Filed Pursuant to Rule 424(B)(3)

Registration No. 333-143840

PROSPECTUS

TOUCHMARK BANCSHARES, INC.

(Formerly Touchstone Bancshares, Inc.)

A Proposed Bank Holding Company for

TOUCHMARK NATIONAL BANK

(in organization)

4,156,250 Shares of Common Stock

$10.00 per share

We are conducting this initial public offering of common stock of Touchmark Bancshares, Inc. to raise capital to fund the start-up of a new community bank, Touchmark National Bank, a national bank to be located in Duluth, Georgia. We received preliminary regulatory approval for the bank and expect to open the bank in the first quarter of 2008. Touchmark Bancshares will be the holding company and sole owner of the bank. The minimum purchase requirement for investors is 1,000 shares and the maximum purchase amount is 400,000 shares, although we may at our discretion accept subscriptions for more or less. This offering will terminate on March 31, 2008, subject to our right to terminate the offering earlier. This is our first offering of stock to the public, and there will be no established public market for our shares following the offering. Shares sold in this offering will not be listed on Nasdaq or any other national securities exchange. The common stock is a new issue of securities for which there is currently no public market. We do not believe that an active trading market will develop for the common stock after this offering. As a result, you may be unable to resell your shares of common stock or you may only be able to sell them at a substantial discount.

We are offering a minimum of 3,125,000 shares and a maximum of 4,156,250 shares of common stock on a best efforts basis. As of December 14, 2007, we have received subscriptions for 2,702,150 shares. All of these subscriptions have been obtained through the efforts of our officers and directors. In addition, we have engaged SAMCO Capital Markets, Inc. (“SAMCO”) to act as our sales agent for this offering. SAMCO has also agreed to serve as the qualifying broker-dealer in those states in which we elect to sell shares that require that all sales be made through a registered broker-dealer. SAMCO will act on a “best efforts” basis and will not have any obligation or commitment to sell any specific dollar amount or number of shares or to acquire any shares for its own account or with a view to their distribution. We have agreed to pay SAMCO a fee equal to 5% of the gross proceeds of all sales to investors, with the exception of (i) subscriptions received from directors, officers or organizers of the company or the bank who were directors, officers or organizers of the company or the bank as of November 22, 2007, and (ii) subscriptions received prior to SAMCO receiving regulatory approval to commence its involvement in the offering. In addition, we will pay SAMCO $10,000 for the first state in which SAMCO serves as the qualifying broker-dealer and $2,500 for each additional state. SAMCO will not participate in the offering until its participation has been approved by the Financial Industry Regulatory Authority (“FINRA”).

Our organizers and executive officers have committed to purchase at least 1,031,500 shares in this offering, for a total investment of $10,315,000. They may purchase more, including up to 100% of the offering amount. All shares purchased by the organizers and executive officers will be for investment and not intended for resale. In recognition of their service and the financial risk they have undertaken, we are also offering our organizers, which include our directors, an aggregate of 450,000 organizer and director warrants to purchase shares of our common stock for $10.00 per share. Each organizer and director warrant will have a term of 10 years. If each organizer exercises his or her warrants in full and we do not issue any other shares, our organizers and executive officers will own 41% of our outstanding stock based on the minimum offering of 3,125,000 shares and 32% based on the maximum offering of 4,156,250 shares. We describe the warrants in more detail in the “Management—Organizer and Director Warrants” section on page 42.

All of the money that we receive from investors will be placed with an independent escrow agent that will hold the money until (1) we sell at least 3,125,000 shares and (2) we receive final approval from our bank regulatory agencies for the new bank. If we do not meet these conditions before the end of the offering period, we will return all funds received to the subscribers promptly without interest.Once we accept your subscription, you may not revoke it without our consent.The following table summarizes the offering and the amounts we expect to receive.

| | | | | | | | | |

| | | Per Share | | Minimum Total 3,125,000 Shares | | Maximum Total 4,156,250 Shares |

Price to public | | $ | 10.00 | | $ | 31,250,000 | | $ | 41,562,500 |

Fees and commissions(1) | | $ | 0.07 | | $ | 212,500 | | $ | 728,125 |

Net proceeds to Touchmark Bancshares, before offering costs | | $ | 9.93 | | $ | 31,037,500 | | $ | 40,834,375 |

| (1) | Assuming $27 million in proceeds received as of December 14, 2007 are excluded from the calculation of SAMCO’s 5% fee. The per share amount is based on the minimum offering. If we sell the maximum amount of shares, the amount of the fees would be $0.18 per $10 share. |

This is a new business. As with all new businesses, an investment will involve risks. It is not a deposit or an account and is not insured by the FDIC or any other government agency. You should not invest in this offering unless you can afford to lose some or all of your investment.

The risks of this investment are described under the heading “Risk Factors” beginning on page 5.

Neither the SEC nor any state securities commission has approved or disapproved these securities or determined whether this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

December 21, 2007.

SUMMARY

This summary highlights information contained elsewhere in this prospectus. It does not contain all of the information you should consider before investing in our common stock. To fully understand this offering, you should read the entire prospectus carefully, including the risk factors and the financial statements included elsewhere in this prospectus.

Touchmark Bancshares, Inc. and Touchmark National Bank

We formed Touchstone Bancshares, Inc. on April 3, 2007 to organize and serve as the holding company for Touchstone National Bank, a proposed new national bank to be headquartered in Gwinnett County, Georgia. On December 10, 2007, we changed our name to Touchmark Bancshares, Inc., and the bank will now become Touchmark National Bank. Upon successful receipt of required regulatory approvals, the bank will engage in a general commercial banking business, emphasizing personal service to individuals and businesses primarily in Gwinnett County and the surrounding areas. We have filed applications with the Office of the Comptroller of the Currency to open the new bank and with the FDIC for deposit insurance. We received preliminary approval from the Office of the Comptroller of the Currency in August 2007 and from the FDIC in September 2007. We have also filed for, and received approval from, the Federal Reserve Board to become a bank holding company and acquire all of the stock of the new bank upon its formation. We expect to receive all final regulatory approvals and open for business in the first quarter of 2008. Until we receive these regulatory approvals, we cannot commence banking operations and generate any operational revenue. During this offering process, we have been, and will continue to, incur start-up expenses. We incurred a net loss of $509,815 for the period from our inception on April 3, 2007 through May 31, 2007. For more detailed information regarding the risks of investing in our company, see “Risk Factors” beginning on page 5.

Why We Are Organizing a New Bank in Gwinnett County, Georgia

Our primary service area will center in Gwinnett County, Georgia, and the adjoining counties, with a focus on the Buford Highway corridor between the Cities of Chamblee and Buford. Located 30 minutes northeast of Atlanta, Gwinnett County has been one of the fastest-growing counties in the country for several decades. Between 1990 and 2000, Gwinnett County saw the largest net increase in population among the counties comprising the greater Metropolitan Atlanta area, and it continues to grow. The population of Gwinnett County is expected to grow from approximately 726,000 in 2005 to nearly 1.3 million by 2030. The area has three major shopping malls, as well as various financial, legal, professional and technical services areas, which serve to attract customers and other businesses. Major employers in Gwinnett County include Gwinnett County Public Schools, Gwinnett County Government, Gwinnett Health Care System, Wal-Mart, Publix, the U.S. Postal Service, and the State of Georgia.

The ethnic diversity of Gwinnett County and the surrounding counties also provides an opportunity to reach a growing but underserved market. Gwinnett County also has one of the fastest growing Asian-American populations in Georgia, a demographic which we believe to be underserved at the present time. This population is expected to grow from 6% of the county’s population to 15% of the county’s population over the next 13 years. Our organizers have extensive business experience, diverse ethnic backgrounds and contacts in the market which we believe will create immediate business opportunities for the bank.

