Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended: December 31, 2008

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number: 001-33816

HECKMANN CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware | 26-0287117 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

| 75080 Frank Sinatra Drive | ||

| Palm Desert, CA | 92211 | |

| (Address of principal executive offices) | (Zip Code) | |

(760) 341-3606

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered | |

Units | New York Stock Exchange | |

Common Stock, $0.001 par value | New York Stock Exchange | |

Common Stock Purchase Warrants | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Exchange Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the Company is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | Accelerated filer x | |||

| Non-accelerated filer ¨ | (Do not check if a smaller reporting company) | Smaller reporting company ¨ |

Indicate by check mark whether the Company is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of June 30, 2008, the aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant was $484,868,608 based on the closing sale price as reported on the New York Stock Exchange. Shares held by executive officers, directors and persons owning directly or indirectly more than 10% of the outstanding common stock have been excluded from the preceding number because such persons may be deemed to be affiliates of the registrant. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

The number of shares outstanding of the registrant’s common stock as of March 13, 2009 was 110,074,223.

Documents Incorporated by Reference

Portions of the registrant’s Proxy Statement for the 2009 Annual Meeting of Stockholders to be held on May 6, 2009 are incorporated by reference into Part III, Items 10-13 of this Annual Report on Form 10-K.

Table of Contents

HECKMANN CORPORATION

| Page | ||||

Item 1. | 2 | |||

Item 1A. | 15 | |||

Item 1B. | 27 | |||

Item 2. | 27 | |||

Item 3. | 28 | |||

Item 4. | 28 | |||

Item 5. | 29 | |||

Item 6. | 31 | |||

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 33 | ||

Item 7A. | 43 | |||

Item 8. | 44 | |||

Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosures | 44 | ||

Item 9A. | 44 | |||

Item 9B. | 46 | |||

Item 10. | 47 | |||

Item 11. | 47 | |||

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 47 | ||

Item 13. | Certain Relationships and Related Transactions, and Director Independence | 47 | ||

Item 14. | 47 | |||

Item 15. | 48 | |||

| 49 | ||||

Table of Contents

HECKMANN CORPORATION

Certain Terms

In this Annual Report on Form 10-K, unless the context indicates otherwise, the terms “the Company,” “we,” “us” and “our” refer to the combined company, which is Heckmann Corporation and its subsidiaries, including China Water and Drinks, Inc. and its affiliated entities (“China Water”), which we acquired by means of a merger and reorganization transaction completed on October 30, 2008.

Forward-Looking Statements

This Annual Report contains statements that are forward-looking and, as such, are not historical facts. Rather, these statements constitute projections, forecasts and forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are not guarantees of performance. They involve known and unknown risks, uncertainties, assumptions and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by these statements. Such statements can be identified by the fact that they do not relate strictly to historical or current facts. These statements use words such as “believe,” “expect,” “should,” “strive,” “plan,” “intend,” “estimate,” “anticipate” or similar expressions. When the Company discusses its strategies or plans, it is making projections, forecasts or forward-looking statements. Actual results and stockholders’ value will be affected by a variety of risks and factors, including, without limitation, the recent crisis in worldwide financial markets, international, national and local economic conditions, merger, acquisition and business combination risks, financing risks, geo-political risks, and acts of terror or war. Many of the risks and factors that will determine these results and stockholder values are beyond the Company’s ability to control or predict. These statements are necessarily based upon various assumptions involving judgment with respect to the future. You should carefully read the risk factor disclosure contained in “Item 1A. Risk Factors” of this Annual Report, where many of the important factors currently known to management that could cause actual results to differ materially from those in our forward-looking statements are discussed.

All such forward-looking statements speak only as of the date of this Annual Report. The Company is under no obligation to, nor does it intend to, release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in the Company’s expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based.

Periodic Reporting and Financial Information

Our units, common stock and warrants are registered under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and each are listed and trade on the New York Stock Exchange (“NYSE”) under the symbols HEK.U, HEK, and HEK.WS, respectively. We have compliance and reporting obligations, including the requirement that we file annual and quarterly reports with the Securities and Exchange Commission (“SEC”), and comply with the NYSE listing policies and procedures. In accordance with the requirements of the Exchange Act, this Annual Report contains financial statements audited and reported on by our independent registered public accounting firm.

1

Table of Contents

Where You Can Find Additional Information About Us

You may read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at (202) 551-8090. The SEC maintains an internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC athttp://www.sec.gov. We also maintain an internet site athttp://www.heckmanncorp.com where you can find our filings with the SEC in the Investor Relations area of the site.

PART I

| Item 1. | Business |

Heckmann Corporation is a holding company that was created to acquire or make investments in attractive businesses. We completed our first investment, the acquisition of China Water & Drinks, Inc. (“China Water”), a bottled water company operating in the People’s Republic of China (“China”), on October 30, 2008. As of December 31, 2008, we had $330 million dollars in invested cash and cash equivalents on our balance sheet. We intend to make additional acquisitions as we find attractive long-term opportunities for our stockholders.

Headquartered in Palm Desert, California, the Company was incorporated in Delaware on May 29, 2007. We began our corporate existence as a blank check development stage company. On November 16, 2007, we completed an initial public offering (“IPO”) of 54,116,800 units (each consisting of one share of common stock and one warrant exercisable for an additional share of common stock), including 4,116,800 units issued pursuant to the partial exercise of the underwriters’ over-allotment option, and received net proceeds of approximately $421 million dollars. On the same date, we also completed a private placement of warrants to our founders at an aggregate purchase price of $7 million, or $1.00 per warrant.

On October 30, 2008, we completed the acquisition of China Water using a combination of cash and common stock for an aggregate purchase price of approximately $413 million dollars, which excludes 16,532,100 contingently returnable shares of common stock that were placed in escrow and contingent payments totaling $145.5 million.

2

Table of Contents

Our Corporate Structure

As of the date of this report, our ownership structure is as follows:

Our Current Business Operations

At the current time, our only business operations are those of our subsidiary China Water. Through China Water, we produce bottled water products at facilities in the cities of Beijing, Guangzhou (Guangdong Province), Changchun (Jilin Province), Feixian (Shandong Province), Nanning (Guangxi Province), Shenyang (Liaoning Province) and Changsha (Hunan Province).

Our production plants have two types of production lines: one type produces hand-held sized (330 milliliters to 1.5 liters) bottled water (“Small Bottles”) and the other produces carboy-sized (11.4 to 18.9 liters, or 3 to 5 gallons) bottled water (“Carboy Bottles”). We produce a variety of bottled water products including purified water, mineralized water and oxygenated water.

We market our bottled water products in China using the brand names “Darcunk” (which translates to “Absolutely Pure”) and “Grand Canyon.” We also supply bottled water products to beverage companies and servicing companies, including subcontractors of Coca-Cola located in China, which we collectively refer to herein as “Coca-Cola China,” as well as Uni-President and Jian Li Bao. In addition, we provide private label bottled products to companies in the service industry, such as hotels and casinos.

