Transforming Today’s Pharmacy Investor Presentation I August 2023 NASDAQ: MDVL

2 Forward Looking Statement MedAvail Holdings, Inc. (“MedAvail”) cautions you that the statements in this presentation that are not a description of historical fact are forward-looking statements which may be identified by use of the words such as “anticipate,” “believe,” “expand,” “expect,” “grow,” “intend,” “opportunity,” “plan,” “potential,” “project”, “target” and “will” among others. These forward-looking statements are based on MedAvail’s current expectations and involve assumptions that may never materialize or may prove to be incorrect. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of the ability to project future cash utilization and resources need for contingent future liabilities and business operations, the availability of sufficient resources for combined company operations and to conduct or continue planned product development activities, the ability to execute on commercial objectives, regulatory developments and the timing and ability of MedAvail to raise additional capital to fund operations, and other factors, including, but not limited to, those factors discussed in the section entitled “Risk Factors” of our most recent Annual Report on Form 10-K and on our Quarterly Reports Form 10-Q. Although we believe the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, level of activity, performance or achievements. We undertake no obligation to update any of these forward-looking statements for any reason, even if new information becomes available in the future, except as may be required by law. The extent to which the impact of general market and macroeconomic conditions, including the effect of inflationary pressure, including any impact of adverse developments affecting the financial services industry, such as those based on liquidity constraints or concerns and events including the outbreak of war in Ukraine, has on MedAvail’s businesses, operations, and financial results, including the duration and magnitude of such effects, will depend on numerous factors, which are unpredictable and how quickly and to what extent normal economic and operating conditions are affected or impacted. You are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date on which they were made. MedAvail undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they were made, except as may be required by law.

Mission Statement To improve patients' lives by expanding access to medications through innovative technology where and when they need them

4 Investment Highlights Innovative pharmacy technology company with clear roadmap to delivering profitable and sustainable growth Addresses significant unmet needs in the pharmacy space Demonstrable positive impact on Rx adherence and reimbursement Strategic partnerships to drive future deployments across multiple channels 01 02 03 04 05 06 Significant total and serviceable addressable markets Recurring, high-margin predictable revenue stream Strengthened financial position with projected 2+ years of cash on-hand

5 The Current Patient Journey Demonstrates a significant unmet need in today’s pharmacy Patient prescribed an Rx at a Clinic or Urgent Care Rx is transmitted to a retail pharmacy Patient must drive to a retail pharmacy to have the Rx filled Many patients do not have access to reliable transportation Shortage of pharmacists/ pharmacy techs causes: Long wait times (avg. 30 minutes) Limited pharmacy hours Improved access increase outcomes and satisfaction while simplifying provider’s practice and increasing reimbursement