Our Board of Directors and Management Organizers

We were founded and organized by 21 business leaders, many of whom have lived in Gwinnett County for many years and have substantial business and personal connections in our proposed market area. We believe our organizers’ long-standing ties to their communities and their significant business experience will provide Touchmark National Bank with the ability to effectively assess and address the needs of our proposed market area. The board of directors includes several members that have many years of hands on banking experience. The organizers believe that our experienced board will combine with the equally extensive management

1

experience of William R. Short, our president and chief executive officer, to deliver high quality banking services to the community. Our organizers include the following:

| | |

• J. Egerton Burroughs | | • Sudhirkumar C. Patel |

• J. William Butler | | • Thomas E. Persons, Sr. |

• Daniel B. Cowart | | • Hasmukh P. Rama |

• Barry A. Culbertson | | • J. J. Shah |

• Howard R. Greenfield | | • Meena J. Shah |

• Yuling R. Hayter | | • William R. Short |

• John L. Johnson | | • Larry D. Silver |

• Daniel J. Kaufman | | • Debra D. Wilkins |

• Moon K. Kim | | • Bobby G. Williams |

• C. Hiluard Kitchens, Jr. | | • Vivian A. Wong |

• Paul P. Lam | | |

Our management team consists of the following:

| | • | | William (“Bill”) R. Short is our president and chief executive officer. He has over 30 years of banking and finance experience in Metropolitan Atlanta with Wachovia Bank, N.A. He most recently served as senior vice president/group executive and managing director of several Atlanta Wealth Management Teams from 2001 until he resigned in December 2006 to join our bank. |

| | • | | Robert (“Bob”) D. Koncerak is our chief financial officer. He has over 20 years of banking, capital markets and financial services experience. Bob recently served as SVP and regional CFO in the Wealth Management Division of Wachovia Bank, N.A., from February 2002 until he left in February 2007 to join our bank. |

| | • | | James E. LeBow is our chief credit officer. He has over 25 years of banking experience, primarily with SunTrust Bank. James most recently served as president of the Cobb County division of Georgia Trust Bank, and joined our bank in July 2007. |

Products and Services

We plan to offer a variety of traditional banking services. Our lending services will include consumer loans and lines of credit, commercial and business loans and lines of credit, residential and commercial real estate loans, and construction loans. We expect that our initial legal lending limit will be approximately $3.5 million immediately following the offering. We will competitively price our deposit products, which will include checking accounts, savings accounts, money market accounts, certificates of deposit, commercial checking accounts, and IRAs. We will also provide cashier’s checks, credit cards, tax deposits, traveler’s checks, direct deposit, and United States savings bonds. We intend to deliver our services though a variety of methods, including an ATM, on-line banking, banking by mail, courier services and drive-through banking.

Philosophy and Strategy

Our business strategy is to create a community-oriented financial institution focused on providing personalized service to clients and offering products designed to meet their specific needs. We plan to operate a conservative financial institution that targets primarily small-to-medium-sized commercial, professional, and service companies in Gwinnett County and the surrounding areas, who we believe can be better served by a locally based financial institution that can provide timely credit decision-making along with well defined corporate services. We will also target residential and commercial real estate clients seeking a smaller, more customized service delivery.

We will provide a full range of competitive banking services and will emphasize the effective delivery of these services. We believe we can distinguish ourselves by providing the level of personal service often associated with a community bank, while also offering the requisite technology and skilled advisors to deliver more sophisticated financial products and services than a typical community bank. We will implement specialized services for small businesses and professionals through personal contacts by our officers, directors and employees. In addition, we intend to capitalize on our directors’ and organizers’ community involvement, professional expertise and business contacts within our market area. We believe that our community-based, customer-first approach to operations will appeal to customers who have been receiving services from the de-personalized environment of our competitors.

2

The Offering and Ownership by Management

We will be required to capitalize Touchmark National Bank with at least $25,000,000. Therefore, we plan to sell a minimum of 3,125,000 shares and a maximum of 4,156,250 shares in the offering, all at $10.00 per share. We determined the $10.00 per share stock price arbitrarily because it is the usual price for new community bank stock offerings. We determined the minimum number of shares to be sold in the offering based upon the amount of capital that we will need to implement our business plan. The additional $6,250,000 in capital will be used to provide general working capital for the holding company, to acquire real estate and to pay organizational and offering expenses. We also expect to capitalize the bank with 80% of any amounts we raise in excess of $31,250,000. Our organizers and executive officers have committed to purchase at least 1,031,500 shares of the common stock in this offering, which represents approximately 33% of the shares outstanding if we complete the minimum offering and approximately 25% of the shares outstanding if we complete the maximum offering.

To compensate our organizers for their financial risk and efforts in organizing the bank, they will receive, in the aggregate, up to 450,000 organizer and director warrants to purchase one share of common stock for $10.00 per share. If each organizer exercises his or her warrants in full and we do not issue any other shares, our organizers and executive officers will own 41% of our outstanding stock if we complete the minimum offering and 32% if we complete the maximum offering. We intend to sell most of the remaining shares to individuals and businesses in our primary service area who share our desire to support a new local community bank, and to other individuals in surrounding communities and States who support our proposed business model. For more detailed information see “Management—Organizer and Director Warrants” beginning on page 42.

Warrants Granted to a Consultant

As part of the compensation payable by us for consulting services in connection with regulatory matters, our consultant, Interstate Brokers, will receive warrants to purchase one share of common stock for $10.00 per share for every one share it purchases in this offering, up to a maximum of 12,500 shares. The warrants, which will be exercisable upon grant, have been assigned by Interstate Brokers to a sub-contractor as partial payment for services provided to Interstate Brokers. Interstate Brokers is a business interest of one of our organizers, John L. Johnson.

Funds from Irrevocable Subscriptions Will be Placed in Escrow

We cannot open the bank without regulatory approvals. Therefore, we will place all of the proceeds from investors in this offering with an independent escrow agent, The Bankers Bank. You may not revoke your subscription once we accept it. The escrow agent will hold these funds, and no shares will be issued, until:

| | • | | we have accepted subscriptions and payment in full for a minimum of 3,125,000 shares at $10.00 per share; |

| | • | | we have received final approval from the Office of the Comptroller of the Currency to grant us a national bank charter; |

| | • | | we have received final approval of the bank’s application for deposit insurance from the FDIC; and |

| | • | | we have received approval from the Federal Reserve to acquire the stock of Touchmark National Bank. |

In May 2007, we filed an application with the Office of the Comptroller of the Currency to charter the bank and an application with the FDIC for deposit insurance. We received preliminary approval from the Office of the Comptroller of the Currency in August 2007 and from the FDIC in September 2007. We have also received approval from the Federal Reserve to form a bank holding company. We expect to receive all final regulatory approvals by the first quarter of 2008. The offering will terminate on March 31, 2008, subject to our right to terminate the offering earlier. If we fail to meet these conditions by the close of the offering, we will promptly refund your subscription in full, without interest, and will use the cash advances by our organizers to pay expenses and liquidate the company.

3

No Public Market for the Shares for the Foreseeable Future

Shares sold in this offering will not be listed on Nasdaq or any other national securities exchange. The common stock is a new issue of securities for which there is currently no public market. We do not believe that an active trading market will develop for the shares after this offering. As a result, you may be unable to resell your shares or you may only be able to sell them at a substantial discount.

Use of Proceeds

We will use the first $25,000,000 we raise in this offering to capitalize Touchmark National Bank. This is the amount of capital that will be required for us to open the bank and that we believe is necessary to implement our business plan. We will use the remaining net proceeds of the offering at the holding company level to pay organizational and offering expenses of the holding company and to provide general working capital for the holding company.

If we raise funds in excess of the minimum offering, we expect to capitalize the bank with 80% of any amounts we raise in excess of this amount. We will initially invest the remaining proceeds in United States securities or deposit them with Touchmark National Bank. For more detailed information see “Use of Proceeds” beginning on page 14.

We Do Not Initially Plan to Pay Dividends

We will not pay dividends in the foreseeable future. We intend to use all available earnings to fund the continued operation and growth of the bank.