3

Table of Contents

From October 31, 2008, following the acquisition of China Water, to December 31, 2008, we produced a total volume of 107 million liters of purified drinking water. On a pro forma basis in 2008, we produced 1.0 billion liters of purified drinking water. We currently market and sell our bottled water products in multiple regions of China, including Beijing, Guangdong Province, Guangxi Province, Shandong Province, Heilongjiang Province, Jilin Province, Shanxi Province, Shaanxi Province, Gansu Province, Liaoning Province, Anhui Province, Sichuan Province, Hebei Province, Hunan Province and Macau.

Recent Developments at our China Water subsidiary

During the first quarter of 2009, China Water expanded its relationship with Coca-Cola China by entering into a commercial supply agreement to produce and supply assorted fruit juices in Shanxi Province, China. This is our first move beyond bottled water products and into other non-carbonated beverage production. We have also reached an agreement in principle with Coca-Cola China to expand this supply arrangement to other provinces in midwest and southwest China.

Through our China Water subsidiary, we are in the process of completing the previously announced purchase of Harbin Taoda Drinks, Ltd. (“Harbin Taoda”), for $13.9 million in cash. Approximately $12.2 million of the cash purchase price has been paid through previous deposits. We expect to close this acquisition in April of 2009. Harbin Taoda operates a bottled water facility in Harbin, Heilongjiang Province, China. For 2009, Harbin Taoda’s estimated annual capacity through two production lines is 330 million Small Bottles and 3.4 million Carboy Bottles.

In October of 2008, we initiated a capacity rationalization plan involving the relocation of certain equipment from the Zhanjiang Taoda Drink Co. Ltd. (“Zhanjiang Taoda”) facility to the Nanning Taoda Drink Co. Ltd. (“Nanning Taoda”) and Guangdong Taoda Drink Co. Ltd. (“Guangdong Taoda”) facilities. This plan was completed during the first quarter of 2009. The remaining fixed assets at the Zhanjiang Taoda facility were sold for approximately $126,000. The Zhanjiang Taoda customer base and sales orders have been allocated to the Nanning Taoda and Guangdong Taoda operations.

4

Table of Contents

On March 14, 2009, J. John Cheng was promoted to chief executive officer of China Water. He had been serving as President of the Company’s China division. On March 13, 2009, the Company and Xu Hong Bin entered into an agreement, pursuant to which Mr. Xu resigned as chief executive officer and president of China Water and as a director of the Company. In connection with Mr. Xu’s resignation, the Company agreed to return to Mr. Xu 3,500,000 shares of our common stock he had placed in escrow to secure various representations, warranties and covenants made in connection with the acquisition of China Water. Under the terms of the agreement, Mr. Xu will return the remaining 13,032,100 shares in escrow to the Company in exchange for a cash payment of $14 million and termination of his escrow obligations.

The Bottled Water Industry

The Global Industry for Bottled Water. According to Zenith International, a consulting and market research firm, worldwide bottled water consumption increased by 6% to 206 billion liters in 2007. Between 2002 and 2007, the global bottled water industry enjoyed a 7.9% compound annual growth rate. Consumption per person reached 30.8 liters in 2007, an increase of 1.4 liters from 2006. Zenith International estimates that global bottled water consumption will increase to 272 billion liters in 2012. The United States and China are the two largest national markets. Asia/Australasia represents the largest regional market with an estimated 26.5% market share. Still water continues to outpace sparkling water by a wide margin.

The global bottled water market remains highly fragmented and controlled by local brands, but consolidation is occurring. We face competition from leading worldwide operators such as Nestlé S.A., Danone, Coca-Cola and PepsiCo, which had a combined 2006 market share of approximately 33% by volume.

We believe that the most significant trends in the bottled water industry are:

| • | consolidation of industry participants; |

| • | the increasing demand for bottled water in Asia and, particularly, in China; |

| • | the demand of consumers for less expensive brands of bottled water; |

| • | the introduction of nutrient-enriched bottled water products; and |

| • | the proliferation of flavored bottled waters. |

The Chinese Bottled Water Industry. China is facing a severe water crisis. According to the Department for International Development, an entity established by the United Kingdom government, China’s rapid economic growth has put significant stress on its natural resources, especially water. China has approximately 20% of global population, but only 7% of the water. Moreover, its per capita water resources are declining due to the impact of climate change and human activity. Compounding the lack of water resources, the State Environment Protection Administration of China estimated in 2007 that tap water in one-half of China’s major cities was polluted by industrial chemicals and agricultural fertilizers. In 2005, a senior Chinese government official estimated that 360 million people in China were without safe water supplies. Industrial wastewater treatment has not been established everywhere in China and this causes serious water pollution problems because a large amount of wastewater is discharged directly into water bodies. Safe drinking water is one of the government’s top priorities in China. Given the lack of wastewater treatment plants, we believe the drinking water issues will not be easily solved in the near future.

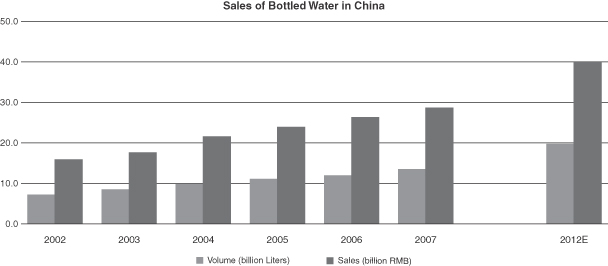

China’s bottled water industry started to grow as the quality of drinking water in China began to deteriorate and as individual Chinese purchasing power increased. According to a May 2008 report by Euromonitor International, a market research firm, Chinese bottled water sales increased from RMB16.2 billion ($2.0 billion based on the average exchange rate in 2002) in 2002 to approximately RMB28.6 billion ($3.8 billion based on the average exchange rate in 2007) in 2007, representing a compound annual growth rate of 12.1%. In China, consumption of bottled water has overtaken consumption of carbonated sweet drinks and China is one of the

5

Table of Contents

largest national markets for bottled water sales. Euromonitor International estimates that bottled water sales in China will reach RMB40.3 billion ($5.9 billion based on the average exchange rate in 2007) by 2012, at a projected compound annual growth rate of 7.1%.

| Source: Euromonitor | International, “Bottled Water in China,” May 2008. |

Although China is the fastest growing and represents one of the largest national markets for bottled water, consumption per person is still among the lowest in the world. According to Beverage Marketing Corporation, a consulting and market research firm China’s bottled water consumption per capita represents less than one-half of the global per capita average, and only 11% of the per capita average of the top 20 national markets by volume.

Source: Beverage Marketing Corporation and CIA World Fact Book.

According to AC Nielson, a market research firm, in 2008, the top three brands of bottled water in China (Tingyi Master Kong, Hangzhou Wahaha Group, and Nongfu Spring Co. Ltd.) accounted for approximately 50% of total market share. While the market is concentrated in several brands, there are several thousand other bottled

6

Table of Contents

water brands in China. Bottled still water accounted for approximately 99% of bottled water sales by volume in 2007 and showed the strongest growth as industry leaders extended their sales efforts to include third tier cities in China, as well as expanded their related distribution networks. Nevertheless, we believe that the distribution breadth of and penetration rates for most bottled water producers will remain limited due to comparatively high transportation costs, constricted geographical coverage, and limited production capacity.

