Q2 2019 Results (Ending March 31, 2019) Alfred F. Kelly, Jr. , Chief Executive Officer, Visa Inc., commented on the results: “Visa had another solid quarter demonstrating the power of the business model. We continue to invest heavily behind important strategic initiatives while delivering net income and earnings per share growth of 14% and 17%, respectively.” in billions, except percentages and per share data USD YoY Change Net Revenues $5.5 8% Net Income $3.0 14% Earnings Per Share $1.31 17% Q2 2019 Key Business Drivers (YoY growth, volume in constant dollars) Payments volume +8% Cross-border volume +4% Processed transactions +11% Visa Inc. Reports Fiscal Second Quarter 2019 Results San Francisco, CA, April 24, 2019 – Visa Inc. (NYSE: V) Net income of $3.0B or $1.31 per share, increases of 14% and 17%, respectively Net revenues of $5.5B, an increase of 8% Payments volume and processed transactions growth remained healthy; cross-border growth slowed in-line with expectations Increased earnings per share outlook for the fiscal full-year 2019 based on strong performance in the first half Returned $2.6B of capital to shareholders in the form of share repurchases and dividends Exhibit 99.1

2 Fiscal Second Quarter 2019 — Financial Highlights Net income in the fiscal second quarter was $3.0 billion or $1.31 per share, increases of 14% and 17%, respectively, over prior year’s results. Exchange rate shifts versus the prior year negatively impacted earnings per share growth by approximately 1.5 percentage points. All references to earnings per share assume fully-diluted class A share count. Net revenues in the fiscal second quarter were $5.5 billion, an increase of 8%, driven by continued growth in payments volume, cross-border volume and processed transactions. Exchange rate shifts versus the prior year negatively impacted reported net revenues growth by approximately 1.5 percentage points. The Company adopted the new revenue accounting standard effective October 1, 2018, which positively impacted reported net revenues growth by 0.8 percentage points. Payments volume for the three months ended December 31, 2018, on which fiscal second quarter service revenues are recognized, grew 11% over the prior year on a constant-dollar basis. Payments volume for the three months ended March 31, 2019, grew 8% over the prior year on a constant-dollar basis. Cross-border volume growth, on a constant-dollar basis, was 4% for the three months ended March 31, 2019. Growth was 6% in the quarter adjusting for an e-commerce platform reorienting acquiring within Europe from cross-border to domestic, which had minimal revenue impact. Total processed transactions, which represent transactions processed by Visa, for the three months ended March 31, 2019, were 32.5 billion, an 11% increase over the prior year. Fiscal second quarter service revenues were $2.4 billion, an increase of 7% over the prior year, and are recognized based on payments volume in the prior quarter. All other revenue categories are recognized based on current quarter activity. Data processing revenues rose 14% over the prior year to $2.4 billion. International transaction revenues grew 3% over the prior year to $1.8 billion. Other revenues of $327 million rose 42% over the prior year. Client incentives, which are a contra revenue item, were $1.5 billion and represent 21.2% of gross revenues. Operating expenses were $1.9 billion for the fiscal second quarter, a 7% increase over the prior year's results, primarily driven by personnel and general and administrative costs. The new revenue accounting standard increased reported operating expense growth by 2.8 percentage points. Non-operating income was $36 million for the fiscal second quarter driven by investment gains, higher interest income on cash and investments, and lower interest expense. Effective income tax rate was 19.0% for the quarter ended March 31, 2019. Cash, cash equivalents and investment securities were $15.0 billion as of March 31, 2019. The weighted-average number of diluted shares of class A common stock outstanding was 2.28 billion for the quarter ended March 31, 2019.

3 Fiscal Second Quarter 2019 — Other Notable Items During the three months ended March 31, 2019, the Company recognized $84 million of investment gains recorded in non- operating income. Several private companies in which the Company has strategic investments executed transactions or funding rounds during the quarter, which established new and higher valuations. The Company adopted the accounting standard ASU 2016-01 in fiscal year 2019 that requires companies to recognize unrealized gains and losses in their income statement each quarter. During the three months ended March 31, 2019, the Company repurchased 14.0 million shares of class A common stock, at an average price of $145.40 per share, using $2.0 billion of cash on hand. In the six months ended March 31, 2019, the Company repurchased a total of 30.9 million shares of class A common stock, at an average price of $141.26 per share, using $4.4 billion of cash on hand. The Company has $8.3 billion of authorized funds available for share repurchase as of March 31, 2019. On April 16, 2019, the board of directors declared a quarterly cash dividend of $0.25 per share of class A common stock (determined in the case of class B and C common stock and series B and C convertible participating preferred stock on an as- converted basis) payable on June 4, 2019, to all holders of record as of May 17, 2019. Financial Outlook for Fiscal Full-Year 2019 Visa Inc. reaffirms its fiscal full-year 2019 financial outlook for the following metrics: Annual net revenue growth: Low double-digits on a nominal basis, with approximately 1 percentage point of negative foreign currency impact and de minimus impact from the new revenue accounting standard Annual operating expense growth: Mid-single digit decrease on a GAAP basis and mid-to-high single digit increase adjusted for special items in fiscal 2018 (see note below). GAAP and non-GAAP growth includes an approximately 1.5 to 2 percentage point increase from the new revenue accounting standard Visa Inc. updates its fiscal full-year 2019 financial outlook for the following metrics: Client incentives as a percentage of gross revenues: 22% to 23% range for the second half of the fiscal year and low end of 22% to 23% range for the full fiscal year Effective tax rate: Approximately 20% Annual diluted class A common stock earnings per share growth: Low twenties on a GAAP nominal dollar basis and high- end of mid-teens on an adjusted, non-GAAP nominal dollar basis (see note below). Both include approximately 1.5 percentage points of negative foreign currency impact Note: Annual adjusted operating expense growth is derived from adjusted full-year 2018 operating expenses of $6.9 billion. Annual adjusted diluted class A common stock earnings per share growth is derived from adjusted full-year 2018 earnings per share results of $4.61. Refer to the accompanying financial tables for details and a reconciliation of the adjusted fiscal full-year 2018 results. Fiscal Second Quarter 2019 Earnings Results Conference Call Details Visa’s executive management team will host a live audio webcast beginning at 5:00 p.m. Eastern Time (2:00 p.m. Pacific Time) today to discuss the financial results and business highlights. All interested parties are invited to listen to the live webcast at http://investor.visa.com. A replay of the webcast will be available on the Visa Investor Relations website for 30 days. Investor information, including supplemental financial information, is available on Visa Inc.’s Investor Relations website at http://investor.visa.com.

