Form 6-K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of June 2010

Commission File Number: 001-33623

WuXi PharmaTech (Cayman) Inc.

288 Fute Zhong Road, Waigaoqiao Free Trade Zone

Shanghai 200131

People’s Republic of China

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934. Yes ¨ No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):82-N/A

WuXi PharmaTech (Cayman) Inc.

Form 6-K

TABLE OF CONTENTS

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | |

| | WuXi PharmaTech (Cayman) Inc. |

| | |

| | By: | | /S/ GE LI |

| | Name: | | Ge Li |

| | Title: | | Chairman and Chief Executive Officer |

| | |

Date: June 11, 2010 | | | | |

3

Exhibit 99.1

Charles River and

WuXi PharmaTech:

The First Global

Early-Stage CRO

Jefferies 2010

Global Life Sciences

Conference

JUNE 10, 2010

James C. Foster

Chairman, President & CEO

charles river

© 2010 Charles River Laboratories International, Inc.

4

Safe Harbor Statement

This document includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements may be identified by the use of words such as “anticipate,” “believe,” “expect,” “estimate,” “plan,” “outlook,” and “project” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These statements are based on current expectations and beliefs of Charles River Laboratories (“Charles River”) and WuXi PharmaTech (Cayman) Inc (“WuXi”), and involve a number of risks and uncertainties that could cause actual results to differ materially from those stated or implied by the forward-looking statements. Those risks and uncertainties include, but are not limited to: 1) the possibility that the companies may be unable to obtain stockholder or regulatory approvals required for the combination; 2) problems may arise in successfully integrating the businesses of the two companies (including retention of key executives); 3) the acquisition may involve unexpected costs; 4) the combined company may be unable to achieve cost and revenue synergies or achieve potential revenue growth and non-GAAP margin expansion; 5) the businesses may suffer as a result of uncertainty surrounding the acquisition; and 6) the industry may be subject to future regulatory or legislative actions and other risks that are described in Securities and Exchange Commission (“SEC”) reports filed or furnished by Charles River and WuXi.

In addition, these statements include the combined financial outlook of Charles River for 2011 and anticipated use of cash flow, the availability of funding for our customers and the impact of economic and market conditions on them generally, the anticipated strength of our balance sheet, the effects of our 2009 and 2010 cost-saving actions and other actions designed to manage expenses, operating costs and capital spending, and to streamline efficiency, and the ability of the Company to withstand the current market conditions. Forward-looking statements are based on Charles River’s current expectations and beliefs, and involve a number of risks and uncertainties that are difficult to predict and that could cause actual results to differ materially from those stated or implied by the forward-looking statements. Those risks and uncertainties include, but are not limited to: the ability to successfully integrate the businesses we acquire; the ability to successfully develop and commercialize SPC’s technology platform; a decrease in research and development spending, a decrease in the level of outsourced services, or other cost reduction actions by our customers; the ability to convert backlog to sales; special interest groups; contaminations; industry trends; new displacement technologies; USDA and FDA regulations; changes in law; continued availability of products and supplies; loss of key personnel; interest rate and foreign currency exchange rate fluctuations; changes in tax regulation and laws; changes in generally accepted accounting principles; and any changes in business, political, or economic conditions due to the threat of future terrorist activity in the U.S. and other parts of the world, and related U.S. military action overseas. A further description of these risks, uncertainties, and other matters can be found in the Risk Factors detailed in Charles River’s Annual Report on Form 10-K as filed on February 19, 2010 and Quarterly Report on Form 10-Q as filed on April 29, 2010, as well as other filings we make with the SEC.

Because forward-looking statements involve risks and uncertainties, actual results and events may differ materially from results and events currently expected by Charles River and WuXi. Charles River and WuXi assume no obligation and expressly disclaim any duty to update information contained in this filing except as required by law.

Charles River

2

5

Non-GAAP Financial Measures

This presentation includes discussion of non-GAAP financial measures. We believe that the inclusion of these non-GAAP financial measures provides useful information to allow investors to gain a meaningful understanding of our core operating results and future prospects, without the effect of one-time charges, consistent with the manner in which management measures and forecasts the Company’s performance. The non-GAAP financial measures included in this presentation are not meant to be considered superior to or a substitute for results of operations prepared in accordance with GAAP. The company intends to continue to assess the potential value of reporting non-GAAP results consistent with applicable rules and regulations.

Additional Information

This document may be deemed to be solicitation material in respect of the proposed combination of Charles River and WuXi. In connection with the proposed transaction, Charles River has filed a preliminary proxy statement and will file a definitive proxy statement with the SEC. The information contained in the preliminary filing is not complete and may be changed. Before making any voting or investment decisions, investors and security holders are urged to read the definitive proxy statement when it becomes available and any other relevant documents filed with the SEC because they will contain important information. The definitive proxy statement will be mailed to the shareholders of Charles River seeking their approval of the proposed transaction. Charles River’s shareholders will also be able to obtain a copy of the definitive proxy statement free of charge by directing a request to: Charles River Laboratories, 251 Ballardvale Street, Wilmington, MA 01887, Attention: General Counsel. In addition, the preliminary proxy statement is and the definitive proxy statement will be available free of charge at the SEC’s website, www.sec.gov. Shareholders may also access copies of the documents filed with the SEC by Charles River on Charles River’s website at www.criver.com.

Charles River and its directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information regarding Charles River’s directors and executive officers is available in Charles River’s proxy statement for its 2010 annual meeting of shareholders, which was filed with the SEC on March 30, 2010. Information regarding the persons who may, under the rules of the SEC, be considered participants in the solicitation of Charles River shareholders in connection with the proposed transaction is set forth in the preliminary proxy statement filed with the SEC.

This document does not constitute an offer of any securities for sale or a solicitation of an offer to buy any securities. The Charles River shares to be issued in the proposed transaction have not been and will not be registered under the Securities Act of 1933, as amended (the “Securities Act”), and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements. Charles River intends to issue such Charles River shares pursuant to the exemption from registration set forth in Section 3(a)(10) of the Securities Act.

charles river

3

6

Charles River and WuXi:

A Transformational Combination

The combination creates the first fully integrated global early-stage contract research organization (CRO)

Offers a full range of products and services from molecule creation to first-in-human testing

Leverages increasing strategic importance of China

Drives Charles River (CRL) shareholder value through profitable growth and higher combined margins

Expanded portfolio drives increased sales

Provides compelling value to clients, meeting their needs for early-stage drug development efforts on a global basis

charles river

4

7

Timing of the Acquisition is Key

Critical inflection point in terms of rapid client consolidation and infrastructure reductions

Accelerating need for strategic outsourcing

Clients are reducing the number of strategic partners to those with financial strength, scientific depth, global footprint and an expanding portfolio of services

As client strategies evolve, next 12-24 months are key to gaining significant business pursuant to longer-term contracts

CRL is a stronger organization due to PCS reorganization, sales force realignment, ERP implementation and Six Sigma initiative

