Table of Contents

As filed with the Securities and Exchange Commission on July 6, 2007

Registration No 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ALERIS INTERNATIONAL, INC.

And the Registrant Guarantors Listed in the Table Below

(Exact name of registrant as specified in its charter)

| Delaware | 3341 | 75-2008280 | ||

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

25825 Science Park Drive, Suite 400

Beachwood, Ohio 44122-7392

(216) 910-3400

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Christopher R. Clegg, Esq.

25825 Science Park Drive, Suite 400

Beachwood, Ohio 44122-7392

(216) 910-3400

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies of all communications to:

Christopher Ewan, Esq.

Daniel J. Bursky, Esq.

Fried, Frank, Harris, Shriver & Jacobson LLP

One New York Plaza

New York, New York 10004

(212) 859-8000

Approximate date of commencement of proposed exchange offer: As soon as practicable after the effective date of this Registration Statement.

If the securities being registered on this form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ¨

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered | Amount to be Registered | Proposed Maximum Per Note(1) | Proposed Maximum Aggregate Offering Price | Amount of Registration Fee | ||||

9%/9 3/4% Senior Notes due 2014 | $600,000,000 | 100% | $600,000,000 | $18,420(1) | ||||

Guarantees of 9%/9 3/4% Senior Notes due 2014 | $600,000,000 | — | — | (2) | ||||

10% Senior Subordinated Notes due 2016 | $400,000,000 | 100% | $400,000,000 | $12,280(1) | ||||

Guarantees of 10% Senior Subordinated Notes due 2016 | $400,000,000 | — | — | (2) | ||||

| (1) | Estimated solely for purposes of calculating the registration fee pursuant to Rule 457(f) under the Securities Act. |

| (2) | No separate filing fee is required pursuant to Rule 457(n) under the Securities Act. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

TABLE OF ADDITIONAL REGISTRANT GUARANTORS

Exact Name of Registrant Guarantor as Specified in its Charter (1) | State or Other Jurisdiction of Incorporation or Organization | Primary Classification | I.R.S. Employer Identification Number | |||

ALCHEM ALUMINUM, INC. | Delaware | 3341 | 75-2685207 | |||

ALCHEM ALUMINUM SHELBYVILLE INC. | Delaware | 3341 | 75-2798122 | |||

ALERIS ALUMINUM EUROPE, INC. (F/K/A HOOGOVENS ALUMINIUM EUROPE INC. ) | Delaware | 9995 | 94-1710921 | |||

ALERIS ALUMINUM U. S. SALES, INC. (F/K/A CORUS ALUMINIUM CORP.) | Delaware | 3350 | 22-1929536 | |||

ALERIS BLANKING AND RIM PRODUCTS, INC. (F/K/A INDIANA ALUMINUM INC.) | Indiana | 3350 | 75-2857340 | |||

ALERIS, INC. | Delaware | 9995 | 20-8046630 | |||

ALERIS OHIO MANAGEMENT, INC. | Delaware | 9995 | 20-2520637 | |||

ALSCO HOLDINGS, INC. | Delaware | 9995 | 30-0175535 | |||

ALSCO METALS CORPORATION | Delaware | 3490 | 65-1177792 | |||

ALUMITECH, INC. | Delaware | 3341 | 34-1769351 | |||

ALUMITECH OF CLEVELAND, INC. | Delaware | 3341 | 34-1721568 | |||

ALUMITECH OF WABASH, INC. | Indiana | 3341 | 35-1804425 | |||

ALUMITECH OF WEST VIRGINIA, INC. | Delaware | 3341 | 43-1953237 | |||

AWT PROPERTIES, INC. | Ohio | 3341 | 34-1725332 | |||

CA LEWISPORT, LLC | Delaware | 9995 | 95-0816561 | |||

CI HOLDINGS, LLC | Delaware | 9995 | 34-1569484 | |||

COMMONWEALTH ALUMINUM, LLC | Delaware | 9995 | 61-1335039 | |||

COMMONWEALTH ALUMINUM CONCAST, INC. | Ohio | 3350 | 34-0697844 | |||

COMMONWEALTH ALUMINUM LEWISPORT, LLC | Delaware | 3350 | 61-1377736 | |||

COMMONWEALTH ALUMINUM METALS, LLC | Delaware | 3350 | 61-1378491 | |||

COMMONWEALTH ALUMINUM SALES CORPORATION | Delaware | 3350 | 95-1398512 | |||

COMMONWEALTH ALUMINUM TUBE ENTERPRISES, LLC | Delaware | 9995 | 62-1817895 | |||

COMMONWEALTH FINANCING CORPORATION | Delaware | 9995 | 31-1568294 | |||

COMMONWEALTH INDUSTRIES, INC. | Delaware | 3350 | 13-3245741 | |||

ETS SCHAEFER CORPORATION | Ohio | 3341 | 20-8597311 | |||

GULF REDUCTION CORPORATION | Delaware | 3341 | 76-0264927 | |||

IMCO INDIANA PARTNERSHIP L.P. | Indiana | 3341 | 35-1963840 | |||

IMCO INTERNATIONAL, INC. | Delaware | 3341 | 75-2578362 | |||

IMCO INVESTMENT COMPANY | Delaware | 3341 | 75-2345738 | |||

IMCO MANAGEMENT PARTNERSHIP L.P. | Texas | 3341 | 75-2402738 | |||

IMCO RECYCLING OF CALIFORNIA, INC. | Delaware | 3341 | 33-0590255 | |||

IMCO RECYCLING OF IDAHO INC. | Delaware | 3341 | 06-1308990 | |||

IMCO RECYCLING OF ILLINOIS INC. | Illinois | 3341 | 36-3107227 | |||

IMCO RECYCLING OF INDIANA INC. | Delaware | 3341 | 75-2614357 | |||

IMCO RECYCLING OF MICHIGAN L.L.C. | Delaware | 3341 | 75-2635772 | |||

IMCO RECYCLING OF OHIO INC. | Delaware | 3341 | 75-2421405 | |||

IMCO RECYCLING OF UTAH INC. | Delaware | 3341 | 87-0522330 | |||

IMCO RECYCLING SERVICES COMPANY | Delaware | 3341 | 75-2920589 | |||

IMSAMET, INC. | Delaware | 3341 | 86-0747929 | |||

INTERAMERICAN ZINC, INC. | Delaware | 3341 | 75-2397569 | |||

METALCHEM, INC. | Pennsylvania | 3341 | 25-1424086 | |||

MIDWEST ZINC CORPORATION | Delaware | 3341 | 76-0375134 | |||

ROCK CREEK ALUMINUM, INC. | Ohio | 3341 | 34-1453607 | |||

SILVER FOX HOLDING CORP. | Delaware | 9995 | 20-1261188 | |||

U.S. ZINC CORPORATION | Delaware | 3341 | 76-0264925 | |||

U.S. ZINC EXPORT CORPORATION | Texas | 3341 | 76-0202744 | |||

WESTERN ZINC CORPORATION | California | 3341 | 33-0202774 |

| (1) | The address for each of the additional registrant guarantors is c/o Aleris International, Inc., 25825 Science Park Drive, Suite 400, Beachwood, Ohio 44122-7392. |

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities or consummate the exchange offer until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell or exchange these securities and it is not soliciting an offer to acquire or exchange these securities in any jurisdiction where the offer, sale or exchange is not permitted.

PRELIMINARY PROSPECTUS

Subject to Completion, dated July 6, 2007

Aleris International, Inc.

