FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of June 2009

Commission File Number: 1-33659

COSAN LIMITED

(Translation of registrant’s name into English)

Av. Juscelino Kubitschek, 1726 – 6th floor

São Paulo, SP 04543-000 Brazil

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate by check mark whether by furnishing the information contained in this Form, the Registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): N/A

COSAN LIMITED

| | |

| 1. | | Minutes of the Fiscal Council Meeting of Cosan S.A. Indústria e Comércio held on June 1, 2009 |

| 2. | | Minutes of the Board of Directors’ Meeting of Cosan S.A. Indústria e Comércio held on June 1, 2009 |

| 3. | | Call Notice for Extraordinary Shareholders’ Meeting of Cosan S.A. Indústria e Comércio to be held on June 18, 2009 |

| 4. | | Material Fact of Cosan S.A. Indústria e Comércio dated June 2, 2009 |

| 5. | | Protocol and Justification of Merger of Curupay S.A. Participações into Cosan S.A. Indústria e Comércio |

| | | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | COSAN LIMITED | |

| | | | |

| | | | |

| Date: | June 5, 2009 | | By: | /s/ Marcelo Eduardo Martins | |

| | | | | Name: | Marcelo Eduardo Martins | |

| | | | | Title: | Chief Financial and Investor Relations Officer | |

ITEM 1

COSAN S.A. INDÚSTRIA E COMÉRCIO

Corporate Taxpayers' ID (CNPJ): No. 50.746.577/0001-15

Company Registry (NIRE) 35.300.177.045

Minutes of the Fiscal Council Meeting held on June 1, 2009.

Date, time and venue: June 1, 2009 at 10:00 am, at the Company´s headquarters at Avenida Juscelino Kubitscheck, 1.726, 6º andar, in the city and state of São Paulo. Attendance: All members of the Company´s Fiscal Council: João Ricardo Ducatti, Luiz Cláudio Gomes Recchia and Ademir José Scarpin. Presiding: Chairman – João Ricardo Ducatti; Secretary – Ademir José Scarpin. Agenda: To discuss the merger of Curupay S.A. Participações by Cosan S.A. Indústria e Comércio. Resolutions: After carefully analyzing the Protocol and Justification of Merger of Curupay S.A. Participações and the associated evaluation reports prepared by Deloitte Touche Tohmatsu Auditores Independentes and Banco de Investimentos Credit Suisse (Brasil) S.A., the members of the Fiscal Council, in accordance with item III of article 163 and paragraph 2 of article 166 of law No. 6.404/76, recommended its submission to a Shareholders Meeting. Closure and approval of the minutes: There being no further matters to address, the meeting was called to order and the present minutes were drawn up, read, approved and signed by all members of the Fiscal Council.

São Paulo, June 1st, 2009.

______________________________________

JOÃO RICARDO DUCATTI

______________________________________

ADEMIR JOSÉ SCARPIN

______________________________________

LUIZ CLÁUDIO GOMES RECCHIA

ITEM 2

COSAN S.A. INDÚSTRIA E COMÉRCIO

Corporate Taxpayer’s ID (CNPJ) 50.746.577/0001-15

Company Registry ID (NIRE) 35.300.177.045

PUBLICLY-HELD COMPANY

MINUTES OF THE BOARD OF DIRECTORS’ MEETING

HELD ON JUNE 01, 2009

1. DATE, TIME AND PLACE: June 1, 2009, at 9:00 am, at the Company’s administrative office located at Avenida Juscelino Kubitschek, 1726, 6º andar, in the city and state of São Paulo.

2. ATTENDANCE: All members of the Company’s Board of Directors attended the meeting, namely: Mr. Rubens Ometto Silveira Mello, Chairman of the Board of Directors, Mr. Pedro Isamu Mizutani, Vice Chairman of the Board of Directors, Mr. Burkhard Otto Cordes, Mr. Marcus Vinícius Pratini de Moraes, Mr. Serge Varsano (representing Mr. Rubens Ometto Silveira Mello by proxy), Mr. Maílson Ferreira da Nóbrega, Mr. Sylvio Ricardo Pereira de Castro and Mr. Pedro Luiz Cerize. The following members of the Fiscal Council also attended the meeting: Mr. João Ricardo Ducatti, Mr. Luiz Cláudio Gomes Recchia and Mr. Ademir José Scarpin. All members attended the meeting by conference call, as provided for in paragraph 2 of Article 20 of the Company’s Bylaws, except for the Fiscal Council members, who attended the meeting exclusively for consideration of item I. (iii).

3. CALL NOTICE: Sent by e-mail and waved in view of the presence of all members.

4. PRESIDING BOARD: Chairman: Rubens Ometto Silveira Mello; Secretary: Marcelo de Souza Scarcela Portela.

5. AGENDA: I. Discussion and resolution on the corporate reorganization proposed by the Board of Executive Officers, which shall result in the merger of the companies of the Nova America group; a) Authorization for the Company to sign the Private Instrument of 2nd Addendum to the Deed of the 2nd Public Issue of Simple Debentures, of unsecured type, of Nova América S.A. – Agroenergia with Rezende Barbosa S.A. Administração e Participações and others; b) Assumption of all sureties and aval guarantees of debts with various financial institutions contracted by the companies: Nova América S.A. Agroenergia; América Trading S.A., Teaçu Armazéns Gerais S.A., Nova América S.A. Trading and Destilaria Paraguaçu Ltda.; c) Approval of the signature of the “Protocol and Justification”, as well as all articles of association and documents related to the merger by the Company of Curupay S.A. Participações, a company controlled by Rezende Barbosa S.A. Administração e Participações and controlling company of Nova América S.A. Agroenergia; d) Approval of the call to competent Extraordinary Shareholders’ Meeting. II. Discussion and resolution on the ratification of the management’s actions that resulted in the sale of the aviation business to Shell; III. Offering of assets as guarantee: authorization for the Company to offer as guarantee of loans contracted by the Company or any of its controlled companies, or as judicial guarantee in execution suits filed against the Company or any of its controlled companies, any of its assets, including, but not limited to, the following Industrial Complexes, as well as the respective rural areas where these Industrial Complexes are located: São Francisco Unit, located at Fazenda Sobrado, in Elias Fausto (SP); Santa Helena Unit, located at Bairro Campestre, in Rio das Pedras (SP); Costa Pint Unit, located at Bairro Costa Pinto, in Piracicaba (SP); Diamante Unit, located at Fazenda São José, district of Potunduva, Jaú (SP); Rafard Unit, located on Rua do Engenho, in Rafard (SP); Serra Unit, located at Fazenda da Serra, in Ibaté (SP), Junqueira Unit, located at Estação Coronel Quito, in Igarapava (SP); Mundial Unit, located on Estrada Mirandópolis/Pacaembu, in Mirandópolis (SP); and Bom Retiro Unit, located at Fazenda Bom Retiro, in Capivari (SP).

6. RESOLUTIONS: After the discussion of the matters in the agenda, the members of the Board of Directors resolved, by unanimous vote, without any restriction:

I. Corporate Restructuring

(i) to authorize the Company to sign the Private Instrument of 2nd Addendum to the Deed of the 2nd Public Issue of Simple Debentures, of unsecured type, of Nova América S.A. – Agroenergia with Rezende Barbosa S.A. Administração e Participações and others, as addendum made on September 21, 2008 (“2º Aditamento”), to be signed on this date, in which the Company is depicted as the new intervenor-obligor;

(ii) to assume all sureties and aval guarantees of debts with various financial institutions contracted by the companies: Nova América S.A. Agroenergia; América Trading S.A., Teaçu Armazéns Gerais S.A., Nova América S.A. Trading and Destilaria Paraguaçu Ltda “Nova América”), which shall become controlled by the Company after the corporate reorganization, in the amount of approximately R$1,200,000,000.00, on April 30, 2009;

(iii) to approve the signature of the “Protocol and Justification”, as well as all documents related to the operations aimed at corporate reorganization and the calling of general shareholders’ meeting to resolve on this subject, all documents shall be signed by the Company’s management, which provides for the merger by this Company of Curupay S.A. Participações, a company controlled by Rezende Barbosa S.A. Administração e Participações and controlling company of Nova América;

(iv) to approve the calling of Extraordinary Shareholders’ Meeting to resolve on the corporate reorganization aforementioned.

II. Sale of the aviation business to Shell Brasil Ltda.

(iv) to ratify all the actions of the management of the Company and its subsidiaries, as follows, related to the sale of aviation assets to Shell Brasil Ltda., which include the contribution, by Cosan Combustíveis e Lubrificantes S.A. (“CCL”), of assets listed and evaluated pursuant to the evaluation report included in the minutes of the Board of Directors’ meeting of CCL held on May 20, 2009 and registered at JUCERJA, to the capital of Jacta Participações S.A., a corporation headquartered in the City of Piracicaba, State of São Palo, at the access to Bairro Costa Pinto, s/nº, Casa Sede, Sala 7, CEP 13411-900, Corporate Taxpayer’s ID (CNPJ/MF)

no. 10.795.274/0001-78; and authorize Cosanpar Participações S.A. to vote for the redemption of CCL’s shares on the delivery of the totality of shares issued by Jacta Participações S.A., which has already been approved by CCL’s Extraordinary General Meeting held on April 30, 2009, minutes already approved at JUCERJA.

III. Offer of assets as Collateral

(v) to authorize collaterals and/or indications to pledge of the abovementioned assets, within the limits of the authorization herein.

7. Closure: There being no further business to discuss, the meeting was adjourned by the Chairman and were drawn up, read, declared accurate and signed by all shareholders.

This is a free English translation of the original instrument drawn up in the Company’s records.

São Paulo, June 1, 2009.

Marcelo de Souza Scarcela Portela

Secretary

ITEM 3

COSAN S.A. INDÚSTRIA E COMÉRCIO

Corporate Taxpayers ID (CNPJ/MF): 50.746.577/0001-15

Company Registry (NIRE): 35300177045

Publicly Held Company

Call Notice

Extraordinary Shareholders' Meeting

Shareholders are hereby invited to attend the Extraordinary Shareholders’ Meeting of Cosan S.A. Indústria e Comércio (“Company”), to be held on June 18, 2009, at 11:00 a.m., at the Company’s headquarters, in Bairro Costa Pinto, s/nº, Piracicaba, state of São Paulo, to resolve on the following agenda: (a) to examine, discuss and approve the Protocol and Justification of Merger of Curupay Participações S.A. by the Company; (b) to ratify the appointment and hiring of Deloitte Touche Tohmatsu Auditores Independentes as the firm responsible for preparing the evaluation of Curupay Participações S.A.’s Shareholders’ Equity; (c) to approve the evaluation report referred to in the above-mentioned item “b”; (d) to resolve on the merger of Curupay Participações S.A. by the Company and the consequent capital increase through the issue of common shares to Rezende Barbosa S.A. Administração e Participações, the sole shareholder of Curupay Participações S.A., by virtue of said merger, and the consequent amendment to the caput of Article 5 of the Company’s Bylaws; and (e) to authorize the Company’s management to take all the necessary measures for to implement said merger, should it be approved.

General Instructions: In order to take part in and vote at the Shareholders’ Meeting, shareholders should confirm their status as such by presenting, at the Company’s headquarters at least 2 (two) days before the date of the Meeting, an identity document and a statement of shareholdings issued by the depository institution (Banco Itaú S.A. or the CBLC – Brazilian Clearing and Depository Institution) in the original or in the form of a copy sent by facsimile to (19) 3403-2030. Shareholders represented by proxies should present the respective powers of attorney within the same term and in the same manner mentioned above. Neither originals nor copies of said documents require authentication and notarization of signature, should be presented to the Company on or before the opening of the aforementioned Meeting.

The documents pertaining to the matters on the Agenda have been duly submitted to the BM&FBovespa S.A. (São Paulo Paulo Stock, Futures and Commodities Exchange) pursuant to article 124, paragraph 6 of the Brazilian Corporation Law, and are available to shareholders as of today on the Company’s website.

Piracicaba (SP), June 2, 2009.

RUBENS OMETTO SILVEIRA MELLO

Chairman of the Board of Directors

| | |

COSAN S.A. INDÚSTRIA E COMÉRCIO Corporate Taxpayer’s ID (CNPJ/MF) 50.746.577/0001-15 Corporate Registry ID (NIRE) 35.300.177.045 | NOVA AMÉRICA S.A. AGROENERGIA Corporate Taxpayer’s ID (CNPJ/MF) 62.092.739/0001-28 Corporate Registry ID (NIRE) 35.300.127.242 |

Material Fact

COSAN S.A. INDÚSTRIA E COMÉRCIO (“COSAN”, Bovespa: CSAN3) and NOVA AMÉRICA S.A. AGROENERGIA (“NAA”), both companies hereinafter referred to as “Companies”, pursuant to CVM Rules 358/2002 and 319/1999, and as a supplement to information purpose of the Material fact published on March 12, 2009, herein informs the shareholders of COSAN and Curupay S.A. Participações (“Curupay”), a subsidiary of Rezende Barbosa S.A. Administração e Participações (“Rezende Barbosa”) and parent company of NAA and controller of other assets related to trading, logistics and industrial production of sugar and ethanol and energy co-generation, that will be submitted for approval, at Extraordinary Shareholders Meetings to be held on June 18, 2009, the corporate reorganization of both groups resulting in the association of COSAN’s and Curupay’s sugar, ethanol and energy activities.

The association will be executed by means of the merger of Curupay into COSAN, with the subsequent transfer to COSAN of the shareholders' equity of Curupay “Corporate Reorganization”), as described below.

1. Objectives of the Corporate Reorganization.

1.1. The Corporate Reorganization is part of the project of merging the sugar, ethanol and energy activities of COSAN and the Rezende Barbosa Group, whose implementation will be performed pursuant to the Protocol and Justification of the Merger of Curupay into COSAN (“Protocol and Justification”).

1.2. The Companies’ managements believe the Corporate Reorganization will generate important synergies in the activities of their respective economic conglomerates, allowing for meeting customer demands in an optimized manner. Therefore, after the Corporate Reorganization, the Companies shall use the logistics and operating structure of COSAN and its strong penetration in the worldwide sugar-ethanol market, while taking advantage of the expertise and tradition of the subsidiaries of Curupay and of the operating capacity of its plants.

1.3. The Companies’ managements thus believe the Corporate Reorganization will strengthen their competitive positioning, reducing risks for their shareholders and allowing for the generation of value in the long term.

2. Conditions Precedent to the Corporate Reorganization.

2.1. COSAN has assumed the obligation of, up to the date of the execution of the Corporate Reorganization and subject to its completion, taking the necessary actions with regard to the transfer, before government–held and private financial institutions, of Rezende Barbosa and/or its respective shareholders and/or companies of the Rezende Barbosa Group which are not subsidiaries of Curupay, as well as of the assets and/or properties offered by said persons as guarantee in any surety, mortgage, collateral, pledge or any other guarantee granted on behalf of Curupay’s subsidiaries and/or companies controlled by these subsidiaries.