PCS business has stabilized

WuXi will achieve its vision of becoming a global integrated service provider on an accelerated basis

charles river

5

8

Charles River Today

A leading in vivo biology company

$1.20B in net sales (FY ‘09)

Unique portfolio of products and services focused on the research and development continuum for new drugs

A multinational company with ~8,000 employees worldwide

~70 facilities in 16 countries

Continuous expansion to support client needs

Client Base

Non-Commercial 16%

Commercial 84%

ROW 34%

North America 66%

Geographic Sales by Facility Location

6 Source: Based on Charles River’s FY 2009 net sales.

charles river

9

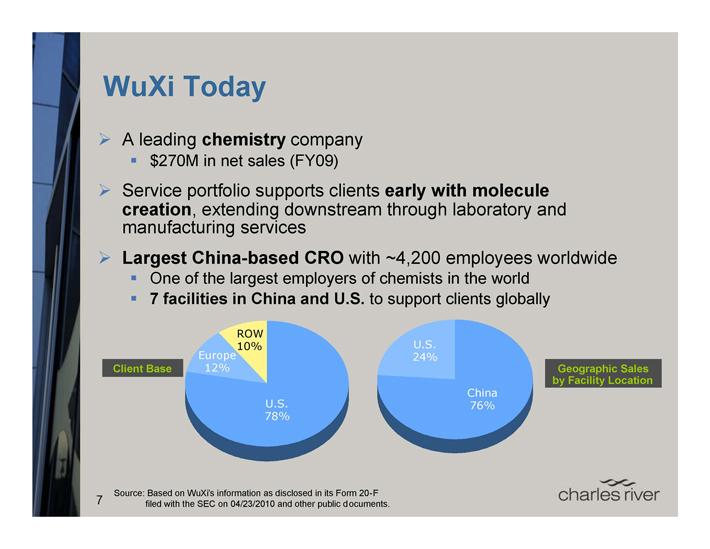

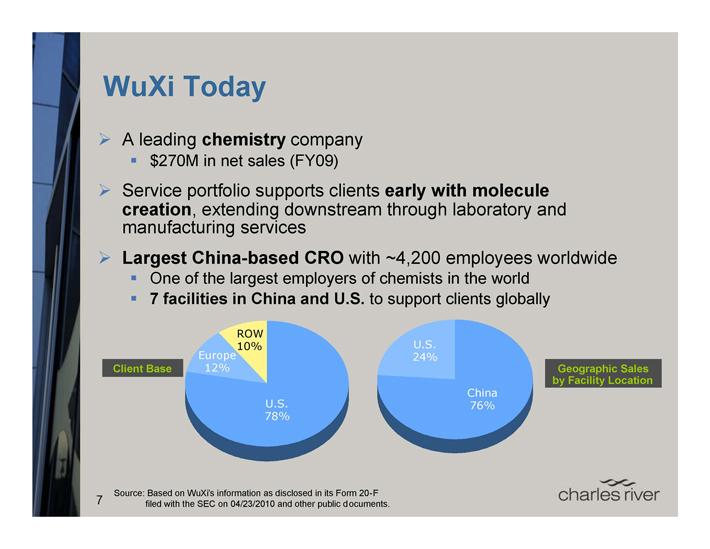

WuXi Today

A leading chemistry company

$270M in net sales (FY09)

Service portfolio supports clients early with molecule creation, extending downstream through laboratory and manufacturing services Largest China-based CRO with ~4,200 employees worldwide

One of the largest employers of chemists in the world

7 facilities in China and U.S. to support clients globally

Client Base

Europe 12%

ROW 10%

U.S. 78%

U.S. 24%

China 76%

Geographic Sales by Facility Location

7 Source: Based on WuXi’s information as disclosed in its Form 20-F filed with the SEC on 04/23/2010 and other public documents.

charles river

10

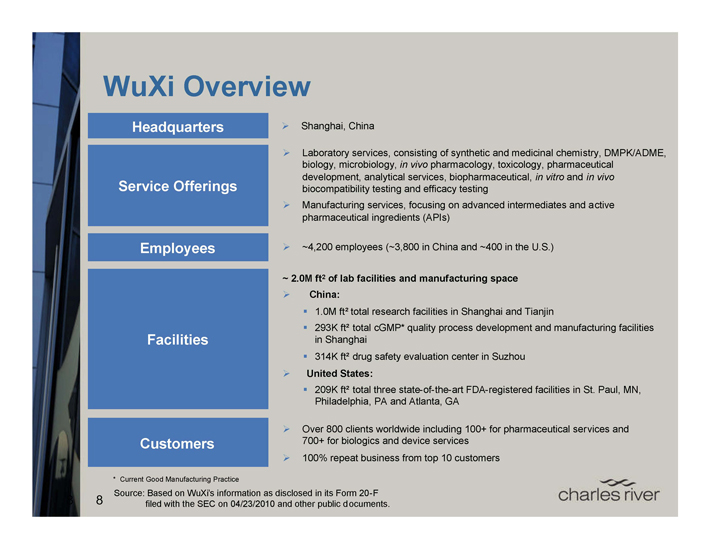

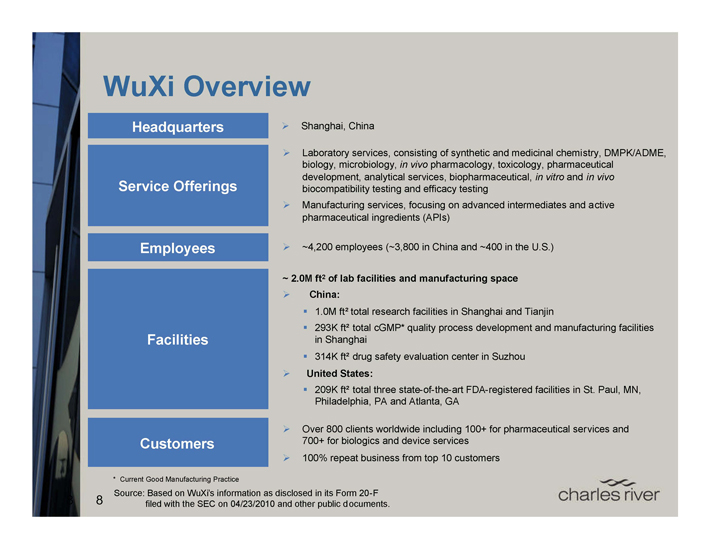

WuXi Overview

Headquarters

Shanghai, China

Laboratory services, consisting of synthetic and medicinal chemistry, DMPK/ADME, biology, microbiology, in vivo pharmacology, toxicology, pharmaceutical development, analytical services, biopharmaceutical, in vitro and in vivo biocompatibility testing and efficacy testing

Service Offerings

Manufacturing services, focusing on advanced intermediates and active pharmaceutical ingredients (APIs)

Employees

~4,200 employees (~3,800 in China and ~400 in the U.S.)

