Table of Contents

Filed Pursuant to Rule 424(b)(5)

Registration No. 333-179518

Prospectus Supplement

(To Prospectus dated March 26, 2012)

18,200,000 Shares

Common Stock

We are selling 18,200,000 shares of our common stock in this offering.

You should read carefully this prospectus supplement and the accompanying prospectus, together with the documents we incorporate by reference, before you invest in our common stock.

Our common stock is listed on the New York Stock Exchange under the symbol “HEK.” On March 23, 2012, the last reported sale price of our common stock on the New York Stock Exchange was $4.50 per share.

Investing in our common stock involves risks. See “Risk Factors” beginning on page S-16 of this prospectus supplement and on page 4 of the accompanying prospectus to read about factors you should consider before buying shares of our common stock.

| Price to Public | Underwriting Discounts and Commissions | Proceeds to Us | ||||

Per Share | $4.40 | $0.22 | $4.18 | |||

Total | $80,080,000 | $4,004,000 | $76,076,000 |

We have granted the underwriters an option to purchase, within a period of 30 days beginning with the date of this prospectus supplement, up to an additional 2,730,000 shares solely to cover over-allotments.

The underwriters expect to deliver shares to purchasers on or about March 30, 2012.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

| Credit Suisse | Jefferies | Roth Capital Partners |

The date of this prospectus supplement is March 27, 2012.

Table of Contents

Prospectus Supplement

| Page | ||||

| S-ii | ||||

| S-ii | ||||

| S-iii | ||||

| S-iii | ||||

| S-1 | ||||

| S-16 | ||||

| S-32 | ||||

| S-34 | ||||

| S-36 | ||||

| S-37 | ||||

| S-39 | ||||

| S-39 | ||||

| S-40 | ||||

| S-47 | ||||

| S-50 | ||||

| S-62 | ||||

| S-64 | ||||

| S-68 | ||||

| S-80 | ||||

| S-82 | ||||

| S-86 | ||||

| S-87 | ||||

| S-91 | ||||

| S-94 | ||||

| S-94 | ||||

| S-95 | ||||

| F-1 | ||||

Prospectus

| Page | ||||

| 1 | ||||

| 1 | ||||

| 3 | ||||

| 4 | ||||

| 4 | ||||

| 5 | ||||

| 5 | ||||

| 16 | ||||

| 17 | ||||

| 19 | ||||

| 22 | ||||

| 23 | ||||

| 24 | ||||

| 25 | ||||

| 26 | ||||

| 28 | ||||

| 31 | ||||

| 31 | ||||

| 31 | ||||

Table of Contents

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is in two parts. The first part consists of this prospectus supplement, which describes the specific terms of this offering. The second part consists of the accompanying prospectus, which gives more general information about securities that we may offer from time to time, some of which may not be applicable to the shares of common stock offered by this prospectus supplement and the accompanying prospectus. For more information about our common stock offered in this offering, see “Description of Common Stock” in this prospectus supplement and “Description of Capital Securities—Common Stock” in the accompanying prospectus.

Before you invest in our common stock, you should read the registration statement of which this prospectus supplement and the accompanying prospectus form a part. You should also read the exhibits to that registration statement, as well as this prospectus supplement, the accompanying prospectus, any free writing prospectus we may file and the documents incorporated by reference into this prospectus supplement and the accompanying prospectus. The documents incorporated by reference are described in this prospectus supplement under “Where You Can Find More Information.”

If the information set forth in this prospectus supplement varies in any way from the information set forth in the accompanying prospectus, you should rely on the information contained in this prospectus supplement. If the information set forth in this prospectus supplement varies in any way from the information set forth in a document that we have incorporated by reference into this prospectus supplement, you should rely on the information in the more recent document.

You should rely only on the information contained or incorporated by reference in this prospectus supplement, the accompanying prospectus and any free writing prospectus we may file. We have not, and the underwriters have not, authorized any other person to provide you with different information. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus supplement, the accompanying prospectus, any free writing prospectus we may file and the documents incorporated by reference is accurate only as of their respective dates. Our business, financial condition, results of operations and prospects may have changed since those dates.

In this prospectus supplement, unless otherwise specified or the context requires otherwise, we use the terms “Heckmann,” the “Company,” “we,” “us” and “our” to refer to Heckmann Corporation and its subsidiaries, including Thermo Fluids Inc., and the term “TFI” to refer to TFI Holdings, Inc., together with Thermo Fluids Inc.

The term “TFI Acquisition” refers to our purchase of Thermo Fluids Inc. through the purchase of all of the issued and outstanding common stock of its parent corporation TFI Holdings, Inc. and the related financing transactions as described in “The Transactions” in this prospectus supplement. The term “combined company” refers to Heckmann and its subsidiaries (including TFI) after the completion of the TFI Acquisition.

This prospectus supplement includes market and industry data and forecasts that we have derived from a variety of sources, including independent reports, publicly available information, various industry publications, other published industry sources and internal data and estimates. Third-party publications and surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, but there can be no assurance as to the accuracy or completeness of included information. Although we believe that such information is reliable, we have not had this information verified by any independent sources.

ii

Table of Contents

USE OF NON-GAAP FINANCIAL MEASURES

This prospectus supplement contains non-GAAP financial measures as defined by the rules and regulations of the United States Securities and Exchange Commission. A non-GAAP financial measure is a numerical measure of a company’s historical or future financial performance, financial position or cash flows that excludes amounts, or is subject to adjustments that have the effect of excluding amounts, that are included in the most directly comparable measure calculated and presented in accordance with GAAP in the statements of operations, balance sheets, or statements of cash flows of Heckmann Corporation and TFI Holdings, Inc.; or includes amounts, or is subject to adjustments that have the effect of including amounts, that are excluded from the most directly comparable measure so calculated and presented. Reconciliations of these non-GAAP financial measures to their comparable GAAP financial measures are included in this prospectus supplement.

These non-GAAP financial measures are provided because management of the Company uses these financial measures in maintaining and evaluating the Company’s ongoing financial results and trends. Management uses this non-GAAP information as an indicator of business performance, and evaluates overall management with respect to such indicators. Management believes that excluding items such as acquisition expenses, amortization of intangible assets and stock-based compensation, among other items that are inconsistent in amount and frequency (as with acquisition and earn-out expenses), or determined pursuant to complex formulas that incorporate factors, such as market volatility, that are beyond our control (as with stock-based compensation), for purposes of calculating these non-GAAP financial measures facilitates a more meaningful evaluation of the Company’s current operating performance and comparisons to the past and future operating performance. The Company believes that providing non-GAAP financial measures such as EBITDA, and adjusted EBITDA, in addition to related GAAP financial measures, provides investors with greater transparency to the information used by the Company’s management in its financial and operational decision-making. These non-GAAP measures should be considered in addition to, but not as a substitute for, measures of financial performance prepared in accordance with GAAP; moreover, other companies in our industry may calculate Adjusted EBITDA differently than we do, limiting its usefulness as a comparative measure.

This prospectus supplement and the documents we incorporate by reference in this prospectus supplement contain forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the United States Securities Exchange Act of 1934, as amended (the “Exchange Act”). These statements relate to our expectations for future events and time periods. All statements other than statements of historical fact are statements that could be deemed to be forward-looking statements, including, but not limited to, statements regarding:

| • | future financial performance and growth targets or expectations; |

| • | market and industry trends and developments; |

| • | the benefits of our completed and future acquisition and disposition transactions, including our recently announced TFI Acquisition and any future acquisitions; and |

| • | plans to increase operational capacity, including additional trucks, saltwater disposal and underground injection wells, frac tanks, rail cars, processing facilities and pipeline construction or expansion. |

You can identify these and other forward-looking statements by the use of words such as “anticipates,” “expects,” “intends,” “plans,” “predicts,” “believes,” “seeks,” “estimates,” “may,” “will,” “should,” “would,” “could,” “potential,” “future,” “continue,” “ongoing,” “forecast,” “project,” “target” or similar expressions, and variations or negatives of these words.

