Cosan Limited

Unaudited Condensed Consolidated Financial Statements

for the nine-month periods ended January 31, 2008 and 2007

COSAN LIMITED

UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

TABLE OF CONTENTS

| | Page |

| | |

| Report of Independent Registered Public Accounting Firm | 1 |

| | |

Condensed Consolidated Balance Sheets at January 31, 2008 (Unaudited) and April 30, 2007 | 2 |

Condensed Consolidated Statements of Income for the nine-month periods ended January 31, 2008 and 2007 (Unaudited) | 4 |

Condensed Consolidated Statements of Shareholders’ Equity for the nine-month period ended January 31, 2008 (Unaudited) | 5 |

Condensed Consolidated Statements of Cash Flows for the nine-month periods ended January 31, 2008 and 2007 (Unaudited) | 6 |

Notes to the Condensed Consolidated Financial Statements (Unaudited) | 7 |

CONDENSED CONSOLIDATED BALANCE SHEETS

January 31, 2008 and April 30, 2007

(In thousands of U.S. dollars, except share data)

| | | (Unaudited) January 31, 2008 | | | April 30, 2007 | |

| Assets | | | | | | |

| Current assets: | | | | | | |

| Cash and cash equivalents | | | 83,412 | | | | 316,542 | |

| Restricted cash | | | 35,206 | | | | 17,672 | |

| Marketable securities | | | 1,188,494 | | | | 281,879 | |

| Trade accounts receivable, less allowances: January, 31, 2008 – 3,113; April 30, 2007 – 4,013 | | | 59,846 | | | | 55,206 | |

| Inventories | | | 571,204 | | | | 247,480 | |

| Advances to suppliers | | | 137,130 | | | | 103,961 | |

| Deferred income taxes | | | 47,909 | | | | - | |

| Other current assets | | | 57,265 | | | | 116,763 | |

| | | | 2,180,466 | | | | 1,139,503 | |

| | | | | | | | | |

| Property, plant and equipment, net | | | 1,514,286 | | | | 1,194,050 | |

| Goodwill | | | 626,344 | | | | 491,857 | |

| Intangible assets, net | | | 102,016 | | | | 93,973 | |

| Accounts receivable from Federal Government | | | 192,713 | | | | 156,526 | |

| Other non-current assets | | | 237,938 | | | | 177,461 | |

| | | | 2,673,297 | | | | 2,113,867 | |

| | | | | | | | | |

| Total assets | | | 4,853,763 | | | | 3,253,370 | |

| | | (Unaudited) January 31, 2008 | | | April 30, 2007 | |

| Liabilities and shareholders’ equity | | | | | | |

| Current liabilities: | | | | | | |

| Trade accounts payable | | | 110,523 | | | | 55,938 | |

| Advances from customers | | | 17,014 | | | | 24,275 | |

| Taxes payable | | | 47,139 | | | | 57,543 | |

| Salaries payable | | | 29,232 | | | | 31,109 | |

| Current portion of long-term debt | | | 27,875 | | | | 36,076 | |

| Derivative financial instruments | | | 102,332 | | | | 9,779 | |

| Dividends payable | | | - | | | | 37,261 | |

| Other liabilities | | | 7,838 | | | | 22,238 | |

| | | | 341,953 | | | | 274,219 | |

| Long-term liabilities: | | | | | | | | |

| Long-term debt | | | 1,226,478 | | | | 1,342,496 | |

| Estimated liability for legal proceedings and labor claims | | | 441,969 | | | | 379,191 | |

| Taxes payable | | | 150,115 | | | | 106,897 | |

| Advances from customers | | | - | | | | 24,333 | |

| Deferred income taxes | | | 133,792 | | | | 141,587 | |

| Other long-term liabilities | | | 50,413 | | | | 47,485 | |

| | | | 2,002,767 | | | | 2,041,989 | |

| | | | | | | | | |

| Minority interest in consolidated subsidiaries | | | 873,419 | | | | 463,551 | |

| | | | | | | | | |

| Shareholders’ equity | | | | | | | | |

| Common stock class A, $.01 par value, 1,000,000,000 shares authorized; 111,678,000 shares issued and outstanding | | | 1,117 | | | | - | |

| Common stock class B1, $.01 par value, 96,332,044 shares authorized, issued and outstanding | | | 963 | | | | 963 | |

| Common stock class B2, $.01 par value, 92,554,316 shares authorized; no shares issued | | | - | | | | - | |

| Additional paid-in capital | | | 1,471,039 | | | | 354,022 | |

| Accumulated other comprehensive income | | | 121,288 | | | | 36,696 | |

| Retained earnings | | | 41,217 | | | | 81,930 | |

| Total shareholders’ equity | | | 1,635,624 | | | | 473,611 | |

| Total liabilities and shareholders' equity | | | 4,853,763 | | | | 3,253,370 | |

See accompanying notes to condensed consolidated financial statements.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

Nine-month periods ended January 31, 2008 and 2007

(In thousands of U.S. dollars, except share data)

(Unaudited)

| | | Nine months | |

| | | ended January 31, | |

| | | 2008 | | | 2007 | |

| | | | | | (restated) | |

| Net sales | | | 1,005,932 | | | | 1,350,901 | |

| Cost of goods sold | | | (927,170 | ) | | | (932,509 | ) |

| Gross profit | | | 78,762 | | | | 418,392 | |

| Selling expenses | | | (123,714 | ) | | | (98,648 | ) |

| General and administrative expenses | | | (84,658 | ) | | | (72,517 | ) |

| Operating income (loss) | | | (129,610 | ) | | | 247,227 | |

| | | | | | | | | |

| Other income (expense): | | | | | | | | |

| Financial income | | | 188,245 | | | | 315,802 | |

| Financial expenses | | | (190,771 | ) | | | (239,845 | ) |

| Other | | | (1,849 | ) | | | 18,909 | |

| | | | | | | | | |

| Income (loss) before income taxes, equity in income (loss) of affiliates and minority interest | | | (133,985 | ) | | | 342,093 | |

| | | | | | | | | |

| Income taxes | | | 47,711 | | | | (116,587 | ) |

| | | | | | | | | |

| Income (loss) before equity in income (loss) of affiliates and minority interest | | | (86,274 | ) | | | 225,506 | |

| Equity in income (loss) of affiliates | | | (2,551 | ) | | | 210 | |

| Minority interest in (net income) loss of subsidiaries | | | 48,112 | | | | (111,618 | ) |

| Net income (loss) | | | (40,713 | ) | | | 114,098 | |

| | | | | | | | | |

| Earnings (losses) per share: | | | | | | | | |

| Basic and Diluted | | | (0.25 | ) | | | 1.18 | |

| | | | | | | | | |

| Weighted average number of shares outstanding: | | | | | | | | |

| Basic and Diluted | | | 163,250,273 | | | | 97,039,181 | |

See accompanying notes to condensed consolidated financial statements.

