Cosan S.A. Indústria e Comércio

Condensed Consolidated Financial Statements

For the six-month periods ended September 30, 2009 and October 31, 2008

COSAN S.A. INDÚSTRIA E COMÉRCIO

CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

CONTENTS

| Report of independent registered public accounting firm | 1 |

| Condensed consolidated balance sheets | 2 |

| Condensed consolidated statements of operations | 4 |

Condensed consolidated statements of shareholders’ equity and comprehensive income (loss) | 5 |

| Condensed consolidated statements of cash flows | 6 |

| Notes to the condensed consolidated financial statements | 7 |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Shareholders of

Cosan S.A. Indústria e Comércio

We have reviewed the condensed consolidated balance sheet of Cosan S.A. Indústria e Comércio and subsidiaries as of September 30, 2009, the related condensed consolidated statements of operations and cash flows for the six-month periods ended September 30, 2009 and October 31, 2008 and the condensed consolidated statement of shareholders’ equity and comprehensive income (loss) for the six-month period ended September 30, 2009. These financial statements are the responsibility of the Company's management.

We conducted our review in accordance with the standards of the Public Company Accounting Oversight Board (United States). A review of interim financial information consists principally of applying analytical procedures and making inquiries of persons responsible for financial and accounting matters. It is substantially less in scope than an audit conducted in accordance with the standards of the Public Company Accounting Oversight Board, the objective of which is the expression of an opinion regarding the financial statements taken as whole. Accordingly, we do not express such an opinion.

Based on our review, we are not aware of any material modifications that should be made to the condensed consolidated financial statements referred to above for them to be in conformity with U.S. generally accepted accounting principles.

We have previously audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheet of Cosan S.A. Indústria e Comércio and subsidiaries as of March 31, 2009, and the related consolidated statements of operations, shareholders’ equity and cash flows for the eleven-month period then ended not presented herein and in our report dated June 19, 2009, we expressed an unqualified opinion on those consolidated financial statements. In our opinion, the information set forth in the accompanying condensed consolidated balance sheet as of March 31, 2009, is fairly stated, in all material respects, in relation to the consolidated balance sheet from which it has been derived.

| São Paulo, Brazil | ERNST & YOUNG |

| November 12, 2009 | Auditores Independentes S.S. |

| | CRC2SP015199/O-8 |

| | |

| | |

| | Luiz Carlos Nannini |

| | Accountant CRC 1SP171638/O-7 |

COSAN S.A. INDÚSTRIA E COMÉRCIO

Condensed consolidated balance sheets

September 30, 2009 and March 31, 2009

(In thousands of U.S. dollars, except share data)

| | | (Unaudited) September 30, | | | March 31, | |

| | | 2009 | | | 2009 | |

| Assets | | | | | | |

| Current assets: | | | | | | |

| Cash and cash equivalents | | | 533,517 | | | | 310,710 | |

| Restricted cash | | | 84,097 | | | | 5,078 | |

| Derivative financial instruments | | | 54,793 | | | | 7,352 | |

| Trade accounts receivable, less allowances: September 30, 2009 – $33,672; March 31, 2009 – $21,241 | | | 331,628 | | | | 258,863 | |

| Inventories | | | 861,325 | | | | 477,793 | |

| Advances to suppliers | | | 189,386 | | | | 88,991 | |

| Recoverable taxes | | | 192,843 | | | | 114,641 | |

| Other current assets | | | 56,129 | | | | 62,145 | |

| | | | 2,303,718 | | | | 1,325,573 | |

| | | | | | | | | |

| Property, plant, and equipment, net | | | 3,400,677 | | | | 2,114,188 | |

| Goodwill | | | 1,507,951 | | | | 803,270 | |

| Intangible assets, net | | | 255,130 | | | | 228,950 | |

| Accounts receivable from federal government | | | 185,057 | | | | 139,700 | |

| Judicial deposits | | | 101,851 | | | | 73,975 | |

| Other non-current assets | | | 459,882 | | | | 277,028 | |

| | | | 5,910,548 | | | | 3,637,111 | |

| Total assets | | | 8,214,266 | | | | 4,962,684 | |

| | | (Unaudited) September 30, | | | March 31, | |

| | | 2009 | | | 2009 | |

| Liabilities and shareholders’ equity | | | | | | |

| Current liabilities: | | | | | | |

| Trade accounts payable | | | 400,710 | | | | 197,009 | |

| Taxes payable | | | 125,395 | | | | 69,273 | |

| Salaries payable | | | 101,740 | | | | 40,237 | |

| Current portion of long-term debt | | | 672,469 | | | | 630,260 | |

| Derivative financial instruments | | | 121,143 | | | | 28,894 | |

| Other liabilities | | | 70,704 | | | | 47,946 | |

| | | | 1,492,161 | | | | 1,013,619 | |

| | | | | | | | | |

| Long-term liabilities: | | | | | | | | |

| Long-term debt | | | 2,629,133 | | | | 1,246,994 | |

| Estimated liability for legal proceedings and labor claims | | | 672,647 | | | | 497,648 | |

| Taxes payable | | | 176,311 | | | | 149,621 | |

| Due to Cosan Limited | | | - | | | | 175,000 | |

| Deferred income taxes | | | 118,321 | | | | 40,377 | |

| Other long-term liabilities | | | 167,641 | | | | 116,429 | |

| | | | 3,764,053 | | | | 2,226,069 | |

| | | | | | | | | |

| Shareholders’ equity | | | | | | | | |

| Cosan shareholders’ equity: | | | | | | | | |

| Common stock, no par value. Authorized 372,810,142 shares; issued and outstanding 372,810,142 in September 30, 2009 and 328,284,884 shares in March 31, 2009 | | | 2,121,369 | | | | 1,945,741 | |

| Treasury stock | | | (1,979 | ) | | | (1,979 | ) |

| Common stock warrants | | | 25,273 | | | | 25,273 | |

| Additional paid-in capital | | | 350,310 | | | | 167,610 | |

| Accumulated other comprehensive income (accumulated loss) | | | 316,164 | | | | (280,888 | ) |

| Retained earnings (losses) | | | 124,463 | | | | (146,099 | ) |

| Equity attributable to shareholders of Cosan | | | 2,935,600 | | | | 1,709,658 | |

| Equity attributable to noncontrolling interests | | | 22,452 | | | | 13,338 | |

| Total shareholders’ equity | | | 2,958,052 | | | | 1,722,996 | |

| Total liabilities and shareholders' equity | | | 8,214,266 | | | | 4,962,684 | |

See accompanying notes to condensed consolidated financial statements.

COSAN S.A. INDÚSTRIA E COMÉRCIO

Condensed consolidated statements of operations

Six-month period ended September 30, 2009 and October 31, 2008

(In thousands of U.S. dollars, except share data)

(Unaudited)

| | | September 30, | | | October 31, | |

| | | 2009 | | | 2008 | |

| Net sales | | | 3,635,926 | | | | 777,834 | |

| Cost of goods sold | | | (3,215,304 | ) | | | (717,368 | ) |

| Gross profit | | | 420,622 | | | | 60,466 | |

| Selling expenses | | | (217,156 | ) | | | (100,948 | ) |

| General and administrative expenses | | | (70,204 | ) | | | (70,464 | ) |

| Operating income (loss) | | | 133,262 | | | | (110,946 | ) |

| Other income (expenses): | | | | | | | | |

| Financial income | | | 61,205 | | | | 130,772 | |

| Financial expenses | | | 207,330 | | | | (338,253 | ) |

| Other | | | (7,007 | ) | | | (11,601 | ) |

| Income (loss) before income taxes and equity in income (loss) of affiliates | | | 394,790 | | | | (330,028 | ) |

| Income taxes benefit (expense) | | | (125,959 | ) | | | 116,011 | |

| Income (loss) before equity in income (loss) of affiliates | | | 268,831 | | | | (214,017 | ) |

| Equity income (loss) of affiliates | | | (1,698 | ) | | | 574 | |

| | | | | | | | | |

| Net (loss) income | | | 267,133 | | | | (213,443 | ) |

| Net income (loss) attributable to noncontrolling interests | | | 3,429 | | | | (1,602 | ) |

| Net income (loss) attributable to Cosan | | | 270,562 | | | | (215,045 | ) |

| | | | | | | | | |

| Per-share amounts attributable to Cosan | | | | | | | | |

| Net Income (loss) | | | | | | | | |

| Basic | | | 0.77 | | | | (0,77 | ) |

| Diluted | | | 0.76 | | | | (0.77 | ) |

| | | | | | | | | |

| Weighted number of shares outstanding | | | | | | | | |

| Basic | | | 353,351,384 | | | | 279,267,670 | |

| Diluted | | | 358,195,397 | | | | 279,267,670 | |

See accompanying notes to condensed consolidated financial statements.