These forward-looking statements are based on information available to us as of the date of this prospectus supplement and our current expectations, forecasts and assumptions and involve a number of risks and

iii

Table of Contents

uncertainties. Accordingly, forward-looking statements should not be relied upon as representing our views as of any subsequent date and we do not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made.

Future performance cannot be ensured. Actual results may differ materially from those in the forward-looking statements. Some factors that could cause actual results to differ include:

| • | financial results that may be volatile and may not reflect historical trends due to, among other things, acquisition and disposition activities, fluctuations in consumer trends, pricing pressures, changes in raw material or labor prices or rates related to our business and changing regulations or political developments in the markets in which we operate; |

| • | difficulties encountered in integrating acquired assets, businesses and management teams, including the TFI Acquisition; |

| • | our ability to attract, motivate and retain key executives and qualified employees in key areas of our business; |

| • | fluctuations in prices and demand for commodities such as natural gas and oil; |

| • | availability of supplies of used motor oil and demand for recycled fuel oil, and prices thereof; |

| • | changes in customer drilling activities and capital expenditure plans, including impacts due to lower natural gas prices; |

| • | difficulties in identifying and completing acquisitions and differences in the type and availability to us of consideration or financing for such acquisitions; |

| • | risks associated with the operation, construction and development of salt water disposal wells and pipelines, including access to additional disposal well locations and pipeline rights-of-way, and unscheduled delays or inefficiencies; |

| • | the effects of competition in the markets in which we operate, including the adverse impact of competitive product announcements or new entrants into our markets; |

| • | changes in economic conditions in the markets in which we operate or in the world generally; |

| • | reduced demand for our services, including due to regulatory or other influences related to extraction methods such as hydrofracturing, or the loss of key customers; |

| • | control of costs and expenses; |

| • | present and possible future claims, litigation or enforcement actions or investigations; |

| • | natural disasters, such as hurricanes, earthquakes and floods, or acts of terrorism that may impact our corporate headquarters or our assets, including our wells or pipelines, our distribution channels, or which otherwise disrupt the markets we serve; |

| • | the threat or occurrence of international armed conflict and terrorist activities; |

| • | the unknown future impact on our business from the Dodd-Frank Wall Street Reform and Consumer Protection Act and the rules to be promulgated under it; |

| • | risks involving developments in environmental or other governmental laws and regulations in the markets in which we operate and our ability to effectively respond to those developments including laws and regulations relating to oil and gas extraction and re-refining businesses, particularly relating to water usage and water and waste disposal, transportation and treatment, uses of recycled fuel oil, collection of used motor oil, and transportation of oil; and |

| • | other risks referenced from time to time in our past and future filings with the SEC and those factors listed in this prospectus supplement under “Risk Factors” beginning on page S-16. |

iv

Table of Contents

You are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date of this prospectus supplement. Except as required by law, we do not undertake any obligation to update or release any revisions to these forward-looking statements to reflect any events or circumstances, whether as a result of new information, future events, changes in assumptions or otherwise, after the date hereof.

v

Table of Contents

The following summary should be read together with the information contained or incorporated by reference in other parts of this prospectus supplement. This summary does not contain all of the information you should consider before investing in the common stock. You should read carefully the rest of this prospectus supplement, the accompanying prospectus and other referenced documents and should consider, among other things, the matters set forth under the sections titled “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations of Heckmann Corporation,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations of TFI Holdings, Inc.,” and our combined financial statements and related notes to those statements and other financial data included elsewhere in this prospectus supplement and referenced documents. Some of the statements in the following summary are forward-looking statements. See the section titled “Forward-Looking Statements.” Unless the context requires otherwise, references in this prospectus supplement to the “Company,” “we,” “us,” “our” or “ours” refer to Heckmann Corporation, together with its subsidiaries and predecessor entities. Unless the context requires otherwise, references in this prospectus supplement to TFI refer to TFI Holdings, Inc., together with Thermo Fluids Inc. All historical financial data is for continuing operations after giving effect to our disposition of China Water and Drinks, Inc. (“China Water”) in September 2011. Unless otherwise indicated, all statistical information concerning the Company and TFI relating to quantity, location and character of assets and number of employees is as of December 31, 2011.

Company Overview

We offer a “one-stop” shop for energy-related water solutions to customers in the oil and gas exploration and production (“E&P”) industry across the United States. We provide these services utilizing our scaled infrastructure and asset base, which includes 25 disposal wells, more than 500 trucks, and approximately 1,100 frac tanks, 50 miles of permanent pipeline and 200 miles of temporary pipeline operating in key unconventional resource basins such as the Haynesville, Eagle Ford, Utica, Marcellus, Barnett and Tuscaloosa Marine Shales.

Advances in drilling technology and development of unconventional North American hydrocarbon resources—oil and gas shale fields—allow previously inaccessible or non-economical formations in the earth’s crust to be exploited by utilizing high water pressure methods (or the process known as hydraulic fracturing, or fracking) combined with proppant fluids (containing sand grains or microscopic ceramic beads) to crack open new perforation depths and fissures to extract large quantities of natural gas, oil, and other hydrocarbon condensates. Complex water flows represent the largest waste stream from these methods of hydrocarbon exploration and production. We provide, and continue to develop, total water service solutions for the effective and efficient delivery, treatment and disposal of fresh water, flowback and produced water flows resulting from increased exploration in these unconventional oil and gas fields, which are often referred to as “shale” or “unconventional” resource areas or plays.

In addition, through our March 8, 2012 announced acquisition of TFI (the “TFI Acquisition”), we will expand our operations to include the collection of used motor oil (“UMO”), which we process and sell as reprocessed fuel oil (“RFO”), as well as providing complementary environmental services for a diverse commercial and industrial customer base. TFI operates 35 processing facilities and 290 tanker trucks, vacuum trucks, trailers and other vehicles and serves more than 20,000 commercial and industrial customer locations, which significantly enhances our existing asset base and positions us for further growth across the environmental services spectrum. TFI will form our new operating segment, Heckmann Environmental Services.

We believe this acquisition will:

| • | increase the scale of our operations; |

| • | diversify our revenue sources by service offering, commodity exposure, geographic footprint and customer base; |

S-1

Table of Contents

| • | further leverage our business model to complex environmental regulations; and |

| • | enhance cash flow with minimal capital expenditure requirements. |

For the year ended December 31, 2011, we generated pro forma revenues and Adjusted EBITDA of $270.6 million and $59.4 million, respectively, compared to the 2011 net loss of $0.1 million from continuing operations for Heckmann and 2011 net income of $8.3 million for TFI.

Upon completion of the TFI Acquisition, we will conduct our operations through two business segments:

Heckmann Water Resources (“HWR”)—58% of total 2011 pro forma revenue

Through our Heckmann Water Resources segment, we address the pervasive demand for diverse water solutions required for the production of shale oil and gas in an integrated and efficient manner through our broad array of service and product offerings. Water issues are critical to the development of the unconventional energy industry. Millions of gallons of fresh water are typically required for each fracked well. We expect companies to drill and frac thousands of wells to retrieve the trapped natural gas, oil and other natural resources. The water must be delivered to the well site, by truck or pipeline, stored on site (generally in temporary ponds or frac tanks), and then delivered to the well head for hydrofracturing operations. Water is then injected at extremely high pressures, breaking the shale and releasing the oil and/or natural gas. Subsequently, water returns to the surface over time: approximately 15%—20% of the water is returned as flowback water generally within the first two to three weeks after the hydrofracturing has commenced, and water from the formation is produced alongside oil and/or natural gas over the life of the well. These waters are generally re-used, recycled or treated and disposed off-site.