Location of Offices

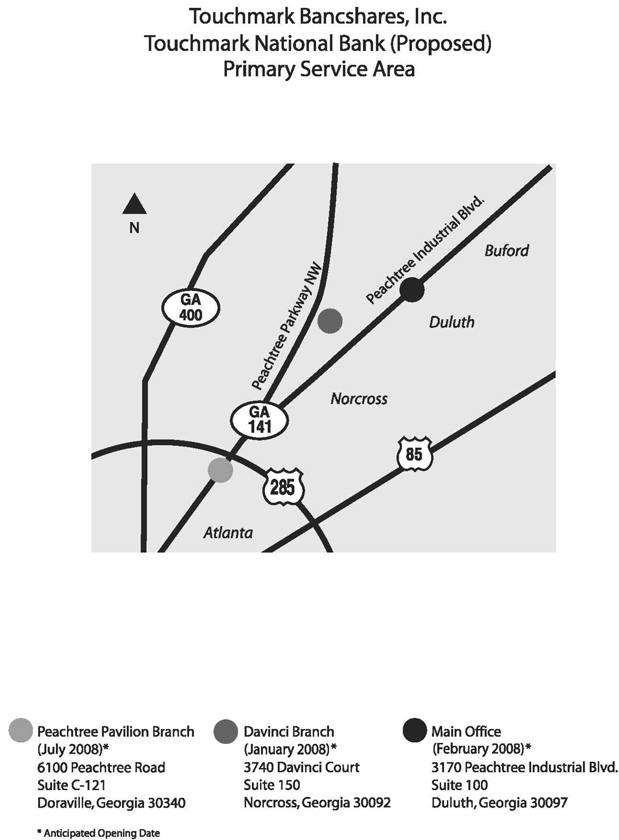

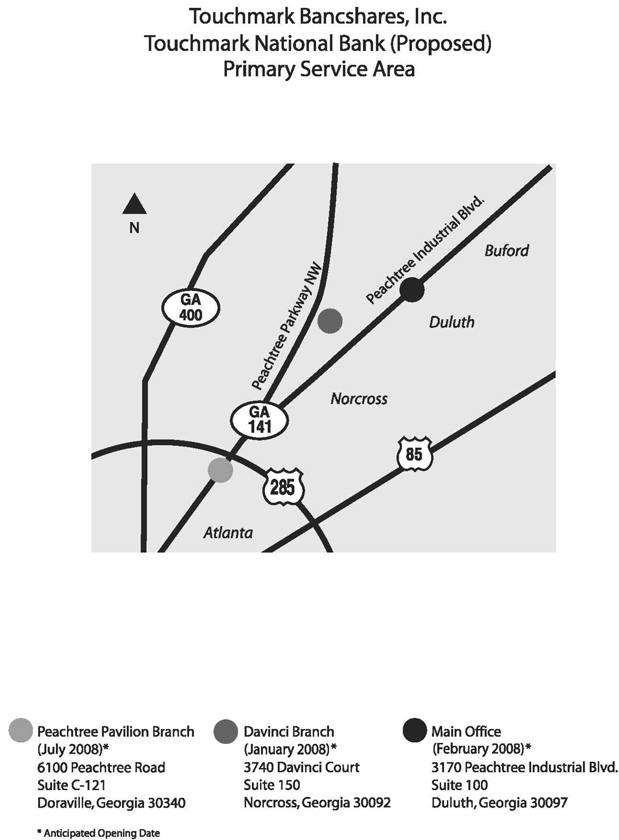

Our initial main office will be located in a leased facility at the intersection of Peachtree Industrial Boulevard and Abbotts Bridge Road in the end cap of a shopping center. Our address will be 3170 Peachtree Industrial Boulevard, Suite 100, Duluth, Georgia 30097. We are presently located at 3740 Davinci Court, Suite 150, Norcross, Georgia 30092. Our telephone number is (770) 407-6700. This site, which we also lease, will be used as a limited branch office when the bank opens. We anticipate that we will relocate to a new headquarters building during the third year of operations. We also intend to open a branch office in Doraville, Georgia, during the third quarter of 2008, at the intersection of Peachtree Industrial Boulevard and Peachtree Road. This branch will be located in the Pavilion Shopping Center, which is currently under development. We are leasing this site from a business interest owned by two of our organizers, J. William Butler and Daniel B. Cowart, who are also the developers of the Pavilion Shopping Center.

On December 7, 2007, we purchased 9.7 acres of land on Satellite Boulevard near I-85 in Duluth, Georgia, for approximately $2.3 million. This location may be the site of our future main office. We acquired rights to purchase this property after being assigned an option, at par, from JWB Realty Services, LLC, a business interest of one of our organizers, J. William Butler.

4

RISK FACTORS

The following is a summary of the risks that we expect to encounter in starting and operating the new bank. An investment in our common stock involves a significant degree of risk and you should not invest in the offering unless you can afford to lose your investment. Please read the entire prospectus for a more thorough discussion of the risks of an investment in our common stock.

We are a new business and there is a risk that we will not be successful.

Neither Touchmark Bancshares nor Touchmark National Bank has any operating history. Opening a new bank involves substantial risk. Because Touchmark National Bank has not yet opened, we do not have historical financial data and similar information that would be available for a financial institution that has been operating for several years.

We expect to incur losses for at least our first two years of operations, and there is a risk that we will never become profitable.

We expect to incur significant initial expenses and have already incurred a net loss of $509,815 for the period from our inception on April 3, 2007 through May 31, 2007. In order for us to become profitable, we will need to attract a large number of customers to deposit and borrow money. This will take time. We expect to incur significant initial expenses and expect to incur losses for at least our first two years of operations. Our future profitability is dependent on numerous factors including the continued success of the economy of our primary market area and favorable government regulation. While the economy in our market area has been strong in recent years, an economic downturn in the area would hurt our business. We are also a highly regulated institution. Our ability to grow and achieve profitability may be adversely affected by state and federal regulations that limit a bank’s right to make loans, purchase securities, and pay dividends. Although we expect to become profitable in our third year, there is a risk that a deterioration of the local economy or adverse government regulation could affect our plans. If this happens, we may never become profitable and you will lose part or all of your investment.

Your investment may be held until March 31, 2008 and your subscription may be rejected until that time with no interest paid.

We cannot break escrow until we receive subscriptions and payment in full for a minimum of 3,125,000 shares, including subscriptions from our organizers, and we also receive final regulatory approvals from the Office of the Comptroller of the Currency, the FDIC and the Federal Reserve. If we terminate the offering or if the offering period ending March 31, 2008 expires before these conditions are satisfied, then we will cancel accepted subscription agreements. In this event, subscribers in the offering will not become shareholders, and we will return the full amount of all subscription funds promptly to subscribers, without paying any interest, and the expenses incurred by us will be borne by our directors and not by subscribers.

Any delay in opening Touchmark National Bank will result in additional losses.

We intend to open the bank during the first quarter of 2008. If we do not receive all necessary regulatory approvals as planned, the bank’s opening will be delayed or may not occur at all. If the bank’s opening is delayed, our organizational and pre-opening expenses will increase. Because the bank would not be open and generating revenue, these additional expenses would cause our accumulated losses to increase. We anticipate that these costs would range from $90,000 to $110,000 each month our opening is delayed.

Failure to implement key elements of our business strategy may adversely affect our financial performance.

If we cannot implement key elements of our business strategy, our financial performance may be adversely affected. Our organizers have developed a business plan that details the strategies that we intend to implement in our efforts to achieve profitable operations. The strategies include hiring and retaining experienced and qualified employees and attracting individual and business customers. Even if the key elements of our business strategy are successfully implemented, they may not have the favorable impact on operations that we anticipate.

5

We will depend heavily on Bill Short and our business would suffer if his employment with us were to terminate for any reason.

Our growth and development will largely be the result of the contributions of our executive officers, including Bill Short, our president and chief executive officer. The performance of community banks, like Touchmark National Bank, is often dependent upon the ability of executive officers to promote the bank in the local market area. Mr. Short has extensive and long-standing ties within our primary service areas and will provide us with an important medium through which to market our products and services. If we lose the services of Mr. Short, he would be difficult to replace and our business and development could be materially and adversely affected.

We will depend on the recruitment and retention of qualified personnel, and our failure to attract and retain such personnel could seriously harm our business.

