Visa Inc. Fiscal First Quarter 2019 Financial Results January 30, 2019

Fiscal First Quarter 2019 Financial Results2 ©2019 Visa. All rights reserved. This presentation contains forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 that relate to, among other things, our future operations, prospects, developments, strategies, business growth and financial outlook for fiscal full-year 2019. Forward-looking statements generally are identified by words such as "believes," "estimates," "expects," "intends," "may," "projects," “outlook”, "could," "should," "will," "continue" and other similar expressions. All statements other than statements of historical fact could be forward-looking statements, which speak only as of the date they are made, are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, many of which are beyond our control and are difficult to predict. Actual results could differ materially from those expressed in, or implied by, our forward-looking statements due to a variety of factors, including, but not limited to: • increased oversight and regulation of the global payments industry and our business; • impact of government-imposed restrictions on international payment systems; • outcome of tax, litigation and governmental investigation matters; • increasingly intense competition in the payments industry, including competition for our clients and merchants; • proliferation and continuous evolution of new technologies and business models; • our ability to maintain relationships with our clients, merchants and other third parties; • brand or reputational damage; • management changes; • impact of global economic, political, market and social events or conditions; • exposure to loss or illiquidity due to settlement guarantees; • uncertainty surrounding the impact of the United Kingdom’s withdrawal from the European Union; • a disruption, failure, breach or cyber-attack of our networks or systems; • our ability to successfully integrate and manage our acquisitions and other strategic investments; and • other factors described in our filings with the U.S. Securities and Exchange Commission, including our Annual Report on Form 10-K for the year ended September 30, 2018, and our subsequent reports on Forms 10-Q and 8-K. Except as required by law, we do not intend to update or revise any forward-looking statements as a result of new information, future events or otherwise. Forward-Looking Statements

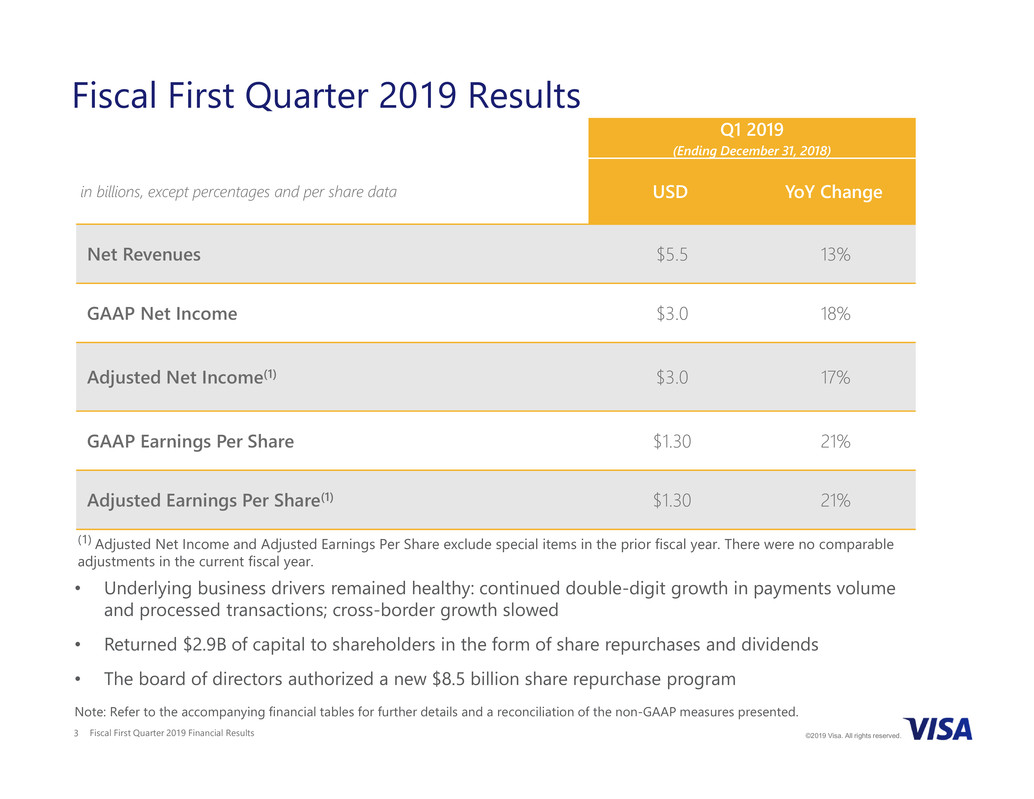

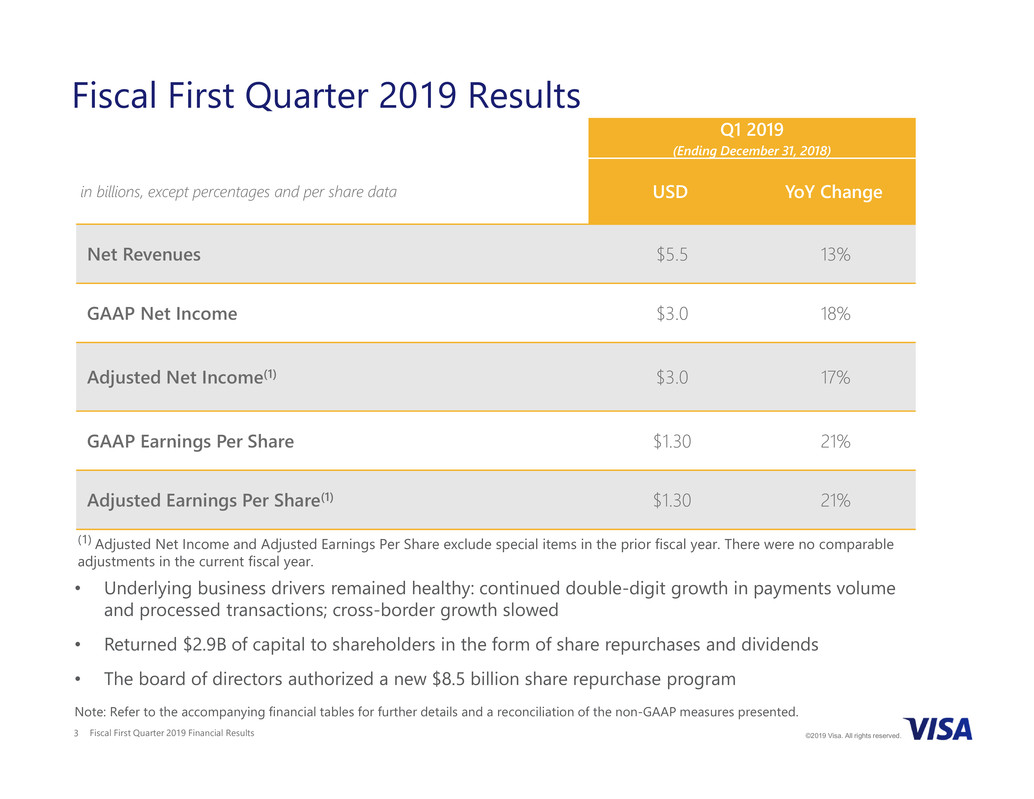

Fiscal First Quarter 2019 Financial Results3 ©2019 Visa. All rights reserved. Fiscal First Quarter 2019 Results Q1 2019 (Ending December 31, 2018) in billions, except percentages and per share data USD YoY Change Net Revenues $5.5 13% GAAP Net Income $3.0 18% Adjusted Net Income(1) $3.0 17% GAAP Earnings Per Share $1.30 21% Adjusted Earnings Per Share(1) $1.30 21% Note: Refer to the accompanying financial tables for further details and a reconciliation of the non-GAAP measures presented. • Underlying business drivers remained healthy: continued double-digit growth in payments volume and processed transactions; cross-border growth slowed • Returned $2.9B of capital to shareholders in the form of share repurchases and dividends • The board of directors authorized a new $8.5 billion share repurchase program (1) Adjusted Net Income and Adjusted Earnings Per Share exclude special items in the prior fiscal year. There were no comparable adjustments in the current fiscal year.

