Delivering growth and success through strategic evolution Virtual KBW West Coast Bank Field Trip November 16, 2021

2 Nasdaq: BMRC Forward-Looking Statements This presentation may contain certain forward-looking statements that are based on management's current expectations regarding economic, legislative, and regulatory issues that may impact Bancorp's earnings in future periods. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. They often include the words “believe,” “expect,” “intend,” “estimate” or words of similar meaning, or future or conditional verbs such as “will,” “would,” “should,” “could” or “may.” Factors that could cause future results to vary materially from current management expectations include, but are not limited to, the businesses of Bank of Marin Bancorp and/or American River Bankshares may not be integrated successfully or such integration may be more difficult, time-consuming or costly than expected; expected revenue synergies and cost savings from the acquisition may not be fully realized or realized within the expected time frame; revenues following the merger may be lower than expected; customer and employee relationships and business operations may be disrupted by the acquisition; the ability to obtain required regulatory and shareholder approvals, and the ability to complete the acquisition on the expected timeframe may be more difficult, time-consuming or costly than expected; natural disasters (such as wildfires and earthquakes), our borrowers’ actual payment performance as loan deferrals related to the COVID-19 pandemic expire, changes to statutes, regulations, or regulatory policies or practices as a result of, or in response to COVID-19, including the potential adverse impact of loan modifications and payment deferrals implemented consistent with recent regulatory guidance, general economic conditions, economic uncertainty in the United States and abroad, changes in interest rates, deposit flows, real estate values, costs or effects of acquisitions, competition, changes in accounting principles, policies or guidelines, legislation or regulation (including the Coronavirus Aid, Relief and Economic Security Act of 2020, as amended, and the Economic Aid to Hard-Hit Small Businesses, Nonprofits and Venues Act of 2020), interruptions of utility service in our markets for sustained periods, and other economic, competitive, governmental, regulatory and technological factors (including external fraud and cybersecurity threats) affecting Bancorp's operations, pricing, products and services. These and other important factors are detailed in various securities law filings made periodically by Bancorp, copies of which are available from Bancorp without charge. Bancorp undertakes no obligation to release publicly the result of any revisions to these forward-looking statements that may be made to reflect events or circumstances after the date of this presentation or to reflect the occurrence of unanticipated events. GAAP to Non-GAAP Financial Measures This presentation includes some non-GAAP financial measures. Please refer to the reconciliation of GAAP to Non-GAAP financial measures included on page 3 of our Form 8-K under Item 9 - Financial Statements and Exhibit 99.1 filed with the SEC on October 25, 2021. A condensed version of the reconciliation is shown on page 13 of this presentation.

Bank of Marin Bancorp Recent awards: FIVE STAR BANK BAUER 3 Nasdaq: BMRC Headquarters Novato, California Marin County, North of San Francisco Employees, full-time equivalent 348 Assets $4.3 billion Footprint 31 branches and 8 commercial banking offices across 10 Northern California counties Ticker BMRC (Nasdaq Capital Markets) Founded 1989 First branch opened in 1990 COMMUNITY BANKERS CUP AWARD 2014 - 2015 - 2016 Piper Sandler Sm-All Stars: Class of 2020 SINCE 2003 (As of September 30, 2021)

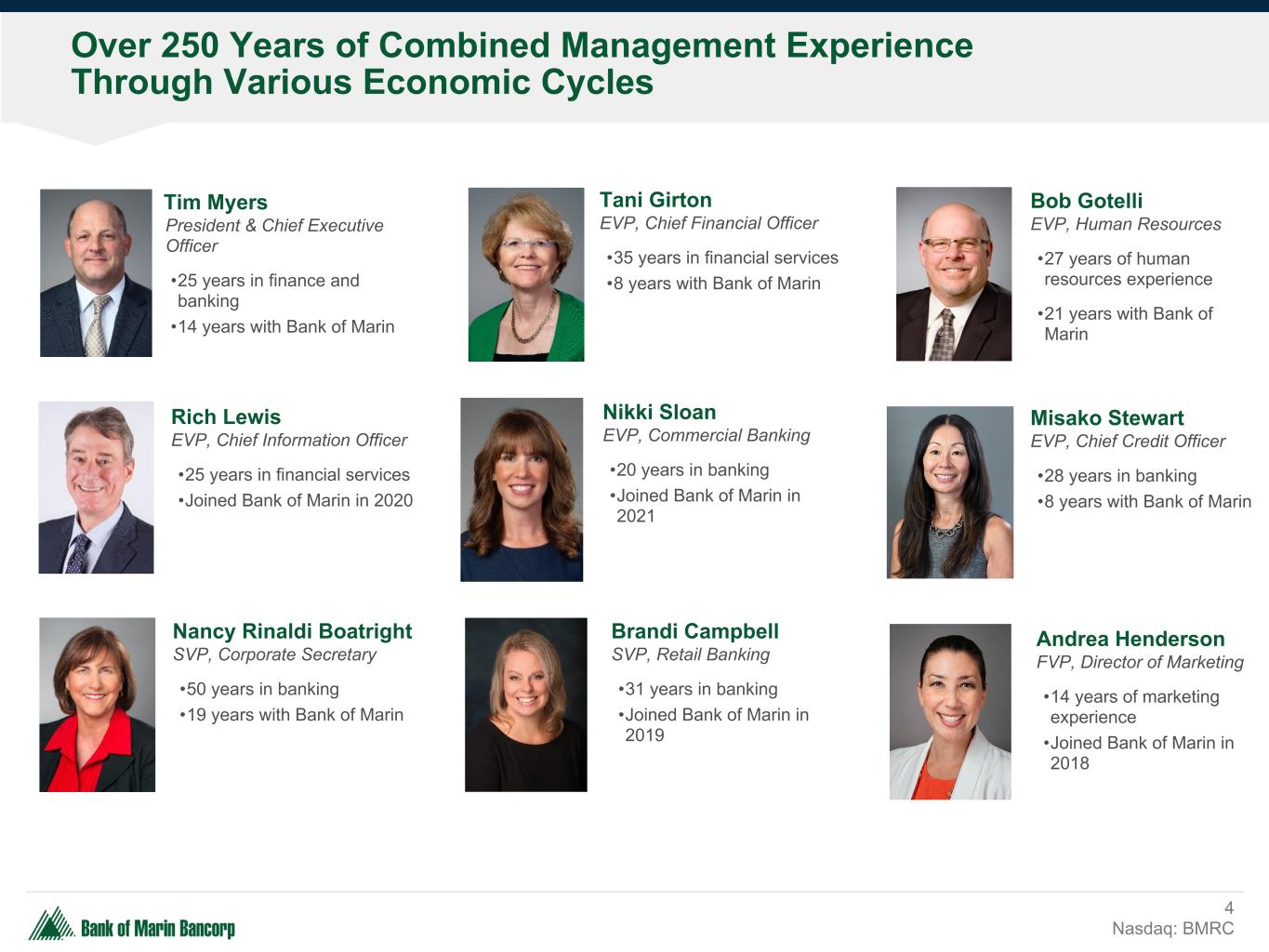

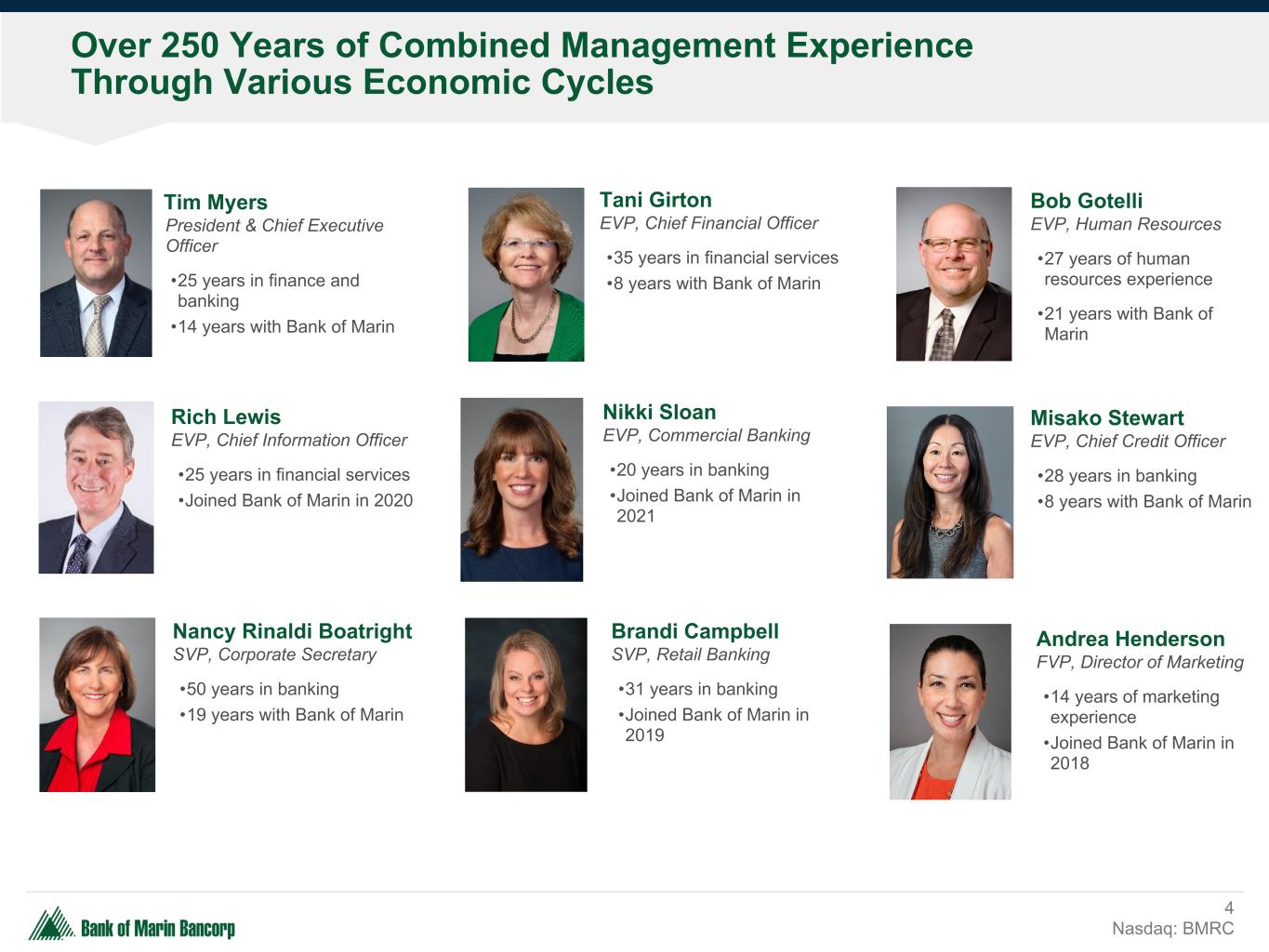

Tim Myers President & Chief Executive Officer •25 years in finance and banking •14 years with Bank of Marin Rich Lewis EVP, Chief Information Officer •25 years in financial services •Joined Bank of Marin in 2020 Tani Girton EVP, Chief Financial Officer •35 years in financial services •8 years with Bank of Marin Over 250 Years of Combined Management Experience Through Various Economic Cycles 4 Nasdaq: BMRC Misako Stewart EVP, Chief Credit Officer •28 years in banking •8 years with Bank of Marin Nancy Rinaldi Boatright SVP, Corporate Secretary •50 years in banking •19 years with Bank of Marin Bob Gotelli EVP, Human Resources •27 years of human resources experience •21 years with Bank of Marin Nikki Sloan EVP, Commercial Banking •20 years in banking •Joined Bank of Marin in 2021 Brandi Campbell SVP, Retail Banking •31 years in banking •Joined Bank of Marin in 2019 Andrea Henderson FVP, Director of Marketing •14 years of marketing experience •Joined Bank of Marin in 2018