2.2. An agreement was also entered into for an exports pre-payment operation with the main creditors, maturing in five (5) years.

3. Acts which Preceded the Operation.

3.1. On April 17, 2009, an operation was completed for the sale of 49% of the shares issued by Teaçu Armazéns Gerais S.A. (“Teaçu”) owned by Rezende Barbosa, in order to allow for the integration of the port activities of Cosan Operadora Portuária S.A. and of Teaçu. These companies are currently subsidiaries of Rumo Logística S.A., which in its turn is a subsidiary of Novo Rumo Logística (“Novo Rumo”), whose control is shared between Rezende Barbosa and COPSAPAR Participações S.A. (“COPSAPAR”), a subsidiary of COSAN which, after the merger, will control 100% of Novo Rumo’s capital stock.

3.2. On April 30, 2009, NAA performed a partial spin-off, transferring part of its equity to Rezende Barbosa. The portion transferred by NAA consisted of agricultural assets of the company that, pursuant to an agreement between COSAN and Rezende Barbosa, are not included in the Corporate Reorganization operation.

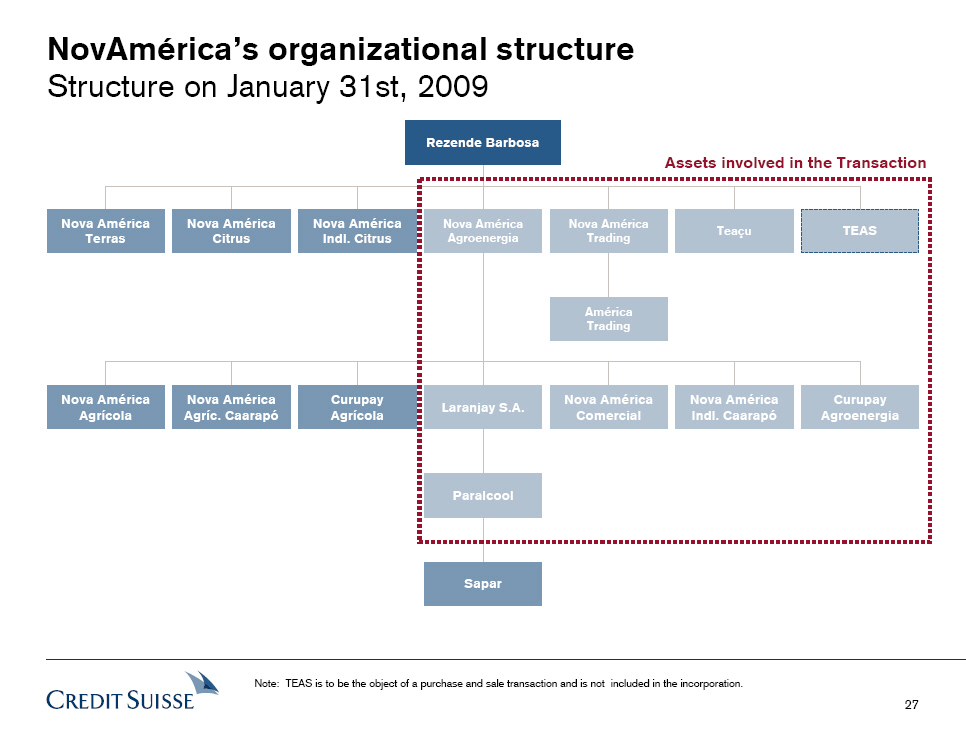

3.3. Also on April 30, 2009, and immediately after the spin-off operation mentioned on item 3.2 above, shares were transferred to the capital stock of Curupay by Rezende Barbosa, representing: (i) 66.26% of NAA’s capital stock; (ii) 100% of the capital stock of Nova América S.A. Trading (“NAT”), which in its turn holds an interest of 33.74% in NAA’s capital stock; and (iii) 28.82% of the capital stock of Novo Rumo.

3.4. As a preliminary step towards the implementation of the Corporate Reorganization, in June 1st, 2009, the Board of Directors of COSAN has approved the Protocol and Justification, as well as the operations purpose thereto, and the call for the shareholders general meeting to resolve on the matter.

4. Criteria for the evaluation of the equity of COSAN and Curupay, and treatment of equity changes.

4.1. Curupay’s shareholders' equity will be incorporated at book value, based on the items of the special balance sheet prepared on April 30, 2009 (“Reporting Date”). Deloitte Touche Tohmatsu Auditores Independentes, with headquarters at Av. Dr. Jose Bonifácio Coutinho Nogueira, nº 150, in the City of Campinas, State of São Paulo, Corporate Taxpayer’s ID (CNPJ) 49.928.567.0011-93 (“Deloitte”), was chosen as the specialized company to appraise the value of the net assets of Curupay to be merged into COSAN, by referendum of the Shareholders General Meetings of Curupay and COSAN. Deloitte and its professionals in charge of the appraisal declare (i) not to have any direct or indirect interest in the Companies involved or in the operation itself, and there is no other material circumstance which may characterize conflict of interests, and (ii) the controllers and the management of the Companies involved have not guided, restrained or impeded, or practiced any acts which have or might have compromised the access to, the use of, or the knowledge of information, assets, documents or work methodologies which are relevant to the quality of their respective conclusions. Pursuant to the appraisal report (“Equity Report”), the shareholders' equity of Curupay was worth R$334,172,000.00 on the Reporting Date.

4.2. The Merger will be executed based on the replacement ratio discussed and determined by the management of the Companies, provided for in item 5.2, which is supported by an economic-financial analysis on the economic value of COSAN and Curupay, prepared by Banco de Investimentos Credit Suisse (Brazil) S.A. (“Credit Suisse”), with headquarters at Av. Brigadeiro Faria Lima, nº 3.064 13º andar, in the City of São Paulo, State of São Paulo, Corporate Taxpayer’s ID (CNPJ) 33.987.793/0001-33 (“Economic-Financial Appraisal Report”). Credit Suisse appraised, on the Reporting Date, COSAN and Curupay based on identical criteria and dates, pursuant to the Economic-Financial Appraisal Report.

4.3. As the Economic-Financial Appraisal Report provides ranges of share replacement ratios, the managements of both Companies, considering the ranges of share replacement ratios provided, understand the proposed replacement ratio is a fair and equitable parameter to determine the relation between the economic values of the Companies.

4.4. The changes in equity ascertained on the Reporting Date and up to the date of the execution of the Corporate Reorganization shall be appropriated by COSAN.

5. Replacement ratio, number and species of the shares to be assigned to Curupay’s shareholder, share rights granted by the new shares.

5.1. The replacement ratios referred to herein have been negotiated between the managements of COSAN and Curupay, are deemed fair and equitable for the shareholders of both Companies, and have been proposed by the managements of COSAN and Curupay.

5.2. A total of 132.567627 common shares of COSAN will be assigned to Rezende Barbosa for each one common share of Curupay, with the issuance by COSAN of a total of 44,300,389 non-par registered book-entry common shares, representing eleven point eighty-nine percent (11.89%) of its capital stock, immediately after the issuance of the shares mentioned in this item 5.2. The share replacement ratio is supported by an economic-financial appraisal prepared by a specialized company, pursuant to item 4.2. above, based on available economic and financial information on the current status and future business perspectives of both COSAN and Curupay.

5.2.1 The shares representing 0.89% of Cosan’s capital stock, which shall be transferred to Rezende Barbosa, will be deposited under Banco Itaú S.A.’s custody, and will be released to Rezende Barbosa as certain promissory notes in the amount of R$136,946,880.21 are effectively received by NAA and NAT. Rezende Barbosa emitted promissory noted (i) in favor of NAA in the amount of twenty million, twenty eight thousand and one hundred thirty three Brazilian Reais and three cents (R$ 20,028,133.03); (ii) in favor of NAT in the amount of one hundred and sixteen million, nine hundred and eighteen thousand and seven hundred forty seven Brazilian Reais and eighteen cents (R$ 116,918,747.18).

5.3. COSAN’s common shares to be assigned to Rezende Barbosa, single holder of common shares of Curupay, in replacement to the current shares of Curupay that shall be cancelled will be entitled the same rights of the common shares issued by COSAN currently outstanding, including the right to receive integral dividends and/or interest on shareholder's equity to be declared by the Company.

5.4. There are currently no shares issued by Curupay held by COSAN, nor shares issued by COSAN held by Curupay.

6. Increase in and breakdown of COSAN’s capital stock following the Corporate Reorganization.

6.1. The book value of the shareholders' equity of Curupay to be merged into COSAN is R$334,172,000.00, pursuant to the Equity Report.

6.2. The merger of the shareholders' equity of Curupay will result in an increase in the capital stock of COSAN in the same amount referred to in item 6.1. The capital stock of COSAN will thus be increased from R$3,819,769,887.34 to R$4,153,941,887.34, with the issuance of 44,300,389 non-par registered book-entry common shares to be fully assigned to Rezende Barbosa. The issued shares shall be paid-up with the absorption of Curupay’s shareholders' equity, pursuant to article 227, paragraph 1 of Law 6.404/76.

6.3 All shares of Curupay held by Rezende Barbosa shall be cancelled upon the merger into COSAN, and replaced by the new common shares issued by COSAN, pursuant to the replacement ratio provided for in item 5.2. above.

7. Costs.

7.1. The managements of the Companies estimate the costs to perform the Corporate Reorganization shall amount to two million reais (R$2,000,000.00), comprising the expenses with publications, auditors, appraisers and attorneys contracted to provide consulting services related to the Corporate Reorganization.

8. Further information on the operation.

8.1. Submission to Authorities

8.1.1. The Corporate Reorganization has been reported to the Administrative Council for Economic Defense – CADE. Any further communications related to the Corporate Reorganization shall be submitted to the proper government authorities, pursuant to applicable law.

8.2. Liabilities and contingencies not accounted for

8.2.1. There are no material contingent liabilities that have not been duly accounted for.

9. Documents availability.

9.1. The Protocol and Justification and the other documents referenced by this Material Fact and article 3 of CVM Rule 319/99 shall be filed with, pursuant to applicable law, the CVM and the Bovespa, and shall be available at the Companies’ headquarters and on COSAN’s website (www.cosan.com.br). The financial statements from NAA will be published until Cosan General Shareholders Meetings that will deliberate over the Corporate Reorganization.

São Paulo, June 02, 2009.

| Marcelo Eduardo Martins | Alberto Asato |

CFO and Investor Relations Officer Cosan S.A. Indústria e Comércio | Managing Director and Investor Relations Officer Nova América S.A. Agroenergia |

PROTOCOL AND JUSTIFICATION OF MERGER OF

CURUPAY S.A. PARTICIPAÇÕES INTO COSAN S.A. INDÚSTRIA E COMÉRCIO

The parties hereinbelow:

COSAN S.A. INDÚSTRIA E COMÉRCIO, a joint-stock company, with headquarters in the City of Piracicaba, State of São Paulo, in the administrative building of Cosan, Bairro Costa Pinto, s/n.º, Corporate Taxpayer’s ID 50.746.577/0001-15, whose articles of incorporation are filed with the Registry of Commerce of the State of São Paulo under Corporate Registry ID – NIRE number 35.300.177.045, herein represented in the form of its bylaws (“Cosan” or “Merging Company”); and

CURUPAY S.A. PARTICIPAÇÕES, a joint-stock company, with headquarters in the City of Tarumã, State of São Paulo, at Fazenda Nova América, s/n.º, Bairro Água da Aldeia, Miguel Jubran Highway, SP 333, towards Assis from Tarumã, Km 418 + 500m, turning right on the Antônio Maia Highway, towards Frutal do Campo, plus 9 Km, Rural Zone, Corporate Taxpayer's ID (CNPJ/MF) 09.460.704/0001-11, whose articles of incorporation are filed with the Registry of Commerce of the State of São Paulo, herein represented in the form of its bylaws (“Curupay” or “Merged Company”)

Hereby agree upon entering into this Protocol and Justification of Merger (“Protocol and Justification”), which provides for the merger of Curupay (“Merger”), pursuant to articles 224 to 227 of Law 6,404 of December 15, 1976, as amended (“Brazilian Corporate Law”), whose terms will be submitted to the shareholders general meetings of both companies, pursuant to the applicable law.

| 1. | JUSTIFICATION OF THE MERGER |

1.1 The Merger is part of a project for the strategic association between Cosan and Rezende Barbosa S.A. Administração e Participações (“Rezende Barbosa”), controlling shareholder of Curupay, for joint operation in the Brazilian sugar and ethanol market, whose implementation shall be performed pursuant to this Protocol and Justification. Cosan and Rezende Barbosa understand that, in the current situation of the worldwide sugar and ethanol market, the synergy of their activities will allow for meeting the demand for the products manufactured and traded by them in an optimized manner.

1.2 Therefore, Cosan and Rezende Barbosa intend to structure a form of association what allows for the use of the logistics and operating structure of Cosan and its strong penetration in the worldwide sugar and ethanol market, while taking advantage of the expertise and tradition of the companies that are part of the economic group of Curupay and of the operating capacity of Curupay’s plants.

1.3 Cosan will remain, after the Merger, a publicly–held company listed on the Novo Mercado segment of the BM&F Bovespa S.A. – Securities, Commodities and Futures Exchange (“Bovespa”), counting on the financial, human and technological resources of Cosan and Curupay, in addition to the expertise of the companies in their respective areas of operation.

1.4 The Companies’ managements believe the Merger will allow for Cosan to be better positioned in the current scenario of the market where the company operates, will strengthen its competitive positioning, reducing risks for its shareholders and allowing for the generation of value in the long term.

1.5 The Merger will also allow for the exploration of potential synergies between Cosan and Curupay, in addition to the creation of a company with recurring revenue, operating cash generation, and increased alignment of interests between the shareholders and the management.

| 2. | BASIS FOR THE MERGER OPERATION |

2.1 The Merger shall be performed in such a manner that Cosan receives, for its respective equity values – the entirety of the assets, rights and liabilities of Curupay, including immovable assets.

2.2 As a result of the Merger, Cosan shall increase its shareholders' equity in an amount corresponding to the total value of the shareholders' equity of Curupay to be merged.

| 3. | REPLACEMENT RATIO, NUMBER AND SPECIES OF THE SHARES TO BE ASSIGNED TO CURUPAY’S SHAREHOLDERS AND SHARE RIGHTS GRANTED BY THE NEW SHARES |

3.1 As a result of the Merger, 132.567627 common shares of the Company for each 1 common share issued by Curupay will be assigned to Rezende Barbosa, single shareholder of Curupay, of a total of

44,300,389 common shares issued by Cosan, representing 11.89% of the capital stock of this company after the Merger and respective increase in Cosan’s capital stock.

