Investor Presentation August 2019

Safe Harbor Statement The matters discussed in this presentation may constitute or include projections or other forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, the provisions of which the Company is availing itself. Certain forward-looking statements can be identified by the use of forward-looking terminology, such as 'believes', 'expects', 'may', 'will', 'could', 'should', 'seeks', 'approximately', 'intends', 'plans', 'estimates', or 'anticipates', or the negative thereof or other comparable terminology, or by discussions of strategy, plans, objectives, intentions, estimates, forecasts, outlook, assumptions, or goals. In particular, statements regarding future operations or results, including those set forth in this presentation, and any other statement, express or implied, concerning future operating results or the future generation of or ability to generate revenues, income, net income, profit, EBITDA, EBITDA margin, or cash flow, including to service debt, and including any estimates, forecasts or assumptions regarding future revenues or revenue growth, are forward-looking statements. Forward looking statements also include estimated project start date, anticipated revenues, and contract options which may or may not be awarded in the future. Forward looking statements involve risks, including those associated with the Company's fixed price contracts that impacts profits, unforeseen productivity delays that may alter the final profitability of the contract, cancellation of the contract by the customer for unforeseen reasons, delays or decreases in funding by the customer, levels and predictability of government funding or other governmental budgetary constraints and any potential contract options which may or may not be awarded in the future, and are the sole discretion of award by the customer. Past performance is not necessarily an indicator of future results. In light of these and other uncertainties, the inclusion of forward-looking statements in this presentation should not be regarded as a representation by the Company that the Company's plans, estimates, forecasts, goals, intentions, or objectives will be achieved or realized. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. The Company assumes no obligation to update information contained in this document whether as a result of new developments or otherwise. Please refer to the Company's Annual Report on Form 10-K, filed on March 27, 2019, which is available on its website at www.oriongroupholdingsinc.com or at the SEC's website at www.sec.gov, for additional and more detailed discussion of risk factors that could cause actual results to differ materially from our current expectations, estimates or forecasts. 2

Core Values Consistent with Strategy We take pride in our personal We are committed to performing workmanship and that of the entire assigned tasks in the most efficient, organization; we are committed to timely and cost effective manner; ensuring that each task is properly we expect employees to safeguard performed the first time’ and we will company assets; and we always act continuously improve upon everything in the best interest of the company we do, every day Quality Production We are responsible and accountable for Safety Integrity The foundation of our success rests our own personal safety; we are equally upon integrity; we view integrity as our responsible for the safety of all our ability to be honest, ethical, sincere coworkers and any others we come into and forthright in our dealings with contact with; and we are authorized to others; we will apply the foundation of and obligated to stop work whenever an integrity in everything we do; and unsafe condition, or situation is observed when the Company makes a commitment, that commitment must be kept 3

Company Overview Orion Group Holdings, Inc., a leading NYSE: ORN Marine Concrete specialty construction company, provides services in the Headquarters: Houston, Texas Infrastructure, Industrial, and Building sectors through its marine # of Employees: ~2,500 construction segment and its 47% 53% 72% 28% concrete construction segment in the Market Cap: $135 million continental United States, Alaska, Canada and the Caribbean Basin. Average project duration: 6-9 Months Q2’19 LTM Q2’19 Revenue Backlog Book value per share $4.56 Services Customers Competition Financials • Broad range of • Federal, State, Municipal • Highly fragmented market • $533. 2 MM Revenue TTM marine construction including Governments • Barriers to entry • $14.6 MM Adj. EBITDA TTM marine transportation facility (45% of Revenue in Q2’19) construction and dredging services • Local, regional, and • $661 MM Backlog (6/30/19) • Private commercial and national competitors • Concrete construction services industrial clients including light commercial, structural (55% of Revenue in Q2’19) and industrial services 4

Investment Highlights • Diverse end markets with favorable macro trends • Unique turnkey project capabilities • Specialized fleet of equipment creates barriers to entry and a competitive advantage • Positive free cash flow for over 10 consecutive years • Operational transformation underway focused on significantly improved, sustainable profitability 5

Attractive Geographic Footprint = Headquarters 6

Favorable Macro Drivers Across Business Segments Marine Concrete • Port expansions and maintenance • Institutional developments and expansion • Downstream energy • Structural developments • Bridges and causeways • Recreational developments • Marine Infrastructure • Industrial developments • Coastal Rehabilitation 7

Marine Segment Capabilities Marine Transportation • Port Facility • Bulkheads • Piers • Docks • Wharves • Military Installations • Dry Bulk Terminals • Marinas Facility Construction • Cruise Ship Terminals • Liquid Cargo Terminals • Container Terminals • Marine Construction • Intracoastal Waterway • Port Expansion Dredging Services • Wildlife Refuge Creation Maintenance • Port Depending • Electric Capabilities • Reclamation • Beach Nourishment • Hurricane Restoration • Shoreline Protection • Wetlands Creation • Erosion Control Marine Environmental • Environmental Remediation • Concrete Mattress • Levee installation Structures • GeoTube® Installation Installation • Sea-Grass Bed Creation Marine Pipeline • Pipeline Anchoring • Cool Water Intakes • Velocity Control • Outfalls • Communication Pipeline • Effluent Discharge Outfalls Structures • Hot-taps Construction • Tie-ins • Intakes • Transmission Pipelines • Jetting • Risers • Heavy Lift • Inspections • Encapsulation Specialty Services • Diving • Demolition • Repair • Towing • Surveying • Salvage 8

Fleet of Specialized Marine Equipment Over 300 Vessels & Pieces of Equipment • 45 spud and material barges • 7 cutter suction dredges • 24 tug and push boats • 2 portable dredges -200 pieces of • 49 crawler and hydraulic cranes other equipment $2.44 book value per share Estimated Replacement Spud Barges Value of over $200 million Cranes and Other Dredge Fleet Tug and Push Boats Equipment 9

Commercial Concrete Construction Overview One of the largest Texas-based Concrete Contractors • Concrete construction primarily driven by population growth • Houston and Dallas/FW are two of the Top 10 growing metro MSA’s in U.S. • Significant market share in Houston • Expanded to D/FW market in 2014 • Expanded to Austin market in 2017 • Provides turnkey services covering all phases of commercial concrete construction • Acquired in 2015 10

