FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of February 2010

Commission File Number: 1-33659

COSAN LIMITED

(Translation of registrant’s name into English)

Av. Juscelino Kubitschek, 1726 – 6th floor

São Paulo, SP 04543-000 Brazil

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate by check mark whether by furnishing the information contained in this Form, the Registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): N/A

COSAN LIMITED

| |

| 1. | Communication regarding 3rd Quarter Fiscal Year 2010 earnings release |

Item 1

Sugar prices reach record levels

São Paulo, February 1, 2010 - COSAN LIMITED (NYSE: CZZ; Bovespa: CZLT11) and COSAN S.A. INDÚSTRIA E COMÉRCIO (Bovespa: CSAN3) disclose today their results referring to the third quarter of the 2010 fiscal year (3Q’10). The results presented below are consolidated in accordance with Brazilian accounting policies.

Marcelo Martins, CFO & IRO Luiz Felipe Jansen de Mello, Investors Relations ri@cosan.com.br www.cosan.com.br | | o Record net revenue in 3Q’10 of R$3.8 billion, 48.1% higher than last year’s net revenue in the same quarter. o New record EBITDA affected by the Company’s enrollment in the Refis (Tax Recovery Program) |

| | | |

| | Summary of Financial and Operating Information (R$MM) - Cosan S.A. |

| | 3Q'09 | 3Q'10 | | | | | | | | YTD'09 | YTD'10 |

| | 438.1 | 379.2 | | Ethanol Sold (millions liters) | | 1,058.3 | 1,586.6 |

| | 808.8 | 887.2 | | Sugar Sold (thousand tonnes) | | 2,340.3 | 2,976.8 |

| | | 864.4 | 1,460.0 | | Fuels Sold (million liters) | | 3,565.5 | 4,150.3 |

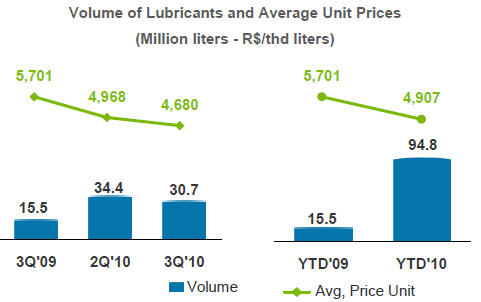

| | 15.5 | 30.7 | | Lubes Sold (million liters) | | 84.7 | 94.8 |

| | 2,565.6 | 3,800.5 | | Net sales | | | 3,920.3 | 10,941.9 |

| | 378.0 | 460.0 | | l | Gross profit | | 559.5 | 1,351.5 |

| | 14.7% | 12.1% | | | Gross Margin | | 14.3% | 12.4% |

| | 58.5 | 253.0 | | l | Operating income (loss) | | (609.6) | 1,016.4 |

| | 2.3% | 6.7% | | | Operating margin | | -15.5% | 9.3% |

| | 340.4 | 490.4 | | l | EBITDA | | | 552.1 | 1,157.2 |

| | 13.3% | 12.9% | | | EBITDA Margin | | 14.1% | 10.6% |

| | 465.3 | 508.4 | | l | EBITDAH | | 725.3 | 1,319.3 |

| | 17.3% | 13.3% | | | EBITDAH Margin | | 17.7% | 11.9% |

| | 5.2 | 167.8 | | l | Income (loss) before minority interest | (434.5) | 669.4 |

| | 5.2 | 167.1 | | l | Net income (loss) | | (433.6) | 677.8 |

| | 0.2% | 4.4% | | | Profit (loss) Margin | | -11.1% | 6.2% |

| | 432.4 | 401.0 | | Capex | | | | 1,011.5 | 1,180.7 |

| | 3,113.3 | 4,300.8 | | l | Net Debt | | 3,113.3 | 4,300.8 |

| | 3,728.1 | 4,963.9 | | l | Shareholders' & Minorities Equity | 3,728.1 | 4,963.9 |

| | | A. Market Overview According to UNICA, the sugarcane growers’ association, crushed cane volume in Brazil’s Central-South totaled 527.0 million tonnes through January 16, 2010, 5.5% up on the same period in the previous harvest. Given the heavy rainfall, the TSR (total sugar recoverable) fell by 7.23% over the previous season to 130.86kg/t. The production mix prioritized sugar production compared to the year before, with sugar and ethanol absorbing 43.17% and 56.83% of the TSR, respectively. As a result, sugar production totaled 28.4 million tonnes, 6.54% up year-on-year, hydrous ethanol output came to 16.8 billion liters, up by 3.7%, and anhydrous ethanol production stood at 6.1 billion liters, down by 28.7%. More than 70 mills were still crushing in the second week of January. UNICA’s initial estimates pointed to total crushed cane volume of 550 million tonnes, with production of 31.2 million tonnes of sugar and 26.3 billion liters of ethanol, numbers that were not achieved due to the exceptionally heavy rainfall. According to its latest publication, crushed volume could have reached 580 million tonnes under normal conditions. On the other hand, Thailand’s harvest is improving substantially and crushed volume is expect to reach approximately 71 million tonnes, versus 67 million last year, with sugar output of 7.5 million tonnes, resulting in exports of close to 5 million tonnes, 8% up on the previous harvest. The European Union’s main sugar producers, Germany and France, expect higher output this year thanks to favorable weather conditions during planting, which encouraged the EU to issue export licenses totaling 1.35 million tonnes, slightly below the maximum limit of 1.375 million tonnes established by the WTO. It also approved exports of 500,000 tonnes outside these licenses, given that international prices were higher than in Europe, enabling producers to export without subsidies. According to UNICA, however, EU current excess production is result of sugar inventories accumulated over the past crops, when international prices for this product was below EU’s, therefore exports should be limited to the volumes established by the WTO. In India, rainfall delayed the beginning of crushing in the state of Maharashtra and protests over the minimum sugarcane price in Uttar Pradesh resulted in larger volumes of cane being allocated to the production of gur and kandshari (types of raw brown sugar), as well as animal feed (in the previous harvest, 23% of cane went to the production of products other than sugar). Consequently, overall production estimates were once again revised down, this time to around 15 million tonnes, putting even more pressure on the country’s low inventories. In addition, fueled by low yields, domestic sugar prices continued to move up, reaching Rs3.311/quintal (US$709.5/t), 87.6% up on the same quarter last year. In Russia, floundering inventories and expectations of lower yields (close to 30 tonnes of sugar beet per hectare, versus the record of 36.3 t/ha in the previous harvest), led the government to impose a new sugar import tariff band during the inter-harvest period. Between January and April 2010, the tariff will be US$140/t, whereas between May and July it will be variable and may reach as low as US$50/t if the NY#11 price |

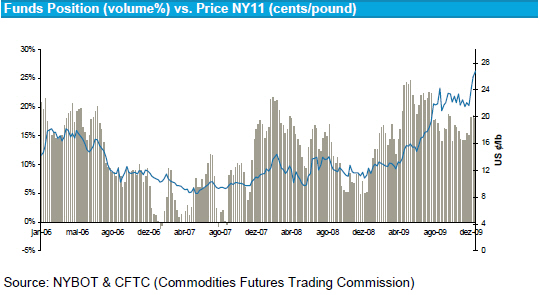

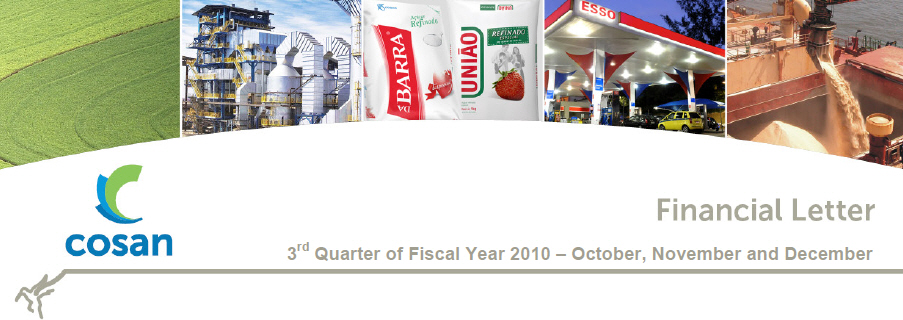

| | | remains above 22 US¢/lb in the first three quarters of the year, substantially less than the US$165/t in the same period last year. China has also been suffering. Some producing regions have been affected by prolonged drought while others have been hit by frost and blizzards, which not only damage the sugarcane, but also jeopardize sugar distribution, forcing the government to auction part of its strategic inventories. Nevertheless, domestic prices continue to increase and the country may be forced to resort to imports in 2010. Indonesia has also been impacted by higher domestic prices. Consequently, its government allocated import licenses for 500,000 tonnes of white sugar, expected to arrive between December 2009 and April 2010. During the quarter, the major hedge funds, plus smaller funds and speculators, reduced their long sugar positions to an average of 190,000 lots, equivalent to 18% of all open contracts, 13.0% down year-on-year. |

| | |  |

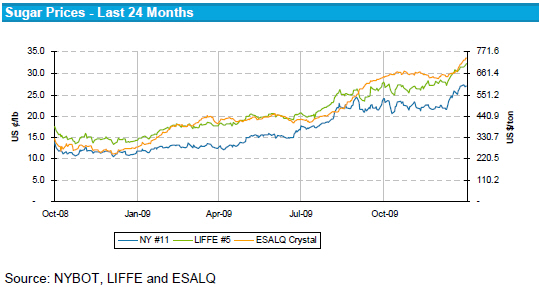

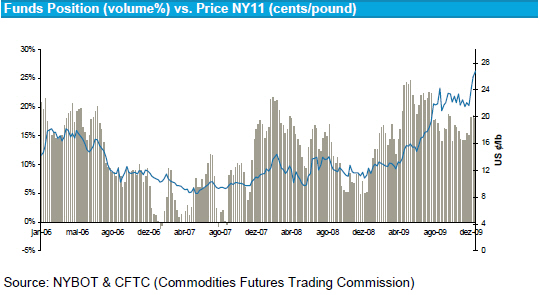

| | | Despite the news from Thailand and the EU, sugar supply and demand forecasts remained unfavorable, pushing up international raw sugar prices by 12.8% over 2Q’10 and 99.6% over 3Q09 to 23.15 US¢/lb. Thanks to the period appreciation of the Real against the dollar, prices in Reais averaged 40.28 R$¢/lb, 53.0% up year-on-year and 5.4% more than the previous quarter. The first future maturity of the NY#11 contract, expiring in March 2010, closed 2009 at 26.95 US¢/lb, reflecting the need to advance supply and defer consumption. International refined sugar averaged US$613.76/t in 3Q’10, 89.2% and 17.3% higher than the 3Q’09 and 2Q’10, respectively, outpacing the raw sugar upturn. The white premium averaged US$116.05/t in the period, thanks to increased demand for refined sugar. The Real continued to appreciate in 3Q’10, averaging R$1.74/US$, 6.9% up on the quarter before, and closing at R$1.74/US$, versus R$1.78/US$ in September 2009 and R$2.34/US$ in December 2008. Domestic crystal sugar prices (ESALQ) averaged R$57.65 per 50Kg bag, 21.7% up on the previous three months and 84.4% more than 3Q’09, reflecting low yields due to heavy harvest rainfall and booming sugar exports, which totaled 19.6 million tonnes between April and December, 21.7% up year-on-year. |

| | |  |

| | | |

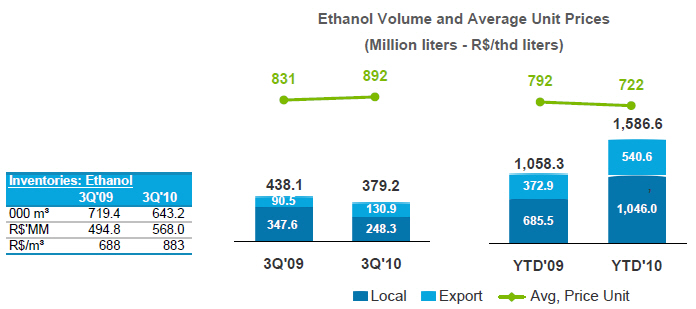

| | | Domestic hydrous ethanol prices (ESALQ) averaged R$0.957/liter in 3Q’10, 30% up on 3Q’09 and 30.4% more than the previous three months, while anhydrous prices averaged R$1.099/liter, 22.6% up year-on-year and 31.1% improvement over 2Q’10. These prices reflect flagging inter-harvest inventories due to the continuing acceleration of demand (in turn due to growth in vehicle sales despite the financial crisis) and reduced supply due to the heavy rainfall. The window for ethanol exports to Europe and the United States (directly or under the Caribbean Agreement, which allows Caribbean ethanol exports without the ¢US$54/gallon) remains closed, chiefly due to the profitable domestic market price, making exports substantially less competitive. |

| | | |

| | |  |

| | | |

| | | According to Brazil’s National Petroleum Agency (ANP), the average hydrous ethanol/gasoline price parity (weighted by the size of the fleet) closed 3Q’10 at 71.1%. In early January, the parity was above 70% in the state of São Paulo, the country’s biggest consumption center, leading consumers with flex-fuel vehicles to opt for C gasoline (a blend of 75% A gasoline and 25% anhydrous ethanol) instead of hydrous ethanol, thereby increasing the consumption of anhydrous. Given this scenario, and seeking to minimize the impact on inter-harvest ethanol supply, in January 2010, the Brazilian government reduced the ratio of |