Exchange Offer For

$600,000,000 9%/9 3/4% Senior Notes due 2014

$400,000,000 10% Senior Subordinated Notes due 2016

We are offering to exchange up to $600,000,000 of our new 9%/9 3/4% Senior Notes due 2014, which we refer to as the senior exchange notes, for up to $600,000,000 of our outstanding 9%/9 3/4% Senior Notes due 2014, which we refer to as the outstanding senior notes. We are also offering to exchange up to $400,000,000 of our new 10% Senior Subordinated Notes due 2016, which we refer to as the senior subordinated exchange notes, for up to $400,000,000 of our currently outstanding 10% Senior Subordinated Notes due 2016, which we refer to as the outstanding senior subordinated notes. We refer to the outstanding senior notes and the outstanding senior subordinated notes collectively as the outstanding notes, the senior exchange notes and the senior subordinated exchange notes collectively as the exchange notes, and the outstanding notes and the exchange notes collectively as the notes. The exchange notes are substantially identical to the outstanding notes, except that the exchange notes have been registered under the federal securities laws, are not subject to transfer restrictions and are not entitled to certain registration rights relating to the outstanding notes. The exchange notes will represent the same debt as the outstanding notes and we will issue the exchange notes under the same indenture as the outstanding notes.

There is no existing public market for the outstanding notes or the exchange notes offered hereby. We do not intend to list the exchange notes on any securities exchange or seek approval for quotation through any automated trading system.

The exchange offer will expire at 12:00 a.m., New York City time on , 2007, unless we extend it.

Broker-dealers receiving exchange notes in exchange for outstanding notes acquired for their own account through market-making or other trading activities must acknowledge that they will deliver this prospectus in any resale of the exchange notes. The letter of transmittal states that by so acknowledging and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an “underwriter” within the meaning of the Securities Act. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of the exchange notes received in exchange for outstanding notes where such outstanding notes were acquired by such broker-dealer as a result of market-making activities or other trading activities. We have agreed that, for a period of 180 days after the expiration date of the exchange offer, we will make this prospectus available to any broker-dealer for use in connection with any such resale. See “Plan of Distribution.”

You should consider carefully the “Risk Factors” beginning on page 17 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of the prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2007.

Table of Contents

| Page | ||

| ii | ||

| iv | ||

| v | ||

| 1 | ||

| 17 | ||

| 33 | ||

| 34 | ||

| 35 | ||

UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION | 36 | |

| 40 | ||

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 41 | |

| 82 | ||

| 95 | ||

| 97 | ||

| 116 | ||

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | 118 | |

| 120 | ||

| 124 | ||

| 133 | ||

| 191 | ||

| 252 | ||

| 258 | ||

| 260 | ||

| 261 | ||

| 262 | ||

| F-1 |

i

Table of Contents

As used in this prospectus, unless the context indicates otherwise:

| • | the terms “Aleris,” “we,” “our,” “us” and the “Company” refer to Aleris International, Inc. and its consolidated subsidiaries; |

| • | references to “Corus Aluminum” are to Corus Aluminium Rolled Products BV, Corus Aluminium NV, Corus Aluminium GmbH, Corus Aluminium Corp., Corus Hylite BV and Hoogovens Aluminium Europe Inc. and certain of their subsidiaries, Corus LP, Corus Aluminum Inc. and a 61% shareholding in Corus Aluminium Extrusions Tianjin Company Limited, which collectively comprised the downstream aluminum business of Corus, and which are referred to as the “Fabricator Group” in the related historical condensed combined financial statements included elsewhere in this prospectus; |

| • | references to “Corus” are to Corus Group plc and its subsidiaries, from whom we purchased Corus Aluminum on August 1, 2006; |

| • | the term “Acquisition” means the merger of Merger Sub with and into Aleris through which we became a wholly owned subsidiary of Holdings; |

| • | references to “Holdings” are to Aurora Acquisition Holdings, Inc., a company formed by TPG for the purposes of acquiring us; |

| • | references to “Merger Sub” are to Aurora Acquisition Merger Sub, Inc., a company formed by TPG for the purposes of acquiring us; |

| • | references to the “Sponsor” are to the investment funds affiliated with TPG Advisors IV, Inc. and TPG Advisors V, Inc. that made the equity investment to fund a portion of the cash consideration paid as part of the merger; |

| • | references to “TPG” are to the Texas Pacific Group; |

| • | references to the “9% notes” are to the $125.0 million principal amount of 9% senior unsecured notes due 2014, for which we completed a cash tender offer and consent solicitation on August 1, 2006 and effected a legal defeasance on August 2, 2006 that resulted in the discharge of our obligations under the 9% notes and the indenture governing the 9% notes; |

• | references to the “10 3/8% notes” are to the $210.0 million principal amount of 10 3/8% senior secured notes due 2010, for which we completed a cash tender offer and consent solicitation on August 1, 2006, effected a covenant defeasance on August 2, 2006 that terminated our obligations with respect to substantially all of the remaining restrictive covenants on the 10 3/8% notes and effected the satisfaction and discharge of the indenture governing the 10 3/8% notes on October 20, 2006, including the release of all liens on the collateral securing the 10 3/8% notes; |

| • | the term “old credit facilities” refers to (i) the $750.0 million senior secured asset-based revolving credit facility (the “old revolving credit facility”), (ii) the $650.0 million senior secured term loan facility (the “old term loan facility”) and (iii) the $505.0 million senior unsecured credit facility (the “old senior unsecured facility”), each as entered into on August 1, 2006 in conjunction with the acquisition of Corus Aluminum; |

| • | the term “Transactions” refers to (i) the Acquisition, (ii) the equity investments made as part of the merger funding, (iii) the offering of the outstanding senior notes and the outstanding senior subordinated notes, (iv) the execution of the $750.0 million amended and restated senior secured asset based revolving credit facility (the “revolving credit facility”), (v) the execution of the amended and restated senior secured term loan facility (the “term loan facility” and together with the revolving credit facility, the “2006 credit facilities”) and (vi) the payment of costs related to these transactions; and |

| • | the term “2005 Acquisitions” refers to the acquisition of (i) ALSCO Holdings, Inc. (“ALSCO”) on October 3, 2005 (a manufacturer and fabricator of aluminum sheet products for the building and |

ii

Table of Contents

construction industry), (ii) Alumitech, Inc. (“Alumitech”) on December 12, 2005 (an aluminum recycler and salt cake processor), (iii) Tomra Latasa Reciclagem (“Tomra Latasa”) on August 23, 2005 (a Brazilian aluminum recycler) and (iv) certain assets of Ormet Corporation (“Ormet”) on December 20, 2005 (including rolling mill assets, a recycling operation and an aluminum blanking operation). |

The financial statements contained in this prospectus include the accounts of Aleris and all of its majority-owned subsidiaries. On December 19, 2006 we were acquired by affiliates of TPG. On December 9, 2004, we acquired Commonwealth Industries, Inc., (“Commonwealth”) when it merged with one of our wholly-owned subsidiaries, and changed our name from IMCO Recycling Inc. to Aleris International, Inc. This acquisition resulted in the inclusion of the financial condition and results of operations of Commonwealth with ours effective December 9, 2004.

In this prospectus, when we refer to 2004 shipment or financial information presented on a “pro forma” basis, we are giving pro forma effect to the acquisition of Commonwealth and the financing transactions related thereto as if they had occurred on January 1, 2004, and are including the results of operations of Commonwealth (excluding that of its Alflex subsidiary, which was sold in July 2004) with ours for all of 2004.

When we refer to 2006 shipment or financial information presented on a “pro forma” basis, we are giving pro forma effect to the Transactions and the acquisition of Corus Aluminum as if they had occurred on January 1, 2006 and are including the results of Corus Aluminum with ours for all of 2006.

Information in this prospectus concerning processing volumes, production capacity, rankings and other industry information, including our general expectations concerning the rolled aluminum products and aluminum and zinc recycling industries, are based on estimates prepared by us using certain assumptions and our knowledge of these industries as well as data from third party sources. This data includes, but is not limited to, data from The Aluminum Association and U.S. Geological Surveys. Such sources generally state that the information contained therein is believed to be reliable, but there can be no assurance as to the accuracy or completeness of included information. We have not independently verified any of the data from third party sources, nor have we ascertained the underlying economic assumptions relied upon therein.

iii

Table of Contents

This prospectus contains forward-looking statements as defined by the Private Securities Litigation Reform Act of 1995. Forward-looking statements should be read in conjunction with the cautionary statements and other important factors included in this prospectus under “Summary,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business,” which include descriptions of important factors which could cause actual results to differ materially from those contained in the forward-looking statements. Our expectations, beliefs and projections are expressed in good faith, and we believe we have a reasonable basis to make these statements through our management’s examination of historical operating trends, data contained in our records and other data available from third parties, but there can be no assurance that our management’s expectations, beliefs or projections will result or be achieved.

