UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by the Registrantx |

| Filed by a Party other than the Registrant¨ |

| Check the appropriate box: |

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a–6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a–12 |

| SAMSON OIL & GAS LIMITED |

| (Name of Registrant as Specified In Its Charter) |

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| |

| Payment of Filing Fee (Check the appropriate box): |

| x | No fee required. |

| | |

| ¨ | Fee computed on table below per Exchange Act Rules 14a–6(i)(1) and0–11. |

| | |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0–11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | (5) | Total fee paid: |

| | | |

| | |

| ¨ | Fee paid previously with preliminary materials. |

| | |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule0–11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | Amount Previously Paid: |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | |

| | (3) | Filing Party: |

| | | |

| | (4) | Date Filed: |

| | | |

TABLE OF CONTENTS

SAMSON OIL & GAS LIMITED

(ABN 25 009 069 005)

NOTICE OF ANNUAL GENERAL MEETING

EXPLANATORY MEMORANDUM

PROXY FORM

| Date: | | 29, November 2019 |

| | | |

| Time: | | 11.00 am AWST |

| | | |

| Venue: | | Level 8, 99 St Georges Terrace |

| | | Perth, Western Australia 6000 |

These documents should be read in their entirety. If shareholders are in doubt as to how they should vote, they should seek advice from their accountant, solicitor or other professional adviser prior to voting.

Notice of Annual General Meeting 2019

SAMSON OIL & GAS LIMITED

(ABN 25 009 069 005)

NOTICE OF ANNUAL GENERAL MEETING

NOTICE IS HEREBY GIVEN that the annual general meeting of Samson Oil & Gas Limited will be held at Minerva Corporate, Level 8, 99 St Georges Terrace, Western Australia 6000 on 29, November 2019 at 11.00am (Perth, Western Australia time).

AGENDA

ORDINARY BUSINESS

Financial Statements

To receive, consider and discuss the Company’s financial statements for the year ended 30 June 2019 and the reports of the directors and auditors on those statements.

Note:

There is no requirement for Shareholders to approve these reports.

Resolution 1- Re-election of Director - Mr. Nicholas Ong

To consider and, if thought fit, to pass the following resolution as an ordinary resolution:

“That, Mr. Nicholas Ong, having been appointed by the Directors on 22 July 2019 until this Annual General Meeting, retires in accordance with clause 12.7 of the Constitution and having offered himself for re-election and being eligible, is hereby re-elected as a Director of the Company”.

Resolution 2- Re-election of Director – Mr. Gregory Channon

To consider and, if thought fit, to pass the following resolution as an ordinary resolution:

“In accordance with Listing Rule 14.5 and clause 12.3 of the Constitution, that Mr. Gregory Channon, who retires by rotation and, being eligible, offers himself for re-election, be re-elected as a Director of the Company”.

Resolution 3 – Adoption of Remuneration Report

To consider and, if thought fit, to pass the following resolution as a non-binding resolution:

“That, for the purposes of section 250R(2) of the Corporations Act 2001 and for all other purposes, the Remuneration Report contained in the 2019 Annual Report which accompanied the notice convening this meeting be adopted by shareholders”.

Note:

In accordance with section 250R(2) of the Corporations Act 2001, this resolution is advisory only and does not bind the Directors or the Company.

Voting Exclusion Statement:

The Company will disregard any votes cast on Resolution 3 by or on behalf of any member of the Key Management Personnel, details of whose remuneration are included in the Remuneration Report, or any Closely Related Party of such a member.

| Notice of Annual General Meeting 2019 |

However, the Company will not disregard any votes cast on Resolution 3 by such a person if the vote is not cast on behalf of such a person and either:

| | (a) | the person is acting as proxy and the proxy form specifies how the proxy is to vote on the Resolution; or |

| | (b) | the person is the Chairman of the Meeting voting an undirected proxy and their appointment expressly authorises the Chairman to exercise the proxy even though Resolution 3 is connected with the remuneration of the Key Management Personnel of the Company. |

If you are a member of the KMP of the Company or a Closely Related Party of such a member (or are acting on behalf of any such person) and purport to cast a vote (other than as a proxy as permitted in the manner set out above), that vote will be disregarded by the Company (as indicated above) and you may be liable for an offence for breach of voting restrictions that apply to you under the Corporations Act.