We focus on providing total water solutions. We currently conduct multi-modal water disposal, treatment, trucking and pipeline transportation operations in key unconventional basins such as the Haynesville, Eagle Ford, Utica, Marcellus, Barnett and Tuscaloosa Marine Shale areas in the United States, and are extending our businesses and operations into other oil- and liquids-rich shale areas and repositioning assets into those areas. We serve customers seeking sourcing and delivery, transmission, storage, transportation, treatment or disposal of fresh water and complex wastewater flows, such as flowback from shale oil and gas hydraulic fracturing drilling operations, as well as produced brine water, recycling and fluids recovery. We generally expect to assist customers with their produced water recovery requirements for the life of wells, which enhances visibility in our financial performance.

We place great emphasis on health, safety and the environment (“HSE”), which our customers often value as a critical characteristic of their service providers, particularly larger companies that have invested billions of dollars in unconventional oil and gas assets over the past several years. Our large customers, including Chesapeake Energy Corporation, Encana Corporation, Chief Oil & Gas, LLC, EXCO Resources, Inc. and Goodrich Petroleum Corporation, understand the importance of proper disposal and treatment of water waste. We believe our HSE focus, our suite of services and scale across unconventional basins provides a competitive advantage relative to many smaller competitors.

HWR’s assets include a substantially completed 50-mile underground pipeline network in the Haynesville Shale area for the efficient delivery of fresh water and removal of produced water. We also have approximately 200 miles of portable poly and aluminum pipe and associated pumps and other equipment that are used above ground for pumping and transporting water. We also own and operate a fleet of more than 500 trucks for water transportation and approximately 1,100 frac tanks, which can generally be moved to meet customer demand and market conditions. In addition, we have 25 operating salt water disposal or underground injection wells in the Haynesville and Eagle Ford Shale areas, which have a combined permitted salt water disposal capacity of more

S-2

Table of Contents

than 400,000 barrels per day, and we are also in various stages of acquiring, developing and permitting additional salt water disposal wells in our operating markets. We believe our collection of assets and their diversity within and across various shale areas is a competitive strength.

Heckmann Environmental Services (“HES”)—42% of total 2011 pro forma revenue

Our HES segment will initially consist of TFI’s operations and assets. TFI provides route-based environmental services and waste recycling solutions. Founded in 1993, TFI today operates a highly scalable network infrastructure of 35 processing facilities and 290 tanker trucks, vacuum trucks, trailers and other vehicles. Serving customers in 19 states stretching from Washington to Texas, we provide a full suite of essential services to a diverse range of more than 20,000 commercial and industrial customer facilities that collectively generate high volumes of regulated non-hazardous waste on a daily basis.

TFI offers customers a reliable, high-quality and environmentally responsible solution through TFI’s “one-stop” shop of collection and recycling services for waste products, including UMO, wastewater, spent antifreeze, used oil filters and parts washers. Currently, TFI collects more than 50 million gallons of UMO annually, making it one of the largest used oil collection and recycling firms in the Western United States. TFI collects UMO and reprocesses it to be sold in the form of RFO to industrial customers as a lower cost, higher British Thermal Unit (“BTU”) alternative to diesel fuel and increasingly to re-refiners as a critical feedstock for the production of base lubricants. TFI also provides essential environmental services that assist customers with the removal and safe disposal and/or recycling of non-UMO waste products such as oily wastewater, industrial waste, antifreeze, oil filters and parts washers solvent. These highly complementary environmental services leverage TFI’s existing route-based infrastructure, deepen relationships with its customer base, and enhance revenue and profit diversity.

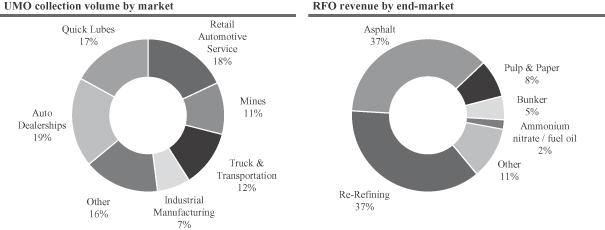

Approximately 55% of TFI’s UMO volume is sourced from participants within the automotive service industry (e.g., quick lube shops, auto dealerships, retail automotive service providers, etc.). The remaining UMO volumes are generally collected from a diverse array of commercial and industrial operations across the trucking, railroad, manufacturing and mining industries. TFI also sells RFO to more than 250 customer facilities in the Western United States typically associated with energy-intensive industries that require the use of a boiler or furnace, such as the asphalt, pulp, paper and bunker fuel markets. Since 2008, TFI has increased its volume to the re-refining market, which has experienced significant growth due to the value proposition of processed products relative to virgin alternatives (such as crude oil or diesel fuel) and a continued trend toward sustainable manufacturing and purchasing initiatives.

Our Strengths

Large Scale and Range of Services in Highly Fragmented Sectors. Our size and breadth of services allow us to more effectively and efficiently serve our customers than many of our smaller local and regional competitors. We believe that we are the leading provider of total water and wastewater solutions in the Haynesville Shale area, with a growing presence in other unconventional basins in which we operate. We are a “one-stop” shop for integrated water solutions in our markets, with many of our competitors offering selected water services which are secondary to their broader oilfield service offerings. We believe that TFI is a leading vertically-integrated provider in the Western United States of environmental waste collection services specializing in UMO collection and RFO production. Many of our large customers are focused on utilizing larger, more qualified service providers, such as ourselves, which offer comprehensive services, highly qualified employees and high standards of regulatory compliance.

Visible Cash Flows from Stable Demand Drivers and Contractual Agreements. We believe the demand drivers from many of our services and our contractual agreements produce cash flow visibility and reduce the impact of volatile commodity prices. Our HWR segment derives a significant portion of its revenue from long-term, stable produced water flows, and we have existing long-term contracts with several industry leaders such as

S-3

Table of Contents

our recent five-year take-or-pay agreement with a large oil and gas exploration company for our LNG truck services. Our HES segment benefits from the correlation of UMO and RFO prices, which increases margin and cash flow visibility. In addition, in 2011, a significant majority of TFI’s UMO and RFO volumes were subject to indexed or fixed price contracts that limit margin and cash flow volatility associated with changes in commodity prices. We intend to maintain similar percentages of our UMO and RFO volumes under fixed or indexed price contracts going forward.

Diversified Revenue Sources and Customer Base. Our service offerings cover the unconventional oil and gas development market and, following the TFI Acquisition, the environmental services and used oil collection and recycling markets. The additional service offerings from the TFI Acquisition provide a large, new customer base and when combined with our growth in oil- and liquids-rich unconventional basins will further balance our exposure between crude oil and natural gas demand and activity. Over the past year, we have expanded our services and repositioned assets to the Eagle Ford, Utica, Tuscaloosa Marine and Permian Basin areas, which are characterized by oil and liquids production. Between our HWR and HES segments we have the ability to offer our services across the United States, with operations in multiple shale areas from Texas and Louisiana to Pennsylvania and Ohio and customers in more than 19 states in the Western United States. Our diversified revenue sources and high quality customer base include integrated majors, independent oil and gas producers and more than 20,000 commercial and industrial facilities.

Customer Demand Enhanced by Complex Environmental Regulations. We believe we are well positioned as a water and environmental services provider in a period of increasing regulations governing water and UMO processing, disposal and treatment. As shale drilling has rapidly increased, many new regulations are addressing all aspects of these operations and much of the new regulatory focus centers around the source, disposal and recycling of water. HWR is well positioned as a large-scale water service company providing leading edge practices for managing E&P companies’ water issues. Through its comprehensive Green Shield ServicesTM program, our HES segment offers a full-service waste stream management solution. The collection of UMO is subject to stringent regulatory requirements and facility permitting processes that, depending on the type of facility, can take several years to complete. We provide customers in both segments the ability to effectively outsource many of the regulatory issues surrounding their business, including frequent regulatory changes and developments, and allow them the ability to focus on their respective core competencies.