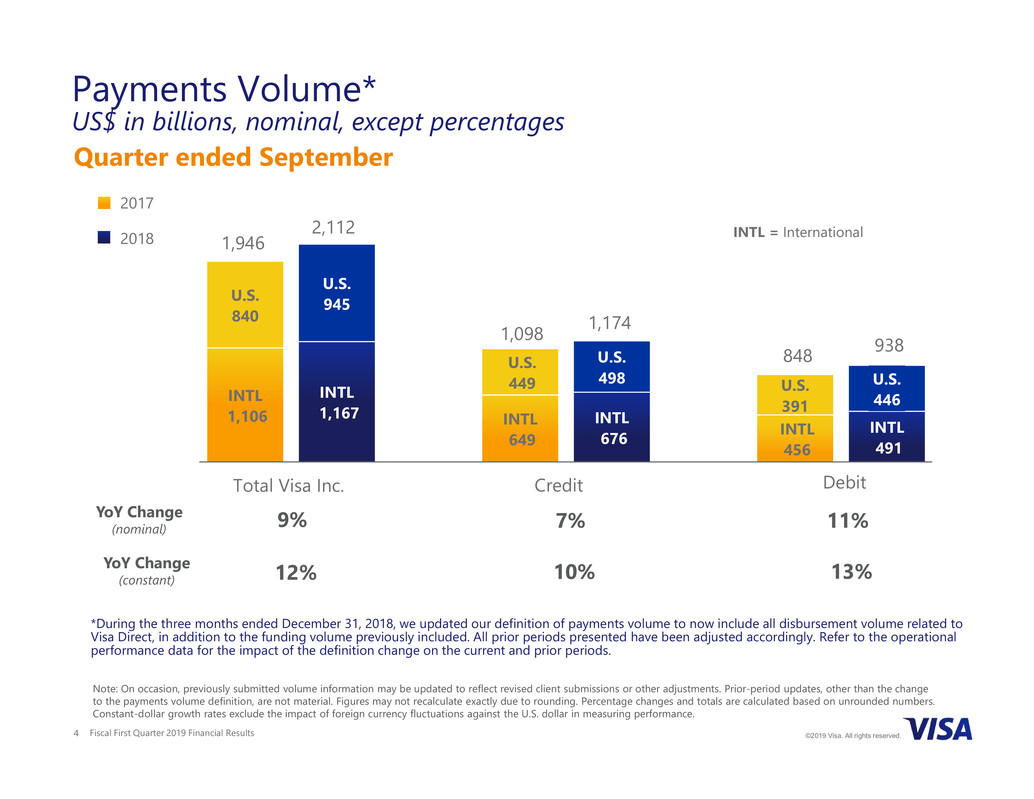

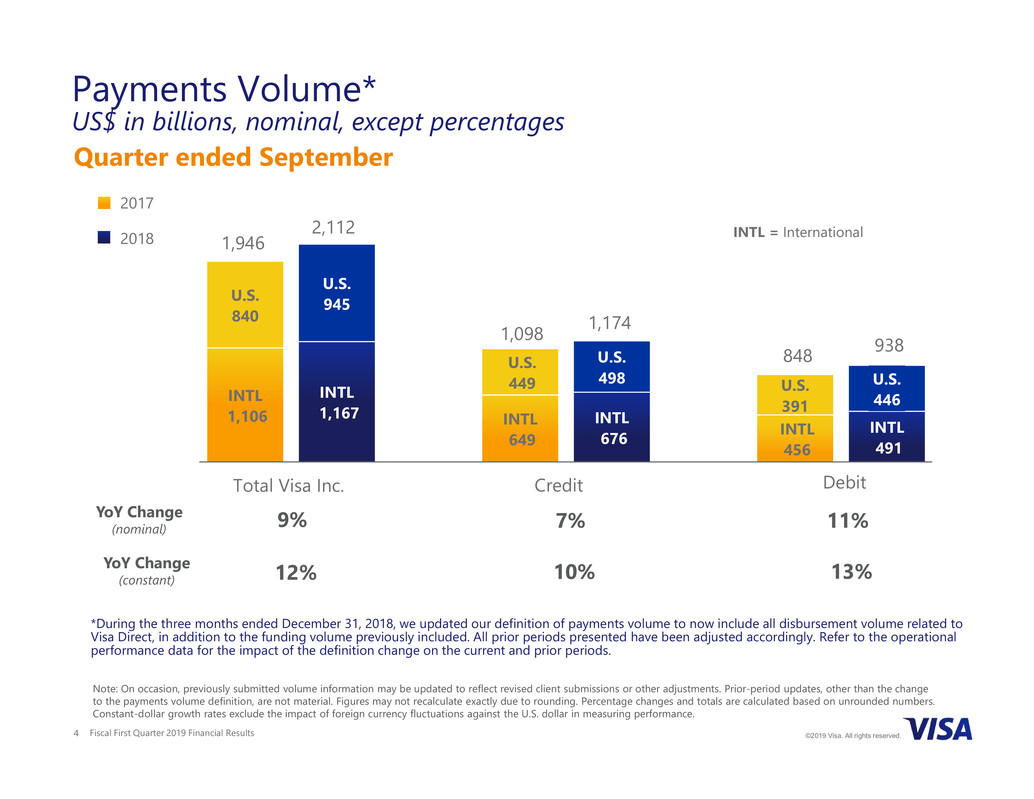

Fiscal First Quarter 2019 Financial Results4 ©2019 Visa. All rights reserved. Quarter ended September Payments Volume* US$ in billions, nominal, except percentages INTL 1,106 INTL 1,167 INTL 649 INTL 676 INTL 456 INTL 491 U.S. 840 U.S. 945 U.S. 449 U.S. 498 U.S. 391 U.S. 446 1,946 2,112 1,098 1,174 848 938 INTL = International Total Visa Inc. Credit Debit YoY Change (constant) 12% 10% 13% YoY Change (nominal) 7% 11%9% Note: On occasion, previously submitted volume information may be updated to reflect revised client submissions or other adjustments. Prior-period updates, other than the change to the payments volume definition, are not material. Figures may not recalculate exactly due to rounding. Percentage changes and totals are calculated based on unrounded numbers. Constant-dollar growth rates exclude the impact of foreign currency fluctuations against the U.S. dollar in measuring performance. 2017 2018 *During the three months ended December 31, 2018, we updated our definition of payments volume to now include all disbursement volume related to Visa Direct, in addition to the funding volume previously included. All prior periods presented have been adjusted accordingly. Refer to the operational performance data for the impact of the definition change on the current and prior periods.