4 Forward-Looking Statements This press release contains forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 that relate to, among other things, our future operations, prospects, developments, strategies, business growth and financial outlook for fiscal full-year 2019. Forward-looking statements generally are identified by words such as “believes,” “estimates,” “expects,” “intends,” “may,” “projects,” “outlook”, “could,” “should,” “will,” “continue” and other similar expressions. All statements other than statements of historical fact could be forward-looking statements, which speak only as of the date they are made, are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, many of which are beyond our control and are difficult to predict. Actual results could differ materially from those expressed in, or implied by, our forward-looking statements due to a variety of factors, including, but not limited to: increased oversight and regulation of the global payments industry and our business; impact of government-imposed restrictions on international payment systems; outcome of tax, litigation and governmental investigation matters; increasingly intense competition in the payments industry, including competition for our clients and merchants; proliferation and continuous evolution of new technologies and business models; our ability to maintain relationships with our clients, merchants and other third parties; brand or reputational damage; management changes; impact of global economic, political, market and social events or conditions; exposure to loss or illiquidity due to settlement guarantees; uncertainty surrounding the impact of the United Kingdom’s withdrawal from the European Union; a disruption, failure, breach or cyber-attack of our networks or systems; our ability to successfully integrate and manage our acquisitions and other strategic investments; and other factors described in our filings with the U.S. Securities and Exchange Commission, including our Annual Report on Form 10-K for the year ended September 30, 2018, and our subsequent reports on Forms 10-Q and 8-K. Except as required by law, we do not intend to update or revise any forward-looking statements as a result of new information, future events or otherwise. About Visa Inc. Visa Inc. (NYSE: V) is the world’s leader in digital payments. Our mission is to connect the world through the most innovative, reliable and secure payment network - enabling individuals, businesses and economies to thrive. Our advanced global processing network, VisaNet, provides secure and reliable payments around the world, and is capable of handling more than 65,000 transaction messages a second. Our relentless focus on innovation is a catalyst for the rapid growth of connected commerce on any device, and a driving force behind the dream of a cashless future for everyone, everywhere. As the world moves from analog to digital, Visa is applying our brand, products, people, network and scale to reshape the future of commerce. For more information, visit usa.visa.com/about-visa.html, usa.visa.com/visa-everywhere/blog.html and @VisaNews. Contacts Investor Relations Mike Milotich, 650-432-7644, InvestorRelations@visa.com Media Relations Will Stickney, 650-432-2990, Press@visa.com

5 Fiscal Second Quarter 2019 — Financial Summary Revenues Service revenues 2,417$ 7% Data processing revenues 2,432 14% International transaction revenues 1,796 3% Other revenues 327 42% Client incentives (1,478) 15% Net revenues 5,494 8% Operating Expenses Personnel 894 8% Marketing 241 (8%) Network and processing 171 1% Professional fees 101 (7%) Depreciation and amortization 160 4% General and administrative 264 19% Litigation provision 22 NM Total operating expenses 1 ,853 7% Operating income 3,641 9% Non-operat ing Income (Expense) Non-operating income 36 NM Effective tax rate 19.0% 0 ppt Net income 2,977$ 14% Earnings per share 1 .31$ 17% NM - Not Meaningful YoY Change Constant Nominal Payments volume 8% 4% Cross-border volume 4% (2%) Processed transactions 11% 11% Q2 FISCAL 2019 KEY BUSINESS DRIVERS (in millions, except percentages and per share data) Three Months Ended March 31, 2019 YoY Change Q2 FISCAL 2019 INCOME STATEMENT SUMMARY

6 Visa Inc. Consolidated Balance Sheets (unaudited) March 31, 2019 September 30, 2018 (in millions, except par value data) Assets Cash and cash equivalents $ 7,648 $ 8,162 Restricted cash equivalents—U.S. litigation escrow 899 1,491 Investment securities 3,876 3,547 Settlement receivable 1,574 1,582 Accounts receivable 1,404 1,208 Customer collateral 1,735 1,324 Current portion of client incentives 589 340 Prepaid expenses and other current assets 765 562 Total current assets 18,490 18,216 Investment securities 3,506 4,082 Client incentives 1,664 538 Property, equipment and technology, net 2,456 2,472 Goodwill 15,088 15,194 Intangible assets, net 26,966 27,558 Other assets 1,695 1,165 Total assets $ 69,865 $ 69,225 Liabilities Accounts payable $ 119 $ 183 Settlement payable 2,081 2,168 Customer collateral 1,735 1,325 Accrued compensation and benefits 578 901 Client incentives 3,484 2,834 Accrued liabilities 1,207 1,160 Deferred purchase consideration 1,262 1,300 Accrued litigation 914 1,434 Total current liabilities 11,380 11,305 Long-term debt 16,630 16,630 Deferred tax liabilities 4,911 4,618 Other liabilities 2,669 2,666 Total liabilities 35,590 35,219 Equity Preferred stock, $0.0001 par value, 25 shares authorized and 5 shares issued and outstanding as follows: Series A convertible participating preferred stock, none issued (the “class A equivalent preferred stock”) — — Series B convertible participating preferred stock, 2 shares issued and outstanding at March 31, 2019 and September 30, 2018 (the “UK&I preferred stock”) 2,286 2,291 Series C convertible participating preferred stock, 3 shares issued and outstanding at March 31, 2019 and September 30, 2018 (the “Europe preferred stock”) 3,178 3,179 Class A common stock, $0.0001 par value, 2,001,622 shares authorized, 1,741 and 1,768 shares issued and outstanding at March 31, 2019 and September 30, 2018, respectively — — Class B common stock, $0.0001 par value, 622 shares authorized, 245 shares issued and outstanding at March 31, 2019 and September 30, 2018 — — Class C common stock, $0.0001 par value, 1,097 shares authorized, 12 shares issued and outstanding at March 31, 2019 and September 30, 2018 — — Right to recover for covered losses (163) (7) Additional paid-in capital 16,547 16,678 Accumulated income 12,513 11,318 Accumulated other comprehensive income (loss), net: Investment securities 1 (17) Defined benefit pension and other postretirement plans (67) (61) Derivative instruments 96 60 Foreign currency translation adjustments (116) 565 Total accumulated other comprehensive income (loss), net (86) 547 Total equity 34,275 34,006 Total liabilities and equity $ 69,865 $ 69,225