~2.0M ft2 of lab facilities and manufacturing space

China:

1.0M ft² total research facilities in Shanghai and Tianjin

293K ft² total cGMP* quality process development and manufacturing facilities in Shanghai

Facilities

314K ft² drug safety evaluation center in Suzhou

United States:

209K ft² total three state-of-the-art FDA-registered facilities in St. Paul, MN,

Philadelphia, PA and Atlanta, GA

Over 800 clients worldwide including 100+ for pharmaceutical services and 700+ for biologics and device services

Customers

100% repeat business from top 10 customers

* Current Good Manufacturing Practice

8 Source: Based on WuXi’s information as disclosed in its Form 20-F filed with the SEC on 04/23/2010 and other public documents.

charles river

11

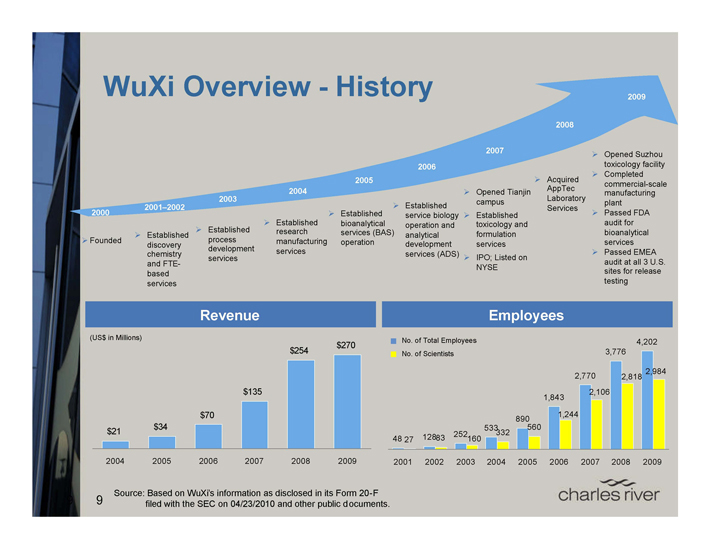

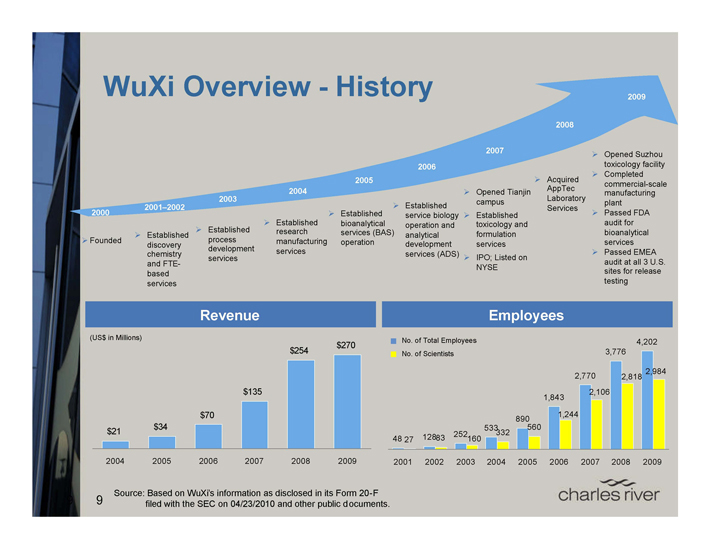

WuXi Overview - History

2000

Founded

2001–2002

Established discovery chemistry and FTE-based services

2003

Established process development services

2004

Established research manufacturing services

2005

Established bioanalytical services (BAS) operation

2006

Established service biology operation and analytical development services (ADS)

2007

Opened Tianjin campus Established toxicology and formulation services IPO; Listed on NYSE

2008

Acquired AppTec Laboratory Services

2009

Opened Suzhou toxicology facility Completed commercial-scale manufacturing plant Passed FDA audit for bioanalytical services Passed EMEA audit at all 3 U.S. sites for release testing

Revenue

(US$ in Millions) $270 $254

$135

$70 $34 $21

2004 2005 2006 2007 2008 2009

Employees

No. of Total Employees

No. of Scientists

4,202 3,776

2,984 2,770 2,818

2,106 1,843

1,244 890 533 560 252 332

48 27 12883 160

2001 2002 2003 2004 2005 2006 2007 2008 2009

Source: Based on WuXi’s information as disclosed in its Form 20-F filed with the SEC on 04/23/2010 and other public documents.

charles river

9

12

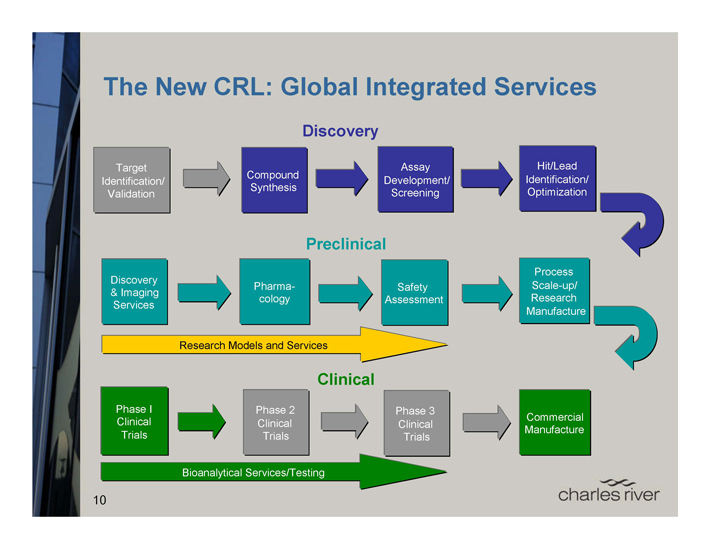

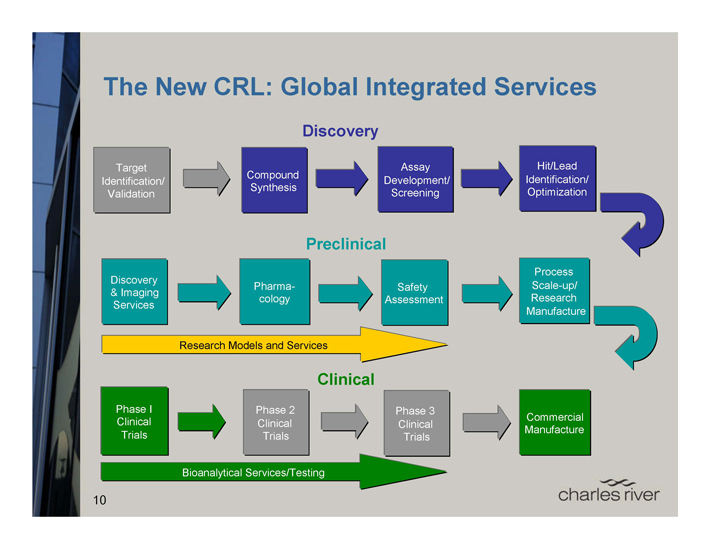

The New CRL: Global Integrated Services

Discovery

Target Assay Hit/Lead Compound Identification/ Synthesis Development/ Identification/ Validation Screening Optimization

