The accompanying notes are an integral part of these consolidated financial statement.

| CONSOLIDATED STATEMENTS OF OPERATIONS AND OTHER COMPREHENSIVE LOSS | |

| FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2008 AND 2007 | |

| AND FROM INCEPTION (MARCH 1, 2006) TO SEPTEMBER 30, 2008 | |

| (UNAUDITED) | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | From inception | |

| | | Three months ended | | | Nine months ended | | | (March 1, 2006) | |

| | | September 30, | | | September 30, | | | to September 30, | |

| | | 2008 | | | 2007 | | | 2008 | | | 2007 | | | 2008 | |

| | | | | | | | | | | | (Restated) | | | (Restated) | |

| | | | | | | | | | | | | | | | |

| REVENUE | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | |

| COST OF SALES | | | - | | | | - | | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | | | |

| GROSS PROFIT | | | - | | | | - | | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | | | |

| RESEARCH AND DEVELOPMENT COSTS | | | 16,495 | | | | 48,140 | | | | 120,831 | | | | 323,875 | | | | 901,183 | |

| GENERAL AND ADMINISTRATIVE EXPENSES | | | 1,727,521 | | | | 903,525 | | | | 5,860,570 | | | | 3,448,936 | | | | 12,908,703 | |

| LOSS FROM EXPECTED SERVICES NOT RECEIVED | | | - | | | | - | | | | - | | | | 2,205,492 | | | | 2,205,492 | |

| LIQUIDATED DAMAGE EXPENSE | | | 69,600 | | | | - | | | | 265,650 | | | | - | | | | 265,650 | |

| | | | | | | | | | | | | | | | | | | | | |

| LOSS FROM OPERATIONS | | | (1,813,616 | ) | | | (951,665 | ) | | | (6,247,051 | ) | | | (5,978,303 | ) | | | (16,281,028 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| OTHER (EXPENSE) INCOME | | | | | | | | | | | | | | | | | | | | |

| Non-operating income (expense), net | | | - | | | | 73 | | | | (25,000 | ) | | | 10,190 | | | | (25,000 | ) |

| Interest expense, net | | | (26,785 | ) | | | 10,064 | | | | (143,014 | ) | | | 14,418 | | | | (226,565 | ) |

| Finance expense | | | (29,526 | ) | | | (82,695 | ) | | | (428,615 | ) | | | (82,695 | ) | | | (428,615 | ) |

| Total other (expense) income, net | | | (56,311 | ) | | | (72,558 | ) | | | (596,629 | ) | | | (58,087 | ) | | | (680,180 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| LOSS BEFORE PROVISION FOR INCOME TAXES | | | (1,869,927 | ) | | | (1,024,223 | ) | | | (6,843,680 | ) | | | (6,036,390 | ) | | | (16,961,208 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| PROVISION FOR INCOME TAXES | | | - | | | | - | | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | | | |

| NET LOSS | | | (1,869,927 | ) | | | (1,024,223 | ) | | | (6,843,680 | ) | | | (6,036,390 | ) | | | (16,961,208 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| OTHER COMPREHENSIVE INCOME | | | | | | | | | | | | | | | | | | | | |

| Foreign currency translation adjustment | | | 2,092 | | | | 2,687 | | | | 33,425 | | | | 8,100 | | | | 58,591 | |

| | | | | | | | | | | | | | | | | | | | | |

| COMPREHENSIVE LOSS | | $ | (1,867,835 | ) | | $ | (1,021,536 | ) | | $ | (6,810,255 | ) | | $ | (6,028,290 | ) | | $ | (16,902,617 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| LOSS PER SHARE | | | | | | | | | | | | | | | | | | | | |

| Basic and diluted loss per share | | $ | (0.03 | ) | | $ | (0.03 | ) | | $ | (0.13 | ) | | $ | (0.18 | ) | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Basic and diluted weighted average shares outstanding | | | 67,717,019 | | | | 40,029,773 | | | | 52,270,826 | | | | 33,478,825 | | | | | |

The accompanying notes are an integral part of these consolidated financial statement.

DOMINION MINERALS CORP. AND SUBSIDIARIES (FORMERLY EMPIRE MINERALS CORP.) |

| | | | | | | | | | | | | | | | | | | | | | | | ACCUMU-LATED | | | | |

| | | PREFERRED STOCK | | | COMMON STOCK | | | ESCROWED COMMON STOCK | | | | | | | | | NOT | | | ACCUMU-LATED | | | INCOME | | | | |

| | | SHARES | | PAR | | | SHARES | | | PAR | | | SHARES | | | PAR | | | CAPITAL | | | RECEIVABLE | | | RECEIVED | | | DEFICIT | | | (LOSS) | | | EQUITY | |

| Balance at inception, March 1, 2006 | | | - | | | $ | - | | | | - | | | $ | - | | | | - | | | $ | - | | | $ | - | | | $ | - | | | | | | $ | - | | | $ | - | | | $ | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Founders stock issued for cash, $0.001 per share | | | | | | | 6,460,000 | | | | 646 | | | | | | | | | | | | 5,814 | | | | (3,060 | ) | | | | | | | | | | | | | | 3,400 | |

Shares issued March 29, 2006 for $76,500 in services and $8,500 cash, at $0.01 per share | | | | | | | | | | | 8,500,000 | | | | 850 | | | | | | | | | | | | 84,150 | | | | | | | | | | | | | | | | | | | 85,000 | |

Stock sold through subscription agreements April through December 2006 at $0.50 per share | | | | | | | | | | | 5,505,000 | | | | 551 | | | | | | | | | | | | 2,751,949 | | | | | | | | | | | | | | | | | | | 2,752,500 | |

Stock issued through the exercise of warrants | | | | | | | | 20,000 | | | | 2 | | | | | | | | | | | | 1,998 | | | | | | | | | | | | | | | | | | | 2,000 | |

Stock warrants issued to employees | | | | | | | | | | | | | | | | | | | | | | | | | | | 474 | | | | | | | | | | | | | | | | | | | 474 | |

Stock warrants issued to consultants for advisory services | | | | | | | | | | | | | | | | | | | | 197,113 | | | | | | | | | | | | | | | | | | | 197,113 | |

| Foreign currency translation loss | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | (2,651 | ) | | | (2,651 | ) |

| Net loss | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | (2,123,672 | ) | | | | | | | (2,123,672 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance, December 31, 2006 | | | - | | | $ | - | | | | 20,485,000 | | | $ | 2,049 | | | | - | | | $ | - | | | $ | 3,041,498 | | | $ | (3,060 | ) | | $ | - | | | $ | (2,123,672 | ) | | $ | (2,651 | ) | | $ | 914,164 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Stock issued | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

$0.10 per share, conversion of warrants for cash | | | | 450,000 | | | | 45 | | | | | | | | | | | | 44,955 | | | | | | | | | | | | | | | | | | | | 45,000 | |

$0.10 per share, cashless conversion of warrants | | | | 1,600,000 | | | | 160 | | | | | | | | | | | | (160 | ) | | | | | | | | | | | | | | | | | | | - | |

$0.50 per share, CEO for compensation | | | | | | | | 1,500,000 | | | | 150 | | | | | | | | | | | | 749,850 | | | | | | | | | | | | | | | | | | | | 750,000 | |

| $0.50 per share, for cash | | | | | | | | | | | 1,994,000 | | | | 199 | | | | | | | | | | | | 996,801 | | | | (210,000 | ) | | | | | | | | | | | | | | | 787,000 | |

$0.50 per share, for consulting services | | | | | | | | 1,475,000 | | | | 148 | | | | | | | | | | | | 737,352 | | | | | | | | | | | | | | | | | | | | 737,500 | |

$0.50 per share, for investment in Cuprum | | | | | | | | 4,000,000 | | | | 400 | | | | (2,666,667 | ) | | | (267 | ) | | | 666,533 | | | | | | | | | | | | | | | | | | | | 666,666 | |

$0.50 per share, for conversion of notes | | | | | | | | 100,000 | | | | 10 | | | | | | | | | | | | 49,990 | | | | | | | | | | | | | | | | | | | | 50,000 | |