7 Visa Inc. Consolidated Statements of Operations (unaudited) Three Months Ended March 31, Six Months Ended March 31, 2019 2018 2019 2018 (in millions, except per share data) Net revenues $ 5,494 $ 5,073 $ 11,000 $ 9,935 Operating Expenses Personnel 894 824 1,701 1,503 Marketing 241 261 517 484 Network and processing 171 169 344 329 Professional fees 101 108 192 200 Depreciation and amortization 160 153 319 298 General and administrative 264 222 540 458 Litigation provision 22 — 29 — Total operating expenses 1,853 1,737 3,642 3,272 Operating income 3,641 3,336 7,358 6,663 Non-operating Income (Expense) Interest expense, net (140 ) (153) (285) (307 ) Investment income and other 176 34 234 100 Total non-operating income (expense) 36 (119) (51) (207 ) Income before income taxes 3,677 3,217 7,307 6,456 Income tax provision 700 612 1,353 1,329 Net income $ 2,977 $ 2,605 $ 5,954 $ 5,127 Basic Earnings Per Share Class A common stock $ 1.31 $ 1.12 $ 2.61 $ 2.19 Class B common stock $ 2.13 $ 1.84 $ 4.25 $ 3.61 Class C common stock $ 5.23 $ 4.46 $ 10.44 $ 8.76 Basic Weighted-average Shares Outstanding Class A common stock 1,748 1,798 1,754 1,805 Class B common stock 245 245 245 245 Class C common stock 12 12 12 13 Diluted Earnings Per Share Class A common stock $ 1.31 $ 1.11 $ 2.61 $ 2.19 Class B common stock $ 2.13 $ 1.84 $ 4.25 $ 3.60 Class C common stock $ 5.23 $ 4.46 $ 10.42 $ 8.74 Diluted Weighted-average Shares Outstanding Class A common stock 2,279 2,337 2,285 2,345 Class B common stock 245 245 245 245 Class C common stock 12 12 12 13

