Company Update Fall 2017

Forward Looking Statements The matters discussed in this presentation may constitute or include projections or other forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, the provisions of which the Company is availing itself. Certain forward-looking statements can be identified by the use of forward-looking terminology, such as 'believes', 'expects', 'may', 'will', 'could', 'should', 'seeks', 'approximately', 'intends', 'plans', 'estimates', or 'anticipates', or the negative thereof or other comparable terminology, or by discussions of strategy, plans, objectives, intentions, estimates, forecasts, outlook, assumptions, or goals. In particular, statements regarding future operations or results, including those set forth in this presentation, and any other statement, express or implied, concerning future operating results or the future generation of or ability to generate revenues, income, net income, profit, EBITDA, EBITDA margin, or cash flow, including to service debt, and including any estimates, forecasts or assumptions regarding future revenues or revenue growth, are forward-looking statements. Forward looking statements also include estimated project start date, anticipated revenues, and contract options which may or may not be awarded in the future. Forward looking statements involve risks, including those associated with the Company's fixed price contracts that impacts profits, unforeseen productivity delays that may alter the final profitability of the contract, cancellation of the contract by the customer for unforeseen reasons, delays or decreases in funding by the customer, levels and predictability of government funding or other governmental budgetary constraints and any potential contract options which may or may not be awarded in the future, and are the sole discretion of award by the customer. Past performance is not necessarily an indicator of future results. In light of these and other uncertainties, the inclusion of forward-looking statements in this presentation should not be regarded as a representation by the Company that the Company's plans, estimates, forecasts, goals, intentions, or objectives will be achieved or realized. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. The Company assumes no obligation to update information contained in this press release whether as a result of new developments or otherwise. Please refer to the Company's Annual Report on Form 10-K, filed on March 24, 2017, which is available on its website at www.oriongroupholdingsinc.com or at the SEC's website at www.sec.gov, for additional and more detailed discussion of risk factors that could cause actual results to differ materially from our current expectations, estimates or forecasts. 2

Current Status

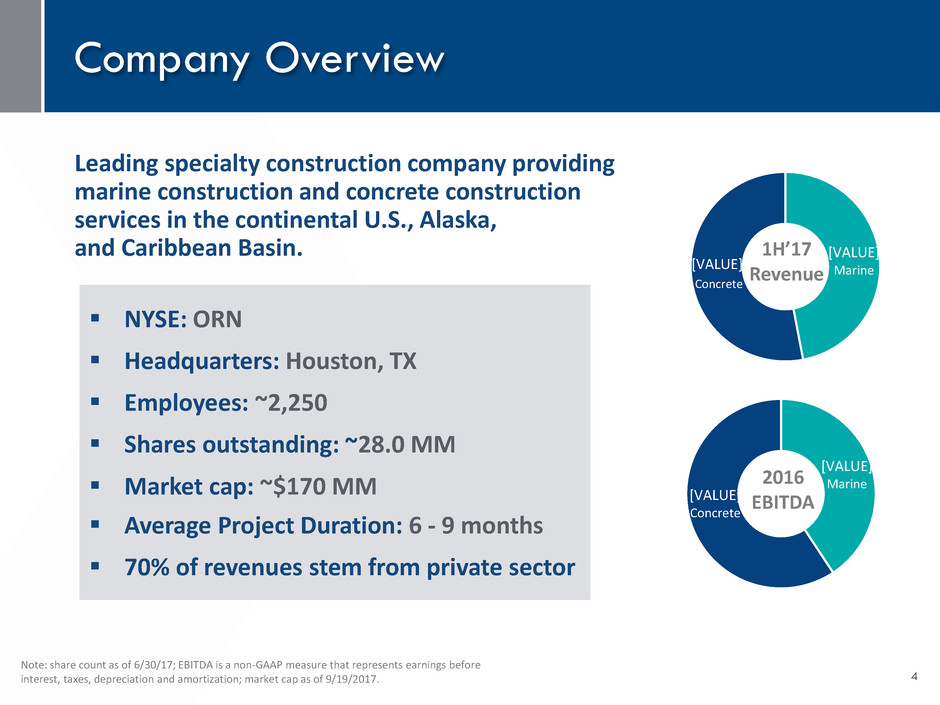

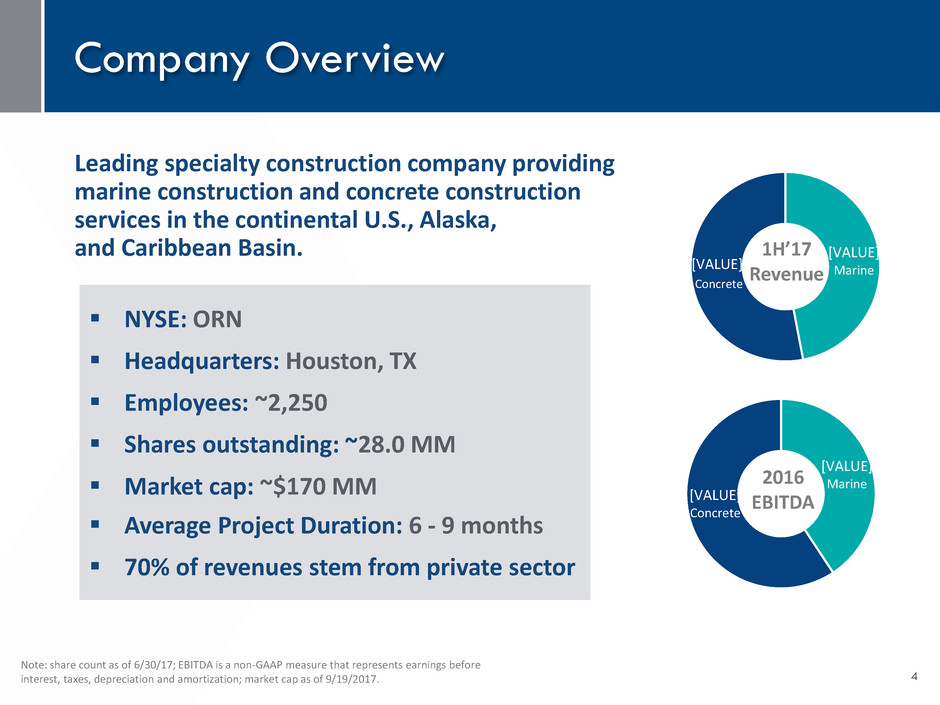

NYSE: ORN Headquarters: Houston, TX Employees: ~2,250 Shares outstanding: ~28.0 MM Market cap: ~$170 MM Average Project Duration: 6 - 9 months 70% of revenues stem from private sector Leading specialty construction company providing marine construction and concrete construction services in the continental U.S., Alaska, and Caribbean Basin. [VALUE] Marine [VALUE] Concrete 2016 EBITDA [VALUE] Marine [VALUE] Concrete Company Overview 1H’17 Revenue Note: share count as of 6/30/17; EBITDA is a non-GAAP measure that represents earnings before interest, taxes, depreciation and amortization; market cap as of 9/19/2017. 4

