FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of March, 2015

Commission File Number: 1-33659

COSAN LIMITED

(Translation of registrant’s name into English)

Av. Juscelino Kubitschek, 1327 – 4th floor

São Paulo, SP 04543-000 Brazil

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

COSAN LIMITED

| |

| 1. | Press Release dated March 18, 2015 regarding results for 4th quarter and Fiscal Year 2014 |

| 2. | Consolidated financial statements at December 31, 2014 and report of independent registered public accounting firm |

Item 1

Net revenue growth of 11% and EBITDA of R$4.0 billion in 2014

São Paulo, March 18, 2015 - COSAN LIMITED S.A. (NYSE: CZZ; BM&FBOVESPA: CZLT33) announces today its results for the fourth quarter of fiscal year 2014 (4Q14)—October, November, and December 2014—and fiscal year 2014. The results are consolidated in accordance with the accounting principles adopted in Brazil and internationally (IFRS).

Earnings Conference Call Portuguese March 19, 2015 11:00 A.M. (Brasilia time) Phone: + 55 11 3193 1001 + 55 11 2820 4001 Access Code: COSAN English March 19, 2015 12:00 A.M. (Brasilia time) Phone (BR): + 55 11 3193 1001 + 55 11 2820 4001 Phone (USA): +1 786 924 6977 Access Code: COSAN | Highlights 2014 |

o Raízen Combustíveis’s EBITDA was R$2.2 billion with growth of 8% in volume sold in 2014 o Raízen Energia's EBITDA was R$2.5 billion with 57 million tons of sugarcane crushed in the 2014/15 harvest o 40% growth in the commercial segment connections in Comgás o Record of 11.1 million tons loaded by Rumo at the Port of Santos |

| | 4Q14 | 4Q13 | Summary of Financial Information - Cosan Consolidated¹ | 2014 | 2013 |

| | (Oct-Dec) | (Oct-Dec) | Amount in R$ MM | (Jan-Dec) | (Jan-Dec) |

Telephone: +55 11 3897 9797 | | 10,526.0 | 9,390.0 | Net Revenue | 39,998.7 | 36,165.1 |

| | 1,199.9 | 1,156.5 | Gross Profit | 4,825.7 | 4,606.4 |

| | 11.4% | 12.3% | Gross Margin (%) | 12.1% | 12.7% |

4Q14 - quarter ended December 30, 2014 | | 588.3 | 577.5 | Operating Profit | 2,144.9 | 2,186.5 |

| | 1,096.2 | 1,014.1 | EBITDA | 4,047.1 | 3,953.1 |

| | 10.4% | 10.8% | EBITDA Margin (%) | 10.1% | 10.9% |

4Q13 - quarter ended December 31, 2013 | | (6.2) | 4.5 | Equity Pick-up | (29.4) | (10.2) |

| | 69.0 | 344.2 | Net Income before non-controlling Interest | 659.3 | 697.3 |

| | (29.1) | 132.7 | Net Income | 171.0 | 210.9 |

2014 - 12 months beginning January 1, 2014 and closing December 31, 2014 | | -0.3% | 1.4% | Net Margin (%) | 0.4% | 0.6% |

| | | | | | |

| | | 666.9 | 806.6 | CAPEX | 2,690.8 | 2,910.1 |

2013 - 12 months beginning January 1, 2013 and closing December 31, 2013 | | 12,246.3 | 10,548.9 | Proforma Net Debt (w/ preferred shareholders payable in subsidiaries) | 12,246.3 | 10,548.9 |

| | 13,560.2 | 13,374.4 | Shareholders' Equity and Minority Shareholders | 13,560.2 | 13,374.4 |

| | Note 1: Considering the consolidation of 50% of Raízen Combustíveis and Raízen Energia |

| Cosan Limited-Earnings Release 4th Quarter of Fiscal Year 2014 |

Message from the CEO

We ended 2014 with many achievements reflected in our business’s performance. Despite the challenger economic scenario - with the downturn in the Brazilian economy, currency devaluation and high inflation - we were able to achieve the results committed with our shareholders.

We also announced a large corporate restructuring following the simplification of our business model in line with market demands. Gas, Energy and Logistics segments will operate more independently, with a focus on operational efficiency, organic growth and pursuing opportunities in their sectors.

We cannot expect a favorable economic scenario in 2015. It will be a period of great adjustments and high volatility. However, we are confident in our position and Raízen, Comgás, Radar and Lubrificantes are references in their markets.

Additionally, we have a huge challenge related to the integration of Rumo and ALL, recently approved by competent agencies. Our project will transform and expand cargo transportation business in Brazil through an efficient logistics.

Our main focus this year is on cash generation and leverage reduction. We aim to do more with less and to create organic value in operations. These will be the main themes of 2015.

Simplicity, agility, and entrepreneurism will continue to guide us seeking results that create value for our shareholders in our whole business portfolio.

Marcos Marinho Lutz

CEO – Cosan

| Cosan Limited-Earnings Release 4th Quarter of Fiscal Year 2014 |

| A. | Highlights and Business Units |

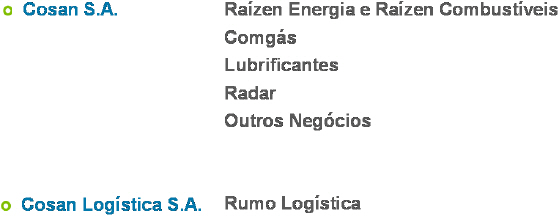

A.1 Business Units

Listed below are the business units that make up Cosan S/A and Cosan Logística S/A, companies that comprise Cosan Limited’s portfolio.

The business units (reportable segments) are organized as follows:

| Cosan Limited-Earnings Release 4th Quarter of Fiscal Year 2014 |

A.2 Cosan Limited’s Consolidated Result

Cosan Limited’s consolidated financial statements considers 100% of the results of Cosan S/A and Cosan Logística S/A.

EBITDA reported herein is in compliance with CVM Rule 527/12, published by the Brazilian Securities and Exchange Commission on October 4, 2012, and may differ from the amounts reported in prior periods as a result of the equity accounting income adjustment. Therefore, EBITDA now consists of operating profit before financial expenses, plus depreciation, amortization and equity accounting.

| 4Q14 | 4Q13 | | | EBITDA (Reconciliation ICVM 527) | 2014 | 2013 | |

| (Oct-Dec) | (Oct-Dec) | Chg. % | | Amounts in R$ MM | (Jan-Dec) | (Jan-Dec) | Chg. % |

| (29.1) | 132.7 | n/a | | Net Income | 171.0 | 211.0 | (19.)% |

| (130.0) | (88.9) | 46.3% | | (-) Equity Pick-up | (592.0) | (340.2) | 74.% |

| - | - | n/a | | (-) Income from Discontinued Operations | - | 3.4 | -100.% |

| 92.3 | 209.2 | -55.9% | | (+) Minority Shareholders | 471.5 | 472.3 | -0.2% |

| 17.9 | (155.6) | n/a | | (+) Income Taxes | 43.8 | 103.3 | -57.6% |

| 333.8 | 254.4 | 31.2% | | (+) Net Financial Expense (Revenue) | 982.8 | 893.6 | 10.% |

| 175.2 | 158.7 | 10.4% | | (+) Depreciation and Amortization | 679.1 | 598.4 | 13.5% |

| 460.1 | 510.4 | -9.9% | | EBITDA (before ICVM 527) | 1,756.3 | 1,941.9 | -9.6% |

| 130.0 | 88.9 | 46.3% | | (+) Equity Pick-up | 592. | 340.2 | 74.% |

| 590.2 | 599.3 | -1.5% | | EBITDA (after ICVM 527) | 2,348.3 | 2,282.1 | 2.9% |

| Cosan Limited-Earnings Release 4th Quarter of Fiscal Year 2014 |

Below we present 4Q14 and 2014 results by business segment as previously detailed. All information reflect 100% of their financial performance, regardless of Cosan Limited’s interest.

For reconciliation purposes of the consolidated EBITDA, the Adjustments and Eliminations column refers to the elimination of net profits of the business controlled by Cosan for consolidation purposes.

Results by Business Unit4Q14 | Cosan Energia Proforma | Cosan Logística | CZZ (Parent) | Ajustments and Eliminations | CZZ Proforma |

| Net Revenue | 10,270.2 | 255.7 | - | - | 10,526.0 |

| Cost of Goods and Services | (9,148.5) | (177.6) | - | - | (9,326.1) |

| Gross Profit | 1,121.8 | 78.1 | - | 0.0 | 1,199.9 |

| Gross Margin(%) | 10.9% | 30.6% | n/a | - % | 11.4% |

| Selling Expenses | (429.8) | - | - | - | (429.8) |

| General and Administrative Expenses | (264.8) | (24.2) | (1.2) | 0.0 | (290.2) |

| Other Operating Revenues (Expenses) | 118.7 | (10.3) | - | - | 108.4 |

| Equity Pick-up | (6.2) | (0.0) | (40.3) | 40.3 | (6.2) |

| Depreciation and Amortization | 487.3 | 26.9 | - | - | 514.1 |

| EBITDA | 1,026.9 | 70.5 | (41.5) | 40.3 | 1,096.2 |

| EBITDA Margin (%) | 10.% | 27.6% | n/a | - % | 10.4% |

| Financial income | (432.2) | (13.8) | (6.7) | (0.0) | (452.7) |

| Financial expense | 157.8 | 2.5 | 0.0 | - | 160.4 |

| Foreign exchange gain (losses), net | (349.8) | 0.7 | 13.3 | - | (335.8) |

| Derivatives | 114.1 | - | 5.8 | - | 119.9 |

| Income taxes expenses | 6.5 | (11.3) | - | 0.0 | (4.8) |

| Non-controlling interests | (119.5) | (5.5) | - | 26.9 | (98.1) |

| Profit (loss) for the period | (83.5) | 16.3 | (29.1) | 67.2 | (29.1) |

Results by Business Unit2014 | Cosan Energia Proforma | Cosan Logística | CZZ (Parent) | Ajustments and Eliminations | CZZ Proforma |