$0.50 per share, for services and conversion of note | | | | | | | 7,925,000 | | | | 793 | | | | | | | | | | | | 3,961,707 | | | | | | | | (1,654,167 | ) | | | | | | | | | | | 2,308,333 | |

| Shares assumed pursuant to reverse merger | | | 100 | | | | | | | | 232,696 | | | | 23 | | | | | | | | | | | | (135,230 | ) | | | | | | | | | | | | | | | | | | | (135,207 | ) |

| Repurchase preferred stock | | | (100 | ) | | | | | | | | | | | | | | | | | | | | | | | (10,000 | ) | | | | | | | | | | | | | | | | | | | (10,000 | ) |

| Warrants issued with convertible note | | | | | | | | | | | | | | | | | | | | | | | | | | | 14,276 | | | | | | | | | | | | | | | | | | | | 14,276 | |

| Proceeds on subscription receivable | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 200 | | | | | | | | | | | | | | | | 200 | |

| Foreign currency translation gain | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 5,413 | | | | 5,413 | |

| Net loss | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | (5,012,167 | ) | | | | | | | (5,012,167 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance, June 30, 2007, unaudited, Restated | | | - | | | | - | | | | 39,761,696 | | | | 3,977 | | | | (2,666,667 | ) | | | (267 | ) | | | 10,117,572 | | | | (212,860 | ) | | | (1,654,167 | ) | | | (7,135,839 | ) | | | 2,762 | | | | 1,121,178 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Proceeds on subscription receivable | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 1,300 | | | | | | | | | | | | | | | | 1,300 | |

| Stock issued | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| $0.50 per share, for cash | | | | | | | | | | | 1,320,000 | | | | 132 | | | | | | | | | | | | 659,868 | | | | 210,000 | | | | | | | | | | | | | | | | 870,000 | |

$0.50 per share, for consulting services | | | | | | | | 824,000 | | | | 82 | | | | | | | | | | | | 411,918 | | | | | | | | | | | | | | | | | | | | 412,000 | |

$0.50 per share, for loan issuance cost | | | | | | | | 700,000 | | | | 70 | | | | | | | | | | | | 349,930 | | | | | | | | | | | | | | | | | | | | 350,000 | |

| Warrants issued with convertible note | | | | | | | | | | | | | | | | | | | | | | | | | | | 53,151 | | | | | | | | | | | | | | | | | | | | 53,151 | |

| Special warrants issued | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Issued for cash | | | | | | | | | | | | | | | | | | | | | | | | | | | 2,230,000 | | | | | | | | | | | | | | | | | | | | 2,230,000 | |

Issued with convertible promissory note | | | | | | | | | | | | | | | | | | | | | | | | 500,000 | | | | | | | | | | | | | | | | | | | | 500,000 | |

| Preferred stock issued for compensation expense | | | 100 | | | | - | | | | | | | | | | | | | | | | | | | | 10,000 | | | | | | | | | | | | | | | | | | | | 10,000 | |

| Stock compensation expense | | | | | | | | | | | | | | | | | | | | | | | | | | | 594,370 | | | | | | | | | | | | | | | | | | | | 594,370 | |

| Foreign currency translation gain | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 22,404 | | | | 22,404 | |

| Net loss | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | (2,981,689 | ) | | | | | | | (2,981,689 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance, December 31, 2007 | | | 100 | | | $ | - | | | | 42,605,696 | | | $ | 4,261 | | | | (2,666,667 | ) | | $ | (267 | ) | | $ | 14,926,809 | | | $ | (1,560 | ) | | $ | (1,654,167 | ) | | $ | (10,117,528 | ) | | $ | 25,166 | | | $ | 3,182,714 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Stock issued | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| $0.46 per share, for cash | | | | | | | | | | | 21,789,566 | | | | 2,179 | | | | | | | | | | | | 9,771,021 | | | | | | | | | | | | | | | | | | | | 9,773,200 | |

$0.46 per share, for consulting services | | | | | | | | | | | 650,000 | | | | 65 | | | | | | | | | | | | 298,935 | | | | | | | | | | | | | | | | | | | | 299,000 | |

$0.46 per share, for loan issuance cost | | | | | | | | | | | 376,000 | | | | 38 | | | | | | | | | | | | 187,962 | | | | | | | | | | | | | | | | | | | | 188,000 | |

Special warrants converted to stock | | | | | | | | | | | 2,015,000 | | | | 200 | | | | | | | | | | | | (200 | ) | | | | | | | | | | | | | | | | | | | - | |

| Release of escrow shares | | | | | | | | | | | | | | | | | | | 1,333,334 | | | | 133 | | | | 666,534 | | | | | | | | | | | | | | | | | | | | 666,667 | |

| Shares issued to extend convertible note | | | | | | | | | | | 250,000 | | | | 25 | | | | | | | | | | | | 124,975 | | | | | | | | | | | | | | | | | | | | 125,000 | |

| Shares issued as employee compensation | | | | | | | | | | | 5,216,666 | | | | 522 | | | | | | | | | | | | 2,581,144 | | | | | | | | | | | | | | | | | | | | 2,581,666 | |

Special warrants issued Issued for cash | | | | | | | | | | | | | | | | | | | | | | | | | | | 77,500 | | | | | | | | | | | | | | | | | | | | 77,500 | |

| Stock compensation expense | | | | | | | | | | | | | | | | | | | | | | | | | | | 947,536 | | | | | | | | | | | | | | | | | | | | 947,536 | |

| Stock option expense | | | | | | | | | | | | | | | | | | | | | | | | | | | 50,870 | | | | | | | | | | | | | | | | | | | | 50,870 | |

| Warrants issued for services | | | | | | | | | | | | | | | | | | | | | | | | | | | 29,668 | | | | | | | | | | | | | | | | | | | | 29,668 | |

| Foreign currency translation gain | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 33,425 | | | | 33,425 | |

| Net loss | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | (6,843,680 | ) | | | | | | | (6,843,680 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance, September 30, 2008, unaudited, Restated | | | 100 | | | $ | - | | | | 72,902,928 | | | $ | 7,290 | | | | (1,333,333 | ) | | $ | (134 | ) | | $ | 29,662,754 | | | $ | (1,560 | ) | | $ | (1,654,167 | ) | | $ | (16,961,208 | ) | | $ | 58,591 | | | $ | 11,111,566 | |

The accompanying notes are an integral part of these consolidated financial statements.

| DOMINION MINERALS CORP. AND SUBSIDIARIES | |

| (FORMERLY EMPIRE MINERALS CORP.) | |

| (AN EXPLORATION COMPANY) | |

| CONSOLIDATED STATEMENTS OF CASH FLOWS | |

| FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2008 AND 2007 AND FROM INCEPTION (MARCH 1, 2006) TO SEPTEMBER 30, 2008 | |

| | | | | | | | | | |

| (UNAUDITED) | |

| | | | | | | | | From inception | |

| | | Nine months ended | | | (March 1, 2006) | |

| | | September 30, | | | to September 30, | |

| | | 2008 | | | 2007 | | | 2008 | |

| | | | | | (Restated) | | | (Restated) | |

| | | | | | | | | | |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | | | | | | | |

| Net loss | | $ | (6,843,680 | ) | | $ | (6,036,390 | ) | | $ | (16,961,208 | ) |

| Adjustments to reconcile net loss to net cash | | | | | | | | | | | | |

| used in operating activities: | | | | | | | | | | | | |

| Depreciation | | | 43,221 | | | | 7,488 | | | | 52,568 | |

| Bad debt expense | | | - | | | | - | | | | 80,000 | |

| Warrants issued for services | | | 29,668 | | | | - | | | | 227,255 | |

| Amortization of debt discount | | | - | | | | 16,671 | | | | 31,641 | |

| Amortization of loan issuance cost | | | 303,615 | | | | 144,083 | | | | 509,787 | |

| Common stock issued for advisory services | | | 487,000 | | | | 1,605,479 | | | | 2,393,479 | |

| Loss from write-off of services due from note holders | | | | 2,202,262 | | | | 2,202,262 | |

| Stock option expense | | | 998,406 | | | | - | | | | 1,592,776 | |

| Common stock issued for notes | | | 125,000 | | | | - | | | | 125,000 | |

| Common stock issued for employee compensation | | | 2,581,666 | | | | - | | | | 2,581,666 | |

| Preferred stock issued for employee compensation | | | - | | | | - | | | | 10,000 | |

| Loss on currency exchange | | | - | | | | 11,080 | | | | 11,080 | |

| Change in operating assets and liabilities: | | | | | | | | | | | | |

| Prepaid expense | | | 31,987 | | | | - | | | | 31,987 | |

| Other assets | | | (21,000 | ) | | | - | | | | (21,000 | ) |

| Accrued liabilities | | | (54,538 | ) | | | (32,320 | ) | | | 474,996 | |

| Liquidated damages payable | | | 265,650 | | | | - | | | | 265,650 | |

| Net cash used in operating activities | | | (2,053,005 | ) | | | (2,081,647 | ) | | | (6,392,061 | ) |

| | | | | | | | | | | | | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | | | | | | | | | | | |

| Equipment purchase | | | (30,210 | ) | | | (4,166 | ) | | | (76,698 | ) |

| Long term investment | | | (2,820,915 | ) | | | (1,544,189 | ) | | | (4,874,529 | ) |

| Advances for notes receivable | | | - | | | | (80,000 | ) | | | (80,000 | ) |

| Net cash used in investing activities | | | (2,851,125 | ) | | | (1,628,355 | ) | | | (5,031,227 | ) |

| | | | | | | | | | | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | | | | | | | | | | |

| Proceeds from sale of common stock | | | 10,023,200 | | | | 1,632,000 | | | | 14,444,600 | |