Resolution 4 - Advisory Vote on named Executive Officer Compensation

In accordance with the requirement of the U.S. Securities Exchange Act of 1934, the compensation paid to the Company’s “named executive officers”, as disclosed in Annexure “A” to the Explanatory Memorandum accompanying the notice convening this meeting, is hereby submitted to an advisory vote of Shareholders.

To consider and, if thought fit, to pass the following resolution as an ordinary resolution:

“That the Shareholders approve, on an advisory basis, the compensation of the Company’s “named executive officers,” as disclosed in Annexure “A” to the Explanatory Memorandum accompanying the notice convening this meeting, including the “Compensation Discussion and Analysis,” compensation tables and narrative disclosed”.

Note:

In accordance with Section 14A of the U.S. Securities Exchange Act of 1934, this resolution is advisory only and does not bind the Directors of the Company.

ENTITLEMENT TO ATTEND AND VOTE

You will be entitled to attend and vote at the Annual General Meeting if you are registered as a Shareholder of the Company as at 11.00am on Wednesday, 27 November 2019. This is because, in accordance with the Corporations Regulations 2001 (Cth), the Board has determined that the Shares on issue at that time will be taken, for the purposes of the Meeting, to be held by the persons who held them at that time. Accordingly, transactions registered after that time will be disregarded in determining entitlements to attend and vote at the Meeting.

HOW TO VOTE

Voting in person

Shareholders who plan to attend the Meeting are asked to arrive at the venue 15 minutes prior to the time designated for the Meeting if possible, so that their holding may be checked against the Company’s register of members and attendances recorded.

Corporate representatives

A body corporate, which is a Shareholder or which has been appointed as a proxy, may appoint an individual to act as its corporate representative at the Meeting in accordance with section 250D of the Corporations Act. The appropriate appointment document must be produced prior to admission. A form of the certificate can be obtained from the Company’s registered office.

Voting by proxy

A Shareholder who is entitled to attend and cast a vote at the Meeting may appoint a proxy. A proxy need not be a Shareholder and may be an individual or body corporate. If a body corporate is appointed as a proxy it must appoint a corporate representative in accordance with section 250D of the Corporations Act to exercise its powers as proxy at the Meeting (see above).

| Notice of Annual General Meeting 2019 |

A Shareholder who is entitled to cast two or more votes may appoint two proxies to attend the Meeting and vote on their behalf and may specify the proportion or a number of votes each proxy is appointed to exercise. If a Shareholder appoints two proxies and the appointment does not specify the proportion or number of the Shareholder’s votes each proxy may exercise, each proxy may exercise half of the votes (disregarding fractions). If you wish to appoint a second proxy, you may copy the enclosed proxy form or obtain a form from the Company’s registered office.

To be effective for the Meeting a proxy appointment (and any power of attorney or other authority under which it is signed or otherwise authenticated, or a certified copy of that authority) must be received at an address or fax number below no later than 11.00am on Wednesday, 27 November 2019, being 48 hours before the time of the Meeting. Any proxy appointment received after that time will not be valid for the Meeting.

| Registered Office: | | Minerva Corporate, Level 8, 99 St Georges Terrace Perth WA 6000 |

| | | |

| Facsimile Number: | | (08) 9486 4799 |

| | | |

| Postal Address: | | PO Box 5638, St Georges Terrace, Perth, WA 6831 |

| | | |

| Email Address: | | Nicholas.ong@minervacorporate.com.au |

For further information concerning the appointment of proxies and the ways in which proxy appointments may be submitted, please refer to the enclosed proxy form.

Voting by attorney

A Shareholder may appoint an attorney to attend and vote on their behalf. For an appointment to be effective for the Meeting, the instrument effecting the appointment (or a certified copy of it) must be received by the Company’s share registry at least 48 hours prior to the commencement of the Meeting.

Chairman as proxy

If you appoint a proxy, the Company encourages you to consider directing them how to vote by marking the appropriate box on each of the proposed Resolutions.

