Corporate Presentation

2 MedAvail Holdings, Inc. (“MedAvail”) cautions you that the statements in this presentation that are not a description of historical fact are forward- looking statements which may be identified by use of the words such as “anticipate,” “believe,” “expand,” “expect,” “grow,” “intend,” “opportunity,” “plan,” “potential,” “project”, “target” and “will” among others. These forward-looking statements are based on MedAvail’s current expectations and involve assumptions that may never materialize or may prove to be incorrect. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of the ability to project future cash utilization and resources need for contingent future liabilities and business operations, the availability of sufficient resources for combined company operations and to conduct or continue planned product development activities, the ability to execute on commercial objectives, regulatory developments and the timing and ability of MedAvail to raise additional capital to fund operations, and other factors , including, but not limited to, those factors discussed in the section entitled “Risk Factors” of our Annual Report on Form 10-K filed on March 29, 2022 and on Form 10-Q filed on May 13, 2022. Although we believe the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, level of activity, performance or achievements. We undertake no obligation to update any of these forward-looking statements for any reason, even if new information becomes available in the future, except as may be required by law. The risks and uncertainties may be amplified by the COVID- 19 pandemic, which has caused significant economic uncertainty. The extent to which the impact of COVID-19, the ongoing military action launched by Russian forces in Ukraine, or the impact of other global economic conditions, including any economic effects stemming from adverse geopolitical events, an economic downturn and changes to inflation or interest rates has on MedAvail’s businesses, operations, and financial results, including the duration and magnitude of such effects, will depend on numerous factors, which are unpredictable and how quickly and to what extent normal economic and operating conditions are affected or impacted. You are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date on which they were made. MedAvail undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they were made, except as may be required by law. Safe Harbor Statements

3 Investment Highlights $16B TAM - Medicare Part D revenues across 7,000 clinics in six initial states Proprietary technology platform enables on-site pharmacy at the point-of-care Highly scalable hub & spoke model; low capital cost Improves economics for at-risk Medicare providers Embedded pharmacy model aligned with value-based care providers Near-term market expansion opportunities with pharmacy management integrations

4Initial Target Markets – Estimated $16.5B1 of Annual Prescription Revenue CALIFORNIA $4.5B Live 2020 ARIZONA $0.6B Live 2019 ILLINOIS $2.2B Targeting FLORIDA $3.7B Live 2021TEXAS $3.6B Targeting MICHIGAN $2.0B Live 2020 $16.5B1 Increasing Medicare population and prescription utilization Growing with expanding clinic partners while propelling new partnerships Meeting rising demand with proven model and scalable infrastructure for key markets 1 Internal estimates based on 2017 CMS Medicare Provider Utilization and Payment Data: Part D Prescriber 2 Internal estimates based on clinic qualification model and projected patient adoption rate Est. Opportunity within 5,800 large clinics (~700 based on existing partners) seeing ~6.5M Medicare patients/year $16.5B Annual Rx Spend across 5,800 clinics in 6 states ~700 clinics with current SpotRx partners in 4 states ~$500M2 serviceable revenue in today’s current core market “Today’s Market” “Total Market”

5 Meeting the Needs of Medicare Patients and Clinic Providers Significant VALUE # of 90 DAY Rxs/YEAR GROSS PROFIT/RX Medicare Commercial Medicaid 0 10 15 20 25 305 VALUABLE LOW VALUE HIGHLY VALUABLE MODERATE VALUE On multiple medications (5 = avg) Source: Kaiser Family Foundation; LEK Insights Large, Growing MARKET 2015 2019 2025 54M 65M 76M Medicare Enrollment All Other Medicare Medicare Advantage Concentrated VALUE Patients Revenue Gross Profit 10% of patients drive 60% retail pharmacy industry gross margins Low Value Moderate Value Valuable Highly Valuable 10% 60%

6Fragmented Pharmacy Model Negatively Impacts At-Risk Providers AT-RISK VALUE-BASED CARE PROVIDERSPHARMACY PROVIDERS • Labor shortages • Shortened hours of operation • High cost of operations & space restrictions • Lower patient satisfaction & medication adherence • Reimbursement tied to medication adherence • Inefficient provider engagement to multiple pharmacies • Lack of data sharing across stakeholders • Ineffective medication utilization

7 Platform solution enables cost-effective pharmacy integration at the point of care to improve patient access and outcomes as well as improve provider satisfaction & reimbursement in a value/risk-based care model Turn-key, full-service pharmacy optimized to deliver tele-pharmacy care leveraging onsite MedCenters combined with convenient home delivery for healthcare organizations requiring pharmacy capabilities MedCenter and SpotRx Provide Flexible & Comprehensive Solutions Solution for pharmacy providers Solution for at-risk Medicare providers

