Exhibit 99.1

Heckmann Corporation

March 2013 Investor Presentation

Heckmann Corporation

Legal Disclaimer

ABOUT FORWARD-LOOKING STATEMENTS:

This presentation may contain “forward-looking statements” within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify such forward-looking statements. Forward-looking statements include, without limitation, forecasts of growth, revenues, adjusted EBITDA and pipeline expansion, and other matters that involve known and unknown risks, uncertainties and other factors that may cause results, levels of activity, performance or achievements to differ materially from results expressed or implied herein. Such risk factors include, among others: difficulties encountered in acquiring and integrating businesses, including Badlands Power Fuels, LLC (“Power Fuels”); whether certain markets grow as anticipated; and the competitive and regulatory environment. Additional risks and uncertainties are set forth in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2011, as well as the Company’s other reports filed with the United States Securities and Exchange Commission and are available at http://www.sec.gov/ as well as the Company’s website at http://heckmanncorp.com/. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. All forward-looking statements are qualified in their entirety by this cautionary statement. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results. Neither Heckmann, Power Fuels nor the combined company are responsible for updating the information contained in this document beyond the publication date.

ABOUT NON-GAAP FINANCIAL MEASURES:

This presentation contains non-GAAP financial measures as defined by the rules and regulations of the SEC. A non-GAAP financial measure is a numerical measure of a company’s historical or future financial performance, financial position or cash flows that excludes amounts, or is subject to adjustments that have the effect of excluding amounts, that are included in the most directly comparable measure calculated and presented in accordance with GAAP in the statements of operations, balance sheets, or statements of cash flows of Heckmann; or includes amounts, or is subject to adjustments that have the effect of including amounts, that are excluded from the most directly comparable measure so calculated and presented. For a reconciliation of these non-GAAP financial measures to their comparable GAAP financial measures please see the Appendix to this presentation.

These non-GAAP financial measures are provided because our management uses these financial measures in maintaining and evaluating our ongoing financial results and trends. Management uses this non-GAAP information as an indicator of business performance, and evaluates overall management with respect to such indicators. Management believes that excluding items such as acquisition expenses, amortization of intangible assets and stock-based compensation, among other items that are inconsistent in amount and frequency (as with acquisition and earn-out expenses), or determined pursuant to complex formulas that incorporate factors, such as market volatility, that are beyond our control (as with stock-based compensation), for purposes of calculating these non-GAAP financial measures facilitates a more meaningful evaluation of our current operating performance and comparisons to the past and future operating performance. We believe that providing non-GAAP financial measures such as EBITDA, and Adjusted EBITDA, in addition to related GAAP financial measures, provides investors with greater transparency to the information used by our management in its financial and operational decision-making. EBITDA represents net income (loss) before interest expense, net, income tax (benefit) provision, depreciation and amortization. Adjusted EBITDA represents EBITDA as further adjusted for items that management does not consider reflective of our core operating performance. EBITDA and Adjusted EBITDA are supplemental measures of our performance and our ability to service debt that are not required by, or presented in accordance with, GAAP. EBITDA and Adjusted EBITDA are not measurements of our financial performance under GAAP and should not be considered as alternatives to net income or any other performance measures derived in accordance with GAAP, or as alternatives to cash flow from operating activities as measures of our liquidity. In addition, our measurements of EBITDA and Adjusted EBITDA may not be comparable to similarly titled measures of other companies, limiting their usefulness as a comparative measure.

Company Presenters

Company Presenters

Mark Johnsrud

Chief Executive Officer and Vice Chairman of the Board of Directors

Former President and Chief Executive Officer of Badlands Power Fuels

Former senior executive with several financial services firms, most recently as a Managing Director and Senior Vice President at Bank of America

Jay Parkinson

Executive Vice President and Chief Financial Officer

Previously a Managing Director, Energy Investment Banking at Jefferies & Company, Inc.

Prior to Jefferies & Company, Inc., Mr. Parkinson worked in the Investment Banking Group at Johnson Rice & Company L.L.C.