If a Shareholder entitled to vote on a Resolution appoints the Chairman of the Meeting as his proxy (or the Chairman becomes his proxy by default) and the Shareholder does not direct the Chairman how to vote on the Resolution, then:

| · | the Chairman intends to vote in favour of the Resolution as proxy for that Shareholder on a poll; and |

| · | for Resolution 3, the Shareholder will be taken to have given the Chairman express authority to vote as the Shareholder’s proxy on those resolutions even though those resolutions are connected directly or indirectly with the remuneration of a member of the KMP for the Company and even though the Chairman is a member of the KMP, unless the Shareholder expressly indicates to the contrary in the proxy appointment. |

If you do not want to put the Chairman in the position of casting your votes in favour of any of the proposed Resolutions, you should complete the appropriate box on the Proxy Form, directing your proxy to vote against, or to abstain from voting, on the Resolution.

Other members of KMP as proxy

If a Shareholder appoints a Director (other than the Chairman) or another member of the KMP (or a Closely Related Party of any such person) as his proxy and does not direct the proxy how to vote on Resolution 3 by marking the ‘For’, ‘Against’ or ‘Abstain’ box opposite the relevant Resolution on the proxy appointment, the proxy will not be able to exercise the Shareholder’s proxy and vote on his behalf on those Resolutions.

| Notice of Annual General Meeting 2019 |

QUESTIONS FROM SHAREHOLDERS

The Chairman will allow a reasonable opportunity for Shareholders at the Meeting to ask questions about and make comments on the management of the Company and on the annual financial report, the Directors’ report (including the Remuneration Report) and the auditor’s report (Reports), as well as each of the Resolutions to be considered at the Meeting.

A representative of the Company’s auditor will attend the Meeting. During the Meeting’s consideration of the Reports, the Chairman will allow a reasonable opportunity for Shareholders at the Meeting to ask the auditor’s representative questions relevant to the:

| · | conduct of the audit; |

| · | preparation and content of the auditor’s report for the financial year ended 30 June 2019; |

| · | accounting policies adopted by the Company in relation to the preparation of the financial statements contained in the Reports for that year; and |

| · | independence of the auditor in relation to the conduct of the audit. |

Shareholders may also submit a written question to the Company’s auditor if the question is relevant to the content of the auditor’s report or the conduct of the audit.

If you wish to submit a question in advance of the Meeting, you may do so by sending your question to one of the addresses or facsimile numbers above by no later than 5:00 pm 26 November 2019. The Company and the auditor will attempt to respond to as many of the more frequently asked questions as possible. Due to the large number of questions that may be received, the Company and the auditor will not be replying on an individual basis.

By Order of the Board

Nicholas Ong

Director/Company Secretary

28 October 2019

| Notice of Annual General Meeting 2019 |

SAMSON OIL & GAS LIMITED

(ABN 25 009 069 005)

EXPLANATORY MEMORANDUM TO SHAREHOLDERS

This Explanatory Memorandum has been prepared for the information of Shareholders of Samson Oil & Gas Limited in connection with the business to be transacted at the annual general meeting of the Company to be held on Friday, 29 November 2019.

At that meeting, Shareholders will be asked to consider resolutions:

| | • | re-electing a director who retires; |

| | • | re-electing a director who retires by rotation; |

| | • | adopting the Remuneration Report; and |

| | • | advisory vote on named Executive Officer compensation |

The purpose of this Explanatory Memorandum is to provide information that the Board believes to be material to Shareholders in deciding whether or not to pass those resolutions. The Explanatory Memorandum explains the resolutions and identifies the Board’s reasons for putting them to Shareholders. It should be read in conjunction with the accompanying Notice of Meeting.

If you have any questions regarding the matters set out in this Explanatory Memorandum or the preceding Notice of Annual General Meeting, please contact the Company Secretary, Mr Nicholas Ong, your stockbroker or other professional adviser.

The following terms and abbreviations used in this Explanatory Memorandum and the accompanying Notice of Meeting have the following meanings:

| AGM, Annual General Meeting or Meeting | | The annual general meeting of the Company to be held on Friday, 29 November 2019. |

| | | |

| ASIC | | Australian Securities and Investments Commission. |

| | | |

| ASX | | ASX Limited (ACN 008 624 691), trading as the Australian Securities Exchange. |

| | | |

| ASX Listing Rules or Listing Rules | | The Official Listing Rules of the ASX, as amended from time to time. |