Executive Team with Extensive Experience in Water and Environmental Services. Our senior management has decades of combined global water and environmental services industry experience with an emphasis on acquiring and building sustainable businesses, driving operational excellence, developing regulatory acumen, and utilizing financial discipline. Our CEO, Richard Heckmann, COO, Charles Gordon, CFO, Chris Chisholm, and CLO, Damian Georgino, have extensive experience building and managing water and environmental services companies and TFI’s James Devlin and other senior team members are also experienced environmental industry executives. We believe our collective experience provides a key strength in managing and driving our growth.

Our Strategy

We plan to build upon our competitive strengths to grow our business through the following strategies:

Capitalize on Our Operational, Environmental and Regulatory Expertise. We believe our management team and employees have developed significant expertise regarding the issues surrounding water solutions and waste products, and can efficiently and safely provide services to our customers to manage this aspect of their business. We plan to use this ability to provide superior service and identify new service offerings, customers or geographies. We expect demand for our services to increase as regulations increase the financial and operational burdens on our customers.

S-4

Table of Contents

Focus on Consistent and Analytical Operational Improvement. We aggressively integrate and develop best practices that are implemented across the business. Our customers require high levels of service with regard to regulatory and environmental compliance, which we emphasize through extensive employee training, routine maintenance of our asset base and consistent analysis of our operating performance. Our offices and assets are standardized to facilitate training, maintenance efficiency and optimize costs. Within our HWR segment, we are currently taking delivery of new trucks (including LNG trucks) to reduce fuel costs, and implementing new accounting, invoicing, and fleet management systems to reduce costs and paperwork, improve data collection and increase operating efficiency.

Pursue Disciplined Growth in Core Segments. Our strategy is to grow our operating footprint, strategically reposition our assets and increase our service offerings in our core areas of competency. Specifically, in our HWR segment we are opportunistically growing our geographic footprint and strategically repositioning assets into new shale and unconventional areas, leveraging existing customer relationships in new operating regions. Additionally, while our UMO environmental services revenue has grown to nearly 20% of TFI’s total revenue in 2011, only one half of TFI’s customers utilize non-UMO environmental services. We plan to strategically expand the operating footprint of our HWR and HES segments through selective strategic acquisitions, increasing the scale and operating efficiency of our water solutions, oil collection and recycling operations and environmental services.

Industry Overview

Unconventional Oil and Gas Exploration

Over the past decade, E&P companies have focused on exploiting the vast resource potential available across many of North America’s unconventional resource areas through the application of horizontal drilling and completion technologies, including multi-stage hydraulic fracturing technologies that are highly water-intensive. We believe long-term capital for the continued development in new and existing basins will be provided in part by the large, well-capitalized domestic and international oil and natural gas companies that have made and continue to make significant capital commitments through joint ventures and direct investments in North America’s unconventional basins. We believe these companies are more likely to focus on environmental regulatory issues and prefer to work with large, highly qualified service providers.

While falling natural gas prices have resulted in a decline in drilling in natural gas unconventional areas, there continues to be increasing drilling activity in oil- and liquids-rich formations in the United States, such as the Eagle Ford, Utica, Bakken, Cana Woodford, Granite Wash, Niobrara and Permian Basin resource areas. According to Baker Hughes Incorporated, the oil- and liquids-focused rig count increased from a low of 20.9% of 876 total active rigs in June 2009 to 66.4% of 1,984 total active rigs as of March 16, 2012. We believe ongoing drilling activity and resulting increased water production from wells in these resource areas will continue to support sustained growth in demand for comprehensive water management services and further balance our exposure between oil and natural gas drilling activity and production as we make acquisitions and strategically position our assets in response to market demand and customer requirements.

Used Oil Collection and Recycling

The used oil collection and recycling industry is comprised of companies that provide routine and event based collections of UMO and other used oil (and other related waste) from a broad range of commercial and industrial businesses. As a result of environmental regulations that prohibit the disposal of used oil into sewers or landfills, generators of used oil must arrange to have their waste picked up periodically in order to avoid their storage tanks getting full. Following collection, the UMO is reprocessed into RFO, a commercial-grade fuel

S-5

Table of Contents

product, and typically sold into energy-intensive industries as an inexpensive and efficient alternative source to crude oil or diesel fuel. In recent years, the U.S. re-refining industry has grown significantly as an alternative end market for RFO, driving increased demand.

Used Motor Oil

An estimated 1.4 billion gallons of used oil are generated in the U.S. every year, of which approximately 1.0 billion gallons are collected. The balance of 0.4 billion gallons is lost due to improper management, on-site reuse and disposal. Approximately two-thirds of the overall market volume is generated by automotive service providers as a result of performing oil changes on passenger cars and trucks. The remaining one-third of market volume is generated by industrial plants as a result of changing lubricants used in heavy machinery or cutting oils used in manufacturing production processes. A relatively mature market, the amount of UMO volumes generated in any given year is typically driven by a number of factors, including annual vehicle miles driven, consumer preference for “do-it-for-me” oil change services (vs. “do-it-yourself”) and population growth.

Reprocessed Fuel Oil

Approximately 80% of the RFO produced in the U.S. is sold to asphalt plants, pulp and paper mills, commercial shipping and other energy-intensive industries in which it can be burned as a fuel source. RFO has historically sold at a substantial discount to diesel fuel, which is the primary alternative to RFO for these industries. On a per-gallon basis, the discount of RFO to diesel has typically ranged between 30% and 50% of the cost of diesel fuel. In addition to its cost advantage, RFO’s value proposition is further enhanced by its higher BTU content than diesel fuel. As a result, at December 2011, RFO could be obtained for less than half of the cost of diesel while also generating more than twice the energy output on a per-dollar basis.

The remaining 20% of RFO production is sold to the re-refining industry. Re-refining is the process by which a plant converts RFO feedstock into vacuum gas oil, marine diesel oil, and Group 1, 2 and 3 base lube, which is used to as the primary constituent of motor oil and other industrial lubricants. The growing re-refining sector is estimated to have nearly doubled over the last decade due to the value propositions of processed products relative to virgin alternatives and an increased awareness of “green” energy trends, which is expected to continue driving re-refining capacity growth going forward. As a result, U.S. re-refining capacity is expected to grow from 210 million gallons in 2010 to over 300 million gallons of capacity in 2013. In addition, there are four known capacity additions expected to be announced over the next two years which are not included in these estimates. Re-refiners generally lack the regional presence and required scale to self-source a reliable and economically feasible supply of feedstock. As a result, re-refiners are expected to continue to seek reliable UMO supplies from companies such as TFI.

Recent Developments

TFI Acquisition

On March 8, 2012, we announced that we entered into a definitive agreement to purchase TFI. The purchase price for the TFI Acquisition is $245.0 million, subject to purchase price adjustments, of which $227.5 million is payable in cash and $17.5 million is payable in our common stock, which will be placed into escrow for approximately one year at the closing date. We expect that the TFI Acquisition will close in the second quarter of fiscal 2012.

We intend to finance a portion of the consideration with the net proceeds from this offering. The consummation of the TFI Acquisition is subject to customary closing conditions. See “Use of Proceeds.” The closing of the TFI Acquisition is not a condition to the closing of this offering.

