusives that cut through the basement and lower units of the Khorat Basin. In most cases these intrusives are quartz diorites and granodiorites.

The Porphyry Creek license includes a large area of propylitic alteration and some weak mineralization that may represent the peripheral parts of a porphyry mineralization system.

7

Samples also suggest that it may also contain intrusive related breccia pipe or vein style mineralization.

Mineralization

Bulk samples were collected from in and around the mineralized zones in Trench 1 (PCT1 series samples), and from float in the mullock heap surrounding the French Pit (FP series samples). Approximately 100kg of samples was collected from the three Trench 1 outcrops and 10kg from the French Pit. The samples, apart from PCT1-0004, contained rocks displaying variable mineralization intensity and are therefore reasonably representative. Sample PCT1-0004 was assayed separately owing to its obvious intense mineral content.

The samples were sent to Mineral Assay and Services Co Ltd, an internationally accredited laboratory located in Bangkok, Thailand. All samples were assayed for gold, silver, arsenic, copper, lead and zinc. Of the metals tested for, copper and gold grades stand out. As a result, a large sampling exercise is part of the planned works program.

Observations

Both fracture controlled copper mineralization and weak to moderate alteration with some disseminated copper mineralization within the altered granite rock mass has major significance as these may represent the surface expression of a deep seated copper or copper-gold type porphyry mineralization target are visible.

Most of the mineralization observed to date appears to be intrusive related vein style deposits, but the geological environment suggests potential for larger stockwork, breccia pipe and replacement styles. There is potential in the Porphyry Creek license for a porphyry type mineralization system.

The intrusives have consistent fine grainsize, but rare porphyry textures indicating a shallow plutonic environment of intrusion. This is an ideal crustal level for the development of Intrusion Related Gold (IRG) deposits.

Exploration

The exploration approach at Porphyry Creek area is reconnaissance mapping and sampling to locate additional evidence of copper mineralization and veining. Efforts continue to be focused on locating the source of the mineralized breccia samples provided by third party prospectors.

Apart from early plans for 1,500m of diamond core and exploration drilling, shaft sinking to a depth of 15m to 20m is a priority.

In all of the areas, management believes that the Airborne EM methods would be a fast effective way to search for the sulphide rich skarns and may also detect large sulphide rich veins or breccias.

8

Picacho Ecuador Gold Project

Settlement under the Letter of Intent will entitle the Company to acquire 99% of the share capital of Minera Monteverde SA which owns the Picacho property code number 300869 located in the El Oro Province Ecuador.

Considerable effort is concentrated on the preparation and negotiation of the Share Purchase Agreement and on working through the due diligence process. The Company is evaluating the options available to it to procure the necessary funding to settle on the purchase of the Monteverde share capital.

The priority for project development funding is the Porphyry Creek property.

Due diligence observations on the Picacho property by Consulting Geologist and Mining Auditor, Wilmer C Vaca, a person qualified and certified by the Ministry of Mines and Petroleum Ecuador with Registration No. 046, included in Geologist Vaca’s technical report on the property, are as follows:

·

4.5 million ounces of gold produced in the area over a 50 year period ( from official records of Sadco, major regional mining company).

·

Active projects in the area include Dynasty’s Zaruma, Dynasty and Jerusalem projects which between the three projects have a reported two (2) million measured and indicated ounces of gold with over three (3) million ounces inferred.

·

The district area is 150 km2purported to contain 15 important veins

·

Evidence of the veins extending up to 1 km

·

The claim has been mined to a depth of 200m, with reports that this may extend to 1500m.