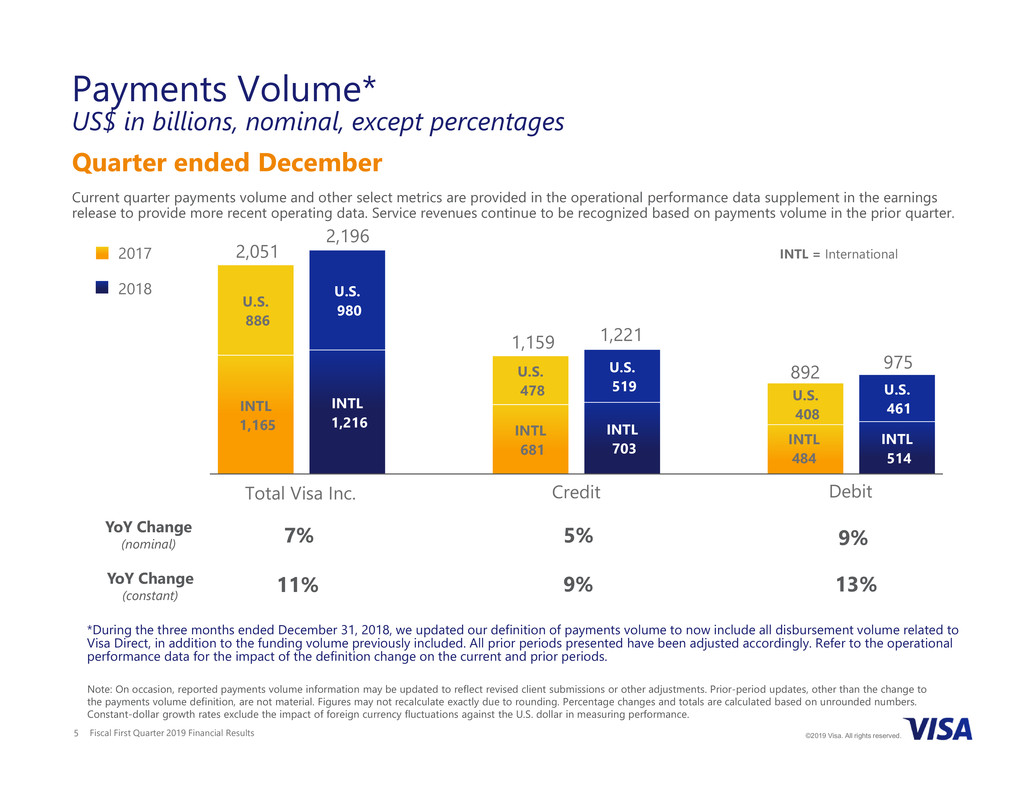

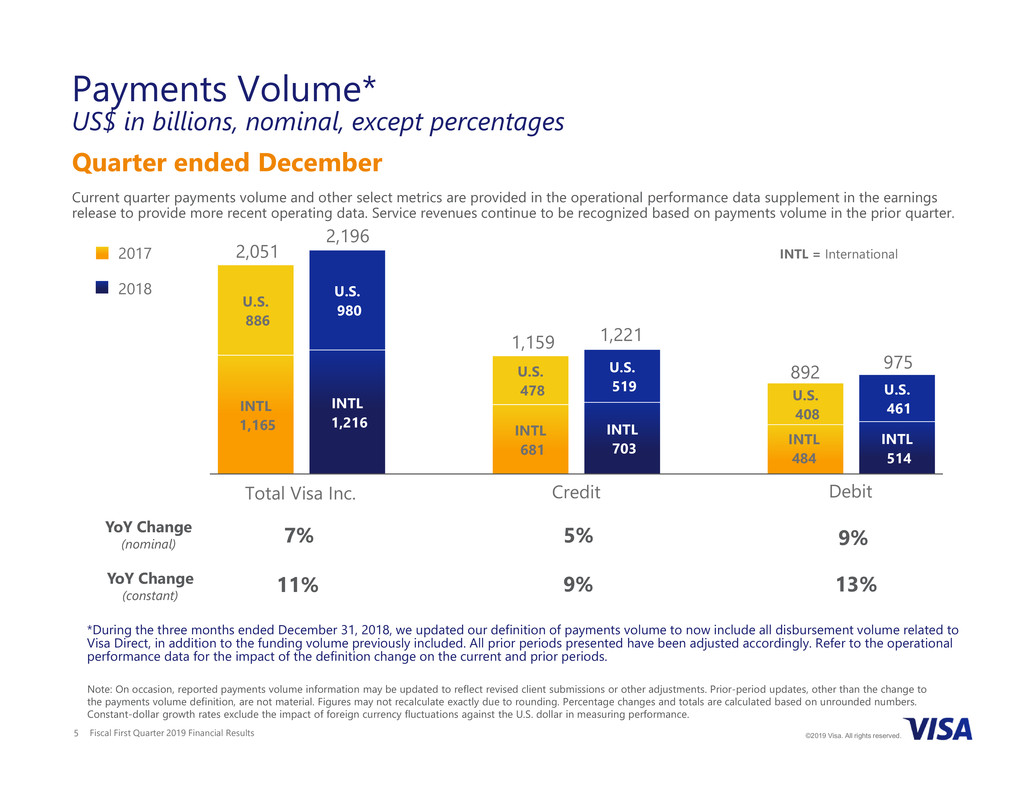

Fiscal First Quarter 2019 Financial Results5 ©2019 Visa. All rights reserved. Quarter ended December Current quarter payments volume and other select metrics are provided in the operational performance data supplement in the earnings release to provide more recent operating data. Service revenues continue to be recognized based on payments volume in the prior quarter. Payments Volume* US$ in billions, nominal, except percentages YoY Change (constant) 11% 9% 13% YoY Change (nominal) 5% 9%7% Note: On occasion, reported payments volume information may be updated to reflect revised client submissions or other adjustments. Prior-period updates, other than the change to the payments volume definition, are not material. Figures may not recalculate exactly due to rounding. Percentage changes and totals are calculated based on unrounded numbers. Constant-dollar growth rates exclude the impact of foreign currency fluctuations against the U.S. dollar in measuring performance. INTL 420 INTL 09 U.S. 575 U.S. 631 U.S. 277 U.S. 313 INTL 1,165 INTL 1,216 INTL 681 INTL 703 INTL 484 INTL 514 U.S. 886 U.S. 980 U.S. 478 U.S. 519 U.S. 408 U.S. 461 2,051 2,196 1,159 1,221 892 975 INTL = International Total Visa Inc. Credit Debit 2017 2018 *During the three months ended December 31, 2018, we updated our definition of payments volume to now include all disbursement volume related to Visa Direct, in addition to the funding volume previously included. All prior periods presented have been adjusted accordingly. Refer to the operational performance data for the impact of the definition change on the current and prior periods.