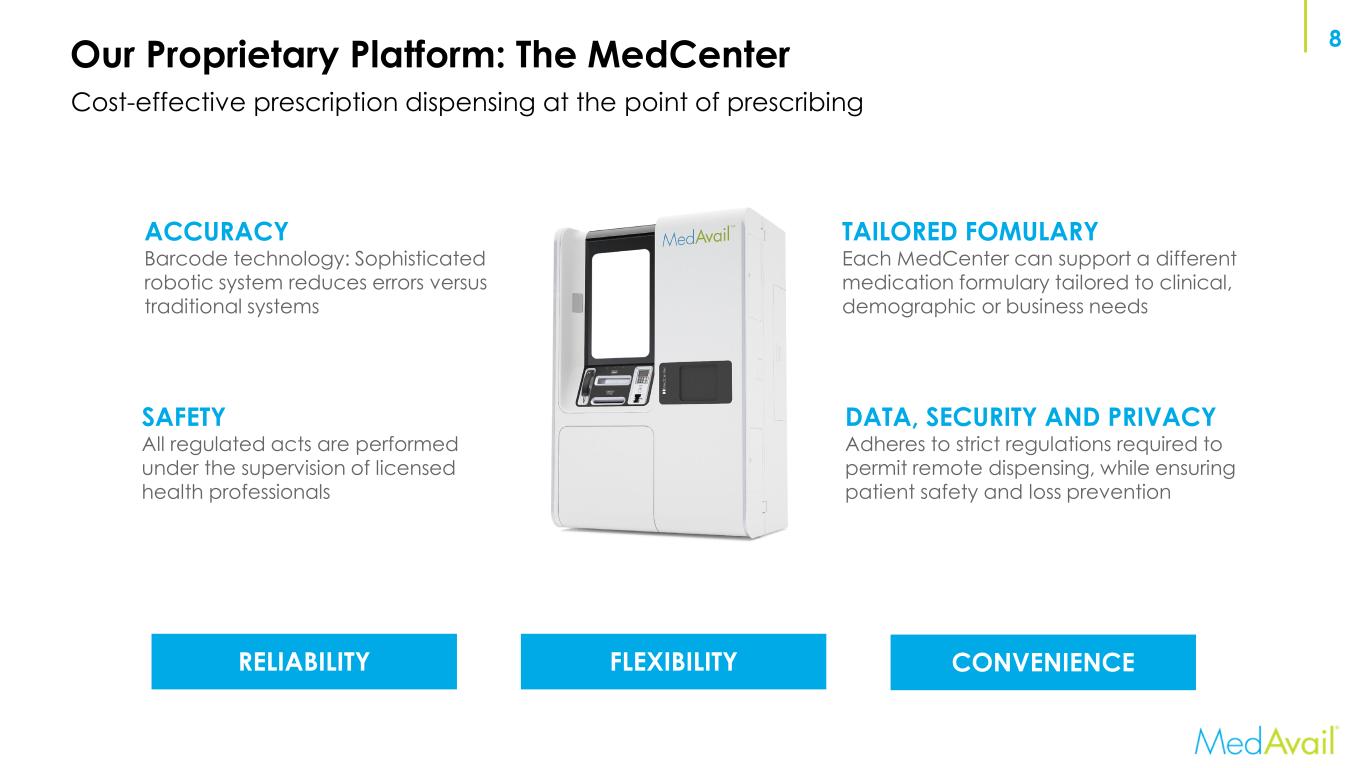

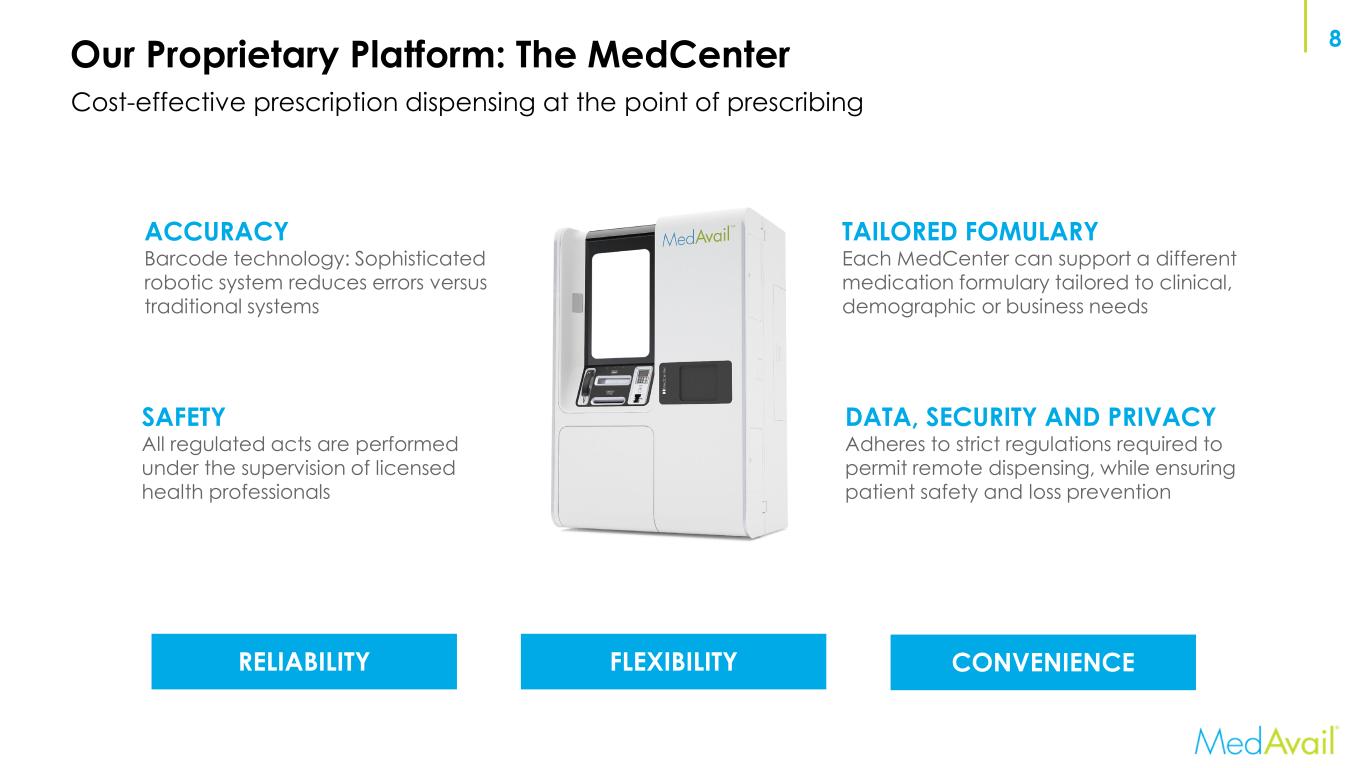

8 Cost-effective prescription dispensing at the point of prescribing Our Proprietary Platform: The MedCenter RELIABILITY FLEXIBILITY CONVENIENCE TAILORED FOMULARY Each MedCenter can support a different medication formulary tailored to clinical, demographic or business needs DATA, SECURITY AND PRIVACY Adheres to strict regulations required to permit remote dispensing, while ensuring patient safety and loss prevention ACCURACY Barcode technology: Sophisticated robotic system reduces errors versus traditional systems SAFETY All regulated acts are performed under the supervision of licensed health professionals

9 SpotRx: Rapid Scaling through Hub and Spoke Model Unique Embedded Pharmacy Model Results in Improved Medication Adherence and Satisfaction Rapid in-clinic, embedded deployment through proprietary MedCenter technology Open CENTRALIZED PHARMACY HUBS in Each SpotRx Service Area 1 NPS measured from January 2020 to December 2020, N=6962 Localized inventory replenishment, including specialty medications Access to first fill and refills through onsite SpotRx MedCenter kiosk or home delivery On-site SpotRx clinic account manager for patients and clinic staff Opportunities for providers to drive patient adherence and satisfaction Delivering 90% Net Promotor Score1