3.2 The ratio for the replacement of Curupay’s common shares for common shares issued by Cosan has been determined in a negotiation between the managements of both companies, and is supported by an economic-financial appraisal prepared by a specialized company, pursuant to item 4 below, based on available economic and financial information on the current status and future business perspectives of both Cosan and Curupay.

3.3 Cosan’s common shares to be assigned to the holders of common shares of Curupay – in replacement to the current shares of Curupay that shall be cancelled – will be entitled the same rights of the common shares issued by Cosan currently outstanding, and will participate in the results for the current fiscal year declared as of this date. The rights and statutory benefits of Cosan’s currently outstanding shares shall remain unchanged.

| 4. | CRITERIA FOR THE EVALUATION OF THE EQUITY OF CURUPAY AND COSAN, AND TREATMENT OF EQUITY CHANGES |

4.1 Curupay’s shareholders' equity shall be incorporated at book value, based on the items of the special balance sheet dated April 30, 2009 (“Reporting Date”). Deloitte Touche Tohmatsu Auditores Independentes, with headquarters at Av. Dr. Jose Bonifácio Coutinho Nogueira, nº 150, in the City of Campinas, State of São Paulo, Corporate Taxpayer’s ID (CNPJ/MF) 49.928.567.0011-93 (“Deloitte”), was chosen as the specialized company to appraise the value of the net assets of Curupay to be merged into Cosan.

4.2 The appointment of Deloitte as the appraiser of the book value of Curupay’s shares shall be ratified by Cosan’s shareholders, at the Extraordinary General Meeting called to resolve on the Merger, and it shall also be ratified by Curupay’s shareholders, at the meeting called to resolve on the Merger.

4.3 Deloitte and its professionals in charge of the appraisal declare (i) not to have any direct or indirect interest in the Companies involved or in the operation itself, and there is no other material circumstance which may characterize conflict of interests, and (ii) the controller and the management of the Companies involved have not guided, restrained or impeded, or practiced any acts which have or

might have compromised the access to, the use of, or the knowledge of information, assets, documents or work methodologies which are relevant to the quality of their respective conclusions. Pursuant to the appraisal report attached hereto as Exhibit I (“Equity Report”), the book value of the shareholders' equity of Curupay was worth R$334,172,000.00 on the Reporting Date.

4.4 The Merger shall be executed based on the replacement ratio discussed and determined by the managements of the companies, provided for in item 3.1 above. The replacement ratio is supported by an economic-financial appraisal of the economic value of Cosan and Curupay, pursuant to applicable law, prepared by Banco de Investimentos Credit Suisse (Brazil) S.A. (“Credit Suisse”), with headquarters at Avenida Brigadeiro Faria Lima, n.º 3.064, 13º floor, in the City of São Paulo, State of São Paulo, Corporate Taxpayer’s ID 33.987.793/0001-33 (“Economic-Financial Appraisal Report”). Credit Suisse appraised, on the Reporting Date, COSAN and Curupay based on identical criteria and dates, pursuant to the Economic-Financial Appraisal Report.

4.5 As the Economic-Financial Appraisal Report provides ranges of share replacement ratios, the managements of both Companies, considering the ranges of share replacement ratios provided, understand the proposed replacement ratio is a fair and equitable parameter to determine the relation between the economic values of the Companies.

4.6 The changes in equity ascertained as of the Reporting Date and up to the date of the execution of the Merger shall be appropriated by COSAN.

| 5. | SHARES OF ONE COMPANY HELD BY THE OTHER |

5.1 There are currently no shares issued by Curupay held by Cosan, nor shares issued by Cosan held by Curupay.

| 6. | INCREASE IN AND BREAKDOWN OF COSAN’S CAPITAL STOCK FOLLOWING THE MERGER |

6.1 The book value of the shareholders' equity of Curupay to be merged into Cosan is R$334,172,000.00, pursuant to the Equity Report.

6.2 The Merger of the shareholders' equity of Curupay shall result in an increase in the capital stock of Cosan in the same amount referred to in item 6.1 above. The capital stock of Cosan will thus be increased from R$3,819,769,887.34 to R$4,153,941,887.34, with the issuance by Cosan of 44,300,389 non-par registered book-entry common shares to be fully assigned to Rezende Barbosa. The issued shares shall be paid-up with the absorption of Curupay’s shareholders' equity, pursuant to article 227, paragraph 1 of the Brazilian Corporate Law.

6.3 All shares of Curupay shall be cancelled upon the Merger and replaced by the new common shares issued by Cosan, pursuant to the replacement ratio provided for in item 3.1 above.

| 7. | AMENDMENT TO COSAN’S BYLAWS |

7.1 Upon the approval of the Merger in the terms provided for herein, the capital stock of Cosan shall consist of 372,585,273 non-par registered common shares, and the caput of article 5 of Cosan’s bylaws shall be amended to reflect this change. The following wording for article 5 shall be submitted to Cosan’s shareholders:

“Article 5. The subscribed and paid-up capital stock is R$4,153,941,887.34, divided into 372,585,273 non-par book-entry registered common shares.

| 8. | EXTRAORDINARY GENERAL MEETINGS |

8.1 On the date of the Merger, an Extraordinary General Meeting shall be held by Cosan to: (i) examine, discuss and approve the Protocol and Justification of the Merger of Curupay into Cosan; (ii) ratify the appointment and contracting of Deloitte as the company in charge of preparing the appraisal report, at book value, of Curupay’s shareholders' equity; (iii) approve the appraisal report referred to in (ii) above; (iv) ratify the appointment and contracting of Credit Suisse as the company in charge of preparing the appraisal report, at market value, of Curupay, for purposes of determining the share replacement ratio; (v) approve the appraisal report referred to in (iv) above; (vi) resolve on the merger of Curupay and the consequent increase in Cosan’s capital stock through the issuance, for private subscription, of common shares to be subscribed and paid up by Rezende Barbosa, in virtue of the transfer of Curupay’s shareholders' equity to Cosan as a result of the merger, with the subsequent

amendment to the caput of Article 5 of Cosan’s Bylaws; and (vii) authorize Cosan’s Management to take the necessary actions to implement the merger referred to in item (vi) above.

8.2 Likewise, on the date of the Merger, an Extraordinary General Meeting shall be held by Curupay to: (i) examine, discuss and approve the Protocol and Justification of the Merger of Curupay into Cosan; (ii) ratify the appointment and contracting of Deloitte as the company in charge of preparing the appraisal report, at book value, of Curupay’s shareholders' equity; (iii) approve the appraisal report referred to in (ii) above; (iv) ratify the appointment and contracting of Credit Suisse as the company in charge of preparing the appraisal report, at market value, of Curupay, for purposes of determining the share replacement ratio; (v) approve the appraisal report referred to in (iv) above; (vi) resolve on the merger of Curupay into Cosan, at market value, pursuant to the Protocol and Justification; and (vii) authorize Curupay’s Management to take the necessary actions to implement the merger referred to in item (vi) above.

8.3 Upon the approval of the Merger, it shall be incumbent upon Cosan to file all pertinent acts with the appropriate Registry of Commerce. Cosan’s Management undertakes to execute all other acts necessary for the Merger to be in full compliance with the law. All costs and expenses arising from the implementation of the Merger shall be incumbent upon Cosan.

9.1 The execution of the Merger described herein shall result in the winding-up of Curupay, which shall be succeeded by Cosan in all its assets, rights and liabilities.

| 10. | NOTICES AND NOTIFICATIONS |

10.1 All notices, notifications or any other communication related to this Protocol and Justification shall be made in written, and be considered as duly delivered (a) upon receipt, if delivered in person, (b) if facsimiled or e-mailed, (c) if delivered through an express delivery service or as a registered or certified correspondence, with request of receipt acknowledgement with the postal fees paid free of charge for the recipients to be sent to the following addresses (or any other address specified in such notice):

(i) if addressed to Cosan’s Management:

C/O: Legal Officer

Cosan’s administrative building, Bairro Costa Pinto, s/n.º

Piracicaba – SP

E-mail: jurídico@cosan.com.br

(ii) if addressed to Curupay’s shareholders and Management:

C/O: Mr. Alberto Asato

Fazenda Nova América, s/n.º

Tarumã – São Paulo

E-mail: alberto.asato@novamerica.com.br

10.2 The party whose address, fax number or email address indicated above, has been changed shall promptly inform the new address, fax number or e-mail address to the other parties. All notifications, communications and summons sent to the address, fax number or email provided above shall be considered valid and in force until this notification of change has been made.

11.1 Pursuant to article 12 of CVM Rule 319 of December 03, 1999, as amended (“CVM Rule 319”), Curupay’s financial statements supporting the Merger have been audited by Deloitte.

11.2 There are no material liabilities or contingent liabilities that have not been duly accounted for in the Equity Report. Furthermore, Curupay’s and Cosan’s managements mutually declare not to be aware of the existence of any material liability or contingent liability that has not been informed to the Management of the other company and to their advisors during the period of negotiation of the replacement ratio.

11.3 This Protocol and Justification and the financial statements supporting the Merger, as well as the other documents referred to by article 3 of CVM Rule 319 are available to their shareholders as of this date at the headquarters of Cosan and Curupay.

11.4 Up to the approval of the operation by the authorities, Cosan shall not exercise any interference whatsoever on the management or control of Curupay, not appointing managers, nor participating in the

management of personnel, acquisition or sale of assets, investment projects, trade policy, budget or business plan, budget execution, compliance with legal or contractual obligations, changes in the number of employees, or any other act that shall imply a change in the production capacity or efficiency of Cosan, or any other act that shall imply the irreversibility of the operation should it not be approved by the competent authorities. The provisions of this item apply mutatis mutandis for Cosan with regard to Curupay.

11.5 The Merger has been reported to the Administrative Council for Economic Defense – CADE. Any further and due communications related to the Merger shall be submitted to the competent government authorities, pursuant to applicable law.

11.6 Should any provision, term or condition of this Protocol and Justification be considered void, the remaining provisions, terms and conditions not affected by this annulment shall not be affected.

12.1 Should lawsuits or divergences related to this Protocol and Justification arise, the parties agree to endeavor their best efforts to settle them in a friendly manner and in accordance with the principles of good faith. Should the controversy not be settled in a friendly fashion as mentioned above, the controversy shall be definitely settled by means of arbitration, to be established and processed pursuant to the Regulations of the Arbitration Center of the Brazil-Canada Chamber of Commerce (“Regulations”). The management and development of the arbitration proceedings shall be incumbent upon said Chamber (“Chamber”).

12.2 The Court of Arbitration shall comprise three (3) arbitrators, and it shall be incumbent upon each of the parties to appoint one arbitrator and a respective deputy, not necessarily members of the Chamber’s Body of Arbitrators, within the fifteen (15) days following the date of receipt of the notification sent by the Chamber.

12.3 The arbitrators appointed by the parties shall jointly appoint the third arbitrator, who shall preside the Court of Arbitration and submit his name to the approval of the Chamber.

12.4 If any of the parties refrains from appointing an arbitrator and/or deputy, it shall be incumbent upon the Chamber’s president to appoint them. Should the arbitrators appointed by the parties not come to an agreement with regard to the appointment of the third arbitrator, it shall also be incumbent upon the Chamber’s president to appoint him.

12.5 The Court of Arbitration shall be settled in the City of São Paulo, and Portuguese shall be the official language for all its acts.

12.6 The arbitration decision shall be final and binding for the parties, and it shall not be subject to ratification or any resource before the Justice.

12.7 The parties herein agree that during the arbitration proceedings or in the case of a pending court decision in any lawsuit between the parties, none of them is authorized to terminate or refrain from fulfilling the obligations hereby established.

12.8 In order to settle preventive matters arising from this instrument before the formation of the Court of Arbitration, as well as matters of an enforceable nature, the parties choose the jurisdiction of the City of São Paulo, State of São Paulo, and expressly waive any other jurisdiction, no matter how privileged it may be.

(remainder of the page intentionally left blank)

In witness whereof, the parties hereto execute this instrument in two (2) counterparts of equal tenor and form, in the presence of two (2) witnesses undersigned below.

São Paulo/Piracicaba (SP), June 2, 2009.

| Merged Company: | |

| | |

| | |

| CURUPAY S.A. PARTICIPAÇÕES |

| |

| | |

| | |

COSAN S.A. INDÚSTRIA E COMÉRCIO |

| Witnesses: | | | | |

| | | | | |

| | | | | |

| | | | | |

| Name: | | | Name: | |

| Identity Card (RG): | | | Identity Card (RG): | |

| Individual Taxpayers' ID (CPF/MF): | | | Individual Taxpayers' ID (CPF/MF): | |

