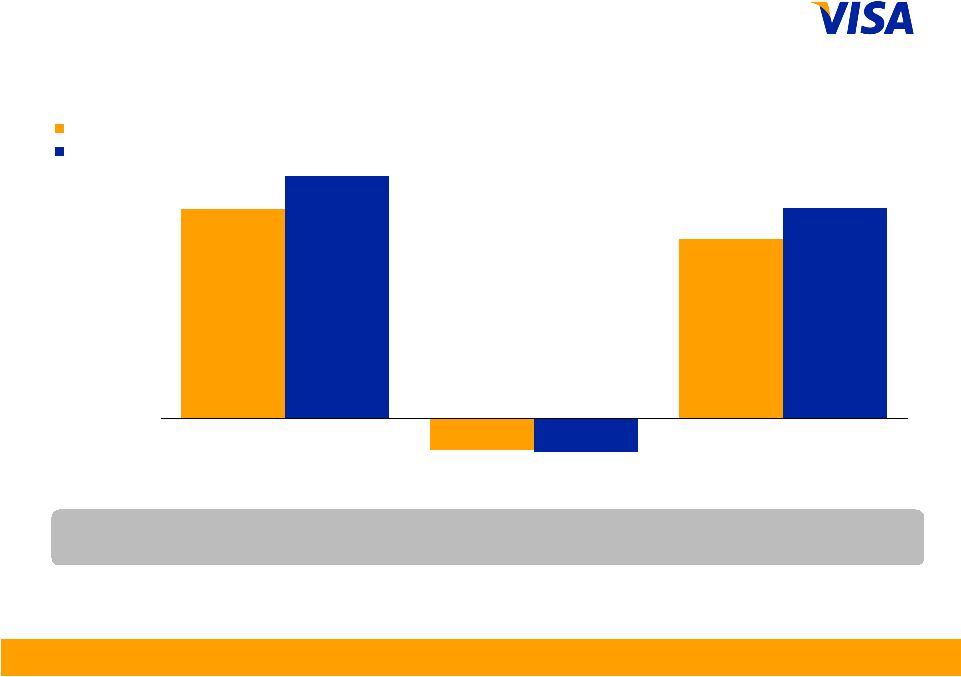

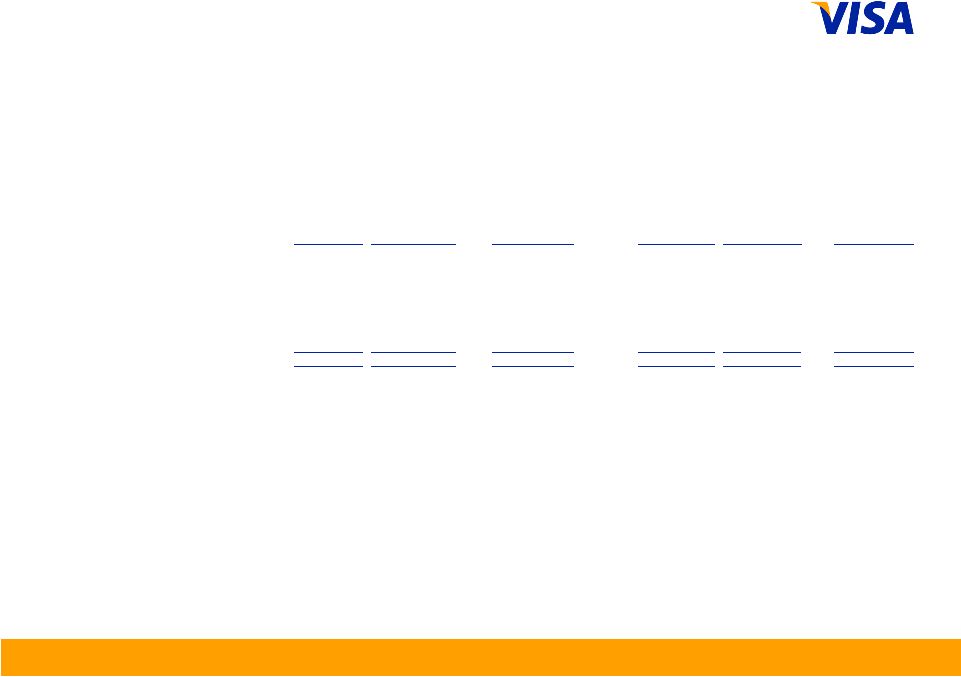

15 Fiscal Q1 2009 Earnings Results 15 Adjusted Operating Income and Net Income US$ in millions (1) (2) (3) (4) (5) (6) (7) Investment income earned during the period on all IPO proceeds held, including amounts held in the litigation escrow and amounts the Company used in October 2008 to redeem all class C (series II) common stock and a portion of the class C (series III) common stock stock held by Visa Europe. Other expense (income) recorded in the periods presented as a result of changes in the Company's estimated liability under the Framework Agreement, which governs its relationship with Visa Europe. The changes were primarily due to movement in the LIBOR rates in the periods presented. This liability terminated after the October 2008 redemptions described above. Reflects a normalized tax rate of 40% and 41% for fiscal 2009, and 2008, respectively. Restructuring costs associated with workforce consolidation and elimination of overlapping functions. Non-cash amortization and depreciation of the incremental basis in technology and building assets acquired in the reorganization. Non-cash interest expense recorded on future payments to be made under the settlement agreement with American Express. These payments will be paid from the litigation escrow account. Interest expense recorded on future payments to be made under the settlement agreement with Discover. These payments will be paid from the litigation escrow account. Net income (as reported) $ 574 $ 424 Addback: Income tax expense (as reported) 379 259 Net income before taxes (as reported) $ 953 $ 683 Adjustments: Restructuring (1) 28 36 Asset step-up amortization (2) 17 17 Adjustments to operating income 45 53 Interest accretion on American Express settlement (3) 10 23 Interest expense on Discover settlement (4) 3 - Investment income on Litigation Escrow and EU proceeds (5) (13) - Underwater contract (LIBOR adjustment) (6) - (8) Adjustments to non-operating income - 15 Total adjustments 45 68 Adjusted net income before tax 998 751 Adjusted income tax expense (7) (399) (308) Adjusted net income $ 599 $ 443 Operating income (as reported) $ 966 $ 678 Addback: Adjustments to operating income 45 53 Adjusted operating income $ 1,011 $ 731 Operating revenues (as reported) $ 1,739 $ 1,488 Adjusted operating margin 58% 49% Total operating expenses (as reported) $ 773 $ 810 Less: Adjustments to operating expenses (45) (53) Adjusted operating expenses $ 728 $ 757 December 31, 2008 For the Three Months Ended For the Three Months Ended December 31, 2007 |