In China, the competitive landscape is shaped by two layers of companies: branding companies and production companies. The first layer consists of those companies that have marketing, distribution and branding capabilities. The second layer consists of those companies that actually produce bottled water. Although some branding companies also build plants themselves, they still need production companies to address their production gaps and fill in the locations where their facilities do not cover. Because the China market is so large, we believe that no single branding company can cover all locations with their own plants.

Industry Trends in China’s Bottled Water Industry. In 2009, we believe that our water business in China will be influenced by the following factors:

| • | Growth and evolution of China’s bottled water industry. The bottled water industry in China is in a process of continuous growth, consolidation, and development. According to a May 2008 report by Euromonitor International, Chinese bottled water sales grew by 12.1% annually from 2002 to 2007, which represented the fastest national growth rate in bottled water consumption. With the growth in demand and addition of new industry participants offering new and varied bottled water products, the Chinese bottled water industry is poised for continued growth and consolidation. |

| • | Health consciousness of Chinese individuals. We believe that Chinese citizens are becoming increasingly health conscious. Given concerns with the quality and hygiene standards of available drinking water in China, we believe that consumers will increasingly purchase and consume bottled drinking water that has been purified and treated to afford consumers greater health benefits. |

| • | Consolidation in the industry. Although there are 3 leading brands in China, the rest of the market is fragmented and highly regionalized. This presents an opportunity for consolidation in the bottled water market. |

| • | Growing middle class in China. According to research by McKinsey Global Institute, a market research firm, by 2011, the middle class in China will number more than 350 million people, representing the largest segment in urban China and accounting for more than 50% of the urban population. This group is likely to possess increased spending power and a desire and ability to consume products, including bottled water. |

| • | Demand for greater product mix offerings. Consumers are demanding specialty bottled water products, such as flavored waters and nutrient-enriched water products. We believe that bottled water producers that have the resources to offer to consumers a variety of specialty water products will be industry leaders. |

Our Competitive Strengths in the Chinese Bottled Water Business

We believe that the following key competitive strengths enable us to compete effectively in the bottled water market in China:

| • | Strong Long-term Relationship with Well Known Global Brands. We have maintained stable and trusted long-term relationships with several globally recognized beverage companies and original equipment manufacturers involved in the bottled water production businesses in China, including Coca-Cola China, Uni-President and Jian Li Bao. Our relationship with Coca-Cola China dates back to 1996. As a sponsor of the 2008 Olympic Games in Beijing, Coca-Cola appears to have successfully expanded its sales and penetration rate in China and we have expanded our own production capacity in order to leverage and capitalize upon Coca-Cola’s business plans in China. |

7

Table of Contents

| • | Top Tier Production Capability and Quality Control. As a long-term supplier of Coca-Cola China and other well known beverage companies, we are required to comply with their production requirements and rigid quality control standards. We have implemented these high standards in all of our manufacturing facilities. Our plants are audited frequently by independent assessors for compliance with our customers’ procedures, quality control requirements and hygiene standards. |

| • | Production Cost Advantages. We believe that we enjoy production cost advantages due to a variety of factors. We have fully integrated production to minimize costs and maximize profitability. The majority of our production processes are standardized and fully automated, and we are upgrading our remaining production lines to full automation. We believe increased automation will increase production yields and efficiency as well as reduce labor costs and minimize the impact of any labor shortages. In addition, given our strong, long-term relationship with our vendors and suppliers of raw materials, we believe that we can continue to achieve production cost advantages. |

| • | Established Distribution Network. We sell the majority of our bottled water products through an extensive distribution network of local and regional distributors, which help us establish a presence in each regional market we serve. We have maintained a stable long-term relationship with the majority of our distributors. |

Strategy for our Bottled Water Business in China

We believe that our competitive strengths will enable us to participate in water industry markets throughout the world and take advantage of growth opportunities in China’s bottled water market. We are committed to enhancing our sales, profitability and cash flows through the following strategies:

| • | Growth opportunities through expansion and acquisitions. We are exploring growth through both new facility construction and acquisitions. For new construction opportunities, we target regions where adding plants and equipment can service new incremental demand. We also seek to acquire businesses that add value and fit sensibly into our model for a worldwide industrial enterprise. To complement our existing business, we seek to acquire additional bottled water production facilities, bottled water brands, and purification and treatment facilities. We believe that pursuing selective acquisitions at competitive valuations could help expand our production capacity, enhance our market competitiveness and expand our geographical coverage. We intend to leverage our production and operating expertise to enhance the production efficiency, yields and product quality at all future acquired facilities. Our recent expansions in 2008 increased our Small Bottle production capacity by over 75% to approximately 1.7 billion Small Bottles, and Carboy Bottle production capacity by 35% to 24.0 million Carboy Bottles, at the end of 2008. We believe that additional capacity in China could help enhance profit margins and increase market share for our bottled water products. |

| • | Capitalize on our brand recognition to increase sales of new and existing products. In China, we intend to leverage the favorable market recognition of our “Absolutely Pure” and “Grand Canyon” bottled water brands by expanding our product offerings. In 2008, we launched new super-oxygenated water products and we anticipate testing and launching additional new product offerings in 2009 and 2010. In addition, we are also making targeted investments in increased advertising and promotional activities to increase brand awareness. |

| • | Expand distribution channels for our own branded products. Our distribution network currently consists of over 70 major distributors across China. We intend to further expand our distribution network by establishing relationships with, and offering competitive programs to incentivize, additional distributors. |

8

Table of Contents

Our Products and Production Processes at our China Water subsidiary

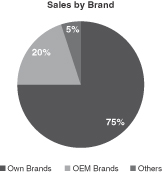

In China, our purified bottled water products are produced and marketed through a vertically integrated production and sales process that begins with the manufacturing and processing of raw materials and concludes with the sale of our bottled water end products through our broad distribution network. Our two main bottled water production lines produce Small Bottles ranging in size from 330 milliliters to 1.5 liter and Carboy Bottles ranging in size from 11.4 to 18.9 liters (3 to 5 gallons). During the two months ended December 31, 2008 and pro forma for the twelve months then ended, Small Bottles accounted for approximately 84% and 83%, respectively, of sales and Carboy Bottles accounted for approximately 11% and 16%, respectively. For the two months ended December 31, 2008 and pro forma for the twelve months then ended, the remaining 5% and 1%, respectively, of revenue was derived from the sale of pre-forms. Within these product lines, we bottle natural mineral water, spring water, purified water, and oxygenated water. Due to the scarcity of sources of natural mineral water and spring water, purified water is the most popular bottled water type in the China market. The following charts indicate the percentage of our sales during the two months ended December 31, 2008 and pro forma for the twelve months then ended that are derived from Small Bottles and Carboy Bottles, as well as the percentage derived from sales of our own branded products and from those of our OEM customers. For this purpose, we define “OEM” customers as those customers for which we provide private label services. In these relationships, the OEM customer provides its branded labels to us, which we affix to certain bottled water products and sell back to the customer.

