UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 2

TO

FORM 10-QSB

ON

FORM 10-Q

(Mark One)

| x | Quarterly report pursuant to section 13 or 15(d) of the Securities Exchange Act of 1934 for the Quarter ended September 30, 2007 |

| ¨ | Transition report pursuant to section 13 or 15 (d) of the Securities Exchange Act of 1934 |

Commission file number 000-52696

(Exact name of registrant as specified in its charter)

| Delaware | | 22-3091075 |

| (State or other jurisdiction | | (I.R.S. Employer Identification No.) |

| of incorporation or organization) | | |

410 Park Avenue, 15th Floor

New York, New York 10022

(Address of principal executive offices)

(212) 231-8171

(Issuer’s telephone number)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Check whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No x

State the number of shares outstanding of each of the issuer’s class of common equity, as of the latest practicable date: 41,246,852.

Transitional Small Business Disclosure Format (Check one): Yes x No ¨

AMENDMENT NO. 2 TO FORM 10-QSB ON FORM 10-Q

This Amendment No. 2 to Form 10-QSB on Form 10-Q amends our Quarterly Report on Amendment No. 1 to Form 10-QSB as previously filed with the Securities and Exchange Commission on November 20, 2007.

As described in Note 3 to the Company’s financial statements included herein, the Company has restated its financial statements as of and for the quarter ended and nine months ended September 30, 2007, to revise the accounting for common stock issued in connection with the conversion on April 1, 2007 of a promissory note previously issued by the Company and services that the Company expected to receive from the holders of the promissory note. As described in Note 3, the Company filed suit on December 23, 2008 in an effort to recover the shares of common stock issued and reached a settlement agreement on February 11, 2009, under which a portion of the shares issued were cancelled or returned to the Company. The Company has re-stated its accounting for the issuance of the shares and has recorded a non-cash charge to income of $2,205,492 in the quarter ended June 30, 2007 related to the shares that will not be returned to the Company and for which the Company will not receive the services it expected.

The restatement of the Company’s financial statements, as described in Note 3, reduced the Company’s net income for the quarter ended and nine months ended September 30, 2007 by $2,205,492. The restatement reduced the total amount of Shareholders’ Equity by $3,230 and increased Current Liabilities by $3,230, as of that date. Except for these effects and the inclusion of Note 3 and related revisions to Note 1, paragraph (g) Note 7, paragraph (a) and Note 10, this Amendment No. 2 and the Company’s financial statements included herein are unchanged from the Report previously filed.

This Amendment contains the complete text of the original report with the corrected information appearing in the financial statements.

PART I – FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

| EMPIRE MINERALS CORP. AND SUBSIDIARIES |

| (FORMERLY KNOWN AS XACORD CORP.) |

| (AN EXPLORATION COMPANY) |

| CONSOLIDATED BALANCE SHEET |

| AS OF SEPTEMBER 30, 2007 |

| ASSETS | | | |

| | | SEPTEMBER 30 | |

| | | 2007 | |

| | | UNAUDITED | |

| | | (Restated) | |

| CURRENT ASSETS: | | | |

| Cash and cash equivalents | | $ | 2,091,228 | |

| Notes receivable | | | 80,000 | |

| Prepaid expense | | | 94,521 | |

| | | | | |

| Total current assets | | | 2,265,749 | |

| | | | | |

| EQUIPMENT, net | | | 41,467 | |

| | | | | |

| OTHER ASSETS: | | | | |

| Notes issuance cost | | | 29,916 | |

| Long term investment | | | 2,210,855 | |

| Total other assets | | | 2,240,771 | |

| | | | | |

| Total assets | | $ | 4,547,987 | |

| | | | | |

| LIABILITIES AND SHAREHOLDERS' EQUITY | | | | |

| CURRENT LIABILITIES: | | | | |

| Accrued liabilities | | $ | 157,070 | |

| Convertible note payable, net of discount $14,970 | | | 585,110 | |

| Total current liabilities | | | 742,180 | |

| | | | | |

| COMMITMENTS AND CONTINGENCIES | | | - | |

| | | | | |

| SHAREHOLDERS' EQUITY: | | | | |

| Preferred stock, Voting Series I, $0.0001 par value; 5,000,000 shares authorized; | |

| 0 shares issued and outstanding | | | - | |

| Common stock, $0.0001 par value; 700,000,000 shares authorized | | | | |

| 41,556,696 and 20,485,000 issued and outstanding | | | | |

| as of September 30, 2007 and December 31, 2006, respectively | | | 4,156 | |

| Escrowed common stock | | | (267 | ) |

| Additional paid-in capital | | | 13,612,258 | |

| Shares to be returned for services not received | | | (1,654,167 | ) |

| Stock subscription receivable | | | (1,560 | ) |

| Deficit accumulated during the development stage | | | 5,449 | |

| Accumulated other comprehensive income | | | (8,160,062 | ) |

| Total shareholders' equity | | | 3,805,807 | |

| | | | | |

| Total liabilities and shareholders' equity | | $ | 4,547,987 | |

The accompanying notes are an integral part of this consolidated statement.

Table of Contents

| EMPIRE MINERALS CORP. AND SUBSIDIARIES |

| (FORMERLY KNOWN AS XACORD CORP.) |

| (AN EXPLORATION COMPANY) |

| CONSOLIDATED STATEMENTS OF OPERATIONS AND OTHER COMPREHENSIVE INCOME |

| (UNAUDITED) |

| | | | | | | | | Nine months | | | From inception | | | From inception | |

| | | Three months ended | | | ended | | | (March 1, 2006) | | | (March 1, 2006) | |

| | | September 30, | | | September 30, | | | to September 30, | | | to September 30, | |

| | | 2007 | | | 2006 | | | 2007 | | | 2006 | | | 2007 | |

| | | | | | | | | (Restated) | | | | | | (Restated) | |

| | | | | | | | | | | | | | | | |

| REVENUE | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | |

| COST OF SALES | | | - | | | | - | | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | | | |

| GROSS PROFIT | | | - | | | | - | | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | | | |

| RESEARCH AND DEVELOPMENT COSTS | | | 48,140 | | | | 155,163 | | | | 323,875 | | | | 200,000 | | | | 722,565 | |

| GENERAL AND ADMINISTRATIVE EXPENSES | | | 903,525 | | | | 386,599 | | | | 3,448,936 | | | | 864,312 | | | | 5,180,502 | |

| LOSS FROM EXPECTED SERVICES NOT RECEIVED | | | | | | | | | | | 2,205,492 | | | | | | | | 2,205,492 | |

| | | | | | | | | | | | | | | | | | | | | |

| LOSS FROM OPERATIONS | | | (951,665 | ) | | | (541,762 | ) | | | (5,978,303 | ) | | | (1,064,312 | ) | | | (8,108,559 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| OTHER EXPENSE | | | (72,558 | ) | | | - | | | | (58,087 | ) | | | - | | | | (51503 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| LOSS BEFORE PROVISION FOR INCOME TAXES | | | (1,024,223 | ) | | | (541,762 | ) | | | (6,036,390 | ) | | | (1,064,312 | ) | | | (8,160,062 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| PROVISION FOR INCOME TAXES | | | - | | | | - | | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | | | |

| NET LOSS | | | (1,024,223 | ) | | | (541,762 | ) | | | (6,036,390 | ) | | | (1,064,312 | ) | | | (8,160,062 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| OTHER COMPREHENSIVE INCOME | | | | | | | | | | | | | | | | | | | | |

| Foreign currency translation adjustment | | | 2,687 | | | | - | | | | 8,100 | | | | - | | | | 5,449 | |

| | | | | | | | | | | | | | | | | | | | | |

| COMPREHENSIVE LOSS | | $ | (1,021,536 | ) | | $ | (541,762 | ) | | $ | (6,028,290 | ) | | $ | (1,064,312 | ) | | $ | (8,154,613 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| LOSS PER SHARE | | | | | | | | | | | | | | | | | | | | |

| Basic and diluted loss per share | | $ | (0.03 | ) | | $ | (0.03 | ) | | $ | (0.18 | ) | | $ | (0.07 | ) | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Basic and diluted weighted average number of common shares | | | 40,029,773 | | | | 18,168,352 | | | | 33,478,825 | | | | 15,979,566 | | | | | |

The accompanying notes are an integral part of this consolidated statement.