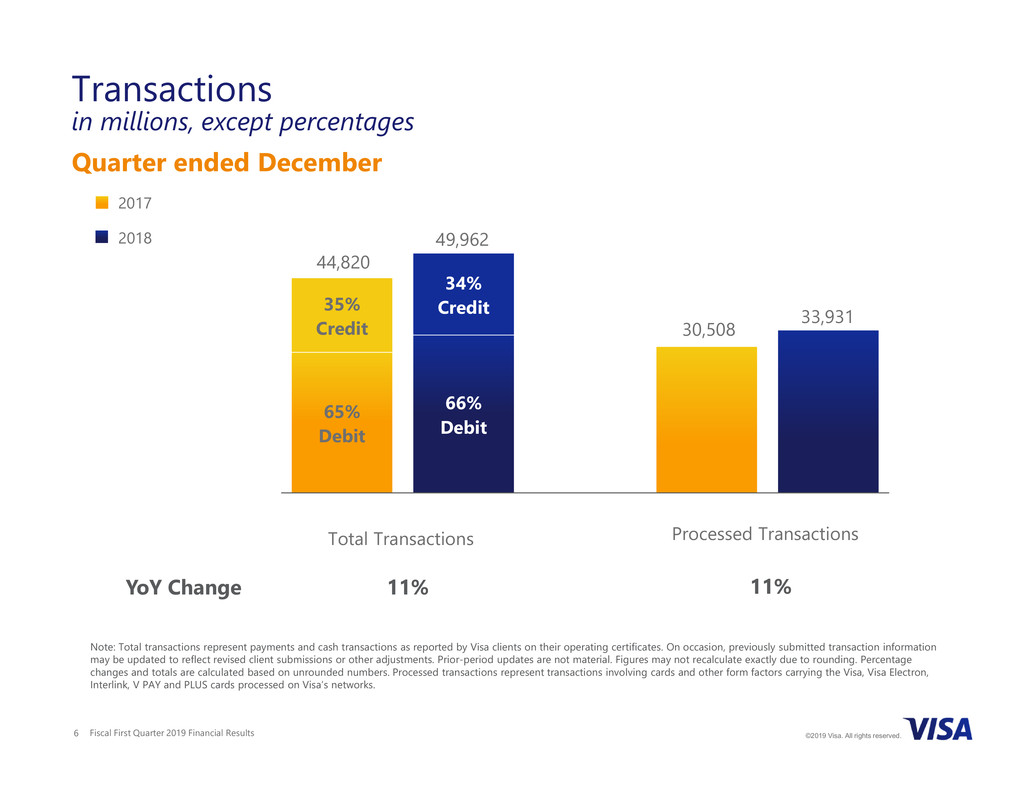

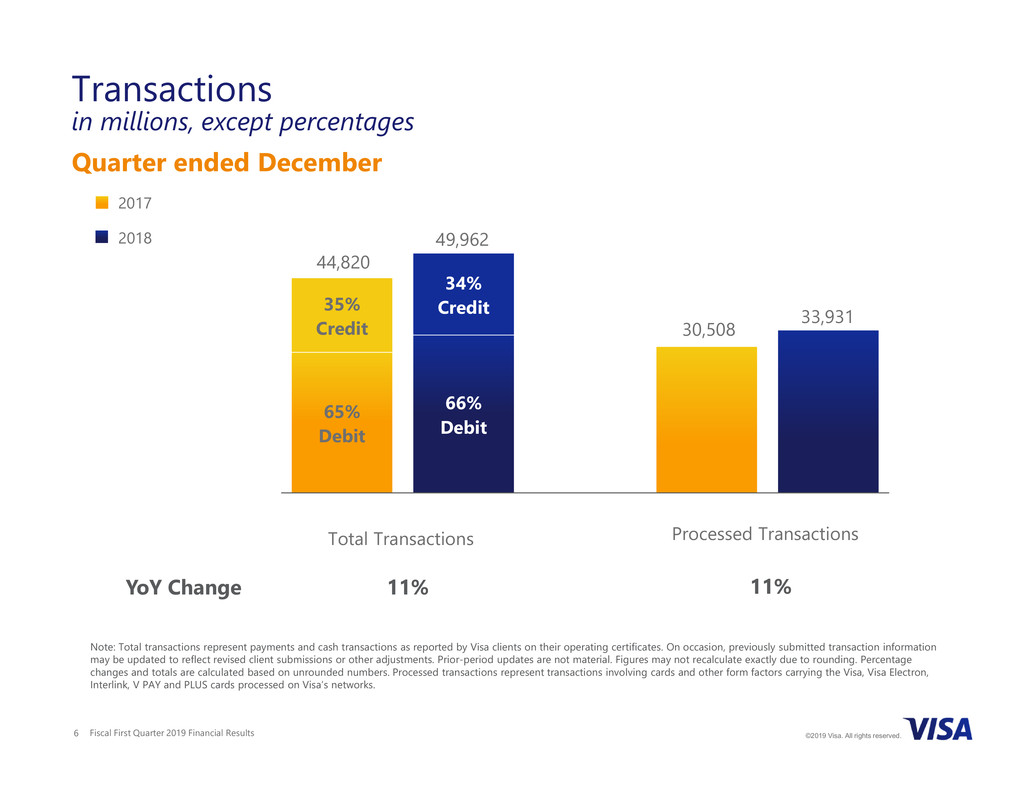

Fiscal First Quarter 2019 Financial Results6 ©2019 Visa. All rights reserved. Quarter ended December Transactions in millions, except percentages Note: Total transactions represent payments and cash transactions as reported by Visa clients on their operating certificates. On occasion, previously submitted transaction information may be updated to reflect revised client submissions or other adjustments. Prior-period updates are not material. Figures may not recalculate exactly due to rounding. Percentage changes and totals are calculated based on unrounded numbers. Processed transactions represent transactions involving cards and other form factors carrying the Visa, Visa Electron, Interlink, V PAY and PLUS cards processed on Visa’s networks. Credit 38% YoY Change 11% 11% Debit 62% Credit 38% 65% Debit 66% Debit 35% Credit 34% Credit 44,820 49,962 30,508 33,931 Processed TransactionsTotal Transactions 2017 2018

Fiscal First Quarter 2019 Financial Results7 ©2019 Visa. All rights reserved. Quarter ended September Total Cards in millions, except percentages 3,209 1,070 2,139 3,347 1,107 2,240 Total Visa Inc. Credit Debit Note: The data presented is based on results reported quarterly by Visa clients on their operating certificates. Estimates may be utilized if data is unavailable. On occasion, previously submitted card information may be updated to reflect revised client submissions or other adjustments. Prior-period updates are not material. Figures may not recalculate exactly due to rounding. Percentage changes are calculated based on unrounded numbers. YoY Change 3% 5%4% 2017 2018

