Visa Inc. Reports Fiscal First Quarter 2020 Results San Francisco, CA, January 30, 2020 – Visa Inc. (NYSE: V) GAAP and non-GAAP net income of $3.3B or $1.46 per share Net revenues of $6.1B, an increase of 10% Growth in underlying business drivers remained strong Returned $3.0B of capital to shareholders in the form of share repurchases and dividends The board of directors authorized a new $9.5 billion share repurchase program Q1 2020 Results Alfred F. Kelly, Jr., Chairman and Chief Executive (Ended December 31, 2019) Officer, Visa Inc., commented on the results: GAAP Non-GAAP (1) in billions, except “Our fiscal first quarter 2020 reflected stable and YoY YoY percentages and robust business growth around the world. We per share data USD Change USD Change continue to have great success in building and Net Revenues $6.1 10% $6.1 10% renewing partnerships and growing our acceptance network. We are excited about the recent announcement to acquire Plaid which will enhance Net Income $3.3 10% $3.3 10% the growth trajectory of our business well into the Earnings Per future.” $1.46 12% $1.46 12% Share (1) Non-GAAP results exclude equity investment gains and losses, amortization of acquired intangible assets and non-recurring acquisition-related costs. . Q1 2020 Key Business Drivers (YoY growth, volume in constant dollars) Payments Volume Cross-Border Volume Processed Transactions +8% +9% +11%

Fiscal First Quarter 2020 — Financial Highlights GAAP net income in the fiscal first quarter was $3.3 billion or $1.46 per share, increases of 10% and 12%, respectively, over prior year’s results. Current and prior year’s results included $13 million gains and $4 million losses for equity investments, respectively. Current year’s results also included $13 million related to amortization of acquired intangible assets and non-recurring acquisition- related costs. Excluding these items, non-GAAP net income for the quarter was $3.3 billion or $1.46 per share, increases of 10% and 12%, respectively, over prior year’s results (refer to the accompanying financial tables for further details and a reconciliation of the non-GAAP measures presented). Non-GAAP earnings per share growth was approximately 14% on a constant-dollar basis. All references to earnings per share assume fully-diluted class A share count. Net revenues in the fiscal first quarter were $6.1 billion, an increase of 10%, driven by continued growth in payments volume, cross-border volume and processed transactions. Net revenues growth was over 11% on a constant-dollar basis. Payments volume for the three months ended September 30, 2019, on which fiscal first quarter service revenues are recognized, grew 9% over the prior year on a constant-dollar basis. Payments volume for the three months ended December 31, 2019, grew 8% over the prior year on a constant-dollar basis. Cross-border volume growth, on a constant-dollar basis, was 9% for the three months ended December 31, 2019. Excluding cross- border transactions within Europe, which have revenue yields similar to Europe’s domestic volume, growth was 9% in the quarter. Total processed transactions, which represent transactions processed by Visa, for the three months ended December 31, 2019, were 37.8 billion, an 11% increase over the prior year. Fiscal first quarter service revenues were $2.6 billion, an increase of 9% over the prior year, and are recognized based on payments volume in the prior quarter. All other revenue categories are recognized based on current quarter activity. Data processing revenues rose 16% over the prior year to $2.9 billion. International transaction revenues grew 9% over the prior year to $2.0 billion. Other revenues of $365 million rose 22% over the prior year. Client incentives, which are a contra-revenue item, were $1.7 billion and represented 22.4% of gross revenues. GAAP operating expenses were $2.0 billion for the fiscal first quarter, a 14% increase over the prior year's results, including the amortization of acquired intangible assets and non-recurring acquisition-related costs. Excluding these operating expense items, non-GAAP operating expenses grew 13% over the prior year, primarily driven by personnel and general and administrative costs. GAAP non-operating expense was $42 million for the fiscal first quarter, including $13 million of net equity investment gains. GAAP and non-GAAP effective income tax rate was 17.7% for the quarter ended December 31, 2019. Cash, cash equivalents and investment securities were $14.4 billion as of December 31, 2019. The weighted-average number of diluted shares of class A common stock outstanding was 2.24 billion for the quarter ended December 31, 2019. 2

Other Notable Items On October 22, 2019, Visa announced it completed the acquisition of the token services and ticketing businesses of Rambus. These businesses will enable Visa to extend the security and convenience of tokenization to all types of transactions, including the ability to support domestic card networks and account-based and real-time payments systems. On December 13, 2019, the district court granted final approval of the 2018 settlement agreement relating to claims brought by the damages class plaintiffs in the multi-district litigation. The 2018 damages class settlement agreement included, among other terms, monetary relief for Visa and Mastercard merchants of approximately $5.5 billion. While the district court’s order is a significant step toward resolving this long-running litigation, the case is not yet fully resolved as several objectors have filed notices to appeal the district court’s decision. In addition, claims by merchants that opted out of the class settlement and by a class of merchants seeking injunctive relief against certain of Visa’s rules and practices remain pending. On January 13, 2020, Visa announced it signed a definitive agreement to acquire Plaid, a network that makes it easy for people to securely connect their financial accounts to the apps they use to manage their financial lives. Visa will pay $4.9 billion cash consideration and $0.4 billion of retention equity and deferred equity consideration. Starting in fiscal 2020, Visa revised its non-GAAP methodology to exclude the impacts of equity investment gains and losses, amortization of acquired intangible assets for acquisitions in fiscal year 2019 and forward, and non-recurring acquisition-related costs. Prior-year non-GAAP results were restated to reflect this change. During the three months ended December 31, 2019, Visa repurchased 13.0 million shares of class A common stock, at an average price of $179.71 per share, using $2.3 billion of cash on hand. The Company had $1.7 billion of remaining authorized funds for share repurchase as of December 31, 2019. On January 28, 2020, the board of directors authorized a new $9.5 billion class A common stock share repurchase program. On January 28, 2020, the board of directors declared a quarterly cash dividend of $0.30 per share of class A common stock (determined in the case of class B and C common stock and series B and C convertible participating preferred stock on an as- converted basis) payable on March 3, 2020, to all holders of record as of February 14, 2020. Visa will host an Investor Day in San Francisco on Tuesday, February 11, 2020 beginning at 8:00 a.m. Pacific Time. Visa’s management team will provide a comprehensive update of our strategies and key initiatives. A live webcast and replay of the presentation will be available at http://investor.visa.com. 3