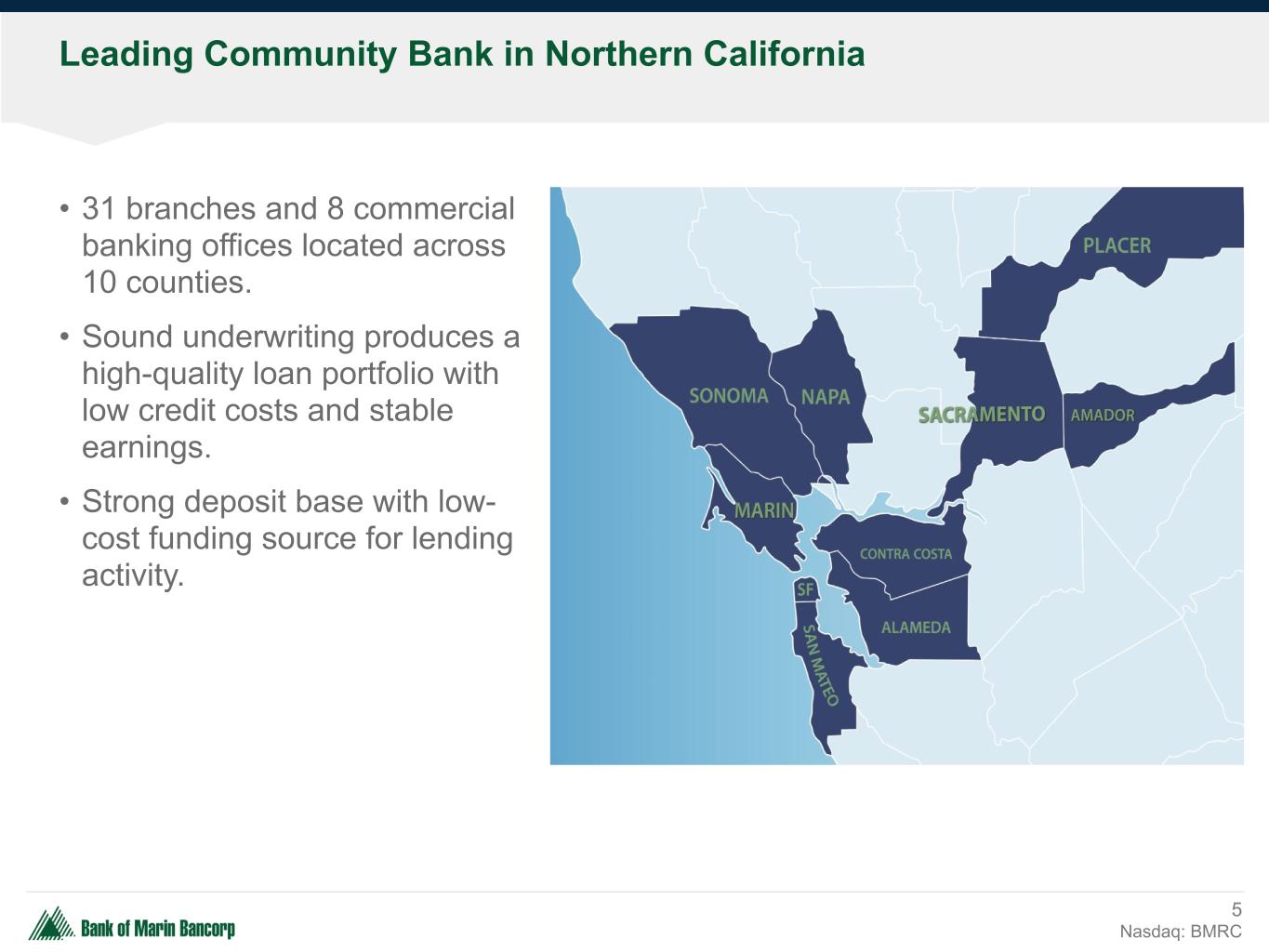

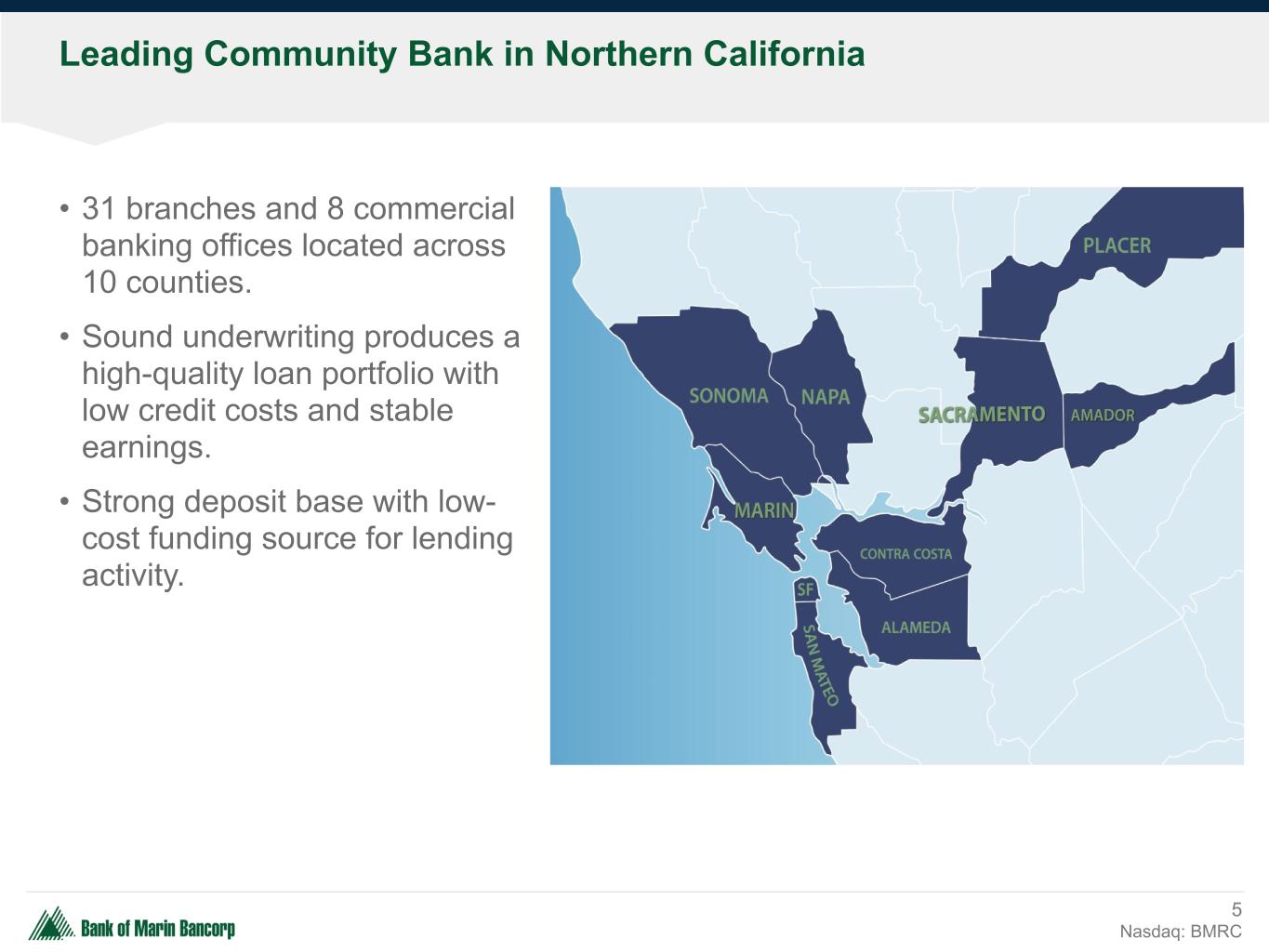

5 Nasdaq: BMRC • 31 branches and 8 commercial banking offices located across 10 counties. • Sound underwriting produces a high-quality loan portfolio with low credit costs and stable earnings. • Strong deposit base with low- cost funding source for lending activity. Leading Community Bank in Northern California (loan production office) (loan production office)