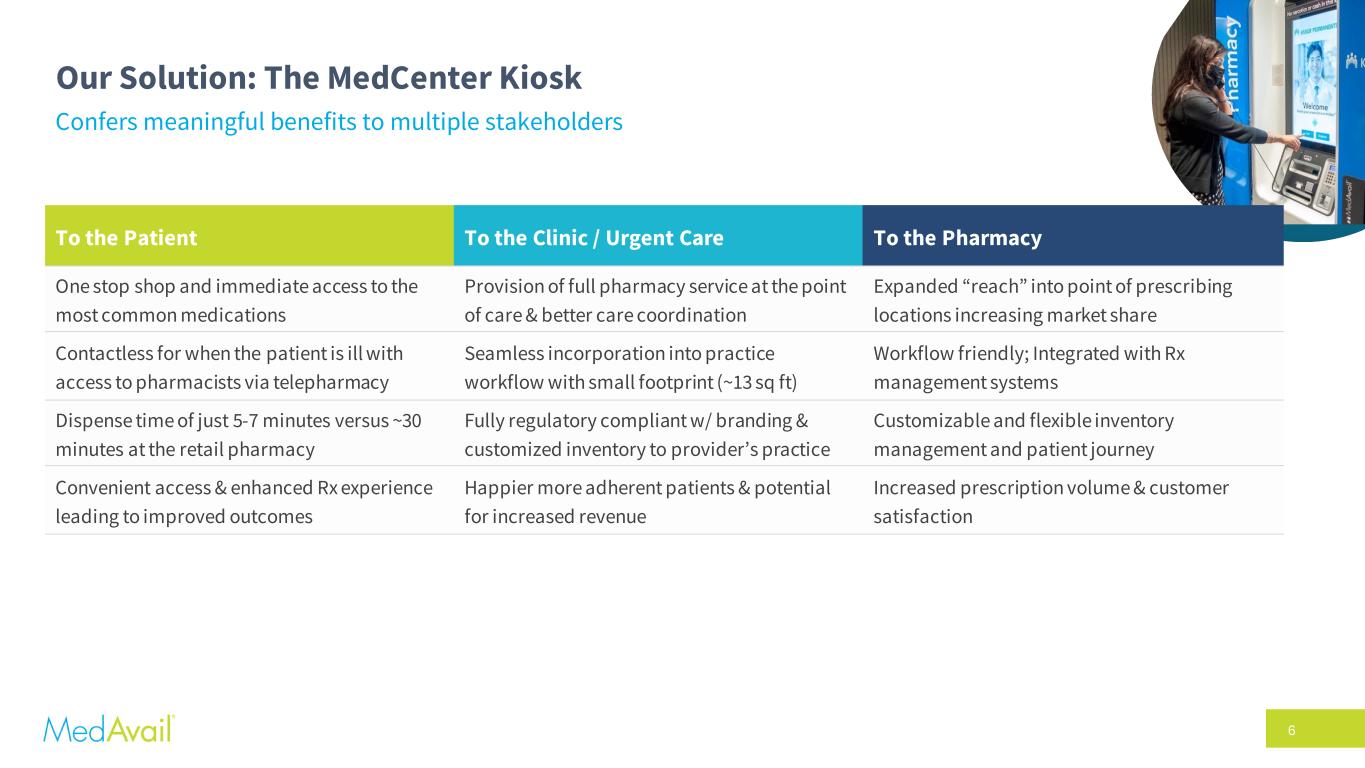

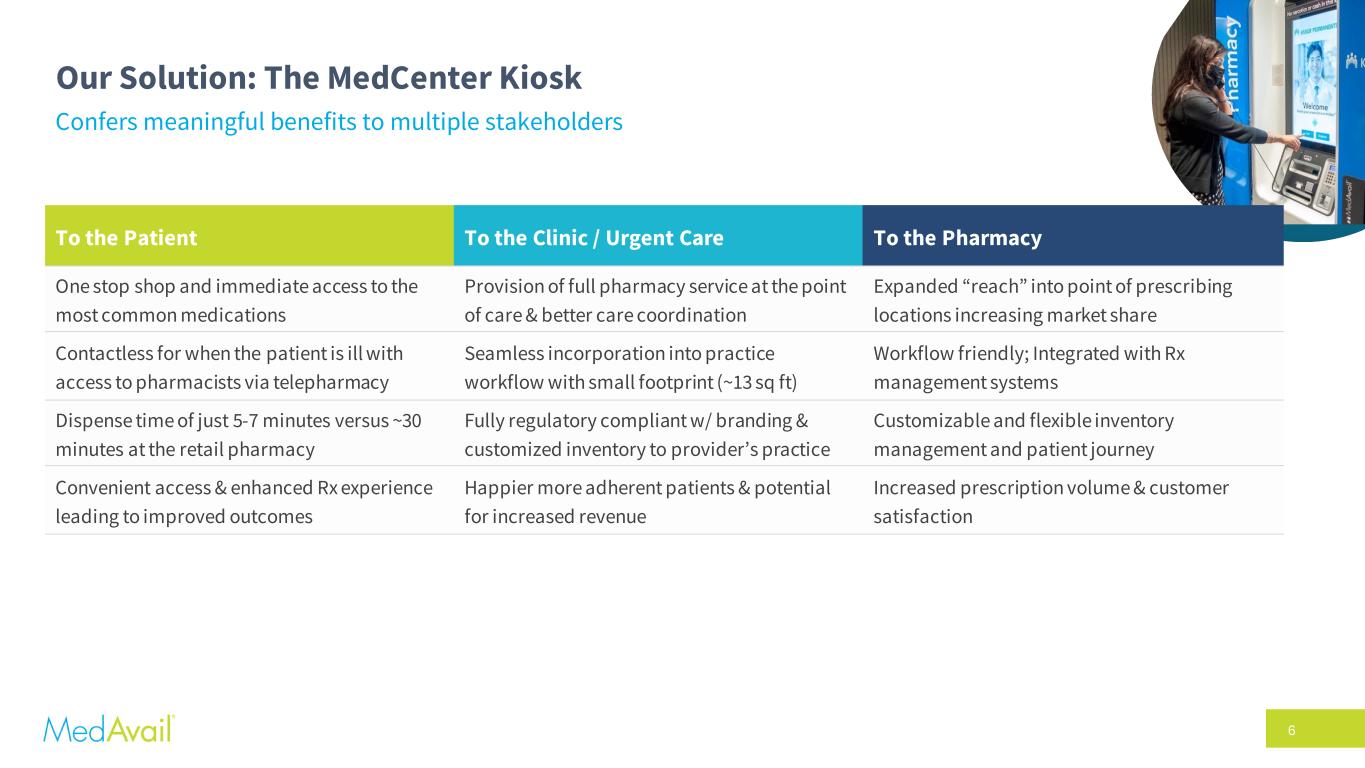

6 To the Patient To the Clinic / Urgent Care To the Pharmacy One stop shop and immediate access to the most common medications Provision of full pharmacy service at the point of care & better care coordination Expanded “reach” into point of prescribing locations increasing market share Contactless for when the patient is ill with access to pharmacists via telepharmacy Seamless incorporation into practice workflow with small footprint (~13 sq ft) Workflow friendly; Integrated with Rx management systems Dispense time of just 5-7 minutes versus ~30 minutes at the retail pharmacy Fully regulatory compliant w/ branding & customized inventory to provider’s practice Customizable and flexible inventory management and patient journey Convenient access & enhanced Rx experience leading to improved outcomes Happier more adherent patients & potential for increased revenue Increased prescription volume & customer satisfaction Our Solution: The MedCenter Kiosk Confers meaningful benefits to multiple stakeholders