Breadth of Concrete Services and Resources Provides Services Across Three Avenues: • Light Commercial – Horizontally poured concrete, tilt-walls, trenches, rebar installation, and pumping services • Structural – Elevated concrete pouring, including columns, elevated beams, and structural walls • Industrial – Warehouses, manufacturing plants, water treatment facilities, and refineries 150 – 4,000 > 12 Yr. - 90% Avg. Project/Yr. Completed Projects Avg. Customer Tenure Repeat Business 11

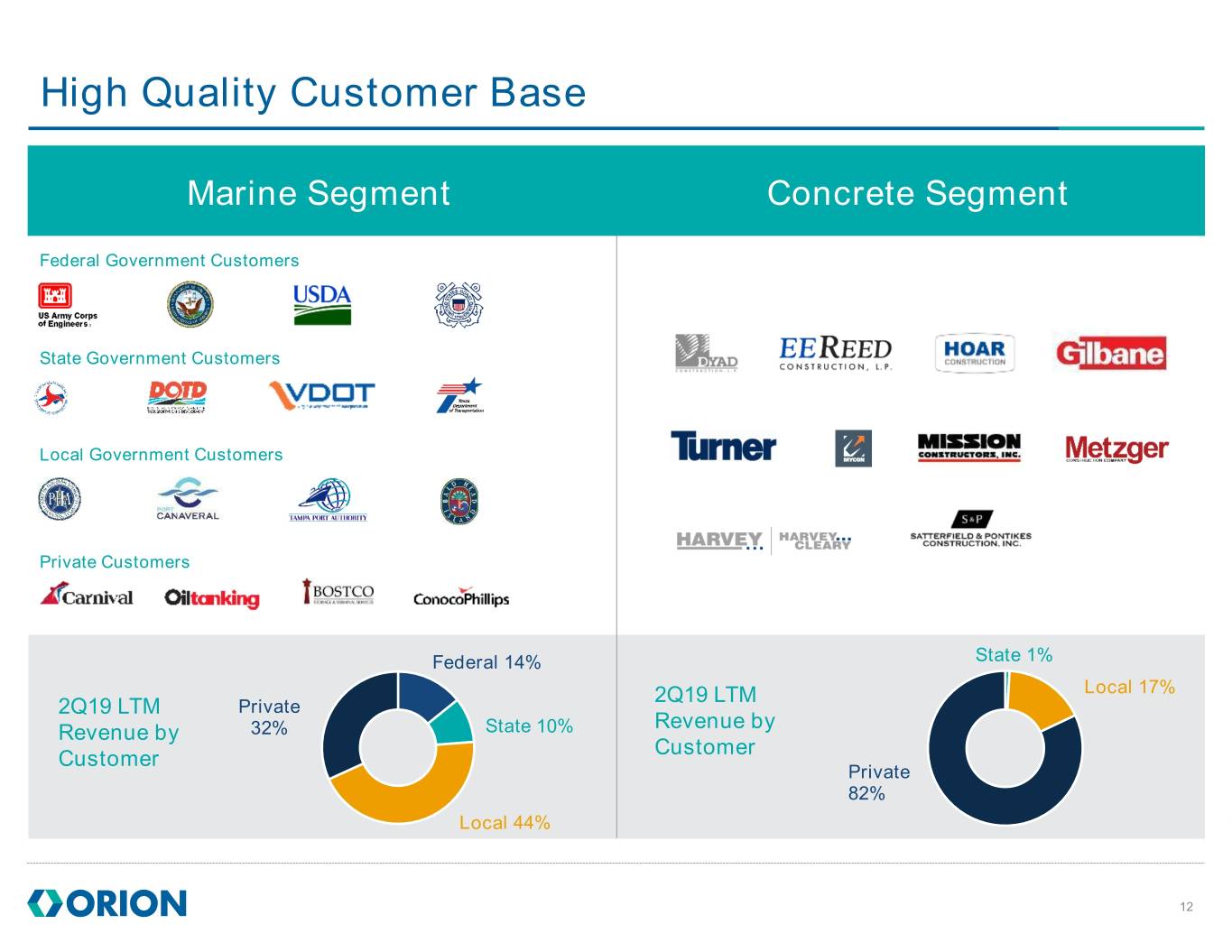

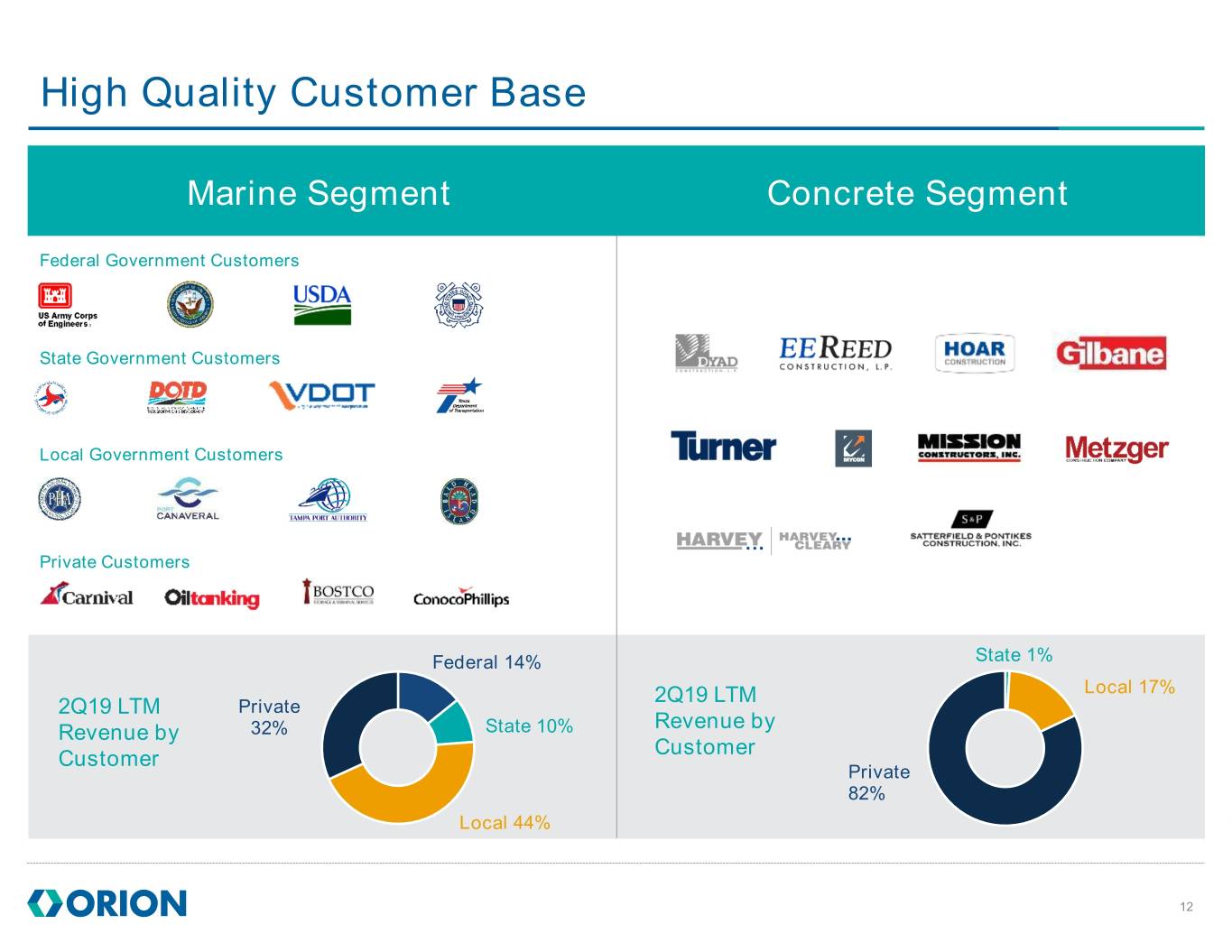

High Quality Customer Base Marine Segment Concrete Segment Federal Government Customers State Government Customers Local Government Customers Private Customers Federal 14% State 1% 2Q19 LTM Local 17% 2Q19 LTM Private Revenue by Revenue by 32% State 10% Customer Customer Private 82% Local 44% 12