Two Months Ended December 31, 2008

|  |

Pro Forma Basis for 2008

|  |

The initial stages of our production operations involve manufacturing the plastic containers in which our water is to be bottled and sourcing water from municipal water supplies or natural water collected from streams, lakes and wells. Before bottling, we process the water through a series of water purification and processing methods and procedures based on established governmental and industry standards and our customers’

9

Table of Contents

specifications. Clarification, pre-filtration, final filtration, ultra-violet radiation and sterilization are the most fundamental and necessary steps in processing water, but special treatment and additional processing, such as oxy-hydrating or water softening, may be required to meet water quality standards, customers’ specifications and differing product requirements. Once the water treatment and processing stage is completed, the water is bottled and undergoes the final stage of quality and hygiene check. The bottled water is then packaged and delivered.

All of the bottles we produce are PET (Polyethylene terephthalate)bottles which are well known for their high standard in the industry and superiority to traditional PVC (polyvinyl chloride) bottles and glass bottles because PET bottles are clearer, lightweight and durable with good resistance to heat and chemicals. We produce a wide range of bottles, with volumes ranging from 330 milliliters to 1.5 liters.

Our production process from manufacturing to end products is depicted below:

Our Sales Network of Distributors and Customers in China

In China, we market and sell our bottled water products to distributors that sell our bottled water products to end users under our own brands, and OEM customers, which include major global drink and beverage companies such as Coca-Cola China, Uni-President and Jian Li Bao, which usually sell our bottled water products under their brand or brands. For the two months ended December 31, 2008 and pro forma for the twelve months then ended, approximately 75% and 78%, respectively, of our revenue was derived from sales of our bottled water products to consumers directly under our own brands, 20% and 21%, respectively, of our revenue was derived from sales of our bottled water products to OEM customers such as Coca-Cola China, which represented the largest customer for our OEM sales. For the two months ended December 31, 2008 and pro forma for the twelve months then ended, the remaining 5% and 1%, respectively, of revenue was derived from the sale of pre-forms.

For certain customers in China, such as Coca-Cola China, we are one of the few bottled water suppliers that has been qualified to produce products from raw materials to end products. By virtue of our relationship with Coca-Cola China, we have been recognized as one of the leading bottled water suppliers in China. We also market to customers in the travel and hospitality industry, such as hotels, casinos and bus companies and provide

10

Table of Contents

total solutions from bottle design, production and packaging to delivery. In addition, we produce and sell bottled water directly under our brands “Absolutely Pure” and “Grand Canyon” and distribute our products through local distribution networks. With respect to the sales through distributors, we have established and maintained long-term relationships with major distributors who we believe have local business experience and established regional sales networks.

For the two months ended December 31, 2008 and pro forma for the twelve months then ended, distribution through our 5 largest distributors and customers accounted for approximately 42% and 48%, respectively, of our total sales as shown in the table below:

Top 5 Customers/Distributors | Pro forma % of 2008 sales | % of last 2 months sales | ||||

Coca Cola China (OEM) | 8 | % | 12 | % | ||

Rongsheng Logistics (distributor) | 19 | % | 10 | % | ||

Nanfong Fu Da (distributor) | 10 | % | 7 | % | ||

Bai Cun (distributor) | 5 | % | 7 | % | ||

Guilin Da Men Guan (distributor) | 6 | % | 6 | % |

Raw Materials and Principal Suppliers for our China Water Subsidiary

The main raw materials for our products are water, which is obtained from local municipal water system and streams, lakes and wells, and PET bottling materials, such as PET plastic materials and containers, caps, oil byproducts and packaging materials. PET bottling materials account for a significant percentage of our product costs and are subject to a high degree of price volatility caused by the supply and demand, as well the price, of oil. The following table lists our top five suppliers of raw materials, the nature of the raw materials supplied by each to us, and the percentage of our raw material costs represented by each supplier for the two months ended December 31, 2008 and pro forma for the twelve months then ended:

Top 5 Suppliers | Raw Material Supplied | Pro forma % of 2008 Purchases | % of last 2 Months’ Purchases | |||||

Shun De Rong Rui | Packaging | 13 | % | 17 | % | |||

Foshan Expanding Industry Trade | PET plastic material | 7 | % | 10 | % | |||

Shenzhen Nanbei Star | PET plastic material | 17 | % | 9 | % | |||

Teng Long Premium Resin | PET plastic material | 4 | % | 6 | % | |||

Foshan Mingmin | PET plastic material | 5 | % | 5 | % | |||

Percentage of total purchases from top five suppliers | 46 | % | 47 | % | ||||

Competition in China Markets

The bottled water industry in China is highly fragmented, consisting of several large Chinese and international competitors and a number of smaller local and regional manufacturers. We primarily compete with Chinese bottled water producers, including Hangzhou Wahaha Group, Nongfu Spring Company Ltd., and Guandong Robust Corp. In addition to local Chinese producers, we compete with global beverage companies and brands including Nestle S.A., the leading company in the global bottled water market, as well as Coca-Cola, C’est Bon, Danone, Tingyi Master Kong, and Uni-President. Many of these competitors have substantially greater resources than we have and pose significant competition to us. Nevertheless, we believe that we can compete effectively in our markets given the fragmentation of the market, the heavily regional aspect of bottled water in China, our strong brand recognition and established distributorships and customer relationships, and our strong balance sheet, which may allow us to seize on appropriately valued acquisition and new facilities manufacturing opportunities without accessing credit markets. We also believe that we can effectively compete based on price, quality and hygiene standards.

11

Table of Contents

Seasonality

Our sales in China are subject to seasonality factors. We typically experience higher sales of bottled water in the summer time in coastal cities while sales remain constant throughout the entire year in some inland cities. In general, our sales are higher in the second and third quarters of the year when the weather is hot and dry, and lower in the first and fourth quarters when the weather is cold and wet.

Sales can also fluctuate throughout the year for a number of other reasons, including the timing of advertising and promotional campaigns, and unforeseen circumstances, such as production interruptions.

Research and Development

We conduct on-going research and development activities relating to the improvement of our bottled water products and production facilities. In China, our primary research and development facilities are located in Guangzhou and are led by team has over 20 years of experience in the bottled water industry. Our research and development activities are focused primarily on maintaining and enhancing quality control measures for our bottled water products, creating new and better methodologies for turning natural spring water and other types of purified water into mineral water and enhancing our product mix through the development of oxygenated, flavored, and nutrient-enriched water.

Intellectual Property

In China, we sell our bottled water products primarily under the brand names “Absolutely Pure” and “Grand Canyon.” We maintain trademark registrations with the Trademark Office of the State Administration for Industry and Commerce of China for the “Absolutely Pure” and “Grand Canyon” names and logos. We rely on trade secrets laws and contractual agreements to protect our proprietary technology and processes. We currently do not own any patents and have not applied for patents on our proprietary technology or processes. We do not believe that such protection is necessary to protect our intellectual property rights and business interests.

Employees

As of December 31, 2008, we had 1,181 full-time employees, of which 175 were executive, sales, administrative and accounting staff, and 1,006 were manufacturing workers. We also hire temporary manufacturing workers to supplement our manufacturing capabilities at periods of high demand. None of our employees are under collective bargaining agreements. We believe that we maintain a satisfactory working relationship with our employees and we have not experienced any significant labor disputes or any difficulty in recruiting staff for our operations.