COSAN S.A. INDÚSTRIA E COMÉRCIO

Condensed consolidated statements of shareholders’ equity and comprehensive income (loss)

Six-month period ended September 30, 2009

(In thousands of U.S. dollars, except share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | Retained | | | Accumulated | | | | | | | |

| | | Common stock | | | Treasury stock | | | Common stock | | | Additional | | | earnings | | | other | | | Non | | | Total | |

| | | | | | | | | | | | | | | warrants | | | paid-in | | | (accumulated | | | comprehensive | | | controlling | | | shareholders | |

| | | shares | | | Amount | | | Shares | | | amount | | | number | | | amount | | | capital | | | loss) | | | income (loss) | | | interest | | | equity | |

| Balances at March 31, 2009 | | | 328,284,884 | | | | 1,945,741 | | | | 343,139 | | | | (1,979 | ) | | | 55,000,000 | | | | 25,273 | | | | 167,610 | | | | (146,099 | ) | | | (280,888 | ) | | | 13,338 | | | | 1,722,996 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Acquisition of Teaçu | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 60,009 | | | | - | | | | - | | | | 68,285 | | | | 128,294 | |

| Issuance of common shares in business combination | | | 44,300,389 | | | | 169,553 | | | | - | | | | - | | | | - | | | | - | | | | 123,557 | | | | - | | | | - | | | | (62,476 | ) | | | 230,634 | |

| Exercise of stock options | | | 224,819 | | | | 6,074 | | | | - | | | | - | | | | - | | | | - | | | | (5,367 | ) | | | - | | | | - | | | | - | | | | 707 | |

| Exercise of common stock warrants | | | 50 | | | | 1 | | | | - | | | | - | | | | (83 | ) | | | - | | | | - | | | | - | | | | - | | | | - | | | | 1 | |

| Share based compensation | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 4,501 | | | | - | | | | - | | | | - | | | | 4,501 | |

| Pension plan | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (85 | ) | | | - | | | | (85 | ) |

| Net income | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 270,562 | | | | - | | | | (3,429 | ) | | | 267,133 | |

| Currency translation adjustment | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 597,137 | | | | 6,734 | | | | 603,871 | |

| Total comprehensive income | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 870,919 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balances at September 30, 2009 | | | 372,810,142 | | | | 2,121,369 | | | | 343,139 | | | | (1,979 | ) | | | 54,999,917 | | | | 25,273 | | | | 350,310 | | | | 124,463 | | | | 316,164 | | | | 22,452 | | | | 2,958,052 | |

See accompanying notes to condensed consolidated financial statements.

COSAN S.A. INDÚSTRIA E COMÉRCIO

Condensed consolidated statements of cash flows

Six-month period ended September 30, 2009 and October 31, 2008

(In thousands of U.S. dollars)

(Unaudited)

| | | September 30, | | | October 31, | |

| | | 2009 | | | 2008 | |

| Cash flow from operating activities | | | | | | |

| Net (loss) income for the period attributable to Cosan | | | 270,562 | | | | (215,045 | ) |

| Adjustments to reconcile net income to cash provided by operating activities: | | | | | | | | |

| Depreciation and amortization | | | 205,371 | | | | 257,024 | |

| Deferred income and social contribution taxes | | | 125,959 | | | | (116,011 | ) |

| Interest, monetary and exchange variation | | | (206,095 | ) | | | 315,453 | |

| Others | | | (38,641 | ) | | | 17,512 | |

| | | | | | | | | |

| Decrease/increase in operating assets and liabilities | | | | | | | | |

| Trade accounts receivable, net | | | 48,076 | | | | 260 | |

| Inventories | | | (90,194 | ) | | | (411,156 | ) |

| Advances to suppliers | | | (31,518 | ) | | | (28,887 | ) |

| Trade accounts payable | | | 54,393 | | | | 142,356 | |

| Derivative financial instruments | | | 41,622 | | | | 6,525 | |

| Taxes payable | | | (58,948 | ) | | | (12,926 | ) |

| Other assets and liabilities, net | | | 16,980 | | | | 2,229 | |

| Net cash provided by (used in) operating activities | | | 337,567 | | | | (42,666 | ) |

| | | | | | | | | |

| Cash flows from investing activities: | | | | | | | | |

| Restricted cash | | | (77,485 | ) | | | 37,546 | |

| Marketable securities | | | - | | | | (228,348 | ) |

| Cash received from sales of noncurrent assets | | | 67,027 | | | | - | |

| Others | | | (7,383 | ) | | | - | |

| Acquisition of property, plant and equipment | | | (438,509 | ) | | | (315,998 | ) |

| Acquisitions, net of cash acquired | | | 23,903 | | | | (17,490 | ) |

| Net cash used in investing activities | | | (432,447 | ) | | | (524,290 | ) |

| | | | | | | | | |

| Cash flows from financing activities: | | | | | | | | |

| Related parties | | | (256,896 | ) | | | - | |

| Proceeds from issuance of common stock | | | 707 | | | | 456,084 | |

| Treasury stock | | | - | | | | (1,979 | ) |

| Additions of long-term debts | | | 685,371 | | | | 174,501 | |

| Payments of long-term debts | | | (250,652 | ) | | | (66,013 | ) |

| Net cash provided by financing activities | | | 178,530 | | | | 562,593 | |

| Effect of exchange rate changes on cash and | | | | | | | | |

| cash equivalents | | | 139,157 | | | | 29,138 | |

| Net increase in cash and cash equivalents | | | 222,807 | | | | 24,775 | |

| Cash and cash equivalents at beginning of period | | | 310,710 | | | | 38,832 | |

| Cash and cash equivalents at end of period | | | 533,517 | | | | 63,607 | |

| | | | | | | | | |

| Supplemental cash flow information | | | | | | | | |

| Cash paid during the period for: | | | | | | | | |

| Interest | | | 77,584 | | | | 37,302 | |

| Income taxes | | | 20,431 | | | | - | |

See accompanying notes to condensed consolidated financial statements.

COSAN S.A. INDÚSTRIA E COMÉRCIO

Notes to the condensed consolidated financial statements

(In thousands of U.S. dollars, unless otherwise stated)

(Unaudited)

Cosan S.A. Indústria e Comércio and subsidiaries (“Cosan” or “the Company”) is incorporated under the laws of the Federative Republic of Brazil. Cosan shares are traded on the São Paulo Stock Exchange (Bovespa).

Cosan Limited, a company incorporated in Bermuda, is the controlling shareholder of Cosan holding a 60.67% interest therein as of September 30, 2009 (68.89% as of March 31, 2009). The change in interest was mainly related to the issuance of shares for the acquisition of Curupay S.A. Participações (Note 3). The class “A” common shares of Cosan Limited are traded on the New York Stock Exchange (NYSE) and Bovespa.

The companies included in the consolidated financial statements have as their primary activity the production of ethanol and sugar, and the marketing and distribution of fuel and lubricants in Brazil.

On April 23, 2008, the Company entered into an agreement with ExxonMobil International Holding B.V., or “Exxon”, for the acquisition of 100% of the outstanding shares of Esso Brasileira de Petróleo Ltda. and its subsidiaries (“Essobrás”), a distributor and seller of fuels and producer and seller of lubricants and specialty petroleum products of ExxonMobil in Brazil. On December 1, 2008 the Company completed the acquisition. On January 16, 2009 the Company changed the corporate name of Essobrás to Cosan Combustíveis e Lubrificantes S.A. (“Cosan CL”).

On August 29, 2008 the Company held an Annual and Special General Shareholders Meeting and unanimously approved the modification of the end of its fiscal year from April 30 to March 31 of each year. Therefore the income statement and cash flow information presented in these financial statements lack comparison to the prior period represented by the six-month period ended October 31, 2008.

On August 28, 2008, the Company announced the incorporation of a new affiliate named Radar Propriedades Agrícolas S.A. (“Radar”), which engages in farm real estate investments in Brazil by identifying and acquiring rural properties likely to experience an increase in value and acquiring them for later leasing and/or sale. The initial capital contribution was US$185,000, of which US$35,000 was invested by Cosan (18.92%) and US$150,000 by another shareholder (81.08%). On August 25, 2009, an additional capital contribution of US$33,262, was approved, of which US$6,293 (18.92%) was invested by Cosan and the remainder by the other shareholder.

COSAN S.A. INDÚSTRIA E COMÉRCIO

Notes to the condensed consolidated financial statements (Continued)

(In thousands of U.S. dollars, unless otherwise stated)

(Unaudited)

On April 09, 2009, the Company entered into an agreement with Rezende Barbosa S.A. Administração e Participações (“Rezende Barbosa”) to acquire 100% of the outstanding shares of Teaçu Armazéns Gerais S.A. (“Teaçu”). Teaçu operates a port terminal concession in the city of Santos. See further discussion regarding this acquisition at Note 3.

On June 17, 2009, Cosanpar Participações S.A. (“Cosanpar”), a wholly-owned subsidiary of Cosan sold its equity interest in Jacta Participações S.A. (“Jacta”), a distributor of aviation fuel that was acquired in the Essobrás acquisition, to Shell Brasil Ltda. for US$59,234 cash. The results of operations of Jacta were recorded in the fuel distribution segment. The carrying value of the net assets sold was US$40,084, which resulted in a gain of US$19,150.

On June 18, 2009, the Company entered into an agreement with Rezende Barbosa to acquire 100% of the outstanding shares of Curupay S.A. Participações (“Curupay”). The principal investment of Curupay was 100% of the outstanding shares of Cosan Alimentos S.A. (former Nova América S.A. Agroenergia). Cosan Alimentos S.A. (“Cosan Alimentos”) is a producer of sugar, ethanol and energy co-generation which also operates in trading and logistics. See further discussion regarding this acquisition at Note 3.

| 2. | Presentation of the consolidated financial statements |

| a. | Basis of reporting for interim financial statements |

In the opinion of management, the unaudited condensed consolidated financial statements reflect all adjustments (consisting of normal recurring accruals) considered necessary for a fair presentation of the Company’s results for the periods presented. Interim results for the six-month period ended September 30, 2009, are not necessarily indicative of the results that may be expected for the fiscal year.