| | | |

| Board | | The board of directors of the Company. |

| | | |

| Chairman | | The chairman of the Annual General Meeting. |

| | | |

| Constitution | | The constitution of the Company. |

| | | |

| Corporations Act | | Corporations Act 2001 (Cth). |

| | | |

| Closely Related Party | | Of a member of the Key Management Personnel means: |

| | | |

| | | (i) | a spouse or child of the member; |

| | | (ii) | a child of the member’s spouse |

| | | (iii) | a dependant of the member or of the member’s spouse; |

| | | (iv) | anyone else who is one of the member’s family and may be expected to influence the member or be influenced by the member, in the member’s dealing with the entity; |

| | | (v) | a company the member controls; or |

| | | (vi) | a person prescribed by the Corporations Regulations 2001 (Cth.). |

| Notice of Annual General Meeting 2019 |

| Director | | A director of the Company. |

| | | |

| Explanatory Memorandum | | The explanatory memorandum that accompanies this Notice of Meeting. |

| | | |

| Equity Security | | Has the meaning given to that term in the Listing Rules. |

| | | |

| Key Management Personnel | | Has the same meaning as in the accounting standards and broadly includes those persons having authority and responsibility for planning, directing and controlling the activities of the Company, directly or indirectly, including any director (whether executive or otherwise) of the Company. |

| | | |

| Notice of Meeting | | The notice convening the Annual General Meeting which accompanies this Explanatory Memorandum. |

| | | |

| Option | | An option to subscribe for a Share. |

| | | |

| Optionholder | | A registered holder of an Option |

| | | |

| Remuneration Report | | The annual remuneration report included in the Company’s annual report for the year ended 30 June 2019. |

| | | |

| SamsonorCompany | | Samson Oil & Gas Limited (ABN 25 009 069 005). |

| | | |

| Samson SharesorShares | | Fully paid ordinary shares in the Company. |

| | | |

| Shareholder | | A registered holder of a Share. |

| 3. | Financial Statements and Reports |

The Corporations Act requires the annual financial report, Directors’ report and the auditor’s report (Annual Financial Statements) to be received and considered at the Annual General Meeting. The Annual Financial Statements for the period ended 30 June 2019 are included in the Company’s annual financial report, a copy of which will be made available on request.

There is no requirement for Shareholders to approve these reports and no vote will be taken on the Annual Financial Statements. However, Shareholders attending the Annual General Meeting will be given a reasonable opportunity to ask questions about, or make comments on, the Annual Financial Statements and the management of the Company.

| Notice of Annual General Meeting 2019 |

| 4. | Resolution 1 – Re-election of Nicholas Ong as a Director |

Clause 12.7 of the Constitution requires that a person appointed as a Director during the period shall hold office only until the next general meeting and is then eligible for re-election.

Mr Nicholas Ong brings 15 years’ experience in IPO, listing rules compliance and corporate governance for public listed companies. Nicholas is a fellow of the Governance Institute of Australia and holds a Bachelor of Commerce and a Master of Business Administration from the University of Western Australia.

Mr Ong was appointed Non-Executive Director on 22 July 2019 and seeks re-election.

The Board, excluding Mr Ong who declines to make a recommendation on Resolution 1, recommends that Shareholders vote in favour of Resolution 1.

| 5. | Resolution 2 – Re-election of Gregory Channon as a Director |

In accordance with clause 12.3 of the Constitution, a Director must not hold office without re-election past the third annual general meeting following the Directors appointment of last election of for more than three years (whichever is the longer).

Under clause 12.3 of the Constitution and Listing Rule 14.5, there must be an election of Directors at each annual general meeting of the Company. This may be satisfied by either:

| a) | a person standing for election as a new Director; |

| b) | any Director appointed to fill a casual vacancy or as an additional Director standing for election; |

| c) | any Director who is retiring at the end of the meeting due to the tenure limitation standing for re-election; or |

| d) | if no person or Director is standing for election or re-election, in accordance with (a) – (c) above, then the Director who has been a Director the longest without re-election must retire and stand for re-election. If two or more Directors have been a Director the longest and an equal time without re-election, then in default of agreement, the Director to retire will be determined by ballot. |

In accordance with these provisions, Mr Gregory Channon will retire by rotation at the end of the AGM. Mr Channon is eligible for re-election and he seeks re-election as a director of the Company at the AGM.