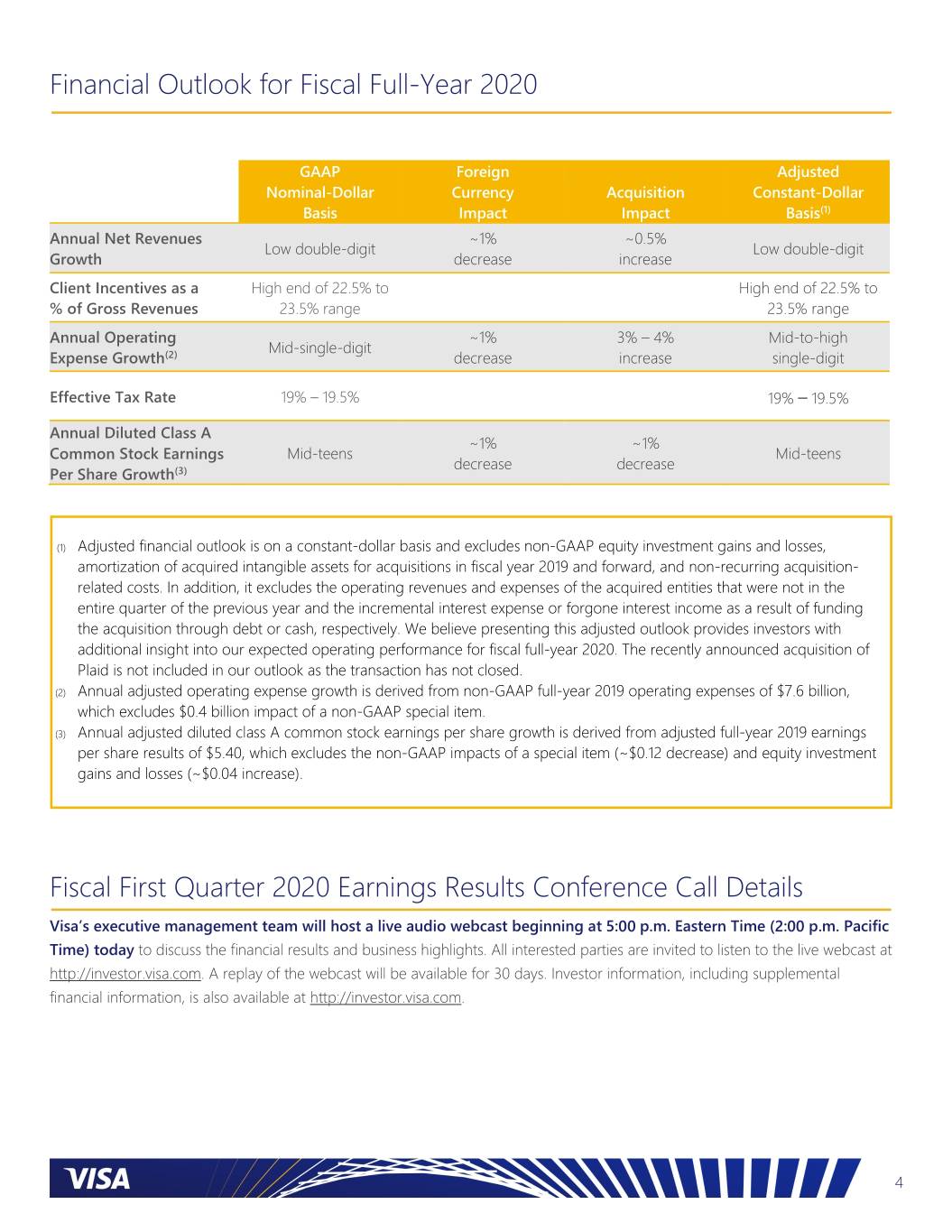

Financial Outlook for Fiscal Full-Year 2020 GAAP Foreign Adjusted Nominal-Dollar Currency Acquisition Constant-Dollar Basis Impact Impact Basis(1) Annual Net Revenues ~1% ~0.5% Low double-digit Low double-digit Growth decrease increase Client Incentives as a High end of 22.5% to High end of 22.5% to % of Gross Revenues 23.5% range 23.5% range Annual Operating ~1% 3% – 4% Mid-to-high Mid-single-digit Expense Growth(2) decrease increase single-digit Effective Tax Rate 19% – 19.5% 19% – 19.5% Annual Diluted Class A ~1% ~1% Common Stock Earnings Mid-teens Mid-teens decrease decrease Per Share Growth(3) (1) Adjusted financial outlook is on a constant-dollar basis and excludes non-GAAP equity investment gains and losses, amortization of acquired intangible assets for acquisitions in fiscal year 2019 and forward, and non-recurring acquisition- related costs. In addition, it excludes the operating revenues and expenses of the acquired entities that were not in the entire quarter of the previous year and the incremental interest expense or forgone interest income as a result of funding the acquisition through debt or cash, respectively. We believe presenting this adjusted outlook provides investors with additional insight into our expected operating performance for fiscal full-year 2020. The recently announced acquisition of Plaid is not included in our outlook as the transaction has not closed. (2) Annual adjusted operating expense growth is derived from non-GAAP full-year 2019 operating expenses of $7.6 billion, which excludes $0.4 billion impact of a non-GAAP special item. (3) Annual adjusted diluted class A common stock earnings per share growth is derived from adjusted full-year 2019 earnings per share results of $5.40, which excludes the non-GAAP impacts of a special item (~$0.12 decrease) and equity investment gains and losses (~$0.04 increase). Fiscal First Quarter 2020 Earnings Results Conference Call Details Visa’s executive management team will host a live audio webcast beginning at 5:00 p.m. Eastern Time (2:00 p.m. Pacific Time) today to discuss the financial results and business highlights. All interested parties are invited to listen to the live webcast at http://investor.visa.com. A replay of the webcast will be available for 30 days. Investor information, including supplemental financial information, is also available at http://investor.visa.com. 4

Forward-Looking Statements This press release contains forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 that relate to, among other things, our future operations, prospects, developments, strategies, business growth and financial outlook for fiscal full-year 2020. Forward-looking statements generally are identified by words such as “believes,” “estimates,” “expects,” “intends,” “may,” “projects,” “outlook,” “could,” “should,” “will,” “continue” and other similar expressions. All statements other than statements of historical fact could be forward-looking statements, which speak only as of the date they are made, are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, many of which are beyond our control and are difficult to predict. Actual results could differ materially from those expressed in, or implied by, our forward-looking statements due to a variety of factors, including, but not limited to: increased oversight and regulation of the global payments industry and our business; impact of government-imposed restrictions on international payment systems; outcome of tax, litigation and governmental investigation matters; increasingly intense competition in the payments industry, including competition for our clients and merchants; proliferation and continuous evolution of new technologies and business models; our ability to maintain relationships with our clients, merchants and other third parties; brand or reputational damage; management changes; impact of global economic, political, market, health and social events or conditions; exposure to loss or illiquidity due to settlement guarantees; uncertainty surrounding the impact of the United Kingdom’s withdrawal from the European Union; a disruption, failure, breach or cyber-attack of our networks or systems; risks, uncertainties and the failure to achieve the anticipated benefits with respect to our acquisitions and other strategic investments; and other factors described in our filings with the U.S. Securities and Exchange Commission, including our Annual Report on Form 10-K for the year ended September 30, 2019, and our subsequent reports on Forms 10-Q and 8-K. Except as required by law, we do not intend to update or revise any forward-looking statements as a result of new information, future events or otherwise. About Visa Inc. Visa Inc. (NYSE: V) is the world’s leader in digital payments. Our mission is to connect the world through the most innovative, reliable and secure payment network - enabling individuals, businesses and economies to thrive. Our advanced global processing network, VisaNet, provides secure and reliable payments around the world, and is capable of handling more than 65,000 transaction messages a second. Our relentless focus on innovation is a catalyst for the rapid growth of digital commerce on any device for everyone, everywhere. As the world moves from analog to digital, Visa is applying our brand, products, people, network and scale to reshape the future of commerce. For more information, visit usa.visa.com/about-visa.html, usa.visa.com/visa- everywhere/blog.html and @VisaNews. Investor Relations Media Relations Contacts Mike Milotich, 650-432-7644, Will Stickney, 415-805-4892, InvestorRelations@visa.com Press@visa.com 5

