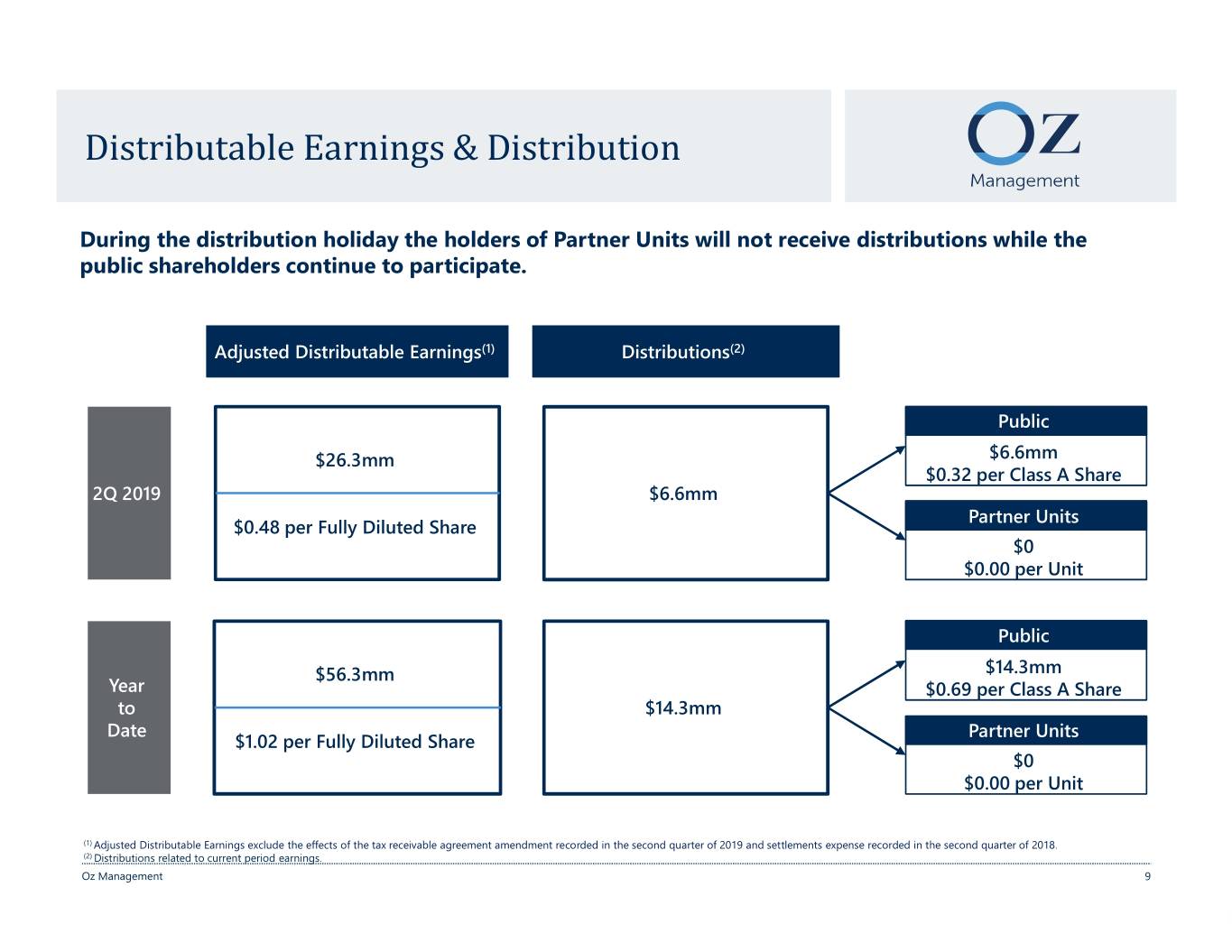

Oz Management Reports Second Quarter 2019 Results Dividend of $0.32 per Class A Share NEW YORK, August 2, 2019 – Och-Ziff Capital Management Group Inc. (NYSE: OZM) (the “Company”, “Oz Management”) today reported GAAP net loss attributable to Class A Shareholders of $8.6 million, or $0.42 per basic and $0.46 per diluted Class A Share for the second quarter of 2019. Distributable Earnings (1) were $80.7 million or, $1.46 per Fully Diluted Share, and Adjusted Distributable Earnings(2) were $26.3 million, or $0.48 per Fully Diluted Share, for the second quarter of 2019. A cash dividend of $0.32 per Class A Share was declared for the second quarter of 2019, payable on August 21, 2019, to holders of record on August 14, 2019. Rob Shafir, Chief Executive Officer of Oz Management, said, “Our second quarter results reflect our strong momentum as we continue to make progress on our strategic objectives. We had solid performance across our investment products, saw capital inflows across a broader range of products, and we have made meaningful progress in the management of our expenses and balance sheet.” . As of June 30, 2019, assets under management were $33.7 billion, up $1.3 billion in the second quarter due to net inflows of $1.1 billion. . Oz Master Fund was up 3.5% net for the second quarter of 2019 and up 11.7% net for the first half of 2019. . Oz Master Fund was down an estimated 0.6% net for July 2019 and up 11.0% net year-to-date through July 31, 2019. . Oz Credit Opportunities Master Fund was up 1.1% net for the second quarter of 2019, and up 3.3% net for the first half of 2019. CONFERENCE CALL Robert Shafir and Thomas Sipp, Chief Financial Officer, will host a conference call today, August 2, 2019, 8:30 a.m. Eastern Time to discuss the Company’s second quarter 2019 results. The call can be accessed by dialing +1-866-393-4306 (in the U.S.) or +1-734-385-2616 (international), passcode 5787756. A simultaneous webcast of the call will be available on the Public Investors page of the Company’s website (www.ozm.com). For those unable to listen to the live broadcast, a webcast replay will also be available on the Company’s website as noted above. (1) Distributable Earnings, Adjusted Distributable Earnings and Fully Diluted Shares represent non-GAAP financial measures. For additional information about non-GAAP measures, including, where applicable, reconciliations to the most directly comparable financial measures presented in accordance with GAAP, please see “Reconciliation of Non-GAAP Measures to the Respective GAAP Measures (Unaudited)” on pages 20 through 23. (2) Adjusted Distributable Earnings exclude the effects of tax receivable agreement amendment recorded in the second quarter of 2019.

FORWARD-LOOKING STATEMENTS Please see page 24 of this presentation for disclosures on forward-looking statements contained herein. ABOUT OZ MANAGEMENT Oz Management is one of the largest institutional alternative asset managers in the world, with offices in New York, London, Hong Kong, Mumbai and Shanghai. The Company provides asset management services to investors globally through its multi-strategy funds, dedicated credit funds, including opportunistic credit funds and Institutional Credit Strategies products, real estate funds and other alternative investment vehicles. Oz Management seeks to generate consistent, positive, absolute returns across market cycles, with low volatility compared to the broader markets, and with an emphasis on preservation of capital. The Company’s funds invest across multiple strategies and geographies, consistent with the investment objectives of each fund. The global investment strategies employed include convertible and derivative arbitrage, corporate credit, global equities, merger arbitrage, private investments, real estate and structured credit. As of August 1, 2019, Oz Management had approximately $33.2 billion in assets under management. For more information, please visit the Company’s website (www.ozm.com). Investor Relations Contact Media Relations Contact Elise King Jonathan Gasthalter Oz Management Gasthalter & Co. LP +1-212-719-7381 +1-212-257-4170 investorrelations@ozm.com jg@gasthalter.com