| | | anhydrous ethanol in the C gasoline blend from 25% to 20% for February, March and April 2010, which should reduce period demand for this product by around 300 million liters. According to Anfavea, the auto manufacturers’ association, new flex-fuel vehicle sales totaled 690,500 units in 3Q’10, accounting for 86.6% of new car sales. In calendar year 2009, flex-fuel vehicle sales were 13.9% higher than in 2008. |

| | | |

| | |  |

| | | |

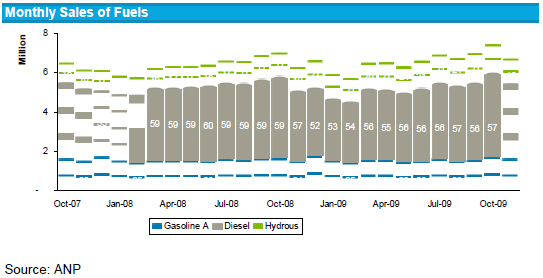

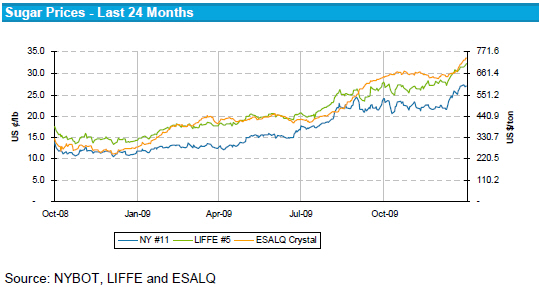

| | | According to the ANP (National Oil Agency), diesel sales volume in October and November, 2009 (December data are not available yet) reached 8.1 billion liters, 5.2% higher compared to the same months of 2008. Gasoline A fuel volume also showed a slight increase of 4.3% in such period, reaching 3.3 billion liters. Ethanol showed the highest demand increase, due to an increased flex-fuel fleet, reaching 2.7 billion liters, 13.7% higher than Oct and Nov/09. |

| | | |

| | | B. Production Data |

| | | 3Q'09 | | 3Q'10 | | Production Highlights | YTD'09 | | YTD'10 |

| | | 8,190 | | 14,228 | | Crushed Cane (thd tons) | 42,388 | | 50,133 |

| | | 4,283 | | 5,778 | | Own Cane (thd tons) | 21,405 | | 23,443 |

| | | 3,907 | | 8,450 | | Suppliers (thd tons) | 20,983 | | 26,690 |

| | | | | | | Production | | | |

| | | 452 | | 662 | | Raw Sugar (thd tons) | 2,522 | | 2,519 |

| | | 139 | | 274 | | Refined Sugar (thd tons) | 656 | | 994 |

| | | 187 | | 228 | | Anhydous Ethanol (thd cbm) | 734 | | 623 |

| | | 148 | | 303 | | Hydrous Ethanol (thd cbm) | 929 | | 1,202 |

| | | 138.1 | | 126.6 | | Sugarcane TSR (kg/ton) | 139.1 | | 129.8 |

| | | 52.2% | | 68.4% | | Mechanization (%) | 50.8% | | 64.5% |

| | | In 3Q’10, Cosan crushed 14.2 million tons of sugarcane, out of which approximately 41% of its own and 59% coming from suppliers, with 68% of mechanic harvesting. Despite the unseasonal rain levels, which lowered the number of days available for crushing this year to 70% of use of the installed capacity, as well as the change in fiscal year, the volume of sugarcane processed in the accumulated up to 3Q’10 shows a growth of 18.2% in relation to the compared period, especially due to the merger of NovAmérica. Also, as an effect of excessive rain, the TRS quantity obtained in 3Q’10 was 8.3% lower than that of the same quarter in the 2008/09 crop, resulting in a production of 936 thousand |

| | | tons of sugar, out of which 70.7% was raw sugar and 29.3% was refined sugar, and 531 million liters of ethanol, out of which 42.9% was anhydrous ethanol and 57.1% was hydrated ethanol. |

| | | | |

| | | C. Operating Performance |

| | | | |

| | | (i) | In view of the alteration of the fiscal year of 2009, which had an earlier ending, on March 31, 2009, the periods related to 3Q’09 and 3Q’10 are displaced, that is, 3Q’09 comprises the months of November and December, 2008, and of January, 2009, while 3Q’10 comprises the months of October, November and December, 2009; |

| | | | |

| | | (ii) | The depreciation presented in the statements and analysis of result had its criteria changed for this fiscal year, to reflect the depreciation included in the COGS (Cost of Goods Sold) and in operating expenses (SG&A), as opposed to the previous fiscal year, when depreciation was shown based on production, that is, by entry into production of the goods and services provided, in addition to the depreciation assessed in operating expenses. It must be stressed that the depreciation included in operating expenses did not undergo any change of criterion, only production depreciation; |

| | | | |

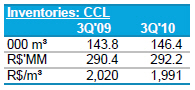

| | | (iii) | CCL only started to be consolidated in December, 2008, so CCL figures disclosed for 3Q’09 and YTD’09 comprises only the months of December, 2008 and January, 2009. In view of the fact that these periods cannot be compared and on an extraordinary basis, the comparison of 3Q’10 CCL results will be made with 2Q’10 this quarter; |

| | | | |

| | | (iv) | As already commented in previous letters, NovAmérica’s results started to be consolidated as from June, 2009, so there is no comparison between the results of 3Q’10 and 3Q’09. |

| | 3Q'09 | | 3Q'10 | | Income Statement (R$MM) | YTD'09 | | YTD'10 |

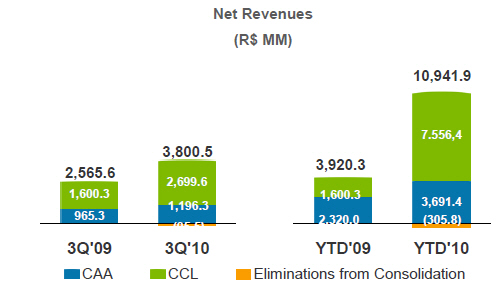

| | 2,565.6 | | 3,800.5 | | | Net Operating Revenue | 3,920.3 | | 10,941.9 |

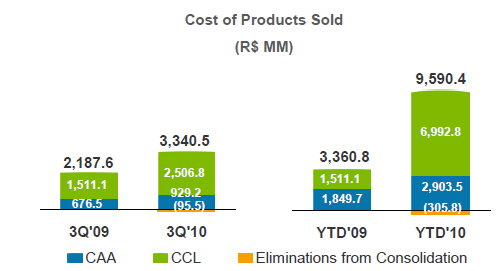

| | (2,187.6) | | (3,340.5) | | | (-) | Cost of Goods Sold | (3,360.8) | | (9,590.4) |

| | 378.0 | | 460.0 | | | (=) | Gross Profit | 559.5 | | 1,351.5 |

| | 14.7% | | 12.1% | | | | Gross Margin | 14.3% | | 12.4% |

| | (156.8) | | (218.4) | | | (-) | Selling Expenses | (331.1) | | (639.3) |

| | (72.3) | | (117.9) | | | (-) | General & Adm. Expenses | (197.6) | | (323.4) |

| | 120.2 | | 217.0 | | | (±) | Other Operating Expenses | 116.1 | | 292.0 |

| | 71.1 | | 149.7 | | | (+) | Depreciation & Amortization | 405.2 | | 476.4 |

| | 340.4 | | 490.4 | | | (=) | EBITDA | | 552.1 | | 1,157.2 |

| | 13.3% | | 12.9% | | | | EBITDA Margin | 14.1% | | 10.6% |

| | 465.3 | | 508.4 | | | (=) | EBITDAH (Adjusted by Hedge) | 725.3 | | 1,319.3 |

| | 17.3% | | 13.3% | | | | EBITDAH Margin | 17.7% | | 11.9% |

| | (159.2) | | (78.3) | | | (±) | Net Financial Expenses | (624.0) | | 434.0 |

| | 13.6 | | (9.4) | | | (±) | Equity Income | 13.5 | | (12.9) |

| | (65.2) | | - | | | (-) | Goodwill Amortization | (145.9) | | (85.6) |

| | 58.5 | | 253.0 | | | (=) | Profit Before Income Tax | (609.6) | | 1,016.4 |

| | (53.3) | | (85.3) | | | (±) | Income Tax | 175.0 | | (347.0) |

| | 0.0 | | (0.7) | | | (±) | Minority Interests | 0.9 | | 8.3 |

| | 5.2 | | 167.1 | | | (=) | Net Profit (Loss) | (433.6) | | 677.8 |

| | 0.2% | | 4.4% | | | | Net Margin | -11.1% | | 6.2% |

| | | Net Revenues |

| | | |

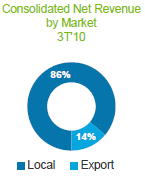

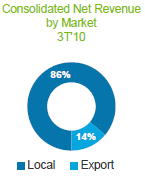

| | The net revenues amounted to R$3.8 billion in the quarter. The major contribution to such increase came from CCL, with revenues of R$2.7 billion in the period, representing 71.0% of net invoicing. Among the fuel, diesel accounted for 46.0% of revenues, followed by gasoline with 43.5% and ethanol with 9.5%. Sales of lubricants represented 3.8% of the restated net revenues. In CAA, sugar and ethanol accounted for 63.0% and 28.3% of the total revenues, respectively. Sales to the foreign market represented 43.9% of CAA’s net revenues in the quarter, versus 60.3% in the previous period, mainly due to sugar sales increase in the domestic market as a result of the NovAmérica merger. |

| | | |

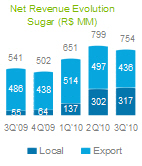

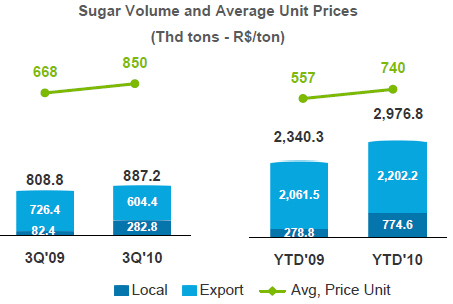

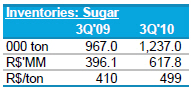

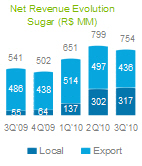

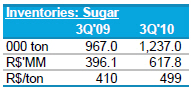

| | CAA - Sugar The 39.4% growth in the sugar revenue, comparing this year’s quarter to the same quarter in the previous year, going from R$540.6 million in 3Q’09 to R$753.8 million in 3Q’10 is a result of the greater volume sold (9.7% higher in 3Q’10 than in 3Q’09) and the increase in average unit price (27.2% higher in 3Q’10 than in 3Q’09). In addition, sales of sugar |

| | | by NovAmérica are more concentrated in the domestic market, raising the share of this market, in which average prices obtained were 55.4% higher than that of the international market, still reflecting price fixations previously established. |

| | | |

| | In the foreign market, the average sugar price, of R$722/ton, represented an appreciation of 7.9% when compared to 3Q’09. As explained in previous letters, sugar revenue in the foreign market reflects the results of prices fixed in previous periods. In this quarter, shipped volumes reflect fixations established throughout the last 6 months, presenting an average price of ¢US$17.74/lb. On the other hand, sales in the domestic market, the share of which went from 10.2% of the volume sold in 3Q’09 to 31.9% in the current quarter, almost immediately reflected market prices. |

| | | |

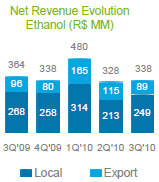

| | | CAA – Ethanol |

| | | |

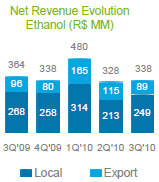

| | In spite of prices being 7.3% higher when we compare 3Q’10 to 3Q’09, ethanol revenues (R$338.3 million in the quarter) were 7.1% lower than the obtained in 3Q’09. This negative outcome is mainly due to reduction in volumes sold, dropping from 438.1 million liters in 3Q’09 to 379.2 million liters in 3Q’10 and also due to the mix of sales between the domestic and foreign market, the latter having prices significantly below in the compared quarters, due to export contracts executed in the beginning of the fiscal year, at prices lower than current ones. Such effects were partially offset by internal market prices, which were 30.2% higher when compared to 3Q’10 and 3Q’09 quarters (R$771/m3 in 3Q’09 versus R$1.004/m3 in 3Q’10). |