The unaudited condensed consolidated financial statements include the accounts of Cosan and its subsidiaries. All significant intercompany transactions have been eliminated.

These financial statements should be read in conjunction with Cosan`s annual financial statements for the fiscal year ended March 31, 2009.

COSAN S.A. INDÚSTRIA E COMÉRCIO

Notes to the condensed consolidated financial statements (Continued)

(In thousands of U.S. dollars, unless otherwise stated)

(Unaudited)

| 2. | Presentation of the consolidated financial statements (Continued) |

| a. | Basis of reporting for interim financial statements (Continued) |

The accounts of Cosan and its subsidiaries are maintained in Brazilian reais, which is the functional currency. The accounts have been translated into U.S. dollars in accordance with Accounting Standards Codification 830 “Foreign Currency Matters”.

The exchange rate of the Brazilian real (R$) to the US$ was R$1.7781=US$ 1.00 at September 30, 2009 and R$2.3152=US$1.00 at March 31, 2009.

The preparation of condensed consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the amounts reported in the condensed consolidated financial statements and accompanying notes. Actual results could differ from these estimates. These estimates and assumptions are reviewed and updated regularly to reflect recent experience.

| c. | Recently issued accounting standards |

FASB Accounting Standards Codification

In September 2009, the Accounting Standards Codification (“ASC”) became the source of authoritative U.S. GAAP recognized by the Financial Accounting Standards Board (“FASB”) for nongovernmental entities, except for certain FASB Statements not yet incorporated into ASC. Rules and interpretive releases of the SEC under federal securities laws are also sources of authoritative U.S. GAAP for registrants. The authoritative guidance mentioned in these financial statements includes the applicable ASC reference.

Subsequent Events

We adopted ASC 855, Subsequent Events, which established general accounting standards and disclosure for subsequent events,during the six-month period ended September 30, 2009. In accordance with ASC 855, the Company has evaluated subsequent events through November 12, 2009, the date the financial statements were issued or available to be issued.

COSAN S.A. INDÚSTRIA E COMÉRCIO

Notes to the condensed consolidated financial statements (Continued)

(In thousands of U.S. dollars, unless otherwise stated)

(Unaudited)

| 2. | Presentation of the consolidated financial statements (Continued) |

| c. | Recently issued accounting standards (continued) |

Noncontrolling Interests

Effective April 1, 2009, the Company adopted new accounting guidance ASC 810, which changed the accounting for and the reporting of an entity’s minority ownership. Such minority ownership, previously referred to as minority interest, is now referred to as noncontrolling interests. The adoption of this guidance resulted in the reclassification of amounts previously attributable to minority interest and classified in the mezzanine outside of shareholders’ equity, to a separate component of stockholders’ equity titled “Noncontrolling Interests” in the accompanying condensed consolidated balance sheets and statement of changes in equity.

Additionally, net income and comprehensive income attributable to noncontrolling interests are shown separately from consolidated net income and comprehensive income in the accompanying condensed consolidated statements of operations and statements of changes in equity. Prior period financial statements have been reclassified to conform to the current year presentation as required by the authoritative guidance.

New Accounting Pronouncements

The following accounting standards have been issued, but as of September 30, 2009 are not yet effective and have not been adopted by the Company.

SFAS No. 166, Accounting for Transfers of Financial Assets – an amendment of FASB Statement No. 140 (“SFAS No. 166”)

In June 2009, the FASB issued SFAS No. 166, which removes the concept of a qualifying special-purpose entity (“QSPE”) from SFAS No. 140, Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities-a replacement of FASB Statement No. 125. The QSPE concept had initially been established to facilitate off-balance sheet treatment for certain securitizations. SFAS No. 166 also removes the exception from applying FASB Interpretation (“FIN”) No. 46(R), Consolidation of Variable Interest Entities (“FIN No. 46(R)”), to QSPEs. SFAS No. 166 has not been incorporated into ASC and is effective for fiscal years beginning after November 15, 2009, or April 1, 2010 for Cosan. The Company does not believe the adoption of SFAS No. 166 will have a material impact on its financial statements.

COSAN S.A. INDÚSTRIA E COMÉRCIO

Notes to the condensed consolidated financial statements (Continued)

(In thousands of U.S. dollars, unless otherwise stated)

(Unaudited)

| 2. | Presentation of the consolidated financial statements (Continued) |

| c. | Recently issued accounting standards (Continued) |

New Accounting Pronouncements (Continued)

SFAS No. 167, Amendments to FASB Interpretation No. 46(R) (“SFAS No. 167”)

In June 2009, the FASB issued SFAS No. 167, which amends FIN 46(R) to among other things, require an entity to qualitatively rather than quantitatively assess the determination of the primary beneficiary of a variable interest entity (“VIE”). This determination should be based on whether the entity has 1) the power to direct matters that most significantly impact the activities of the VIE and 2) the obligation to absorb losses or the right to receive benefits of the VIE that could potentially be significant to the VIE. Other key changes include: the requirement for an ongoing reconsideration of the primary beneficiary, the criteria for determining whether service provider or decision maker contracts are variable interests, the consideration of kick-out and removal rights in determining whether an entity is a VIE, the types of events that trigger the reassessment of whether an entity is a VIE and the expansion of the disclosures previously required under FASB Staff Position (“FSP”) SFAS 140-4 and FIN 46(R), Disclosures by Public Entities (Enterprises) about Transfers of Financial Assets and Interests in Variable Interest Entities. SFAS No. 167 has not been incorporated into ASC and is effective for fiscal years beginning after November 15, 2009, or April 1, 2010 for Cosan. The Company does not believe the adoption of SFAS No. 166 will have a material impact on its financial statements.

SFAS No. 168, FASB Codification and the Hierarchy of GAAP (“SFAS No. 168”)

In June 2009, the FASB issued SFAS No. 168, which identifies the sources of accounting principles and the framework for selecting the principles used in the preparation of financial statements of nongovernmental entities that are presented in conformity with U.S. GAAP. SFAS No. 168 replaces SFAS No. 162, The Hierarchy of Generally Accepted Accounting Principles, and establishes the FASB Accounting Standards Codification (“the Codification”) as the single source of authoritative guidance recognized by the FASB. Under the Codification, all guidance carries an equal level of authority. SFAS No. 168 has not been incorporated into ASC and is effective for interim and annual periods ending after September 15, 2009, or the quarter ending September 30, 2009 for Cosan. We adopted this guidance effective July 1, 2009, with no impact on our consolidated results of operations or financial position.

COSAN S.A. INDÚSTRIA E COMÉRCIO

Notes to the condensed consolidated financial statements (Continued)

(In thousands of U.S. dollars, unless otherwise stated)

(Unaudited)

a. Teaçu Armazéns Gerais S.A.

On April 9, 2009, Cosan S.A. Indústria e Comércio, through its 90% owned subsidiary, Copsapar Participações S.A., which owns 100% of Novo Rumo Logística S.A. (“Novo Rumo”), acquired 100% of the outstanding shares of Teaçu Armazéns Gerais S.A. (“Teaçu”) from Rezende Barbosa S.A. Administração e Participações (“Rezende Barbosa”) for $52,985 cash and issuance of 90,736,131 shares of Novo Rumo, equivalent to 28.82% of its share capital. Teaçu holds a port concession in the city of Santos and operates a terminal dedicated to exporting sugar and other agricultural products. This acquisition combines the Santos port operations previously held separately by Cosan S.A. and Teaçu.

As a result of this transaction, Cosan S.A. reduced its indirect share ownership in Novo Rumo to 64.06%.

The acquisition-date fair value of the consideration transferred totaled $150,501, which consisted of the following:

| Cash | | | 52,985 | |

| Common stock at estimated fair value | | | 97,516 | |

| Total | | | 150,501 | |

The fair value of the 90,736,131 common shares issued was provisionally determined at the acquisition date and is being reviewed in order to finalize the purchase price.

COSAN S.A. INDÚSTRIA E COMÉRCIO

Notes to the condensed consolidated financial statements (Continued)

(In thousands of U.S. dollars, unless otherwise stated)

(Unaudited)

| 3. | Acquisitions (Continued) |

a. Teaçu Armazéns Gerais S.A. (Continued)

The following table summarizes the estimated fair values of the assets acquired and liabilities assumed at the acquisition date. The company is in the process of obtaining valuations of certain intangible assets and fixed assets; thus, the provisional measurements of intangible assets, goodwill and deferred income tax assets are subject to change.

| Description | | | |

| Property, plant and equipment | | | 40,224 | |

| Inventories | | | 973 | |

| Other assets | | | 29,012 | |

| Long-term debt including current installments | | | (18,780 | ) |

| Trade accounts payable | | | (361 | ) |

| Estimated liability for legal proceedings and labor claims | | | (976 | ) |

| Other liabilities | | | (1,922 | ) |

| Net assets acquired | | | 48,170 | |

| Provisional purchase price, net of cash acquired | | | 150,222 | |

| Goodwill | | | 102,052 | |

The provisional goodwill of $102,052 arising from the acquisition, which will be substantially deductible for tax purposes, consists largely of the synergies and economies of scale expected from combining the port operations of Cosan S.A. and Teaçu. The provisional goodwill was assigned to the sugar segment.