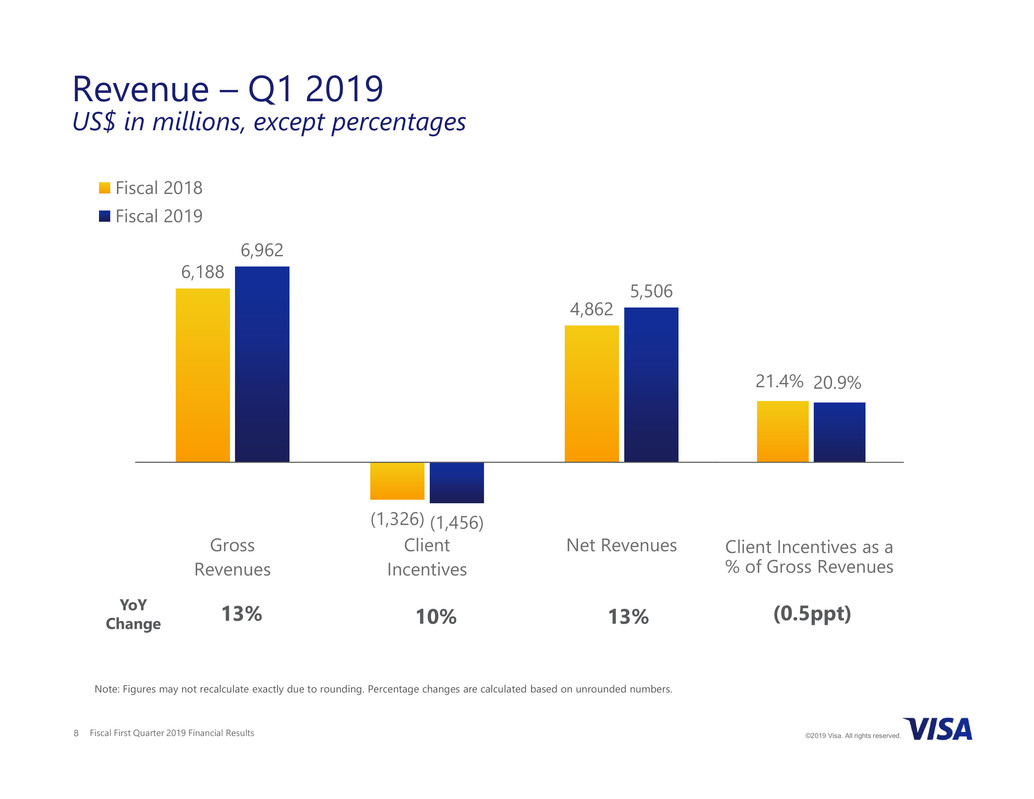

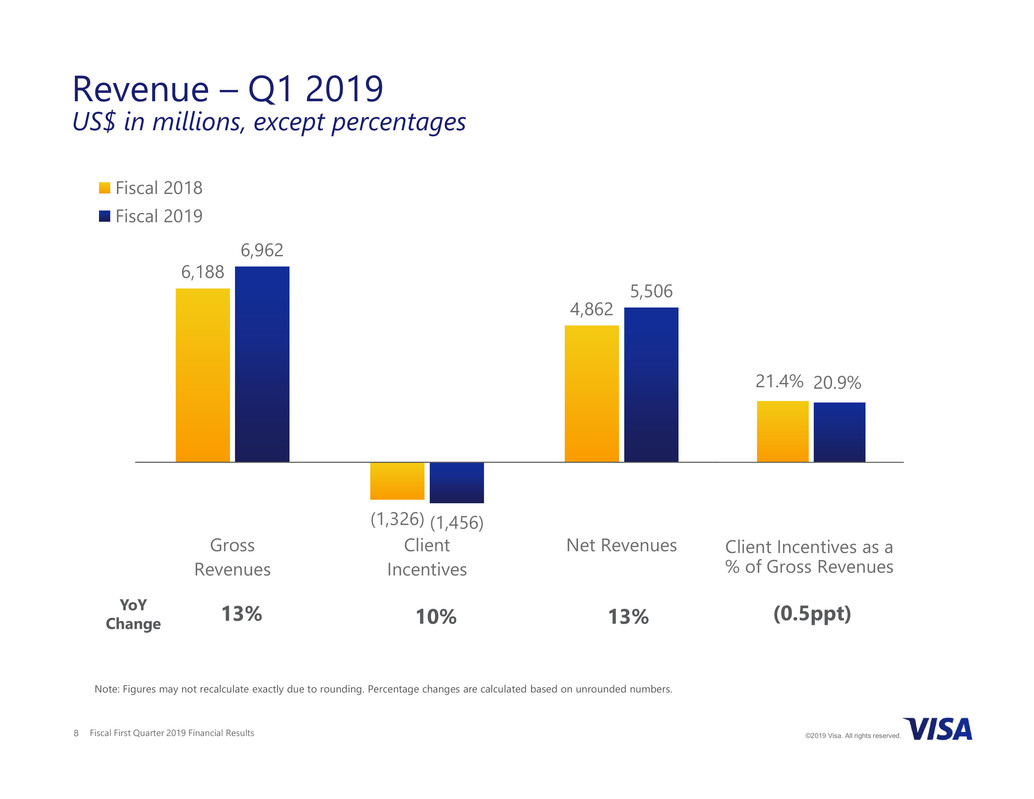

Fiscal First Quarter 2019 Financial Results8 ©2019 Visa. All rights reserved. 6,188 (1,326) 4,862 6,962 (1,456) 5,506 Gross Revenues Client Incentives Net Revenues Fiscal 2018 Fiscal 2019 Revenue – Q1 2019 US$ in millions, except percentages YoY Change 10% 13%13% Note: Figures may not recalculate exactly due to rounding. Percentage changes are calculated based on unrounded numbers. 21.4% 20.9% Client Incentives as a % of Gross Revenues (0.5ppt)