The Board, excluding Mr Channon who declines to make a recommendation on Resolution 2, recommends that Shareholders vote in favour of Resolution 2.

| 6. | Resolution 3 – Adoption of Remuneration Report |

The Company’s auditor, RSM Australia Partners, will be present at the Annual General Meeting and Shareholders will have the opportunity to ask the auditor questions in relation to the conduct of the audit, the auditor’s report, the Company’s accounting policies, and the independence of the auditor.

| Notice of Annual General Meeting 2019 |

Pursuant to Section 250R(2) of the Corporations Act, the Company submits to Shareholders for consideration and adoption, by way of a non-binding resolution, its Remuneration Report for the year ended 30 June 2019. The Remuneration Report is a distinct section of the annual Directors’ report which deals with the remuneration of Directors, executives and senior managers of the Company. More particularly, the Remuneration Report can be found within the Directors’ report in the Company’s 30 June 2019 annual financial report, which is available on the Company's website athttp://www.samsonoilandgas.com/IRM/content/default.aspx.

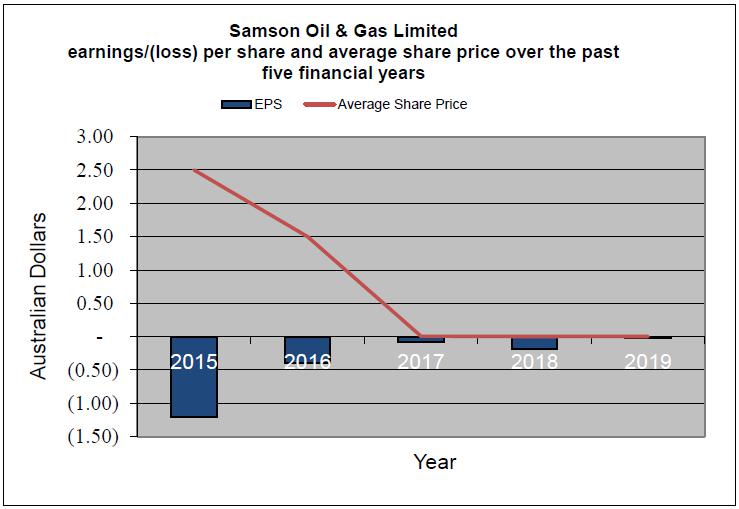

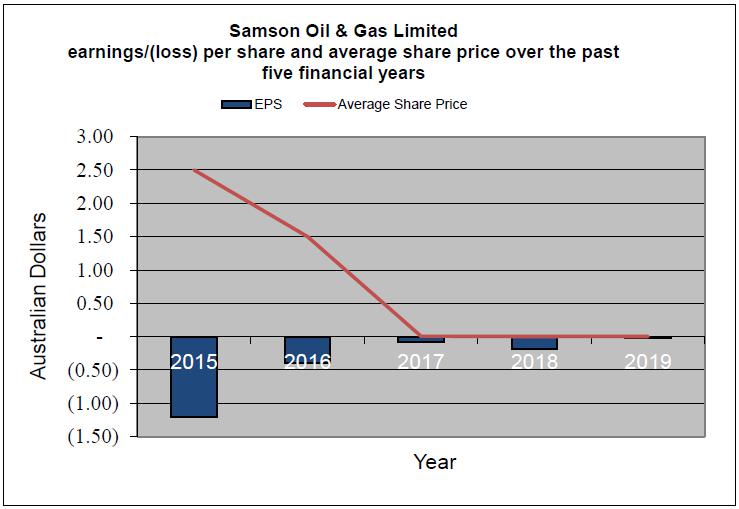

By way of summary, the Remuneration Report:

| a) | explains the Company’s remuneration policy and the process for determining the remuneration of its Directors and executive officers; |

| b) | addresses the relationship between the Company’s remuneration policy and the Company’s performance; and |

| c) | sets out the remuneration details for each Director and executive officer named in the Remuneration Report for the financial year ended 30 June 2019. |

The remuneration levels for Directors, executives and senior managers are competitively set to attract and retain appropriate Directors and KMP of the Company.

The Chairman will allow a reasonable opportunity for Shareholders as a whole to ask about, or make comments on, the Remuneration Report.

| 6.2 | Regulatory requirements |

The corporations act provides that Resolution 2 need only be an advisory vote of shareholders and does not bind the directors. However, the corporations act provides that if the company’s remuneration report resolution receives a “no” vote of 25% or more of votes cast at the annual general meeting, the company’s subsequent remuneration report must explain the board’s proposed action in response or, if the board does not propose any action, the board’s reasons for not making any changes. The board will take into account the outcome of the vote when considering the remuneration policy, even if it receives less than a 25% “no” vote.