Fiscal First Quarter 2020 — Financial Summary Q1 FISCAL 2020 INCOME STATEMENT SUMMARY Three Months Ended (in millions, except percentages and per YoY Change December 31, 2019 share data) GAAP Non-GAAP GAAP Non-GAAP Revenues Service revenues$ 2,555 $ 2,555 9% 9% Data processing revenues 2,864 2,864 16% 16% International transaction revenues 2,018 2,018 9% 9% Other revenues 365 365 22% 22% Client incentives (1,748) (1,748) 20% 20% Net revenues 6,054 6,054 10% 10% Operating Expenses Personnel 982 982 22% 21% Marketing 274 274 (1%) (1%) Network and processing 181 181 5% 4% Professional fees 106 104 16% 15% Depreciation and amortization 182 171 15% 8% General and administrative 313 313 13% 13% Litigation provision — — (94%) (94%) Total operating expenses 2,038 2,025 14% 13% Operating income 4,016 4,029 8% 8% Non-operating expense (42) (55) (52%) (34%) Effective tax rate 17.7% 17.7% (0 ppt) (0 ppt) Net income$ 3,272 $ 3,272 10% 10% Earnings per share$ 1.46 $ 1.46 12% 12% Q1 FISCAL 2020 KEY BUSINESS DRIVERS YoY Change Constant Nominal Payments volume 8% 8% Cross-border volume 9% 7% Processed transactions 11% 11% 6

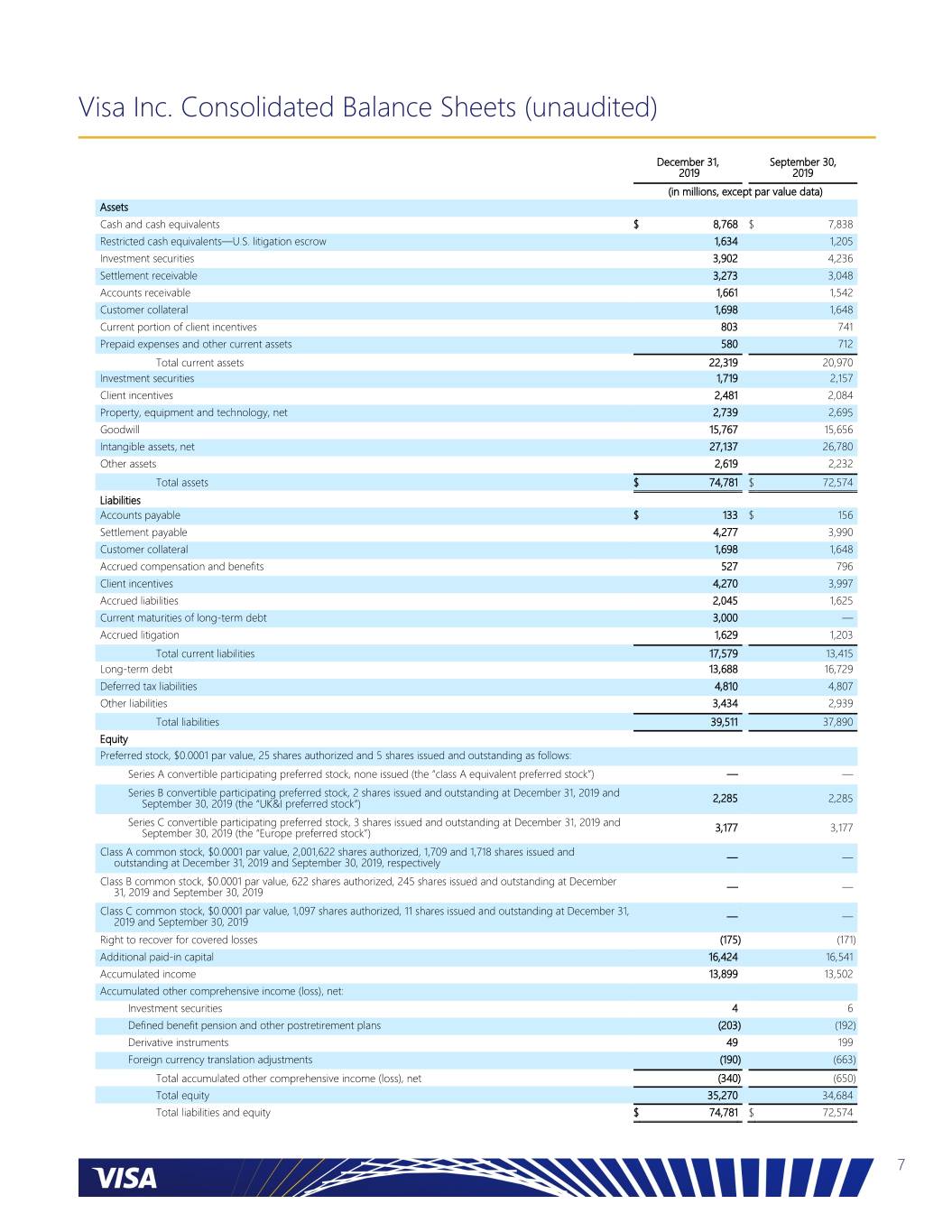

Visa Inc. Consolidated Balance Sheets (unaudited) December 31, September 30, 2019 2019 (in millions, except par value data) Assets Cash and cash equivalents $ 8,768 $ 7,838 Restricted cash equivalents—U.S. litigation escrow 1,634 1,205 Investment securities 3,902 4,236 Settlement receivable 3,273 3,048 Accounts receivable 1,661 1,542 Customer collateral 1,698 1,648 Current portion of client incentives 803 741 Prepaid expenses and other current assets 580 712 Total current assets 22,319 20,970 Investment securities 1,719 2,157 Client incentives 2,481 2,084 Property, equipment and technology, net 2,739 2,695 Goodwill 15,767 15,656 Intangible assets, net 27,137 26,780 Other assets 2,619 2,232 Total assets $ 74,781 $ 72,574 Liabilities Accounts payable $ 133 $ 156 Settlement payable 4,277 3,990 Customer collateral 1,698 1,648 Accrued compensation and benefits 527 796 Client incentives 4,270 3,997 Accrued liabilities 2,045 1,625 Current maturities of long-term debt 3,000 — Accrued litigation 1,629 1,203 Total current liabilities 17,579 13,415 Long-term debt 13,688 16,729 Deferred tax liabilities 4,810 4,807 Other liabilities 3,434 2,939 Total liabilities 39,511 37,890 Equity Preferred stock, $0.0001 par value, 25 shares authorized and 5 shares issued and outstanding as follows: Series A convertible participating preferred stock, none issued (the “class A equivalent preferred stock”) — — Series B convertible participating preferred stock, 2 shares issued and outstanding at December 31, 2019 and September 30, 2019 (the “UK&I preferred stock”) 2,285 2,285 Series C convertible participating preferred stock, 3 shares issued and outstanding at December 31, 2019 and 3,177 3,177 September 30, 2019 (the “Europe preferred stock”) Class A common stock, $0.0001 par value, 2,001,622 shares authorized, 1,709 and 1,718 shares issued and — — outstanding at December 31, 2019 and September 30, 2019, respectively Class B common stock, $0.0001 par value, 622 shares authorized, 245 shares issued and outstanding at December 31, 2019 and September 30, 2019 — — Class C common stock, $0.0001 par value, 1,097 shares authorized, 11 shares issued and outstanding at December 31, — — 2019 and September 30, 2019 Right to recover for covered losses (175) (171) Additional paid-in capital 16,424 16,541 Accumulated income 13,899 13,502 Accumulated other comprehensive income (loss), net: Investment securities 4 6 Defined benefit pension and other postretirement plans (203) (192) Derivative instruments 49 199 Foreign currency translation adjustments (190) (663) Total accumulated other comprehensive income (loss), net (340) (650) Total equity 35,270 34,684 Total liabilities and equity $ 74,781 $ 72,574 7