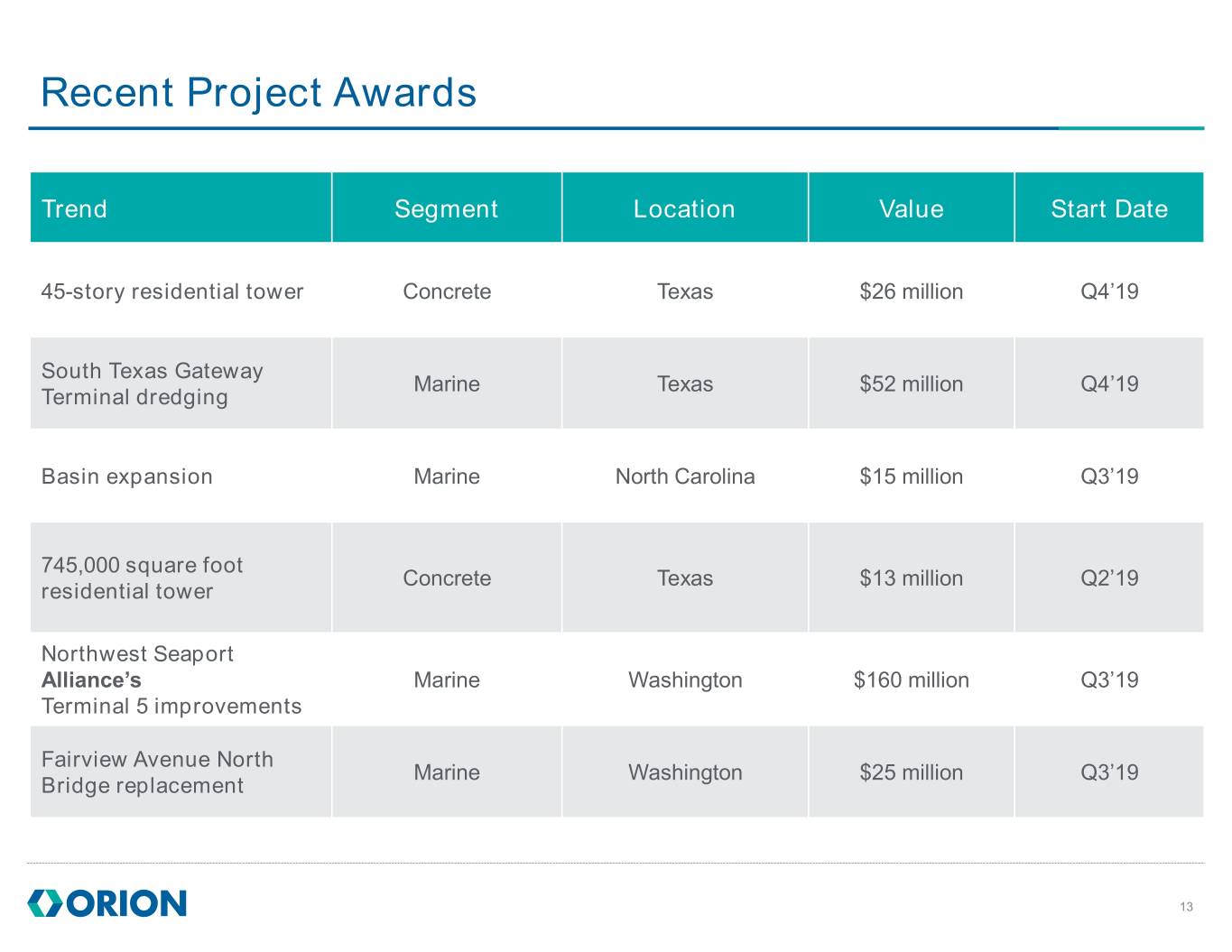

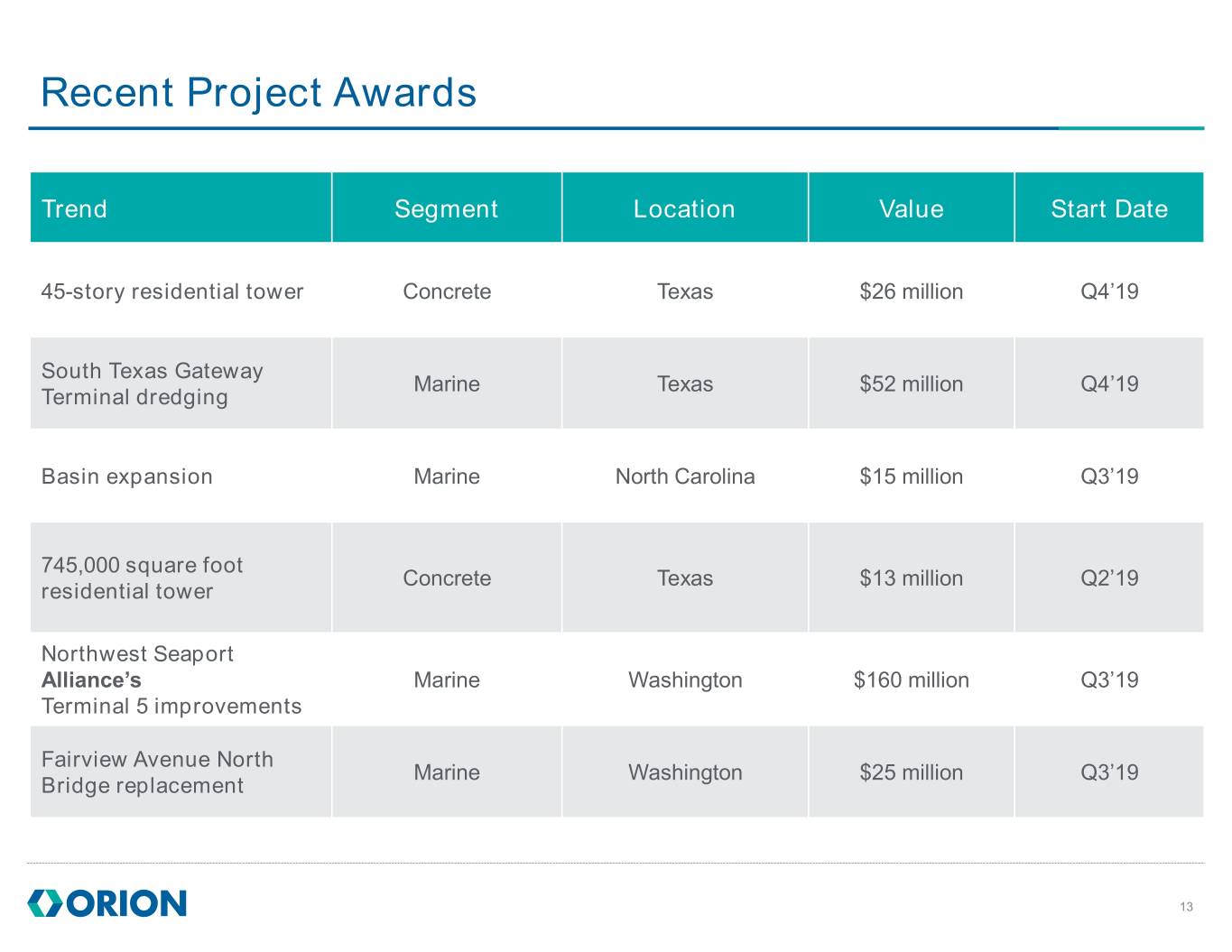

Recent Project Awards Trend Segment Location Value Start Date 45-story residential tower Concrete Texas $26 million Q4’19 South Texas Gateway Marine Texas $52 million Q4’19 Terminal dredging Basin expansion Marine North Carolina $15 million Q3’19 745,000 square foot Concrete Texas $13 million Q2’19 residential tower Northwest Seaport Alliance’s Marine Washington $160 million Q3’19 Terminal 5 improvements Fairview Avenue North Marine Washington $25 million Q3’19 Bridge replacement 13

Backlog at Record Levels Concrete Marine $700.00 $661.0 $600.00 $500.00 $434.0 $441.0 477.0 $400.00 $357.6 $360.6 257.0 $300.00 280.7 194.3 177.0 $200.00 $100.00 163.3 153.3 183.6 184.0 184.0 $0.00 2015 2016 2017 2018 Q2'2019 *All numbers in Millions 14

Expansion In Industrial Sector Orion Capabilities Service Existing New Structural Excavations & Backfill “ Foundations (Drive, Piles, Pile Caps, Footings, Piers) The industrial sector represents a broad range of Form/Concrete/Rebar Columns/Pipe Supports/Walls opportunities for our company. By leveraging our Slab-on-grade and Paving skill sets and customer base, we are expanding Elevated Concrete our addressable markets to provide high-quality Hoisting services to meet more of our customers needs. Utilities, Waterproofing & Coatings (1) (1) Represents scopes of work that will be subcontracted. 15

Expansion in Industrial Sector • Orion is geographically well positioned to capture Positive Industry Fundamentals share of industrial market Trend Significance • The industrial sector represents a broad range of opportunities that leverages the talent and • The rapid increase in America’s hydrocarbon skill sets of both the Marine and Concrete output combined with aging facilities will drive growth and investment in the sector segments, while extending our offerings to current Petrochemical • According to the American Chemistry Council, customers capital spending is expected to reach $70 billion annually