S-6

Table of Contents

New Senior Credit Facility

On March 20, 2012, we entered into a Commitment Letter (the “Commitment Letter”) for a new senior secured credit facility (our “New Credit Facility”) with Wells Fargo Securities, LLC and Regions Capital Markets, a division of Regions Bank, as joint bookrunners and joint lead arrangers, and Wells Fargo Bank, National Association, as Administrative Agent and as a Lender. Under the terms of the Commitment Letter, upon our entry into definitive documentation and satisfaction of the other conditions to effectiveness, we expect our New Credit Facility will establish a revolving credit facility with a five-year term that may be used for revolving credit loans up to an aggregate principal amount of $150.0 million, including up to $10.0 million available for letters of credit. In addition, the New Credit Facility has an uncommitted accordion feature that permits us to increase the aggregate principal amount of the New Credit Facility to $250.0 million, subject to certain conditions. The New Credit Facility will be secured by substantially all of our assets, including substantially all of our tangible and intangible personal property, material real property and other assets, as well as the capital stock of our domestic subsidiaries, including TFI. Borrowings under our New Credit Facility will bear interest ranging from a base rate plus a margin of 1.75% to 3.00% on base rate borrowings and LIBOR plus a margin of 2.75% to 4.00% on LIBOR borrowings. Our New Credit Facility will be deemed effective when all conditions precedent have been met, including the termination of our existing credit facility, the receipt of gross proceeds of not less than $250.0 million from an offering of debt securities, and the closing of the TFI Acquisition. Effectiveness of our New Credit Facility is also subject to other customary closing conditions. See “Description of the New Credit Facility” for additional information regarding our New Credit Facility and our existing credit facility. The closing of the New Credit Facility is not a condition to this offering.

Asset Repositioning

The decline in natural gas prices has resulted in a shift away from, and has adversely affected our business in, those shale areas that produce primarily dry gas, including the Haynesville Shale, where our fixed pipeline and most of our disposal wells are located and the majority of our trucks and frac trucks were historically located. With the significant decline in active rig count in the Haynesville Shale, beginning in the fourth quarter of 2011, we began to redeploy a portion of our truck fleet and frac tanks from the Haynesville Shale area, to more active shale areas where we have existing operations, such as the Eagle Ford, Utica and Marcellus Shale areas, as well as the Permian Basin and Tuscaloosa Marine Shale areas where we have recently established operations. These shale areas include oil- and liquids-rich hydrocarbon zones where drilling activity has been increasing. We continue to maintain a meaningful presence in the Haynesville Shale area to service existing customers and we believe that we will continue to have a competitive advantage in that shale area.

S-7

Table of Contents

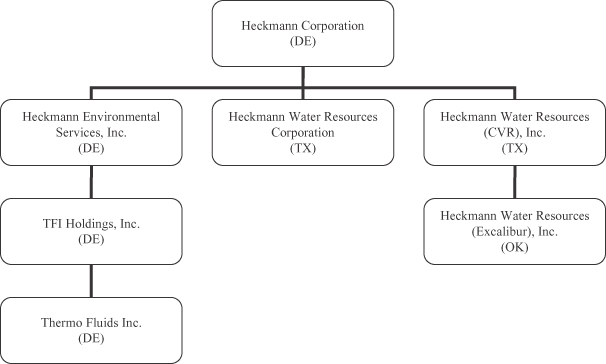

Corporate Structure

We present below a summary corporate structure chart of our continuing operations, including TFI:

General Corporate Information

Headquartered in Pittsburgh, Pennsylvania, Heckmann Corporation was incorporated in Delaware on May 29, 2007. Our address is 300 Cherrington Parkway, Suite 200, Coraopolis, Pennsylvania 15108 and our website is http://www.heckmanncorp.com. The contents of our website are not a part of this prospectus supplement.

S-8

Table of Contents

THE OFFERING

The following summary contains basic information about the common stock and is not intended to be complete. Certain of the terms and conditions described below are subject to important limitations and exceptions. For a more complete understanding of the common stock, please refer to the section of this document entitled “Description of the Common Stock” and “Description of Capital Stock—Common Stock” in the accompanying prospectus. For purposes of the description of the common stock included in this prospectus supplement, references to the “Company,” “issuer,” “us,” “we” and “our” refer only to Heckmann Corporation and do not include its subsidiaries.

Issuer | Heckmann Corporation |

Shares of our common stock offered | 18,200,000 shares(1) |

Option to purchase additional shares | We have granted the underwriters an option exercisable for a period of 30 days from the date of this prospectus supplement to purchase up to an additional 2,730,000 shares of our common stock at the public offering price, less the underwriting discount, to cover over-allotments, if any. |

Common stock to be outstanding after this offering | 148,815,013 shares(2) |

Use of proceeds | Based on the offering price of $4.40 per share, we estimate that the net proceeds from this offering will be approximately $75.6 million (or approximately $87.0 million if the underwriters’ over-allotment option is exercised in full), after deducting underwriting discounts and estimated fees and expenses. We expect to use the net proceeds of this offering to finance a portion of the cash consideration for the TFI Acquisition; additional funding will be required to consummate the TFI Acquisition and to repay all borrowings under our existing credit facility. If the TFI Acquisition is not completed, we intend to use the net proceeds from this offering to repay debt under our existing credit facility. See “Use of Proceeds” and “Unaudited Pro Forma Combined Financial Information.” |

| (1) | If the underwriters exercise their option to purchase such additional shares in full, the total number of shares of common stock offered will be 20,930,000. |

| (2) | The number of shares of common stock that will be outstanding after this offering is based on the number of shares outstanding on March 5, 2012, and assumes no exercise of the underwriters’ over-allotment option. 126,726,124 shares of our common stock were outstanding as of March 5, 2012. The number of issued shares of our common stock as ofMarch 5, 2012, excludes an aggregate of approximately 2.7 million shares of our common stock issuable upon the exercise of stock options outstanding as of December 31, 2011 at a weighted average exercise price of $4.67 per share and an aggregate of approximately 400,000 shares of our common stock issuable upon vesting of certain restricted stock awards that we have issued to our executive officers. The number of outstanding shares of our common stock as of March 5, 2012, has also been adjusted to include the 3,888,889 unregistered shares (assuming a value of $4.50 per share, which was the share price assumed in the preparation of our pro forma financial information) to be issued into escrow pursuant to the TFI Acquisition. |

S-9

Table of Contents

Risk factors | You should carefully consider the information set forth in the “Risk Factors” section of this prospectus supplement as well as all other information included in or incorporated by reference in this prospectus supplement and the accompanying prospectus before deciding whether to invest in our common stock. |

NYSE symbol | HEK |

S-10

Table of Contents

SUMMARY HISTORICAL AND PRO FORMA COMBINED FINANCIAL DATA

The following table sets forth the summary historical consolidated financial data of Heckmann as of and for the fiscal years ended December 31, 2009, 2010 and 2011. The summary historical consolidated financial data of Heckmann as of and for the fiscal years ended December 31, 2009, 2010 and 2011 have been derived from Heckmann’s audited consolidated financial statements as of such dates and for such periods. Heckmann’s audited consolidated financial statements as of December 31, 2009, 2010 and 2011 and for each of the years ended December 31, 2009, 2010 and 2011 are included elsewhere in this prospectus supplement. On September 30, 2011, we completed the disposition, through sale and abandonment, of all of our China Water business. Accordingly, the China Water business is reported as a discontinued operation for financial reporting purposes for all relevant reporting periods. See Note 12 to our 2011 Consolidated Financial Statements included and incorporated by reference in this prospectus supplement.

The following table also sets forth the summary historical consolidated financial data of TFI as of and for the fiscal year ended December 31, 2011 which have been derived from TFI’s audited consolidated financial statements as of such date and for such period, included and incorporated by reference in this prospectus supplement.

The following table also sets forth the summary pro forma combined financial statements presenting the pro forma combined financial position and results of operations of TFI and Heckmann Corporation. The unaudited pro forma combined financial statements are prepared with Heckmann Corporation treated as the acquiror and as if the TFI Acquisition had been consummated on December 31, 2011, for purposes of the unaudited combined balance sheet as of December 31, 2011, and on January 1, 2011, for purposes of the unaudited combined statement of operations for year ended December 31, 2011.

You should read the following information together with “Unaudited Pro Forma Combined Financial Information of Heckmann,” “Selected Consolidated Financial Data of Heckmann,” “Selected Consolidated Financial Data of TFI Holdings, Inc.,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations of Heckmann Corporation,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations of TFI Holdings, Inc.” and our audited consolidated financial statements, including the accompanying notes, included and incorporated by reference in this prospectus supplement.