Visa Inc. Consolidated Statements of Operations (unaudited) Three Months Ended December 31, 2019 2018 (in millions, except per share data) Net revenues $ 6,054 $ 5,506 Operating Expenses Personnel 982 807 Marketing 274 276 Network and processing 181 173 Professional fees 106 91 Depreciation and amortization 182 159 General and administrative 313 276 Litigation provision — 7 Total operating expenses 2,038 1,789 Operating income 4,016 3,717 Non-operating Income (Expense) Interest expense, net (111 ) (145) Investment income and other 69 58 Total non-operating income (expense) (42 ) (87) Income before income taxes 3,974 3,630 Income tax provision 702 653 Net income $ 3,272 $ 2,977 Basic Earnings Per Share Class A common stock $ 1.46 $ 1.30 Class B common stock $ 2.37 $ 2.12 Class C common stock $ 5.85 $ 5.20 Basic Weighted-average Shares Outstanding Class A common stock 1,713 1,760 Class B common stock 245 245 Class C common stock 11 12 Diluted Earnings Per Share Class A common stock $ 1.46 $ 1.30 Class B common stock $ 2.37 $ 2.12 Class C common stock $ 5.84 $ 5.20 Diluted Weighted-average Shares Outstanding Class A common stock 2,240 2,291 Class B common stock 245 245 Class C common stock 11 12 8

Visa Inc. Consolidated Statements of Cash Flows (unaudited) Three Months Ended December 31, 2019 2018 (in millions) Operating Activities Net income $ 3,272 $ 2,977 Adjustments to reconcile net income to net cash provided by (used in) operating activities: Client incentives 1,748 1,456 Share-based compensation 116 100 Depreciation and amortization of property, equipment, technology and intangible assets 182 159 Deferred income taxes (47) 139 VE territory covered losses incurred (4) (91) Other (50) 9 Change in operating assets and liabilities: Settlement receivable (183) (1,551) Accounts receivable (107) (200) Client incentives (1,943) (1,361) Other assets 123 (37) Accounts payable (12) (46) Settlement payable 218 1,739 Accrued and other liabilities 136 (54) Accrued litigation 426 55 Net cash provided by (used in) operating activities 3,875 3,294 Investing Activities Purchases of property, equipment and technology (191) (157) Investment securities: Purchases (400) (1,124) Proceeds from maturities and sales 1,202 1,233 Acquisitions, net of cash acquired (77) — Purchases of / contributions to other investments (9) (22) Proceeds / distributions from other investments 1 — Other investing activities 36 — Net cash provided by (used in) investing activities 562 (70) Financing Activities Repurchase of class A common stock (2,370) (2,393) Dividends paid (671) (572) Cash proceeds from issuance of common stock under employee equity plans 55 48 Restricted stock and performance-based shares settled in cash for taxes (147) (101) Net cash provided by (used in) financing activities (3,133) (3,018) Effect of exchange rate changes on cash and cash equivalents 127 (68) Increase (decrease) in cash, cash equivalents, restricted cash and restricted cash equivalents 1,431 138 Cash, cash equivalents, restricted cash and restricted cash equivalents at beginning of period 10,832 10,977 Cash, cash equivalents, restricted cash and restricted cash equivalents at end of period $ 12,263 $ 11,115 Supplemental Disclosure Income taxes paid, net of refunds $ 345 $ 168 Interest payments on debt $ 234 $ 234 Accruals related to purchases of property, equipment and technology $ 66 $ 34 9

Visa Inc. Fiscal 2020 and 2019 Quarterly Results of Operations (unaudited) Fiscal 2020 Quarter Ended Fiscal 2019 Quarter Ended December 31, September 30, June 30, March 31, December 31, 2019 2019 2019 2019 2018 (in millions) Net revenues $ 6,054 $ 6,137 $ 5,840 $ 5,494 $ 5,506 Operating Expenses Personnel 982 871 872 894 807 Marketing 274 306 282 241 276 Network and processing 181 193 184 171 173 Professional fees 106 149 113 101 91 Depreciation and amortization 182 172 165 160 159 General and administrative 313 341 315 264 276 Litigation provision — 370 1 22 7 Total operating expenses 2,038 2,402 1,932 1,853 1,789 Operating income 4,016 3,735 3,908 3,641 3,717 Non-operating Income (Expense) Interest expense, net (111) (120 ) (128) (140) (145 ) Investment income and other 69 96 86 176 58 Total non-operating income (expense) (42) (24 ) (42) 36 (87 ) Income before income taxes 3,974 3,711 3,866 3,677 3,630 Income tax provision 702 686 765 700 653 Net income $ 3,272 $ 3,025 $ 3,101 $ 2,977 $ 2,977 10