Organization Structure 2016 Revenue $ 284.6 MM 2016 EBITDA $15.9 MM 2016 EBITDA Margin 5.6% 12/31/16 Backlog $ 280.7 MM 2016 Revenue $ 293.6 MM 2016 EBITDA $ 22.4 MM 2016 EBITDA Margin 7.6% 12/31/16 Backlog $ 153.3 MM Marine Segment Concrete Segment Note: EBITDA is a non-GAAP measure that represents earnings before interest, taxes, depreciation and amortization. EBITDA margin is a non-GAAP measure calculated by dividing EBITDA by contract revenues. Reconciliation available on www.oriongroupholdingsinc.com within press release dated 3/9/2017 5

Volatility in Marine Market Has Increased 6 Increase Competition Dysfunctional Federal Budgeting Process Continuing Resolution inconsistency Federal debt ceiling issues Permitting Delays

The Future

Forward Vision 8 Orion seeks to be the premier specialty construction company, focused on providing solutions for our customers across the infrastructure, industrial, and building sectors, while maintaining a healthy financial position and maximizing stakeholder value. Strategic Plan Established in 2014

Strategic Vision Infrastructure Industrial Marine Concrete Building 9 Sectors Se gmen ts Industrial Industrial brings the talents of the marine and concrete segments together to execute concreate based work inside the industrial plant environment. * *

Infrastructure Sector

Infrastructure Sector Overview Orion’s Infrastructure sector is made up of its Marine Construction Segment Provides turnkey solutions on and over waterways Construction, restoration, and maintenance of marine facilities, pipelines, bridges, causeways, environmental structures, and dredging of waterways Legacy marine business, including construction and dredging services, established in 1994 11 Infrastructure Marine Concrete Se gmen ts Industrial

Extensive Suite of Marine Capabilities Port Facilities Wharves Cruise Ship Terminals Bulkheads Military Installations Liquid Cargo Terminals Piers Dry Bulk Terminals Container Terminals Docks Marinas Marine Transportation Facility Construction Marine Environmental Structures Dredging Services Specialty Services Shoreline Protection Environmental Remediation GeoTube® Installation Wetlands Creation Concrete Mattress Installation Sea-Grass Bed Creation Erosion Control Levee installation Marine Construction Wildlife Refuge Creation Electric Capabilities Intracoastal Waterway Maintenance Reclamation Hurricane Restoration Port Expansion Port Depending Beach Nourishment Heavy Lift Diving Towing Inspections Demolition Surveying Encapsulation Repair Salvage Marine Pipeline Construction Pipeline Anchoring Communication Pipeline Tie-ins Cool Water Intakes Effluent Discharge Outfalls Intakes Velocity Control Structures Transmission Pipelines Risers Outfalls Hot-taps Jetting 12

Example Customer Types Federal Government Customers State Government Customers Local Government Customers Private Customers 13 Broad Customer Base Federal [VAL UE] State [VAL UE] Local [VAL UE] Private [VAL UE] 2016 Revenue by Customer

Trend Significance Relevant Data Port Expansion and Maintenance > Expected increases in cargo volume from larger ships transiting the expanded Panama Canal will require ports to expand their dock capacity and port infrastructure and perform additional dredging services to deepen their channels > Increased demand along Eastern Seaboard for ports to handle large vessels > Focused on expanding the usability of the Gulf Intracoastal Waterways Bridges and Causeways > According to the American Society of Civil Engineers, one in nine of the nation’s bridges is structurally deficient, and the average age of the nation's bridges is 42 years old > Fixing America's Surface Transportation (“FAST”) Act authorizes expenditures for bridge construction Marine Infrastructure > Channels and waterways must maintain certain depths to accommodate ship and barge traffic. Natural sedimentation in these channels and waterways require routine maintenance dredging to maintain navigability > Water Resources Reform and Development Act (WRRDA) for the conservation and development of the nation's waterways Coastal Rehabilitation > Renewed focus on rehabilitation projects along the Gulf Coast following the 2010 oil spill > Increases in coastal population density and demographic trends will lead to an increase in the number of coastal restoration and reclamation projects > RESTORE Act dedicates 80 percent of all administrative and civil penalties related to the Deepwater Horizon spill to Gulf Coast Restoration + + + $23+ BN U.S. Port Projects $300+ BN 5 year Transportation Bill $5+ BN For Marine Projects $10+ BN Over next 15 years 14 Source: Company presentation, fhwa.dot.gov, EPA and restorethegulf.gov. Key Market Drivers

Building Sector

Building Sector Overview Orion’s Building sector is made up of its Concrete Construction Segment Commercial concrete construction is a stable growing market with opportunities to grow geographically and within service offerings Services Offered: Concrete foundations Tilt wall buildings Structural Flat work 16 Building Marine Concrete Se gmen ts Industrial

