May 17, 2011

Mr. John Cash

Accounting Branch Chief

Securities and Exchange Commission

Division of Corporation Finance

100 F Street, N.E.

Mailstop 7010

Washington, D.C. 20549-7010

| Re: | Och-Ziff Capital Management Group LLC |

Form 10-K for the fiscal year ended December 31, 2010

Filed February 28, 2011

Form 8-K filed on February 10, 2011

Definitive Proxy on Schedule 14A filed on April 5, 2011

File No, 1-33805

Dear Mr. Cash:

On behalf of Och-Ziff Capital Management Group LLC (the “Company”), this letter responds to the comments of the Staff of the SEC set forth in your letter dated May 6, 2011, relating to the Company’s filings as noted above (the “Letter”). For convenience, each Staff comment contained in the Letter is followed by the Company’s response to that comment.

Form 10-K for the fiscal year ended December 31, 2010

Item 1. Business, page 3

| | 1. | In future filings, please provide the financial information about segments, or include a cross reference to your segment note in the financial statements, in accordance with Item 101(b) of Regulation S-K. |

In response to the Staff’s comment, the Company undertakes to include a cross reference to its segment note in the Business section of its Form 10-K for the year ended December 31, 2011 and in other future filings as required by S-K Item 101(b).

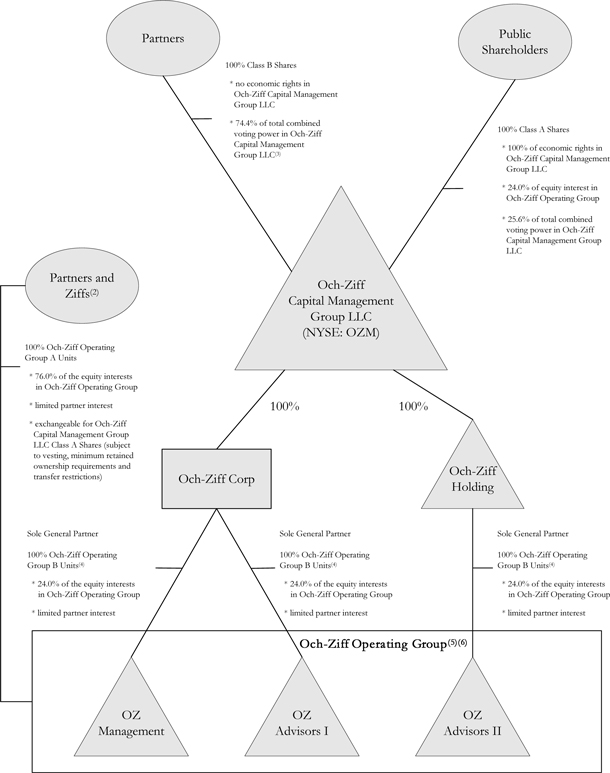

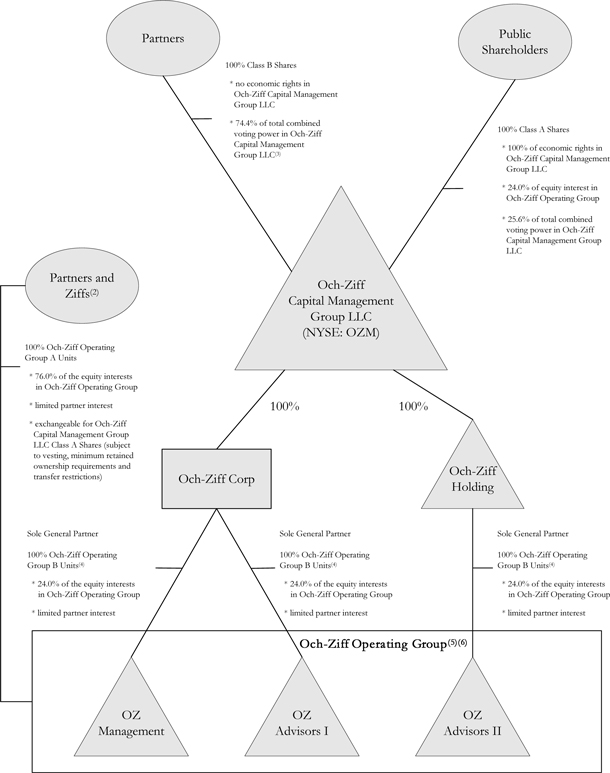

Organizational Structure, page 15

| | 2. | On page 13 and in the footnotes to the organizational diagram, we note disclosure that the Ziffs do not hold any of your Class B shares. However, the diagram itself suggests that the Ziffs do own Class B shares. Please revise this diagram in future filings to show that the Ziffs do own Units in the Operating Group, but do not hold Class B shares, consistent with your other disclosures. |

