SS&C Technologies (NASDAQ:SSNC) Q1 2022 Earnings Results

Safe Harbor Statement This presentation contains forward-looking statements, as defined by federal and state securities laws, which are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements concerning plans, objectives, goals, strategies, expectations, intentions, projections, developments, future events, performance or products, underlying assumptions, and other statements which are other than statements of historical facts. In some cases, you can identify forward-looking statements by terminology such as ''may,'' ''will,'' ''should,'' “hope,'' "expects,'' ''intends,'' ''plans,'' ''anticipates,'' "contemplates," ''believes,'' ''estimates,'' ''predicts,'' ''projects,'' ''potential,'' ''continue,'' and other similar terminology or the negative of these terms. From time to time, we may publish or otherwise make available forward-looking statements of this nature. All such forward-looking statements, whether written or oral, and whether made by us or on our behalf, are expressly qualified by the cautionary statements described on this message including those set forth below. All statements contained in this presentation are made only as of the date of this presentation. In addition, except to the extent required by applicable securities laws, we undertake no obligation to update or revise any forward-looking statements to reflect events, circumstances, or new information after the date of the information or to reflect the occurrence or likelihood of unanticipated events, and we disclaim any such obligation.� �Forward-looking statements are only predictions that relate to future events or our future performance and are subject to known and unknown risks, uncertainties, assumptions, and other factors that may cause actual results, outcomes, levels of activity, performance, developments, or achievements to be materially different from any future results, outcomes, levels of activity, performance, developments, or achievements expressed, anticipated, or implied by these forward-looking statements. Other factors that could affect actual results, outcomes, levels of activity, performance, developments or achievements can be found under the heading “Risk Factors” in SS&C Technologies Holdings, Inc.’s most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q. As a result, we cannot guarantee future results, outcomes, levels of activity, performance, developments, or achievements, and there can be no assurance that our expectations, intentions, anticipations, beliefs, or projections will result or be achieved or accomplished.

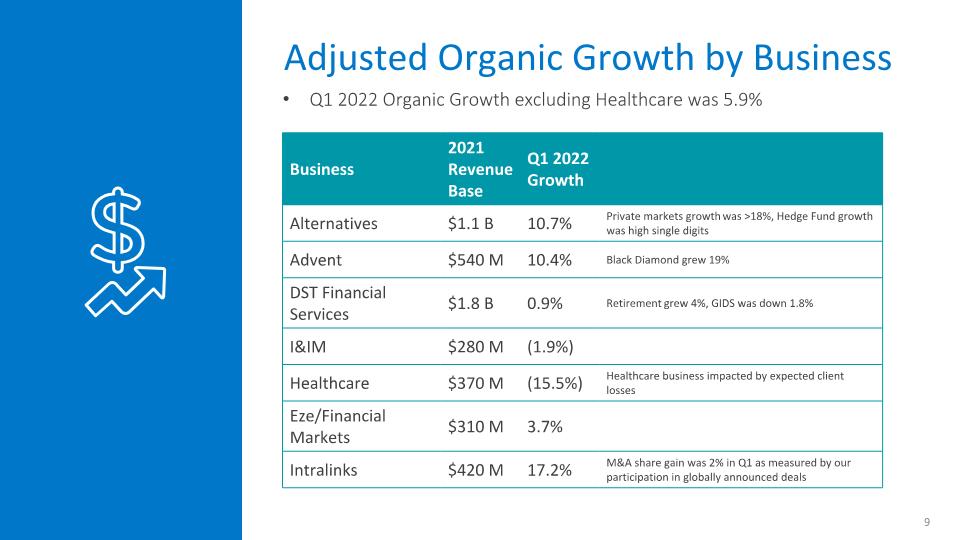

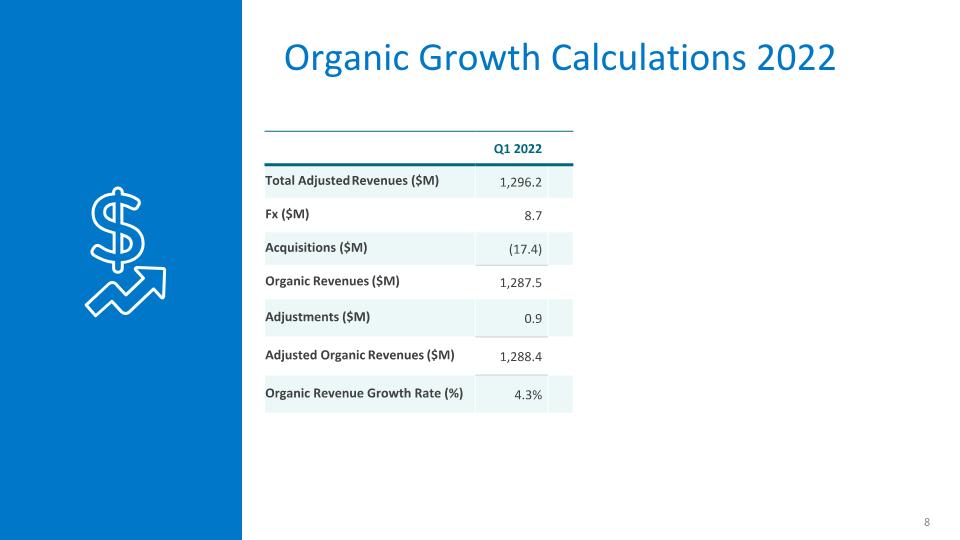

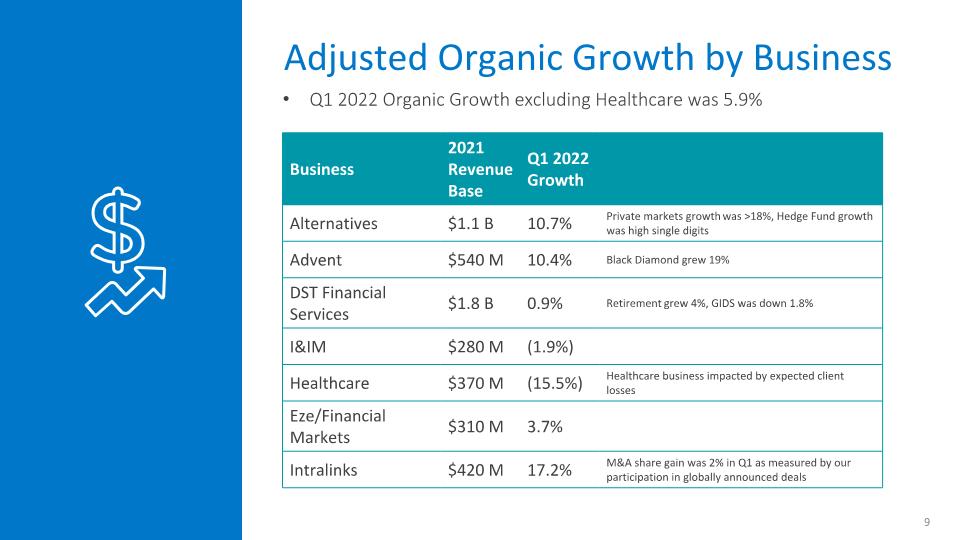

Q1 2022 organic growth was 4.3%, with strong performance from our Alternatives, Intralinks, and Advent business units. Q1 2022 Organic Growth excluding Healthcare was 5.9%. SS&C generated net cash from operating activities of $183.5 million for the three months ended March 31, 2022. Repurchased 2.3 million shares of common stock in Q1 2022 at an average price of $75.22 per share for $170.9 million. SS&C reported adjusted consolidated EBITDA attributable to SS&C of $514.9 million for Q1 2022. Completed the acquisitions of Blue Prism and Hubwise. In March, SS&C launched GoCentral. This new, more modern fund administration platform amplifies our processing and technology efficiency and provides our clients with higher quality deliverables with increased transparency. Q1 2022 Highlights

