UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 1, 2020

VISA INC.

(Exact name of Registrant as Specified in Its Charter)

| | | | | | | | | | | | | | |

| | | | | |

| Delaware | | 001-33977 | | 26-0267673 |

(State or Other Jurisdiction

of Incorporation) | | (Commission File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | |

| | | |

| P.O. Box 8999 | | |

| San Francisco, | | |

| California | | 94128-8999 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (650) 432-3200

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Class A common stock, par value $0.0001 per share | | V | | New York Stock Exchange |

| (Title of each Class) | | (Trading Symbol) | | (Name of each exchange on which registered) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

Visa continues to monitor the COVID-19 impact globally. In July and through August 30th ("August"), while many countries had positive year-over-year domestic spending growth, only a few have seen cross-border travel related spending improve as the majority of borders remain closed. Throughout it all, our focus remains on our employees, clients and the communities in which we live and operate.

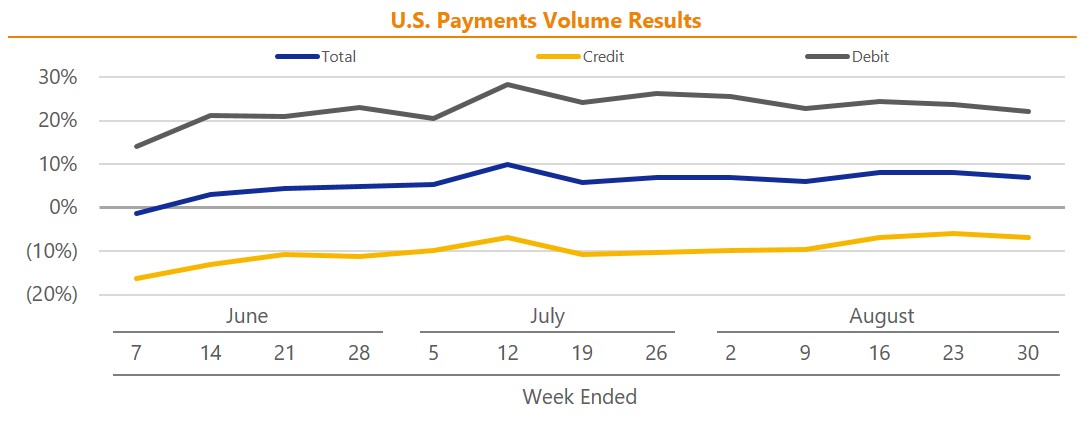

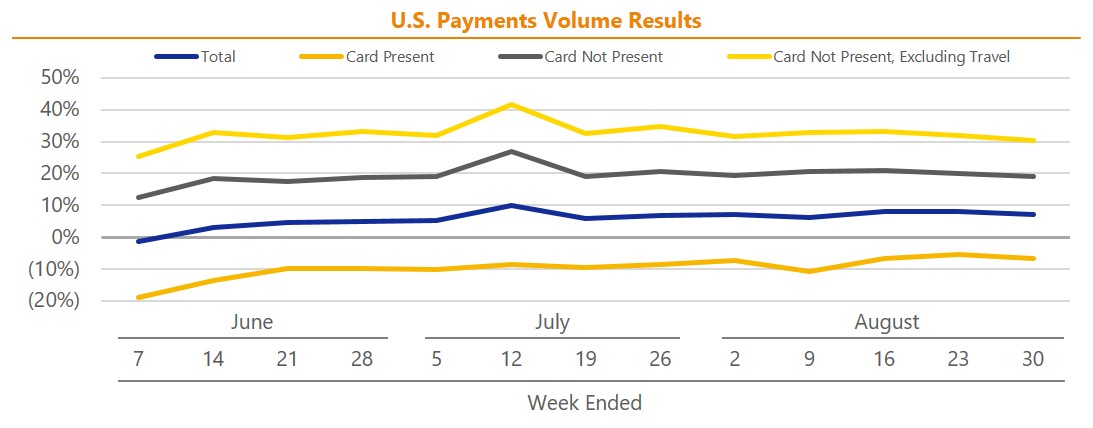

In August, total U.S. payments volume rose 7% year-over-year. Credit declined 8% year-over-year, consistent with July levels. Debit grew 24% year-over-year, a 2 ppt decline from July, partially due to the expiration of the elevated unemployment benefits. Card not present excluding travel grew 30% year-over-year in August while card present declined 7%. The year-over-year growth in spending by merchant category remained generally in line with July.