by 2021 Example Customer Types • Aging infrastructure, high utilization rates and the structural cost advantage of domestic refiners will continue to fuel investment in the space Refinery • Of the 140 refineries operating today, approximately 90% are between 40 and 120 years old • Production of fertilizers, herbicides and pesticides for agriculture is driven by increasing demand for food production Chemical • 65% of agrichemical facilities in the U.S. are 45 years old or older driving ongoing maintenance and investment • Vast natural gas reserves in the U.S. have created a price advantage, driving major investments in domestic LNG facilities LNG • Several new facilities are scheduled for construction in Orion’s coverage area that will require ongoing maintenance and expansion 16

Invest, Scale, and Grow Transformation Underway Labor Management Equipment Management Project Execution Corporate Processes • Enhanced management • Improve management • Enhance management • Utilized outside resources reporting to improve reporting to benefit: training to review our workflow project labor efficiency equipment scheduling, processes • Improve data analytics for repair and maintenance • Advanced resource project selection process • Enhanced or upgraded planning and project expenditures, capital personnel in key positions • Enhance productivity continuity to minimize expenditures and dispositions of reporting tools and push • Implementing a shared unassigned/unabsorbed for standardization services platform to labor underutilized equipment between our locations eliminate duplication of • Will reduce our net efforts and costs equipment expense and • Improve oversight improve margin processes consistency 17

Recent Annual Results ($ in thousands) 2016 2017 2018 Contract Revenues $578,236 $578,553 $ 520,894 Operating Income $4,074 $1,538* ($39,811)** Adjusted EBITDA $38,295 $31,070 $24,036 Adjusted EPS $0.19 ($0.14) ($0.37) Operating Cash Flows $23,149 $34,133 $21,931 * Harvey impacts ** Weather, project adjustment impacts 18