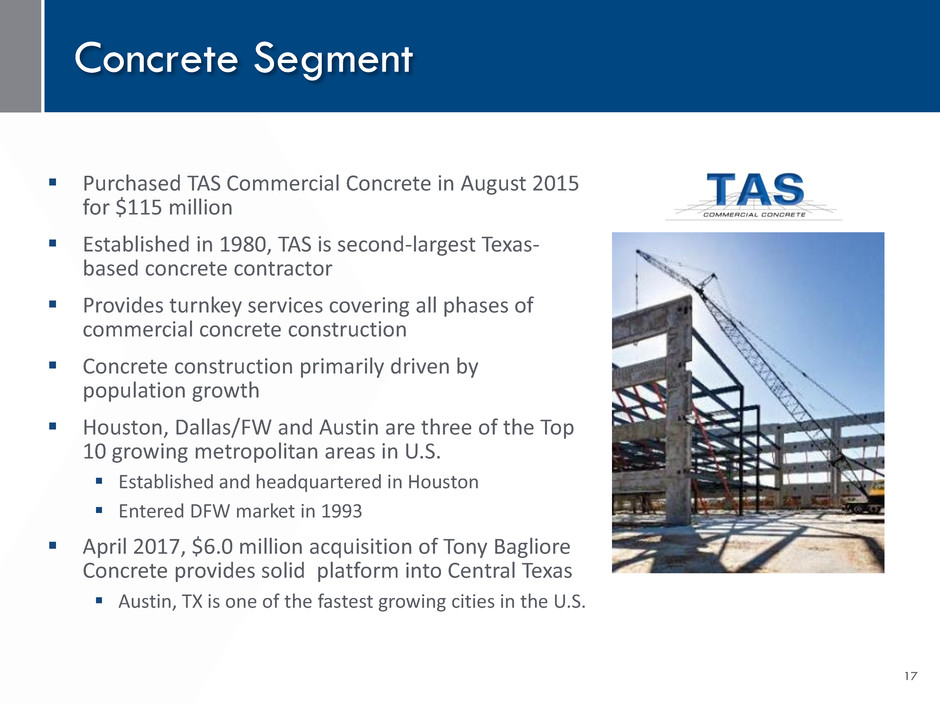

Concrete Segment Purchased TAS Commercial Concrete in August 2015 for $115 million Established in 1980, TAS is second-largest Texas- based concrete contractor Provides turnkey services covering all phases of commercial concrete construction Concrete construction primarily driven by population growth Houston, Dallas/FW and Austin are three of the Top 10 growing metropolitan areas in U.S. Established and headquartered in Houston Entered DFW market in 1993 April 2017, $6.0 million acquisition of Tony Bagliore Concrete provides solid platform into Central Texas Austin, TX is one of the fastest growing cities in the U.S. 17

>90% Repeat Business Concrete Services and Resources TAS provides services across three avenues: Light Commercial – Horizontally poured concrete, tilt-walls, trenches, rebar installation and pumping services Structural – Elevated concrete pouring, including columns, elevated beams and structural walls Industrial – Warehouses, manufacturing plants, water treatment facilities and refineries Dirt Work & Layout Forming Rebar & Mesh Pour & Finish 150 Avg. Projects/Yr. ~3,000 Tot. Completed Projects >12 Yr. Avg. Customer Tenure 18

Building Sector – Customer Overview Example Customer Types 19 Local [VAL UE] Private [VAL UE] 2016 Revenue by Customer

Trend Significance Relevant Data Institutional Developments and Expansions > The Company’s institutional markets include educational facilities, medical facilities, museums, and religious developments > Due to significant population growth in Texas, there has been great demand for institutional development and expansion in certain markets Structural Developments > Orion’s structural markets include mid and high- rise multi-family living, single and multi-story office buildings, parking garages, shopping malls, and free standing retail outlets > As population continues to grow, so does the need for office space and apartment complexes Recreational Developments > The Company’s recreational markets include a wide-range of hotels, sports venues and stadiums > The increase in new businesses and new educational facilities has sparked the need for additional hotels and stadiums across the metropolitan areas of Texas Industrial Developments > Orion’s industrial markets include manufacturing plants, industrial warehouses, and distribution centers > An expected increase in distribution has generated a need for industrial park developments + + + 0 7 14 21 28 35 42 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Mill ions of Sq. Ft . 0 10 20 30 40 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Mill ions of Sq. Ft . 0 3 6 9 12 15 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Mill ions of Sq. Ft. 2016 2017 11.1% 10.0% 2016 2017 9.4% 14.3% 2016 2017 (13.2%) 17.7% 0 3 6 9 12 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Mill ions of Sq. Ft . 2016 2017 (44.8%) 25.0% Manufacturing Buildings Educational Buildings Offices Hotels 20 Source: Dodge Data & Analytics presentation from 6/15/17. Positive Industry Fundamentals

Industrial Sector

Industrial Sector Overview Orion’s Industrial sector is a new development bringing talent from both segments to meet customer’s needs Industrial brings the talents of the marine and concrete segments together to execute concrete based work inside the industrial plant environment. Services Offered: Pile driving Concrete foundations Tilt wall buildings Storage tank foundations Concrete finish work 22 Industrial Marine Concrete Se gmen ts Industrial