The New Heckmann – Investment Thesis

Comprehensive environmental solutions provider exposed to a secular domestic energy growth story

Full-cycle environmental service provider: delivery, collection, treatment, recycling, and disposal

Transportation “system” in place in leading unconventional shale basins – can be utilized to add-on additional environmental services

70% of energy-related revenues levered to oil / liquids activity

Strong balance sheet with over $190 million in liquidity

Business Overview

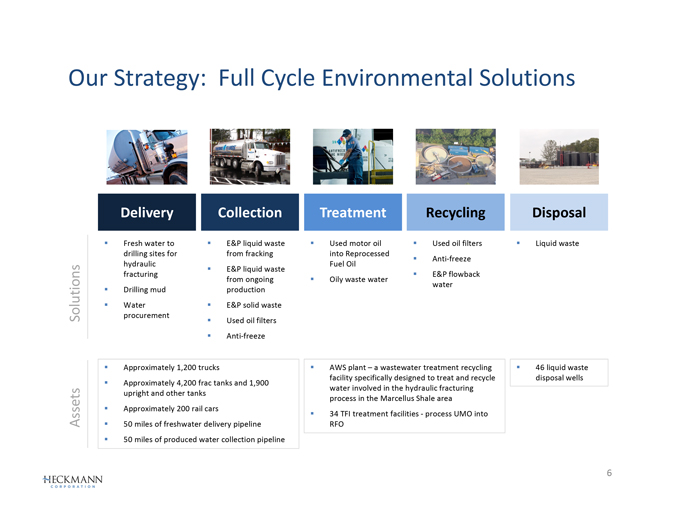

Our Strategy: Full Cycle Environmental Solutions

Delivery

Fresh water to drilling sites for hydraulic fracturing

Drilling mud

Water procurement

Collection

E&P liquid waste from fracking

E&P liquid waste from ongoing production

E&P solid waste

Used oil filters

Anti-freeze

Treatment

Used motor oil into Reprocessed Fuel Oil

Oily waste water

Recycling

Used oil filters

Anti-freeze

E&P flowback water

Disposal

Liquid waste

Solutions

Assets

Approximately 1,200 trucks

Approximately 4,200 frac tanks and 1,900 upright and other tanks

Approximately 200 rail cars

50 miles of freshwater delivery pipeline

50 miles of produced water collection pipeline

AWS plant – a wastewater treatment recycling facility specifically designed to treat and recycle water involved in the hydraulic fracturing process in the Marcellus Shale area