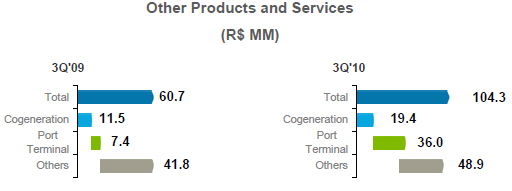

| | | CAA – Other Products and Services Revenues with other products and services showed an increase of 71.8%, from R$60.7 million to R$104.3 million. |

| | | |

| | | |

| | | |

| | | Cogeneration Revenues of energy cogeneration units totaled R$19.4 million in 3Q’10 versus R$11.5 million in 3Q’09. This variation between the compared quarters basically reflects the commissioning of the Costa Pinto and Rafard mills and the merger of the NovAmérica results, through Tarumã and Maracaí. It is worth mentioning that, in the middle of the 3Q’10, the cogeneration units completed the deliveries of all volumes contracted through energy auctions and bilateral contracts to this crop, therefore the exceeding energy was commercialized on a spot basis, in which prices averaged R$16/MWh, lowering this quarter’s average prices when comparing to past quarters. |

| | | |

| | Cogeneration | 3Q'10 | | YTD'10 | |

| | | Volume Sold (MWh) | 177,721 | | 533,261 | |

| | | Price (R$/MWh) | 94.83 | | 150.98 | |

| | | Revenues (R$ thd) | 16,854 | | 80,511 | |

| | | Revenues - Steam (R$ thd) | 2,580 | | 7,408 | |

| | | |

| | | Rumo In 3Q’10, Rumo Logística revenues amounted R$36.0 million, with 2.2 million tons of shipped sugar, despite the heavy raining in the period. |

| | | Out of that total, 1.7 million tons, or R$26 million of revenues, came from services rendered to third parties. |

| Rumo | 3Q'10 | | YTD'10 | |

| | Loading (thd tons) | 2,247.0 | | 6,832.0 | |

| | Price (R$/ton) | 16.0 | | 17.6 | |

| | Revenues (R$ thd) | 36,029 | | 120,243 | |

| | | Others Other two important invoicing items in this category were sales of products Da Barra Alimentos (R$14.1 million in 3Q’10) and Diesel Oil (R$12.7 million in 3Q’10). |

| | | |

| | | CCL – Fuels |

| | | |

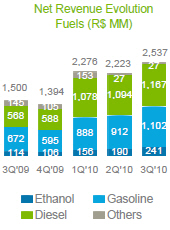

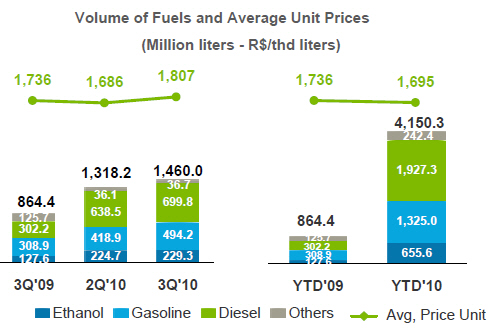

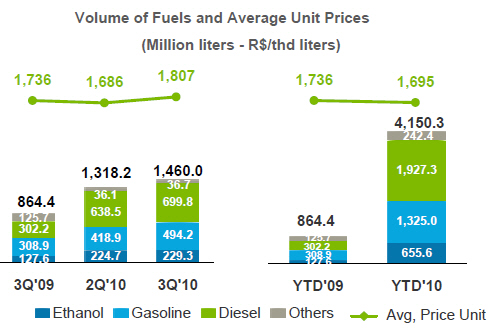

| | Revenues from the fuel distribution business increased R$313.8 million, or 14.1% comparing the 3Q’10 to the 2Q’10. With the recovery in ethanol prices, exceeding, in many Brazilian states the 70% parity, part of the flex fuel car owners stopped fueling their cars with ethanol and shifted to gasoline instead. Therefore, the higher revenues from CCL fuels distribution business was result of (i) R$163.8 million from the 18.0% increase in sales of gasoline and (ii) R$45.9 million from the 24.2% recovery in ethanol prices.  |

| | | |

| | | |

| | | CCL – Lubricants |

| | | |

| | In the lubricants business, sales were lower than those in 2Q’10 by 15.8%, or R$27.0 million, affected by the following factors: Þ Reduction of R$ 18.1 million, caused by the 10.6% drop in the volume sold which was, chiefly, result of lower demand, reflecting typical seasonality of year-end sales; Þ Due to a lower participation of added value products in the sales mix and punctual prices reductions in 3Q’10, unit prices were reduced by 5.8% |

| | | |

| | | |

| | | Cost of Goods Sold |

| | | |

| | | |

| | | |

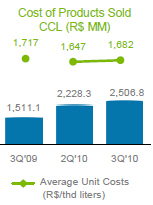

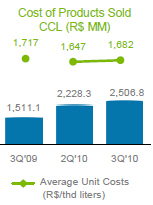

| | | The large increment in the cost of goods sold reflects the consolidation of the distribution of fuels and lubricants business, that increased COGS by R$ 2,506.8 million in this quarter, compared to R$1,511.1 million in 3Q’09. |

| | 3Q'09 | | 3Q'10 | | Cost of Goods Sold | | YTD'09 | | YTD'10 |

| | (2,187.6) | | (3,340.5) | | Cost of Goods Sold (R$MM) | | (3,360.8) | | (9,590.4) |

| | (330.3) | | (516.4) | | | Sugar | | (970.0) | | (1,470.5) |

| | (303.7) | | (314.2) | | | Ethanol | | (735.8) | | (1,178.5) |

| | (42.6) | | (98.6) | | | Other Products & Services - CA | (143.9) | | (254.4) |

| | (1,511.1) | | (2,506.8) | | | CCL | | (1,511.1) | | (6,992.8) |

| | - | | 95.5 | | | Eliminations from Consolidation | - | | 305.8 |

| | | | | | Average Unit Cost (R$) | | - | | - |

| | 408 | | 582 | | | Unit COGS of Sugar (R$/ton) | | 418 | | 457 |

| | 693 | | 829 | | | Unit COGS of Ethanol (R$/thousand liters) | 697 | | 716 |

| | 1,717 | | 1,682 | | | Unit COGS of CCL (R$/thd liters) | 1,717 | | 1,647 |

| | | CAA Sugar and Ethanol cost of products sold showed an increase of 31%, or R$196.7 million, when compared with costs from 3Q’09. The main reasons for such increase in the COGS are: (i) a 9.7% increase in the volume of sugar sold in the compared period, (ii) increase in the share |

| | | of sugar in the domestic market, which has higher value added, and (iii) origination of sugar especially for sales in the domestic market. Other factors negatively influenced the costs of products sold that are common to sugar and ethanol; in short, such effects were: |

| | | |

| | | Þ In view of increase in sugar prices both domestic and foreign markets and also due to recovery of ethanol in the domestic market, the TRS price, according to Consecana’s formula, which defines the compensation of suppliers and land leases, raised by 23.1%, going from R$0.2653 in 3Q’09 to R$0.3267 in 3Q’10; |

| | | |

| | | Þ Increase in the costs of production and processing of sugar and ethanol due to poor yield of sucrose (TSR), which dropped from 138.17kg per ton to 129.14kg per ton of sugarcane in 3Q’10, that is, 6.5% shorter than the previous fiscal year, due to excessive rain in the period between harvests; |

| | | |

| | | Þ Offsetting part of the negative impacts above, cutting, loading and transportation (CCT) costs presented the effects of the consolidation of the mechanization process, which covered 64.5% of the areas harvested up to December 31, 14% higher than the 2008/09 harvest. This category of CCT was R$4.78/ton of cane lower than the traditional cutting process, which is carried out with the burning of sugarcane straw. |

| | | |

| | | CCL |

| | | |

| | CCL’s COGS totaled R$2,506.8 million in 3Q’10, representing a 12.5% increase when compared to 2Q’10. In unit terms, costs varied by 2.4% in the period, which increase was mainly due to (i) the increase of 21.4% in ethanol costs in the compared period, reflecting the price recovery of such product at the mills and (ii) the increase in the commercialized volume of gasoline. Part of such increases was compensated by an improvement in the cost of lubricants costs, a reduction of 4.9% in the period, reflecting a sales mix with a lower participation of value added products. Gross Profit With these results, 3Q’10 showed a gross profit of R$460.0 million, an increase of 21.7% compared to the same period in the previous year, with a 12.1% margin. In CAA, ethanol continues to operate with low margins, of 7.1% versus 16.6% of the same comparison period, whereas sugar showed a positive margin of 31.5%, benefiting, in part, from higher prices in the international market and greater participation of sugar sold in the domestic market. In CCL, in turn, the unit gross margin (R$/m3) of the lubricants division remained as the most profitable, followed by the gasoline margin. |

| | 3Q'09 | | 3Q'10 | | Gross Margin | YTD'09 | | YTD'10 |

| | | | | | Average Unit COGS | | | |

| | 260 | | 268 | | | Sugar (R$/ton) | 142 | | 246 |

| | 138 | | 63 | | | Ethanol (R$/thd liters) | 97 | | (21) |

| | 101 | | 129 | | | CCL (R$/thd liters) | 101 | | 133 |

| | | | | | Gross Margin % | | | |

| | 38.9% | | 31.5% | | | Sugar | 25.5% | | 33.3% |

| | 16.6% | | 7.1% | | | Ethanol | 12.3% | | -2.9% |

| | 5.6% | | 7.1% | | | CCL | 5.6% | | 7.5% |

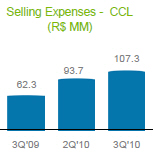

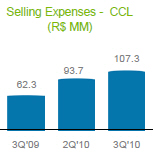

| | | Selling Expenses CAA’s selling expenses in 3Q’10 were 17.7% higher compared to 3Q’09, mainly due to NovAmérica’s merger (R$23.0 million), which did not have its results consolidated at CAA in 3Q’09. Excluding these effects, selling expenses decreased 6.8% (R$88.0 million in 3Q’10 versus R$94.4 million in 3Q’09), justified by a smaller volume of sugar exported in 3Q’10 as opposed to 3Q’09 (726.4 thd ton versus 604.4 thd ton, respectively). |

| | 3Q'09 | | 3Q'10 | | Selling Expenses | YTD'09 | | YTD'10 |

| | (156.8) | | (218.4) | | Selling Expenses (R$MM) | (331.1) | | (639.3) |

| | (94.4) | | (111.1) | | | CAA | (268.8) | | (343.9) |

| | (62.3) | | (107.3) | | | CCL | (62.3) | | (295.4) |

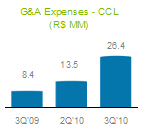

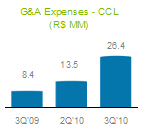

| | Increase of 14.5% in CCL’s Selling expenses, as opposed to 2Q’10, refer mainly to marketing expenses, aiming to increasing brand exposure and ethanol visibility, as well as increase in expenses with maintenance and repairs expenses, to improve the image of service stations. General and Administrative Expenses General and administrative expenses of R$117.9 million, representing 3.1% of the net revenues in 3Q’10, showed a significant increase (63.1%) in relation to the R$72.3 million of 3Q’09, mainly due to the incoming of CCL expenses (R$26.4 million) and NovAmérica (R$6.6 million). Excluding CCL and NovAmérica impacts, general and administrative expenses grew 44% (R$84.9 million in 3Q’10 versus R$72.3 million in 3Q’09). The growth of general and administrative expenses was mainly leveraged by the following factors: (i) expenses related to the adoption of book-entry of Stock Options accounting, which started to be recognized only in this fiscal year, as per Technical Opinion CPC10; (ii) referring to the provisioning of amounts payable on account of variable compensation of the management and employees, in view of better results verified, and (iii) higher expenditures with consulting services, aimed at projects such as the CAN and EVA implementation. |

| | | |

| | Regarding CCL, administrative expenses increase of R$ 12.9 million this quarter, as opposed to 2Q’10. This increase is mainly due to non-recurring effects of expenditures with consulting services, occurred in the quarter, provision for Profit Sharing (PLR) and bonus, as well as a positive impact due to the reversion of the provision for contingencies, occurred in 2Q’10 but not repeated in 3Q’10. |

| | 3Q'09 | | 3Q'10 | | General & Administrative Expenses | YTD'09 | | YTD'10 |

| | (72.3) | | (117.9) | | G&A Expenses (R$MM) | | (197.6) | | (323.4) |

| | (63.9) | | (91.5) | | | CAA | | (189.2) | | (267.2) |

| | (8.4) | | (26.4) | | | CCL | | (8.4) | | (56.2) |

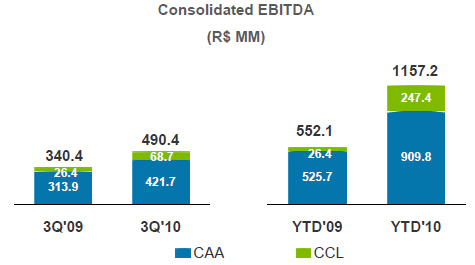

| | | EBITDA Depreciations and amortizations of R$149.7 million, 110.5% higher than those registered in 3Q’09 (R$71.1 million), are mainly due to the changed in the criteria determining the depreciation adjusted to EBITDA calculations, as previously mentioned. In 3Q’09, the criteria for recognizing depreciation in the result was based on production and, with the end of the productive harvest, acknowledged amounts were shorter. With the new criteria adopted, part of the depreciations and amortizations of the production remain in the inventory, and are only included in the result as the products are sold. Thus, excluding this non-cash effect of operating costs and expenses, the Company showed an EBITDA of R$490.4 million, versus R$340.4 million in the same period of the previous year. Out of this amount, R$421.7 million were generated by CAA, and the highest impact (R$211.6 million) is a result of the Company’s decision to adhere to the Refis Program, as explained later in section F. CCL’s contribution was of R$68.7 million, compared to R$86.3 million in the previous quarter, mostly affected by non-recurring expenses stated in Selling Expenses, General and Administrative expenses above. |