Oz Management 2Q 2019 Earnings Presentation August 2, 2019 Oz Management

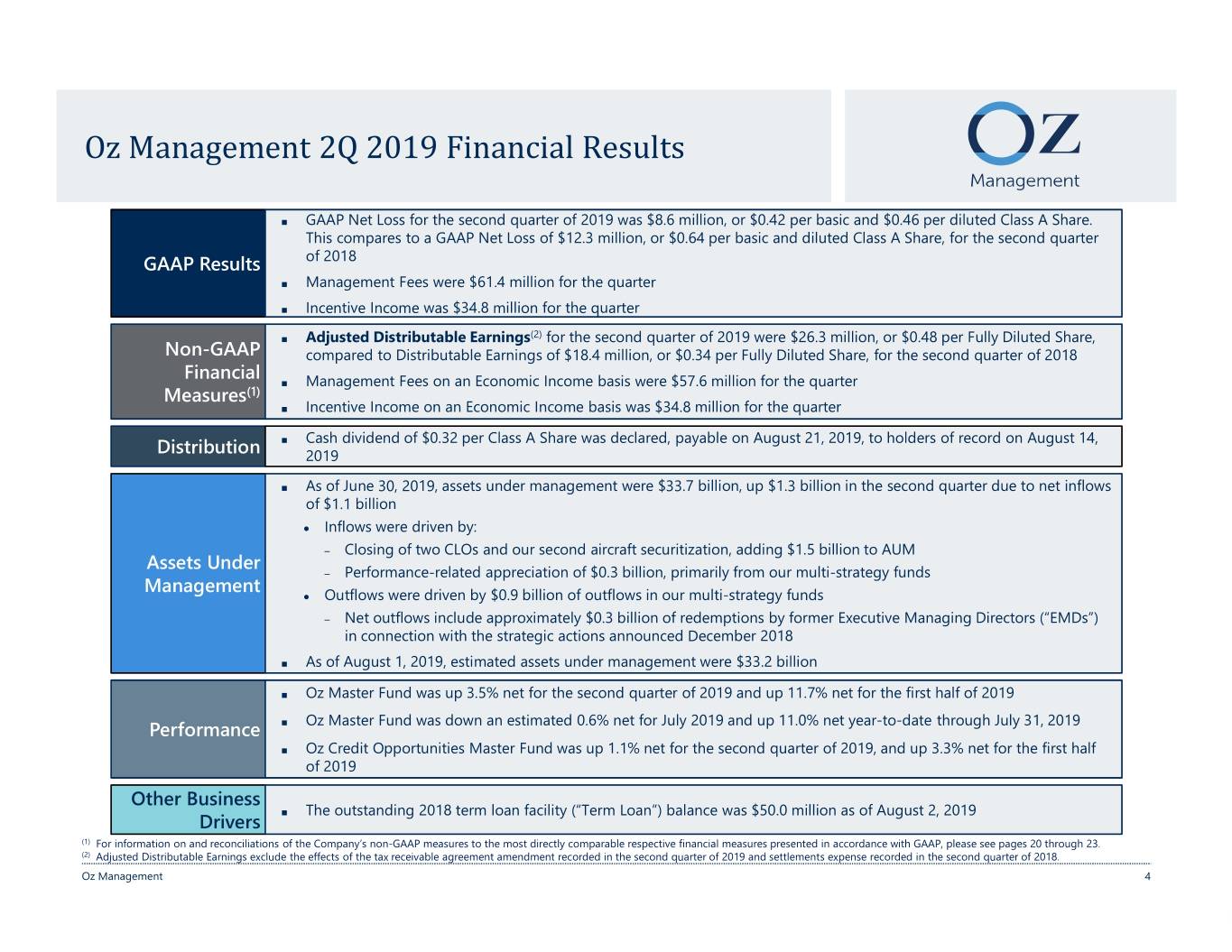

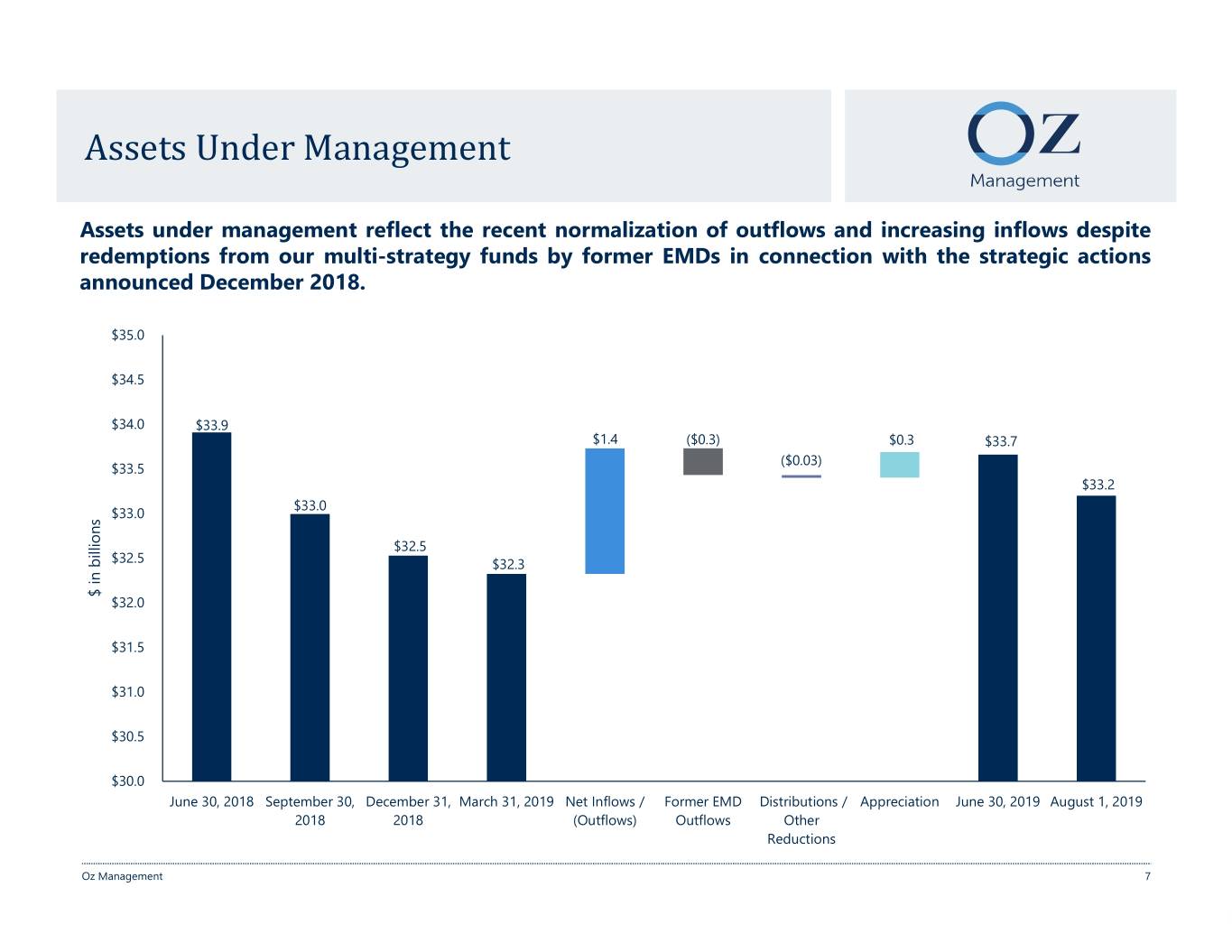

Oz Management 2Q 2019 Financial Results ■ GAAP Net Loss for the second quarter of 2019 was $8.6 million, or $0.42 per basic and $0.46 per diluted Class A Share. This compares to a GAAP Net Loss of $12.3 million, or $0.64 per basic and diluted Class A Share, for the second quarter GAAP Results of 2018 ■ Management Fees were $61.4 million for the quarter ■ Incentive Income was $34.8 million for the quarter ■ Adjusted Distributable Earnings(2) for the second quarter of 2019 were $26.3 million, or $0.48 per Fully Diluted Share, Non-GAAP compared to Distributable Earnings of $18.4 million, or $0.34 per Fully Diluted Share, for the second quarter of 2018 Financial ■ Management Fees on an Economic Income basis were $57.6 million for the quarter Measures(1) ■ Incentive Income on an Economic Income basis was $34.8 million for the quarter ■ Cash dividend of $0.32 per Class A Share was declared, payable on August 21, 2019, to holders of record on August 14, Distribution 2019 ■ As of June 30, 2019, assets under management were $33.7 billion, up $1.3 billion in the second quarter due to net inflows of $1.1 billion ● Inflows were driven by: – Closing of two CLOs and our second aircraft securitization, adding $1.5 billion to AUM Assets Under – Performance-related appreciation of $0.3 billion, primarily from our multi-strategy funds Management ● Outflows were driven by $0.9 billion of outflows in our multi-strategy funds – Net outflows include approximately $0.3 billion of redemptions by former Executive Managing Directors (“EMDs”) in connection with the strategic actions announced December 2018 ■ As of August 1, 2019, estimated assets under management were $33.2 billion ■ Oz Master Fund was up 3.5% net for the second quarter of 2019 and up 11.7% net for the first half of 2019 ■ Oz Master Fund was down an estimated 0.6% net for July 2019 and up 11.0% net year-to-date through July 31, 2019 Performance ■ Oz Credit Opportunities Master Fund was up 1.1% net for the second quarter of 2019, and up 3.3% net for the first half of 2019 Other Business ■ The outstanding 2018 term loan facility (“Term Loan”) balance was $50.0 million as of August 2, 2019 Drivers (1) For information on and reconciliations of the Company’s non-GAAP measures to the most directly comparable respective financial measures presented in accordance with GAAP, please see pages 20 through 23. (2) Adjusted Distributable Earnings exclude the effects of the tax receivable agreement amendment recorded in the second quarter of 2019 and settlements expense recorded in the second quarter of 2018. Oz Management 4

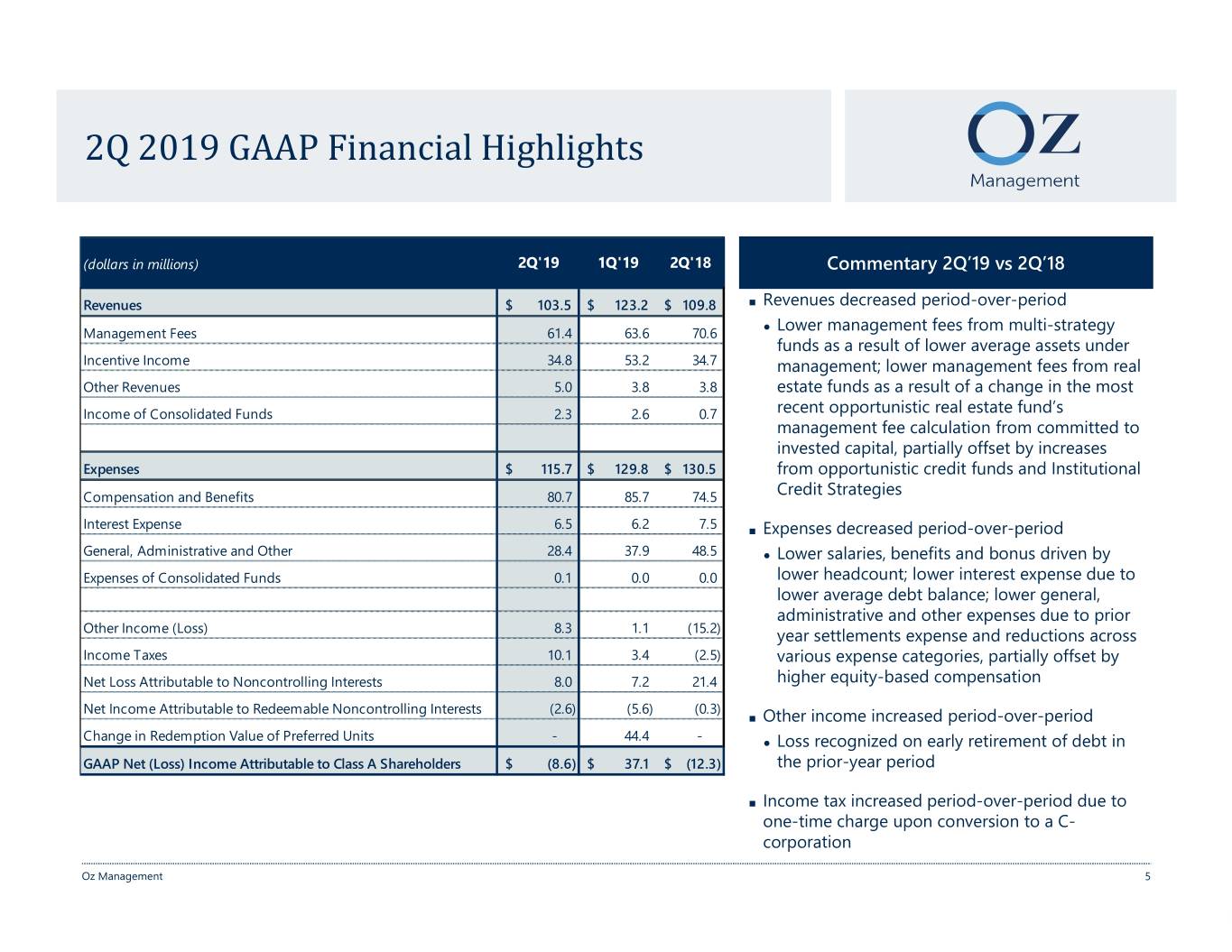

2Q 2019 GAAP Financial Highlights (dollars in millions) 2Q'19 1Q'19 2Q'18 Commentary 2Q’19 vs 2Q’18 Revenues$ 103.5 $ 123.2 $ 109.8 ■ Revenues decreased period-over-period ● Management Fees 61.4 63.6 70.6 Lower management fees from multi-strategy funds as a result of lower average assets under Incentive Income 34.8 53.2 34.7 management; lower management fees from real Other Revenues 5.0 3.8 3.8 estate funds as a result of a change in the most Income of Consolidated Funds 2.3 2.6 0.7 recent opportunistic real estate fund’s management fee calculation from committed to invested capital, partially offset by increases Expenses$ 115.7 $ 129.8 $ 130.5 from opportunistic credit funds and Institutional Compensation and Benefits 80.7 85.7 74.5 Credit Strategies Interest Expense 6.5 6.2 7.5 ■ Expenses decreased period-over-period General, Administrative and Other 28.4 37.9 48.5 ● Lower salaries, benefits and bonus driven by Expenses of Consolidated Funds 0.1 0.0 0.0 lower headcount; lower interest expense due to lower average debt balance; lower general, administrative and other expenses due to prior Other Income (Loss) 8.3 1.1 (15.2) year settlements expense and reductions across Income Taxes 10.1 3.4 (2.5) various expense categories, partially offset by Net Loss Attributable to Noncontrolling Interests 8.0 7.2 21.4 higher equity-based compensation Net Income Attributable to Redeemable Noncontrolling Interests (2.6) (5.6) (0.3) ■ Other income increased period-over-period Change in Redemption Value of Preferred Units - 44.4 - ● Loss recognized on early retirement of debt in GAAP Net (Loss) Income Attributable to Class A Shareholders$ (8.6) $ 37.1 $ (12.3) the prior-year period ■ Income tax increased period-over-period due to one-time charge upon conversion to a C- corporation Oz Management 5

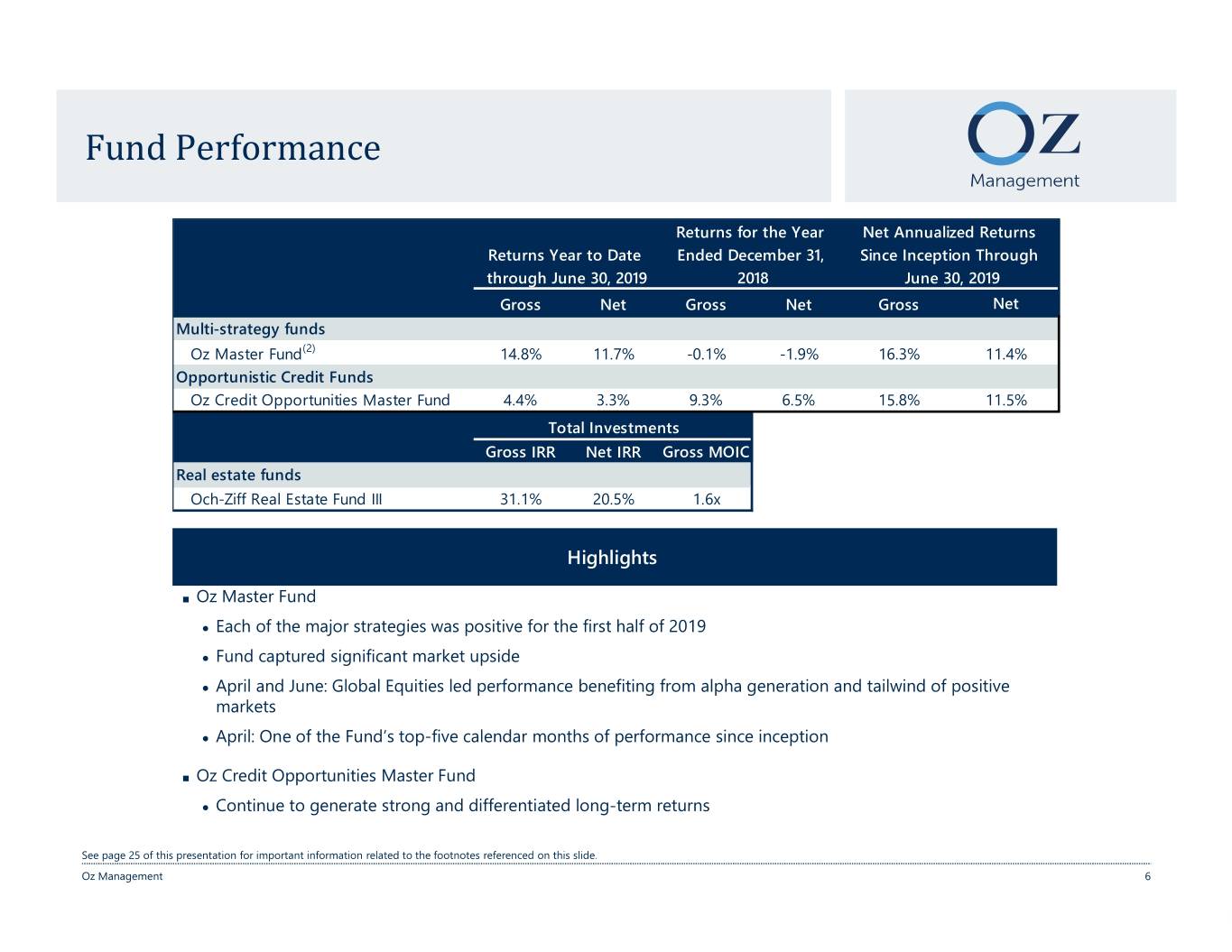

Fund Performance Returns for the Year Net Annualized Returns Returns Year to Date Ended December 31, Since Inception Through through June 30, 2019 2018 June 30, 2019 Gross Net Gross Net Gross Net Multi-strategy funds Oz Master Fund(2) 14.8% 11.7% -0.1% -1.9% 16.3% 11.4% Opportunistic Credit Funds Oz Credit Opportunities Master Fund 4.4% 3.3% 9.3% 6.5% 15.8% 11.5% Total Investments Gross IRR Net IRR Gross MOIC Real estate funds Och-Ziff Real Estate Fund III 31.1% 20.5% 1.6x Highlights ■ Oz Master Fund ● Each of the major strategies was positive for the first half of 2019 ● Fund captured significant market upside ● April and June: Global Equities led performance benefiting from alpha generation and tailwind of positive markets ● April: One of the Fund’s top-five calendar months of performance since inception ■ Oz Credit Opportunities Master Fund ● Continue to generate strong and differentiated long-term returns See page 25 of this presentation for important information related to the footnotes referenced on this slide. Oz Management 6