34 TFI treatment facilities - process UMO into RFO

46 liquid waste disposal wells

Our National Operating Platform

Liquids-Rich Area

Gas-Rich Area

Industrial End-Market Operating Area

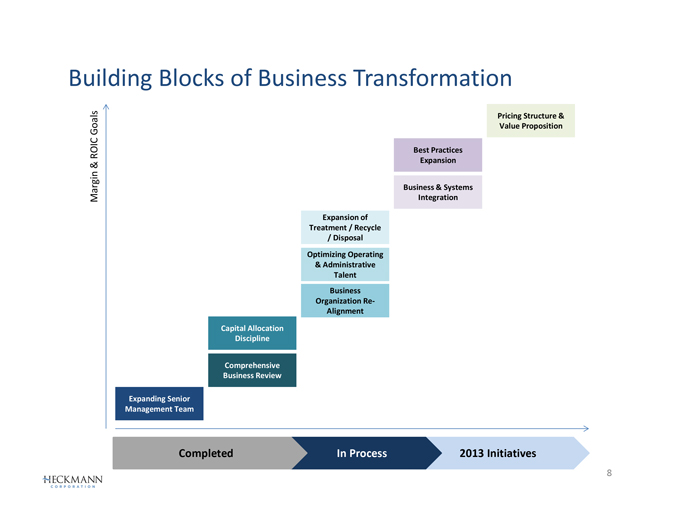

Building Blocks of Business Transformation

Pricing Structure & Value Proposition

Best Practices Expansion

Business & Systems Integration

Expansion of Treatment / Recycle

/ Disposal

Optimizing Operating

& Administrative Talent

Business Organization ReAlignment

Capital Allocation Discipline

Comprehensive Business Review

Expanding Senior Management Team

Margin & ROIC Goals

Completed In Process 2013 Initiatives

In Process

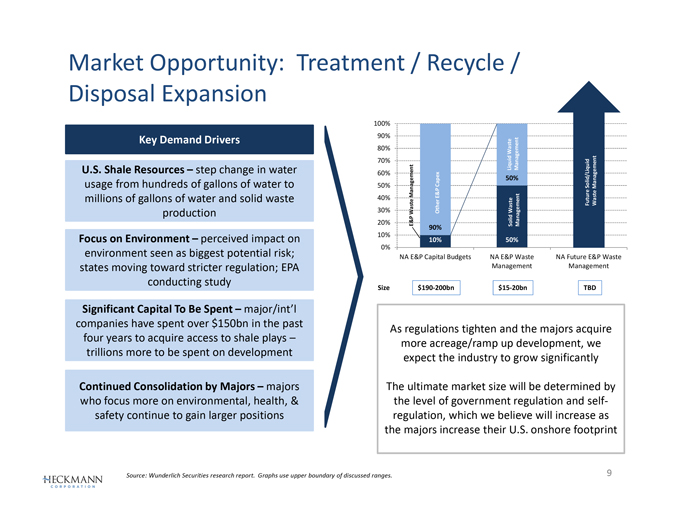

Market Opportunity: Treatment / Recycle / Disposal Expansion

Key Demand Drivers

U.S. Shale Resources – step change in water usage from hundreds of gallons of water to millions of gallons of water and solid waste production

Focus on Environment – perceived impact on environment seen as biggest potential risk; states moving toward stricter regulation; EPA conducting study

Significant Capital To Be Spent – major/int’l companies have spent over $150bn in the past four years to acquire access to shale plays –trillions more to be spent on development

Continued Consolidation by Majors – majors who focus more on environmental, health, & safety continue to gain larger positions

NA E&P Capital Budgets NA E&P Waste NA Future E&P Waste

Management Management

Size $190-200bn $15-20bn TBD

As regulations tighten and the majors acquire more acreage/ramp up development, we expect the industry to grow significantly

The ultimate market size will be determined by the level of government regulation and self-regulation, which we believe will increase as the majors increase their U.S. onshore footprint

Source: Wunderlich Securities research report. Graphs use upper boundary of discussed ranges.

Industry Commentary And What Our Customers Are Saying…

“An energy renaissance in the United States is redrawing the global energy map, with implications for energy markets and trade.”

- IEA, World Energy Outlook November 2012

“I never dreamed I’d be spending at this level”

- Rex Tillerson, ExxonMobil CEO

March 7, 2013

“So our plan would be to leverage those efficiencies and be able to drill additional wells…”

- Winston Bott, Continental COO

February 28, 2013

“Exxon to Invest $190 Billion Upstream Over Five Years”

- Wall Street Journal March 6, 2013

“The United States is projected to become the largest global oil producer before 2020, exceeding Saudi Arabia until the mid-2020s.”

- IEA, World Energy Outlook November 2012

“At our 2013 pace of 175 net wells annually, this equates to 18 years of drilling from only our Williston Basin and Central Rockies locations and 26 years of drilling, including our prospective locations.”

- James J. Volker, Whiting CEO

February 28, 2013

“We need you to be a full-cycle environmental solutions provider”

- Heckmann Customer

“Drilling permit activity was up significantly in January.”

- Lynn Helms, Director of North Dakota’s Department of Mineral Resources February 15, 2013

“The takeaway from our Bakken/Three Forks asset is the wells are getting better with continued success in down-spacing, the number of potential locations is growing and this provides us many years of high IRR investment opportunity in the play.”