The discussions of our financial condition and results of operations may include various forward-looking statements about future costs and prices of commodities, production volumes, market trends, demand for our products and services and projected results of operations. Statements contained in this prospectus that are not historical in nature are considered to be forward-looking statements. They include statements regarding our expectations, hopes, beliefs, estimates, intentions or strategies regarding the future. The words “believe,” “expect,” “anticipate,” “intend,” “estimate,” “will,” “look forward to” and similar expressions are intended to identify forward-looking statements.

The forward-looking statements set forth in this prospectus regarding, among other things, achievement of anticipated cost savings and synergies, estimates of volumes, revenues, profitability and net income in future quarters, future prices and demand for our products, and estimated cash flows and sufficiency of cash flows to fund capital expenditures, reflect only our expectations regarding these matters. Important factors that could cause actual results to differ materially from the forward-looking statements include, but are not limited to:

| • | our success in (and the costs of) integrating acquired businesses into Aleris; |

| • | our ability to successfully implement our business strategy; |

| • | the cyclical nature of the metals industry, our end-use segments and our customers’ industries; |

| • | our ability to retain the services of certain members of our management; |

| • | our ability to continue to generate positive operating results; |

| • | our ability to maintain effective internal controls over financial reporting and disclosure controls and procedures; |

| • | increases in the cost of raw material and energy; |

| • | our ability to manage effectively our exposure to commodity price fluctuations and changes in the pricing of metals; |

| • | the loss of order volumes from any of our largest customers; |

| • | our ability to retain customers, a substantial number of which do not have long-term contractual arrangements with us; |

| • | our ability to generate sufficient cash flows to fund our capital expenditure requirements and to meet our debt service obligations; |

| • | our ability to fulfill our substantial capital investment requirements; |

| • | competitor pricing activity, competition of aluminum with alternative materials and the general impact of competition in the industry segments we serve; |

| • | risks of investing in and conducting operations in international countries, including political, social, economic, currency and regulatory factors; |

iv

Table of Contents

| • | current environmental liabilities and the cost of compliance with and liabilities under health and safety laws; |

| • | labor relations (i.e., disruptions, strikes or work stoppages) and labor costs; |

| • | any impairment of goodwill or asset values; |

| • | our substantial leverage and debt service obligations; |

| • | the possibility that we may incur additional indebtedness in the future; |

| • | limitations on operating our business as a result of covenant restrictions under our indebtedness, and our ability to pay amounts due under the notes; and |

| • | our ability to repurchase the notes upon a change of control. |

Additional risks, uncertainties and other factors that may cause our actual results, performance or achievements to be different from those expressed or implied in our written or oral forward-looking statements may be found under “Risk Factors” contained in this prospectus.

These factors and other risk factors disclosed in this prospectus and elsewhere are not necessarily all of the important factors that could cause our actual results to differ materially from those expressed in any of our forward-looking statements. Other unknown or unpredictable factors could also harm our results. Consequently, there can be no assurance that the actual results or developments anticipated by us will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, us. Given these uncertainties, you are cautioned not to place undue reliance on such forward-looking statements.

The forward-looking statements contained in this prospectus are made only as of the date of this prospectus. Except to the extent required by law, we do not undertake, and specifically decline any obligation, to update any forward-looking statements or to publicly announce the results of any revisions to any of such statements to reflect future events or developments.

WHERE YOU CAN FIND MORE INFORMATION

We and our guarantor subsidiaries have filed with the Securities and Exchange Commission, or the SEC, a registration statement on Form S-4 under the Securities Act with respect to the exchange notes. This prospectus, which forms a part of the registration statement, does not contain all of the information set forth in the registration statement. For further information with respect to us and the exchange notes, reference is made to the registration statement. Statements contained in this prospectus as to the contents of any contract or other document are not necessarily complete. We file reports and other information with the SEC. The registration statement, such reports and other information can be read and copied at the Public Reference Room of the SEC located at 100 F Street, N.E., Washington D.C. 20549. Copies of such materials, including copies of all or any portion of the registration statement, can be obtained from the Public Reference Room of the SEC at prescribed rates. You can call the SEC at 1-800-SEC-0330 to obtain information on the operation of the Public Reference Room. Such materials may also be accessed electronically by means of the SEC’s home page on the Internet (http://www.sec.gov).

You may also request copies of these documents, at no cost to you, by contacting us at the following address: Aleris International, Inc., 25825 Science Park Drive, Suite 400, Beachwood, OH 44122-7392, Attn: General Counsel, (216) 910-3500. To obtain timely delivery, holders of original notes must request the information no later than five business days before , 2007, the date they must make their investment decision.

We have agreed that, even if we are not required under the Exchange Act to furnish reports to the SEC, we will nonetheless continue to furnish information that would be required to be furnished by us on Forms 10-Q, 10-K and 8-K if we were subject to Sections 13 or 15(d) of the Exchange Act. See “Description of Senior Exchange Notes” and “Description of Senior Subordinated Exchange Notes.”

v

Table of Contents

This summary provides a brief overview of certain information appearing elsewhere in this prospectus. Because it is abbreviated, this summary does not contain all of the information that you should consider before participating in the exchange offer. We encourage you to read the entire prospectus carefully, including the “Risk Factors” section, the historical and pro forma financial statements and notes to those financial statements before participating in the exchange offer.

Unless otherwise stated, references to “pro forma” results of operations and cash flow data give pro forma effect to the Transactions and the acquisition of Corus Aluminum on a combined basis as if they occurred on January 1, 2006.

The Company

Overview

We are a global leader in aluminum rolled and extruded products, aluminum recycling and specification alloy production. We are also a recycler of zinc and a leading U.S. manufacturer of zinc metal and value-added zinc products that include zinc oxide and zinc dust. We generate substantially all of our revenues from the manufacture and sale of these products. We operate 50 production facilities in North America, Europe, South America and Asia. We possess a combination of low-cost, flexible and technically advanced manufacturing operations supported by an industry-leading research and development platform. Our facilities are strategically located and well positioned to service our customers, which include a number of the world’s largest companies in the aerospace, building and construction, containers and packaging, metal distribution and transportation industries. On a pro forma basis, we generated revenues of $6.0 billion in the year ended December 31, 2006, of which approximately 58% were derived from North America and the remaining 42% were derived from the rest of the world.

Since the end of 2004, we have increased revenues and profitability through a combination of internal growth and productivity initiatives for our existing operations and strategic acquisitions. We have grown significantly through the successful completion of five strategic acquisitions targeted at broadening product offerings and geographic presence, diversifying our end-use customer base and increasing our scale and scope. We focus on acquisitions that are accretive to earnings and from which we expect to be able to realize significant operational efficiencies within 12 to 24 months through the integration process. While we have already achieved substantial savings from our acquisition activity, we believe additional significant synergies remain to be realized, including synergies from our recent acquisition of Corus Aluminum completed on August 1, 2006.

We operate our business in the following global segments: global rolled and extruded products; global recycling; and global zinc.

Global Rolled and Extruded Products

We are a producer of rolled aluminum products with leading positions in technically sophisticated applications, including aerospace plate and sheet, brazing sheet and demanding automotive sheet end-uses as well as high-volume applications used in building and construction and general distribution. We produce aluminum sheet, plate and fabricated products using direct-chill and continuous-cast processes. We believe that many of our facilities are state-of-the-art and provide us with proprietary manufacturing processes and a competitive advantage in servicing high-margin, growing end-uses, such as aerospace and heat transfer applications. We compete successfully in these highly technical applications based on our industry-leading research and development capabilities, which have developed over 130 process and alloy patent families. We

1

Table of Contents

have 20 production facilities that provide rolled and extruded aluminum products to the major aluminum consuming regions worldwide.