The amounts of Teaçu’s revenue and earnings included in Cosan S.A.’s consolidated income statement for the six-month period ended October 31, 2008, and the revenue and earnings of the combined entity had the acquisition date been May 1, 2008, are:

| | | Revenue | | | Earnings (Loss) | |

| Actual from April 9, 2009 – September 30, 2009 (*) | | | 18,589 | | | | 2,775 | |

| Supplemental pro forma from May 1, 2008 – October 31, 2008 | | | 793,679 | | | | (213,583 | ) |

(*) Revenues and earning represent the full six-month period ended September 30, 2009.

COSAN S.A. INDÚSTRIA E COMÉRCIO

Notes to the condensed consolidated financial statements (Continued)

(In thousands of U.S. dollars, unless otherwise stated)

(Unaudited)

| 3. | Acquisitions (Continued) |

b. Curupay S.A. Participações

On June 18, 2009, Cosan S.A. acquired 100% of the outstanding shares of Curupay S.A. Participações from Rezende Barbosa, through the issuance of 44,300,389 common shares valued at $7.25 per share (fair value at the acquisition date) and a total purchase price of US$321,087. The assets acquired include the non-controlling interest in Novo Rumo representing 28.82% of its outstanding shares which were issued in the Teaçu acquisition, and 100% of the outstanding shares of two operating companies, Nova América S.A. Trading and Cosan Alimentos (collectively referred to as “Nova América”). Nova América is a producer of sugar, ethanol and energy co-generation and also operates in trading and logistics.

With the acquisition of the noncontrolling interest of Novo Rumo, Cosan S.A. increased its share ownership in Novo Rumo to 92.88%. This transaction was a change in ownership interest without a loss of control and accounted for as a transaction in shareholders’ equity.

The following table summarizes the assets acquired and liabilities assumed in relation to Nova América. These amounts are preliminary as valuations of certain intangible assets, fixed assets and other assets and liabilities are currently in process.

| Description | | | |

| Property, plant and equipment | | | 370,651 | |

| Noncontrolling interest in Novo Rumo | | | 62,476 | |

| Inventories | | | 63,572 | |

| Account receivables | | | 62,377 | |

| Other assets | | | 251,267 | |

| Long-term debt including current installments | | | (606,118 | ) |

| Trade accounts payable | | | (81,563 | ) |

| Related parties | | | (16,591 | ) |

| Estimated liability for legal proceedings and labor claims | | | (7,009 | ) |

| Taxes and contributions payable | | | (28,821 | ) |

| Other liabilities | | | (66,155 | ) |

| Net assets acquired | | | 4,086 | |

| Purchase price, net of cash acquired | | | 294,605 | |

| Goodwill | | | 290,519 | |

COSAN S.A. INDÚSTRIA E COMÉRCIO

Notes to the condensed consolidated financial statements (Continued)

(In thousands of U.S. dollars, unless otherwise stated)

(Unaudited)

| 3. | Acquisitions (Continued) |

b. Curupay S.A. Participações (Continued)

The provisional goodwill of $290,519 arising from the acquisition consists largely of the synergies and economies of scale expected from combining the ethanol and sugar operations of Cosan S.A. and Nova America. US$207,285 of the provisional goodwill was assigned to the sugar segment and US$83,234 was assigned to the ethanol segment.

The amounts of Nova America’s revenue and earnings included in Cosan S.A.’s consolidated income statement for the six-month period ended October 31, 2008, and the revenue and earnings of the combined entity had the acquisition date been May 1, 2008, are:

| | | Revenue | | | Earnings | |

| Actual from June 18, 2009 – September 30, 2009 | | | 219,290 | | | | 12,988 | |

| Supplemental pro forma from April 1, 2009 – September 30, 2009 | | | 3,728,870 | | | | 259,225 | |

| Supplemental pro forma from May 1, 2008 – October 31, 2008 | | | 1,116,831 | | | | (221,731 | ) |

COSAN S.A. INDÚSTRIA E COMÉRCIO

Notes to the condensed consolidated financial statements (Continued)

(In thousands of U.S. dollars, unless otherwise stated)

(Unaudited)

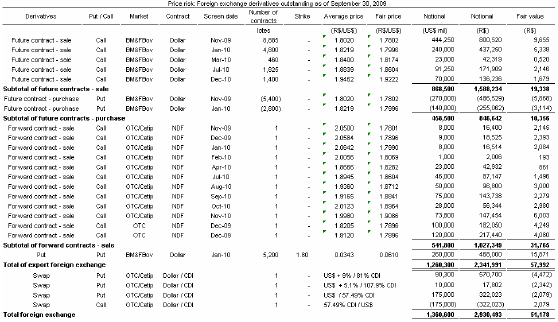

| 4. | Derivative financial instruments |

Cosan enters into derivative financial instruments with various counterparties and uses derivatives to manage the overall exposures related to sugar price variations in the international market, interest rate and exchange rate variation. The instruments are commodity futures contracts, forward currency agreements, interest rate and foreign exchange swap contracts, and option contracts. Cosan recognizes all derivatives on the balance sheet at fair value.

The following table summarizes the notional value of derivative financial instruments as well as the related amounts recorded in balance sheet accounts:

| | | Notional amounts | | | Carrying value asset (liability) | |

| | | September 30, 2009 | | | March 31, 2009 | | | September 30, 2009 | | | March 31, 2009 | |

| Commodities derivatives | | | | | | | | | | | | |

| Future contracts: | | | | | | | | | | | | |

| Purchase commitments - sugar | | | 38,194 | | | | 61 | | | | 2,429 | | | | (4 | ) |

| Purchase Commitments - oil | | | 28,577 | | | | - | | | | 724 | | | | - | |

| Sell commitments | | | 316,583 | | | | 182,943 | | | | (30,099 | ) | | | 4,163 | |

| Swap agreements - sugar | | | 56,594 | | | | - | | | | 4,622 | | | | - | |

| | | | | | | | | | | | | | | | | |

| Options: | | | | | | | | | | | | | | | | |

| Purchased | | | 186,599 | | | | - | | | | 9,351 | | | | - | |

| Written | | | 302,227 | | | | 64,366 | | | | (82,161 | ) | | | (2,906 | ) |

| | | | | | | | | | | | | | | | | |

| Foreign exchange derivatives | | | | | | | | | | | | | | | | |

| Forward contracts: | | | | | | | | | | | | | | | | |

| Purchase Commitments | | | 417,069 | | | | - | | | | (5,051 | ) | | | - | |

| Sale commitments | | | 893,220 | | | | 184,653 | | | | 10,876 | | | | (23,035 | ) |

| | | | | | | | | | | | | | | | | |

| Swap agreements | | | | | | | | | | | | | | | | |

| Swap agreements – Senior notes 2009 | | | 320,961 | | | | 246,501 | | | | (2,515 | ) | | | (2,949 | ) |

| Swap agreements – Note export credit | | | 10,012 | | | | - | | | | (1,317 | ) | | | - | |

| | | | | | | | | | | | | | | | | |

| Future contracts | | | | | | | | | | | | | | | | |

| Sale commitments | | | 577,779 | | | | 372,230 | | | | 17,865 | | | | 3,189 | |

| | | | | | | | | | | | | | | | | |

| Options | | | | | | | | | | | | | | | | |

| Purchased | | | 263,202 | | | | - | | | | 8,926 | | | | - | |

| | | | | | | | | | | | | | | | | |

| Total assets | | | | | | | | | | | 54,793 | | | | 7,352 | |

| Total liabilities | | | | | | | | | | | (121,143 | ) | | | (28,894 | ) |

When quoted market prices were not available, fair values were based on estimates using discounted cash flows or other valuation techniques.

COSAN S.A. INDÚSTRIA E COMÉRCIO

Notes to the condensed consolidated financial statements (Continued)

(In thousands of U.S. dollars, unless otherwise stated)

(Unaudited)

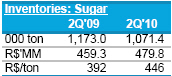

| | | September 30, 2009 | | | March 31, 2009 | |

| Finished goods: | | | | | | |

| Sugar | | | 269,857 | | | | 47,195 | |

| Ethanol | | | 177,371 | | | | 86,809 | |

| Lubricants | | | 40,525 | | | | 38,852 | |

| Fuel (Gasoline, Diesel and Ethanol) | | | 96,692 | | | | 74,582 | |

| Valuation allowance | | | (8,441 | ) | | | (5,222 | ) |

| Others | | | 12,948 | | | | 11,896 | |

| | | | 588,952 | | | | 254,112 | |

| Annual maintenance cost of growing crops | | | 181,105 | | | | 167,576 | |

| Others | | | 91,268 | | | | 56,105 | |

| | | | 861,325 | | | | 477,793 | |

Long-term debt is summarized as follows:

| | Index | | Average annual interest rate | | | September 30, 2009 | | | March 31, 2009 | |

| Resolution No. 2471 (PESA) | IGP-M | | | 4.0 | % | | | 287,877 | | | | 213,314 | |

| | Corn price | | | 12.5 | % | | | - | | | | 56 | |

| Senior notes due 2009 | US Dollar | | | 9.0 | % | | | 37,343 | | | | 37,343 | |

| Senior notes due 2014 | US Dollar | | | 9.5 | % | | | 354,293 | | | | - | |

| Senior notes due 2017 | US Dollar | | | 7.0 | % | | | 404,589 | | | | 404,589 | |

| IFC | US Dollar | | | 7.4 | % | | | 46,655 | | | | 49,379 | |

| Perpetual notes | US Dollar | | | 8.3 | % | | | 455,303 | | | | 455,304 | |

| BNDES | TJLP | | | 2.6 | % | | | 401,980 | | | | 99,561 | |

| Promissory notes | DI | | | 3.0 | % | | | 693,834 | | | | 501,888 | |

| Export credit notes | DI | | | 2.4 | % | | | 125,374 | | | | - | |

| Debentures | DI | | | 3.3 | % | | | 85,797 | | | | - | |

| Credit notes | DI | | | 3.9 | % | | | 122,290 | | | | - | |

| Export credit notes | US Dollar | | | 2.6 | % | | | 53,475 | | | | - | |

| Others | Various | | Various | | | | 232,792 | | | | 115,820 | |

| | | | | | | | | 3,301,602 | | | | 1,877,254 | |

| Current portion | | | | | | | | (672,469 | ) | | | (630,260 | ) |

| Long-term debt | | | | | | | | 2,629,133 | | | | 1,246,994 | |

COSAN S.A. INDÚSTRIA E COMÉRCIO

Notes to the condensed consolidated financial statements (Continued)