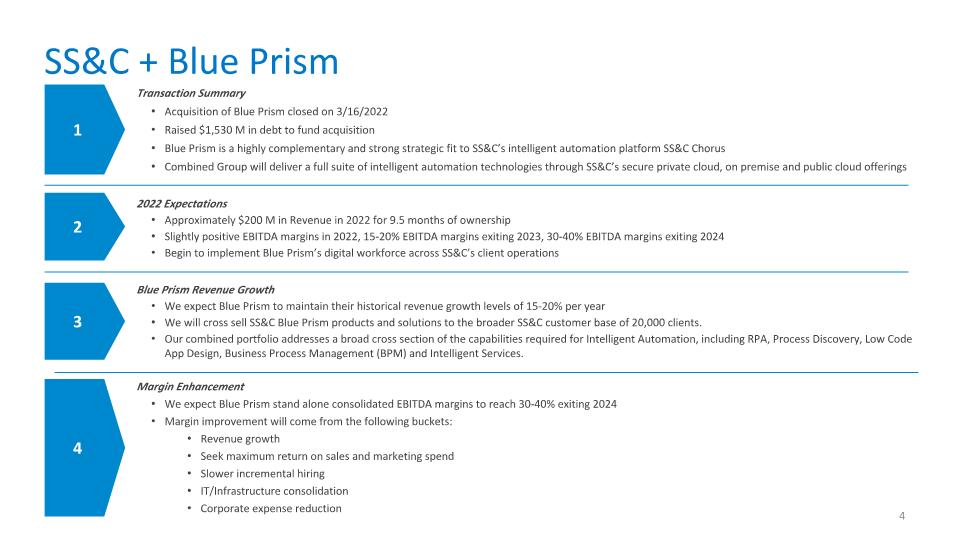

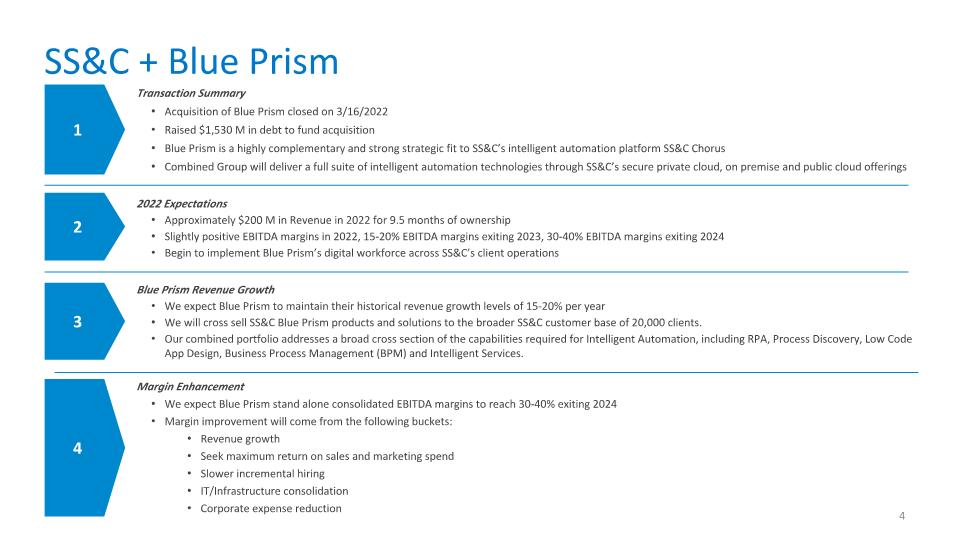

SS&C + Blue Prism Blue Prism Revenue Growth We expect Blue Prism to maintain their historical revenue growth levels of 15-20% per year We will cross sell SS&C Blue Prism products and solutions to the broader SS&C customer base of 20,000 clients. Our combined portfolio addresses a broad cross section of the capabilities required for Intelligent Automation, including RPA, Process Discovery, Low Code App Design, Business Process Management (BPM) and Intelligent Services. 1 4 3 Transaction Summary Acquisition of Blue Prism closed on 3/16/2022 Raised $1,530 M in debt to fund acquisition Blue Prism is a highly complementary and strong strategic fit to SS&C’s intelligent automation platform SS&C Chorus Combined Group will deliver a full suite of intelligent automation technologies through SS&C’s secure private cloud, on premise and public cloud offerings Margin Enhancement We expect Blue Prism stand alone consolidated EBITDA margins to reach 30-40% exiting 2024 Margin improvement will come from the following buckets: Revenue growth Seek maximum return on sales and marketing spend Slower incremental hiring IT/Infrastructure consolidation Corporate expense reduction 2022 Expectations Approximately $200 M in Revenue in 2022 for 9.5 months of ownership Slightly positive EBITDA margins in 2022, 15-20% EBITDA margins exiting 2023, 30-40% EBITDA margins exiting 2024 Begin to implement Blue Prism’s digital workforce across SS&C’s client operations 2