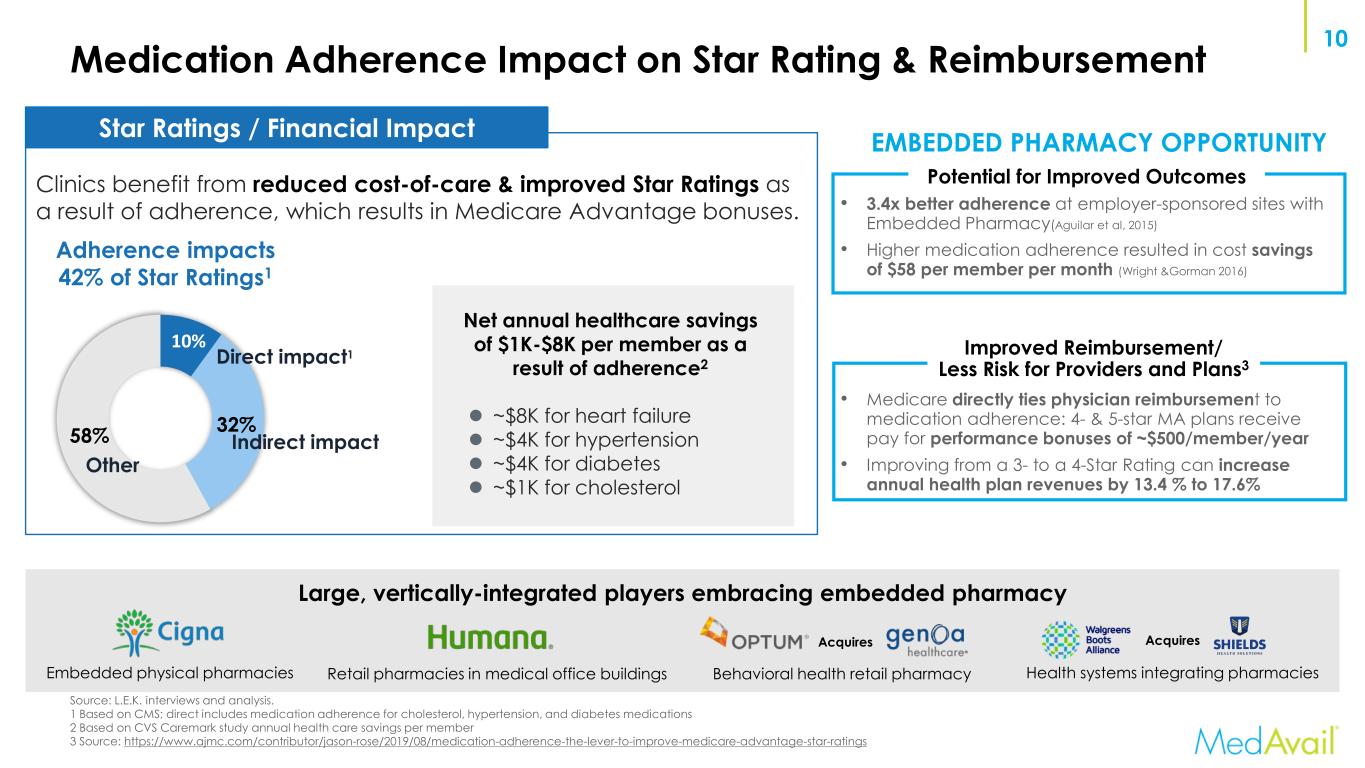

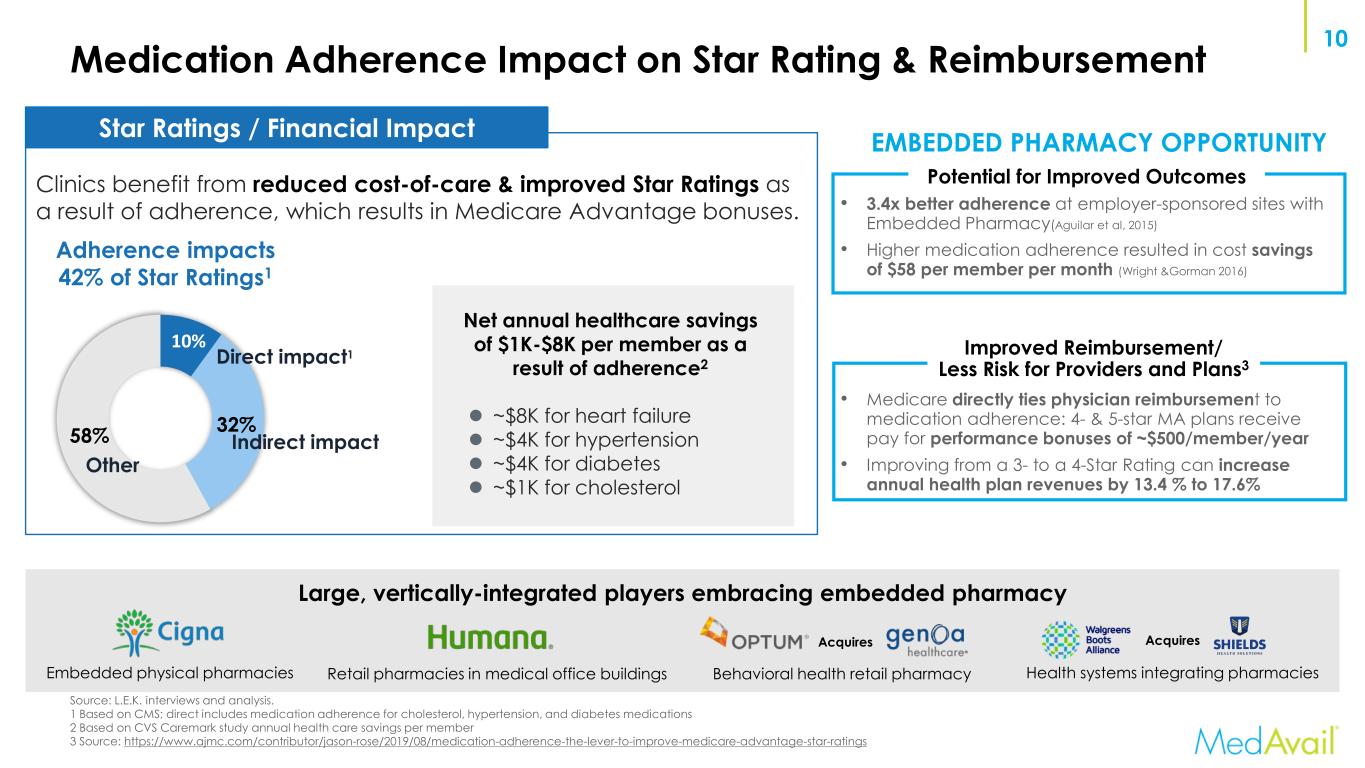

10Medication Adherence Impact on Star Rating & Reimbursement 32%58% 10% Direct impact1 Indirect impact Clinics benefit from reduced cost-of-care & improved Star Ratings as a result of adherence, which results in Medicare Advantage bonuses. Star Ratings / Financial Impact Adherence impacts 42% of Star Ratings1 Net annual healthcare savings of $1K-$8K per member as a result of adherence2 ~$8K for heart failure ~$4K for hypertension ~$4K for diabetes ~$1K for cholesterol Source: L.E.K. interviews and analysis. 1 Based on CMS; direct includes medication adherence for cholesterol, hypertension, and diabetes medications 2 Based on CVS Caremark study annual health care savings per member 3 Source: https://www.ajmc.com/contributor/jason-rose/2019/08/medication-adherence-the-lever-to-improve-medicare-advantage-star-ratings Embedded physical pharmacies Retail pharmacies in medical office buildings Acquires Behavioral health retail pharmacy Acquires Large, vertically-integrated players embracing embedded pharmacy Health systems integrating pharmacies Other EMBEDDED PHARMACY OPPORTUNITY Potential for Improved Outcomes • 3.4x better adherence at employer-sponsored sites with Embedded Pharmacy(Aguilar et al, 2015) • Higher medication adherence resulted in cost savings of $58 per member per month (Wright &Gorman 2016) Improved Reimbursement/ Less Risk for Providers and Plans3 • Medicare directly ties physician reimbursement to medication adherence: 4- & 5-star MA plans receive pay for performance bonuses of ~$500/member/year • Improving from a 3- to a 4-Star Rating can increase annual health plan revenues by 13.4 % to 17.6%

11Broadening Footprint with Strong Partnerships ARIZONA CALIFORNIA MICHIGAN FLORIDA 21 3 4