Our future performance will depend upon our ability to attract and retain qualified loan officers and management personnel for our operations. Competition for personnel is intense, and we may not be successful in attracting or retaining qualified personnel. Our failure to compete for these personnel could seriously harm our business, results of operations, and financial condition.

Because of our lack of a historical loan loss experience, we may underestimate our allowance for loan losses and could be required to decrease our net income or capital in order to increase it.

Making loans and other extensions of credit will be essential elements of our business, and we recognize there is a risk that our loans or other extensions of credit will not be repaid. If our loans are not repaid, we will incur losses and be required to charge those losses against our allowance for loan losses. There is no precise method of predicting credit losses. Therefore, we will always face the risk that charge-offs in future periods will exceed our allowance for loan losses, and that additional increases in the allowance for loan losses will be required. Moreover, because we do not have any historical loan loss experience, the risk that we could underestimate the allowance actually needed may be greater than if we had historical information from which to derive our allowance. If we underestimate our allowance for loan losses, our regulators may require us to increase it. Additions to our allowance for loan losses would result in a decrease of our net income and, possibly, our capital. If the additions to our allowance for loan losses deplete too much of our capital, our capital ratios could fall below regulatory standards, and our regulators could restrict or cease our operations and take control of the bank. See the “Proposed Business—Lending Activities—Allowance for Loan Losses” section beginning on page 23 for the factors we will use to determine our allowance, and the “Supervision and Regulation—Touchmark National Bank - Capital Regulations” section beginning on page 33 for information regarding our capital requirements.

It is unlikely that an active trading market for our shares will develop.

There is no public trading market for our common stock, and an active trading market is not likely to develop after the offering. We do not intend to apply for listing for our common stock on any securities exchange or for quotation of our common stock on any automated quotation system. If an active trading market does not develop, investors may not be able to sell their shares at or above the offering price of $10.00 price per share. Accordingly, investors should consider carefully the limited liquidity of an investment in our common stock before purchasing any shares in this offering.

We do not intend to pay dividends for the foreseeable future for both regulatory and business reasons, which could prevent you from obtaining a return on your investment.

It is unlikely that we will pay any cash dividends in the near future. Because we will have no operations independent from the bank, our ability to pay any cash dividends will depend primarily on the bank’s ability to pay dividends to us, which depends on the profitability of the bank. Our bank will not be permitted to pay dividends until all losses in our bank are recovered and the bank becomes cumulatively profitable. Once our bank is cumulatively profitable, we still may not pay any dividends as our future dividend policy will depend on our earnings, capital requirements, regulatory requirements, financial condition, and other factors that we consider relevant. See “Dividend Policy” on page 16. Until we begin paying dividends, the only return you could realize from an investment in our shares would be profit from the sale of your shares if you sold them at a price in excess of $10.00 per share. However, there is no assurance that the value of our shares will increase or that there will be any liquid market in which you could sell your shares.

6

Our directors and executive officers will purchase a large percentage of our stock in the offering, which may allow them to control the company and affect our shareholders’ ability to receive a premium for their shares.

Our organizers, directors and executive officers have committed to purchase at least 1,031,500 shares in this offering, for a total investment of $10,315,000. As a result, they will own approximately 33% of the shares outstanding if we complete the minimum offering or 25% of the shares outstanding if we complete the maximum offering. Additionally, upon completion of the minimum offering, we expect to grant to our organizers, which includes our directors, organizer and director warrants to purchase an additional 450,000 shares of our common stock in recognition of the financial risks undertaken by them in forming Touchmark Bancshares and Touchmark National Bank. Each warrant will entitle the organizer to purchase one additional share of common stock, at a purchase price of $10.00 per share. If each organizer exercises his or her warrants in full, the organizers’ and executive officers’ ownership of Touchmark Bancshares will increase to 41% if we complete the minimum offering or 32% if we complete the maximum offering. These amounts represent the minimum amount our organizers have committed to purchase. They may purchase more, including up to 100% of the offering amount, especially if necessary to meet the minimum offering amount. As a result, this group will have significant influence over our affairs and policies. Additionally, we intend to adopt a stock option plan covering a number of shares equal to approximately 5% of the total outstanding shares immediately following the offering. The plan will permit us to issue options from time to time to our employees and directors. If these options are exercised, our executive officers and directors will control a greater percentage of our common stock. Their voting power may be sufficient to control the outcome of director elections or block significant transactions affecting Touchmark Bancshares, including acquisitions. This could prevent shareholders from receiving a premium for their shares, which may be offered by a potential acquirer. Of the shares that will be reserved for issuance under our stock option plan, we intend to grant Messrs. Short, Koncerak and LeBow options to purchase up to 41,563, 15,000 and 7,500 shares, respectively, at a purchase price of $10.00 per share. See “The Offering—General” section on page 11.

Our success will depend significantly upon general economic conditions in Gwinnett County and the surrounding areas.

Our operations and profitability may be more adversely affected by a local economic downturn than those of our larger competitors which are more geographically diverse. Since the majority of our borrowers and depositors are expected to be individuals and businesses located and doing business in Gwinnett County and the surrounding areas, our success will depend significantly upon the general economic conditions in and around this primary service area. An adverse change in the local economy of this area could make it more difficult for borrowers to repay their loans, which could lead to loan losses for Touchmark National Bank.

Rapidly rising or falling interest rates could significantly harm our business.

A rapid increase or decrease in interest rates could significantly harm our net interest income, capital and liquidity. Our profitability will depend substantially on our net interest income, which is the difference between the interest income earned on our interest-earning assets, such as loans and investment securities, and the interest expense paid on our interest-bearing liabilities, such as deposits and borrowings. To the extent that the maturities of these assets and liabilities differ, rapidly rising or falling interest rates could significantly and adversely effect our earnings, which, in turn, would impact our business. See “Proposed Business” on page 20.

We determined the offering price of $10.00 arbitrarily and it will fluctuate once the shares become freely tradable after the offering.

Because we do not have any history of operations, we determined the stock price arbitrarily. The offering price is essentially the book value of the shares prior to deduction for expenses of the offering and the organization of the bank. The offering price may not be indicative of the present or future value of the common stock. As a result, the market price of the stock after the offering may be more susceptible to fluctuations than it otherwise might be. The market price will be affected by our operating results, which could fluctuate greatly. These fluctuations could result from expenses of operating and expanding the bank, trends in the banking industry, economic conditions in our market area, and other factors that are beyond our control. If our operating results are below expectations, the market price of the common stock will probably fall.

7

We will face strong competition for customers from larger and more established banks, which could prevent us from obtaining customers, and may cause us to have to pay higher interest rates to attract customers.

We will encounter strong competition from existing banks and other types of financial institutions operating in Gwinnett County and the surrounding communities. Some of these competitors have been in business for a long time and have already established their customer base and name recognition. Most of these competitors are larger than we will be, and will likely have greater financial and personnel resources than Touchmark National Bank. Some are large national, super-regional or regional banks, like Wachovia Bank and Bank of America, and others are more established community banks, like Haven Trust Bank, Gwinnett Community Bank and Peachtree Bank. These institutions offer services including extensive and established branch networks and trust services that we either do not expect to provide or will not provide for some time. Due to this competition, we may have to pay higher rates of interest to attract deposits. Paying higher interest rates will decrease our profitability. In addition, competitors that are not depository institutions are generally not subject to the extensive regulations that will apply to the bank. See “Proposed Business” on page 20.

We may not be able to compete with our larger competitors for larger customers because our lending limits will be lower than theirs.

We will be limited in the amount we can loan a single borrower by the amount of the bank’s capital. The legal lending limit is 15% of the bank’s capital and surplus. We expect that our initial legal lending limit will be approximately $3.5 million immediately following the offering if we complete the minimum offering. Until the bank is profitable, our capital, and therefore our lending limit, will continue to decline. Our lending limit will be significantly less than the limit for many of our competitors and may affect our ability to seek relationships with larger businesses in our market area. We intend to accommodate larger loans by selling participations in those loans to other financial institutions. However, our strategy to accommodate larger loans by selling participations in those loans to other financial institutions may not be successful. In addition, we will initially have limited working capital to fund our anticipated loan growth. Through our banking operations, our ability to attract deposits will serve as our primary source of working capital to fund loans. To provide additional sources of working capital, we plan to maintain a federal funds borrowed line of credit with one or more correspondent banks and we may apply for membership to the Federal Home Loan Bank of Atlanta which would permit us to borrow against our loan portfolio at preferred rates.