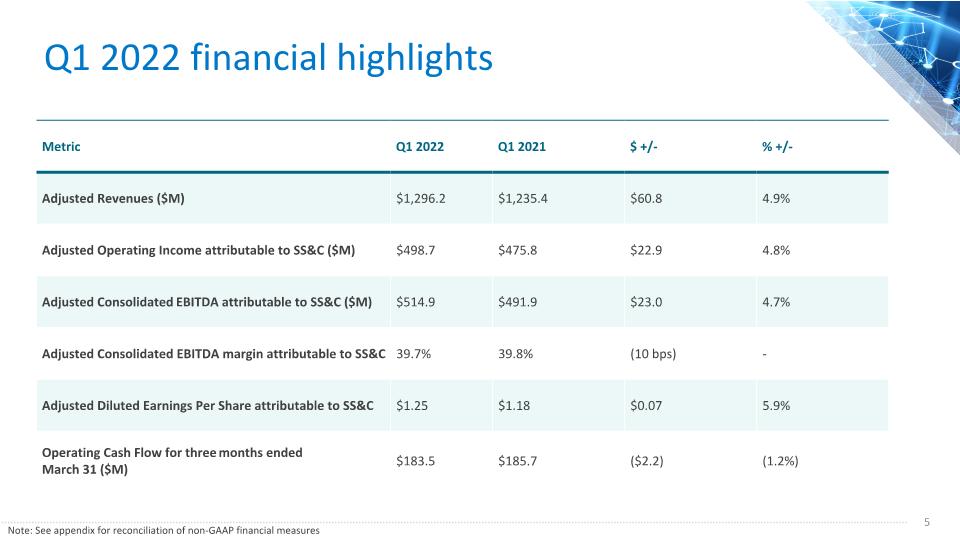

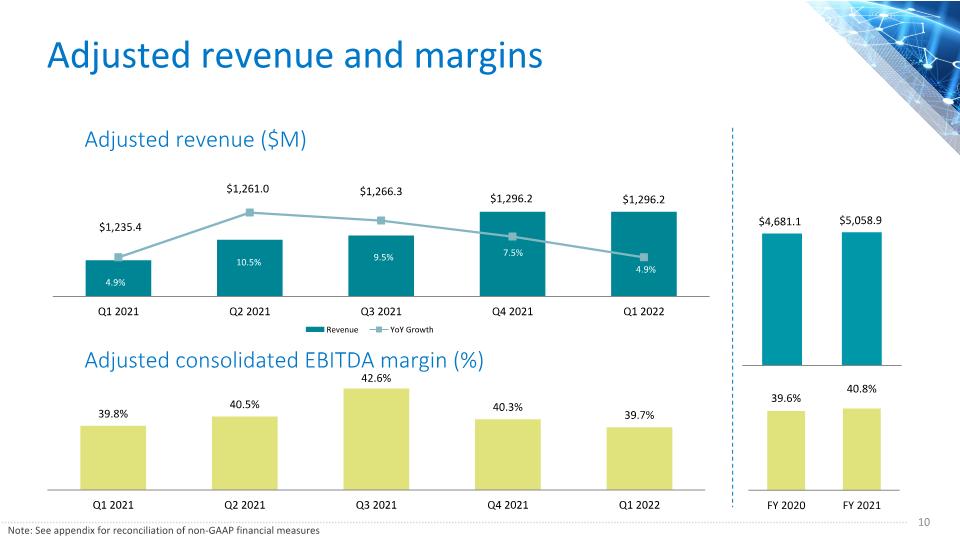

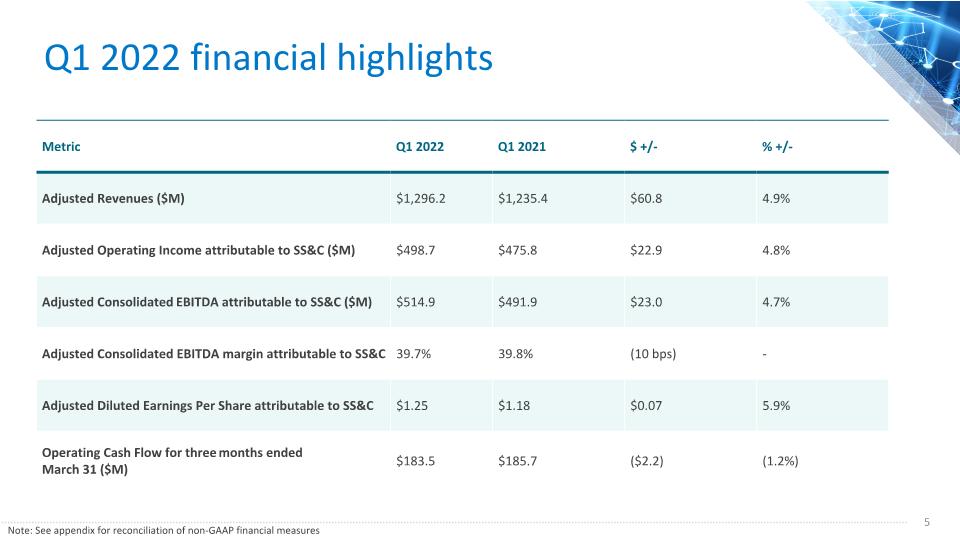

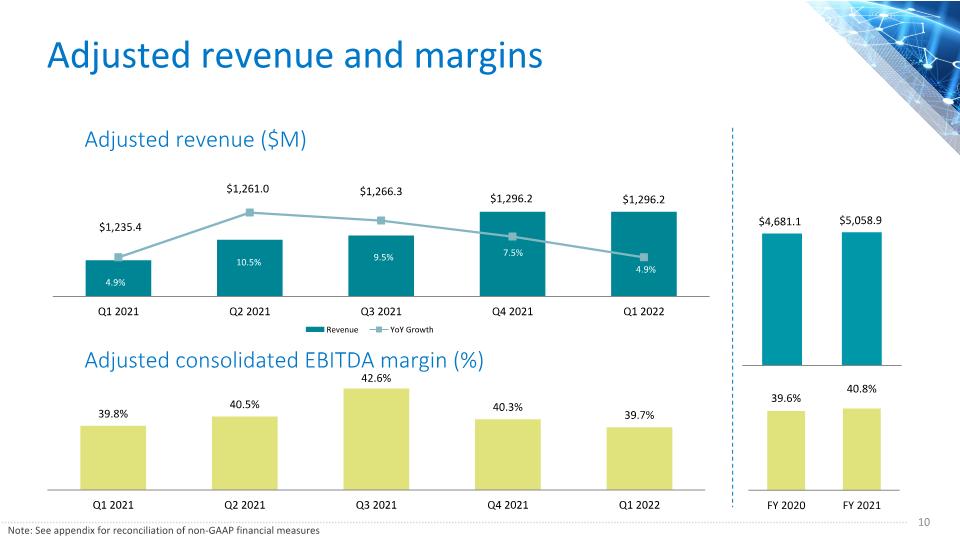

Q1 2022 financial highlights Metric Q1 2022 Q1 2021 $ +/- % +/- Adjusted Revenues ($M) $1,296.2 $1,235.4 $60.8 4.9% Adjusted Operating Income attributable to SS&C ($M) $498.7 $475.8 $22.9 4.8% Adjusted Consolidated EBITDA attributable to SS&C ($M) $514.9 $491.9 $23.0 4.7% Adjusted Consolidated EBITDA margin attributable to SS&C 39.7% 39.8% (10 bps) - Adjusted Diluted Earnings Per Share attributable to SS&C $1.25 $1.18 $0.07 5.9% Operating Cash Flow for three months ended March 31 ($M) $183.5 $185.7 ($2.2) (1.2%) Note: See appendix for reconciliation of non-GAAP financial measures