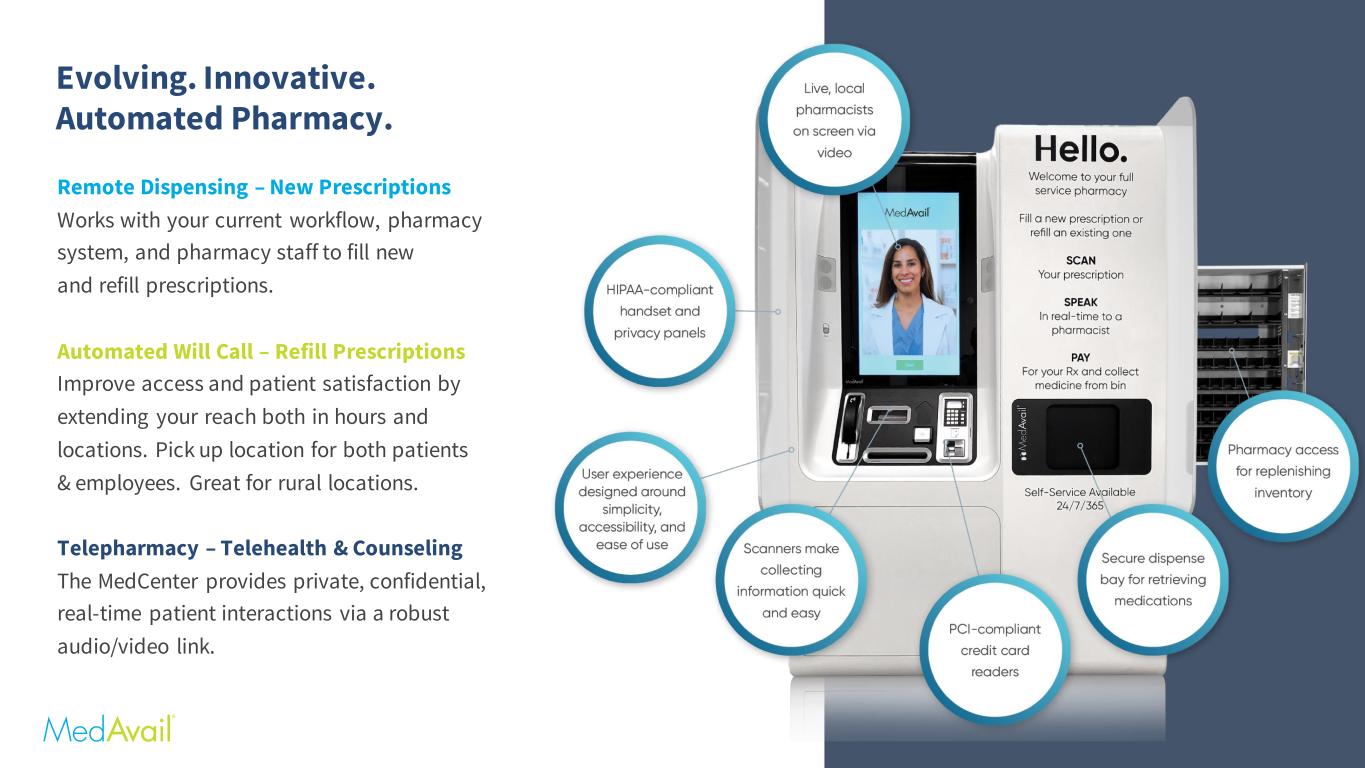

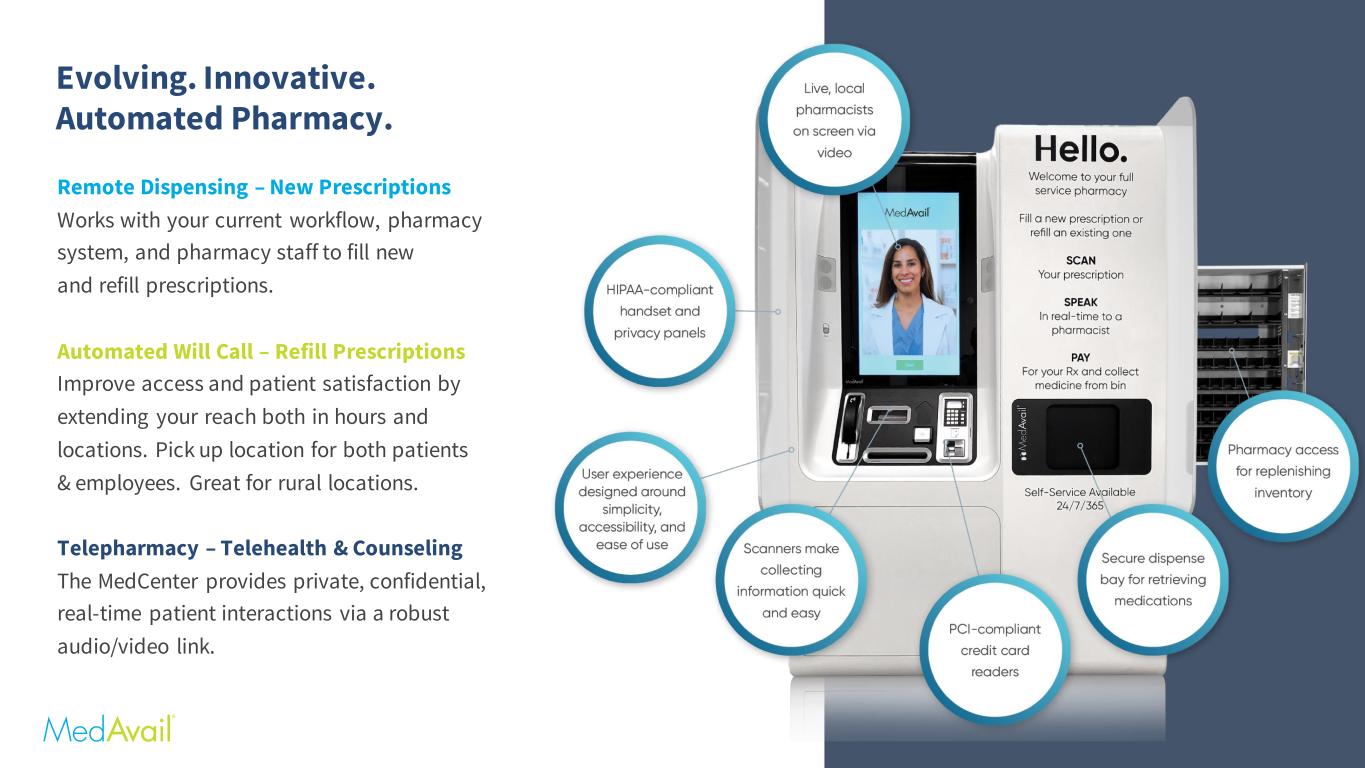

77 Remote Dispensing – New Prescriptions Works with your current workflow, pharmacy system, and pharmacy staff to fill new and refill prescriptions. Automated Will Call – Refill Prescriptions Improve access and patient satisfaction by extending your reach both in hours and locations. Pick up location for both patients & employees. Great for rural locations. Telepharmacy – Telehealth & Counseling The MedCenter provides private, confidential, real-time patient interactions via a robust audio/video link. Evolving. Innovative. Automated Pharmacy.

8 MedCenter Deployment Use Cases Urgent Care/Emergency Extended Hours Hard to Staff/Rural Locations In Clinic Dispense University Employer Placement

9 Broadening Footprint through Partnerships Also integrated with industry leading pharmacy management systems: EnterpriseRx Willow Urgent Care Emergency Department Primary Care / Clinic