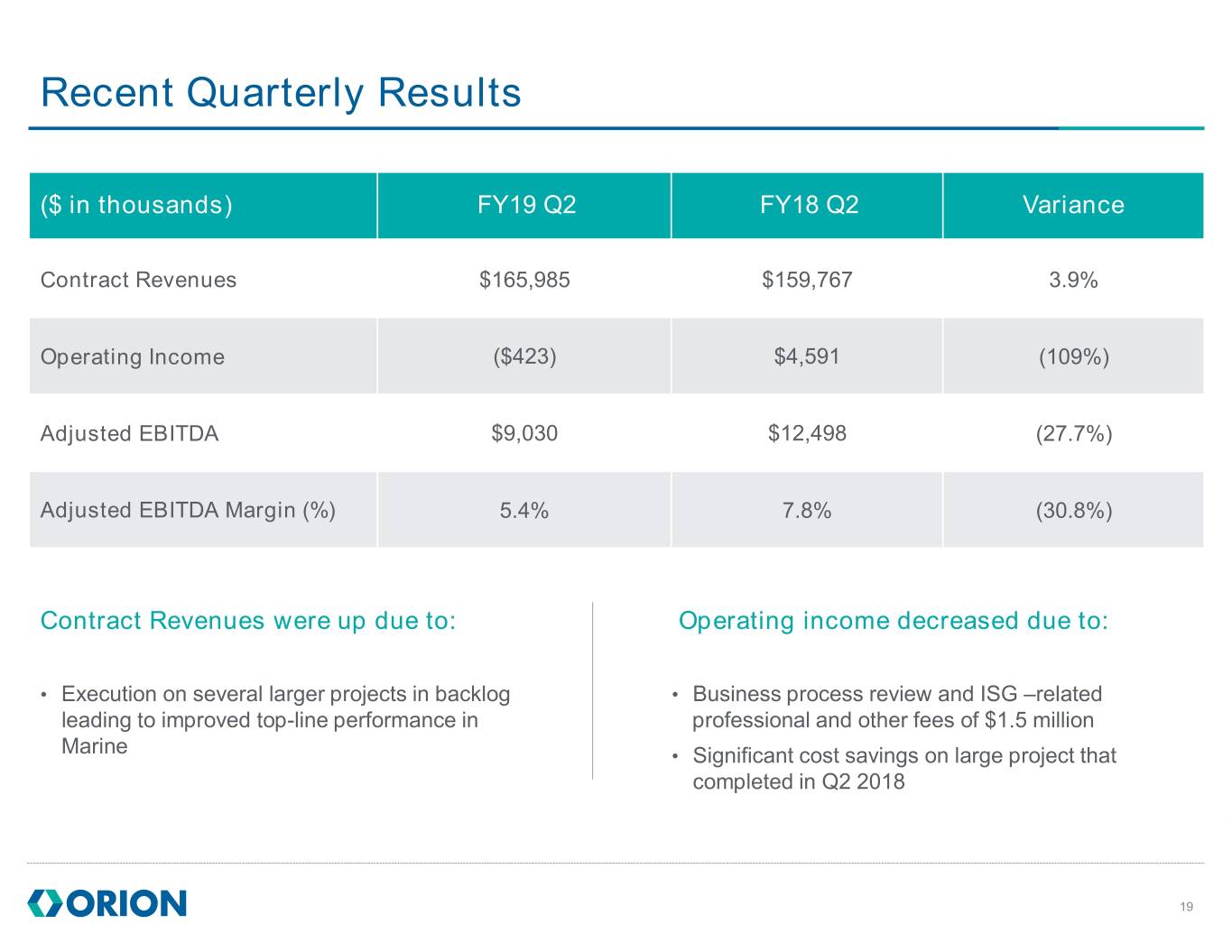

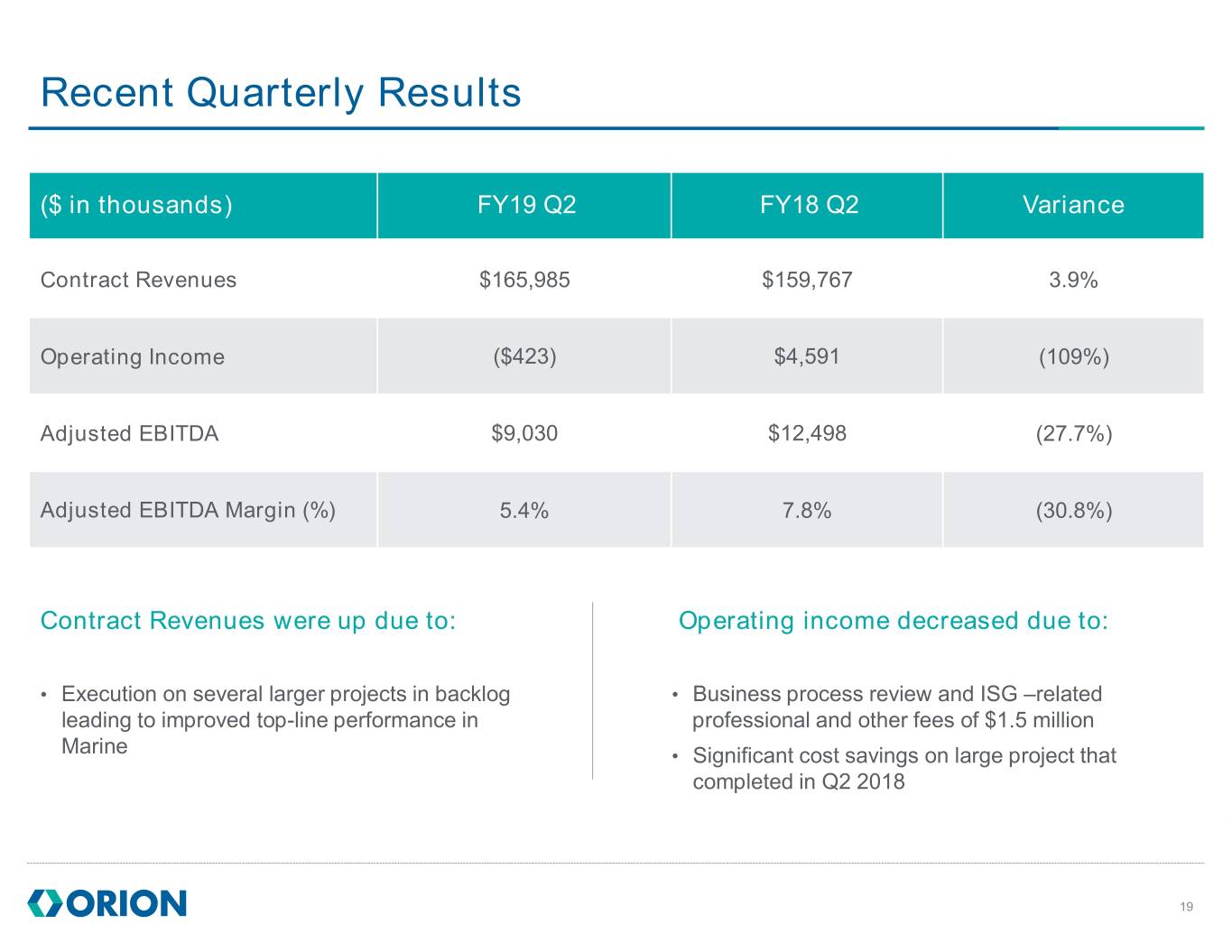

Recent Quarterly Results ($ in thousands) FY19 Q2 FY18 Q2 Variance Contract Revenues $165,985 $159,767 3.9% Operating Income ($423) $4,591 (109%) Adjusted EBITDA $9,030 $12,498 (27.7%) Adjusted EBITDA Margin (%) 5.4% 7.8% (30.8%) Contract Revenues were up due to: Operating income decreased due to: • Execution on several larger projects in backlog • Business process review and ISG –related leading to improved top-line performance in professional and other fees of $1.5 million Marine • Significant cost savings on large project that completed in Q2 2018 19