| Net Revenue | 39.083,3 | 915,4 | - | - | 39.998,7 |

| Cost of Goods and Services | (34.562,6) | (610,4) | - | - | (35.173,0) |

| Gross Profit | 4.520,7 | 305,1 | - | 0.0 | 4.825,7 |

| Gross Margin(%) | 11.6% | 33.3% | n/a | - % | 12.1% |

| Selling Expenses | (1.746,3) | - | - | - | (1.746,3) |

| General and Administrative Expenses | (1.004,5) | (87,8) | (19,3) | - | (1.111,6) |

| Other Operating Revenues (Expenses) | 187,8 | 7,8 | - | (18.6) | 177,1 |

| Equity Pick-up | (29,4) | 0,0 | 193,6 | (193.6) | (29,4) |

| Depreciation and Amortization | 1.834,4 | 97,2 | - | - | 1.931,6 |

| EBITDA | 3.762,7 | 322,3 | 174,3 | (212.2) | 4.047,1 |

| EBITDA Margin (%) | 9.6% | 35.2% | n/a | n/a | 10.1% |

| Financial income | (1.416,3) | (66,1) | (20,8) | - | (1.503,2) |

| Financial expense | 506,1 | 31,1 | 1,8 | - | 539,0 |

| Foreign exchange gain (losses), net | (533,9) | 1,3 | 17,2 | - | (515,4) |

| Derivatives | 226,4 | - | (1,4) | - | 225,0 |

| Income taxes expenses | (143.3) | (58.3) | - | - | (201.6) |

| Non-controlling interests | (344.8) | (28.8) | - | (114.7) | (488.3) |

| Results of discontinued operations | 69.4 | - | - | (69.4) | - |

| Profit (loss) for the period | 292.0 | 104.3 | 171.0 | (396.3) | 171.0 |

| Cosan Limited-Earnings Release 4th Quarter of Fiscal Year 2014 |

B.1 Cosan S/A - Proforma

We present below the main highlights of Cosan S/A’s results, the Company's business unit responsible for the operations of Raízen Fuels, Raizen Energia, Comgás, Lubricants, Radar and Other Businesses.

Due to the adoption of the IFRS 11 accounting standard – Joint Arrangements, since April 2013, Cosan S/A no longer consolidates Raízen on its balance sheet, income statement and cash flows, and the result of this business unit is only reported under the “Equity Accounting Result”. Due to the relevance of Raízen on Cosan S/A’s financial information, we will report in the table below the proforma results, including Raízen’s proportional interest of 50% in the results.

For complete information on Cosan S/A results, its Earning Release is available at ri.cosan.com.br.

| 4T14 | 4Q13 | | COSAN S/A PROFORMA | 2014 | 2013 |

| (Oct-Dec) | (Oct-Dec) | | | (Jan-Dec) | (Jan-Dec) |

| 10,270.2 | 9,183.5 | | Net Revenue | 39,083.3 | 35,247.4 |

| (9,148.5) | (8,120.4) | | Cost of Goods and Services | (34,562.6) | (31,016.1) |

| 1,121.8 | 1,063.1 | | Gross Profit | 4,520.7 | 4,231.3 |

| 10.9% | 11.6% | | Gross Margin(%) | 11.6% | 12.% |

| (429.8) | (420.2) | | Selling Expenses | (1,746.3) | (1,674.8) |

| (264.8) | (264.3) | | General and Administrative Expenses | (1,004.5) | (990.2) |

| 118.7 | 138.2 | | Other Operating Revenues (Expenses) | 187.8 | 350.9 |

| (6.2) | 4.5 | | Equity Pick-up | (29.4) | (10.2) |

| 487.3 | 412.2 | | Depreciation and Amortization | 1,834.4 | 1,699.3 |

| 1,026.9 | 933.4 | | EBITDA | 3,762.7 | 3,606.2 |

| 10.% | 10.2% | | EBITDA Margin (%) | 9.6% | 10.2% |

| (432.2) | (375.5) | | Financial income | (1,416.3) | (1,248.2) |

| 157.8 | 101.5 | | Financial expense | 506.1 | 356.3 |

| (349.8) | (201.5) | | Foreign exchange gain (losses), net | (533.9) | (577.3) |

| 114.1 | 79.1 | | Derivatives | 226.4 | 213.6 |

| 6.5 | 182.6 | | Income taxes expenses | (143.3) | (195.4) |

| (119.5) | (114.0) | | Non-controlling interests | (344.8) | (336.0) |

| - | 36.4 | | Results of discontinued operations | 69.4 | 141.5 |

| (83.5) | 229.8 | | Profit (loss) for the period | 292.0 | 261.3 |

Raízen Combustíveis

For comparison purposes, the following information presented consider 100% of Raízen Combustíveis operations, even though Cosan S/A holds 50% share in the segment.

Raízen Combustíveis closed 2014 with growth of 7.8% of total volume sold, especially gasoline, ethanol and diesel which grew 10.0%, 11.1% and 7.9% respectively. Net revenue for the year reached R$55.7 billion, 14.8% higher than in 2013, driven by higher volumes sold and average prices, primarily by variations in petrol and diesel prices by Petrobras. EBITDA was R$2.1 billion, an 11.7% growth compared to 2013.

| Cosan Limited-Earnings Release 4th Quarter of Fiscal Year 2014 |

Raízen Combustíveis ended 2014 with 5,356 Shell service stations and 944 convenience stores in its network, a growth of 496 stations and 94 stores compared to 2013.

Raízen Energia

For comparison purposes, the following information consider 100% of Raízen Energia operations, even though Cosan S/A holds 50% share in the segment. Additionally, it is worth mentioning that the analysis of Raizen Energia information should consider the crop year that began in April 2014 and will end in March 2015.

Raizen Energia ended 4Q14 with a crushing volume of 57.1 million tons, concluding crushing for the 2014/15 harvest with a 7.1% reduction in the total volume of sugarcane crushed. The main factor for the reduction of the volume crushed was the dry climate throughout the year, which hampered the process of planting and growth of sugarcane, reducing agricultural productivity. The product mix was more focused on sugar (54%) and ethanol (46%).

The volume of sugar and ethanol sold in 4Q14 grew 39.2% and 14.2% respectively, representing 1.3 million tons of sugar and 828,200 m³. The volume of energy sold was 7.7% lower in the quarter, compared to 4Q13, reaching 593,000 MWh. Raízen Energia’s total net revenue in 4Q14 was R$2.6 billion, 24.3% higher compared to the same period last year. EBITDA in the quarter was R$595.1 million, up 53.3%, with an EBITDA margin of 22.5%. EBITDA adjusted by the effects of biological assets was R$655.7 million.

Comgás

Comgás’ volume sold remained stable compared to 2013, with 5.5 million m³ sold in 2014. This stability is due to higher temperatures in 2014 that reduced the consumption of residential units and lowered industrial activity. Comgás’ net revenue was R$6.4 billion in 2014, 0.8% higher than 2013. EBITDA was R$1.4 billion, 7.2% higher compared to the previous year, with an EBITDA margin of 22.5%.

Lubrificantes

Net revenue from the sale of lubricants, base oil resale and other goods and services increased 3.8% in 2014, reaching R$1.6 billion. This result is due to higher average unit price and a 1.3% increase in the volume sold, which totaled 319.8 million m³. EBITDA was R$103.4 million in the year, with a margin of 6.5%.

Radar

Radar ended 2014 with 246,700 hectares of land under its management, with a market value of R$4.6 billion. Net income in 2014 was R$157.6 million, increased by the sale of properties during the year. In 2014, EBITDA was R$193.0 million, down 15.2% compared to 2013 due to the lower valuation of the Company’s own land portfolio.

| Cosan Limited-Earnings Release 4th Quarter of Fiscal Year 2014 |

B.2 Cosan Logística

| 4Q14 | 4Q13 | | COSAN LOGÍSTICA | 2014 | 2013 |

| (Oct-Dec) | (Oct-Dec) | | | (Jan-Dec) | (Jan-Dec) |

| 255.7 | 206.5 | | Net Revenue | 915.4 | 917.7 |

| (177.6) | (113.0) | | Cost of Goods and Services | (610.4) | (542.6) |

| 78.1 | 93.5 | | Gross Profit | 305.1 | 375.1 |

| 30.6% | 45.3% | | Gross Margin(%) | 33.3% | 40.9% |

| (24.2) | (22.6) | | General and Administrative Expenses | (87.8) | (74.3) |

| (10.3) | (1.9) | | Other Operating Revenues (Expenses) | 26.4 | (20.4) |

| (0.0) | (0.0) | | Equity Pick-up | (18.6) | (0.0) |

| 26.9 | 20.0 | | Depreciation and Amortization | 97.2 | 77.5 |

| 70.5 | 89.0 | | EBITDA | 322.3 | 358.0 |

| 27.6% | 43.1% | | EBITDA Margin (%) | 35.2% | 39.% |

| (13.8) | (11.0) | | Financial income | (66.1) | (38.1) |

| 2.5 | 12.6 | | Financial expense | 31.1 | 50.2 |

| 0.7 | 0.3 | | Foreign exchange gain (losses), net | 1.3 | 0.4 |

| (11.3) | (23.8) | | Income taxes expenses | (58.3) | (99.7) |

| (5.5) | (10.7) | | Non-controlling interests | (28.8) | (48.4) |

| 16.3 | 36.4 | | Profit (loss) for the period | 104.3 | 144.8 |

Rumo

Rumo reported a record high volume of sugar loaded at the port of Santos, reaching 11.2 million tons in 2014, an increase of 21.1% over 2013. Net revenue for the year was R$915.4 million, in line with 2013. This stability was due to the drop in transportation revenue offset by the growth of the port loading revenue. Cosan Logística’s EBITDA was R$ 322.3 million in 2014, with an EBITDA margin of 35.2%.