CONDENSED CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

Nine-month period ended January 31, 2008

(In thousands of U.S. dollars, except share data)

(Unaudited)

| | | Class A Common number | | | Class A Common amount | | | Class B Common number | | | Class B Common amount | | | Additional paid-in capital | | | Accumulated other comprehensive income | | | Retained earnings | | | Total shareholders’ equity | |

| Balance at May 1, 2007 | | | - | | | | - | | | | 1,000 | | | | - | | | | - | | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Contribution of 51% of Cosan S.A. equity | | | - | | | | - | | | | 96,331,044 | | | | 963 | | | | 354,872 | | | | 76,159 | | | | 81,930 | | | | 513,924 | |

| Issuance of common shares class A for cash | | | 100,000,000 | | | | 1,000 | | | | - | | | | - | | | | 994,814 | | | | - | | | | - | | | | 995,814 | |

| Issuance of common shares class A for cash | | | 11,678,000 | | | | 117 | | | | - | | | | - | | | | 122,502 | | | | - | | | | - | | | | 122,619 | |

| Stock compensation | | | - | | | | - | | | | - | | | | - | | | | 2,139 | | | | | | | | | | | | 2,139 | |

| Dilution upon exercise of Cosan S.A. stock options | | | | | | | | | | | | | | | | | | | (3,288 | ) | | | | | | �� | | | | | (3,288 | ) |

| Net income | | | - | | | | - | | | | - | | | | - | | | | | | | | | | | | (40,713 | ) | | | (40,713 | ) |

| Currency translation adjustment | | | - | | | | - | | | | - | | | | - | | | | | | | | 45,129 | | | | | | | | 45,129 | |

| Total comprehensive income | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 4,416 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balances at January 31, 2008 | | | 111,678,000 | | | | 1,117 | | | | 96,332,044 | | | | 963 | | | | 1,471,039 | | | | 121,288 | | | | 41,217 | | | | 1,635,624 | |

See accompanying notes to condensed consolidated financial statements.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

Nine-month periods ended January 31, 2008 and 2007

(In thousands of U.S. dollars)

(Unaudited)

| | | Nine months | |

| | | Ended January 31, | |

| | | 2008 | | | 2007 | |

| Cash flow from operating activities | | | | | (restated) | |

| Net income (loss) | | | (40,713 | ) | | | 114,098 | |

| Adjustments to reconcile net income (loss) to cash provided (used in) by operating activities | | | | | | | | |

| Depreciation and amortization | | | 210,766 | | | | 97,051 | |

| Deferred income and social contribution taxes | | | (66,432 | ) | | | 73,938 | |

| Interest, monetary and exchange variation | | | (41,142 | ) | | | 91,583 | |

| Minority interest in net income (loss) of subsidiaries | | | (48,112 | ) | | | 111,618 | |

| Others | | | 6,499 | | | | (12,674 | ) |

| Decrease (increase) in operating assets and liabilities | | | | | | | | |

| Trade accounts receivable, net | | | 5,135 | | | | 533 | |

| Inventories | | | (285,258 | ) | | | (219,736 | ) |

| Advances to suppliers | | | (17,010 | ) | | | (24,122 | ) |

| Trade accounts payable | | | 45,891 | | | | (2,118 | ) |

| Derivative financial instruments | | | 169,938 | | | | (116,292 | ) |

| Taxes payable | | | (2,481 | ) | | | (27,106 | ) |

| Other assets and liabilities, net | | | (122,399 | ) | | | (71,565 | ) |

| Net cash provided by (used in) operating activities | | | (185,318 | ) | | | 15,208 | |

| Cash flows from investing activities | | | | | | | | |

| Restricted cash | | | (14,787 | ) | | | 59,594 | |

| Marketable securities | | | (862,803 | ) | | | 221,428 | |

| Acquisition of property, plant and equipment | | | (342,113 | ) | | | (113,651 | ) |

| Others | | | (1,200 | ) | | | - | |

| Net cash provided by (used in) investing activities | | | (1,220,903 | ) | | | 167,371 | |

| Cash flows from financing activities | | | | | | | | |

| Proceeds from issuance of common stock | | | 1,118,433 | | | | 3,201 | |

| Capital increase on subsidiary from minority interest | | | 312,673 | | | | - | |

| Additions of long-term debt | | | - | | | | 423,803 | |

| Payments of long-term debt | | | (320,836 | ) | | | (182,555 | ) |

| Net cash provided by financing activities | | | 1,110,270 | | | | 244,449 | |

| Effect of exchange rate changes on cash and | | | | | | | | |

| cash equivalents | | | 62,821 | | | | 3,487 | |

| Net increase (decrease) in cash and cash equivalents | | | (233,130 | ) | | | 430,515 | |

| Cash and cash equivalents at beginning of period | | | 316,542 | | | | 29,215 | |

| Cash and cash equivalents at end of period | | | 83,412 | | | | 459,730 | |

See accompanying notes to condensed consolidated financial statements.

COSAN LIMITED

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED

FINANCIAL STATEMENTS

(In thousands of U.S. dollars, unless otherwise stated)

Cosan Limited (“Cosan” or the “Company”) was incorporated in Bermuda as an exempted company on April 30, 2007. In connection with its incorporation, Cosan Limited issued 1,000 shares of common stock for US$10.00 to Mr. Rubens Ometto Silveira Mello, who indirectly controls Cosan S.A. Indústria e Comércio and its subsidiaries (“Cosan S.A.”).

The companies included in the unaudited consolidated interim financial statements have as their primary activity the production of ethanol and sugar. They are constantly pursuing opportunities to capitalize on the growing demand for ethanol and sugar in the world. They are focused on increasing production capacity through expansion of existing facilities, development of greenfield projects and, as opportunities present themselves, acquisitions.