| Proceeds from special warrants | | | 77,500 | | | | 2,068,920 | | | | 2,298,420 | |

| Proceeds from exercise of warrants | | | - | | | | 45,000 | | | | 45,000 | |

| Payment of note issuance cost | | | - | | | | (74,000 | ) | | | (74,000 | ) |

| Payment on notes payables | | | (2,300,000 | ) | | | (25,000 | ) | | | (2,625,000 | ) |

| Payment on equity transactions | | | (250,000 | ) | | | - | | | | (250,000 | ) |

| Proceeds from short term loan | | | 75,868 | | | | - | | | | 75,868 | |

| Proceeds from notes payable | | | 2,000,000 | | | | 1,105,000 | | | | 3,105,000 | |

| Proceeds from subscription receivable | | | - | | | | 1,500 | | | | 1,500 | |

| Payment to repurchase preferred stock | | | - | | | | (10,000 | ) | | | (10,000 | ) |

| Net cash provided by financing activities | | | 9,626,568 | | | | 4,743,420 | | | | 17,011,388 | |

| | | | | | | | | | | | | |

| EFFECT OF EXCHANGE RATE CHANGES ON CASH | | | 18,085 | | | | 9,933 | | | | 30,539 | |

| | | | | | | | | | | | | |

| NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS | | | 4,740,523 | | | | 1,043,351 | | | | 5,618,639 | |

| | | | | | | | | | | | | |

| CASH AND CASH EQUIVALENTS, beginning of the period | | | 878,116 | | | | 1,047,877 | | | | - | |

| | | | | | | | | | | | | |

| CASH AND CASH EQUIVALENTS, end of period | | $ | 5,618,639 | | | $ | 2,091,228 | | | $ | 5,618,639 | |

| | | | | | | | | | | | | |

| SUPPLEMENTAL DISCLOSURES: | | | | | | | | | | | | |

| Interest paid | | $ | - | | | $ | 66,024 | | | $ | 66,024 | |

| Income taxes paid | | $ | - | | | $ | - | | | $ | - | |

| Net liabilities assumed in reverse acquisition | | $ | - | | | $ | 135,207 | | | $ | 135,207 | |

| Conversion of notes and interest for common stock | | $ | - | | �� | $ | 106,071 | | | $ | 106,071 | |

| Issuance of founders stock for subscription receivable | | $ | - | | | $ | - | | | $ | 14,960 | |

| Shares issued for exploration and development of investment | | $ | 666,666 | | | $ | 666,666 | | | $ | 1,333,332 | |

| Common stock issued to prepay for consulting services | | $ | - | | | $ | - | | | $ | 69,521 | |

| Special warrants issued for repayment of convertible promissory note | | $ | - | | | $ | 500,000 | | | $ | 500,000 | |

| Warrants issued for discount on debt | | $ | - | | | $ | - | | | $ | 31,641 | |

| Warrants issued for loan issuance costs | | $ | - | | | $ | 31,641 | | | $ | 35,786 | |

| Common stock issued for loan issuance cost | | $ | 240,090 | | | $ | 100,000 | | | $ | 446,262 | |

The accompanying notes are an integral part of these consolidated financial statements.

| 1. | Nature of Business and Significant Accounting Policies |

| a. | Nature of business – Dominion Minerals Corp. (“Company”) (formerly Empire Minerals Corp.) was incorporated January 4, 1996, under the laws of the state of Delaware. The Company is engaged in the exploration of precious and base metals including gold and copper. All potential properties currently under exploration are located in the People’s Republic of China (“PRC” or “China”) and the Republic of Panama (“Panama”). |

From September 2005 to November 2007, the Company changed its name 4 times to reflect the changing business plans. The original name of the Company was ObjectSoft Corporation. In June 2005, the name was changed to Nanergy, Inc. In June 2006, the name was changed to Xacord Corp., in January 2007, the name was changed to Empire Minerals Corp, and in November 2007, the name was changed to its current name, Dominion Minerals Corp.

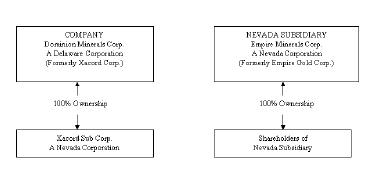

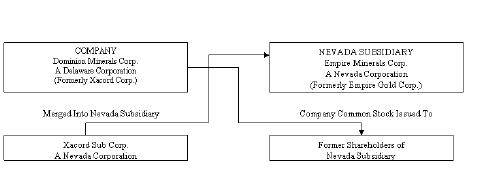

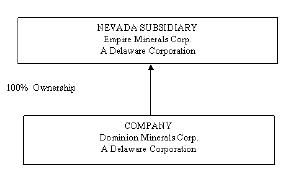

On February 20, 2007, the Company completed a triangular reverse merger with Empire Minerals Corp., a Nevada Corporation (formerly Empire Gold Corp. and referred to as “Subsidiary”) and Xacord Acquisition Sub Corp, then the Company’s subsidiary (“Xacord”). All 26,504,000 shares in the Subsidiary were exchanged for 26,504,000 shares in the Company. Additionally, 5,950,000 warrants in the Subsidiary were exchanged for 5,950,000 warrants in the Company. The Subsidiary was the accounting acquirer and the Company was the legal acquirer. The transaction was accounted for as a reverse merger and recapitalization. As such, the accompanying consolidated financial statements reflect the historical operations of the Subsidiary in the capital structure of the Company at the beginning of the first period presented herein.

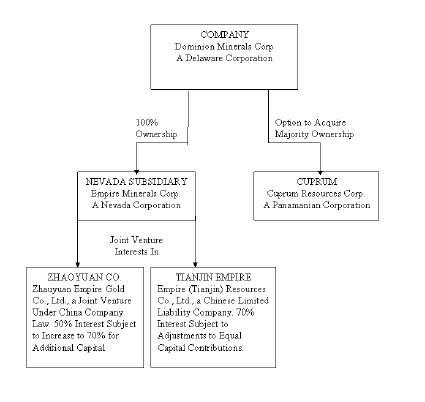

| b. | Basis of presentation – The accompanying consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America. The consolidated financial statements include the financial statements of the Company, its wholly-owned subsidiaries Empire Minerals Corp., 50% owned Zhaoyuan Dongxing Gold Mining Co., Ltd. (“Dongxing”), and 70% owned Empire (Tianjin) Resources Co., Ltd. (“Tianjin”) (together the “Subsidiaries”). All significant inter-company transactions and balances have been eliminated in consolidation. Minority interest has not been presented on the consolidated balance sheet because accumulated losses have exceeded the minority shareholders’ equity. In accordance with APB No. 18, The Equity Method of Accounting for Investments in Common Stock, the minority interest has been written down to zero on the accompanying consolidated balance sheet. |

Management has included all normal recurring adjustments considered necessary to give a fair presentation of operating results for the periods presented. Interim results are not necessarily indicative of results for a full year. The information included in these interim consolidated financial statements should be read in conjunction with information included in the Company's consolidated financial statements for the year ended December 31, 2007, appearing elsewhere and in the Company's annual report on 10-KSB filed on April 16, 2008.

DOMINION MINERALS CORP. AND SUBSIDIARIES

(FORMERLY EMPIRE MINERALS CORP.)

(AN EXPLORATION COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2008

(UNAUDITED)

The Company is currently in an exploration stage, which is characterized by significant expenditures for the examination and development of exploration opportunities by its Subsidiaries. The Subsidiaries' focus for the foreseeable future will continue to be on securing joint venture agreements within PRC and Panama to begin conducting mining operations.

| c. | Use of estimates – The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect certain reported amounts and disclosures. The significant estimates made in the preparation of the Company’s consolidated financial statements relate to the fair value of warrants and stock issued for services as well as various accruals. For example, the Company calculates the fair value of the options granted based on various assumptions. Accordingly, the actual results could materially differ from those estimates. |

| d. | Fair value of financial instruments – On January 1, 2008, the Company adopted Statement of Financial Accounting Standards (“SFAS”) No. 157, Fair Value Measurements. SFAS No. 157 defines fair value, establishes a three-level valuation hierarchy for disclosures of fair value measurement and enhances disclosures requirements for fair value measures. The carrying amounts reported in the accompanying consolidated balance sheet for current assets and current liabilities qualify as financial instruments are a reasonable estimate of fair value because of the short period of time between the origination of such instruments and their expected realization and their current market rate of interest. The three levels are defined as follows: |

| · | Level 1 inputs to the valuation methodology are quoted prices (unadjusted) for identical assets or liabilities in active markets. |

| · | Level 2 inputs to the valuation methodology include quoted prices for similar assets and liabilities in active markets, and inputs that are observable for the assets or liabilities, either directly or indirectly, for substantially the full term of the financial instruments. |

| · | Level 3 inputs to the valuation methodology are unobservable and significant to the fair value. |

The Company invested $6,207,862 to Cuprum Resources Corp. as of September 30, 2008. Since there is no quoted or observable market price for the fair value of similar investments in long term joint ventures, the Company then used the level 3 inputs for its valuation methodology. The determination of the fair value was based on the cost of the capital contributeed to the investment.