- William R. Thomas, EOG President February 14, 2013

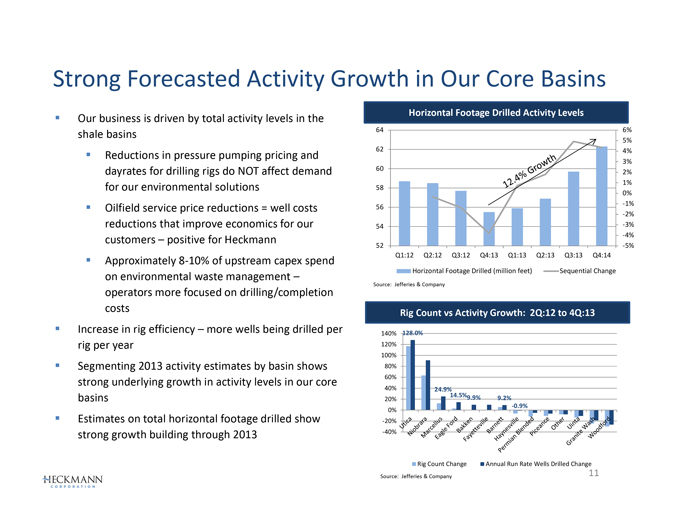

Strong Forecasted Activity Growth in Our Core Basins

Our business is driven by total activity levels in the shale basins

Reductions in pressure pumping pricing and dayrates for drilling rigs do NOT affect demand for our environmental solutions

Oilfield service price reductions = well costs reductions that improve economics for our customers – positive for Heckmann

Approximately 8-10% of upstream capex spend on environmental waste management –operators more focused on drilling/completion costs

Increase in rig efficiency – more wells being drilled per rig per year

Segmenting 2013 activity estimates by basin shows strong underlying growth in activity levels in our core basins

Estimates on total horizontal footage drilled show strong growth building through 2013

Horizontal Footage Drilled Activity Levels

Q1:12 Q2:12 Q3:12 Q4:13 Q1:13 Q2:13 Q3:13 Q4:14

Horizontal Footage Drilled (million feet) Sequential Change

Source: Jefferies & Company

Rig Count vs Activity Growth: 2Q:12 to 4Q:13

Rig Count Change Annual Run Rate Wells Drilled Change

Source: Jefferies & Company

Financial Review

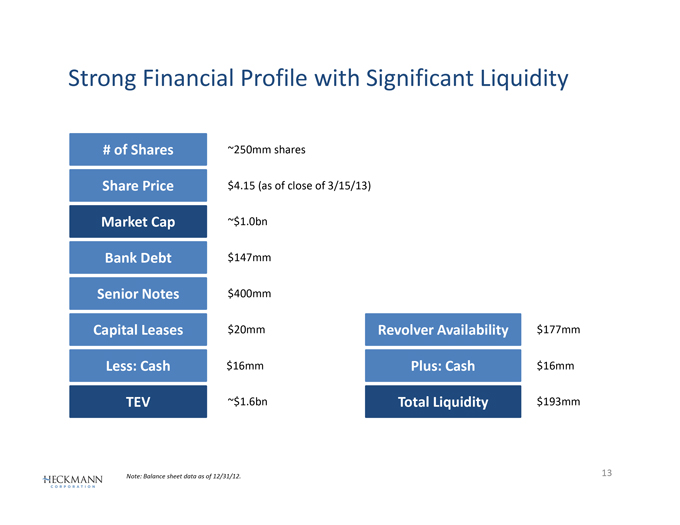

Strong Financial Profile with Significant Liquidity

# of Shares Share Price Market Cap Bank Debt Senior Notes Capital Leases Less: Cash TEV

~250mm shares

$4.15 (as of close of 3/15/13)

~$1.0bn $147mm

$400mm $20mm $16mm

~$1.6bn

Revolver Availability $177mm

Plus: Cash $16mm

Total Liquidity $193mm

Note: Balance sheet data as of 12/31/12.

