| July 7, 2008 | Direct Phone Number: (212) 659-4971 |

| | Direct Fax Number: (212) 884-8210 |

| | ed.schauder@haynesboone.com |

Via Edgar and Federal Express

Ms. Barbara C. Jacobs

Assistant Director

United States Securities and Exchange Commission

Washington, D.C. 20549

| Re: | Geeks On Call Holdings, Inc. |

Amendment No. 1 to Registration Statement on Form S-1

Filed May 28, 2008

(File No. 333-150319)

Dear Ms. Jacobs:

We are counsel to Geeks On Call Holdings, Inc. (the “Company”). We hereby submit on behalf of the Company a response to the letter of comment, dated June 20, 2008 (the “Comment Letter”), from the staff of the Division of Corporation Finance of the Securities and Exchange Commission (the “Staff”) to the Company’s Amendment No. 1 to Registration Statement on Form S-1 filed with the Securities and Exchange Commission (the “Commission”) on May 28, 2008 (“Form S-1”).

The Company’s responses are numbered to correspond to the Commission’s comments and are filed in conjunction with Amendment No. 2 to the Form S-1. For your convenience, each of the Staff’s comments contained in the Comment Letter has been restated below in its entirety, with the Company’s response set forth immediately under such comment. We are also sending courtesy copies of this letter to you by Federal Express, together with a redline of Amendment No. 2 to the Form S-1 marked to show changes from Amendment No. 1 as filed.

* * *

Risk Factors, page 4

“We are dependent upon our managers and skilled professional technicians...,” page 6

Comment No. 1:

We note your response to prior comment 2, in which we asked you to disclose what experience, if any, you have had with employee retention. Although your revised disclosure addresses your ability to access the job market for potential employees, it does not address your past experience with retaining your employees. Please revise.

Response:

The Company has revised its disclosure on page 6 to respond to the Staff’s comments.

“The requirements of being a public company may strain our resources…,” page 9

Ms. Barbara C. Jacobs

July 7, 2008

Page 2

Comment No. 2:

We note your revisions in response to prior comment 3, in which we asked you to include an estimated cost of compliance with the requirements of being a public company. Please quantify this amount either in this risk factor or in your MD&A section.

Response:

The Company has revised its disclosure in its MD&A section, on page 19, to quantify the cost of compliance with the requirements of being a public company.

Management’s Discussion and Analysis of Financial Condition and Results of Operations, page 14

Overview, page 14

Comment No. 3:

We note your response to prior comment 4, in which we asked you to clarify the key indicators of financial condition and operating performance that your management relies upon when analyzing your financial results. In your supplemental response, you listed certain key indicators you use to analyze financial results. Revise your MD&A to address these key variables and other qualitative and quantitative factors that are peculiar to and necessary for an understanding and evaluation of your company.

Response:

The Company has revised its disclosure on page 14 to include the key indicators of financial condition and operating performance it uses to analyze its financial results.

In addition, please provide us with a detailed legal analysis supporting your claim that FTC and state regulations prohibit a registrant from disclosing or discussing details of revenue from franchise or corporate operations in their registration statement.

Response:

The basis for the Company’s claim that FTC and state regulations prohibit it from disclosing or discussing details of revenue from franchise or corporate operations in its registration statement is 16 C.F.R. Part 436 - Disclosure Requirements and Prohibitions Concerning Franchising (the “FTC Rule”), promulgated by the Federal Trade Commission (“FTC”) on January 22, 2007 and effective July 1, 2007. Specifically, 16 C.F.R. §436.9 provides, in part:

It is an unfair or deceptive act or practice in violation of Section 5 of the Federal Trade Commission Act for any franchise seller covered by part 436 to:

(c) Disseminate any financial performance representations to prospective franchisees unless the franchisor has a reasonable basis and written substantiation for the representation at the time the representation is made, and the representation is included in Item 19 (§ 436.5(s)) of the franchisor's disclosure document.

The term “financial performance representation” is defined in 16 C.F.R. §436.1(e) as follows:

Ms. Barbara C. Jacobs

July 7, 2008

Page 3

“any representation, including any oral, written, or visual representation, to a prospective franchisee, including a representation in the general media, that state, expressly or by implication, a specific level or range of actual or potential sales, income, gross profits, or net profits. The term includes as chart, table, or mathematical calculation that shows possible results based on a combination of variables.” (Emphasis added.)

Further, 16 C.F.R. §436.5(s) prohibits a franchisor from making any financial performance representations about the future or past financial performance of company-owned or franchised outlets, unless the franchisor provides financial performance disclosure in its franchise disclosure document (or “FDD”).