Government Regulation

Our China operations are heavily regulated. Like other bottled water manufacturers within China, we are subject to compliance with China’s food hygiene, tax, licensing, and environmental laws and regulations. In addition, acquisitions in China subject us to complicated Chinese regulations governing mergers and acquisitions of Chinese operating companies.

Food and Hygiene Regulatory System of China. We are subject to laws regulating the production, distribution and sale of bottled water in China, including the Food Hygiene Law of China and other laws and regulations relating to the hygiene and standardization of bottled water products in China.

The Food Hygiene Law sets out the hygiene standards for the production of bottled water, water additives, water packaging and containers, and the prescribed contents of water packaging labels. It also stipulates hygiene requirements in respect of premises, facilities and equipment for the production, transport and sale of bottled water.

China’s Ministry of Health is responsible for the regulation and supervision of bottled water hygiene in China. The Food Hygiene Law requires all enterprises proposing to be involved in bottled water production and

12

Table of Contents

processing to obtain a hygiene license from the relevant local department of the Ministry of Health before they can register their enterprise with the relevant Local Administration for Industry and Commerce, which is responsible for issuing business licenses. Enterprises cannot begin bottled water production and processing activities without first obtaining a hygiene license.

If an enterprise fails to comply with the Food Hygiene Law, the Ministry of Health may issue a warning notice or rectification order, confiscate the proceeds earned as a result of the unlawful behavior, impose a fine, order the enterprise to cease production and operation, recall and destroy the bottled water products already sold, or revoke the enterprise’s hygiene license. In more extreme cases where harm is caused to human health, criminal proceedings may be initiated against the enterprise and its management.

China Tax Regulations. Our subsidiaries incorporated in China are all foreign-invested enterprises and, as such, face tax assessments and regulation by the government of China. The rate of income tax chargeable on companies in China varies depending on the availability of preferential tax treatment or subsidies based on industry or location. Previously, a foreign-invested enterprise was entitled to enjoy preferential enterprise income tax treatment in China. A full exemption from China’s enterprise income tax applied in the first and second profitable years and a 50% exemption applied in the third, fourth and fifth years. However, on March 16, 2007, China’s National People’s Congress passed a new corporate income tax law, effective on January 1, 2008, which unifies the corporate income tax rate, cost deduction and tax incentive policies for both domestic and foreign-invested enterprises. The new corporate income tax rate applicable to all enterprises in China is 25%. However, the new corporate income tax law grants a five-year grandfathering period for a foreign-invested enterprise incorporated before March 16, 2007. Therefore, the applicable corporate income tax rate of our China operations will gradually move up to a rate of 25% over a five-year grandfather period.

Regulation by the Chinese Administration of Production Licenses for Industrial Products. China’s Administration of Production Licenses for Industrial Products requires us to maintain a production license for manufacturing bottled water products. Spot tests and product inspection, as well as periodic supervisory inspections are conducted. To date, we have passed spot tests and product inspections, but have yet to be selected for any supervisory inspections.

Environmental Protection Law of China. The Environmental Protection Law of China, promulgated in 1989, establishes a basic legal framework for environmental protection in China. The purposes of the Environmental Protection Law are to protect and enhance the living environment, prevent and cure pollution and other public hazards, and safeguard human health. The State Environment Protection Administration is responsible for the overall supervision and administration of environmental protection work at the national level and the environmental protection bureaus at the county level are responsible for environmental protection in their respective jurisdictions.

Government authorities can impose various types of penalties on persons or enterprises who are in violation of the Environmental Protection Law depending on the circumstances and extent of pollution. Penalties can include issuing a warning notice, imposing fines, setting a time limit for rectification, suspending production, ordering, reinstallation and operation of environmental protection facilities that have been dismantled or left unused, imposing administrative sanctions against management in charge, or ordering the termination and closure of enterprises or institutions conducting such operations. In cases where the pollution causes physical damage, compensation may be paid to victims. In serious cases, those who are directly responsible may be subject to criminal liability.

In accordance with the Environmental Protection Law, we have completed the required environmental assessments and our environmental assessment reports have been approved by the local environmental administration. Also, we have installed the necessary environmental protection equipment, adopted advanced environmental protection technologies, established responsibility systems for environmental protection, and reported to and registered with the relevant local environmental protection departments. We believe we are in material compliance with relevant environmental laws and regulations.

13

Table of Contents

Chinese Regulation of Merger and Acquisition Activities. On August 8, 2006, six Chinese regulatory agencies, including the China Securities Regulatory Commission, promulgated the Regulation on Mergers and Acquisitions of Domestic Companies by Foreign Investors, which became effective on September 8, 2006. This new regulation, among other things, governs the approval process by which a Chinese company may participate in an acquisition of assets or equity interests. Depending on the structure of the transaction, the new regulation will require the Chinese parties to make a series of applications and supplemental applications to the government agencies. In some instances, the application process may require the presentation of economic data concerning a transaction, including appraisals of the target business and evaluations of the acquirer, which are designed to allow the government to assess the transaction. Government approvals will have expiration dates by which a transaction must be completed and reported to the government agencies. Compliance with the new regulations is likely to be more time consuming and expensive than in the past and the government can now exert more control over the combination of two businesses. Accordingly, due to the new regulation, our ability to engage in business combination transactions in China has become significantly more complicated, time consuming and expensive, and we may not be able to negotiate a transaction that is acceptable to us or sufficiently protective of our interests in a transaction.

In October 2005, China’s State Administration of Foreign Exchange, or SAFE, issued the Notice on Relevant Issues in the Foreign Exchange Control over Financing and Return Investment Through Special Purpose Companies by Residents Inside China, generally referred to as Circular 75. Circular 75 requires Chinese residents to register with an applicable branch of SAFE before establishing or acquiring control over an offshore special purpose company for the purpose of engaging in an equity financing outside of China that is supported by domestic Chinese assets originally held by those residents. Following the issuance of Circular 75, SAFE issued internal implementing guidelines for Circular 75 in June 2007. These implementing guidelines, known as Notice 106, effectively expanded the reach of Circular 75 by:

| • | purporting to regulate the establishment or acquisition of control by Chinese residents of offshore entities which merely acquire “control” over domestic companies or assets, even in the absence of legal ownership; |

| • | adding requirements relating to the source of the Chinese resident’s funds used to establish or acquire the offshore entity; |

| • | regulating the use of existing offshore entities for offshore financings; |

| • | purporting to regulate situations in which an offshore entity establishes a new subsidiary in China or acquires an unrelated company or unrelated assets in China; |

| • | making the domestic affiliate of the offshore entity responsible for the accuracy of certain documents which must be filed in connection with any such registration, notably, the business plan which describes the overseas financing and the use of proceeds; and |

| • | requiring that the registrant establish that all foreign exchange transactions undertaken by the offshore entity and its affiliates were in compliance with applicable laws and regulations. |