| Cosan Limited-Earnings Release 4th Quarter of Fiscal Year 2014 |

C. Other Items in the Consolidated Result

Financial Result

| 4Q14 | 4Q13 | | | Financial Results | 2014 | 2013 | |

| (Oct-Dec) | (Oct-Dec) | Chg. % | | Amounts in R$ MM | (Jan-Dec) | (Jan-Dec) | Chg. % |

| (157.1) | (202.7) | -22.5% | | Gross Debt Charges | (719.7) | (746.7) | -3.6% |

| 41.4 | 31.3 | 32.1% | | Income from Financial Investments | 139.7 | 122.0 | 14.5% |

| (115.7) | (171.3) | -32.4% | | (=) Subtotal: Net Debt Interests | (580.0) | (624.7) | -7.2% |

| (84.5) | (55.1) | 53.4% | | Other Charges and Monetary Variation | (113.3) | (86.1) | 31.7% |

| (196.9) | (101.7) | 93.6% | | Exchange Rate Variation | (300.5) | (324.6) | -7.4% |

| 110.1 | 90.8 | 21.3% | | Gains (losses) with Derivatives | 161.4 | 230.2 | -29.9% |

| (46.8) | (17.0) | n/a | | Amortization, Debt Cost and Other | (150.4) | (88.4) | 70.1% |

| (333.8) | (254.4) | 31.2% | | (=) Financial, Net | (982.8) | (893.6) | 10.0% |

Financial result for 4Q14 was a net financial expense of R$333.8 million, versus a net debt of R$254.4 million in 4Q13, with an increase of 31.2%, mainly due to:

(i) Debt charges decreased 22.5% year-over-year mainly due to the lower indebtedness level from one period to the other, due to the corporate restructuring in 2Q14.

(ii) Increase of 32.1% on income from financial investments, due to the increase in interest rates in the period, partially offset by the reduction in average cash in the period.

(iii) The negative net result of R$86.8 million from foreign exchange rate variation and derivatives losses in the quarter reflects the valuation of the US Dollar against the Brazilian Real by 8.4% (R$2.6562/US$ on December 31, 2014 compared to R$2.4510/US$ on September 30, 2014), and its impact on debt denominated in dollars.

(iv) Amortization of debt and other costs totaled a net expense of R$46.8 million in 4Q14, mainly due to cost US $ 6.0 million from Cosan S.A. Consent expense.

The financial result for fiscal year 2014 presented net expense of R$982.8 million, while for 2013 it was R$893.6 million. This growth is mainly due to the increase of bank charges in the year, impacted by the corporate restructuring and the payment of a consent fee in the period.

| Cosan Limited-Earnings Release 4th Quarter of Fiscal Year 2014 |

Net Income

| 4Q14 | 4Q13 | | Net Income | 2014 | 2013 |

| (Oct-Dec) | (Oct-Dec) | | Amounts in R$ MM | (Jan-Dec) | (Jan-Dec) |

| (29.1) | 132.7 | | Net Income | 171.0 | 211.0 |

Cosan Limited’s net loss was R$29.1 million in the quarter, below the amount in 4Q13, which was R$132.7 million. However, net income during the year was R$171.0 million versus R$215.2 in the same period of 2013.

The main drivers of this change in net income during the period were:

| 4Q | | Net Income | FY |

| (Oct-Dec) | | Amounts in R$ MM | (Jan-Dec) |

| 132.7 | | Net Income - 2013 | 211.0 |

| | | EBIT variation | |

| (48.5) | | Cosan Energia | (184.1) |

| (25.3) | | Cosan Logística | (55.4) |

| 7.0 | | Outros | (8.1) |

| - | | Adjustments | (18.6) |

| (66.8) | | EBIT Businesses Total | (266.3) |

| | | Variation in other lines | |

| (79.5) | | Financial result | (89.3) |

| 40.2 | | Equity pick-up | 250.8 |

| (173.6) | | Income taxes | 59.5 |

| 117.9 | | Non-controlling Interest | 1.9 |

| - | | Discontinued operation | 3.4 |

| (29.1) | | Net Income - 2014 | 171.0 |

| (i) | Increase in the equity accounting result line of R$40.2 million due to Raízen’s results, outlined in previous sections, as well as the impact of foreign exchange rate variations on Raizen’s debt; |

| (ii) | Reduction of R$79.5 million in financial results mainly due to the foreign exchange rate variation and the results from derivatives as described in the Financial Result section; |

| (iii) | EBIT variation and profit of non-controlling shareholders of R$51.1 million. |

| Cosan Limited-Earnings Release 4th Quarter of Fiscal Year 2014 |

D. Loans and Financing

At the close of 4Q14, Cosan Limited’s pro forma consolidated gross debt (excluding PESA) reached R$15.5 billion, compared to R$14.1 billion, an increase of 9.3% over 3Q14.

Cosan Limited pro forma consolidated

Cash and cash equivalents totaled R$3.2 billion at the end of 4Q14 compared to R$2.4 billion in 3Q14. The pro forma net debt (including preferred) for the quarter was R$12.2 billion, compared to R$11.7 billion in 3Q14, equivalent to a leverage of 3.0x considering the pro forma EBITDA of R$4.0 billion in the last 12 months.

| Debt per Business Units (Amount in R$ MM) | | | |

| | 4Q14 | 3Q14 | |

| COSAN S/A PROFORMA | (Oct-Dec) | (Jul-Sep) | Chg. % |

| Raízen (50%) | 5,581.7 | 4,870.0 | 14.6% |

| Comgás | 2,803.3 | 2,724.9 | 2.9% |

| Lubrificantes | 261.2 | 244.6 | 6.8% |

| Other business | 3,786.3 | 3,285.3 | n/a |

| Total Debt Proforma | 12,432.4 | 11,124.8 | 11.8% |

| Cash and Cash Equivalents and Securities | (3,098.6) | (2,388.2) | 29.7% |

| Proforma Net Debt | 9,333.8 | 8,736.6 | 6.8% |

| Preferred shareholders payable in subsidiaries | 1,962.7 | 2,036.3 | -3.6% |

| Proforma Net Debt (w/ preferred shareholders payable in subsidiaries) | 11,296.5 | 10,772.9 | 4.9% |

| | | | |

| COSAN LOGÍSTICA | | | |

| Rumo | 784.7 | 715.7 | 9.6% |

| Total Debt | 784.7 | 715.7 | 9.6% |

| Cash and Cash Equivalents and Securities | 86.5 | 97.8 | -11.5% |

| Net Debt | 698.2 | 617.9 | 13.0% |

| Cosan Limited-Earnings Release 4th Quarter of Fiscal Year 2014 |

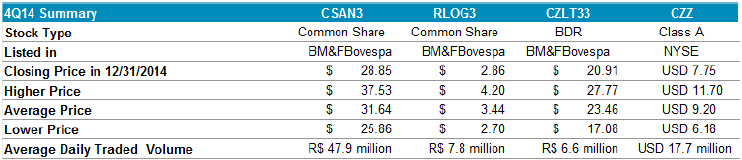

E. Stock Performance

The shares issued by Cosan Limited have been listed on NYSE – New York Stock Exchange, since its IPO in 2007, under the ticker symbol CZZ. The company has also issued share deposit certificates (Brazilian Depositary Receipts – BDR) on the BM&FBovespa under the symbol CZLT33.

The tables and graphs below represent the performance of shares issued by the companies:

| Cosan Limited-Earnings Release 4th Quarter of Fiscal Year 2014 |

Disclaimer

This document contains forward-looking statements and estimates. These forward-looking statements and estimates are solely forecasts and do not represent any guarantee of prospective results. All stakeholders should know that these statements and estimates are and will be, depending on the case, subject to risks, uncertainties and factors related to the operations and business environment of Cosan and its subsidiaries, and therefore the actual results of these companies may significantly differ from the estimated or implied prospective results contained in such forward-looking statements and estimates.