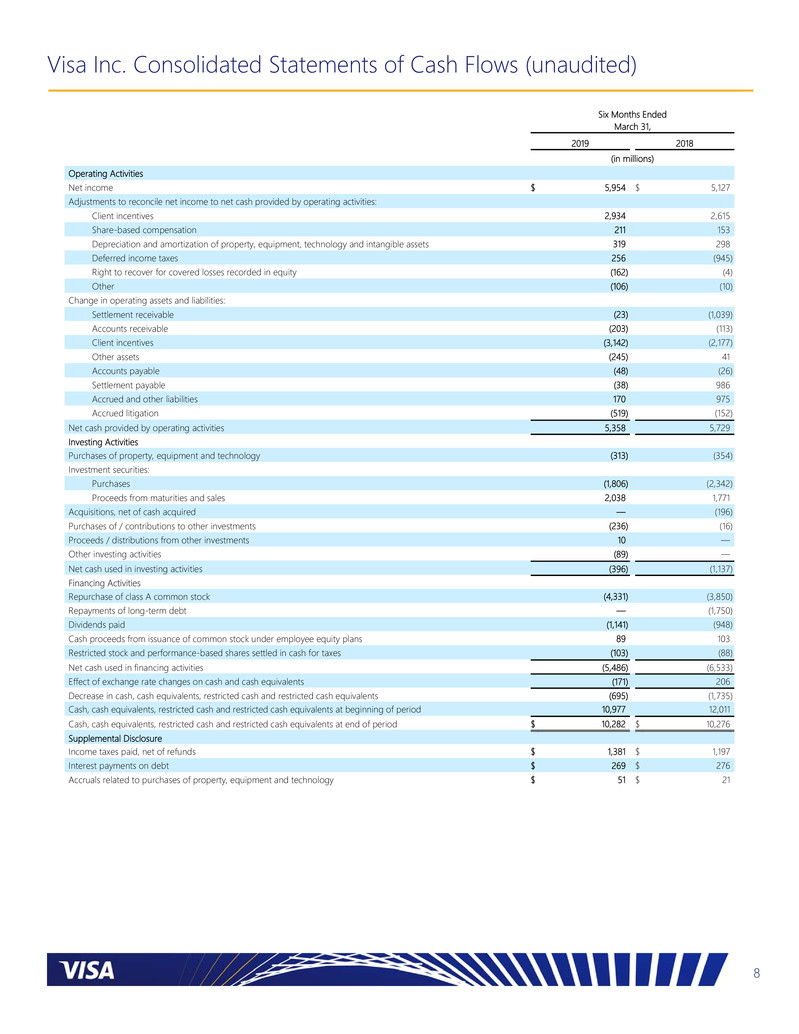

8 Visa Inc. Consolidated Statements of Cash Flows (unaudited) Six Months Ended March 31, 2019 2018 (in millions) Operating Activities Net income $ 5,954 $ 5,127 Adjustments to reconcile net income to net cash provided by operating activities: Client incentives 2,934 2,615 Share-based compensation 211 153 Depreciation and amortization of property, equipment, technology and intangible assets 319 298 Deferred income taxes 256 (945 ) Right to recover for covered losses recorded in equity (162) (4 ) Other (106) (10 ) Change in operating assets and liabilities: Settlement receivable (23) (1,039 ) Accounts receivable (203) (113 ) Client incentives (3,142) (2,177 ) Other assets (245) 41 Accounts payable (48) (26 ) Settlement payable (38) 986 Accrued and other liabilities 170 975 Accrued litigation (519) (152 ) Net cash provided by operating activities 5,358 5,729 Investing Activities Purchases of property, equipment and technology (313) (354 ) Investment securities: Purchases (1,806) (2,342 ) Proceeds from maturities and sales 2,038 1,771 Acquisitions, net of cash acquired — (196 ) Purchases of / contributions to other investments (236) (16 ) Proceeds / distributions from other investments 10 — Other investing activities (89) — Net cash used in investing activities (396) (1,137 ) Financing Activities Repurchase of class A common stock (4,331) (3,850 ) Repayments of long-term debt — (1,750 ) Dividends paid (1,141) (948 ) Cash proceeds from issuance of common stock under employee equity plans 89 103 Restricted stock and performance-based shares settled in cash for taxes (103) (88 ) Net cash used in financing activities (5,486) (6,533 ) Effect of exchange rate changes on cash and cash equivalents (171) 206 Decrease in cash, cash equivalents, restricted cash and restricted cash equivalents (695) (1,735 ) Cash, cash equivalents, restricted cash and restricted cash equivalents at beginning of period 10,977 12,011 Cash, cash equivalents, restricted cash and restricted cash equivalents at end of period $ 10,282 $ 10,276 Supplemental Disclosure Income taxes paid, net of refunds $ 1,381 $ 1,197 Interest payments on debt $ 269 $ 276 Accruals related to purchases of property, equipment and technology $ 51 $ 21

9 Visa Inc. Fiscal 2019 and 2018 Quarterly Results of Operations (unaudited) Fiscal 2019 Quarter Ended Fiscal 2018 Quarter Ended March 31, 2019 December 31, 2018 September 30, 2018 June 30, 2018 March 31, 2018 (in millions) Net revenues $ 5,494 $ 5,506 $ 5,434 $ 5,240 $ 5,073 Operating Expenses Personnel 894 807 815 852 824 Marketing 241 276 264 240 261 Network and processing 171 173 188 169 169 Professional fees 101 91 134 112 108 Depreciation and amortization 160 159 163 152 153 General and administrative 264 276 457 230 222 Litigation provision 22 7 7 600 — Total operating expenses 1,853 1,789 2,028 2,355 1,737 Operating income 3,641 3,717 3,406 2,885 3,336 Non-operating Income (Expense) Interest expense, net (140) (145) (150) (155) (153) Investment income and other 176 58 282 82 34 Total non-operating income (expense) 36 (87) 132 (73) (119) Income before income taxes 3,677 3,630 3,538 2,812 3,217 Income tax provision 700 653 693 483 612 Net income $ 2,977 $ 2,977 $ 2,845 $ 2,329 $ 2,605

10 Visa Inc. Reconciliation of Non-GAAP Financial Results (unaudited) Our financial results for the six months ended March 31, 2018 reflected the impact of certain significant items that we believe were not indicative of our operating performance in these or future periods, as they were either non-recurring or had no cash impact. As such, we believe the presentation of adjusted financial results excluding the following items provides a clearer understanding of our operating performance for the periods presented. There were no comparable adjustments recorded for the three and six months ended March 31, 2019 and the three months ended March 31, 2018. • Remeasurement of deferred tax balances. During the six months ended March 31, 2018, in connection with the Tax Cuts and Jobs Act's reduction of the corporate income tax rate, we remeasured our net deferred tax liabilities as of the enactment date, resulting in the recognition of a non-recurring, non-cash income tax benefit of $1.1 billion. • Transition tax on foreign earnings. During the six months ended March 31, 2018, in connection with the Tax Cuts and Jobs Act's requirement that we include certain untaxed foreign earnings of non-U.S. subsidiaries in our fiscal 2018 taxable income, we recorded a one-time transition tax estimated to be approximately $1.1 billion. Adjusted financial results are non-GAAP financial measures and should not be relied upon as substitutes for measures calculated in accordance with U.S. GAAP. The following table reconciles our as-reported financial measures, calculated in accordance with U.S. GAAP, to our respective non-GAAP adjusted financial measures for the six months ended March 31, 2018. There were no comparable adjustments recorded for the three and six months ended March 31, 2019 and the three months ended March 31, 2018. Six Months Ended March 31, 2018 (in millions, except percentages and per share data) Income Before Income Taxes Income Tax Provision Effective Income Tax Rate(1) Net Income Diluted Earnings Per Share(1) As reported $ 6,456 $ 1,329 20.6 % $ 5,127 $ 2.19 Remeasurement of deferred tax balances — 1,133 (1,133) (0.48) Transition tax on foreign earnings — (1,147) 1,147 0.49 As adjusted $ 6,456 $ 1,315 20.4 % $ 5,141 $ 2.19 (1) Figures in the table may not recalculate exactly due to rounding. Effective income tax rate, diluted earnings per share and their respective totals are calculated based on unrounded numbers.