The majority of international markets exhibited a similar trajectory as the U.S. in August. Several countries, including Japan, Germany and Canada, experienced positive year-over-year domestic spending growth that was relatively consistent with July. Some countries had positive and improving year-over-year domestic spending growth, such as Brazil, UAE, Italy and the UK, while others reflected recovering but still negative year-over-year domestic spending growth, such as India and South Africa.

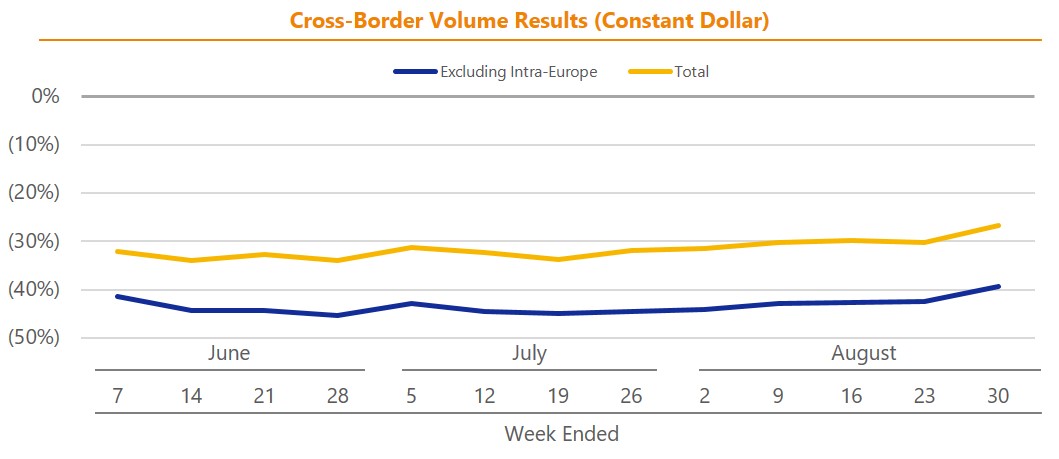

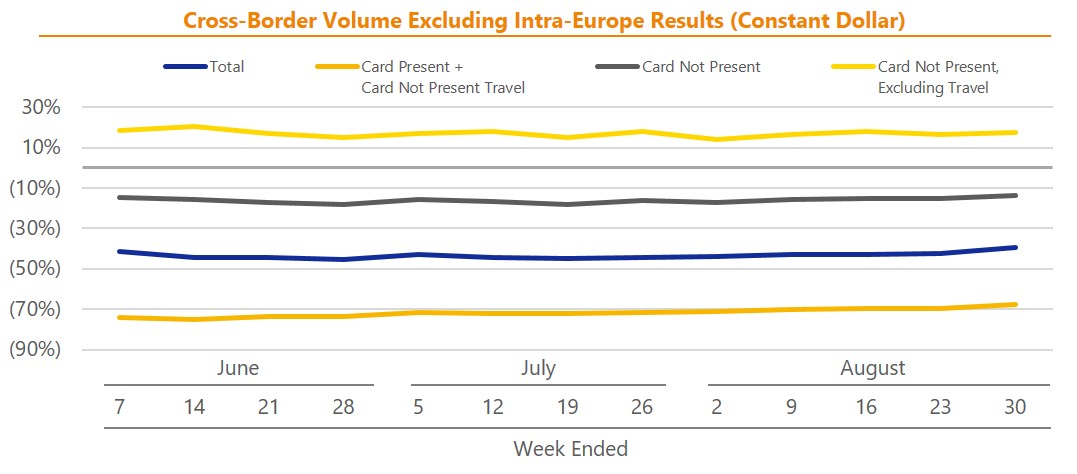

Since May, cross-border volume growth excluding intra-Europe transactions has essentially remained at the same level, posting a 43% year-over-year decline in August. Cross-border eCommerce (excluding travel) continued to grow strongly, up 15% year-over-year in August, while travel related cross-border volumes (card present and card not present) declined 70%. For the few countries that have relaxed their border restrictions, such as Turkey, Mexico and areas of the Caribbean, inbound cross-border card present spend growth has steadily improved upon opening. Cross-border volumes including intra-Europe transactions declined 30% year-over-year in August.