Preclinical

Discovery Process Pharma-cology Safety Scale-up/

& Imaging Assessment Research Services Manufacture

Research Models and Services

Clinical

Phase I Phase 2 Phase 3 Commercial Clinical Clinical Clinical Manufacture Trials Trials Trials

Bioanalytical Services/Testing

charles river

10

13

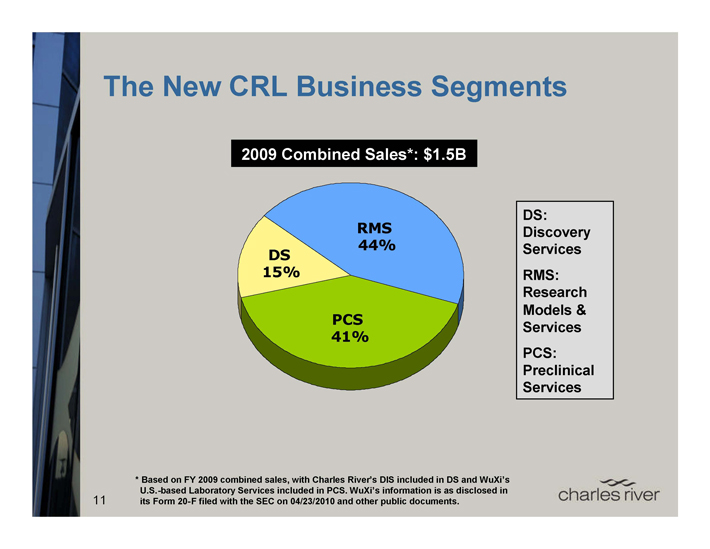

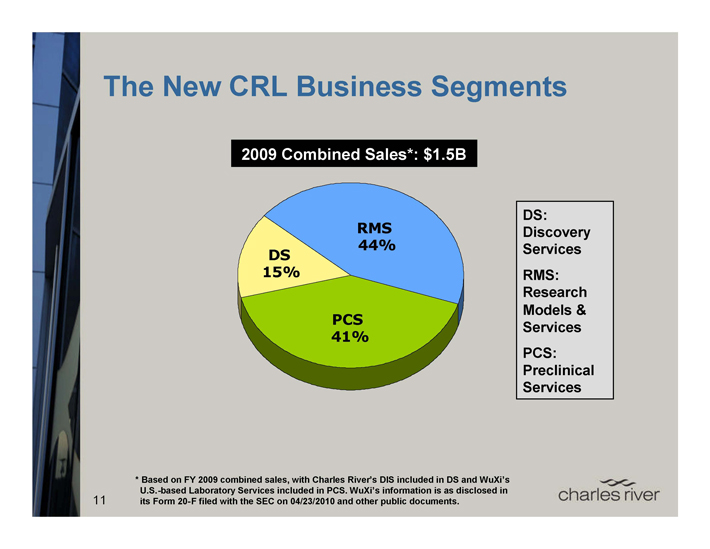

The New CRL Business Segments

2009 Combined Sales*: $1.5B

RMS 44% DS

15%

PCS 41%

DS: Discovery Services

RMS: Research Models & Services

PCS: Preclinical Services

* Based on FY 2009 combined sales, with Charles River’s DIS included in DS and WuXi’s U.S.-based Laboratory Services included in PCS. WuXi’s information is as disclosed in its Form 20-F filed with the SEC on 04/23/2010 and other public documents.

charles river

11

14

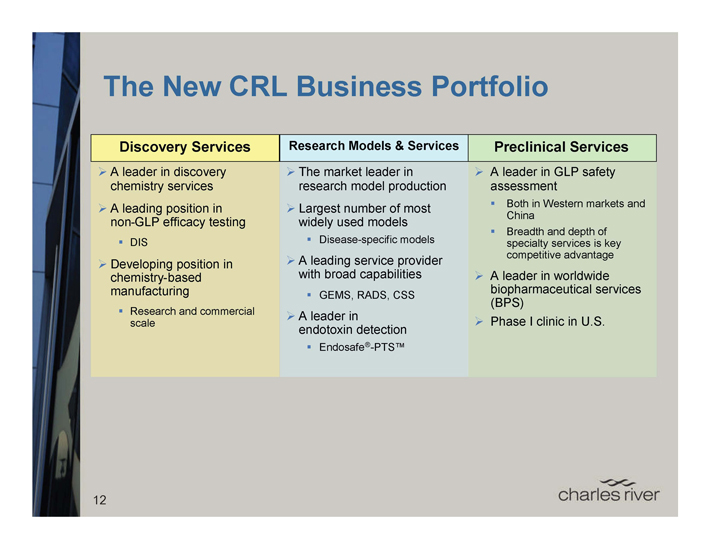

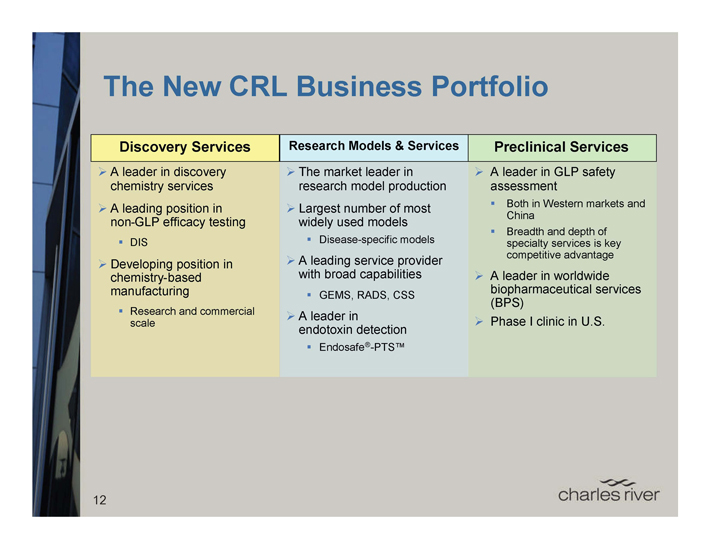

The New CRL Business Portfolio

Discovery Services

A leader in discovery chemistry services

A leading position in non-GLP efficacy testing

• DIS

Developing position in chemistry-based manufacturing

• Research and commercial scale

Research Models & Services

The market leader in research model production

Largest number of most widely used models

• Disease-specific models

A leading service provider with broad capabilities

• GEMS, RADS, CSS

A leader in endotoxin detection

• Endosafe®-PTS™

Preclinical Services

A leader in GLP safety assessment

• Both in Western markets and China

• Breadth and depth of specialty services is key competitive advantage

A leader in worldwide biopharmaceutical services (BPS) Phase I clinic in U.S.

charles river

12

15

Drives Profitable Revenue Growth

Global outsourced discovery chemistry segment is estimated to be at least $2B in 2010, with a mid-teens CAGR over the next 3-5 years*

• Currently ~20-30% outsourced

Growth in Discovery Chemistry and other downstream services accelerated by pharma outsourcing

• Service biology, DMPK/ADME, formulation, process research, bioanalytical chemistry, manufacturing

Emerging opportunity for Manufacturing services

• Active pharmaceutical ingredients (APIs) for clinical trials and commercial-scale manufacturing