| | | |

| | | |

| | | |

| | | Financial Results The net financial result was negative by R$78.3 million in 3Q’10 as opposed to R$159.2 million in the same quarter of the previous year. From this negative result, R$128.1 million are due to less expenses with net exchange variation, in view of the exposure of assets and liabilities in foreign currency and considering that the Real appreciated only 2% in relation to the dollar in 3Q’10, as opposed to the 21% appreciation in 3Q’09. The derivatives result was positive by R$ 18.0 million in 3Q’10 (R$125.0 million in 3Q’09), represented by a loss of R$33.9 million with commodities derivatives, compensated by gains of R$ 51.9 million with currency derivatives. |

| | | Interest on Financial debt totaled R$111.3 million this quarter, as opposed to R$95.2 million in the same quarter of the previous year. This increase is mainly due to the indebtedness of Cosan Alimentos (former NovAmérica), which was only consolidated as of June, 2009, and because the indebtedness assumed to acquire CCL impacted only two months of 3Q’09 |

| | 3Q'09 | | 3Q'10 | | Financial Expenses, Net (R$MM) | YTD'09 | | YTD'10 |

| | (95.2) | | (111.3) | | Interest on Financial Debt | (176.2) | | (312.8) |

| | 19.4 | | 14.1 | | Financial Investments Income | 55.0 | | 41.7 |

| | (75.8) | | (97.2) | | (=) | Sub-total: Interest on Net Financial Debt | (121.2) | | (271.1) |

| | (28.5) | | (47.2) | | Other interest and monetary variation | (95.5) | | (88.7) |

| | (179.0) | | 50.1 | | Exchange Variation | (578.9) | | 629.0 |

| | 125.0 | | 18.0 | | Gains (losses) with Derivatives | 173.1 | | 162.1 |

| | (0.9) | | (2.0) | | CPMF Taxes, Banking Fees and Other | (1.6) | | (2.9) |

| | (159.2) | | (78.3) | | (=) | Net Financial Expenses | (624.0) | | 434.0 |

| | | The position of volumes and prices fixed on December 31, 2009, with the purpose of hedging prices of sugar, ethanol and the currency exchange rate is as follows: |

| Summary of Hedge on December 31, 2009: | Fiscal Year |

| | 2009/10 | | 2010/11 | | 2011/12 |

| Sugar | | | | | |

| Sugar #11 (NY) - * | | | | | |

| Volume (thd tons) | 861.4 | | 1,249.6 | | 119.0 |

| Average Price (¢US$/lb) | 20.7 | | 20.5 | | 18.8 |

| London #5 | | | | | |

| Volume (thd tons) | 70.0 | | 50.0 | | - |

| Average Price (US$/ton) | 591.4 | | 567.2 | | - |

| FX | | | | | |

| US$ | | | | | |

| Volume (US$ million) | 103.3 | | 624.2 | | - |

| Average Price (R$/US$) | 1,808 | | 1,882 | | - |

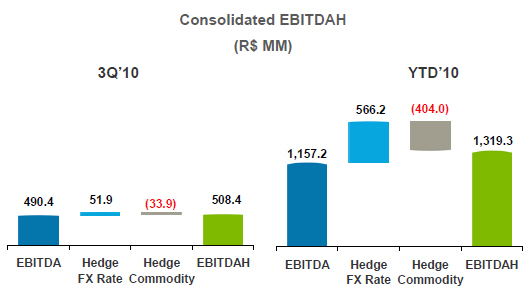

| | | EBITDAH The EBITDAH for the quarter was of R$508.4 million, as opposed to R$465.3 million in the same quarter last year. Hedge results of these periods, though, cannot be compared, since, as from 4Q’09, according to changes in the Brazilian accounting policies, the results from derivatives began to reflect the adjustments to the portfolio of contracted and open derivative positions at market value in the period, which is already performed under US GAAP. Therefore, the results from derivatives no longer reflects the amount of gains or losses with derivatives associated with the volume of operating revenue in the period, but rather the adjustment of open derivative positions to their fair value independent of the objected being hedged by the derivatives. The result of R$508.4 million in the quarter was affected by a net positive derivative effect of R$18 million, as demonstrated below: |

| | | |

| | | |

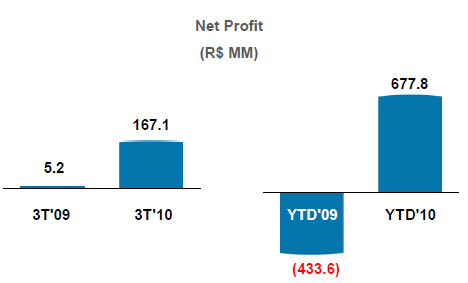

| | | Net Profit Cosan ended 3Q’10 with a net profit of R$167.1 million, as opposed to R$ 5.2 million in the same quarter of the previous year. This result was strongly impacted by the appropriation of Refis gains, in the amount of R$211.6 million, and negatively affected by reductions in the sales volumes of sugar and ethanol. |

| | | |

| | | |

| | | |

| | | D. Financial Situation |

| | | |

| | | The Company closed 3Q’10 with gross financial debt of R$5,164.9 million, 1.8% down on the R$5,258.3 recorded at the end of 2Q’10. In November 2009, the Company implemented several measures to improve its debt profile, including full payment of the promissory notes, 2009 senior notes, bank credit certificates and debentures, the last two resulting from the acquisition of NovAmérica, and the contracting of (i) US$ 430 million in export pre-payments maturing in 5 years, (ii) US$ 100 million in export credit notes (NCE) maturing in 3 years; (iii) R$ 300 million in export credit certificates (CCE) maturing in 2 years. In addition, the BNDES (Brazilian Development Bank) disbursed part of the funding for Jataí and Gasa. |

| Debt per Type (R$MM) | 2Q'10 | | 3Q'10 | | % ST | | Var. |

| Foreign Currency | 2,717.8 | | 3,591.8 | | | | 874.0 |

| Perpetual Notes | 809.6 | | 792.8 | | 1.2% | | (16.8) |

| Senior Notes 2017 | 719.4 | | 716.7 | | 2.8% | | (2.7) |

| Senior Notes 2009 | 66.4 | | - | | 0.0% | | (66.4) |

| Senior Notes 2014 | 630.5 | | 632.3 | | 3.6% | | 1.7 |

| IFC | 83.0 | | 90.9 | | 100.0% | | 8.0 |

| FX Advances | 91.0 | | 223.2 | | 100.0% | | 132.2 |

| Pre-Export Contracts | 95.1 | | 960.0 | | 20.7% | | 864.9 |

| Export Credit Notes | 222.9 | | 176.0 | | 0.0% | | (46.9) |

| Local Currency | 2,540.5 | | 1,573.0 | | | | (967.4) |

| Promissory Notes | 1,233.7 | | - | | 0.0% | | (1,233.7) |

| BNDES | 714.8 | | 844.8 | | 6.5% | | 130.0 |

| Finame (BNDES) | 210.0 | | 156.1 | | 31.0% | | (53.9) |

| Working Capital | 20.5 | | 20.0 | | 21.7% | | (0.5) |

| Overdraft | 36.7 | | 42.0 | | 100.0% | | 5.3 |

| Credit Banking Notes | 217.4 | | 121.1 | | 100.0% | | (96.4) |

| Debentures | 152.6 | | - | | 0.0% | | (152.6) |

| Credit Notes | - | | 334.5 | | 10.9% | | 334.5 |

| CDCA | - | | 60.2 | | 50.2% | | 60.2 |

| PROINFA | - | | 42.2 | | 0.0% | | 42.2 |

| Expenses with Placement of Debt | (45.2) | | (47.7) | | 32.4% | | (2.5) |

| Gross Debt | 5,258.3 | | 5,164.9 | | 17.2% | | (93.4) |

| Cash and Marktable Securities | 948.6 | | 864.1 | | | | (84.6) |

| Net Debt | 4,309.7 | | 4,300.8 | | | | (8.9) |

| | | Also at the end 3Q’10, Cosan’s cash position totaled R$864.1 million, reducing its net debt to R$4,300.8 or 3.0 times EBITDA in the last 12 months. This EBITDA is calculated using CCL’s and CAA’s last 12 month EBITDA and NovAmérica’s annualized last 7 month EBITDA. The debt profile improved substantially, given that of the 17.2% of the total corresponding to short-term debt, approximately R$400 million was in advances on foreign exchange contracts (ACC) and in part of exports prepayment, both products linked to the Company’s exports. A further R$90 million also classified as short-term referred to the debt with the IFC, which the Company decided to prepay due to its high cost, given that a portion is linked to the Group’s operating cash flow. In addition, we preferred to initiate new negotiations with IFC in order to create a new loan agreement that properly reflect the Company’s current financial and ownership situation. |

| | | |

| | | E. Investments |

| | | |

| | | Cosan totaled R$ 413.9 million in its investment flow for 3Q’10. Out of the total amount of investments, R$ 401.0 million were invested in Capex, that is, investments in fixed assets. The substantial difference when one analyses the total investment flow in 3Q’10 as opposed to 3Q’09, is the fact that, in the same period of the previous year, the amount was disbursed for CCL acquisition. The operating Capex of R$210.1 million is related to the maintenance of the sugarcane plantations, industrial mills and to several projects to improve the efficiency of already existing assets. This quarter we accelerated expansion projects of sugar plants that, when concluded, will raise our sugar production capacity by 400 thd ton/year. |

| 3Q'09 | | 3Q'10 | | Capex (R$MM) | | YTD'09 | | YTD'10 |

| 17.4 | | 48.2 | | l | Sugar Cane Planting Costs | | 96.9 | | 164.6 |

| 45.4 | | 36.7 | | l | Inter-harvest Maintenance Costs | 60.2 | | 63.2 |

| 95.0 | | 104.7 | | l | Projects CAA | | 229.4 | | 232.6 |

| 4.8 | | 20.5 | | l | Projects CCL | | 4.8 | | 39.7 |

| 162.7 | | 210.1 | | (=) | Operating Capex | | 391.3 | | 500.2 |

| 103.5 | | 93.5 | | l | Co-generation Projects | | 272.4 | | 264.4 |

| 166.3 | | 97.5 | | l | Greenfield | | 347.9 | | 416.1 |

| 432.4 | | 401.0 | | (=) | Capex | | 1,011.5 | | 1,180.7 |

| 1,533.7 | | 14.7 | | l | Investments | | 1,595.9 | | (14.6) |

| - | | (1.8) | | l | Cash received on Sale of Fixed Assets | | - | | (121.0) |

| 1,966.1 | | 413.9 | | (=) | Investment Cash Flow | | 2,607.4 | | 1,045.1 |

| | | Capex on 3Q’10’s is 7.3% lower than the same period in the previous year, especially due to the slowdown of disbursements in greenfield projects that were about to be concluded. On the other hand, operating projects significantly increased, as described below. The planting in 3Q’09 was reduced to adapt cane levels to the installed capacity. In 3Q’10, investments in the renewal of the planting were retaken, increasing the invested amount to R$ 48.2 million, throughout 8,400 hectares. This amount also includes the soil preparation in areas not yet planted. Inter-harvest maintenance investments were 19% lower than in the previous year, even with the inclusion of the NovAmérica units, since 3Q’09 comprises months from November to January, and this last month is typically strong in inter-harvest maintenance. Several CAA projects used up R$ 104.7 million, and have the purpose of expanding crushing capacity at existing units, increasing capacity at sugar plants, internal infrastructure and environmental and processes improvements. CCL’s capex in 3Q’10 was of R$ 20.5 million, 166% higher than in the previous quarter. The main investments were concentrated in the infrastructure area, aiming at supporting the company’s growth plans, such as the reopening of the Belém and Governador Valadares terminals, and the beginning of the construction of the Alto Taquari terminal. Additionally, investments were made in image improvement and in the expansion of the Esso network gas stations chain. Investments in power cogeneration were of R$93.5 million in the period, 9.6% lower than the same period in the previous fiscal year; especially due to the current stage of the works in progress, if compared to the works in the conclusion stage as of 3Q’09, which used up a high amount of resources. The capex for Cosan’s greenfield projects was of R$97.5 million in the period, associated with the stage of conclusion stage of the Jataí (Goiás) and Caarapó (Mato Grosso do Sul) projects. In 3Q’10, the CCL capex shows investments of R$ 20.5 million in improvements to service stations, terminals expansion and renovation, and interventions in the lubricants plant. The 165% increase, compared to the previous quarter, can be explained by the retaking of the works pace and service stations branding. |

| | | F. Effects of the Program for Paying Tax debts in Installments (“Refis”) |

| | | |

| | | During the 3Q’10, the Company adhered to the program for paying tax debts in installments, set by the Brazilian Government in accordance with law No. 11.941/09 and Provisional Measure MP 470/09. In the scope of the program, Cosan had reductions in contingent tax liabilities, mainly related to the IPI Tax, which generated a benefit in the quarter, recognized in the entry of other operating revenues, in the amount of R$ 211.6 million. Additionally, this program also enabled the company to use income tax losses credits in the amount of approximately R$ 204 million, to reduce tax obligations that were previously being the subject contest of dispute by the Company. This last benefit, in spite of not impacting the result under the accounting point of view, benefited the Company, in the sense that the mentioned tax credits of the Income Tax are used only as the Company profits according to tax criteria, and are limited to 30% of the same in each annual period. |