| EMPIRE MINERALS CORP. AND SUBSIDIARIES (FORMERLY XACORD CORP.) |

| (FORMERLY KNOWN AS XACORD CORP.) |

| (AN EXPLORATION COMPANY) |

| STATEMENT OF SHAREHOLDERS' EQUITY |

| | | | | | | | | | | | | | | | | | | | | | | | | | | SHARES TO | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | ADDITIONAL | | | STOCK | | | BE RETURNED | | | | | | OTHER | | | TOTAL | |

| | | PREFERRED STOCK | | | COMMON STOCK | | | SHARES IN ESCROW | | | PAID-IN | | | SUBSCRIPTION | | | FOR SERVICES | | | ACCUMULATED | | | COMPREHENSIVE | | | SHAREHOLDERS' | |

| | | SHARES | | | AMOUNT | | | SHARES | | | AMOUNT | | | SHARES | | | AMOUNT | | | CAPITAL | | | RECEIVABLE | | | NOT RECEIVED | | | DEFICIT | | | GAIN (LOSS) | | | EQUITY | |

| Balance at inception, March 1, 2006 | | | - | | | $ | - | | | | - | | | $ | - | | | | - | | | $ | - | | | $ | - | | | $ | - | | | | | | $ | - | | | $ | - | | | $ | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Founders stock issued for cash, $0.001 per share | | | | | | | | | | | 6,460,000 | | | | 646 | | | | | | | | | | | | 5,814 | | | | (6,460 | ) | | | | | | | | | | | | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Shares issued March 29, 2006 for $80,500 in services | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| and $4,500 cash, at $0.01 per share | | | | | | | | | | | 8,500,000 | | | | 850 | | | | | | | | | | | | 84,150 | | | | (8,500 | ) | | | | | | | | | | | | | | 76,500 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Stock sold through subscription agreements | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| through September 30, 2006 at $0.50 per share | | | | | | | | | | | 3,695,000 | | | | 369 | | | | | | | | | | | | 1,847,131 | | | | | | | | | | | | | | | | | | | 1,847,500 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Stock warrants issued to employees | | | | | | | | | | | | | | | | | | | | | | | | | | | 474 | | | | | | | | | | | | | | | | | | | 474 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Stock warrants issued to consultants for advisory services | | | | | | | | | | | | | | | | | | | | | | | | | | | 829 | | | | | | | | | | | | | | | | | | | 829 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net loss | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | (1,064,312 | ) | | | | | | | (1,064,312 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance as of September 30, 2006 (Unaudited) | | | - | | | $ | - | | | | 18,655,000 | | | $ | 1,865 | | | | - | | | $ | - | | | $ | 1,938,398 | | | $ | (14,960 | ) | | $ | - | | | $ | (1,064,312 | ) | | $ | - | | | $ | 860,991 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Proceeds on subscription receivable | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 11,900 | | | | | | | | | | | | | | | | 11,900 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Shares issued | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| $0.50 per share, for cash | | | | | | | | | | | 1,810,000 | | | | 182 | | | | | | | | | | | | 904,818 | | | | | | | | | | | | | | | | | | | | 905,000 | |

| $0.10 per share, conversion of warrants, for cash | | | | | | | | | | | 20,000 | | | | 2 | | | | | | | | | | | | 1,998 | | | | | | | | | | | | | | | | | | | | 2,000 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Warrants issued for consulting services | | | | | | | | | | | | | | | | | | | | | | | | | | | 196,284 | | | | | | | | | | | | | | | | | | | | 196,284 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Foreign currency translation loss | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | -2,651 | | | | (2,651 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net loss | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | (1,059,360 | ) | | | | | | | (1,059,360 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance, December 31, 2006 | | | - | | | $ | - | | | | 20,485,000 | | | $ | 2,049 | | | | - | | | $ | - | | | $ | 3,041,498 | | | $ | (3,060 | ) | | $ | - | | | $ | (2,123,672 | ) | | $ | (2,651 | ) | | $ | 914,164 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Proceeds on subscription receivable | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 1,500 | | | | | | | | | | | | | | | | 1,500 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Stock issued | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| $0.10 per share, conversion of warrants for cash | | | | | | | | | | | 450,000 | | | | 45 | | | | | | | | | | | | 44,955 | | | | | | | | | | | | | | | | | | | | 45,000 | |

| $0.10 per share, cashless conversion of warrants | | | | | | | | | | | 1,600,000 | | | | 160 | | | | | | | | | | | | (160 | ) | | | | | | | | | | | | | | | | | | | - | |

| $0.50 per share, CEO for compensation | | | | | | | | | | | 1,500,000 | | | | 150 | | | | | | | | | | | | 749,850 | | | | | | | | | | | | | | | | | | | | 750,000 | |

| $0.50 per share, for cash | | | | | | | | | | | 3,264,000 | | | | 326 | | | | | | | | | | | | 1,631,674 | | | | | | | | | | | | | | | | | | | | 1,632,000 | |

| $0.50 per share, for consulting services | | | | | | | | | | | 1,900,000 | | | | 190 | | | | | | | | | | | | 949,810 | | | | | | | | | | | | | | | | | | | | 950,000 | |

| $0.50 per share, for exploration & development | | | | | | | | | | | 4,000,000 | | | | 400 | | | | (2,666,667 | ) | | | (267 | ) | | | 666,533 | | | | | | | | | | | | | | | | | | | | 666,666 | |

| $0.50 per share, for loan issuance cost | | | | | | | | | | | 200,000 | | | | 20 | | | | | | | | | | | | 99,980 | | | | | | | | | | | | | | | | | | | | 100,000 | |

| $0.50 per share, for services and conversion of note | | | | | | | | | | | 7,925,000 | | | | 793 | | | | | | | | | | | | 3,961,707 | | | | | | | | (1,654,167 | ) | | | | | | | | | | | 2,308,333 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Shares assumed pursuant to reverse merger | | | 100 | | | | 10,000 | | | | 232,696 | | | | 23 | | | | | | | | | | | | (145,230 | ) | | | | | | | | | | | | | | | | | | | (135,207 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Repurchase preferred stock | | | (100 | ) | | | (10,000 | ) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | (10,000 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Warrants issued with convertible note | | | | | | | | | | | | | | | | | | | | | | | | | | | 31,641 | | | | | | | | | | | | | | | | | | | | 31,641 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Special Warrants | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| issued for cah | | | | | | | | | | | | | | | | | | | | | | | | | | | 2,080,000 | | | | | | | | | | | | | | | | | | | | 2,080,000 | |

| issued with convertible promissory note | | | | | | | | | | | | | | | | | | | | | | | | | | | 500,000 | | | | | | | | | | | | | | | | | | | | 500,000 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Foreign currency translation gain | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 8,100 | | | | 8,100 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net loss | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | (6,036,390 | ) | | | | | | | (6,036,390 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance, September 30, 2007 (Unaudited) (Restated) | | | - | | | $ | - | | | | 41,556,696 | | | $ | 4,156 | | | | (2,666,667 | ) | | $ | (267 | ) | | $ | 13,612,258 | | | $ | (1,560 | ) | | $ | (1,654,167 | ) | | $ | (8,160,062 | ) | | $ | 5,449 | | | $ | 3,805,807 | |

The accompanying notes are an integral part of this consolidated statement.

| EMPIRE MINERALS CORP. AND SUBSIDIARIES |

| (FORMERLY KNOWN AS XACORD CORP.) |

| (AN EXPLORATION COMPANY) |

| CONSOLIDATED STATEMENT OF CASH FLOWS |

| (UNAUDITED) |

| | | | | | | | | | |

| | | Nine months | | | From inception | | | From inception | |

| | | ended | | | (March 1, 2006) | | | (March 1, 2006) | |

| | | Septermber 30, | | | to September 30, | | | to September 30, | |

| | | 2007 | | | 2006 | | | 2007 | |

| | | (Restated) | | | | | | (Restated) | |

| | | | | | | | | | |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | | | | | | | |

| | $ | (6,036,390 | ) | | $ | (1,064,312 | ) | | $ | (8,160,062 | ) |

| Adjustments to reconcile net loss to net cash | | | | | | | | | | | | |

| used in operating activities: | | | | | | | | | | | | |

| Depreciation | | | 7,488 | | | | - | | | | 7,488 | |

| Warrants issued for services | | | - | | | | 1,303 | | | | 197,587 | |

| Amortization of debt discount | | | 16,671 | | | | - | | | | 93,171 | |

| Amortization of loan issuance cost | | | 144,083 | | | | - | | | | 144,083 | |

| Common stock issued for advisory services | | | 1,605,479 | | | | 76,500 | | | | 1,605,479 | |