Emerging opportunity for GLP safety assessment in China

13 * Source: Citigroup Global Markets, Deutsche Bank and Company estimates. charles river

16

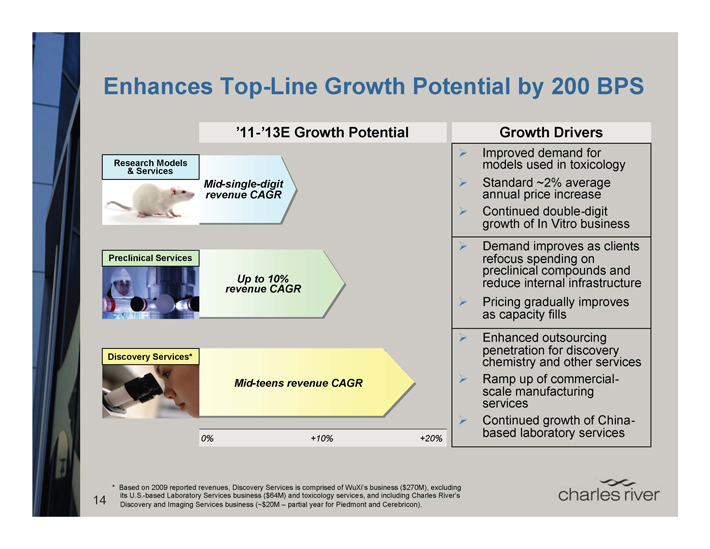

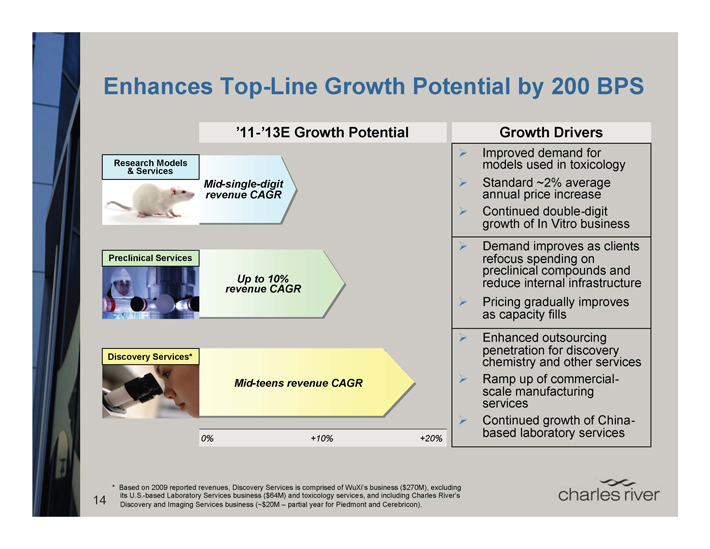

Enhances Top-Line Growth Potential by 200 BPS

’11-’13E Growth Potential

Research Models & Services

Mid-single-digit revenue CAGR

Preclinical Services

Up to 10% revenue CAGR

Discovery Services*

Mid-teens revenue CAGR

0% +10% +20%

Growth Drivers

Improved demand for models used in toxicology Standard ~2% average annual price increase Continued double-digit growth of In Vitro business

Demand improves as clients refocus spending on preclinical compounds and reduce internal infrastructure Pricing gradually improves as capacity fills

Enhanced outsourcing penetration for discovery chemistry and other services Ramp up of commercial-scale manufacturing services Continued growth of China-based laboratory services

14 * Based on 2009 reported revenues, Discovery Services is comprised of WuXi’s business ($270M), excluding its U.S.-based Laboratory Services business ($64M) and toxicology services, and including Charles River’s Discovery and Imaging Services business (~$20M – partial year for Piedmont and Cerebricon).

charles river

17

Revenue Synergies

Cross-selling and combined sales force create incremental opportunity to drive more business upstream and downstream with existing and prospective clients based on unprecedented scope of early-stage portfolio

Increased presence and scale in the emerging China market

Mid-tier and academic accounts where WuXi has limited penetration and CRL has significant share