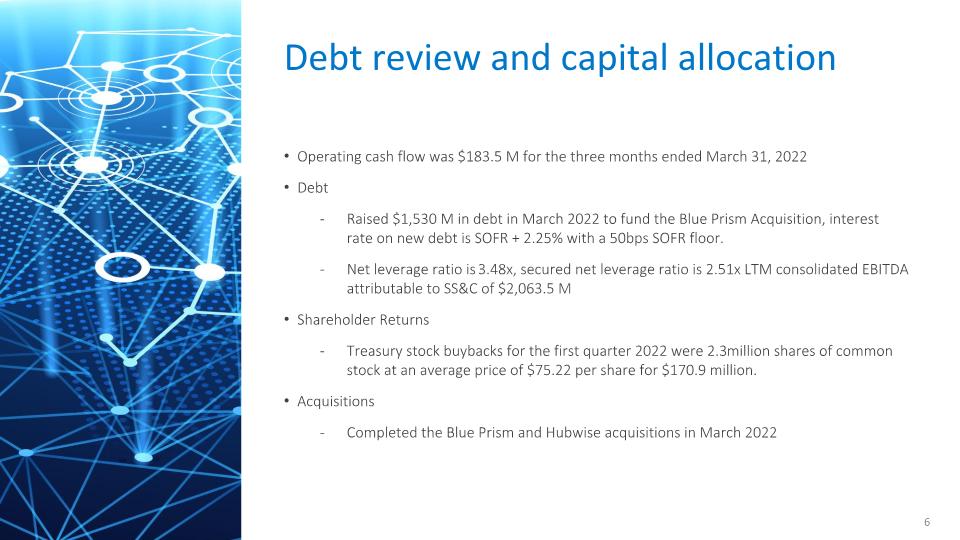

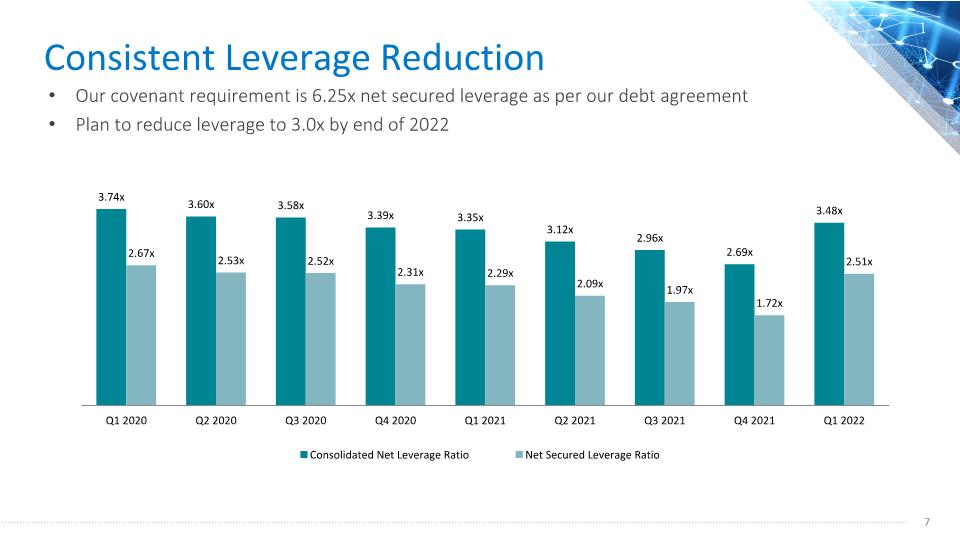

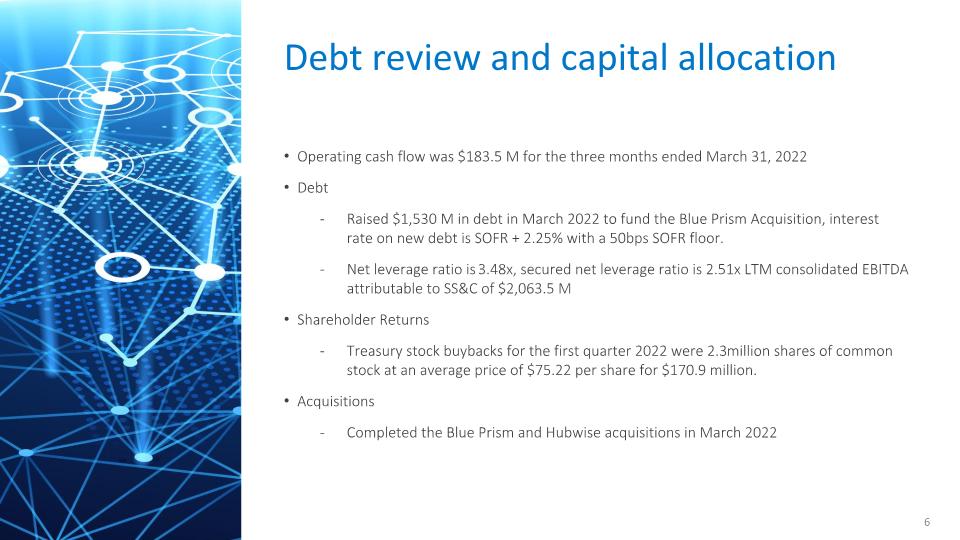

Operating cash flow was $183.5 M for the three months ended March 31, 2022 Debt Raised $1,530 M in debt in March 2022 to fund the Blue Prism Acquisition, interest rate on new debt is SOFR + 2.25% with a 50bps SOFR floor. Net leverage ratio is 3.48x, secured net leverage ratio is 2.51x LTM consolidated EBITDA attributable to SS&C of $2,063.5 M Shareholder Returns Treasury stock buybacks for the first quarter 2022 were 2.3 million shares of common stock at an average price of $75.22 per share for $170.9 million. Acquisitions Completed the Blue Prism and Hubwise acquisitions in March 2022 Debt review and capital allocation

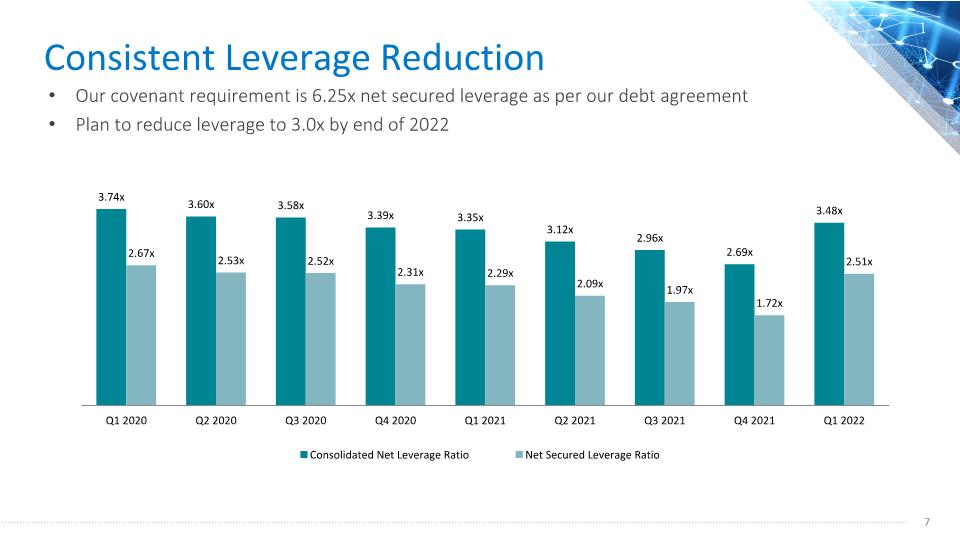

Consistent Leverage Reduction Our covenant requirement is 6.25x net secured leverage as per our debt agreement Plan to reduce leverage to 3.0x by end of 2022

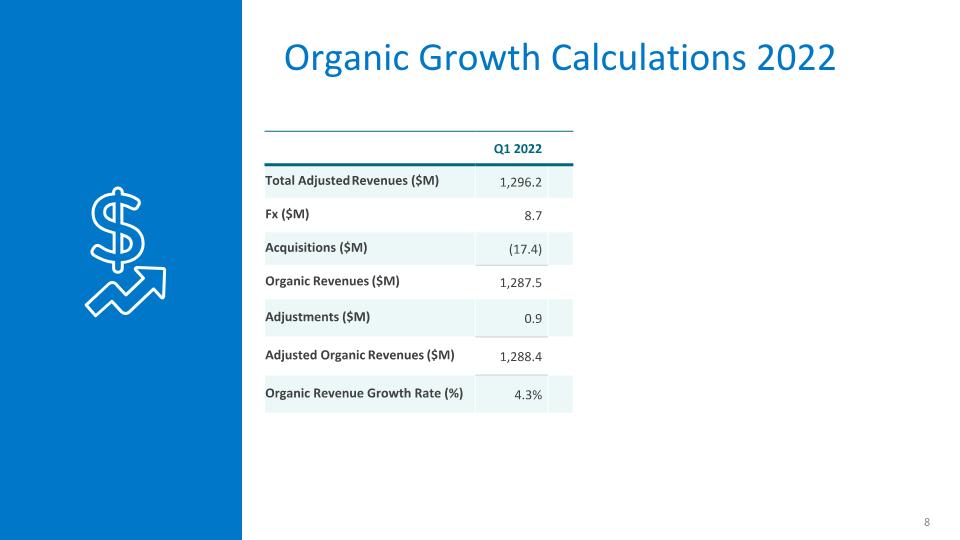

Organic Growth Calculations 2022 Q1 2022 Total Adjusted Revenues ($M) 1,296.2 Fx ($M) 8.7 Acquisitions ($M) (17.4) Organic Revenues ($M) 1,287.5 Adjustments ($M) 0.9 Adjusted Organic Revenues ($M) 1,288.4 Organic Revenue Growth Rate (%) 4.3%