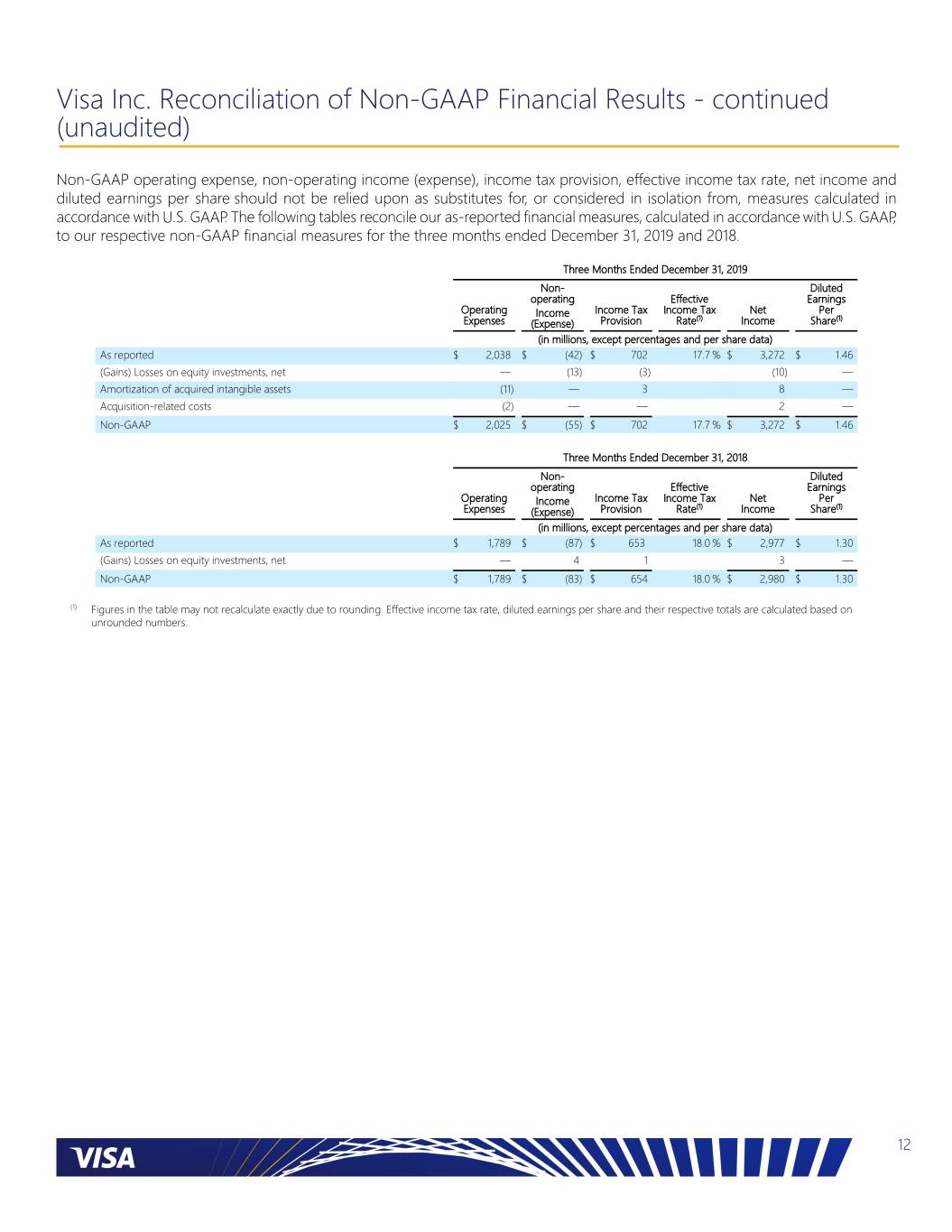

Visa Inc. Reconciliation of Non-GAAP Financial Results (unaudited) We use non-GAAP financial measures of our performance which exclude certain items which we believe are not representative of our continuing operations and may distort our longer-term operating trends. We consider non-GAAP measures useful to investors because they provide greater transparency into management’s view and assessment of our ongoing operating performance. Starting in fiscal 2020, we revised our non-GAAP methodology to exclude the impact of gains and losses on our equity investments, amortization of acquired intangible assets and acquisition-related costs for acquisitions that closed in fiscal 2019 and subsequent periods. Prior year amounts have been restated to conform to our current presentation. • Gains and losses on equity investments. Gains and losses on equity investments include periodic non-cash fair value adjustments and gains and losses upon sale of an investment. These long-term investments are strategic in nature and are primarily private company investments. Gains and losses and the related tax impacts associated with these investments are tied to the performance of the companies that we invest in and therefore do not correlate to the underlying performance of our business. During the three months ended December 31, 2019 and 2018, we recorded net realized and unrealized gains of $13 million and losses of $4 million, respectively, and related tax expense of $3 million and tax benefit of $1 million, respectively. • Amortization of acquired intangible assets. Amortization of acquired intangible assets consists of amortization of intangible assets such as developed technology, customer relationships and brands acquired in connection with business combinations executed beginning in fiscal 2019. Amortization charges for our acquired intangible assets are non-cash and are significantly affected by the timing, frequency and size of our acquisitions, rather than our core operations. As such, we have excluded this amount and the related tax impact to facilitate an evaluation of our current operating performance and comparison to our past operating performance. During the three months ended December 31, 2019, we recorded amortization of acquired intangible assets of $11 million and related tax benefit of $3 million. There were no comparable amounts during the three months ended December 31, 2018 since we are only adjusting for transactions that closed in fiscal 2019 and subsequent periods. • Acquisition-related costs. Acquisition-related costs consist primarily of one-time transaction and integration costs associated with our business combinations. These costs include professional fees, technology integration fees, restructuring activities and other direct costs related to the purchase and integration of acquired entities. It also includes retention equity and deferred equity compensation when they are agreed upon as part of the purchase price of the transaction but are required to be recognized as expense post-combination. We have excluded these amounts and the related tax impacts as the expenses are recognized for a limited duration and do not reflect the underlying performance of our business. During the three months ended December 31, 2019, we recorded acquisition-related costs of $2 million. There were no comparable amounts during the three months ended December 31, 2018 since we are only adjusting for transactions that closed in fiscal 2019 and subsequent periods. 11

Visa Inc. Reconciliation of Non-GAAP Financial Results - continued (unaudited) Non-GAAP operating expense, non-operating income (expense), income tax provision, effective income tax rate, net income and diluted earnings per share should not be relied upon as substitutes for, or considered in isolation from, measures calculated in accordance with U.S. GAAP. The following tables reconcile our as-reported financial measures, calculated in accordance with U.S. GAAP, to our respective non-GAAP financial measures for the three months ended December 31, 2019 and 2018. Three Months Ended December 31, 2019 Non- Diluted operating Effective Earnings Operating Income Tax Income Tax Net Per Income (1) (1) Expenses (Expense) Provision Rate Income Share (in millions, except percentages and per share data) As reported $ 2,038 $ (42) $ 702 17.7 % $ 3,272 $ 1.46 (Gains) Losses on equity investments, net — (13) (3) (10) — Amortization of acquired intangible assets (11) — 3 8 — Acquisition-related costs (2) — — 2 — Non-GAAP $ 2,025 $ (55) $ 702 17.7 % $ 3,272 $ 1.46 Three Months Ended December 31, 2018 Non- Diluted operating Effective Earnings Operating Income Tax Income Tax Net Per Income (1) (1) Expenses (Expense) Provision Rate Income Share (in millions, except percentages and per share data) As reported $ 1,789 $ (87) $ 653 18.0 % $ 2,977 $ 1.30 (Gains) Losses on equity investments, net — 4 1 3 — Non-GAAP $ 1,789 $ (83) $ 654 18.0 % $ 2,980 $ 1.30 (1) Figures in the table may not recalculate exactly due to rounding. Effective income tax rate, diluted earnings per share and their respective totals are calculated based on unrounded numbers. 12