(In thousands of U.S. dollars, unless otherwise stated)

(Unaudited)

| 6. | Long-term debt (Continued) |

Long-term debt has the following scheduled maturities:

| 2011 | | | 643,361 | |

| 2012 | | | 118,851 | |

| 2013 | | | 70,067 | |

| 2014 | | | 394,854 | |

| 2015 | | | 43,151 | |

| 2016 | | | 40,203 | |

| 2017 | | | 438,855 | |

| 2018 and thereafter | | | 879,791 | |

| | | | 2,629,133 | |

Resolution No. 2471 - Special Agricultural Financing Program (Programa Especial de Saneamento de Ativos), or PESA

To extend the repayment period of debts incurred by Brazilian agricultural producers, the Brazilian government passed Law 9.138 followed by Central Bank Resolution 2,471, which, together, formed the PESA program. PESA offered certain agricultural producers with certain types of debt the opportunity to acquire Brazilian treasury bills (“CTNs”) in an effort to restructure their agricultural debt. The face value of the Brazilian treasury bills was the equivalent of the value of the restructured debt and was for a term of 20 years.

The acquisition price was calculated by the present value, discounted at a rate of 12% per year or at the equivalent of 10.4% of its face value. The CTNs were deposited as a guarantee with a financial institution and cannot be renegotiated until the outstanding balance is paid in full. The outstanding balance associated with the principal is adjusted in accordance with the IGP-M until the expiration of the restructuring term, which is also 20 years, at which point the debt will be discharged in exchange for the CTNs. Because the CTNs will have the same face value as the outstanding balance at the end of the term, it will not be necessary to incur additional debt to pay PESA debt.

COSAN S.A. INDÚSTRIA E COMÉRCIO

Notes to the condensed consolidated financial statements (Continued)

(In thousands of U.S. dollars, unless otherwise stated)

(Unaudited)

| 6. | Long-term debt (Continued) |

Resolution No. 2471 - Special Agricultural Financing Program (Programa Especial de Saneamento de Ativos), or PESA (Continued)

On July 31, 2003, the Central Bank issued Resolution 3,114, authorizing the reduction of up to five percentage points of PESA related interest rates, effectively lowering the above-mentioned rates to 3%, 4% and 5%, respectively. The CTNs held by Cosan as of September 30, 2009 and March 31, 2009 amounted to US$125,043 and US$113,877, respectively, and are classified as Other non-current assets.

Senior notes due 2017

On January 26, 2007, the wholly-owned subsidiary Cosan Finance Limited issued US$400,000 of senior notes in the international capital markets. These senior notes, listed on the Luxembourg Stock Exchange, mature in November 2017 and bear interest at a rate of 7% per annum, payable semi-annually. The senior notes are guaranteed by Cosan, and its subsidiary, Usina da Barra.

Senior notes due 2014

On August 4, 2009, the indirect subsidiary CCL Finance Limited issued US$ 350,000 of senior notes in the international capital markets. These senior notes, listed on the Luxembourg Stock Exchange, mature in August 2014 and bear interest at a rate of 9,5% per annum, payable semi-annually in February and August of each year, from February of 2010.

Perpetual notes

On January 24 and February 10, 2006, Cosan issued perpetual notes which are listed on the Luxembourg Stock Exchange - EURO MTF. These notes bear interest at a rate of 8.25% per year, payable quarterly on May 15, August 15, November 15 and February 15 of each year, beginning May 15, 2006.

These notes may, at the discretion of Cosan, be redeemed on any interest payment date subsequent to February 15, 2011. The notes are guaranteed by Cosan and by Usina da Barra.

COSAN S.A. INDÚSTRIA E COMÉRCIO

Notes to the condensed consolidated financial statements (Continued)

(In thousands of U.S. dollars, unless otherwise stated)

(Unaudited)

| 6. | Long-term debt (Continued) |

Promissory Notes

On November 17, 2008, the Company issued one series of 44 registered promissory notes for US$613,941. The notes which are due in one year, will bear interest, due at maturity, at the average rates of DI - Interbank Deposits plus 3%.

On June 25, 2009 the Company signed a Stand-by Facility, which extended the maturity date from November 12, 2009 to November 12, 2010. Management intends to pay US$170,000 before November 12, 2009. Therefore, the remaining balance of US$523,834 was reclassified to long term debt as management intends to utilize the stand by facility to settle this remaining balance on a long-term basis.

The notes are secured by a guarantee from Mr. Rubens Ometto Silveira Mello (Controlling Shareholder) and collateralized by a chattel mortgage to be established for the units of interest issued by Cosan CL which are or may be held by the Company.

Covenants

Cosan and its subsidiaries are subject to certain restrictive covenants related to their indebtedness, including the following: limitation on transactions with shareholders and affiliated companies; limitation on payment of dividends and other payments affecting subsidiaries; and limitation on guarantees granted on assets.

Also, the Company and its subsidiaries are subject to other financial restrictive covenants, as follows:

- net debt/EBTIDA ratio must be less than 3.5 to 1;

- current asset/current liability ratio equal or higher than 1.3; and

- long-term indebtedness/shareholders´ equity ratio must be lower than 1.3.

At September 30, 2009, Cosan was in compliance with its debt covenants.

COSAN S.A. INDÚSTRIA E COMÉRCIO

Notes to the condensed consolidated financial statements (Continued)

(In thousands of U.S. dollars, unless otherwise stated)

(Unaudited)

| | | Assets | |

| | | September 30, 2009 | | | March 31, 2009 | |

| Cosan Alimentos | | | - | | | | 13,123 | |

| Rezende Barbosa S.A. Administração e Participações | | | 89,519 | | | | - | |

| Vertical UK LLP | | | 7,297 | | | | 11,597 | |

| Others | | | 723 | | | | - | |

| | | | 97,539 | | | | 24,720 | |

| Current (*) | | | (12,155 | ) | | | (24,720 | ) |

| Noncurrent (*) | | | 85,384 | | | | - | |

| | | | |

| | | Liabilities | |

| | | September 30, 2009 | | | March 31, 2009 | |

| Cosan Limited | | | - | | | | 175,307 | |

| Others | | | 2,158 | | | | 1,926 | |

| | | | 2,158 | | | | 177,233 | |

| Current (*) | | | (2,158 | ) | | | (2,233 | ) |

| Noncurrent | | | - | | | | 175,000 | |

(*) included in other current and noncurrent assets or liabilities captions

Cosan conducts some of its operations through various joint ventures and other partnership forms which are principally accounted for using the equity method. The income statement includes the following amounts resulting from transactions with related parties:

| | | September 30, 2009 | | | October 31, 2008 | |

| Transactions involving assets | | | | | | |

| Cash received due to the sale of finished products and assets and services held, net of payments | | | (84,757 | ) | | | (75,694 | ) |

| Sale of finished products and services in a affiliated company | | | 73,349 | | | | 81,564 | |

| Added through acquisition of Nova América | | | 70,379 | | | | - | |

| | | | | | | | | |

| Transactions involving liabilities | | | | | | | | |

| Payment of financial resources, net of funding | | | (3,507 | ) | | | - | |

| Payment to Cosan Limited | | | (175,307 | ) | | | - | |

| Financial income | | | (39,202 | ) | | | - | |

The purchase and sale of products are carried out at arm’s length and unrealized profit or losses with consolidated companies have been eliminated.

COSAN S.A. INDÚSTRIA E COMÉRCIO

Notes to the condensed consolidated financial statements (Continued)

(In thousands of U.S. dollars, unless otherwise stated)

(Unaudited)

| 7. | Related parties (Continued) |

In addition, at March 31, 2009, the Company and its subsidiary Usina da Barra leased 35,000 hectares (unaudited) of land (37,599 hectares (unaudited) in 2008) from related companies under the same control as Cosan. These leases are carried out on an arm’s length basis, and the rent is calculated based on sugarcane tons per hectare, valued according to price established by CONSECANA (São Paulo State Council of Sugarcane, Sugar and Ethanol Producers).

The amount receivable from Cosan Alimentos S.A. (“Cosan Alimentos”, former Nova América S.A. – Agroenergia) refered to an intercompany loan subject to interest equivalent to 100% of CDI.

A receivable of US$89,519 with Rezende Barbosa S.A. Administração e Participações related to credits assumed by Rezende Barbosa, in connection with the acquisition of Nova América and intercompany loans at the interest rate equivalent to 100% of CDI.

The amount receivable from the affiliate Vertical UK LLP, located in British Virgin Islands, refers to ethanol trading, whith average maturity date of 30 days.