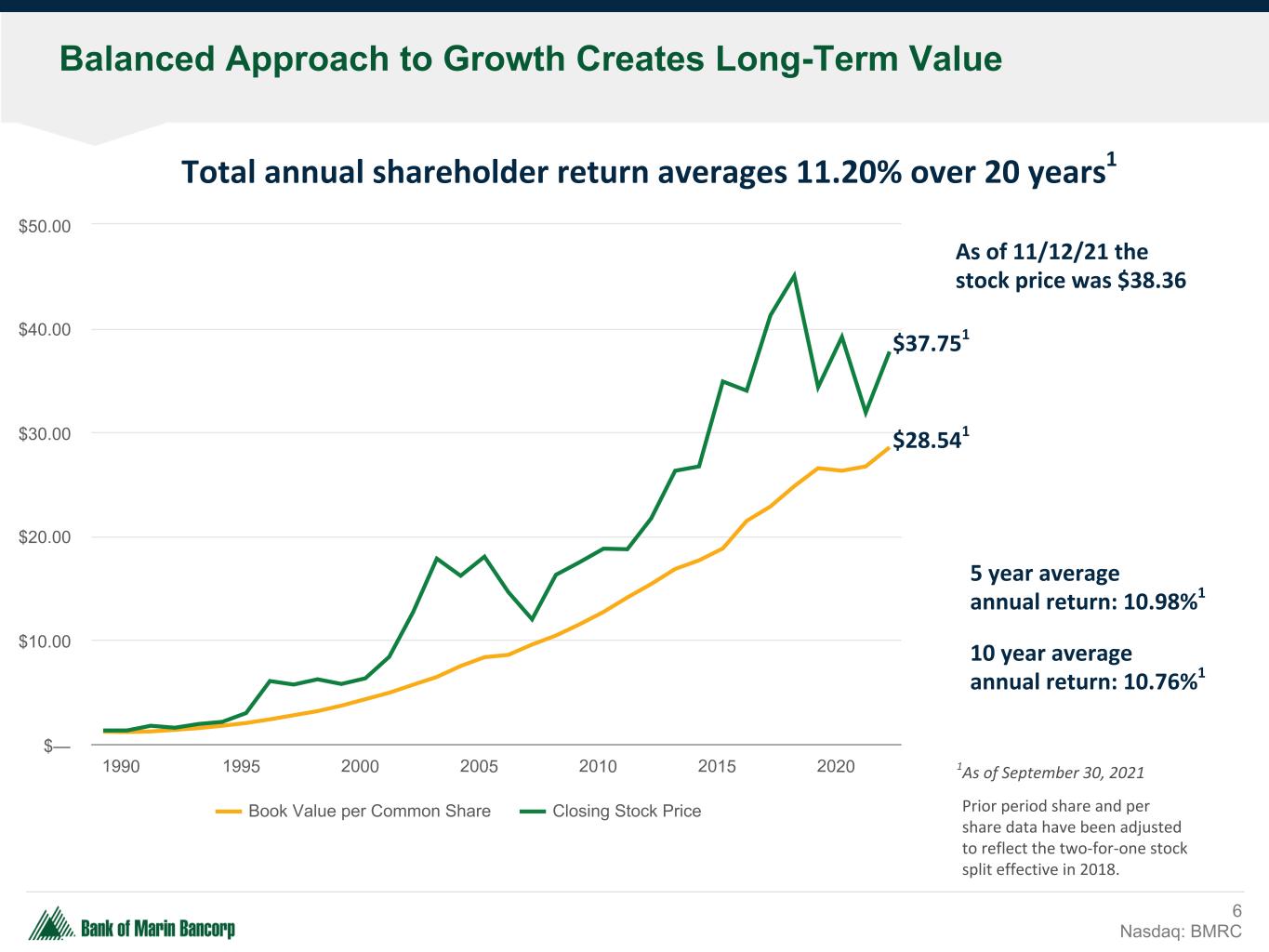

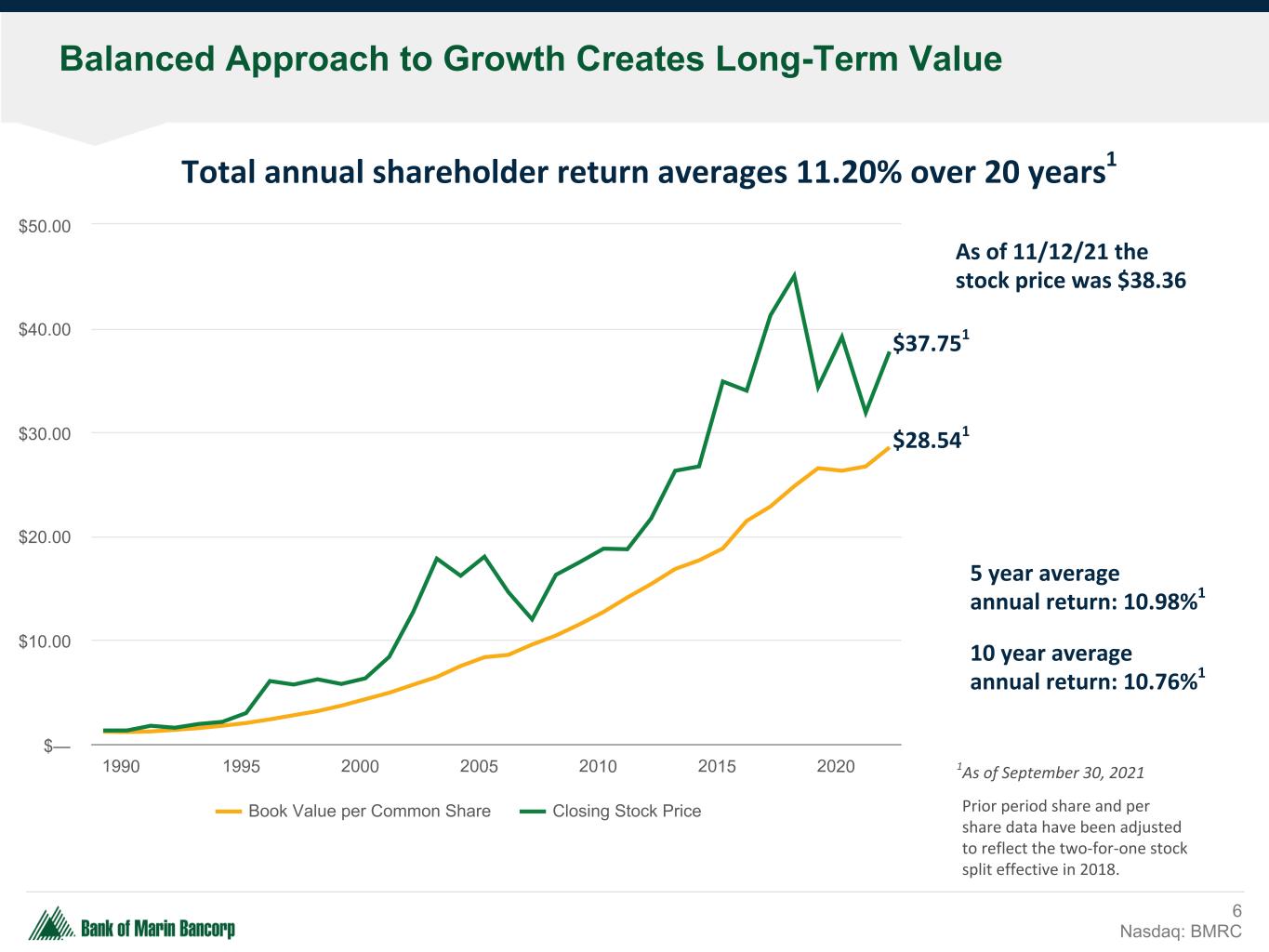

6 Nasdaq: BMRC Balanced Approach to Growth Creates Long-Term Value 5 year average annual return: 10.98%1 1As of September 30, 2021 10 year average annual return: 10.76%1 Total annual shareholder return averages 11.20% over 20 years1 As of 11/12/21 the stock price was $38.36 Book Value per Common Share Closing Stock Price 1990 1995 2000 2005 2010 2015 2020 $— $10.00 $20.00 $30.00 $40.00 $50.00 $37.751 $28.541 Prior period share and per share data have been adjusted to reflect the two-for-one stock split effective in 2018.