Operational Performance Data The tables below provide information regarding the available operational results for the 3 months ended December 31, 2019, as well as the prior four quarterly reporting periods and the 12 months ended December 31, 2019 and 2018, for cards and other form factors carrying the Visa, Visa Electron, V PAY and Interlink brands. 1. Branded Volume and Transactions The tables present regional total volume, payments volume, and cash volume, and the number of payments transactions, cash transactions, accounts and cards for cards and other form factors carrying the Visa, Visa Electron, V PAY and Interlink brands and excludes Europe co-badged volume and transactions for all periods. Card counts include PLUS proprietary cards. Nominal and constant dollar growth rates over prior years are provided for volume-based data. For the 3 Months Ended December 31, 2019 Total Growth Growth Payments Growth Growth Payments Cash Growth Growth Cash Volume (Nominal (Constant Volume (Nominal (Constant Transactions Volume (Nominal (Constant Transactions Accounts Cards ($ billions) USD) USD) ($ billions) USD) USD) (millions) ($ billions) USD) USD) (millions) (millions) (millions) All Visa Credit & Debit Asia Pacific $633 2.8% 2.6% $511 3.7% 4.3% 8,210 $122 (0.9%) (3.9%) 1,116 3 4 Canada 79 4.5% 4.5% 74 4.4% 4.4% 1,057 6 5.6% 5.7% 11 63 62 CEMEA 321 11.5% 10.3% 141 24.0% 22.0% 5,630 180 3.3% 2.5% 1,271 3 3 LAC 254 0.9% 8.6% 116 7.5% 17.3% 4,139 138 (4.0%) 2.1% 1,236 2 2 US 1,201 7.1% 7.1% 1,056 7.8% 7.8% 18,990 145 2.3% 2.3% 923 6 6 Europe 596 4.3% 5.1% 462 7.5% 8.0% 11,302 134 (5.3%) (3.6%) 961 19 22 Visa Inc. 3,084 5.5% 6.1% 2,360 7.5% 8.1% 49,327 724 (0.7%) 0.1% 5,517 96 101 Visa Credit Programs US $569 6.7% 6.7% $554 6.8% 6.8% 6,767 $14 1.0% 1.0% 15 - - International 779 3.5% 4.8% 731 4.1% 5.4% 11,587 48 (4.9%) (4.1%) 209 976 1,124 Visa Inc. 1,348 4.8% 5.6% 1,285 5.2% 6.0% 18,354 63 (3.6%) (3.0%) 224 976 1,124 Visa Debit Programs US $632 7.5% 7.5% $502 8.9% 8.9% 12,223 $130 2.4% 2.4% 908 - - International 1,104 5.2% 6.1% 573 11.7% 12.4% 18,750 531 (1.1%) (0.1%) 4,386 2,057 2,244 Visa Inc. 1,736 6.0% 6.6% 1,075 10.4% 10.8% 30,973 661 (0.4%) 0.4% 5,293 2,057 2,244 For the 3 Months Ended September 30, 2019 Total Growth Growth Payments Growth Growth Payments Cash Growth Growth Cash Volume (Nominal (Constant Volume (Nominal (Constant Transactions Volume (Nominal (Constant Transactions Accounts Cards ($ billions) USD) USD) ($ billions) USD) USD) (millions) ($ billions) USD) USD) (millions) (millions) (millions) All Visa Credit & Debit Asia Pacific $609 1.8% 2.9% $494 3.8% 5.7% 7,901 $115 (6.0%) (7.4%) 987 872 973 Canada 77 7.5% 8.3% 71 7.9% 8.7% 1,048 6 2.9% 3.7% 11 71 79 CEMEA 308 11.3% 11.6% 133 25.4% 25.0% 5,396 175 2.5% 3.0% 1,259 361 358 LAC 241 4.4% 9.8% 108 11.7% 18.3% 3,830 133 (0.9%) 3.7% 1,213 440 478 US 1,170 7.4% 7.4% 1,023 8.2% 8.2% 18,812 148 2.1% 2.1% 953 767 939 Europe 579 1.9% 6.0% 441 4.5% 8.8% 10,845 137 (5.6%) (2.2%) 998 509 560 Visa Inc. 2,983 5.3% 6.8% 2,270 7.5% 9.1% 47,832 714 (1.3%) 0.1% 5,421 3,020 3,385 Visa Credit Programs US $547 6.7% 6.7% $533 6.8% 6.8% 6,610 $14 0.3% 0.3% 16 274 340 International 763 4.8% 7.0% 712 5.2% 7.4% 11,283 51 (0.9%) 1.3% 224 712 800 Visa Inc. 1,310 5.6% 6.9% 1,245 5.9% 7.2% 17,892 65 (0.6%) 1.1% 240 987 1,140 Visa Debit Programs US $623 8.1% 8.1% $490 9.8% 9.8% 12,202 $133 2.3% 2.3% 937 493 599 International 1,050 3.2% 5.9% 535 9.1% 13.1% 17,737 515 (2.2%) (0.6%) 4,243 1,541 1,647 Visa Inc. 1,674 5.0% 6.7% 1,025 9.5% 11.5% 29,939 648 (1.3%) (0.0%) 5,181 2,034 2,246 13