As described in the footnotes to the following table, the pro forma information does not include adjustments for all of the transactions that are contemplated in connection with the TFI Acquisition and the transactions described under the caption “The Transactions” herein. See “Capitalization.”

S-11

Table of Contents

| Heckmann Corporation | TFI Holdings, Inc. | Pro Forma(1) | ||||||||||||||||||

| Fiscal Year Ended December 31, | ||||||||||||||||||||

| 2009 | 2010 | 2011 | 2011 | 2011 | ||||||||||||||||

| (dollars in thousands) | ||||||||||||||||||||

Statement of Operations Data: | ||||||||||||||||||||

Revenue | $ | 3,820 | $ | 15,208 | $ | 156,837 | $ | 113,798 | $ | 270,635 | ||||||||||

Cost of sales | 2,100 | 11,337 | 123,509 | 72,127 | 195,636 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Gross profit | 1,720 | 3,871 | 33,328 | 41,671 | 74,999 | |||||||||||||||

Operating expenses | 9,194 | 23,384 | 38,740 | 19,254 | 59,876 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Income (loss) from operations | (7,474 | ) | (19,513 | ) | (5,412 | ) | 22,417 | 15,123 | ||||||||||||

Interest income (expense), net | 3,928 | 2,087 | (4,243 | ) | (8,691 | ) | (18,708 | ) | ||||||||||||

Loss from equity investment | — | (689 | ) | (462 | ) | — | (462 | ) | ||||||||||||

Other income (expense), net | 149 | 4,411 | 6,232 | — | 6,232 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Income (loss) before income taxes | (3,397 | ) | (13,704 | ) | (3,885 | ) | 13,726 | 2,185 | ||||||||||||

Income tax benefit (expense) | 80 | 3,404 | 3,777 | (5,390 | ) | 14,326 | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Income (loss) from continuing operations | (3,317 | ) | (10,300 | ) | (108 | ) | 8,336 | 16,511 | ||||||||||||

Loss from discontinued operations | (392,078 | ) | (4,393 | ) | (22,898 | ) | — | (22,898 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Net income (loss) | $ | (395,395 | ) | $ | (14,693 | ) | $ | (23,006 | ) | $ | 8,336 | $ | (6,387 | ) | ||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Balance Sheet Data (at period end): | ||||||||||||||||||||

Cash and cash equivalents | $ | 80,194 | $ | 2,857 | $ | 82,739 | ||||||||||||||

Marketable securities | 5,169 | — | 5,169 | |||||||||||||||||

Property and equipment, net | 270,054 | 18,842 | 288,896 | |||||||||||||||||

Total assets | 539,681 | 170,431 | 816,142 | |||||||||||||||||

Long-term debt(2) | 144,070 | 71,075 | 310,570 | |||||||||||||||||

Total shareholders’ equity | 341,810 | 69,516 | 440,912 | |||||||||||||||||

Other Financial Data: | ||||||||||||||||||||

Adjusted EBITDA(3) | $ | (2,519 | ) | $ | 1,659 | $ | 28,546 | $ | 30,948 | $ | 59,417 | |||||||||

Capital expenditures (excludes acquisitions) | 19,970 | 17,443 | 150,921 | 2,570 | 153,491 | |||||||||||||||

| (1) | Does not fully incorporate the impact of all of the transactions described in the “Transactions” section of this prospectus supplement, including our planned offering of debt securities, repayment of existing bank debt and the use of cash from our balance sheet. It also does not reflect fees and expenses associated with these Transactions. |

| (2) | Includes both current and long-term portions. |

| (3) | EBITDA represents net income before interest expense, net, tax expense (benefit) provision, depreciation and amortization. Adjusted EBITDA represents EBITDA as further adjusted for items that management does not consider reflective of our core operating performance. EBITDA and Adjusted EBITDA are supplemental measures of our performance and our ability to service debt that are not required by, or presented in accordance with, GAAP. EBITDA and Adjusted EBITDA are not measurements of our financial performance under GAAP and should not be considered as alternatives to net income or any other performance measures derived in accordance with GAAP, or as alternatives to cash flow from operating activities as measures of our liquidity. In addition, our measurements of EBITDA and Adjusted EBITDA may not be comparable to similarly titled measures of other companies. See “Use of Non-GAAP Financial Measures.” |

S-12

Table of Contents

The following table reconciles net income (loss) to EBITDA and EBITDA to Adjusted EBITDA for the Company for the periods presented:

| Heckmann Corporation | TFI Holdings, Inc. | Pro Forma | ||||||||||||||||||

| Fiscal Year Ended December 31, | ||||||||||||||||||||

| 2009 | 2010 | 2011 | 2011 | 2011 | ||||||||||||||||

| (dollars in millions) | ||||||||||||||||||||

Income (loss) from continuing operations | $ | (3.3 | ) | $ | (10.3 | ) | $ | (0.1 | ) | $ | 8.3 | $ | 16.5 | |||||||

Income tax expense (benefit) | (0.1 | ) | (3.4 | ) | (3.8 | ) | 5.4 | (14.3 | ) | |||||||||||

Interest expense (income) | (3.9 | ) | (2.1 | ) | 4.2 | 8.7 | 18.7 | |||||||||||||

Depreciation | 0.6 | 3.4 | 21.4 | 2.9 | 24.3 | |||||||||||||||

Amortization | 0.1 | 1.2 | 3.9 | 5.0 | 8.9 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

EBITDA | (6.6 | ) | (11.2 | ) | 25.6 | 30.3 | 54.1 | |||||||||||||

Adjustments: | ||||||||||||||||||||

Transaction costs(1) | 0.3 | 2.1 | 2.6 | — | 5.0 | |||||||||||||||

Stock-based compensation(2) | 2.1 | 0.9 | 2.0 | — | 2.0 | |||||||||||||||

Earn-out adjustments(3) | — | (4.1 | ) | (5.8 | ) | — | (5.8 | ) | ||||||||||||

Pipeline start-up(4) | — | 11.2 | 2.1 | — | 2.1 | |||||||||||||||

China Water litigation(5) | 1.7 | 2.8 | 2.0 | — | 2.0 | |||||||||||||||

Management / consulting fees(6) | — | — | — | 0.6 | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Adjusted EBITDA | $ | (2.5 | ) | $ | 1.7 | $ | 28.5 | $ | 30.9 | $ | 59.4 | |||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

| (1) | Legal, advisory, diligence and other non-capitalized transaction expenses associated with the TFI Acquisition ($2.4 million reflected in pro forma income from continuing operations) and other completed and potential acquisitions, credit facilities, other financing activities and loss on a dissolved joint venture. |

| (2) | Reflects non-cash stock-based compensation pursuant to the Company’s 2009 Equity Compensation Plan. |

| (3) | We typically include equity compensation in the form of earn-out payments as a portion of the consideration for acquisitions we have made. These payments have business performance targets associated with them and may vary in size over time depending on actual business results until the balance of the earn-out consideration has been paid. Adjustments reflect performance-related reductions in our earn-out liabilities. |

| (4) | Expenses associated with commissioning and start-up of our Haynesville fresh and waste water pipeline, including repair and remediation resulting from leaks and breakages. |

| (5) | As described in greater detail in Note 11, Commitments and Contingencies, to our 2011 consolidated financial statements included and incorporated by reference in the prospectus supplement, we and certain of our directors and officers are involved in litigation arising from or relating to our China Water acquisition in October 2008, including a purported class action and a derivative action. In addition, on June 10, 2011, we received a subpoena from the Denver Regional Office of the SEC seeking information and documents concerning China Water. The litigation and the SEC inquiry have resulted in substantial legal fees and expenses. |

| (6) | Includes management and consulting fees paid by TFI that will not continue after closing of the TFI Acquisition. Pro forma income from continuing operations in 2011 already reflects adjustment for removal of $0.6 million of management fees. |

S-13

Table of Contents

SUMMARY CONSOLIDATED HISTORICAL FINANCIAL DATA OF TFI HOLDINGS, INC.