| Loss from expected services not received | | | 2,205,492 | | | | - | | | | 2,205,492 | |

| Loss on currency exchange | | | 11,080 | | | | - | | | | 11,080 | |

| Change in operating liabilities: | | | | | | | - | | | | | |

| Accrued liabilities | | | (35,550 | ) | | | 75,632 | | | | 153,840 | |

| Net cash used in operating activities | | | (2,081,647 | ) | | | (910,877 | ) | | | (3,741,842 | ) |

| | | | | | | | | | | | | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | | | | | | | | | | | |

| Capital contribution | | | - | | | | (138,000 | ) | | | - | |

| Equipment Purchases | | | (4,166 | ) | | | - | | | | (46,471 | ) |

| Long term investment | | | (1,544,189 | ) | | | - | | | | (1,544,189 | ) |

| Notes receivable | | | (80,000 | ) | | | - | | | | (80,000 | ) |

| Net cash used in investing activites | | | (1,628,355 | ) | | | (138,000 | ) | | | (1,670,660 | ) |

| | | | | | | | | | | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | | | | | | | | | | |

| Proceeds from sale of common stock | | | 1,632,000 | | | | 1,847,500 | | | | 4,396,400 | |

| Proceeds from special warrants | | | 2,068,920 | | | | - | | | | 2,068,920 | |

| Proceeds from exercise of warrants | | | 45,000 | | | | - | | | | 47,000 | |

| Payment on note issuance cost | | | (74,000 | ) | | | | | | | (74,000 | ) |

| Payment for notes payables | | | (25,000 | ) | | | - | | | | (25,000 | ) |

| Proceeds from notes payable | | | 1,105,000 | | | | - | | | | 1,105,000 | |

| Proceeds from subscription receivable | | | 1,500 | | | | - | | | | 1,500 | |

| Payment for buy back preferred stock | | | (10,000 | ) | | | - | | | | (10,000 | ) |

| Net cash provided by financing activities: | | | 4,743,420 | | | | 1,847,500 | | | | 7,509,820 | |

| | | | | | | | | | | | | |

| EFFECT OF EXCHANGE RATE CHANGES ON CASH | | | 9,933 | | | | - | | | | (6,090 | ) |

| | | | | | | | | | | | | |

| NET INCREASE IN CASH AND CASH EQUIVALENTS | | | 1,043,351 | | | | 798,623 | | | | 2,091,228 | |

| | | | | | | | | | | | | |

| CASH AND CASH EQUIVALENTS, beginning of the period | | | 1,047,877 | | | | - | | | | - | |

| | | | | | | | | | | | | |

| CASH AND CASH EQUIVALENTS, end of period | | $ | 2,091,228 | | | $ | 798,623 | | | $ | 2,091,228 | |

| | | | | | | | | | | | | |

| SUPPLEMENTAL DISCLOSURES: | | | | | | | | | | | | |

| Interest paid | | $ | 66,024 | | | $ | - | | | $ | 66,024 | |

| Income taxes paid | | $ | - | | | $ | - | | | $ | - | |

| Assumption of liabilities in reverse merger | | $ | 149,186 | | | $ | - | | | $ | 149,186 | |

| Conversion of notes and interest for common stock | | $ | 106,071 | | | $ | - | | | $ | 106,071 | |

| Issuance of founders stock for subscription receivable | | $ | - | | | $ | (14,960 | ) | | $ | (14,960 | ) |

| Shares issued for exploration and development of investment | | $ | 666,667 | | | $ | - | | | $ | 666,667 | |

| Warrants issued for debt issuance costs | | $ | 31,641 | | | $ | - | | | $ | 31,641 | |

| Net liabitlities assumed in reverse acquisition | | $ | 135,207 | | | $ | - | | | $ | 135,207 | |

| Warrants issued for repayment of notes | | $ | 500,000 | | | $ | - | | | $ | 500,000 | |

| Common stock issued for loan issuance cost | | $ | 100,000 | | | $ | - | | | $ | 100,000 | |

The accompanying notes are an integral part of this consolidated statement.

EMPIRE MINERALS CORP. AND SUBSIDIARIES

(FORMERLY KNOWN AS XACORD CORP.)

(AN EXPLORATION COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2007

(UNAUDITED)

| 1. | Nature of Business and Significant Accounting Policies |

| | a. | Nature of Business — Empire Minerals Corp. (“Company”) (formerly known as Xacord Corp.) was incorporated January 4, 1996 under the laws of Delaware. The Company is engaged in the exploration of precious and base metals including gold and copper. All potential properties currently under exploration are located in the People’s Republic of China and Panama. |

From September 2005 to January 2007, the Company changed its name 3 times to reflect the changing business plans. The original name of the Company was Objectsoft Corporation. In June 2005, the name was changed to Nanergy, Inc. In, June 2006, the name was changed to Xacord Corp and in January 2007, the name was changed to its current name, Empire Minerals Corp.

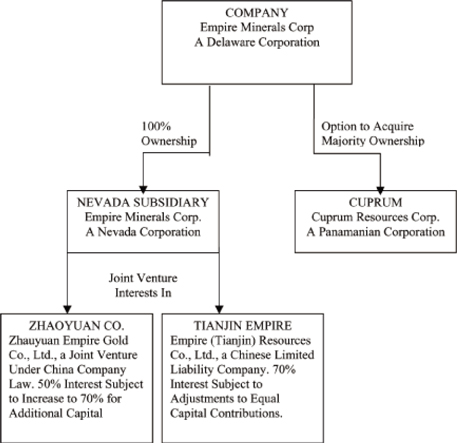

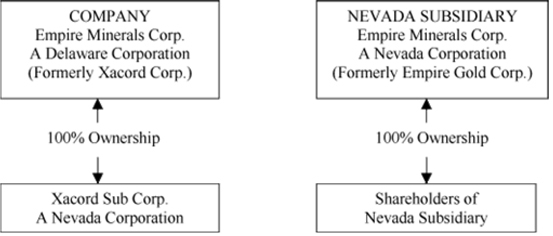

On February 20, 2007, the Company completed a triangular reverse merger with Empire Minerals Corp., a Nevada Corporation (formerly known as Empire Gold Corp.) (“Subsidiary”) and Xacord Acquisition Sub Corp, then the Company’s subsidiary (“Xacord”). All 26,504,000 shares in the Subsidiary were exchanged one for one for 26,504,000 shares in the Company. Additionally, 5,950,000 warrants in the Subsidiary were exchanged one for one for 5,950,000 warrants in the Company. The Subsidiary was the accounting acquirer and the Company was the legal acquirer. The transaction was accounted for as a reverse merger and recapitalization. As such, the accompanying financial statements reflect the historical operations of the Subsidiary in the capital structure of the Company at the beginning of the first period presented herein.

| | b. | Basis of Presentation — The accompanying consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America. The consolidated financial statements include the financial statements of the Company, its wholly owned subsidiaries Empire Minerals Corp., a Nevada corporation (formerly known as Empire Gold Corp.), 50% owned Zhaoyuan Dongxing Gold Mining Co., Ltd. (“Dongxing”), and 70% owned Empire (Tianjin) Resources Co., Ltd. (“Tianjin”) (“Subsidiaries”). All significant inter-company transactions and balances between the Company and its subsidiaries are eliminated upon consolidation. Minority interest has not been presented on the consolidated balance sheet because accumulated losses have exceeded the minority shareholders’ equity. In accordance with APB No. 18, the minority interest has been written down to zero on the accompanying balance sheet. |

The Company is currently in an exploration stage, which is characterized by significant expenditures for the examination and development of exploration opportunities by its Subsidiaries. The Subsidiaries’ focus for the foreseeable future will continue to be on securing joint venture agreements within the People’s Republic of China and Panama to begin conducting mining operations.

| | c. | Use of Estimates — The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect certain reported amounts and disclosures, such as the fair value of warrants and stock issued for services as well as various accruals, for example, we must calculate the fair value of options granted based on various assumptions. Accordingly, the actual results could differ from those estimates. |

EMPIRE MINERALS CORP. AND SUBSIDIARIES

(FORMERLY KNOWN AS XACORD CORP.)

(AN EXPLORATION COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2007

(UNAUDITED)

| | d. | Fair value of financial instruments - The Company believes the carrying value of its financial instruments, including convertible notes, approximate fair value due to their short maturities. |

| | e. | Cash and Cash Equivalents — For purposes of the statements of cash flows, the Company defines cash equivalents as all highly liquid debt instruments purchased with an original maturity of three months or less. |

Financial instruments, which potentially subject the Company to concentrations of credit risk, consist of cash and cash equivalents. The Company places its cash with high quality financial institutions and at times may exceed the FDIC $100,000 insurance limit. The Company has limited experience as it is an exploration stage company but does not anticipate incurring any losses related to this credit risk. As of September 30, 2007, the Company had amounts in bank accounts in excess of FDIC insurance of $1,877,963.