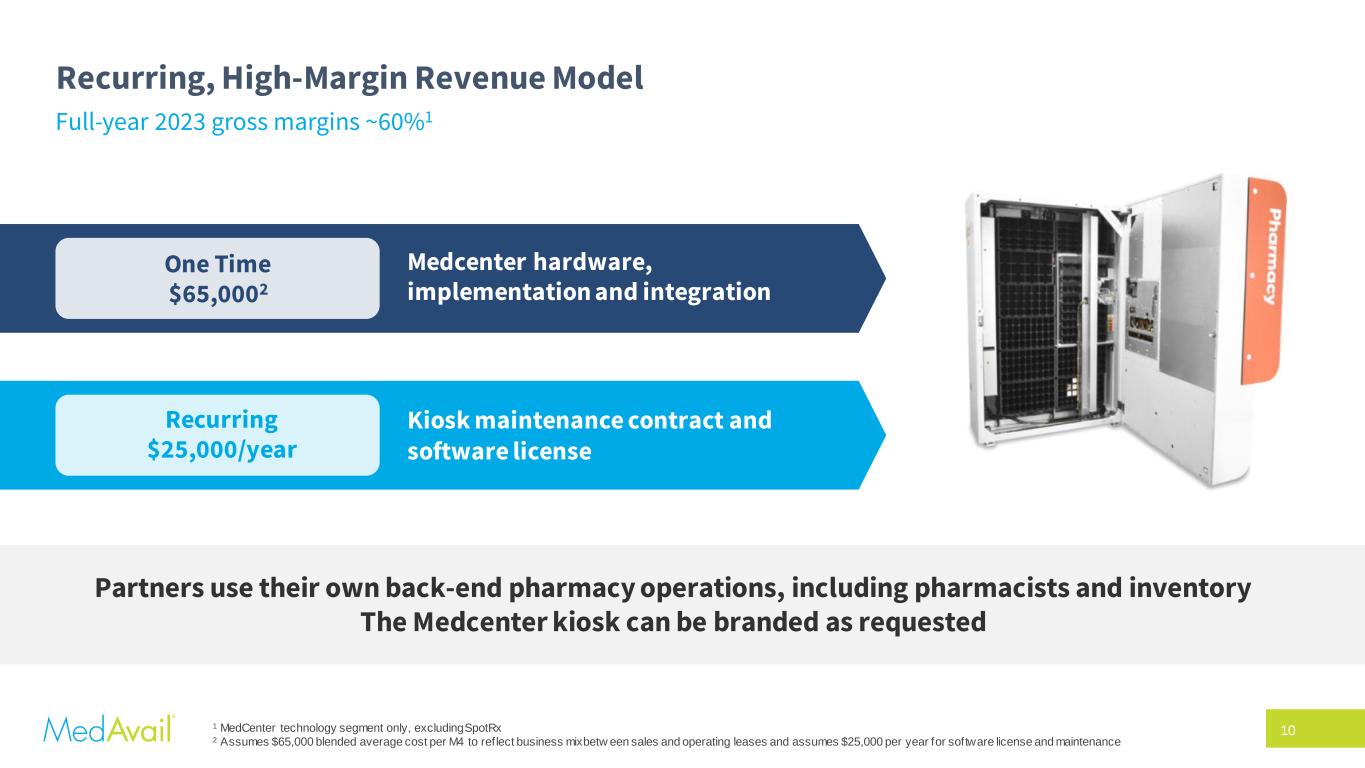

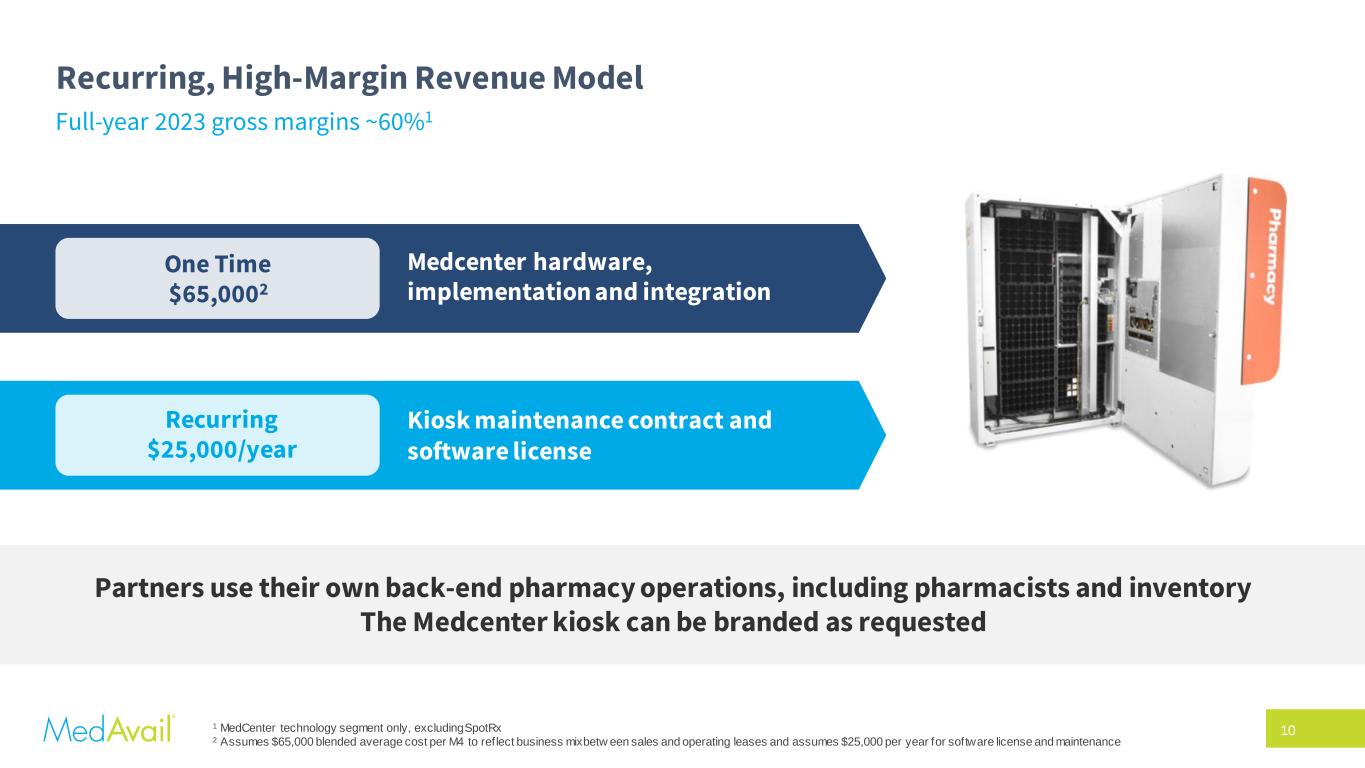

10 Recurring, High-Margin Revenue Model Partners use their own back-end pharmacy operations, including pharmacists and inventory The Medcenter kiosk can be branded as requested One Time $65,0002 Medcenter hardware, implementation and integration Recurring $25,000/year Full-year 2023 gross margins ~60%1 1 MedCenter technology segment only, excluding SpotRx 2 Assumes $65,000 blended average cost per M4 to reflect business mixbetw een sales and operating leases and assumes $25,000 per year for software license and maintenance Kiosk maintenance contract and software license

11 Favorable Regulatory Environment Current regulatory open to deploy & favorable waiver rules for MedCenter kiosks cover > 72% of the US population Open to deploy (Serviceable Addressable Market, SAM) Rule-making in process to be open to deploy Favorable waiver rules available to allow deployment Currently restricted or unfavorable rules