| Cosan Limited-Earnings Release 4th Quarter of Fiscal Year 2014 |

F. Financial Statements

F.1 Cosan Energia

| Cosan Consolidated | 4Q14 | 4Q13 |

| Income statement for the period | 12/31/2014 | 12/31/2013 |

| Net operating revenue | 2,041,186 | 2,011,255 |

| Gross Profit | 540,406 | 558,884 |

| Sales, general and administrative expenses | (390,344) | (345,350) |

| Other operating income (expenses), net | 92,460 | 77,490 |

| Financial revenue | 40,364 | 60,710 |

| Financial expenses | (269,509) | (301,685) |

| Foreign exchange variation | (210,907) | (106,041) |

| Derivative | 104,326 | 92,932 |

| Equity pick up | 130,036 | 91,478 |

| Income and social contribution taxes | (6,649) | 179,439 |

| Equity attributable to non-controlling interests | (113,661) | (124,020) |

| Net Income from discontinued operations | - | 48,557 |

| Net Income (loss) | (83,478) | 232,395 |

| | | |

| Cosan Consolidated | 4Q14 | 3Q14 |

| Balance sheet | 12/31/2014 | 09/30/2014 |

| Cash and cash equivalents | 1,540,192 | 1,209,732 |

| Securities | 149,735 | 202,352 |

| Accounts receivable | 822,424 | 835,565 |

| Inventories | 347,903 | 321,268 |

| Other current assets | 548,134 | 3,516,540 |

| Investments | 8,535,180 | 8,687,985 |

| Investment property | 2,641,978 | 2,167,221 |

| Biological assets | (0) | (0) |

| Property, plant and equipment | 351,435 | 313,532 |

| Intangible | 9,426,120 | 9,398,821 |

| Other non-current assets | 2,740,614 | 2,641,710 |

| Total Assets | 27,103,712 | 29,294,726 |

| | | |

| Loans and financing | (7,397,601) | (6,624,781) |

| Suppliers | (971,170) | (881,746) |

| Salaries payable | (101,115) | (99,383) |

| Other current liabilities | (616,590) | (1,562,779) |

| Other non-current liabilities | (5,567,962) | (6,221,007) |

| Net Equity | (12,449,273) | (13,905,030) |

| Total Liabilities | (27,103,712) | (29,294,726) |

| Cosan Limited-Earnings Release 4th Quarter of Fiscal Year 2014 |

F.2 Cosan Logística

| Cosan Logística | 4Q14 | 4Q13 |

| Income statement for the period | 12/31/2014 | 12/31/2013 |

| Net operating revenue | 255,726 | 206,511 |

| Gross profit | 78,131 | 93,477 |

| Sales, general and administrative expenses | (24,199) | (22,574) |

| Other operating income (expenses), net | (10,281) | (1,934) |

| Financial revenue | 2,547 | 12,644 |

| Financial expenses | (13,830) | (11,016) |

| Foreign exchange variation | 740 | 341 |

| Equity pick up | (0) | (0) |

| Income and social contribution taxes | (11,296) | (23,789) |

| Equity attributable to non-controlling interests | (5,530) | (10,730) |

| Net Income (loss) | 16,280 | 36,418 |

| | | |

| Cosan Logística | 4Q14 | 3Q14 |

| Balance sheet | 12/31/2014 | 09/30/2014 |

| Cash and cash equivalents | 86,487 | 97,765 |

| Accounts receivable | 42,685 | 36,908 |

| Inventories | 5,817 | 6,099 |

| Other current assets | 24,175 | 21,695 |

| Investments | (0) | 0 |

| Property, plant and equipment | 1,084,455 | 1,047,280 |

| Intangible | 860,253 | 834,405 |

| Other non-current assets | 481,483 | 406,374 |

| Total Assets | 2,585,358 | 2,450,526 |

| | | |

| Loans and financing | (784,709) | (715,698) |

| Suppliers | (141,289) | (114,947) |

| Salaries payable | (19,302) | (16,368) |

| Other current liabilities | (89,960) | (49,677) |

| Other non-current liabilities | (221,850) | (215,847) |

| Net Equity | (1,328,250) | (1,337,989) |

| Total Liabilities | (2,585,358) | (2,450,526) |

| Cosan Limited-Earnings Release 4th Quarter of Fiscal Year 2014 |

F.3 Cosan Limited (Parent company)

| Cosan Limited (Parent company) | 4Q14 | 4Q13 |

| Income statement for the period | 12/31/2014 | 12/31/2013 |

| Sales, general and administrative expenses | (1,203) | (1,206) |

| Other operating income (expenses), net | - | (6,981) |

| Financial revenue | 23 | 221 |

| Financial expenses | (6,669) | (4,322) |

| Foreign exchange variation | 13,257 | 3,997 |

| Derivative | 5,813 | (2,164) |

| Equity pick up | (40,314) | 143,165 |

| Net Income (loss) | (29,092) | 132,709 |

| | | |

| Cosan Limited (Parent company) | 4Q14 | 3Q14 |

| Balance sheet | 12/31/2014 | 09/30/2014 |

| Cash and cash equivalents | 22,661 | 24,123 |

| Other current assets | 19,658 | 22,569 |

| Investments | 6,132,772 | 6,223,146 |

| Other non-current assets | 10,220 | - |

| Total Assets | 6,185,311 | 6,269,837 |

| | | |

| Loans and financing | (320,329) | (303,619) |

| Other current liabilities | (12,712) | (18,778) |

| Other non-current liabilities | (7,721) | - |

| Net Equity | (5,844,549) | (5,947,438) |

| Total Liabilities | (6,185,311) | (6,269,837) |

| Cosan Limited-Earnings Release 4th Quarter of Fiscal Year 2014 |

F.4 Cosan Limited

| Cosan Limited | 4Q14 | 4Q13 |

| Income statement for the period | 12/31/2014 | 12/31/2013 |

| Net Operating Revenue | 2,296,912 | 2,217,765 |

| Gross Profit | 618,537 | 652,361 |

| Sales, general and administrative expenses | (415,746) | (369,130) |

| Other operating income (expenses), net | 82,178 | 68,576 |

| Financial revenue | 42,935 | 73,574 |

| Financial expenses | (290,008) | (317,024) |

| Foreign exchange variation | (196,910) | (101,704) |

| Derivative | 110,139 | 90,768 |

| Equity pick up | 130,040 | 89,856 |

| Income and Social Contribution Taxes | (17,945) | 155,650 |

| Equity attributable to non-controlling interests | (92,312) | (210,218) |

| Net Income from discontinued operations | - | (0) |

| Net Income (loss) | (29,092) | 132,709 |

| | | |

| Cosan Limited | 4Q14 | 3Q14 |

| Balance sheet | 12/31/2014 | 09/30/2014 |

| Cash and cash equivalents | 1,649,340 | 1,330,619 |

| Securities | 149,735 | 202,352 |

| Accounts receivable | 865,109 | 872,473 |

| Inventories | 353,720 | 327,367 |

| Other current assets | 547,202 | 1,089,081 |

| Investments | 8,535,180 | 8,687,859 |

| Investment property | 2,641,978 | 2,167,221 |

| Property, plant and equipment | 1,435,890 | 1,360,812 |

| Intangible | 10,286,373 | 10,233,226 |

| Other non-current assets | 3,231,821 | 3,048,084 |

| Total Assets | 29,696,348 | 29,319,095 |

| | | |

| Loans and financing | (8,502,640) | (7,644,098) |

| Suppliers | (1,112,459) | (996,693) |

| Salaries payable | (120,416) | (115,751) |

| Other current liabilities | (681,714) | (496,504) |

| Other non-current liabilities | (5,789,814) | (6,436,853) |

| Net Equity | (13,489,303) | (13,629,198) |

| Total Liabilities | (29,696,348) | (29,319,095) |

| Cosan Limited-Earnings Release 4th Quarter of Fiscal Year 2014 |

F.5 Consolidated, including Raízen

| Cosan Limited Proforma | 4Q14 | 4Q13 |

| Income Statement for the period | 12/31/2014 | 12/31/2013 |

| Net Operating Revenue | 10,525,966 | 9,389,991 |

| Gross Profit | 1,199,897 | 1,156,548 |

| Sales, general and administrative expenses | (720,024) | (708,341) |

| Other operating income (expenses), net | 108,430 | 129,318 |

| Financial revenue | 160,382 | 114,413 |

| Financial expenses | (452,701) | (390,821) |

| Foreign exchange variation | (335,818) | (197,189) |

| Derivative | 119,935 | 76,986 |

| Equity pick up | (6,240) | 5,446 |

| Income and Social Contribution Taxes | (4,833) | 158,768 |

| Equity attributable to non-controlling interests | (98,120) | (212,419) |

| Net Income from discontinued operations | (0) | 0 |

| Net Income (loss) | (29,092) | 132,709 |

| | | |

| Cosan Limited Proforma | 4Q14 | 3Q14 |

| Balance Sheet | 12/31/2014 | 09/30/2014 |

| Cash and cash equivalents | 3,058,050 | 2,209,986 |

| Securities | 149,735 | 202,352 |

| Accounts receivable | 2,007,869 | 1,888,490 |

| Inventories | 2,076,059 | 2,137,958 |

| Other current assets | 1,246,121 | 1,823,292 |

| Investments | 338,800 | 330,152 |

| Investment property | 2,641,978 | 2,167,221 |

| Biological assets | 914,152 | 914,414 |

| Property, plant and equipment | 7,584,036 | 7,515,186 |

| Intangible | 14,064,484 | 14,027,265 |

| Other non-current assets | 4,825,854 | 4,288,228 |

| Total Assets | 38,907,140 | 37,504,545 |

| | | |

| Loans and Financing | (14,470,324) | (12,895,998) |

| Suppliers | (1,695,764) | (1,561,504) |

| Salaries Payable | (279,925) | (308,224) |

| Other current liabilities | (1,369,292) | (881,747) |

| Other non-current liabilities | (7,531,602) | (8,162,749) |

| Net Equity | (13,560,232) | (13,694,323) |

| Total Liabilities | (38,907,140) | (37,504,545) |

19 of 19

Item 2

| | Cosan Limited

Consolidated financial statements at December 31, 2014 and report of independent registered public accounting firm |

Cosan Limited

Consolidated financial statements

December 31, 2014

Contents

| Report of independent registered public accounting firm | 3 |

| | |

| Consolidated statement of financial position | 5 |

| | |

Consolidated statement of profit or loss and other comprehensive income | 7 |

| | |

| Statement of changes in shareholders’ equity | 9 |

| | |

| Consolidated statement of cash flows | 12 |

| | |

| Notes to the consolidated financial statements | 14 |

Report of Independent Registered Public Accounting Firm

To the Board of Directors and Shareholders

Cosan Limited

In our opinion, the accompanying consolidated statement of financial position and the related consolidated statements of profit or loss and other comprehensive income, of changes in shareholders’ equity and of cash flows present fairly, in all material respects, the financial position of Cosan Limited and its subsidiaries at December 31, 2014 and 2013, and the results of their operations and their cash flows for the year ended December 31, 2014, nine month-period ended December 31, 2013 and for the year ended March 31, 2013 in conformity with International Financial Reporting Standards as issued by the International Accounting Standards Board. Also in our opinion, the Company maintained, in all material respects, effective internal control over financial reporting as of December 31, 2014, based on criteria established in Internal Control - Integrated Framework 2013 issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO). The Company's management is responsible for these financial statements, for maintaining effective internal control over financial reporting and for its assessment of the effectiveness of internal control over financial reporting, included in “Management’s report on internal control over financial reporting”. Our responsibility is to express opinions on these financial statements and on the Company's internal control over financial reporting based on our integrated audits. We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement and whether effective internal control over financial reporting was maintained in all material respects. Our audits of the financial statements included examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our audit of internal control over financial reporting included obtaining an understanding of internal control over financial reporting, assessing the risk that a material weakness exists, and testing and evaluating the design and operating effectiveness of internal control based on the assessed risk. Our audits also included performing such other procedures as we considered necessary in the circumstances. We believe that our audits provide a reasonable basis for our opinions.