Adjusted Organic Growth by Business Business 2021 Revenue Base Q1 2022 Growth Alternatives $1.1 B 10.7% Private markets growth was >18%, Hedge Fund growth was high single digits Advent $540 M 10.4% Black Diamond grew 19% DST Financial Services $1.8 B 0.9% Retirement grew 4%, GIDS was down 1.8% I&IM $280 M (1.9%) Healthcare $370 M (15.5%) Healthcare business impacted by expected client losses Eze/Financial Markets $310 M 3.7% Intralinks $420 M 17.2% M&A share gain was 2% in Q1 as measured by our participation in globally announced deals Q1 2022 Organic Growth excluding Healthcare was 5.9%

Adjusted revenue and margins Adjusted revenue ($M) Adjusted consolidated EBITDA margin (%) Note: See appendix for reconciliation of non-GAAP financial measures

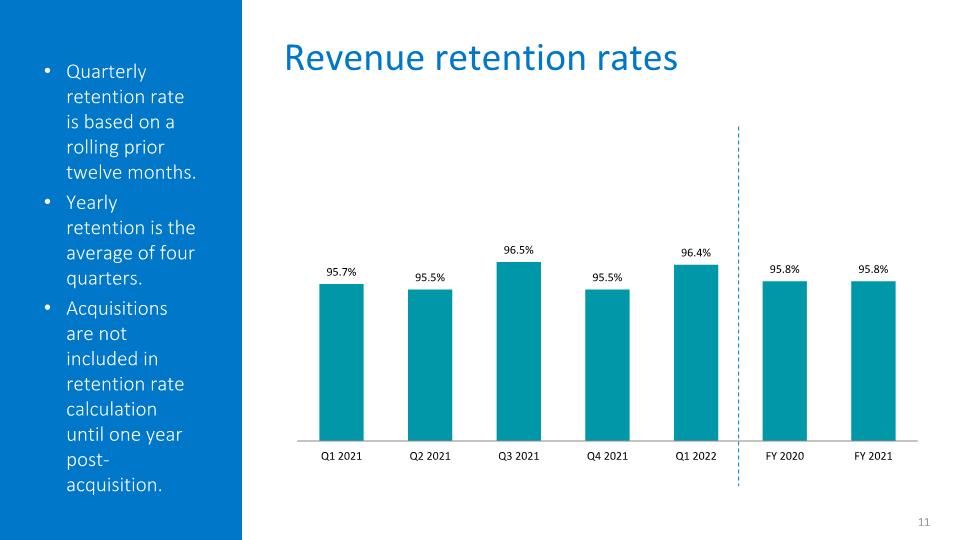

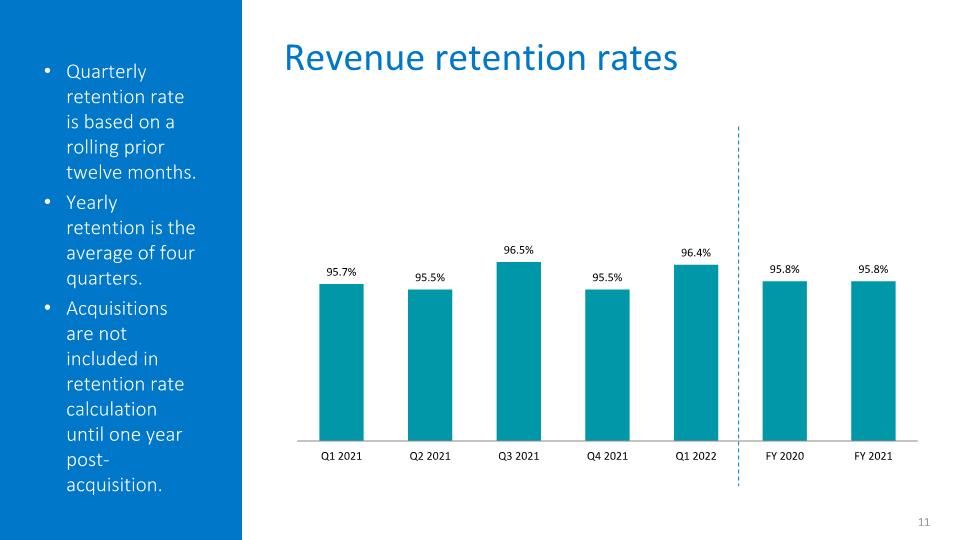

Quarterly retention rate is based on a rolling prior twelve months. Yearly retention is the average of four quarters. Acquisitions are not included in retention rate calculation until one year post-acquisition. Revenue retention rates

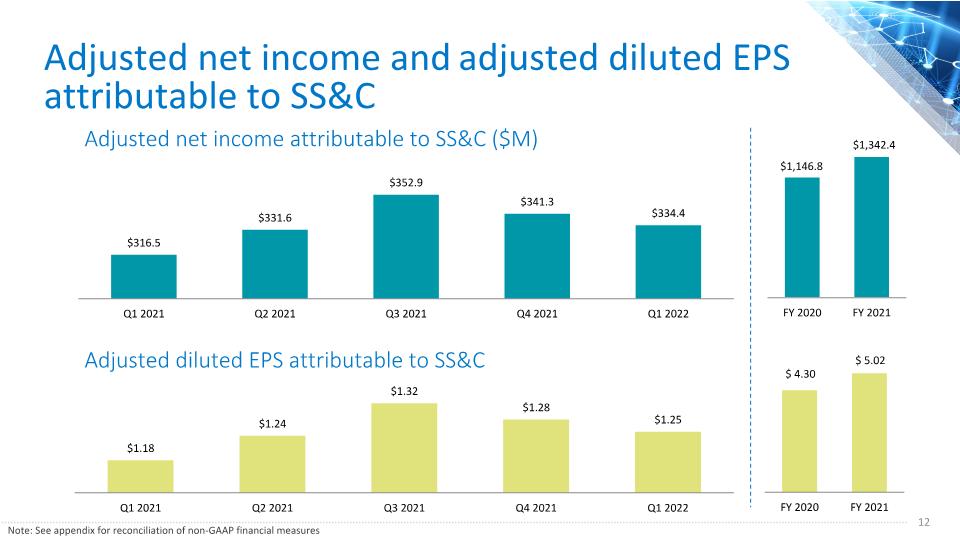

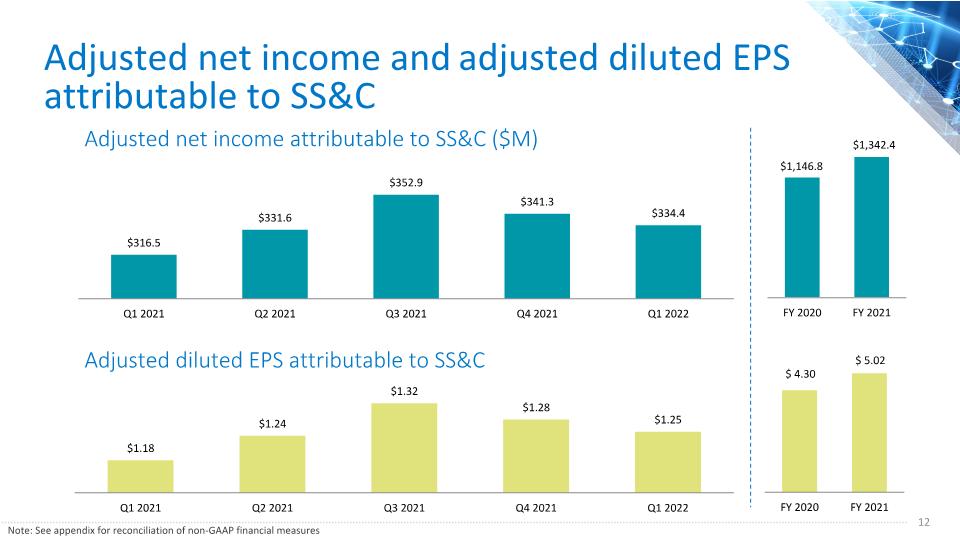

Adjusted net income and adjusted diluted EPS attributable to SS&C Adjusted net income attributable to SS&C ($M) Adjusted diluted EPS attributable to SS&C Note: See appendix for reconciliation of non-GAAP financial measures