Assets Under Management Assets under management reflect the recent normalization of outflows and increasing inflows despite redemptions from our multi-strategy funds by former EMDs in connection with the strategic actions announced December 2018. $35.0 $34.5 $34.0 $33.9 $1.4 ($0.3) $0.3 $33.7 ($0.03) $33.5 $33.2 $33.0 $33.0 $32.5 $32.5 $32.3 $ in in billions $ $32.0 $31.5 $31.0 $30.5 $30.0 June 30, 2018 September 30, December 31, March 31, 2019 Net Inflows / Former EMD Distributions / Appreciation June 30, 2019 August 1, 2019 2018 2018 (Outflows) Outflows Other Reductions Oz Management 7

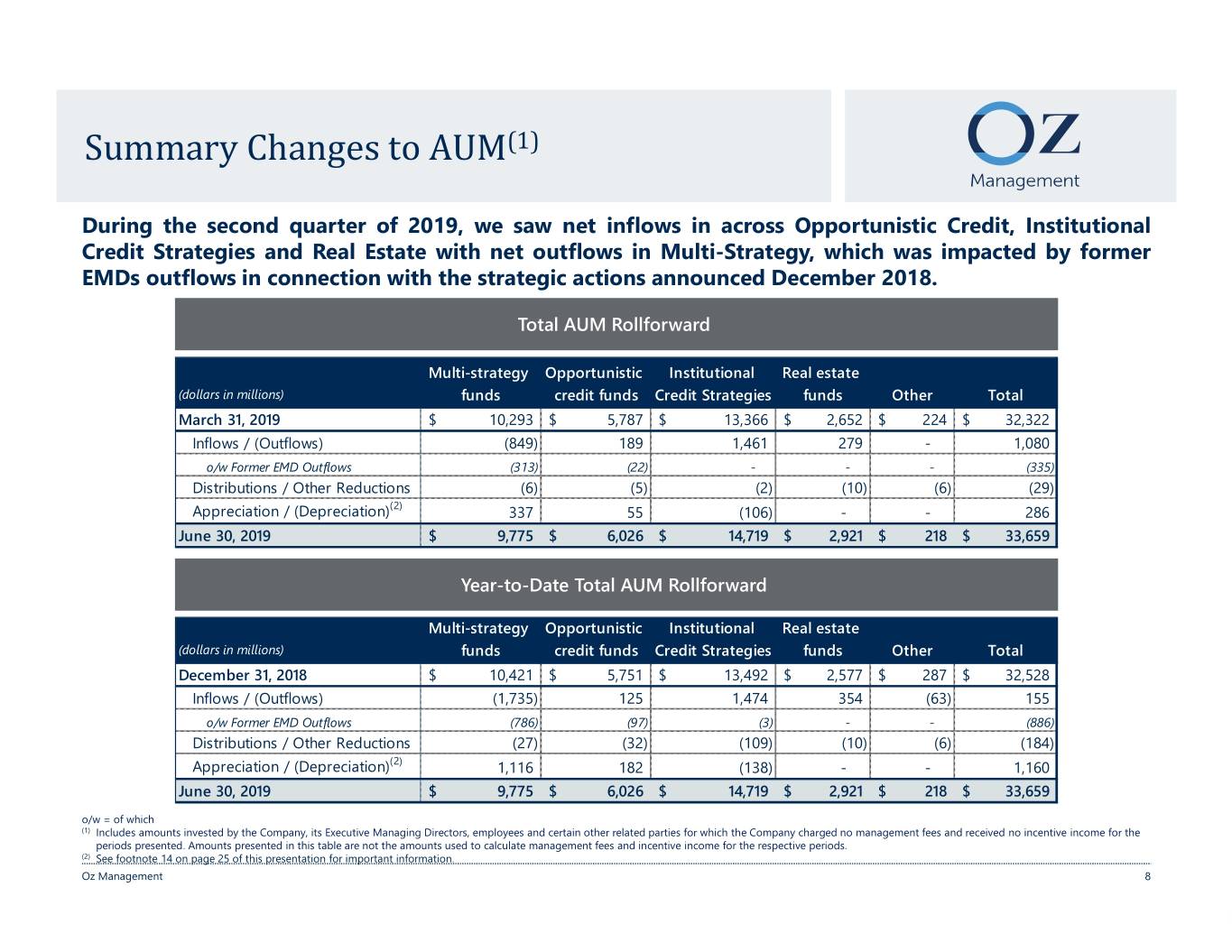

Summary Changes to AUM(1) During the second quarter of 2019, we saw net inflows in across Opportunistic Credit, Institutional Credit Strategies and Real Estate with net outflows in Multi-Strategy, which was impacted by former EMDs outflows in connection with the strategic actions announced December 2018. Total AUM Rollforward Multi-strategy Opportunistic Institutional Real estate (dollars in millions) funds credit funds Credit Strategies funds Other Total March 31, 2019 $ 10,293 $ 5,787 $ 13,366 $ 2,652 $ 224 $ 32,322 Inflows / (Outflows) (849) 189 1,461 279 - 1,080 o/w Former EMD Outflows (313) (22) - - - (335) Distributions / Other Reductions (6) (5) (2) (10) (6) (29) (2) Appreciation / (Depreciation) 337 55 (106) - - 286 June 30, 2019$ 9,775 $ 6,026 $ 14,719 $ 2,921 $ 218 $ 33,659 Year-to-Date Total AUM Rollforward Multi-strategy Opportunistic Institutional Real estate (dollars in millions) funds credit funds Credit Strategies funds Other Total December 31, 2018 $ 10,421 $ 5,751 $ 13,492 $ 2,577 $ 287 $ 32,528 Inflows / (Outflows) (1,735) 125 1,474 354 (63) 155 o/w Former EMD Outflows (786) (97) (3) - - (886) Distributions / Other Reductions (27) (32) (109) (10) (6) (184) (2) Appreciation / (Depreciation) 1,116 182 (138) - - 1,160 June 30, 2019$ 9,775 $ 6,026 $ 14,719 $ 2,921 $ 218 $ 33,659 o/w = of which (1) Includes amounts invested by the Company, its Executive Managing Directors, employees and certain other related parties for which the Company charged no management fees and received no incentive income for the periods presented. Amounts presented in this table are not the amounts used to calculate management fees and incentive income for the respective periods. (2) See footnote 14 on page 25 of this presentation for important information. Oz Management 8

Distributable Earnings & Distribution During the distribution holiday the holders of Partner Units will not receive distributions while the public shareholders continue to participate. Adjusted Distributable Earnings(1) Distributions(2) Public $26.3mm $6.6mm $0.32 per Class A Share 2Q 2019 $6.6mm Partner Units $0.48 per Fully Diluted Share $0 $0.00 per Unit Public $56.3mm $14.3mm Year $0.69 per Class A Share to $14.3mm Date Partner Units $1.02 per Fully Diluted Share $0 $0.00 per Unit (1) Adjusted Distributable Earnings exclude the effects of the tax receivable agreement amendment recorded in the second quarter of 2019 and settlements expense recorded in the second quarter of 2018. (2) Distributions related to current period earnings. Oz Management 9

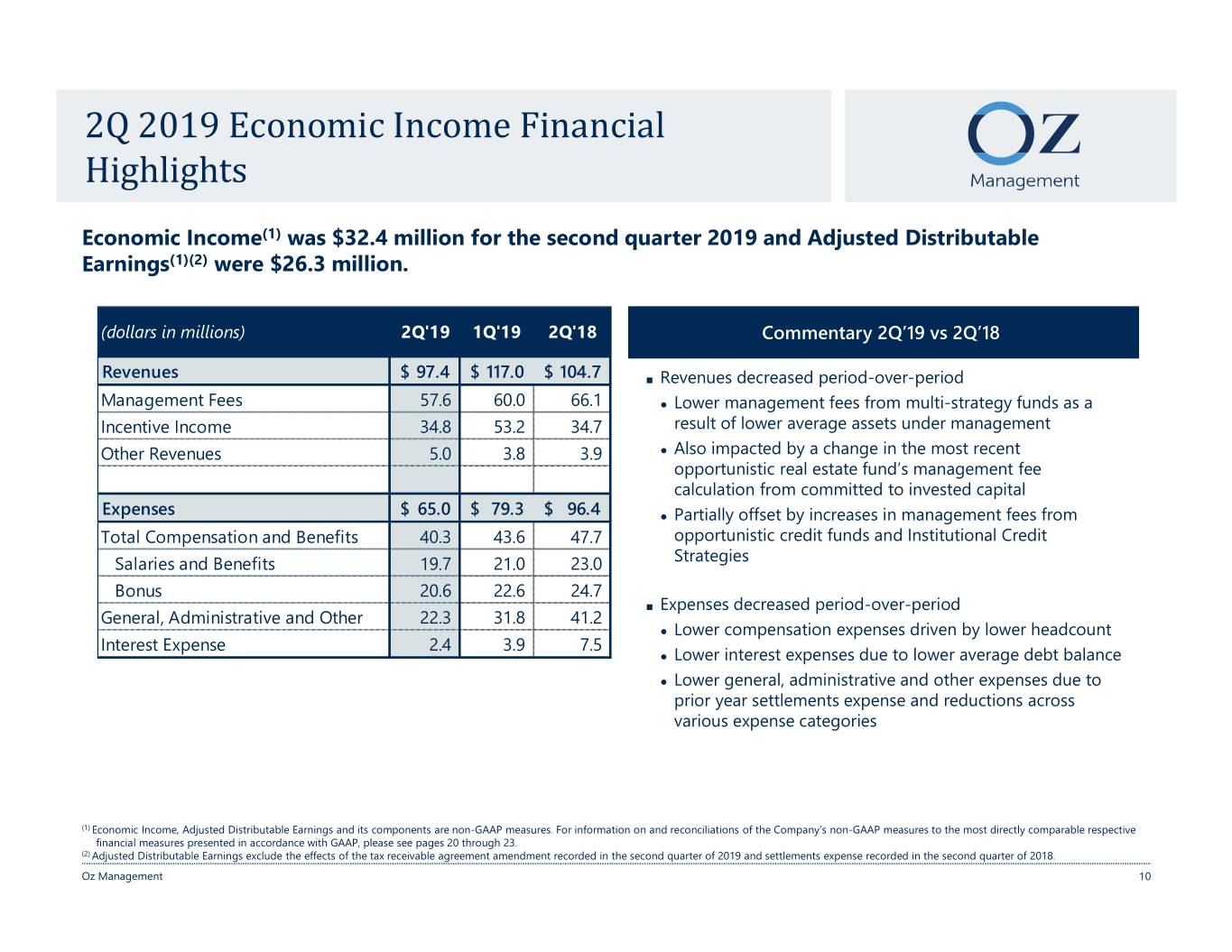

2Q 2019 Economic Income Financial Highlights Economic Income(1) was $32.4 million for the second quarter 2019 and Adjusted Distributable Earnings(1)(2) were $26.3 million. (dollars in millions) 2Q'19 1Q'19 2Q'18 Commentary 2Q’19 vs 2Q’18 Revenues$ 97.4 $ 117.0 $ 104.7 ■ Revenues decreased period-over-period Management Fees 57.6 60.0 66.1 ● Lower management fees from multi-strategy funds as a Incentive Income 34.8 53.2 34.7 result of lower average assets under management Other Revenues 5.0 3.8 3.9 ● Also impacted by a change in the most recent opportunistic real estate fund’s management fee calculation from committed to invested capital Expenses$ 65.0 $ 79.3 $ 96.4 ● Partially offset by increases in management fees from Total Compensation and Benefits 40.3 43.6 47.7 opportunistic credit funds and Institutional Credit Salaries and Benefits 19.7 21.0 23.0 Strategies Bonus 20.6 22.6 24.7 ■ Expenses decreased period-over-period General, Administrative and Other 22.3 31.8 41.2 ● Lower compensation expenses driven by lower headcount Interest Expense 2.4 3.9 7.5 ● Lower interest expenses due to lower average debt balance ● Lower general, administrative and other expenses due to prior year settlements expense and reductions across various expense categories (1) Economic Income, Adjusted Distributable Earnings and its components are non-GAAP measures. For information on and reconciliations of the Company’s non-GAAP measures to the most directly comparable respective financial measures presented in accordance with GAAP, please see pages 20 through 23. (2) Adjusted Distributable Earnings exclude the effects of the tax receivable agreement amendment recorded in the second quarter of 2019 and settlements expense recorded in the second quarter of 2018. Oz Management 10