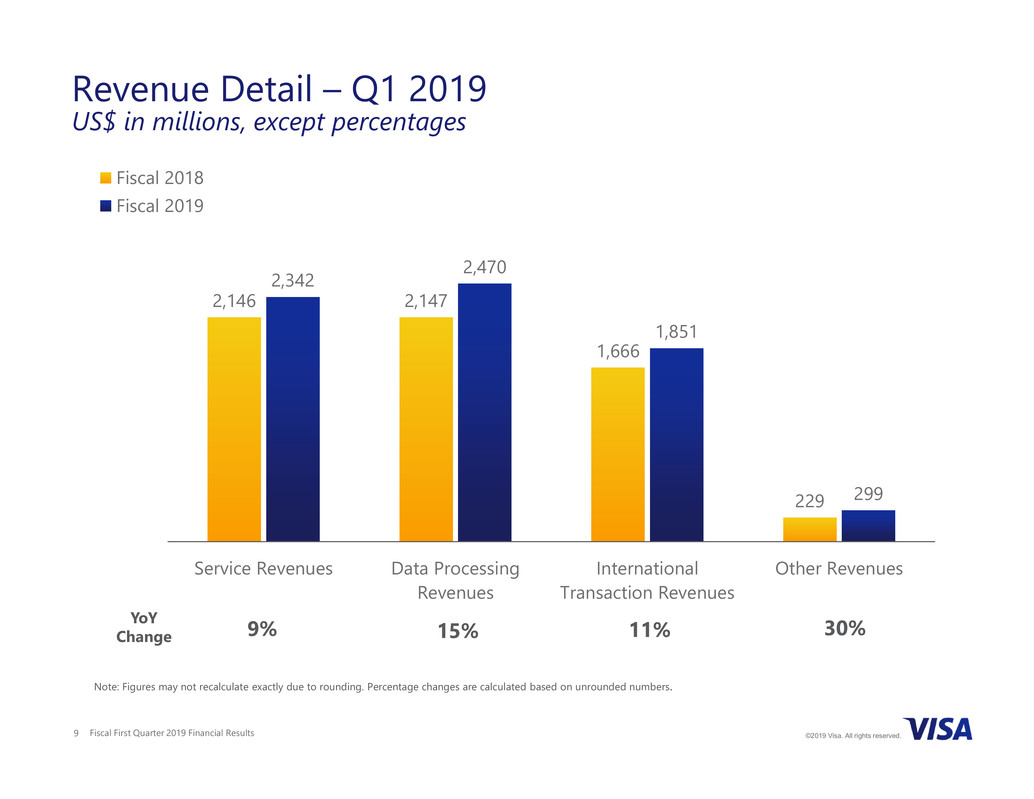

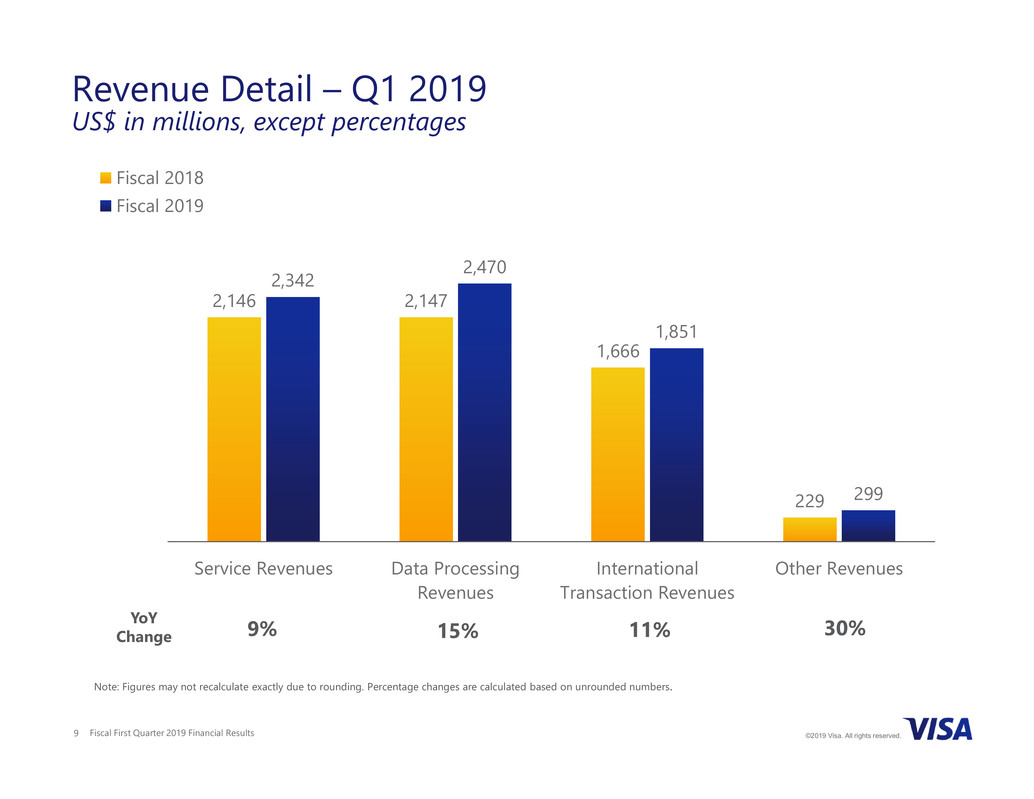

Fiscal First Quarter 2019 Financial Results9 ©2019 Visa. All rights reserved. Revenue Detail – Q1 2019 US$ in millions, except percentages 2,146 2,147 1,666 229 2,342 2,470 1,851 299 Service Revenues Data Processing Revenues International Transaction Revenues Other Revenues Fiscal 2018 Fiscal 2019 YoY Change 15% 11%9% 30% Note: Figures may not recalculate exactly due to rounding. Percentage changes are calculated based on unrounded numbers.

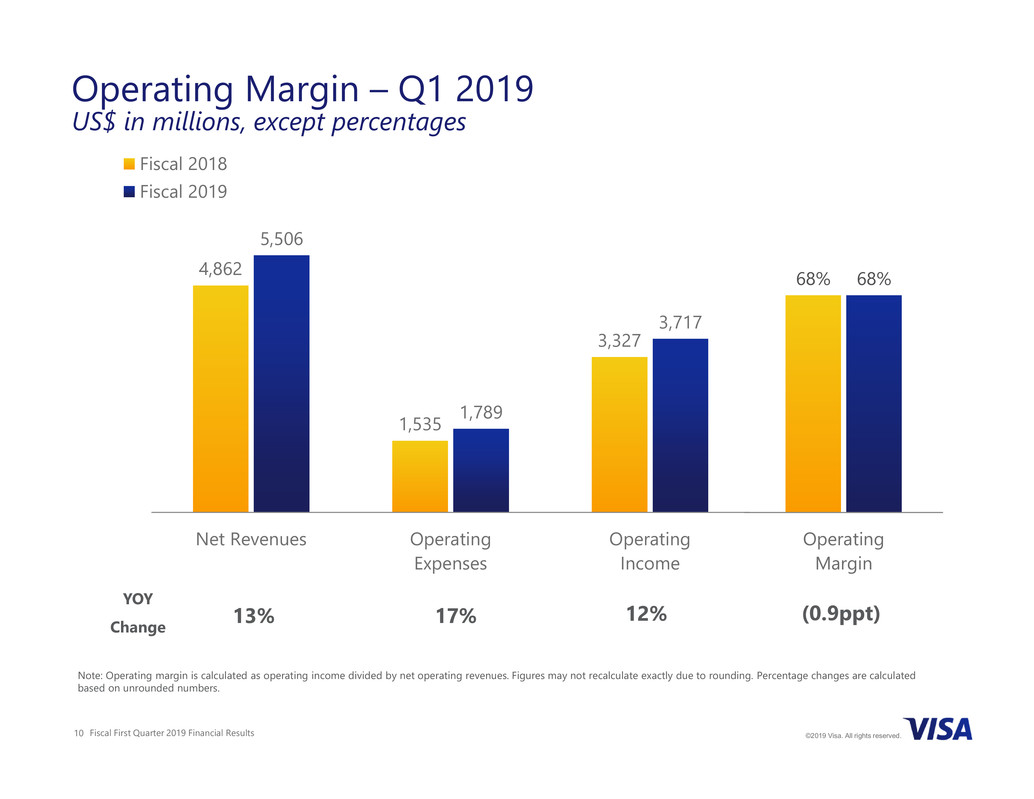

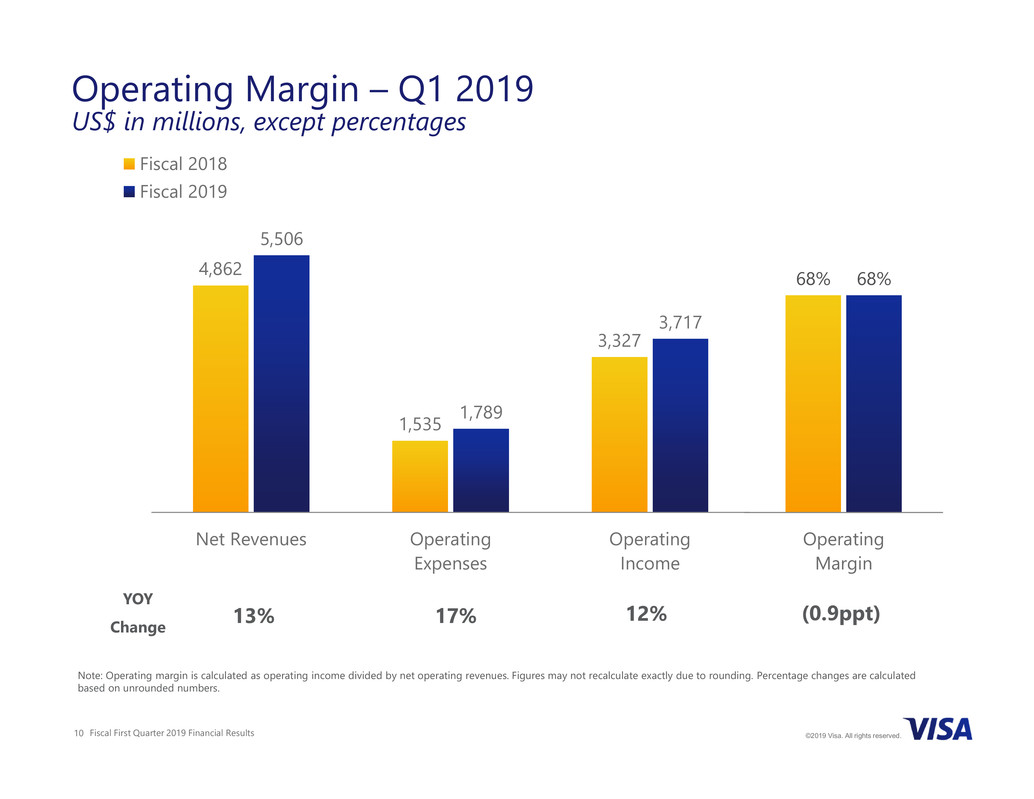

Fiscal First Quarter 2019 Financial Results10 ©2019 Visa. All rights reserved. Operating Margin – Q1 2019 US$ in millions, except percentages Note: Operating margin is calculated as operating income divided by net operating revenues. Figures may not recalculate exactly due to rounding. Percentage changes are calculated based on unrounded numbers. 13% 12%17% (0.9ppt) YOY Change 4,862 1,535 3,327 5,506 1,789 3,717 Net Revenues Operating Expenses Operating Income Fiscal 2018 Fiscal 2019 68% 68% Operating Margin