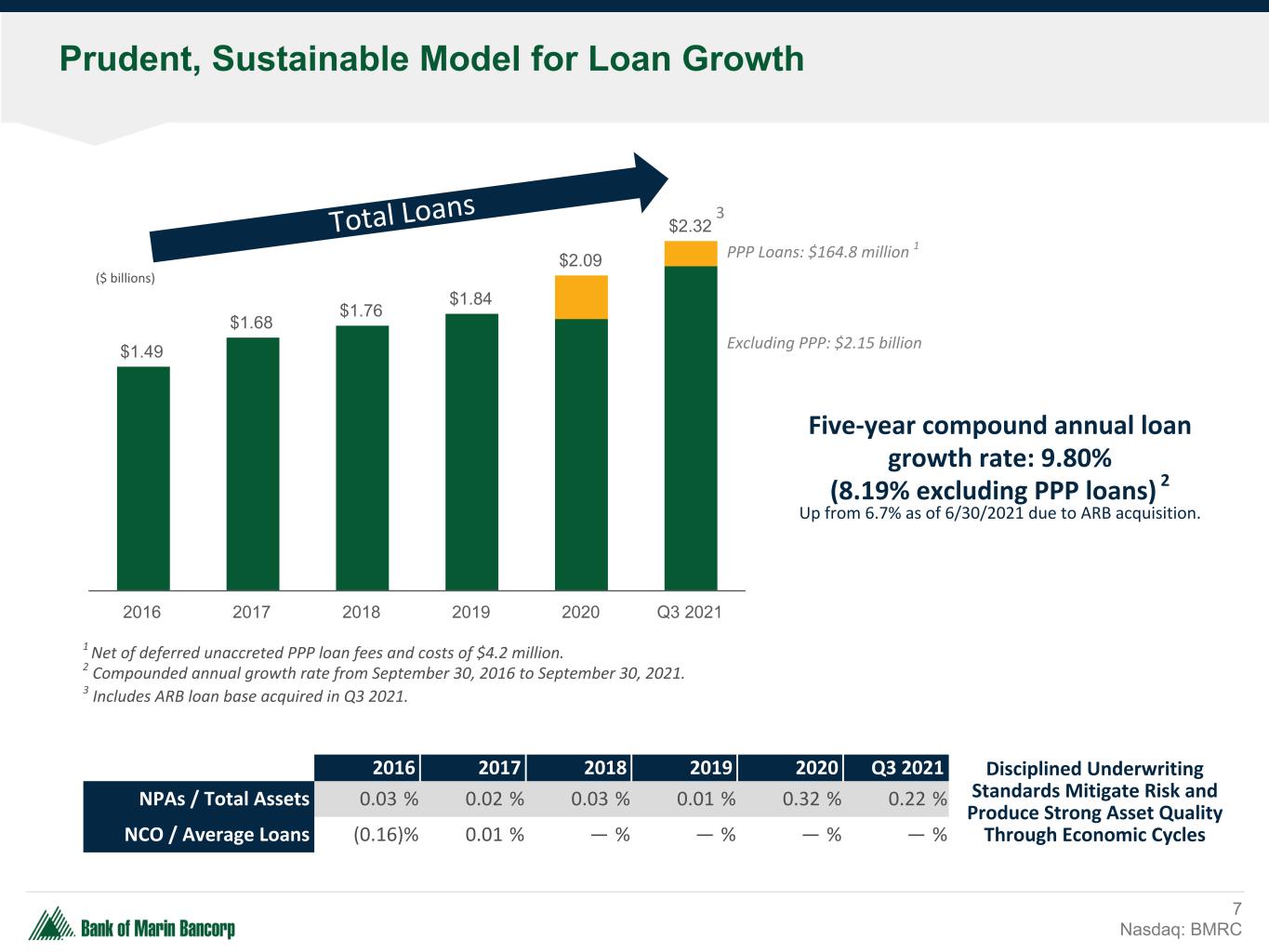

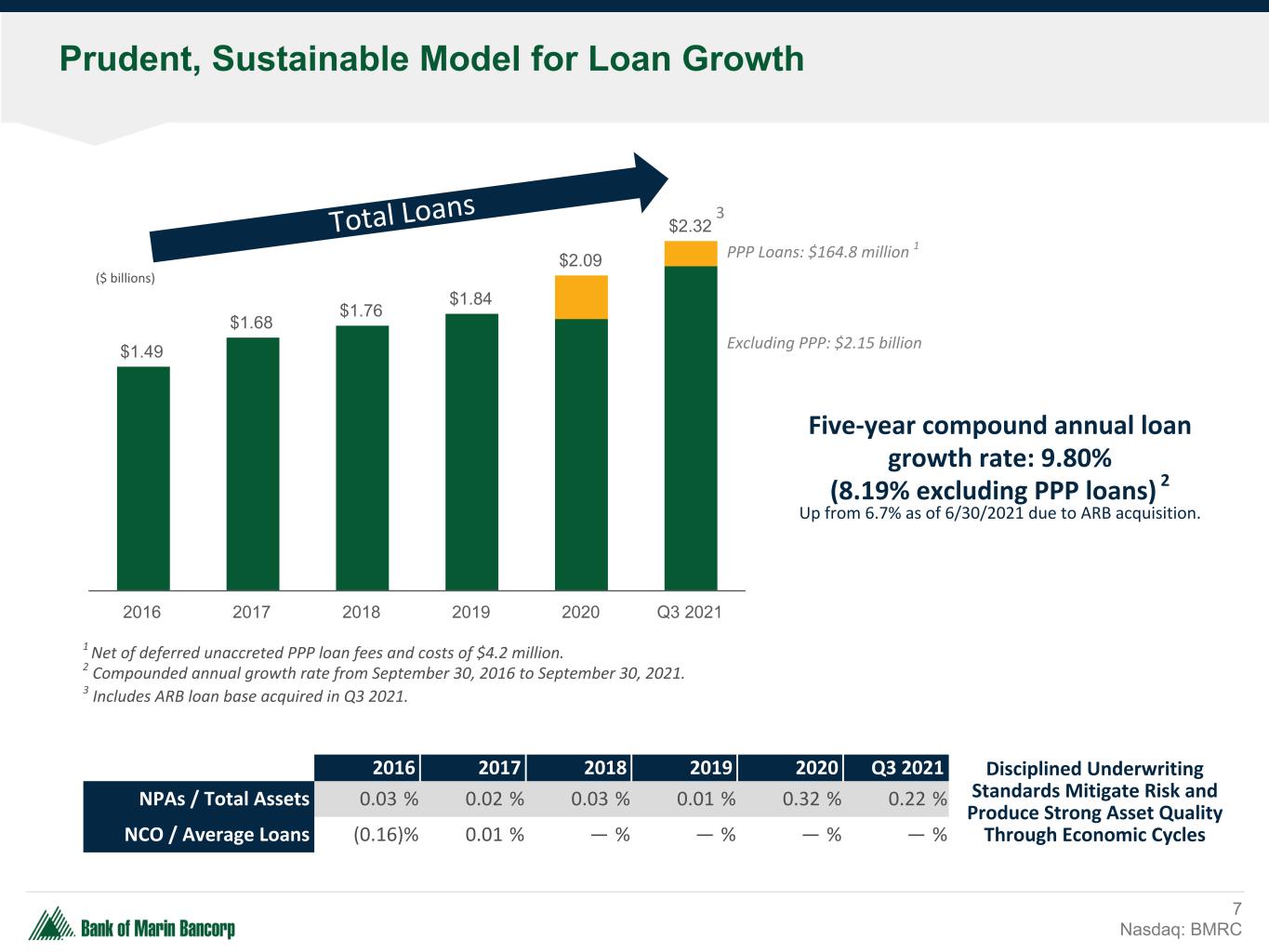

Prudent, Sustainable Model for Loan Growth 7 Nasdaq: BMRC ($ billions) Five-year compound annual loan growth rate: 9.80% (8.19% excluding PPP loans) 2 Up from 6.7% as of 6/30/2021 due to ARB acquisition. 1 Net of deferred unaccreted PPP loan fees and costs of $4.2 million. 2 Compounded annual growth rate from September 30, 2016 to September 30, 2021. PPP Loans: $164.8 million 1 Excluding PPP: $2.15 billion$1.49 $1.68 $1.76 $1.84 $2.09 $2.32 2016 2017 2018 2019 2020 Q3 2021 Total Loans 2016 2017 2018 2019 2020 Q3 2021 NPAs / Total Assets 0.03 % 0.02 % 0.03 % 0.01 % 0.32 % 0.22 % NCO / Average Loans (0.16) % 0.01 % — % — % — % — % Disciplined Underwriting Standards Mitigate Risk and Produce Strong Asset Quality Through Economic Cycles 3 Includes ARB loan base acquired in Q3 2021. 3

8 Nasdaq: BMRC Pandemic Response SBA Paycheck Protection Program • Bank of Marin and American River originated a combined total of over 3,500 loans amounting to more than $550 million in two rounds of financing. $6.6 million of total fee income recognized as of September 30, 2021. • Of the 2,876 PPP loans funded by Bank of Marin, the SBA has forgiven and paid off 2,036 loans. • As of September 30, Bank of Marin had 871 loans outstanding (including 31 from legacy ARB) totaling almost $165 million, net of $4.2 million in unrecognized fees and costs. Payment Relief Program • At September 30, we had remaining just two borrowing relationships with five loans totaling approximately $24 million. • We monitor the financial situation of these clients closely and expect them to resume payments as the economy continues to gain momentum.

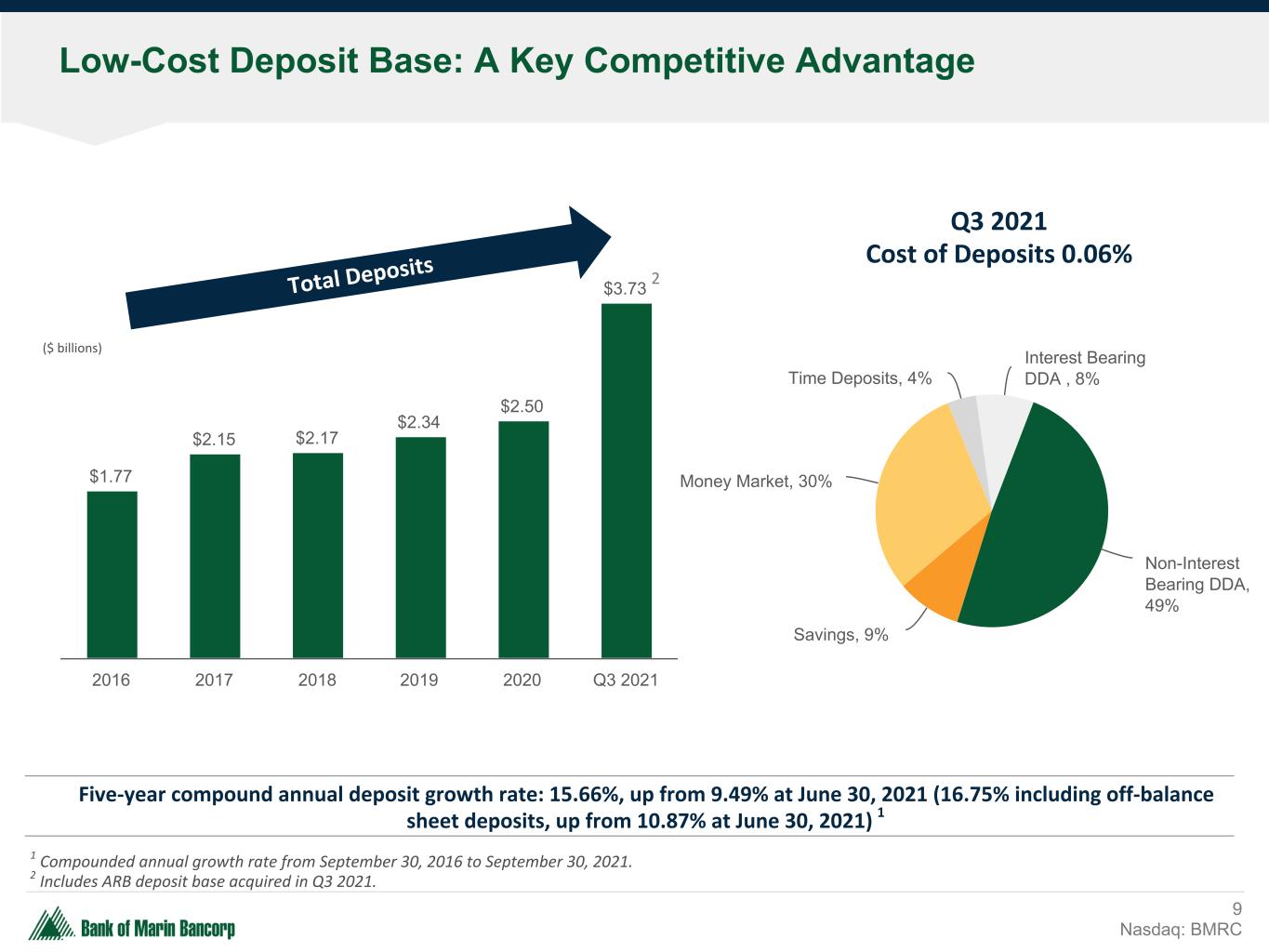

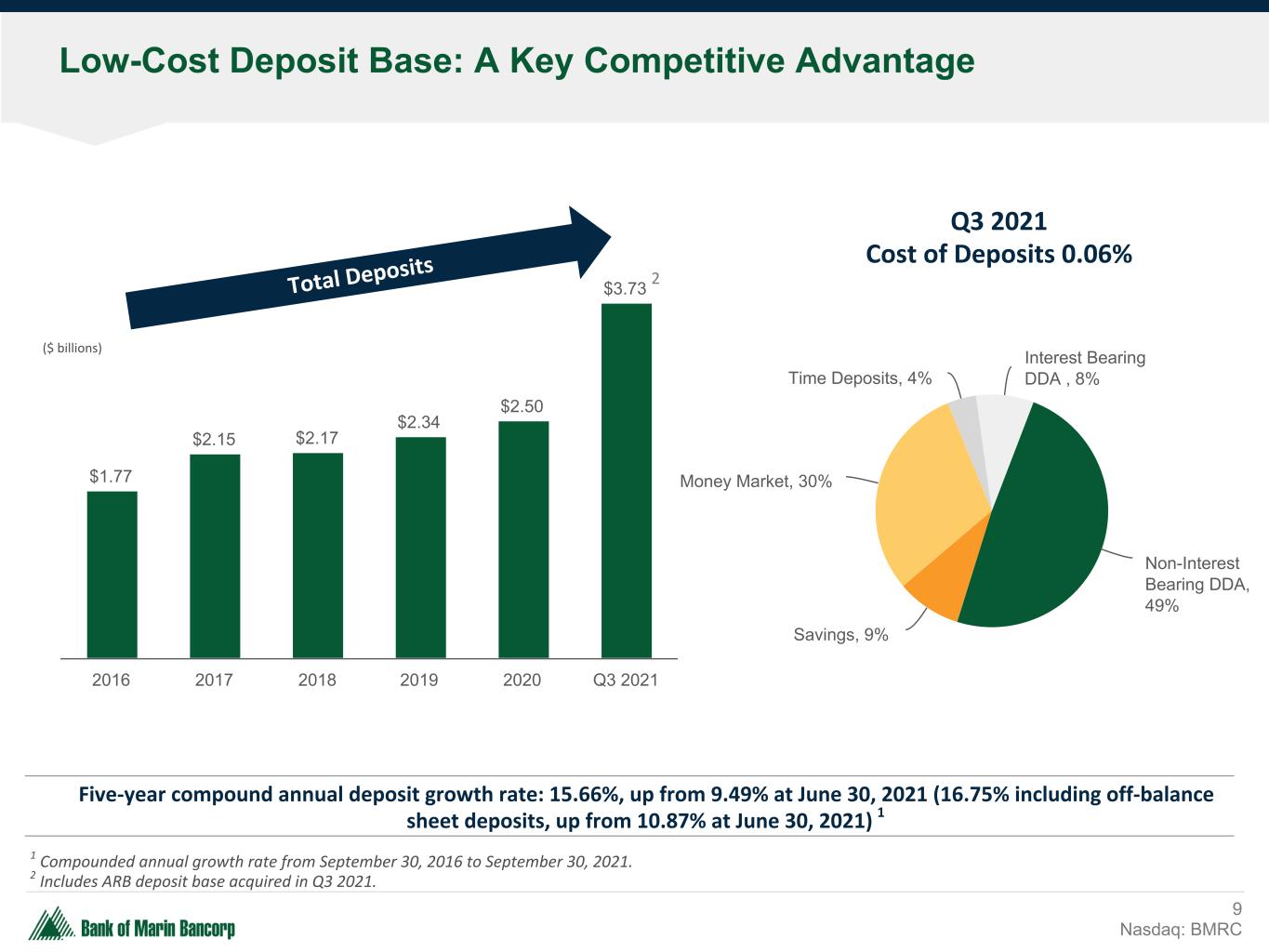

Low-Cost Deposit Base: A Key Competitive Advantage ($ billions) 9 Nasdaq: BMRC 1 Compounded annual growth rate from September 30, 2016 to September 30, 2021. Q3 2021 Cost of Deposits 0.06% Five-year compound annual deposit growth rate: 15.66%, up from 9.49% at June 30, 2021 (16.75% including off-balance sheet deposits, up from 10.87% at June 30, 2021) 1 Total Dep osits $1.77 $2.15 $2.17 $2.34 $2.50 $3.73 2016 2017 2018 2019 2020 Q3 2021 Non-Interest Bearing DDA, 49% Savings, 9% Money Market, 30% Time Deposits, 4% Interest Bearing DDA , 8% 2 2 Includes ARB deposit base acquired in Q3 2021.