On August 1, 2007, Aguassanta Participações S.A. and Usina Costa Pinto S.A. Açúcar e Álcool, controlling shareholders of Cosan S.A. and both indirectly controlled by Mr. Rubens Ometto Silveira Mello, the controlling shareholder, contributed their common shares of Cosan S.A. to Cosan in exchange for 96,332,044 of our class B1 common shares. The common shares contributed to the Company by Aguassanta Participações S.A. and Usina Costa Pinto S.A. Açúcar e Álcool consisted of 96,332,044 common shares of Cosan, representing 51.0% of Cosan S.A. outstanding common shares. As a result of this operation Cosan Ltd. became the controlling shareholder of Cosan S.A.

This is a transaction among companies under common control. The transferred equity interests of Cosan S.A. have been recognized at the carrying amounts in the accounts of Cosan Limited at the date of transfer. The financial statements of Cosan Limited for the nine-month period ended January 31, 2008 reflect the results of operations of the entities as though the transfer of equity occurred at the beginning of the period. Additionally, the financial statements for the nine-month period ended January 31, 2007 have been restated to reflect the combination of entities under common control to furnish comparative information. Earnings per share has been computed assuming that the shares issued in connection with the formation of Cosan Limited, and the shares of Cosan S.A. contributed into Cosan Limited have been outstanding from the beginning of the periods.

COSAN LIMITED

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED

FINANCIAL STATEMENTS--Continued

(In thousands of U.S. dollars, unless otherwise stated)

| 1. | Operations and Purpose--Continued |

At an Extraordinary General Meeting held by Cosan S.A. on December 5, 2007, the shareholders approved the issuance of 82,700,000 common shares at an issue price of R$21.00 (US$11.93) per share which resulted in a capital increase of R$1,736,700 thousand, (US$978,228). The non-controlling shareholders contributed only 64.1% of their subscription rights which represented 26,092.604 shares valued at R$547,945 thousand (US$309,333). Cosan subscribed for the remainder of the shares, 56,607,396, valued at R$1,188,755 thousand (US$668,895). Cosan had expressed its intention to subscribe the entire remainder of capital increase at the time the Extraordinary General Meeting was held, capitalizing at Cosan S.A. a portion of the funds raised from the Company’s initial public offering of its shares on August 17, 2007.

Based on the above, holdings of the non-controlling shareholders have been diluted and the Company increased its proportionate interest of Cosan S.A. from 50.75% to 56.11%. The transaction has been accounted for using the purchase method. The preliminary purchase price allocation based on the estimated fair value of assets acquired and liabilities assumed has resulted in goodwill of US$73,760.

Shareholders’ equity as April 30, 2007 has been stated as follows:

| | | Class B Common stock number | | | Class B Common stock amount | | | Additional paid-in capital | | | Accumulated other comprehensive income | | | Retained earnings | | | Total shareholders’ equity | |

| As stated | | | | | | | | | | | | | | | | | | |

| Cosan Limited | | | 1,000 | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Cosan S.A. Indústria e Comércio | | | - | | | | 535,105 | | | | 160,944 | | | | 71,953 | | | | 160,648 | | | | 928,650 | |

| Contribution of 51% of Cosan S.A. equity as of April 30, 2007 | | | 96,331,044 | | | | 272,904 | | | | 82,081 | | | | 36,696 | | | | 81,930 | | | | 473,611 | |

| Reclassification from common stock | | | - | | | | (271,941 | ) | | | 271,941 | | | | - | | | | - | | | | - | |

| As restated | | | 96,332,044 | | | | 963 | | | | 354,022 | | | | 36,696 | | | | 81,930 | | | | 473,611 | |

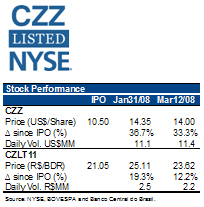

On August 17, 2007, the Company concluded its global offering of 111,678,000 class A common shares which resulted in gross proceeds in the amount of U$1,171,027. As a result of the global offering, Cosan’s shares are traded on the New York Stock Exchange (NYSE) and on the São Paulo Stock Exchange (Bovespa) by BDR (Brazilian Depositary Receipts).

The costs directly attributable to the offering were charged against the gross proceeds of the offering in a total amount of US$52,594. Therefore the net proceeds related to the IPO totaled US$1,118,433.

COSAN LIMITED

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED

FINANCIAL STATEMENTS--Continued

(In thousands of U.S. dollars, unless otherwise stated)

| 2. | Presentation of the Consolidated Financial Statements |

a. Basis of Reporting for Interim Financial Statements

In the opinion of management, the unaudited condensed consolidated financial statements reflect all adjustments (consisting of normal recurring accruals) considered necessary for a fair presentation of the Company’s results for the periods presented. Interim results for the nine-month period ended January 31, 2008, are not necessarily indicative of the results that may be expected for the year ending April 30, 2008.

The unaudited condensed consolidated financial statements include the accounts of Cosan Limited and its subsidiaries. All significant intercompany transactions have been eliminated.

The accounts of Cosan are maintained in U.S. Dollars and the accounts of its subsidiaries are maintained in Brazilian reais, which have been translated into U.S. dollars in accordance with Statement of Financial Accounting Standards (“SFAS”) No. 52 “Foreign Currency Translation” using the real as the functional currency.

The exchange rate of the Brazilian real (R$) to the US$ was R$1.7603=US$ 1.00 at January 31, 2008 and R$2.0339=US$1.00 at April 30, 2007.

The preparation of condensed consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the amounts reported in the consolidated financial statements and accompanying notes. Actual results could differ from these estimates. These estimates and assumptions are reviewed and updated regularly to reflect recent experience.

COSAN LIMITED

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED

FINANCIAL STATEMENTS--Continued

(In thousands of U.S. dollars, unless otherwise stated)

| 2. | Presentation of the Consolidated Financial Statements--Continued |

c. Recently issued accounting standards

In December 2007, the FASB issued Statement of Financial Accounting Standards No. 160, “Noncontrolling Interests in Consolidated Financial Statements” (“SFAS 160”) which amends ARB 51 to establish accounting and reporting standards for the noncontrolling interest in a subsidiary and for the deconsolidation of a subsidiary. It clarifies that a noncontrolling interest in a subsidiary is an ownership interest in the consolidated entity that should be reported as equity in the consolidated financial statements. Before this Statement was issued, limited guidance existed for reporting noncontrolling interests. This Statement changes the way the consolidated income statement is presented. It requires consolidated net income to be reported at amounts that include the amounts attributable to both the parent and the noncontrolling interest. It also requires disclosure, on the face of the consolidated statement of income, of the amounts of consolidated net income attributable to the parent and to the noncontrolling interest. This Statement is effective for Cosan as of May 1, 2009. As this statement was recently issued, Cosan is evaluating the impact on its consolidated financial statements and related disclosures.