11 Visa Inc. Reconciliation of Non-GAAP Financial Results – continued (unaudited) Our financial outlook for fiscal full-year 2019 annual operating expense growth and annual diluted class A common stock earnings per share growth are based on adjusted non-GAAP fiscal full-year 2018 results, which are reconciled to their closest comparable U.S. GAAP financial measure below. Our financial results during the twelve months ended September 30, 2018 reflected the impact of certain significant items that we believe were not indicative of our ongoing operating performance in these or future periods as they were either non-recurring or had no cash impact. As such, we believe the presentation of adjusted financial results excluding the following items provides a clearer understanding of our operating performance for the periods presented. • Charitable contribution. During the three months ended September 30, 2018, we donated available-for-sale investment securities to the Visa Foundation and recognized a non-cash general and administrative expense of $195 million, before tax, and recorded $193 million of realized gain on the donation of these investments as non-operating income. Net of the related cash tax benefit of $51 million, determined by applying applicable tax rates, adjusted net income decreased by $49 million. • Litigation provision. During the twelve months ended September 30, 2018, we recorded a litigation provision of $600 million and related tax benefits of $137 million associated with the interchange multidistrict litigation. The tax impact is determined by applying applicable federal and state tax rates to the litigation provision. Under the U.S. retrospective responsibility plan, we recover the monetary liabilities related to the U.S. covered litigation through a reduction to the conversion rate of our class B common stock to shares of class A common stock. • Remeasurement of deferred tax balances. During the twelve months ended September 30, 2018, in connection with the Tax Cuts and Jobs Act’s reduction of the corporate income tax rate, we remeasured our net deferred tax liabilities as of the enactment date, resulting in the recognition of a non-recurring, non-cash income tax benefit of $1.1 billion. • Transition tax on foreign earnings. During the twelve months ended September 30, 2018, in connection with the Tax Cuts and Jobs Act’s requirement that we include certain untaxed foreign earnings of non-U.S. subsidiaries in our fiscal 2018 taxable income, we recorded a one-time transition tax estimated to be approximately $1.1 billion. Adjusted financial results are non-GAAP financial measures and should not be relied upon as substitutes for measures calculated in accordance with U.S. GAAP. The following table reconciles our as-reported financial measures, calculated in accordance with U.S. GAAP, to our respective non-GAAP adjusted financial measures for the twelve months ended September 30, 2018. Twelve Months Ended September 30, 2018 (in millions, except percentages and per share data) Operating Expenses Operating Margin (1),(2) Non- operating (Expense) Income Income Before Income Taxes Income Tax Provision Effective Income Tax Rate(1) Net Income Diluted Earnings Per Share(1) As reported $ 7,655 63 % $ (148) $ 12,806 $ 2,505 19.6 % $ 10,301 $ 4.42 Charitable contribution (195) 1 % (193) 2 51 (49) (0.02) Litigation provision (600) 3 % — 600 137 463 0.20 Remeasurement of deferred tax liability — — % — — 1,133 (1,133) (0.49) Transition tax on foreign earnings — — % — — (1,147) 1,147 0.49 As adjusted $ 6,860 67 % $ (341) $ 13,408 $ 2,679 20.0 % $ 10,729 $ 4.61 (1) Figures in the table may not recalculate exactly due to rounding. Operating margin, effective income tax rate, diluted earnings per share and their respective totals are calculated based on unrounded numbers. (2) Operating margin is calculated as operating income divided by total operating revenues.

