KBW Community Bank Investor Conference August 8 - 9, 2023

2 Nasdaq: BMRC Forward-Looking Statements This discussion of financial results includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, (the "1933 Act") and Section 21E of the Securities Exchange Act of 1934, as amended, (the "1934 Act"). Those sections of the 1933 Act and 1934 Act provide a "safe harbor" for forward-looking statements to encourage companies to provide prospective information about their financial performance so long as they provide meaningful, cautionary statements identifying important factors that could cause actual results to differ significantly from projected results. Our forward-looking statements include descriptions of plans or objectives of management for future operations, products or services, and forecasts of revenues, earnings or other measures of economic performance. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. They often include the words "believe," "expect," "intend," "estimate" or words of similar meaning, or future or conditional verbs preceded by "will," "would," "should," "could" or "may." Forward-looking statements are based on management's current expectations regarding economic, legislative, and regulatory issues that may affect our earnings in future periods. Factors that could cause future results to vary materially from current management expectations include, but are not limited to, general economic conditions and the economic uncertainty in the United States and abroad, including economic or other disruptions to financial markets caused by acts of terrorism, war or other conflicts such as Russia's military action in Ukraine, impacts from inflation, supply change disruptions, changes in interest rates (including the actions taken by the Federal Reserve to control inflation), California's unemployment rate, deposit flows, real estate values, and expected future cash flows on loans and securities; costs or effects of acquisitions; competition; changes in accounting principles, policies or guidelines; changes in legislation or regulation; natural disasters (such as wildfires and earthquakes in our area); adverse weather conditions; interruptions of utility service in our markets for sustained periods; and other economic, competitive, governmental, regulatory and technological factors (including external fraud and cybersecurity threats) affecting our operations, pricing, products and services; and successful integration of acquisitions. Important factors that could cause results or performance to materially differ from those expressed in our prior forward-looking statements are detailed in ITEM 1A, Risk Factors section of our December 31, 2022 Form 10-K as filed with the SEC, copies of which are available from us at no charge. Forward-looking statements speak only as of the date they are made. Bancorp undertakes no obligation to release publicly the result of any revisions to these forward-looking statements that may be made to reflect events or circumstances after the date of this press release or to reflect the occurrence of unanticipated events. GAAP to Non-GAAP Financial Measures This presentation includes some non-GAAP financial measures as shown in the Appendix of this presentation. Please refer to the reconciliation of GAAP to Non-GAAP financial measures included on page 5 and 6 of our Form 8-K under Item 9 - Financial Statements and Exhibit 99.1 filed with the SEC on July 24, 2023.

Second Quarter 2023 Highlights 3 Nasdaq: BMRC Earnings and Profitability • Net Income of $4.6 million • Diluted EPS of $0.28 • Return on Average Assets of 0.44% • Return on Average Equity of 4.25% Key Operating Trends Loans and Credit Quality Deposits and Liquidity Capital • Tax-equivalent NIM of 2.45% • Tax-equivalent yield on interest-earning assets of 3.51%, up 2 bps from 1Q23 • Interest-bearing liabilities costs of 2.09%, up 114 bps from 1Q23 • Stable non-interest expense • Total portfolio loan balances decreased 0.4% from 1Q23 • Classified and non-accrual loans of only 1.81% and 0.10%, respectively • Reported NOO-CRE office portfolio average LTV and DCR were unchanged • Total deposits increased 2% from 1Q23, due to proactive prospect and customer outreach • Non-interest bearing deposits represent 48% of total deposits • Insured deposits estimated to represent 71% of total deposits • Strong liquidity provides 209% coverage of estimated uninsured deposits • Cash and unencumbered investment securities of $778.2 million • Other immediately available contingent funding of $1.2 billion • Bancorp total risk-based capital of 16.4% • Bancorp TCE / TA of 8.6%, 6.7% when adjusted for HTM securities 1 1See Reconciliation of Non-GAAP Financial Measures in the Appendix