Fiscal First Quarter 2019 Financial Results11 ©2019 Visa. All rights reserved. Operating Expenses – Q1 2019 US$ in millions, except percentages Note: Figures may not recalculate exactly due to rounding. Percentage changes are calculated based on unrounded numbers. 679 223 160 92 145 236 0 807 276 173 91 159 276 7 Personnel Marketing Network & Processing Professional Fees Depreciation & Amortization General & Administrative Litigation Provision Fiscal 2018 Fiscal 2019 YoY Change 8% (1)%19% 17%9%24% NM NM- Not meaningful

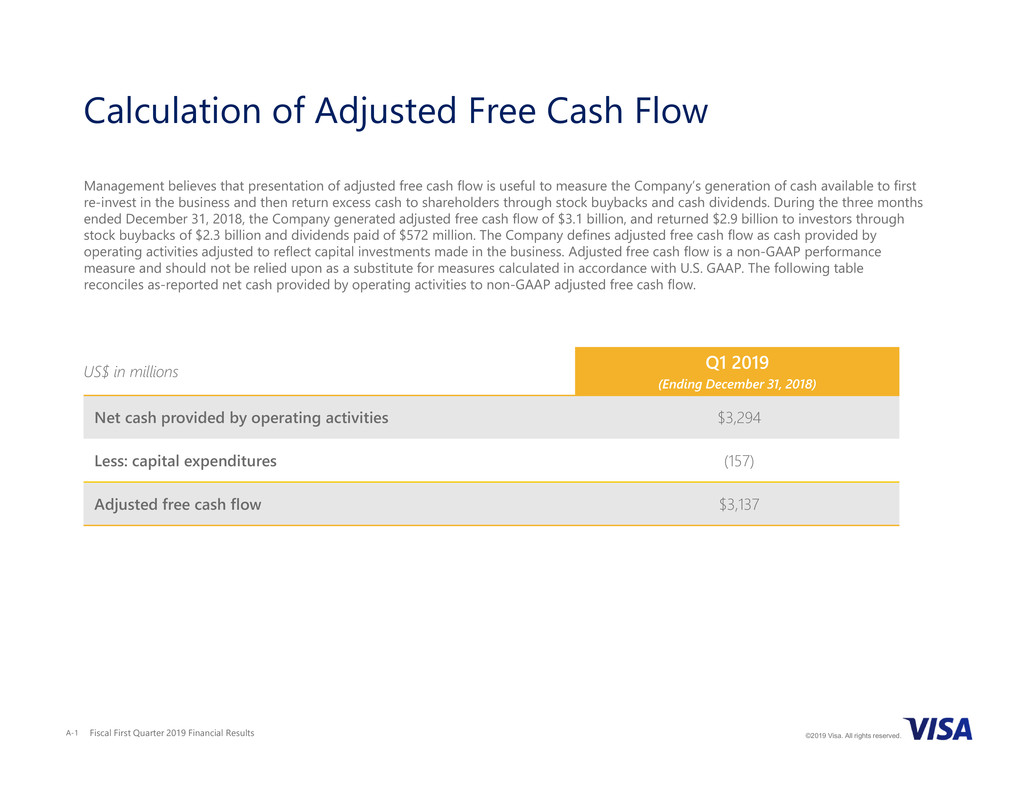

Fiscal First Quarter 2019 Financial Results12 ©2019 Visa. All rights reserved. Other Financial Results and Highlights • Cash, cash equivalents and investment securities of $15.9 billion as of December 31, 2018 • Adjusted free cash flow of $3.1 billion for the fiscal first quarter • Capital expenditures of $157 million during the fiscal first quarter • On January 24, 2019, the district court granted preliminary approval of the settlement which was announced in September 2018 to resolve monetary class claims in the multi-district interchange litigation. The court scheduled a final approval hearing in November 2019 See appendix for reconciliation of adjusted free cash flow to the closest comparable U.S. GAAP financial measure.