In response to the Staff’s comment, the Company undertakes to revise the organizational diagram to more clearly reflect that the Ziffs own Group A Units in the Operating Group but do not hold Class B shares. See Exhibit A hereto for the revised diagram.

Management’s Discussion and Analysis of Financial Condition and Results of Operations, Results of Operations, page 70

| 3. | Please revise future annual and quarterly filings to include a more specific and comprehensive discussion of the following items that impacted your results: |

| | • | | We note you cite offsetting factors that impacted incentive income, including the absence of high water marks and changes in investment performance. Please address the underlying reasons for changes in these factors and quantify their impact. |

| | • | | We note you cite several factors that impacted compensation and benefits, including bonus expense and equity-based compensation. Please address the underlying reasons for changes in these factors and quantify their impact. Also, please quantify and discuss changes in compensation and benefits as a percent of revenues. |

In response to the Staff’s comment, the Company undertakes to disclose and discuss in future quarterly and annual filings reasons for changes in our incentive income and compensation and benefits and to quantify their impacts. We note, however, that the relevance of high-water marks will exist only in years with prior, unrecouped losses. Accordingly, we would not expect to discuss the impact of high-water marks when no such losses exist.

To address the Staff’s comment regarding reasons for the change in incentive income, the Company undertakes to include disclosure in its Form 10-K for the year ended December 31, 2011 substantially as set forth below:

Incentive income increased in 2010 by $97.3 million from 2009. The increase was driven by an approximately $[—] million increase primarily due to the absence of high-water marks in our funds in 2010. As a result of the losses experienced by our funds in 2008, we did not earn incentive income in 2009 until those losses were recovered. As of December 31, 2009, we had recovered substantially all of the losses experienced in 2008, and therefore entered 2010 with virtually no high-water marks in effect. Partially offsetting this increase was an approximately $[—] million decrease driven by lower performance-related appreciation in our funds in 2010.

To address the Staff’s comment regarding reasons for the change in compensation and benefits, the Company undertakes to include disclosure in its Form 10-K for the year ended December 31, 2011 substantially as set forth below:

Compensation and benefits expenses increased in 2010 by $17.3 million from 2009. The increase was primarily due to the following: (i) a $12.3 million increase in cash bonus expense, which was primarily driven by higher incentive income earned in 2010 compared to 2009; (ii) a $6.3 million increase in equity-based compensation expense largely driven by 2009 year-end equity grants; and (iii) a $4.5 million increase in allocations to Och-Ziff Operating Group D Units, which are non-equity profit interests held by certain partners, driven by higher profitability of the Och-Ziff Operating Group and an increased number of Och-Ziff Operating Group D Units outstanding in 2010 compared to 2009. Partially offsetting these

- 2 -

increases was a $7.3 million decrease in amortization of deferred cash compensation expenses, as deferred bonus compensation is now generally in the form of RSUs rather than deferred cash compensation. The remaining variance was driven by an increase in salaries and benefits primarily due to the increase in our worldwide headcount from 378 at December 31, 2009 to 405 at December 31, 2010.

As to the Staff’s last comment in the second bullet above, the Company respectfully informs the Staff that management does not review the ratio of compensation and benefits to total revenues on a U.S. GAAP consolidated basis. Management does, however, review the ratio of salaries and benefits to management fees (on a quarterly basis) and bonus expense to total revenues (on an annual basis) on an Economic Income basis. The Company undertakes to discuss these ratios in the Economic Income Analysis section of the MD&A in future quarterly and annual filings.