Substantially all of our rolled aluminum products are produced in response to specific customer orders. Our more technically advanced products require the use of primary-based alloys for which we have secured long-term supply agreements for approximately 42% of our expected needs through 2010. Our continuous-cast and common alloy sheet production can utilize primary or scrap aluminum, which allows us to optimize input costs and maximize margins. In addition, to further mitigate the impact of metal prices on our profitability, aluminum costs are passed through to customers for approximately 81% of our rolled product sales, and we strive to manage the remaining key commodity risks through our hedging programs.

We are also a leading producer of soft and hard alloy extruded aluminum profiles targeted at end-uses such as the building and construction, electrical, mechanical engineering and transportation sectors. We have four separate product categories which reflect our customers’ needs, including industrial extrusions, building systems, hard alloys and rail and transport projects. We currently operate one of the largest extrusion presses in the world, which provides us with the capability to produce high-end, value-added products such as larger profiles in addition to the production of hard alloy extrusions for transportation applications. We operate five extrusion product facilities in Europe and China.

Pro forma for the year ended December 31, 2006, shipments of aluminum rolled and extruded products totaled 2.3 billion pounds, establishing us as the number four producer globally based on volume, which accounted for approximately $4.0 billion of revenues.

Global Recycling

We are a leading recycler of aluminum and manufacturer of specification alloys serving customers in North America, Europe and South America. Our global recycling operations primarily convert aluminum scrap, dross (a by-product of the melting process) and other alloying agents as needed and deliver the recycled metal and specification alloys in molten or ingot form to our customers. Our recycling operations typically service other aluminum producers and manufacturers, generally under tolling arrangements, where we convert customer-owned scrap and dross and return the recycled metal to our customers for a fee. Our specification alloy operations principally service customers in the automotive industry. For the year ended December 31, 2006, approximately 71% of the total pounds shipped by our recycling and specification alloy operations were under tolling arrangements. Tolling arrangements eliminate our metal commodity exposure and reduce our overall working capital requirements. As we only charge our customers a fee for processing the metal, revenues generated from shipments of tolled material are less than for shipments of owned material. Our global recycling network operates 24 strategically located production plants, with 17 in the United States, two in Brazil, three in Germany, and one in each of Mexico and the United Kingdom.

Pro forma for the year ended December 31, 2006, we shipped 2.9 billion pounds of recycled metal and specification alloys, which accounted for approximately $1.5 billion of our revenues.

Global Zinc

We process and recycle zinc metal for use in the manufacture of galvanized steel and produce value-added zinc products, primarily zinc oxide and zinc dust, which are used in the vulcanization of rubber products, the production of corrosion-resistant paint and in other specialty chemical applications. We operate six zinc facilities in the United States and are in the process of constructing a zinc recycling facility outside of Shanghai, China.

Pro forma for the year ended December 31, 2006, we shipped 384.1 million pounds of zinc products, which accounted for approximately $553.2 million of our revenues.

2

Table of Contents

Our Sponsor

Texas Pacific Group (“TPG”), founded in 1992, is a global private investment firm with $30 billion under management with offices in San Francisco, New York, London and throughout Asia. TPG seeks to invest in world-class franchises across a range of industries, including significant industrial-related investments as well as retail businesses, technology, consumer products, airlines and healthcare. Significant investments include investments in leading industrial-related businesses (Texas Genco, Altivity Packaging, Kraton Polymers, British Vita), retailers (Neiman Marcus, J. Crew, Debenhams (UK), Petco), technology companies (Lenovo, SunGard Data Systems, MEMC Electronic Materials, ON Semiconductor, Seagate Technology), branded consumer franchises (Beringer, Burger King, Del Monte, Ducati Motorcycles, Metro-Goldwyn-Mayer), airlines (Continental, America West), and healthcare companies (IASIS, Oxford Health Plans, Quintiles Transnational).

The Acquisition of Aleris by TPG

On August 7, 2006, we entered into an Agreement and Plan of Merger with Merger Sub and its parent company, Holdings, pursuant to which each share of our common stock (other than shares held in treasury or owned by Holdings, Merger Sub or any direct or indirect subsidiary of us or Holdings, and other than shares held by stockholders who properly demanded appraisal rights) was converted into the right to receive $52.50 in cash, without interest and less any required withholding taxes. As a result of the merger, all of the issued and outstanding capital stock of Holdings is owned, directly or indirectly, by the Investors (as defined below). The merger was structured as a reverse subsidiary merger, under which Merger Sub was merged with and into us at the closing on December 19, 2006, and we are the surviving corporation. As the surviving corporation in the merger, we assumed by operation of law all of the rights and obligations of Merger Sub, including under the notes and related indentures. We refer to the merger of Merger Sub with and into Aleris through which we became a wholly owned subsidiary of Holdings as the “Acquisition.”

The amount of equity contributions made as part of the Acquisition funding was $848.8 million, consisting of amounts contributed by (i) investment funds associated with TPG (collectively, the “Sponsor Funds”) and (ii) certain of our executive officers and members of our senior management (the “Management Participants”). We refer to the Sponsor Funds and the Management Participants collectively as the “Investors.”

TPG financed the purchase of Aleris through application of the proceeds from the outstanding notes, initial borrowings under the 2006 credit facilities, the equity investments described above and our cash on hand. The closing of the Acquisition occurred simultaneously with the closing of the offering of the outstanding notes, the closing of the 2006 credit facilities and the equity investments described above.

As a result of the Acquisition, we are a wholly-owned subsidiary of Holdings and the Investors directly or indirectly own all of our equity interests. Holdings is an entity that was formed in connection with the Transactions and has no assets or liabilities other than the shares of Aleris.

We refer to these transactions, including the Acquisition and our payment of the costs related to these transactions, collectively as the “Transactions.” In connection with the Transactions, we incurred significant indebtedness and became highly leveraged. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Highlights of the Year Ended December 31, 2006” and “—Liquidity and Capital Resources—December 2006 Refinancing” and Note B and Note K of our audited consolidated financial statements included elsewhere in this prospectus for a description of the Acquisition, the 2006 credit facilities and the outstanding notes.

3

Table of Contents

The Acquisition of Corus Aluminum by Aleris

On August 1, 2006, we consummated the acquisition of Corus Aluminum, which included Corus’s aluminum rolling and extrusion businesses but not Corus’s primary aluminum smelters. Aggregate net cash consideration for the acquisition was €695.5 million (approximately $885.7 million), subject to adjustment based on the finalization of the working capital delivered and net debt assumed. We currently estimate that the purchase price adjustment will be approximately $65.0 million (approximately €49.0 million) and have included this amount in our determination of the purchase price allocation and as a current accrued liability in our audited consolidated balance sheet included elsewhere in this prospectus. Corus Aluminum generated revenues of $1,850.0 million in 2005.

The acquisition of Corus Aluminum expanded our product offering, increased our participation in high-growth industry segments and strengthened our technology platform. Corus Aluminum’s aircraft plate and sheet and heat exchanger materials introduced new, higher-margin products to our product mix while Corus Aluminum’s automotive body sheet and brazing sheet product offering complemented our existing rolled products capabilities. Additionally, we gained the capability to produce high-quality specialized hard alloy extruded products used in the automotive and aerospace sectors, as well as soft alloy extrusions. While the acquisition of Corus Aluminum strengthened our cross-selling opportunities within our existing automotive, building and construction and packaging end-use applications, it also diversified our business into the heavy transportation, aerospace and engineering industries, which are sectors that have demonstrated strong growth characteristics. The acquisition of Corus Aluminum also increased our participation in important international industry segments. For example, we expanded our presence in existing European sectors, such as the German automotive sector, and gained access to the high-growth economy of China.