The exercise of warrants and stock options will cause stock dilution and may adversely affect the value of our common stock.

The organizers and directors may exercise warrants and options to purchase common stock, which would result in the dilution of your proportionate interests in us. Upon completion of the offering, we expect to grant to our organizers and directors warrants to purchase an additional 450,000 shares of our common stock in recognition of the financial risks undertaken by them in forming Touchmark Bancshares and Touchmark National Bank. The warrants will entitle the organizer or director to purchase one additional share of common stock, at a purchase price of $10.00 per share. See “Terms of the Offering – Purchases by Organizers and Directors” and “Management–Organizer and Director Warrants”. In addition, after the offering, we expect to adopt a stock option plan which will permit us to grant options to our officers, directors, and employees. We anticipate that we will initially authorize the issuance of a number of shares under the stock option plan not to exceed 5% of the shares outstanding after the offering. Of the shares that will be reserved for issuance under our stock option plan, we intend to grant Messrs. Short, Koncerak and LeBow options to purchase up to 41,563, 15,000 and 7,500 shares, respectively, at a purchase price of $10.00 per share. We do not intend to issue stock options with an exercise price less than the fair market value of the common stock on the date of grant.

8

We are subject to extensive regulation that could limit or restrict our activities. This regulation is for protection of the bank’s depositors and not for the investors.

We will operate in a highly regulated industry and will be subject to examination, supervision, and comprehensive regulation by various regulatory agencies. Our compliance with these regulations will be costly and will restrict certain of our activities, including payment of dividends, mergers and acquisitions, investments, loans and interest rates charged, interest rates paid on deposits, and locations of offices. We will also be subject to capitalization guidelines established by our regulators, which require us to maintain adequate capital to support our growth.

The laws and regulations applicable to the banking industry could change at any time, and we cannot predict the effects of these changes on our business and profitability. Because government regulation greatly affects the business and financial results of all commercial banks and bank holding companies, our cost of compliance could adversely affect our ability to operate profitably.

Although we are subject to extensive and comprehensive regulation by various banking regulatory agencies such as the FDIC and the Office of the Comptroller of the Currency, the purpose of these banking regulatory agencies is to protect and insure the interests and deposits of the bank’s depositors. These agencies do not consider preserving or maximizing the investment made by the company’s investors when regulating the bank’s activities.

The costs of being an SEC registered company are proportionately higher for small companies such as Touchmark Bancshares.

The Sarbanes-Oxley Act of 2002 and the related rules and regulations promulgated by the Securities and Exchange Commission have increased the scope, complexity, and cost of corporate governance, reporting, and disclosure practices. These regulations are applicable to our company. We expect to experience increasing compliance costs, including costs related to internal controls, as a result of the Sarbanes-Oxley Act. These necessary costs are proportionately higher for a company of our size and will affect our profitability more than that of some of our larger competitors.

If at any time we have fewer than 300 shareholders, we anticipate that we will not register or will terminate our registration as a reporting company under the Securities and Exchange Act of 1934 and therefore current information about us will not be publicly available for review.

As a result of this offering, we will be subject to the disclosure obligations under Section 15(d) of the Securities Exchange Act. We will file periodic reports with the SEC but will not be subject to compliance with the proxy rules under the Securities Exchange Act. If we have more than 500 shareholders on December 31, 2008 or at the end of any fiscal year thereafter, we will be required to register our securities under Section 12(g) of the Securities Exchange Act. In addition to the obligation to file periodic reports with the SEC, we would also become subject to the proxy rules. If we have fewer than 300 shareholders on December 31, 2008 or at the end of any fiscal year thereafter, we anticipate that we will deregister as a reporting company with the SEC. As a result, we would no longer be obligated to file periodic reports with the SEC or comply with the proxy rules. Upon completion of the offering, we anticipate that we will have more than 300 and may have more than 500 shareholders.

This is a “best efforts” offering and if we only raise the minimum offering amount we may have difficulty fully implementing our business plan.

We are seeking to raise a minimum of $31,250,000 and a maximum of $41,562,500 in this offering. We plan to capitalize the bank with at least $25,000,000, which we believe is the minimum amount we will need in order to successfully implement our business plan. However, if we only raise the minimum amount, we may have to raise additional capital sooner than expected. We cannot assure investors that we will be successful in raising additional capital when needed, and as a result, we may not be able to implement fully our business plan. In addition, we will have a lower loan limit than many of our competitors, which may force us to seek relationships with primarily the smaller businesses in our market area.

9

A WARNING ABOUT FORWARD LOOKING STATEMENTS

This prospectus contains “forward-looking statements” about us and our operations, performance, financial conditions, and likelihood of success. These statements are based on many assumptions and estimates. Our actual results will depend on a number of factors, including many that are beyond our control. The words “may,” “would,” “could,” “will,” “expect,” “anticipate,” “believe,” “intend,” “plan,” and “estimate,” as well as similar expressions, identify forward-looking statements. We discuss what we believe are the most significant of these risks, uncertainties, and other factors under the heading “Risk Factors” beginning on page 5 of this prospectus. We urge you to carefully consider these factors prior to making an investment in our common stock.

10

THE OFFERING

General

We are offering a minimum of 3,125,000 shares and a maximum of 4,156,250 shares of our common stock at a price of $10.00 per share to raise between $31,250,000 and $41,562,500. We intend to impose a minimum purchase for any investor of 1,000 shares and a maximum purchase of 400,000 shares, although we reserve the right to accept subscriptions for a lesser or greater amount of shares.

Our organizers and executive officers have committed to purchase at least 1,031,500 shares in the offering, for a total investment of $10,315,000. Although they have not promised to do so, the organizers may purchase additional shares in the offering, including up to 100% of the minimum offering. All shares purchased by the organizers and executive officers will be for investment and not intended for resale. Because purchases by the organizers may be substantial, you should not assume that the sale of a specified minimum offering amount indicates the merits of this offering.

We must receive your subscription for shares before midnight, Eastern Time, on March 31, 2008, unless we sell all of the shares earlier or we terminate the offering. All subscriptions will be binding on the investor and may not be revoked without our consent. We reserve the right to cancel or reject any or all subscriptions before or after acceptance until the proceeds of this offering are released from escrow. We may also allocate shares among subscribers if the offering is oversubscribed. In deciding which subscriptions to accept, we may take into account many factors, including:

| | • | | the order in which subscriptions are received; |

| | • | | a subscriber’s potential to do business with or to direct customers to the bank; and |

| | • | | our desire to have a broad distribution of stock ownership. |

Our board has full discretion to decide which subscriptions to accept and is not limited to a pro rata allocation. If we reject any subscription, or accept a subscription but subsequently elect to cancel all or part of the subscription, we will refund the amount remitted for shares for which the subscription is rejected or canceled without interest. We will issue certificates for shares which have been subscribed and paid for promptly after we receive the funds out of escrow.

Conditions to the Offering and Release of Funds

We will place all subscription proceeds received from investors with The Bankers Bank, which will serve as an independent escrow agent. The escrow agent will hold these funds, and no shares will be issued, until:

| | • | | We have accepted subscriptions and payment in full for a minimum of 3,125,000 shares at $10.00 per share (including subscriptions from our organizers); |

| | • | | We have received final approval from the Office of the Comptroller of the Currency to grant us a national bank charter; |

| | • | | We have received final approval of the bank’s application for deposit insurance from the FDIC; and |

| | • | | We have obtained approval from the Federal Reserve to acquire the stock of the bank. |

If we terminate the offering or if the offering period expires before these conditions are satisfied, then:

| | • | | We will cancel accepted subscription agreements and subscribers in the offering will not become shareholders; |

| | • | | The funds held in the escrow account will not be subject to the claims of any of our creditors or be available to defray the expenses of this offering which will be borne by our organizers; and |

| | • | | Our escrow agent will promptly return the full amount of all subscription funds to subscribers without interest. |

11

The escrow agent has not investigated the desirability, advisability, or merits of investing in our common stock. The escrow agent will invest escrowed funds directly in, or in a mutual fund consisting solely of, United States government securities. We do not intend to invest the subscription proceeds held in escrow in instruments that would mature after the expiration date of the offering.