Location

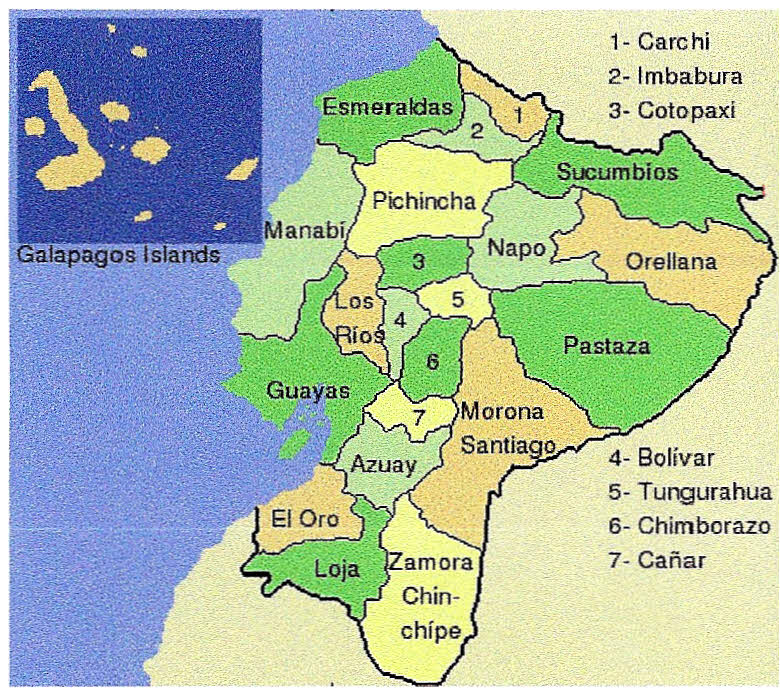

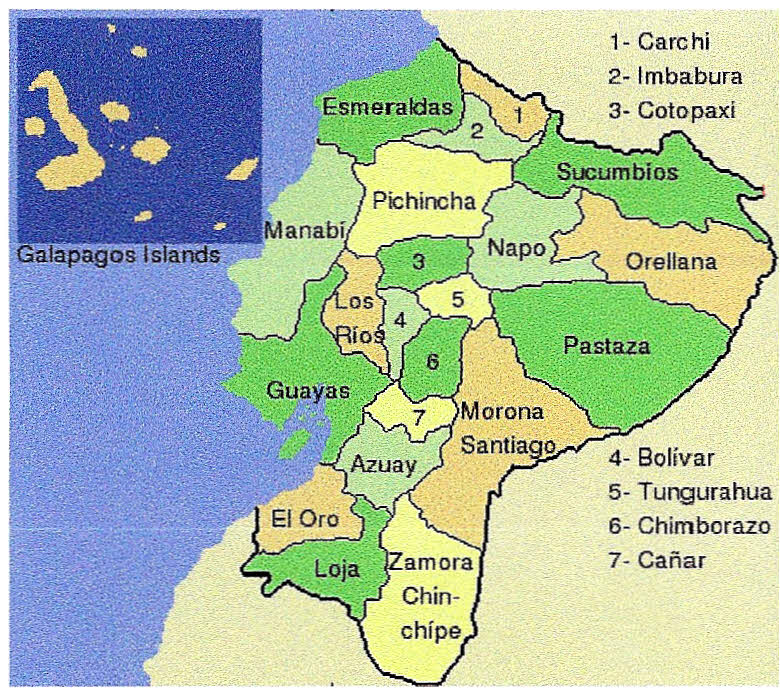

The Picacho concession is found at the Northeast side of the mining exploitation field of Portovelo-Zaruma-Ayapamba. The area is located 80 kms on the East side of the city of Machala, and lays on the Cordillera Occidental of the Andes, which is part of Los Andes, a high mountain range which extends down the Americas from North to South.

Accessibility and Climate

The ingress to the district is by a bituminized two lane road in good condition. The journey is done in approximately 2 hrs 30 mins from the city of Machala to the city of Zaruma then on to Huertas a further 40 mins to the Picacho concession.

The climate is subtropical and humid with temperatures of 18žC - 30žC with rainfall 1,341 mm. The heaviest rainfalls are from January to June. The district containing the concession is traditionally underground exploitation.

9

‘Picacho’ Ecuador gold project in El Oro Provence

Geology

The rock that forms the base of the Picacho concession consists in volcanic andesitic lavas of the cretacean period from the celica formation. Geologist Vaca has not been informed about any type of detailed study on these wall rocks and on the West margin of a sub-volcanic andesitic intrusion of the series of Portovelo, in the area where a series of parallel structures is grouped. On the West there are a series of basaltic flows of Mesozoic (Capiro formation).

This vein system is the continuation to the Northeast of the main system of veins (eg Abundancia) which has been intensely exploited in the area of Zaruma-Portovelo for 400 years.

Structual Geology

There are two important regional faults, the fault of Pinas and Puente Buza – Palestina, which have produced three tectonic blocks with their sides sunk interrupting the celica mafica formation to an intermediate of the volcanic rocks between these two faults. The celic formation is formed by andesitic lavas of the Portovelo series. Two altered volcanic series of intermediate composition and its subvolcanic systems that are incompatible cover the formation of celica. The series are formed by pyroclasts and intermediate breccias, cut by a subsequent action of riolitic stock, of the dikes.