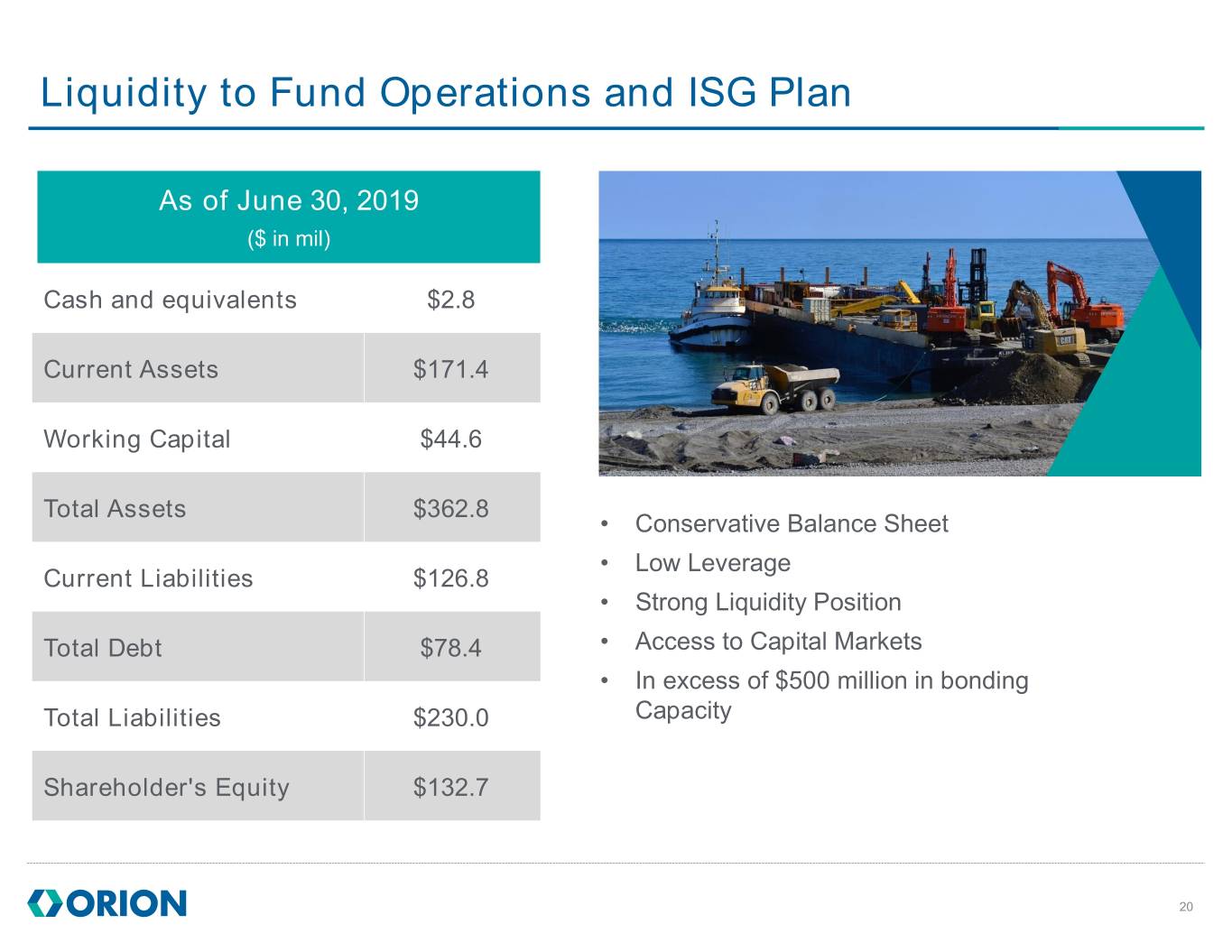

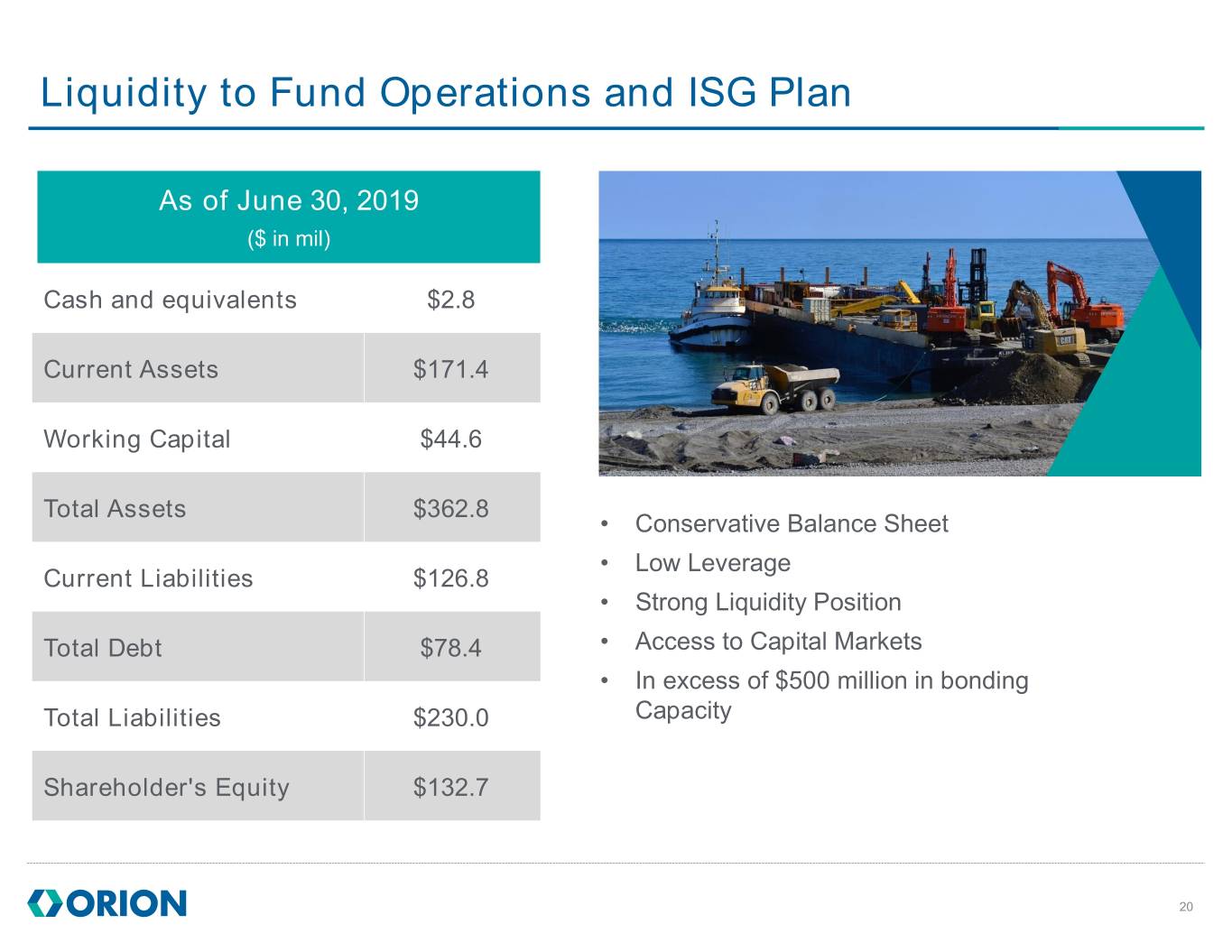

Liquidity to Fund Operations and ISG Plan As of June 30, 2019 ($ in mil) Cash and equivalents $2.8 Current Assets $171.4 Working Capital $44.6 Total Assets $362.8 • Conservative Balance Sheet • Low Leverage Current Liabilities $126.8 • Strong Liquidity Position Total Debt $78.4 • Access to Capital Markets • In excess of $500 million in bonding Total Liabilities $230.0 Capacity Shareholder's Equity $132.7 20

2019 Full Year Financial Outlook 2019 vs 2018 Revenues SG&A Adj. EBITDA Margin Low double digit growth rate Down as % of Revenue Improved margins reflecting reflecting improving results increased utilization and more related to ISG program selective bidding 21