In December 2007, the FASB issued Statement of Financial Accounting Standards No. 141(R), “Business Combinations” (“SFAS 141(R)”) which replaces FASB Statement No. 141, Business Combinations. This Statement establishes principles and requirements for how the acquirer recognizes and measures in its financial statements the identifiable assets acquired, the liabilities assumed, and any noncontrolling interest in the acquiree; recognizes and measures the goodwill acquired in the business combination or a gain from a bargain purchase; and determines what information to disclose to enable users of the financial statements to evaluate the nature and financial effects of the business combination. This Statement is effective for Cosan as of May 1, 2009. This Statement will only impact Cosan’s financial statements in the event of a business combination on or after May 1, 2009.

COSAN LIMITED

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED

FINANCIAL STATEMENTS--Continued

(In thousands of U.S. dollars, unless otherwise stated)

| 2. | Presentation of the Consolidated Financial Statements--Continued |

c. Recently issued accounting standards--Continued

In February 2007, the Financial Accounting Standards Board (“FASB”) issued Statement of Financial Accounting Standards No. 159, “The Fair Value Option for Financial Assets and Financial Liabilities—including an amendment of FASB Statement No. 115” (“SFAS 159”), which expands the use of fair value measurement by permitting entities to choose to measure many financial instruments and certain other items at fair value at specified election dates. This statement is required to be adopted by Cosan as of May 1, 2008. Cosan does not believe the adoption of SFAS 159 will have a material effect on its consolidated financial position, results of operations or cash flows.

In September 2006, the FASB also issued Statement of Financial Accounting Standards No. 157, “Fair Value Measurements” (“SFAS 157”), which defines fair value, establishes a framework for measuring fair value and expands disclosures about fair value measurements. SFAS 157 does not require any new fair value measurements but instead is intended to eliminate inconsistencies with respect to this topic found in various other accounting pronouncements. This Statement is effective for Cosan as of May 1, 2008. Cosan does not believe the adoption of SFAS 157 will have a material effect on its consolidated financial position, results of operations or cash flows.

| 3. | Cash and Cash Equivalents |

| | | January 31, 2008 | | | April 30, 2007 | |

| Local currency | | | | | | |

| Cash and bank accounts | | | 67,068 | | | | 16,208 | |

| Foreign currency | | | | | | | | |

| Cash and bank accounts | | | 16,344 | | | | 300,334 | |

| | | | 83,412 | | | | 316,542 | |

COSAN LIMITED

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED

FINANCIAL STATEMENTS--Continued

(In thousands of U.S. dollars, unless otherwise stated)

| | | January 31, 2008 | | | April 30, 2007 | |

| Investment funds | | | 431,514 | | | | - | |

| Bank Deposits Certificate | | | 756,974 | | | | 281,873 | |

| Other | | | 6 | | | | 6 | |

| | | | 1,188,494 | | | | 281,879 | |

The investment funds balance consists of fixed income investments expressed in U.S. dollars with international prime banks, remunerated at an average rate of 5.2% p.a. and available for prompt redemption.

| 5. | Derivative Financial Instruments |

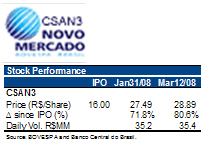

Cosan S.A. has entered into derivative financial instruments with various counterparties and uses derivatives to manage the overall exposures related to sugar price variation in the international market and exchange rate variation. The instruments are commodity futures contracts, forward currency agreements, interest rate and foreign exchange swap contracts, and option contracts. Cosan S.A. recognizes all derivatives on the balance sheet at fair value.

There are no derivative instruments designated as hedges.

The following table summarizes the notional value of derivative financial instruments as well as the related amounts recorded in balance sheet accounts:

| | | Notional amounts | | | Carrying value asset (liability) | |

| | | January 31, 2008 | | | April 30, 2007 | | | January 31, 2008 | | | April 30, 2007 | |

| Commodities derivatives | | | | | | | | | | | | |

| Future contracts: | | | | | | | | | | | | |

| Purchase commitments | | | 222 | | | | - | | | | 27 | | | | - | |

| Sell commitments | | | 455,561 | | | | 247,882 | | | | (63,262 | ) | | | 47,427 | |

| Options: | | | | | | | | | | | | | | | | |

| Purchased | | | - | | | | 58,587 | | | | - | | | | 4,502 | |

| Written | | | 136,746 | | | | - | | | | (26,836 | ) | | | - | |

| | | | | | | | | | | | | | | | | |

| Foreign exchange derivatives | | | | | | | | | | | | | | | | |

| Forward contracts: | | | | | | | | | | | | | | | | |

| Sale commitments | | | 481,808 | | | | 153,824 | | | | 12,712 | | | | 13,274 | |

| Swap agreements | | | 324,206 | | | | 328,419 | | | | (12,234 | ) | | | (9,779 | ) |

| Total assets | | | | | | | | | | | 12,739 | | | | 65,203 | |

| Total liabilities | | | | | | | | | | | (102,332 | ) | | | (9,779 | ) |

COSAN LIMITED

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED

FINANCIAL STATEMENTS--Continued

(In thousands of U.S. dollars, unless otherwise stated)

| 5. | Derivative Financial Instruments--Continued |

Where quoted market prices were not available, fair values were based on estimates using discounted cash flows or other valuation techniques. Asset figures are classified as other current assets.

| | | January 31, 2008 | | | April 30, 2007 | |

| Finished goods: | | | | | | |

| Sugar | | | 182,397 | | | | 5,730 | |

| Ethanol | | | 173,641 | | | | 8,731 | |

| Others | | | 2,122 | | | | 1,681 | |

| | | | 358,160 | | | | 16,142 | |

| Annual maintenance cost of growing crops | | | 147,702 | | | | 183,157 | |

| Others | | | 65,342 | | | | 48,181 | |

| | | | 571,204 | | | | 247,480 | |

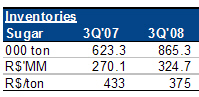

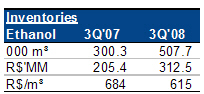

The increase in the finished goods balances is due to quantity increases in sugar and ethanol from the 2007-2008 harvest period, which will be sold during the inter-harvest period (from January to April).