| | | |

| | | G. Material Facts |

| | | |

| | | In November 2009, the Company’s first greenfield project began operations in the city of Jataí, in Goiás state. With a crushing capacity of 4 million tonnes p.a., the Jataí plant is considered to be among the most modern in Brazil and the world, thanks to its exceptionally high level of automation. Also on this quarter, the Caarapó greenfield Project, which Cosan assumed with the acquisition of NovAmérica, started operating. On November 24th, the Company acquired a 26.7% of participation in TEAS, an ethanol port terminal in Santos, for the amount of R$20 million, becoming the owner of 66.67% of this society’s total and voting capital On December 24, 2009, Rumo Logística notified ALL – América Latina Logística S.A. that as of that date the long-term agreements entered into by the two parties in March 2009 were valid and executable in all their terms and conditions, in the form set forth therein. The object of the agreements include the transportation by ALL of bulk sugar and other byproducts, with the expansion of the parties’ operational capacity through investments of around R$ 1.2 billion in rights of way, yards, rail cars, locomotives and terminals to be realized by Rumo in ALL’s network. By January 20, 2010, Rumo had already transported approximately 230,000 tonnes of sugar through ALL’s network. The period for the exercise of subscription warrants conferred during the capital increase of Cosan S.A. on November 10, 2008, expired on December 31, 2009. A total of 54,987,554 warrants were exercised, increasing the Company's capital by 32,992,531 new shares. Cosan Limited exercised all of the warrants it held, subscribing to 26,996,089 new Cosan S.A. shares and increasing the latter’s capital by R$ 431,937,424.00, while other shareholders were responsible for |

| | | exercising warrants corresponding to 5,996,442 new shares, equivalent to R$ 95,943,072.00. |

| | Shareholder | | Common shares | | % |

| | Cosan Limited | | 253,703,323 | | 62.40 |

| | Rezende Barbosa | | 44,300,389 | | 10.90 |

| | Novo Mercado | | 108,539,605 | | 26.70 |

| | Total | | 406,543,317 | | 100.00 |

| | | In December 2009, Cosan and Amyris announced a partnership to implement Amyris’ technology in one of the Group’s plants to produce high added-value biofuels, involving investments of up to R$ 50 million. In addition to sugar and ethanol, the unit will also be capable of producing a chemical compound resulting from the fermentation of sugarcane juice and yeast. Both companies are still studying the details regarding the implementation and funding of these operations. For Cosan, investments in the development of new renewable energy sources such as biofuels are strategic, and the partnership with Amyris underlines this commitment. |

| | | |

| | | H. Guidance |

| | | |

| | | This section contains guidance ranges for selected key parameters of the Company. Note that statements in other sections of this letter may also contain projections. These projections and guidance are merely estimates and indicative, and should not be construed as a guarantee of future performance. This guidance takes into consideration the operations held by the Cosan group today, which includes CCL, NovAmérica Agroenergia (10 months) and Rumo Logística, as well as the typical and known sugar, ethanol and cogeneration operations of Cosan. |

| Guidance | 2008FY | | 2009FY | | 2010FY |

| Crushed Cane Volume (thousand tons) | 40,315 | | 43,127 | | +20% ≤ ∆ ≤ +30% |

| Sugar Volume Sold (thousand tons) | 3,147 | | 3,052 | | +30% ≤ ∆ ≤ +50% |

| Ethanol Volume Sold (million liters) | 1,568 | | 1,495 | | +40% ≤ ∆ ≤ +60% |

| Revenues (R$MM) | 2,736 | | 6,270 | | +110% ≤ ∆ ≤ +140% |

| EBITDA (R$MM) | 183 | | 718 | | +100% ≤ ∆ ≤ +120% |

| Net Profit/Loss (R$MM) | (48) | | (474) | | * |

| Capex (R$MM) | 1,053 | | 1,346 | | +20% ≤ ∆ ≤ +40% |

| | | * The Net profit (loss) is very sensitive to FX variations. Considering today’s FX rate of R$1.89/US$, it is expected that the FY’09 net loss of R$473.8 million will be reverted to net profit in the next fiscal year. |

| | | I. Attachments |

| | | |

| | | 1. Net Revenues |

| 3Q'09 | | 3Q'10 | | | Sales Composition (R$MM) | | YTD'09 | | YTD'10 |

| 2,565.6 | | 3,800.5 | | | Net Operating Revenue | | 3,920.3 | | 10,941.9 |

| 540.6 | | 753.8 | | | l | Sugar Revenue - CAA | | 1,302.7 | | 2,203.7 |

| 54.6 | | 317.3 | | | | | Local | | 169.7 | | 756.1 |

| 486.0 | | 436.5 | | | | | Export | | 1,133.0 | | 1,447.7 |

| 364.0 | | 338.3 | | | l | Ethanol Revenue - CAA | | 838.5 | | 1,145.5 |

| 268.0 | | 249.3 | | | | | Local | | 517.3 | | 776.2 |

| 96.0 | | 89.0 | | | | | Export | | 321.2 | | 369.3 |

| 60.7 | | 104.3 | | | l | Other Revenue - CAA | | 178.7 | | 342.1 |

| 55.4 | | 104.3 | | | | | Local | | 163.6 | | 325.0 |

| 5.3 | | 0.0 | | | | | Export | | 15.2 | | 17.1 |

| 1,500.2 | | 2,537.0 | | | l | Fuels Revenue - CCL | | 1,500.2 | | 7,035.7 |

| 114.3 | | 240.7 | | | | | Ethanol | | 114.3 | | 586.5 |

| 672.4 | | 1,102.4 | | | | | Gasoline | | 672.4 | | 2,902.3 |

| 568.2 | | 1,166.5 | | | | | Diesel | | 568.2 | | 3,339.3 |

| 145.3 | | 27.4 | | | | | Other | | 145.3 | | 207.6 |

| 88.2 | | 143.9 | | | l | Lubes Revenue - CCL | | 88.2 | | 465.1 |

| 12.0 | | 18.7 | | | l | Other Revenue - CCL | | 12.0 | | 55.6 |

| - | | (95.5) | | | l | Eliminations from Consolidation | - | | (305.8) |

| 3Q'09 | | 3Q'10 | | | Volume Sold | | YTD'09 | | YTD'10 |

| 808.8 | | 887.2 | | | | Sugar (thd tons) | | 2,340.3 | | 2,976.8 |

| 82.4 | | 282.8 | | | | | Local | | 278.8 | | 774.6 |

| 726.4 | | 604.4 | | | | | Export | | 2,061.5 | | 2,202.2 |

| 438.1 | | 379.2 | | | | Ethanol (MM liters) | | 1,058.3 | | 1,586.6 |

| 347.6 | | 248.3 | | | | | Local | | 685.5 | | 1,046.0 |

| 90.5 | | 130.9 | | | | | Export | | 372.9 | | 540.6 |

| 864.4 | | 1,460.0 | | | | Fuels (MM liters) | | 864.4 | | 4,150.3 |

| 127.6 | | 229.3 | | | | | Ethanol | | 127.6 | | 655.6 |

| 308.9 | | 494.2 | | | | | Gasoline | | 308.9 | | 1,325.0 |

| 302.2 | | 699.8 | | | | | Diesel | | 302.2 | | 1,927.3 |

| 125.7 | | 36.7 | | | | | Others | | 125.7 | | 242.4 |

| 15.5 | | 30.7 | | | | Lubes (MM liters) | | 15.5 | | 94.8 |

| 3Q'09 | | 3Q'10 | | Average Price | | YTD'09 | | YTD'10 |

| 668 | | 850 | | | Sugar (R$/ton) | | 557 | | 740 |

| 663 | | 1,122 | | | | Local | | 609 | | 976 |

| 669 | | 722 | | | | Export | | 550 | | 657 |

| 831 | | 892 | | | Ethanol (R$/thd liters) | | 792 | | 722 |

| 771 | | 1,004 | | | | Local | | 755 | | 742 |

| 1,060 | | 680 | | | | Export | | 861 | | 683 |

| 1,736 | | 1,738 | | | Fuels (R$/Thd liters) | | 1,736 | | 1,695 |

| 896 | | 1,050 | | | | Ethanol | | 896 | | 895 |

| 2,176 | | 2,231 | | | | Gasoline | | 2,176 | | 2,190 |

| 1,880 | | 1,667 | | | | Diesel | | 1,880 | | 1,733 |

| 1,156 | | 745 | | | | Others | | 1,156 | | 856 |

| 5,701 | | 4,680 | | | Lubes (R$/Thd liters) | | 5,701 | | 4,907 |

J. Financial Statements of Cosan S.A. – BR GAAP

| Income Statement | | Apr'07 | | | Apr'08 | | | Mar'09 | | | Apr'08 | | | Jul'08 | | | Oct'08 | | | Jan'09 | | | Mar'09 | | | Jun'09 | | | Sep'09 | | | Dec'09 | |

| (In million of reais) | | FY'07 | | | FY'08 | | | FY'09 | | | 4Q'08 | | | 1Q'09 | | | 2Q'09 | | | 3Q'09 | | | 4Q'09 | | | 1Q'10 | | | 2Q'10 | | | 3Q'10 | |

| Gross Operating Revenue | | | 3,902.9 | | | | 2,978.6 | | | | 6,732.8 | | | | 916.4 | | | | 692.7 | | | | 760.1 | | | | 2,746.4 | | | | 2,533.6 | | | | 3,843.5 | | | | 3,907.2 | | | | 4,145.1 | |

| (-) | Sales Taxes and Deductions | | | (297.8 | ) | | | (242.5 | ) | | | (462.7 | ) | | | (73.4 | ) | | | (53.1 | ) | | | (45.0 | ) | | | (180.7 | ) | | | (183.8 | ) | | | (277.4 | ) | | | (331.9 | ) | | | (344.6 | ) |

| (=) | Net Operating Revenue | | | 3,605.1 | | | | 2,736.2 | | | | 6,270.1 | | | | 843.0 | | | | 639.6 | | | | 715.1 | | | | 2,565.6 | | | | 2,349.8 | | | | 3,566.1 | | | | 3,575.3 | | | | 3,800.5 | |

| (-) | Cost of Goods Sold and Services Rendered | | | (2,481.1 | ) | | | (2,387.1 | ) | | | (5,470.7 | ) | | | (693.6 | ) | | | (626.0 | ) | | | (547.1 | ) | | | (2,187.6 | ) | | | (2,109.9 | ) | | | (3,198.4 | ) | | | (3,051.5 | ) | | | (3,340.5 | ) |

| (=) | Gross Profit | | | 1,123.9 | | | | 349.0 | | | | 799.4 | | | | 149.4 | | | | 13.6 | | | | 167.9 | | | | 378.0 | | | | 239.9 | | | | 367.7 | | | | 523.8 | | | | 460.0 | |

| | Margin | | | 31.2% | | | | 12.8% | | | | 12.7% | | | | 17.7% | | | | 2.1% | | | | 23.5% | | | | 14.7% | | | | 10.2% | | | | 10.3% | | | | 14.7% | | | | 12.1% | |

| (-) | Operating Income (Expenses): | | | (556.6 | ) | | | (418.0 | ) | | | (1,508.5 | ) | | | (161.8 | ) | | | (94.9 | ) | | | (754.7 | ) | | | (319.6 | ) | | | (339.4 | ) | | | 117.9 | | | | (246.1 | ) | | | (206.9 | ) |

| (-) | Selling | | | (282.0 | ) | | | (301.3 | ) | | | (432.6 | ) | | | (74.9 | ) | | | (85.7 | ) | | | (88.6 | ) | | | (156.8 | ) | | | (101.5 | ) | | | (209.6 | ) | | | (211.3 | ) | | | (218.4 | ) |

| (-) | General and Administrative | | | (246.2 | ) | | | (210.2 | ) | | | (275.9 | ) | | | (57.7 | ) | | | (59.7 | ) | | | (65.7 | ) | | | (72.3 | ) | | | (78.2 | ) | | | (89.3 | ) | | | (116.2 | ) | | | (117.9 | ) |

| (-) | Financial Income (Expenses), Net | | | 158.0 | | | | 284.3 | | | | (817.4 | ) | | | 1.0 | | | | 86.9 | | | | (551.8 | ) | | | (159.2 | ) | | | (193.4 | ) | | | 433.4 | | | | 78.9 | | | | (78.3 | ) |

| (±) | Earnings (Losses) on Equity Investments | | | (0.1 | ) | | | 6.6 | | | | 14.0 | | | | 6.4 | | | | 0.2 | | | | (0.3 | ) | | | 13.6 | | | | 0.5 | | | | (3.6 | ) | | | 0.0 | | | | (9.4 | ) |

| (-) | Goodwill Amortization | | | (223.7 | ) | | | (201.4 | ) | | | (196.5 | ) | | | (40.6 | ) | | | (40.4 | ) | | | (40.4 | ) | | | (65.2 | ) | | | (50.5 | ) | | | (85.6 | ) | | | - | | | | - | |