EXHIBIT I

EQUITY REPORT

|

Credit Suisse

Appraisal Report

Cosan S.A. Industria e Comercio and Curupay S.A. - Participacoes

April 30th, 2009

|

|

Table of Contents

1. Introduction 2

2. Transaction summary 8

3. Description of the market and the companies 14

3.1. Cosan S.A. Industria e Comercio 18

3.2. Curupay S.A. Participacoes ("NovAmerica") 25

4. General assumptions of the Appraisal Report 32

5. Cosan's Appraisal 34

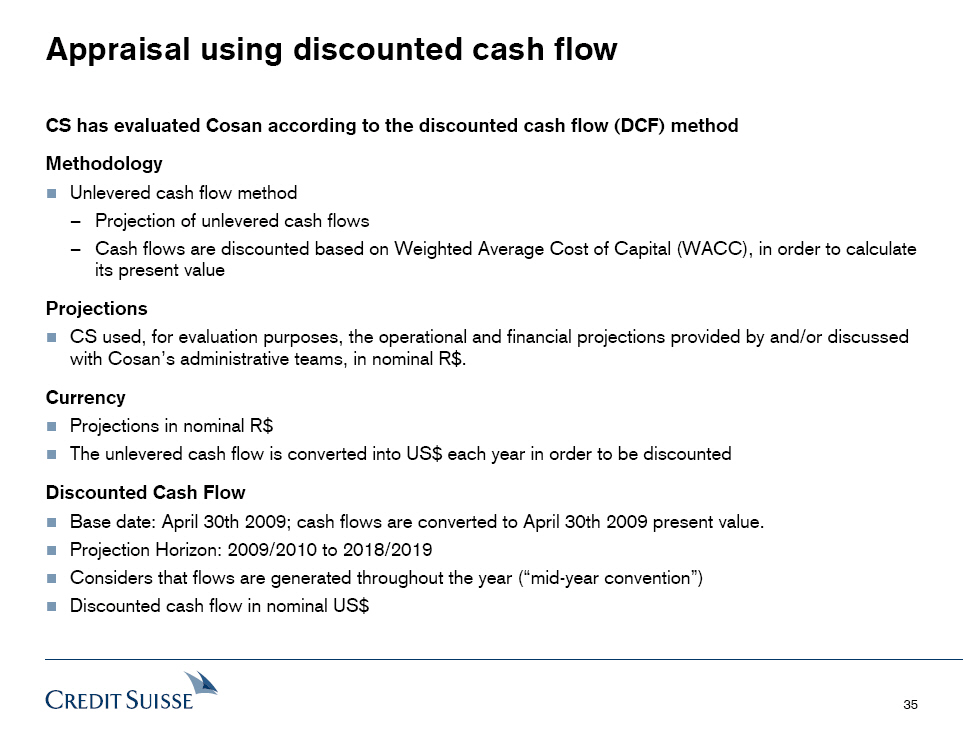

5.1. Discounted Cash Flow 34

5.2. Economic value - comparable companies' multiples 44

5.3. Book value of shareholder's equity 46

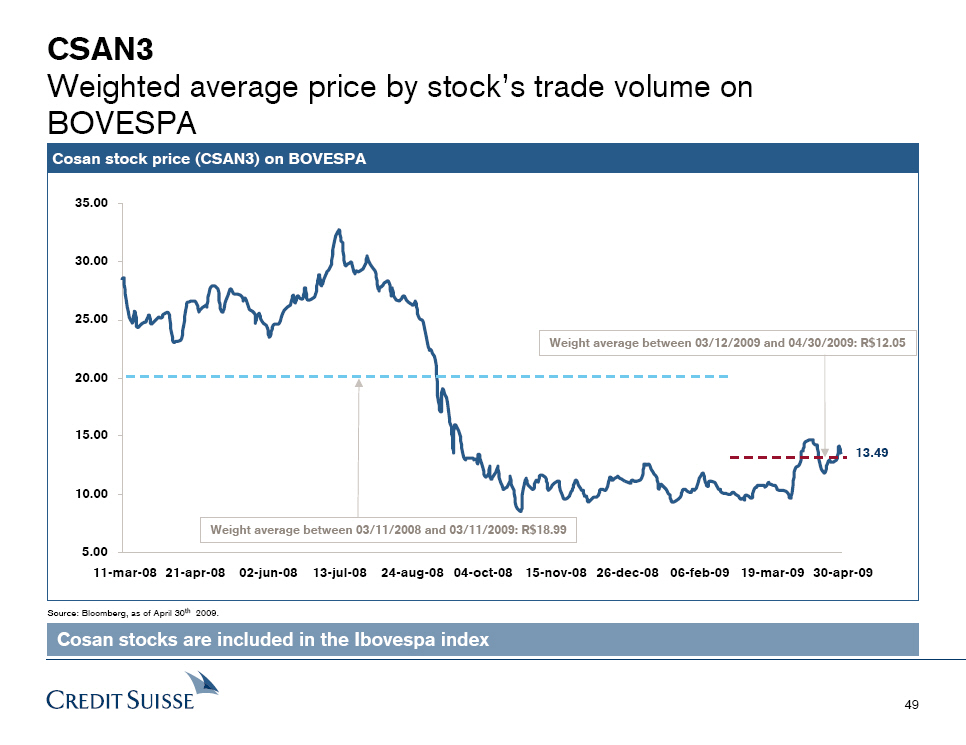

5.4. Weighted average price by the stock's trade volume on BOVESPA 48

6. Nova America's Appraisal 51

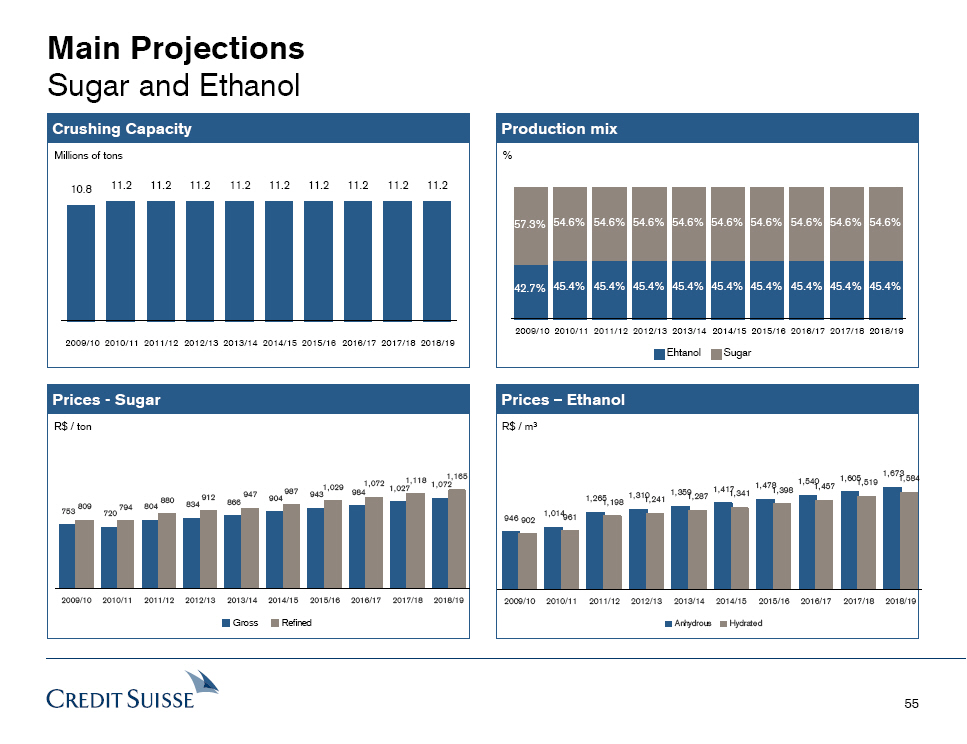

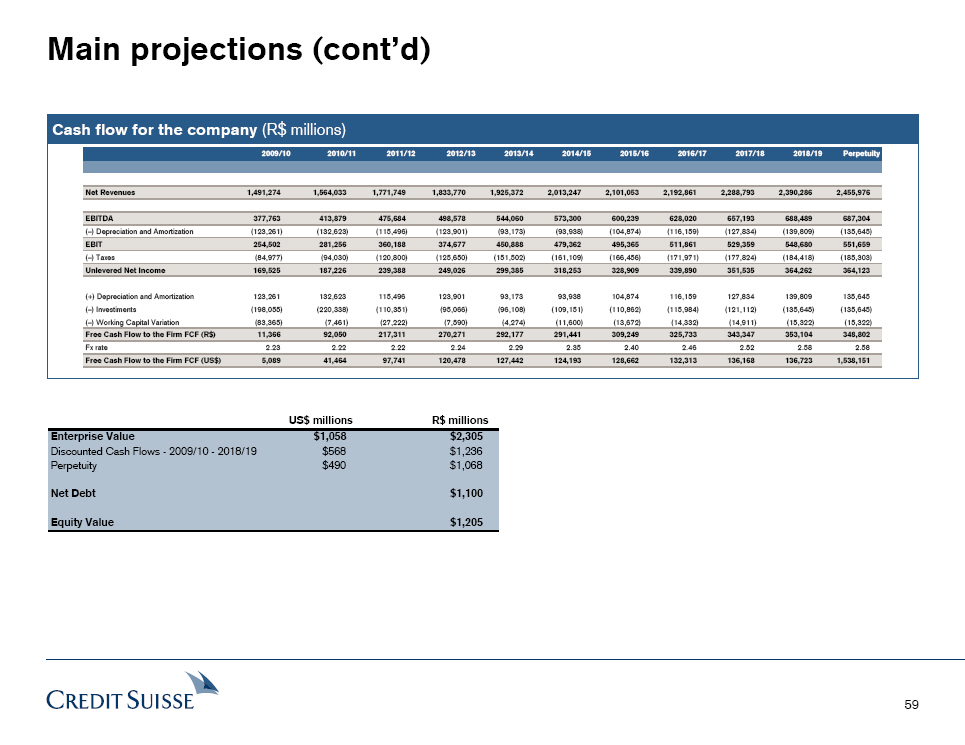

6.1. Discounted Cash Flow 51

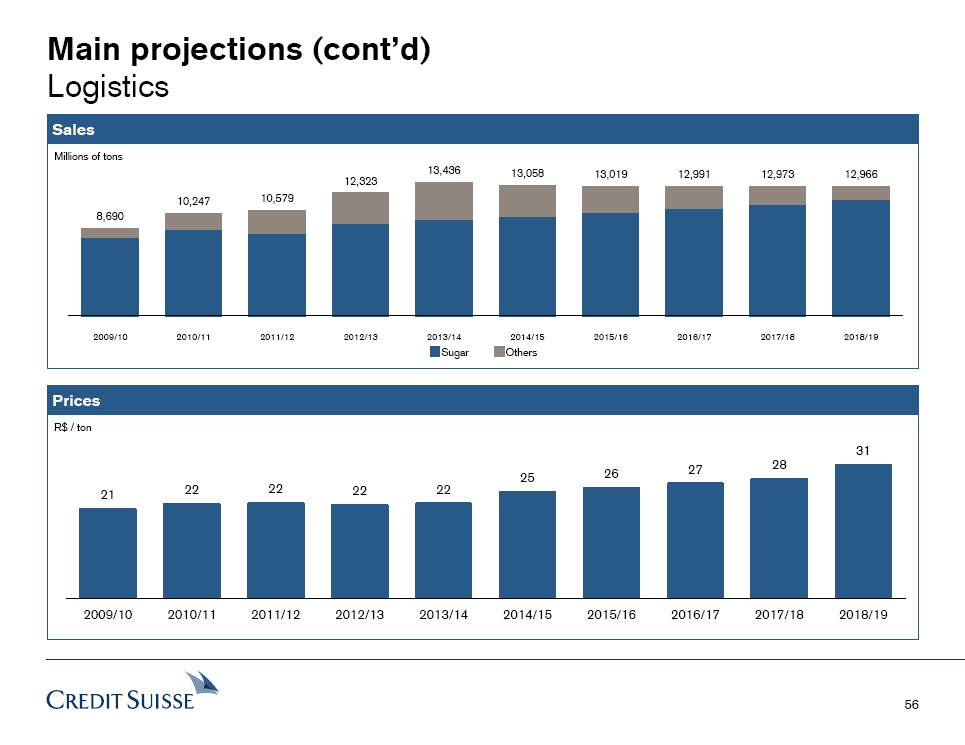

6.2. Economic value - comparable companies' multiples 60

6.3. Book value of shareholder's equity 62

7. Analysis of relationship of substitution 64

Appendix A. Companies' Weighted Average Cost of Capital (WACC) 67

Appendix B. Market multiples of comparable companies 69

Appendix C. Description of the applied evaluation methodologies 73

Appendix D. Terms and definitions used in the appraisal report 78

1

Credit Suisse

|

|

Introduction

The Banco de Investimentos Credit Suisse (Brasil) S.A. ("CS") was appointed by

Cosan SA Industria e Comercio ( "Cosan") to prepare an economic and financial

appraisal report ("Appraisal Report ") in reference to the equity value of

Curupay SA. - Participacoes ( "NovAmerica") and the equity value of Cosan

(NovAmerica and Cosan combined herein denominated "Companies"), for the purposes

of establishing a relationship of substitution between both parties under the

proposed incorporation of NovAmerica (the "Transaction") as provided for in CVM

Rule no. 319 of December 3rd, 1999, ("Regulation CVM 319/99").

The following information is important and should be read carefully and

thoroughly:

1. This Appraisal Report has been prepared solely for the use of Cosan's Board

of Directors and its shareholders for the evaluation of the proposed

Transaction and should not be used for any other purpose, including,

without limitation, to establish and increase capital, under the laws of

S.A. (limited partnerships), in particular Articles 8 and 170, and other

provisions of the S.A. laws involving the Company and / or its affiliates.

This appraisal report should not be used by any other third parties and may

not be used for any other purpose without prior written permission from CS.

This appraisal report, including its analysis and conclusions, do not

constitute a recommendation to any shareholder or member of the Board of

Directors of NovAmerica or Cosan on how to vote or act on any matter

relating to the Transaction. The data base used in this Appraisal Report is

of April 30th, 2009.