The Company has gold mining activities in People’s Repbulic of China (“PRC”). Accordingly, the Company’s mining business, financial condition and results of operations may be influenced by the political, economic and legal environments in the PRC, and by the general state of the PRC’s economy. The Company’s operations in the PRC are subject to specific considerations and significant risks not typically associated with companies in the North America and Western Europe. These include risks associated with, among others, the political, economic and legal environments and foreign currency exchange. The Company’s results may be adversely affected by changes in governmental policies with respect to laws and regulations, anti-inflationary measures, currency conversion and remittance abroad, and rates and methods of taxation, among other things.

| | g. | Net Loss Per Share — In accordance with Statement of Financial Accounting Standard (SFAS) No. 128, Earnings Per Share, an basic earnings/loss per common share (EPS) is computed by dividing net loss for the period by the weighted average number of common shares outstanding during the period. Under SFAS 128, diluted earnings/loss per share is computed similar to basic loss per share except that the denominator is increased to include the number of additional common shares that would have been outstanding if the potential common shares had been issued and dilutive. Net loss used in determining basic EPS was $6,036,390, $1,064,312 and $8,160,062 for the nine months ended September 30, 2007, the period from inception (March 1, 2006) through September 30, 2006, and the period from inception (March 1, 2006) through September 30, 2007, respectively. The weighted average number of shares of common stock used in determining basic EPS was 33,478,825 and 15,979,566 for the nine months ended September 30, 2007 and the period from inception (March 1, 2006) through September 30, 2006, respectively. |

EMPIRE MINERALS CORP. AND SUBSIDIARIES

(FORMERLY KNOWN AS XACORD CORP.)

(AN EXPLORATION COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2007

(UNAUDITED)

| | h. | Income Taxes — The Company provides for income taxes under SFAS 109, “Accounting for Income Taxes,” which requires the recognition of deferred tax liabilities and assets for the expected future tax consequences of temporary differences between the carrying amounts and the tax bases of assets and liabilities using the enacted income tax rate expected to apply to taxable income in the period in which the deferred tax liability or assets is expected to be settled or realized. SFAS 109 requires that a valuation allowance be established if necessary, to reduce the deferred tax assets to the amount that management believes is more likely than not to be realized. The provision for federal income tax differs from that computed amount by applying federal statutory rates to income before federal income tax expense mainly due to expenses that are not deductible and income that is not taxable for federal income taxes, including permanent differences such as non-deductible meals and entertainment. |

| | i. | Stock based compensation — For stock, options and warrants issued to service providers, employees and founders, the Company follows SFAS No. 123(R), Share-Based Payment, and EITF 96-18, Accounting for Equity Instruments That Are Issued to Other Than Employees for Acquiring, or in Conjunction with Selling, Goods or Services, which requires recording the options and warrants at the fair value of the service provided and expensing over the related service period. |

| | j. | Recently issued accounting pronouncements |

In September 2006, the FASB issued SFAS No. 157, Fair Value Measurements. This statement clarifies the definition of fair value, establishes a framework for measuring fair value and expands the disclosures on fair value measurements. SFAS No. 157 is effective for fiscal years beginning after November 15, 2006. Management has not determined the effect, if any; the adoption of this statement will have on the financial statements.

In November 2006, Emerging Issues Task Force (“EITF”) issued 96-19 “Debtor’s Accounting for a Modification or Exchange of Debt Instruments”. EITF 96-19 provides a test to determine whether a transaction should be accounted for as an “extinguishment” (with gain or loss recognition) or as a “modification” (with no gain or loss recognition). If the change in the fair value of the embedded conversion option is at least 10 percent of the carrying amount of the original debt instrument immediately prior to the modification or exchange, the transaction should be accounted for as an “extinguishment”. EITF 96-19 also provides that when a convertible debt instrument is modified or exchanged in a transaction that is not accounted for as an extinguishment, an increase in the fair value of the embedded conversion option should be reduce the carrying amount of the debt instrument with a corresponding increase in additional paid-in capital. However, a decrease in the fair value of an embedded conversion option resulting from a modification or an exchange should not be recognized. The Company adopted EITF 96-19.

| | k. | Equipment — Equipment is stated at cost and is depreciated using the straight-line method over their estimated useful lives of five years. Expenditures for maintenance and repairs are charged to operations as incurred. The estimated service lives of equipment and vehicles are as follows: |

EMPIRE MINERALS CORP. AND SUBSIDIARIES

(FORMERLY KNOWN AS XACORD CORP.)

(AN EXPLORATION COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2007

(UNAUDITED)

| | | Depreciable life |

| Exploration equipment | | 5 years |

| Office equipment | | 5 years |

| Vehicles | | 5 years |

| | l. | Political and economic risks — The Company entered into joint venture contracts to establish businesses in China and Panama. Accordingly, the Company’s business, financial condition and results of operations may be influenced by the political, economic and legal environments in these countries. |

The Company’s operations in these countries are subject to specific considerations and significant risks not typically associated with companies in the North America and Western Europe. These include risks associated with, among others, the political, economic and legal environments and foreign currency exchange. The Company’s results may be adversely affected by changes in governmental policies with respect to laws and regulations, anti-inflationary measures, currency conversion and remittance abroad, and rates and methods of taxation, among other things.

| | m. | Impairment for long live assets — SFAS No. 144, “Accounting for the Impairment or Disposal of Long-Lived Assets” requires that long-lived assets to be disposed of by sale, including those of discontinued operations, be measured at the lower of carrying amount or fair value less cost to sell, whether reported in continuing operations or in discontinued operations. SFAS No. 144 broadens the reporting of discontinued operations to include all components of an entity with operations that can be distinguished from the rest of the entity and that will be eliminated from the ongoing operations of the entity in a disposal transaction. SFAS No. 144 also establishes a “primary-asset” approach to determine the cash flow estimation period for a group of assets and liabilities that represents the unit of accounting for a long-lived asset to be held and used. The Company has no impairment issues to disclose. |

| | n. | Foreign currency translation — The reporting currency of the Company is US dollar. Dongxing and Tianjin use their local currency RMB, as their functional currency. Results of operations and cash flows are translated at average exchange rates during the period, assets and liabilities are translated at the unified exchange rate as quoted by the People’s Bank of China at the end of the period, and equity is translated at historical exchange rates. |

Translation adjustments amounted to $5,449 gain as of September 30, 2007. Asset and liability accounts at September 30, 2007 were translated at 7.50 RMB to $1.00. Equity accounts were stated at their historical rate. The average translation rates applied to income statement accounts and cash flows for the period ended September 30, 2007, from inception (March 1, 2006) to September 30, 2006, and from inception (March 1, 2006) to September 30, 2007 were 7.65 RMB, 7.99 RMB and 7.81 RMB, respectively. In accordance with Statement of Financial Accounting Standards No. 95, “Statement of Cash Flows,” cash flows from the Company’s operations is calculated based upon the local currencies using the average translation rate. Because cash flows are also translated at average translation rates for the period, amounts reported on the statement of cash flows will not necessarily agree with changes in the corresponding balances on the balance sheet.

EMPIRE MINERALS CORP. AND SUBSIDIARIES

(FORMERLY KNOWN AS XACORD CORP.)

(AN EXPLORATION COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2007

(UNAUDITED)

Transaction gains and losses that arise from exchange rate fluctuations on transactions denominated in a currency other than the functional currency are included in the results of operations as incurred. For the nine months ended September 30, 2007, from inception (March 1, 2006) to September 30, 2006, and from inception (March 1, 2006) to September 30, 2007, total transaction gain (loss) amounted to $11,080, $0, and $11,080 respectively.

The Company is an exploration stage company and therefore has had no revenues or cash flows from operations. The Company has insufficient sources of cash flows raising substantial doubt about its ability to continue as a going concern. In response to these conditions, management is continuing to look for financing from various sources, although there are no guarantees that they will be successful in their endeavors. In addition, the Company is in the process of finding more companies in China and Panama to form joint ventures agreements with in order to begin mining operations. No adjustment has been made to the accompanying financial statements as a result of this uncertainty.