| (±) | Other Operating Income (Expenses), Net | | | 37.3 | | | | 4.0 | | | | 199.9 | | | | 4.0 | | | | 3.9 | | | | (8.0 | ) | | | 120.2 | | | | 83.7 | | | | 72.5 | | | | 2.5 | | | | 217.0 | |

| (=) | Operating Income (Loss) | | | 567.3 | | | | (69.0 | ) | | | (709.1 | ) | | | (12.4 | ) | | | (81.3 | ) | | | (586.7 | ) | | | 58.5 | | | | (99.5 | ) | | | 485.6 | | | | 277.8 | | | | 253.0 | |

| | Margin | | | 15.7% | | | | -2.5% | | | | -11.3% | | | | -1.5% | | | | -12.7% | | | | -82.0% | | | | 2.3% | | | | -4.2% | | | | 13.6% | | | | 7.8% | | | | 6.7% | |

| (±) | Income and Social Contribution Taxes | | | (203.9 | ) | | | 18.7 | | | | 234.7 | | | | 6.6 | | | | 22.4 | | | | 205.9 | | | | (53.3 | ) | | | 59.6 | | | | (157.9 | ) | | | (103.8 | ) | | | (85.3 | ) |

| (±) | Minority Interest | | | (6.2 | ) | | | 2.5 | | | | 0.6 | | | | 0.5 | | | | 0.8 | | | | 0.1 | | | | 0.0 | | | | (0.4 | ) | | | 9.6 | | | | (0.6 | ) | | | (0.7 | ) |

| (=) | Net Income (Loss) for the Year | | | 357.0 | | | | (48.0 | ) | | | (474.0 | ) | | | (5.0 | ) | | | (58.0 | ) | | | (381.0 | ) | | | 5.0 | | | | (40.0 | ) | | | 337.0 | | | | 173.0 | | | | 167.0 | |

| | Margin | | | 9.9% | | | | -1.8% | | | | -7.6% | | | | -0.6% | | | | -9.1% | | | | -53.3% | | | | 0.2% | | | | -1.7% | | | | 9.5% | | | | 4.8% | | | | 4.4% | |

| l | EBITDA | | | 930.0 | | | | 182.9 | | | | 718.0 | | | | 49.9 | | | | 29.2 | | | | 182.5 | | | | 340.4 | | | | 165.9 | | | | 311.2 | | | | 355.7 | | | | 490.4 | |

| | Margin | | | 25.8% | | | | 6.7% | | | | 11.5% | | | | 5.9% | | | | 4.6% | | | | 25.5% | | | | 13.3% | | | | 7.1% | | | | 8.7% | | | | 9.9% | | | | 12.9% | |

| l | EBITDAH (Ebitda adjusted by Hedge) | | | 855.7 | | | | 407.8 | | | | 765.7 | | | | 31.0 | | | | 74.4 | | | | 185.5 | | | | 465.3 | | | | 40.4 | | | | 472.0 | | | | 338.9 | | | | 508.4 | |

| | Margin | | | 24.2% | | | | 13.8% | | | | 12.1% | | | | 3.8% | | | | 10.9% | | | | 25.8% | | | | 17.3% | | | | 1.8% | | | | 12.7% | | | | 9.5% | | | | 13.3% | |

| l | Depreciation & Amortization | | | 297.0 | | | | 341.3 | | | | 427.2 | | | | 29.1 | | | | 157.2 | | | | 176.8 | | | | 71.1 | | | | 22.0 | | | | 169.9 | | | | 156.8 | | | | 149.7 | |

| Balance Sheet | | Apr'07 | | | Apr'08 | | | Mar'09 | | | Apr'08 | | | Jul'08 | | | Oct'08 | | | Jan'09 | | | Mar'09 | | | Jun'09 | | | Sep'09 | | | Dec'09 | |

| (In million of reais) | | FY'07 | | | FY'08 | | | FY'09 | | | 4Q'08 | | | 1Q'09 | | | 2Q'09 | | | 3Q'09 | | | 4Q'09 | | | 1Q'10 | | | 2Q'10 | | | 3Q'10 | |

| Cash and Cash Equivalents | | | 1,217.1 | | | | 1,010.1 | | | | 719.4 | | | | 1,010.1 | | | | 633.9 | | | | 1,276.3 | | | | 689.7 | | | | 719.4 | | | | 932.9 | | | | 948.6 | | | | 864.1 | |

| Restricted Cash | | | 35.9 | | | | 79.6 | | | | 11.8 | | | | 79.6 | | | | 79.4 | | | | 0.2 | | | | 11.9 | | | | 11.8 | | | | 40.1 | | | | 149.5 | | | | 172.1 | |

| Derivative Financial Instruments | | | 1.6 | | | | 6.9 | | | | 17.0 | | | | 6.9 | | | | 9.0 | | | | 8.6 | | | | 6.1 | | | | 17.0 | | | | 86.6 | | | | 97.4 | | | | 72.0 | |

| Trade Accounts Receivable | | | 112.3 | | | | 215.2 | | | | 599.2 | | | | 215.2 | | | | 115.5 | | | | 215.9 | | | | 459.0 | | | | 599.2 | | | | 585.6 | | | | 589.7 | | | | 511.1 | |

| Inventories | | | 503.4 | | | | 570.5 | | | | 1,106.2 | | | | 570.5 | | | | 905.6 | | | | 1,439.9 | | | | 1,643.7 | | | | 1,106.2 | | | | 1,149.9 | | | | 1,531.5 | | | | 1,936.8 | |

| Advances to Suppliers | | | 211.4 | | | | 226.1 | | | | 206.0 | | | | 226.1 | | | | 252.3 | | | | 287.0 | | | | 239.9 | | | | 206.0 | | | | 386.1 | | | | 336.7 | | | | 241.2 | |

| Related Parties | | | - | | | | 16.3 | | | | 57.2 | | | | 16.3 | | | | 1.1 | | | | 28.4 | | | | 35.8 | | | | 57.2 | | | | 36.1 | | | | 21.6 | | | | 24.6 | |

| Deferred Income and Social Contribution Taxes | | | 38.1 | | | | - | | | | 42.5 | | | | - | | | | - | | | | - | | | | - | | | | 42.5 | | | | 53.5 | | | | 48.1 | | | | 29.2 | |

| Recoverable Taxes | | | 54.0 | | | | 129.8 | | | | 265.4 | | | | 129.8 | | | | 121.3 | | | | 160.6 | | | | 240.7 | | | | 265.4 | | | | 299.0 | | | | 342.9 | | | | 307.8 | |

| Other Assets | | | 50.9 | | | | 17.9 | | | | 50.3 | | | | 17.9 | | | | 21.9 | | | | 37.1 | | | | 82.3 | | | | 50.3 | | | | 32.7 | | | | 41.7 | | | | 54.0 | |

| Current Assets | | | 2,224.7 | | | | 2,272.4 | | | | 3,074.9 | | | | 2,272.4 | | | | 2,140.0 | | | | 3,453.9 | | | | 3,409.0 | | | | 3,074.9 | | | | 3,602.6 | | | | 4,107.9 | | | | 4,212.8 | |

| Accounts Receivable from Federal Government | | | 318.4 | | | | 342.2 | | | | 323.4 | | | | 342.2 | | | | 342.2 | | | | 342.2 | | | | 342.2 | | | | 323.4 | | | | 326.4 | | | | 329.0 | | | | 331.4 | |

| CTN's-Restricted Brazilian Treasury Bills | | | 123.3 | | | | 151.7 | | | | 177.6 | | | | 151.7 | | | | 164.8 | | | | 170.9 | | | | 175.5 | | | | 177.6 | | | | 184.7 | | | | 189.3 | | | | 194.6 | |

| Deferred Income and Social Contribution Taxes | | | 242.5 | | | | 357.0 | | | | 700.0 | | | | 357.0 | | | | 386.7 | | | | 567.8 | | | | 665.0 | | | | 700.0 | | | | 644.6 | | | | 551.5 | | | | 334.2 | |

| Advances to Suppliers | | | - | | | | 77.3 | | | | 48.0 | | | | 77.3 | | | | 88.2 | | | | 93.6 | | | | 125.3 | | | | 48.0 | | | | 55.5 | | | | 85.1 | | | | 132.5 | |

| Related Parties | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 153.2 | | | | 151.8 | | | | 149.9 | |

| Other Assets | | | 112.4 | | | | 94.4 | | | | 132.4 | | | | 94.4 | | | | 124.1 | | | | 124.0 | | | | 159.1 | | | | 132.4 | | | | 185.4 | | | | 190.2 | | | | 210.8 | |

| Investments | | | 93.2 | | | | 120.3 | | | | 278.2 | | | | 120.3 | | | | 124.2 | | | | 184.7 | | | | 280.5 | | | | 278.2 | | | | 181.3 | | | | 196.5 | | | | 194.0 | |

| Property, Plant and Equipment | | | 2,015.7 | | | | 2,776.3 | | | | 3,493.9 | | | | 2,776.3 | | | | 2,882.8 | | | | 3,020.8 | | | | 3,389.0 | | | | 3,493.9 | | | | 4,516.4 | | | | 4,671.4 | | | | 4,871.5 | |

| Goodwill | | | 1,133.2 | | | | 1,160.7 | | | | 2,418.8 | | | | 1,160.7 | | | | 1,115.6 | | | | 1,074.5 | | | | 2,493.8 | | | | 2,418.8 | | | | 2,724.3 | | | | 2,737.5 | | | | 2,765.5 | |

| Noncurrent Assets | | | 4,038.6 | | | | 5,079.9 | | | | 7,572.5 | | | | 5,079.9 | | | | 5,228.5 | | | | 5,578.5 | | | | 7,630.4 | | | | 7,572.5 | | | | 8,971.7 | | | | 9,102.3 | | | | 9,184.4 | |

| (=) Total Assets | | | 6,263.4 | | | | 7,352.4 | | | | 10,647.4 | | | | 7,352.4 | | | | 7,368.5 | | | | 9,032.4 | | | | 11,039.4 | | | | 10,647.4 | | | | 12,574.3 | | | | 13,210.2 | | | | 13,397.2 | |

| Loans and Financings | | | 117.2 | | | | 78.2 | | | | 1,449.5 | | | | 78.2 | | | | 74.2 | | | | 311.0 | | | | 1,480.6 | | | | 1,449.5 | | | | 1,127.4 | | | | 1,184.7 | | | | 892.6 | |

| Derivatives Financial Instruments | | | 45.3 | | | | 50.7 | | | | 66.9 | | | | 50.7 | | | | 19.3 | | | | 32.6 | | | | 49.5 | | | | 66.9 | | | | 98.9 | | | | 215.4 | | | | 232.9 | |

| Trade Accounts Payable | | | 113.8 | | | | 191.0 | | | | 456.1 | | | | 191.0 | | | | 331.6 | | | | 489.9 | | | | 518.2 | | | | 456.1 | | | | 662.8 | | | | 712.5 | | | | 712.1 | |

| Salaries Payable | | | 63.3 | | | | 80.7 | | | | 93.2 | | | | 80.7 | | | | 119.0 | | | | 143.0 | | | | 77.7 | | | | 93.2 | | | | 152.3 | | | | 180.9 | | | | 133.0 | |

| Taxes and Social Contributions Payable | | | 126.2 | | | | 116.1 | | | | 168.6 | | | | 116.1 | | | | 115.0 | | | | 109.7 | | | | 163.2 | | | | 168.6 | | | | 189.8 | | | | 230.9 | | | | 201.0 | |

| Related Parties | | | 0.7 | | | | - | | | | 5.2 | | | | - | | | | - | | | | - | | | | 2.5 | | | | 5.2 | | | | 4.5 | | | | 3.8 | | | | 50.5 | |

| Other Liabilities | | | 125.4 | | | | 49.9 | | | | 85.8 | | | | 49.9 | | | | 34.4 | | | | 126.1 | | | | 66.6 | | | | 85.8 | | | | 134.1 | | | | 100.7 | | | | 123.4 | |

| Current Liabilities | | | 591.7 | | | | 566.5 | | | | 2,325.2 | | | | 566.5 | | | | 693.4 | | | | 1,212.3 | | | | 2,358.2 | | | | 2,325.2 | | | | 2,369.7 | | | | 2,629.0 | | | | 2,345.5 | |

| Loans and Financing | | | 2,819.9 | | | | 2,106.2 | | | | 2,885.5 | | | | 2,106.2 | | | | 2,047.9 | | | | 2,679.3 | | | | 2,904.5 | | | | 2,885.5 | | | | 4,091.4 | | | | 4,667.4 | | | | 4,859.1 | |

| Taxes and Social Contributions Payable | | | 338.5 | | | | 359.3 | | | | 328.8 | | | | 359.3 | | | | 351.5 | | | | 346.1 | | | | 336.0 | | | | 328.8 | | | | 335.5 | | | | 288.9 | | | | 255.7 | |

| Provision for Legal Proceedings | | | 728.0 | | | | 832.4 | | | | 1,105.9 | | | | 832.4 | | | | 849.8 | | | | 873.1 | | | | 1,114.1 | | | | 1,105.9 | | | | 1,135.5 | | | | 1,143.4 | | | | 755.7 | |