In Geeks On Call America, Inc.’s (“GOCA”) currently effective FDD, GOCA does not make any financial performance representations. To the contrary, Item 19 of GOCA’s FDD provides the following statement mandated by the Franchise Rule when a franchisor does not include financial performance representations in its FDD:

We do not make any representations about a franchisee’s future financial performance or the past financial performance of company-owned or franchised outlets. We also do not authorize our employees or representatives to make any such representations either orally or in writing. If you are purchasing an existing outlet, however, we may provide you with the actual records of that outlet. If you receive any other financial performance information or projections of your future income, you should report it to the franchisor's management by contacting our Vice President and Chief Information Officer, Richard Artese, c/o Geeks On Call America, Inc. Interstate Corporate Center, Building 17, Suite 106, 814 Kempsville Road, Norfolk, VA 23502, (757) 466-3448, the Federal Trade Commission, and the appropriate state regulatory agency.

GOCA does not include financial performance representations in its FDD for a number of reasons, including the fact that financial performance data collected from franchisees is not necessarily complete and accurate and the need to reduce the risk of litigation resulting from franchisees’ construing these representations as a guarantee of future performance. In fact, in the FTC’s Statement of Basis and Purpose published soon after the approval of the FTC Rule (72 Fed. Reg. 15444, Mar. 30, 2007), the FTC stated: “we recognize that false or misleading financial performance claims are the most common allegation in Commission franchise law enforcement actions.” (Citing FTC v. Minuteman Press, Int’l 93-CV-2494 (DRH) (E.D.N.Y.) (1988 Order) et al.)

Notwithstanding the foregoing, the Company is mindful of the FTC’s recently articulated position concerning financial performance representations made in the general media (referred to as “general media representations”) as related to SEC filings. In the FTC Rule Compliance Guide (CCH Bus. Franchise Guide ¶6086, p. 9129-265) released in May 2008, the FTC clarified that “publicly filed financial performance information submitted to the Securities and Exchange Commission (e.g., 10-Qs and 10-Ks) are not considered general media representations.” This latest statement follows the FTC’s historical policy of excluding from general media representations any communications to financial journals or the trade press undertaken in connection with bona fide news stories and financial performance information provided directly to lenders in connection with arranging financing for prospective franchisees.

Despite the FTC’s recent statements, however, the Company is concerned nonetheless that with the various state franchise statutes that impose liability on franchisors for material misrepresentations and material omissions in connection with the offer and sale of a franchise, the Company may be put in an untenable position if financial performance representations are included in SEC filings but not in the franchisor’s FDD. Further, because these state laws provide franchisees with a cause of action against a franchisor, the lack of a financial performance representation in the FDD when it is otherwise available in an SEC filing could serve as the basis for a franchisee’s material omissions claim.

Ms. Barbara C. Jacobs

July 7, 2008

Page 4

The lack of clarity on this matter is a result, in part, of the fact that state franchise statutes are not pre-empted under the FTC Rule’s ‘Other Laws and Rules’ provision, 16 C.F.R. §436.10(b) and, therefore, the scope of their reach is unclear. Section 436.10(b) specifically provides:

“The FTC does not intend to preempt the franchise practice laws of any state or local government, except to the extent of any inconsistency with this Rule. A law is not inconsistent with this Rule if it affords prospective franchisees equal or greater protection, such as registration of disclosure documents or more extensive disclosures.”

Thus, while it may be permissible under the FTC Rule to omit financial performance representations in an FDD while including such information in an SEC filing, the FTC Rule may be trumped by various state franchise laws prohibiting the offer and sale franchises by means of any communication which is not included in the FDD. Because the 2007 FTC Rule is relatively new and the corresponding Compliance Guide was published only last month, the law on this point has not been fully developed, nor have state legislators or regulators directly addressed it. Given the procedural and historical background on the FTC Rule and the incidence of franchisee litigation generally, until such time as there is a reliable source of authority on this point, the Company believes it is in its best interests to refrain from making any disclosures that are inconsistent with the FDD.