The second significant structures have a NE and N-S direction, with the fault trace having a high angle. The one with the N-S direction that is generally held by the veins, goes from 70ž to 90ž NE.

Mineralization

The ore sub-parallel system with a North-Southwards direction of the quartz veins, which are present in the district of Portovelo-Zaruma, is found exclusively inside altered andesitic Cretacean rocks (series of Portovelo). Mineralization is classified into three zones. In zone 1pyritization with low gold grade is seen in the stockwork and the breccias, around Santa Barbara and the mountains of Zaruma. Zone 2 contains quartz and quartz-adular gold-bearing veins with abundant sulphide which are found in the axis of Portovelo-Zaruma and on the NE of the mountains of Santa Barbara. A large halo of gold bearing quartz-calcite and quartz-clorite

10

with abundant sulphide salts and sulphides of lesser importance, the zone 3 surrounds the base of the mineralization of sulphosalts, in N-NW the continuation we observe mineralization of zone 2, for the presence of adularia-sericite, the structures of the vein and the abundance of sulphides and calcite, the mineralization are considered as a part of the now adularia-sericite, corresponding to the epithermal system of gold of the intermediate sulphidation. Quartz veins are predominant as structures of filling in the fractures shown, feeder, compounded, braided sets, and which adopt looped shapes.

Regionally these horizontal mineralized veins move some 15 kms (the region of Portovelo-Zaruma-Ayapamba), and have probable depths of 1,500 m. (this height is measured from the local surface to the height known as the great mine of Casa Negra mined by Sadco). In the district there is a series of veins with layers that go from 60 cm to 8 m taken as a general average 0.80 m. in the narrow veins, as well as the silicified wallrock, has not proved its gold bearing potential, similarly to the typical gold epithermal standard system, there are some zones of bonanza, mineralization of high gold bearing contents (locally called “clavos”) with Geologist Vaca quoting solid values. The largest portion of free gold is recovered by milling and the rest appears with silver sulphides (electrum, sulphosalts with galena) and lead-zinc (galena-esphalerite) with copper in smaller amounts, North Southwards is the predominant directi on of the veins of quartz with gold, it presents local variations near the faults crossline. To the South of Amarillo river, veins have variations in a Southeast direction, sub-parallel to the fault of Pinas-Portovelo.

Picacho Concession

The important vein inside the perimeter of the concession called Picacho include: La Cristina, Gen, etc. Secondary veins, small veins and disseminated sulphides are present in the wallrock of main veins, which have been widely ignored until now. The vein called Cristina is a very important gold-bearing structure found in the main region of the mining district, on the Northwest side of the concession. These structures have a N-NE direction. Mineralization in the area has a proportional gold range: silver 1:10 near surface and 1:15 in depth. The continuity extends for 1 to 2 km. in longitudinal directional direction (Cristina vein), and the mines are found in the area starting from 1,360 m a.s.l. to 800 m. a.s.l. at a depth known of mineralization of at least 500 m. The potential of veins vary from 0.40 m to 1.40 m and have an angle of inclination which ranges from 70ž to 90ž on the NE. Cristina vein is part of an epithermal system of gold, with milky quartz which is hard but fragile, which contains sulphide minerals such as chalcopyrite (copper), of esphalerite (zinc) and galena (lead). This mineralization is similar to the one commonly found in the area of Portovelo-Zaruma.

Types of Deposit

Mineralization of gold inside the district is considered a low to intermediate epithermal sulphidation, (Hedenquist, 2000), the superior mesothermal system has the presence of gold, silver, lead, zinc and copper. This type of mineralization typically presents pyrite-pyrrotite-arsenopyrite and esphalerite with high contents of Fe. Minerals of gangue vary in the vein for the presence of stockwork. In disseminated forms gold associates typically to sericite, calcite, the quartz-adularia. This is contrasted with the types of high sulphidation which typically contains gold, pyrite, enargite, luzonite, covellite received by a residual lixiviated base, with quartz-alunite, kaolin, pirophylite or diaspore. A subgroup of low sulphidation stage contains pyrite-tetrahedrite/tennantite-calcopyrite and esphalerite with low contents of Fe. This subgroup is also rich in silver and base metals, compared to the extremes of low sulphi dation.

11

Current Workings

Artisan miners near the Picacho concession, work with a series of Chilean mills to extract free gold from quartz and sulphide ore, producing a concentrate of zinc-copper. The production of these mills is low with an average of 20 tons per day being processed.