Debt Obligations, page 84

| | 4. | We note your disclosure on page 23 addresses several restrictive covenants applicable to your term loan that are not discussed in this section. In future filings, please expand your discussion of the restrictive covenants to address all material covenants. |

In future filings, the Company will expand the referenced disclosure as requested, substantially as set forth below:

Debt Obligations -Term Loan

The term loan includes provisions that restrict our ability to:

| | • | | incur further secured indebtednessor issue certain equity interests; |

| | • | | pay dividends or make certain other payments; |

| | • | | merge, consolidate, or sell or otherwise dispose of all or part of our assets; |

| | • | | engage in certain transactions with shareholders or affiliates; |

| | • | | engage in a substantially different line of business; and |

| | • | | amend our organizational documents in a manner materially adverse to the lenders. |

Exhibit Index, page 106

| | 5. | We note that you incorporate the Amended and Restated Credit Agreement, Exhibit 10.6 by reference to an exhibit to a previously filed registration statement. However, it does not appear that you filed all applicable appendices, schedules, and exhibits to the Credit Agreement when you first filed it. If these appendices, schedules, and exhibits have been filed previously, please advise us as to where they are located. Otherwise, in your next Exchange Act filing, please file the full Credit Agreement, including all appendices, schedules, and exhibits. |

- 3 -

In the Company’s next due periodic report, all appendices, schedules and exhibits to the Credit Agreement will be filed together with the Credit Agreement.

Form 8-K filed on February 10, 2011

| | 6. | We note you present a full non-GAAP income statement of Total Company Economic Income here as well as in your Form 8-K filed on May 3, 2011. Please revise future filings to eliminate this presentation so as not to attach undue prominence to this non-GAAP information. To the extent that you continue to present Total Company Economic Income, please ensure that your reconciliations to the applicable GAAP measure are on an individual basis, similar to your presentation on page 96 of your Form 10-K for the fiscal year ended December 31, 2010. Refer to Question 102.10 in the non-GAAP C&DIs. |

In response to the Staff’s comment, the Company undertakes to replace the non-GAAP presentations of Total Company Economic Income with reconciliations of Economic Income to U.S. GAAP net loss allocated to Class A Shareholders in a manner consistent with the Staff’s comment. Please see Exhibits B and C hereto. Exhibit B presents the reconciliation of Economic Income to the Company’s U.S. GAAP net loss in the same format as presented in its Form 10-K and includes reconciliations of other non-GAAP measures that the Company discusses in its earnings releases and other disclosures. Exhibit C presents all of the components of Economic Income for the Och-Ziff funds segment, Other Operations and the Company. For each component that represents a non-GAAP measure, the table shows the reconciliation of such measure to the corresponding U.S. GAAP measure. Certain components of Economic Income, such as Incentive Income and Other Revenues, are not non-GAAP measures and accordingly do not require any reconciliation. These unadjusted items are important components of other non-GAAP measures, however, and so are presented together with relevant non-GAAP measures and their reconciliations to U.S. GAAP to further facilitate an investor’s understanding of the components of Economic Income. For example, Total Revenues – Economic Income Basis is calculated by aggregating the non-GAAP measure for Management Fees and the U.S. GAAP measures for Incentive Income and Other Revenues. The reconciliations of the non-GAAP measurements for Management Fees and Total Revenues are clearly shown and, when presented together with their unadjusted U.S. GAAP components, result in a highly transparent presentation that enables investors to identify all of the components of a non-GAAP measure – whether such components are non-GAAP measures or U.S. GAAP measures.

Definitive Proxy Statement on Schedule 14A filed on April 5, 2011

General

| | 7. | We note that you did not check the box on your Form 10-K indicating that no disclosure of delinquent Form 3, 4 or 5 filers is included in the 10K or proxy statement. However, such disclosure does not appear in your filings. Please tell us supplementally, with a view toward future disclosure, what disclosure should have been included in response to Item 405 of Regulation S-K. |

- 4 -

The Company supplementally advises the Staff that there were no late Section 16 filings that required different or additional disclosure in our proxy statement pursuant to Regulation S-K Item 405. The box on the cover of the Form 10-K was not, but should have been, checked.

Director Compensation, page 34

| | 8. | In future filings, please disclose whether your independent directors are in compliance with the minimum Class A Share ownership requirements. |

In future filings, the Company will disclose whether its independent directors are in compliance with the minimum Class A Share ownership requirements. In this regard, the Company supplementally advises the Staff that, as of this date, each of the Company’s independent directors is in full compliance with such requirements.