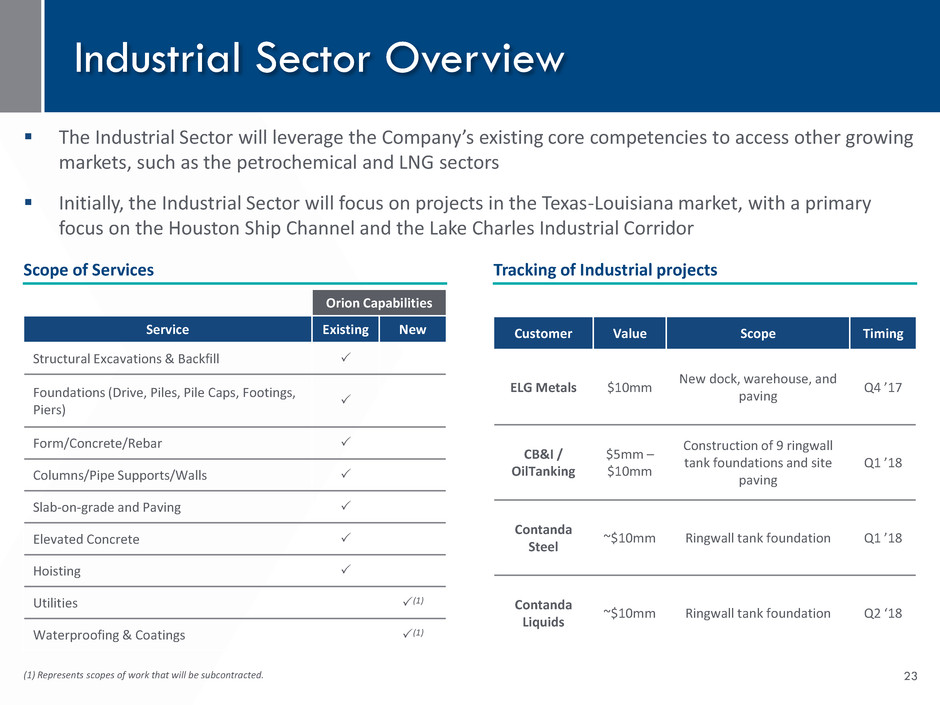

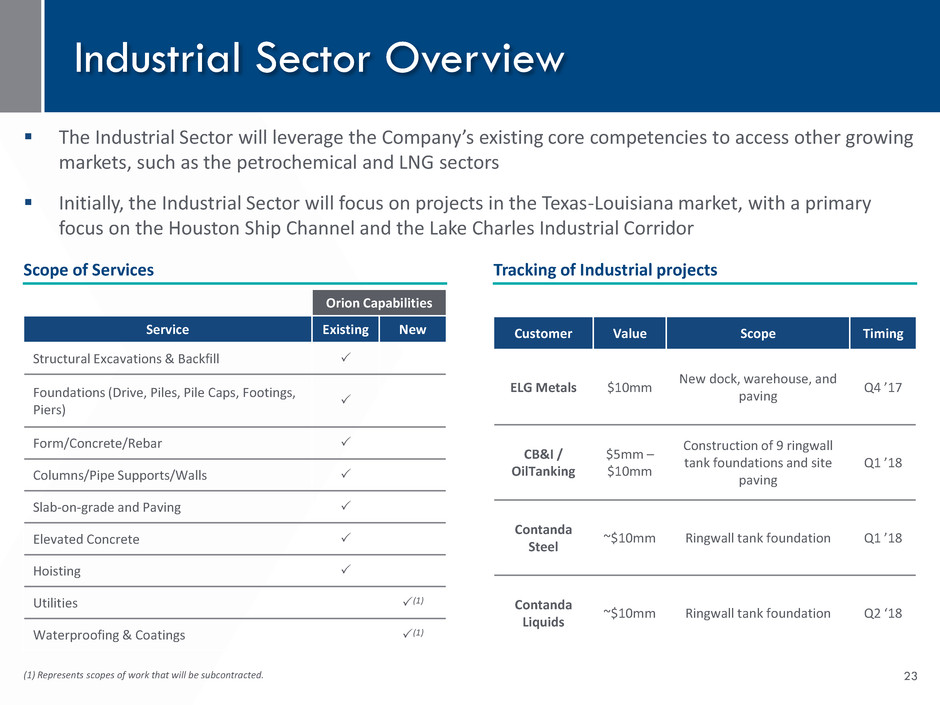

Industrial Sector Overview 23 The Industrial Sector will leverage the Company’s existing core competencies to access other growing markets, such as the petrochemical and LNG sectors Initially, the Industrial Sector will focus on projects in the Texas-Louisiana market, with a primary focus on the Houston Ship Channel and the Lake Charles Industrial Corridor Scope of Services Tracking of Industrial projects Orion Capabilities Service Existing New Structural Excavations & Backfill Foundations (Drive, Piles, Pile Caps, Footings, Piers) Form/Concrete/Rebar Columns/Pipe Supports/Walls Slab-on-grade and Paving Elevated Concrete Hoisting Utilities (1) Waterproofing & Coatings (1) (1) Represents scopes of work that will be subcontracted. Customer Value Scope Timing ELG Metals $10mm New dock, warehouse, and paving Q4 ’17 CB&I / OilTanking $5mm – $10mm Construction of 9 ringwall tank foundations and site paving Q1 ’18 Contanda Steel ~$10mm Ringwall tank foundation Q1 ’18 Contanda Liquids ~$10mm Ringwall tank foundation Q2 ‘18

Example Customer Types Private Customers 24 Broad Customer Base Proforma Revenue by Customer Private 100% Industrial leverages the talents of both Orion Marine Group and TAS to meet the demands of existing and new customers in a plant environment

Trend Significance Relevant Data Petrochemical > The rapid increase in America’s hydrocarbon output combined with aging facilities will drive growth and investment in the sector > According to the American Chemistry Council, capital spending is expected to reach $70 billion annually by 2021 Refinery > Aging infrastructure, high utilization rates and the structural cost advantage of domestic refiners will continue to fuel investment in the space > Of the 140 refineries operating today, approximately 90% are between 40 and 120 years old Chemical > Production of fertilizers, herbicides and pesticides for agriculture is driven by increasing demand for food production > 65% of agrichemical facilities in the U.S. are 45 years old or older driving ongoing maintenance and investment LNG > Vast natural gas reserves in the U.S. have created a price advantage, driving major investments in domestic LNG facilities > Several new facilities are scheduled for construction in Orion’s coverage area that will require ongoing maintenance and expansion + + + 25 1,099 1,879 - 500 1,000 1,500 2,000 2,500 Existing Plant Capacity Total Planned Capacity (2018P) MBp d $12 $13 $13 $14 $14 $15 $- $5 $10 $15 $20 2015 2016E 2017P 2018P 2019P 2020P $ in Bill ionsPlanned projects will expand capacity over 70% by 2018 Planned Capacity Expansion Refinery Capital Expenditures 29% 36% 14% 3% 19% Pre-1950 1951 to 1970 1971 to 1990 1991 to 2000 Post-2000 Aging Agrichemical Facilities Approved Domestic LNG Projects Company Location Capacity (Bcfd) Cheniere Sabine, LA 0.7 Sempra Hackberry, LA 2.1 Freeport LNG Freeport, TX 2.1 Cheniere Corpus Christi, TX 2.1 Sabine Pass Liquefaction Sabine Pass, LA 1.4 Source: American Chemistry Council and Industrial Information Resources. Positive Industry Fundamentals