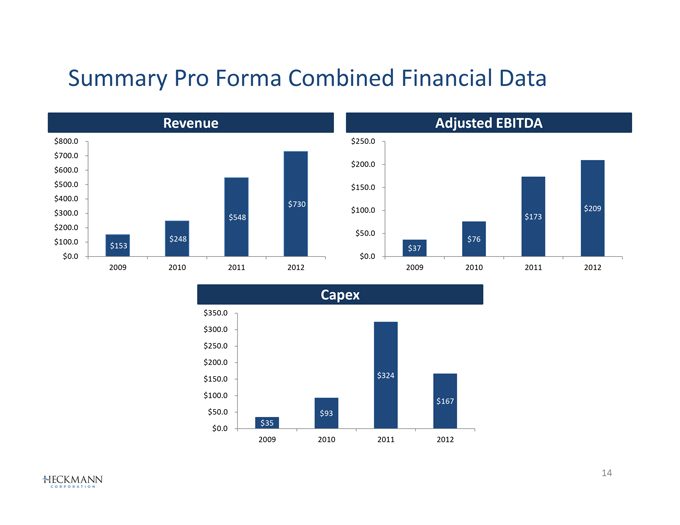

Summary Pro Forma Combined Financial Data

Revenue

2009 2010 2011 2012

Adjusted EBITDA

2009 2010 2011 2012

Capex

2009 2010 2011 2012

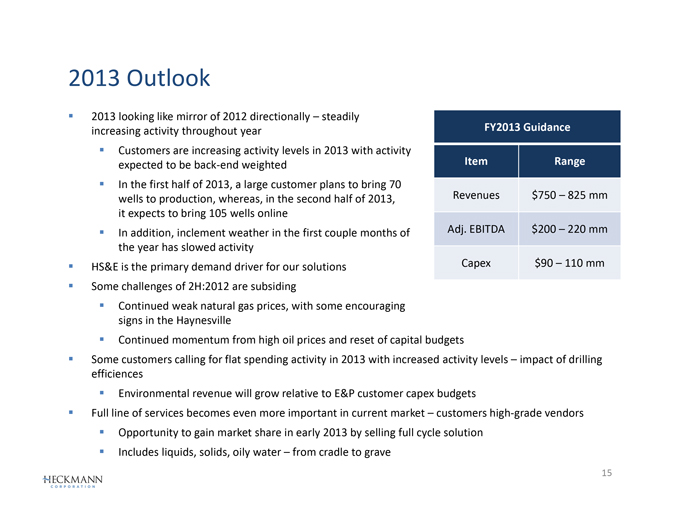

2013 Outlook

2013 looking like mirror of 2012 directionally – steadily increasing activity throughout year

Customers are increasing activity levels in 2013 with activity expected to be back-end weighted

In the first half of 2013, a large customer plans to bring 70 wells to production, whereas, in the second half of 2013, it expects to bring 105 wells online

In addition, inclement weather in the first couple months of the year has slowed activity

HS&E is the primary demand driver for our solutions

Some challenges of 2H:2012 are subsiding

Continued weak natural gas prices, with some encouraging signs in the Haynesville

Continued momentum from high oil prices and reset of capital budgets

Some customers calling for flat spending activity in 2013 with increased activity levels – impact of drilling efficiences

Environmental revenue will grow relative to E&P customer capex budgets

Full line of services becomes even more important in current market – customers high-grade vendors