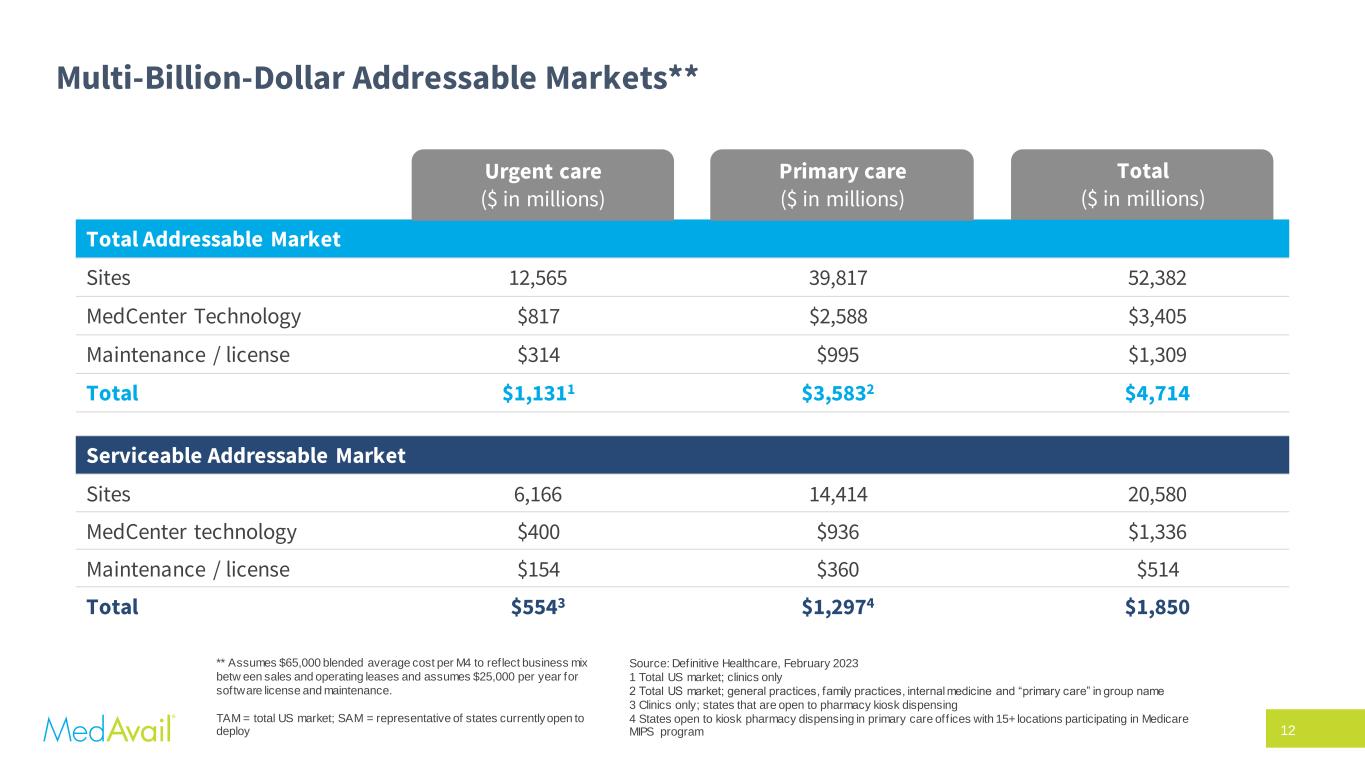

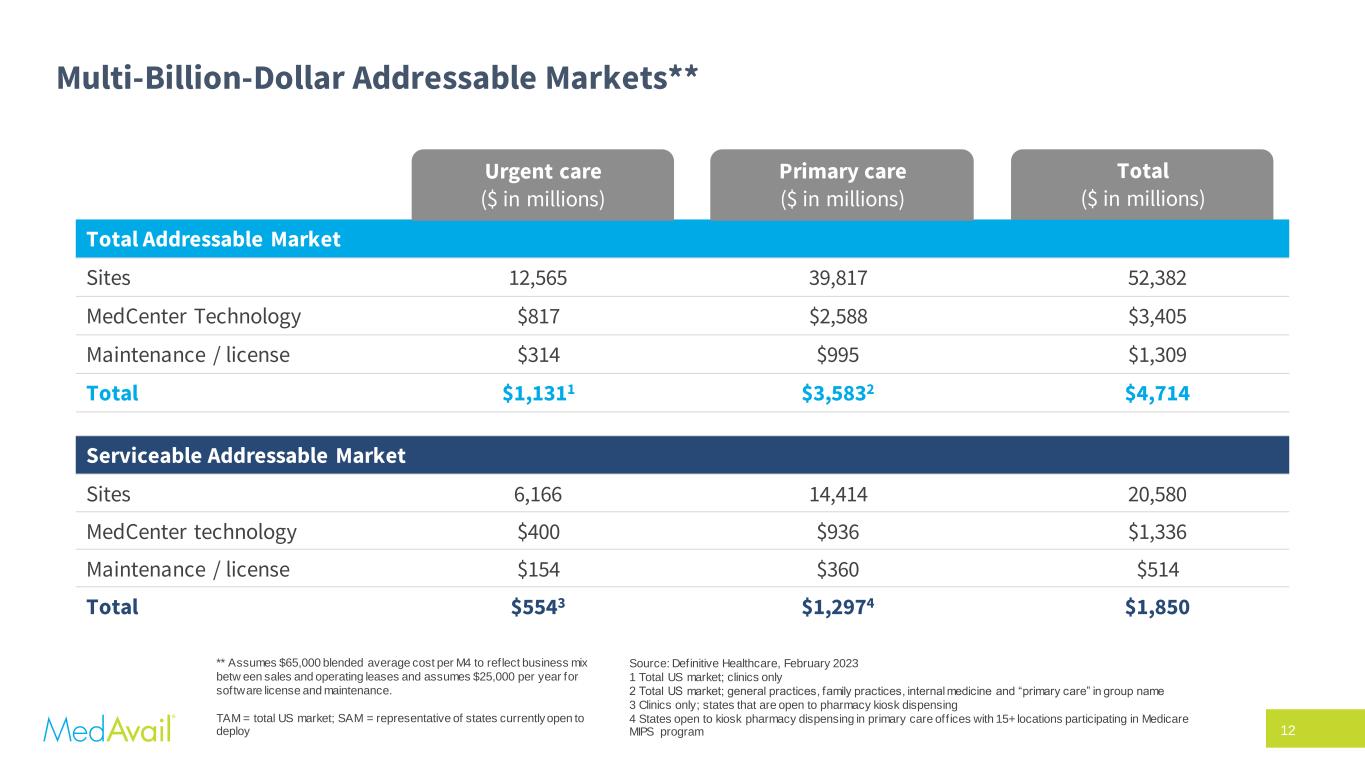

12 Multi-Billion-Dollar Addressable Markets** Source: Definitive Healthcare, February 2023 1 Total US market; clinics only 2 Total US market; general practices, family practices, internal medicine and “primary care” in group name 3 Clinics only; states that are open to pharmacy kiosk dispensing 4 States open to kiosk pharmacy dispensing in primary care off ices with 15+ locations participating in Medicare MIPS program Total Addressable Market Sites 12,565 39,817 52,382 MedCenter Technology $817 $2,588 $3,405 Maintenance / license $314 $995 $1,309 Total $1,1311 $3,5832 $4,714 Serviceable Addressable Market Sites 6,166 14,414 20,580 MedCenter technology $400 $936 $1,336 Maintenance / license $154 $360 $514 Total $5543 $1,2974 $1,850 Urgent care ($ in millions) Primary care ($ in millions) Total ($ in millions) ** Assumes $65,000 blended average cost per M4 to reflect business mix betw een sales and operating leases and assumes $25,000 per year for software license and maintenance. TAM = total US market; SAM = representative of states currently open to deploy