As of September 30, 2008, the Company did not identify any other assets or liabilities that are required to be presented on the consolidated balance sheet at fair value in accordance with SFAS No. 157.

DOMINION MINERALS CORP. AND SUBSIDIARIES

(FORMERLY EMPIRE MINERALS CORP.)

(AN EXPLORATION COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2008

(UNAUDITED)

SFAS No. 159 (“SFAS 159”), The Fair Value Option for Financial Assets and Financial Liabilities—including an amendment of FASB Statement No. 115, became effective for the Company on January 1, 2008. SFAS 159 provides the Company with the irrevocable option to elect fair value for the initial and subsequent measurement for certain financial assets and liabilities on a contract-by-contract basis with the difference between the carrying value before election of the fair value option and the fair value recorded upon election as an adjustment to beginning retained earnings. The Company chose not to elect the fair value option under SFAS 159.

| e. | Cash and cash equivalents – For purposes of the statements of cash flows, the Company defines cash equivalents as all highly liquid debt instruments purchased with original maturities of three months or less. |

| f. | Advances – From time to time, the Company advances funds to its consultants and business partners to further the Company’s business plans. Management monitors these advances to ensure appropriate progress is made pursuant to the funding terms. Additionally, management evaluates the collectibility of these monies and records reserves if collections are in doubt. |

| g. | Concentration of risk – Financial instruments, which potentially subject the Company to concentrations of credit risk, consist of cash and cash equivalents. The Company maintains cash deposits in financial institutions that exceed the amounts insured by the U.S. government. Balances at financial institutions or state-owned banks within the PRC are not covered by insurance. Non-performance by these institutions could expose the Company to losses for amounts in excess of insured balances. The Company has limited experience as it is an exploration stage company but does not anticipate incurring any losses related to this credit risk. As of September 30, 2008, the Company’s bank balances exceeded government-insured limits by $5,426,145. |

The Company has gold mining activities in PRC and an investment in copper mining activities in Panama. Accordingly, the Company’s mining business, financial condition and results of operations may be influenced by the political, economic and legal environments in the PRC and Panama, and by the general state of the PRC’s and Panama’s economy. The Company’s operations in the PRC and investments in Panama are subject to specific considerations and significant risks not typically associated with companies in the United States. These include risks associated with, among others, the political, economic and legal environments and foreign currency exchange. The Company’s results may be adversely affected by changes in governmental policies with respect to laws and regulations, anti-inflationary measures, currency conversion and remittance abroad, and rates and methods of taxation, among other things.

| h. | Net loss per share – In accordance with SFAS No. 128 (“SFAS 128”), Earnings Per Share, an basic earnings/loss per common share (“EPS”) is computed by dividing net loss for the period by the weighted average number of common shares outstanding during the period. Under SFAS 128, diluted earnings/loss per share is computed similar to basic loss per share except that the denominator is increased to include the number of additional common shares that would have been outstanding if the potential common shares had been issued and dilutive. |

DOMINION MINERALS CORP. AND SUBSIDIARIES

(FORMERLY EMPIRE MINERALS CORP.)

(AN EXPLORATION COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2008

(UNAUDITED)

The following is a reconciliation of the basic and diluted loss per share computations:

| Three months ended September 30, | | 2008 | | | 2007 | |

| Net loss | | $ | 1,869,927 | | | $ | 1,024,223 | |

| | | | | | | | | |

| Weighted average shares used in basic computation | | | 67,717,019 | | | | 40,029,773 | |

| Diluted effect of stock options, warrants | | | - | | | | - | |

| Weighted average shares used in diluted computation | | | 67,717,019 | | | | 40,029,773 | |

| | | | | | | | | |

| Losses per share: | | | | | | | | |

| Basic | | $ | 0.03 | | | $ | 0.03 | |

| Diluted | | $ | 0.03 | | | $ | 0.03 | |

| | | | | | | | | |

All warrants and options were excluded from the diluted loss per share due to the anti-diluted effect.

| Nine months ended September 30, | | 2008 | | | 2007 | |

| | | | | | (Restated) | |

| Net loss | | $ | 6,843,680 | | | $ | 6,036,390 | |

| | | | | | | | | |

| Weighted average shares used in basic computation | | | 52,270,826 | | | | 33,478,825 | |

| Diluted effect of stock options and warrants | | | - | | | | - | |

| Weighted average shares used in diluted computation | | | 52,270,826 | | | | 33,478,825 | |

| | | | | | | | | |

| Losses per share: | | | | | | | | |

| Basic | | $ | 0.13 | | | $ | 0.18 | |

| Diluted | | $ | 0.13 | | | $ | 0.18 | |

| | | | | | | | | |

All warrants and options were excluded from the diluted loss per share due to the anti-dilutive effect.

| i. | Income Taxes – The Company provides for income taxes under SFAS No. 109 (“SFAS 109”), Accounting for Income Taxes, which requires the recognition of deferred tax assets and liabilities for the expected future tax consequences of temporary differences between the carrying amounts and the tax bases of assets and liabilities using the enacted income tax rate expected to apply to taxable income in the period in which the deferred tax assets or liabilities are expected to be settled or realized. SFAS 109 requires that a valuation allowance be established if necessary, to reduce the deferred tax assets to the amount that management believes is more likely than not to be realized. The provision for federal income tax differs from that computed amount by applying federal statutory rates to income before federal income tax expense mainly due to expenses that are not deductible and income that is not taxable for federal income taxes, including permanent differences such as non-deductible meals and entertainment. |

DOMINION MINERALS CORP. AND SUBSIDIARIES

(FORMERLY EMPIRE MINERALS CORP.)

(AN EXPLORATION COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2008

(UNAUDITED)

The Company adopted FASB Interpretation 48 (“FIN 48”), Accounting for Uncertainty in Income Taxes, on January 1, 2007. A tax position is recognized as a benefit only if it is “more likely than not” that the tax position would be sustained in a tax examination, with a tax examination being presumed to occur. The amount recognized is the largest amount of tax benefit that is greater than 50% likely of being realized on examination. For tax positions not meeting the “more likely than not” test, no tax benefit is recorded. The adoption had no effect on the Company’s consolidated financial statements.

| j. | Stock-based compensation – For stock, options and warrants issued to service providers, employees and founders, the Company follows SFAS No. 123(R), Share-Based Payment, and EITF 96-18, Accounting for Equity Instruments That Are Issued to Other Than Employees for Acquiring, or in Conjunction with Selling, Goods or Services, which requires recording the options and warrants at the fair value of the service provided and expensing over the related service period. |

| k. | Recently issued accounting pronouncements |

In December 2007, the Financial Accounting Standards Board (“FASB”) issued SFAS No. 160 (“SFAS 160”), Noncontrolling Interests in Consolidated Financial Statements - an amendment of Accounting Research Bulletin No. 51, which establishes accounting and reporting standards for ownership interests in subsidiaries held by parties other than the parent, the amount of consolidated net income attributable to the parent and to the noncontrolling interest, changes in a parent’s ownership interest and the valuation of retained non-controlling equity investments when a subsidiary is deconsolidated. SFAS 160 also establishes reporting requirements that provide sufficient disclosures that clearly identify and distinguish between the interests of the parent and the interests of the non-controlling owners. SFAS 160 is effective for fiscal years beginning after December 15, 2008. The Company has not yet determined the impact that SFAS 160 will have on its consolidated financial statements.

In December 2007, SFAS No. 141(R) (“SFAS 141R”), Business Combinations, was issued. SFAS 141R replaces SFAS No. 141, Business Combinations. SFAS 141R retains the fundamental requirements in SFAS 141 that the acquisition method of accounting (which SFAS 141 called the purchase method) be used for all business combinations and for an acquirer to be identified for each business combination. SFAS 141R requires an acquirer to recognize the assets acquired, the liabilities assumed, and any noncontrolling interest in the acquiree at the acquisition date, measured at their fair values as of that date, with limited exceptions. This replaces SFAS 141’s cost-allocation process, which required the cost of an acquisition to be allocated to the individual assets acquired and liabilities assumed based on their estimated fair values. SFAS 141R also requires the acquirer in a business combination achieved in stages (sometimes referred to as a step acquisition) to recognize the identifiable assets and liabilities, as well as the noncontrolling interest in the acquiree, at the full amounts of their fair values (or other amounts determined in accordance with SFAS 141R. SFAS 141R applies prospectively to business combinations for which the acquisition date is on or after the beginning of the first annual reporting period beginning on or after December 15, 2008. Early adoption is prohibited. The Company is currently evaluating the impact that adopting SFAS 141R will have on its consolidated financial statements.