For the 3 Months Ended June 30, 2019 Total Growth Growth Payments Growth Growth Payments Cash Growth Growth Cash Volume (Nominal (Constant Volume (Nominal (Constant Transactions Volume (Nominal (Constant Transactions Accounts Cards ($ billions) USD) USD) ($ billions) USD) USD) (millions) ($ billions) USD) USD) (millions) (millions) (millions) All Visa Credit & Debit Asia Pacific $601 (1.9%) 3.1% $484 (0.3%) 5.4% 7,529 $118 (7.8%) (5.7%) 991 934 1,034 Canada 74 1.5% 5.5% 68 1.7% 5.6% 999 6 (0.2%) 3.6% 11 64 70 CEMEA 296 5.2% 8.7% 123 17.2% 21.0% 5,100 173 (1.9%) 1.3% 1,250 356 353 LAC 234 (2.6%) 7.5% 104 2.5% 16.0% 3,620 130 (6.3%) 1.6% 1,197 435 472 US 1,168 7.9% 7.9% 1,022 8.9% 8.9% 18,601 147 1.7% 1.7% 947 759 923 Europe 562 (2.8%) 5.1% 430 0.3% 7.8% 10,335 133 (11.5%) (2.9%) 1,003 505 553 Visa Inc. 2,936 2.4% 6.3% 2,231 4.9% 8.7% 46,185 705 (5.0%) (0.6%) 5,399 3,053 3,405 Visa Credit Programs US $542 7.0% 7.0% $528 7.1% 7.1% 6,399 $14 5.3% 5.3% 15 270 334 International 741 (0.7%) 6.0% 691 (0.3%) 6.4% 10,760 50 (4.8%) 1.0% 226 708 793 Visa Inc. 1,283 2.5% 6.4% 1,219 2.7% 6.7% 17,159 64 (2.7%) 1.9% 241 978 1,128 Visa Debit Programs US $626 8.8% 8.8% $494 10.9% 10.9% 12,202 $132 1.3% 1.3% 932 489 589 International 1,027 (1.2%) 4.8% 518 4.8% 11.6% 16,824 509 (6.8%) (1.4%) 4,226 1,586 1,688 Visa Inc. 1,653 2.3% 6.2% 1,012 7.7% 11.3% 29,026 642 (5.2%) (0.8%) 5,158 2,076 2,277 For the 3 Months Ended March 31, 2019 Total Growth Growth Payments Growth Growth Payments Cash Growth Growth Cash Volume (Nominal (Constant Volume (Nominal (Constant Transactions Volume (Nominal (Constant Transactions Accounts Cards ($ billions) USD) USD) ($ billions) USD) USD) (millions) ($ billions) USD) USD) (millions) (millions) (millions) All Visa Credit & Debit Asia Pacific $598 (1.4%) 3.6% $477 0.7% 6.3% 6,942 $121 (9.1%) (5.6%) 1,002 933 1,027 Canada 65 (1.1%) 3.4% 59 (0.7%) 3.8% 878 5 (5.5%) (1.2%) 11 63 69 CEMEA 268 (0.4%) 7.9% 110 10.5% 21.1% 4,467 158 (6.8%) 0.2% 1,157 355 350 LAC 230 (9.4%) 5.9% 101 (4.7%) 14.1% 3,437 129 (12.9%) 0.2% 1,148 428 463 US 1,071 7.0% 7.0% 931 7.9% 7.9% 16,970 141 0.9% 0.9% 889 757 917 Europe 529 (5.1%) 4.4% 406 (2.6%) 6.3% 9,461 124 (12.6%) (1.3%) 926 504 550 Visa Inc. 2,762 0.2% 5.6% 2,084 3.3% 8.0% 42,154 677 (8.1%) (1.0%) 5,134 3,040 3,378 Visa Credit Programs US $488 6.1% 6.1% $474 6.3% 6.3% 5,699 $15 0.6% 0.6% 14 271 336 International 715 (1.3%) 6.5% 668 (0.9%) 7.0% 9,893 47 (7.7%) 0.1% 206 703 786 Visa Inc. 1,203 1.6% 6.3% 1,141 2.0% 6.7% 15,592 62 (5.8%) 0.2% 220 974 1,122 Visa Debit Programs US $583 7.7% 7.7% $457 9.7% 9.7% 11,271 $126 1.0% 1.0% 874 486 581 International 975 (5.2%) 3.6% 486 0.8% 9.6% 15,291 490 (10.4%) (1.7%) 4,040 1,580 1,675 Visa Inc. 1,558 (0.7%) 5.1% 943 4.9% 9.7% 26,562 615 (8.3%) (1.2%) 4,914 2,066 2,256 For the 3 Months Ended December 31, 2018 Total Growth Growth Payments Growth Growth Payments Cash Growth Growth Cash Volume (Nominal (Constant Volume (Nominal (Constant Transactions Volume (Nominal (Constant Transactions Accounts Cards ($ billions) USD) USD) ($ billions) USD) USD) (millions) ($ billions) USD) USD) (millions) (millions) (millions) All Visa Credit & Debit Asia Pacific $616 2.7% 6.5% $493 5.1% 9.1% 7,387 $123 (5.8%) (2.4%) 1,058 921 1,020 Canada 76 5.1% 9.0% 70 5.2% 9.1% 995 6 3.9% 7.8% 11 63 69 CEMEA 288 2.3% 8.9% 114 14.6% 22.7% 4,506 174 (4.4%) 1.3% 1,292 345 340 LAC 252 (7.4%) 7.9% 108 (3.3%) 15.9% 3,545 144 (10.2%) 2.6% 1,276 426 463 US 1,121 9.5% 9.5% 980 10.5% 10.5% 17,891 142 3.1% 3.1% 925 754 914 Europe 571 1.1% 7.3% 430 3.2% 8.6% 10,000 141 (4.6%) 3.6% 1,061 503 550 Visa Inc. 2,924 3.9% 8.2% 2,195 7.1% 10.6% 44,324 729 (4.5%) 1.7% 5,623 3,011 3,355 Visa Credit Programs US $533 8.5% 8.5% $519 8.6% 8.6% 6,330 $14 4.7% 4.7% 15 273 337 International 753 2.4% 8.8% 702 3.0% 9.4% 10,427 51 (5.0%) 0.4% 223 700 781 Visa Inc. 1,286 4.9% 8.6% 1,221 5.3% 9.1% 16,756 65 (3.1%) 1.3% 239 973 1,118 Visa Debit Programs US $588 10.5% 10.5% $461 12.8% 12.8% 11,562 $127 2.9% 2.9% 910 481 577 International 1,050 (0.5%) 6.5% 513 6.3% 12.3% 16,007 537 (6.3%) 1.4% 4,475 1,557 1,660 Visa Inc. 1,638 3.2% 7.9% 974 9.3% 12.6% 27,568 664 (4.6%) 1.7% 5,385 2,038 2,237 14

For the 12 Months Ended December 31, 2019 Total Growth Growth Payments Growth Growth Payments Cash Growth Growth Cash Volume (Nominal (Constant Volume (Nominal (Constant Transactions Volume (Nominal (Constant Transactions Accounts Cards ($ billions) USD) USD) ($ billions) USD) USD) (millions) ($ billions) USD) USD) (millions) (millions) (millions) All Visa Credit & Debit Asia Pacific $2,442 0.3% 3.0% $1,966 2.0% 5.4% 30,582 $476 (6.0%) (5.7%) 4,097 Canada 295 3.2% 5.5% 272 3.4% 5.7% 3,982 23 0.7% 3.0% 44 CEMEA 1,193 7.0% 9.6% 508 19.5% 22.3% 20,593 685 (0.7%) 1.8% 4,936 LAC 959 (1.8%) 7.9% 430 4.1% 16.5% 15,026 529 (6.2%) 1.9% 4,794 US 4,611 7.4% 7.4% 4,031 8.2% 8.2% 73,372 580 1.8% 1.8% 3,711 Europe 2,266 (0.4%) 5.2% 1,738 2.5% 7.8% 41,943 527 (8.8%) (2.5%) 3,889 Visa Inc. 11,765 3.4% 6.2% 8,945 5.9% 8.5% 185,498 2,820 (3.8%) (0.3%) 21,471 Visa Credit Programs US $2,146 6.6% 6.6% $2,089 6.8% 6.8% 25,475 $57 1.8% 1.8% 61 International 2,998 1.6% 6.1% 2,801 2.0% 6.5% 43,523 196 (4.6%) (0.4%) 1,661 Visa Inc. 5,144 3.6% 6.3% 4,890 4.0% 6.6% 68,997 254 (3.2%) 0.0% 1,722 Visa Debit Programs US $2,465 8.0% 8.0% $1,942 9.8% 9.8% 47,898 $522 1.8% 1.8% 3,651 International 4,157 0.5% 5.1% 2,113 6.7% 11.7% 68,603 2,044 (5.2%) (0.9%) 16,114 Visa Inc. 6,622 3.2% 6.2% 4,055 8.2% 10.8% 116,500 2,567 (3.8%) (0.4%) 19,765 For the 12 Months Ended December 31, 2018 Total Growth Growth Payments Growth Growth Payments Cash Growth Growth Cash Volume (Nominal (Constant Volume (Nominal (Constant Transactions Volume (Nominal (Constant Transactions Accounts Cards ($ billions) USD) USD) ($ billions) USD) USD) (millions) ($ billions) USD) USD) (millions) (millions) (millions) All Visa Credit & Debit Asia Pacific $2,434 8.9% 8.0% $1,928 11.6% 10.6% 27,377 $507 (0.1%) (0.5%) 4,093 921 1,020 Canada 286 8.5% 9.0% 263 8.6% 9.0% 3,675 23 8.1% 8.4% 45 63 69 CEMEA 1,115 4.8% 8.5% 425 17.9% 22.4% 16,448 691 (1.9%) 1.4% 4,942 345 340 LAC 976 (3.8%) 6.8% 413 0.7% 14.3% 13,108 563 (6.9%) 2.1% 4,827 426 463 US 4,294 10.1% 10.1% 3,725 11.3% 11.3% 68,611 570 2.9% 2.9% 3,848 754 914 Europe 2,275 8.7% 7.5% 1,697 10.9% 9.0% 36,873 578 2.6% 3.2% 4,236 503 550 Visa Inc. 11,381 7.7% 8.7% 8,450 10.9% 11.2% 166,092 2,931 (0.8%) 1.9% 21,990 3,011 3,355 Visa Credit Programs US $2,013 9.8% 9.8% $1,956 10.1% 10.1% 23,886 $56 0.4% 0.4% 61 273 337 International 2,951 8.3% 9.3% 2,746 9.0% 10.1% 39,138 206 (0.1%) 0.2% 868 700 781 Visa Inc. 4,964 8.9% 9.5% 4,702 9.5% 10.1% 63,025 262 0.0% 0.2% 930 973 1,118 Visa Debit Programs US $2,282 10.4% 10.4% $1,768 12.7% 12.7% 44,725 $513 3.2% 3.2% 3,787 481 577 International 4,136 4.8% 6.7% 1,980 13.0% 12.7% 58,342 2,156 (1.7%) 1.8% 17,274 1,557 1,660 Visa Inc. 6,417 6.7% 8.0% 3,748 12.8% 12.7% 103,067 2,669 (0.8%) 2.0% 21,061 2,038 2,237 15