3. Restatement – Conversion of Promissory Note, Issuance of Common Stock, Litigation and Partial Recovery of Common Stock Shares issued

As discussed in the Company’s Report on Form 8-K filed on April 22, 2009, the Company has concluded, based on further review, that it should restate the accounting for the issuance of 7,925,000 shares of its common stock under agreements entered into on April 1, 2007 for the conversion of a promissory note, previously issued by the Company and discussed below. The transaction was previously reported as the conversion of the outstanding balance of the promissory note, including accrued interest, of $106,071, at that carrying value, into 7,925,000 shares of the Company’s common stock, representing a conversion price of $0.013 per share. The Company has concluded that the accounting for the transaction should have been recorded at the fair value of the common stock issued and the Company should have recognized the value of services that, at that time, the Company expected to receive from the holders of the promissory note. The Company has not received the services that it expected to receive and on December 23, 2008, the Company filed suit in the Supreme Court of the State of New York, seeking return of the shares issued and other relief. On February 11, 2009, the Company entered into a Settlement Agreement of that suit, as a result of which a total of 3,308,333 of the 7,925,000 shares originally issued will be returned to the Company or otherwise cancelled and the Company will make payments aggregating $63,230 to the defendants, as more fully discussed below. Reflecting the terms of the Settlement Agreement, the Company has restated its financial statements to record the shares issued at their estimated fair value and to recognize a loss of $2,205,492 as of April 1, 2007, the date of the agreements under which the shares were issued, as discussed below.

On February 14, 2001, the Company (which was then known as ObjectSoft Corporation) executed the promissory note (the “Note”) in the amount of $100,000 to Jay N. Goldberg (the “Original Holder”). The Note, which was due on March 16, 2001 (the “Maturity Date”), accrued interest at 12% per annum and, in the event of default, accrued interest at 20% per annum. The principal plus all accrued and unpaid interest was payable in cash on the Maturity Date or, at the option of the holder, was convertible into equity securities of the Company to be issued to certain institutional investors in a proposed private placement expected to be completed at or prior to the Maturity Date.

On May 30, 2001, the Company and the Original Holder executed an Allonge and Amendment to Promissory Note, amending the Maturity Date to December 31, 2001. The Original Holder also waived any Events of Default that may have occurred and agreed to cooperate with the Company in a potential restructuring of the Company or other transaction pursuant to which the terms of the Note may be restructured. This restructuring was unsuccessful. In July 2001, ObjectSoft filed a Bankruptcy Petition in the Bankruptcy Court for the District of New Jersey and, in November of 2004, emerged from the Bankruptcy filing with no assets and a single liability for the principal amount of the Note of $100,000. None of our present officers, directors or employees were associated with us at the time of, or involved in any way in, the bankruptcy proceeding.

On November 16, 2004, the Original Holder executed an “Assignment and Endorsement of Note” and assigned all of the Original Holder’s right, title and interest in and to the Note, to Securities Acquisition New York, LLC (“SANY”). Prior to June 2006, with the agreement of the then management of the Company, SANY converted $32,300 of the principal amount of the Note into 807,500 shares of common stock of the Company (as adjusted for subsequent stock splits), at an effective conversion price of $0.04 per share. On October 26, 2006, SANY executed an “Agreement of Assignment of Note” and assigned all of their right, title and interest in and to the Note to West Greenwood Foundation (“WGF”). On the date of assignment, the principal balance was $67,700 and the amount of accrued interest was $28,170.

As described in Note 8a, the Company previously entered into consulting agreements with Saddle River Associates (“SRA”) for general business consulting and financial advisory services. SRA introduced the Company to Xacord Corporation (as ObjectSoft was then known), which entity had originally issued the Note and with whom we completed the reverse triangular merger on February 20, 2007 (see Note 1a). In addition, SRA advised the Company of the opportunity to invest in the Exploration and Development Agreement with Bellhaven Copper & Gold, Inc., which Agreement is described in Note 4.

Following our reverse triangular merger on February 20, 2007 (see Note 1a), on April 1, 2007, WGF and various entities and individuals (“designees”), which designees simultaneously purchased various interests in the Note from WGF, requested to convert the outstanding balance of the Note of $106,071 ($67,700 of principle and $38,371 of accrued interest) into 7,925,000 shares of our common stock, representing a conversion rate of approximately $0.013 per share. The Company was advised by SRA that these designees would be able to provide the Company with expertise and assistance to further the development of the Company’s Panamanian Exploration and Development Agreement with Bellhaven. Consequently, the Company agreed to the conversion and the Note was cancelled.

Over time, the Company has become aware that the designees did not possess the expertise necessary to provide the services that the Company expected that it would receive to assist it with its Panamanian operations. On December 23, 2008, the Company filed suit in the Supreme Court of the State of New York, against SRA, WGF and the designees, seeking return of the shares issued for conversion of the Note and other relief. The written agreements related to conversion of the Note did not refer to the provision of any services by the holders of the Note and the defendants asserted that no such agreement related to future services existed. Notwithstanding that assertion, the defendants agreed to return a portion of the shares issued and on February 11, 2009, the Company entered into a Settlement Agreement with the defendants. The Company concluded that it was in its best interests to accept the terms of the Settlement Agreement, rather than continue to litigate the matter. As a result of the Settlement Agreement, of the 7,925,000 shares originally issued, 1,000,000 shares will be cancelled and a further 2,308,333 shares (one-third of the remaining shares issued of 6,925,000) will be returned to the Company. The Company will make payments aggregating $63,230 to the defendants, representing (1) payment of principal and interest on the Note from April 2007 to the date of the Settlement Agreement for that portion of the Note for which shares are being returned and (2) outstanding consulting fees due to SRA of $25,000.

The Company originally accounted for the conversion of the Note based on the written terms of the agreements with WGF and the designees and recorded the common shares issued at the carrying amount of the note. However, to reflect the company’s expectation that it would also receive future services in addition to the conversion of the Note, the 7,925,000 shares issued should have been recorded at their fair value. On April 1, 2007, the closing price of the Company’s common stock was $2.50 per share. Although the Company’s common stock is publically traded, the trading volume is small; during the two year period ended December 31, 2007, the total trading volume of our common stock was less than 250,000 shares. In various private placements of the Company’s common stock that occurred between April 2006 and October 2007, the Company sold an aggregate of 12,819,000 shares of its common stock for cash, each placement at a price of $0.50 per share. Because the 7,925,000 shares issued represents a number of shares substantially in excess of the Company’s historical trading volume, the Company believes that the price of $0.50 per share at which it has effected private placements is a more reasonable estimate of fair value for the 7,925,000 shares issued than the quoted market price. Accordingly, the Company has restated its financial statements for the period ended June 30, 2007 and all subsequent periods to reflect the April 2007 issuance of the 7,925,000 shares at a fair value of $0.50 per share or an aggregate of $3,962,500.

As discussed above, the written terms of the Note provide for conversion only if a private placement was completed at or prior to maturity of the Note on December 31, 2001. The Note bears interest at 12% and accordingly the carrying value of the Note together with accrued interest at the date of conversion is considered to be a reasonable approximation of the fair value of the Note as of that date. In relation to the services that the Company expected to receive from the designees, EITF Issue 96-18 provides that the fair value of shares issued to non-employees for services to be performed should be determined as of the earlier of the date at which a commitment for performance by the counterparty to earn the shares is reached or the date at which their performance is complete. EITF Issue 00-18 further provides that where there are no specific performance criteria required by the recipient in order to retain the shares issued, a measurement date has been reached and the shares should be valued as of the date of the agreement. The Company expected that the designees would provide their services over the multi-year life of the Company’s Panamanian operations but no specific performance criteria were established. Accordingly, the Company has valued the services it expected to receive based on the fair value of the common shares at the time they were issued, which as discussed above has been estimated at $0.50 per share. The difference of $3,856,429 between the fair value of the shares issued of $3,962,500 and the carrying value of the Note at the date of conversion of $106,071, which carrying value is considered to be a reasonable approximation of its fair value at that date, has been allocated as the value of the services the Company expected to receive.