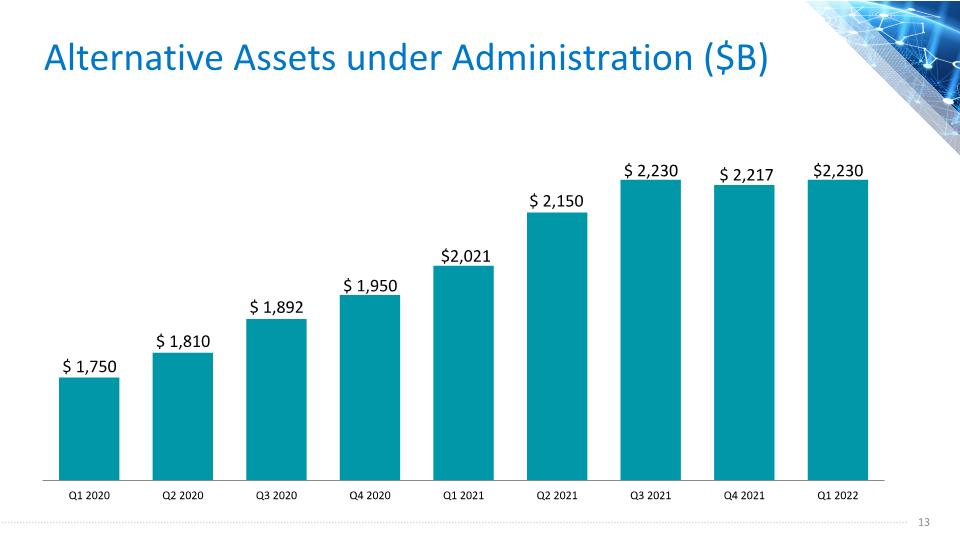

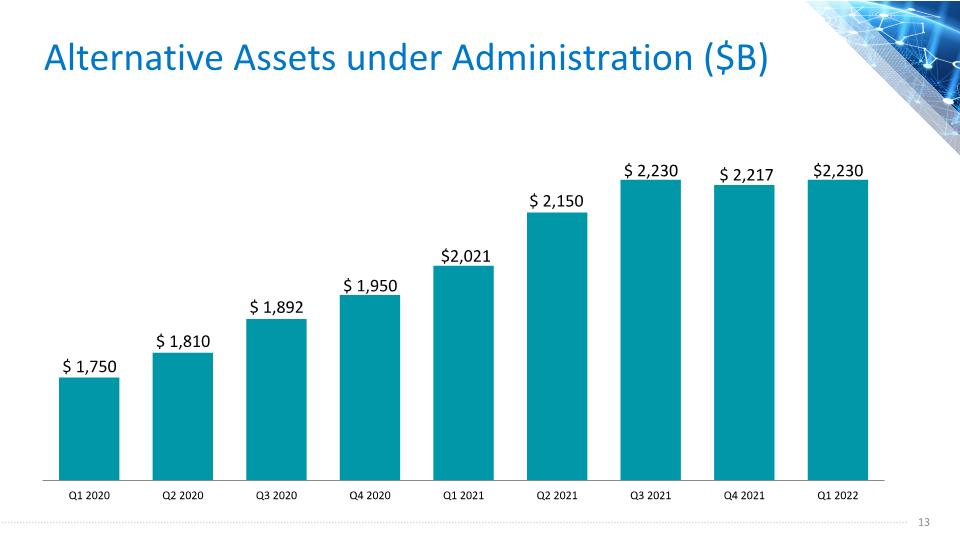

Alternative Assets under Administration ($B)