During the due diligence, the Geologist’s preliminary estimation of ore in the Picacho concession’s 2 veins known as Cristina and Gen, with an estimated length of 400m, an average potential of 0.8m and an average depth of 600m (evidenced by regional geology of the concession and mineralization) would equate to 1 million tons for the two veins. Secondary veins, breccias and disseminated mineralization has never been mined or determined. Aim is to employ updated mining methods to exploit this resource.

Prospecting Works

As part of the Picacho due diligence, prospecting work included geological recognition and sampling of the current sediment and litogeochemical sampling was conducted. Samples were collected and tagged and will be tested for gold by way of fire assay testing, with A.A. or final gravimetric testing. In addition, other elements will be analysed in series for 35 elements by induced plasma gathered ( ICP-MS) to prove and know if there is a content of sulphide, hallo effects, standards of alteration and indicating elements.

Prospecting Works to be Done

Air photographs have to be examined to draft the outline of structures and to project the continuity of known mineralized zones. The present and past underground mining work has to be projected , examined and sampled (material of the walls from the vein) in order to have an idea of the zones of enrichment of gold. The samples will be taken every 3m along each of the cuttings where there are veins. The testing of these samples is for the gold through fire assay and other elements by ICP-MS.

Projects Proposed Program of Exploration and Development

Our exploration programs are directed at defining mineral resources at all the project sites, within a realistic timeframe. We plan to carry out exploration on all projects over a two year period from April 2010 to April 2012 with the aim of advancing the projects to a stage where they are ready for early resource definition drilling. Porphyry Creek is slated to be progressed to early completion of initial exploration drilling of defined drill targets.

The work programs for the projects is divided into two stages. Stage 1 includes the following:

·

Data compilation

·

Surface (and underground) geological mapping

·

Surface (and underground) geochemical sampling

·

Geophysics

·

Definition of drill targets

Stage 2 includes:

12

·

Exploration drilling

·

Preliminary metallurgical testwork

·

Scoping studies

Porphyry Creek project is being worked with geological mapping and surface geochemical sampling continuing to locate the hydrothermal system that is indicated from previous reconnaissance mapping. Stage 1 (data compilation, reconnaissance mapping and surface sampling) has commenced. Stage 1 (geological mapping, surface sampling, geophysics and drill target definition) and Stage 2 (all components) all components from June to December 2010. We have planned for 1,500m of diamond core and RC exploration drilling.

With the Picacho concession, prospecting work being done during the due diligence process is described above under prospecting work to be done.

| | |

Projects | Stage Specifics | Time Frame |

Porphyry Creek Copper and Gold Project | Stage 1: Data compilation Reconnaissance geological mapping Surface geological sampling Sinking of an exploration shaft Surface geological mapping Surface geochemical sampling Geophysics Definition of drill targets Stage 2: Exploration drilling (1,500m of diamond core & RC) Preliminary metallurgical testwork Scoping study | March 2010-July 2010

October 2010-Dec 2010

January 2011-Sept 2011 |

Picacho Ecuador Gold Project (prospective acquisition) | Due diligence continues on this opportunity. Technical report is being finalized by Geologist. Prospecting work to be done is detailed above. | Will be guided by independent geologist’s final recommendations. . |

Intellectual Property and Patents

We have no intellectual property such as patents or trademarks other than experience, know-how and contacts. Additionally, we have no royalty agreements or local labor contracts.

Compliance with Government Regulations

We will be required to comply with all regulations, rules and directives of governmental authorities and agencies applicable to the exploration of minerals in Cambodia, Ecuador and Indonesia

Approvals and authorizations may be required also from other government agencies, depending upon the nature and scope of the proposed exploration program. If the exploration activities require the falling of timber, then either a free use permit or a license to cut must be issued by the relevant authorities. Items such as waste approvals may be required from the relevant authorities if the proposed exploration activities are significantly large enough to warrant them. Waste

13

approvals refer to the disposal of rock materials removed from the earth which must be reclaimed. An environmental impact statement may be required.

We have budgeted for regulatory compliance costs in the proposed work program.

We will also have to sustain the cost of reclamation and environmental remediation for all exploration work undertaken. Both reclamation and environmental remediation refer to putting disturbed ground back as close to its original state as possible. Other potential pollution or damage must be cleaned up and renewed along standard guidelines outlined in the usual permits. Reclamation is the process of bringing the land back to its natural state after completion of exploration activities. Environmental remediation refers to the physical activity of taking steps to remediate, or remedy, any environmental damage caused. The amount of these costs is not known at this time as we do not know the extent of the exploration program that will be undertaken beyond completion of the recommended work program. Because there is presently no information on the size, tenor, or quality of any resource or reserve at this time, it is impossibl e to assess the impact of any capital expenditures on earnings, our competitive position, or us in the event that a potentially economic deposit is discovered.