A company’s internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. A company’s internal control over financial reporting includes those policies and procedures that (i) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (ii) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and (iii) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company’s assets that could have a material effect on the financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Campinas, Brazil

March 18, 2015

/s/ PricewaterhouseCoopers

PricewaterhouseCoopers

Auditores Independentes

Cosan Limited

Consolidated statement of financial position

(In thousands of Brazilian Reais - R$)

| | | Note | | | December 31, 2014 | | | December 31, 2013 | |

| Assets | | | | | | | | | |

| Cash and cash equivalents | | | 6 | | | | 1,649,340 | | | | 1,509,565 | |

| Investment securities | | | | | | | 149,735 | | | | 87,978 | |

| Trade receivables | | | 7 | | | | 865,109 | | | | 844,483 | |

| Derivative financial instruments | | | 31 | | | | 30,069 | | | | - | |

| Inventories | | | 8 | | | | 353,720 | | | | 311,980 | |

| Receivables from related parties | | | 11 | | | | 38,357 | | | | 46,788 | |

| Income tax receivable | | | | | | | 94,100 | | | | 56,340 | |

| Other current tax receivable | | | 9 | | | | 78,818 | | | | 85,433 | |

| Other financial assets | | | 10 | | | | 69,683 | | | | 63,054 | |

| Dividends receivable | | | | | | | 36,130 | | | | 26,350 | |

| Other | | | | | | | 174,957 | | | | 217,927 | |

| | | | | | | | 3,540,018 | | | | 3,249,898 | |

| | | | | | | | | | | | | |

| Assets held for sale | | | 14 | | | | 25,089 | | | | 314,104 | |

| | | | | | | | | | | | | |

| Total current assets | | | | | | | 3,565,107 | | | | 3,564,002 | |

| | | | | | | | | | | | | |

| Trade receivables | | | 7 | | | | 480,992 | | | | 238,460 | |

| Deferred tax assets | | | 20 | | | | 214,164 | | | | 232,188 | |

| Receivables from related parties | | | 11 | | | | 212,527 | | | | 504,481 | |

| Income tax receivable | | | | | | | 8,778 | | | | 49,268 | |

| Taxes recoverable | | | 9 | | | | 17,299 | | | | 18,366 | |

| Judicial deposits | | | 21 | | | | 418,385 | | | | 361,554 | |

| Other financial assets | | | 10 | | | | 370,497 | | | | 407,107 | |

| Derivative financial instruments | | | 31 | | | | 860,509 | | | | 513,934 | |

| Other non-current assets | | | | | | | 648,669 | | | | 493,340 | |

| Investment in associates | | | 12 | | | | 130,677 | | | | 103,316 | |

| Investment in joint ventures | | | 13 | | | | 8,404,503 | | | | 8,498,259 | |

| Investment properties | | | 14 | | | | 2,641,978 | | | | 2,281,509 | |

| Property, plant and equipment | | | 15 | | | | 1,435,890 | | | | 1,271,910 | |

| Intangible assets and goodwill | | | 16 | | | | 10,286,373 | | | | 10,078,040 | |

| | | | | | | | | | | | | |

| Total non-current assets | | | | | | | 26,131,241 | | | | 25,051,732 | |

| | | | | | | | | | | | | |

| Total assets | | | | | | | 29,696,348 | | | | 28,615,734 | |

Cosan Limited

Consolidated statement of financial position

(In thousands of Brazilian Reais - R$)

| | | Note | | | December 31, 2014 | | | December 31, 2013 | |

| Liabilities | | | | | | | | | |

| Loans and borrowings | | | 17 | | | | 1,056,353 | | | | 1,050,862 | |

| Derivative financial instruments | | | 31 | | | | 13,803 | | | | 50,879 | |

| Trade payables | | | 18 | | | | 1,112,459 | | | | 862,429 | |

| Employee benefits payable | | | | | | | 120,416 | | | | 103,296 | |

| Income tax payable | | | | | | | 30,905 | | | | 28,143 | |

| Other taxes payable | | | 19 | | | | 307,741 | | | | 199,056 | |

| Dividends payable | | | | | | | 33,354 | | | | 92,759 | |

| Payables to related parties | | | 11 | | | | 137,441 | | | | 105,463 | |

| Other | | | | | | | 158,471 | | | | 157,806 | |

| | | | | | | | | | | | | |

| Total current liabilities | | | | | | | 2,970,943 | | | | 2,650,693 | |

| | | | | | | | | | | | | |

| Loans and borrowings | | | 17 | | | | 7,446,287 | | | | 8,042,094 | |

| Derivative financial instruments | | | 31 | | | | 319,632 | | | | 280,462 | |

| Other taxes payable | | | 19 | | | | 334,565 | | | | 1,010,767 | |

| Provision for legal proceedings | | | 21 | | | | 657,779 | | | | 722,458 | |

| Pension and post-employment benefits | | | 33 | | | | 301,850 | | | | 339,135 | |

| Deferred tax liabilities | | | 20 | | | | 1,739,274 | | | | 1,698,622 | |

| Preferred shareholders payable in subsidiaries | | | 22 | | | | 1,926,888 | | | | - | |

| Other | | | | | | | 509,823 | | | | 551,739 | |

| | | | | | | | | | | | | |

| Total non-current liabilities | | | | | | | 13,236,098 | | | | 12,645,277 | |

| | | | | | | | | | | | | |

| Total liabilities | | | | | | | 16,207,041 | | | | 15,295,970 | |

| | | | | | | | | | | | | |

| Shareholders' equity | | | | | | | | | | | | |

| Share capital | | | | | | | 5,328 | | | | 5,328 | |

| Additional paid in capital | | | | | | | 3,887,109 | | | | 3,828,858 | |

| Other comprehensive loss | | | | | | | (165,618 | ) | | | (84,887 | ) |

| Retained earnings | | | | | | | 2,117,739 | | | | 2,136,975 | |

| Equity attributable to owners of the parent | | | | | | | 5,844,558 | | | | 5,886,274 | |

| Non-controlling interests | | | 12 | | | | 7,644,749 | | | | 7,433,490 | |

| | | | | | | | | | | | | |

| Total shareholders' equity | | | | | | | 13,489,307 | | | | 13,319,764 | |

| | | | | | | | | | | | | |

| Total shareholders' equity and liabilities | | | | | | | 29,696,348 | | | | 28,615,734 | |

The accompanying notes are an integral part of these consolidated financial statements.

Cosan Limited

Consolidated statement of profit or loss and other comprehensive income

(In thousands of Brazilian Reais – R$, except earnings per share)

| | | Note | | | Twelve months ended December 31, 2014 | | | Nine months ended December 31, 2013 | | | Twelve months ended March 31, 2013 | |

| Net sales | | | 26 | | | | 9,062,304 | | | | 6,878,214 | | | | 4,586,209 | |

| Cost of sales | | | 27 | | | | (6,413,720 | ) | | | (4,878,229 | ) | | | (3,211,309 | ) |

| | | | | | | | | | | | | | | | | |

| Gross profit | | | | | | | 2,648,584 | | | | 1,999,985 | | | | 1,374,900 | |

| | | | | | | | | | | | | | | | | |

| Selling expenses | | | 27 | | | | (881,543 | ) | | | (603,965 | ) | | | (459,433 | ) |

| General and administrative expenses | | | 27 | | | | (668,613 | ) | | | (466,933 | ) | | | (419,533 | ) |

| Other income (expense), net | | | 29 | | | | (21,240 | ) | | | 76,272 | | | | 173,739 | |

| | | | | | | | | | | | | | | | | |

| Operating expense | | | | | | | (1,571,396 | ) | | | (994,626 | ) | | | (705,227 | ) |

| | | | | | | | | | | | | | | | | |

| Income before financial results, | | | | | | | | | | | | | | | | |

| equity in earnings in and income taxes | | | | | | | 1,077,188 | | | | 1,005,359 | | | | 669,673 | |

| | | | | | | | | | | | | | | | | |

| Equity in earnings of investees | | | | | | | | | | | | | | | | |

| Equity in earnings of associates | | | 12 | | | | 3,540 | | | | 5,497 | | | | 70,414 | |

| Equity in earnings of joint ventures | | | 13 | | | | 588,428 | | | | 242,036 | | | | 603,912 | |

| | | | | | | | 591,968 | | | | 247,533 | | | | 674,326 | |

| Financial results | | | 28 | | | | | | | | | | | | | |

| Finance expense | | | | | | | (1,060,802 | ) | | | (804,606 | ) | | | (578,005 | ) |

| Finance income | | | | | | | 217,112 | | | | 179,904 | | | | 163,663 | |

| Foreign exchange losses, net | | | | | | | (300,521 | ) | | | (324,495 | ) | | | (83,254 | ) |

| Derivatives | | | | | | | 161,363 | | | | 235,485 | | | | 74,483 | |

| | | | | | | | (982,848 | ) | | | (713,712 | ) | | | (423,113 | ) |

| | | | | | | | | | | | | | | | | |

| Profit before taxes | | | | | | | 686,308 | | | | 539,180 | | | | 920,886 | |

| | | | | | | | | | | | | | | | | |

| Income tax (expense) benefit | | | 20 | | | | | | | | | | | | | |

| Current | | | | | | | (156,502 | ) | | | (129,976 | ) | | | (100,049 | ) |

| Deferred | | | | | | | 112,673 | | | | 90,782 | | | | (26,304 | ) |

| | | | | | | | (43,829 | ) | | | (39,194 | ) | | | (126,353 | ) |

| | | | | | | | | | | | | | | | | |

Cosan Limited

Consolidated statement of profit or loss and other comprehensive income

(In thousands of Brazilian Reais – R$, except earnings per share)