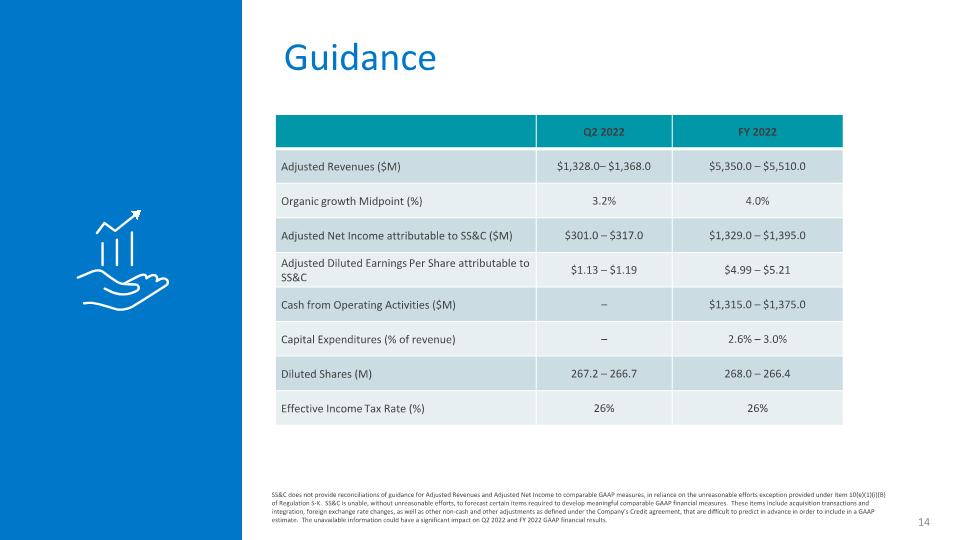

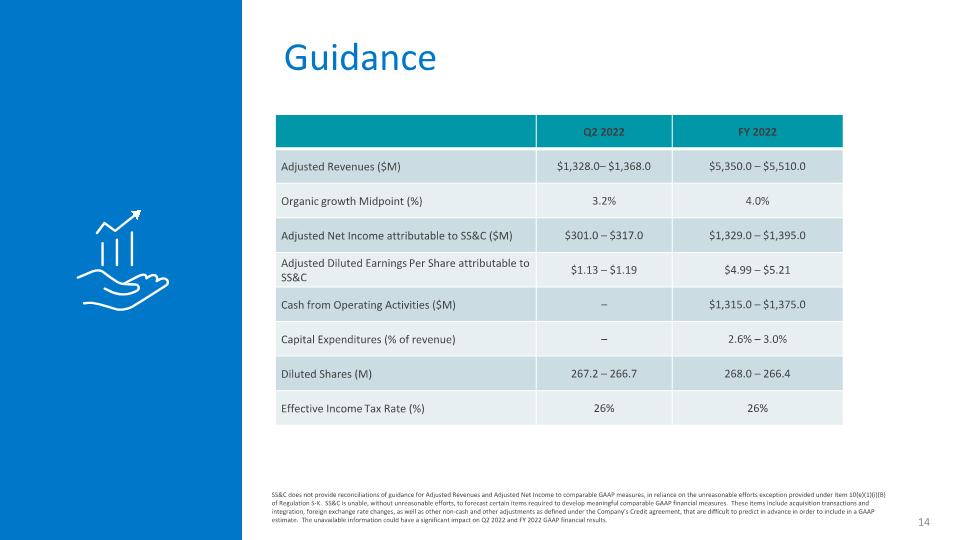

Guidance SS&C does not provide reconciliations of guidance for Adjusted Revenues and Adjusted Net Income to comparable GAAP measures, in reliance on the unreasonable efforts exception provided under Item 10(e)(1)(i)(B) of Regulation S-K. SS&C is unable, without unreasonable efforts, to forecast certain items required to develop meaningful comparable GAAP financial measures. These items include acquisition transactions and integration, foreign exchange rate changes, as well as other non-cash and other adjustments as defined under the Company’s Credit agreement, that are difficult to predict in advance in order to include in a GAAP estimate. The unavailable information could have a significant impact on Q2 2022 and FY 2022 GAAP financial results. Q2 2022 FY 2022 Adjusted Revenues ($M) $1,328.0– $1,368.0 $5,350.0 – $5,510.0 Organic growth Midpoint (%) 3.2% 4.0% Adjusted Net Income attributable to SS&C ($M) $301.0 – $317.0 $1,329.0 – $1,395.0 Adjusted Diluted Earnings Per Share attributable to SS&C $1.13 – $1.19 $4.99 – $5.21 Cash from Operating Activities ($M) – $1,315.0 – $1,375.0 Capital Expenditures (% of revenue) – 2.6% – 3.0% Diluted Shares (M) 267.2 – 266.7 268.0 – 266.4 Effective Income Tax Rate (%) 26% 26%