Long-term debt is summarized as follows:

| | Financial charges | | | | | | | |

| | Index | | Average annual interest rate | | January 31, 2008 | | | April 30, 2007 | |

| Resolution 2471 (PESA) | IGP-M | | | 3.95 | % | | | 250,866 | | | | 196,545 | |

| | Corn price variation | | | 12.50 | % | | | 412 | | | | 685 | |

| Senior notes due 2009 | US Dollar | | | 9.0 | % | | | 34,418 | | | | 200,000 | |

| Senior notes due 2017 | US Dollar | | | 7.0 | % | | | 399,922 | | | | 407,311 | |

| IFC | US Dollar | | | 7.44 | % | | | 56,972 | | | | 67,677 | |

| Perpetual notes | US Dollar | | | 8.25 | % | | | 458,839 | | | | 459,035 | |

| Others | Various | | Various | | | 52,924 | | | | 47,319 | |

| | | | | | | | | 1,254,353 | | | | 1,378,572 | |

| Current portion | | | | | | | | (27,875 | ) | | | (36,076 | ) |

| Long-term debt | | | | | | | | 1,226,478 | | | | 1,342,496 | |

COSAN LIMITED

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED

FINANCIAL STATEMENTS--Continued

(In thousands of U.S. dollars, unless otherwise stated)

| 7. | Long-term Debt--Continued |

Long-term debt has the following scheduled maturities:

| | | January 31, | |

| 2010 | | | 47,688 | |

| 2011 | | | 7,632 | |

| 2012 | | | 38,705 | |

| 2013 | | | 10,408 | |

| 2014 | | | 1,353 | |

| 2015 | | | 1,353 | |

| 2016 and thereafter | | | 1,119,339 | |

| Total | | | 1,226,478 | |

Senior notes due 2009

The senior notes are listed on the Luxembourg Stock Exchange, mature in November 2009 and bear interest at a rate of 9% per annum, payable semi-annually in May and November as from May 1, 2005. Guarantees have been provided by Cosan S.A.’s indirect subsidiary, Usina da Barra.

On October 25, 2007, Cosan S.A. advanced payment of part of the debt thus reducing debt principal by US$164,192, of which US$3,301 was paid on November 8, 2007. In this operation there was advance settlement of interest and payment of bonus in the total amount of US$17,294, which was recorded in Financial expenses account.

Senior notes due 2017

On January 26, 2007, the indirect wholly-owned subsidiary Cosan Finance Limited issued US$400 million of senior notes in the international capital markets. These senior notes, listed on the Luxembourg Stock Exchange, mature in February 2017 and bear interest at a rate of 7% per annum, payable semi-annually. Guarantees have been provided by the subsidiary, Usina da Barra.

COSAN LIMITED

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED

FINANCIAL STATEMENTS--Continued

(In thousands of U.S. dollars, unless otherwise stated)

| 7. | Long-term Debt--Continued |

Perpetual notes

On January 24 and February 10, 2006, Cosan S.A. issued perpetual notes. The perpetual notes are listed in the Luxembourg Stock Exchange - EURO MTF and are subject to interest of 8.25% per year, payable quarterly on the 15th of May, August, November and February of each year, beginning May 15, 2006. These notes may, at the discretion of Cosan S.A., be redeemed as from February 15, 2011 on any interest payment date. Perpetual notes are guaranteed by Cosan S.A. and by Usina da Barra.

Special Agricultural Financing Program (Programa Especial de Saneamento de Ativos), or PESA

To extend the repayment period of debts incurred by Brazilian agricultural producers, the Brazilian government passed Law 9.138 followed by Central Bank Resolution 2,471, which, together, formed the PESA program. PESA offered certain agricultural producers with certain types of debt the opportunity to acquire Brazilian treasury bills (CTNs) in an effort to restructure their agricultural debt. The face value of the Brazilian treasury bills was the equivalent of the value of the restructured debt and was for a term of 20 years.

The acquisition price was calculated by the present value, discounted at a rate of 12% per year or at the equivalent of 10.4% of its face value. The CTNs were deposited as a guarantee with a financial institution and cannot be renegotiated until the outstanding balance is paid in full. The outstanding balance associated with the principal is adjusted in accordance with the IGP-M until the expiration of the restructuring term, which is also 20 years, at which point the debt will be discharged in exchange for the CTNs. Because the CTNs will have the same face value as the outstanding balance at the end of the term, it will not be necessary to incur additional debt to repay our PESA debt.

On July 31, 2003, the Central Bank issued Resolution 3,114, authorizing the reduction of up to five percentage points of PESA related interest rates, effectively lowering the above-mentioned rates to 3%, 4% and 5%, respectively. The CTNs held by Cosan S.A. as of January 31, 2008 and April 30, 2007 amounted to US$105,633 and US$82,205 respectively, and are classified as other non-current assets.

COSAN LIMITED

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED

FINANCIAL STATEMENTS--Continued

(In thousands of U.S. dollars, unless otherwise stated)

| 7. | Long-term Debt--Continued |

Special Agricultural Financing Program (Programa Especial de Saneamento de Ativos), or PESA--Continued

Cosan’s subsidiaries are subject to certain restrictive covenants related to limitation on transactions with shareholders and affiliated companies; and limitation on payment of dividends and other payments affecting subsidiaries.

| 8. | Estimated Liability for Legal Proceedings and Labor Claims |

| | | January 31, 2008 | | | April 30, 2007 | |

| Tax contingencies | | | 386,138 | | | | 329,493 | |

| Civil and labor contingencies | | | 55,831 | | | | 49,698 | |

| | | | 441,969 | | | | 379,191 | |

Cosan´s subsidiaries are parties in various ongoing labor claims, civil and tax proceedings arising in the normal course of its business. Respective provisions for contingencies were recorded considering those cases in which the likelihood of loss has been rated as probable. Management believes resolution of these disputes will have no effect significantly different than the estimated amounts accrued.