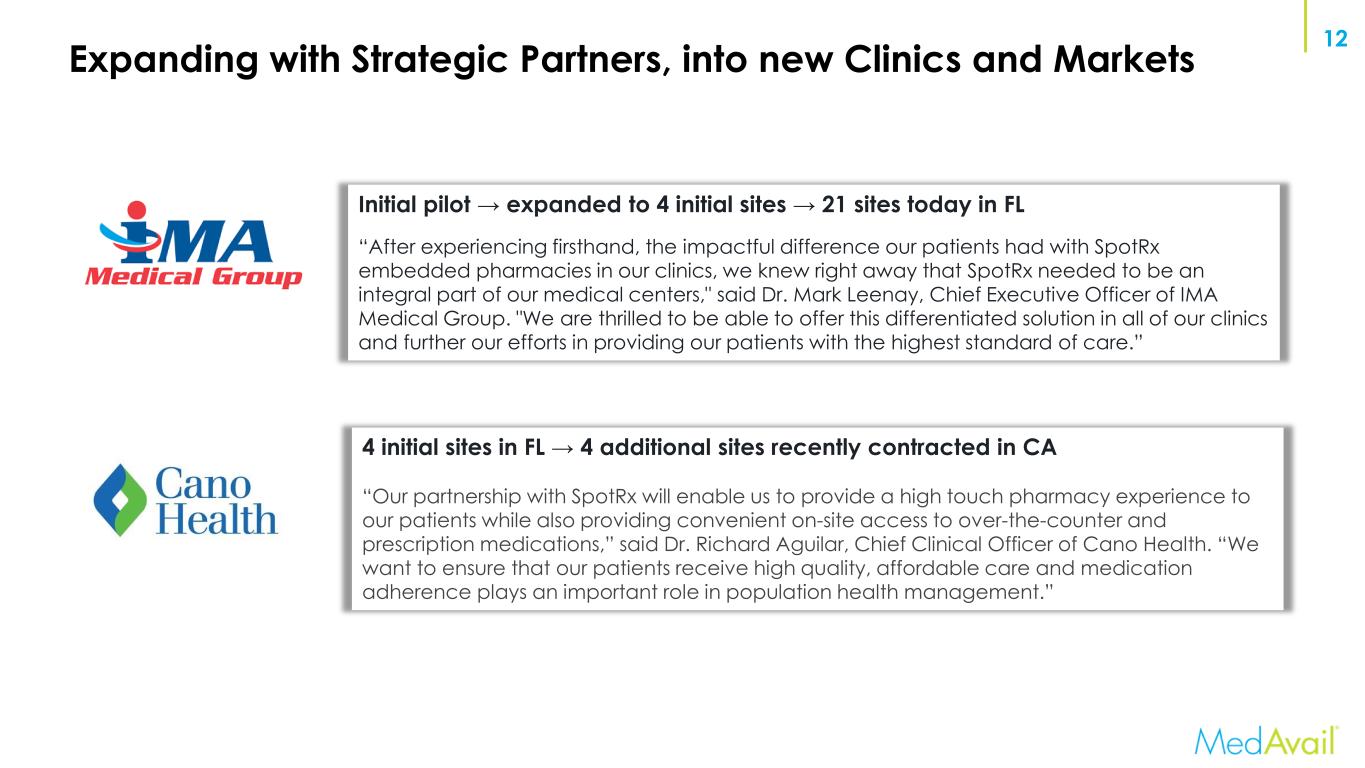

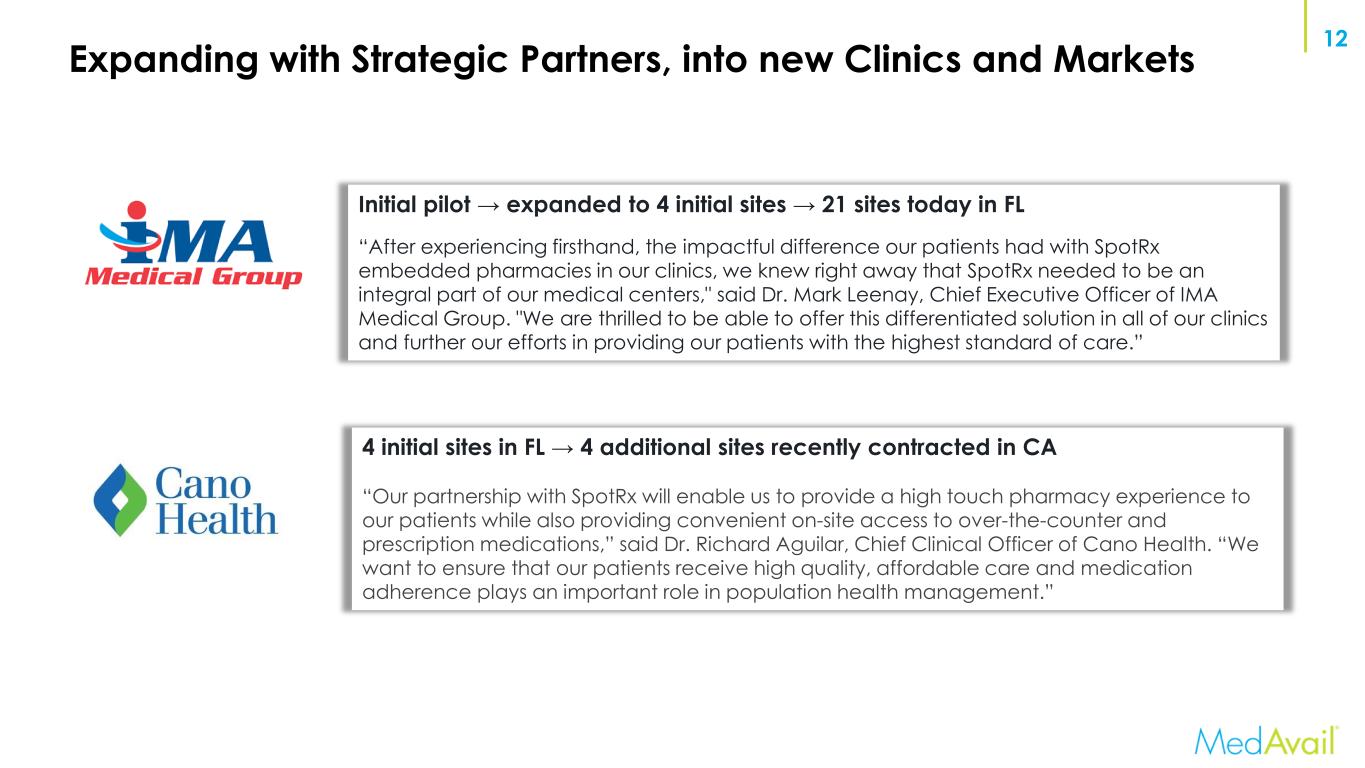

12Expanding with Strategic Partners, into new Clinics and Markets Initial pilot → expanded to 4 initial sites → 21 sites today in FL “After experiencing firsthand, the impactful difference our patients had with SpotRx embedded pharmacies in our clinics, we knew right away that SpotRx needed to be an integral part of our medical centers," said Dr. Mark Leenay, Chief Executive Officer of IMA Medical Group. "We are thrilled to be able to offer this differentiated solution in all of our clinics and further our efforts in providing our patients with the highest standard of care.” 4 initial sites in FL → 4 additional sites recently contracted in CA “Our partnership with SpotRx will enable us to provide a high touch pharmacy experience to our patients while also providing convenient on-site access to over-the-counter and prescription medications,” said Dr. Richard Aguilar, Chief Clinical Officer of Cano Health. “We want to ensure that our patients receive high quality, affordable care and medication adherence plays an important role in population health management.”