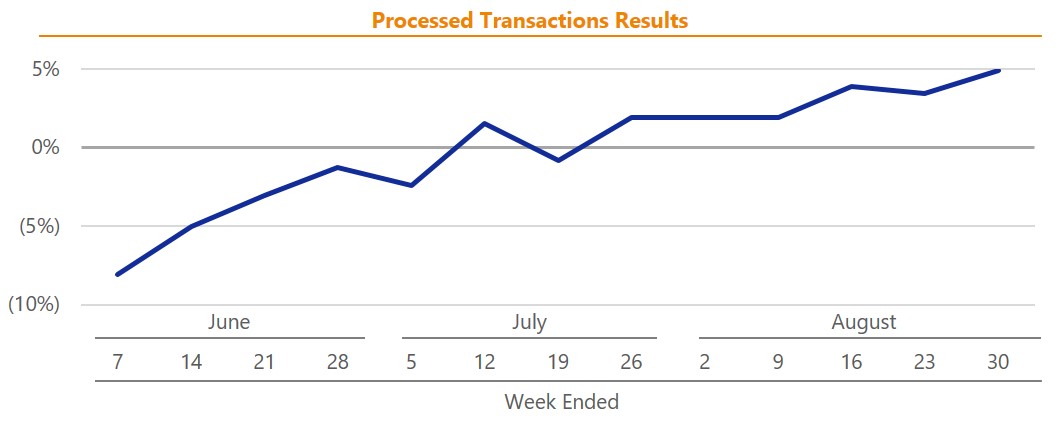

Global processed transactions grew 3% in August due to accelerating domestic transactions. The improvement since May has shifted the mix to reflect more domestic than higher-yielding cross-border transactions.

The table below shows the increase / (decrease) in certain key metrics against the comparable 2019 periods for July, August and quarter-to-date (July 1 – August 30, 2020):

| | | | | | | | | | | |

| Year-over-Year Increase / (Decrease) | July | August | Quarter-to-Date |

| U.S. Payments Volume | 8% | 7% | 8% |

| Credit | (8%) | (8%) | (8%) |

| Debit | 26% | 24% | 25% |

| Processed Transactions | 1% | 3% | 2% |

| Cross-Border Volume Excluding Intra-Europe Transactions* | (44%) | (43%) | (43%) |

| Cross-Border Volume Including Intra-Europe Transactions* | (32%) | (30%) | (31%) |

*In constant dollars

Charts that follow provide growth trends against the comparable 2019 periods by week in June, July and August for U.S. payments volumes, processed transactions and cross-border volumes:

The foregoing information is preliminary in nature and has not been audited or reviewed by our auditors and is subject to change.

All information in Item 7.01 is furnished but not filed and shall not be deemed to be incorporated by reference into any of Visa’s filings under the Securities Act of 1933 or the Securities Exchange Act of 1934 except to the extent otherwise set forth therein.

Forward-Looking Statements

This current report contains forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 that relate to, among other things, the impact on our underlying business drivers and other volume and transaction trends as a result of COVID-19, our future operations, prospects, developments, strategies and business growth. Forward-looking statements generally are identified by words such as “anticipates,” “estimates,” “expects,” “intends,” “may,” “projects,” “outlook,” “could,” “should,” “will,” “continue” and other similar expressions. All statements other than statements of historical fact could be forward-looking statements, which speak only as of the date they are made, are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, many of which are beyond our control and are difficult to predict.

Actual results could differ materially from those expressed in, or implied by, our forward-looking statements due to a variety of factors, including, but not limited to:

•impact of global economic, political, market, health and social events or conditions, including the impact of COVID-19;

•increased oversight and regulation of the global payments industry and our business;

•impact of government-imposed restrictions on international payment systems;

•outcome of tax, litigation and governmental investigation matters;

•increasingly intense competition in the payments industry, including competition for our clients and merchants;

•proliferation and continuous evolution of new technologies and business models;

•our ability to maintain relationships with our clients, merchants and other third parties;

•brand or reputational damage;

•management changes;

•exposure to loss or illiquidity due to settlement guarantees;

•uncertainty surrounding the impact of the United Kingdom’s withdrawal from the European Union;

•a disruption, failure, breach or cyber-attack of our networks or systems;

•risks, uncertainties and the failure to achieve the anticipated benefits with respect to our acquisitions and other strategic investments; and

•other factors described in our filings with the U.S. Securities and Exchange Commission, including our Annual Report on Form 10-K for the year ended September 30, 2019, and our subsequent reports on Forms 10-Q and 8-K.

Except as required by law, we do not intend to update or revise any forward-looking statements as a result of new information, future events or otherwise.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | | |

| | | VISA INC. | | |

| | | | |

| Date: September 1, 2020 | | By: | | /s/ Vasant M. Prabhu |

| | | | | Vasant M. Prabhu

Vice Chairman and Chief Financial Officer |