| Related Parties | | | - | | | | - | | | | 405.2 | | | | - | | | | - | | | | - | | | | 405.3 | | | | 405.2 | | | | 341.5 | | | | - | | | | - | |

| Pension Fund | | | - | | | | - | | | | 60.4 | | | | - | | | | - | | | | - | | | | 58.5 | | | | 60.4 | | | | 61.0 | | | | 62.3 | | | | 61.6 | |

| Other Liabilities | | | 134.0 | | | | 144.4 | | | | 139.9 | | | | 144.4 | | | | 141.3 | | | | 138.4 | | | | 134.8 | | | | 139.9 | | | | 169.2 | | | | 168.4 | | | | 155.8 | |

| Noncurrent Liabilities | | | 4,020.4 | | | | 3,442.3 | | | | 4,925.5 | | | | 3,442.3 | | | | 3,390.5 | | | | 4,037.0 | | | | 4,953.1 | | | | 4,925.5 | | | | 6,134.1 | | | | 6,330.3 | | | | 6,087.8 | |

| Minority Shareholders' Interest | | | 20.2 | | | | 17.7 | | | | 30.9 | | | | 17.7 | | | | 17.0 | | | | 20.3 | | | | 31.5 | | | | 30.9 | | | | 29.9 | | | | 30.4 | | | | 47.0 | |

| Capital | | | 1,192.7 | | | | 2,935.3 | | | | 3,819.8 | | | | 2,935.3 | | | | 2,935.3 | | | | 3,815.3 | | | | 3,815.3 | | | | 3,819.8 | | | | 4,153.9 | | | | 4,155.3 | | | | 4,687.7 | |

| Capital Reserve | | | - | | �� | | - | | | | 41.7 | | | | - | | | | - | | | | (4.2 | ) | | | (4.2 | ) | | | 41.7 | | | | 45.1 | | | | 50.2 | | | | 50.1 | |

| Profits Reserve | | | 227.3 | | | | 180.2 | | | | - | | | | 180.2 | | | | 180.2 | | | | 180.2 | | | | 180.2 | | | | - | | | | - | | | | - | | | | - | |

| Legal Reserve | | | 16.0 | | | | 16.0 | | | | - | | | | 16.0 | | | | 16.0 | | | | 16.0 | | | | 16.0 | | | | - | | | | - | | | | - | | | | - | |

| Revaluation Reserves | | | 195.0 | | | | 194.4 | | | | - | | | | 194.4 | | | | 194.2 | | | | 193.8 | | | | 93.2 | | | | - | | | | - | | | | - | | | | - | |

| Accumulated losses | | | - | | | | - | | | | (495.7 | ) | | | - | | | | (57.9 | ) | | | (438.2 | ) | | | (403.9 | ) | | | (495.7 | ) | | | (158.4 | ) | | | 15.0 | | | | 179.1 | |

| Shareholders' Equity | | | 1,631.0 | | | | 3,325.8 | | | | 3,365.7 | | | | 3,325.8 | | | | 3,267.7 | | | | 3,762.8 | | | | 3,696.6 | | | | 3,365.7 | | | | 4,040.7 | | | | 4,220.5 | | | | 4,917.0 | |

| (=) Total Liabilities & Shareholders' Equity | | | 6,263.4 | | | | 7,352.4 | | | | 10,647.4 | | | | 7,352.4 | | | | 7,368.5 | | | | 9,032.4 | | | | 11,039.4 | | | | 10,647.4 | | | | 12,574.3 | | | | 13,210.2 | | | | 13,397.2 | |

| Cash Flow Statement | | Apr'07 | | | Apr'08 | | | Mar'09 | | | Apr'08 | | | Jul'08 | | | Oct'08 | | | Jan'09 | | | Mar'09 | | | Jun'09 | | | Sep'09 | | | Dec'09 | |

| (In millions of reais) | | FY'07 | | | FY'08 | | | FY'09 | | | 4Q'08 | | | 1Q'09 | | | 2Q'09 | | | 3Q'09 | | | 4Q'09 | | | 1Q'10 | | | 2Q'10 | | | 3Q'10 | |

| Net Income (Loss) for the Year | | | 357.3 | | | | (47.8 | ) | | | (473.8 | ) | | | (5.3 | ) | | | (58.1 | ) | | | (380.7 | ) | | | 5.2 | | | | (40.2 | ) | | | 337.3 | | | | 173.4 | | | | 167.1 | |

| Non-cash Adjustments: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Earnings (Losses) from Equity Investments | | | 0.1 | | | | (6.6 | ) | | | (14.0 | ) | | | (6.4 | ) | | | (0.2 | ) | | | 0.3 | | | | (13.6 | ) | | | (0.5 | ) | | | 3.6 | | | | (0.0 | ) | | | 9.4 | |

| Depreciation & Amortization | | | 297.0 | | | | 341.3 | | | | 427.2 | | | | 29.1 | | | | 157.2 | | | | 176.8 | | | | 71.1 | | | | 22.0 | | | | 169.9 | | | | 156.8 | | | | 149.7 | |

| Losses (Gains) in Fixed Assets Disposals | | | 8.4 | | | | (1.2 | ) | | | (208.9 | ) | | | (8.1 | ) | | | 1.2 | | | | 4.5 | | | | 3.0 | | | | (217.6 | ) | | | (103.2 | ) | | | 0.8 | | | | 1.1 | |

| Goodwill Amortization | | | 223.7 | | | | 201.4 | | | | 196.5 | | | | 40.6 | | | | 40.4 | | | | 40.4 | | | | 65.2 | | | | 50.5 | | | | 85.6 | | | | - | | | | - | |

| Accrued Financial Expenses | | | (190.6 | ) | | | (116.0 | ) | | | 932.5 | | | | (37.2 | ) | | | (26.2 | ) | | | 572.0 | | | | 297.8 | | | | 89.0 | | | | (287.8 | ) | | | (84.0 | ) | | | (60.5 | ) |

| Other Non-cash Items | | | 119.7 | | | | (42.4 | ) | | | (197.9 | ) | | | (0.7 | ) | | | (32.2 | ) | | | (162.9 | ) | | | 49.3 | | | | (52.1 | ) | | | 133.1 | | | | 74.0 | | | | (154.1 | ) |

| (=) Adjusted Net Profit (Loss) | | | 815.5 | | | | 328.8 | | | | 661.5 | | | | 12.1 | | | | 82.0 | | | | 250.4 | | | | 478.0 | | | | (148.9 | ) | | | 338.5 | | | | 321.0 | | | | 112.6 | |

| (±) Variation on Assets and Liabilities | | | (148.0 | ) | | | (360.1 | ) | | | (234.5 | ) | | | 323.9 | | | | (129.5 | ) | | | (399.0 | ) | | | (140.7 | ) | | | 434.7 | | | | 195.7 | | | | (312.9 | ) | | | (142.7 | ) |

| (=) Cash Flow from Operating Activities | | | 667.5 | | | | (31.3 | ) | | | 427.0 | | | | 335.9 | | | | (47.4 | ) | | | (148.6 | ) | | | 337.3 | | | | 285.8 | | | | 534.2 | | | | 8.1 | | | | (30.1 | ) |

| Additions on Investments, Net of Cash Received | �� | | (83.7 | ) | | | (160.5 | ) | | | (1,823.6 | ) | | | (155.9 | ) | | | (0.7 | ) | | | (61.4 | ) | | | (1,533.7 | ) | | | (227.7 | ) | | | 58.5 | | | | (29.2 | ) | | | (14.7 | ) |

| Additions on Property, Plant and Equipment | | | (684.2 | ) | | | (1,053.1 | ) | | | (1,346.1 | ) | | | (474.4 | ) | | | (264.8 | ) | | | (314.3 | ) | | | (432.4 | ) | | | (334.6 | ) | | | (420.6 | ) | | | (359.1 | ) | | | (401.0 | ) |

| Cash Received on Sale of Fixed Asset | | | - | | | | 12.2 | | | | 372.1 | | | | 12.2 | | | | 1.6 | | | | (1.6 | ) | | | - | | | | 372.1 | | | | 117.7 | | | | 1.5 | | | | 1.8 | |

| (=) Cash Flow from Investment Activities | | | (767.9 | ) | | | (1,201.4 | ) | | | (2,797.6 | ) | | | (618.1 | ) | | | (263.9 | ) | | | (377.4 | ) | | | (1,966.1 | ) | | | (190.3 | ) | | | (244.3 | ) | | | (386.8 | ) | | | (413.9 | ) |

| Additions of Debt | | | 854.7 | | | | 198.3 | | | | 1,478.0 | | | | (25.5 | ) | | | 3.0 | | | | 315.8 | | | | 1,196.4 | | | | (37.1 | ) | | | 172.9 | | | | 1,045.8 | | | | 1,665.5 | |

| Payments of Principal and Interest on Debt | | | (375.6 | ) | | | (839.4 | ) | | | (257.2 | ) | | | (52.2 | ) | | | (67.8 | ) | | | (26.7 | ) | | | (148.3 | ) | | | (14.4 | ) | | | (127.8 | ) | | | (317.3 | ) | | | (1,838.4 | ) |

| Capital Increase | | | 6.9 | | | | 1,742.6 | | | | 884.5 | | | | - | | | | - | | | | 880.0 | | | | - | | | | 4.5 | | | | - | | | | 1.4 | | | | 532.4 | |

| Treasury Stock | | | - | | | | - | | | | (4.2 | ) | | | - | | | | - | | | | (4.2 | ) | | | - | | | | - | | | | - | | | | - | | | | - | |

| Capital Increase at subsidiaries | | | - | | | | - | | | | 15.4 | | | | - | | | | - | | | | 3.5 | | | | - | | | | 11.9 | | | | - | | | | - | | | | - | |

| Dividends | | | - | | | | (75.8 | ) | | | - | | | | (75.8 | ) | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Other | | | - | | | | - | | | | (36.6 | ) | | | (2.4 | ) | | | - | | | | - | | | | (5.9 | ) | | | (30.7 | ) | | | (121.4 | ) | | | (335.4 | ) | | | - | |

| (=) Cash Flows from Financing Activities | | | 486.0 | | | | 1,025.7 | | | | 2,079.9 | | | | (155.9 | ) | | | (64.8 | ) | | | 1,168.4 | | | | 1,042.2 | | | | (65.8 | ) | | | (76.3 | ) | | | 394.4 | | | | 359.5 | |

| (=) Total Cash Flow | | | 385.6 | | | | (207.0 | ) | | | (290.7 | ) | | | (438.1 | ) | | | (376.2 | ) | | | 642.4 | | | | (586.7 | ) | | | 29.7 | | | | 213.6 | | | | 15.7 | | | | (84.6 | ) |

| (+) Cash & Equivalents, Beginning | | | 831.5 | | | | 1,217.1 | | | | 1,010.1 | | | | 1,448.2 | | | | 1,010.1 | | | | 633.9 | | | | 1,276.3 | | | | 689.7 | | | | 719.4 | | | | 932.9 | | | | 948.6 | |

| (=) Cash & Equivalents, Closing | | | 1,217.1 | | | | 1,010.1 | | | | 719.4 | | | | 1,010.1 | | | | 633.9 | | | | 1,276.3 | | | | 689.7 | | | | 719.4 | | | | 932.9 | | | | 948.6 | | | | 864.1 | |

| Credit Statistics (LTM) | | Apr'07 | | | Apr'08 | | | Mar'09 | | | Apr'08 | | | Jul'08 | | | Oct'08 | | | Jan'09 | | | Mar'09 | | | Jun'09 | | | Sep'09 | | | Dec'09 | |

| (In million of reais) | | FY'07 | | | FY'08 | | | FY'09 | | | 4Q'08 | | | 1Q'09 | | | 2Q'09 | | | 3Q'09 | | | 4Q'09 | | | 1Q'10 | | | 2Q'10 | | | 3Q'10 | |

| Net Operating Revenues | | | 3,605.1 | | | | 2,736.2 | | | | 6,270.1 | | | | 2,736.2 | | | | 2,784.1 | | | | 2,871.6 | | | | 4,763.3 | | | | 6,270.1 | | | | 9,196.6 | | | | 12,056.9 | | | | 13,291.7 | |

l Gross Profit | | | 1,123.9 | | | | 349.0 | | | | 799.4 | | | | 349.0 | | | | 318.9 | | | | 410.5 | | | | 708.9 | | | | 799.4 | | | | 1,153.6 | | | | 1,509.4 | | | | 1,591.4 | |

l EBITDA | | | 930.0 | | | | 182.9 | | | | 718.0 | | | | 182.9 | | | | 159.6 | | | | 264.0 | | | | 602.1 | | | | 718.0 | | | | 1,000.0 | | | | 1,173.1 | | | | 1,323.1 | |

l EBIT | | | 633.1 | | | | (158.4 | ) | | | 290.8 | | | | (158.4 | ) | | | (213.5 | ) | | | (147.0 | ) | | | 167.7 | | | | 290.8 | | | | 560.2 | | | | 753.3 | | | | 824.7 | |