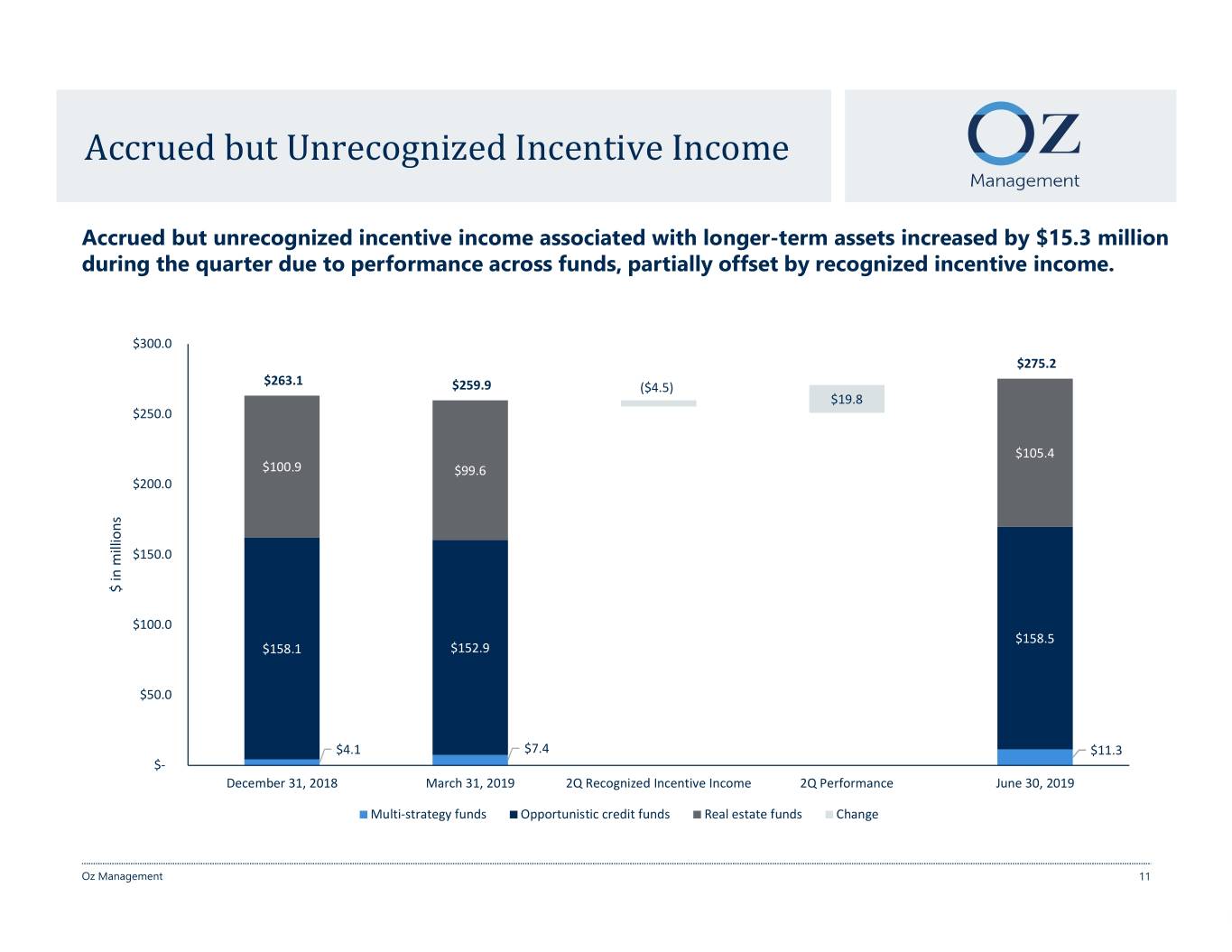

Accrued but Unrecognized Incentive Income Accrued but unrecognized incentive income associated with longer-term assets increased by $15.3 million during the quarter due to performance across funds, partially offset by recognized incentive income. $300.0 $275.2 $263.1 $259.9 ($4.5) $19.8 $250.0 $105.4 $100.9 $99.6 $200.0 $150.0 $ in millions $ in $255.4 $250.9 $100.0 $158.5 $158.1 $152.9 $50.0 $4.1 $7.4 $11.3 $- December 31, 2018 March 31, 2019 2Q Recognized Incentive Income 2Q Performance June 30, 2019 Multi-strategy funds Opportunistic credit funds Real estate funds Change Oz Management 11

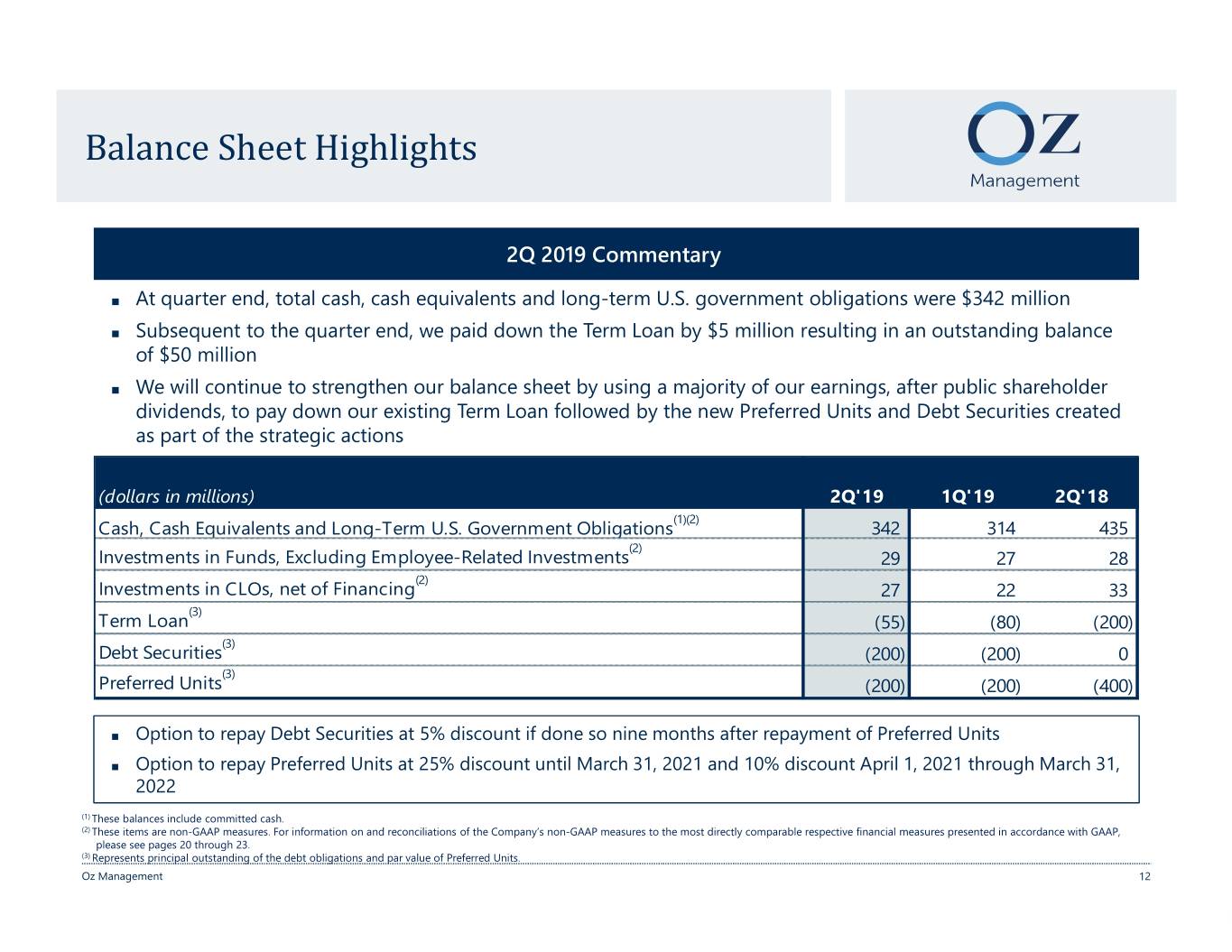

Balance Sheet Highlights 2Q 2019 Commentary ■ At quarter end, total cash, cash equivalents and long-term U.S. government obligations were $342 million ■ Subsequent to the quarter end, we paid down the Term Loan by $5 million resulting in an outstanding balance of $50 million ■ We will continue to strengthen our balance sheet by using a majority of our earnings, after public shareholder dividends, to pay down our existing Term Loan followed by the new Preferred Units and Debt Securities created as part of the strategic actions (dollars in millions) 2Q'19 1Q'19 2Q'18 (1)(2) Cash, Cash Equivalents and Long-Term U.S. Government Obligations 342 314 435 (2) Investments in Funds, Excluding Employee-Related Investments 29 27 28 (2) Investments in CLOs, net of Financing 27 22 33 (3) Term Loan (55) (80) (200) (3) Debt Securities (200) (200) 0 (3) Preferred Units (200) (200) (400) ■ Option to repay Debt Securities at 5% discount if done so nine months after repayment of Preferred Units ■ Option to repay Preferred Units at 25% discount until March 31, 2021 and 10% discount April 1, 2021 through March 31, 2022 (1) These balances include committed cash. (2) These items are non-GAAP measures. For information on and reconciliations of the Company’s non-GAAP measures to the most directly comparable respective financial measures presented in accordance with GAAP, please see pages 20 through 23. (3) Represents principal outstanding of the debt obligations and par value of Preferred Units. Oz Management 12

Appendix, Reconciliations and Disclosures Oz Management 13

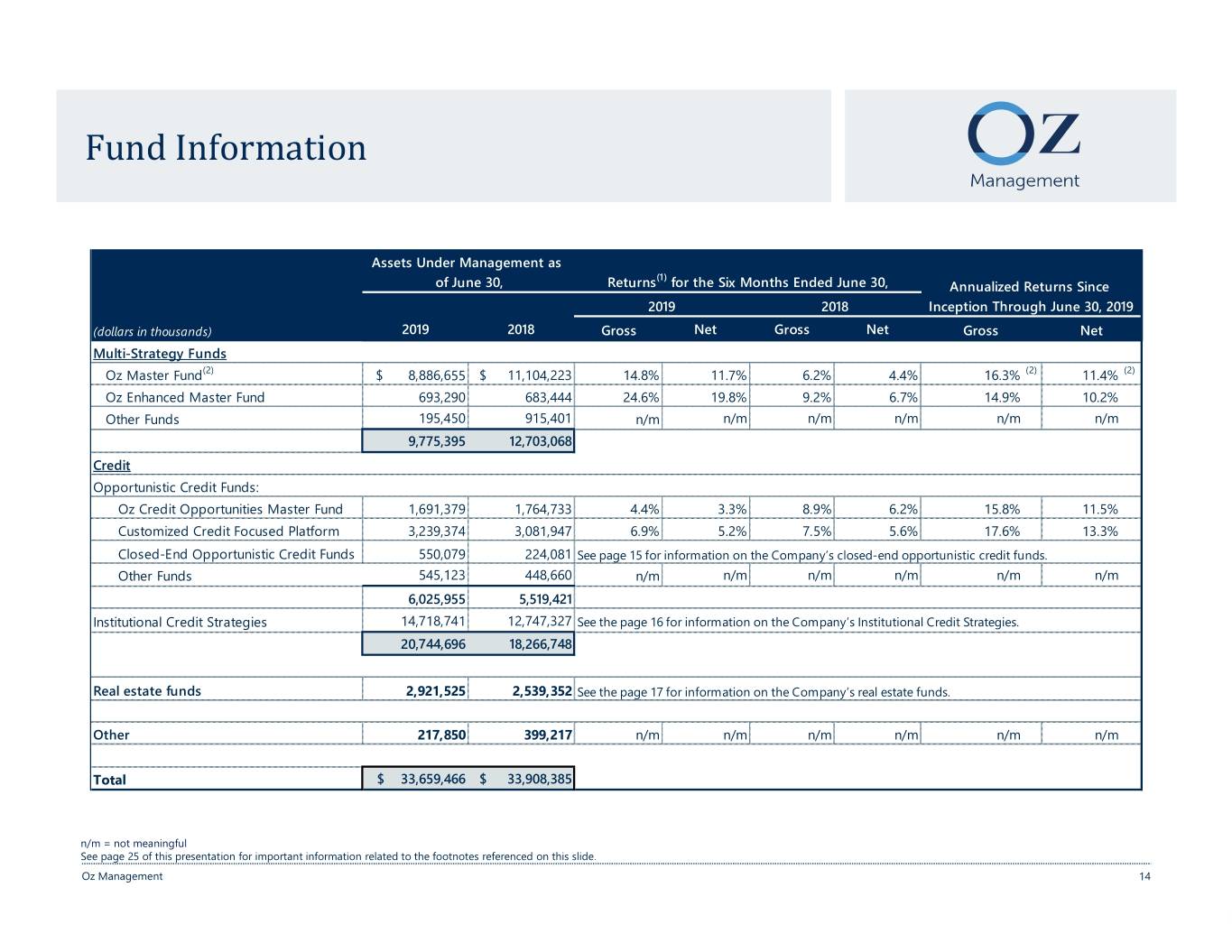

Fund Information Assets Under Management as (1) of June 30, Returns for the Six Months Ended June 30, Annualized Returns Since 2019 2018 Inception Through June 30, 2019 (dollars in thousands) 2019 2018 Gross Net Gross Net Gross Net Multi-Strategy Funds Oz Master Fund(2) $ 8,886,655 $ 11,104,223 14.8% 11.7% 6.2% 4.4% 16.3% (2) 11.4% (2) Oz Enhanced Master Fund 693,290 683,444 24.6% 19.8% 9.2% 6.7% 14.9% 10.2% Other Funds 195,450 915,401 n/m n/m n/m n/m n/m n/m 9,775,395 12,703,068 Credit Opportunistic Credit Funds: Oz Credit Opportunities Master Fund 1,691,379 1,764,733 4.4% 3.3% 8.9% 6.2% 15.8% 11.5% Customized Credit Focused Platform 3,239,374 3,081,947 6.9% 5.2% 7.5% 5.6% 17.6% 13.3% Closed-End Opportunistic Credit Funds 550,079 224,081 See page 15 for information on the Company’s closed-end opportunistic credit funds. Other Funds 545,123 448,660 n/m n/m n/m n/m n/m n/m 6,025,955 5,519,421 Institutional Credit Strategies 14,718,741 12,747,327 See the page 16 for information on the Company’s Institutional Credit Strategies. 20,744,696 18,266,748 Real estate funds 2,921,525 2,539,352 See the page 17 for information on the Company’s real estate funds. Other 217,850 399,217 n/m n/m n/m n/m n/m n/m Total $ 33,659,466 $ 33,908,385 n/m = not meaningful See page 25 of this presentation for important information related to the footnotes referenced on this slide. Oz Management 14