12 Operational Performance Data The tables below provide information regarding the available operational results for the 3 months ended March 31, 2019, as well as the prior four quarterly reporting periods and the 12 months ended March 31, 2019 and 2018, for cards and other form factors carrying the Visa, Visa Electron, V PAY and Interlink brands. Sections 1-3 below reflect the acquisition of Visa Europe, with Europe included in Visa Inc. results effective the 3 months ended September 30, 2016. 1. Branded Volume and Transactions The tables present regional total volume, payments volume, and cash volume, and the number of payments transactions, cash transactions, accounts and cards for cards and other form factors carrying the Visa, Visa Electron, V PAY and Interlink brands and excludes Europe co-badged volume and transactions for all periods. Card counts include PLUS proprietary cards. Nominal and constant dollar growth rates over prior years are provided for volume-based data. Total Volume ($ billions) Growth (Nominal USD) Growth (Constant USD) Payments Volume ($ billions) Growth (Nominal USD) Growth (Constant USD) Payments Transactions (millions) Cash Volume ($ billions) Growth (Nominal USD) Growth (Constant USD) Cash Transactions (millions) Accounts (millions) Cards (millions) All Visa Credit & Debit Asia Pacific $599 (1.3%) 3.7% $478 1.0% 6.5% 6,963 $121 (9.6%) (6.1%) 1,008 3 4 Canada 67 2.0% 6.6% 61 2.4% 7.1% 914 5 (2.5%) 2.0% 11 63 62 CEMEA 268 (0.5%) 7.8% 111 11.0% 21.7% 4,460 157 (7.2%) (0.2%) 1,139 3 3 LAC 230 (9.5%) 5.9% 101 (4.7%) 14.2% 3,439 129 (12.9%) 0.1% 1,148 2 2 US 1,071 6.9% 6.9% 930 7.9% 7.9% 16,962 140 0.8% 0.8% 885 6 6 Europe 536 (3.9%) 5.7% 407 (2.3%) 6.6% 9,446 129 (8.7%) 3.1% 989 19 22 Visa Inc. 2,770 0.6% 6.0% 2,089 3.5% 8.2% 42,184 681 (7.5%) (0.4%) 5,180 96 101 Visa Credit Programs US $488 6.1% 6.1% $473 6.3% 6.3% 5,698 $15 0.4% 0.4% 14 - - International 717 (1.1%) 6.8% 669 (0.6%) 7.2% 9,933 48 (7.1%) 0.7% 217 976 1,124 Visa Inc. 1,205 1.7% 6.5% 1,143 2.1% 6.8% 15,631 62 (5.4%) 0.7% 231 976 1,124 Visa Debit Programs US $583 7.6% 7.6% $457 9.7% 9.7% 11,264 $126 0.8% 0.8% 871 - - International 983 (4.5%) 4.4% 489 1.4% 10.3% 15,289 493 (9.7%) (0.9%) 4,079 2,057 2,244 Visa Inc. 1,565 (0.3%) 5.6% 946 5.2% 10.0% 26,553 619 (7.7%) (0.5%) 4,949 2,057 2,244 For the 3 Months Ended March 31, 2019 Total Volume ($ billions) Growth (Nominal USD) Growth (Constant USD) Payments Volume ($ billions) Growth (Nominal USD) Growth (Constant USD) Payments Transactions (millions) Cash Volume ($ billions) Growth (Nominal USD) Growth (Constant USD) Cash Transactions (millions) Accounts (millions) Cards (millions) All Visa Credit & Debit Asia Pacific $619 3.2% 7.1% $496 5.7% 9.7% 7,485 $123 (5.8%) (2.4%) 1,058 921 1,019 Canada 76 5.1% 9.0% 70 5.2% 9.1% 995 6 3.9% 7.8% 11 63 69 CEMEA 287 2.0% 8.7% 114 14.8% 23.0% 4,513 173 (4.9%) 1.0% 1,269 348 343 LAC 252 (7.5%) 8.7% 108 (3.4%) 16.7% 3,541 144 (10.3%) 3.4% 1,276 426 464 US 1,121 9.5% 9.5% 979 10.5% 10.5% 17,888 142 3.2% 3.2% 924 753 912 Europe 571 1.1% 7.3% 429 3.0% 8.5% 9,988 142 (4.4%) 3.8% 1,064 502 549 Visa Inc. 2,926 4.0% 8.4% 2,197 7.2% 10.8% 44,410 729 (4.6%) 1.9% 5,601 3,012 3,358 Visa Credit Programs US $533 8.4% 8.4% $519 8.5% 8.5% 6,324 $14 4.6% 4.6% 16 272 337 International 755 2.7% 9.2% 704 3.3% 9.8% 10,512 51 (4.9%) 0.7% 223 701 781 Visa Inc. 1,288 5.0% 8.8% 1,223 5.4% 9.3% 16,836 65 (3.0%) 1.5% 239 973 1,118 Visa Debit Programs US $588 10.6% 10.6% $461 12.9% 12.9% 11,564 $128 3.0% 3.0% 908 480 575 International 1,050 (0.5%) 6.7% 514 6.4% 12.5% 16,010 536 (6.4%) 1.6% 4,454 1,559 1,664 Visa Inc. 1,638 3.2% 8.1% 974 9.4% 12.7% 27,574 663 (4.7%) 1.9% 5,362 2,039 2,239 For the 3 Months Ended December 31, 2018