DOMINION MINERALS CORP. AND SUBSIDIARIES

(FORMERLY EMPIRE MINERALS CORP.)

(AN EXPLORATION COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2008

(UNAUDITED)

In February 2008, the FASB issued FASB Staff Position No. 157-1 ("FSP 157-1"), Application of FASB Statement No. 157 to FASB Statement No. 13 and Other Accounting Pronouncements That Address Fair Value Measurements for Purposes of Lease Classification or Measurement under Statement 13. FSP 157-1 indicates that it does not apply under FASB Statement No. 13 (“SFAS 13”), Accounting for Leases, and other accounting pronouncements that address fair value measurements for purposes of lease classification or measurement under SFAS 13. This scope exception does not apply to assets acquired and liabilities assumed in a business combination that are required to be measured at fair value under SFAS No. 141 or SFAS No. 141R, regardless of whether those assets and liabilities are related to leases.

Also in February 2008, the FASB issued FASB Staff Position No. 157-2 ("FSP 157-2"), Effective Date of FASB Statement No. 157. With the issuance of FSP 157-2, the FASB agreed to: (a) defer the effective date in SFAS No. 157 for one year for certain nonfinancial assets and nonfinancial liabilities, except those that are recognized or disclosed at fair value in the financial statements on a recurring basis (at least annually), and (b) remove certain leasing transactions from the scope of SFAS No. 157. The deferral is intended to provide the FASB time to consider the effect of certain implementation issues that have arisen from the application of SFAS No. 157 to these assets and liabilities.

In March 2008, the FASB issued SFAS No. 161 (“SFAS 161”), Disclosures about Derivative Instruments and Hedging Activities – an amendment of FASB Statement No. 133, which changes the disclosure requirements for derivative instruments and hedging activities. Entities are required to provide enhanced disclosures about (a) how and why an entity uses derivative instruments, (b) how derivative instruments and related hedged items are accounted for under SFAS No. 133 and its related interpretations, and (c) how derivative instruments and related hedged items affect an entity’s financial position, financial performance and cash flows. SFAS 161 is effective for financial statements issued for fiscal years and interim periods beginning after November 15, 2008. The Company has not yet determined the impact that the application of SFAS 161 will have on its consolidated financial statements.

In May 2008, the FASB issued SFAS No. 162 (“SFAS 162”), The Hierarchy of Generally Accepted Accounting Principles. SFAS 162 identifies the sources of accounting principles and the framework for selecting the principles to be used in the preparation of financial statements of nongovernmental entities that are presented in conformity with generally accepted accounting principles (“GAAP”) in the United States (the “GAAP hierarchy”). The Company does not expect the adoption of SFAS 162 will not have a material impact on the Company’s consolidated financial statements.

DOMINION MINERALS CORP. AND SUBSIDIARIES

(FORMERLY EMPIRE MINERALS CORP.)

(AN EXPLORATION COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2008

(UNAUDITED)

In May 2008, the FASB issued SFAS No. 163 (“SFAS 163”), Accounting for Financial Guarantee Insurance Contracts, an interpretation of FASB Statement No. 60. The scope of SFAS 163 is limited to financial guarantee insurance (and reinsurance) contracts, as described in SFAS 163, issued by enterprises included within the scope of SFAS No. 60. Accordingly, SFAS 163 does not apply to financial guarantee contracts issued by enterprises excluded from the scope of SFAS No. 60 or to some insurance contracts that seem similar to financial guarantee insurance contracts issued by insurance enterprises (such as mortgage guaranty insurance or credit insurance on trade receivables). SFAS No. 163 also does not apply to financial guarantee insurance contracts that are derivative instruments included within the scope of SFAS No. 133, Accounting for Derivative Instruments and Hedging Activities. The Company does not expect the application of SFAS 163 will have a material impact on the Company’s consolidated financial statements.

In May 2008, the FASB issued FASB Staff Position No. APB 14-1 ("FSP APB 14-1"), Accounting for Convertible Debt Instruments That May Be Settled in Cash upon Conversion (Including Partial Cash Settlement). FSP APB 14-1 clarifies that convertible debt instruments that may be settled in cash upon conversion (including partial cash settlement) are not addressed by paragraph 12 of APB Opinion No. 14, Accounting for Convertible Debt and Debt Issued with Stock Purchase Warrants. Additionally, FSP APB 14-1 specifies that issuers of such instruments should separately account for the liability and equity components in a manner that will reflect the entity's nonconvertible debt borrowing rate when interest cost is recognized in subsequent periods. FSP APB14-1 is effective for financial statements issued for fiscal years beginning after December 15, 2008, and interim periods within those fiscal years. The Company is currently evaluating the impact that FSP APB 14-1 will have on its consolidated results of operations or consolidated financial position

In June 2008, the FASB issued Emerging Issues Task Force (“EITF”) Issue 07-5 (“EITF No. 07-5”) Determining whether an Instrument (or Embedded Feature) is indexed to an Entity’s Own Stock. EITF No. 07-5 is effective for financial statements issued for fiscal years beginning after December 15, 2008, and interim periods within those fiscal years. Early application is not permitted. Paragraph 11(a) of SFAS No. 133, Accounting for Derivatives and Hedging Activities, specifies that a contract that would otherwise meet the definition of a derivative but is both (a) indexed to the company’s own stock and (b) classified in stockholders’ equity in the statement of financial position would not be considered a derivative financial instrument. EITF No.07-5 provides a new two-step model to be applied in determining whether a financial instrument or an embedded feature is indexed to an issuer’s own stock and thus able to qualify for the SFAS No. 133 paragraph 11(a) scope exception. Management is currently evaluating the impact of adoption of EITF No. 07-5 on the accounting for the convertible notes and related warrants transactions.

DOMINION MINERALS CORP. AND SUBSIDIARIES

(FORMERLY EMPIRE MINERALS CORP.)

(AN EXPLORATION COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2008

(UNAUDITED)

In June 2008, FASB issued EITF Issue No. 08-4 (“EITF No. 08-4”), Transition Guidance for Conforming Changes to Issue No. 98-5. The objective of EITF No.08-4 is to provide transition guidance for conforming changes made to EITF No. 98-5, Accounting for Convertible Securities with Beneficial Conversion Features or Contingently Adjustable Conversion Ratios, that result from EITF No. 00-27, Application of Issue No. 98-5 to Certain Convertible Instruments, and SFAS No. 150, Accounting for Certain Financial Instruments with Characteristics of both Liabilities and Equity. This Issue is effective for financial statements issued for fiscal years ending after December 15, 2008. Early application is permitted. The Company’s management is currently evaluating the impact of adoption of EITF No. 07-5 on the accounting for the convertible notes and related warrants transactions.

On October 10, 2008, the FASB issued FSP 157-3, Determining the Fair Value of a Financial Asset When the Market for That Asset Is Not Active, which clarifies the application of SFAS 157 in a market that is not active and provides an example to illustrate key considerations in determining the fair value of a financial asset when the market for that financial asset is not active. FSP 157-3 became effective on October 10, 2008, and its adoption did not have a material impact on the Company’s consolidated financial position or results of operations for the quarter ended September 30, 2008.

| l. | Property and equipment – Property and equipment is stated at cost and is depreciated using the straight-line method over their estimated useful lives. Major renewals are charged to the property and equipment accounts while replacements, maintenance and repairs, which do not improve or extend the respective lives of the assets, are expensed currently. The estimated useful lives of property and equipment are as follows: |

| | | Useful lives |

| Exploration equipment | | 5 years |

| Office equipment | | 5 years |

| Vehicles | | 5 years |

| m. | Impairment for long lived assets – SFAS No. 144 (“SFAS 144”), Accounting for the Impairment or Disposal of Long−Lived Assets requires that long−lived assets to be disposed of by sale, including those of discontinued operations, be measured at the lower of carrying amount or fair value, less cost to sell, whether reported in continuing operations or in discontinued operations. SFAS 144 broadens the reporting of discontinued operations to include all components of an entity with operations that can be distinguished from the rest of the entity and that will be eliminated from the ongoing operations of the entity in a disposal transaction. SFAS 144 also establishes a "primary−asset" approach to determine the cash flow estimation period for a group of assets and liabilities that represents the unit of accounting for a long−lived asset to be held and used. The Company determined that no impairment issues exist as of September 30, 2008. |

| n. | Foreign currency translation – The reporting currency of the Company is the US dollar. Dongxing and Tianjin use their local currency, the Chinese Renminbi (“RMB”), as their functional currency. Results of operations and cash flows are translated at average exchange rates during the period, assets and liabilities are translated at the unified exchange rate as quoted by the People’s Bank of China at the end of the period, and equity is translated at the historical exchange rates. |

DOMINION MINERALS CORP. AND SUBSIDIARIES

(FORMERLY EMPIRE MINERALS CORP.)