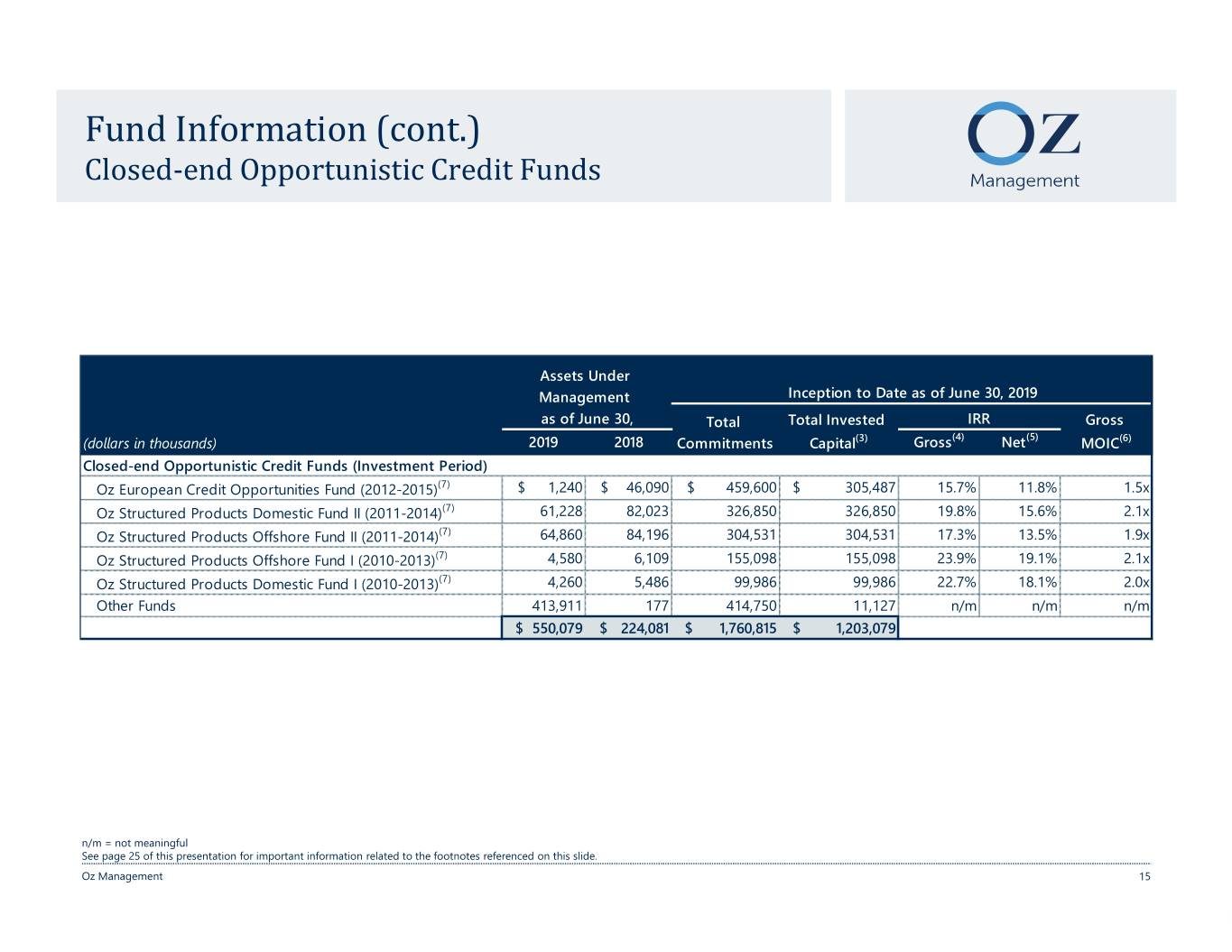

Fund Information (cont.) Closed-end Opportunistic Credit Funds Assets Under Management Inception to Date as of June 30, 2019 as of June 30, Total Total Invested IRR Gross (4) (5) (dollars in thousands) 2019 2018Commitments Capital(3) Gross Net MOIC(6) Closed-end Opportunistic Credit Funds (Investment Period) Oz European Credit Opportunities Fund (2012-2015)(7) $ 1,240 $ 46,090 $ 459,600 $ 305,487 15.7% 11.8% 1.5x Oz Structured Products Domestic Fund II (2011-2014)(7) 61,228 82,023 326,850 326,850 19.8% 15.6% 2.1x Oz Structured Products Offshore Fund II (2011-2014)(7) 64,860 84,196 304,531 304,531 17.3% 13.5% 1.9x Oz Structured Products Offshore Fund I (2010-2013)(7) 4,580 6,109 155,098 155,098 23.9% 19.1% 2.1x Oz Structured Products Domestic Fund I (2010-2013)(7) 4,260 5,486 99,986 99,986 22.7% 18.1% 2.0x Other Funds 413,911 177 414,750 11,127 n/m n/m n/m $ 550,079 $ 224,081 $ 1,760,815 $ 1,203,079 n/m = not meaningful See page 25 of this presentation for important information related to the footnotes referenced on this slide. Oz Management 15

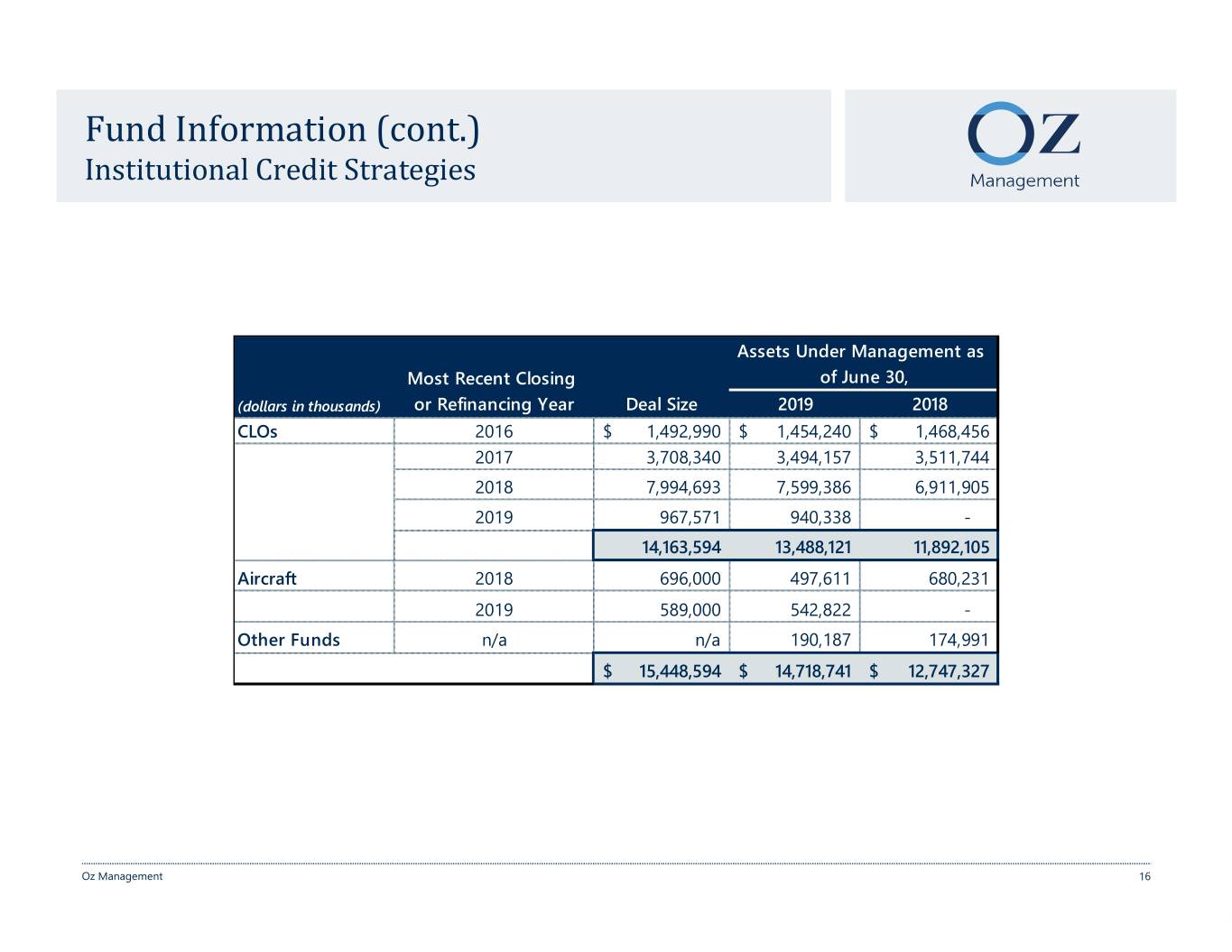

Fund Information (cont.) Institutional Credit Strategies Assets Under Management as Most Recent Closing of June 30, (dollars in thousands) or Refinancing Year Deal Size 2019 2018 CLOs 2016$ 1,492,990 $ 1,454,240 $ 1,468,456 2017 3,708,340 3,494,157 3,511,744 2018 7,994,693 7,599,386 6,911,905 2019 967,571 940,338 - 14,163,594 13,488,121 11,892,105 Aircraft 2018 696,000 497,611 680,231 2019 589,000 542,822 - Other Funds n/a n/a 190,187 174,991 $ 15,448,594 $ 14,718,741 $ 12,747,327 Oz Management 16

Fund Information (cont.) Real Estate Funds Assets Under Management as Inception to Date as of June 30, 2019 of June 30, (8) Total Investments Realized/Partially Realized Investments Total Invested (10) Gross Net Gross Invested Gross Gross (9) Total Value (11) (5) (12) Total Value (11) (12) (dollars in thousands) 2019 2018 Commitments Capital IRR IRR MOIC Capital IRR MOIC Real Estate Funds (Investment Period) (7) Och-Ziff Real Estate Fund I (2005-2010) $ 13,578 $ 13,478 $ 408,081 $ 386,298 $ 837,573 25.4% 16.0% 2.2x $ 372,720 $ 837,262 26.8% 2.2x (7) Och-Ziff Real Estate Fund II (2011-2014) 92,234 143,803 839,508 762,588 1,523,027 32.9% 21.5% 2.0x 718,888 1,437,600 33.0% 2.0x Och-Ziff Real Estate Fund III (2014-2019) 1,487,960 1,462,161 1,500,000 1,006,086 1,596,343 31.1% 20.5% 1.6x 526,695 990,332 37.6% 1.9x (13) Och-Ziff Real Estate Credit Fund I (2015-2020) 724,854 697,704 736,225 171,080 209,349 n/m n/m n/m 87,921 113,630 n/m n/m Other Funds 602,899 222,206 742,221 229,546 317,365 n/m n/m n/m 60,438 110,832 n/m n/m $ 2,921,525 $ 2,539,352 $ 4,226,035 $ 2,555,598 $ 4,483,657 $ 1,766,662 $ 3,489,656 Unrealized Investments as of June 30, 2019 (12) Invested Capital Total Value Gross MOIC Real Estate Funds (Investment Period) (7) Och-Ziff Real Estate Fund I (2005-2010) $ 13,578 $ 311 0.0x (7) Och-Ziff Real Estate Fund II (2011-2014) 43,700 85,427 2.0x Och-Ziff Real Estate Fund III (2014-2019) 479,391 606,011 1.3x (13) Och-Ziff Real Estate Credit Fund I (2015-2020) 83,159 95,719 n/m Other Funds 169,108 206,533 n/m $ 788,936 $ 994,001 n/m = not meaningful See page 25 of this presentation for important information related to the footnotes referenced on this slide. Oz Management 17