Recent Developments

On July 3, 2007, we entered into a definitive purchase agreement to (a) acquire all of the issued and outstanding limited or unlimited company interests, shares or other equity interests of Wabash Alloys, L.L.C., Connell Industries Canada Company and Aluminum Recycling Services, S. de R.L. de C.V., (b) acquire all of the assets, properties, rights, privileges, franchises, operations, goodwill and business of Wabash Alloys, S. de R.L. de C.V. (which we refer to as “Wabash Mexico” and, together with the aforementioned entities, “Wabash Alloys”), and (c) assume substantially all of the liabilities and obligations of Wabash Mexico), for approximately $194 million, subject to certain post-closing adjustments. Wabash Alloys produces aluminum casting alloys and molten metal at its seven facilities in the United States, Canada and Mexico, with 2006 revenues of over $900 million. We refer to this transaction as the “Wabash Alloys Acquisition.” We currently intend to finance the Wabash Alloys Acquisition from a combination of either cash flows from operations, additional drawdowns of our revolving credit facility or additional debt, which may include term loan credit facilities and bonds.

4

Table of Contents

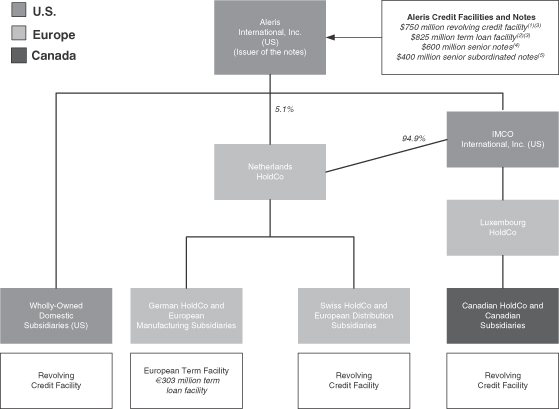

Corporate Structure

A simplified overview of our corporate structure is shown in the diagram below. See “The Transactions,” “Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters” and “Capitalization.”

| (1) | Our revolving credit facility provides up to $750.0 million of senior secured financing, subject to borrowing base limitations. We and certain of our domestic and Canadian subsidiaries, as well as Aleris Switzerland GmbH (referred to in the diagram above as Swiss HoldCo), are borrowers under the revolving credit facility. See “Description of Other Indebtedness.” |

| (2) | Our term loan facility provides senior secured financing, and permits $825.0 million in borrowings by us and €303.0 million in borrowings by Aleris Deutschland Holding GmbH (referred to in the diagram above as German HoldCo). See “Description of Other Indebtedness.” |

| (3) | All borrowings by foreign subsidiaries under our revolving credit facility and our term loan facility are guaranteed on a senior secured basis by us and substantially all of our wholly-owned domestic subsidiaries and certain of our other foreign subsidiaries. All borrowings by us and each domestic subsidiary borrower under our revolving credit facility and our term loan facility are guaranteed on a senior secured basis by substantially all of our wholly-owned domestic subsidiaries. Aleris International, Inc. also guarantees the borrowings of each domestic subsidiary borrower under our revolving credit facility. The 2006 credit facilities are secured, subject to certain exceptions, by substantially all of our assets and the assets of our guarantors located in the United States, Canada and Europe and the equity of certain of our foreign and domestic direct and indirect subsidiaries. See “Description of Other Indebtedness.” |

| (4) | The outstanding senior notes are guaranteed on a senior unsecured basis by each of our restricted subsidiaries that is a wholly-owned domestic subsidiary and that guarantees our obligations under our 2006 credit facilities. |

| (5) | The outstanding senior subordinated notes are guaranteed on a senior subordinated unsecured basis by each of our restricted subsidiaries that is a wholly-owned domestic subsidiary and that guarantees our obligations under our 2006 credit facilities. |

5

Table of Contents

Corporate Information

Aleris is incorporated in the state of Delaware. Our principal executive offices are located at 25825 Science Park Drive, Suite 400, Beachwood, Ohio. Our telephone number is (216) 910-3400.

6

Table of Contents

The Exchange Offer

On December 19, 2006, we completed a private offering of our outstanding senior notes and our outstanding senior subordinated notes, which we refer to collectively as the “outstanding notes.” We entered into a registration rights agreement with the initial purchasers in the private offering in which we agreed, among other things, to file the registration statement of which this prospectus forms a part and to complete an exchange offer for the outstanding senior notes and the outstanding senior subordinated notes. The following is a summary of the exchange offer.

Outstanding Notes | On December 19, 2006, we issued: |

• | $600.0 million aggregate principal amount of our 9%/9 3/4% senior notes due 2014; and |

| • | $400.0 million aggregate principal amount of our 10% senior subordinated notes due 2016. |

Exchange Notes | • $600.0 million aggregate principal amount of 9%/9 3/4% senior notes due 2014, which we refer to as the “senior exchange notes.” We refer to the senior exchange notes and the outstanding senior notes collectively as the “senior notes.” |

| • | $400.0 million aggregate principal amount of 10% senior subordinated notes due 2016, which we refer to as the “senior subordinated exchange notes.” We refer to the senior subordinated exchange notes and the outstanding senior subordinated notes collectively as the “senior subordinated notes.” |

| • | We refer to the outstanding senior notes and the outstanding senior subordinated notes collectively as the “outstanding notes.” We refer to the senior exchange notes and the senior subordinated exchange notes collectively as the “exchange notes,” and the outstanding notes and the exchange notes collectively as the “notes.” |

| • | The terms of each series of exchange notes are substantially identical to those terms of the applicable series of outstanding notes, except that the transfer restrictions, registration rights and provisions for additional interest relating to the outstanding notes do not apply to the exchange notes. |

Exchange Offer | We are offering exchange notes in exchange for a like principal amount of our outstanding notes. You may tender your outstanding notes for exchange notes by following the procedures described under the heading “The Exchange Offer.” |

Tenders; Expiration Date; Withdrawal | The exchange offer will expire at 12:00 a.m., New York City time, on , 2007, unless we extend it. You may withdraw any outstanding notes that you tender for exchange at any time prior to the expiration of this exchange offer. See “The Exchange Offer—Terms of the Exchange Offer” for a more complete description of the tender and withdrawal period. |

7

Table of Contents

Conditions to the Exchange Offer | The exchange offer is not subject to any conditions, other than that: |

| • | the exchange offer does not violate any applicable law or any interpretations of the staff of the SEC; |

| • | there is no action or proceeding instituted or threatened in any court or by any governmental agency that in our judgment would reasonably be expected to impair our ability to proceed with the exchange offer or there is a material adverse development in any existing action or proceeding with respect to us; and |

| • | we obtain the governmental approvals we deem necessary to obtain for the consummation of the exchange offer. |

The exchange offer is not conditioned upon any minimum aggregate principal amount of outstanding notes being tendered in the exchange.

Procedures for Tendering Outstanding Notes | To participate in this exchange offer, you must properly complete and duly execute a letter of transmittal, which accompanies this prospectus, and transmit it, along with all other documents required by such letter of transmittal, to the exchange agent on or before the expiration date at the address provided on the cover page of the letter of transmittal. |

In the alternative, you can tender your outstanding notes by book-entry delivery following the procedures described in this prospectus, whereby you will agree to be bound by the letter of transmittal and we may enforce the letter of transmittal against you.

If a holder of outstanding notes desires to tender such notes and the holder’s outstanding notes are not immediately available, or time will not permit the holder’s outstanding notes or other required documents to reach the exchange agent before the expiration date, or the procedure for book-entry transfer cannot be completed on a timely basis, a tender may be effected pursuant to the guaranteed delivery procedures described in this prospectus. See “The Exchange Offer—How to Tender Outstanding Notes for Exchange.”