Judicial deposits recorded by Cosan under the caption other non-current assets have been made for some of these suits amounting to US$26,579 (US$21,274 on April 30, 2007). Judicial deposits are restricted assets of Cosan placed on deposit with the court and held in judicial escrow pending of legal resolution certain legal proceedings.

Tax contingencies refer, substantially, to suits filed by Cosan and its subsidiaries, relating to several aspects of the legislation ruling PIS, Cofins, contributions to the extinct IAA - Sugar and Ethanol Institute, and the Federal VAT (IPI), as well as tax delinquency notices related to ICMS and contributions to the INSS.

The major tax contingencies as of January 31, 2008 are related to Excise tax - IPI credit premium in the amount of US$150,700, Value added tax - ICMS in the amount of US$25,225, IAA tax contribution in the amount of US$44,789, and Social Contributions in the amount of US$71,269.

COSAN LIMITED

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED

FINANCIAL STATEMENTS--Continued

(In thousands of U.S. dollars, unless otherwise stated)

| 8. | Estimated Liability for Legal Proceedings and Labor Claims--Continued |

In addition to the aforementioned claims, Cosan and its subsidiaries are involved in other contingent liabilities relating to tax claims and environmental matters, which have not been recorded, considering their current stage and the likelihood of favorable outcomes. These claims are broken down as follows:

| | | January 31, 2008 | | | April 30, 2007 | |

| Tax assessment – Withholding Income Tax | | | 87,162 | | | | 73,037 | |

| IPI Premium Credit resulting from Regulatory Ruling No. 67/98 | | | 84,740 | | | | 70,860 | |

| ICMS - State value added tax | | | 41,163 | | | | 28,964 | |

| IAA – Sugar and Ethanol Institute | | | 26,706 | | | | 23,706 | |

| IPI – Federal value-added tax | | | 41,999 | | | | 31,921 | |

| Others | | | 35,482 | | | | 18,574 | |

| | | | 317,252 | | | | 247,062 | |

The subsidiary Usina da Barra has several indemnification suits filed against the Federal Government. The suits relate to product prices that did not conform to the reality of the market, which were mandatorily established at the time the sector was under the Government’s control.

In connection with one of these suits, a final and unappealable decision in the amount of US$149,121 was rendered in September 2006 in favor of Usina de Barra. This has been recorded as a gain in the statement of operations for the year ended April 30, 2007. Since the recorded amount is substantially composed of interest and monetary restatement, it was recorded in Financial income and in a non-current receivable on the balance sheet. In connection with the settlement process, the form of payment is being determined. The Company is expecting a final decision relative to the payment terms within three years, which is expected to be in the form of public debt, to be received over a ten year period. The amount is subject to interest and inflation adjustment by an official index. Lawyers’ fees in the amount of US$18,783 relating to this suit were recorded in general and administrative expenses in the statements of operations for the year ended April 30, 2007. At January 31, 2008, the updated amounts are US$192,713 and US$23,126, respectively.

COSAN LIMITED

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED

FINANCIAL STATEMENTS--Continued

(In thousands of U.S. dollars, unless otherwise stated)

As mentioned in note 1, the Company is an exempted company located in Bermuda. Nevertheless, the Company’s subsidiaries located in Brazil file income tax returns in the Brazilian federal jurisdiction. These subsidiaries are no longer subject to Brazilian federal income tax examinations by tax authorities for years before December 31, 2002. Additionally, the Cosan S.A. has not been under a Brazilian Internal Revenue Service (IRS) income tax examination for 2003 through 2007.

Effective May 1, 2007, the Company adopted FASB Interpretation No. 48, Accounting for Uncertainty in Income Taxes, an interpretation of FASB Statement 109 (FIN 48). FIN 48 clarifies the accounting for uncertainty in income taxes recognized in financial statements and prescribes a threshold of more-likely-than-not for recognition of tax benefits of uncertain tax positions taken or expected to be taken in a tax return. FIN 48 also provides related guidance on measurement, derecognition, classification, interest and penalties, and disclosure. Also, FIN 48 excludes income taxes from the scope of Statement of Financial Accounting Standards No. 5, Accounting for Contingencies.

Prior to the adoption of FIN 48, the Company recognized tax benefits of uncertain tax positions only if it was probable that the positions would be sustained. There was no retained earnings impact upon adoption of FIN 48 as no additional tax position met the recognition threshold under FIN 48.

A reconciliation of the beginning and ending amount of unrecognized tax benefits is as follows:

| Balance at May 1, 2007 | | | 21,824 | |

| Accrued interest on unrecognized tax benefit | | | 597 | |

| Settlements | | | (22 | ) |

| Balance at January 31, 2008 | | | 22,399 | |

It is possible that the amount of unrecognized tax benefits will change in the next twelve months, however, an estimate of the range of the possible change cannot be made at this time due to the long time to reach a settlement agreement or decision with the taxing authorities.

The Company recognizes interest accrued related to unrecognized tax benefits in interest expense and penalties in operating expenses.

COSAN LIMITED

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED

FINANCIAL STATEMENTS--Continued

(In thousands of U.S. dollars, unless otherwise stated)

| 10. | Share-based Compensation |

In the ordinary and extraordinary general meeting held on August 30, 2005, the guidelines for the outlining and structuring of a stock option plan for Cosan S.A’s officers and employees were approved, thus authorizing the issue of up to 5% of shares comprising Cosan S.A.’s share capital. This stock option plan was outlined to attract and retain services rendered by officers and key employees, offering them the opportunity to become shareholders of Cosan S.A. On September 22, 2005, the board of directors approved the distribution of stock options corresponding to 4,302,780 common shares to be issued or purchased by Cosan related to 3.50% of the share capital at the time, authorized by the annual/extraordinary meeting. The remaining 1.75% may be distributed. On September 22, 2005, the officers and key employees were informed regarding the key terms and conditions of the share-based compensation arrangement.

According to the market value on the date of issuance, the exercise price is US$3.47 per share which does not include any discount. The exercise price was calculated before the valuation mentioned above based on an expected private equity deal which did not occur. Options may be exercised after a one-year vesting period starting November 18, 2005, at the maximum percentage of 25% per year of the total stock options offered by Cosan S.A. The options for each 25% have a five-year period to be exercised.

On September 11, 2007, the board of directors approved additional distribution of stock options, in connection with the stock option plan mentioned above, corresponding to 450,000 common shares to be issued or purchased by Cosan S.A. related to 0.4% of the share capital at September 22, 2005. The remaining 1.35% may still be distributed.