Actions and Results Subsequent to Second Quarter through July 31st 4 Nasdaq: BMRC Deposits Borrowings and Liquidity Interest Rate Risk Investment Securities Loans and Credit Quality • Cash increased $82 million to $122 million • Borrowings down another $92 million to $200 million with excess cash, mostly from the post- quarter-end sale of AFS securities, available for further reductions • Net improvement in liquidity of $175 million • Entered into $102 million pay fixed, receive floating interest rate swaps split between 2.5 and 3 year terms • Fair value hedge of AFS securities increases asset sensitivity and reduces market value risk • Sold $83 million AFS securities and offset losses of $2.8 million with a $2.8 million gain on the sale of VISA Class B shares • Settlement proceeds retained on balance sheet • Improves net interest margin and capital and liquidity ratios • Reduces market value/tangible capital sensitivity to interest rate increases • Increased AFS portfolio duration from 3.8 to 4.0 • Sold only other real estate owned property at a slight gain 1See Reconciliation of Non-GAAP Financial Measures in the Appendix • Deposits up $69 million and less than $80 million below balance immediately preceding 1st quarter bank failures and resulting industry disruption • At over 48% as of July 31st, we have successfully maintained high non-interest bearing deposit balances consistent with pre-pandemic levels and despite market and industry turbulence • Cost of deposits for the month of July was 0.88%

Strong Deposit Franchise 5 Nasdaq: BMRC • Total deposits increased $74.6 million, or 2.3%, compared to March 31, 2023 • Deposit mix continues to favor a high percentage of non-interest bearing deposits • Total cost of deposits of 0.69% (interest-bearing 1.37%) for the quarter and 0.82% (interest-bearing 1.60%) for the month of June • Time deposit balances grew $59MM in Q2 with the total time deposit portfolio average maturity of approximately 11 months and an average rate of 2.18% NIB DDA 47.8% Money Markets 30.9% Savings 8.3% IB DDA 6.9% Time Deposits 6.1% Total Deposit Mix ($3.33B) at 2Q23 NIB DDA 50.3% Money Markets 28.0% Savings 9.5% IB DDA 7.8% Time Deposits 4.4% Total Deposit Mix ($3.25B) at 1Q23 Total Deposit Mix ($3.44B) at July 18, 2023 NIB DDA 49.5% Money Markets 29.9% Savings 8.0% IB DDA 6.6% Time Deposits 6.0%

6 • Proactive outreach and relationship management continues to make us the Bank of choice with 1432 new accounts opened in the quarter (excludes new reciprocal accounts), bringing the YTD total to over 2400 new accounts. The Q2 portion is comprised 87% of interest-bearing accounts at a weighted average interest rate of 3.29%, and 13%, or $22MM, of non-interest-bearing deposits, for a combined rate of 2.84%. • Customer behaviors center around rate and/or FDIC insurance. Second quarter cost of deposits at 0.69%, reflected the first full quarter of higher deposit pricing. Our reciprocal deposit network program (expanded FDIC insurance products) utilization grew by $200.6MM in Q2. • Deposit pricing is stringently managed in the context of each relationship. We expect our cost of deposits to normalize moving forward. New Account Activity New Relationships 41% Existing Relationships - New $ 24% Existing Relationships - Internal $ Movement 35% 1,432 New Accounts Mix (by count) 2Q23

Strong Liquidity: $2.0 Billion in Net Availability 7 Nasdaq: BMRC At June 30, 2023 ($ in millions) Total Available Amount Used Net Availability Internal Sources Unrestricted Cash $ 16.7 $ — $ 16.7 Unencumbered Securities 761.5 — 761.5 External Sources FHLB 1,033.8 (292.2) 741.6 FRB 337.0 — 337.0 Contingent Lines at Correspondents 135.0 — 135.0 Total Liquidity $ 2,284.0 $ (292.2) $ 1,991.8 • The Bank has long-established minimum liquidity and diversification requirements using tools similar to large banks such as the Liquidity Coverage Ratio and multi-scenario, long-horizon stress testing • Deposit outflow assumptions for liquidity monitoring and stress testing are conservative relative to actual experience and have been reevaluated and updated subsequent to events of the first quarter • Markets and internal activity monitored daily for signs of systemic and idiosyncratic risk • Immediately available contingent funding represented 209% of 6/30/23 estimated uninsured deposits Note: Access to brokered deposit purchases through networks such as Intrafi and Reich & Tang and brokered CD sales not included above.