U.S. Federal Income Tax Considerations | Your exchange of outstanding notes for exchange notes to be issued in the exchange offer will not result in any gain or loss to you for U.S. federal income tax purposes. See “Certain U.S. Federal Income Tax Considerations” for a summary of U.S. federal tax consequences associated with the exchange of outstanding notes for the exchange notes and the ownership and disposition of those exchange notes. |

Use of Proceeds | We will not receive any cash proceeds from the exchange offer. |

Exchange Agent | LaSalle Bank National Association, the trustee under the indentures governing the notes, is serving as exchange agent in connection with the exchange offer. The address and telephone number of the exchange agent are set forth under the heading “The Exchange Offer—The Exchange Agent.” |

8

Table of Contents

Consequences of Failure to Exchange Your Outstanding Notes | Outstanding notes not exchanged in the exchange offer will continue to be subject to the restrictions on transfer that are described in the legend on the outstanding notes. In general, you may offer or sell your outstanding notes only if they are registered under, or offered or sold under an exemption from, the Securities Act and applicable state securities laws. Except as required by the registration rights agreement, we do not currently intend to register the outstanding notes under the Securities Act. If your outstanding notes are not tendered and accepted in the exchange offer, it may become more difficult for you to sell or transfer your outstanding notes. |

Resales of the Exchange Notes | Based on interpretations of the staff of the SEC, we believe that you may offer for sale, resell or otherwise transfer the exchange notes that we issue in the exchange offer without complying with the registration and prospectus delivery requirements of the Securities Act if: |

| • | you are not a broker-dealer tendering notes acquired directly from us; |

| • | you acquire the exchange notes issued in the exchange offer in the ordinary course of your business; |

| • | you are not participating, do not intend to participate, and have no arrangement or undertaking with anyone to participate, in the distribution of the exchange notes issued to you in the exchange offer; and |

| • | you are not an “affiliate” of our company, as that term is defined in Rule 405 of the Securities Act. |

If any of these conditions are not satisfied and you transfer any exchange notes issued to you in the exchange offer without delivering a proper prospectus or without qualifying for a registration exemption, you may incur liability under the Securities Act. We will not be responsible for, or indemnify you against, any liability you incur.

Any broker-dealer that acquires exchange notes in the exchange offer for its own account in exchange for outstanding notes which it acquired through market-making or other trading activities must acknowledge that it will deliver this prospectus when it resells or transfers any exchange notes issued in the exchange offer. See “Plan of Distribution” for a description of the prospectus delivery obligations of broker-dealers.

9

Table of Contents

The Exchange Notes

The summary below describes the principal terms of the exchange notes. Certain of the terms and conditions described below are subject to important limitations and exceptions. A more detailed description of the terms and conditions of the exchange notes is set forth in “Description of Senior Exchange Notes” and “Description of Senior Subordinated Exchange Notes.”

Issuer | Aleris International, Inc. |

Securities Offered

Senior Exchange Notes | $600,000,000 aggregate principal amount of 9%/9 3/4% senior notes due 2014. |

Senior Subordinated Exchange Notes | $400,000,000 aggregate principal amount of 10% senior subordinated notes due 2016. |

Maturity | The senior exchange notes will mature on December 15, 2014. |

The senior subordinated exchange notes will mature on December 15, 2016.

Interest Payment Dates | Interest on the senior exchange notes will be payable on June 15 and December 15 of each year, commencing June 15, 2007. |

Interest on the senior subordinated exchange notes will be payable on June 15 and December 15 of each year, commencing on June 15, 2007.

Form of Interest Payment

Senior Exchange Notes | We will pay interest on the senior exchange notes for the initial interest period in cash. For any interest period thereafter through December 15, 2010, we may elect to pay interest on the senior exchange notes, at our option: |

| • | entirely in cash (“cash interest”); |

| • | entirely by increasing the principal amount of the senior notes (“PIK interest”); or |

| • | 50% cash interest and 50% PIK interest. |

Cash interest will accrue at a rate of 9% per annum, and PIK interest will accrue at a rate of 9 3/4% per annum. If we elect to pay PIK interest, we will increase the principal amount of the senior exchange notes in an amount equal to the amount of PIK interest for the applicable interest period (rounded up to the nearest $1,000 in the case of global notes and to the nearest whole dollar in the case of senior notes in certificated form) to holders of senior exchange notes on the relevant record date. The senior exchange notes will bear

10

Table of Contents

interest on the increased principal amount thereof from and after the applicable interest payment date on which a payment of PIK interest is made. We must elect the form of interest payment with respect to each interest period prior to the beginning of the applicable interest period. In the absence of such an election or proper notification of such election to the trustee, interest will be payable entirely in cash. After December 15, 2010, we must pay all interest on the senior notes entirely in cash. |

Senior Subordinated Exchange | In cash. |

Ranking | The senior exchange notes will be our unsecured senior obligations and will: |

| • | rank senior in right of payment to our existing and future debt and other obligations that are, by their terms, expressly subordinated in right of payment to the senior exchange notes, including the senior subordinated notes; |

| • | rank equally in right of payment to all of our existing and future debt and other obligations (including under our 2006 credit facilities) that are not, by their terms, expressly subordinated in right of payment to the senior exchange notes; and |

| • | be effectively subordinated in right of payment to all of our existing and future secured debt (including under our 2006 credit facilities), to the extent of the value of the assets securing such debt, and be structurally subordinated to all existing and future debt and other obligations, including trade payables, of each of our subsidiaries that is not a guarantor of the senior exchange notes. |

Similarly, the senior exchange note guarantees will be unsecured senior obligations of the guarantors and will:

| • | rank senior in right of payment to all of the applicable guarantor’s existing and future debt and other obligations that are, by their terms, expressly subordinated in right of payment to such guarantor’s senior exchange note guarantee, including such guarantor’s guarantee of the senior subordinated exchange notes; |

| • | rank equally in right of payment to all of the applicable guarantor’s existing and future debt and other obligations that are not, by their terms, expressly subordinated in right of payment to such guarantor’s senior exchange note guarantee, including such guarantor’s guarantee of our 2006 credit facilities; and |

| • | be effectively subordinated in right of payment to all of the applicable guarantor’s existing and future secured debt (including such guarantor’s guarantee under our 2006 credit facilities), to the extent of the value of the assets securing such debt, and be structurally subordinated to all existing and future |

11

Table of Contents

debt and other obligations, including trade payables, of each of such guarantor’s subsidiaries that do not guarantee the senior exchange notes.

The senior subordinated exchange notes will be our unsecured senior subordinated obligations and will: |

| • | be subordinated in right of payment to our existing and future senior debt, including the senior exchange notes and our 2006 credit facilities; |

| • | rank equally in right of payment to all of our existing and future senior subordinated debt; |

| • | be structurally subordinated to all existing and future debt and other obligations, including trade payables, of each of our subsidiaries that is not a guarantor of the senior subordinated exchange notes; and |

| • | rank senior in right of payment to all of our existing and future debt and other obligations that are, by their terms, expressly subordinated in right of payment to the senior subordinated exchange notes. |

Similarly, the senior subordinated exchange note guarantees are the unsecured senior subordinated obligations of the guarantors and:

| • | are subordinated in right of payment to all of the applicable guarantor’s existing and future senior debt, including such guarantor’s guarantee of the senior exchange notes and our 2006 credit facilities; |

| • | rank equally in right of payment to all of the applicable guarantor’s existing and future senior subordinated debt; |

| • | are structurally subordinated to all of the applicable guarantor’s existing and future debt and other obligations, including trade payables, of each of such guarantor’s subsidiaries that do not guarantee the senior subordinated exchange notes; and |

| • | rank senior in right of payment to all existing and future debt and other obligations that are, by their terms, expressly subordinated in right of payment to such guarantor’s senior subordinated exchange note guarantee. |

As of March 31, 2007, we had $1,623.7 million of secured senior debt, including approximately $23.3 million in respect of letters of credit, and excluding up to an additional $388.7 million of unused commitments, net of outstanding letters of credit, that we were able to borrow under our 2006 credit facilities to which the exchange notes would be effectively subordinated, as well as an additional $600.0 million of unsecured senior debt to which the senior subordinated exchange notes would be subordinated.