The payable to Cosan Limited related to Floating Rate Notes issued by Cosan CL., equivalent to US$175,000, with original maturity in 2018. Such balance bore variable interest equivalent to the quarterly Libor rate plus interest of 2.8% p.a., paid quarterly. On August 25, 2009, Cosan CL fully paid this debt with the proceeds from the issuance of the Senior Notes due 2014 (Note 6).

During the six-month period the Company executed lease contracts with Radar to formalize land leases that were already in existence, with an average lease term of 19 years. Total lease expense in the six-month period was US$7,297.

COSAN S.A. INDÚSTRIA E COMÉRCIO

Notes to the condensed consolidated financial statements (Continued)

(In thousands of U.S. dollars, unless otherwise stated)

(Unaudited)

| 8. | Estimated liability for legal proceedings and labor claims and commitments |

| | | September 30, 2009 | | | March 31, 2009 | |

| Tax contingencies | | | 585,848 | | | | 430,342 | |

| Civil and labor contingencies | | | 86,799 | | | | 67,306 | |

| | | | 672,647 | | | | 497,648 | |

Cosan and its subsidiaries are parties in various ongoing labor claims, civil and tax proceedings in Brazil arising in the normal course of its business. Respective provisions for contingencies were recorded considering those cases in which the likelihood of loss has been rated as probable. Management believes resolution of these disputes will have no effect significantly different than the estimated amounts accrued.

Judicial deposits recorded by Cosan under non-current assets, amounting to US$101,851 at September 30, 2009 (US$73,975 at March 31, 2009) have been made for certain of these suits. Judicial deposits are restricted assets of Cosan placed on deposit with the court and held in judicial escrow pending legal resolution of the related legal proceedings. Judicial deposits include US$66,601 related to exposures of Cosan CL prior to its acquisition by Cosan. If the Company prevails in the defense of these exposures, these related judicial deposits must be refunded to the seller.

The tax contingencies as of September 30, 2009 and March 31, 2009 are described as follows:

| | | September 30, 2009 | | | March 31, 2009 | |

| Credit premium – IPI | | | 155,628 | | | | 116,256 | |

| PIS and Cofins | | | 83,181 | | | | 62,556 | |

| IPI credits | | | 53,445 | | | | 40,049 | |

| Contribution to IAA | | | 48,599 | | | | 36,672 | |

| IPI – Federal VAT | | | 53,969 | | | | 23,626 | |

| ICMS credits | | | 32,178 | | | | 19,966 | |

| Compensation with Finsocial | | | 94,796 | | | | 70,693 | |

| Other | | | 64,052 | | | | 60,524 | |

| | | | 585,848 | | | | 430,342 | |

COSAN S.A. INDÚSTRIA E COMÉRCIO

Notes to the condensed consolidated financial statements (Continued)

(In thousands of U.S. dollars, unless otherwise stated)

(Unaudited)

| 8. | Estimated liability for legal proceedings and labor claims and commitments (Continued) |

On May 27, 2009, the paragraph 1st and 3rd of Brazilian Law No 9718/98 that regulated the collection of PIS and Cofins (federal tax contributions) on exchange variation and other financial income was revoked by Law No 11941/09. The Company is evaluating its ongoing judicial demands related to the legal obligations not paid related to the increase in the calculation basis of PIS and Cofins. Once the absence of errors or flaws in the ongoing demands is confirmed, the Company will revaluate the maintenance of the provision for the respective legal obligations in its financial statements.

The company is currently evaluating the options provided by Brazilian Law No 11941/09 to settle tax related claims (e.g. credit premium – IPI), as well as the impacts in its financial statements.

In addition to the aforementioned claims, Cosan and its subsidiaries are involved in other contingent liabilities relating to tax, civil and labor claims and environmental matters, which have not been recorded, considering their current stage and the likelihood of unfavorable outcomes rated as possible. These claims are broken down as follows:

| | | September 30, 2009 | | | March 31, 2009 | |

| Withholding Income Tax | | | 92,409 | | | | 69,730 | |

| ICMS – State VAT | | | 102,700 | | | | 77,052 | |

| IAA - Sugar and Ethanol Institute | | | 41,554 | | | | 31,610 | |

| IPI - Federal Value-added tax | | | 169,528 | | | | 100,722 | |

| INSS | | | 1,204 | | | | 795 | |

| PIS and COFINS | | | 20,635 | | | | 15,529 | |

| Civil and labor | | | 127,789 | | | | 94,599 | |

| Other | | | 79,636 | | | | 34,851 | |

| | | | 635,455 | | | | 424,888 | |

The subsidiary Usina da Barra has several indemnification suits filed against the Federal Government. The suits relate to product prices that did not conform to the reality of the market, which were mandatorily established at the time the sector was under the Government‘s control.

COSAN S.A. INDÚSTRIA E COMÉRCIO

Notes to the condensed consolidated financial statements (Continued)

(In thousands of U.S. dollars, unless otherwise stated)

(Unaudited)

| 8. | Estimated liability for legal proceedings and labor claims and commitments (Continued) |

In connection with one of these suits, a final and unappealable decision in the amount of US$149,121 was rendered in September 2006 in favor of Usina de Barra. This has been recorded as a gain in the statement of operations. Since the recorded amount is substantially composed of interest and monetary restatement, it was recorded in Financial income and in a non-current receivable on the balance sheet. In connection with the settlement process, the form of payment is being determined.

The Company is expecting to finalize the payment terms within three years which will result in the amount being received over a ten year period. The amount is subject to interest and inflation adjustment by an official index. Lawyers fees in the amount of US$18,783 relating to this suit have been recorded in General and administrative expenses in 2007 and remain unpaid at September 30, 2009.

At September 30, 2009, these amounts totaled US$185,057 and US$22,207 (US$139,700 and US$16,764 at March 31, 2009), corresponding to related suit and lawyers’ fees, respectively.

The Company and its subsidiaries file income tax returns in the Brazilian federal jurisdiction. These subsidiaries are no longer subject to Brazilian federal income tax examinations by tax authorities for years before December 31, 2003. Additionally, Cosan has not been under a Brazilian Internal Revenue Service (IRS) income tax examination for 2003 through 2008.

Cosan accounts for unrecognized tax benefits in accordance with ASC 740, Accounting for Uncertainly in Income Taxes. A reconciliation of the beginning and ending amount of unrecognized tax benefits in the estimated liability for legal proceedings, and labor claims, is as follows:

| Balance at March 31, 2009 | | | 53,995 | |

| Accrued interest on unrecognized tax benefit | | | 1,968 | |

| Effect of foreign currency translation | | | 16,310 | |

| Settlements | | | (36 | ) |

| Balance at September 30, 2009 (*) | | | 72,237 | |

(*) Recorded as taxes payable (non-current)

COSAN S.A. INDÚSTRIA E COMÉRCIO

Notes to the condensed consolidated financial statements (Continued)

(In thousands of U.S. dollars, unless otherwise stated)

(Unaudited)

| 9. | Income taxes (Continued) |

It is possible that the amount of unrecognized tax benefits will change in the next twelve months, however, an estimate of the range of the possible change cannot be made at this time due to the long time to reach a settlement agreement or decision with the taxing authorities.

The Company recognizes interest accrued related to unrecognized tax benefits in interest expense and penalties in operating expenses.

On September 19, 2008, the board of directors approved a capital increase of US$456,084 through issuance of 55,000,000 previously unissued registered common shares without par value in a private subscription at an issuance price of US$8.29 each. The subscribers of each new share also received one Subscription Warrant (Warrant) which resulted in 55,000,000 Warrants being issued. Each Warrant grants its holder the right to subscribe 0.6 common shares, with the distribution of fractional shares not being permitted. Therefore, the Warrants issued allow the holders to purchase 33,000,000 shares. The Warrants are valid from their issue date to December 31, 2009. The exercise price of each amount of Warrants which totals one share is US$8.29 per share. As of September 30, 2009, Warrants to purchase 32,999,950 shares of Common stock at US$9.00 per share were outstanding and expire on December 31, 2009.

October 22, 2008 was the deadline to exercise the right of capital subscription, approved in the meeting of the board of directors on September 19, 2008. Since a large number of the minority shareholders did not exercise their preemptive rights, Cosan Limited, the controlling shareholder, subscribed for and paid up 54,993,482 common shares valued at US$456,034, and the minority shareholders subscribed for and paid up 6,518 common shares, valued at US$50. As a result, Cosan Limited increased its holding of company’s common shares from 171,172,252 to 226,165,734. This increased their ownership percentage from 62.81% to 69.05% of the Company’s capital.

On March 6, 2009, the Board of Directors approved a capital increase of US$1,945 through issuance of 736,852 new common shares, with no par value, for purposes of meeting the needs of the Stock Option Plan, due to exercise of such options by qualifying executives.

COSAN S.A. INDÚSTRIA E COMÉRCIO

Notes to the condensed consolidated financial statements (Continued)

(In thousands of U.S. dollars, unless otherwise stated)

(Unaudited)

| 10. | Shareholders’ equity (Continued) |

On June 18, 2009, the shareholders approved a capital increase of US$169,533 through the issuance of 44,300,389 new common shares, with no par value, for purposes of the acquisition of Curupay. As part of this acquisition Cosan acquired noncontrolling interest in Novo Rumo in the amount of US$62,476, which has been accounted for as an equity transaction, with a dilution of noncontrolling interest. (Note 3).

On July 15, 2009, the Board of Directors approved a capital increase of US$707 through issuance of 224,819 new common shares, with no par value, for purposes of meeting the needs of the Stock Option Plan, due to exercise of such options by qualifying executives.