$1.52 $1.89 $1.27 $2.33 $2.48 $2.22 $0.45 $0.51 $0.56 $0.64 $0.80 $0.92 $18.4 $30.2 Earnings per Share Dividends per Share Net Income 2015 2016 2017 2018 2019 2020 $0.50 $1.00 $1.50 $2.00 $2.50 $3.00 $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 $35.0 $40.0 Dependable Earnings and Dividend Growth 10 Nasdaq: BMRC 1 Prior period share and per share data have been adjusted to reflect the two-for-one stock split effective in 2018. 11 D ol la rs p er s ha re $M M Bank of Napa Acquisition & Tax Cuts and Jobs Act

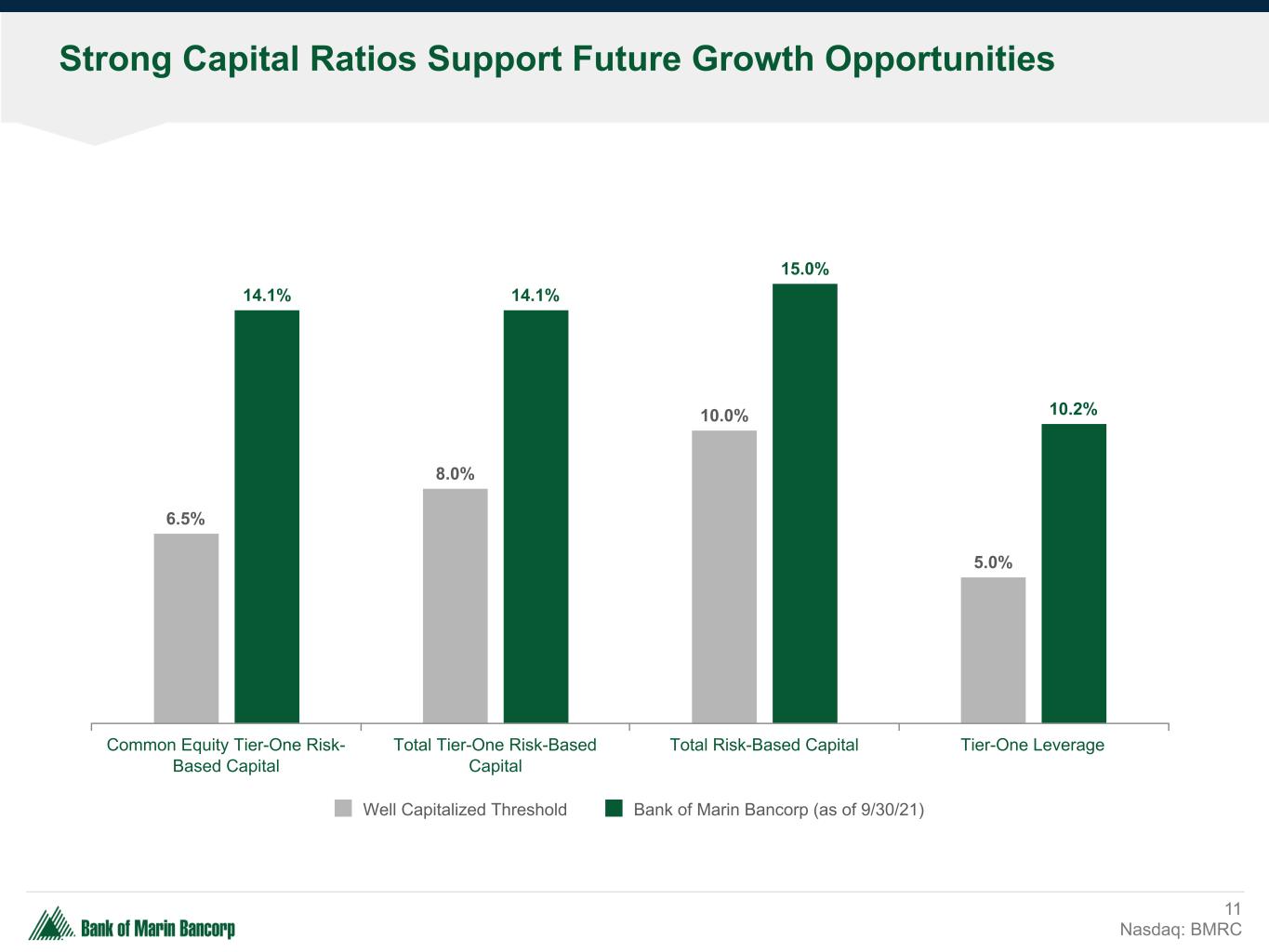

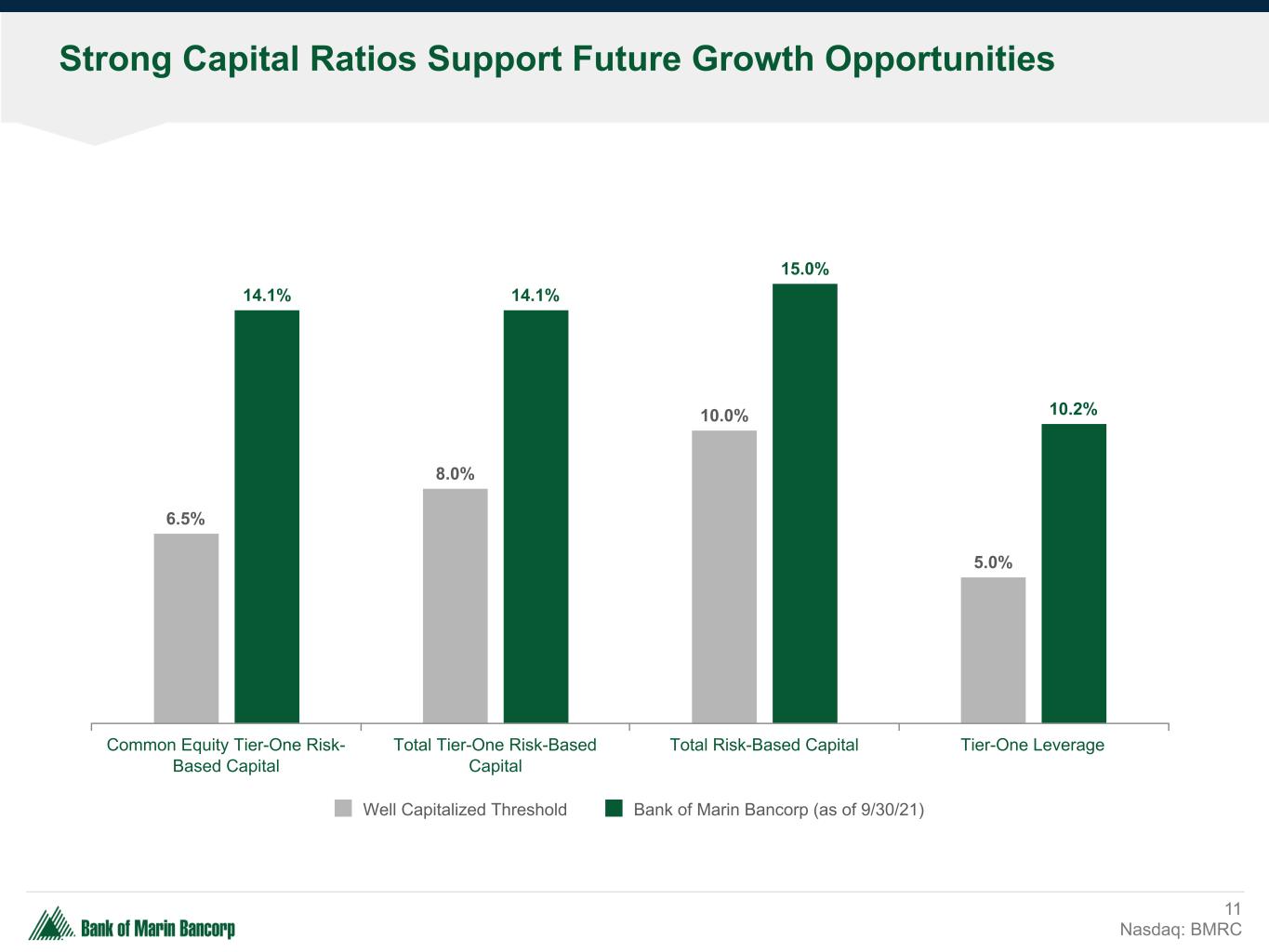

Strong Capital Ratios Support Future Growth Opportunities 11 Nasdaq: BMRC 6.5% 8.0% 10.0% 5.0% 14.1% 14.1% 15.0% 10.2% Well Capitalized Threshold Bank of Marin Bancorp (as of 9/30/21) Common Equity Tier-One Risk- Based Capital Total Tier-One Risk-Based Capital Total Risk-Based Capital Tier-One Leverage