Appendix EBITDA/Adjusted EBITDA reconciliation 22

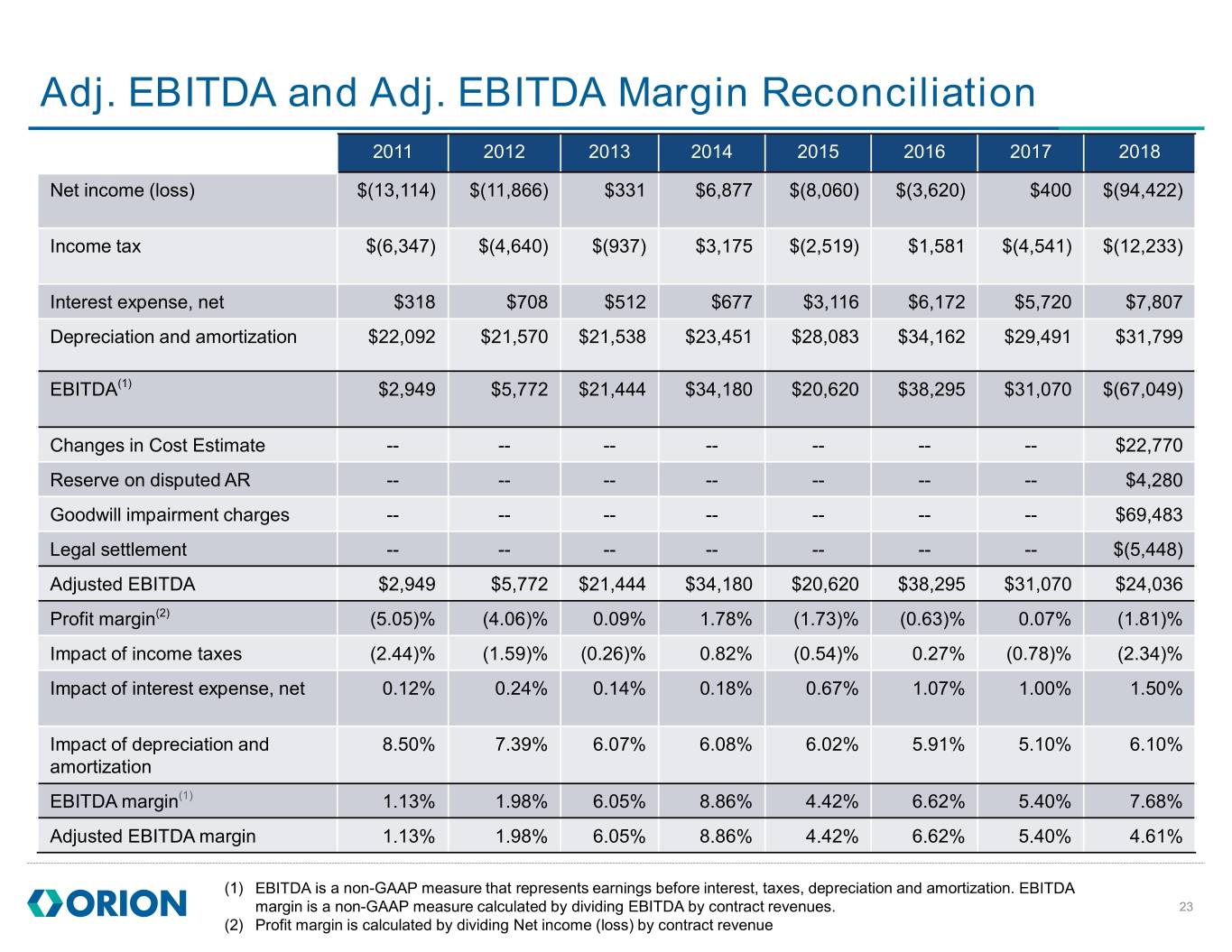

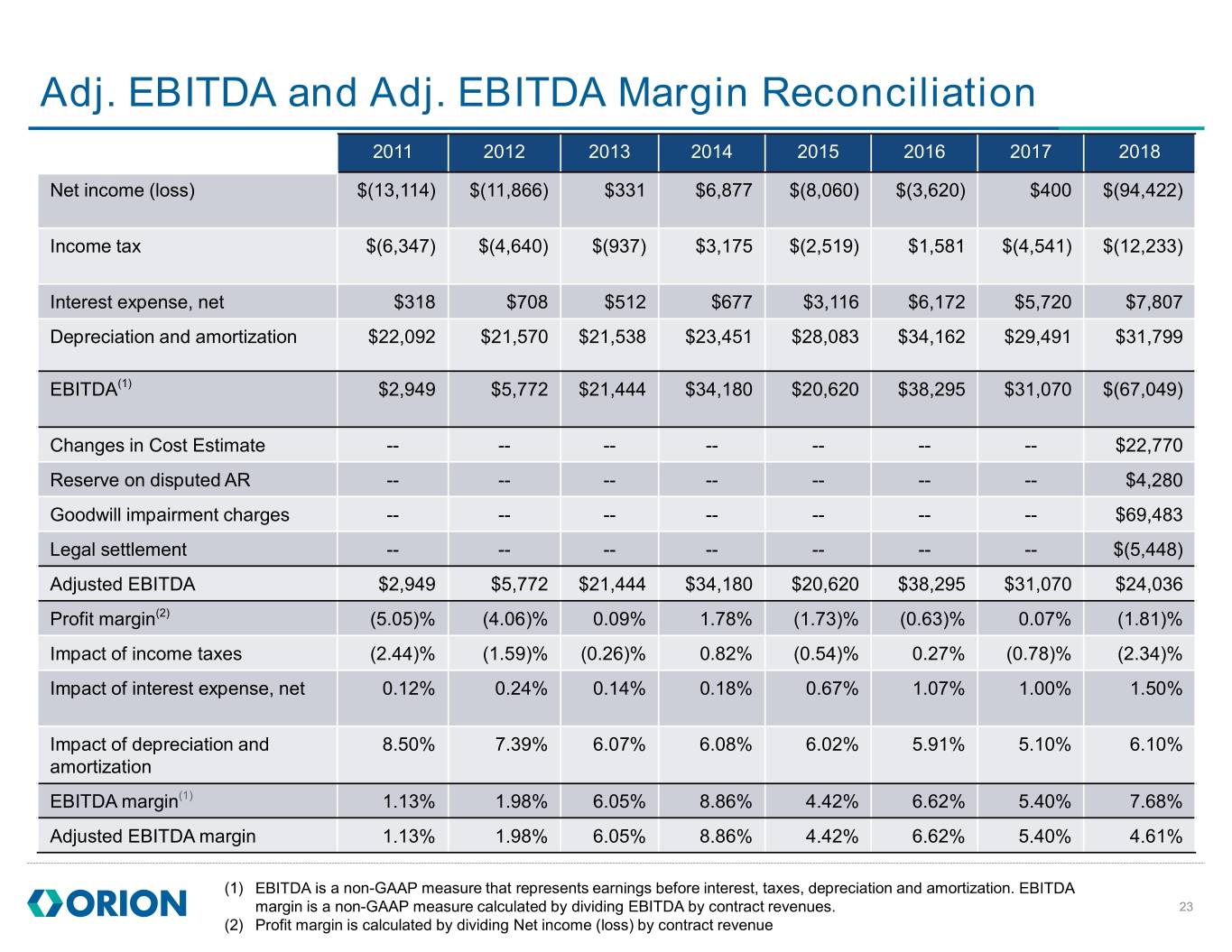

Adj. EBITDA and Adj. EBITDA Margin Reconciliation 2011 2012 2013 2014 2015 2016 2017 2018 Net income (loss) $(13,114) $(11,866) $331 $6,877 $(8,060) $(3,620) $400 $(94,422) Income tax $(6,347) $(4,640) $(937) $3,175 $(2,519) $1,581 $(4,541) $(12,233) Interest expense, net $318 $708 $512 $677 $3,116 $6,172 $5,720 $7,807 Depreciation and amortization $22,092 $21,570 $21,538 $23,451 $28,083 $34,162 $29,491 $31,799 EBITDA(1) $2,949 $5,772 $21,444 $34,180 $20,620 $38,295 $31,070 $(67,049) Changes in Cost Estimate -- -- -- -- -- -- -- $22,770 Reserve on disputed AR -- -- -- -- -- -- -- $4,280 Goodwill impairment charges -- -- -- -- -- -- -- $69,483 Legal settlement -- -- -- -- -- -- -- $(5,448) Adjusted EBITDA $2,949 $5,772 $21,444 $34,180 $20,620 $38,295 $31,070 $24,036 Profit margin(2) (5.05)% (4.06)% 0.09% 1.78% (1.73)% (0.63)% 0.07% (1.81)% Impact of income taxes (2.44)% (1.59)% (0.26)% 0.82% (0.54)% 0.27% (0.78)% (2.34)% Impact of interest expense, net 0.12% 0.24% 0.14% 0.18% 0.67% 1.07% 1.00% 1.50% Impact of depreciation and 8.50% 7.39% 6.07% 6.08% 6.02% 5.91% 5.10% 6.10% amortization EBITDA margin(1) 1.13% 1.98% 6.05% 8.86% 4.42% 6.62% 5.40% 7.68% Adjusted EBITDA margin 1.13% 1.98% 6.05% 8.86% 4.42% 6.62% 5.40% 4.61% (1) EBITDA is a non-GAAP measure that represents earnings before interest, taxes, depreciation and amortization. EBITDA margin is a non-GAAP measure calculated by dividing EBITDA by contract revenues. 23 (2) Profit margin is calculated by dividing Net income (loss) by contract revenue