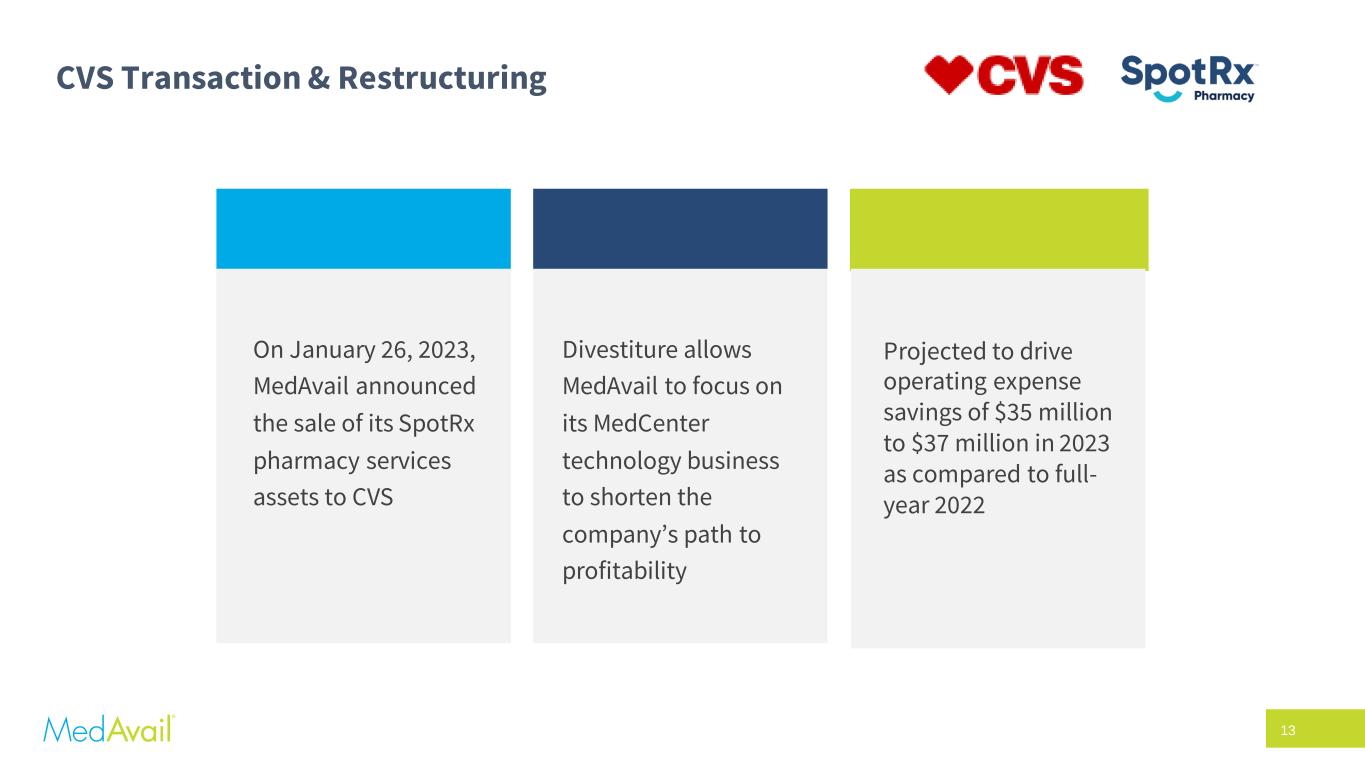

13 CVS Transaction & Restructuring Divestiture allows MedAvail to focus on its MedCenter technology business to shorten the company’s path to profitability On January 26, 2023, MedAvail announced the sale of its SpotRx pharmacy services assets to CVS Projected to drive operating expense savings of $35 million to $37 million in 2023 as compared to full- year 2022

14 Current Leadership Introduces New Strategy Mark Doerr, Chief Executive Officer Experience: CEO, eRx Network; SVP GM, Pharmacy, Change Healthcare; SVP Pharmacy, Giant Eagle Ramona Seabaugh, Chief Financial Officer Experience: VP, Vixxo; VP, Ascension; CFO Banner Health Pharmacy Services Led restructuring and divestiture of SpotRx business Exclusive focus on pharmacy technology business going forward Significant reduction in OpEx and cash burn; improved margin profile Addressing significant unmet needs in today's pharmacy industry

15 2023 Guidance Existing inventory of more than 100 pre-built MedCenter kiosks – not included in the SpotRx divestiture – are ready to be deployed and will drive higher near-term company margins 2022 Pro-Forma 2023E Revenue $1.4 million ~$3 million Full-year net gross margins 47% ~60% Net new dispensing MedCenters1 25 Cumulative net dispensing MedCenters (as of Q1 2023)2 32 1 Net new dispensing MedCenters: Units recorded after completion of shipment and training such that the MedCenter is ready to dispense and generating revenue for MedAvail, which were not previously included in Cumulative Net Dispensing MedCenters. 2 Cumulative net dispensing MedCenters: Cumulative units recorded after completion of shipment and training such that the MedCenter is ready to dispense and generating revenue for MedAvail, but excluding decommissioned units and demo units.

16 Investment Highlights Innovative pharmacy technology company with clear roadmap to delivering profitable and sustainable growth Addresses significant unmet needs in the pharmacy space Demonstrable positive impact on Rx adherence and reimbursement Strategic partnerships to drive future deployments across multiple channels 01 02 03 04 05 06 Significant total and serviceable addressable markets Recurring, high-margin predictable revenue stream Strengthened financial position with projected 2+ years of cash on-hand