(AN EXPLORATION COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2008

(UNAUDITED)

| | Translation adjustments amounted to $58,591 gain as of September 30, 2008. Asset and liability accounts at September 30, 2008, were translated at 6.84 RMB to $1.00. Equity accounts were stated at their historical rate. The average translation rates applied to income statement accounts and cash flows for the nine months ended September 30, 2008 and 2007, and from inception (March 1, 2006) to September 30, 2008 were 6.97 RMB, 7.65 RMB and 7.51 RMB to $1.00, respectively. In accordance with SFAS No. 95, Statement of Cash Flows, cash flows from the Company's operations is calculated based upon the local currencies using the average translation rates. Because cash flows are translated at average translation rates for the period, amounts reported on the consolidated statements of cash flows will not necessarily agree with changes in the corresponding balances on the consolidated balance sheet. |

| | Transaction gains and losses that arise from exchange rate fluctuations on transactions denominated in a currency other than the functional currency are included in the results of operations as incurred. |

The Company is an exploration stage company and therefore has had no revenues or cash flows from operations. The Company has an accumulated deficit of approximately $17.0 million as of September 30, 2008 and has insufficient sources of cash to execute its business plan, raising substantial doubt about its ability to continue as a going concern. In response to these conditions, management is continuing to seek both debt and equity financing from various sources, although there are no guarantees that they will be successful in their endeavors. No adjustment has been made to the accompanying financial statements as a result of this uncertainty.

| 3. | Restatement – Conversion of Promissory Note, Issuance of Common Stock, Litigation and Partial Recovery of Common Stock Shares issued |

As discussed in the Company’s Report on Form 8-K filed on April 22, 2009, the Company has concluded, based on further review, that it should restate the accounting for the issuance of 7,925,000 shares of its common stock under agreements entered into on April 1, 2007 for the conversion of a promissory note, previously issued by the Company and discussed below. The transaction was previously reported as the conversion of the outstanding balance of the promissory note, including accrued interest, of $106,071, at that carrying value, into 7,925,000 shares of the Company’s common stock, representing a conversion price of $0.013 per share. The Company has concluded that the accounting for the transaction should have been recorded at the fair value of the common stock issued and the Company should have recognized the value of services that, at that time, the Company expected to receive from the holders of the promissory note. The Company has not received the services that it expected to receive and on December 23, 2008, the Company filed suit in the Supreme Court of the State of New York, seeking return of the shares issued and other relief. On February 11, 2009, the Company entered into a Settlement Agreement of that suit, as a result of which a total of 3,308,333 of the 7,925,000 shares originally issued will be returned to the Company or otherwise cancelled and the Company will make payments aggregating $63,230 to the defendants, as more fully discussed below. Reflecting the terms of the Settlement Agreement, the Company has restated its financial statements to record the shares issued at their estimated fair value and to recognize a loss of $2,205,492 as of April 1, 2007, the date of the agreements under which the shares were issued, as discussed below.

DOMINION MINERALS CORP. AND SUBSIDIARIES

(FORMERLY EMPIRE MINERALS CORP.)

(AN EXPLORATION COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2008

(UNAUDITED)

On February 14, 2001, the Company (which was then known as ObjectSoft Corporation) executed the promissory note (the “Note”) in the amount of $100,000 to Jay N. Goldberg (the “Original Holder”). The Note, which was due on March 16, 2001 (the “Maturity Date”), accrued interest at 12% per annum and, in the event of default, accrued interest at 20% per annum. The principal plus all accrued and unpaid interest was payable in cash on the Maturity Date or, at the option of the holder, was convertible into equity securities of the Company to be issued to certain institutional investors in a proposed private placement expected to be completed at or prior to the Maturity Date.

On May 30, 2001, the Company and the Original Holder executed an Allonge and Amendment to Promissory Note, amending the Maturity Date to December 31, 2001. The Original Holder also waived any Events of Default that may have occurred and agreed to cooperate with the Company in a potential restructuring of the Company or other transaction pursuant to which the terms of the Note may be restructured. This restructuring was unsuccessful. In July 2001, ObjectSoft filed a Bankruptcy Petition in the Bankruptcy Court for the District of New Jersey and, in November of 2004, emerged from the Bankruptcy filing with no assets and a single liability for the principal amount of the Note of $100,000. None of our present officers, directors or employees were associated with us at the time of, or involved in any way in, the bankruptcy proceeding.

On November 16, 2004, the Original Holder executed an “Assignment and Endorsement of Note” and assigned all of the Original Holder’s right, title and interest in and to the Note, to Securities Acquisition New York, LLC (“SANY”). Prior to June 2006, with the agreement of the then management of the Company, SANY converted $32,300 of the principal amount of the Note into 807,500 shares of common stock of the Company (as adjusted for subsequent stock splits), at an effective conversion price of $0.04 per share. On October 26, 2006, SANY executed an “Agreement of Assignment of Note” and assigned all of their right, title and interest in and to the Note to West Greenwood Foundation (“WGF”). On the date of assignment, the principal balance was $67,700 and the amount of accrued interest was $28,170.

DOMINION MINERALS CORP. AND SUBSIDIARIES

(FORMERLY EMPIRE MINERALS CORP.)

(AN EXPLORATION COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2008

(UNAUDITED)

As described in Note 7a, the Company previously entered into consulting agreements with Saddle River Associates (“SRA”) for general business consulting and financial advisory services. SRA introduced the Company to Xacord Corporation (as ObjectSoft was then known), which entity had originally issued the Note and with whom we completed the reverse triangular merger on February 20, 2007 (see Note 1a). In addition, SRA advised the Company of the opportunity to invest in the Exploration and Development Agreement with Bellhaven Copper & Gold, Inc., which Agreement is described in Note 5.

Following our reverse triangular merger on February 20, 2007 (see Note 1a), on April 1, 2007, WGF and various entities and individuals (“designees”), which designees simultaneously purchased various interests in the Note from WGF, requested to convert the outstanding balance of the Note of $106,071 ($67,700 of principle and $38,371 of accrued interest) into 7,925,000 shares of our common stock, representing a conversion rate of approximately $0.013 per share. The Company was advised by SRA that these designees would be able to provide the Company with expertise and assistance to further the development of the Company’s Panamanian Exploration and Development Agreement with Bellhaven. Consequently, the Company agreed to the conversion and the Note was cancelled.

Over time, the Company has become aware that the designees did not possess the expertise necessary to provide the services that the Company expected that it would receive to assist it with its Panamanian operations. On December 23, 2008, the Company filed suit in the Supreme Court of the State of New York, against SRA, WGF and the designees, seeking return of the shares issued for conversion of the Note and other relief. The written agreements related to conversion of the Note did not refer to the provision of any services by the holders of the Note and the defendants asserted that no such agreement related to future services existed. Notwithstanding that assertion, the defendants agreed to return a portion of the shares issued and on February 11, 2009, the Company entered into a Settlement Agreement with the defendants. The Company concluded that it was in its best interests to accept the terms of the Settlement Agreement, rather than continue to litigate the matter. As a result of the Settlement Agreement, of the 7,925,000 shares originally issued, 1,000,000 shares will be cancelled and a further 2,308,333 shares (one-third of the remaining shares issued of 6,925,000) will be returned to the Company. The Company will make payments aggregating $63,230 to the defendants, representing (1) payment of principal and interest on the Note from April 2007 to the date of the Settlement Agreement for that portion of the Note for which shares are being returned and (2) outstanding consulting fees due to SRA of $25,000.

DOMINION MINERALS CORP. AND SUBSIDIARIES

(FORMERLY EMPIRE MINERALS CORP.)

(AN EXPLORATION COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2008

(UNAUDITED)

The Company originally accounted for the conversion of the Note based on the written terms of the agreements with WGF and the designees and recorded the common shares issued at the carrying amount of the note. However, to reflect the company’s expectation that it would also receive future services in addition to the conversion of the Note, the 7,925,000 shares issued should have been recorded at their fair value. On April 1, 2007, the closing price of the Company’s common stock was $2.50 per share. Although the Company’s common stock is publically traded, the trading volume is small; during the two year period ended December 31, 2007, the total trading volume of our common stock was less than 250,000 shares. In various private placements of the Company’s common stock that occurred between April 2006 and October 2007, the Company sold an aggregate of 12,819,000 shares of its common stock for cash, each placement at a price of $0.50 per share. Because the 7,925,000 shares issued represents a number of shares substantially in excess of the Company’s historical trading volume, the Company believes that the price of $0.50 per share at which it has effected private placements is a more reasonable estimate of fair value for the 7,925,000 shares issued than the quoted market price. Accordingly, the Company has restated its financial statements for the period ended June 30, 2007 and all subsequent periods to reflect the April 2007 issuance of the 7,925,000 shares at a fair value of $0.50 per share or an aggregate of $3,962,500.