Acquisition Strategy

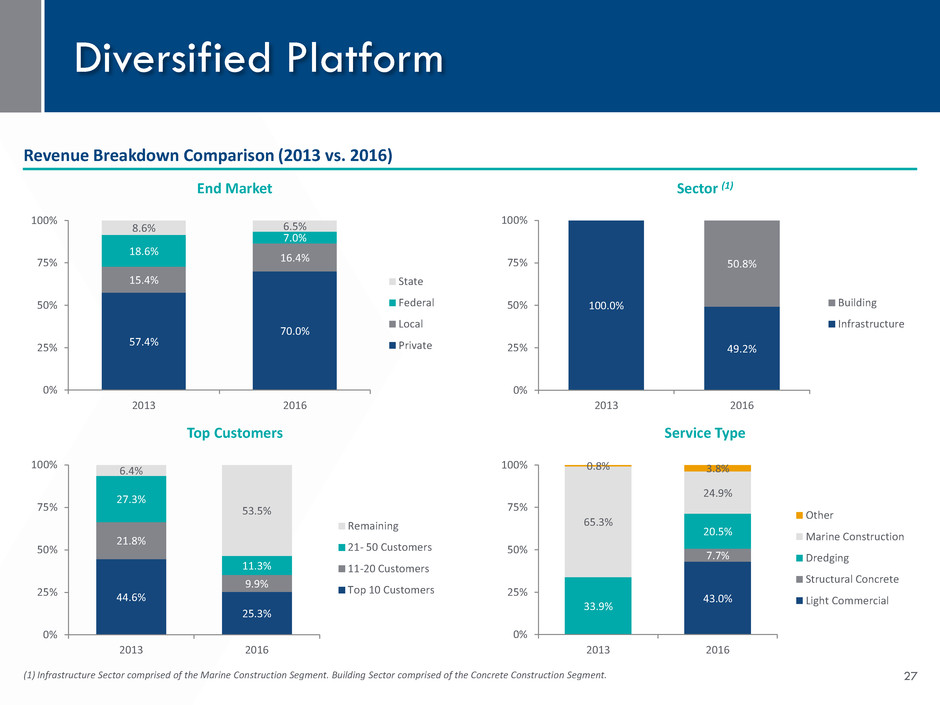

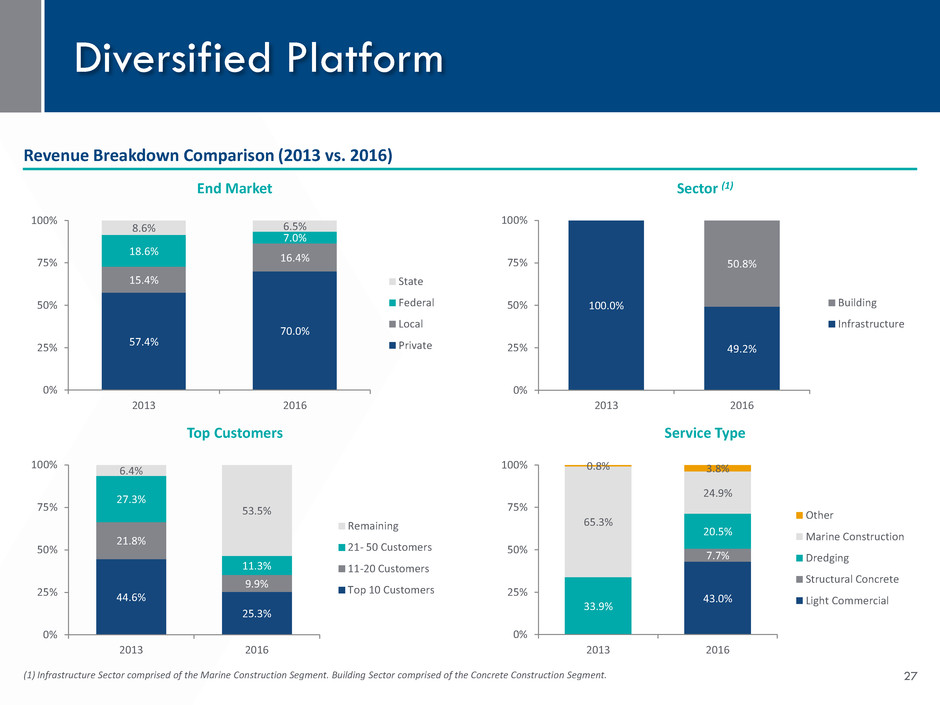

Diversified Platform 27 (1) Infrastructure Sector comprised of the Marine Construction Segment. Building Sector comprised of the Concrete Construction Segment. Revenue Breakdown Comparison (2013 vs. 2016) End Market Top Customers Sector (1) Service Type 57.4% 70.0% 15.4% 16.4% 18.6% 7.0% 8.6% 6.5% 0% 25% 50% 75% 100% 2013 2016 State Federal Local Private 100.0% 49.2% 50.8% 0% 25% 50% 75% 100% 2013 2016 Building Infrastructure 44.6% 25.3% 21.8% 9.9% 27.3% 11.3% 6.4% 53.5% 0% 25% 50% 75% 100% 2013 2016 Remaining 21- 50 Customers 11-20 Customers Top 10 Customers 43.0% 7.7% 33.9% 20.5% 65.3% 24.9% 0.8% 3.8% 0% 25% 5 % 75% 100% 2013 2016 Other Marine Construction Dredging Structural Concrete Light Commercial