If we enter the production phase, of which there is no assurance, the cost of complying with permit and regulatory environment laws will be greater because the impact on the project area is greater. Permits and regulations will control all aspects of the production program if the project continues to that stage. The regulatory requirements that we will have to meet will likely include:

(i)

Ensuring that any water discharge meets required water standards;

(ii)

Dust generation will have to be minimal or otherwise re-mediated;

(iii)

Dumping of material on the surface will have to be re-contoured and re-vegetated with natural vegetation;

(iv)

All materials to be left on the surface will need to be environmentally benign;

(v)

Ground water will have to be monitored for any potential contaminants;

(vi)

The socio-economic impact of the project will have to be evaluated and, if deemed negative, will have to be re-mediated; and

(vii)

There will have to be an impact report of the work on the local fauna and flora including a study of potentially endangered species.

Competition

As an exploration stage company, we compete with other mineral resource exploration and development companies for financing and for the acquisition of new mineral properties. Many of the mineral resource exploration and development companies with whom we compete have greater financial and technical resources than we do. Accordingly, these competitors may be able to spend greater amounts on acquisitions of mineral properties of merit, on exploration of their mineral properties and on development of their mineral properties. In addition, they may be able to afford greater geological expertise in the targeting and exploration of mineral properties. This competition could result in competitors having mineral properties of greater quality and interest

14

to prospective investors who may finance additional exploration and development. This competition could adversely impact our ability to finance further exploration and to achieve the financing necessary for us to develop our mineral property.

Employees

As of the date of this report, we have no employees other than directors. We do not intend any material change in the number of employees over the next 12 month. We are conducting and intend to conduct our business largely through consultants on a contract and fee for service basis.

Item 1A.

Risk Factors

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

Item 1B.

Unresolved Staff Comments

The Company is to reply to a current SEC comments letter relating to the carried value of its mineral rights and internal controls. The Company expects no significant changes to the way it accounts for assets or maintains its internal controls..

Item 2.

Properties

The Company’s business office is located at #15, 291 Street, Sangkat Boeng Kok 1, Tourl Kok District, Phnom Penh, Cambodia.

The description of our mineral properties is set out above under the section entitled “Description of Business.”

Item 3.

Legal Proceedings

We are not presently a party to any litigation.

Item 4.

Submission of Matters to a Vote of Security Holders

No matters were submitted to a vote of security holders of the Registrant, through the solicitation of proxies or otherwise, during the fiscal year covered by this report.

PART II

Item 5.

Market for Registrant’s Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities.

Market Information.

The principal United States market for our common equity is the Over-The-Counter Bulletin Board (the“OTC Bulletin Board”), a quotation medium for subscribing members. Our common

stock is quoted for trading on the OTC Bulletin Board under the symbol ELRA.

15

The table below sets out the range of high and low bid information for our common stock for each full quarterly period within the last fiscal year as regularly quoted in the automated quotation system of the OTC Bulletin Board.

| | |

Quarter Ended | High | Low |

December 31, 2009 | $0.19 | $0.12 |

September 30, 2009 | $0.16 | $0.15 |

June 30, 2009 | $0.24 | $0.22 |

March 31, 2009 | $0.24 | $0.11 |

These quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not represent actual transactions.

Holders.

As of December 31, 2009, there were approximately 56 holders of our common stock.

Dividends.

We have not paid dividends on our common stock, and do not anticipate paying dividends on our common stock in the foreseeable future.

Securities authorized for issuance under equity compensation plans.

We have no compensation plans under which our equity securities are authorized for issuance.

Performance graph.

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

Recent sales of unregistered securities.

None.

Issuer Repurchases of Equity Securities.

None.

Item 6.

Selected Financial Data.

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

16

Item 7.

Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Forward-looking statements

This report contains "forward-looking statements" relating to the registrant which represent the registrant's current expectations or beliefs, including statements concerning registrant’s operations, performance, financial condition and growth. For this purpose, any statement contained in this report that are not statements of historical fact are forward-looking statements. Without limiting the generality of the foregoing, words such as "may", "anticipation", "intend", "could", "estimate", or "continue" or the negative or other comparable terminology are intended to identify forward-looking statements. These statements by their nature involve substantial risks and uncertainties, such as credit losses, dependence on management and key personnel and variability of quarterly results, ability of registrant to continue its growth strategy and competition, certain of which are be yond the registrant's control. Should one or more of these risks or uncertainties materialize or should the underlying assumptions prove incorrect, actual outcomes and results could differ materially from those indicated in the forward-looking statements.

The following discussion and analysis should be read in conjunction with the information set forth in the Company’s audited financial statements for the period ended December 31, 2009.

As at December 31, 2009, we had a nil cash balance. In order to meet our budgeted cash requirements over the next 12 months, we anticipate raising money from equity financing from the sale of our common stock, additional shareholder loan commitments and/or the sale of part of our interest in our mineral claims. If we are not successful in raising additional financing, we anticipate that we will not be able to proceed with our business plan. In such a case, we may decide to discontinue our current business plan and seek other business opportunities in the resource sector. Any business opportunity would require our management to perform due diligence on possible acquisition of additional resource properties. Such due diligence would likely include purchase investigation costs such as professional fees by consulting geologists, preparation of geological reports on the properties, conducting title searches and travel costs for site visits. It is anticipated that such costs will not be sufficient to acquire any resource property and additional funds will be required to close any possible acquisition. During this period, we will need to maintain our periodic filings with the appropriate regulatory authorities and will incur legal and accounting costs. If no other such opportunities are available and we cannot raise additional capital to sustain minimum operations, we may be forced to discontinue business. We do not have any specific alternative business opportunities in mind and have not planned for any such contingency.

Based on the nature of our business, we anticipate incurring operating losses in the foreseeable future. We base this expectation, in part, on the fact that very few mineral claims in the exploration stage ultimately develop into producing, profitable mines. Our future financial results are also uncertain due to a number of factors, some of which are outside our control. These factors include the following:

?

our ability to raise additional funding;

?

the market price for minerals that may be found;

?

the results of our proposed exploration programs on the mineral properties; and

?

our ability to find joint venture partners for the development of our property interests

17

Due to our lack of operating history and present inability to generate revenues, our auditors have raised substantial doubt about our ability to continue as a going concern.

Results of Operations

We have had no operating revenues since our inception on June 26, 2006 through to the period ended December 31, 2009, but have incurred operating expenses in the amount of $1,274,000 for the same period. Our activities have been financed from the proceeds of share subscriptions and additional paid in capital.

For the fiscal year ended December 31, 2009, general and administrative expenses were$73,000, exploration expenses were $391,000 and depreciation expenses were $29,000. For the period from inception on June 26, 2006 through December 31, 2009, general and administrative expenses were $356,000, exploration expenses were $841,000 and depreciation expenses were $77,000

We have received a going concern opinion from our auditors because we have not generated sufficient revenues since our inception to cover our expenses and are therefore sustaining losses, resulting in substantial doubt about our ability to continue as a going concern. From inception (June 26, 2006) to December 31, 2009 our operations have resulted in an accumulated deficit of $1,274,000.

Our financial statements are prepared in accordance with U.S. generally accepted accounting principles. We have expensed all development costs related to our establishment.

Liquidity and Capital Resources

Since inception through to and including December 31, 2009, we have raised $1,180,000 through placements of our common shares and other capital contributions from shareholders and related parties. The Company has no cash or cash equivalents as at December 31, 2009.

We believe the Company will have adequate resources to implement its strategic objectives in upcoming quarters.

We expect to have the appropriate financing commitments in place well in advance of June 30, 2010, although we cannot guarantee that we will be able to obtain such additional financing, on acceptable terms, or at all, which may require us to reduce our operating costs and other expenditures, including reductions of personnel and capital expenditures. Failure to raise new capital or to operate a viable business with reduced operating costs and other expenditures may cause the business to fail, which in turn will result in the loss of the investments of our investors.

There are no assurances that we will be able to achieve further sales of our common stock or any other form of additional financing. If we are unable to achieve the financing necessary to continue our plan of operations, then we will not be able to continue our exploration of our mineral claims and our venture will fail.

Off-balance sheet arrangements

We have no off-balance sheet arrangements including arrangements that would affect our liquidity, capital resources, market risk support and credit risk support or other benefits.

18

Item 7A.

Quantative and Qualitative Disclosures About Market Risk.

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

Item 8.

Financial Statements and Supplementary Data.

19