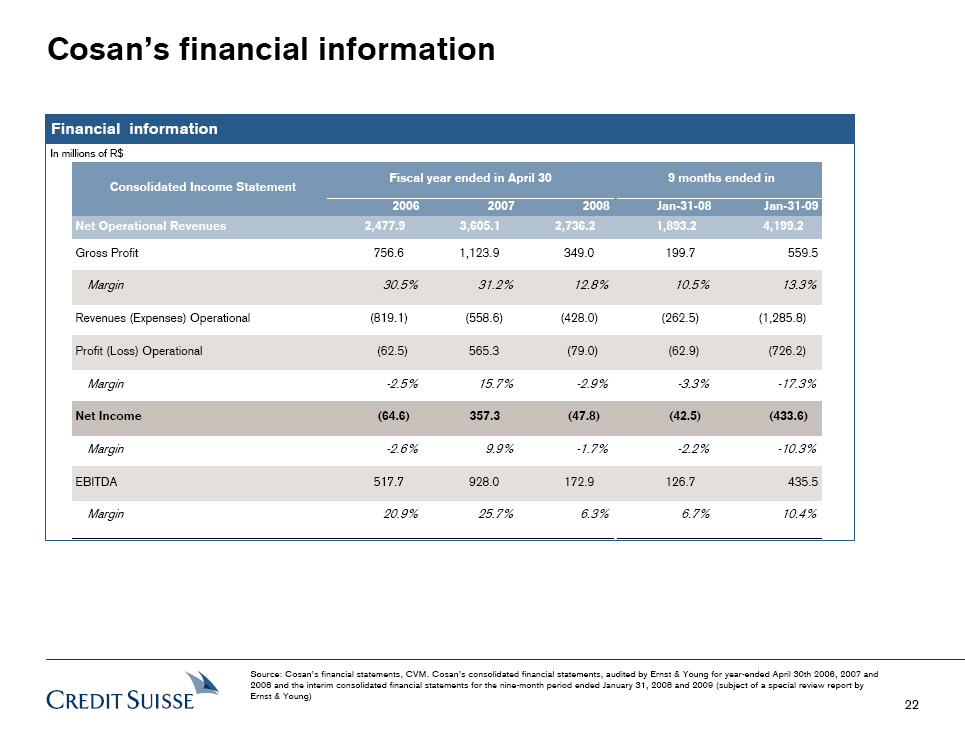

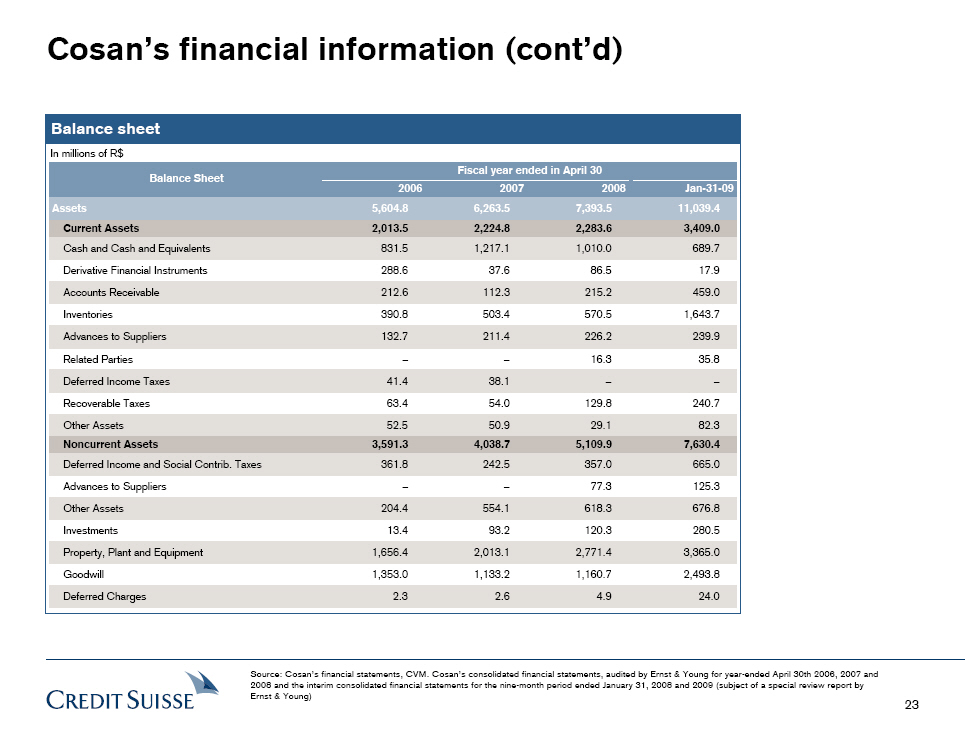

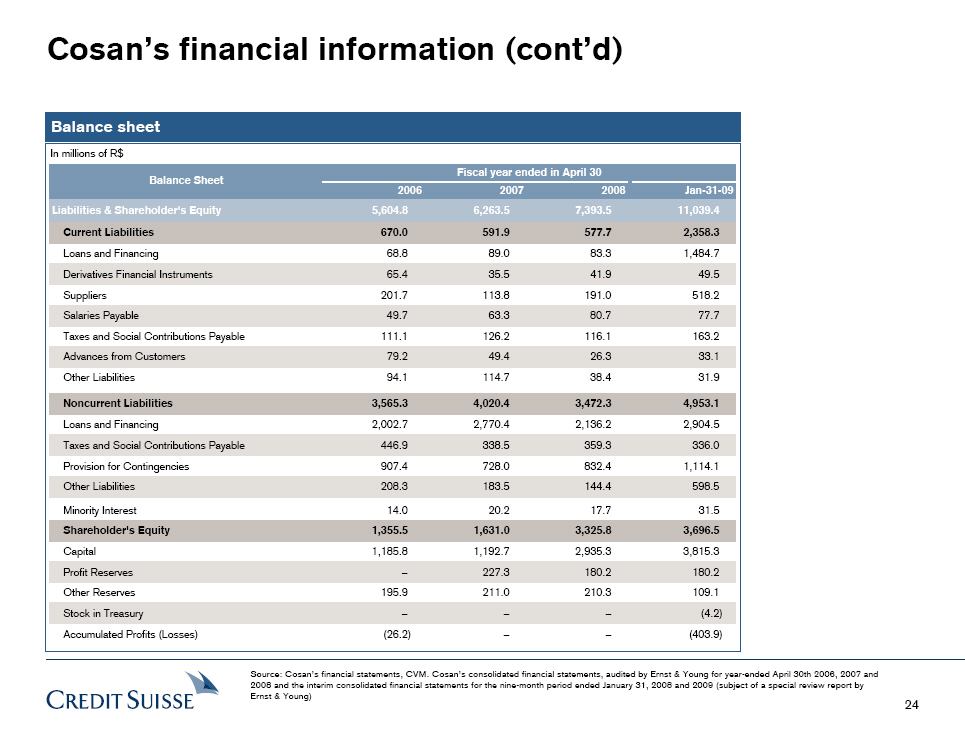

2. To reach the conclusions presented in this Appraisal Report, among other

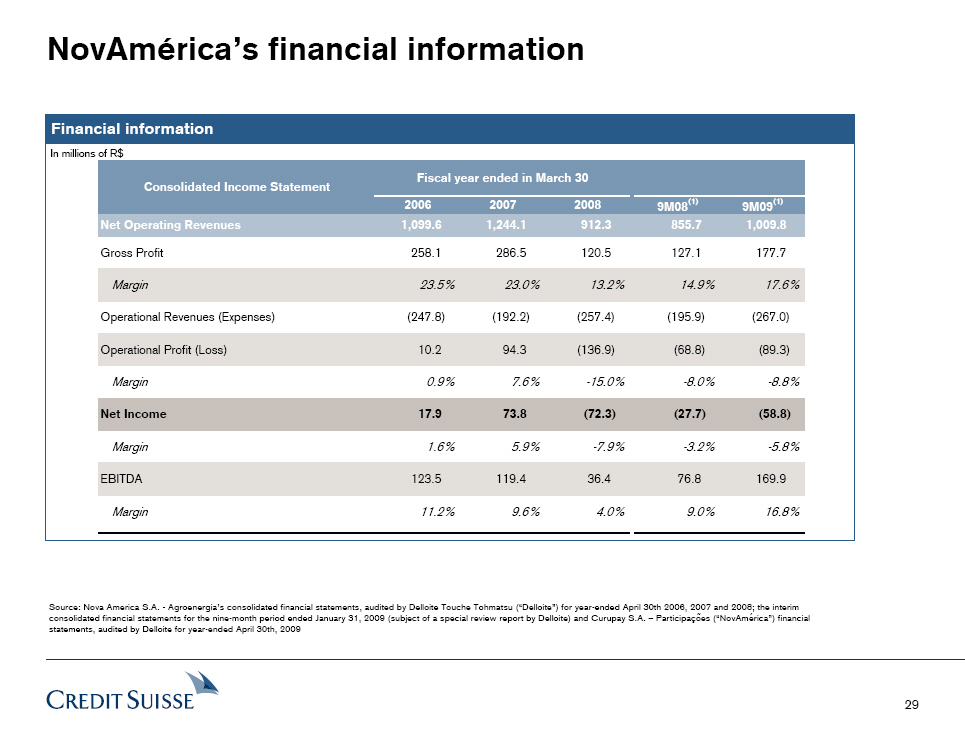

things: (i) we reviewed the consolidated financial statements of Nova

America S.A. - Agroenergia , audited by Delloite Touche Tohmatsu

("Delloite") for the years ended April 30th, 2006, 2007 and 2008 and the

interim consolidated financial statements for the nine-month period ended

January 31, 2009 (subject of a special review report by Delloite), this

information does not reflect the effects of the corporate reorganization

that preceded the Transaction, (ii) we reviewed the consolidated financial

statements of Curupau S.A. - Participacoes ("NovAmerica"), audited by

Delloite for the year ended April 30th, 2009, (iii) we reviewed the

consolidated financial statements of Cosan, audited by Ernst & Young

Independent Auditors S.C. ("Ernst & Young") for the years ended April 30th,

2006, 2007 and 2008 and the interim consolidated financial statements for

the nine-month period ended January 31, 2009 (subject of a special review

report by Ernst & Young), we (iv) reviewed and discussed with the

administration of Cosan and NovAmerica the financial, operational and

management projections of each of the Companies for the next 10 years, (v)

discussed with the members of the administration of NovAmerica and Cosan

the Company's business and prospects, (vi) in appraisals of this nature we

have access to historical information on a comparable basis as to our

projections, however, in this case, we had no access to historical

financial statements of Curupay S.A. - Participacoes ("NovAmerica") pro

forma effects of the corporate reorganization and these effects were not

discussed with Delloite, however, we discussed with the administration of

NovAmerica the impacts of the corporate reorganization in the result

projections of NovAmerica and incorporated them in these projections and

(vi) took into account other information, financial studies, analysis,

research and financial, economic and market criteria that we consider

relevant (collectively, the "Information").

3. In the scope our review, we do not assume any responsibility for

independent investigations of any of the information above and we trust

that such information was complete and accurate in all material respects.

Furthermore, we were not asked to perform, and did not perform an

independent verification of such information, or independent verification

or appraisal of any assets or liabilities (contingent or otherwise) of any

of the Companies, we were not given any evaluation in this respect and we

did not evaluate the solvency or fair value of the Companies considering

the laws relating to bankruptcy, insolvency or similar issues. 3

|

|

Introduction (cont'd)

4. We will not, explicitly or implicitly, make any representation or statement

with respect to any information (including financial and operating

projections for each of the Companies or assumptions and estimates on which

such projections were based) used for the preparation of the Appraisal

Report. Furthermore, we do not assume any obligation to conduct, and did

not conduct, any physical inspection of the Companies' properties or

premises. We are not an accounting firm and do not provide accounting or

auditing services in relation to this Appraisal Report or the Transaction.

5. The operational and financial projections of NovAmerica and Cosan were

based on information obtained from the NovAmerica and Cosan and other

public information, and we assume that these projections reflect the best

estimates currently available with respect to the Companies' future

financial performance, which were evaluated on a stand alone basis, without

synergies.

6. In relation to the Companies' operational and financial projections that

were sent to us, the Administration declared that these projections were

prepared in a reasonable manner on assumptions that reflect the best

estimates currently available and the Administration's best judgment with

respect to the Companies' future financial performance. If this assumption

is not valid, the results presented here may be altered substantially.

7. Projections related to demand and market growth were submitted by the

Companies. We assumed, in good faith, that these projections were prepared

in a reasonable manner reflecting the best estimates currently availables.

8. The Appraisal Report is not and should not be used as (i) an opinion on the

adequacy (fairness opinion) of the Transaction, (ii) a recommendation in

relation to any aspect of the Transaction and (iii) an opinion on the

adequacy or determination of the fair and/or correct value of the

Companies' shares.

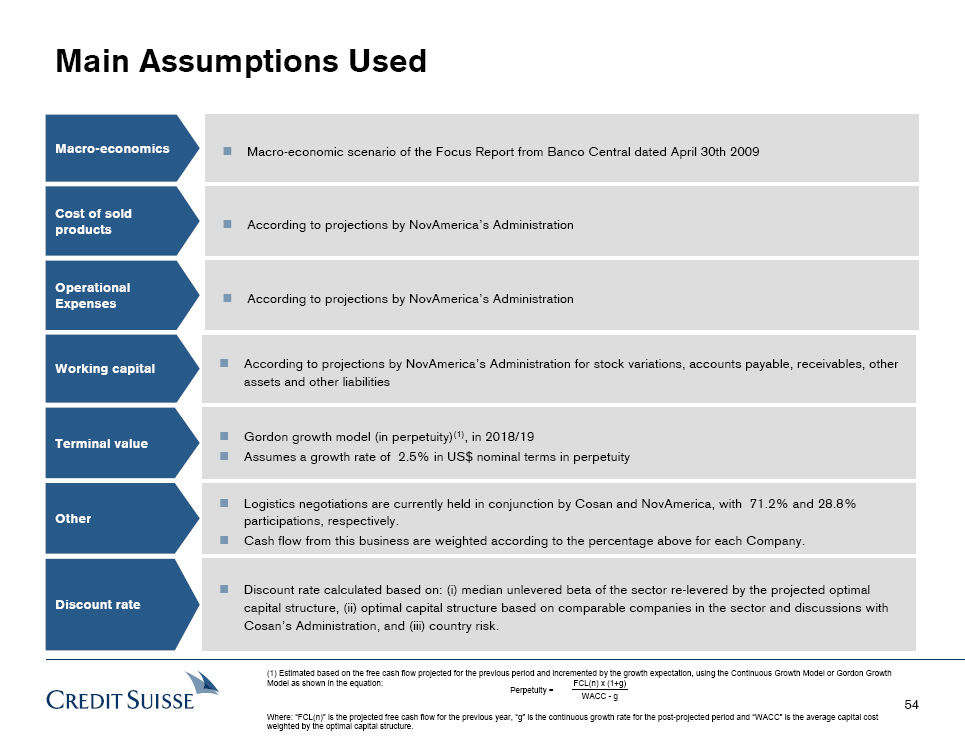

9. Based on the discounted cash flow methodology, we assumed the macroeconomic

scenario announced by the Central Bank of Brazil in its Focus Report, which

reflects average market expectations and may present substantially

different future results. Since the analysis and values are based on

forecasts of future results, they do not necessarily indicate the

Companies' actual and future financial results, which may be significantly

more or less favorable than those suggested by our analysis. Moreover,

since these analysis are inherently subject to uncertainties and are based

on various events and factors outside of our and the Companies' control, we

are not in any way responsible if any of the Companies' future results

differ substantially from the results presented in this Appraisal Report.

There is no guarantee that the Companies' future results will correspond to

the financial projections used as basis for our analysis, and the

differences between our projections and the Companies' financial results

may not be relevant. The Companies' future results may also be affected by

economic and market conditions.

4

|

|

Introduction (cont'd)

10. The preparation of a financial analysis is a complex process involving

several definitions regarding methods of financial analysis most

appropriate and relevant as well as the application of such methods. To

reach the conclusions presented in the Appraisal Report, we conducted

qualitative reasoning in regards to the considered analysis and factors. We

reached a final conclusion based on the results of the conducted analysis,

as a whole, and did not arrive at conclusions based on, or related to, any

separate factors or methods of analysis. Thus, we believe that our analysis

should be considered as a whole and that the selection of parts of our

analysis and specific factors, without considering the entire analysis and

conclusions, can result in an incomplete and incorrect understanding of the

processes used for our analysis and conclusions.

11. This Appraisal Report indicates only the Companies' value and does not

evaluate any aspect or implication of the Transaction or any contract,

agreement or understanding reached with respect to the Transaction. We do

not express any opinion as to what the value of the issued stock should be

pursuant to the Transaction or as to the amount in which the Companies'

stock will be or could be traded in the securities market at any time. This

Appraisal Report does not address the merits of the Transaction as compared

to other business strategies that may be available to NovAmerica and to

Cosan, nor addresses the business decision of the parties involved of

whether to carry out the Transaction. The results presented in this

Appraisal Report refer exclusively to the Transaction and do not apply to

any other matter or operation, present or future, relative to any of the

Companies, the economic group to which they belong or the their industry.