In addition, sections 250u and 250v of the Corporations Act set out a “two strikes” re-election process. Under the “two strikes” re-election process, if the company’s remuneration report receives a “no” vote of 25% or more of all votes cast at two consecutive annual general meetings (that is, “two strikes”), a resolution (Spill Resolution) must be put to the second annual general meeting, requiring shareholders to vote on whether the company must hold another general meeting (known as the “Spill Meeting”) to consider the appointment of all of the directors at the time the directors’ report was approved by the board who must stand for re-appointment (other than the managing director).

If the Spill Resolution is approved at the annual general meeting by a simple majority of 50% or more of the eligible votes cast, the spill meeting must be held within 90 days of the Spill Resolution being passed (unless none of the Directors, other than the Managing Director, stand for reappointment).

| 6.3 | Previous voting results |

The votes cast against the adoption of the remuneration report considered at the Company’s 2018 Annual General Meeting were less than 25%, and as such the Spill Resolution will not be relevant for this Annual General Meeting.

The Board unanimously recommends that Shareholders vote in favour of Resolution 3.

| Notice of Annual General Meeting 2019 |

| 8. | Resolution 4 - Advisory Vote on “Named Executive Officer” Compensation |

The advisory vote being put to Shareholders is for US regulatory purposes only and is not a requirement of either the Corporations Act or the ASX Listing Rules. An explanation of the resolution is set out in Annexure "A".

The Board unanimously recommends that Shareholders vote in favour of Resolution 4.

| 9. | Action to be taken by Shareholders |

Shareholders should read this Explanatory Memorandum carefully before deciding how to vote on the resolutions set out in the Notice of Meeting.

Attached to the Notice of Meeting is a proxy form for use by Shareholders. All Shareholders are invited and encouraged to attend the AGM or, if they are unable to attend in person, to complete, sign and return the proxy form to the Company in accordance with the instructions contained in the proxy form and the Notice of Meeting. Lodgment of a proxy form will not preclude a Shareholder from attending and voting at the AGM in person.

| Notice of Annual General Meeting 2019 |

PROXY FORM

The Company Secretary

Samson Oil & Gas Limited

C/- Minerva Corporate, Level 8

99 St Georges Terrace

PERTH WA 6000

I/We ��

(Full Name – Block Letters)

of

being a member of Samson Oil & Gas Limited hereby appoint

to exercise % of my/our voting rights

(Name of 1st Proxy)

to exercise % of my/our voting rights

(2ndProxy – Optional)

or in his/her absence, or if no person is named, the Chairman of the meeting as my/our proxy/proxies to act generally and vote on my/our behalf at the AGM of the Company to be held at 11.00am on Friday, 29 November 2019 and at any adjournment thereof in accordance with this proxy form.

The Chairman of the meeting will act as your proxy if you do not appoint someone. It is the Chairman’s intention to exercise all undirected proxies in favour of all of the resolutions.

If the Chairman is appointed as your proxy (either expressly or by default) and you donot wish to direct your proxy how to vote, please place a mark in this box¨

By marking the box above you acknowledge that if you have appointed the Chairman as your proxy (either expressly or by default):

| (1) | he may exercise the undirected proxy even if he has an interest in the outcome of Resolution 3 and votes cast by him other than as proxy would be disregarded because of that interest; and |

| (2) | he is expressly authorized to exercise the undirected proxy in respect of Resolution 3 in the manner described above even though Resolution 3 is connected with the remuneration of a member of the Key Management Personnel. |

If you do not mark the box above, and you have not directed your proxy how to vote, then in respect of Resolution 3 the Chairman will not cast your votes and your votes will not be counted in calculating the required majority if a poll is called on that resolution.

| | | RESOLUTIONS | | FOR | | AGAINST | | ABSTAIN* |

| 1. | | To re-elect Nicholas Ong as a director | | ¨ | | ¨ | | ¨ |

| 2. | | To re-elect Gregory Channon as a director | | ¨ | | ¨ | | ¨ |

| 3. | | Advisory vote to approve the adoption of remuneration report | | ¨ | | ¨ | | ¨ |

| 4. | | Advisory vote on named Executive Officer compensation | | ¨ | | ¨ | | ¨ |