12

Table of Contents

Guarantees | All of our restricted subsidiaries that are domestic subsidiaries and that guarantee our obligations under the 2006 credit facilities unconditionally guarantee the exchange notes. |

Mandatory Redemption | A portion of the senior notes is subject to mandatory redemption in the circumstances described, and at the redemption prices referred to, under “Description of Senior Exchange Notes—Mandatory Redemption; Offer to Purchase, Open Market Purchases.” |

Optional Redemption | Prior to December 15, 2010, we may redeem some or all of the senior exchange notes at a price equal to 100% of the principal amount thereof, plus the applicable premium set forth under “Description of Senior Exchange Notes—Optional Redemption.” Beginning on December 15, 2010, we may redeem some or all of the senior exchange notes at the redemption prices listed under “Description of Senior Exchange Notes—Optional Redemption” plus accrued and unpaid interest to the redemption date. |

Prior to December 15, 2011, we may redeem some or all of the senior subordinated exchange notes at a price equal to 100% of the principal amount thereof, plus the applicable premium set forth under “Description of Senior Subordinated Exchange Notes—Optional Redemption.” Beginning on December 15, 2011, we may redeem some or all of the senior subordinated exchange notes at the redemption prices listed under “Description of Senior Subordinated Exchange Notes—Optional Redemption” plus accrued and unpaid interest to the redemption date.

Optional Redemption After Certain Equity Offerings | At any time (which may be more than once) until December 15, 2009, we can choose to redeem up to 35% of the original aggregate principal amount of the exchange notes of either series (plus the aggregate principal amount of any additional notes of such series issued after the issue date) with money that we raise in certain equity offerings, so long as: |

| • | we pay 109% of the face amount of the senior exchange notes or 110% of the face amount of the senior subordinated exchange notes, as applicable, plus accrued and unpaid interest; |

| • | we redeem the exchange notes within 180 days of completing such equity offering; and |

| • | at least 50% of the aggregate principal amount of the applicable series of exchange notes originally issued (plus the aggregate principal amount of any additional notes of such series issued after the issue date) remains outstanding afterwards. |

Change of Control Offer | If we experience a change in control, we must give holders of the exchange notes the opportunity to sell us their exchange notes at 101% of their face amount, plus accrued and unpaid interest. |

13

Table of Contents

Asset Sale Offer | If we or our restricted subsidiaries engage in asset sales, we generally must either invest the net cash proceeds from such sales in our business within a specified period of time, permanently reduce senior debt, permanently reduce senior subordinated debt, including the senior subordinated exchange notes (in the case of senior subordinated exchange notes), permanently reduce debt of a restricted subsidiary that is not a subsidiary guarantor or make an offer to purchase a principal amount of the exchange notes equal to the net cash proceeds, subject to certain exceptions. The purchase price of the notes will be 100% of their principal amount, plus accrued and unpaid interest. |

Certain Covenants | The indentures governing the senior exchange notes and the senior subordinated exchange notes contain covenants limiting our ability and the ability of our restricted subsidiaries to, among other things: |

| • | incur additional debt; |

| • | pay dividends or distributions on our capital stock or redeem, repurchase or retire our capital stock or subordinated debt; |

| • | issue preferred stock of restricted subsidiaries; |

| • | make certain investments; |

| • | create liens on our or our subsidiary guarantors’ assets to secure debt; |

| • | in the case of the senior exchange notes only, enter into sale and leaseback transactions; |

| • | create restrictions on the payment of dividends or other amounts to us from our restricted subsidiaries that are not guarantors of the notes; |

| • | enter into transactions with affiliates; |

| • | merge or consolidate with another company; and |

| • | sell assets, including capital stock of our subsidiaries. |

These covenants are subject to a number of important limitations and exceptions.

Risk Factors | See “Risk Factors” and the other information in this prospectus for a discussion of some of the factors you should carefully consider before participating in the exchange offer. |

14

Table of Contents

Summary Historical Consolidated and Unaudited Pro Forma Condensed Combined Financial and Other Data

The following summary historical consolidated financial and other data for each of the years in the two-year period ended December 31, 2005, for the period from January 1, 2006 to December 19, 2006, and for the period from December 20, 2006 to December 31, 2006, and as of December 31, 2005 and 2006 have been derived from our audited consolidated financial statements included elsewhere in this prospectus. The balance sheet data as of December 31, 2004 have been derived from our audited consolidated financial statements not included in this prospectus. The summary historical consolidated financial and other data for the three months ended March 31, 2007 and 2006 have been derived from our unaudited consolidated financial statements included elsewhere in this prospectus. The unaudited consolidated financial statements have been prepared on the same basis as our audited consolidated financial statements and, in the opinion of our management, reflect all adjustments, consisting of normal recurring adjustments, necessary for a fair presentation of these data. The acquisition of Corus Aluminum, the 2005 Acquisitions and our acquisition of Commonwealth in 2004 have all affected the comparability of our financial data between periods. The audited consolidated financial statements for each of the periods in the three-year period ended December 31, 2006 have been audited by Ernst & Young LLP, an independent registered public accounting firm.

The following table also sets forth summary unaudited pro forma condensed combined financial and other data for the year ended December 31, 2006. The summary unaudited pro forma consolidated results of operations give pro forma effect to the Transactions and the acquisition of Corus Aluminum on a combined basis as if they had occurred on January 1, 2006. Corus Aluminum’s historical combined financial statements from which the summary pro forma condensed combined financial and other data are in part derived were prepared in accordance with International Financial Reporting Standards as adopted by the European Union, or IFRS, which differ in certain material respects from U.S. generally accepted accounting principles (“U.S. GAAP”). See “Unaudited Pro Forma Condensed Combined Financial Information” for a more detailed description of the assumptions made in preparing the following pro forma condensed combined financial data. In accordance with SEC rules, the summary unaudited pro forma condensed combined financial information presented below does not give effect to the Wabash Alloys Acquisition for which we entered into a definitive purchase agreement on July 3, 2007, as the Wabash Alloys Acquisition is below the significance threshold contained in applicable SEC rules. See “—Recent Developments.”

15

Table of Contents

The financial data set forth in this table are not necessarily indicative of the results of future operations and should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” our audited and unaudited consolidated financial statements and accompanying notes thereto included elsewhere in this prospectus as well as the audited and unaudited combined financial statements and accompanying notes thereto of Corus Aluminum included elsewhere in this prospectus. All numbers are in millions, except ratios.

| Pro Forma | ||||||||||||||||||||||||||||

| For the three months ended March 31, | For the 2006 | For the 2006 | For the year ended December 31, | For the year 2006 | ||||||||||||||||||||||||

| 2007 | 2006 | 2005 | 2004 | |||||||||||||||||||||||||

| (Successor) | (Predecessor) | (Successor) | (Predecessor) | (unaudited) | ||||||||||||||||||||||||

| (unaudited) | ||||||||||||||||||||||||||||

Statement of Operations Data: | ||||||||||||||||||||||||||||

Revenues | $ | 1,599.1 | $ | 847.6 | $ | 111.8 | $ | 4,637.0 | $ | 2,429.0 | $ | 1,226.6 | $ | 6,027.7 | ||||||||||||||

Operating income | 3.3 | 59.5 | 2.4 | 234.9 | 118.7 | 12.7 | 263.6 | |||||||||||||||||||||

Net (loss) income | $ | (53.1 | ) | $ | 28.2 | $ | (3.4 | ) | $ | 73.7 | $ | 74.3 | $ | (23.8 | ) | 9.3 | ||||||||||||

Balance Sheet Data (at end of period): | ||||||||||||||||||||||||||||

Cash and cash equivalents | $ | 85.9 | $ | 8.2 | $ | 126.1 | $ | 6.8 | $ | 17.8 | ||||||||||||||||||

Total assets | 4,821.6 | 1,611.8 | 4,808.4 | 1,554.1 | 1,081.1 | |||||||||||||||||||||||

Total debt | 2,600.4 | 628.2 | 2,588.0 | 651.8 | 412.4 | |||||||||||||||||||||||

Total stockholder’s equity | 801.4 | 420.1 | 845.4 | 393.8 | 282.7 | |||||||||||||||||||||||