13 $0.0 $0.2 $0.4 $0.6 $0.8 $1.0 $1.2 Year 1 Year 2 Year 3 Notes 1. Sites included have been dispensing for continuous 18 months or longer, total sites as of 12/31/21 is 13. 2. Revenue ramp rates based on historical actuals for at least 18 months. Sites with less than 3 years of actuals, used most recent 2 month average straight-lined for remaining months. 3. Sites ramping during COVID ($ in millions) 75th Percentile Median KEY DRIVERS IMPACTING REVENUE RAMP Timing • New or existing clinic • New or existing market Volume Drivers • Clinic staffing • Patient penetration rates Average Sales Price Drivers • Payer mix • Prescription type (days supply, brand, generic, specialty) Historical Site Revenue Ramp ~25 – 30 net new dispensing units in FY 2022

14 Deployment Momentum Drives Strong Revenue Growth Net Cumulative Deployments1 Dispensing YoY Revenue Growth2 $3.8 $9.3 FY19 FY20 FY21 Total Consolidated Net Revenue QoQ Revenue Growth $5.0 $5.8 $7.3 $9.1 Q2 2021 Q3 2021 Q4 2021 Q1 2022 1 Net cumulative deployments excludes decommissioned clinics, pilot and demo sites. 2 Net revenue in 2020 excludes a non-recurring benefit recognized in conjunction with a commercial agreement from 2018. Consolidated Net Revenue +145% +26% +138% +16% +25% FY 2020 FY 2021 Q1 2022 92 81 46 88 4 Deployments not Dispensing 13 68 8 38