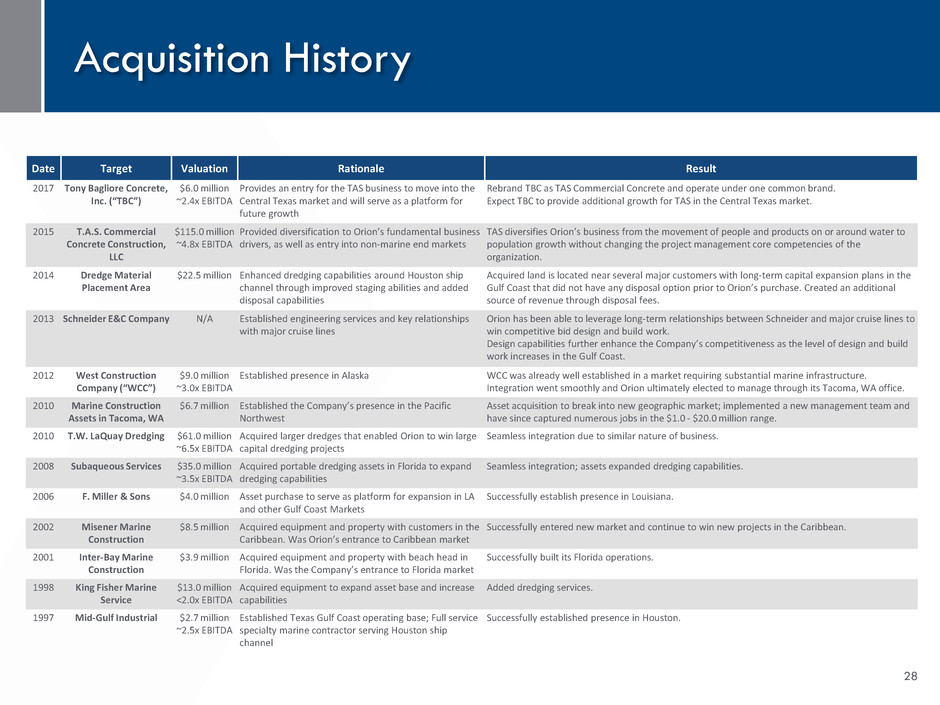

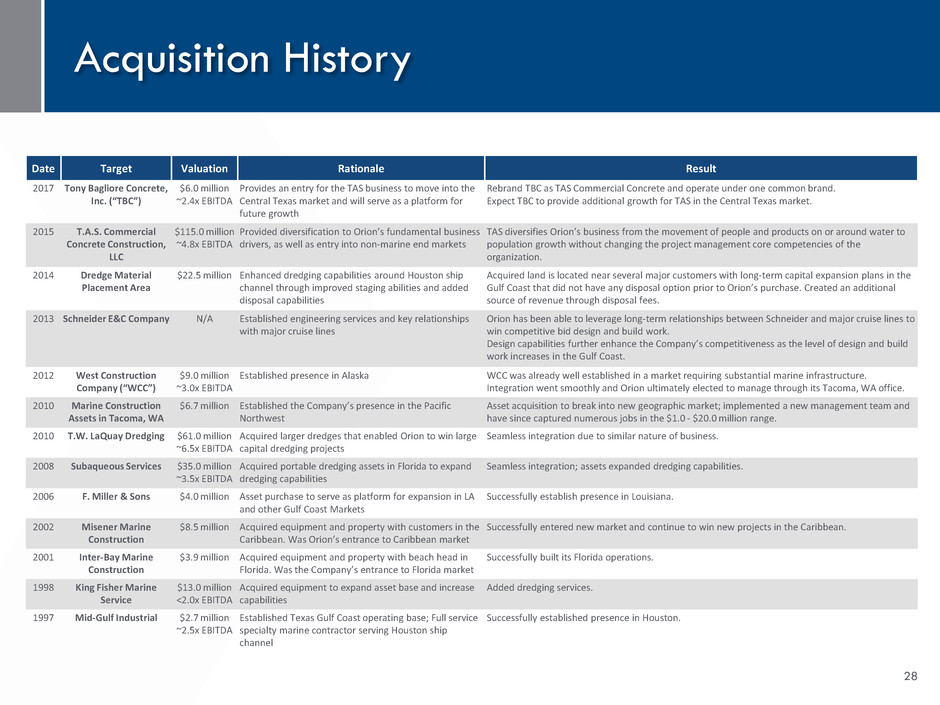

Date Target Valuation Rationale Result 2017 Tony Bagliore Concrete, Inc. (“TBC”) $6.0 million ~2.4x EBITDA Provides an entry for the TAS business to move into the Central Texas market and will serve as a platform for future growth Rebrand TBC as TAS Commercial Concrete and operate under one common brand. Expect TBC to provide additional growth for TAS in the Central Texas market. 2015 T.A.S. Commercial Concrete Construction, LLC $115.0 million ~4.8x EBITDA Provided diversification to Orion’s fundamental business drivers, as well as entry into non-marine end markets TAS diversifies Orion’s business from the movement of people and products on or around water to population growth without changing the project management core competencies of the organization. 2014 Dredge Material Placement Area $22.5 million Enhanced dredging capabilities around Houston ship channel through improved staging abilities and added disposal capabilities Acquired land is located near several major customers with long-term capital expansion plans in the Gulf Coast that did not have any disposal option prior to Orion’s purchase. Created an additional source of revenue through disposal fees. 2013 Schneider E&C Company N/A Established engineering services and key relationships with major cruise lines Orion has been able to leverage long-term relationships between Schneider and major cruise lines to win competitive bid design and build work. Design capabilities further enhance the Company’s competitiveness as the level of design and build work increases in the Gulf Coast. 2012 West Construction Company (“WCC”) $9.0 million ~3.0x EBITDA Established presence in Alaska WCC was already well established in a market requiring substantial marine infrastructure. Integration went smoothly and Orion ultimately elected to manage through its Tacoma, WA office. 2010 Marine Construction Assets in Tacoma, WA $6.7 million Established the Company’s presence in the Pacific Northwest Asset acquisition to break into new geographic market; implemented a new management team and have since captured numerous jobs in the $1.0 - $20.0 million range. 2010 T.W. LaQuay Dredging $61.0 million ~6.5x EBITDA Acquired larger dredges that enabled Orion to win large capital dredging projects Seamless integration due to similar nature of business. 2008 Subaqueous Services $35.0 million ~3.5x EBITDA Acquired portable dredging assets in Florida to expand dredging capabilities Seamless integration; assets expanded dredging capabilities. 2006 F. Miller & Sons $4.0 million Asset purchase to serve as platform for expansion in LA and other Gulf Coast Markets Successfully establish presence in Louisiana. 2002 Misener Marine Construction $8.5 million Acquired equipment and property with customers in the Caribbean. Was Orion’s entrance to Caribbean market Successfully entered new market and continue to win new projects in the Caribbean. 2001 Inter-Bay Marine Construction $3.9 million Acquired equipment and property with beach head in Florida. Was the Company’s entrance to Florida market Successfully built its Florida operations. 1998 King Fisher Marine Service $13.0 million <2.0x EBITDA Acquired equipment to expand asset base and increase capabilities Added dredging services. 1997 Mid-Gulf Industrial $2.7 million ~2.5x EBITDA Established Texas Gulf Coast operating base; Full service specialty marine contractor serving Houston ship channel Successfully established presence in Houston. 28 Acquisition History