13 Total Volume ($ billions) Growth (Nominal USD) Growth (Constant USD) Payments Volume ($ billions) Growth (Nominal USD) Growth (Constant USD) Payments Transactions (millions) Cash Volume ($ billions) Growth (Nominal USD) Growth (Constant USD) Cash Transactions (millions) Accounts (millions) Cards (millions) All Visa Credit & Debit Asia Pacific $600 5.3% 8.2% $477 7.7% 10.4% 7,089 $123 (3.3%) 0.3% 1,041 920 1,017 Canada 71 3.4% 8.5% 66 3.5% 8.6% 939 6 1.7% 6.7% 11 60 66 CEMEA 277 1.8% 7.9% 106 13.3% 20.8% 4,211 171 (4.3%) 1.2% 1,227 353 345 LAC 231 (9.5%) 7.8% 97 (5.3%) 16.0% 3,284 134 (12.3%) 2.6% 1,198 436 472 US 1,089 10.9% 10.9% 945 12.4% 12.4% 17,498 144 2.0% 2.0% 955 736 897 Europe 568 2.3% 7.6% 422 4.8% 9.1% 9,478 145 (4.5%) 3.4% 1,089 499 548 Visa Inc. 2,835 4.9% 9.0% 2,112 8.6% 11.7% 42,500 723 (4.5%) 1.9% 5,521 3,004 3,345 Visa Credit Programs US $513 10.8% 10.8% $499 11.1% 11.1% 6,148 $14 0.6% 0.6% 16 269 336 International 728 3.6% 9.3% 677 4.2% 10.1% 10,027 51 (4.2%) 0.4% 220 692 771 Visa Inc. 1,241 6.5% 9.9% 1,176 7.0% 10.5% 16,175 66 (3.2%) 0.4% 236 961 1,107 Visa Debit Programs US $576 11.0% 11.0% $446 13.9% 13.9% 11,350 $130 2.2% 2.2% 940 468 561 International 1,018 0.0% 6.9% 491 7.8% 12.6% 14,976 527 (6.2%) 2.1% 4,346 1,576 1,676 Visa Inc. 1,594 3.8% 8.4% 937 10.6% 13.2% 26,325 657 (4.7%) 2.1% 5,285 2,044 2,238 For the 3 Months Ended September 30, 2018 Total Volume ($ billions) Growth (Nominal USD) Growth (Constant USD) Payments Volume ($ billions) Growth (Nominal USD) Growth (Constant USD) Payments Transactions (millions) Cash Volume ($ billions) Growth (Nominal USD) Growth (Constant USD) Cash Transactions (millions) Accounts (millions) Cards (millions) All Visa Credit & Debit Asia Pacific $613 13.3% 9.3% $485 17.0% 12.3% 6,700 $128 1.1% (0.7%) 1,006 902 1,002 Canada 73 13.6% 9.2% 67 13.8% 9.4% 922 6 11.2% 6.9% 11 59 65 CEMEA 282 4.4% 8.0% 105 18.3% 22.6% 4,054 176 (2.4%) 0.9% 1,238 347 339 LAC 240 (3.4%) 8.3% 101 1.6% 16.3% 3,199 138 (6.7%) 3.1% 1,180 430 466 US 1,082 10.0% 10.0% 938 11.3% 11.3% 17,275 144 2.0% 2.0% 993 707 853 Europe 578 13.0% 7.4% 428 15.2% 8.8% 9,075 150 7.1% 3.5% 1,096 498 547 Visa Inc. 2,868 9.5% 9.0% 2,125 13.2% 11.7% 41,225 742 0.1% 1.8% 5,525 2,943 3,273 Visa Credit Programs US $507 10.0% 10.0% $493 10.5% 10.5% 5,990 $14 (4.5%) (4.5%) 15 265 333 International 745 12.7% 10.5% 693 13.6% 11.4% 9,708 52 2.3% 0.1% 219 685 764 Visa Inc. 1,252 11.6% 10.3% 1,186 12.3% 11.0% 15,699 66 0.8% (0.9%) 234 950 1,097 Visa Debit Programs US $576 10.0% 10.0% $445 12.3% 12.3% 11,285 $131 2.8% 2.8% 978 442 520 International 1,040 6.8% 6.8% 494 16.5% 12.8% 14,242 546 (0.6%) 1.9% 4,312 1,551 1,656 Visa Inc. 1,616 7.9% 7.9% 939 14.5% 12.6% 25,527 677 0.0% 2.1% 5,291 1,993 2,175 For the 3 Months Ended June 30, 2018 Total Volume ($ billions) Growth (Nominal USD) Growth (Constant USD) Payments Volume ($ billions) Growth (Nominal USD) Growth (Constant USD) Payments Transactions (millions) Cash Volume ($ billions) Growth (Nominal USD) Growth (Constant USD) Cash Transactions (millions) Accounts (millions) Cards (millions) All Visa Credit & Debit Asia Pacific $607 15.7% 8.4% $473 18.0% 10.9% 6,227 $133 8.2% 0.7% 988 887 987 Canada 66 13.4% 9.1% 60 13.1% 8.9% 819 6 16.7% 12.3% 11 58 64 CEMEA 269 11.2% 9.0% 100 25.7% 22.1% 3,679 170 4.1% 2.6% 1,185 342 336 LAC 254 5.8% 5.7% 106 10.5% 12.3% 3,080 148 2.6% 1.5% 1,172 428 462 US 1,001 9.9% 9.9% 862 10.9% 10.9% 15,939 139 4.6% 4.6% 973 705 875 Europe 558 20.9% 7.7% 416 23.0% 9.5% 8,746 141 15.1% 2.6% 990 495 543 Visa Inc. 2,755 13.0% 8.7% 2,018 15.6% 11.1% 38,062 737 6.6% 2.5% 5,320 2,915 3,266 Visa Credit Programs US $460 10.0% 10.0% $446 10.3% 10.3% 5,418 $15 0.9% 0.9% 15 265 335 International 725 16.0% 9.3% 673 16.6% 10.1% 9,004 51 8.1% 0.8% 206 676 754 Visa Inc. 1,185 13.6% 9.6% 1,119 14.0% 10.2% 14,422 66 6.4% 0.8% 221 942 1,090 Visa Debit Programs US $541 9.9% 9.9% $417 11.5% 11.5% 10,520 $125 5.0% 5.0% 958 440 539 International 1,029 14.2% 6.9% 482 23.5% 12.9% 13,119 546 7.0% 2.1% 4,141 1,533 1,637 Visa Inc. 1,570 12.7% 8.0% 899 17.6% 12.2% 23,640 671 6.7% 2.7% 5,099 1,974 2,176 For the 3 Months Ended March 31, 2018