On August 7, 2009, the Board of Directors approved a capital increase of US$440 (four hundred and forty dollars) through issuance of 50 new common shares, with no par value, at issue price of US$9.00, due to exercise of subscription warrants by the holders.

As of September 30, 2009, the Company’s capital is represented by 372,810,142 common shares (328,284,884 as of March 31, 2009), with no par value.

| 11. | Deferred gain on sale of investments in subsidiaries |

| | Agrícola Ponte Alta S.A. is a subsidiary whose principal assets are land used for the growing of sugarcane for Cosan. On December 15, 2008, the shareholders approved a partial spin-off of the assets of Ponte Alta and created four new subsidiaries. Agricultural land was then transferred from Ponte Alta to each of the entities. On December 30, 2008, two of the entities, Nova Agrícola Ponte Alta S.A. and Terras da Ponte Alta S.A. were sold to Radar, an affiliate company accounted for by the equity method. The selling price was fair value, US$123,596, which resulted in a gain of US$47,080. This gain has previously been deferred since there were no lease contracts executed for the land, which was being used by Cosan for a monthly fee. During the current period the lease contracts were executed, and the gain is being amortized to profit and loss over the 19 year average term of the leases. |

| | During the six-month period ended September 30, 2009, the Company has amortized a gain of US$1,505 related to this sale-leaseback transaction. |

COSAN S.A. INDÚSTRIA E COMÉRCIO

Notes to the condensed consolidated financial statements (Continued)

(In thousands of U.S. dollars, unless otherwise stated)

(Unaudited)

| 12. | Share-based compensation |

In the ordinary and extraordinary general meeting held on August 30, 2005, the guidelines for the outlining and structuring of a stock option plan for Cosan officers and employees were approved, thus authorizing the issue of up to 5% of shares comprising Cosan’s share capital. This stock option plan was outlined to attract and retain services rendered by officers and key employees, offering them the opportunity to become shareholders of Cosan. On September 22, 2005, Cosan’s board of directors approved the distribution of stock options corresponding to 4,302,780 common shares to be issued or purchased by Cosan related to 3.25% of the share capital at the time, authorized by the annual/extraordinary meeting. The remaining 1.75% remained to be distributed. On September 22, 2005, the officers and key employees were informed regarding the key terms and conditions of the share-based compensation arrangement.

According to the fair value at the grant date, the exercise price is US$2.64 (two dollars and sixty four cents) per share which does not include any discount. The exercise price was calculated before the valuation mentioned above based on an expected private equity deal which did not occur. Options may be exercised after a one-year vesting period starting November 18, 2005, at the maximum percentage of 25% per year of the total stock options offered by Cosan. The options for each 25% have a five-year period to be exercised.

On September 11, 2007, the board of directors approved an additional distribution of stock options, in connection with the stock option plan mentioned above, corresponding to 450,000 common shares to be issued or purchased by Cosan related to 0.24% of the share capital at September 22, 2005. The remaining 1.51% may still be distributed.

On August 7, 2009, the board of directors approved an additional distribution of stock options, in connection with the stock option plan mentioned above, corresponding to 165,657 common shares to be issued or purchased by Cosan. Such options were issued without a vesting period, therefore the intrinsic value at grant date was the basis for calculating the fair value of the options, at US$9,82 per option, and an expense of US$1,071 was fully recorded by the company.

The exercise of options may be settled only through issuance of new common shares or treasury shares.

The employees that leave Cosan before the vesting period will forfeit 100% of their rights. However, if the employment is terminated by Cosan without cause, the employees will have the right to exercise 100% of their options of that particular year plus the right to exercise 50% of the options of the following year.

COSAN S.A. INDÚSTRIA E COMÉRCIO

Notes to the condensed consolidated financial statements (Continued)

(In thousands of U.S. dollars, unless otherwise stated)

(Unaudited)

| 12. | Share-based compensation (Continued) |

The fair value of share-based awards was estimated using a binominal model with the following assumptions:

| | | Options granted on September 22, 2005 | | | Options granted on September 11, 2007 | |

| Grant price - in U.S. dollars | | | 3.44 | | | | 3.44 | |

| Expected life (in years) | | | 7.5 | | | | 7.5 | |

| Interest rate | | | 14.52 | % | | | 9.34 | % |

| Volatility | | | 34.00 | % | | | 46.45 | % |

| Dividend yield | | | 1.25 | % | | | 1.47 | % |

| Weighted-average fair value at grant date - in U.S. dollars | | | 6.94 | | | | 10.23 | |

As of September 30, 2009, the amount of US$ 1,670 related to the unrecognized compensation cost related to stock options is expected to be recognized in 12 months. Cosan currently has 343,139 common shares in treasury.

As of September 30, 2009 there were 1,411,670 options outstanding with a weighted-average exercise price of US$3.44.

| 13. | Fair value measurements |

Effective May 1, 2008, Cosan adopted ASC 820, Fair Value Measurements (SFAS 157), for all financial instruments and non-financial instruments accounted for at fair value on a recurring basis. ASC 820 establishes a new framework for measuring fair value and expands related disclosures. Broadly, the ASC 820 framework requires fair value to be determined based on the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants. ASC 820 establishes market or observable inputs as the preferred source of values, followed by assumptions based on hypothetical transactions in the absence of market inputs.

The valuation techniques required by ASC 820 are based upon observable and unobservable inputs. Observable inputs reflect market data obtained from independent sources, while unobservable inputs reflect market assumptions. These two types of inputs create the following fair value hierarchy:

COSAN S.A. INDÚSTRIA E COMÉRCIO

Notes to the condensed consolidated financial statements (Continued)

(In thousands of U.S. dollars, unless otherwise stated)

(Unaudited)

| 13. | Fair value measurements (Continued) |

Level 1 - Quoted prices for identical instruments in active markets.

Level 2 - Quoted prices for similar instruments in active markets; quoted prices for identical or similar instruments in markets that are not active; and model-derived valuations whose inputs are observable or whose significant value drivers are observable.

Level 3 - Significant inputs to the valuation model are unobservable.

The following section describes the valuation methodologies Cosan uses to measure different financial instruments at fair value.

Marketable securities

When quoted market prices are unobservable, we use other relevant information including market interest rate curves. These investments are included in Level 2 and primarily comprise fixed-income securities, which are debt securities issued by highly rated financial institutions indexed in reais with Inter Deposit Rates (CDI).

Derivatives

Cosan uses closing prices for derivatives included in Level 1, which are traded either on exchanges or liquid over-the-counter markets.

The remainder of the derivatives portfolio is valued using internal models, most of which are primarily based on market observable inputs including interest rate curves and both forward and spot prices for currencies and commodities. Derivative assets and liabilities included in Level 2 primarily represent interest rate swaps, foreign currency swaps and commodity forward contracts.

The following table presents our assets and liabilities measured at fair value on a recurring basis at September 30, 2009.

| | | Level 1 | | | Level 2 | | | Total | |

| Assets | | | | | | | | | |

| Derivatives | | | 9,351 | | | | 45,442 | | | | 54,793 | |

| Total | | | 9,351 | | | | 45,442 | | | | 54,793 | |

| | | | | | | | | | | | | |

| Liabilities | | | | | | | | | | | | |

| Derivatives | | | 82,161 | | | | 38,982 | | | | 121,143 | |

| Total | | | 82,161 | | | | 38,982 | | | | 121,143 | |

COSAN S.A. INDÚSTRIA E COMÉRCIO

Notes to the condensed consolidated financial statements (Continued)

(In thousands of U.S. dollars, unless otherwise stated)

(Unaudited)

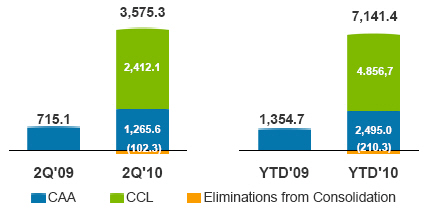

The following information about segments is based upon information used by Cosan’s senior management to assess the performance of operating segments and decide on the allocation of resources. Cosan’s reportable segments are business units in Brazil that target different industry segments. Each reportable segment is managed separately because of the need to specifically address customer needs in these different industries. Cosan has four segments: sugar, ethanol, fuel distribution and others group. The operations of these segments are based solely in Brazil.

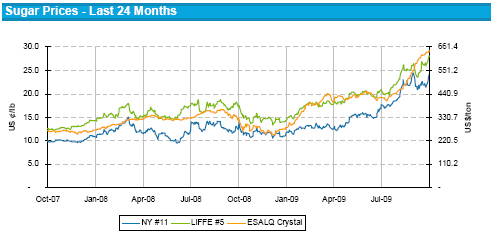

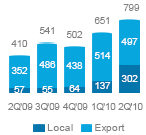

The sugar segment mainly operates and produces a broad variety of sugar products, including raw (also known as very high polarization - VHP sugar), organic, crystal and refined sugars, and sells these products to a wide range of customers in Brazil and abroad. Cosan exports the majority of the sugar produced through international commodity trading companies. Cosan’s domestic customers include wholesale distributors, food manufacturers and retail supermarkets, through which it sells its “Da Barra” and “União” branded products.