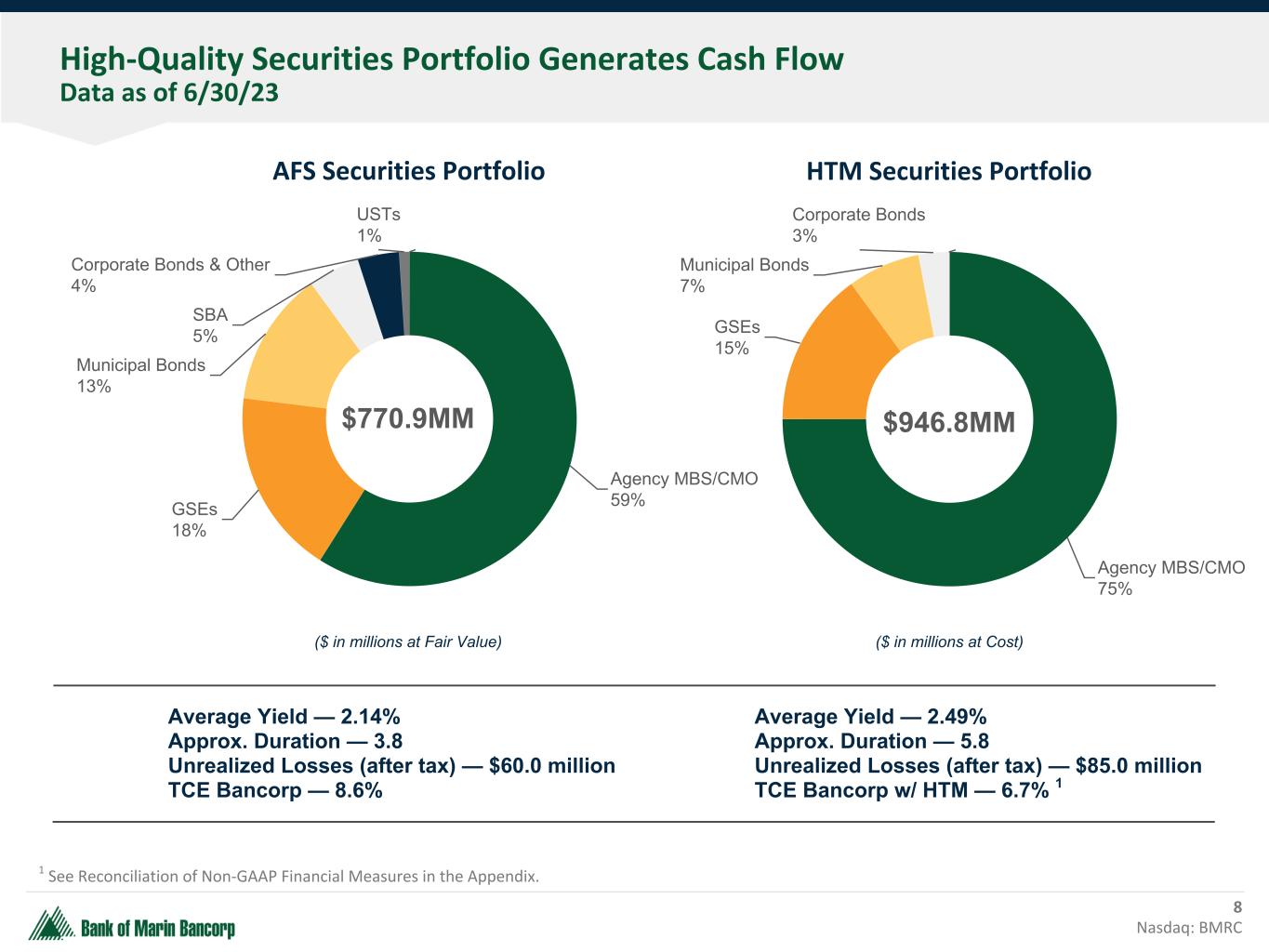

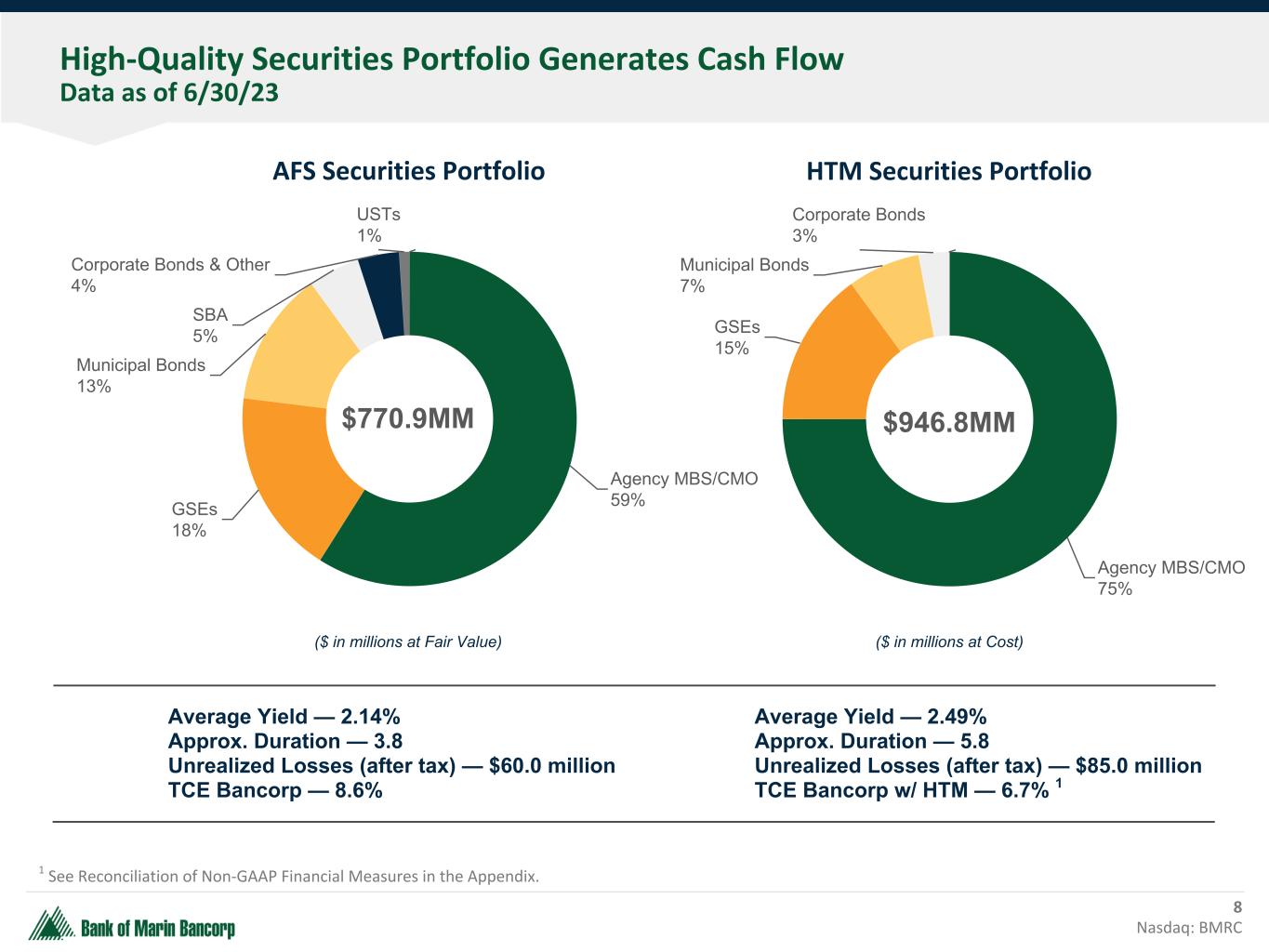

HTM Securities Portfolio Agency MBS/CMO 75% GSEs 15% Municipal Bonds 7% Corporate Bonds 3% AFS Securities Portfolio Agency MBS/CMO 59%GSEs 18% Municipal Bonds 13% SBA 5% Corporate Bonds & Other 4% USTs 1% High-Quality Securities Portfolio Generates Cash Flow Data as of 6/30/23 8 Nasdaq: BMRC $770.9MM $946.8MM Average Yield — 2.14% Approx. Duration — 3.8 Unrealized Losses (after tax) — $60.0 million TCE Bancorp — 8.6% Average Yield — 2.49% Approx. Duration — 5.8 Unrealized Losses (after tax) — $85.0 million TCE Bancorp w/ HTM — 6.7% 1 ($ in millions at Fair Value) ($ in millions at Cost) 1 See Reconciliation of Non-GAAP Financial Measures in the Appendix.

Well-diversified Loan Portfolio As of 6/30/23 - No material changes to Q1 2023 9 Nasdaq: BMRC • The loan portfolio is well-diversified across borrowers, industries, loan and property types within our geographic footprint — 93% of loans are guaranteed by borrower guarantors • Non-owner occupied commercial real estate ("NOO-CRE") is well-diversified by property type with 89% of loans being guaranteed by borrower guarantors • Since 2001, net charge-offs for all NOO-CRE total $1.2 million. • Construction loans represent a small portion of the overall portfolio OO-CRE 16% C&I 9% Consumer 13% Construction 5% NOO-CRE 57% Office 31% Mixed Use 7% Retail 20% Warehouse & Industrial 12% Multi-Family 13% Other, 17% 2Q23 Total Loans 2Q23 Total NOO-CRE Loans $2.1B $1.2B

Non-owner Occupied Office Exposure As of 6/30/23 - No material changes to Q1 2023 10 Nasdaq: BMRC • $366 million in exposure spread across our 10-county footprint comprised of 142 loans • $2.6 million average loan balance – largest loan at $17.1 million • 55% average loan-to-value and 1.67x average debt-service coverage ratio* • City of San Francisco NOO-CRE office exposure is 3% of total loan portfolio and 6% of total NOO-CRE loans Marin, 26% Sonoma, 14% San Francisco, 19% Alameda, 7% Sacramento, 6% Napa, 10% Other Bay Area, 14% Other, 4% NOO-CRE Office Portfolio by County City of S.F. NOO-CRE Office Portfolio Total Balance: $71.4 million Average Loan Bal: $6.5 million Number of Loans: 11 loans Average LTV*: 63% Average DCR: 1.20x Average Occupancy: 85% 10 of the 11 properties are low rise buildings, the other is 10 stories. $366MM *Based on the most recent annual review process

NOO-CRE Portfolio Diversified Across Property Types & Geographies As of 6/30/23 - No material changes to Q1 2023 11 Nasdaq: BMRC Retail as of 2Q23 Warehouse & Industrial as of 2Q23 Multi-Family as of 2Q23 Marin, 18% Sonoma, 16% San Francisco, 3% Alameda, 8% Sacramento, 14% Napa, 18% Other Bay Area, 13% Other, 10% Marin, 15% Sonoma, 15% San Francisco, 25% Alameda, 15% Sacramento, 4% Napa, 6% Other Bay Area, 4% Other, 16% Marin, 11% Sonoma, 27% San Francisco, 11% Alameda, 18% Sacramento, 17% Napa, 3% Other Bay Area, 4% Other, 9% $235MM $152MM $144MM Avg. Loan Bal: $2.1MM Largest Bal: $15.1MM # of Loans: 70 Avg. LTV*: 43% Avg. Loan Bal: $1.5MM Largest Bal: $12.1MM # of Loans: 104 Avg. LTV*: 49% Avg. Loan Bal: $1.8MM Largest Bal: $14.3MM # of Loans: 132 Avg. LTV*: 44% *Loan-to-value at origination.