| Profit from continuing operations | | | | | | | 642,479 | | | | 499,986 | | | | 794,533 | |

| Profit from discontinued operations, net of tax | | | | | | | - | | | | - | | | | 138,918 | |

| | | | | | | | | | | | | | | | | |

| Profit for the period | | | | | | | 642,479 | | | | 499,986 | | | | 933,451 | |

| | | | | | | | | | | | | | | | | |

| Other comprehensive income | | | | | | | | | | | | | | | | |

| Items that will not be reclassified to profit or loss: | | | | | | | | | | | | | | | | |

| Actuarial gain (loss) on defined benefit plan | | | | | | | 46,988 | | | | 42,438 | | | | (52,253 | ) |

| Taxes on items that will not | | | | | | | | | | | | | | | | |

| be reclassified to profit or loss | | | | | | | (15,976 | ) | | | (14,429 | ) | | | 17,766 | |

| | | | | | | | 31,012 | | | | 28,009 | | | | (34,487 | ) |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Items that may be reclassified to profit or loss: | | | | | | | | | | | | | | | | |

| Foreign currency translation effect | | | | | | | (75,408 | ) | | | (42,891 | ) | | | 2,583 | |

| Gain (loss) on cash flow hedge in joint ventures and | | | | | | | | | | | | | | | | |

| subsidiary | | | | | | | (53,958 | ) | | | (6,426 | ) | | | 35,695 | |

| Revaluation of investment properties | | | | | | | - | | | | - | | | | 83,318 | |

| Changes in fair value of | | | | | | | | | | | | | | | | |

| available for sale securities | | | | | | | 9,110 | | | | 13,753 | | | | 10,806 | |

| Taxes on items that may be | | | | | | | | | | | | | | | | |

| reclassified to profit or loss | | | | | | | (3,097 | ) | | | (4,676 | ) | | | 103,743 | |

| | | | | | | | (123,353 | ) | | | (40,240 | ) | | | 236,145 | |

| | | | | | | | | | | | | | | | | |

| Total other comprehensive income (loss), net of tax | | | | | | | (92,341 | ) | | | (12,231 | ) | | | 201,658 | |

| | | | | | | | | | | | | | | | | |

| Total comprehensive income | | | | | | | 550,138 | | | | 487,755 | | | | 1,135,109 | |

| | | | | | | | | | | | | | | | | |

| Net income attributable to: | | | | | | | | | | | | | | | | |

| Owners of the Parent (including | | | | | | | | | | | | | | | | |

| discontinued operations) | | | | | | | 171,006 | | | | 122,618 | | | | 424,070 | |

| Non-controlling interests | | | | | | | 471,473 | | | | 377,368 | | | | 509,381 | |

| | | | | | | | | | | | | | | | | |

| Total comprehensive income attributable to: | | | | | | | | | | | | | | | | |

| Owners of the Parent | | | | | | | 90,275 | | | | 96,639 | | | | 541,662 | |

| Non-controlling interests | | | | | | | 459,863 | | | | 391,116 | | | | 593,447 | |

| | | | | | | | | | | | | | | | | |

| Basic earnings per share | | | 24 | | | | | | | | | | | | | |

| Continuing operations | | | | | | R$ | 0.65 | | | R$ | 0.46 | | | R$ | 1.27 | |

| Discontinued operations | | | | | | | - | | | | - | | | R$ | 0.33 | |

| | | | | | | R$ | 0.65 | | | R$ | 0.46 | | | R$ | 1.60 | |

| Diluted earnings per share | | | 24 | | | | | | | | | | | | | |

| Continuing operations (as revised - Note 24) | | | | | | R$ | 0.58 | | | R$ | 0.40 | | | R$ | 1.21 | |

| Discontinued operations | | | | | | | - | | | | - | | | R$ | 0.33 | |

| | | | | | | R$ | 0.58 | | | R$ | 0.40 | | | R$ | 1.54 | |

| | | | | | | | | | | | | | | | | |

| The accompanying notes are an integral part of these consolidated financial statements. | |

Cosan Limited

Statement of changes in shareholders’ equity

(In thousands of Brazilian Reais - R$)

| | | | | | Capital reserve | | | | | | | | | | | | | | | | |

| | | | | | Additional | | | Other | | | | | | Equity attributable | | | Non- | | | | |

| | | Share | | | paid in | | | comprehensive | | | Retained | | | to owners | | | controlling | | | Total | |

| | | capital | | | capital | | | income | | | earnings | | | of the parent | | | interests | | | equity | |

| At April 1, 2012 | | | 5,328 | | | | 3,811,808 | | | | (176,500 | ) | | | 1,923,638 | | | | 5,564,274 | | | | 3,862,281 | | | | 9,426,555 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Profit for the year | | | - | | | | - | | | | - | | | | 424,070 | | | | 424,070 | | | | 509,381 | | | | 933,451 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Other comprehensive income | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Foreign currency translation effects | | | - | | | | - | | | | (3,381 | ) | | | - | | | | (3,381 | ) | | | 5,964 | | | | 2,583 | |

Gain on cash flow hedge in joint ventures | | | - | | | | - | | | | 22,239 | | | | - | | | | 22,239 | | | | 13,456 | | | | 35,695 | |

| Revaluation of investment property | | | - | | | | - | | | | 118,832 | | | | - | | | | 118,832 | | | | 71,903 | | | | 190,735 | |

| Actuarial loss on defined benefit plan | | | - | | | | - | | | | (21,486 | ) | | | - | | | | (21,486 | ) | | | (13,001 | ) | | | (34,487 | ) |

| Changes in fair value of | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| available for sale Securities | | | - | | | | - | | | | 1,388 | | | | - | | | | 1,388 | | | | 5,744 | | | | 7,132 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total comprehensive income for the year | | | - | | | | - | | | | 117,592 | | | | 424,070 | | | | 541,662 | | | | 593,447 | | | | 1,135,109 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Contributions by and distributions to | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| owners of the Parent | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Share options exercised - Subsidiaries | | | - | | | | 10,444 | | | | - | | | | - | | | | 10,444 | | | | 6,320 | | | | 16,764 | |

| Dividends - non-controlling interests | | | - | | | | (1,295 | ) | | | - | | | | - | | | | (1,295 | ) | | | 1,316 | | | | 21 | |

| Share based compensation - Subsidiaries | | | - | | | | 8,284 | | | | - | | | | - | | | | 8,284 | | | | 5,012 | | | | 13,296 | |

| Dividends | | | - | | | | - | | | | - | | | | (153,657 | ) | | | (153,657 | ) | | | (315,259 | ) | | | (468,916 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total contributions by and distributions to | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| owners of the Parent | | | - | | | | 17,433 | | | | - | | | | (153,657 | ) | | | (136,224 | ) | | | (302,611 | ) | | | (438,835 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Transactions with owners of the Parent | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Corporate reorganization - Raízen Group | | | - | | | | 31,693 | | | | - | | | | - | | | | 31,693 | | | | 19,173 | | | | 50,866 | |

| Acquisition of treasury shares | | | - | | | | (17,250 | ) | | | - | | | | - | | | | (17,250 | ) | | | - | | | | (17,250 | ) |

| Acquisition of non-controlling interest | | | - | | | | (2,859 | ) | | | - | | | | - | | | | (2,859 | ) | | | (79,641 | ) | | | (82,500 | ) |

| Business combination COMGÁS | | | - | | | | 15,754 | | | | - | | | | - | | | | 15,754 | | | | 1,863,331 | | | | 1,879,085 | |

| Business combination Radar | | | - | | | | 270 | | | | - | | | | - | | | | 270 | | | | 1,285,593 | | | | 1,285,863 | |

| Business combination Logispot | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| non-controlling interest | | | - | | | | - | | | | - | | | | - | | | | - | | | | (32,872 | ) | | | (32,872 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total transactions with owners of the Parent | | | - | | | | 27,608 | | | | - | | | | - | | | | 27,608 | | | | 3,055,584 | | | | 3,083,192 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| At March 31, 2013 | | | 5,328 | | | | 3,856,849 | | | | (58,908 | ) | | | 2,194,051 | | | | 5,997,320 | | | | 7,208,701 | | | | 13,206,021 | |

Cosan Limited

Statement of changes in shareholders’ equity

(In thousands of Brazilian Reais - R$)

| | | | | | Capital reserve | | | | | | | | | | | | | | | | |

| | | | | | Additional | | | Other | | | | | | Equity attributable | | | Non- | | | | |

| | | Share | | | paid in | | | comprehensive | | | Retained | | | to owners | | | controlling | | | Total | |

| | | capital | | | capital | | | income | | | earnings | | | of the parent | | | interests | | | equity | |

| At April 1, 2013 | | | 5,328 | | | | 3,856,849 | | | | (58,908 | ) | | | 2,194,051 | | | | 5,997,320 | | | | 7,208,701 | | | | 13,206,021 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Profit for the nine-month period | | | - | | | | - | | | | - | | | | 122,618 | | | | 122,618 | | | | 377,368 | | | | 499,986 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Other comprehensive income | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Foreign currency translation effects | | | - | | | | - | | | | (34,984 | ) | | | - | | | | (34,984 | ) | | | (7,907 | ) | | | (42,891 | ) |

| Loss on cash flow hedge in joint ventures | | | - | | | | - | | | | (4,004 | ) | | | - | | | | (4,004 | ) | | | (2,422 | ) | | | (6,426 | ) |

| Actuarial gain on defined benefit plan | | | - | | | | - | | | | 11,334 | | | | - | | | | 11,334 | | | | 16,675 | | | | 28,009 | |

| Changes in fair value of | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| available for sale Securities | | | - | | | | - | | | | 1,675 | | | | - | | | | 1,675 | | | | 7,402 | | | | 9,077 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total comprehensive income for the nine months | | | - | | | | - | | | | (25,979 | ) | | | 122,618 | | | | 96,639 | | | | 391,116 | | | | 487,755 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Contributions by and distributions to | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| owners of the Parent | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Share options exercised - Subsidiaries | | | - | | | | 10,120 | | | | - | | | | - | | | | 10,120 | | | | 6,123 | | | | 16,243 | |