Additional Service Offerings 29 Fabrication Vertical Integration Land Based Industrial Infrastructure Industrial Building Fireproofing Equipment Rental Fabrication Equipment Rental Fabrication Fu tu re Se rvi ce O ff eri n gs Orion will continue to explore potential additional profitable service offerings within the Infrastructure, Industrial, and Building Sectors Plant Services

Financial Highlights

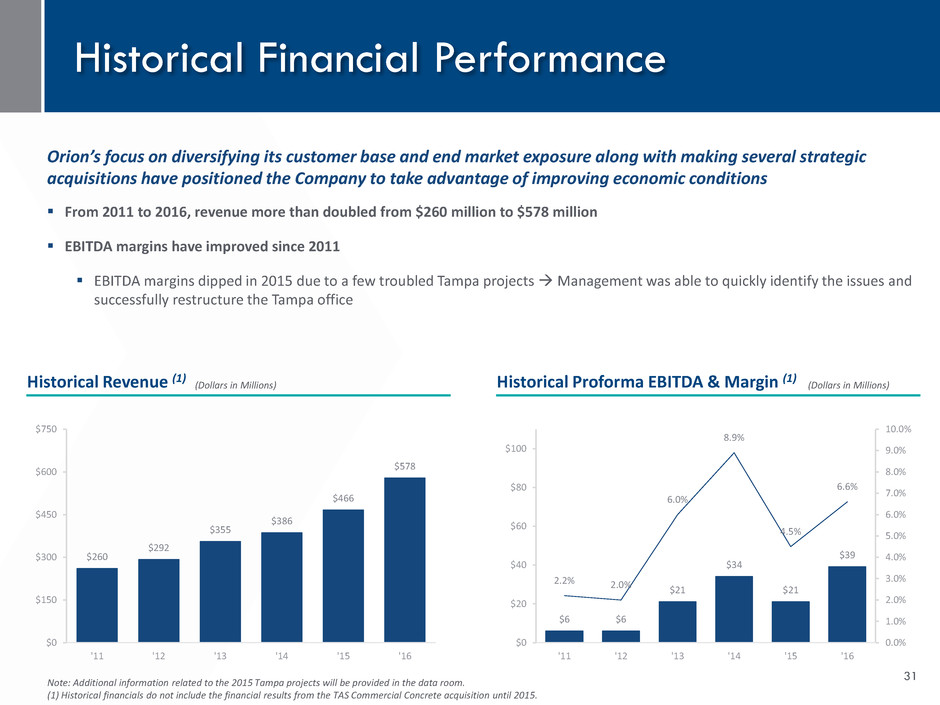

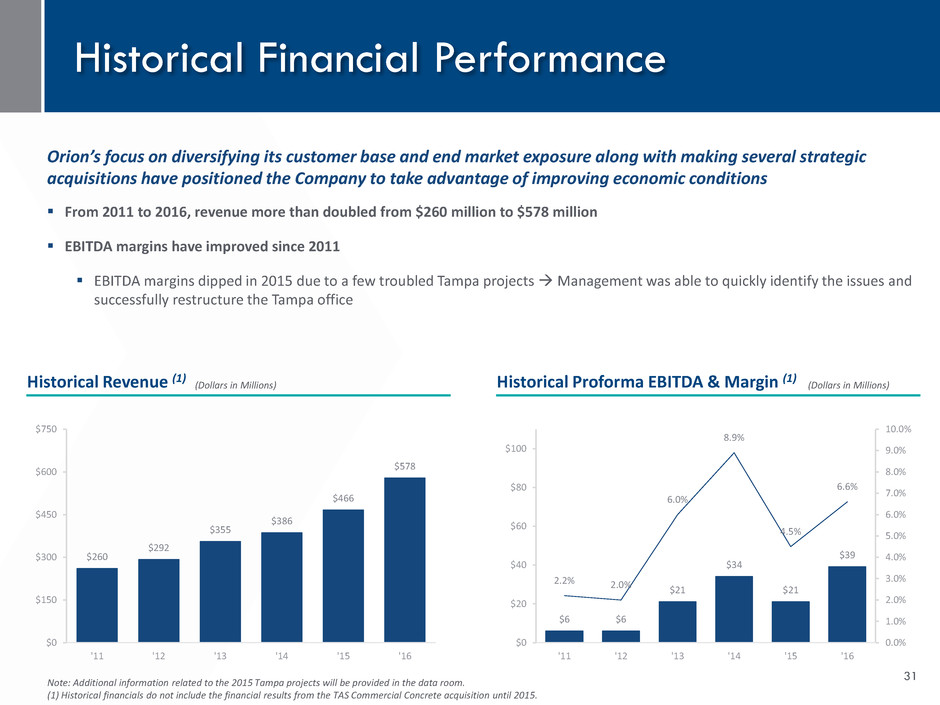

Historical Financial Performance 31 (Dollars in Millions) Historical Revenue (1) Historical Proforma EBITDA & Margin (1) Orion’s focus on diversifying its customer base and end market exposure along with making several strategic acquisitions have positioned the Company to take advantage of improving economic conditions From 2011 to 2016, revenue more than doubled from $260 million to $578 million EBITDA margins have improved since 2011 EBITDA margins dipped in 2015 due to a few troubled Tampa projects Management was able to quickly identify the issues and successfully restructure the Tampa office Note: Additional information related to the 2015 Tampa projects will be provided in the data room. (1) Historical financials do not include the financial results from the TAS Commercial Concrete acquisition until 2015. (Dollars in Millions) $260 $292 $355 $386 $466 $578 $0 $150 $300 $450 $600 $750 '11 '12 '13 '14 '15 '16 $6 $6 $21 $34 $21 $39 2.2% 2.0% 6.0% 8.9% 4.5% 6.6% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% 9.0% 10.0% $0 $20 $40 $60 $80 $100 '11 '12 '13 '14 '15 '16

Potential Projected Annual Revenue Marine Concrete EBITDA 32 Se gmen ts Industrial $250 $300 - 50 200 - 300 400 - $600 $900 - $30 $36 - 8 30 - 24 32 - $62 $98 - @ 12% @ 15% @ 8% Potential projected annual revenue and EBITDA with existing businesses