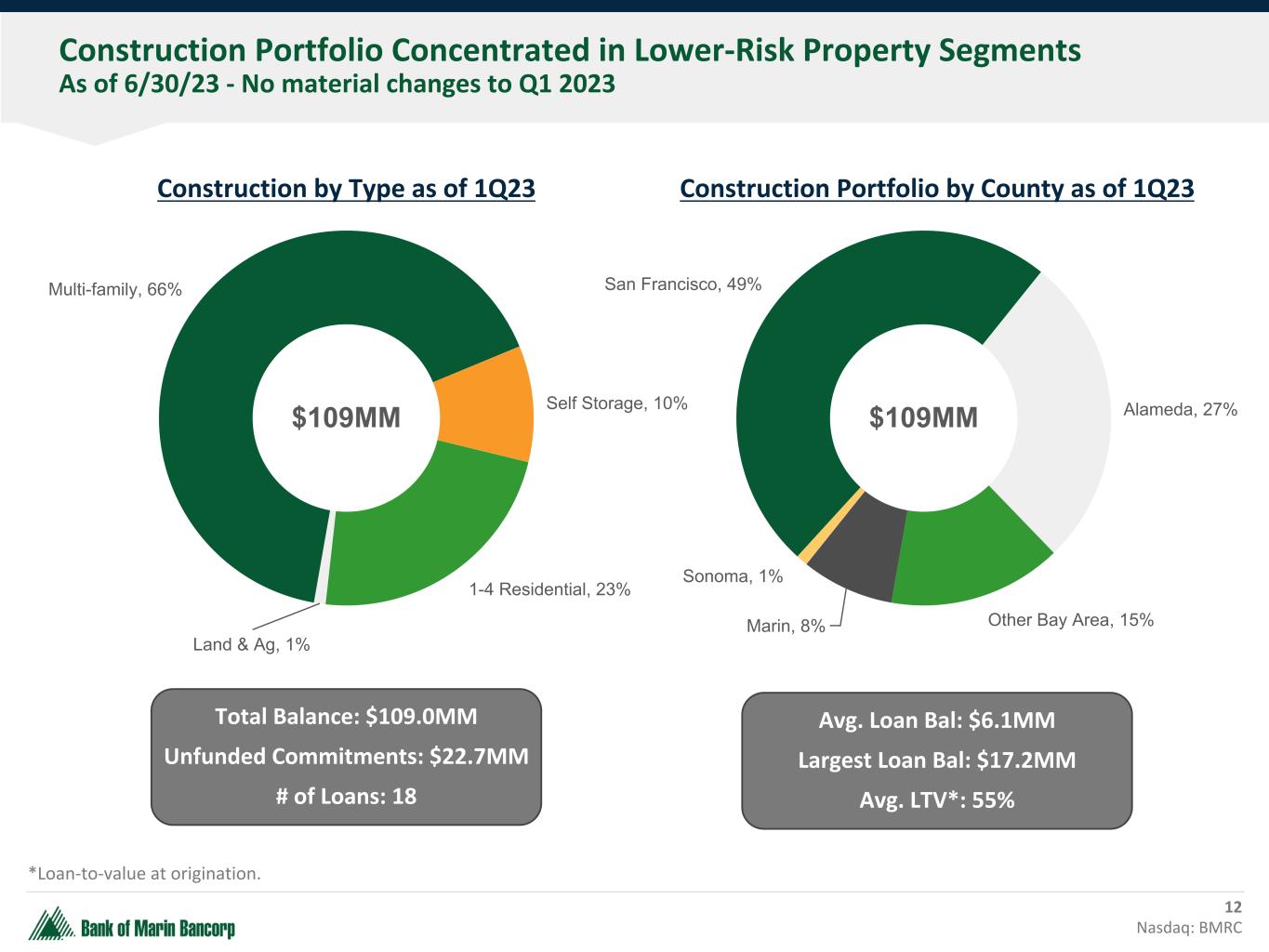

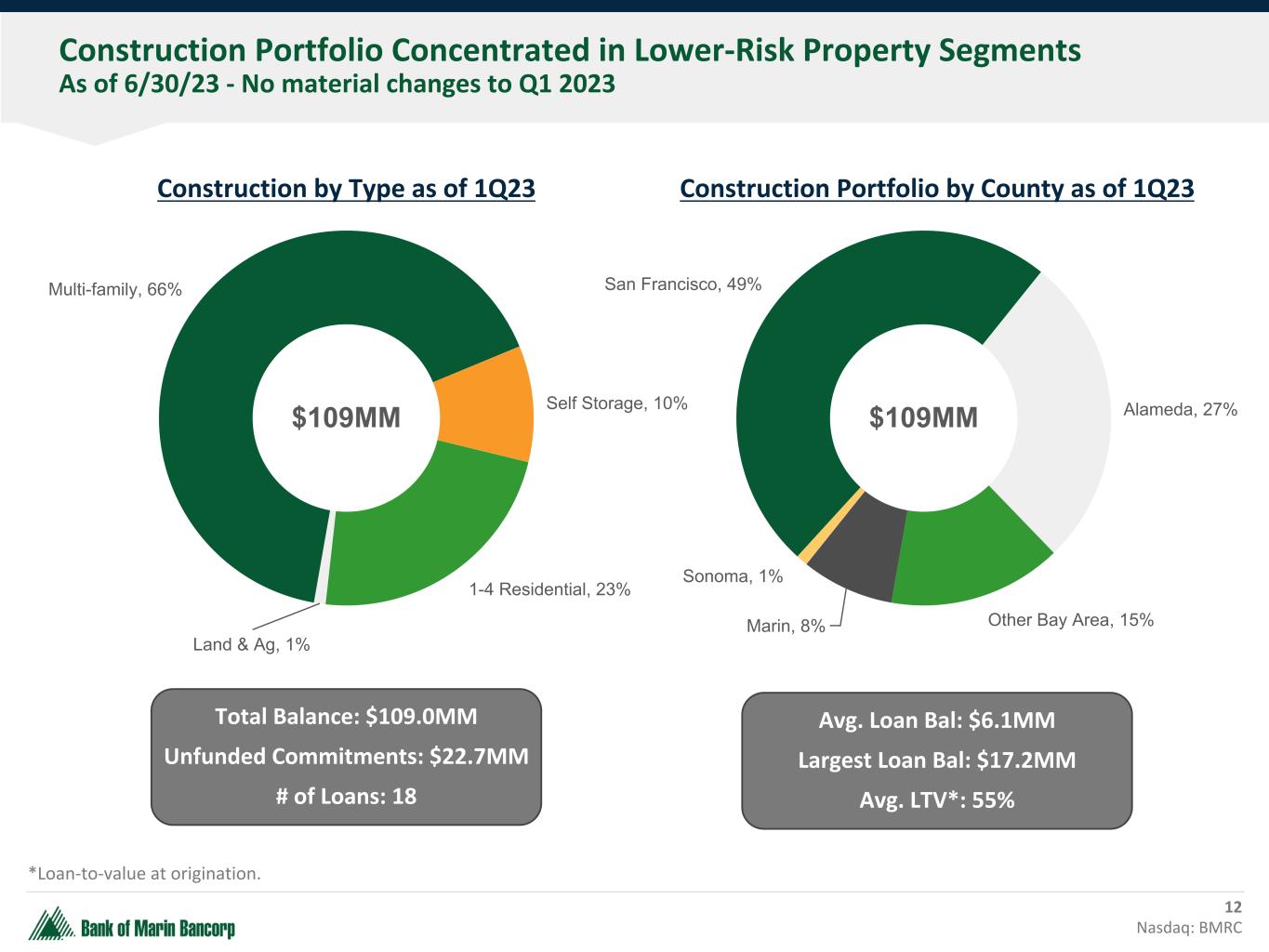

Construction Portfolio Concentrated in Lower-Risk Property Segments As of 6/30/23 - No material changes to Q1 2023 12 Nasdaq: BMRC Marin, 8% Sonoma, 1% San Francisco, 49% Alameda, 27% Other Bay Area, 15% Construction by Type as of 1Q23 Construction Portfolio by County as of 1Q23 Multi-family, 66% Self Storage, 10% 1-4 Residential, 23% Land & Ag, 1% Total Balance: $109.0MM Unfunded Commitments: $22.7MM # of Loans: 18 Avg. Loan Bal: $6.1MM Largest Loan Bal: $17.2MM Avg. LTV*: 55% *Loan-to-value at origination. $109MM $109MM