The exercised options will be settled only through issuance of new common shares or treasury stock that Cosan S.A. may have in each date.

The employees that leave Cosan S.A. before the vesting period will forfeit 100% of their rights. However, if the employment is terminated by Cosan S.A. with no cause, the employees will have right to exercise 100% of their options of that particular year plus the right to exercise 50% of the options of the following year.

COSAN LIMITED

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED

FINANCIAL STATEMENTS--Continued

(In thousands of U.S. dollars, unless otherwise stated)

| 10. | Share-based Compensation--Continued |

The fair value of stock-based awards was estimated using a binominal model with the following assumptions for the nine-month period ended January 31, 2008:

| | | Awards granted on September 22, 2005 | | | Awards granted on September 11, 2007 | |

| Grant price – US$ | | | 3.47 | | | | 3.47 | |

| Expected life (in years) | | | 7.5 | | | | 7.5 | |

| Interest rate | | | 14.52 | % | | | 9.34 | % |

| Volatility | | | 34.00 | % | | | 46.45 | % |

| Dividend yield | | | 1.25 | % | | | 1.47 | % |

| Weighted-average fair value at grant date – US$ | | | 7.02 | | | | 10.33 | |

As of January 31, 2008 the amount of US$15,377 related to the unrecognized stock option compensation cost is expected to be recognized in 2.5 years. Cosan S.A. currently has no shares in treasury.

On November 19, 2007 and on December 11, 2007 the holders of stock options exercised 922,947 and 38,725 options, respectively. As of January 31, 2008 there were 2,373,341 options outstanding with a weighted-average exercise price of US$3.47.

| 11. | Other Comprehensive Income |

The table below presents accumulated other comprehensive income for the nine month periods ended January 31:

| | | Nine months ended January 31, | |

| | | 2008 | | | 2007 | |

| Net income (loss) | | | (40,713 | ) | | | 114,098 | |

| Currency translation adjustment | | | 45,129 | | | | (2,478 | ) |

| Total comprehensive income | | | 4,416 | | | | 111,620 | |

COSAN LIMITED

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED

FINANCIAL STATEMENTS--Continued

(In thousands of U.S. dollars, unless otherwise stated)

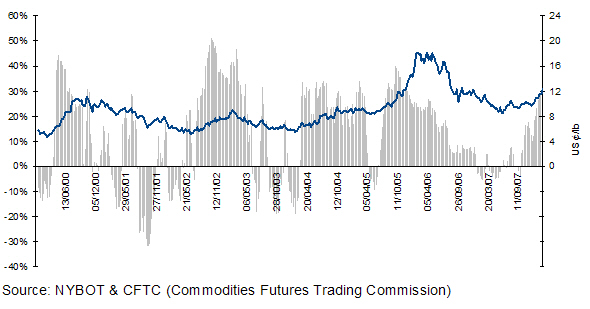

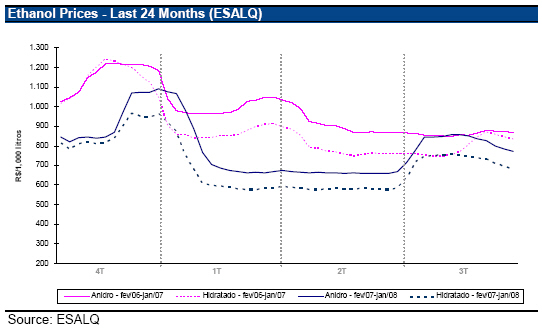

The following information about segments is based upon information used by Cosan’s senior management to assess the performance of operating segments and decide on the allocation of resources. Cosan’s reportable segments are business units that target different industry segments. Each reportable segment is managed separately because of the need to specifically address customer needs in these different industries. Cosan has three segments: Sugar, Ethanol and others group. The operations of these segments are based solely in Brazil.

The sugar segment mainly operates and produces a broad variety of sugar products, including raw (also known as very high polarization - VHP sugar), organic, crystal and refined sugars, and sell these products to a wide range of customers in Brazil and abroad. Cosan exports the majority of the sugar produced through international commodity trading companies. Cosan’s domestic customers include wholesale distributors, food manufacturers and retail supermarkets, through which it sells its “Da Barra” branded products.

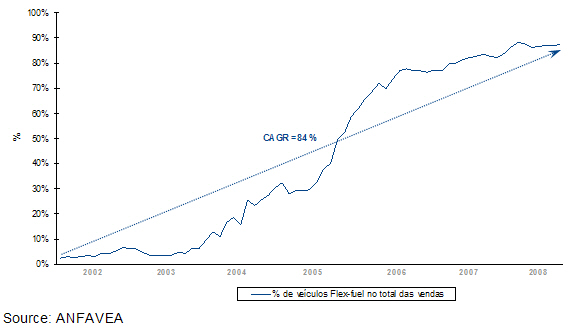

The ethanol segment substantially produces and sells fuel ethanol, both hydrous and anhydrous (which has lower water content than hydrous ethanol) and industrial ethanol. Cosan’s principal ethanol product is fuel ethanol, which is used both as an automotive fuel and as an additive in gasoline, and is mainly sold in the domestic market by fuel distribution companies. Consumption of hydrous ethanol in Brazil is increasing as a result of the introduction of flex fuel vehicles that can run on either gasoline or ethanol (or a combination of both) to the Brazilian market in 2003. In addition, Cosan sells liquid and gel ethanol products used mainly in the production of paint and cosmetics and alcoholic beverages for industrial clients in various sectors.

The accounting policies underlying the financial information provided for the segments are based on Brazilian GAAP. We evaluate segment performance information generated from the statutory accounting records from the subsidiaries.

Others segment is comprised by selling cogeneration of electricity, diesel and corporate activities.

No asset information is provided by reportable segment due to the fact that the majority of the assets used in production of sugar an ethanol are the same.