* If you mark the “Abstain” box with an “X” for a particular resolution, you are directing your proxy not to vote on your behalf on a show of hands or on a poll and your votes will not be counted in computing the required majority.

| Date: 2019. | | |

| | | |

| | | |

| Signature of Member | | Signature of Joint Member |

| | | |

| or if a company: | | |

| THE COMMON SEAL OF | | ) |

| was affixed in the presence of, and the sealing is attested by: | | ) |

| | | |

| | |

| Director/Secretary | | Director |

| | | |

| or if a company with no common seal: | | |

| EXECUTED by authority of its directors | | |

| | | |

| | | |

| | |

| Director | | Director / Company Secretary |

| Notice of Annual General Meeting 2019 |

INSTRUCTIONS FOR APPOINTMENT OF PROXY

| (1) | A member entitled to attend and vote at the meeting is entitled to appoint not more than two proxies. |

| (2) | Where more than one proxy is appointed, each proxy must be appointed to represent a specified proportion of the member's voting rights. If that proportion is not specified, each proxy may exercise one-half of the member’s voting rights. |

| (3) | A proxy need not be a member of the Company. |

Forms to appoint proxies and the Power of Attorney (if any) under which it is signed or an office copy or notarially certified copy thereof must be deposited with the Company at the registered office, Minerva Corporate, Level 8, 99 St Georges Terrace, Perth WA 6000 or faxed to the Company (Fax No: (08) 9486 4799) or email it to nicholas.ong@minervacorporate.com.au, not less than 48 hours before the time for holding the meeting. A proxy presented by a company should be under the common seal of that company.

ANNEXURE “A”

SCHEDULE 14A PROXY STATEMENT

pursuant to the U.S. Securities Exchange Act of 1934

GENERAL INFORMATION

Proxy Solicitation

This proxy statement, in the form mandated by the U.S. Securities and Exchange Commission (the “SEC”) under United States securities laws (this “U.S. Proxy Statement”), is being furnished by the Board of Directors (the “Board”) of Samson Oil & Gas Limited, an Australian corporation (“we,” “us,” “Samson” or the “Company”), in connection with our solicitation of proxies for Samson’s annual general meeting of shareholders to be held at the Company’s headquarters Level 8, 99 St. Georges Terrace, Perth, Western Australia 6000 on November 29, 2019 at 11:00 a.m. Western Australian Standard Time, and at any adjournments or postponements thereof (the “Annual General Meeting”). The information contained in this U.S. Proxy Statement supplements the information provided to holders of ordinary shares in the Notice of Annual General Meeting and the accompanying Explanatory Memorandum to Shareholders (“Explanatory Memorandum”) and proxy form.

In addition to solicitation by mail, certain of our directors, officers and employees may, to the extent permitted by Australian law, solicit proxies by telephone, personal contact, or other means of communication. They will not receive any additional compensation for these activities. Also, brokers, banks and other persons holding ordinary shares or American Depositary Shares (“ADSs”) representing ownership of ordinary shares on behalf of beneficial owners will be requested to solicit proxies or authorizations from beneficial owners. To the extent permitted by Australian law, we will bear all costs incurred in connection with the preparation, assembly and mailing of the proxy materials and the solicitation of proxies and will reimburse brokers, banks and other nominees, fiduciaries and custodians for reasonable expenses incurred by them in forwarding proxy materials to beneficial owners of our ordinary shares or ADSs.

This U.S. Proxy Statement and accompanying proxy materials are expected to be first sent to our ordinary shareholders on or about October 29, 2019, and are also available at http://www.samsonoilandgas.com.

Business of the Annual General Meeting

At the Annual General Meeting, shareholders will:

| | · | Receive, consider and discuss the Company’s financial statements for the year ended June 30, 2019 and the reports of the directors and auditors on those statements. |

| | · | Be asked to consider resolutions to: |

| | o | Approve the re-election of Nicholas Ong; |

| | |

| | o | Approve the re-election of Gregory Channon; |

| | o | Approve the adoption of the Remuneration Report, which is attached asExhibit A; and |

| | o | Approve, on an advisory basis, named executive officer compensation. |

The matters described in this U.S. Proxy Statement constitute the only business that the Board intends to present or is informed that others will present at the meeting. The proxy does, however, confer discretionary authority upon the Chairman of the Annual General Meeting to vote on any other business that may properly come before the meeting.