No assurance can be given that our stockholders who are Chinese residents as defined in Circular 75, and who owned China Water or any of its China based subsidiaries prior to our acquisition of China Water, have fully complied with, and will continue to comply with, all applicable registration and approval requirements of Circular 75 in connection with their equity interests in the Company and the Company’s acquisition of equity interests in its China based subsidiaries by virtue of our acquisition of China Water. Moreover, because of uncertainty over how Circular 75 will be interpreted and implemented, and how or whether SAFE will apply it to the Company following the China Water acquisition, we cannot predict how it will affect our business operations or future strategies. For example, the ability of our present and prospective China subsidiaries to conduct foreign exchange activities, such as the remittance of dividends and foreign currency-denominated borrowings, may be subject to compliance with Circular 75 by our Chinese resident beneficial holders. In addition, such Chinese residents may not always be able to complete the necessary registration procedures required by Circular 75. We have little control over either our present or prospective direct or indirect stockholders or the outcome of such

14

Table of Contents

registration procedures. If our Chinese stockholders or the Chinese stockholders of the target companies we acquired in the past or acquire in the future fail to comply with Circular 75, if SAFE requires it, they may be subject to fines or legal sanctions, and Chinese authorities could restrict our investment activities in China, limit our subsidiaries’ ability to make distributions or pay dividends, or even unwind the transaction and revoke the right of our subsidiaries to do business in China.

| Item 1A. | Risk Factors |

You should carefully consider the following risk factors, together with all of the other information included in this Annual Report. We are subject to a number of risks, including those relating to having substantially all of our operating assets in China. The market price of our common stock and warrants could decline due to any of the risks discussed below, in which case you could lose all or part of your investment. In assessing these risks, you should also refer to the other information included in this Annual Report, including our financial statements and accompanying notes. Because we are a holding company with operating subsidiaries in China, we are subject to legal and regulatory environments that differ in many respects from those of the United States. Our business, financial condition or results of operations could be affected materially and adversely by any of the risks discussed below.

Risks Related to Our Business

Our business strategy of making attractive acquisitions subjects us to all of the risks inherent in identifying, acquiring and operating newly acquired businesses.

We are a holding company that was created to acquire or make investments in attractive businesses. We face all the risks associated with such a strategy, including, but not limited to:

| • | the potential disruption of our existing business, including the diversion of management attention and the redeployment of resources; |

| • | entering new markets or industries in which we have limited prior experience; |

| • | failure to identify in due diligence key issues specific to the businesses we seek to acquire or the industries or other environments in which they operate, or, failure to protect against contingent liabilities arising from those issues; |

| • | difficulties in integrating, aligning and coordinating organization, which will likely be geographically separated and may involve diverse business operations and corporate cultures; |

| • | difficulties in integrating and retaining key management, sales, research and development, production and other personnel; |

| • | difficulties in incorporating the acquired business into our organization; |

| • | the potential loss of customers, distributors or suppliers; |

| • | difficulties in integrating or expanding information technology systems and other business processes to accommodate the acquired businesses; |

| • | risks associated with integrating financial reporting and internal control systems; |

| • | the potential for future impairments of goodwill if the acquired business does not perform as expected; |

| • | the inability to obtain necessary government approvals for the acquisition, if any; and |

| • | successfully operating the acquired business. |

If we cannot overcome these challenges, we may not realize actual benefits from past and future acquisitions, which will impair our overall business results. If we complete an investment or acquisition, we may not realize the anticipated benefits from the transaction.

15

Table of Contents

The process of targeting, selecting, acquiring, and operating newly acquired businesses is time consuming and potentially expensive. We may be unable to identify other suitable investment or acquisition candidates or may be unable to make these investments or acquisitions on commercially reasonable terms, if at all.

If we use stock as consideration, this would have a dilutive effect on existing stockholders. If we use cash, this would reduce our liquidity and impact our financial flexibility. We may seek debt financing for particular acquisitions, which may not be available on commercially reasonable terms, or at all.

Future charges due to possible impairments of acquired assets may have a material adverse affect on our financial condition and results of operations.

A substantial portion of our assets is comprised of goodwill and other intangible assets, which may be subject to future impairment that would result in financial statement write-offs. Our China Water acquisition resulted, and any future acquisitions are likely to result, in significant increases in goodwill and other intangible assets. Goodwill and other intangible assets represent approximately 45% of our total assets at December 31, 2008. If there is a material change in our business operations or prospects, the value of the intangible assets we have acquired or may acquire in the future could decrease significantly. On an ongoing basis and at least annually, we will evaluate, partially based on discounted expected future cash flows, whether the carrying value of such intangible assets may no longer be recoverable, in which case a charge to earnings may be necessary. Any future determination requiring the write-off of a significant portion of unamortized intangible assets, although not requiring any additional cash outlay, could have a material adverse affect on our financial condition, results of operations and stock price.

The worldwide financial crisis is likely to cause reductions in consumer consumption, which would have a negative impact on our results of operations.

We are in the midst of a worldwide financial and credit crisis, and we expect a reduction in consumer spending in 2009, including in China. We have limited visibility and limited data concerning the actual long-term impact of the financial crisis on consumer spending in China. Therefore, we cannot provide meaningful estimates of the risks and potential changes to the revenues, profit margins, market share or expansion opportunities concerning our China Water subsidiary. However, we do expect our operations to be impacted in 2009 as a result of economic conditions and related consumer spending patterns. Separately, the worldwide financial and credit crisis may impact the return on our cash and investments.

In light of recent economic conditions, and deferrals of plant expansions and acquisitions, we do not believe that the estimates provided to us by China Water in connection with its acquisition by us will be achieved in 2009.

During our due diligence investigation of China Water in connection with its acquisition by us, we were presented with estimated levels of pro forma annualized revenue and net income that China Water could achieve by the end of 2008 and forward. This forward-looking information pre-dated the worldwide crisis in financial and credit markets and was based on our review of internal financial projections prepared by China Water, general due diligence and anticipated plant expansions and acquisitions. Because some of these plant expansions and acquisitions have not yet occurred and we did not anticipate the significance of the worldwide financial crisis, we expect that our revenues and net income for 2009 will be lower than we originally forecast. The consequences of this determination could include a decline in the stock price.

We are subject to litigation risks, which may be costly to defend and the outcome of which is uncertain.

All industries, including the bottled water industry in China, are subject to legal claims. As a public company we are particularly susceptible to securities and derivative lawsuits. These claims may be costly to defend and divert the attention of our management and our resources in general. Defense and settlement costs can be substantial, even with respect to claims that have no merit. Due to the inherent uncertainty of the litigation process, the resolution of any particular legal claim or proceeding could have a material effect on our business, financial condition, results of operations or cash flows.

16

Table of Contents

Our obligation to pay contingent payments of $145.5 million if we achieve a stated 2009 adjusted net income milestone would dilute our stockholders if we satisfy such payments in stock, and would affect our liquidity and our ability to operate if we are unable to satisfy such payments in stock.