Thank You www.medavail.com ir@medavail.com NASDAQ: MDVL

18 Appendix

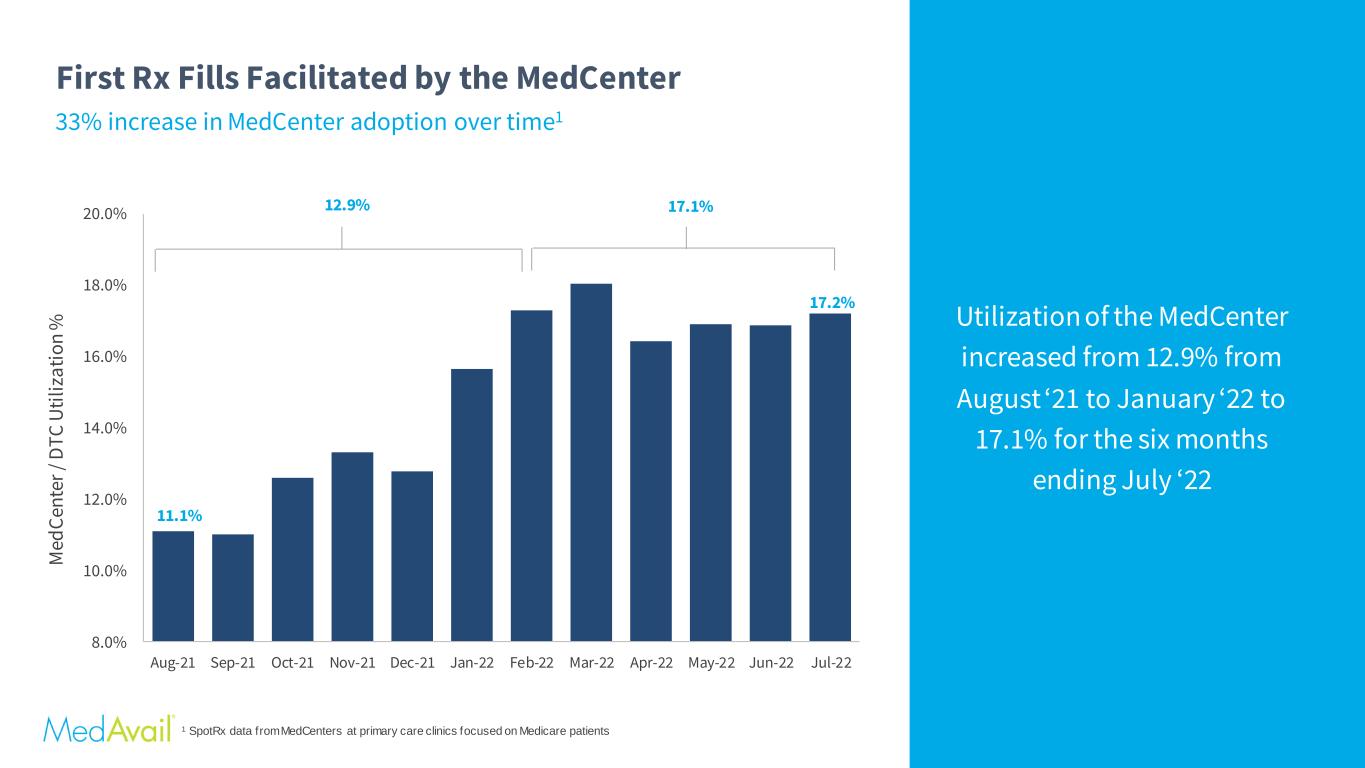

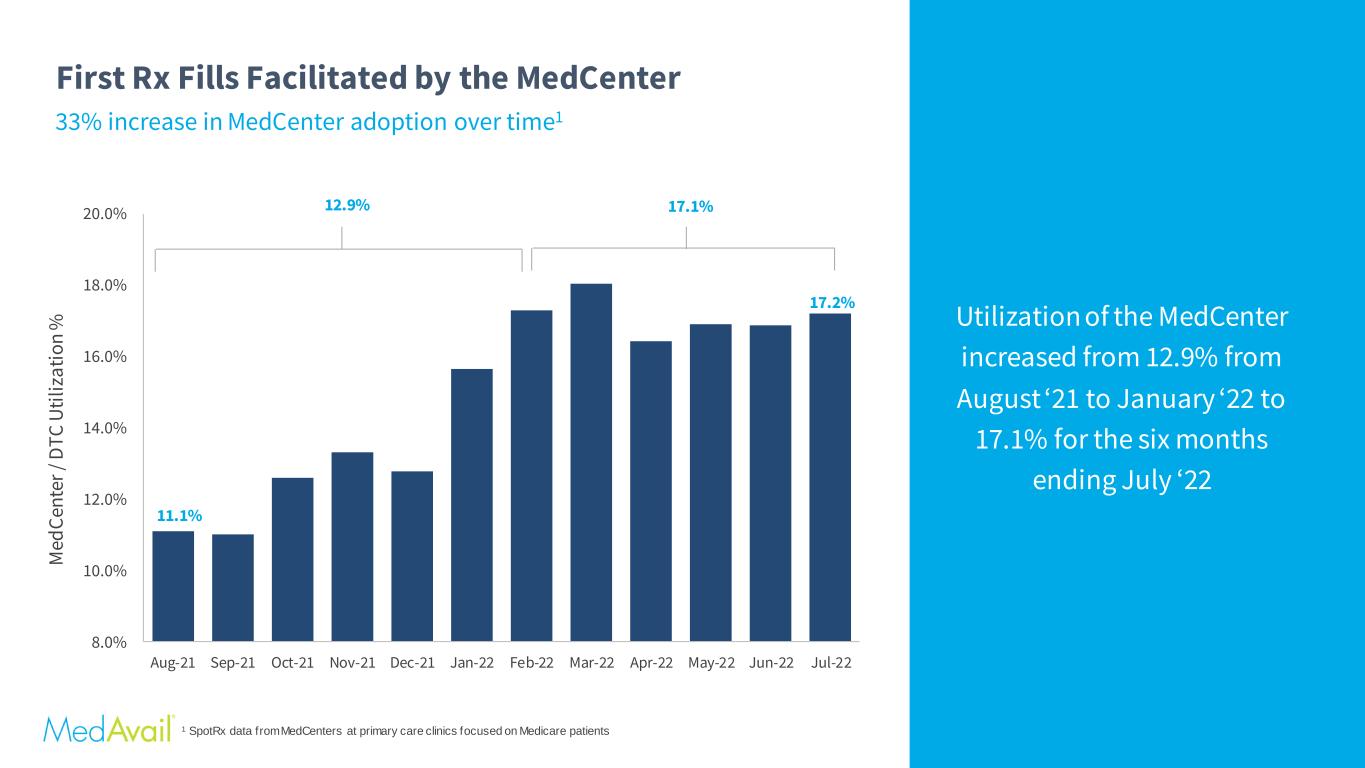

19 First Rx Fills Facilitated by the MedCenter 1 SpotRx data from MedCenters at primary care clinics focused on Medicare patients 33% increase in MedCenter adoption over time1 11.1% 17.2% 8.0% 10.0% 12.0% 14.0% 16.0% 18.0% 20.0% Aug-21 Sep-21 Oct-21 Nov-21 Dec-21 Jan-22 Feb-22 Mar-22 Apr-22 May-22 Jun-22 Jul-22 M ed C en te r / D T C U ti li za ti o n % 17.1%12.9% Utilization of the MedCenter increased from 12.9% from August ‘21 to January ‘22 to 17.1% for the six months ending July ‘22