The following table sets forth the summary historical consolidated financial data of TFI Holdings, Inc. as of and for the fiscal years ended December 31, 2009, 2010 and 2011 which have been derived from TFI Holdings, Inc.’s audited consolidated financial statements as of such dates and for such periods, included and incorporated by reference in this prospectus supplement.

The historical results presented below are not necessarily indicative of results that can be expected for any future period and you should read the following information in conjunction with the sections entitled “Selected Consolidated Financial Data of TFI Holdings, Inc.,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations of TFI Holdings, Inc.,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations of Heckmann Corporation,” and our and TFI Holdings, Inc.’s audited consolidated financial statements, including the accompanying notes, included and incorporated by reference in this prospectus supplement.

| Fiscal Year Ended December 31, | ||||||||||||

| 2009 | 2010 | 2011 | ||||||||||

| (dollars in thousands) | ||||||||||||

Statement of Operations Data: | ||||||||||||

Revenue | $ | 73,192 | $ | 80,778 | $ | 113,798 | ||||||

Cost of sales | 52,465 | 54,645 | 72,127 | |||||||||

|

|

|

|

|

| |||||||

Gross profit | 20,727 | 26,134 | 41,671 | |||||||||

Operating expenses: | ||||||||||||

Sales and marketing | 1,076 | 1,976 | 2,663 | �� | ||||||||

General and administrative | 3,638 | 4,631 | 8,125 | |||||||||

Goodwill impairment | 11,128 | — | — | |||||||||

Depreciation and amortization | 7,875 | 7,634 | 7,907 | |||||||||

Loss (gain) on sale of property, plant and equipment | (8 | ) | — | — | ||||||||

Consulting fees to related parties | 441 | 400 | 408 | |||||||||

Management fees | 117 | 117 | 152 | |||||||||

|

|

|

|

|

| |||||||

Income (loss) from operations | (3,540 | ) | 11,376 | 22,417 | ||||||||

Other income (expense): | ||||||||||||

Interest income, net | 7 | 16 | 24 | |||||||||

Interest expense | (8,430 | ) | (7,778 | ) | (8,715 | ) | ||||||

|

|

|

|

|

| |||||||

Income before income taxes | (11,963 | ) | 3,614 | 13,726 | ||||||||

|

|

|

|

|

| |||||||

Income tax (expense) benefit | 298 | (339 | ) | (5,390 | ) | |||||||

|

|

|

|

|

| |||||||

Net income (loss) | $ | (11,665 | ) | $ | 3,275 | $ | 8,336 | |||||

|

|

|

|

|

| |||||||

Balance Sheet Data (at period end): | ||||||||||||

Cash and cash equivalents | $ | 1,749 | $ | 230 | $ | 2,857 | ||||||

Property and equipment, net | 18,968 | 18,439 | 18,842 | |||||||||

Total assets | 172,123 | 166,713 | 170,431 | |||||||||

Long-term debt (1) | 85,314 | 76,042 | 71,075 | |||||||||

Total shareholders’ equity | 57,916 | 61,190 | 69,516 | |||||||||

Other Financial Data: | ||||||||||||

Adjusted EBITDA (2) | 16,038 | 19,578 | 30,948 | |||||||||

Capital expenditures (excludes acquisitions) | 1,577 | 2,641 | 2,570 | |||||||||

S-14

Table of Contents

| (1) | Includes current and long-term portions. |

| (2) | EBITDA represents net income before interest expense, net, income tax expense (benefit), depreciation and amortization. EBITDA and Adjusted EBITDA are supplemental measures of our performance and our ability to service debt that are not required by, or presented in accordance with, GAAP. EBITDA and Adjusted EBITDA are not measurements of our financial performance under GAAP and should not be considered as alternatives to net income or any other performance measures derived in accordance with GAAP, or as alternatives to cash flow from operating activities as measures of our liquidity. In addition, our measurements of EBITDA and Adjusted EBITDA may not be comparable to similarly titled measures of other companies. See “Use of Non-GAAP Financial Measures.” |

The following table reconciles net income (loss) to EBITDA and EBITDA to Adjusted EBITDA for TFI Holdings, Inc. and pro forma to reflect the TFI Acquisition for the periods presented:

| Fiscal Year Ended December 31, | ||||||||||||

| 2009 | 2010 | 2011 | ||||||||||

| (dollars in millions) | ||||||||||||

Net income (loss) | $ | (11.7 | ) | $ | 3.3 | $ | 8.3 | |||||

Income tax expense (benefit) | (0.3 | ) | 0.3 | 5.4 | ||||||||

Interest expense | 8.4 | 7.8 | 8.7 | |||||||||

Depreciation | 2.9 | 2.8 | 2.9 | |||||||||

Amortization | 5.0 | 4.8 | 5.0 | |||||||||

|

|

|

|

|

| |||||||

EBITDA | 4.3 | 19.0 | 30.3 | |||||||||

Adjustments: | ||||||||||||

Goodwill impairment (1) | 11.1 | — | — | |||||||||

Management / consulting fees (2) | 0.6 | 0.5 | 0.6 | |||||||||

Transaction costs (3) | 0.0 | 0.0 | — | |||||||||

|

|

|

|

|

| |||||||

Adjusted EBITDA | $ | 16.0 | $ | 19.6 | $ | 30.9 | ||||||

|

|

|

|

|

| |||||||

| (1) | Reflects a goodwill impairment based on an annual impairment analysis due primarily to economic conditions. |

| (2) | Includes management and consulting fees paid by TFI that will not continue after closing of the TFI Acquisition. |

| (3) | Non-capitalized expenses associated with completed and potential acquisitions, credit facilities and other transactions. |

S-15

Table of Contents

Investing in the common stock involves a high degree of risk. In addition to the other information contained in this prospectus supplement and in documents that we incorporate by reference, you should carefully consider the risks discussed below before making a decision about investing in our securities. The risks and uncertainties discussed below, which assume that the acquisition of TFI has been consummated, are not the only ones facing us. Additional risks and uncertainties not presently known to us, or that we currently see as immaterial, may also harm our business. If any of these risks occur, our business, financial condition and operating results could be harmed, the market value of the common stock could decline and you could lose part or all of your investment.

Risks Related to this Offering

We may issue a substantial number of shares of our common stock in the future and stockholders may be adversely affected by the issuance of those shares.

In this offering, we expect to issue 18,200,000 shares of our common stock (or 20,930,000 shares of our common stock if the underwriter exercise their over-allotment option in full), which may result in dilution to the equity interest of our current stockholders and may adversely affect the market price of our common stock. We may raise additional capital by issuing shares of common stock, which will further increase the number of shares of common stock outstanding and may result in dilution in the equity interest of our current stockholders and may adversely affect the market price of our common stock. We have filed a registration statement on Form S-4 with the SEC, which allows us, in connection with acquisitions, to issue up to 13.4 million additional shares of common stock. We have also filed a shelf registration statement on Form S-3 that allows us to issue up to an additional $400.0 million minus the proceeds of this offering in debt, equity and hybrid securities following this offering. In addition, upon closing of the TFI Acquisition, we will issue $17.5 million worth of shares into escrow under a private placement exemption from Securities Act registration requirements, and may issue unregistered securities again in the future in connection with acquisitions. The issuance, and the resale or potential resale, of shares of our common stock in connection with acquisitions or otherwise could adversely affect the market price of our common stock, and could be dilutive to our stockholders depending on the performance of the acquired business and other factors.