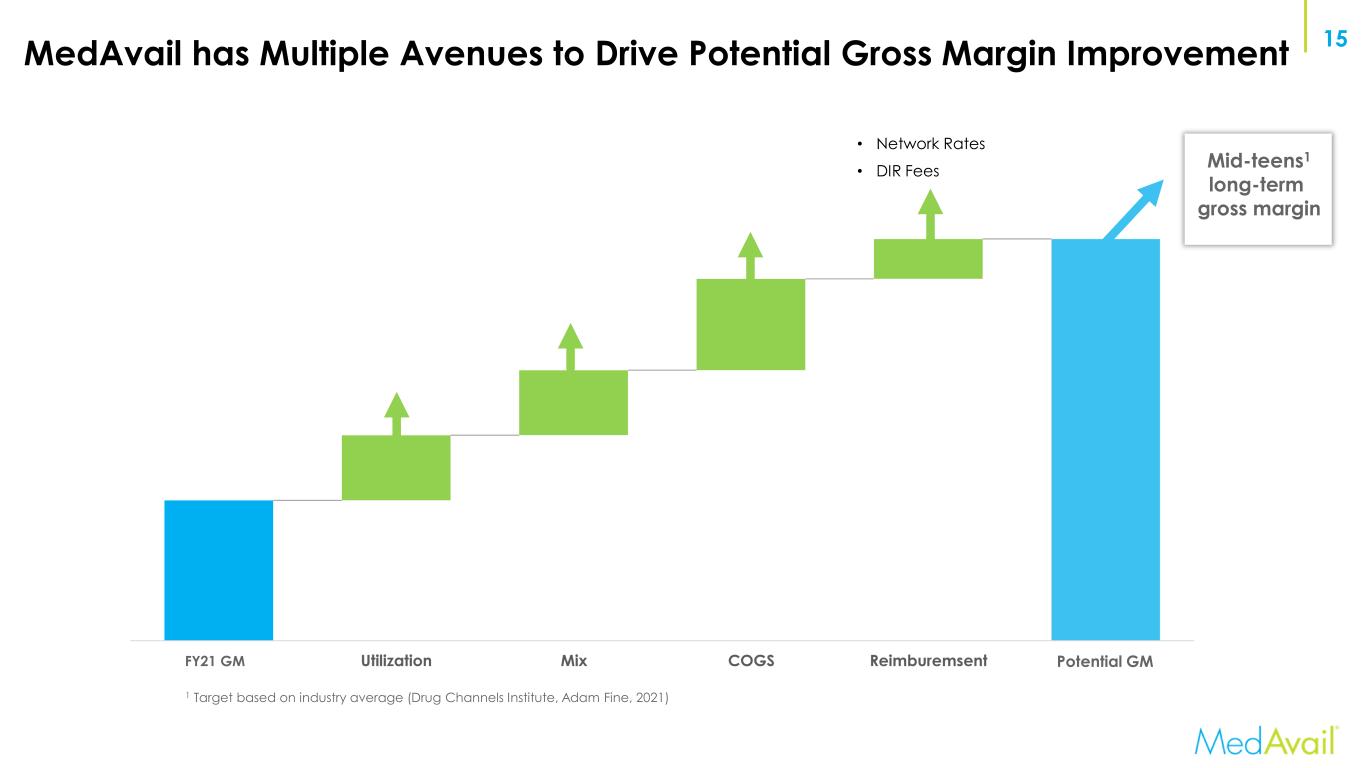

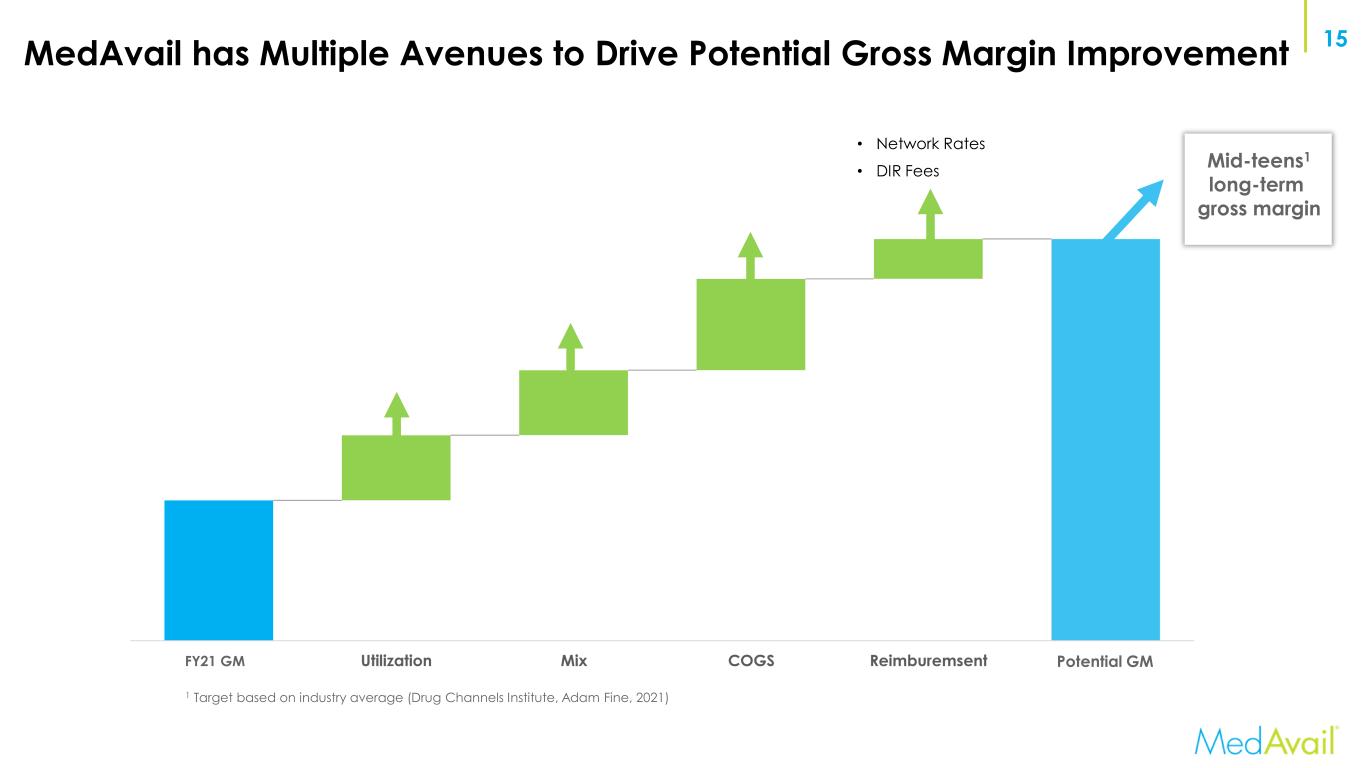

15MedAvail has Multiple Avenues to Drive Potential Gross Margin Improvement • Network Rates • DIR Fees Mid-teens1 long-term gross margin Potential GMFY21 GM 1 Target based on industry average (Drug Channels Institute, Adam Fine, 2021)

16 Key Targeted Milestones • Planned 50% growth in dispensing MedCenters to over 100 in existing markets • Planned 20% reduction in quarterly cash burn by: • Gross margin improvement • Greater hub pharmacy utilization as clinics onboard and mature • Optimization of clinic and pharmacy labor • G&A leverage - existing team able to support increase in scale • Technology business segment expansion with new partners leveraging the EPIC integration

17 $25,634 $1,582 Segmented LTM Revenue1 (USD in thousands) 1 For the twelve months ended March 31, 2022 MedCenter kiosk and software & maintenance for customers that operate their own pharmacies Revenues comprise of initial lump sum payments upon integration and monthly payments for software & maintenance Technology RevenuePharmacy Revenue Customer branded and customized patient workflow utilizing integration with customer pharmacy management System Revenue from prescription & OTC product dispensing out of MedCenter & delivered to patients’ home Full-service retail pharmacy platform where a centralized pharmacy supports and operates a network of kiosks Segment focuses on the Medicare market (65+ year old) & at-risk providers Complementary Deployment Models Drive Expansion

18MedAvail Takeaways Executing and growing traction with technology enabled embedded pharmacy platform Technology sales setting up for growth with EPIC integration Well Established hub pharmacy infrastructure to support substantial and efficient growth in current markets Partnerships with leading Medicare providers with aggressive expansion goals that include SpotRx New leadership with pharmacy experience focused on profitable growth Refined partner & clinic qualification model and improved go live playbook