* * * * *

The Company acknowledges the following:

| | • | | The Company is responsible for the adequacy and accuracy of the disclosure in the filings; |

| | • | | Staff comments or changes to disclosure in response to Staff comments do not foreclose the Commission from taking any action with respect to the filings; and |

| | • | | The Company may not assert Staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

If you have any questions or need any additional information or wish to discuss any part of the Company’s responses, please call me at (212) 790-0160 or Rani Doyle at (646) 562-4546.

|

| Very Truly Yours, |

|

| OCH-ZIFF CAPITAL MANAGEMENT GROUP LLC |

|

/s/ Joel M. Frank By: Joel M. Frank |

| Title: Chief Financial Officer and Senior Chief Operating Officer |

| Cc: | Securities and Exchange Commission |

Tricia Armelin

Anne McConnell

Jessica Kane

Pamela Long

- 5 -

Exhibit A

* (As of December 31, 2010)

| (1) | This diagram does not give effect to 14,079,612 Class A restricted share units, or “RSUs”, that were outstanding as of December 31, 2010, and which were granted to our partners, managing directors, other employees and the independent members of our Board of Directors. |

| (2) | Mr. Och, the other partners and the Ziffs hold Och-Ziff Operating Group A Units representing 38.9%, 30.5% and 6.6%, respectively, of the equity in the Och-Ziff Operating Group, excluding the 1,181,601 Class A Shares owned directly by Mr. Och. Our partners also hold Class C Non-Equity Interests and Och-Ziff Operating Group D Units as described below in notes (5) and (6). |

| (3) | Mr. Och holds Class B Shares representing 41.6% of the voting power of our Company and the other partners hold Class B Shares representing 32.7% of the voting power of our Company. Our partners have granted an irrevocable proxy to vote all of their Class B Shares to the Class B Shareholder Committee, the sole member of which is currently Mr. Och, as it may determine in its sole discretion. In addition, Mr. Och controls an additional 0.3% of the combined voting power through his direct ownership of 1,181,601 Class A Shares. The Ziffs do not hold any of our Class B Shares and, therefore, will not have any voting power in our Company except to the extent they exchange their Och-Ziff Operating Group A Units for Class A Shares and retain such Class A Shares. |

| (4) | The Och-Ziff Operating Group Equity Units have no preference or priority over other securities of the Och-Ziff Operating Group (other than the Och-Ziff Operating Group D Units to the extent described above) and, upon liquidation, dissolution or winding up, will be entitled to any assets remaining after payment of all debts and liabilities of the Och-Ziff Operating Group. |

| (5) | Certain partners also hold Class C Non-Equity Interests. Class C Non-Equity Interests represent non-equity interests in the Och-Ziff Operating Group entities. No holder of Class C Non-Equity Interests will have any right to receive distributions on such interests. Our partners hold all of the Class C Non-Equity Interests, which may be used for discretionary income allocations, if any, in the future. |

| (6) | Partners admitted to the Och-Ziff Operating Group subsequent to the Offerings hold Och-Ziff Operating Group D Units. The Och-Ziff Operating Group D Units, which represent an approximately 1.3% profits interest in the Och-Ziff Operating Group, are not considered equity interests for U.S. GAAP purposes. |

Exhibit B

Reconciliation of Non-GAAP and Segment Financial Measures to U.S. GAAP Measures (Unaudited)

(dollars in thousands, except per share amount)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended March 31, 2011 | | | Three Months Ended March 31, 2010 | |

| | | Och-Ziff Funds

Segment | | | Other

Operations | | | Total

Company | | | Och-Ziff Funds

Segment | | | Other

Operations | | | Total

Company | |

| | | | | | |

Net income (loss) allocated to Class A Shareholders - U.S. GAAP | | $ | (95,589 | ) | | $ | 125 | | | $ | (95,464 | ) | | $ | (79,242 | ) | | $ | (9,397 | ) | | $ | (88,639 | ) |

Reorganization expenses | | | 405,855 | | | | — | | | | 405,855 | | | | 424,806 | | | | — | | | | 424,806 | |

Net loss allocated to the Och-Ziff Operating Group A Units | | | (276,988 | ) | | | — | | | | (276,988 | ) | | | (320,001 | ) | | | — | | | | (320,001 | ) |