Under the terms of the agreements entered into in connection with our acquisition of China Water, we agreed that if the adjusted net income of our Company exceeds $90.0 million for our fiscal year ending December 31, 2009, we will pay to China Water’s pre-existing noteholders and private placement investors a pro rata portion of contingent payments of $45.0 million and $85.5 million, respectively. In addition, the merger agreement provides for the creation of a $15.0 million bonus plan to be paid out to the management team of China Water (all of whom have not yet been identified or selected) if the $90.0 million adjusted net income target for 2009 is achieved. These contingent payments can be paid, in our sole discretion, through the payment of cash, the issuance of our common stock, or a combination of cash and common stock.

We do not believe we will achieve the $90 million adjusted net income target for 2009. However, if we were to achieve such target, we would be required to pay the contingent payment in cash, which would reduce our liquidity, and/or issue stock, in which case our stockholders would experience dilution to their holdings.

Our ability to succeed will largely depend upon the efforts of our directors and officers, and in particular our chief executive officer, Mr. Richard J. Heckmann. The loss of Mr. Heckmann could affect our ability to operate.

Our ability to succeed is largely dependent upon the efforts of our officers and directors, especially Mr. Heckmann, our Chairman and Chief Executive Officer. Even though we believe that our success depends on the continued services of Mr. Heckmann, we have not entered into an employment agreement with Mr. Heckmann, nor obtained “key man” life insurance. Accordingly, we cannot be sure that Mr. Heckmann will remain with the company for the immediate or foreseeable future. In addition, though Mr. Heckmann has expressed a commitment of his full time to our success, he is not required to commit any specified amount of time to the company’s affairs and, as a result, he may have conflicts of interest in allocating management time among various business activities, including identifying more potential business acquisitions and monitoring the related due diligence and closing process. The loss of the services of Mr. Heckmann or any other of our other executive officers and directors could have a material adverse effect on our ability to successfully achieve our business objectives, including seeking out and consummating more acquisitions.

If the Company is deemed to be an investment company, it must meet burdensome compliance requirements and restrictions on its activities that would increase the difficulty of completing new investments and/or acquisitions.

We do not believe that our planned principal activities will subject us to the Investment Company Act of 1940. In this regard, although we seek to acquire or make investments in additional businesses, we are primarily engaged in the operation of China Water and, in the future, we will be primarily engaged in the operation of the businesses we acquire. However, if the Company is deemed to be primarily engaged in the business of investing, reinvesting or trading securities or is otherwise considered to be an investment company, it would be subject to the Investment Company Act of 1940. If we are deemed to be subject to that act, compliance with additional regulatory burdens would increase our operating expenses and would make future acquisitions and investments more difficult to complete.

There are material weaknesses in our internal control over financial reporting that could cause investors to lose confidence in our reported financial information and thereby cause a decline in our stock price.

We inherited, and have undertaken to fix and remediate, certain previously reported and currently reported weaknesses in China Water’s internal controls over financial reporting. See “Item 9A. Controls and Procedures.” Additional acquisitions could place further pressure on our internal controls.

17

Table of Contents

We have begun efforts towards remediation of China Water’s control deficiencies. However, if we are unable to address these or other material weaknesses in our internal control over financial reporting, this might result in errors in our financial statements that could result in a restatement of our financial statements, cause us to fail to meet our reporting deadlines, and cause investors to lose confidence in our reported financial information, leading to a decline in our stock price.

The results of China Water during the 10 month pre-acquisition period ended October 30, 2008 have not been audited.

We have included in this filing pro forma operating results of China Water for the ten months ended October 31, 2008, which is based on unaudited information, and unaudited information of China Water for the year ended December 31, 2008. Changes could be required to this information as a result of an audit, and there can be no assurance those changes will not be material. Further, China Water’s actual operating results may differ, and those differences may be material, from the pro forma operating results.

Changes to the fair market or carrying value of our investment in China Bottles, Inc., our unconsolidated equity investee, could affect the value of our investment and any potential recordable income from the investment, which could result in a substantial write down.

We own 48% of the outstanding equity of China Bottles, Inc. (“China Bottles”), a manufacturer of bottling equipment and provider of contract manufacturing and finished product services. At December 31, 2008, our investment in China Bottles totaled $13.0 million, and the market value of our shares of China Bottles common stock (based on the closing market price on the Over-the-Counter Bulletin Board) was $18.4 million and $9.0 million at December 31, 2008 and March 10, 2009, respectively. For the two months ended December 31, 2008 and pro forma for the twelve months then ended, we recorded $4,000 and $4.2 million, respectively, in equity income based on the interim financial reports of China Bottles management. China Bottles has a significant insider ownership, the observable market price of its stock has been volatile, and there is no liquidity in the stock. Changes to the fair market or carrying value of our investment in China Bottles could affect the value of our investment and any potential recordable income from the investment, which could result in a substantial write down.

Risks Related to Our Current Business Operations in China

We face risks associated with recent acquisitions by China Water and if we fail to successfully integrate these acquired businesses our operating results will be negatively affected.

Within the past three years, our China Water subsidiary acquired outright control or a controlling interest in several businesses through the acquisitions of Nanning Taoda, Shenyang Aixin Industry Company Ltd. (“Shenyang Aixin”), Beijing Changsheng Taoda Drink Co. Ltd. (“Beijing Taoda”), Changsha Rongtai Packing Containers Co., Ltd. (“Changsha Rongtai”) and Grand Canyon Pure Distilled Water Co. Ltd. (“Grand Canyon”).

The ongoing process of integrating these businesses is distracting, time consuming, expensive, and requires continuous optimization and allocation of resources. Geographic distance between business operations, the compatibility of the technologies and operations being integrated, and combining disparate corporate cultures also present significant challenges. The acquired businesses also have different standards, controls, contracts, procedures, and policies, making it difficult to implement and harmonize company-wide financial, accounting, billing, information, and other systems. Continuing the successful integration of the recently acquired companies will require us to integrate and retain key management and other personnel, incorporate the acquired products or capabilities into our product offerings from an engineering, sales and marketing perspective, coordinate research and development efforts, integrate and support pre-existing supplier, distribution and customer relationships, and combine or centralize back office accounting, order processing, purchasing, and support functions. China Water’s

18

Table of Contents

focus on integrating operations may also distract attention from China Water’s day-to-day business and may disrupt key research and development, marketing, or sales efforts. If China Water cannot overcome these challenges, we may not realize actual benefits from past and future acquisitions, which will impair our overall business results.

Due to rapid growth in recent years, the past results in China of China Water may not be indicative of our future performance, so evaluating our overall business and prospects may be difficult.

Prior to our acquisition of China Water, its business had grown and evolved rapidly in recent years as demonstrated by its growth in sales revenue from approximately $35.7 million in 2006 to $56.8 million in 2007, and to $95.9 million (unaudited) in 2008. However, China Water may not be able to achieve similar growth in future periods, and historical operating results may not provide a meaningful basis for evaluating our overall business, financial performance and prospects. Therefore, you should not rely on past results or historical growth rates of our China subsidiary as an indication of its future performance. China Water suffered operating and net losses in 2008 and 2007, and there can be no assurance we will achieve operating and net income in 2009.

Part of our strategy involves the development of new products and if we fail to timely develop new products or incorrectly gauge the potential market for new products, our financial results may suffer.