Opportunity to gain market share in early 2013 by selling full cycle solution

Includes liquids, solids, oily water – from cradle to grave

FY2013 Guidance

Item Range

Revenues $750 – 825 mm Adj. EBITDA $200 – 220 mm Capex $90 – 110 mm

Appendix

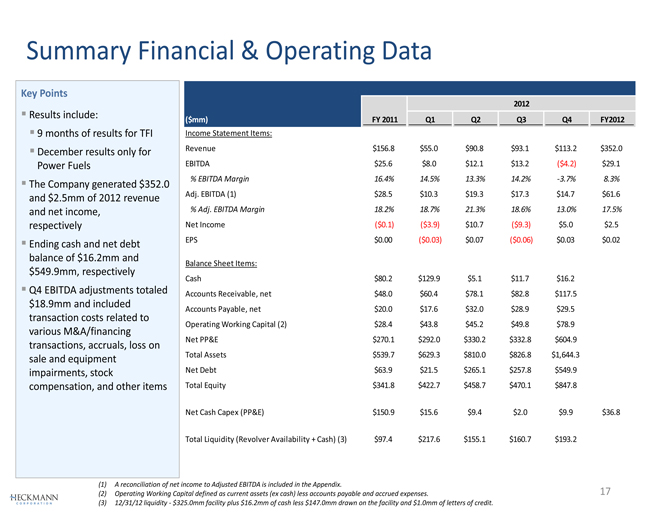

Summary Financial & Operating Data

Key Points

Results include:

9 months of results for TFI

December results only for Power Fuels

The Company generated $352.0 and $2.5mm of 2012 revenue and net income, respectively

Ending cash and net debt balance of $16.2mm and $549.9mm, respectively

Q4 EBITDA adjustments totaled $18.9mm and included transaction costs related to various M&A/financing transactions, accruals, loss on sale and equipment impairments, stock compensation, and other items

2012

($mm) FY 2011 Q1 Q2 Q3 Q4 FY2012

Income Statement Items:

Revenue $156.8 $55.0 $90.8 $93.1 $113.2 $352.0

EBITDA $25.6 $8.0 $12.1 $13.2 ($4.2) $29.1

% EBITDA Margin 16.4% 14.5% 13.3% 14.2% -3.7% 8.3%

Adj. EBITDA (1) $28.5 $10.3 $19.3 $17.3 $14.7 $61.6

% Adj. EBITDA Margin 18.2% 18.7% 21.3% 18.6% 13.0% 17.5%

Net Income ($0.1) ($3.9) $10.7 ($9.3) $5.0 $2.5

EPS $0.00 ($0.03) $0.07 ($0.06) $0.03 $0.02

Balance Sheet Items:

Cash $80.2 $129.9 $5.1 $11.7 $16.2 Accounts Receivable, net $48.0 $60.4 $78.1 $82.8 $117.5 Accounts Payable, net $20.0 $17.6 $32.0 $28.9 $29.5 Operating Working Capital (2) $28.4 $43.8 $45.2 $49.8 $78.9 Net PP&E $270.1 $292.0 $330.2 $332.8 $604.9 Total Assets $539.7 $629.3 $810.0 $826.8 $1,644.3 Net Debt $63.9 $21.5 $265.1 $257.8 $549.9 Total Equity $341.8 $422.7 $458.7 $470.1 $847.8

Net Cash Capex (PP&E) $150.9 $15.6 $9.4 $2.0 $9.9 $36.8

Total Liquidity (Revolver Availability + Cash) (3) $97.4 $217.6 $155.1 $160.7 $193.2

(1) A reconciliation of net income to Adjusted EBITDA is included in the Appendix.

(2) Operating Working Capital defined as current assets (ex cash) less accounts payable and accrued expenses.

(3) 12/31/12 liquidity - $325.0mm facility plus $16.2mm of cash less $147.0mm drawn on the facility and $1.0mm of letters of credit.

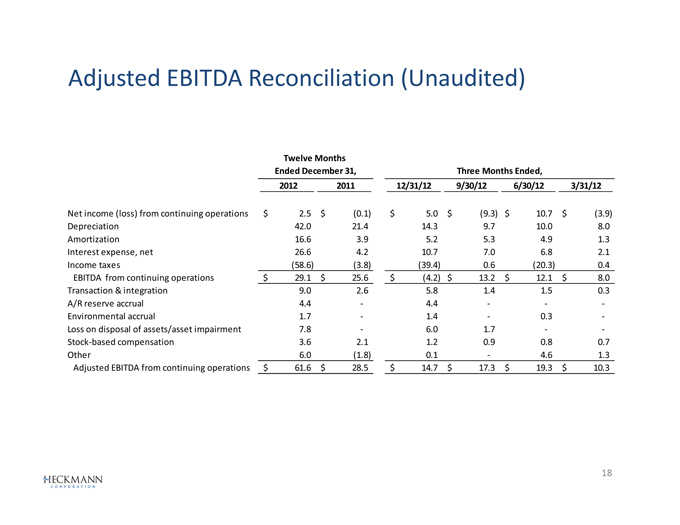

Adjusted EBITDA Reconciliation (Unaudited)