14 (1) Europe payments volume growth, when including Europe in prior periods before the Visa Inc. acquisition, is 10% Constant USD and 13% Nominal USD Total Volume ($ billions) Growth (Nominal USD) Growth (Constant USD) Payments Volume ($ billions) Growth (Nominal USD) Growth (Constant USD) Payments Transactions (millions) Cash Volume ($ billions) Growth (Nominal USD) Growth (Constant USD) Cash Transactions (millions) Accounts (millions) Cards (millions) All Visa Credit & Debit Asia Pacific $2,430 4.9% 7.1% $1,936 7.6% 9.7% 28,238 $494 (4.5%) (2.3%) 4,113 3 4 Canada 287 5.9% 8.4% 265 6.1% 8.6% 3,770 22 3.5% 5.8% 45 63 62 CEMEA 1,114 1.9% 8.1% 437 14.3% 22.0% 17,239 677 (4.7%) 0.7% 4,873 3 3 LAC 952 (7.5%) 7.7% 408 (3.0%) 15.8% 13,462 544 (10.5%) 2.3% 4,802 2 2 US 4,363 9.3% 9.3% 3,792 10.5% 10.5% 69,623 571 2.0% 2.0% 3,758 6 6 Europe 2,252 2.9% 7.0% 1,686 4.9% 8.3% 37,988 566 (2.7%) 3.5% 4,237 1,518 1,667 Visa Inc. 11,399 4.7% 8.1% 8,524 8.0% 10.6% 170,320 2,875 (4.1%) 1.3% 21,827 1,595 1,745 Visa Credit Programs US $2,040 8.8% 8.8% $1,984 9.1% 9.1% 24,161 $57 0.2% 0.2% 61 - - International 2,946 4.3% 9.0% 2,744 4.9% 9.6% 40,180 202 (3.5%) 0.5% 879 976 1,124 Visa Inc. 4,986 6.1% 8.9% 4,728 6.6% 9.4% 64,341 259 (2.7%) 0.4% 940 976 1,124 Visa Debit Programs US $2,323 9.8% 9.8% $1,809 12.2% 12.2% 45,463 $514 2.2% 2.2% 3,697 - - International 4,090 0.4% 6.2% 1,988 7.8% 12.1% 60,516 2,102 (5.7%) 1.2% 17,191 2,057 2,244 Visa Inc. 6,412 3.6% 7.5% 3,796 9.8% 12.1% 105,979 2,616 (4.3%) 1.4% 20,887 2,057 2,244 For the 12 Months Ended March 31, 2019 Total Volume ($ billions) Growth (Nominal USD) Growth (Constant USD) Payments Volume ($ billions) Growth (Nominal USD) Growth (Constant USD) Payments Transactions (millions) Cash Volume ($ billions) Growth (Nominal USD) Growth (Constant USD) Cash Transactions (millions) Accounts (millions) Cards (millions) All Visa Credit & Debit Asia Pacific $2,317 8.0% 5.8% $1,800 10.6% 8.8% 24,632 $517 (0.4%) (3.3%) 3,879 887 987 Canada 271 11.0% 8.4% 250 11.1% 8.5% 3,360 22 9.9% 7.4% 44 58 64 CEMEA 1,093 12.3% 8.8% 382 28.3% 22.7% 14,182 710 5.3% 2.6% 5,003 342 336 LAC 1,029 8.2% 6.3% 420 13.0% 11.4% 12,146 609 5.2% 3.1% 4,702 428 462 US 3,990 9.7% 9.7% 3,431 10.6% 10.6% 64,451 559 4.4% 4.4% 3,941 705 875 Europe (1) 2,189 1,608 33,282 582 4,236 495 543 Visa Inc. 10,890 15.7% 13.9% 7,891 18.2% 16.4% 152,053 2,999 9.7% 7.4% 21,805 2,915 3,266 Visa Credit Programs US $1,875 11.8% 11.8% $1,819 12.4% 12.4% 22,513 $56 (4.0%) (4.0%) 64 265 335 International 2,825 15.2% 12.8% 2,615 15.5% 13.3% 36,253 209 11.2% 7.4% 892 676 754 Visa Inc. 4,699 13.8% 12.4% 4,434 14.2% 12.9% 58,766 266 7.6% 4.7% 956 942 1,090 Visa Debit Programs US $2,115 7.9% 7.9% $1,612 8.7% 8.7% 41,937 $503 5.4% 5.4% 3,877 440 539 International 4,075 22.7% 19.3% 1,845 40.8% 35.6% 51,349 2,230 11.0% 8.2% 16,972 1,533 1,637 Visa Inc. 6,190 17.2% 15.0% 3,457 23.7% 21.3% 93,287 2,733 9.9% 7.7% 20,849 1,974 2,176 For the 12 Months Ended March 31, 2018

15 2. Cross-Border Volume The table below represents cross-border volume growth for cards and other form factors carrying the Visa, Visa Electron, V PAY, Interlink and PLUS brands. Cross-border volume refers to payments and cash volume where the issuing country is different from the merchant country. 3. Visa Processed Transactions The table below represents transactions using cards and other form factors carrying the Visa, Visa Electron, V PAY, Interlink and PLUS brands processed on Visa’s networks. Period Growth (Nominal USD) Growth (Constant USD) 3 Months Ended Mar 31, 2019 (2%) 4% Dec 31, 2018 3% 7% Sep 30, 2018 8% 10% Jun 30, 2018 15% 10% Mar 31, 2018 21% 11% 12 Months Ended Mar 31, 2019 6% 8% Period Processed Transactions (millions) Growth 3 Months Ended Mar 31, 2019 32,544 11% Dec 31, 2018 33,931 11% Sep 30, 2018 32,763 12% Jun 30, 2018 31,728 12% Mar 31, 2018 29,321 12% 12 Months Ended Mar 31, 2019 130,967 12%

16 Footnote Payments volume, including Visa Direct volume, represents the aggregate dollar amount of purchases made with cards and other form factors carrying the Visa, Visa Electron, V PAY and Interlink brands and excludes Europe co-badged volume for the relevant period, and cash volume represents the aggregate dollar amount of cash disbursements obtained with these cards for the relevant period and includes the impact of balance transfers and convenience checks, but excludes proprietary PLUS volume. Total volume represents payments and cash volume. Visa payment products are comprised of credit and debit programs, and data relating to each program is included in the tables. Debit programs include Visa’s signature based and Interlink (PIN) debit programs. The data presented is based on transactions processed by Visa and reported by Visa’s financial institution clients on their operating certificates. Estimates may be utilized if data is unavailable. On occasion, previously presented information may be updated. Prior period updates, if any, are not material. Europe is reported and included in Visa Inc. results effective with the 3 months ended September 2016. Visa’s CEMEA region is comprised of countries in Central Europe, the Middle East and Africa. Several European Union countries in Central Europe, Israel and Turkey are not included in CEMEA. LAC is comprised of countries in Central and South America and the Caribbean. International includes Asia Pacific, Canada, CEMEA, Europe and LAC. Information denominated in U.S. dollars is calculated by applying an established U.S. dollar/local currency exchange rate for each local currency in which Visa Inc. volumes are reported (“Nominal USD”). These exchange rates are calculated on a quarterly basis using the established exchange rate for each quarter. To eliminate the impact of foreign currency fluctuations against the U.S. dollar in measuring performance, Visa Inc. also reports year-over-year growth in total volume, payments volume and cash volume on the basis of local currency information (“Constant USD”). This presentation represents Visa’s historical methodology which may be subject to review and refinement.