Future sales of a substantial number of shares of our common stock in the public market (or the perception that such sales may occur) could reduce the market price of our common stock and could impair our ability to raise capital through future sales of our equity securities. Upon completion of this offering, 148,815,013 shares of our common stock will be outstanding. All of the shares that are being sold in this offering will be freely tradable without restriction under the Securities Act, unless purchased by our affiliates. We have outstanding privately-placed warrants exercisable for 941,176 shares of our common stock at an exercise price of $6.38 per share that expire on January 24, 2013, and privately-placed warrants exercisable for 626,866 shares of our common stock at an exercise price of $2.02 per share that expire on August 22, 2012. All such warrant shares may be freely transferable upon exercise if held by a non-affiliate.

In addition, subject to certain exceptions and extensions described under the heading “Underwriting” in this prospectus supplement, we and our directors and named executive officers have agreed that they will not offer, sell or agree to sell, directly or indirectly, any shares of our common stock for a period of 90 days from the date of this prospectus supplement, subject to certain exceptions. Sales of a substantial number of such shares upon expiration, or early release, of the lock-up (or the perception that such sales may occur) could cause our share price to fall.

The pro forma financial statements included in this prospectus supplement are presented for illustrative purposes only and may not be an indication of our financial condition or results of operations following the merger.

The pro forma financial statements included in this prospectus supplement are presented for illustrative purposes only, are based on various adjustments, assumptions and preliminary estimates, and may not be an indication of our financial condition or results of operations following this offering for several reasons. Our

S-16

Table of Contents

actual financial condition and results of operations following this equity offering and the TFI Acquisition may not be consistent with, or evident from, these pro forma financial statements. In addition, the assumptions used in preparing the pro forma financial information may not prove to be accurate, and other factors may affect our financial condition or results of operations following the offering and TFI Acquisition. The pro forma financial statements do not fully incorporate the impact of all of the transactions described in the “Transactions” section, herein, including our planned offering of debt securities, repayment of existing bank debt and the use of cash from our balance sheet. Additionally, the information contained in “Note 3—Business Acquisitions” in our Annual Report on Form 10-K, dated March 8, 2012, is based on unaudited historical information for companies we acquired in 2011. Investors should not place any undue reliance on the pro forma information.

Following the TFI Acquisition we will have a substantial amount of debt, which will limit our flexibility and impose restrictions on us that may materially affect our ability to meet our future financial commitments and liquidity needs.

After this offering and the proposed issuance of debt securities to fund the TFI Acquisition, we will have a significant amount of indebtedness. As of December 31, 2011, after giving effect to the Transactions (see “The Transactions”), we would have had consolidated indebtedness of approximately $253.9 million outstanding, representing approximately 36.7% of our total expected capitalization. Our ability to satisfy our debt obligations, and our ability to refinance our indebtedness, will depend upon our future operating performance, which will be affected by prevailing economic conditions in the markets that we serve and financial, business and other factors, many of which are beyond our control. We may be unable to generate sufficient cash flow from operations and future borrowings or other financing may be unavailable in an amount sufficient to enable us to fund our future financial obligations or our other liquidity needs.

The amount and terms of our debt could have material consequences to our business, including, but not limited to:

| • | limiting our ability to obtain additional financing to fund growth, mergers and acquisitions, working capital, capital expenditures, debt service requirements or other cash requirements; |

| • | exposing us to the risk of increased interest costs if the underlying interest rates rise; |

| • | limiting our ability to invest operating cash flow in our business due to existing debt service requirements; |

| • | limiting our ability to compete with companies that are not as leveraged and that may be better positioned to withstand economic downturns; |

| • | limiting our ability to make capital expenditures needed to conduct operations; and |

| • | limiting our flexibility in planning for, or reacting to, and increasing our vulnerability to, changes in our business, the industry in which we compete and general economic and market conditions. |

If we further increase our indebtedness, the related risks that we now face, including those described above, could intensify. In addition to the principal repayments on our outstanding debt, we have other demands on our cash resources, including capital expenditures and operating expenses. Our ability to pay our debt depends upon our operating performance. In particular, economic conditions could cause our revenues to decline, and hamper our ability to repay our indebtedness. If we do not have enough cash to satisfy our debt service obligations, we may be required to refinance all or part of our debt, sell assets or reduce our spending. We may not be able to, at any given time, refinance our debt or sell assets on terms acceptable to us or at all.

We may be unable to comply with restrictions imposed by our credit facilities and other existing or proposed financing arrangements.

The agreements governing our outstanding and proposed financing arrangements impose a number of restrictions on us. For example, the terms of our credit facilities and other financing arrangements contain

S-17

Table of Contents

financial and other covenants that create limitations on our ability to borrow the full amount under our credit facilities, effect acquisitions or dispositions and incur additional debt and require us to maintain various financial ratios and comply with various other financial covenants. Our ability to comply with these restrictions may be affected by events beyond our control. A failure to comply with these restrictions could adversely affect our ability to borrow under our credit facilities or result in an event of default under these agreements. In the event of a default, our lenders and the counterparties to our other financing arrangements could terminate their commitments to us and declare all amounts borrowed, together with accrued interest and fees, immediately due and payable. If this were to occur, we might not be able to pay these amounts, or we might be forced to seek an amendment to our financing arrangements which could make the terms of these arrangements more onerous for us. As a result, a default under one or more of our existing or future financing arrangements could have significant consequences for us.

Risks Related to Our Company

We cannot assure you that the TFI Acquisition will be consummated.

Although we plan to use the proceeds of this offering to fund in part the cash portion of the TFI Acquisition consideration, this offering is not conditioned on the consummation of the TFI Acquisition, and we cannot assure you that the acquisition will close. If the TFI Acquisition fails to close, our plans to diversify our business through a new HES segment as described in this prospectus supplement will likely be realized, if at all, only when an alternative acquisition transaction or transactions are identified and consummated. The offering of debt securities we plan to use to fund the remaining portion of the cash consideration, as described in “The Transactions” is not expected to commence until after this offering, and we cannot assure you that the debt securities offering will be successful or that the proceeds thereof will be available to finance the consummation of the TFI Acquisition. If the TFI Acquisition fails to close for any reason, we plan to use the proceeds of this offering to repay indebtedness under our existing credit facility, which would remain in place. If the purchase agreement for the TFI Acquisition is terminated or the TFI Acquisition otherwise fails to close, we could become involved in litigation with the sellers of TFI that, if adversely determined, could materially adversely affect us.

We may not be able to grow successfully through future acquisitions or successfully manage future growth, and we may not be able to effectively integrate the businesses we do acquire.

Our business strategy includes growth through the acquisitions of other businesses in both our HWR and HES segments. We may not be able to continue to identify attractive acquisition opportunities or successfully acquire those opportunities identified. In order to complete acquisitions, we would expect to require additional debt and/or equity financing, which could increase our interest expense, leverage and shares outstanding. In addition, we may not be successful in integrating current or future acquisitions into our existing operations, which may result in unforeseen operational difficulties or diminished financial performance or require a disproportionate amount of our management’s attention.

Even if we are successful in integrating our current or future acquisitions into our existing operations, we may not derive the benefits, such as operational or administrative synergies, that we expected from such acquisitions, which may result in the commitment of our capital resources without the expected returns on such capital. Also, competition for acquisition opportunities may escalate, increasing our cost of making further acquisitions or causing us to refrain from making additional acquisitions.

Additional risks related to our acquisition strategy include, but are not limited to:

| • | the potential disruption of our existing businesses; |

| • | entering new markets or industries in which we have limited prior experience; |

| • | difficulties integrating and retaining key management, sales, research and development, production and other personnel; |

S-18

Table of Contents

| • | difficulties integrating or expanding information technology systems and other business processes to accommodate the acquired businesses; |

| • | risks associated with integrating financial reporting and internal control systems; and |

| • | whether any necessary additional debt or equity financing will be available on terms acceptable to us, or at all, and the impact of such financing on our operating performance and earnings per share. |

We may not be able to successfully integrate or realize the anticipated benefits of our acquisition of TFI and may not be able to maintain or achieve profitability of the acquired businesses or overall.