History of Excellent Asset Quality 13 Nasdaq: BMRC • Consistent, robust credit culture and underwriting principles have supported excellent asset quality • Non-accrual loans continue to remain at historically low levels • Net charge-offs have consistently been negligible for the last five years. • Adequate reserves with allowance for credit losses to total loans of 1.13% Non-accrual Loans / Total Loans 0.01% 0.44% 0.37% 0.12% 0.10% 2019 2020 2021 2022 2Q23 Non-accrual Loans / Total Loans Quarterly Progression 0.49% 0.12% 0.10% 0.10% 3Q22 4Q22 1Q23 2Q23

Robust Capital Ratios as of 6/30/23 14 Nasdaq: BMRC 6.5% 8.0% 10.0% 5.0% 15.5% 15.5% 16.4% 10.1% 8.6% 6.7% Well Capitalized Threshold Bank of Marin Bancorp Bancorp TCE adj. for HTM securities* Common Equity Tier-One Risk-Based Capital Total Tier-One Risk-Based Capital Total Risk-Based Capital Tier-One Leverage Tangible Common Equity *See Reconciliation of Non-GAAP Financial Measures in the Appendix.

Net Interest Margin Drivers 15 Nasdaq: BMRC • Linked-quarter NIM decreased 59 bps, due primarily to higher deposit costs and borrowing balances, partially offset by higher loan yields. • The cost of deposits increased to 82 basis points in the month of June compared to 40 basis points in March 2023. • Our increase in deposit rates has lagged the general market, which benefited our NIM by approximately 40 bps in the first quarter. • The current cycle beta of 27% on non-maturity, interest-bearing deposits compares to our interest rate risk modeling assumption of 35%, which is doubled for stress testing. 0.14% 0.08% 0.14% 0.17% 0.16% 0.17% 0.20% 0.23% 0.83% 1.15% 1.36% 1.60%1.68% 2.33% 2.56% 3.08% 3.78% 4.10% 4.33% 4.57% 4.65% 4.83% 5.05% 5.08% IB Deposits Fed Funds 7-22 8-22 9-22 10-22 11-22 12-22 1-23 2-23 3-23 4-23 5-23 6-23 3.04% 0.03% —% (0.01)% (0.40)% (0.21)% 2.45% 1Q23 Loans Securities Cash Deposits Borrowings 2Q23 Net Interest Margin Linked-Quarter Change Average Monthly Cost of IB Deposits vs. Fed Funds

Appendix

Reconciliation of GAAP to Non-GAAP Financial Measures 17 Nasdaq: BMRC (in thousands, unaudited) June 30, 2023 Tangible Common Equity - Bancorp Total stockholders' equity $ 423,941 Goodwill and core deposit intangible (77,185) Total TCE a 346,756 Unrealized losses on HTM securities, net of tax (85,046) TCE, net of unrealized losses on HTM securities (non-GAAP) b $ 261,710 Total assets $ 4,092,133 Goodwill and core deposit intangible (77,185) Total tangible assets d 4,014,948 Unrealized losses on HTM securities, net of tax (85,046) Total tangible assets, net of unrealized losses on HTM securities (non-GAAP) e $ 3,929,902 Bancorp TCE ratio a / d 8.6 % Bancorp TCE ratio, net of unrealized losses on HTM securities (non-GAAP) b / e 6.7 % For further discussion about our non-GAAP financial measures, refer to page 5 and 6 of our Form 8-K under Item 9 - Financial Statements and Exhibit 99.1 filed with the SEC on July 24, 2023.