19 Appendix

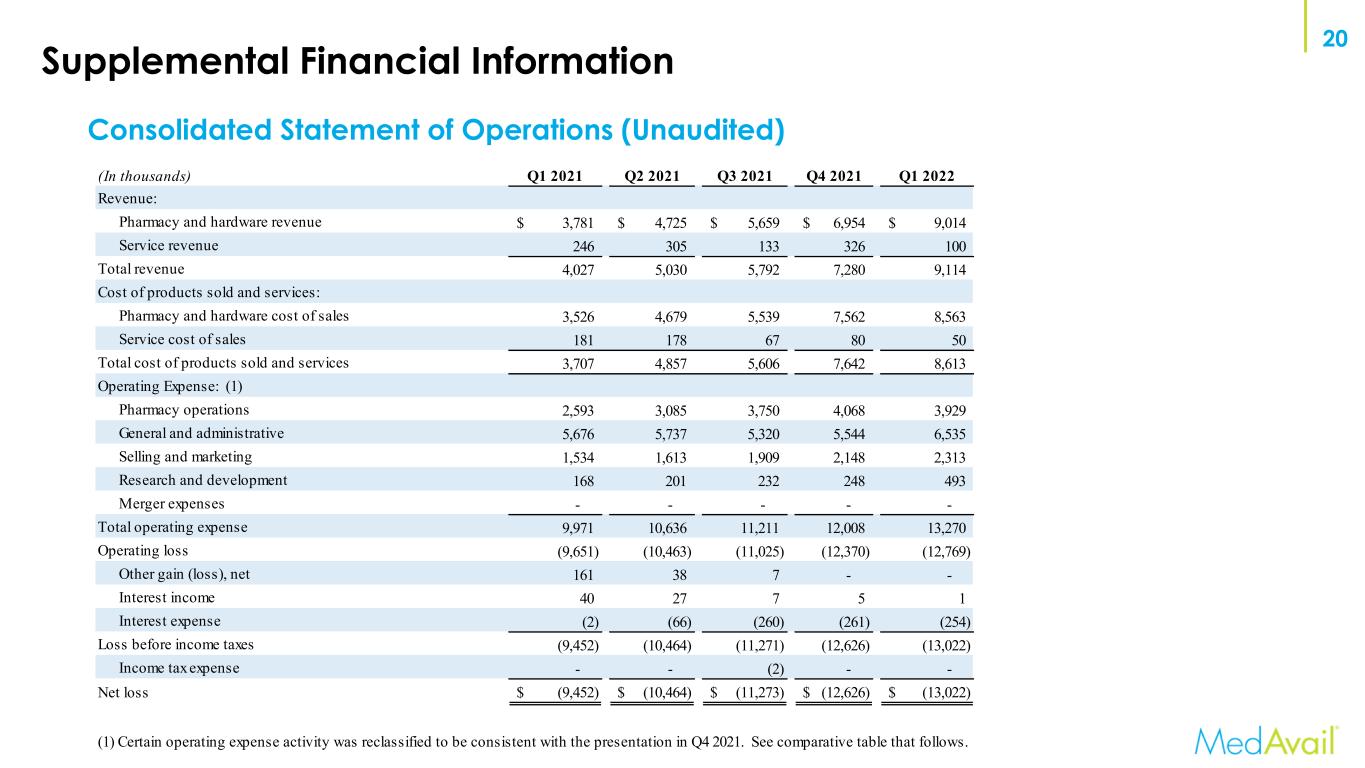

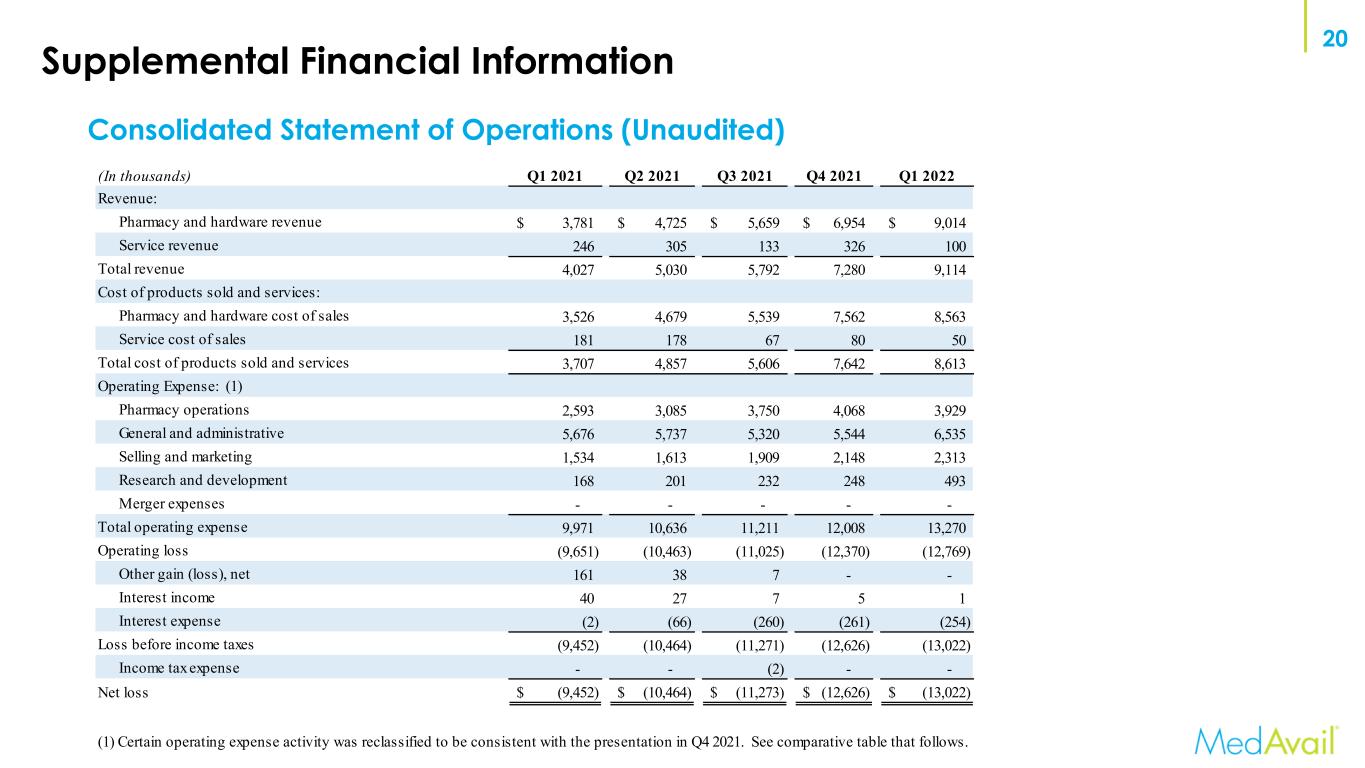

20 Supplemental Financial Information AT-RISK CLINICS PROVIDERS Consolidated Statement of Operations (Unaudited) (In thousands) Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Revenue: Pharmacy and hardware revenue 3,781$ 4,725$ 5,659$ 6,954$ 9,014$ Service revenue 246 305 133 326 100 Total revenue 4,027 5,030 5,792 7,280 9,114 Cost of products sold and services: Pharmacy and hardware cost of sales 3,526 4,679 5,539 7,562 8,563 Service cost of sales 181 178 67 80 50 Total cost of products sold and services 3,707 4,857 5,606 7,642 8,613 Operating Expense: (1) Pharmacy operations 2,593 3,085 3,750 4,068 3,929 General and administrative 5,676 5,737 5,320 5,544 6,535 Selling and marketing 1,534 1,613 1,909 2,148 2,313 Research and development 168 201 232 248 493 Merger expenses - - - - - Total operating expense 9,971 10,636 11,211 12,008 13,270 Operating loss (9,651) (10,463) (11,025) (12,370) (12,769) Other gain (loss), net 161 38 7 - - Interest income 40 27 7 5 1 Interest expense (2) (66) (260) (261) (254) Loss before income taxes (9,452) (10,464) (11,271) (12,626) (13,022) Income tax expense - - (2) - - Net loss (9,452)$ (10,464)$ (11,273)$ (12,626)$ (13,022)$ (1) Certain operating expense activity was reclassified to be consistent with the presentation in Q4 2021. See comparative table that follows.

21 Supplemental Financial Information AT-RISK CLINICS Operating Expense Reclassifications (Unaudited) (In thousands) Current Presentation As Previously Reported Change Pharmacy operations 2,593$ 1,911$ 682$ General and administrative 5,676 6,515 (839) Selling and marketing 1,534 1,377 157 Research and development 168 168 - 9,971$ 9,971$ -$ (In thousands) Current Presentation As Previously Reported Change Pharmacy operations 3,085$ 2,292$ 793$ General and administrative 5,737 6,646 (909) Selling and marketing 1,613 1,497 116 Research and development 201 201 - 10,636$ 10,636$ -$ (In thousands) Current Presentation As Previously Reported Change Pharmacy operations 3,750$ 2,395$ 1,355$ General and administrative 5,320 6,805 (1,485) Selling and marketing 1,909 1,779 130 Research and development 232 232 - 11,211$ 11,211$ -$ Q3 2021 Q1 2021 Q2 2021

22 Supplemental Financial Information AT-RISK CLINICS PROVIDERS Revenue and Cost of Products Sold and Services (Unaudited) (In thousands) Retail Pharmacy Services Pharmacy Technology Total Retail Pharmacy Services Pharmacy Technology Total Retail Pharmacy Services Pharmacy Technology Total Retail Pharmacy Services Pharmacy Technology Total Revenue: Pharmacy and hardware revenue: Retail pharmacy revenue 3,418$ -$ 3,418$ 4,494$ -$ 4,494$ 5,445$ -$ 5,445$ 6,846$ -$ 6,846$ Hardware (1) - 241 241 - 123 123 - 106 106 - - - Subscription - 122 122 - 108 108 - 108 108 - 108 108 Total pharmacy and hardware revenue 3,418 363 3,781 4,494 231 4,725 5,445 214 5,659 6,846 108 6,954 Service revenue: Software integration (1) - - - - - - - - - - - - Software - 33 33 - 41 41 - 51 51 - 134 134 Maintenance and support - 31 31 - 40 40 - 44 44 - 47 47 Installation - 16 16 - 12 12 - 11 11 - - - Professional services and other - 166 166 - 212 212 - 27 27 - 145 145 Total service revenue - 246 246 - 305 305 - 133 133 - 326 326 Total revenue 3,418 609 4,027 4,494 536 5,030 5,445 347 5,792 6,846 434 7,280 Cost of products sold and services 3,329 378 3,707 4,435 422 4,857 5,366 240 5,606 6,901 741 7,642 Segment gross profit (loss) 89$ 231$ 320$ 59$ 114$ 173$ 79$ 107$ 186$ (55)$ (307)$ (362)$ Q1 2021 Q2 2021 Q3 2021 Q4 2021