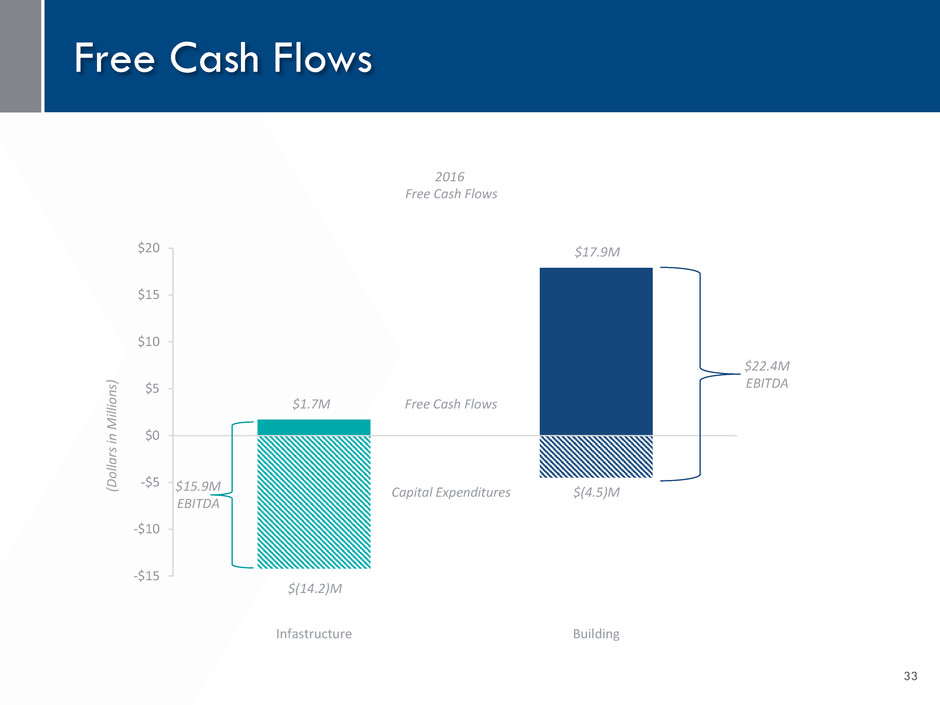

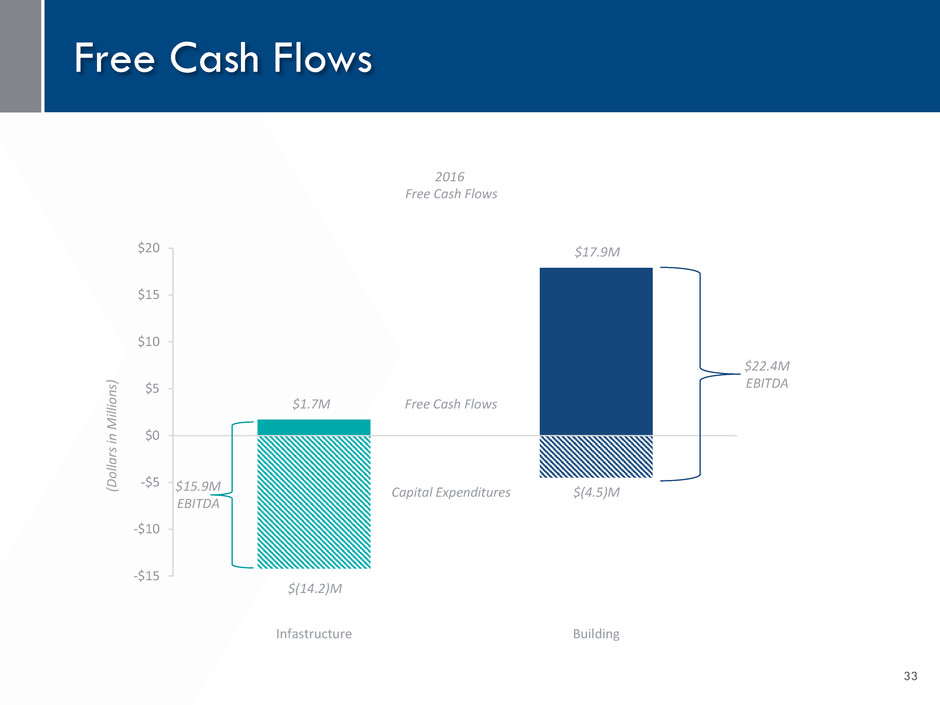

Free Cash Flows 33 -$15 -$10 -$5 $0 $5 $10 $15 $20 Infastructure Building (D o lla rs in M ill io n s) $1.7M $(14.2)M $(4.5)M $17.9M Capital Expenditures Free Cash Flows 2016 Free Cash Flows $15.9M EBITDA $22.4M EBITDA

Investment Highlights 34 Focuses on returning value to shareholders Diverse end markets with improving market demand High EBITDA growth opportunity Diversification of services through accretive acquisitions

Appendix

EBITDA and EBITDA Margin Reconciliation 36 2011 2012 2013 2014 2015 2016 Net income (loss) $(13,114) $(11,866) $331 $6,877 $(8,060) $(3,620) Income tax $(6,347) $(4,640) $(937) $3,175 $(2,519) $1,581 Interest expense, net $318 $708 $512 $677 $3,116 $6,172 Depreciation and amortization $22,092 $21,570 $21,538 $23,451 $28,083 $34,162 EBITDA(1) $2,949 $5,772 $21,444 $34,180 $20,620 $38,295 Profit margin(2) (5.05)% (4.06)% 0.09% 1.78% (1.73)% (0.63)% Impact of income taxes (2.44)% (1.59)% (0.26)% 0.82% (0.54)% 0.27% Impact of interest expense, net 0.12% 0.24% 0.14% 0.18% 0.67% 1.07% Impact of depreciation and amortization 8.50% 7.39% 6.07% 6.08% 6.02% 5.91% EBITDA margin(1) 1.13% 1.98% 6.05% 8.86% 4.42% 6.62% (1) EBITDA is a non-GAAP measure that represents earnings before interest, taxes, depreciation and amortization. EBITDA margin is a non- GAAP measure calculated by dividing EBITDA by contract revenues. (2) Profit margin is calculated by dividing Net income (loss) by contract revenue

Investor Relations (713) 852-6582 ir@orionmarinegroup.com Contact Us 37