As discussed above, the written terms of the Note provide for conversion only if a private placement was completed at or prior to maturity of the Note on December 31, 2001. The Note bears interest at 12% and accordingly the carrying value of the Note together with accrued interest at the date of conversion is considered to be a reasonable approximation of the fair value of the Note as of that date. In relation to the services that the Company expected to receive from the designees, EITF Issue 96-18 provides that the fair value of shares issued to non-employees for services to be performed should be determined as of the earlier of the date at which a commitment for performance by the counterparty to earn the shares is reached or the date at which their performance is complete. EITF Issue 00-18 further provides that where there are no specific performance criteria required by the recipient in order to retain the shares issued, a measurement date has been reached and the shares should be valued as of the date of the agreement. The Company expected that the designees would provide their services over the multi-year life of the Company’s Panamanian operations but no specific performance criteria were established. Accordingly, the Company has valued the services it expected to receive based on the fair value of the common shares at the time they were issued, which as discussed above has been estimated at $0.50 per share. The difference of $3,856,429 between the fair value of the shares issued of $3,962,500 and the carrying value of the Note at the date of conversion of $106,071, which carrying value is considered to be a reasonable approximation of its fair value at that date, has been allocated as the value of the services the Company expected to receive.

The Company has not received the services that it expected to receive when the shares were issued and as a result of the Settlement Agreement, the Company has recorded a loss of $2,205,492 as of April 1, 2007, reflecting the fair value of the shares that will not be returned to the Company or cancelled as a result of the Settlement Agreement, together with the amounts to be paid by the Company under the Settlement Agreement, offset by $60,000 previously recorded by the Company for amounts outstanding under the Company’s previous consulting agreements with SRA. At June 30, 2007, the value of the shares issued on April 1, 2007 but subsequently cancelled or returned to the Company as a result of the Settlement Agreement have been recorded as contra-equity. The affect of restatement of the Company’s financial statements as of September 30, 2007 as described above was as follows:

| | | Nine Months Ended September 30, 2007 | | | From inception (March 1, 2006) to September 30, 2008 | |

| | | As Previously Reported | | | As Restated | | | As Previously Reported | | | As Restated | |

| | | | | | | | | | | | | |

| Loss from expected services not received | | | - | | | $ | 2,205,492 | | | | - | | | $ | 2,205,492 | |

| | | | | | | | | | | | | | | | | |

| Loss from operations | | $ | (3,772,811 | ) | | $ | (5,978,303 | ) | | $ | (14,075,536 | ) | | $ | (16,281,028 | ) |

| | | | | | | | | | | | | | | | | |

| Loss before provision for income taxes | | | (3,830,898 | ) | | | (6,036,390 | ) | | | (14,755,716 | ) | | | (16,961,208 | ) |

| | | | | | | | | | | | | | | | | |

| Net loss | | $ | (3,830,898 | ) | | $ | (6,036,390 | ) | | $ | (14,755,716 | ) | | $ | (16,961,208 | ) |

| | | | | | | | | | | | | | | | | |

| Comprehensive loss | | $ | (3,822,798 | | | $ | (6,028,290 | ) | | $ | (14,697,125 | ) | | $ | (16,902,617 | ) |

| | | | | | | | | | | | | | | | | |

| Net loss per share | | $ | (0.11 | ) | | $ | (0.18 | ) | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | September 30, 2007 | | | December 31, 2007 | |

| | | | | | (Restated) | |

| | | | | | | | | | | | | | | | | |

| Shareholders’ Equity | | $ | 3,809,037 | | | $ | 3,805,807 | | | $ | 3,185,944 | | | $ | 3,182,714 | |

DOMINION MINERALS CORP. AND SUBSIDIARIES

(FORMERLY EMPIRE MINERALS CORP.)

(AN EXPLORATION COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2008

(UNAUDITED)

| 4. | Property and Equipment |

Property and equipment consist of the following at September 30, 2008 and December 31, 2007:

| | | September 30, 2008 | | | December 31, 2007 | |

| Exploration equipment | | $ | - | | | $ | 17,110 | |

| Office equipment | | | 28,727 | | | | 4,843 | |

| Vehicles | | | - | | | | 28,352 | |

| Total | | | 28,727 | | | | 50,305 | |

| Less: accumulated depreciation | | | 994 | | | | 9,588 | |

| Property and equipment, net | | $ | 27,733 | | | $ | 40,717 | |

Depreciation expenses amounted to $43,221, $7,488 and $52,568 for the nine months ended September 30, 2008 and 2007, and for the period from inception (March 1, 2006) through September 30, 2008, respectively.

Cuprum Resources Corp. (“Cuprum”) – In March 2007, the Company, Bellhaven Copper & Gold, Inc. (“Bellhaven”) and Cuprum entered into an Exploration Development Agreement (“Agreement”). The Agreement grants the Company an option to acquire up to 75% of the authorized and outstanding stock of Cuprum, the holder of a Mineral Concession from Panama on a copper prospect located in Panama. The Agreement calls for the Company to pay Cuprum or Bellhaven $2,000,000 in annual installments of $500,000 each beginning in March 2007, issue Bellhaven 4,000,000 shares of the Company’s common stock under an escrow agreement and further cash investments totaling $15,000,000 to be used in exploration and development work on the copper prospect underlying Cuprum’s Mineral Concession. Currently, the Company owns less than 20% of Cuprum and therefore, has recorded this investment under the cost method of accounting for investments. As of September 30, 2008, the Company has made its first two cash installment payments of $500,000, invested another $3,874,528 which was used for exploration and development work, and issued 2,666,667 shares of common stock at $0.50 per share or $1,333,334. Accordingly, the Company recorded $6,207,862 as investments in the accompanying balance sheet which includes the $3,874,528 incurred in exploration and development work. The exploration and development work is made up of the project costs for the period. The project costs include drilling, general geology, camp, mobilization, geophysics, land administration, assays and shipping, helicopter, office and management expenses. The costs have been capitalized by the Company as part of the Company’s acquisition of the 75% stake in Cuprum, as per the Agreement. Another 1,333,333 shares of common stock has been placed into escrow and are recorded as shares in escrow until such time as the shares are released at which time the Company will reflect an increase to both the investment and equity.

| | Zhaoyuan Dongxing Gold Mining Co., Ltd. (“Zhaoyuan Dongxing”) – The Company entered into a joint venture agreement with Zhaoyuan Dongxing Gold Mining Co., Ltd. (“Dongxing”) to conduct gold mining activities in the PRC. The agreement calls for a total capital contribution of $500,000 from the Company. Dongxing will contribute various mining licenses and other assets such as instruments and equipment. The Company will receive a 50% equity stake in the joint venture in exchange for its $500,000 contribution. Dongxing will receive the remaining 50% stake in the joint venture in exchange for its contribution of mining licenses and other assets. The amount was due and payable when Dongxing acquired the required business license approvals in PRC. On December 20, 2006, the joint venture company, Zhaoyuan Dongxing, was approved by the Chinese government and the business license was granted on December 21, 2006. The Company has contributed the full $500,000 capital contribution as per the joint venture agreement. The Company consolidates the financial statements of Zhaoyuan Dongxing into its financial statements because the Company exercises control over the Zhaoyuan Dongxing through its 50% ownership; additionally, the Company has the right to appoint three of the five board of director members and has control over the selection of key management personnel. |

DOMINION MINERALS CORP. AND SUBSIDIARIES

(FORMERLY EMPIRE MINERALS CORP.)

(AN EXPLORATION COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2008

(UNAUDITED)

| | Empire (Tianjin) Resources Co., Ltd. (“Tianjin”) – In November 2006, the Company and Tianjin Institute of Geology and Mineral Resources (“TIGMR”) signed a cooperative joint venture agreement to form Tianjin. The purpose of the joint venture is to engage in the exploration and development of gold and other mineral products in PRC. The agreement calls for a $1,000,000 total capital contribution. The Company obtained a 70% equity stake in the joint venture in exchange for $1,000,000. The $1,000,000 contribution is required to be paid in installments after the approval by the Chinese government. The approval and the business license were received on April 12, 2007. The Company’s made the first two installment payments of $200,000 on July 5, 2007 and $300,000 on September 5, 2007, and was required to make a third installment of $500,000 on or before May 30, 2008. TIGMR was required to contribute mining licenses and mineral data to the joint venture for the remaining 30% interest per Amendment Number 2, by May 30, 2008. As of September 30, 2008, TIGMR had not transferred the licenses and therefore the Company did not transfer the third installment into Tianjin. The Company and TIGMR are currently negotiating an extension for the transfer of the licenses. The term of the joint venture is 30 years beginning on April 12, 2007, the date the business license was issued. The Company has consolidated the financial statements of the joint venture into the its financial statements as the Company exercise control over the joint venture by its 70% of ownership. |

| 6. | Convertible Note Payable and Short Term Loan |

| a. | In February 2001, the Company executed a Promissory Note (“Promissory Note”) in the amount of $100,000 to Jay N. Goldberg (“Holder”). See Note 3 for further discussion on this Note. |