| Dividends - non-controlling interests | | | - | | | | 889 | | | | - | | | | - | | | | 889 | | | | (589 | ) | | | 300 | |

| Share based compensation - Subsidiaries | | | - | | | | 4,109 | | | | - | | | | - | | | | 4,109 | | | | 2,486 | | | | 6,595 | |

| Dividends | | | - | | | | - | | | | - | | | | (179,694 | ) | | | (179,694 | ) | | | (148,586 | ) | | | (328,280 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total contributions by and distributions to | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| owners of the Parent | | | - | | | | 15,118 | | | | - | | | | (179,694 | ) | | | (164,576 | ) | | | (140,566 | ) | | | (305,142 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Transactions with owners of the Parent | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Acquisition of treasury shares | | | - | | | | (43,412 | ) | | | - | | | | - | | | | (43,412 | ) | | | (26,268 | ) | | | (69,680 | ) |

| Unclaimed dividends | | | - | | | | 303 | | | | - | | | | - | | | | 303 | | | | 507 | | | | 810 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total transactions with owners of the Parent | | | - | | | | (43,109 | ) | | | - | | | | - | | | | (43,109 | ) | | | (25,761 | ) | | | (68,870 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| At December 31, 2013 | | | 5,328 | | | | 3,828,858 | | | | (84,887 | ) | | | 2,136,975 | | | | 5,886,274 | | | | 7,433,490 | | | | 13,319,764 | |

Cosan Limited

Statement of changes in shareholders’ equity

(In thousands of Brazilian Reais - R$)

| | | | | | Capital reserve | | | | | | | | | | | | | | | | |

| | | | | | Additional | | | Other | | | | | | Equity attributable | | | Non- | | | | |

| | | Share | | | paid in | | | comprehensive | | | Retained | | | to owners | | | controlling | | | Total | |

| | | capital | | | capital | | | income | | | earnings | | | of the parent | | | interests | | | equity | |

| At January 1, 2014 | | | 5,328 | | | | 3,828,858 | | | | (84,887 | ) | | | 2,136,975 | | | | 5,886,274 | | | | 7,433,490 | | | | 13,319,764 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Profit for the year | | | - | | | | - | | | | - | | | | 171,006 | | | | 171,006 | | | | 471,473 | | | | 642,479 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Other comprehensive income | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Foreign currency translation effects | | | - | | | | - | | | | (66,653 | ) | | | - | | | | (66,653 | ) | | | (8,755 | ) | | | (75,408 | ) |

| Loss on cash flow hedge in joint ventures and subsidiary | | | - | | | | - | | | | (33,687 | ) | | | - | | | | (33,687 | ) | | | (20,271 | ) | | | (53,958 | ) |

| Actuarial gain on defined benefit plan | | | - | | | | - | | | | 18,285 | | | | - | | | | 18,285 | | | | 12,727 | | | | 31,012 | |

| Changes in fair value of | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| available for sale Securities | | | - | | | | - | | | | 1,324 | | | | - | | | | 1,324 | | | | 4,689 | | | | 6,013 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total comprehensive income for the year | | | - | | | | - | | | | (80,731 | ) | | | 171,006 | | | | 90,275 | | | | 459,863 | | | | 550,138 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Contributions by and distributions to | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| owners of the Parent | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Share options exercised - Subsidiaries | | | - | | | | 28,436 | | | | - | | | | - | | | | 28,436 | | | | 17,111 | | | | 45,547 | |

| Dividends - non-controlling interests | | | - | | | | 3,411 | | | | - | | | | - | | | | 3,411 | | | | 857 | | | | 4,268 | |

| Share based compensation - Subsidiaries | | | - | | | | 8,073 | | | | - | | | | - | | | | 8,073 | | | | 4,851 | | | | 12,924 | |

| Dividends | | | - | | | | - | | | | - | | | | (190,242 | ) | | | (190,242 | ) | | | (255,293 | ) | | | (445,535 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total contributions by and distributions to | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| owners of the Parent | | | - | | | | 39,920 | | | | - | | | | (190,242 | ) | | | (150,322 | ) | | | (232,474 | ) | | | (382,796 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Transactions with owners of the Parent | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Acquisition of non-controlling interest | | | - | | | | 18,331 | | | | - | | | | - | | | | 18,331 | | | | (16,130 | ) | | | 2,201 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total transactions with owners of the Parent | | | - | | | | 18,331 | | | | - | | | | - | | | | 18,331 | | | | (16,130 | ) | | | 2,201 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| At December 31, 2014 | | | 5,328 | | | | 3,887,109 | | | | (165,618 | ) | | | 2,117,739 | | | | 5,844,559 | | | | 7,644,749 | | | | 13,489,307 | |

The accompanying notes are an integral part of these consolidated financial statements.

Cosan Limited

Consolidated statement of cash flows

(In thousands of Brazilian Reais - R$)

| | | Note | | | Twelve months ended December 31, 2014 | | | Nine months ended December 31, 2013 | | | Twelve months ended March 31, 2013 | |

| Cash flows from operating activities | | | | | | | | | | | | |

| Profit before taxes | | | | | | 686,308 | | | | 539,180 | | | | 920,886 | |

| Adjustments for: | | | | | | | | | | | | | | | |

| Depreciation and amortization | | | 15 / 16 | | | | 679,101 | | | | 439,144 | | | | 334,786 | |

| Equity in earnings of associates | | | 12 | | | | (3,540 | ) | | | (5,497 | ) | | | (70,414 | ) |

| Equity in earnings of joint ventures | | | 13 | | | | (588,428 | ) | | | (242,036 | ) | | | (603,912 | ) |

| (Gain) loss on disposal of assets | | | | | | | 9,958 | | | | 6,922 | | | | (100,349 | ) |

| Share-based compensation expense | | | 11 / 34 | | | | 12,924 | | | | 6,595 | | | | 13,295 | |

| Change in fair value of investment property | | | 14 / 29 | | | | (131,697 | ) | | | (121,543 | ) | | | (138,776 | ) |

| Provisions for legal proceedings | | | | | | | 51,347 | | | | 80,944 | | | | 49,334 | |

| Indexation charges, interest and | | | | | | | | | | | | | | | | |

| exchange gains/losses, net | | | | | | | 1,086,158 | | | | 825,774 | | | | 438,361 | |

| Other | | | | | | | 42,557 | | | | 40,167 | | | | 67,440 | |

| | | | | | | | 1,844,688 | | | | 1,569,650 | | | | 910,651 | |

| Changes in: | | | | | | | | | | | | | | | | |

| Restricted cash | | | | | | | - | | | | 18,220 | | | | - | |

| Cash from discontinued operations | | | | | | | - | | | | - | | | | 116,387 | |

| Trade receivables | | | | | | | (268,813 | ) | | | (254,236 | ) | | | (62,414 | ) |

| Securities | | | | | | | (98,714 | ) | | | - | | | | (14,276 | ) |

| Inventories | | | | | | | (40,321 | ) | | | (28,324 | ) | | | (33,355 | ) |

| Recoverable taxes | | | | | | | 51,013 | | | | (13,167 | ) | | | (28,488 | ) |

| Related parties | | | | | | | (112,251 | ) | | | (8,519 | ) | | | (104,078 | ) |

| Advances to suppliers | | | | | | | 1,544 | | | | 4,954 | | | | 15,269 | |

| Trade payables | | | | | | | 241,827 | | | | 55,728 | | | | (5,280 | ) |

| Employee benefits | | | | | | | (58,098 | ) | | | (14,216 | ) | | | (55,194 | ) |

| Provisions for legal proceedings | | | | | | | (50,136 | ) | | | (107,484 | ) | | | (9,212 | ) |

| Income and other taxes | | | | | | | (458,979 | ) | | | (156,476 | ) | | | (313,702 | ) |

| Other | | | | | | | 65,390 | | | | 82,340 | | | | (133,193 | ) |

| | | | | | | | (727,538 | ) | | | (421,180 | ) | | | (627,536 | ) |

| | | | | | | | | | | | | | | | | |

| Net cash generated by operating activities | | | | | | | 1,117,150 | | | | 1,148,470 | | | | 283,115 | |

| | | | | | | | | | | | | | | | | |

| Cash flows from investing activities | | | | | | | | | | | | | | | | |

| Acquisitions in associates, net of cash acquired | | | | | | | - | | | | - | | | | (2,995,499 | ) |

| Capital contribution in associates | | | | | | | (46,259 | ) | | | (79,594 | ) | | | (61,014 | ) |

| Dividends received from associates | | | | | | | 3,118 | | | | 3,684 | | | | - | |

| Dividends received from joint ventures | | | | | | | 705,072 | | | | 406,424 | | | | 578,757 | |

| Acquisition of property, plant and | | | | | | | | | | | | | | | | |

| equipment and intangible assets | | | 15 / 16 | | | | (1,063,412 | ) | | | (976,119 | ) | | | (649,681 | ) |

| Proceeds from sale of property, plant | | | | | | | | | | | | | | | | |

| and equipment, intangibles and investments | | | | | | | 1,196 | | | | 65,350 | | | | 220,719 | |

| Proceeds from sale of discontinued operation | | | 30 | | | | 68,633 | | | | 57,175 | | | | 196,546 | |

| Net cash used by discontinued operation | | | | | | | - | | | | - | | | | (411 | ) |

| | | | | | | | | | | | | | | | | |

| Net cash used in investing activities | | | | | | | (331,652 | ) | | | (523,080 | ) | | | (2,710,583 | ) |