The Company has not received the services that it expected to receive when the shares were issued and as a result of the Settlement Agreement, the Company has recorded a loss of $2,205,492 as of April 1, 2007, reflecting the fair value of the shares that will not be returned to the Company or cancelled as a result of the Settlement Agreement, together with the amounts to be paid by the Company under the Settlement Agreement, offset by $60,000 previously recorded by the Company for amounts outstanding under the Company’s previous consulting agreements with SRA. At June 30, 2007, the value of the shares issued on April 1, 2007 but subsequently cancelled or returned to the Company as a result of the Settlement Agreement have been recorded as contra-equity. The affect of restatement of the Company’s financial statements as of September 30, 2007 as described above was as follows:

| | | Nine Months Ended September 30, 2007 | | | From inception (March 1, 2006) to September 30, 2007 | |

| | | As Previously Reported | | | As Restated | | | As Previously Reported | | | As Restated | |

| | | | | | | | | | | | | |

| Loss from expected services not received | | | - | | | $ | 2,205,492 | | | | - | | | $ | 2,205,492 | |

| | | | | | | | | | | | | | | | | |

| Loss from operations | | $ | (3,772,811 | ) | | $ | (5,978,303 | ) | | $ | (5,903,067 | ) | | $ | (8,108,559 | ) |

| | | | | | | | | | | | | | | | | |

| Loss before provision for income taxes | | | (3,830,898 | ) | | | (6,036,390 | ) | | | (5,954,570 | ) | | | (8,160,062 | ) |

| | | | | | | | | | | | | | | | | |

| Net loss | | $ | (3,830,898 | ) | | $ | (6,036,390 | ) | | $ | (5,954,570 | ) | | $ | (8,160,062 | ) |

| | | | | | | | | | | | | | | | | |

| Comprehensive loss | | $ | (3,822,798 | | | $ | (6,028,290 | ) | | $ | (5,949,121 | ) | | $ | (8,154,613 | ) |

| | | | | | | | | | | | | | | | | |

| Net loss per share | | $ | (0.11 | ) | | $ | (0.18 | ) | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | September 30, 2007 | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Shareholders’ Equity | | $ | 3,809,037 | | | $ | 3,805,807 | | | | | | | | | |

On August 9, 2007, the Company entered into a loan agreement with Silver Global S.A., a corporation organized and operating under the laws of the Republic of Panama (the “debtor”) for the amount of $80,000, payable on demand. The debtor pays the Company interest on the principal at 5% per annum.

Equipment consists of the following:

| | | September 30, 2007 | |

| | | (Unaudited) | |

| Exploration equipment | | $ | 16,411 | |

| Office equipment | | | 5,445 | |

| Vehicles | | | 27,194 | |

| | | | | |

| Total | | | 49,050 | |

| Less: accumulated depreciation | | | 7,583 | |

| | | | | |

| Equipment, net | | $ | 41,467 | |

EMPIRE MINERALS CORP. AND SUBSIDIARIES

(FORMERLY KNOWN AS XACORD CORP.)

(AN EXPLORATION COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2007

(UNAUDITED)

Equipment is stated at cost less accumulated depreciation. Depreciation is computed using the straight-line method over the estimated useful lives of the assets. Depreciation expense amounted to $7,488, $0 and $7,488 for the nine months ended September 30, 2007, the period from inception (March 1, 2006) through September 30, 2006 and the period from inception (March 1, 2006) through September 30, 2007, respectively. Accumulated depreciation for the equipment amounted to $7,583 as of September 30, 2007.

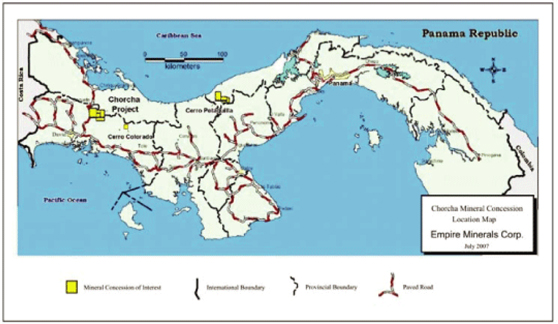

Cuprum Resources Corp. (“Cuprum”) — In March 2007, the Company, Bellhaven Copper & Gold, Inc. (“Bellhaven”) and Cuprum entered into an Exploration Development Agreement (“Agreement”). The Agreement grants the Company an option to acquire up to 75% of the authorized and outstanding stock of Cuprum, the holder of a Mineral Concession from the Republic of Panama on a copper prospect located in the Republic of Panama. The Agreement calls for the Company to pay Cuprum or Bellhaven $2,000,000 in annual installments of $500,000 each beginning in March 2007, issue Bellhaven shares of the Company’s common stock as valued under an escrow agreement with a total value of $4,000,000 and further investments totaling $15,000,000 to be used in exploration and development work on the copper prospect underlying Cuprum’s Mineral Concession. Currently, the Company owns less than 20% of Cuprum and therefore, has recorded this investment under the cost method of accounting for investments. At September 30, 2007, the Company made its first cash installment payment of $500,000, invested another $1,044,189 which was used for exploration and development work, issued 1,333,334 shares of common at $0.50 per share or $666,666. Accordingly, the Company recorded $2,210,855 as investments in the accompanying balance sheet which includes the $1,044,189 incurred in exploration and development work. The exploration and development work is made up of the project costs for the period. The project costs include drilling, general geology, camp, mobilization, geophysics, land administration, assays and shipping, helicopter, office and management expenses. The costs have been capitalized by the Company as part of the Company’s acquisition of the 75% stake in Cuprum, as per the Exploration and Development Agreement. Another 2,666,667 shares of common stock has been placed into escrow and is recorded as an offset to equity until such time as the shares are released at which time the Company will reflect an increase to both the investment and equity. Subsequent to September 30, 2007, the Company invested an additional $354,422 to be used in exploration and development work.

Zhaoyuan Dongxing Gold Mining Co., Ltd. (“Zhaoyuan Dongxing”) — The Company entered into a joint venture agreement with Zhaoyuan Dongxing Gold Minerals Co., Ltd. (“Dongxing”) to conduct gold mining activities in the PRC. The agreement calls for a total capital contribution of $500,000 from the Company. Dongxing will contribute various mining licenses and other assets such as instruments and equipment. The Company will receive a 50% equity stake in the joint venture in exchange for its $500,000 contribution. Dongxing will receive the remaining 50% stake in the joint venture in exchange for its contribution of mining licenses and other assets. The amount was due and payable when Dongxing acquired the required business license approvals in the People’s Republic of China. On December 20, 2006, the joint venture company, Zhaoyuan Dongxing was approved by the Chinese government and the business license was granted on December 21, 2006. The Company has contributed the full $500,000 capital contribution as per the joint venture agreement. The Company consolidates the financial statements of Zhaoyuan Dongxing into its financial statements because the Company exercises control over the Zhaoyuan Dongxing through its 50% ownership; additionally, the Company has the right to appoint three of the five board of director members and has control over the selection of key management personnel.

EMPIRE MINERALS CORP. AND SUBSIDIARIES

(FORMERLY KNOWN AS XACORD CORP.)

(AN EXPLORATION COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2007

(UNAUDITED)

Empire (Tianjin) Resources Co., Ltd. (“Tianjin”) — In November 2006, the Company and Tianjin Institute of Geology and Mineral Resources (“TIGMR”) signed a cooperative joint venture agreement to form Tianjin. The purpose of the joint venture is to engage in the exploration and development of gold and other mineral products in the People’s Republic of China. The agreement calls for a $1,000,000 total capital contribution. The Company obtained a 70% equity stake in the joint venture in exchange for $1,000,000. The $1,000,000 contribution is required to be paid in installments after the approval by the Chinese government. The approval and the business license were received on April 12, 2007. The Company’s made the first two installment payments of $200,000 on July 5, 2007 and $300,000 on September 5, 2007, and will make a third installment payment of $500,000 on or before February 28, 2008. TIGMR will contribute mining licenses and mineral data to the joint venture for the remaining 30% interest. As of September 30, 2007, TIGMR has not contributed mining licenses and mineral data to the joint venture. As per Amendment Number 2 entered into by the Company and TIGMR, the transfer of the licenses is required to be made on or before February 28, 2008. The term of the joint venture is 30 years beginning on April 12, 2007, the date the business license was issued. The Company has consolidated the financial statements of the joint venture into the its financial statements as the Company exercise control over the joint venture by its 70% of ownership.

| 7. | Convertible Note Payable |

| | a. | In February 2001, the Company executed a Promissory Note (“Note”) in the amount of $100,000 to Jay N. Goldberg (“Holder”). |

EMPIRE MINERALS CORP. AND SUBSIDIARIES

(FORMERLY KNOWN AS XACORD CORP.)