23 Supplemental Financial Information AT-RISK CLINICS Revenue and Cost of Products Sold and Services (Unaudited) (In thousands) Retail Pharmacy Services Pharmacy Technology Total Revenue: Pharmacy and hardware Revenue: Retail pharmacy revenue 8,849$ -$ 8,849$ Hardware - 56 56 Subscription - 109 109 Total pharmacy and hardware revenue 8,849 165 9,014 Service revenue: Software integration - - - Software - 48 48 Maintenance and support - 32 32 Installation - 6 6 Professional services and other - 14 14 Total service revenue - 100 100 Total revenue 8,849 265 9,114 Cost of products sold and services 8,482 131 8,613 Segment gross profit (loss) 367$ 134$ 501$ Q1 2022

24 Supplemental Financial Information AT-RISK CLINICS Adjusted EBITDA – Non-GAAP Reconciliation (Unaudited) (In thousands) Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Net loss (9,452)$ (10,464)$ (11,273)$ (12,626)$ (13,022)$ Adjustments to calculate EBITDA: Interest expense, net (38) 39 253 256 253 Income tax expense - - 2 - - Depreciation and amortization 340 392 526 569 432 EBITDA (9,150) (10,033) (10,492) (11,801) (12,337) Adjustments as follows: Share-based compensation expense 260 323 365 257 564 Inventory adjustment - - - 626 - Adjusted EBITDA (8,890)$ (9,710)$ (10,127)$ (10,918)$ (11,773)$

25 Supplemental Financial Information Non-GAAP Measures To supplement our consolidated financial statements, which are prepared and presented in accordance with GAAP, we use the following non- GAAP financial measures: EBITDA, and Adjusted EBITDA. The presentation of this financial information is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. We define Adjusted EBITDA for a particular period as net (loss) income before interest, taxes, depreciation and amortization, share-based compensation expense, and non-recurring inventory impairment charges. We use these non-GAAP financial measures for financial and operational decision-making and as a means to evaluate period-to-period comparisons. We believe that these non-GAAP financial measures provide meaningful supplemental information regarding our performance by excluding certain items that may not be indicative of our recurring core business operating results, like one-time transaction costs related to the reverse merger. We believe that both management and investors benefit from referring to these non-GAAP financial measures in assessing our performance and when planning, forecasting, and analyzing future periods. These non-GAAP financial measures also facilitate management's internal comparisons to our historical performance and liquidity as well as comparisons to our competitors' operating results. We believe these non-GAAP financial measures are useful to investors both because (1) they allow for greater transparency with respect to key metrics used by management in its financial and operational decision-making and (2) they are used by our institutional investors and the analyst community to help them analyze the health of our business. There are a number of limitations related to the use of non-GAAP financial measures. We compensate for these limitations by providing specific information regarding the GAAP amounts excluded from these non-GAAP financial measures and evaluating these non-GAAP financial measures together with their relevant financial measures in accordance with GAAP.