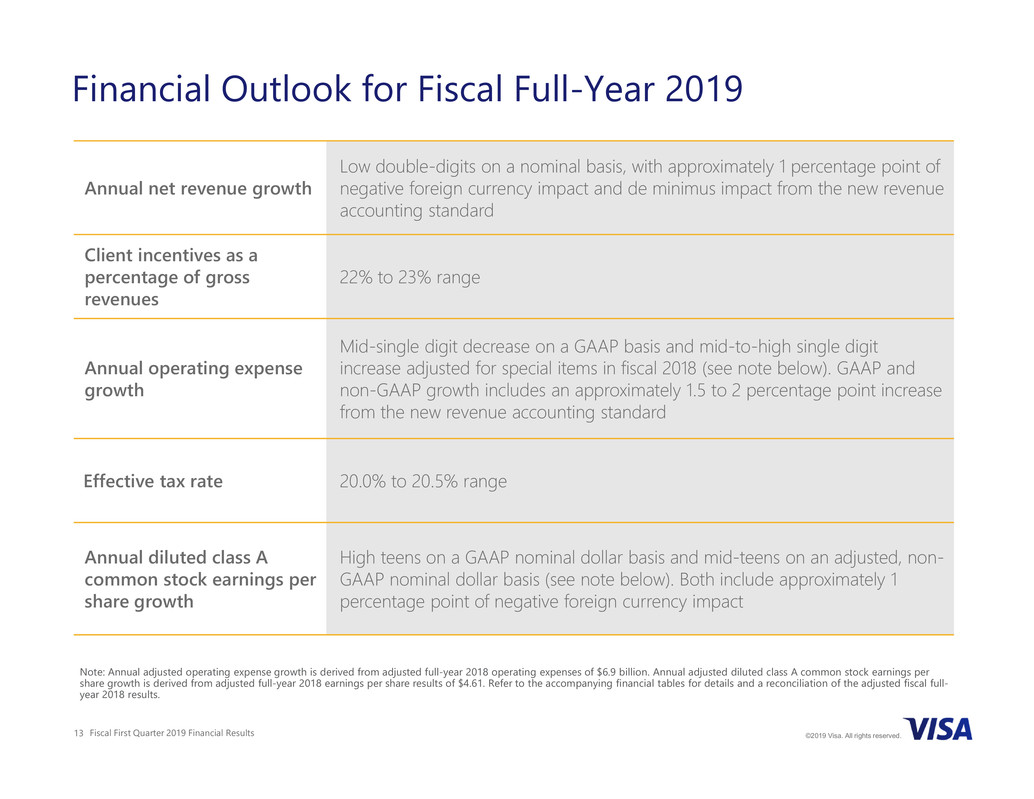

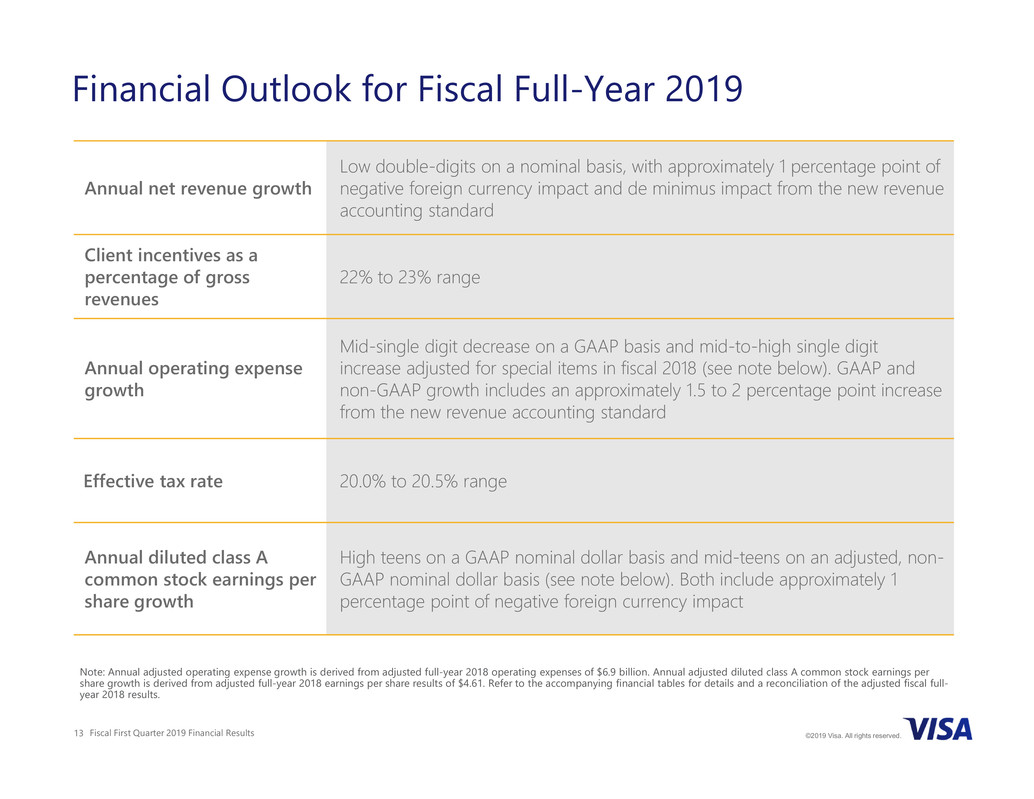

Fiscal First Quarter 2019 Financial Results13 ©2019 Visa. All rights reserved. Financial Outlook for Fiscal Full-Year 2019 Annual net revenue growth Low double-digits on a nominal basis, with approximately 1 percentage point of negative foreign currency impact and de minimus impact from the new revenue accounting standard Client incentives as a percentage of gross revenues 22% to 23% range Annual operating expense growth Mid-single digit decrease on a GAAP basis and mid-to-high single digit increase adjusted for special items in fiscal 2018 (see note below). GAAP and non-GAAP growth includes an approximately 1.5 to 2 percentage point increase from the new revenue accounting standard Effective tax rate 20.0% to 20.5% range Annual diluted class A common stock earnings per share growth High teens on a GAAP nominal dollar basis and mid-teens on an adjusted, non- GAAP nominal dollar basis (see note below). Both include approximately 1 percentage point of negative foreign currency impact Note: Annual adjusted operating expense growth is derived from adjusted full-year 2018 operating expenses of $6.9 billion. Annual adjusted diluted class A common stock earnings per share growth is derived from adjusted full-year 2018 earnings per share results of $4.61. Refer to the accompanying financial tables for details and a reconciliation of the adjusted fiscal full- year 2018 results.

Appendix

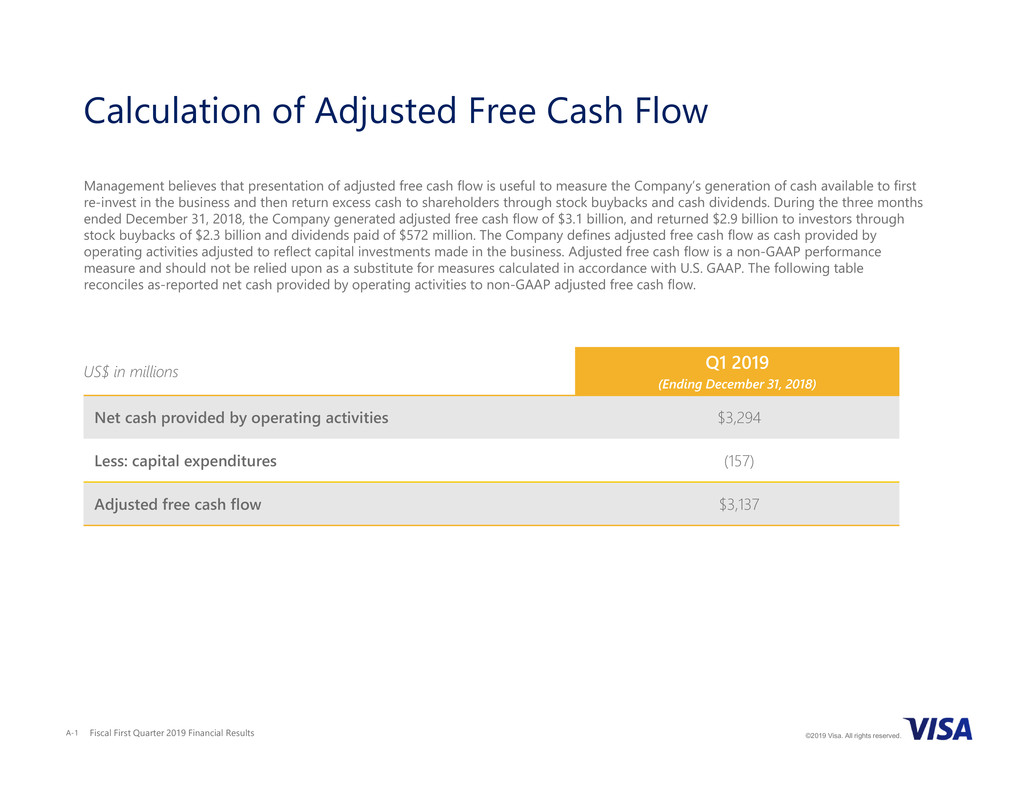

Fiscal First Quarter 2019 Financial Results15 ©2019 Visa. All rights reserved. Calculation of Adjusted Free Cash Flow A- Management believes that presentation of adjusted free cash flow is useful to measure the Company’s generation of cash available to first re-invest in the business and then return excess cash to shareholders through stock buybacks and cash dividends. During the three months ended December 31, 2018, the Company generated adjusted free cash flow of $3.1 billion, and returned $2.9 billion to investors through stock buybacks of $2.3 billion and dividends paid of $572 million. The Company defines adjusted free cash flow as cash provided by operating activities adjusted to reflect capital investments made in the business. Adjusted free cash flow is a non-GAAP performance measure and should not be relied upon as a substitute for measures calculated in accordance with U.S. GAAP. The following table reconciles as-reported net cash provided by operating activities to non-GAAP adjusted free cash flow. US$ in millions Q1 2019 (Ending December 31, 2018) Net cash provided by operating activities $3,294 Less: capital expenditures (157) Adjusted free cash flow $3,137