• Leverage CRL sales force of ~200 professionals to drive strategic outsourcing

Focus on expanding existing client partnerships

• Cross-selling opportunities

These synergies further enhance top-line growth potential

15 charles river

18

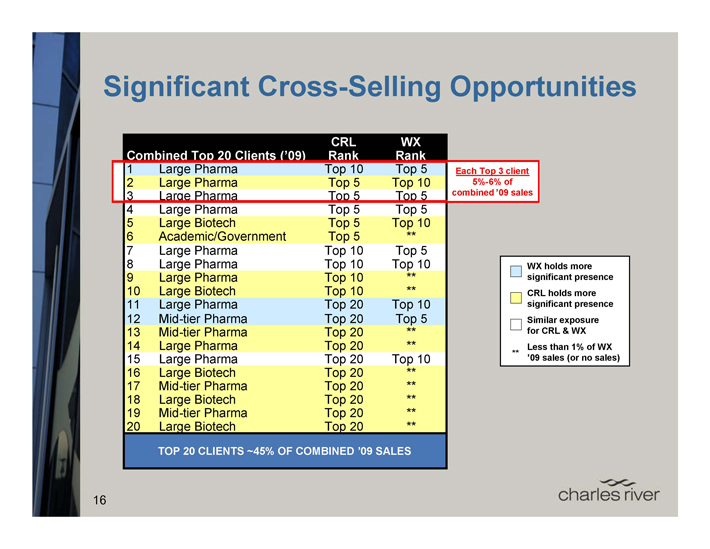

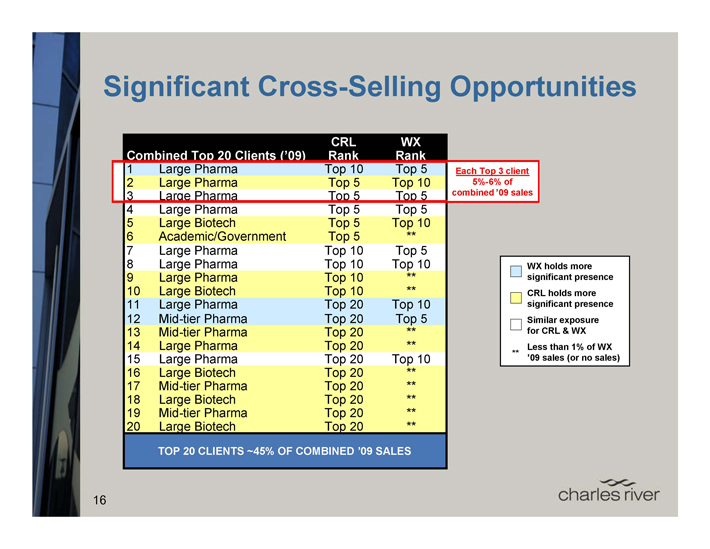

Significant Cross-Selling Opportunities

CRL WX

Combined Top 20 Clients (’09) Rank Rank

1 Large Pharma Top 10 Top 5 Each Top 3 client 5%- 6% of

combined ’09 sales

2 Large Pharma Top 5 Top 10

3 Large Pharma Top 5 Top 5

4 Large Pharma Top 5 Top 5

5 Large Biotech Top 5 Top 10

6 Academic/Government Top 5 **

7 Large Pharma Top 10 Top 5

8 Large Pharma Top 10 Top 10

9 Large Pharma Top 10 **

10 Large Biotech Top 10 **

11 Large Pharma Top 20 Top 10

12 Mid-tier Pharma Top 20 Top 5

13 Mid-tier Pharma Top 20 **

14 Large Pharma Top 20 **

15 Large Pharma Top 20 Top 10

16 Large Biotech Top 20 **

17 Mid-tier Pharma Top 20 **

18 Large Biotech Top 20 **

19 Mid-tier Pharma Top 20 **

20 Large Biotech Top 20 **

TOP 20 CLIENTS ~45% OF COMBINED ’09 SALES

WX holds more significant presence

CRL holds more significant presence

Similar exposure for CRL & WX

** Less than 1% of WX ’09 sales (or no sales)

charles river

16

19

Enthusiastic Client Response

Senior management of CRL and WX each have reviewed the transaction with their respective top 20 pharmaceutical and biotechnology clients

Response has been overwhelmingly positive

Follow-up meetings have been scheduled/initiated

Clients are viewing this transformational combination as a strategic fit for the combined company, which offers them the opportunity to acquire more products and services from a single, larger entity

Clients are requesting a more integrated approach to buying end-to-end services across the drug development continuum

Value of CRL brand seen as an advantage in terms of standardizing products and services in China

charles river

17

20

Leverages Increasing Strategic Importance of China

Supportive of global pharmas who view China as the new frontier for drug development

Pharmas are taking advantage of cost leverage by placing chemistry in China

Lower cost, highly skilled scientists with advanced degrees

Emerging opportunities for chemistry, safety assessment and manufacturing services as clients advance development activities in China

Charles River gains largest early-stage provider in China

Enables clients to choose where to place work

charles river

18

21

The New CRL Revenue Base*

Europe 22%

China 15%

North America 58%

ROW 5%

Leveraging the increasing strategic importance of China

* Based on FY 2009 combined sales. WuXi’s information is as disclosed in its Form 20-F filed with the SEC on 04/23/2010 and other public documents.

charles river

19

22

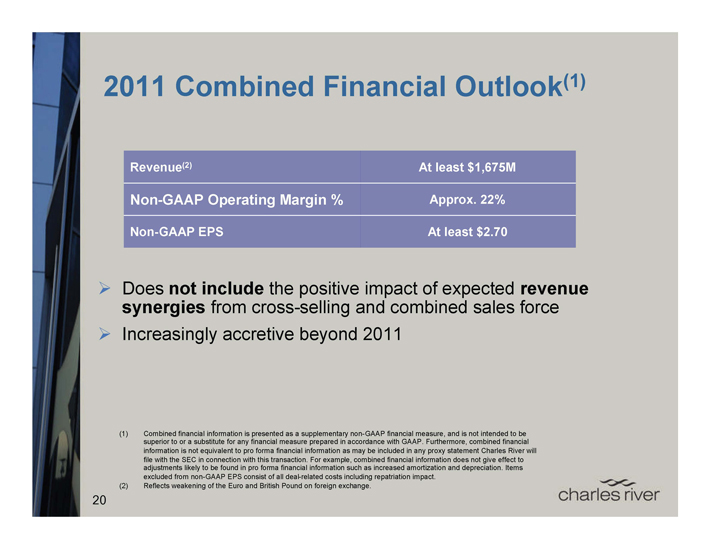

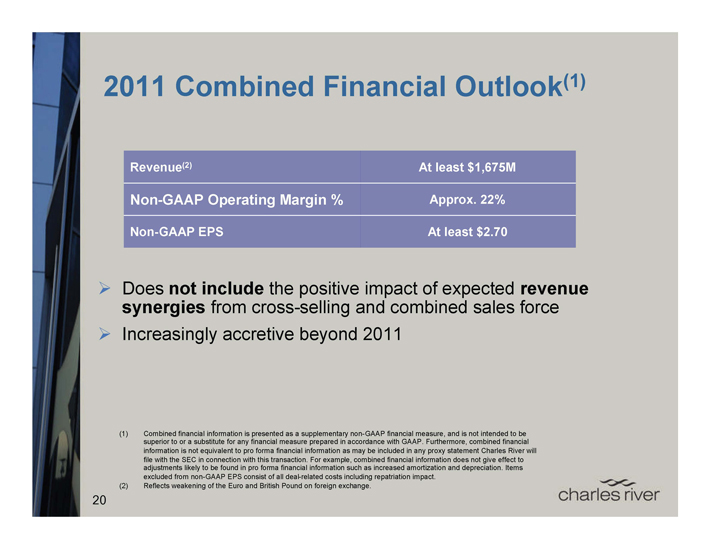

2011 Combined Financial Outlook(1)

Revenue(2) At least $1,675M

Non-GAAP Operating Margin % Approx. 22%

Non-GAAP EPS At least $2.70

Does not include the positive impact of expected revenue synergies from cross-selling and combined sales force

Increasingly accretive beyond 2011

(1) Combined financial information is presented as a supplementary non-GAAP financial measure, and is not intended to be superior to or a substitute for any financial measure prepared in accordance with GAAP. Furthermore, combined financial information is not equivalent to pro forma financial information as may be included in any proxy statement Charles River will file with the SEC in connection with this transaction. For example, combined financial information does not give effect to adjustments likely to be found in pro forma financial information such as increased amortization and depreciation. Items excluded from non-GAAP EPS consist of all deal-related costs including repatriation impact.

(2) Reflects weakening of the Euro and British Pound on foreign exchange.