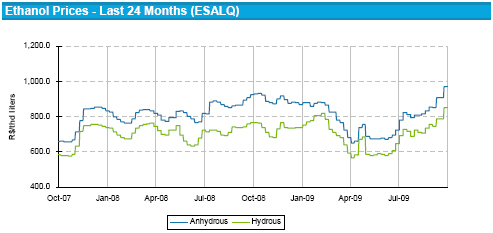

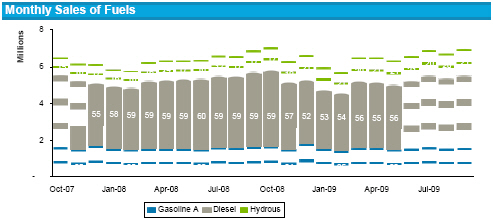

The ethanol segment substantially produces and sells fuel ethanol, both hydrous and anhydrous (which has a lower water content than hydrous ethanol) and industrial ethanol. Cosan’s principal ethanol product is fuel ethanol, which is used both as an automotive fuel and as an additive in gasoline, and is mainly sold in the domestic market by fuel distribution companies. Consumption of hydrous ethanol in Brazil is increasing as a result of the introduction of flex fuel vehicles that can run on either gasoline or ethanol (or a combination of both) to the Brazilian market in 2003. In addition, Cosan sells liquid and gel ethanol products used mainly in the production of paint and cosmetics and alcoholic beverages for industrial clients in various sectors.

With the acquisition of Cosan CL a new fuel distribution segment has been created. The fuel distribution segment is engaged in the distribution in Brazil of oil products, ethanol and lubricants as well as the operation of convenience stores. The network to which the fuel distribution segment distributes such products is comprised of more than 1,500 service stations.

The accounting policies underlying the financial information provided for the segments are based on Brazilian GAAP. We evaluate segment performance based on information generated from the statutory accounting records.

COSAN S.A. INDÚSTRIA E COMÉRCIO

Notes to the condensed consolidated financial statements (Continued)

(In thousands of U.S. dollars, unless otherwise stated)

(Unaudited)

| 14. | Segment information (Continued) |

| a. | Segment information (Continued) |

Others segment is comprised by selling cogeneration of electricity, diesel and corporate activities.

No asset information is provided by reportable segment due to the fact that the majority of the assets used in production of sugar and ethanol are the same.

Measurement of segment profit or loss and segment assets

Cosan S.A. evaluates performance and allocates resources based on return on capital and profitable growth. The primary measurement used by management to measure the financial performance of Cosan S.A. is adjusted EBIT (earnings before interest and taxes excluding special items such as impairment and restructuring, integration costs, one-time gains or losses on sales of assets, acquisition, and other items similar in nature). The accounting policies of the reportable segments are the same as those described in the summary of significant accounting policies.

| | | September 30, 2009 | | | October 31, 2008 | |

| Net sales — Brazilian GAAP | | | | | | |

| Sugar | | | 729,096 | | | | 437,141 | |

| Ethanol | | | 408,267 | | | | 272,337 | |

| Fuel distribution | | | 2,375,822 | | | | - | |

| Others | | | 120,180 | | | | 67,725 | |

| Total | | | 3,633,365 | | | | 777,203 | |

| | | | | | | | | |

| Reconciling items to U.S. GAAP | | | | | | | | |

| Sugar | | | 2,950 | | | | 631 | |

| Fuel distribution | | | (389 | ) | | | - | |

| Total | | | 2,561 | | | | 631 | |

| Total net sales | | | 3,635,926 | | | | 777,834 | |

COSAN S.A. INDÚSTRIA E COMÉRCIO

Notes to the condensed consolidated financial statements (Continued)

(In thousands of U.S. dollars, unless otherwise stated)

(Unaudited)

| 14. | Segment information (Continued) |

| a. | Segment information (Continued) |

Measurement of segment profit or loss and segment assets (Continued)

| | | September 30, 2009 | | | October 31, 2008 | |

| Segment operating income (loss) – Brazilian GAAP | | | | | | |

| Sugar | | | 14,121 | | | | (65,906 | ) |

| Ethanol | | | 8,864 | | | | (41,059 | ) |

| Fuel distribution | | | 78,571 | | | | - | |

| Others | | | 2,547 | | | | (10,210 | ) |

| Operating income (loss) — Brazilian GAAP | | | 104,103 | | | | (117,175 | ) |

| | | | | | | | | |

| Reconciling items to U.S. GAAP | | | | | | | | |

| Depreciation and amortization expenses | | | | | | | | |

| Sugar | | | (4,031 | ) | | | 4,443 | |

| Ethanol | | | (2,530 | ) | | | 2,768 | |

| Fuel distribution | | | (1,648 | ) | | | - | |

| Others | | | (727 | ) | | | 688 | |

| | | | (8,936 | ) | | | 7,899 | |

| | | | | | | | | |

| Other adjustments | | | | | | | | |

| Sugar | | | (5,655 | ) | | | (641 | ) |

| Ethanol | | | (3,550 | ) | | | (824 | ) |

| Fuel distribution | | | 48,319 | | | | - | |

| Others | | | (1,019 | ) | | | (204 | ) |

| | | | 38,095 | | | | (1,669 | ) |

| Total sugar | | | 4,435 | | | | (62,104 | ) |

| Total ethanol | | | 2,784 | | | | (39,115 | ) |

| Fuel distribution | | | 125,242 | | | | - | |

| Total others | | | 801 | | | | (9,727 | ) |

| Operating income (loss) — U.S. GAAP | | | 133,262 | | | | (110,946 | ) |

COSAN S.A. INDÚSTRIA E COMÉRCIO

Notes to the condensed consolidated financial statements (Continued)

(In thousands of U.S. dollars, unless otherwise stated)

(Unaudited)

| 14. | Segment information (Continued) |

| b. | Sales by principal customers |

Sugar

The following table sets forth the amount of sugar that we sold to our principal customers during the six-month period ended September 30, 2009 and October 31, 2008 as a percentage of either domestic or international sales of sugar:

| Market | | Customer | | September 30, 2009 | | | October 31, 2008 | |

| International | | Sucres et Denrées | | | 27 | % | | | 11 | % |

| | | Ceval Internacional Limited | | | 13 | % | | | - | |

| | | Cargill Incorporation Ltd. | | | 9 | % | | | - | |

| | | Cargill International S.A. | | | 7 | % | | | - | |

| | | Coimex Trading Ltd | | | 6 | % | | | 4 | % |

| | | Ableman Trading Limited | | | 4 | % | | | 4 | % |

| | | Fluxo – Cane Overseas Ltd | | | 3 | % | | | 35 | % |

| | | Tate & Lyle International | | | 2 | % | | | 7 | % |

Ethanol

The following table sets forth the amount of ethanol that we sold to our principal customers during the six-month period ended September 30, 2009 and October 31, 2008 as a percentage of either domestic or international sales of ethanol:

| Market | | Customer | | September 30, 2009 | | | October 31, 2008 | |

| International | | Vertical UK LLP | | | 10 | % | | | 19 | % |

| | | Kolmar Petrochemicals | | | 7 | % | | | - | |

| | | Morgan Stanley Capital Group Inc. | | | 6 | % | | | 6 | % |

| | | Alcotra S.A. | | | 3 | % | | | 2 | % |

| | | Sekab Biofuels & Chemicals | | | 2 | % | | | 7 | % |

| | | Vitol Inc. | | | - | | | | 4 | % |

| | | Bauche Energy Br Com Imp Exp Ltda. | | | - | | | | 3 | % |

| | | | | | | | | | | |

| Domestic | | Shell Brasil Ltda. | | | 17 | % | | | 17 | % |

| | | Petrobrás Distribuidora S.A. | | | 12 | % | | | 6 | % |

| | | Cia Brasileira de Petróleo Ipiranga | | | 10 | % | | | - | |

| | | Euro Petróleo do Brasil Ltda. | | | 8 | % | | | 12 | % |

| | | Alesat Combustíveis S.A. | | | 4 | % | | | 2 | % |

| | | Chevron Brasil Ltda. | | | 1 | % | | | 4 | % |

The following table sets forth the amount of fuel distribution that we sold to our principal customers during the six-month period ended September 30, 2009 as a percentage of either domestic or international sales of fuel distribution:

COSAN S.A. INDÚSTRIA E COMÉRCIO

Notes to the condensed consolidated financial statements (Continued)

(In thousands of U.S. dollars, unless otherwise stated)

(Unaudited)

| 14. | Segment information (Continued) |

| b. | Sales by principal customers (Continued) |

Fuel distribution

| Market | | Customer | | September 30, 2009 | | | October 31, 2008 | |

| Domestic | | Mime Distribuidora de Petróleo Ltda. | | | 2 | % | | | - | |

| | | Tam Linhas Aéreas S.A. | | | 1 | % | | | - | |

| | | All – América Latina Logística Malha Sul S.A. | | | 1 | % | | | - | |

| | | Auto Posto Túlio Ltda. | | | 1 | % | | | - | |

| | | Posto Iccar Ltda. | | | 1 | % | | | - | |

Capital increase

On October 5, 2009, the Board of Directors approved a capital increase of US$586 through issuance of 169,500 new common shares, with no par value, in connection with the “Company’s Stock Option Plan” and with the exercise of such options by the eligible executives, at the issuance price of US$3.46 per share, set on the terms of the stock option plan.

On October 29, 2009, the Board of Directors approved a capital increase of US$217,976 through issuance of 23,753,953 new common shares, with no par value, at issue price of US$9.17, due to exercise of 39,589,922 subscription warrants by Cosan Limited.

In connection with the issuance of the new shares, the Company’s capital comprised 396,733,595 registered uncertificated common shares with no par value.

PPE - Export Prepayment Finance