Cosan Limited

Consolidated statement of cash flows

(In thousands of Brazilian Reais - R$)

| Cash flows from financing activities | | | | | | | | | | | | | | | | |

| Loans and borrowings raised | | | | | | | 1,720,385 | | | | 1,072,339 | | | | 6,197,855 | |

| Payment of principal and interest on | | | | | | | | | | | | | | | | |

| loans and borrowings | | | | | | | (3,631,292 | ) | | | (1,460,470 | ) | | | (2,787,121 | ) |

| Related parties | | | | | | | (1,643 | ) | | | - | | | | - | |

| Acquisition of non-controlling interest | | | | | | | - | | | | - | | | | (82,500 | ) |

| Derivative financial instruments | | | | | | | (84,951 | ) | | | 82,621 | | | | - | |

| Share capital paid in preferred shares | | | 22 | | | | 1,946,736 | | | | - | | | | - | |

| Dividends paid | | | | | | | (630,233 | ) | | | (314,446 | ) | | | (396,462 | ) |

| Treasury shares | | | | | | | - | | | | (69,659 | ) | | | (17,250 | ) |

| Proceeds from exercise of share options | | | | | | | 45,547 | | | | 16,243 | | | | 16,764 | |

| | | | | | | | | | | | | | | | | |

| Net cash (used in) generated by financing activities | | | | | | | (635,451 | ) | | | (673,372 | ) | | | 2,931,286 | |

| | | | | | | | | | | | | | | | | |

| Increase (decrease) in cash and cash equivalents | | | | | | | 150,047 | | | | (47,982 | ) | | | 503,818 | |

| | | | | | | | | | | | | | | | | |

| Cash and cash equivalents at beginning of period | | | | | | | 1,509,565 | | | | 1,544,072 | | | | 1,036,217 | |

| Effects of exchange rate changes on cash held | | | | | | | (10,272 | ) | | | 13,475 | | | | 4,037 | |

| | | | | | | | | | | | | | | | | |

| Cash and cash equivalents at ended of period | | | | | | | 1,649,340 | | | | 1,509,565 | | | | 1,544,072 | |

| | | | | | | | | | | | | | | | | |

| Supplemental cash flow information | | | | | | | | | | | | | | | | |

| Interest paid | | | | | | | 725,309 | | | | 376,526 | | | | 166,068 | |

| Income taxes paid | | | | | | | 157,285 | | | | 129,539 | | | | 224,640 | |

| | | | | | | | | | | | | | | | | |

| Non-cash transactions | | | | | | | | | | | | | | | | |

| Offset of tax loss carryforwards - REFIS (Note 19) | | | | | | | 173,559 | | | | - | | | | - | |

| Offset of transaction with joint ventures - REFIS (Note 19) | | | | | | | 231,168 | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | |

| The accompanying notes are an integral part of these consolidated financial statements. | |

Cosan Limited

Notes to the consolidated financial statements

(Amounts in thousands of Brazilian Reais – R$, unless otherwise stated)

Cosan Limited (“Cosan”) was incorporated in Bermuda on April 30, 2007. Cosan’s class A common shares are traded on the New York Stock Exchange (NYSE) (ticker - CZZ). The BDRs (Brazilian Depositary Receipts) representing Cosan’s class A common shares are listed on the Brazilian Stock Exchange (BM&FBovespa) (ticker - CZLT33). Mr. Rubens Ometto Silveira Mello is the ultimate controlling shareholder of Cosan. Cosan controls its subsidiaries Cosan S.A. Indústria e Comércio (“Cosan S.A.”), Cosan Logística S.A. (“Cosan Log”) through a 62.51 % interest. Cosan, Cosan S.A., Cosan Log and its subsidiaries are collectively referred to as the “Company”.

The Company’s primary activities are in the following business segments: (i) Piped natural gas distribution to part of the State of São Paulo through its subsidiary Companhia de Gás de São Paulo – COMGÁS (“COMGÁS”), which has been consolidated since November 2012; (ii) Logistics services including transportation, port loading and storage of sugar, through its indirect subsidiary Rumo Logística Operadora Multimodal S.A. (“Rumo”); (iii) Purchase, sale and leasing of agricultural land through its subsidiary, Radar Propriedades Agrícolas S.A. ("Radar"); (iv) Production and distribution of lubricants under the Mobil licensed trademark in Brazil, Bolivia, Uruguay and Paraguay, in addition to the European and Asian market using the Comma brand and corporate activities; and (v) other investments, in addition to the corporate structures of the Company (“Cosan’s other business”).

The Company also holds interests in two joint ventures ("JVs"): (i) Raízen Combustíveis S.A. (“Raízen Combustíveis”), a fuel distribution business, and (ii) Raízen Energia S.A. (“Raízen Energia”), which operates in the production and marketing of sugar, ethanol and energy cogeneration, produced from sugar cane bagasse. Cosan and Royal Dutch Shell (“Shell”) share control of the two entities, where each owns 50% of the economic control. Up until the adoption of IFRS11 – Joint Arrangements (“IFRS 11”), these investments were accounted for using the proportional consolidation method. Upon the adoption of IFRS 11, during the nine months ended December 31, 2013, these investments have been accounted for under the equity method (all comparative periods was adjusted to conform to IFRS 11 presentation).

The Annual General Shareholders' Meeting held on July 31, 2013, approved a fiscal year end change from March 31st to December 31st. This was driven by changes in the Company’s investment portfolio, in which other businesses that do not use the harvest year (March 31) have become more significant. With this change, the Company’s fiscal year begins on January 1st, and ends on December 31st of each year. Accordingly, these consolidated financial statements are presented for the year ended December 31, 2014, the nine months ended December 31 (transition period) and for the year ended March 31, 2013.

On October 1, 2014 at the Extraordinary General Meeting (EGM), the Cosan S.A. shareholders’ approved the partial spin-off (the “Partial Spin-off”) of Cosan S.A. and merger of the spun-off portion into Cosan Log, composed of Cosan’s logistics operations. The Partial Spin-off seeks to segregate the Cosan S.A.’s activities in order to allow each business segment to focus on its sector, establishing suitable capital structures for each company. It also seeks to provide the market with greater transparency on each company’s performance, which will allow a better evaluation from shareholders and investors of the individual businesses permitting that resources be allocated accordance to the shareholder’s interests and investment strategy.

Cosan Limited

Notes to the consolidated financial statements

(Amounts in thousands of Brazilian Reais – R$, unless otherwise stated)

2.1 Statement of compliance

The consolidated financial statements have been prepared in accordance with International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board (IASB).

These consolidated financial statements were authorized for issue by the Board of Directors on March 6, 2015.

2.2 Basis of measurement

The consolidated financial statements have been prepared on the historical cost basis except for the following material items in the statement of financial position:

| | · | Derivative financial instruments are measured at fair value; |

| | · | Non-derivative financial instruments at fair value through profit or loss are measured at fair value; |

| | · | Available-for-sale financial assets are measured at fair value; |

| | · | Investment property is measured at fair value; and |

| | · | Employees’ defined benefit obligations are presented at the present value of the actuarial obligation net of the fair value of plan assets (Note 33). |

2.3 Functional and presentation currency

The consolidated financial statements are presented in Brazilian Reais. However, the functional currency of Cosan Limited is the U.S. Dollar (US$). The Brazilian Real is the functional currency of Cosan S.A., Cosan Log, its subsidiaries and joint ventures, located in Brazil, as it is the currency of the primary economic environment in which they operate, generate and expend cash. The functional currency for the subsidiaries located outside Brazil is U.S. Dollar or the Pound Sterling.

2.4 Use of estimates and judgments

The preparation of the consolidated financial statements in conformity with IFRS requires management to make judgments, estimates and assumptions that affect the application of accounting policies and the reported amounts of assets, liabilities, revenue and expenses at the end of the reporting period. Actual results may differ from these estimates.

Estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are recognized in the period in which the estimates are revised and in any future periods affected.

Information about critical judgments in applying accounting policies that have the most significant effect on the amounts recognized in the financial statements is included in the following notes:

| | · | Notes 15 and 16 – Property, plant and equipment and intangible assets |

The calculation of amortization and depreciation of intangible assets and property, plant and equipment is based on estimated useful lives. In addition, the determination of the fair value

Cosan Limited

Notes to the consolidated financial statements

(Amounts in thousands of Brazilian Reais – R$, unless otherwise stated)

of intangible assets and property, plant and equipment acquired in a business combination or arising from the formation of a JV is a significant estimate.

The Company performs annually a review of impairment indicators for intangible assets and property, plant and equipment. Also, an impairment test is undertaken for goodwill. Impairment exists when the carrying value of an asset or cash generating unit exceeds its recoverable amount, which is the higher of its fair value less costs to sell and its value in use. The key assumptions used to determine the recoverable amount of the different cash generating units to which goodwill is allocated are explained in Note 16.

COMGÁS has an agreement for the public concession of gas distribution service in accordance to which the Conceding Authority, at the end of the concession, will hold a significant portion of the infrastructure and controls what services must be rendered and what prices will be applied. This concession agreement represents the right to charge from customers for the supply of gas during the effective period of the agreement. Therefore, the Company recognizes this right as intangible assets.

The amortization of intangible assets reflects the pattern expected for the utilization of the future economic benefits by the Company, which corresponds to the useful lives of the assets comprising the infrastructure consonant to the ARSESP provisions, as disclosed in Note 16.

The amortization of the intangible assets is discontinued when the related asset is fully used or written-off, and no longer is included in the calculation basis of the tariff for the rendering of the concession services, whichever occurs first.

The Company may request only once the extension of the distribution services for another 20 years, being subject to evaluation by the Conceding Authority. When the concession is terminated, the assets linked to the rendering of gas distribution services will be returned to the Conceding Authority, and the Company will be entitled to receive an indemnity to be determined based on assessments and evaluations considering the book values to be calculated at the time

| | · | Note 20 – Income taxes and social contribution |

A deferred tax asset is recognized for loss carryforwards to the extent that it is probable that future taxable income will be generated to realize such losses. Significant judgment is required to determine the amount of deferred tax assets that can be recognized, based upon the timing and the level of future taxable income together with future tax planning strategies.