12. Our Appraisal Report is based essentially on information that has been

submitted to us on this date, and considering market, economic and other

conditions as they present themselves and as evaluated on this day.

Although future events and developments may affect the conclusions

presented in this Appraisal Report, we have no obligation to update,

revise, rectify or revoke this Appraisal Report, in whole or in part, due

to any subsequent development or other purpose.

13. Our analysis deal with NovAmerica and Cosan as independent operations

(stand-alone) and, thus, do not include benefits or operating losses,

fiscal or of any other nature, including any premium, nor any synergies,

incremental value and/or costs, if any, that NovAmerica or Cosan may incur

from the completion of the Transaction, if carried out, or from any other

operation. The appraisal also does not take into account any operational

and financial gain or loss that may be incurred subsequent to the

Transaction due to commercial alterations of the currently existing

businesses between NovAmerica and Cosan.

14. Cosan has agreed to reimburse us for our expenses and to indemnify us, and

those connected to us, for certain liabilities and expenses that may arise

as a result of our employment. We will receive a commission relative to the

preparation of this Appraisal Report regardless of the completion of the

Transaction

5

|

|

Introduction (cont'd)

15. We, from time to time, in the past, has provided investment banking and

other financial services to Cosan and its affiliates, for which we have

been compensated, and may in the future provide such services to NovAmerica

and Cosan and/or its affiliates, for which we expect to be compensated. We

are a financial institution that provides a variety of financial and other

services related to securities, brokerage and investment banking. In the

normal course of our activities, we may purchase, hold or sell, for our

account or for account and by order of our customers, stocks, debt

instruments and other securities and financial instruments (including bank

loans and other obligations) of NovAmerica and Cosan and of any other

companies involved in the Transaction, as well as provide investment

banking and other financial services to such companies, their parent

companies or controlled companies. Moreover, the professionals of our

securities analysis departments (research) and of other divisions may base

their analysis and publications on various market and operating assumptions

and different methods of analysis when compared with those used in

preparing this Appraisal Report, in such a manner that the research reports

and other publications prepared by them may contain results and conclusions

that differ from those presented herein. We have implemented policies and

procedures to preserve the independence of our securities analysts, which

may have different views from those of our investment banking department.

We have also implemented policies and procedures to safeguard the

independence between investment banking and other areas and departments of

CS, including but not limited to asset management, proprietary trading desk

for stocks, debt instruments, securities and other financial instruments.

16. This Appraisal Report is the intellectual property of CS.

17. The financial calculations contained in the Appraisal Report may not always

result in a precise sum due to rounding.

18. The Companies' fiscal year has a duration of one (1) year which begins on

May 1st and ends on April 30th of each year, according to the respective

Corporate Bylaws. Thus, at the end of each fiscal year, financial

statements are prepared for the fiscal year ended.

Banco de Investimentos Credit Suisse (Brasil) S.A.

6

|

|

Appraiser's Statement

For the purpose of CVM (SEC) Rule No. 319/99, CS declares:

o The funds managed by CS and its subsidiary, Credit Suisse HG Corretora de

Valores SA, hold a minority share in Cosan, based on data as of April 30th,

2009.

o It has no interest, direct or indirect, in the operation, as well as any

other relevant circumstances that may characterize conflict of interest,

reducing the required independence to perform their duties in preparing

this Appraisal Report.

o Major shareholders or Companies' directors did not direct, restrict, hinder

or exercise any actions that may, or may have, compromised the access, the

use or the knowledge of information, properties, documents or work

methodologies relevant to the quality of the respective conclusions.

o There is no conflict or pooling of interest, actual or potential, with

Cosan's main shareholders, or because of its minority shareholder(s), or

relative to NovAmerica, their respective partners, or concerning the

Transaction.

7

|

|

Transaction Summary

Phase I: reorganizing NovAmerica's structure

Cosan SA Industria e Comercio announced on March 12th, 2009 its intentions to

merger their activities with that of Curupay SA - Participacoes, whereas Curupay

S.A. - Participacoes will be incorporated by Cosan.

o Binding Memorandum of Understanding ("MOU") signed with Rezende Barbosa

S.A. Administracao e Participacoes ("Rezende Barbosa"), controlling

shareholder of Curupay S.A. - Participacoes

o Rezende Barbosa conducted a corporate reorganization, whereas all assets

related to marketing, logistics and industrial production of sugar and

ethanol were incorporated by Curupay S.A - Participacoes ("NovAmerica") and

all assets related to agricultural activity were transferred into a new

company, not involved in the transaction

Phase II: NovAmerica's incorporation by Cosan

Cosan intends to incorporate NovAmerica by substituting all of its common stock

for Cosan's shares of the same class

o Rezende Barbosa will receive approximately 132.5676 shares of Cosan's stock

for each share currently held of NovAmerica's stock, so as to own the

equivalent of 11.89% of Cosan's capital after the Transaction

o Rezende Barbosa owns 100% of NovAmerica's capital

o Cosan is registered with the Securities Commission ( "CVM") and its stock

is traded on the Bolsa de Valores de Sao Paulo

Note: Curupay S.A. - Participacoes was defined in this Appraisal Report as

NovAmerica, thus their only assets are the following corporations: Nova America

Agroenergia, Nova America Trading and NovoRumo. For more details, see page 28 of

this Appraisal Report.

9

|

|

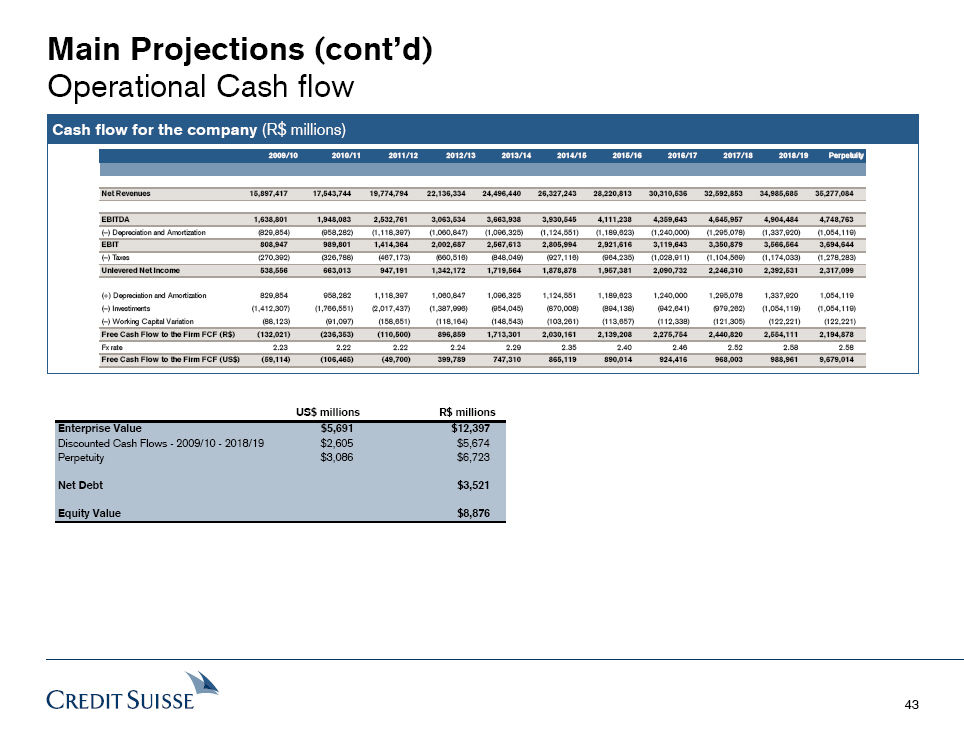

Appraisal Summary

Cosan S.A. Industria e Comercio

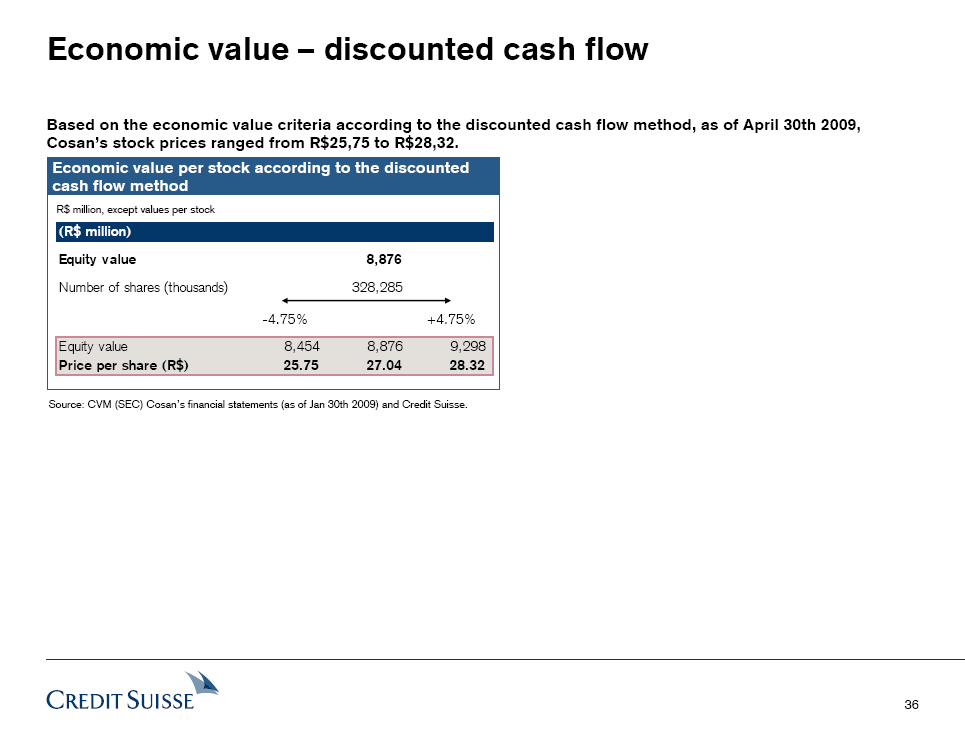

Based on the economic value obtained through the discounted cash flow method

(DCF), the value of Cosan's stock is between R$ 25.75 and R$ 28.32. For more

information with respect to the calculation methodology used, see Appendix C -

Description of applied appraisal methodologies on page 74 of this report

Economic Value (DCF)

(R$ million)

Equity value 8,876

Number of shares (thousands) 328,285

-4.75% +4.75%

- --------------------------------------------------------------------------------

Equity value 8,454 8,876 9,298

Price per share (R$) 25.7527.04 28.32

- --------------------------------------------------------------------------------

Source: Cosan and Credit Suisse. Base date: April 30th, 2009.

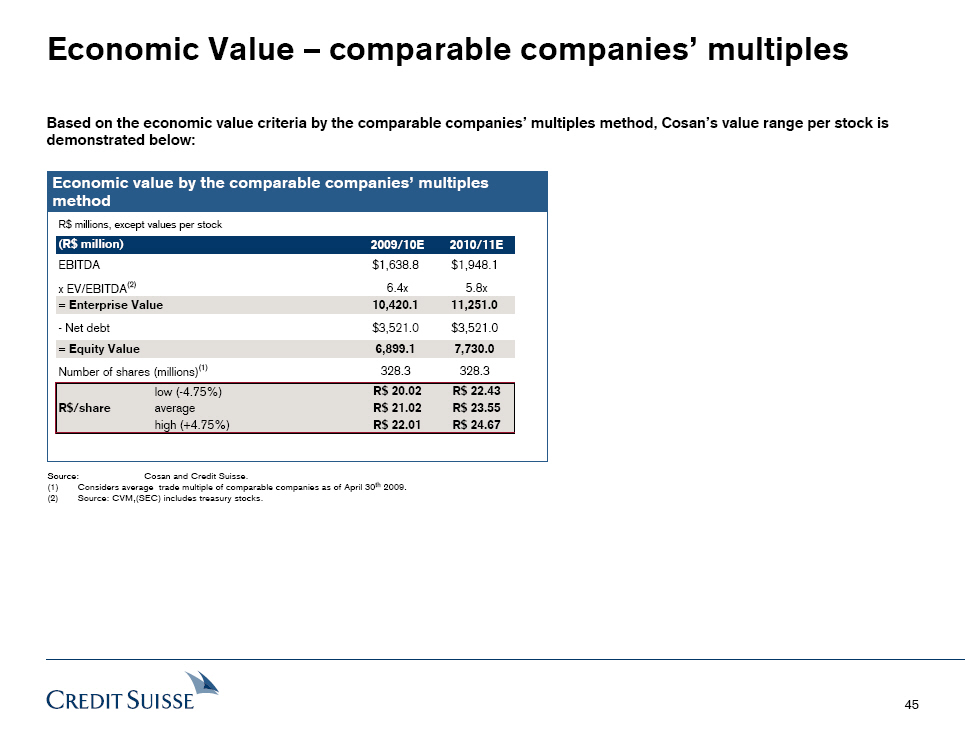

Economic Value (Multiples)

- --------------------------------------------------------------------------------

(R$ million) 2009/10E 2010/11E

EBITDA $1,638.8 $1,948.1

x EV/EBITDA((2)) 6.4x 5.8x

= Enterprise Value 10,420.1 11,251.0

- - Net debt $3,521.0 $3,521.0

= Equity Value 6,899.1 7,730.0

Number of shares (millions)((1)) 328.3 328.3

- --------------------------------------------------------------------------------

low (-4.75%) R$ 20.02 R$ 22.43

R$/share average R$ 21.02 R$ 23.55

high (+4.75%) R$ 22.01 R$ 24.67

- --------------------------------------------------------------------------------

Source: Cosan and Credit Suisse.

Net Worth

(R$ million) 01/31/2009

Total assets R$ 11,039.4

(-) Total liabilities 7,311.3

(-) Minority interest 31.5

= Shareholder's equity 3,696.6

Number of shares (millions)((1)) 328.3

R$/share 11.26

- --------------------------------------------------------------------------------

Source: Cosan.

Weighted Average of Stock Prices

- -------------------------------------------------------------------------------

12 month period prior to communicating the relevant R$ 18.99

fact

- -------------------------------------------------------------------------------

(11-mar-08 to 11-mar-09)

- -------------------------------------------------------------------------------

90 day period prior to communicating the relevant R$ 10.68

fact

- -------------------------------------------------------------------------------

(11-dec-08 to 11-mar-09)

- -------------------------------------------------------------------------------

Period between the date the relevant fact was R$ 12.05

communicated and the date of the appraisal report

- -------------------------------------------------------------------------------

(12-mar-09 to 30-apr-09)

- --------------------------------------------------------------------------------

Source: Bloomberg, according to information on page 49 of this

report.