We are utilizing our in-house research and development capabilities to develop new bottled water products, such as flavored water, oxygenated water and nutrient-enriched bottled water products that could become new sources of revenue for us in the future and help us to diversify our revenue base. Our future research and development efforts will be focused on expanding our product offerings beyond purified water, mineralized water and oxygenated water. If we fail to timely develop new products or if we miscalculate market demand for new products in development, we may not be able to grow our sales revenue sufficiently to outpace our product development expenses.

The revenues of our China business are highly concentrated in a single customer, Coca-Cola China, and we would be harmed if Coca-Cola China reduces its orders.

In the two months ended December 31, 2008 and pro forma for the twelve months then ended, approximately 12% and 8%, respectively, of sales in China were made to Coca-Cola China. Coca-Cola China resells our bottled water products. We believe that our relationship with Coca-Cola China provides consistent sales and credibility for us in our target markets. However, the arrangements with Coca-Cola China are not long-term, they do not impose minimum purchase commitments upon Coca-Cola China, and they are not exclusive. If Coca-Cola China discontinues or reduces purchases and we are unable to generate replacement sales from new and existing customers, our revenue and net income from China operations would decline considerably. Also, because the margins on our sales to Coca-Cola China are generally lower than on our sales to other customers and through distributors, if sales to Coca-Cola China increase as a percentage of overall sales, than our margins would decline.

We face increasing competition which may negatively impact our market share and profit margins.

The bottled water industry in China is highly competitive, and we anticipate it will become even more competitive in the future. We compete with domestic Chinese bottled water producers including Hangzhou Wahaha Group, Nongfu Spring Company Ltd., and Guangdong Robust Corp., and with global beverage companies and brands including Nestle S.A, Coca-Cola, C’est Bon, Danone, Tingyi Master Kong, and Uni-President. Some of our competitors have been in business longer, some have substantially greater financial and other resources, and some are better established in their markets. Some may also benefit from raw material sources or production facilities that are closer to their markets, thereby giving them a competitive advantage in terms of cost and proximity to consumers.

Currently, there are several thousand water brands in China, including those offered by domestic and foreign-invested enterprises. Our ability to compete against these enterprises will depend on our continuing ability to leverage our brand recognition and to distinguish our products by providing quality products at reasonable prices that appeal to wide consumer tastes and preferences.

19

Table of Contents

Some of our competitors may provide products comparable or superior to ours, or adapt more quickly to consumer trends or changing market requirements. Significant consolidation among our competitors is also possible. Increased competition may lead our competitors to substantially increase their advertising expenditures and promotional activities or to engage in irrational or predatory pricing behavior. Third parties may actively engage in activities, whether legal or illegal, designed to undermine our brand name and product quality or to influence consumer confidence in our products. These activities may result in price reductions, reduced margins, and loss of market share, any of which could have a material adverse effect on our profit margins. As a result, we may not be able to compete effectively against current and future competitors.

Any interruption in our production could impair our financial performance and negatively affect our brand.

We produce bottled water products at facilities maintained by eight operating subsidiaries within China in the cities of Beijing, Guangzhou (Guangdong Province), Changchun (Jilin Province), Feixian (Shandong Province), Nanning (Guangxi Province), Shenyang (Liaoning Province) and Changsha (Hunan Province). Our manufacturing operations are complicated and integrated, involving the coordination of sourcing of water and other raw materials from third parties, internal production processes, and external distribution processes. While these operations are modified on a regular basis in an effort to improve manufacturing and distribution efficiency and flexibility, we may experience difficulties in coordinating the various aspects of our manufacturing processes, thereby causing downtime and delays. In the past year, we have also been steadily increasing production capacity organically and through acquisitions, but we have limited experience operating at higher production volumes and we may be unable to sustain production at current or higher levels. In addition, we may encounter interruptions in our manufacturing processes due to events beyond our control, such as fires, explosions, labor disturbances or violent weather conditions. Any interruptions in production could reduce sales revenue and earnings. If there are interruptions at any of our production facilities, even if only temporary, or delays in delivery times to our customers, our business and reputation could be severely harmed. Any significant delays in deliveries to our distributors or customers could also lead to increased returns or cancellations and cause us to lose future sales.

Limitations on or the unavailability of natural resources or energy resources needed to operate our business in China would impair our profitability.

In order to produce our bottled water products in China, we need a readily available supply of water and electricity. We depend mainly on municipal water supplies to provide the water used in our products and on regulated electric companies to provide us with the electricity needed for our production facilities. In the two months ended December 31, 2008 and pro forma for the twelve months then ended, approximately 65% and 60%, respectively, of our water was sourced from municipal water supplies and the remaining 35% and 40%, respectively, was sourced from ground water. It is possible that municipal governments could put usage limits on these water resources in situations when water reserves for their cities are low or curtail electricity usage when the demand for energy resources is high relative to supply. Our business operations, income, and profits would be highly impaired if such limits are imposed.

Increases in raw material prices that we are unable to pass on to our customers would reduce profit margins.

The principal raw materials used in our production, including water, bottled water containers, caps and packaging materials, are subject to a high degree of price volatility caused by external conditions. In particular, the PET we use to manufacture our bottles is petroleum based, and therefore subject to significant price fluctuations. In the two months ended December 31, 2008 and pro forma for the twelve months then ended, PET accounted for approximately 47% and 48%, respectively, of our cost of goods sold. Oil prices have fluctuated at record velocity in recent years and the prices we pay for oil products and other raw materials may escalate in the future. Price changes to our raw materials may result in unexpected increases in production, packaging, and distribution costs, and we may be unable to increase the prices of our products to offset these increased costs. If so, we would suffer a reduction in our profit margins.

20

Table of Contents

Any difficulties or delays in delivery or poor handling by distributors and third party transport operators may affect our sales and damage our reputation.

In China, we sell our own brands of bottled water through distributors. In the two months ended December 31, 2008 and in the twelve months then ended on a pro forma basis, our three largest distributors accounted for approximately 24% and 34%, respectively, of total sales. The delivery of our products by distributors to retailers could be delayed or interrupted in the case of unforeseen events and disruptions that occur for various reasons beyond our control, including poor handling by distributors or third party transport operators, transportation bottlenecks, natural disasters, and labor strikes. Poor handling by distributors and third-party transport operators could also result in damage to our products. If our products are not delivered to retailers on time, or are delivered damaged, we could lose business and our reputation could be harmed.

We may ineffectively allocate and balance the supply of our bottled water products among our distribution channels.

We market and sell our bottled water products to distributors that sell them to end users under our own brands, to major global drink and beverage companies, and to other corporations, hotels, and casinos on a private label basis. Like any other manufacturer or producer of products, we have limited production capacity and there are times when we are resource and capacity constrained. As our production capacity reaches its limit, it becomes more difficult for us to produce, balance, and allocate our bottled water products for sales through our various distribution and sales channels.

If we fail to strike an appropriate balance in producing and delivering our products for sale through our network of sales and distribution channels, we may be unsuccessful in meeting the relative demands of our distributors and the consumer market, which would hurt our sales, reputation, and relationships with distributors and customers.

Our products may become subject to recall in the event of defects or other performance related issues.