(AN EXPLORATION COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2007

(UNAUDITED)

See Note 3 for further discussion of this Note.

| | b. | On June 25, 2007, the Company executed a Convertible Promissory Note (“Note”) in the amount of $300,000. The Note was payable in 90 days, bearing a total of $26,000 interest during the term of the Note. The Company also incurred additional fees associated with the Note in the amount of $34,000 and warrants to purchase 300,000 shares of the Company’s common stock at an exercise price of $1.00 for a two-year term. The Note is secured by 600,000 shares of the Company’s common stock, and the Company’s interest in income generated from the operations and sales of certain identified exploration / mining leases in Panama and China. The Holder of the Note may at any time convert the principal amount for shares of the Company’s common stock at a rate of $1.00 per share. On September 19, 2007, the Company and the Holder executed an Amendment to the Note. Pursuant to the amended agreement, the maturity date was extended to December 15, 2007. In addition, the warrant granted to the holder to purchase 300,000 shares of common stock at $1.00 for a two-year term was canceled and new warrant was granted to the holder to purchase 300,000 shares of common stock at $0.65 for a two-year term. |

| | c. | On June 26, 2007, the Company executed a Convertible Promissory Note (“Note”) in the amount of $300,000. The Company received $150,000 which represents the first half of the proceeds on the same date, and the remaining $150,000 in July, 2007. The Note is payable in 120 days and bears a total of $15,000 interest during the term of the Note. The Company also incurred additional fees associated with the Note in the amount of $15,000 and 100,000 shares of the Company’s common stock. The Note is secured by 600,000 shares of the Company’s common stock, and the Company’s interest in income generated from the operations and sales of certain identified exploration / mining leases in Panama and China. The Holder of the Note may at any time convert the principal amount for shares of the Company’s Common Stock at a rate of $1.00 per share. On October 29, 2007, the Company repaid the entire principal in cash to the Note Holder. On October 30, 2007, the Company paid the Note Holder $15,000, which represented the additional fees incurred in connection with the Note. |

| | d. | On July 2, 2007, the Company executed a Convertible Promissory Note (“Note”) in the amount of $500,000. The Note is payable in 90 days and bears a total of $25,000 interest during the term of the Note. The Company also incurred additional fees associated with the Note in the amount of $25,000 and 100,000 shares of the Company’s common stock. The holder of the Note may at any time convert the principal amount for shares of the Company’s common stock at a rate of $1.00 per share. On July 5, 2007, the Company paid the interest and additional fees and issued 100,000 shares of common stock to the holder pursuant to the Note. On September 19, 2007, the Company repaid the entire principal by issuing 1,000,000 Special Warrants to the Note Holder. |

EMPIRE MINERALS CORP. AND SUBSIDIARIES

(FORMERLY KNOWN AS XACORD CORP.)

(AN EXPLORATION COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2007

(UNAUDITED)

| 8. | Related Party Transactions |

| | a. | Saddle River Associates — The Company entered into three agreements with Saddle River Associates (SRA), a shareholder in the Company. The first transaction dated March 26, 2006 relates to a one year Advisory Agreement in which SRA will provide consulting services related to locating and evaluating financing alternatives, corporate structuring and other business issues for $15,000 per month. The agreement automatically renews annually, unless either party gives 90 days notice to terminate. The Company paid SRA $135,000 for the period from inception (March 1, 2006) through December 31, 2006 and $135,000 for the nine months ended September 30, 2007, under the terms of this agreement. |

The second agreement, an Acquisition Services Agreement, dated April 9, 2006 amended December 15, 2006 and June 1, 2007 relates to additional consulting services whereby SRA will identify and introduce prospective merger entities and will assist the Company with the business aspects of the transaction. Pursuant to this agreement, SRA introduced the Company to Xacord; SRA had no relationship to Xacord prior to identifying and introducing them to the Company as a potential merger partner. The Company paid SRA $250,000 upon signing the agreement and a total of $550,000 which represents payment in full for the services as per the agreement. The related expense is included in the accompanying statement of operations. The Company was also required to issue 500,000 warrants when and if the Company obtained at least $3,000,000 in financing and for each $1,000,000 in financing received over $3 million, the Company was to issue an additional 100,000 warrants up to a total of 1,000,000 warrants. The warrants were to have a 5 year life, would vest upon grant and would be exercisable at $0.50 per share. The warrants were canceled pursuant to Amendment Number 2, executed on June 1, 2007.

Additionally, the Company entered into a third agreement with SRA in October 2006. The agreement called for consulting services to the Company on a month to month basis, for $5,000 per month, prior to the merger between the Company and its subsidiary. This agreement was terminated on the date of the merger, February 21, 2007. The accompanying consolidated balance sheet includes the accrued consulting fees to SRA for the period, October 1, 2006 to February 21, 2007 totaling $23,750.

| | b. | Chief Financial Officer — The Company’s Chief Financial Officer (“CFO”) provided consulting services to the Company prior to the merger to assist in merger preparations at $5,000 per month on a month to month basis beginning in November 2006 through February 21, 2007. As of April 1, 2007, the CFO has resumed providing consulting services to the Company at $6,000 per month on a month to month basis. The services provided include the day to day financial management of the company and any related functions related to the financial operations of the Company. |

On June 18, 2007, the Company and the CFO entered into a Stock Repurchase Agreement in which the company repurchased from the CFO, 100 shares of the Company’s outstanding Series I Preferred Stock (“Preferred Shares”) held by the CFO for $10,000.

| | c. | On July 15, 2007, the Company and Euro Centro Consulting Corp (“Euro”), a shareholder of the Company entered into a consulting agreement. Pursuant to the agreement, the Company received a one-time referral services from Euro in exchange for a cash fee of $50,000 and 100,000 shares of common stock. The shares were valued at $0.50 per share, for a total amount of $50,000, which was expensed as of September 30, 2007. |

EMPIRE MINERALS CORP. AND SUBSIDIARIES

(FORMERLY KNOWN AS XACORD CORP.)

(AN EXPLORATION COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2007

(UNAUDITED)

The Company is authorized to issue 705,000,000 shares: 700,000,000 shares of $0.0001 par value common stock and 5,000,000 shares of $0.0001 par value preferred stock. As of September 30, 2007, the Company has 41,556,696 of Common Stock outstanding, including 2,666,667 shares held in escrow.

| | a. | Effective August 11, 2006, the Company amended the Articles of Incorporation as follows: Each twenty (20) shares of Common Stock then issued was automatically combined into one share of Common Stock of the Company (“20-1 reverse split”). No fractional shares or scrip representing fractions of a share were issued, but in lieu thereof, each fraction of a share that any stockholder would otherwise be entitled to receive was rounded up to the nearest whole share. As a result of the 20 to 1 reverse split, the issued number of shares of Common Stock was reduced by 88,377,055, from 93,028,479 shares of Common Stock issued prior to the 20-1 reverse split to 4,651,424 shares of Common Stock issued subsequent to the 20-1 reverse split. The rounding of fractional shares to the nearest whole share resulted in an additional 661 shares being issued to stockholders who would have been entitled to receive a fraction of a share. The total number of shares of Common Stock issued after the issuance of the rounding of fractional shares was 4,652,085. |

| | b. | Effective January 22, 2007, the Company amended the Articles of Incorporation as follows: Each twenty (20) shares of Common Stock then issued was automatically combined into one share of Common Stock of the Company (“20-1 reverse split”). No fractional shares or scrip representing fractions of a share were issued, but in lieu thereof, each fraction of a share that any stockholder would otherwise be entitled to receive was rounded up to the nearest whole share. As a result of the 20 to 1 reverse split, the issued number of shares of Common Stock was reduced by 4,419,481, from 4,652,085 to 232,604 shares of Common Stock. The rounding of fractional shares to the nearest whole share resulted in an additional 248 shares being issued to stockholders who would have been entitled to receive a fraction of a share. The total number of shares of Common Stock issued after the issuance of the rounding of fractional shares was 232,852. |

| | c. | On February 20, 2007, the Company issued 26,504,000 shares of its common stock for 26,504,000 shares of common stock, representing all of the outstanding stock of its subsidiary pursuant to the triangular merger accounted for as a reverse merger and recapitalization. Additionally, all warrants issued by the subsidiary and outstanding at the date of the mere were exchanged for warrants in the Company. Prior to the merger, the Subsidiary had entered into several agreements which accounted for the shares of common stock outstanding: |

| | (1) | Upon the formation of the Subsidiary, the founding shareholders received 6,460,000 shares of common stock for $6,460. As of September 30, 2007, the Company received $4,900 as payment for the shares. Therefore, the Company recorded subscription receivable for the amount of $1,560 at September 30, 2007 for the remaining balance. |

EMPIRE MINERALS CORP. AND SUBSIDIARIES

(FORMERLY KNOWN AS XACORD CORP.)