Other Financial Data: | ||||||||||||||||||||||||||||

Net cash provided by | ||||||||||||||||||||||||||||

Operating activities | $ | 2.8 | $ | 35.4 | $ | (147.1 | ) | $ | 338.0 | $ | 102.3 | $ | 2.1 | |||||||||||||||

Investing activities | (52.0 | ) | (11.0 | ) | (1,736.1 | ) | (902.5 | ) | (373.9 | ) | (38.9 | ) | ||||||||||||||||

Financing activities | 7.8 | (23.2 | ) | 1,880.5 | 699.9 | 261.3 | 38.7 | |||||||||||||||||||||

Depreciation and amortization | 40.1 | 15.7 | 5.4 | 103.7 | 55.0 | 30.6 | $ | 183.8 | ||||||||||||||||||||

Capital expenditures | 44.7 | 11.0 | 10.7 | 113.2 | 62.1 | 44.8 | 161.0 | |||||||||||||||||||||

Ratio of earnings to fixed charges (a) | — | 4.0 | x | — | 2.3 | x | 2.6 | x | — | 1.0 | x | |||||||||||||||||

| (a) | For purposes of computing the ratio of earnings to fixed charges, “earnings” consists of income (loss) before income tax expense (benefit) and minority interest, plus cash dividends received from equity interests less the equity income recorded. Fixed charges consist of interest expense, including amortization of debt issuance costs and capitalized interest and the interest portion of rental expense. For the three months ended March 31, 2007, the period from December 20, 2006 to December 31, 2006 and for the year ended December 31, 2004, earnings were insufficient to cover fixed charges by approximately $54.8 million, $4.1 million and $16.3 million, respectively. |

16

Table of Contents

You should carefully consider the risk factors set forth below as well as the other information contained in this prospectus before making an investment decision. The risks described below are not the only risks facing us. Additional risks and uncertainties not currently known to us or those we currently deem to be immaterial may also materially and adversely affect our business, financial condition or results of operations. Any of the following risks could materially adversely affect our business, financial condition or results of operations. In such a case, you may lose all or part of your original investment in the notes.

Risks Related to Our Business

The operations of Aleris, Corus Aluminum and the 2005 Acquisitions may not be integrated successfully.

The integration of the operations of Corus Aluminum involves consolidating products, operations and administrative functions of two companies that previously operated separately. Achieving the anticipated benefits of the combination of Aleris and Corus Aluminum will depend in part upon our ability to integrate the two businesses in an efficient and effective manner. The integration of two businesses that have previously operated separately faces significant challenges, and we may be unable to accomplish the integration successfully. In addition, we will need to continue integrating the 2005 Acquisitions.

In particular, the need to coordinate geographically dispersed organizations and address possible differences in corporate cultures and management philosophies may increase the difficulties of the integration of Corus Aluminum. Additionally, we may incur substantial expense in our efforts to integrate the information technology systems of Aleris, Corus Aluminum and the 2005 Acquisitions, and these efforts may not prove successful. The integration of Aleris, Corus Aluminum and the 2005 Acquisitions may take longer than planned and may be subject to unanticipated difficulties and expenses. The integration of these acquisitions will require the dedication of significant management resources and may temporarily distract management’s attention from the day-to-day businesses of our Company. Employee uncertainty and lack of focus during the integration process may also disrupt our businesses. We may lose key personnel from the acquired organizations and employees in the acquired organizations may be resistant to change and may not adapt well to our corporate structure. The process of integrating operations could cause an interruption of, or loss of momentum in, the activities of one or more of our businesses and the loss of key personnel.

Any inability of management to successfully integrate the operations of Corus Aluminum and the 2005 Acquisitions with Aleris could result in our not achieving the projected efficiencies, cost savings and synergies of these transactions and could adversely affect our businesses and financial condition.

We continue to consider strategic alternatives on an ongoing basis, including having discussions concerning potential acquisitions, which may be material.

If we fail to implement our business strategy, our financial condition and results of operations could be adversely affected.

Our future financial performance and success depend in large part on our ability to successfully implement our business strategy. We cannot assure you that we will be able to successfully implement our business strategy or be able to continue improving our operating results. In particular, we cannot assure you that we will be able to achieve all of the operating synergies targeted through focused integration of acquisitions, focused productivity improvements and capacity optimization, further enhancements of our business and product mix, expansion in selected international regions, opportunistic pursuit of strategic acquisitions and management of key commodity exposures.

17

Table of Contents

Furthermore, we cannot assure you that we will be successful in our growth efforts or that we will be able to effectively manage expanded or acquired operations. Our ability to achieve our expansion and acquisition objectives and to effectively manage our growth depends on a number of factors, including:

| • | our ability to introduce new products and end-use applications; |

| • | our ability to identify appropriate acquisition targets and to negotiate acceptable terms for their acquisition; |

| • | our ability to integrate new businesses into our operations; and |

| • | the availability of capital on acceptable terms. |

Implementation of our business strategy could be affected by a number of factors beyond our control, such as increased competition, legal and regulatory developments, general economic conditions or the increase of operating costs. Any failure to successfully implement our business strategy could adversely affect our financial condition and results of operations. We may, in addition, decide to alter or discontinue certain aspects of our business strategy at any time.

The cyclical nature of the metals industry, our end-use segments and our customers’ industries could limit our operating flexibility, which could negatively impact our financial condition and results of operations.

The metals industry in general is cyclical in nature. It tends to reflect and be amplified by changes in general and local economic conditions. These conditions include the level of economic growth, financing availability, the availability of affordable energy sources, employment levels, interest rates, consumer confidence and housing demand. Historically, in periods of recession or periods of minimal economic growth, metals companies have often tended to underperform other sectors. We are particularly sensitive to trends in the transportation and construction industries, which are both seasonal and highly cyclical in nature, and dependent on general economic conditions. For example, during recessions or periods of low growth, the transportation and construction industries typically experience major cutbacks in production, resulting in decreased demand for aluminum and zinc. This leads to significant fluctuations in demand and pricing for our products and services. Because we generally have high fixed costs, our profitability is significantly affected by decreased processing volume. Accordingly, reduced demand and pricing pressures may significantly reduce our profitability and adversely affect our financial condition and results of operations. Economic downturns in regional and global economies or a prolonged recession in our principal industry segments have had a negative impact on our operations in the past, and could have a negative impact on our future financial condition or results of operations. In addition, in recent years global economic and commodity trends have been increasingly correlated. Although we continue to seek to diversify our business on a geographic and industry end-use basis, we cannot assure you that diversification will significantly mitigate the effect of cyclical downturns.

Changes in the market price of aluminum and zinc impact the selling prices of our products. Market prices of aluminum and zinc are dependent upon supply and demand and a variety of factors over which we have minimal or no control, including:

| • | regional and global economic conditions; |

| • | availability and relative pricing of metal substitutes; |

| • | labor costs; |

| • | energy prices; |

| • | environmental and conservation regulations; |

| • | seasonal factors and weather; and |

| • | import and export restrictions. |

18

Table of Contents

The loss of certain members of our management may have an adverse effect on our operating results.

Our success will depend, in part, on the efforts of our senior management and other key employees. These individuals possess sales, marketing, engineering, manufacturing, financial and administrative skills that are critical to the operation of our business. If we lose or suffer an extended interruption in the services of one or more of our senior officers, our financial condition and results of operations may be negatively affected. Moreover, the market for qualified individuals may be highly competitive and we may not be able to attract and retain qualified personnel to replace or succeed members of our senior management or other key employees, should the need arise.

We had substantial historical net losses prior to 2005 and had a net loss in the first quarter of 2007, and any continuation of net losses in the future may reduce our ability to raise needed capital.

We reported net losses for the years ended December 31, 2002, 2003 and 2004, as well as for the first quarter of 2007. Our ability to continue operations may become increasingly constrained if we incur net losses in the future.