| b. | On June 25, 2007, the Company executed a Convertible Promissory Note (“Convertible Promissory Note”) in the amount of $300,000. The Convertible Promissory Note was payable in 90 days, bearing a total of $26,000 interest during the term of the note. The Company also incurred additional fees associated with the Convertible Promissory Note in the amount of $34,000 and warrants to purchase 300,000 shares of the Company’s common stock at an exercise price of $1.00 for a two-year term. This note is secured by 600,000 shares of the Company’s common stock, and the Company’s interest in income generated from the operations and sales of certain identified exploration / mining leases in Panama and PRC. The Holder of the Convertible Promissory Note may at any time convert the principal amount for shares of the Company’s common stock at a rate of $1.00 per share. On September 19, 2007, the Company and the Holder executed an Amendment to the note. Pursuant to the amended agreement, the maturity date was extended to December 15, 2007. In addition, the warrant granted to the Holder to purchase 300,000 shares of common stock at $1.00 for a two-year term was canceled and new warrant was granted to the Holder to purchase 300,000 shares of common stock at $0.65 for a two-year term. On December 15, 2007, the Company and the Holder executed Amendment 2 to Convertible Promissory Note (“Amendment 2”). Pursuant to Amendment 2, the interest rate became 9% and the maturity date was extended to May 31, 2008. Additionally, the Company issued the Holder 600,000 shares of common stock at $0.65 per share. On January 28, 2008, the Company repaid $100,000 of the principal. On July 16, 2008, the Company paid the remaining principal balance of $200,000 plus an additional amount of $69,000, however, the 200,000 shares of common stock relating to late fees pursuant to the Amendment has not been issued as of September 30, 2008. |

DOMINION MINERALS CORP. AND SUBSIDIARIES

(FORMERLY EMPIRE MINERALS CORP.)

(AN EXPLORATION COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2008

(UNAUDITED)

| c. | On June 26, 2007, the Company executed another Convertible Promissory Note in the amount of $300,000. The Company received $150,000 which represents the first half of the proceeds on the same date and the remaining $150,000 in July 2007. This note is payable in 120 days and bears a total of $15,000 interest during the term of the note. The Company also incurred additional fees associated with the note in the amount of $15,000 and 100,000 shares of the Company’s common stock. The note is secured by 600,000 shares of the Company’s common stock, and the Company’s interest in income generated from the operations and sales of certain identified exploration / mining leases in Panama and China. The Holder of the note may at any time convert the principal amount for shares of the Company’s common stock at a rate of $1.00 per share. On October 29, 2007, the Company repaid the entire principal in cash to the Note Holder. On October 30, 2007, the Company paid the Note Holder $15,000, which represented the additional fees incurred in connection with the note. |

| d. | On July 2, 2007, the Company executed a Convertible Promissory Note in the amount of $500,000. This note is payable in 90 days and bears a total of $25,000 interest during the term of the note. The Company also incurred additional fees associated with the note in the amount of $25,000 and 100,000 shares of the Company’s common stock. The holder of the note may at any time convert the principal amount for shares of the Company’s common stock at a rate of $1.00 per share. On July 5, 2007, the Company paid the interest and additional fees and issued 100,000 shares of common stock to the holder pursuant to the note. On September 19, 2007, the Company repaid the entire principal by issuing 1,000,000 Special Warrants to the Note Holder. |

| e. | On January 22, 2008, the Company executed a Convertible Promissory Note in the amount of $350,000. This note is payable in 30 days and bears interest at a rate of 6% per annum. The Company also incurred additional fees associated with the note in the amount of $33,000. The Holder may at any time convert the principal amount for shares of the Company’s common stock at a rate of $1.00 per share. On February 22, 2008, the Company and the Holder executed an Amendment to the note (“Amendment”). Pursuant to the Amendment, the maturity date was extended to May 31, 2008 (“Amended Maturity Date”), bearing interest at a rate of 6% per annum. On April 25, 2008, the Company and the Holder executed Amendment No. 2 to the note (“Amendment 2”). Pursuant to Amendment 2, the maturity date was extended to July 31, 2008 (“Amended Maturity Date 2”), bearing interest at a rate of 6% annum. The Company also incurred additional fees associated with Amendment 2 in the amount 250,000 shares of the Company’s common stock, which approximated $125,000. On July 22, 2008, the Company paid the full amount of principal to the Note Holder to satisfy the note. |

DOMINION MINERALS CORP. AND SUBSIDIARIES

(FORMERLY EMPIRE MINERALS CORP.)

(AN EXPLORATION COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2008

(UNAUDITED)

| f. | Loan Payable – On March 10, 2008, the Company entered into a Loan Agreement in the amount of $1,650,000 with Balstone Investments Ltd. The loan bears interest at a rate of 3-monthly LIBOR (approximately 4.6% at March 10, 2008) plus 1% and is payable in full on September 11, 2008. As security for the prompt and complete payment of the loan, a personal guarantee was granted by the Chief Executive Officer of the Company including a share charge over the Chief Executive Officer’s entire shareholding in the Company. On July 28, 2008, the Company paid the full balance of the loan and interest due to Balstone Investments Ltd. |

| | Total interest expense for the above convertible notes payable and short term loans for the three months ended September 30, 2008 and 2007, and for the nine months ended September 30, 2008 and 2007, and from inception (March 1, 2006) to September 30, 2008 amounted to $35,772 and $0, $158,130 and $0, and $285,180, respectively. |

| 7. | Related Party Transactions |

| a. | Saddle River Associates – The Company entered into three agreements with Saddle River Associates (“SRA”), a shareholder in the Company. The first transaction dated March 26, 2006 relates to a one year Advisory Agreement in which SRA will provide consulting services related to locating and evaluating financing alternatives, corporate structuring and other business issues for $15,000 per month. The agreement automatically renews annually, unless either party gives 90 days notice to terminate. The Company did not pay any amounts to SRA for the nine months ended September 30, 2008, however certain amounts were paid in cash in accordance with the agreement through to November 2007. On April 15, 2008 the Company canceled the agreement. |

| | The second agreement, an Acquisition Services Agreement, dated April 9, 2006 amended on December 15, 2006 and June 1, 2007, relates to additional consulting services whereby SRA will identify and introduce prospective merger entities and will assist the Company with the business aspects of the transaction. Pursuant to this agreement, SRA introduced the Company to Xacord; SRA had no relationship to Xacord prior to identifying and introducing them to the Company as a potential merger partner. The Company paid SRA $250,000 upon signing the agreement and a total of $550,000 which represents payment in full for the services as per the agreement. The related expense is included in the accompanying consolidated statement of operations. The Company was also required to issue 500,000 warrants when and if the Company obtained at least $3,000,000 in financing and for each $1,000,000 in financing received over $3,000,000, the Company was to issue an additional 100,000 warrants up to a total of 1,000,000 warrants. The warrants were to have a 5 year life, would vest upon grant, and would be exercisable at $0.50 per share. The warrants were canceled pursuant to Amendment Number 2, executed on June 1, 2007. |

Additionally, the Company entered into a third agreement with SRA in October 2006. The agreement called for consulting services to the Company on a month to month basis, for $5,000 per month, prior to the merger between the Company and its subsidiary. This agreement was terminated on the date of the merger, February 21, 2007.

DOMINION MINERALS CORP. AND SUBSIDIARIES

(FORMERLY EMPIRE MINERALS CORP.)

(AN EXPLORATION COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2008

(UNAUDITED)

| b. | Chief Financial Officer – The Company’s Chief Financial Officer (“CFO”) provided consulting services to the Company prior to the merger to assist in merger preparations at $5,000 per month on a month to month basis beginning in November 2006 through February 21, 2007. As of April 1, 2007, the CFO resumed providing consulting services to the Company at $8,000 per month on a month to month basis. The services provided include the day to day financial management of the company and any other functions related to the financial operations of the Company. |

On June 18, 2007, the Company and the CFO entered into a Stock Repurchase Agreement in which the Company repurchased from the CFO, 100 shares of the Company’s outstanding Series I Preferred Stock (“Preferred Shares”) held by the CFO for $10,000.

| c. | Euro Centro Consulting Corp. – The Company entered into 2 agreements with Euro Centro Consulting Corp. (“Euro”), as shareholder in the Company. For the first transaction dated July 15, 2007, the Company and Euro entered into a consulting agreement. Pursuant to the agreement, the Company received one-time referral services from Euro in exchange for a cash fee of $50,000 and 100,000 shares of common stock. The shares were valued at $0.50 per share, for a total amount of $50,000, which was expensed for the year ended December 31, 2007. |

Under the terms of the second transaction dated November 2, 2007, the Company received a one-time referral services from Euro in exchange for a cash fee of $50,000 and 10,000 shares of common stock. The shares were valued at $0.50 per share, for a total amount of $5,000 which was expensed for the year ended December 31, 2007.