(AN EXPLORATION COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2007

(UNAUDITED)

| | (2) | On March 29, 2006, the Subsidiary issued managements and key consultants 8,500,000 shares for services valued at $76,500 and cash $8,500, totaling $0.01 per share. As of March 31, 2007, the Subsidiary received $8,500 in cash for payment. The Subsidiary recorded $76,500 of consulting expense during the year ended December 31, 2006. Additionally, the Subsidiary issued warrants to purchase up to a total of 5,970,000 to management and consultants. The warrants were vested upon grant, have a 3 year life, and are exercisable at $0.10 per share. Warrants to purchase up to 3,500,000 shares of common stock issued to management contained a cashless exercise provision. The eight warrants were valued at $197,587 using the Black-Scholes Option Pricing Model, using a volatility rate of 62% based on the volatility of a publicly traded exploration stage company in a similar stage of development, and a risk free rate of 4.79%. The Subsidiary recognized $197,587 of compensation expense during the year ending December 31, 2006. At September 30, 2007, four warrants with options to purchase a total of 470,000 were exercised for cash. The Subsidiary received $47,000 in cash for the exercise of the four warrants. Two warrants with options to purchase a total of up to 2,000,000 were exercised utilizing the cashless exercise provision. A total of 1,600,000 shares of common stock were issued to management in the transaction. Two warrants to purchase a total of up to 3,500,000 shares of common stock, were canceled pursuant to an Agreement for Cancellation of Warrants entered into by and between the parties. As of September 30, 2007, 300,000 warrants to purchase shares of common stock remained outstanding. |

| | (3) | During the period from April 2006 through February 19, 2007, the Subsidiary sold 7,499,000 shares of common stock at a price of $0.50 per share for cash totaling $3,749,500. |

| | (4) | During the period from January 2007 to February 2007, the Subsidiary issued 475,000 shares of its common stock to various individuals and entities in exchange for consulting services to the Subsidiary. The Company recorded consulting expenses in the amount of $237,500 in the accompanying statement of operations. |

| | (5) | On February 19, 2007, the Subsidiary issued to its President and Chief Executive Officer, 1,500,000 shares of common stock as a bonus for his services to the Subsidiary and as incentive compensation for future services. The Company recorded consulting expenses in the amount of $750,000 in the accompanying statement of operations. |

| | d. | On March 1, 2007, the Company issued 1,000,000 shares of its common stock to Silver Global, SA, a Panamanian corporation (“Silver”) pursuant to an agreement between the parties. The agreement provides that Silver will perform consulting services for the Company related to the identification, location, definition of mineral business opportunities in Panama and introductions to persons or entities holding potential acquisition properties involving Panama Mineral Concessions and related services. The Company recorded $500,000 in consulting fees in the accompanying statement of operations. |

EMPIRE MINERALS CORP. AND SUBSIDIARIES

(FORMERLY KNOWN AS XACORD CORP.)

(AN EXPLORATION COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2007

(UNAUDITED)

| | e. | On March 9, 2007, the Company issued 4,000,000 shares of Common Stock to Bellhaven Gold & Copper, Inc. (“Bellhaven”) as part of an Exploration Development Agreement entered into by and between the Company, Bellhaven and its wholly owned subsidiary, Cuprum Resources Corp (“Cuprum”) (“agreement”). The agreement grants the Company an option to acquire up to 75% of the authorized and outstanding stock of Cuprum, the holder of a Mineral Concession from the Republic of Panama on a copper prospect located in the Republic of Panama. The agreement calls for the Company to pay Cuprum or Bellhaven $2,000,000 in annual installments of $500,000 each, issue Bellhaven shares of the Company’s common stock as valued under an escrow agreement with a total value of $4,000,000 and expend $15,000,000 in exploration and development work on the copper prospect underlying Cuprum’s Mineral Concession. As per the agreement, the Company has delivered a certificate in the amount of 1,333,334 shares of common stock to Bellhaven and deposited 2,666,667 shares of its common stock into escrow. The Company has recorded $666,666 as investment on the accompanying balance sheet. |

| | f. | On April 1, 2007, the Company issued 7,925,000 shares of Common Stock to West Greenwood Foundation (“WGF”) and various entities and individuals (“designees”), pursuant to the conversion of the Convertible Promissory Note executed by the Company in February 2001 (“Note”). See Note 3 for further discussion of this stock issuance. |

| | g. | On May 4, 2007, the Company completed a Private Placement to sell 4,000,000 shares of Common Stock at a price of $0.50 per share for cash totaling $2,000,000. The transaction was completed in the form of a Restricted Equity Purchase Agreement and called for the Company to deposit the Stock Certificate representing the sold shares with a Custodial Bank selected by the purchaser. The closing date of the transaction was scheduled for 30 days from the date of the deposit of the Stock Certificate with the Custodial Bank. The agreement was initially amended to extend the closing date to August 31, 2007; the Company is formalizing an extension to November 30, 2007. Proceeds from the sale of the shares of Common Stock are due to the Company on the closing date. |

| | h. | On June 18, 2007, the Company and the Chief Financial Officer (“CFO”) entered into a Stock Repurchase Agreement in which the Company repurchased from the CFO, 100 shares of the Company’s outstanding Series I Preferred Stock (“Preferred Shares”) held by the CFO. The Preferred Shares were repurchased by the Company from the CFO for $10,000. The Preferred Shares repurchased represented the total amount of Preferred Stock issued and outstanding. Subsequent to the repurchase of the Preferred Shares, the Company filed a Certificate of Designation with the State of Delaware and canceled the Series I Preferred Stock. |

EMPIRE MINERALS CORP. AND SUBSIDIARIES

(FORMERLY KNOWN AS XACORD CORP.)

(AN EXPLORATION COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2007

(UNAUDITED)

| | i. | On June 26, 2007, the Company issued 100,000 shares of common stock as a form of payment for additional fees directly related to a Convertible Promissory Note (see Note 7c). |

| | j. | On July 2, 2007, the Company issued 100,000 shares of common stock as a form of payment for additional fees directly related to a Convertible Promissory Note (see Note 7d). |

| | k. | On July 15, 2007, the Company issued 100,000 shares of common stock to Euro Centro Consulting Corp, a shareholder, as a form of payment for additional fees for consulting service. |

| | l. | On July 31, 2007, the Company completed a Private Placement to sell 1,000,000 shares of Common Stock at a price of $0.50 per share for cash totaling $500,000. The transaction was completed in the form of a Subscription Agreement and called for the Company to issue warrants to purchase 1,000,000 shares of common stock at $1.00 per share for a 2 year term. |

| | m. | On July 15, 2007, the Company and Netzach Group, LLC (“Netzach”) a shareholder of the Company, entered into a consulting agreement. Pursuant to the agreement the Company received referral services from Netzach in exchange for 125,000 shares of common stock. The shares were valued at $0.50 per share, for a total amount of $62,000, which was expensed as of September 30, 2007. |

| | n. | From August 2007 to September 2007, the Company sold a total of 270,000 shares of common stock in the form of Subscription Agreements at $.50 per share. The total proceeds to the Company for the sale of the shares were $135,000. |

| | o. | On September 11, 2007, the Company and Openshore Holdings Limited (“Openshore”) entered into a consulting agreement for one year service term. Pursuant to the agreement, the Company received a one time consulting services from Openshore in exchange for 200,000 shares of common stock. The shares were valued at $0.50 per share, for a total amount of $100,000. For the nine months ended September 30, 2007, $5,479 has been expensed as consulting service fee. |

On June 25, 2007, the Company granted a 300,000 warrants to purchase 300,000 shares of the Company’s common stock, as a form of payment for additional fees directly related to a Convertible Promissory Note (see Note 7b). The warrant has an exercise price of $1.00 per share for a two-year term. The warrant was canceled on September 19, 2007 and a new grant was issued in the form of a warrant to purchase 300,000 shares of common stock at an exercise price of $0.65, was issued to the note holder. The fair values of the warrants were estimated at the date of grant using the Black-Scholes option-pricing model with the following assumptions:

EMPIRE MINERALS CORP. AND SUBSIDIARIES

(FORMERLY KNOWN AS XACORD CORP.)

(AN EXPLORATION COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2007

(UNAUDITED)

| Expected | | Expected | | Dividend | | Risk Free | | Grant Date |

| Life | | Volatility | | Yield | | Interest Rate | | Fair Value |

| 2 years | | 48.69% | | — | | 4.78% | | $31,641 |