(1) Source: CVM,(SEC) includes stocks in Treasury.

(2) Considers average trading multiples of comparable companies as of April

30th, 2009.

10

|

|

Appraisal Summary

Curupay S.A. - Participacoes ("NovAmerica")

Based on the economic value obtained through the discounted cash flow method

(DCF), the value of NovAmerica's stock is between $ 3,433.98 and R$ 3,776.47.

For more information with respect to the calculation methodology used, see

Appendix C - Description of applied appraisal methodologies on page 74 of this

report

Economic Value (DCF)

(R$ million)

Equity value 1,205

Number of shares (thousands) 334

-4.75% +4.75%

- --------------------------------------------------------------------------------

Equity value 1,148 1,205 1,262

Price per share (R$) 3,433.98 3,605.223,776.47

- --------------------------------------------------------------------------------

Source: NovAmerica and Credit Suisse. Base date: 30th Apriil 2009.

- --------------------------------------------------------------------------------

Economic Value (Multiples)

- --------------------------------------------------------------------------------

(R$ million) 2009/10E 2010/11E

EBITDA $377.8 $413.9

x EV/EBITDA((2)) 6.4x 5.8x

= Enterprise Value 2,402.0 2,390.3

- - Net debt $1,100.1 $1,100.1

= Equity Value 1,301.9 1,290.3

Number of shares (millions)((1)) 0.3 0.3

------------------------------------------------------------------------------

low (-4.75%) R$ 3,710.79 R$ 3,677.65

R$/share average R$ 3,895.85 R$ 3,861.05

high (+4.75%) R$ 4,080.90 R$ 4,044.45

- --------------------------------------------------------------------------------

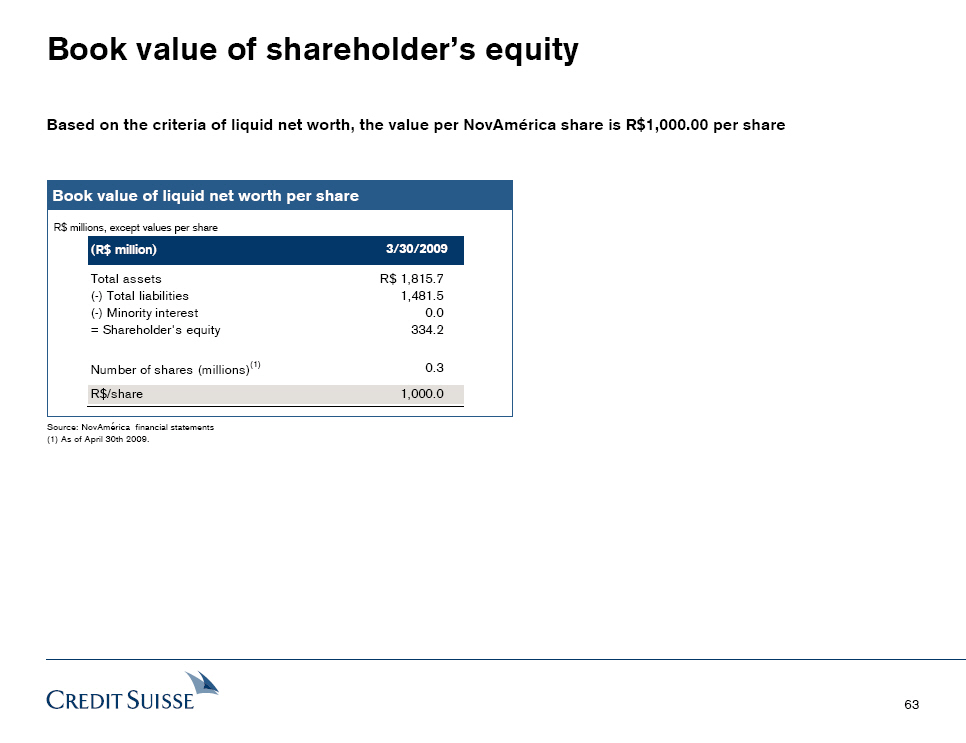

Net Worth((1))

- --------------------------------------------------------------------------------

(R$ million) 3/30/2009

Total assets R$ 1,815.7

(-) Total liabilities 1,481.5

(-) Minority interest 0.0

= Shareholder's equity 334.2

Number of shares (millions)((1)) 0.3

R$/share 1,000.0

- --------------------------------------------------------------------------------

Source: NovAmerica.

Source: NovAmerica and Credit Suisse.

(1) Values of Total Assets, Total Liabilities, Minority Interests, Liquid Net

Worth and Number of Stock Shares according to NovAmerica's audited Balance

Sheet dated April 30th, 2009.

(2) Considers average trading multiples of comparable companies as of April

30th, 2009.

11

|

|

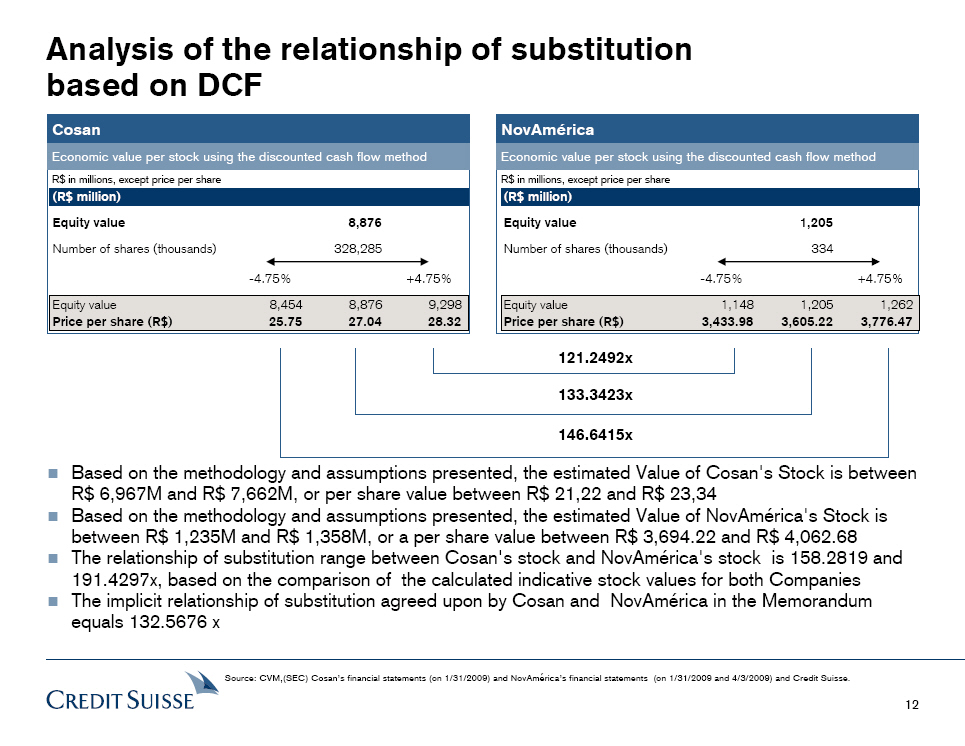

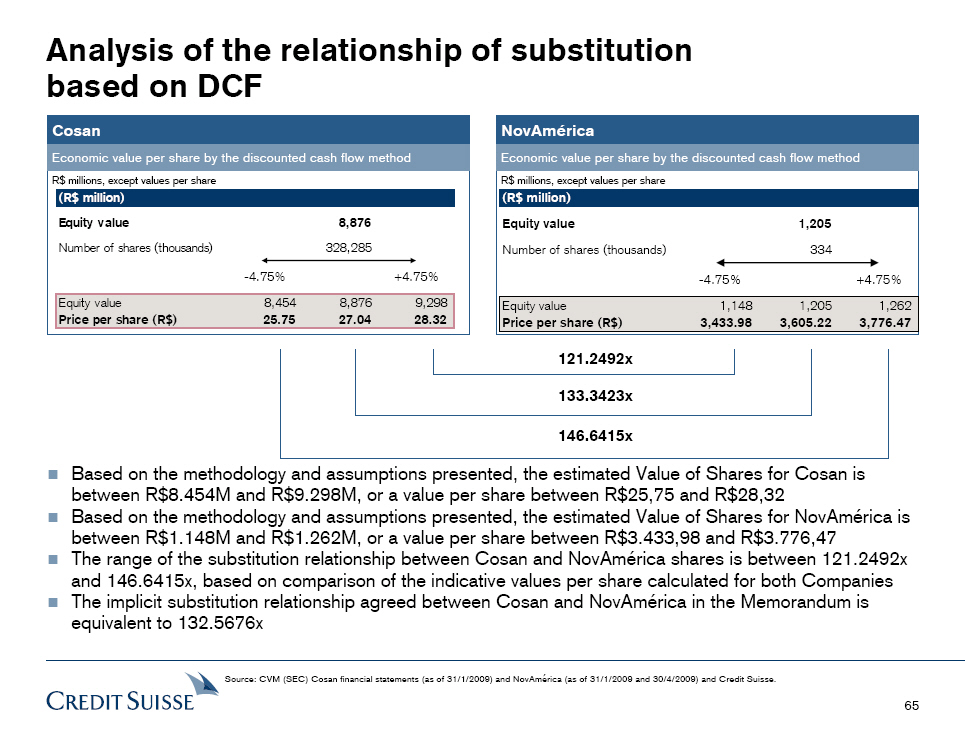

Analysis of the relationship of substitution based on DCF

- -----------------------------------------------------------------------------------

Cosan

- -----------------------------------------------------------------------------------

Economic value per stock using the discounted cash flow method

R$ in millions, except price per share

(R$ million)

Equity value 8,876

Number of shares (thousands) 328,285

-4.75% +4.75%

----------------------------------------------------------------------------------

Equity value 8,454 8,876 9,298

Price per share (R$) 25.75 27.04 28.32

----------------------------------------------------------------------------------

- -----------------------------------------------------------------------------------

NovAmerica

- -----------------------------------------------------------------------------------

Economic value per stock using the discounted cash flow method

R$ in millions, except price per share

(R$ million)

Equity value 1,205

Number of shares (thousands) 334

-4.75% +4.75%

----------------------------------------------------------------------------------

Equity value 1,148 1,205 1,262

Price per share (R$) 3,433.98 3,605.22 3,776.47

----------------------------------------------------------------------------------

121.2492x

133.3423x

146.6415x

o Based on the methodology and assumptions presented, the estimated Value of

Cosan's Stock is between R$ 6,967M and R$ 7,662M, or per share value

between R$ 21,22 and R$ 23,34

o Based on the methodology and assumptions presented, the estimated Value of

NovAmerica's Stock is between R$ 1,235M and R$ 1,358M, or a per share value

between R$ 3,694.22 and R$ 4,062.68

o The relationship of substitution range between Cosan's stock and

NovAmerica's stock is 158.2819 and 191.4297x, based on the comparison of

the calculated indicative stock values for both Companies

o The implicit relationship of substitution agreed upon by Cosan and

NovAmerica in the Memorandum equals 132.5676 x

Source: CVM,(SEC) Cosan's financial statements (on 1/31/2009) and NovAmerica's

financial statements (on 1/31/2009 and 4/3/2009) and Credit Suisse.

12

|

|

Analysis of the relationship of substitution based on Multiples

- -------------------------------------------------------------------------------------- -

Cosan

- -------------------------------------------------------------------------------------- -

Economic value per stock by the multiples method

R$ in millions, except price per share

(R$ millions)

Equity value ((1)) 7,315

Number of shares (thousands ) 328,285

-4.75% +4.75%

- -----------------------------------------------------------------------

Equity value 6,967 7,315 7,662

Price per share (R$) 21.22 22.28 23.34

- -----------------------------------------------------------------------

NovAmerica

- -------------------------------------------------------------------------

Economic value per stock by the multiples method

R$ in millions, except price per

share

(R$ millions)

Equity value ((1)) 1,296

Number of shares (thousands ) 334

-4.75% +4.75%

- ---------------------------------------------------------------------------

Equity value 1,235 1,296 1,358

Price per share (R$) 3,694.22 3,878.45 4,062.68

- ---------------------------------------------------------------------------

158.2819x

174.0686x

191.4297x

o Based on the methodology and assumptions presented, the estimated Value of

Cosan's Stock is between R$ 6,967M and R$ 7,662M, or per share value

between R$ 21.22 and R$ 23.34

o Based on the methodology and assumptions presented, the estimated Value of

NovAmerica's Stock is between R$ 1,235M and R$ 1,358M, or a per share value

between R$ 3,694.22 and R$ 4,062.68

o The relationship of substitution range between Cosan's stock and

NovAmerica's stock is 158.2819 and 191.4297x, based on the comparison of

the calculated indicative stock values for both Companies

o The implicit relationship of substitution agreed upon by Cosan and

NovAmerica in the Memorandum equals 132.5676x

Source: CVM(SEC), Cosan's financial statements (on 1/31/2009) and NovAmerica's

financial statements (on 1/31/2009 and 4/30/2009) and Credit Suisse. (1) Value

of shares equivalent to the average value based on the multiples EV/EBITDA

2009/10E and EV/EBITDA 2010/11E

13

|

|

3. Description of the market and the companies

14

|

|

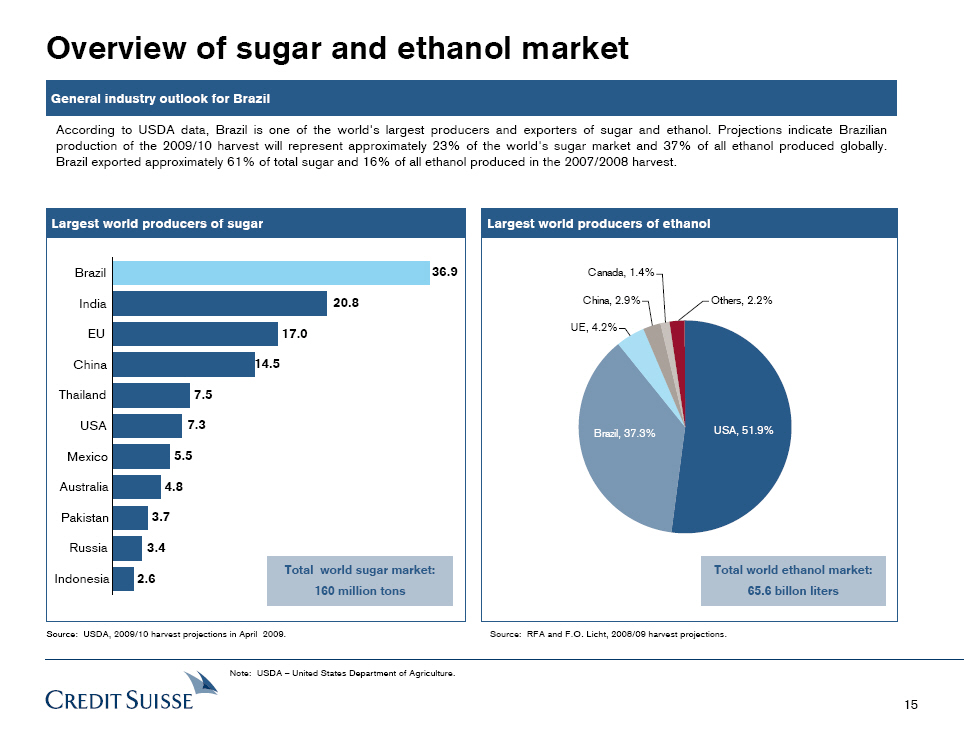

Overview of sugar and ethanol market

General industry outlook for Brazil

According to USDA data, Brazil is one of the world's largest producers and

exporters of sugar and ethanol. Projections indicate Brazilian production of the

2009/10 harvest will represent approximately 23% of the world's sugar market and

37% of all ethanol produced globally. Brazil exported approximately 61% of total

sugar and 16% of all ethanol produced in the 2007/2008 harvest.