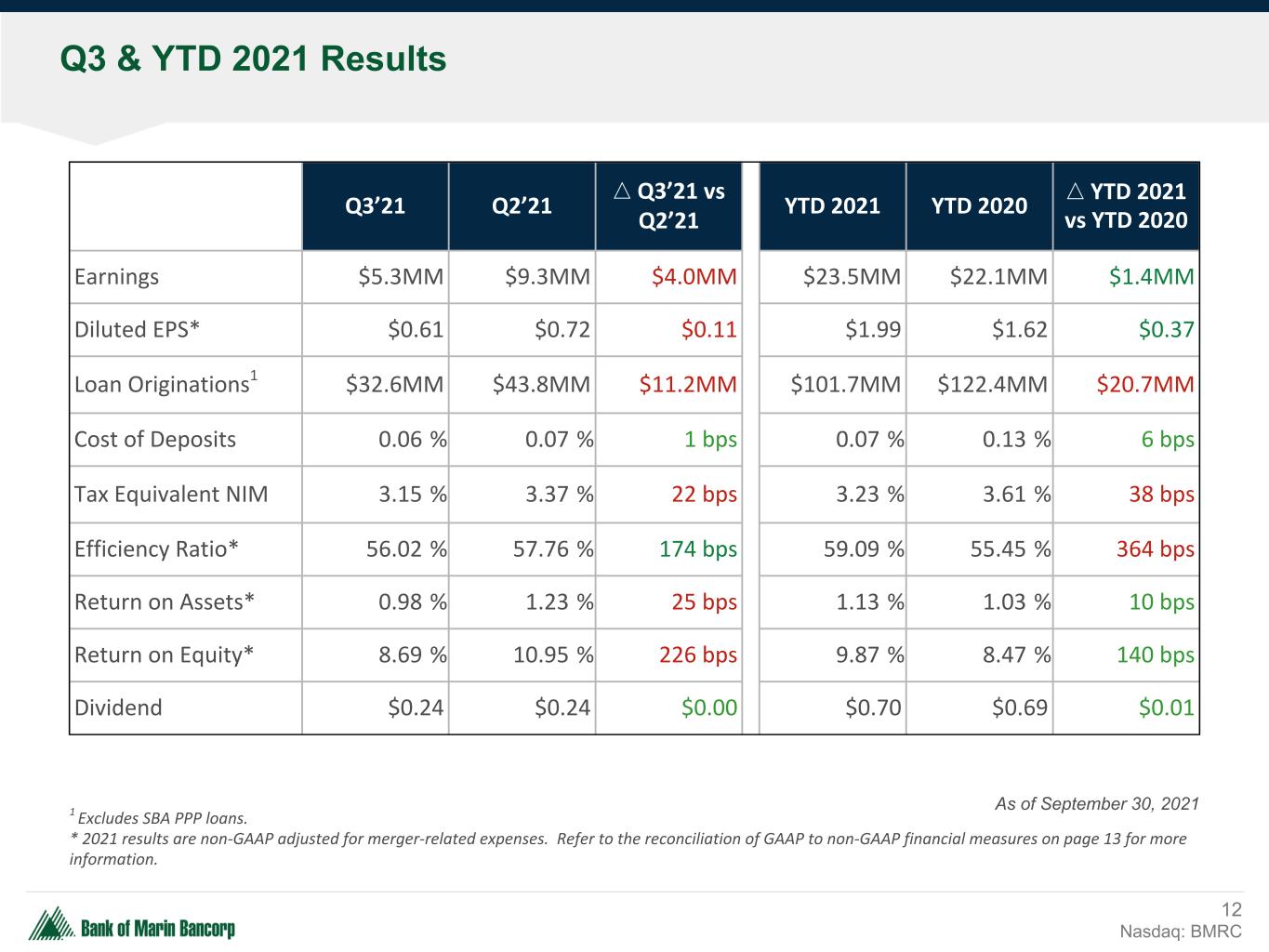

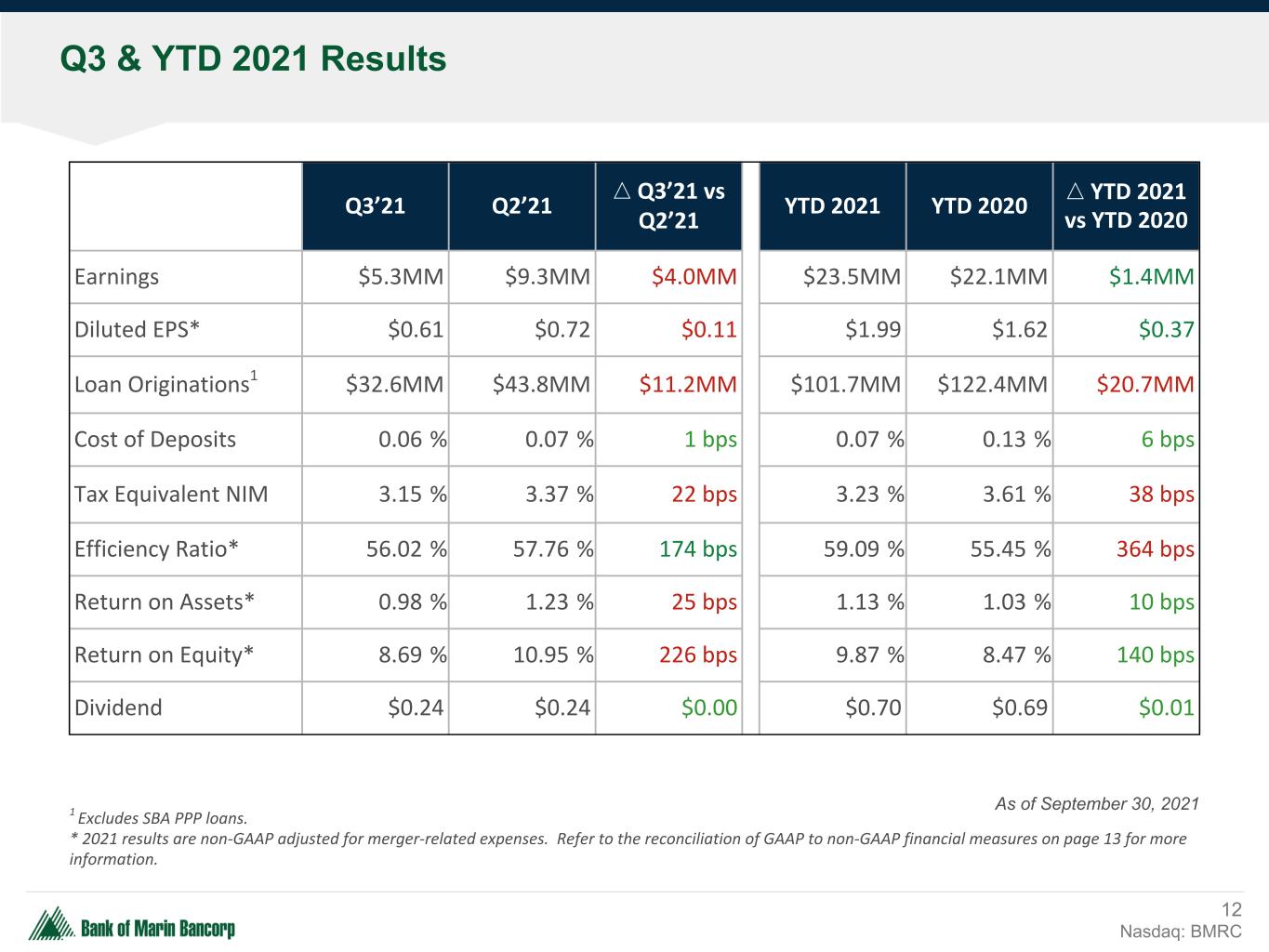

Q3 & YTD 2021 Results 12 Nasdaq: BMRC 1 Excludes SBA PPP loans. * 2021 results are non-GAAP adjusted for merger-related expenses. Refer to the reconciliation of GAAP to non-GAAP financial measures on page 13 for more information. Q3’21 Q2’21 Q3’21 vs Q2’21 YTD 2021 YTD 2020 YTD 2021 vs YTD 2020 Earnings $5.3MM $9.3MM $4.0MM $23.5MM $22.1MM $1.4MM Diluted EPS* $0.61 $0.72 $0.11 $1.99 $1.62 $0.37 Loan Originations1 $32.6MM $43.8MM $11.2MM $101.7MM $122.4MM $20.7MM Cost of Deposits 0.06 % 0.07 % 1 bps 0.07 % 0.13 % 6 bps Tax Equivalent NIM 3.15 % 3.37 % 22 bps 3.23 % 3.61 % 38 bps Efficiency Ratio* 56.02 % 57.76 % 174 bps 59.09 % 55.45 % 364 bps Return on Assets* 0.98 % 1.23 % 25 bps 1.13 % 1.03 % 10 bps Return on Equity* 8.69 % 10.95 % 226 bps 9.87 % 8.47 % 140 bps Dividend $0.24 $0.24 $0.00 $0.70 $0.69 $0.01 As of September 30, 2021