Equity-based compensation | | | 31,929 | | | | 1,569 | | | | 33,498 | | | | 27,048 | | | | 3,787 | | | | 30,835 | |

Income taxes | | | 8,986 | | | | (360 | ) | | | 8,626 | | | | 7,552 | | | | 1,247 | | | | 8,799 | |

Depreciation and amortization | | | 2,290 | | | | 184 | | | | 2,474 | | | | 2,100 | | | | 185 | | | | 2,285 | |

Amortization of deferred cash compensation and expenses related to compensation arrangements indexed to annual fund performance | | | 1,689 | | | | — | | | | 1,689 | | | | 188 | | | | (120 | ) | | | 68 | |

Net gains on investments in Och-Ziff funds | | | (61 | ) | | | (112 | ) | | | (173 | ) | | | (378 | ) | | | — | | | | (378 | ) |

Change in tax receivable agreement liability | | | 112 | | | | — | | | | 112 | | | | (264 | ) | | | — | | | | (264 | ) |

Other | | | 836 | | | | 25 | | | | 861 | | | | 338 | | | | 33 | | | | 371 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Economic Income - Non-GAAP | | $ | 79,059 | | | $ | 1,431 | | | | 80,490 | | | $ | 62,147 | | | $ | (4,265 | ) | | | 57,882 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Adjusted Income Taxes - Non-GAAP(1) | | | | | | | | | | | (15,309 | ) | | | | | | | | | | | (8,698 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Distributable Earnings - Non-GAAP | | | | | | | | | | $ | 65,181 | | | | | | | | | | | $ | 49,184 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Weighted-Average Class A Shares Outstanding | | | | | | | | | | | 96,812,723 | | | | | | | | | | | | 82,708,885 | |

Weighted-Average Partner Units | | | | | | | | | | | 305,215,206 | | | | | | | | | | | | 310,753,603 | |

Weighted-Average Class A Restricted Share Units (RSUs) | | | | | | | | | | | 13,003,234 | | | | | | | | | | | | 14,673,460 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Weighted-Average Adjusted Class A Shares | | | | | | | | | | | 415,031,163 | | | | | | | | | | | | 408,135,948 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Distributable Earnings Per Adjusted Class A Share - Non-GAAP | | | | | | | | | | $ | 0.16 | | | | | | | | | | | $ | 0.12 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | Presents an estimate of income tax expense by assuming the conversion of all Partner Units into Class A Shares, on a one-to-one basis. Therefore, all income (loss) of the Och-Ziff Operating Group allocated to the Partner Units is treated as if it were allocated to Och-Ziff Capital Management Group LLC. |

Exhibit C

Components of Economic Income and Reconciliation of Non-GAAP Measures to the Respective U.S. GAAP Measures (Unaudited)

(dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended March 31, 2011 | | | Three Months Ended March 31, 2010 | |

| | | Och-Ziff Funds

Segment | | | Other

Operations | | | Total

Company | | | Och-Ziff Funds

Segment | | | Other

Operations | | | Total

Company | |

| | | | | | |

Management fees - U.S. GAAP | | $ | 117,060 | | | $ | 4,286 | | | $ | 121,346 | | | $ | 100,865 | | | $ | 877 | | | $ | 101,742 | |

Adjustment to management fees(1) | | | (3,373 | ) | | | — | | | | (3,373 | ) | | | (1,291 | ) | | | — | | | | (1,291 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Management Fees - Economic Income Basis - Non-GAAP | | | 113,687 | | | | 4,286 | | | | 117,973 | | | | 99,574 | | | | 877 | | | | 100,451 | |

Incentive income(2) | | | 6,966 | | | | — | | | | 6,966 | | | | 186 | | | | — | | | | 186 | |

Other revenues(2) | | | 302 | | | | 56 | | | | 358 | | | | 284 | | | | 107 | | | | 391 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Revenues - Economic Income Basis - Non-GAAP | | $ | 120,955 | | | $ | 4,342 | | | $ | 125,297 | | | $ | 100,044 | | | $ | 984 | | | $ | 101,028 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Compensation and benefits - U.S. GAAP | | $ | 56,881 | | | $ | 2,324 | | | $ | 59,205 | | | $ | 45,605 | | | $ | 7,587 | | | $ | 53,192 | |