Largest world producers of sugar

[GRAPHIC OMITTED]

Source: USDA, 2009/10 harvest projections in April 2009.

Largest world producers of ethanol

[GRAPHIC OMITTED]

Source: RFA and F.O. Licht, 2008/09 harvest projections.

Note: USDA - United States Department of Agriculture.

15

c

|

|

Overview of sugar and ethanol market (cont'd)

Brazil has significant competitive advantages that facilitate their position as

one of the world's largest producers of sugar and ethanol:

- - Favorable climatic conditions

- - Vast land availability

- - Strong domestic market

- - Large production scale and low production costs

- - Raw material (sugar cane) with long life cycle (5-6 years)

o The State of Sao Paulo is the largest producer of sugar and ethanol in

Brazil: 62% of total sugar and 59% of all ethanol produced during the

2007/08 harvest

o The sector accounted for approximately 2% of Brazilian GDP in 2007

Regional production of sugar cane

[GRAPHIC OMITTED]

Source: UNICA.

Sugar and ethanol production - South-central region

Production 2007/08 2008/09e2009/10e

------------------------------------------------------------------------

Sugar (millions of tons) 26.2 26.5 27.0

------------------------------------------------------------------------

Ethanol (billions of 20.3 23.9 26.9

liters)

------------------------------------------------------------------------

Domestic Consumption

------------------------------------------------------------------------

Sugar (millions of tons) 9.8 8.0 8.0

------------------------------------------------------------------------

Ethanol (billions of 17.3 19.7 23.7

liters)

------------------------------------------------------------------------

Available for export

-------------------------------------------------------------------------

Sugar (millions of tons) 16.4 18.5 19.0

-------------------------------------------------------------------------

Ethanol (billions of 3.1 4.2 3.2

liters)

-------------------------------------------------------------------------------

Source: UNICA.

- --------------------------------------------------------------------------------

Brazilian production of sugar cane

- --------------------------------------------------------------------------------

[GRAPHIC OMITTED]

Source: UNICA.

16

|

|

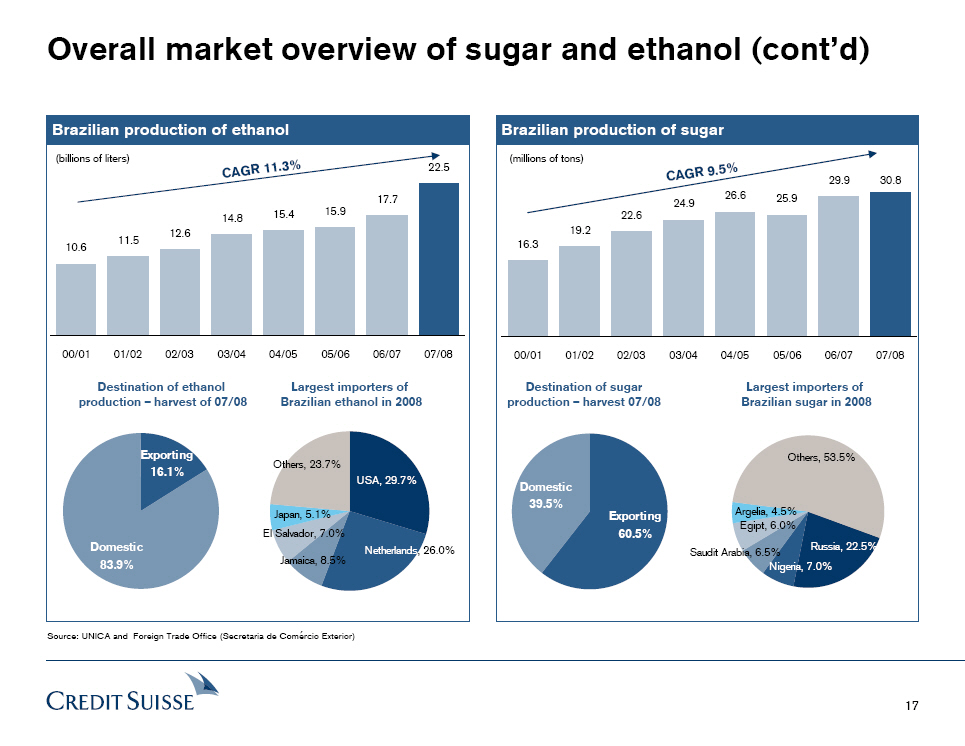

Overall market overview of sugar and ethanol (cont'd)

Brazilian production of ethanol

[GRAPHIC OMITTED]

Brazilian production of sugar

[GRAPHIC OMITTED]

Source: UNICA and Foreign Trade Office (Secretaria de Comercio Exterior)

17

|

|

3. Description of the market and companies

3.1. Cosan S.A. Industria e Comercio

18

|

|

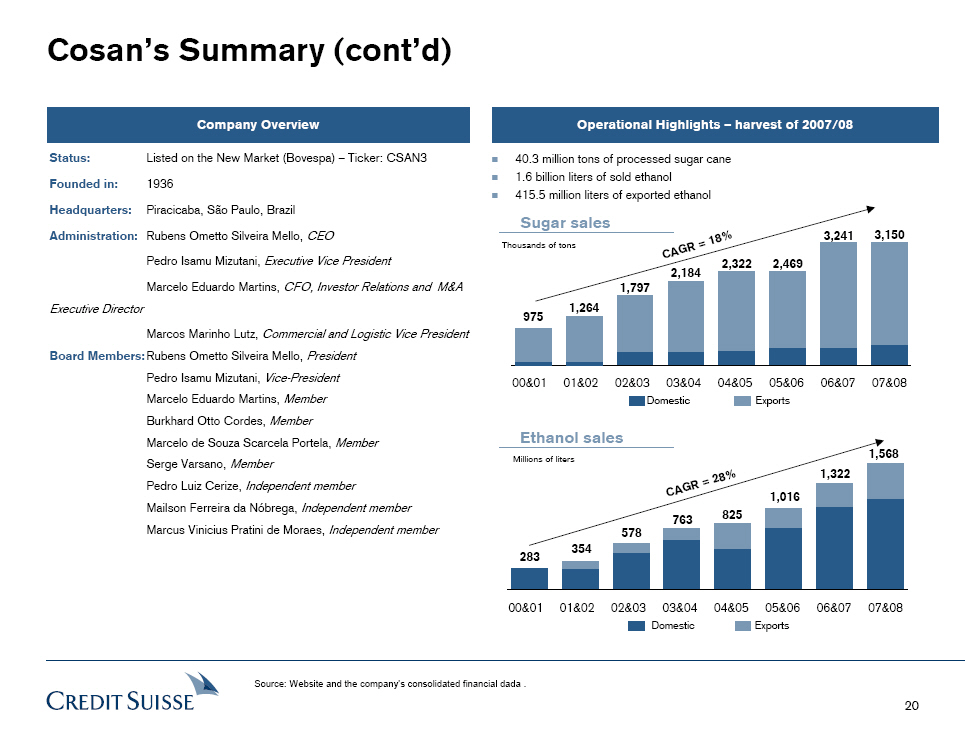

Cosan's Summary

Brief Description

Overview

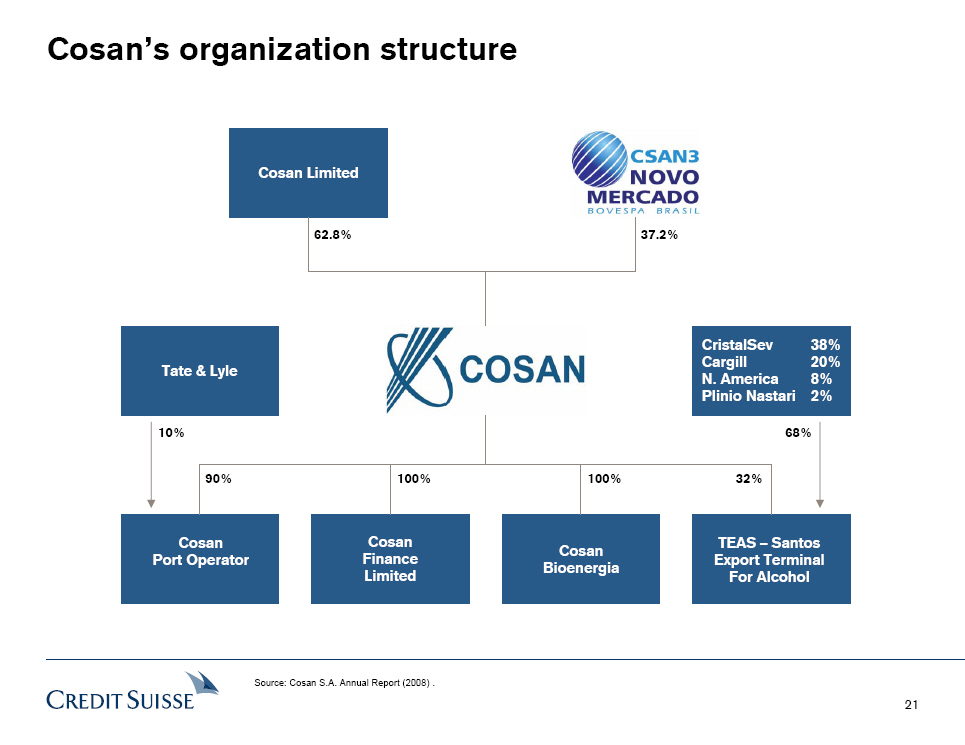

The COSAN Group is one of the largest producers, traders and global exporters of

sugar and ethanol, with milling capacity of 44.8 million tonnes per year

They are the largest global generators of electricity produced from sugar cane

bagasse

The own 18 plants, two refineries and two port terminals, one for sugar and one

for ethanol

With operations thus far concentrated in Sao Paulo, they initiated 2005 - IPO on

Bovespa's New Market the Jatai unit operation in 2009, the first module of a

greenfield project in Goias

Recently, they entered into two new businesses - land acquisition and fuel

distribution - and are present in every link of the sugar- alcohol agro

industrial chain, becoming the first Brazilian company of renewable energy to be

fully integrated Produces seven types of sugar for industrial use: crystal,

crystal demerara, VHP (Very High Polarization), refined amorphous, refined

granulated, liquid sucrose and inverted liquid

Produces four types of alcohol: refined hydrated alcohol, neutral hydrated

alcohol, hydrated ethanol fuel and ethanol anhydrous

History

1936 - Incorporation of Usina Costa Pinto

1984-94 - Development of VHP sugar (Very High Polarization)

1996 - Granted concession of terminal to export sugar

1997 - Partnership with Tate & Lyle

2000 - Official incorporation of Cosan S.A.

2000 - Alliance with Tereos and Sucden

2002 - Acquisition of Da Barra

2005 - Loan with IFC

2005 - Alliance with the Kuok Group

2006 - Perpetual bond issue (US$ 450 million)

2007 - 10 year bond Issue (US$ 400 million)

2007 - NYSE IPO of Cosan Ltd, controlling company

2008 - Cosan S.A. capital Increase (R$ 880 million)

2008 - Establishment of Radar subsidiary

2008 - Acquisition of Exxon assets in Brazil ($ 900 million)

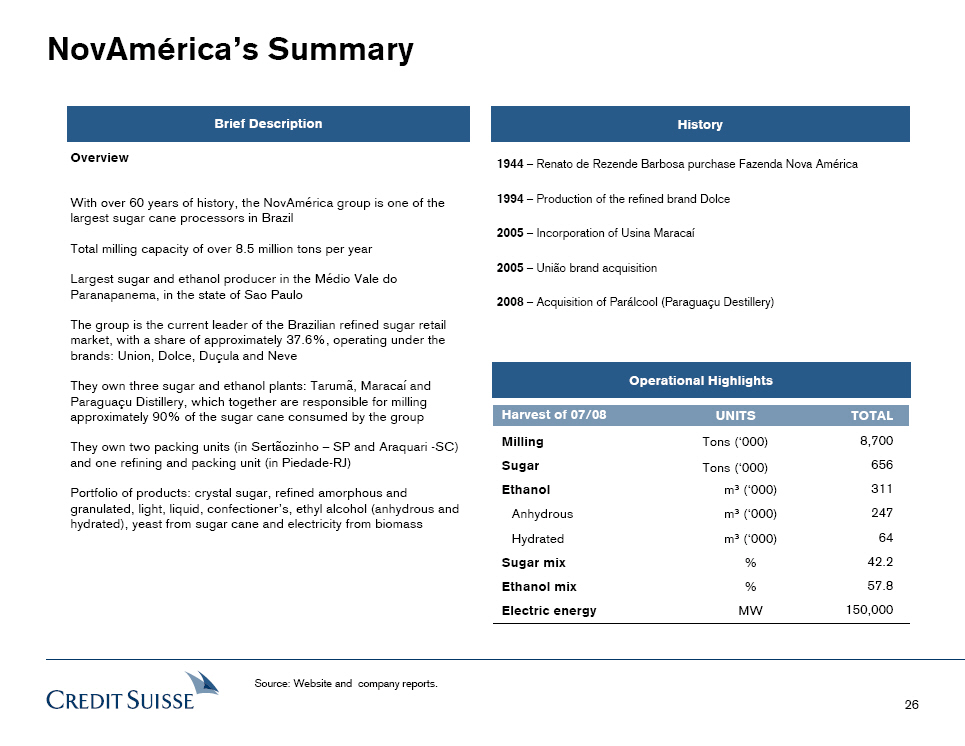

Note: Greenfield: term for projects that take place at a location where there