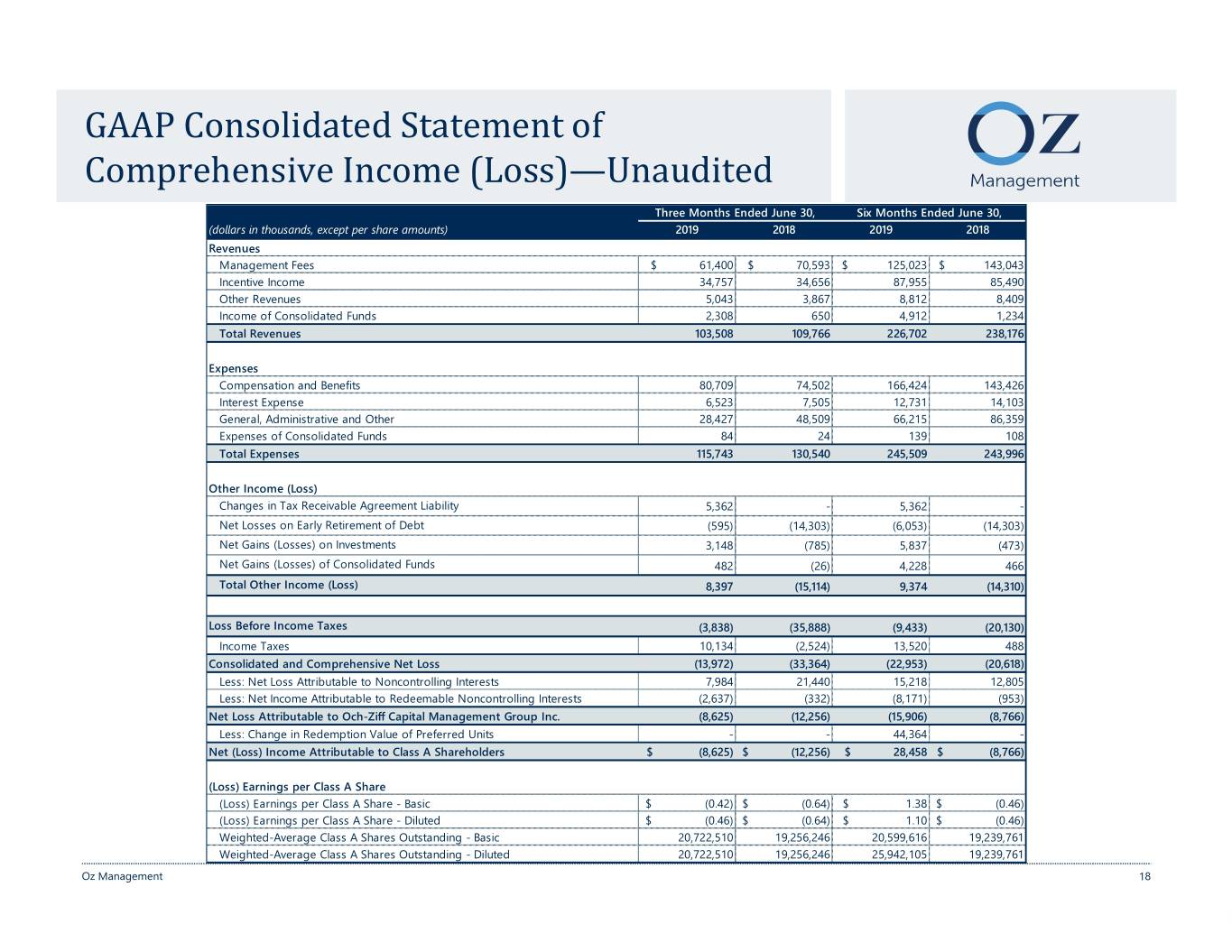

GAAP Consolidated Statement of Comprehensive Income (Loss)—Unaudited Three Months Ended June 30, Six Months Ended June 30, (dollars in thousands, except per share amounts) 2019 2018 2019 2018 Revenues Management Fees $ 61,400 $ 70,593 $ 125,023 $ 143,043 Incentive Income 34,757 34,656 87,955 85,490 Other Revenues 5,043 3,867 8,812 8,409 Income of Consolidated Funds 2,308 650 4,912 1,234 Total Revenues 103,508 109,766 226,702 238,176 Expenses Compensation and Benefits 80,709 74,502 166,424 143,426 Interest Expense 6,523 7,505 12,731 14,103 General, Administrative and Other 28,427 48,509 66,215 86,359 Expenses of Consolidated Funds 84 24 139 108 Total Expenses 115,743 130,540 245,509 243,996 Other Income (Loss) Changes in Tax Receivable Agreement Liability 5,362 - 5,362 - Net Losses on Early Retirement of Debt (595) (14,303) (6,053) (14,303) Net Gains (Losses) on Investments 3,148 (785) 5,837 (473) Net Gains (Losses) of Consolidated Funds 482 (26) 4,228 466 Total Other Income (Loss) 8,397 (15,114) 9,374 (14,310) Loss Before Income Taxes (3,838) (35,888) (9,433) (20,130) Income Taxes 10,134 (2,524) 13,520 488 Consolidated and Comprehensive Net Loss (13,972) (33,364) (22,953) (20,618) Less: Net Loss Attributable to Noncontrolling Interests 7,984 21,440 15,218 12,805 Less: Net Income Attributable to Redeemable Noncontrolling Interests (2,637) (332) (8,171) (953) Net Loss Attributable to Och-Ziff Capital Management Group Inc. (8,625) (12,256) (15,906) (8,766) Less: Change in Redemption Value of Preferred Units - - 44,364 - Net (Loss) Income Attributable to Class A Shareholders $ (8,625) $ (12,256) $ 28,458 $ (8,766) (Loss) Earnings per Class A Share (Loss) Earnings per Class A Share - Basic $ (0.42) $ (0.64) $ 1.38 $ (0.46) (Loss) Earnings per Class A Share - Diluted $ (0.46) $ (0.64) $ 1.10 $ (0.46) Weighted-Average Class A Shares Outstanding - Basic 20,722,510 19,256,246 20,599,616 19,239,761 Weighted-Average Class A Shares Outstanding - Diluted 20,722,510 19,256,246 25,942,105 19,239,761 Oz Management 18

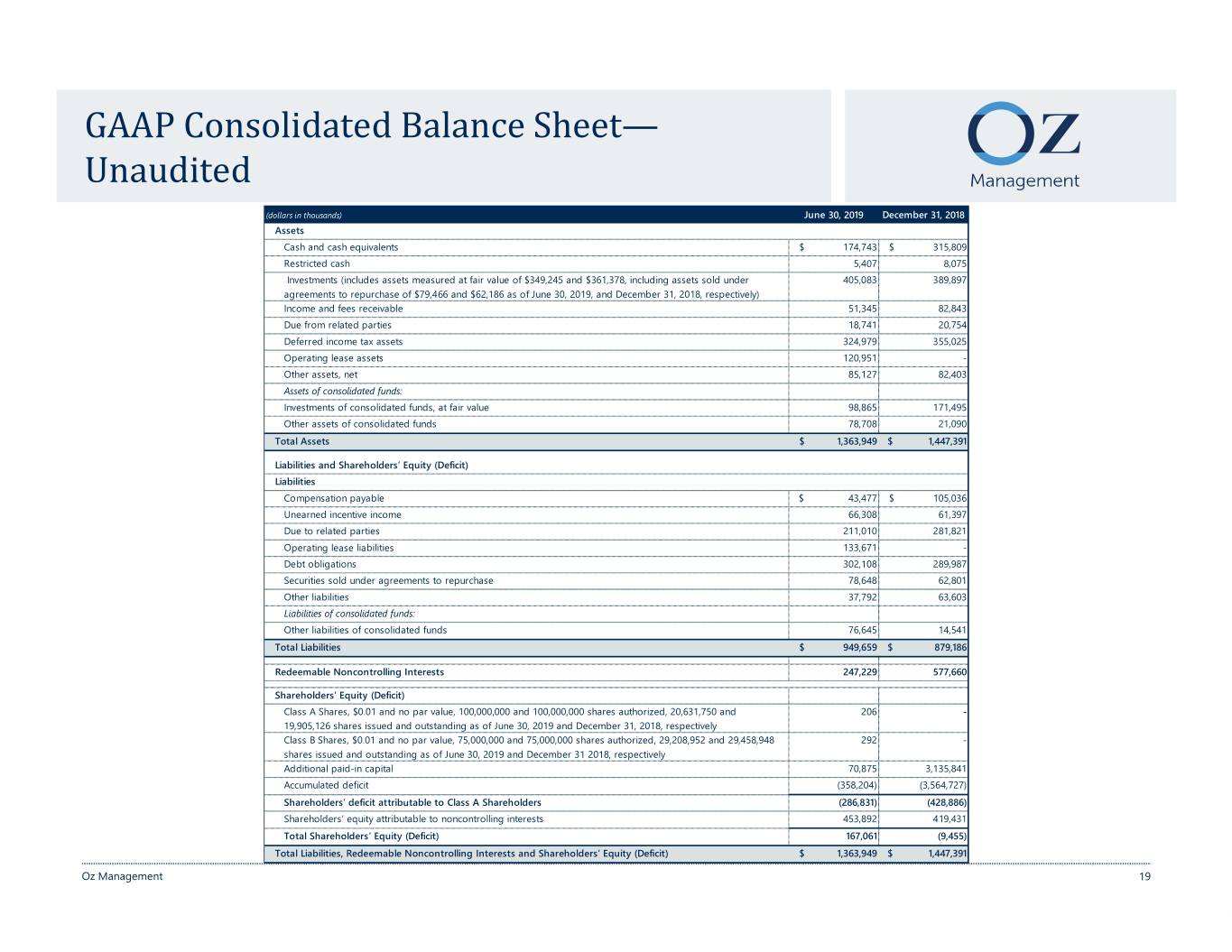

GAAP Consolidated Balance Sheet— Unaudited (dollars in thousands) June 30, 2019 December 31, 2018 Assets Cash and cash equivalents $ 174,743 $ 315,809 Restricted cash 5,407 8,075 Investments (includes assets measured at fair value of $349,245 and $361,378, including assets sold under 405,083 389,897 agreements to repurchase of $79,466 and $62,186 as of June 30, 2019, and December 31, 2018, respectively) Income and fees receivable 51,345 82,843 Due from related parties 18,741 20,754 Deferred income tax assets 324,979 355,025 Operating lease assets 120,951 - Other assets, net 85,127 82,403 Assets of consolidated funds: Investments of consolidated funds, at fair value 98,865 171,495 Other assets of consolidated funds 78,708 21,090 Total Assets $ 1,363,949 $ 1,447,391 Liabilities and Shareholders’ Equity (Deficit) Liabilities Compensation payable $ 43,477 $ 105,036 Unearned incentive income 66,308 61,397 Due to related parties 211,010 281,821 Operating lease liabilities 133,671 - Debt obligations 302,108 289,987 Securities sold under agreements to repurchase 78,648 62,801 Other liabilities 37,792 63,603 Liabilities of consolidated funds: Other liabilities of consolidated funds 76,645 14,541 Total Liabilities $ 949,659 $ 879,186 Redeemable Noncontrolling Interests 247,229 577,660 Shareholders’ Equity (Deficit) Class A Shares, $0.01 and no par value, 100,000,000 and 100,000,000 shares authorized, 20,631,750 and 206 - 19,905,126 shares issued and outstanding as of June 30, 2019 and December 31, 2018, respectively Class B Shares, $0.01 and no par value, 75,000,000 and 75,000,000 shares authorized, 29,208,952 and 29,458,948 292 - shares issued and outstanding as of June 30, 2019 and December 31 2018, respectively Additional paid-in capital 70,875 3,135,841 Accumulated deficit (358,204) (3,564,727) Shareholders’ deficit attributable to Class A Shareholders (286,831) (428,886) Shareholders’ equity attributable to noncontrolling interests 453,892 419,431 Total Shareholders’ Equity (Deficit) 167,061 (9,455) Total Liabilities, Redeemable Noncontrolling Interests and Shareholders’ Equity (Deficit) $ 1,363,949 $ 1,447,391 Oz Management 19