Plan of Distribution

Offers and sales of the common stock will be made by our officers and directors, who will be reimbursed for their reasonable expenses but will not receive commissions or other remuneration. We believe these officers and directors will not be deemed to be brokers or dealers under the Securities Exchange Act of 1934 due to Rule 3a4-1. We have also engaged SAMCO Capital Markets, Inc. to act as our sales agent for this offering. SAMCO is a registered broker-dealer and a member of FINRA. SAMCO will act on a “best efforts” basis and will not have any obligation or commitment to sell any specific dollar amount or number of shares or to acquire any shares for its own account or with a view to their distribution.

We have agreed to pay SAMCO a sales commission fee equal to 5% of the gross proceeds of all sales to investors, with the exception of (i) subscriptions received from directors, officers or organizers of the company or the bank who were directors, officers or organizers of the company or the bank as of November 22, 2007, and (ii) subscriptions received prior to SAMCO receiving regulatory approval to commence its involvement in the offering. We have also agreed to pay SAMCO consulting fees on a monthly basis during the term of this offering which we estimate will total $80,000. If we complete the offering, these consulting fees will be offset against the sales commission fees paid at the closing of the offering. In addition, we will reimburse SAMCO for its reasonable expenses, which we estimate to be $56,000. SAMCO has also agreed to serve as the qualifying broker-dealer in those states in which we elect to sell shares that require all sales to be made through a registered broker-dealer. We have agreed to pay SAMCO $10,000 for the first state and $2,500 for each additional state. SAMCO will not participate in the offering until its participation has been approved by FINRA.

We intend to sell most of our shares to individuals and businesses in Gwinnett County, Georgia and the surrounding areas, who share our desire to support a new local community bank. Our marketing efforts will be focused on persons and businesses in Gwinnett County. Our organizers will also market our common stock to their personal contacts outside of this area, including in South Carolina, where some of our organizers reside. Our marketing will be accomplished through a combination of telephone calls, mail, personal visits and meetings.

Prior to this offering, there has been no established public trading market for our common stock, and we do not anticipate that an established market will develop. See “Description of Capital Stock—Shares Eligible for Future Sale” on page 47.

How to Subscribe

If you desire to purchase shares in this offering, you should:

| | 1. | Complete, date, and execute the subscription agreement that you received with this prospectus; |

| | 2. | Make a check, bank draft, or money order payable to “The Bankers Bank as escrow agent for Touchmark Bancshares, Inc.,” in the amount of $10.00 times the number of shares you wish to purchase; and |

12

| | 3. | Deliver the completed subscription agreement and check to Touchmark Bancshares at the following address: |

Mr. William R. Short

Touchmark Bancshares, Inc.

3740 Davinci Court, Suite 150

Norcross, Georgia 30092

If you have any questions about the offering or how to subscribe, please call Mr. Short at (770) 407-6710, or any of our other organizers. If you subscribe, you should retain a copy of the completed subscription agreement for your records. You must pay the subscription price at the time you deliver the subscription agreement.

13

USE OF PROCEEDS

We estimate that we will receive net proceeds of $30,962,500 if we sell the minimum amount of 3,125,000 shares of common stock in the offering, and up to $40,759,375 if we sell the maximum amount of 4,156,250 shares of common stock in the offering, after deducting estimated offering expenses and the sales agent’s fee. We have funded our initial organizational expenses through non-interest-bearing advances from our organizers. We have also established a line of credit in the amount of up to $2.5 million at a rate of prime minus 0.5% to pay pre-opening expenses of the holding company and the bank prior to the completion of the offering. We have also borrowed $2.3 million to finance the purchase of 9.7 acres of land in Duluth, Georgia near I-85. This location may be the site of our future main office estimated to be completed during our third year of operations. We intend to repay these organizer advances and pay off the line of credit and the loan to purchase land with the proceeds we receive from this offering. The following two paragraphs describe the proposed use of proceeds by our holding company and our bank.

Use of Proceeds by Touchmark Bancshares

The following table shows the anticipated use of the proceeds by Touchmark Bancshares. We describe the bank’s anticipated use of proceeds in the following section. As shown, we will use $25,000,000 to capitalize the bank if we complete the minimum offering. We will also capitalize the bank with 80% of any amounts we raise in excess of the minimum offering. We will initially invest any amounts that we raise in excess of the minimum offering in United States government securities or deposit them with Touchmark National Bank. In the long-term, we will use these funds for operational expenses and other general corporate purposes, including the provision of additional capital to the bank, if necessary. We may also use the proceeds to repay the loan which was used to finance the purchase of a 9.7 acre tract on Satellite Boulevard near I-85 in Duluth that may serve as the site of our future main office. We may also use the proceeds to expand, for example by opening additional facilities, or, eventually, acquiring other financial institutions.

| | | | | | |

| | | Minimum

Offering

3,125,000 shares | | Maximum

Offering

4,156,250 shares |

Gross proceeds from offering | | $ | 31,250,000 | | $ | 41,562,500 |

Offering expenses of Touchmark Bancshares(1) | | $ | 75,000 | | $ | 75,000 |

Sales agent’s fee(2) | | $ | 212,500 | | $ | 728,125 |

Repayment of loan to purchase future main office site | | $ | 2,300,000 | | $ | 2,300,000 |

Investment in capital stock of the bank(2) | | $ | 25,000,000 | | $ | 33,250,000 |

| | | | | | |

Remaining proceeds | | $ | 3,262,500 | | $ | 4,809,375 |

| | | | | | |

| (1) | These expenses include: (i) the registration fee paid to the SEC, (ii) printing and engraving fees, (iii) legal fees and expenses, (iv) accounting fees, (v) state securities filing fees and expenses, and (vi) other miscellaneous disbursements. |

| (2) | This fee is equal to 5% of the gross proceeds of sales to investors (excluding approximately $27.0 million in sales made by us prior to SAMCO’s participation in this offering). SAMCO will not participate in the offering until its participation is cleared by FINRA. |

| (3) | This amount represents the funds we will use to capitalize our bank, which equals the minimum amount that we believe will be required to implement our business plan. For additional information, see “Use of Proceeds by Touchmark National Bank” on page 15. |

14

Use of Proceeds by Touchmark National Bank

The following table shows the anticipated use of the proceeds by Touchmark National Bank. All proceeds received by the bank will be in the form of an investment in the bank’s capital stock by Touchmark Bancshares as described above. The estimated organizational and pre-opening expenses of the bank of approximately $1.1 million will be incurred from the stock offering period through the opening of the bank. We will pay for these expenses using funds advanced by our organizers and with our existing line of credit until we break escrow, a condition of which is attaining the minimum offering. Leasehold improvements, furniture, fixtures, draperies and equipment will be capitalized and amortized over the life of the lease or over the estimated useful life of the asset. The bank will use the remaining proceeds to make loans, purchase securities, and otherwise conduct the business of the bank. In addition to our initial main office and executive headquarters, we currently plan to open a full-service branch office in Doraville during the third quarter of 2008, and to relocate our main office to a new building during our third year of operations. We do not have any other definitive plans for expansion.

| | | | | | | | |

| | | Minimum

Offering

3,125,000 shares | | | Maximum

Offering

4,156,250 shares | |

Investment by Touchmark Bancshares in the bank’s capital stock | | $ | 25,000,000 | | | $ | 33,250,000 | |

Organizational and pre-opening expenses of the bank(1) | | $ | (1,117,000 | ) | | $ | (1,117,000 | ) |

Furniture, fixtures and equipment for initial main office, executive headquarters and branch | | $ | (793,000 | ) | | $ | (793,000 | ) |

Cost of leasehold improvements of main office and site and executive headquarters and site | | $ | (250,000 | ) | | $ | (250,000 | ) |