l Encargos Financeiros da Dívida Líquida | | | 127.8 | | | | 106.2 | | | | 179.9 | | | | 106.2 | | | | 91.9 | | | | 85.2 | | | | 136.1 | | | | 179.9 | | | | 247.0 | | | | 308.4 | | | | 329.8 | |

l Net Profit | | | 357.3 | | | | (47.8 | ) | | | (473.8 | ) | | | (47.8 | ) | | | (119.6 | ) | | | (515.5 | ) | | | (438.9 | ) | | | (473.8 | ) | | | (78.4 | ) | | | 475.6 | | | | 637.5 | |

| Liquid Funds | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

l Cash and Cash Equivalents | | | 1,217.1 | | | | 1,010.1 | | | | 719.4 | | | | 1,010.1 | | | | 633.9 | | | | 1,276.3 | | | | 689.7 | | | | 719.4 | | | | 932.9 | | | | 1,098.2 | | | | 864.1 | |

| Short-Term Debt | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

l Loans and Financings | | | 109.0 | | | | 69.3 | | | | 1,442.7 | | | | 69.3 | | | | 62.9 | | | | 298.6 | | | | 1,475.3 | | | | 1,442.7 | | | | 1,115.9 | | | | 1,171.6 | | | | 886.5 | |

| Long-Term Debt | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

l Loans and Financings | | | 2,324.8 | | | | 1,562.5 | | | | 2,312.3 | | | | 1,562.5 | | | | 1,474.9 | | | | 2,101.7 | | | | 2,327.6 | | | | 2,312.3 | | | | 3,508.5 | | | | 4,086.8 | | | | 4,278.4 | |

| Total Debt | | | 2,433.8 | | | | 1,631.8 | | | | 3,755.0 | | | | 1,631.8 | | | | 1,537.7 | | | | 2,400.3 | | | | 3,802.9 | | | | 3,755.0 | | | | 4,624.4 | | | | 5,258.3 | | | | 5,164.9 | |

| Net Debt | | | 1,216.7 | | | | 621.7 | | | | 3,035.6 | | | | 621.7 | | | | 903.8 | | | | 1,124.0 | | | | 3,113.3 | | | | 3,035.6 | | | | 3,691.5 | | | | 4,160.2 | | | | 4,300.8 | |

| Current Assets | | | 2,224.7 | | | | 2,272.4 | | | | 3,074.9 | | | | 2,272.4 | | | | 2,140.0 | | | | 3,453.9 | | | | 3,409.0 | | | | 3,074.9 | | | | 3,602.6 | | | | 4,107.9 | | | | 4,212.8 | |

| Current Liabilities | | | 591.7 | | | | 566.5 | | | | 2,325.2 | | | | 566.5 | | | | 693.4 | | | | 1,212.3 | | | | 2,358.2 | | | | 2,325.2 | | | | 2,369.7 | | | | 2,629.0 | | | | 2,345.5 | |

| Shareholders' Equity | | | 1,631.0 | | | | 3,325.8 | | | | 3,365.7 | | | | 3,325.8 | | | | 3,267.7 | | | | 3,762.8 | | | | 3,696.6 | | | | 3,365.7 | | | | 4,040.7 | | | | 4,220.5 | | | | 4,917.0 | |

| Capex - Property, Plant and Equipment | | | 684.2 | | | | 1,053.1 | | | | 1,346.1 | | | | 1,053.1 | | | | 1,147.4 | | | | 1,324.5 | | | | 1,485.9 | | | | 1,346.1 | | | | 1,501.9 | | | | 1,546.7 | | | | 1,515.3 | |

l Capex - Operational | | | 598.0 | | | | 781.9 | | | | 565.0 | | | | 781.9 | | | | 796.9 | | | | 762.7 | | | | 727.5 | | | | 565.0 | | | | 588.7 | | | | 626.5 | | | | 673.9 | |

| EBITDA Margin | | | 25.8 | % | | | 6.7 | % | | | 11.5 | % | | | 6.7 | % | | | 5.7 | % | | | 9.2 | % | | | 12.6 | % | | | 11.5 | % | | | 10.9 | % | | | 9.7 | % | | | 10.0 | % |

l Gross Profit Margin | | | 31.2 | % | | | 12.8 | % | | | 12.7 | % | | | 12.8 | % | | | 11.5 | % | | | 14.3 | % | | | 14.9 | % | | | 12.7 | % | | | 12.5 | % | | | 12.5 | % | | | 12.0 | % |

l EBIT Margin | | | 17.6 | % | | | -5.8 | % | | | 4.6 | % | | | -5.8 | % | | | -7.7 | % | | | -5.1 | % | | | 3.5 | % | | | 4.6 | % | | | 6.1 | % | | | 6.2 | % | | | 6.2 | % |

l Net Profit Margin | | | 9.9 | % | | | -1.7 | % | | | -7.6 | % | | | -1.7 | % | | | -4.3 | % | | | -18.0 | % | | | -9.2 | % | | | -7.6 | % | | | -0.9 | % | | | 3.9 | % | | | 4.8 | % |

| Net Debt ÷ Shareholders' Equity | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

l Net Debt % | | | 42.7 | % | | | 15.8 | % | | | 47.4 | % | | | 15.8 | % | | | 21.7 | % | | | 23.0 | % | | | 45.7 | % | | | 47.4 | % | | | 47.7 | % | | | 49.6 | % | | | 46.7 | % |

l Shareholders' Equity % | | | 57.3 | % | | | 84.2 | % | | | 52.6 | % | | | 84.2 | % | | | 78.3 | % | | | 77.0 | % | | | 54.3 | % | | | 52.6 | % | | | 52.3 | % | | | 50.4 | % | | | 53.3 | % |

| Long-Term Payable Debt to Equity Ratio | | | 1.4 | x | | | 0.5 | x | | | 0.7 | x | | | 0.5 | x | | | 0.5 | x | | | 0.6 | x | | | 0.6 | x | | | 0.7 | x | | | 0.9 | x | | | 1.0 | x | | | 0.9 | x |

| Liquidity Ratio (Current Assets ÷ Current Liabilities) | | | 3.8 | x | | | 4.0 | x | | | 1.3 | x | | | 4.0 | x | | | 3.1 | x | | | 2.8 | x | | | 1.4 | x | | | 1.3 | x | | | 1.5 | x | | | 1.6 | x | | | 1.8 | x |

| Net Debt ÷ EBITDA | | | 1.3 | x | | | 3.4 | x | | | 4.2 | x | | | 3.4 | x | | | 5.7 | x | | | 4.3 | x | | | 5.2 | x | | | 4.2 | x | | | 3.7 | x | | | 3.5 | x | | | 3.3 | x |

l Short-Term Net Debt ÷ EBITDA | | | 0.1 | x | | | 0.4 | x | | | 2.0 | x | | | 0.4 | x | | | 0.4 | x | | | 1.1 | x | | | 2.5 | x | | | 2.0 | x | | | 1.1 | x | | | 1.0 | x | | | 0.7 | x |

| Net Debt ÷ (EBITDA - Capex) | | | 4.9 | x | | | -0.7 | x | | | -4.8 | x | | | -0.7 | x | | | -0.9 | x | | | -1.1 | x | | | -3.5 | x | | | -4.8 | x | | | -7.4 | x | | | -11.1 | x | | | -22.4 | x |

l Net Debt ÷ (EBITDA - Operational Capex) | | | 3.7 | x | | | -1.0 | x | | | 19.8 | x | | | -1.0 | x | | | -1.4 | x | | | -2.3 | x | | | -24.8 | x | | | 19.8 | x | | | 9.0 | x | | | 7.6 | x | | | 6.6 | x |

| Interest Cover (EBITDA ÷ Net Financial Exp.) | | | 7.3 | x | | | 1.7 | x | | | 4.0 | x | | | 1.7 | x | | | 1.7 | x | | | 3.1 | x | | | 4.4 | x | | | 4.0 | x | | | 4.0 | x | | | 3.8 | x | | | 4.0 | x |

l Interest Cover (EBITDA - Op.Capes)÷Net Fin.) | | | 2.6 | x | | | -5.6 | x | | | 0.9 | x | | | -5.6 | x | | | -6.9 | x | | | -5.9 | x | | | -0.9 | x | | | 0.9 | x | | | 1.7 | x | | | 1.8 | x | | | 2.0 | x |

| Avg. Debt Cost (Net.Fin.Exp. ÷ Net Debt) | | | 10.5 | % | | | 17.1 | % | | | 5.9 | % | | | 17.1 | % | | | 10.2 | % | | | 7.6 | % | | | 4.4 | % | | | 5.9 | % | | | 6.7 | % | | | 7.4 | % | | | 7.7 | % |

L. Financial Statements of Cosan Ltd – US GAAP

| Income Statement | | Apr'07 | | | Apr'08 | | | Apr'09 | | | Apr'08 | | | Jul'08 | | | Oct'08 | | | Jan'09 | | | Apr'09 | | | Jun'09 | | | Sep'09 | | | Dec'09 | |

| (In millions of U.S. dollars) | | FY'07 | | | FY'08 | | | FY'09 | | | 4Q'08 | | | 1Q'09 | | | 2Q'09 | | | 3Q'09 | | | 4Q'09 | | | 1Q'10 | | | 2Q'10 | | | 3Q'10 | |

| Net sales | | | 1,679.1 | | | | 1,491.2 | | | | 2,926.5 | | | | 485.3 | | | | 394.0 | | | | 383.8 | | | | 1,103.4 | | | | 1,045.3 | | | | 1,720.3 | | | | 1,915.7 | | | | 2,209.5 | |

| (-) Cost of goods sold | | | (1,191.3 | ) | | | (1,345.6 | ) | | | (2,621.9 | ) | | | (418.4 | ) | | | (398.9 | ) | | | (320.2 | ) | | | (950.3 | ) | | | (952.4 | ) | | | (1,561.4 | ) | | | (1,655.5 | ) | | | (1,965.3 | ) |

| (=) Gross profit | | | 487.8 | | | | 145.6 | | | | 304.6 | | | | 66.9 | | | | (4.9 | ) | | | 63.6 | | | | 153.0 | | | | 92.8 | | | | 158.8 | | | | 260.1 | | | | 244.3 | |

| (-) Selling expenses | | | (133.8 | ) | | | (168.6 | ) | | | (213.3 | ) | | | (44.9 | ) | | | (53.0 | ) | | | (47.9 | ) | | | (67.6 | ) | | | (44.7 | ) | | | (102.1 | ) | | | (115.1 | ) | | | (128.0 | ) |

| (-) General and administrative expenses | | | (121.1 | ) | | | (115.1 | ) | | | (140.1 | ) | | | (30.5 | ) | | | (36.3 | ) | | | (34.9 | ) | | | (42.2 | ) | | | (26.8 | ) | | | (7.9 | ) | | | (62.8 | ) | | | (106.7 | ) |

| (=) Operating income (loss) | | | 232.9 | | | | (138.1 | ) | | | (48.8 | ) | | | (8.5 | ) | | | (94.2 | ) | | | (19.2 | ) | | | 43.2 | | | | 21.4 | | | | 48.9 | | | | 82.3 | | | | 9.6 | |

| Operating margin | | | 13.9% | | | | -9.3% | | | | -1.7% | | | | -1.8% | | | | -23.9% | | | | -5.0% | | | | 3.9% | | | | 2.0% | | | | 2.8% | | | | 4.3% | | | | 0.4% | |

| (-) Other income (expense): | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Financial | | | 289.4 | | | | 116.8 | | | | (370.8 | ) | | | 119.3 | | | | 26.5 | | | | (234.4 | ) | | | (137.2 | ) | | | (25.7 | ) | | | 215.7 | | | | 64.1 | | | | (80.4 | ) |

| Other | | | 16.3 | | | | (3.7 | ) | | | (2.3 | ) | | | (1.8 | ) | | | (3.5 | ) | | | (8.1 | ) | | | 6.6 | | | | 2.7 | | | | (7.9 | ) | | | 0.9 | | | | 155.5 | |

| (=) Income (loss) before income taxes | | | 538.5 | | | | (25.0 | ) | | | (421.9 | ) | | | 109.0 | | | | (71.2 | ) | | | (261.7 | ) | | | (87.3 | ) | | | (1.6 | ) | | | 256.7 | | | | 147.3 | | | | 84.7 | |

| (-) Income taxes expense (benefit) | | | (188.8 | ) | | | 19.8 | | | | 144.7 | | | | (27.9 | ) | | | 23.2 | | | | 94.5 | | | | (1.7 | ) | | | 28.7 | | | | (76.5 | ) | | | (49.4 | ) | | | (52.3 | ) |

| (=) Income (loss) before equity | | | 349.7 | | | | (5.2 | ) | | | (277.2 | ) | | | 81.1 | | | | (48.0 | ) | | | (167.2 | ) | | | (89.1 | ) | | | 27.1 | | | | 180.1 | | | | 97.9 | | | | 32.4 | |

| (±) Equity in income of affiliates | | | (0.0 | ) | | | (0.2 | ) | | | 6.1 | | | | 2.3 | | | | 0.1 | | | | 1.2 | | | | 5.2 | | | | (0.3 | ) | | | (1.7 | ) | | | 0.0 | | | | (3.8 | ) |