charles river

20

23

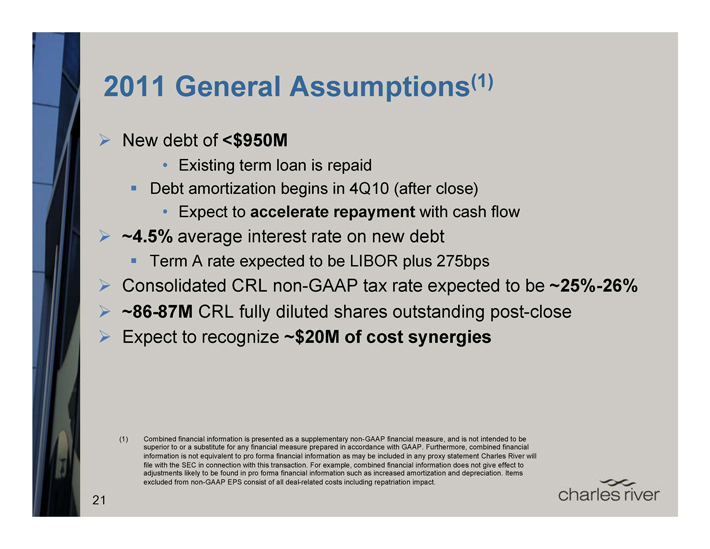

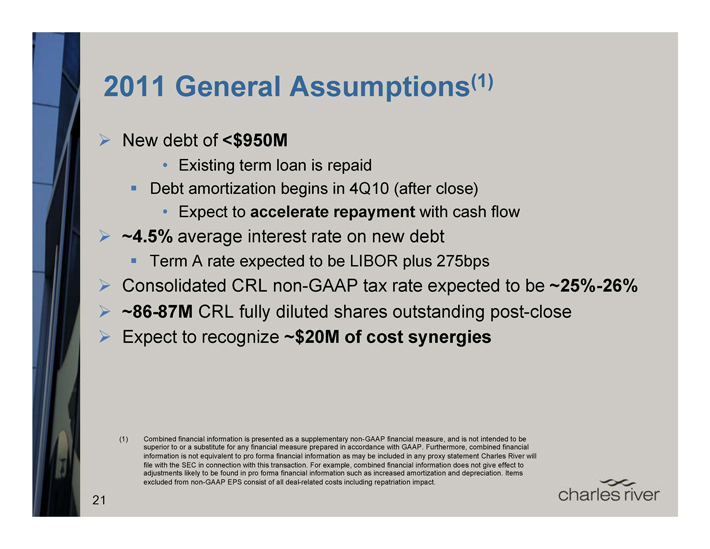

2011 General Assumptions(1)

New debt of <$950M

Existing term loan is repaid

Debt amortization begins in 4Q10 (after close)

Expect to accelerate repayment with cash flow

~4.5% average interest rate on new debt

Term A rate expected to be LIBOR plus 275bps

Consolidated CRL non-GAAP tax rate expected to be ~25%-26%

~86-87M CRL fully diluted shares outstanding post-close

Expect to recognize ~$20M of cost synergies

(1) Combined financial information is presented as a supplementary non-GAAP financial measure, and is not intended to be superior to or a substitute for any financial measure prepared in accordance with GAAP. Furthermore, combined financial information is not equivalent to pro forma financial information as may be included in any proxy statement Charles River will file with the SEC in connection with this transaction. For example, combined financial information does not give effect to adjustments likely to be found in pro forma financial information such as increased amortization and depreciation. Items excluded from non-GAAP EPS consist of all deal-related costs including repatriation impact.

charles river

21

24

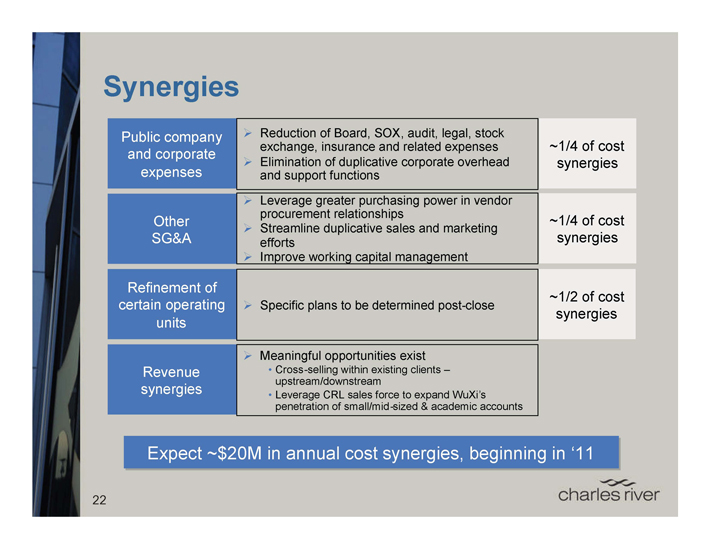

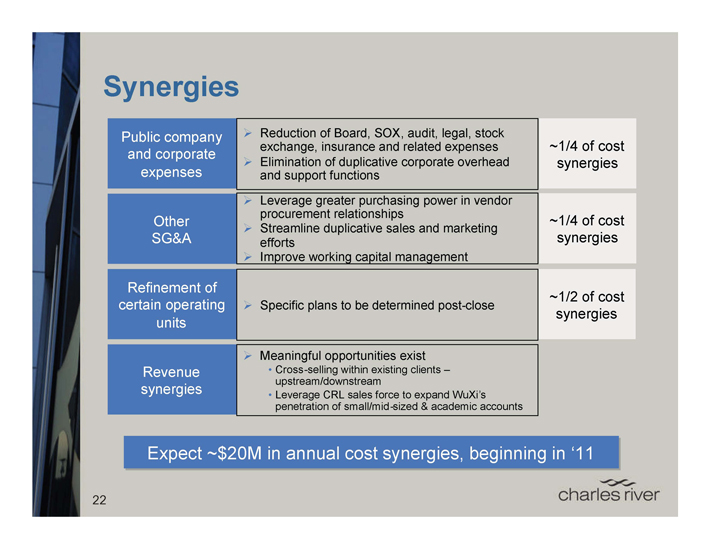

Synergies

Public company and corporate expenses

Reduction of Board, SOX, audit, legal, stock exchange, insurance and related expenses

~1/4 of cost synergies

Elimination of duplicative corporate overhead synergies and support functions

Other SG&A

Leverage greater purchasing power in vendor procurement relationships

~1/4 of cost synergies

Streamline duplicative sales and marketing efforts synergies

Improve working capital management

Refinement of certain operating units

Specific plans to be determined post-close

1/2 of cost synergies

Revenue synergies

Meaningful opportunities exist

Cross -selling within existing clients – upstream/downstream

Leverage CRL sales force to expand WuXi’s penetration of small/mid-sized & academic accounts

Expect ~$20M in annual cost synergies, beginning in ‘11

charles river

22

25

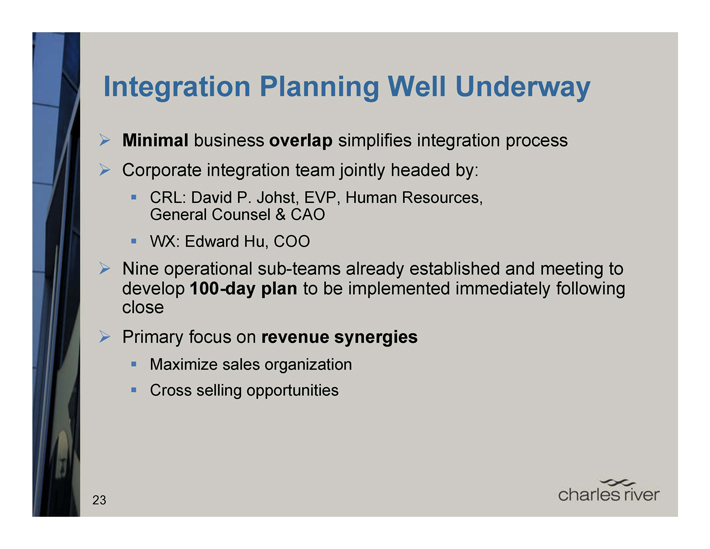

Integration Planning Well Underway

Minimal business overlap simplifies integration process

Corporate integration team jointly headed by:

CRL: David P. Johst, EVP, Human Resources, General Counsel & CAO

WX: Edward Hu, COO

Nine operational sub-teams already established and meeting to develop 100-day plan to be implemented immediately following close

Primary focus on revenue synergies

Maximize sales organization

Cross selling opportunities

charles river

23

26

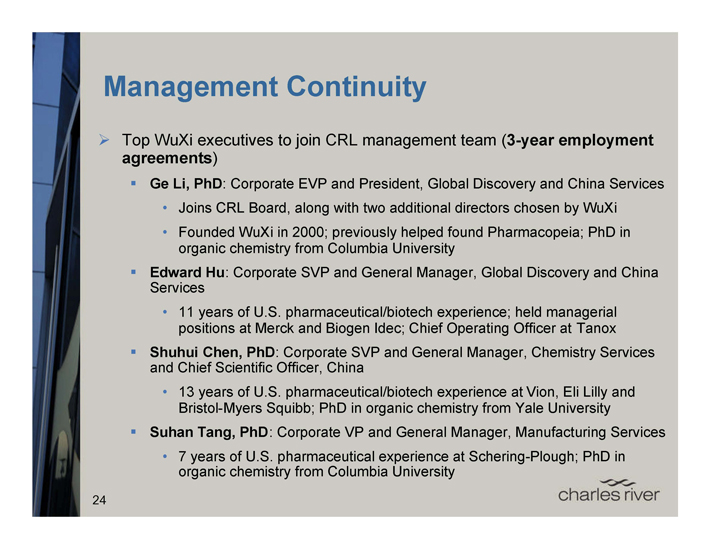

Management Continuity

Top WuXi executives to join CRL management team (3-year employment agreements)

Ge Li, PhD: Corporate EVP and President, Global Discovery and China Services

Joins CRL Board, along with two additional directors chosen by WuXi

Founded WuXi in 2000; previously helped found Pharmacopeia; PhD in organic chemistry from Columbia University

Edward Hu: Corporate SVP and General Manager, Global Discovery and China Services

11 years of U.S. pharmaceutical/biotech experience; held managerial positions at Merck and Biogen Idec; Chief Operating Officer at Tanox

Shuhui Chen, PhD: Corporate SVP and General Manager, Chemistry Services and Chief Scientific Officer, China

13 years of U.S. pharmaceutical/biotech experience at Vion, Eli Lilly and Bristol-Myers Squibb; PhD in organic chemistry from Yale University

Suhan Tang, PhD: Corporate VP and General Manager, Manufacturing Services

7 years of U.S. pharmaceutical experience at Schering-Plough; PhD in organic chemistry from Columbia University

charles river

24

27

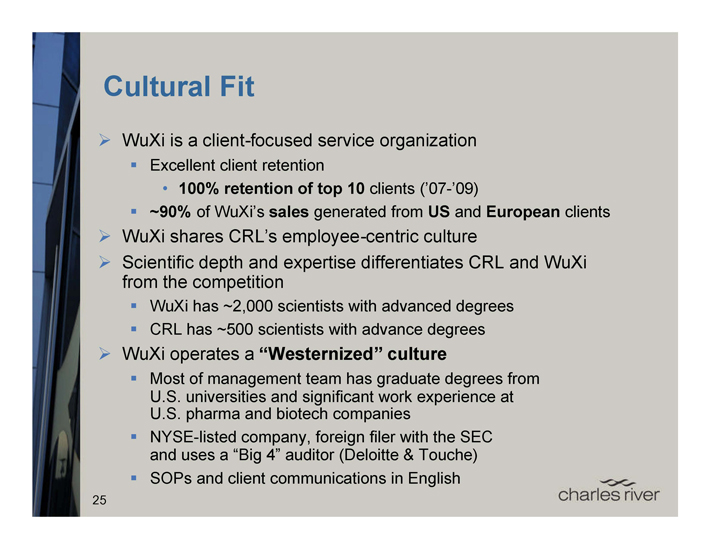

Cultural Fit

WuXi is a client-focused service organization

Excellent client retention

100% retention of top 10 clients (’07-’09)

~90% of WuXi’s sales generated from US and European clients

WuXi shares CRL’s employee-centric culture

Scientific depth and expertise differentiates CRL and WuXi from the competition

WuXi has ~2,000 scientists with advanced degrees

CRL has ~500 scientists with advance degrees

WuXi operates a “Westernized” culture

Most of management team has graduate degrees from U.S. universities and significant work experience at U.S. pharma and biotech companies

NYSE-listed company, foreign filer with the SEC and uses a “Big 4” auditor (Deloitte & Touche)

SOPs and client communications in English

charles river

25

28

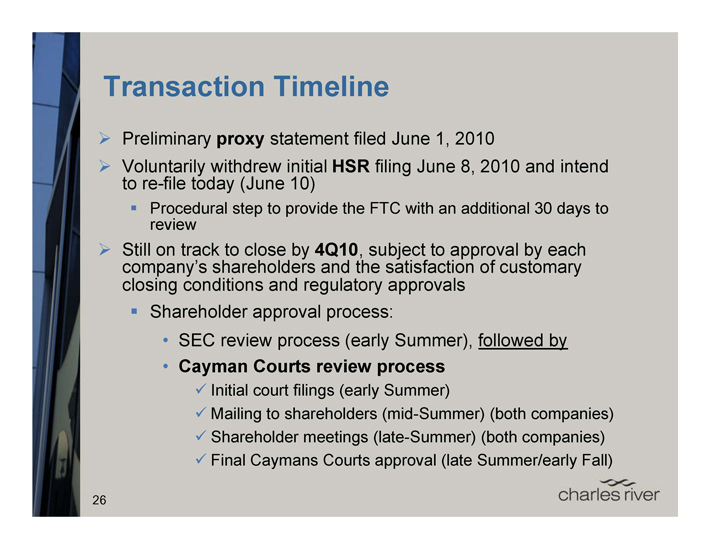

Transaction Timeline

Preliminary proxy statement filed June 1, 2010

Voluntarily withdrew initial HSR filing June 8, 2010 and intend to re-file today (June 10)

Procedural step to provide the FTC with an additional 30 days to review

Still on track to close by 4Q10, subject to approval by each company’s shareholders and the satisfaction of customary closing conditions and regulatory approvals

Shareholder approval process:

SEC review process (early Summer), followed by

Cayman Courts review process

Initial court filings (early Summer)

Mailing to shareholders (mid-Summer) (both companies)

Shareholder meetings (late-Summer) (both companies)

Final Caymans Courts approval (late Summer/early Fall)

charles river

26

29

A Transformational Combination

First fully integrated global early-stage CRO

Overwhelmingly positive response from top 20 clients

Creates opportunities for substantial revenue synergies due to unique portfolio and global footprint

Generates profitable revenue growth, driving long-term return on investment

charles river

27

30

Accelerating Drug Development. Exactly.

CRL

LISTED

NYSE

© 2010 Charles River Laboratories International, Inc.

charles river

31