Estimated cost of leasehold improvements of branch office and site | | $ | (250,000 | ) | | $ | (250,000 | ) |

| | | | | | | | |

Remaining proceeds | | $ | 22,590,000 | | | $ | 30,840,000 | |

| | | | | | | | |

| (1) | Organizational costs are primarily consulting fees and legal fees related to the incorporation and organization of the bank. Pre-opening costs are primarily employees’ salaries and benefits, and other operational expenses related to the preparation for the bank’s opening. |

15

CAPITALIZATION

The following table shows our capitalization as of May 31, 2007, and our pro forma consolidated capitalization as adjusted to give effect to the sale of the minimum and maximum number of shares in this offering, after deducting the expenses of the offering. On April 4, 2007, William R. Short, our president and chief executive officer, agreed to purchase ten shares of our common stock at a price of $10.00 per share. We will redeem these shares after the offering. After the offering, we will have 4,156,250 shares outstanding if the maximum number of shares are sold. The “As Adjusted” column reflects our accumulated deficit through May 31, 2007. See “Use of Proceeds” above.

| | | | | | | | | | | | |

| | | May 31, 2007 | | | As Adjusted

For

Minimum Offering | | | As Adjusted

for

Maximum Offering | |

Shareholder’s Equity: | | | | | | | | | | | | |

Common Stock, par value $.01 per share; 50,000,000 shares authorized; 10 shares issued and outstanding; 3,125,000 shares issued and outstanding as adjusted for the minimum offering; 4,156,250 shares issued and outstanding as adjusted for the maximum offering | | $ | 0 | | | $ | 31,250 | | | $ | 41,562 | |

Preferred Stock, no par value; 10,000,000 shares authorized; no shares issued and outstanding | | | 0 | | | | 0 | | | | 0 | |

Subscribed for, but not paid and issued, 10 shares of Common Stock | | $ | 100 | | | $ | 0 | | | $ | 0 | |

Paid-in capital | | $ | 33,277 | | | $ | 31,177,027 | | | $ | 41,479,215 | |

Common Stock subscription receivable | | $ | (100 | ) | | $ | 0 | | | $ | 0 | |

Accumulated deficit | | $ | (509,815 | ) | | $ | (509,815 | ) | | $ | (509,815 | ) |

| | | | | | | | | | | | |

Total shareholder’s equity (deficit) | | $ | (476,538 | ) | | $ | 30,698,462 | | | $ | 41,010,962 | |

| | | | | | | | | | | | |

DIVIDEND POLICY

We expect initially to retain all earnings to operate and expand the business. It is unlikely that we will pay any cash dividends in the near future. Our ability to pay any cash dividends will depend primarily on Touchmark National Bank’s ability to pay dividends to us, which depends on the profitability of the bank. See “Supervision and Regulation — Touchmark National Bank — Dividends” on page 31 and “Supervision and Regulation — Touchmark National Bank — Capital Regulations” on page 32. In addition to the availability of funds from the bank, our dividend policy is subject to the discretion of our board of directors and will depend upon a number of factors, including future earnings, financial condition, cash needs, and general business conditions.

16

MANAGEMENT’S DISCUSSION AND ANALYSIS OR PLAN OF OPERATION

General

Touchmark Bancshares (formerly Touchstone Bancshares) was incorporated on April 3, 2007 to organize and own all of the capital stock of Touchmark National Bank (formerly Touchstone National Bank). On May 8, 2007, our organizers filed applications with the Office of the Comptroller of the Currency to charter the bank as a national bank and with the FDIC to receive federal deposit insurance. Whether the charter is issued and deposit insurance is granted will depend upon, among other things, compliance with legal requirements imposed by the Office of the Comptroller of the Currency and the FDIC, including capitalization of the bank with at least a specified minimum amount of capital, which will be $25,000,000. We received preliminary approval from the Office of the Comptroller of the Currency in August 2007 and preliminary approval from the FDIC in September 2007. We have also filed an application with, and received approval from, the Federal Reserve to become a bank holding company and acquire the capital stock of the bank. We expect to receive all final regulatory approvals during the first quarter of 2008.

Financial Results

As of May 31, 2007, we had total assets of $143,794, consisting primarily of cash, furniture, equipment and prepaid rent. We incurred a net loss of $509,815 for the period from our inception on April 3, 2007 through May 31, 2007.

Expenses

On completion of the offering and opening of the bank, we expect we will have incurred the following expenses:

| | • | | $75,000 in expenses of the offering, which will be subtracted from the proceeds of the offering. |

| | • | | Approximately $1,433,000 in expenses to organize Touchmark Bancshares and to organize and prepare to open Touchmark National Bank, consisting principally of salaries, leasehold improvements, branch equipment and other operating costs, which will be charged against the income of Touchmark Bancshares and Touchmark National Bank. |

Prior to our completion of this offering, these expenses have been funded by non-interest-bearing advances from our organizers and by establishing a line of credit in the amount of up to $2.5 million at a rate of prime minus 0.5% that are guaranteed by our organizers. We will use the proceeds of this offering to repay these organizer advances and the amounts due under our lines of credit. We anticipate that the proceeds of the offering will be sufficient to satisfy the corporation’s financial needs for at least the next three years.

Offices and Facilities

Our telephone number is (770) 407-6700. We are located at 3740 Davinci Court, Suite 150, Norcross, Georgia 30092, which we are leasing for a period of 39 months with rent of $4,783.00 per month. This office, which we will lease, serves as our executive headquarters and will also become a limited service branch office when the bank opens. Our main office will be located at 3170 Peachtree Industrial Boulevard, Suite 100, Duluth, Georgia 30097. This office is currently undergoing renovations, which are expected to be completed during the fourth quarter of 2007. Our executive headquarters will serve as our temporary main office if these renovations are not completed when we are ready to open the bank. In addition, we plan to open a full service branch in Doraville, Georgia, during the first quarter of 2008. This branch will be located in the Pavilion Shopping Center at the intersection of Peachtree Industrial Boulevard and Peachtree Road, which is currently under development. The address will be Suite C-121, 6100 Peachtree Road, Doraville, Georgia 30340.

17

Liquidity and Interest Rate Sensitivity

Touchmark National Bank, like most banks, will depend on its net interest income for its primary source of earnings. Net interest income is the difference between the interest we charge on our loans and receive from our investments, our assets, and the interest we pay on deposits, our liabilities. Movements in interest rates will cause our earnings to fluctuate. To lessen the impact of these margin swings, we intend to structure our balance sheet so that we can reprice the rates applicable to our assets and liabilities in roughly equal amounts at approximately the same time. We will manage the bank’s asset mix by regularly evaluating the yield, credit quality, funding sources, and liquidity of its assets. We will manage the bank’s liability mix by expanding our deposit base and converting assets to cash as necessary. If there is an imbalance in our ability to reprice assets and liabilities at any point in time, our earnings may increase or decrease with changes in the interest rate, creating interest rate sensitivity. Interest rates have historically varied widely, and we cannot control or predict them. Despite the measures we plan to take to lessen the impact of interest rate fluctuations, large moves in interest rates may negatively impact our profitability.

We have also established a line of credit in the amount of up to $2,500,000 and have received cash advances from our organizers totaling $440,000 that we will use to pay organizational and pre-opening expenses. We believe that the minimum proceeds of $31,250,000 from the offering will satisfy the cash requirements for at least the first three years for both Touchmark Bancshares and Touchmark National Bank. Specifically, we anticipate that Touchmark Bank’s initial capitalization of $25,000,000 will allow us to grow the bank’s loan portfolio at a reasonable pace and to pay operating expenses during the first three years of operations while maintaining capital levels that comply with banking regulatory guidelines. We anticipate that the remaining proceeds will be sufficient to pay our operational expenses for at least three years. Following the completion of the offering, we will manage our liquidity by actively monitoring the bank’s sources and uses of funds to meet cash flow requirements and maximize profits. We do not anticipate that we will need to raise additional funds to meet the required operating expenditures for Touchmark Bancshares and Touchmark National Bank over the next 12 months. All anticipated material expenditures for such period have been identified, including salaries, furniture, fixtures and equipment expenses, and leasehold improvements, and provided for out of the proceeds of this offering. See “Use of Proceeds” on page 13.