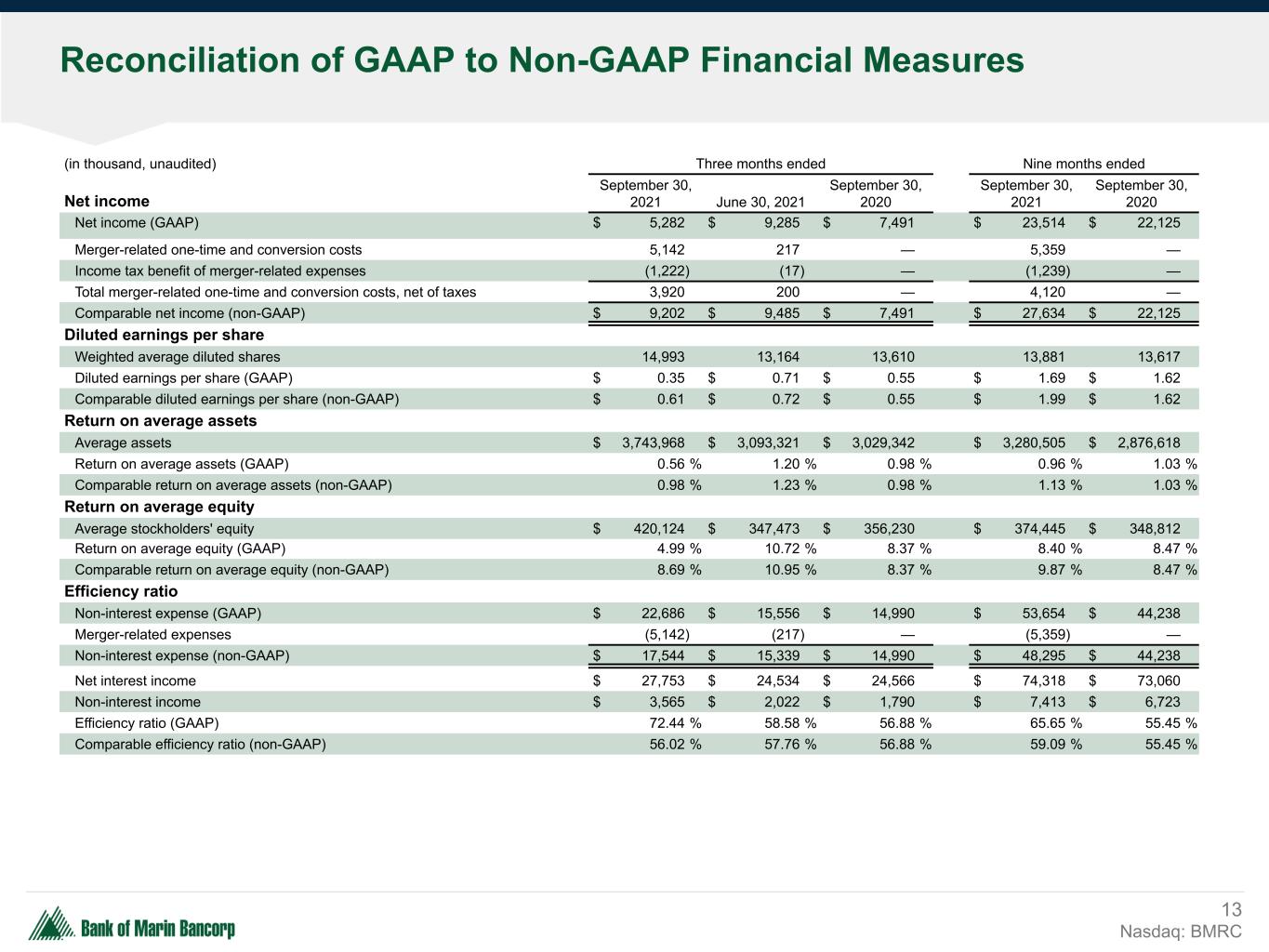

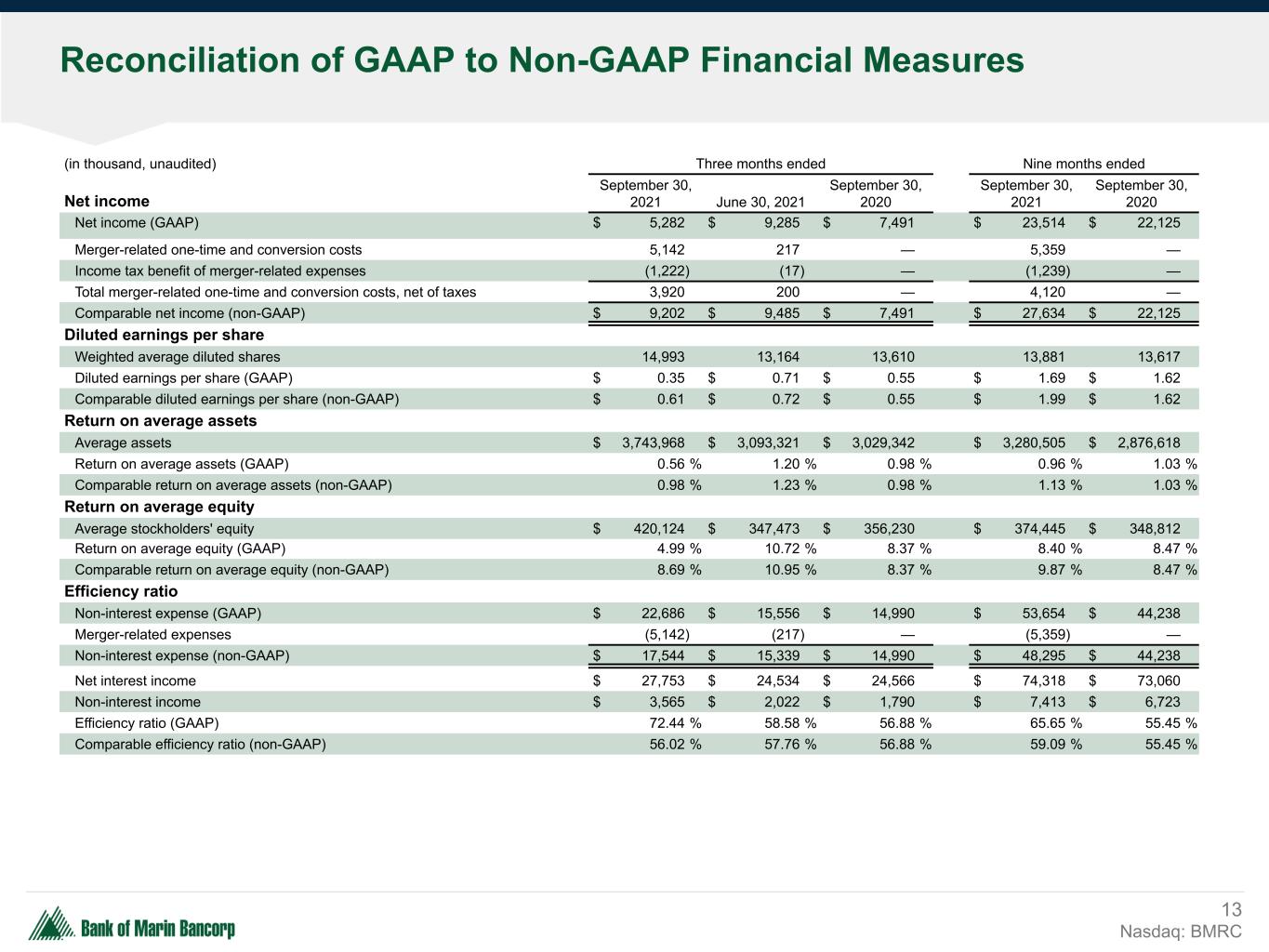

Reconciliation of GAAP to Non-GAAP Financial Measures 13 Nasdaq: BMRC (in thousand, unaudited) Three months ended Nine months ended Net income September 30, 2021 June 30, 2021 September 30, 2020 September 30, 2021 September 30, 2020 Net income (GAAP) $ 5,282 $ 9,285 $ 7,491 $ 23,514 $ 22,125 Merger-related one-time and conversion costs 5,142 217 — 5,359 — Income tax benefit of merger-related expenses (1,222) (17) — (1,239) — Total merger-related one-time and conversion costs, net of taxes 3,920 200 — 4,120 — Comparable net income (non-GAAP) $ 9,202 $ 9,485 $ 7,491 $ 27,634 $ 22,125 Diluted earnings per share Weighted average diluted shares 14,993 13,164 13,610 13,881 13,617 Diluted earnings per share (GAAP) $ 0.35 $ 0.71 $ 0.55 $ 1.69 $ 1.62 Comparable diluted earnings per share (non-GAAP) $ 0.61 $ 0.72 $ 0.55 $ 1.99 $ 1.62 Return on average assets Average assets $ 3,743,968 $ 3,093,321 $ 3,029,342 $ 3,280,505 $ 2,876,618 Return on average assets (GAAP) 0.56 % 1.20 % 0.98 % 0.96 % 1.03 % Comparable return on average assets (non-GAAP) 0.98 % 1.23 % 0.98 % 1.13 % 1.03 % Return on average equity Average stockholders' equity $ 420,124 $ 347,473 $ 356,230 $ 374,445 $ 348,812 Return on average equity (GAAP) 4.99 % 10.72 % 8.37 % 8.40 % 8.47 % Comparable return on average equity (non-GAAP) 8.69 % 10.95 % 8.37 % 9.87 % 8.47 % Efficiency ratio Non-interest expense (GAAP) $ 22,686 $ 15,556 $ 14,990 $ 53,654 $ 44,238 Merger-related expenses (5,142) (217) — (5,359) — Non-interest expense (non-GAAP) $ 17,544 $ 15,339 $ 14,990 $ 48,295 $ 44,238 Net interest income $ 27,753 $ 24,534 $ 24,566 $ 74,318 $ 73,060 Non-interest income $ 3,565 $ 2,022 $ 1,790 $ 7,413 $ 6,723 Efficiency ratio (GAAP) 72.44 % 58.58 % 56.88 % 65.65 % 55.45 % Comparable efficiency ratio (non-GAAP) 56.02 % 57.76 % 56.88 % 59.09 % 55.45 %

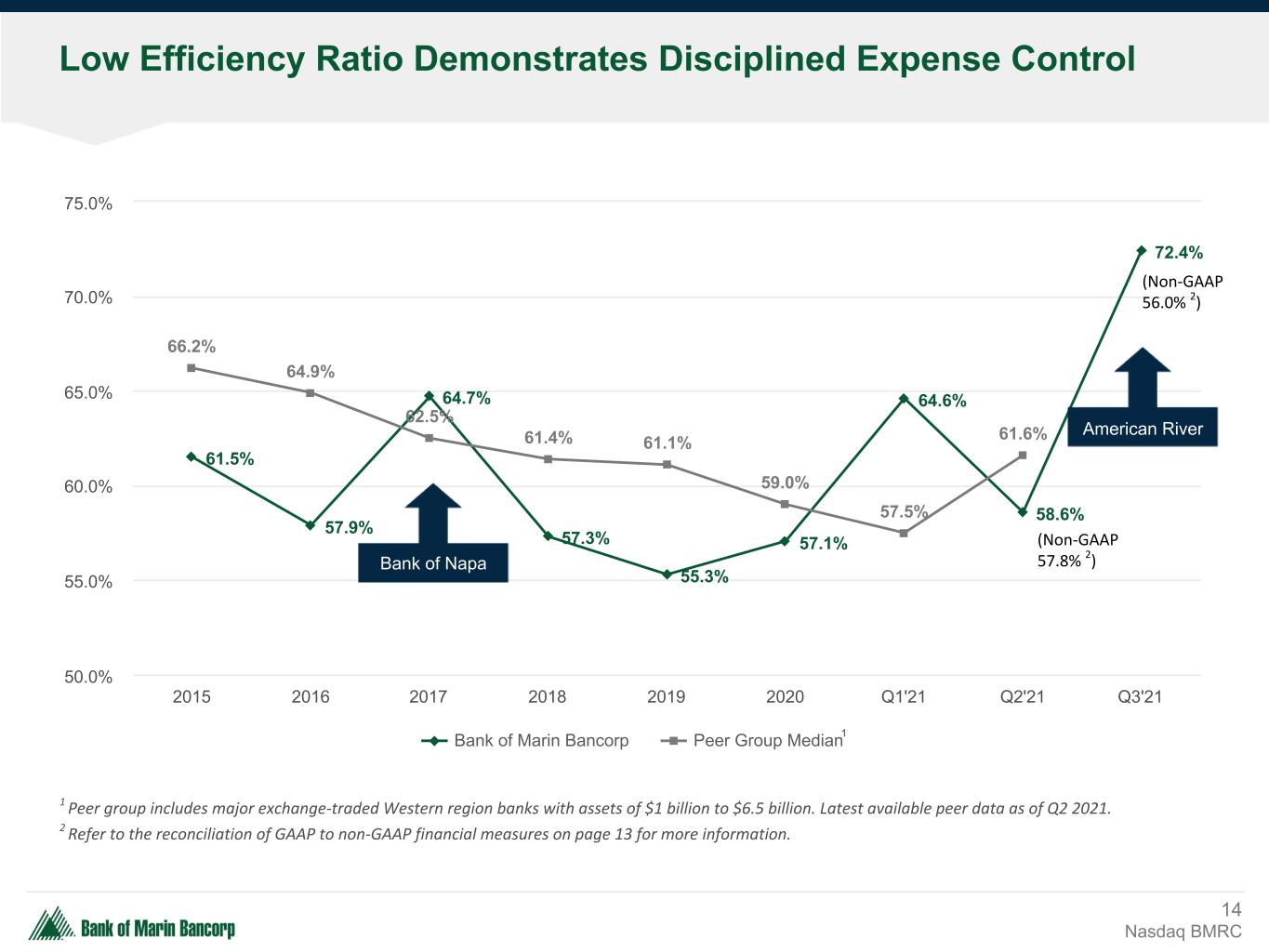

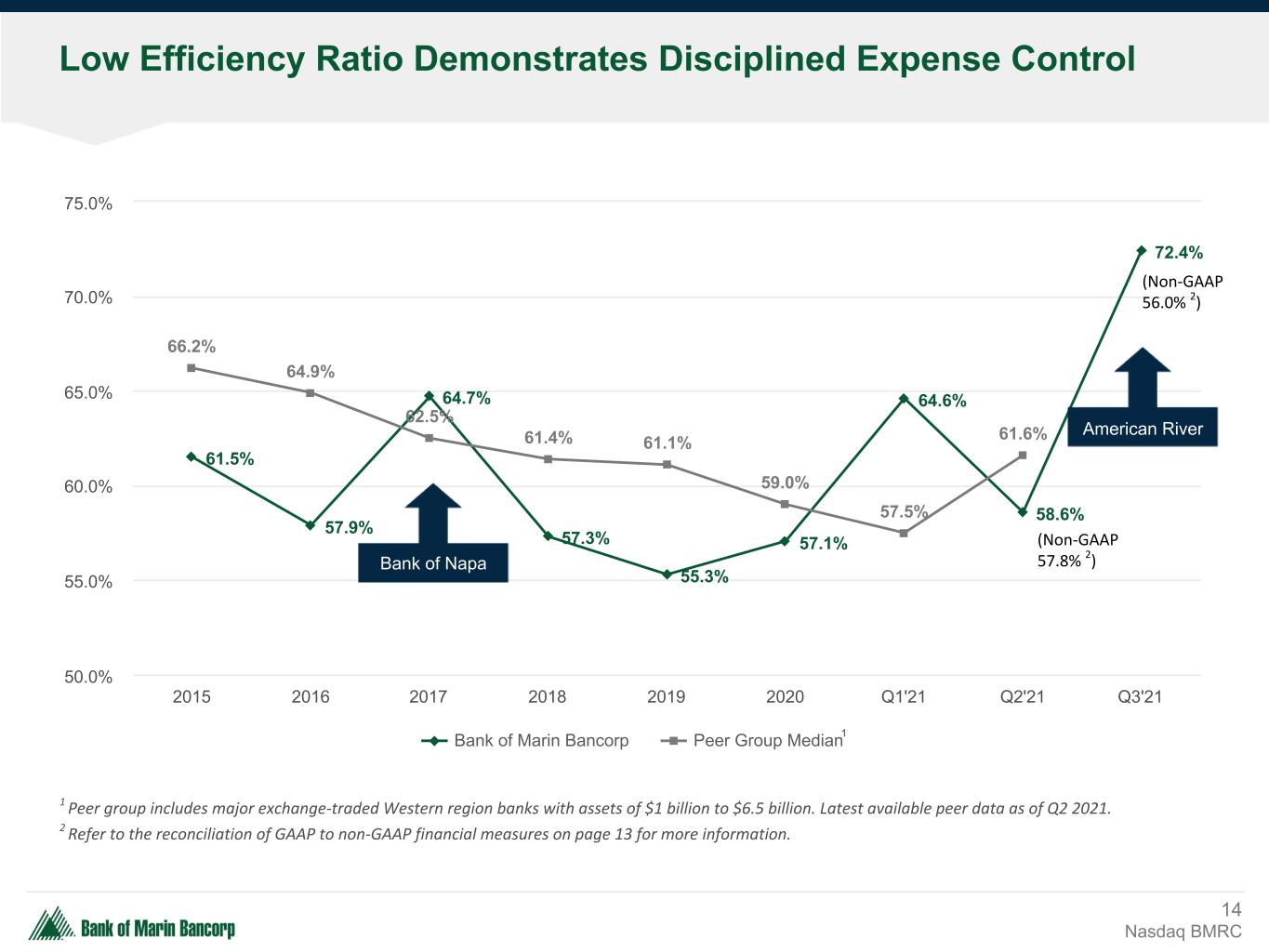

Low Efficiency Ratio Demonstrates Disciplined Expense Control 14 Nasdaq BMRC 1 Peer group includes major exchange-traded Western region banks with assets of $1 billion to $6.5 billion. Latest available peer data as of Q2 2021. 2 Refer to the reconciliation of GAAP to non-GAAP financial measures on page 13 for more information. 1 61.5% 57.9% 64.7% 57.3% 55.3% 57.1% 64.6% 58.6% 72.4% 66.2% 64.9% 62.5% 61.4% 61.1% 59.0% 57.5% 61.6% Bank of Marin Bancorp Peer Group Median 2015 2016 2017 2018 2019 2020 Q1'21 Q2'21 Q3'21 50.0% 55.0% 60.0% 65.0% 70.0% 75.0% Bank of Napa American River (Non-GAAP 57.8% 2) (Non-GAAP 56.0% 2)