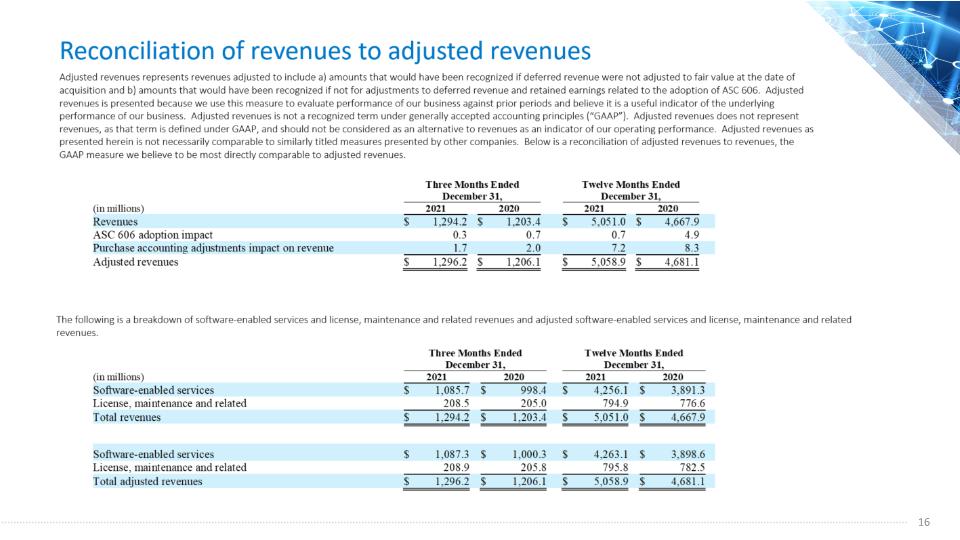

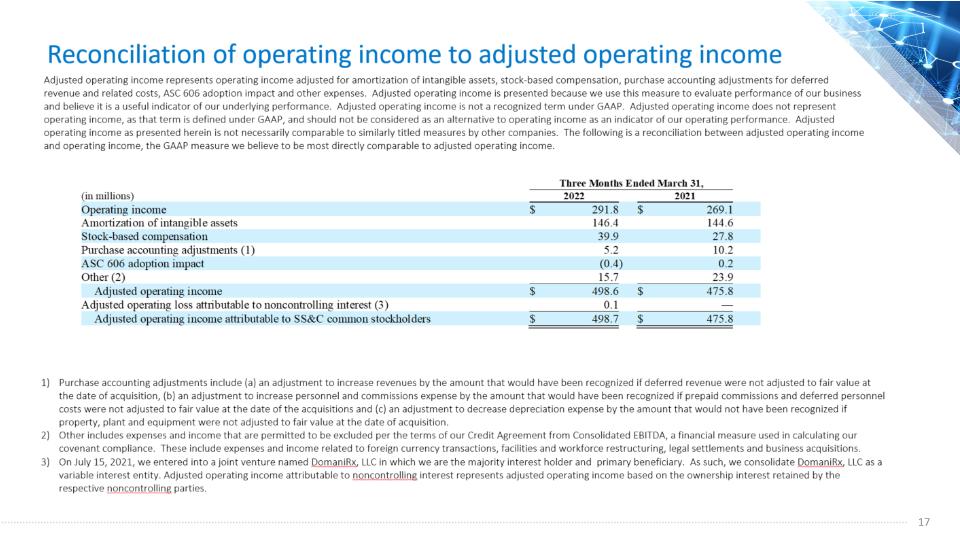

Appendix�Disclosures relating to non-GAAP financial measures

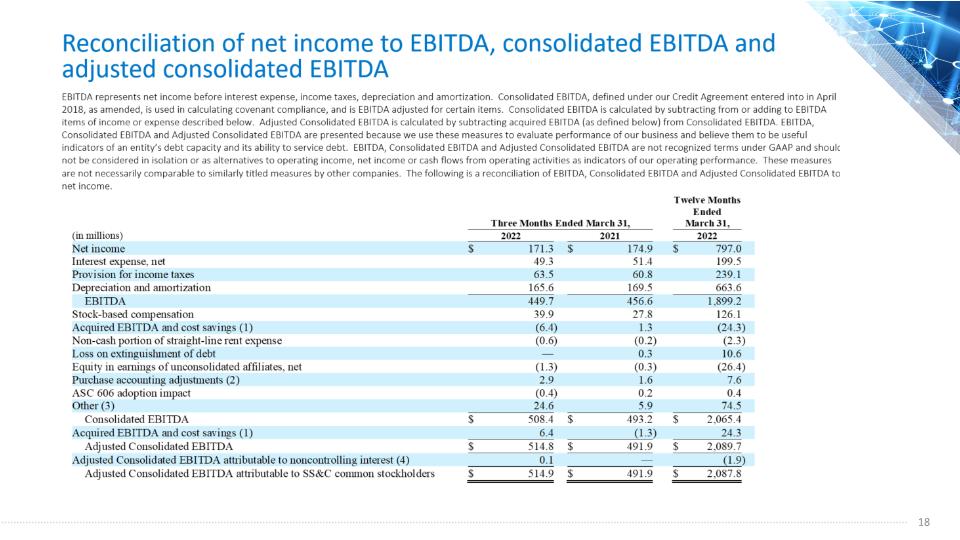

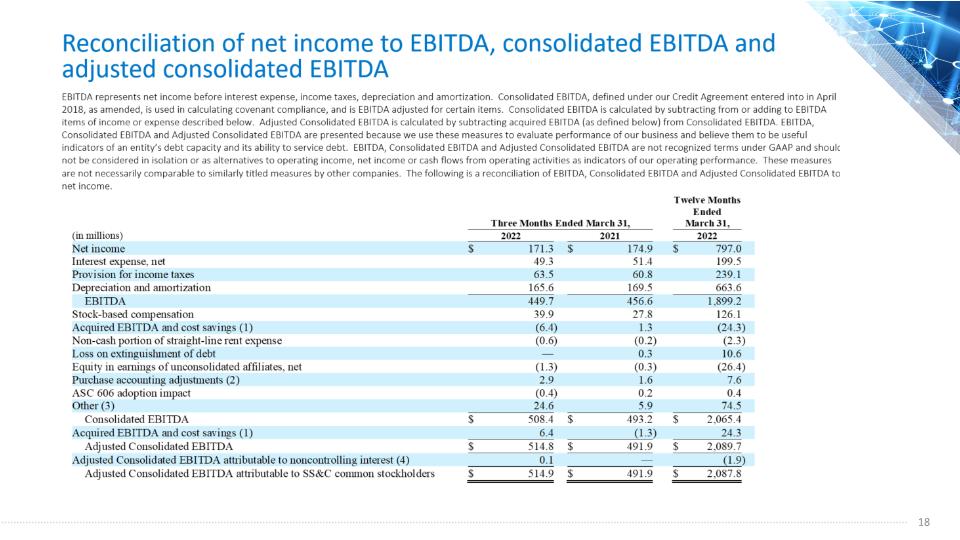

Reconciliation of net income to EBITDA, consolidated EBITDA and adjusted consolidated EBITDA Acquired EBITDA reflects the EBITDA impact of significant businesses that were acquired during the period as if the acquisition occurred at the beginning of the period, as well as cost savings enacted in connection with acquisitions. Purchase accounting adjustments include (a) an adjustment to increase revenues by the amount that would have been recognized if deferred revenue were not adjusted to fair value at the date of acquisitions (b) an adjustment to increase personnel and commissions expense by the amount that would have been recognized if prepaid commissions and deferred personnel costs were not adjusted to fair value at the date of the acquisitions and (c) an adjustment to increase or decrease rent expense by the amount that would have been recognized if lease obligations were not adjusted to fair value at the date of acquisitions. Other includes expenses and income that are permitted to be excluded per the terms of our Credit Agreement from Consolidated EBITDA, a financial measure used in calculating our covenant compliance. These include expenses and income related to foreign currency transactions, investment gains and losses, facilities and workforce restructuring, legal settlements, business combinations and other items. On July 15, 2021, we entered into a joint venture named DomaniRx, LLC in which we are the majority interest holder and primary beneficiary. As such, we consolidate DomaniRx, LLC as a variable interest entity. Adjusted Consolidated EBITDA attributable to noncontrolling interest represents adjusted Consolidated EBITDA based on the ownership interest retained by the respective noncontrolling parties.

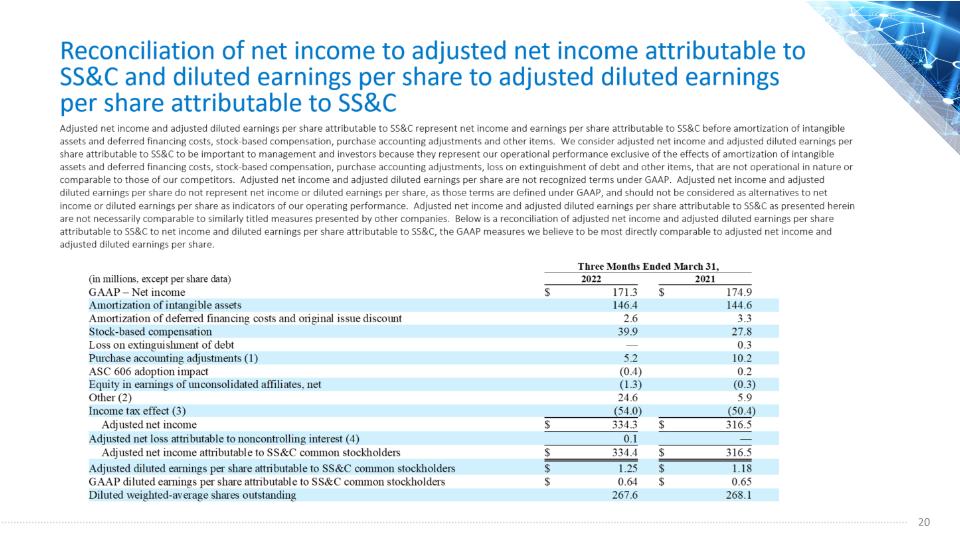

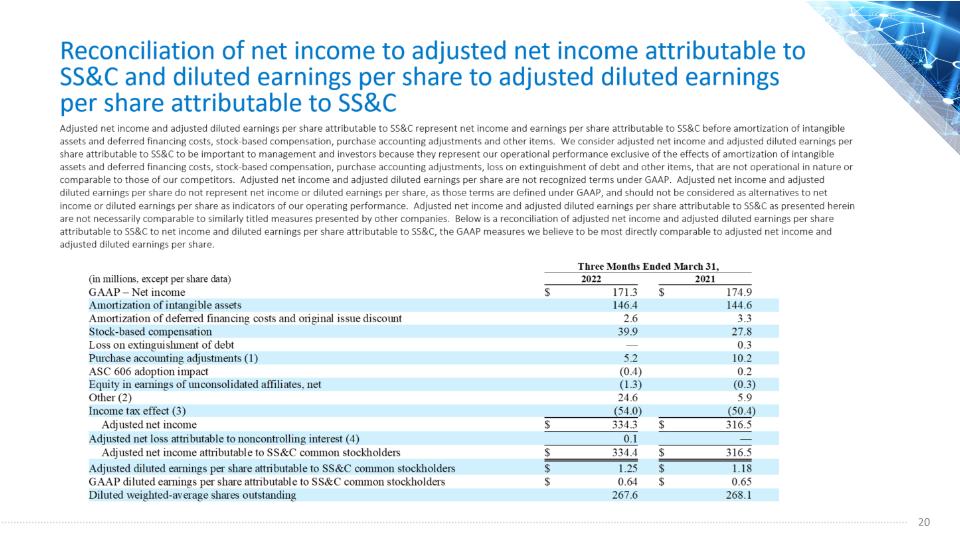

Reconciliation of net income to adjusted net income and diluted earnings per share to adjusted diluted earnings per share Purchase accounting adjustments include (a) an adjustment to increase revenues by the amount that would have been recognized if deferred revenue were not adjusted to fair value at the date of acquisition, (b) an adjustment to increase personnel and commissions expense by the amount that would have been recognized if prepaid commissions and deferred personnel costs were not adjusted to fair value at the date of the acquisitions and (c) an adjustment to decrease depreciation expense by the amount that would not have been recognized if property, plant and equipment were not adjusted to fair value at the date of acquisition. Other includes expenses and income that are permitted to be excluded per the terms of our Credit Agreement from Consolidated EBITDA, a financial measure used in calculating our covenant compliance. These include expenses and income related to foreign currency transactions, investment gains and losses, facilities and workforce restructuring, legal settlements, business acquisitions and other items. An estimated normalized effective tax rate of approximately 26% for the three months ended March 31, 2022 has been used to adjust the provision for income taxes for the purpose of computing adjusted net income. On July 15, 2021, we entered into a joint venture named DomaniRx, LLC in which we are the majority interest holder and primary beneficiary. As such, we consolidate DomaniRx, LLC as a variable interest entity. Adjusted net income attributable to noncontrolling interest represents adjusted net income based on the ownership interest retained by the respective noncontrolling parties.