Adjustment to compensation and benefits(3) | | | (34,454 | ) | | | (1,569 | ) | | | (36,023 | ) | | | (27,574 | ) | | | (3,787 | ) | | | (31,361 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Compensation and Benefits - Economic Income Basis - Non-GAAP | | $ | 22,427 | | | $ | 755 | | | $ | 23,182 | | | $ | 18,031 | | | $ | 3,800 | | | $ | 21,831 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Interest expense and general, administrative and other expenses -U.S. GAAP | | $ | 25,688 | | | $ | 1,465 | | | $ | 27,153 | | | $ | 22,818 | | | $ | 1,731 | | | $ | 24,549 | |

Adjustment to non-compensation expenses(4) | | | (6,050 | ) | | | (184 | ) | | | (6,234 | ) | | | (3,187 | ) | | | (185 | ) | | | (3,372 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Non-Compensation Expenses - Economic Income Basis - Non-GAAP | | $ | 19,638 | | | $ | 1,281 | | | $ | 20,919 | | | $ | 19,631 | | | $ | 1,546 | | | $ | 21,177 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net gains (losses) on investments in Och-Ziff funds and joint ventures - U.S. GAAP | | $ | 230 | | | $ | (54 | ) | | $ | 176 | | | $ | 143 | | | $ | (90 | ) | | $ | 53 | |

Adjustment to net gains (losses) on joint ventures(5) | | | (61 | ) | | | — | | | | (61 | ) | | | (378 | ) | | | — | | | | (378 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net Gains (Losses) on Joint Ventures(2)(6) | | $ | 169 | | | $ | (54 | ) | | $ | 115 | | | $ | (235 | ) | | $ | (90 | ) | | $ | (325 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net loss (income) allocated to partners’ and others’ interests in consolidated subsidiaries - U.S. GAAP | | $ | 271,896 | | | $ | (9,616 | ) | | $ | 262,280 | | | $ | 319,364 | | | $ | (9,367 | ) | | $ | 309,997 | |

Adjustment to net loss (income) allocated to partners’ and others’ interests in consolidated subsidiaries(7) | | | (271,896 | ) | | | 8,795 | | | | (263,101 | ) | | | (319,364 | ) | | | 9,554 | | | | (309,810 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net Loss (Income) Allocated to Partners’ and Others’ Interests in Consolidated Subsidiaries - Economic Income Basis - Non-GAAP(8) | | $ | — | | | $ | (821 | ) | | $ | (821 | ) | | $ | — | | | $ | 187 | | | $ | 187 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | Adjustment to present management fees net of recurring placement and related service fees on assets under management, as management considers these fees a reduction in management fees, not an expense. Additionally, the impact of the consolidated Och-Ziff funds, including the related eliminations, is also removed. |

| (2) | These items are presented on a U.S. GAAP basis, accordingly no adjustments to or reconciliations of these items are presented. |

| (3) | Adjustment to exclude equity-based compensation, as management does not consider these non-cash expenses to be reflective of the operating performance of the Company. Additionally, the full amount of deferred cash compensation and expenses related to compensation arrangements indexed to annual investment performance is recognized on the date it is determined (generally in the fourth quarter of each year), as management determines the total amount of compensation based on the Company’s performance in the year of the award. |

| (4) | Adjustment to exclude depreciation, amortization and changes in the tax receivable agreement liability, as management does not consider these items to be reflective of the operating performance of the Company. Additionally, recurring placement and related service fees on assets under management are excluded, as management considers these fees a reduction in management fees, not an expense. |

| (5) | Adjustment to exclude net gains (losses) on investments in Och-Ziff funds, as management does not consider these gains (losses) to be reflective of the operating performance of the Company. |

| (6) | Represents the Company’s gains (losses) on joint ventures established to expand certain of the Company’s private investments platforms. |

| (7) | Adjustment to exclude amounts allocated to the partners and the Ziffs on their interests in the Och-Ziff Operating Group, as management reviews the performance of the Company at the Och-Ziff Operating Group level. The Company conducts substantially all of its activities through the Och-Ziff Operating Group. Additionally, the impact of the consolidated Och-Ziff funds, including the allocation of earnings (losses) to investors in those funds, is also removed. |

| (8) | Represents the residual interests in the domestic real estate management business not owned by the Company. |