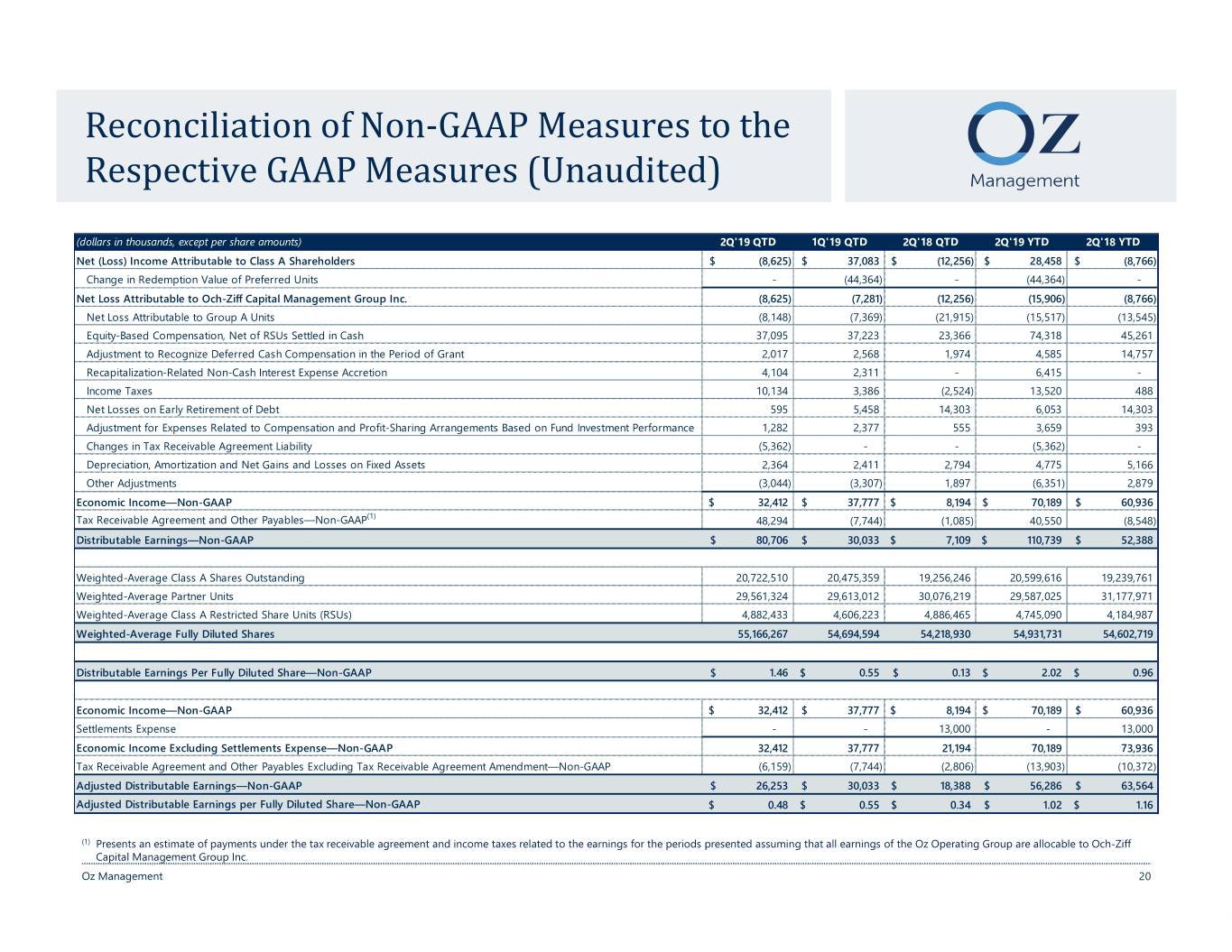

Reconciliation of Non-GAAP Measures to the Respective GAAP Measures (Unaudited) (dollars in thousands, except per share amounts) 2Q'19 QTD 1Q'19 QTD 2Q'18 QTD 2Q'19 YTD 2Q'18 YTD Net (Loss) Income Attributable to Class A Shareholders$ (8,625) $ 37,083 $ (12,256) $ 28,458 $ (8,766) Change in Redemption Value of Preferred Units - (44,364) - (44,364) - Net Loss Attributable to Och-Ziff Capital Management Group Inc. (8,625) (7,281) (12,256) (15,906) (8,766) Net Loss Attributable to Group A Units (8,148) (7,369) (21,915) (15,517) (13,545) Equity-Based Compensation, Net of RSUs Settled in Cash 37,095 37,223 23,366 74,318 45,261 Adjustment to Recognize Deferred Cash Compensation in the Period of Grant 2,017 2,568 1,974 4,585 14,757 Recapitalization-Related Non-Cash Interest Expense Accretion 4,104 2,311 - 6,415 - Income Taxes 10,134 3,386 (2,524) 13,520 488 Net Losses on Early Retirement of Debt 595 5,458 14,303 6,053 14,303 Adjustment for Expenses Related to Compensation and Profit-Sharing Arrangements Based on Fund Investment Performance 1,282 2,377 555 3,659 393 Changes in Tax Receivable Agreement Liability (5,362) - - (5,362) - Depreciation, Amortization and Net Gains and Losses on Fixed Assets 2,364 2,411 2,794 4,775 5,166 Other Adjustments (3,044) (3,307) 1,897 (6,351) 2,879 Economic Income—Non-GAAP$ 32,412 $ 37,777 $ 8,194 $ 70,189 $ 60,936 (1) Tax Receivable Agreement and Other Payables—Non-GAAP 48,294 (7,744) (1,085) 40,550 (8,548) Distributable Earnings—Non-GAAP $ 80,706 $ 30,033 $ 7,109 $ 110,739 $ 52,388 Weighted-Average Class A Shares Outstanding 20,722,510 20,475,359 19,256,246 20,599,616 19,239,761 Weighted-Average Partner Units 29,561,324 29,613,012 30,076,219 29,587,025 31,177,971 Weighted-Average Class A Restricted Share Units (RSUs) 4,882,433 4,606,223 4,886,465 4,745,090 4,184,987 Weighted-Average Fully Diluted Shares 55,166,267 54,694,594 54,218,930 54,931,731 54,602,719 Distributable Earnings Per Fully Diluted Share—Non-GAAP$ 1.46 $ 0.55 $ 0.13 $ 2.02 $ 0.96 Economic Income—Non-GAAP$ 32,412 $ 37,777 $ 8,194 $ 70,189 $ 60,936 Settlements Expense - - 13,000 - 13,000 Economic Income Excluding Settlements Expense—Non-GAAP 32,412 37,777 21,194 70,189 73,936 Tax Receivable Agreement and Other Payables Excluding Tax Receivable Agreement Amendment—Non-GAAP (6,159) (7,744) (2,806) (13,903) (10,372) Adjusted Distributable Earnings—Non-GAAP $ 26,253 $ 30,033 $ 18,388 $ 56,286 $ 63,564 Adjusted Distributable Earnings per Fully Diluted Share—Non-GAAP $ 0.48 $ 0.55 $ 0.34 $ 1.02 $ 1.16 (1) Presents an estimate of payments under the tax receivable agreement and income taxes related to the earnings for the periods presented assuming that all earnings of the Oz Operating Group are allocable to Och-Ziff Capital Management Group Inc. Oz Management 20

��

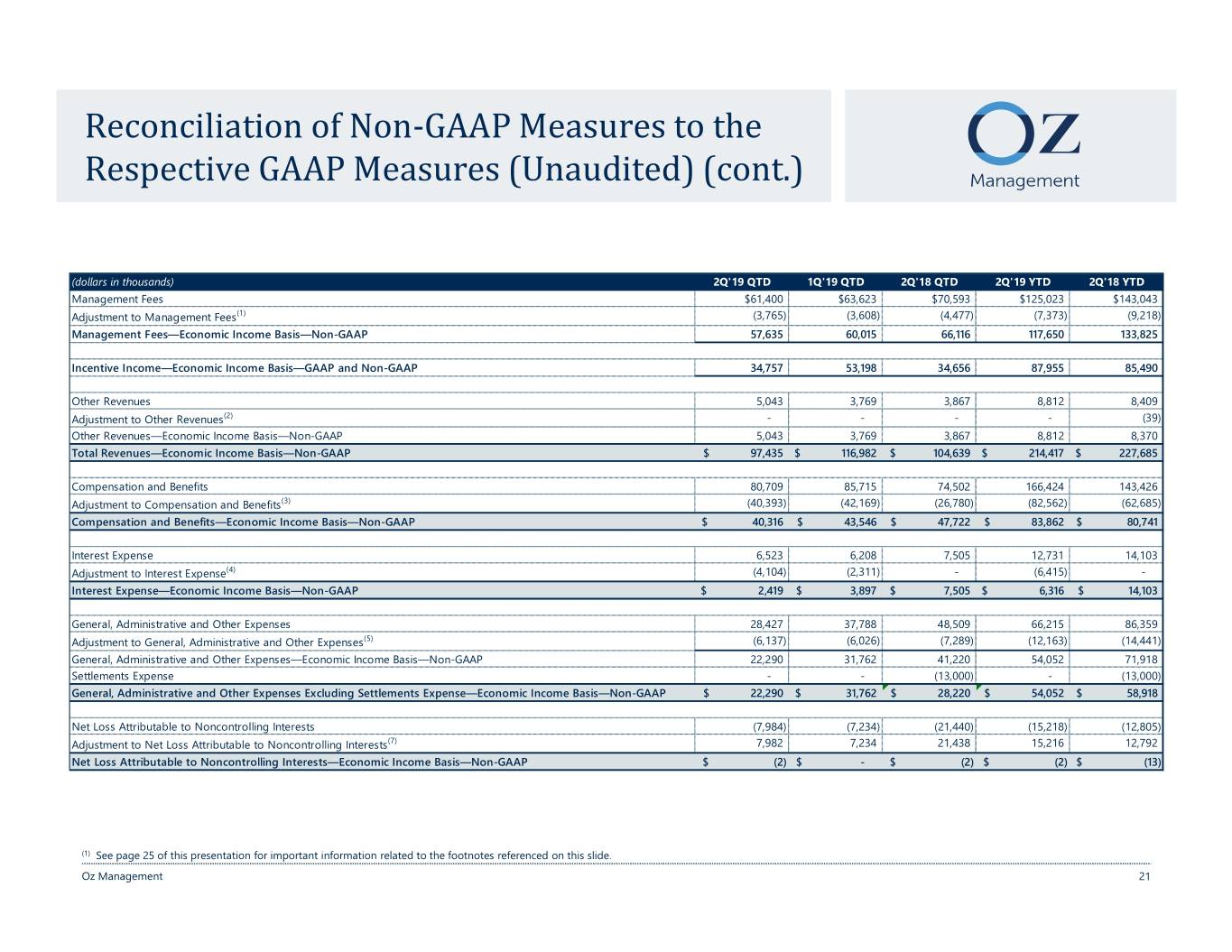

Reconciliation of Non-GAAP Measures to the Respective GAAP Measures (Unaudited) (cont.) (dollars in thousands) 2Q'19 QTD 1Q'19 QTD 2Q'18 QTD 2Q'19 YTD 2Q'18 YTD Management Fees $61,400 $63,623 $70,593 $125,023 $143,043 Adjustment to Management Fees(1) (3,765) (3,608) (4,477) (7,373) (9,218) Management Fees—Economic Income Basis—Non-GAAP 57,635 60,015 66,116 117,650 133,825 Incentive Income—Economic Income Basis—GAAP and Non-GAAP 34,757 53,198 34,656 87,955 85,490 Other Revenues 5,043 3,769 3,867 8,812 8,409 Adjustment to Other Revenues(2) - - - - (39) Other Revenues—Economic Income Basis—Non-GAAP 5,043 3,769 3,867 8,812 8,370 Total Revenues—Economic Income Basis—Non-GAAP$ 97,435 $ 116,982 $ 104,639 $ 214,417 $ 227,685 Compensation and Benefits 80,709 85,715 74,502 166,424 143,426 Adjustment to Compensation and Benefits(3) (40,393) (42,169) (26,780) (82,562) (62,685) Compensation and Benefits—Economic Income Basis—Non-GAAP$ 40,316 $ 43,546 $ 47,722 $ 83,862 $ 80,741 Interest Expense 6,523 6,208 7,505 12,731 14,103 Adjustment to Interest Expense(4) (4,104) (2,311) - (6,415) - Interest Expense—Economic Income Basis—Non-GAAP$ 2,419 $ 3,897 $ 7,505 $ 6,316 $ 14,103 General, Administrative and Other Expenses 28,427 37,788 48,509 66,215 86,359 Adjustment to General, Administrative and Other Expenses(5) (6,137) (6,026) (7,289) (12,163) (14,441) General, Administrative and Other Expenses—Economic Income Basis—Non-GAAP 22,290 31,762 41,220 54,052 71,918 Settlements Expense - - (13,000) - (13,000) General, Administrative and Other Expenses Excluding Settlements Expense—Economic Income Basis—Non-GAAP$ 22,290 $ 31,762 $ 28,220 $ 54,052 $ 58,918 Net Loss Attributable to Noncontrolling Interests (7,984) (7,234) (21,440) (15,218) (12,805) Adjustment to Net Loss Attributable to Noncontrolling Interests(7) 7,982 7,234 21,438 15,216 12,792 Net Loss Attributable to Noncontrolling Interests—Economic Income Basis—Non-GAAP$ (2) $ - $ (2) $ (2) $ (13) (1) See page 25 of this presentation for important information related to the footnotes referenced on this slide. Oz Management 21