COSAN LIMITED

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED

FINANCIAL STATEMENTS--Continued

(In thousands of U.S. dollars, unless otherwise stated)

| 12. | Segment Information--Continued |

Measurement of segment profit or loss and segment assets

Cosan evaluates performance and allocates resources based on return on capital and profitable growth. The primary measurement used by management to measure the financial performance of Cosan is adjusted EBIT (earnings before interests and taxes excluding special items such as impairment and restructuring, integration costs, one-time gains or losses on sales of assets, acquisition, and other items similar in nature). The accounting policies of the reportable segments are the same as those described in the summary of significant accounting policies.

| | | January 31, | |

| | | 2008 | | | 2007 | |

| Net sales — Brazilian GAAP: | | | | | | |

| Sugar | | | 542,721 | | | | 846,005 | |

| Ethanol | | | 379,389 | | | | 422,509 | |

| Others | | | 81,715 | | | | 79,183 | |

| Total | | | 1,003,825 | | | | 1,347,697 | |

| | | | | | | | | |

| Reconciling item to U.S. GAAP | | | | | | | | |

| Sugar | | | 2,107 | | | | 3,204 | |

| Ethanol | | | - | | | | - | |

| Others | | | - | | | | - | |

| Total | | | 2,107 | | | | 3,204 | |

| | | | | | | | | |

| Total net sales | | | 1,005,932 | | | | 1,350,901 | |

COSAN LIMITED

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED

FINANCIAL STATEMENTS--Continued

(In thousands of U.S. dollars, unless otherwise stated)

| 12. | Segment Information--Continued |

Measurement of segment profit or loss and segment assets--Continued

| | | January 31, | |

| | | 2008 | | | 2007 | |

| Segment operating income - Brazilian GAAP | | | | | | |

| Sugar | | | (124,722 | ) | | | 124,746 | |

| Ethanol | | | (87,187 | ) | | | 62,301 | |

| Others | | | (18,779 | ) | | | 11,676 | |

| | | | | | | | | |

| Operating income (loss) under Brazilian GAAP | | | (230,688 | ) | | | 198,723 | |

| | | | | | | | | |

| Reconciling items to U.S. GAAP | | | | | | | | |

| Depreciation and amortization expenses | | | | | | | | |

| Sugar | | | 27,673 | | | | 32,096 | |

| Ethanol | | | 19,345 | | | | 15,460 | |

| Others | | | 4,166 | | | | 2,987 | |

| | | | 51,184 | | | | 50,543 | |

| Other adjustments | | | | | | | | |

| Sugar | | | 27,937 | | | | (87 | ) |

| Ethanol | | | 18,066 | | | | (1,644 | ) |

| Others | | | 3,891 | | | | (308 | ) |

| | | | 49,894 | | | | (2,039 | ) |

| | | | | | | | | |

| Total sugar | | | (69,113 | ) | | | 156,755 | |

| | | | | | | | | |

| Total ethanol | | | (49,776 | ) | | | 76,117 | |

| | | | | | | | | |

| Total others | | | (10,721 | ) | | | 14,355 | |

| | | | | | | | | |

| Operating income (loss) under U.S. GAAP | | | (129,610 | ) | | | 247,227 | |

COSAN LIMITED

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED

FINANCIAL STATEMENTS--Continued

(In thousands of U.S. dollars, unless otherwise stated)

| 12. | Segment Information--Continued |

Sales to principal customers

Sugar

The following table sets forth the amount of sugar that we sold to our principal customers during the nine-month periods ended January 31, as a percentage of our total sales of sugar:

| Market | | Customer | | 2008 | | 2007 |

| International | | Sucres et Denrées | | 19.7% | | 34.2% |

| | | S.A. Fluxo | | 15.2% | | 15.6% |

| | | Tate & Lyle International | | 14.8% | | 6.4% |

| | | Cane International Corporation | | 12.2% | | 2.7% |

| | | Coimex Trading Ltd | | 8.0% | | 11.7% |

| | | | | | | |

| Domestic | | Atacadão Distr. Com. Ind. Ltda. | | 10.0% | | 8.3% |

| | | Minascucar S/A | | 4.1% | | 1.3% |

| | | Companhia Brasileira de Distribuição | | 4.1% | | 9.9% |

| | | Ajinomoto Biolatina Ind. Com. Ltda. | | 3.7% | | 2.3% |

| | | Nova América S/A - Agroenergia | | 3.4% | | 5.1% |

Ethanol

The following table sets forth the amount of ethanol that we sold to our principal customers during the nine-month periods ended January 31, as a percentage of our total sales of ethanol:

| Market | | Customer | | 2008 | | 2007 |

| International | | Vertical UK LLP | | 51.1% | | 44.7% |

| | | Vitol Inc. | | 15.6% | | - |

| | | Noble Americas Corporation | | 7.8% | | - |

| | | Kolmar Petrochemical AG | | - | | 23.4% |

| | | | | | | |

| Domestic | | Shell Brasil Ltda | | 26.1% | | 29.3% |

| | | Euro Petróleo do Brasil Ltda. | | 18.6% | | 0.1% |

| | | Tux Distribuidora de Combustíveis Ltda. | | 8.1% | | 3.6% |

| | | Cia. Brasileira de Petróleo Ipiranga | | 9.3% | | 3.7% |

| | | Manancial Distribuidora de Petróleo Ltda | | - | | 14.4% |

| | | Petrobrás Distribuidora S.A. | | 7.8% | | 9.9% |

| | | Flag Distribuidora de Petróleo Ltda | | - | | 7.6% |

COSAN LIMITED

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED

FINANCIAL STATEMENTS--Continued

(In thousands of U.S. dollars, unless otherwise stated)

On February 14, 2008, subsidiary Usina da Barra S.A. Açúcar e Álcool concluded the acquisition of 100% of the units of interest of Benálcool Açúcar e Álcool and Benagri Agrícola Ltda., both of them located in Araçatuba region – São Paulo State, increasing the Company’s crushing capacity by more 1.3 million tons sugar cane by US$60,730 cash.

Cosan S.A. Indústria e Comércio and parent company Cosan Limited announced the Share Acquisition Voluntary Public Offering (OPA) aimed to acquire up to 100% of the common shares of Cosan S.A. held by non-controlling shareholders by means of a swap of its Class A shares depositary receipts (BDRs), for Class A Shares, or for Class B Shares, series 2, issued by Cosan Limited. This plan was approved by the Brazilian Securities and Exchange Commission – CVM and the US Securities and Exchange Commission – SEC on February 27, 2008 and March 4, 2008, respectively.

The OPA qualification period is from March 6 through April 4, 2008, according to the OPA Bidding Publication issued on March 6, 2008.

All details about the offering are described in the prospectus filed with the regulatory bodies.