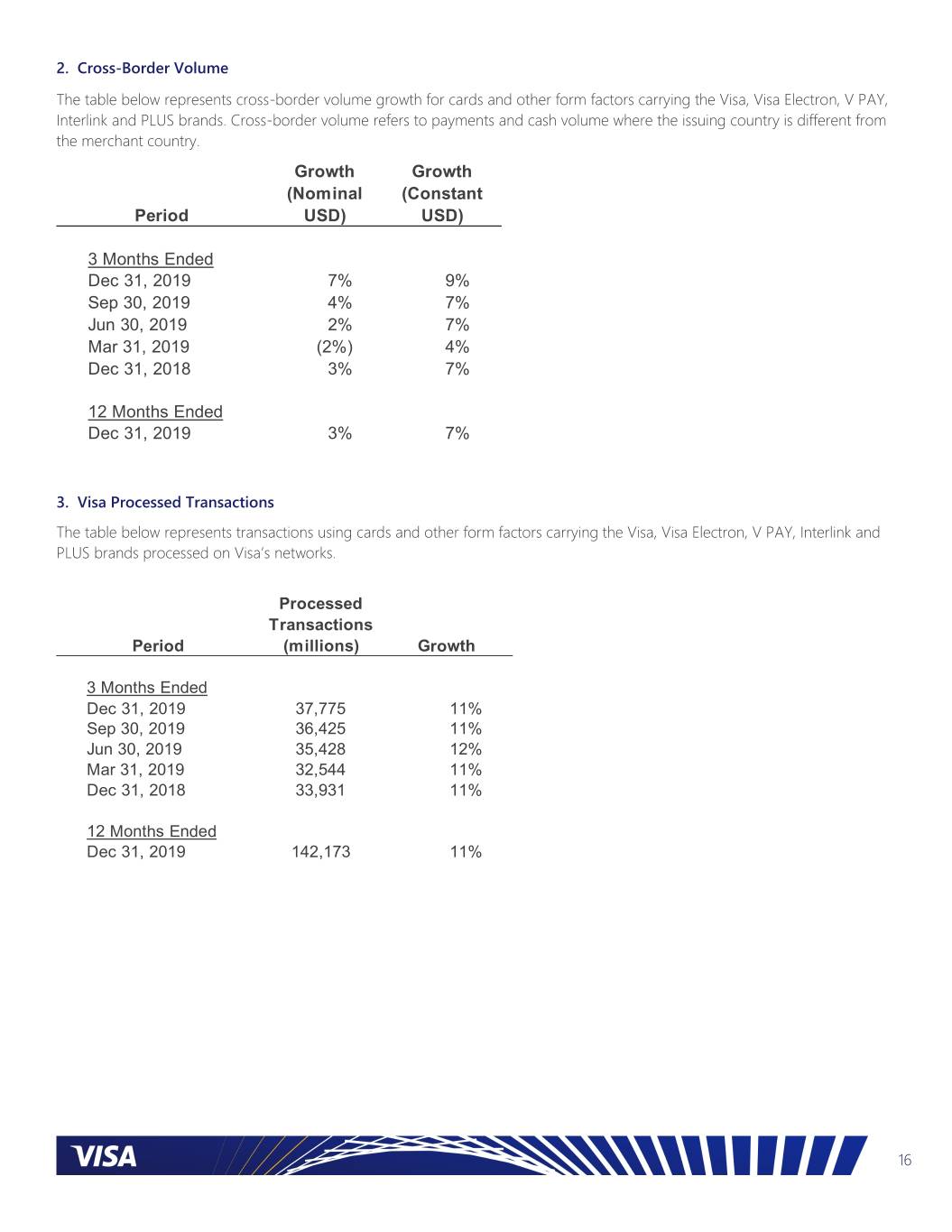

2. Cross-Border Volume The table below represents cross-border volume growth for cards and other form factors carrying the Visa, Visa Electron, V PAY, Interlink and PLUS brands. Cross-border volume refers to payments and cash volume where the issuing country is different from the merchant country. Growth Growth (Nominal (Constant Period USD) USD) 3 Months Ended Dec 31, 2019 7% 9% Sep 30, 2019 4% 7% Jun 30, 2019 2% 7% Mar 31, 2019 (2%) 4% Dec 31, 2018 3% 7% 12 Months Ended Dec 31, 2019 3% 7% 3. Visa Processed Transactions The table below represents transactions using cards and other form factors carrying the Visa, Visa Electron, V PAY, Interlink and PLUS brands processed on Visa’s networks. Processed Transactions Period (millions) Growth 3 Months Ended Dec 31, 2019 37,775 11% Sep 30, 2019 36,425 11% Jun 30, 2019 35,428 12% Mar 31, 2019 32,544 11% Dec 31, 2018 33,931 11% 12 Months Ended Dec 31, 2019 142,173 11% 16

Footnote Payments volume, including Visa Direct volume, represents the aggregate dollar amount of purchases made with cards and other form factors carrying the Visa, Visa Electron, V PAY and Interlink brands and excludes Europe co-badged volume for the relevant period, and cash volume represents the aggregate dollar amount of cash disbursements obtained with these cards for the relevant period and includes the impact of balance transfers and convenience checks, but excludes proprietary PLUS volume. Total volume represents payments and cash volume. Visa payment products are comprised of credit and debit programs, and data relating to each program is included in the tables. Debit programs include Visa’s signature based and Interlink (PIN) debit programs. The data presented is based on transactions processed by Visa and reported by Visa’s financial institution clients on their operating certificates. Estimates may be utilized if data is unavailable. On occasion, previously presented information may be updated. Prior period updates, if any, are not material. Visa’s CEMEA region is comprised of countries in Central Europe, the Middle East and Africa. Several European Union countries in Central Europe, Israel and Turkey are not included in CEMEA. LAC is comprised of countries in Central and South America and the Caribbean. International includes Asia Pacific, Canada, CEMEA, Europe and LAC. Information denominated in U.S. dollars is calculated by applying an established U.S. dollar/local currency exchange rate for each local currency in which Visa Inc. volumes are reported (“Nominal USD”). These exchange rates are calculated on a quarterly basis using the established exchange rate for each quarter. To eliminate the impact of foreign currency fluctuations against the U.S. dollar in measuring performance, Visa Inc. also reports year-over-year growth in total volume, payments volume and cash volume on the basis of local currency information (“Constant USD”). This presentation represents Visa’s historical methodology which may be subject to review and refinement. 17