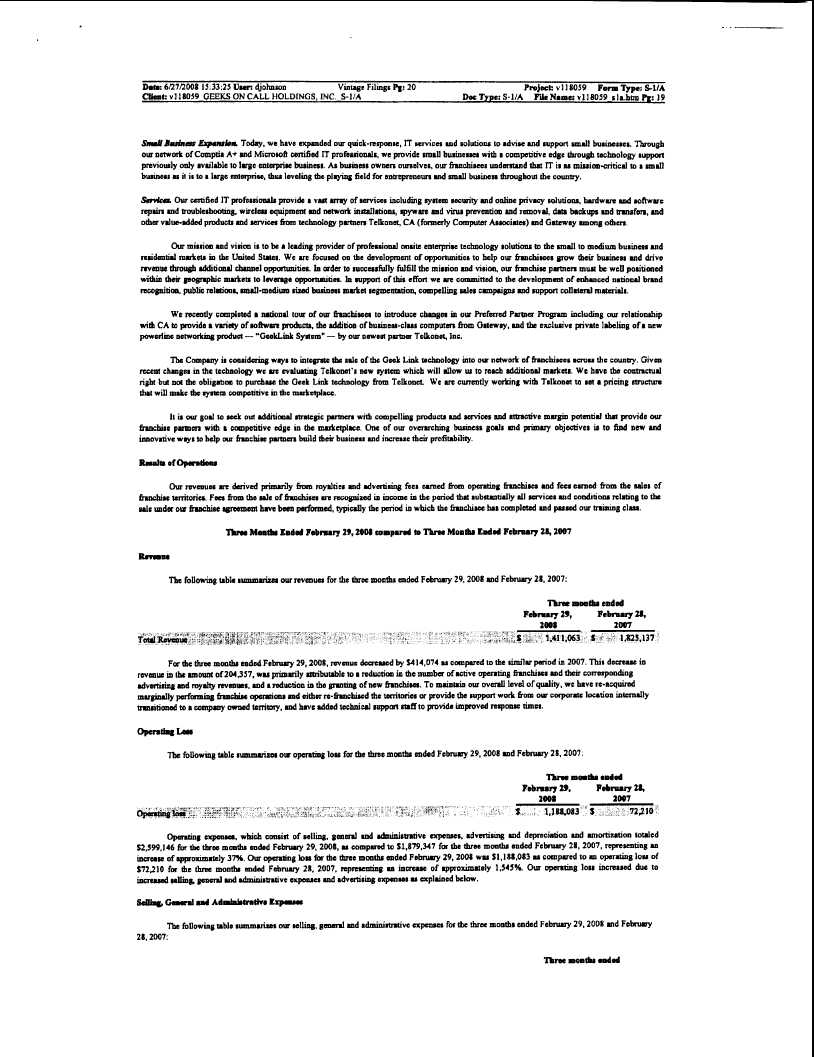

Results of Operations, page 15

Comment No. 4:

We note your response to prior comment 7, and it does not appear that you have complied with our request. In this regard, you provide three factors that contributed to a material change in selling, general and administrative expenses for the three-month period ended February 29, 2008 as compared to the three-month period ended February 28, 2007. However, you have not quantified how each individual factor contributed to the material change. Revise your filing accordingly. Note that our comment is not limited to your disclosure with respect to selling, general and administrative expenses.

Response:

The Company has revised its disclosure on page 15 to quantify how each individual factor contributed to a material change in its selling, general and administrative expenses. Please note that the Company has informed us that selling, general and administrative expenses was the only area of results of operations that displayed a material change in the comparative periods.

Notes to Financial Statements, page F-7

Revenue Recognition, page F-7

Comment No. 5:

Notwithstanding the revisions to your revenue recognition footnote, it would appear that information provided in your response to prior comment 12 would further satisfy the disclosure requirements provided for in paragraph 20 of SFAS 45. In this regard, your disclosure should include a detailed description of the “material obligations” (i.e., training program or other significant commitments and obligations) that you have agreed to provide the franchisee.

Ms. Barbara C. Jacobs

July 7, 2008

Page 5

Response:

The Company has revised its disclosure on page F-7 to include a more detailed description of its material obligations.

Comment No. 6:

We note your response to prior comment 13. As previously requested, revise your filing to provide disclosure with respect to your Area Development Agreement service obligations including how you satisfy these obligations. In this regard, the specific information provided in your response should be disclosed within your financial statement footnotes as this appears to be informative with respect to your revenue recognition policies.

Response:

The Company has revised its disclosure on page F-7 to respond to the Staff’s comment.

* * *

In addition, attached hereto as Annex A is the correspondence that we submitted to the Staff on June 30, 2008.

Should you have any questions regarding the foregoing, please do not hesitate to contact the undersigned at (212) 659-4971.

| | Very truly yours, |

| | |

| | /s/ Edward H. Schauder |

| | |

| | Edward H. Schauder |