Reconciliation of Non-GAAP Measures to the Respective GAAP Measures (Unaudited) (cont.) (dollars in thousands) 2Q'19 1Q'19 2Q'18 Cash and cash equivalents $174,743 $144,750 $183,968 Long-Term U. S. Government Obligations 167,698 168,762 250,790 Cash, Cash Equivalents and Long-Term U. S. Government Obligations$ 342,441 $ 313,512 $ 434,758 Investments in CLOs $181,547 $158,468 $148,127 (8) Financing Related to Investments in CLOs (154,353) (136,509) (114,777) Investments in CLOs, net of Financing$ 27,194 $ 21,959 $ 33,350 Investments in Funds $55,838 $35,608 $34,194 (9) Investments in Funds Eliminated in Consolidation 3,696 21,134 20,435 (10) Less: Investments Related to Employees (30,640) (29,535) (26,514) Investments in Funds, Excluding Investments Related to Employees $ 28,894 $ 27,207 $ 28,115 (1) See page 23 of this presentation for important information related to the footnotes referenced on this slide. Oz Management 22

Footnotes to Non-GAAP Reconciliations Footnotes to Reconciliations (1) Adjustment to present management fees net of recurring placement and related service fees, as management considers these fees a reduction in management fees, not an expense. The impact of eliminations related to the consolidated funds is also removed. (2) Adjustment to exclude gains on fixed assets. (3) Adjustment to exclude equity-based compensation, as management does not consider these non-cash expenses to be reflective of the operating performance of the Company. However, the fair value of RSUs that are settled in cash to employees or executive managing directors is included as an expense at the time of settlement. In addition, expenses related to incentive income profit-sharing arrangements are generally recognized at the same time the related incentive income revenue is recognized, as management reviews the total compensation expense related to these arrangements in relation to any incentive income earned by the relevant fund. Further, deferred cash compensation is expensed in full in the year granted for Economic Income, rather than over the service period for GAAP. Distributions to the Group D Units are also excluded, as management reviews operating performance at the Oz Operating Group level, where substantially all of the Company’s operations are performed, prior to making any income allocations. (4) Adjustment to exclude non-cash interest expense accretion on Debt Securities issued in exchange for Preferred Units in connection with the Recapitalization. Upon exchange, Debt Securities were recognized at fair value and are being accreted to par value over time through interest expense for GAAP; however, management does not consider this interest accretion to be reflective of the operating performance of the Company. (5) Adjustment to exclude depreciation, amortization and losses on fixed assets, as management does not consider these items to be reflective of the operating performance of the Company. Additionally, recurring placement and related service fees are excluded, as management considers these fees a reduction in management fees, not an expense. (6) Adjustment to exclude gains and losses on investments, as management does not consider these items to be reflective of the operating performance of the Company. (7) Adjustment to exclude amounts attributable to the executive managing directors on their interests in the Oz Operating Group, as management reviews the operating performance of the Company at the Oz Operating Group level. The Company conducts substantially all of its activities through the Oz Operating Group. (8) Adjustment to reduce the investments in CLOs by related financing, including CLO investments loans and securities sold under agreements to repurchase. (9) Adjustment to add back investments in funds that are eliminated in consolidation. (10) Adjustment to exclude investments in funds made on behalf of certain employees and EMDs, including deferred compensation arrangements. Non-GAAP Financial Measures Distributable Earnings is a measure of operating performance that equals Economic Income less amounts related to the tax receivable agreement and other payables. Adjusted Distributable Earnings exclude the effects of the tax receivable agreement amendment recorded in the second quarter of 2019 and settlements expense recorded in the second quarter of 2018. Economic Income and certain balance sheet measures presented on page 12 exclude the adjustments described above that are required for presentation of the Company’s results and financial position on a GAAP basis. These measures are non-GAAP measures and should not be considered as alternatives to the Company’s GAAP Net Income or cash flow from operations, or as indicative of liquidity or the cash available to fund operations. You are encouraged to evaluate each of these adjustments and the reasons the Company considers them appropriate for supplemental analysis. In evaluating the Company’s non-GAAP measures, you should be aware that in the future the Company may incur expenses that are the same as or similar to some of the adjustments in such presentations. The Company’s non-GAAP measures may not be comparable to similarly titled measures used by other companies. These measures are presented to provide a more comparable view of the Company’s core operating results year-over-year and the Company believes that providing these measures on a supplemental basis to The Company’s GAAP results is helpful to shareholders in assessing the overall performance of the Company’s business. For purposes of calculating Distributable Earnings per Share, the Company assumes that all the interests held by its current and former executive managing directors in the Oz Operating Group (collectively, “Partner Units”), as well as Class A Restricted Share Units (“RSUs”), have been converted on a one-to-one basis into Class A Shares (“Fully Diluted Shares”). As of June 30, 2019, there were 3,410,000 Group P Units outstanding and 1,000,000 performance-based restricted share units (“PSUs”). Group P Units and PSUs do not participate in the economics of the Company until certain service and market-performance conditions are met; therefore, the Company will not include the Group P Units or PSUs in Fully Diluted Shares until such conditions are met. As of June 30, 2019, the service and market-performance conditions had not yet been met. Management uses Distributable Earnings and Economic Income, among other financial information, as the basis on which it evaluates the financial performance of the Company and makes resource allocation and other operating decisions, as well as to determine the earnings available to distribute as dividends to holders of the Company’s Class A Shares and to the Company’s executive managing directors. Management considers it important that investors review the same operating information that it uses. Oz Management 23

Forward-Looking Statements This press release and earnings presentation contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that reflect the Company’s current views with respect to, among other things, future events, its operations and its financial performance. The Company generally identifies forward-looking statements by terminology such as “outlook,” “believe,” “expect,” “potential,” “continue,” “may,” “will,” “should,” “could,” “seek,” “approximately,” “predict,” “intend,” “plan,” “estimate,” “anticipate,” “opportunity,” “comfortable,” “assume,” “remain,” “maintain,” “sustain,” “achieve,” “see,” “think,” “position” or the negative version of those words or other comparable words. Any forward-looking statements contained in this press release are based upon historical information and on the Company’s current plans, estimates and expectations. The inclusion of this or other forward-looking information should not be regarded as a representation by the Company or any other person that the future plans, estimates or expectations contemplated by the Company will be achieved. The Company cautions that forward-looking statements are subject to numerous assumptions, estimates, risks and uncertainties, including but not limited to the following: global economic, business, market and geopolitical conditions; U.S. and foreign regulatory developments relating to, among other things, financial institutions and markets, government oversight, fiscal and tax policy; the outcome of third-party litigation involving the Company; the consequences of the settlements with the SEC and the U.S. Department of Justice; whether the Company realizes all or any of the anticipated benefits from the Recapitalization and other related transactions; whether the Recapitalization and other related transactions result in any increased or unforeseen costs, indemnification obligations or have an impact on the Company’s ability to retain or compete for professional talent or investor capital; conditions impacting the alternative asset management industry; the Company’s ability to retain existing investor capital; the Company’s ability to successfully compete for fund investors, assets, professional talent and investment opportunities; the Company’s ability to retain its active executive managing directors, managing directors and other investment professionals; the Company’s successful formulation and execution of its business and growth strategies; the Company’s ability to appropriately manage conflicts of interest and tax and other regulatory factors relevant to its business; and assumptions relating to the Company’s operations, investment performance, financial results, financial condition, business prospects, growth strategy and liquidity. If one or more of these or other risks or uncertainties materialize, or if the Company’s assumptions or estimates prove to be incorrect, its actual results may vary materially from those indicated in these statements. These factors are not and should not be construed as exhaustive and should be read in conjunction with the other cautionary statements and risks that are included in the Company’s filings with the SEC, including but not limited to the Company’s annual report on Form 10-K for the year ended December 31, 2018, dated March 15, 2019, as well as may be updated from time to time in the Company’s other SEC filings. There may be additional risks, uncertainties and factors that the Company does not currently view as material or that are not known. The forward-looking statements contained in this press release are made only as of the date of this press release. The Company does not undertake to update any forward-looking statement because of new information, future developments or otherwise. This press release does not constitute an offer of any Oz Management fund. The Company files annual, quarterly and current reports, proxy statements and other information required by the Exchange Act of 1934, as amended, with the SEC. The Company makes available free of charge on its website (www.ozm.com) its annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements and any amendments to those filings as soon as reasonably practicable after such material is electronically filed with or furnished to the SEC. The Company also uses its website to distribute company information, and such information may be deemed material. Accordingly, investors should monitor the Company’s website, in addition to its press releases, SEC filings and public conference calls and webcast. Oz Management 24

Fund Information – Footnotes (1) The return information reflected in these tables represents, where applicable, the composite performance of all feeder funds that comprise each of the master funds presented. Gross return information is generally calculated using the total return of all feeder funds, net of all fees and expenses except management fees and incentive income of such feeder funds and master funds and the returns of each feeder fund include the reinvestment of all dividends and other income. Net return information is generally calculated as the gross returns less management fees and incentive income (except incentive income on unrealized gains attributable to investments in certain funds that the Company, as investment manager, determines lack a readily ascertainable fair value, are illiquid or otherwise should be held until the resolution of a special event or circumstance (“Special Investments”) that could reduce returns on these investments at the time of realization). Return information also includes realized and unrealized gains and losses attributable to Special Investments and initial public offering investments that are not allocated to all investors in the feeder funds. Investors that were not allocated Special Investments and/or initial public offering investments may experience materially different returns. The performance calculation for the Oz Master Fund excludes realized and unrealized gains and losses attributable to currency hedging specific to certain investors investing in Oz Master Fund in currencies other than the U.S. Dollar. (2) The annualized returns since inception are those of the Oz Multi-Strategy Composite, which represents the composite performance of all accounts that were managed in accordance with the Company’s broad multi-strategy mandate that were not subject to portfolio investment restrictions or other factors that limited the Company’s investment discretion since inception on April 1, 1994. Performance is calculated using the total return of all such accounts net of all investment fees and expenses of such accounts, except incentive income on unrealized gains attributable to Special Investments that could reduce returns in these investments at the time of realization, and the returns include the reinvestment of all dividends and other income. For the period from April 1, 1994 through December 31, 1997, the returns are gross of certain overhead expenses that were reimbursed by the accounts. Such reimbursement arrangements were terminated at the inception of the Oz Master Fund on January 1, 1998. The size of the accounts comprising the composite during the time period shown vary materially. Such differences impacted the Company’s investment decisions and the diversity of the investment strategies followed. Furthermore, the composition of the investment strategies the Company follows is subject to its discretion, has varied materially since inception and is expected to vary materially in the future. As of June 30, 2019, the gross and net annualized returns since the Oz Master Fund’s inception on January 1, 1998 were 12.8% and 8.7%, respectively. (3) Represents funded capital commitments net of recallable distributions to investors. (4) Gross internal rate of return (“IRR”) for the Company’s closed-end opportunistic credit funds represents the estimated, unaudited, annualized return based on the timing of cash inflows and outflows for the fund as of June 30, 2019, including the fair value of unrealized investments as of such date, together with any appreciation or depreciation from related hedging activity. Gross IRR does not include the effects of management fees or incentive income, which would reduce the return, and includes the reinvestment of all fund income. (5) Net IRR is calculated as described in footnotes (4) and (11), but is reduced by all management fees and for the real estate funds other fund-level fees and expenses not adjusted for in the calculation of gross IRR. Net IRR is further reduced by accrued and paid incentive income, which will be payable upon the distribution of each fund’s capital in accordance with the terms of the relevant fund. Accrued incentive income may be higher or lower at such time. The net IRR represents a composite rate of return for a fund and does not reflect the net IRR specific to any individual investor. (6) Gross multiple of invested capital (“MOIC”) for the Company’s closed-end opportunistic credit funds is calculated by dividing the sum of the net asset value of the fund, accrued incentive income, life-to- date incentive income and management fees paid, and any non-recallable distributions made from the fund by the invested capital. (7) These funds have concluded their investment periods, and therefore the Company expects assets under management for these funds to decrease as investments are sold and the related proceeds are distributed to the investors in these funds. (8) An investment is considered partially realized when the total amount of proceeds received, including dividends, interest or other distributions of income and return of capital, represents at least 50% of invested capital. (9) Invested capital represents total aggregate contributions made for investments by the fund. (10) Total value represents the sum of realized distributions and the fair value of unrealized and partially realized investments as of June 30, 2019. Total value will be impacted (either positively or negatively) by future economic and other factors. Accordingly, the total value ultimately realized will likely be higher or lower than the amounts presented as of June 30, 2019. (11) Gross IRR for the Company’s real estate funds represents the estimated, unaudited, annualized return based on the timing of cash inflows and outflows for the aggregated investments as of June 30, 2019, including the fair value of unrealized and partially realized investments as of such date, together with any unrealized appreciation or depreciation from related hedging activity. Gross IRR is not adjusted for estimated management fees, incentive income or other fees or expenses to be paid by the fund, which would reduce the return. (12) Gross MOIC for the Company’s real estate funds is calculated by dividing the value of a fund’s investments by the invested capital, prior to adjustments for incentive income, management fees or other expenses to be paid by the fund. (13) This fund has invested less than half of its committed capital; therefore, IRR and MOIC information is not presented, as it is not meaningful. (14) Appreciation (depreciation) reflects the aggregate net capital appreciation (depreciation) for the entire period and is presented on a total return basis, net of all fees and expenses (except incentive income on Special Investments), and includes the reinvestment of all dividends and other income. Management fees and incentive income vary by product. Appreciation/(depreciation) within Institutional Credit Strategies includes the effects of changes in the par value of the underlying collateral of the CLOs, foreign currency translation changes in the measurement of assets under management of our European CLOs and changes in the portfolio appraisal values for aircraft securitizations. Oz Management 25