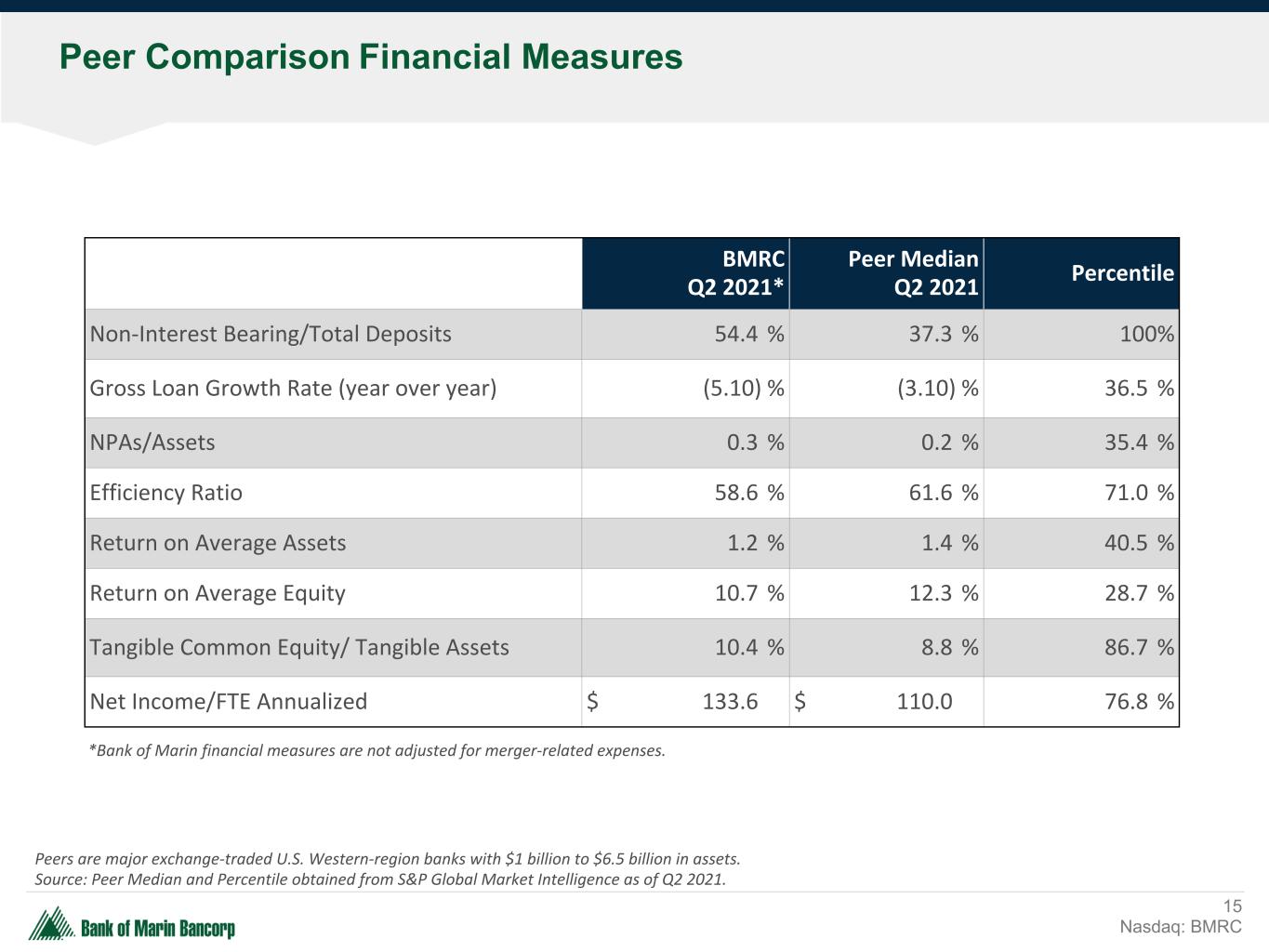

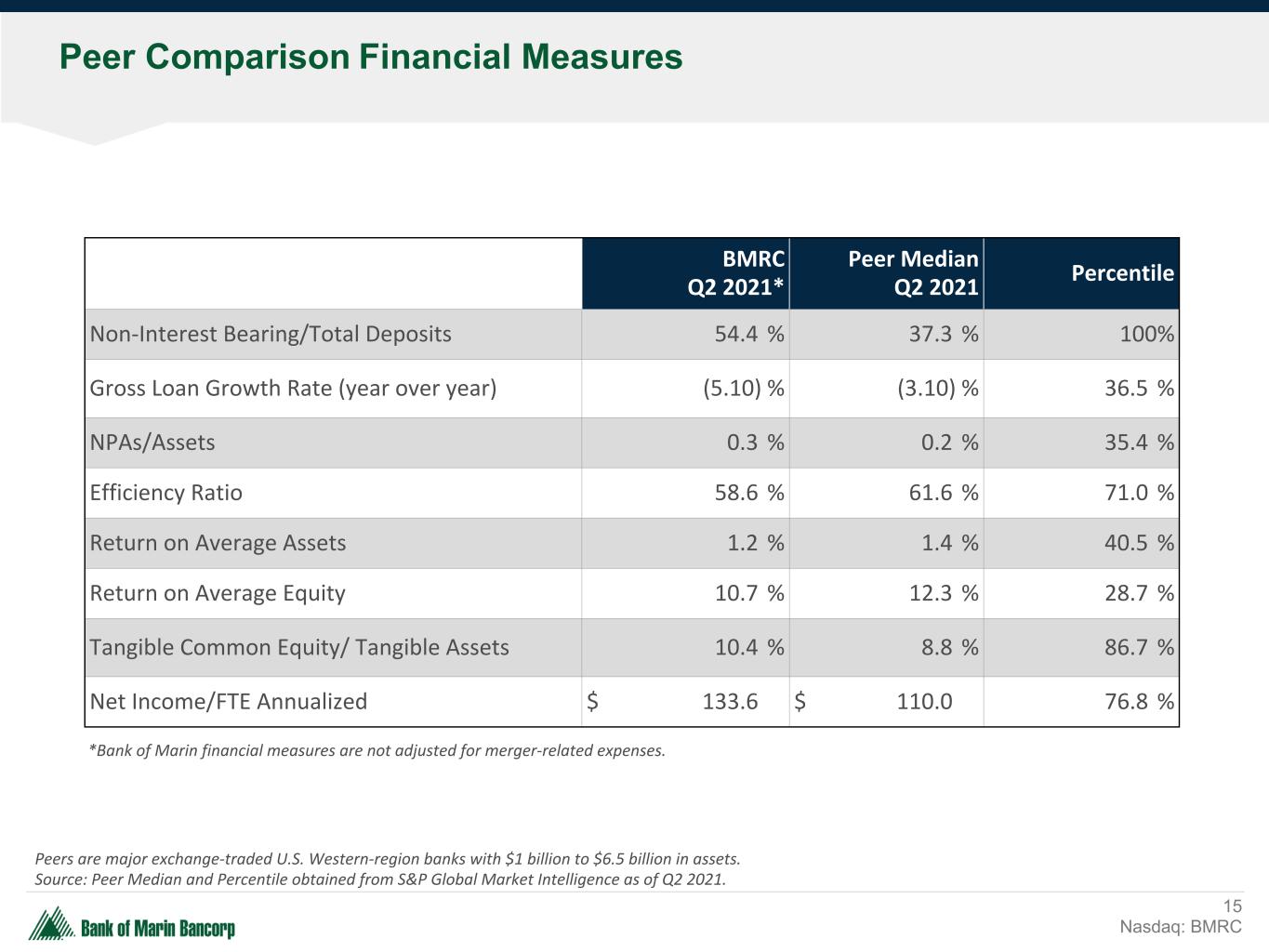

Peer Comparison Financial Measures 15 Nasdaq: BMRC BMRC Q2 2021* Peer Median Q2 2021 Percentile Non-Interest Bearing/Total Deposits 54.4 % 37.3 % 100% Gross Loan Growth Rate (year over year) (5.10) % (3.10) % 36.5 % NPAs/Assets 0.3 % 0.2 % 35.4 % Efficiency Ratio 58.6 % 61.6 % 71.0 % Return on Average Assets 1.2 % 1.4 % 40.5 % Return on Average Equity 10.7 % 12.3 % 28.7 % Tangible Common Equity/ Tangible Assets 10.4 % 8.8 % 86.7 % Net Income/FTE Annualized $ 133.6 $ 110.0 76.8 % Peers are major exchange-traded U.S. Western-region banks with $1 billion to $6.5 billion in assets. Source: Peer Median and Percentile obtained from S&P Global Market Intelligence as of Q2 2021. *Bank of Marin financial measures are not adjusted for merger-related expenses.

AMRB Acquisition Status Update 16 Nasdaq: BMRC The legacy teams from Bank of Marin and American River Bank are aligned and working together toward full conversion in Spring 2022. Currently in progress: • Team, culture and process integrations and alignments • Executive visits with legacy American River Bank clients • Greater Sacramento community engagement through support of local nonprofit events • Preparations for the core systems conversion in Q1 2022

Bank of Marin’s Strategic Evolution 17 Nasdaq: BMRC • Capitalize on resilient San Francisco Bay Area economy and the growth opportunity in new markets: Walnut Creek, Peninsula/South Bay and Greater Sacramento • Continue to expand commercial lending in high-growth regions • Further build our deposit base, among the lowest-cost franchises in the country • Continue to invest in people and infrastructure throughout our footprint, with a focus on greater operational efficiencies. • Focus M&A strategy on expanding market presence in high-growth regions • Record of accretive acquisitions in 2011, 2013, 2017 and 2021; support future acquisitions and organic growth with strong capital base

Contact Us 18 Nasdaq: BMRC Tim Myers President & Chief Executive Officer (415) 763-4970 timmyers@bankofmarin.com Tani Girton EVP, Chief Financial Officer (415) 884-7781 tanigirton@bankofmarin.com Media Requests: Andrea Henderson Director of Marketing (415) 884-4757 andreahenderson@bankofmarin.com