Twelve Months

Ended December 31, Three Months Ended,

2012 2011 12/31/12 9/30/12 6/30/12 3/31/12

Net income (loss) from continuing operations $ 2.5 $ (0.1) $ 5.0 $ (9.3) $ 10.7 $ (3.9) Depreciation 42.0 21.4 14.3 9.7 10.0 8.0 Amortization 16.6 3.9 5.2 5.3 4.9 1.3 Interest expense, net 26.6 4.2 10.7 7.0 6.8 2.1 Income taxes (58.6) (3.8) (39.4) 0.6 (20.3) 0.4 EBITDA from continuing operations $ 29.1 $ 25.6 $ (4.2) $ 13.2 $ 12.1 $ 8.0 Transaction & integration 9.0 2.6 5.8 1.4 1.5 0.3 A/R reserve accrual 4.4 - 4.4 - - -Environmental accrual 1.7 - 1.4 - 0.3 -Loss on disposal of assets/asset impairment 7.8 - 6.0 1.7 - -Stock-based compensation 3.6 2.1 1.2 0.9 0.8 0.7 Other 6.0 (1.8) 0.1 - 4.6 1.3 Adjusted EBITDA from continuing operations $ 61.6 $ 28.5 $ 14.7 $ 17.3 $ 19.3 $ 10.3

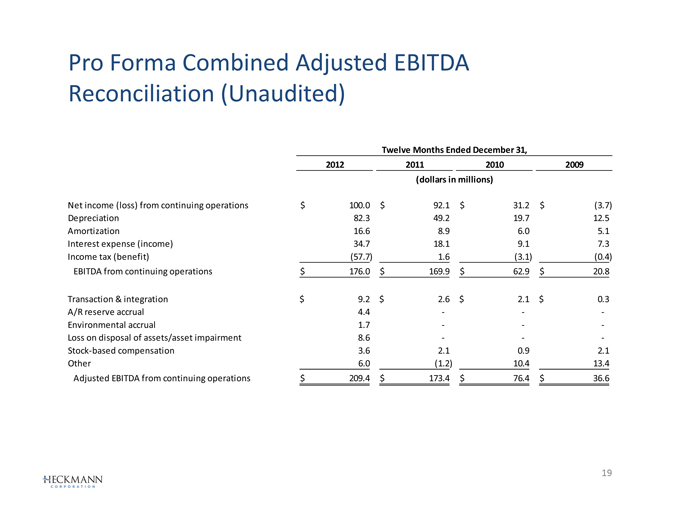

Pro Forma Combined Adjusted EBITDA Reconciliation (Unaudited)

Twelve Months Ended December 31,

2012 2011 2010 2009 (dollars in millions)

Net income (loss) from continuing operations $ 100.0 $ 92.1 $ 31.2 $ (3.7) Depreciation 82.3 49.2 19.7 12.5 Amortization 16.6 8.9 6.0 5.1 Interest expense (income) 34.7 18.1 9.1 7.3 Income tax (benefit) (57.7) 1.6 (3.1) (0.4) EBITDA from continuing operations $ 176.0 $ 169.9 $ 62.9 $ 20.8

Transaction & integration $ 9.2 $ 2.6 $ 2.1 $ 0.3 A/R reserve accrual 4.4 - - -Environmental accrual 1.7 - - -Loss on disposal of assets/asset impairment 8.6 - - -Stock-based compensation 3.6 2.1 0.9 2.1 Other 6.0 (1.2) 10.4 13.4 Adjusted EBITDA from continuing operations $ 209.4 $ 173.4 $ 76.4 $ 36.6