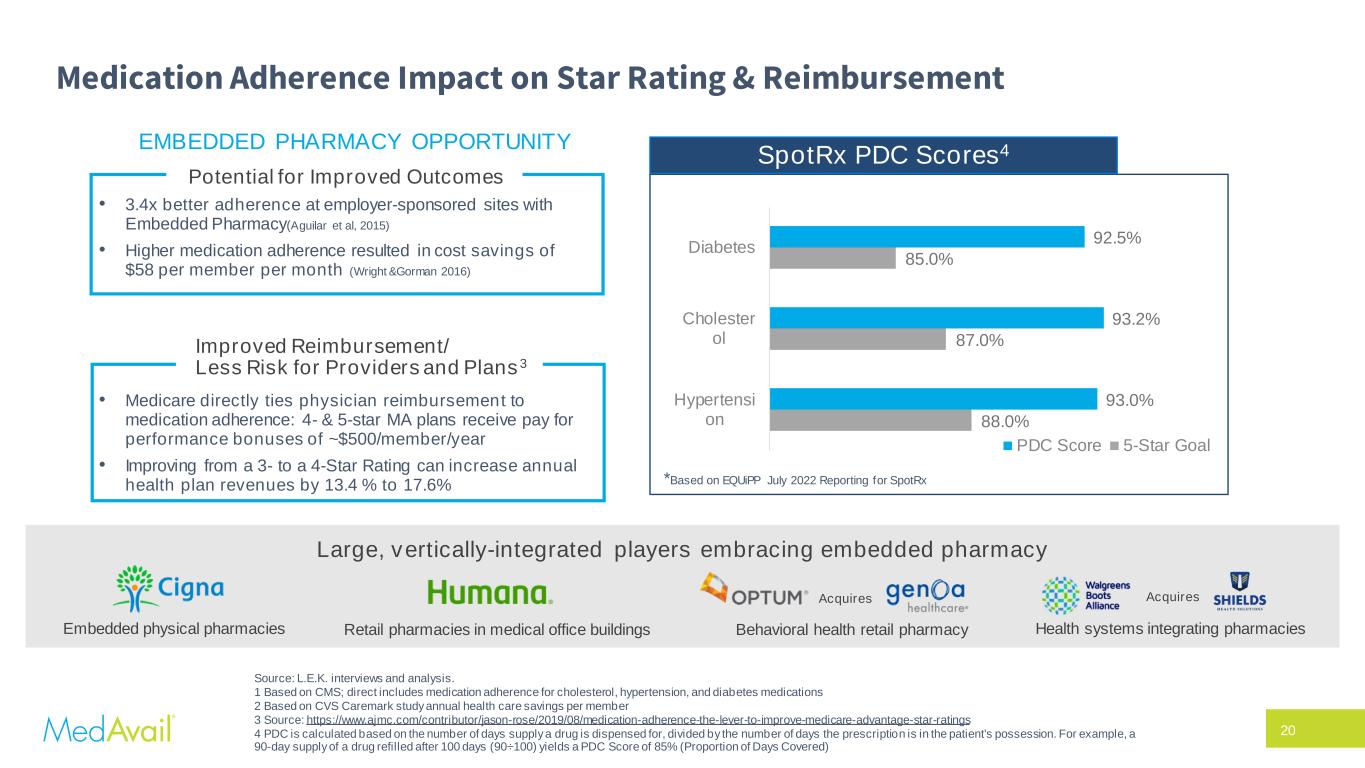

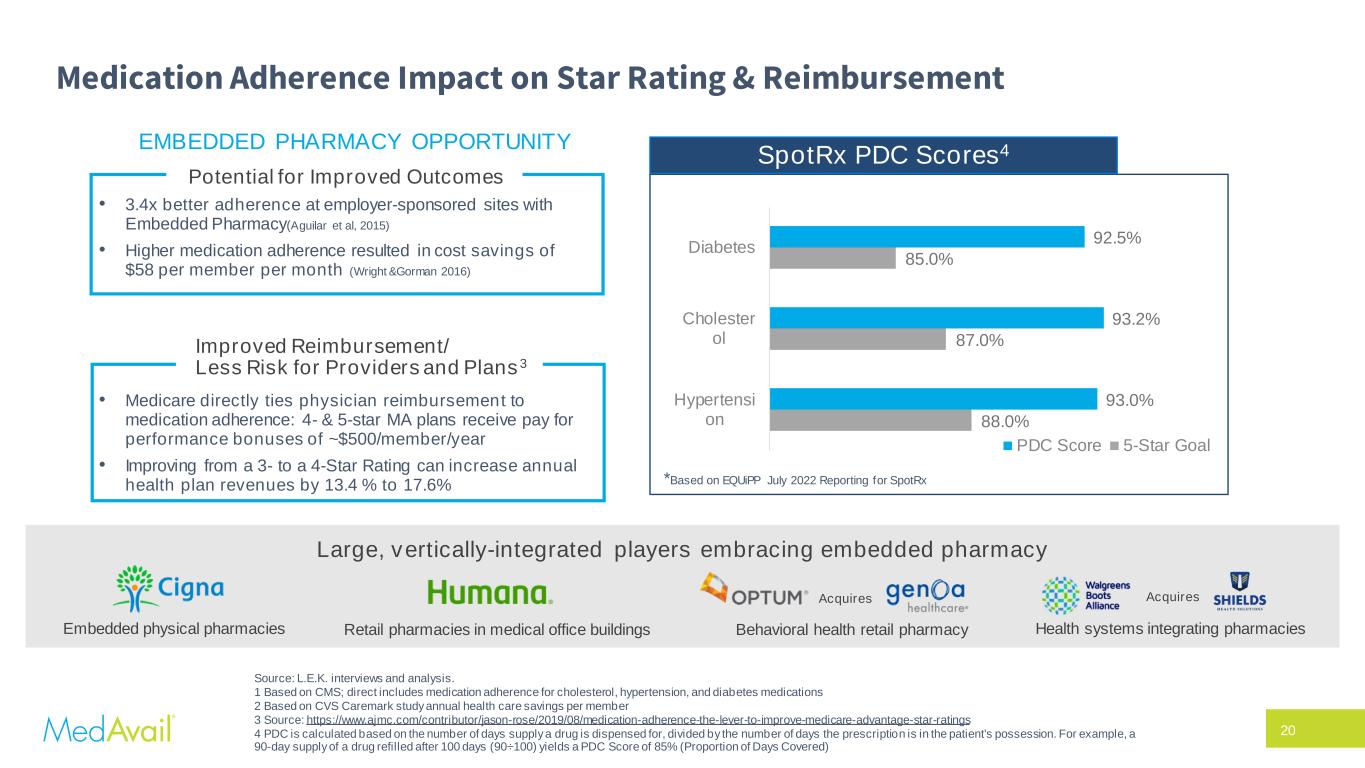

20 Medication Adherence Impact on Star Rating & Reimbursement EMBEDDED PHARMACY OPPORTUNITY Potential for Improved Outcomes • 3.4x better adherence at employer-sponsored sites with Embedded Pharmacy(Aguilar et al, 2015) • Higher medication adherence resulted in cost savings of $58 per member per month (Wright &Gorman 2016) Improved Reimbursement/ Less Risk for Providers and Plans3 • Medicare directly ties physician reimbursement to medication adherence: 4- & 5-star MA plans receive pay for performance bonuses of ~$500/member/year • Improving from a 3- to a 4-Star Rating can increase annual health plan revenues by 13.4 % to 17.6% SpotRx PDC Scores4 88.0% 87.0% 85.0% 93.0% 93.2% 92.5% Hypertensi on Cholester ol Diabetes PDC Score 5-Star Goal *Based on EQUiPP July 2022 Reporting for SpotRx Source: L.E.K. interviews and analysis. 1 Based on CMS; direct includes medication adherence for cholesterol, hypertension, and diabetes medications 2 Based on CVS Caremark study annual health care savings per member 3 Source: https://www.ajmc.com/contributor/jason-rose/2019/08/medication-adherence-the-lever-to-improve-medicare-advantage-star-ratings 4 PDC is calculated based on the number of days supply a drug is dispensed for, divided by the number of days the prescription is in the patient's possession. For example, a 90-day supply of a drug refilled after 100 days (90÷100) yields a PDC Score of 85% (Proportion of Days Covered) Embedded physical pharmacies Retail pharmacies in medical office buildings Acquires Behavioral health retail pharmacy Acquires Large, vertically-integrated players embracing embedded pharmacy Health systems integrating pharmacies