We expect to complete our organizational activities and commence banking operations during the first quarter of 2008. Any delay in opening the bank will increase our organizational and pre-opening expenses and postpone our realization of potential revenues. We anticipate that these costs would range from $90,000 to $110,000 each month the opening of the bank is delayed. Such a delay may occur as a result of, among other things, delays in receiving all necessary regulatory approvals or our inability to achieve the minimum offering of $31,250,000. In the event we experience an extended delay in opening the bank, we may be required to seek additional borrowings, whether through increasing our existing lines of credit with The Bankers Bank, or through an additional line of credit with another lender. There can be no assurance that we will be able to obtain such financing on satisfactory terms.

If we are unable to raise the minimum proceeds of $31,250,000 from this offering, we will use the cash advances by our organizers to pay expenses and, to the extent necessary, each organizer will be responsible for his or her pro rata share of any remaining expenses, including any amounts due under our lines of credit, and we will liquidate the company.

Capital Adequacy

Capital adequacy for banks and bank holding companies is regulated by the Office of the Comptroller of the Currency, the Federal Reserve Board of Governors, and the FDIC. The primary measures of capital adequacy are risk-based capital guidelines and the leverage ratio. Changes in these guidelines or in our levels of capital can affect our ability to expand and pay dividends. Please see “Supervision and Regulation—Touchmark National Bank—Capital Regulations” on page 33 for a more detailed discussion.

18

Recently Issued Accounting Standards

The following is a summary of recent authoritative pronouncements that affect our accounting, reporting, and disclosure of financial information.

In September 2006, the FASB issued SFAS No. 157, “Fair Value Measurements.” SFAS No. 157 defines fair value, establishes a framework for measuring fair value in generally accepted accounting principles (GAAP), and expands disclosures about fair value measurements. This statement does not require any new fair value measurements, but rather eliminates inconsistencies found in various prior announcements. The provisions of this statement are effective for financial statements issued for fiscal years beginning after November 15, 2007, and interim periods within those fiscal years. We do not expect the adoption of SFAS No. 157 to have any material impact on our financial position, results of operations or cash flows.

In February 2007, the FASB issued SFAS No. 159, “The Fair Value Option for Financial Assets and Financial Liabilities.” SFAS No. 159 permits entities to make an irrevocable election, at specified election dates, to measure eligible financial instruments and certain other items at fair value. This statement also establishes presentation and disclosure requirements designed to facilitate comparisons between entities that choose different measurement attributes for similar types of assets and liabilities. The provisions of this statement are effective as of the beginning of the first fiscal year that begins after November 15, 2007. We do not expect the adoption of SFAS No. 159 to have any material impact on our financial position, results of operations or cash flows.

19

PROPOSED BUSINESS

General

We formally initiated activity to form Touchmark National Bank (formerly Touchstone National Bank) in March 2006 and incorporated Touchstone Bancshares, Inc., as a Georgia corporation in April 2007 to function as a holding company to own and control all of the capital stock of Touchmark National Bank. On December 10, 2007, we changed our name from “Touchstone Bancshares, Inc.” to “Touchmark Bancshares, Inc.”. We initially will engage in no business other than owning and managing the bank.

We have chosen this holding company structure because we believe it will provide flexibility that would not otherwise be available. Subject to Federal Reserve Board debt guidelines, the holding company structure can assist the bank in maintaining its required capital ratios by borrowing money and contributing the proceeds to the bank as primary capital. Additionally, a holding company may engage in non-banking activities that the Federal Reserve Board has deemed to be closely related to banking. Although we do not presently intend to engage in other activities, we will be able to do so with a proper notice or filing to the Federal Reserve if we believe that there is a need for these services in our market area and that the activities could be profitable.

We filed an application with the Office of the Comptroller of the Currency on May 8, 2007 to organize the bank as a national bank and with the FDIC to obtain deposit insurance. We received preliminary approval from the Office of the Comptroller of the Currency in August 2007 and from the FDIC in September 2007. We have also filed an application and received approval from the Board of Governors of the Federal Reserve System to become a bank holding company. Subject to receiving final regulatory approval from the OCC and FDIC, we plan to open the bank during the first quarter of 2008 and will engage in a general commercial and consumer banking business as described below. Final approvals will depend on compliance with regulatory requirements, including our capitalization of the bank with at least $25,000,000 from the proceeds of this offering.

Market Area and Competition

Service Area.Our primary service area will lie in Gwinnett County and the surrounding areas, with a focus on the Buford Highway corridor between the cities of Chamblee and Buford. Our initial main office will be located in Duluth near the intersection of Peachtree Industrial Boulevard and Abbotts Bridge Road. This office will be located at the end of a shopping center and will provide excellent visibility and access. We will also have a limited service branch office located in Norcross. This branch office will also serve as our executive headquarters and lending headquarters until we construct a permanent main office located near I-85 in Duluth in the third year of operations. Our anticipated expansion plans also include opening a full service branch in Doraville during the first year of operation. This branch office will extend the reach of our bank into DeKalb County.

Economic and Demographic Factors. Located 30 minutes northeast of Atlanta and situated along I-85 and I-285, Gwinnett County, Georgia is one of the fastest growing counties in Georgia. Our primary service area is characterized by a diverse economy, a large business base, growing jobs and population. Gwinnett County also has a relatively low unemployment rate. According to the Bureau of Labor Statistics, Gwinnett County’s unemployment rate was 3.9% at March 31, 2007, compared with a 4.7% unemployment in Georgia. Major employers in Gwinnett County include Gwinnett County Public Schools, Gwinnett County Government, Gwinnett Health Care System, Wal-Mart, Publix, the U.S. Postal Service, and the State of Georgia. The amenities and opportunities that our primary service area offers are wide-ranging from housing, education, healthcare, shopping, recreation, and culture. We believe these factors make the quality of life in the area attractive.

Our primary service area has also experienced solid population growth. Since 1990, the population in Gwinnett County has increased over 105%. In 2005, the population of Gwinnett County was 726,000, as estimated by Gwinnett County officials. By 2030, growth is expected to reach 1,300,000. Between 1990 and 2000, the Atlanta Metropolitan Statistical Area, which includes Gwinnett County, added almost 1,000,000 new residents. Gwinnett County experienced the largest increase with over 235,538 new residents and the second largest percentage change, an increase of 67%. In addition to this growth, the area’s demographics have changed considerably over the last 15 years. While the population of Gwinnett County grew 67% between 1990 and 2000, the County’s minority population increased by 397%. As a result of this increase, the proportion of the minority population in Gwinnett

20

grew from 11% to 31%. Between 1990 and 2005, Gwinnett County’s Asian and Pacific Islander population increased by 32,276 or 319%. In 2000, over 42,000 Asians resided in Gwinnett County, accounting for 7.2% of the total population, up from 2.9% in 1990. Over the next 13 years, this population is expected to increase from 9% of the County’s population to 15% of the County’s population. We believe that the diverse ethnic backgrounds and strong ethnic ties of our organizers within the Asian business community will create immediate business opportunities for the bank.

Competition.The banking business is highly competitive. We will compete as a financial intermediary with other commercial banks, savings banks, credit unions, finance companies, and money market mutual funds operating in our primary service area. According to FDIC data as of June 30, 2006, there were 132 banking offices representing 37 financial institutions operating in our primary service area and holding over $8.2 billion in deposits. Many of these institutions have substantially greater resources and lending limits than we will have, and many of these competitors offer services, including extensive and established branch networks and trust services, that we either do not expect to provide or will not provide initially. Our competitors include large national, super regional and regional banks like Wachovia Bank, Bank of America, and Sun Trust Bank as well as established community banks such as Haven Trust Bank, Gwinnett Community Bank and Peachtree Bank. Nevertheless, we believe that our management team, our focus on relationship banking, and the economic and demographic dynamics of our service area will allow us to gain a meaningful share of the area’s deposits.

Business Strategy