Shareholders Entitled to Vote

November 27, 2019 has been fixed as the record date for the determination of holders of ordinary shares entitled to vote at the Annual General Meeting, however, ordinary shareholders voting by proxy must return their proxy form to the Company at least 48 hours prior to the Annual General Meeting in order for their votes to be counted. Each ordinary share is entitled to one vote. Votes may not be cumulated.

328,300,044 ordinary shares, no par value, were issued and outstanding as of October 28, 2019, of which 2,146,182,800 were held in the form of 10,730,914 ADSs. Each ADS represents 200 ordinary shares.

Under our constitution, the quorum for a meeting of holders of ordinary shares is two (2) holders of ordinary shares.

For purposes of determining the number of shares that have been cast for a resolution, a vote of “Abstain” does not increase the number of shares needed to achieve a majority vote. Abstentions are treated as if the shares so voted are not present at the vote on such resolution.

ADS holders may vote the ordinary shares underlying their ADSs in accordance with the deposit agreement among us, the depositary and the ADS holders (the “Deposit Agreement”). ADS holders should read “Differences between ADS Holders and Ordinary Shareholders” directly below.

Differences between ADS Holders and Ordinary Shareholders

The Bank of New York Mellon, as depositary, executes and delivers ADSs on our behalf. We are requesting the depositary, which holds the ordinary shares underlying the ADSs, to seek ADS holders’ instructions as to voting for the Annual General Meeting. As a result, ADS holders may instruct the depositary to vote the ordinary shares underlying their ADSs. The depositary establishes the ADS record date. The depositary has set the ADS record date for the Annual General Meeting as October 22, 2019.

Because we have asked the depositary to seek the instructions of ADS holders, the depositary will notify ADS holders of the upcoming vote and arrange to deliver our voting materials and form of notice to them. The depositary then tries, as far as practicable, subject to Australian law and the terms of the Deposit Agreement, to vote the ordinary shares as our ADS holders instruct. The depositary does not vote or attempt to exercise the right to vote other than in accordance with the instructions of the ADS holders. We cannot guarantee that ADS holders will receive this U.S. Proxy Statement and the other proxy materials from the depositary in time to permit them to instruct the depositary to vote their shares. In addition, there may be other circumstances in which ADS holders may not be able to exercise voting rights. Furthermore, ADS holders can exercise their right to vote the ordinary shares underlying their ADSs by exchanging their ADSs for ordinary shares. However, even though we are subject to U.S. domestic issuer proxy rules and our shareholder meetings are announced via press release and filed with the SEC, ADS holders may not know about the meeting early enough to exchange their ADSs for ordinary shares.

ADS holders are not required to be treated as holders of ordinary shares and do not have the rights of holders of ordinary shares. The Deposit Agreement sets out ADS holder rights as well as the rights and obligations of the depositary. New York State law governs the Deposit Agreement and the ADSs.

Differences between Holding Shares of Record and as a Beneficial Owner

If your ordinary shares are registered directly in your name with our transfer agent, Security Transfer Registrars Pty Ltd, you are considered, with respect to those shares, the shareholder of record, and we are sending this U.S. Proxy Statement and the other proxy materials directly to you. As the shareholder of record, you have the right to grant your voting proxy directly to the named proxy holder or to vote in person at the meeting. We have enclosed a proxy form for you to use.

Most holders of ordinary shares hold their ordinary shares through a broker or other nominee rather than directly in their own name. If your ordinary shares are held in a brokerage account or by another nominee, you are considered the beneficial owner of the ordinary shares even though they are held in “street name,” and these proxy materials should be forwarded to you by the broker, trustee or nominee together with a voting instruction card. As the beneficial owner, you have the right to direct your broker, trustee or nominee how to vote and you are also invited to attend the Annual General Meeting. Since a beneficial owner is not the shareholder of record, you may not vote these shares in person at the meeting unless you obtain a “legal proxy” from the broker, trustee or nominee that holds your shares, giving you the right to vote the shares at the meeting. Your broker, trustee or nominee has enclosed or provided voting instructions for you to use in directing the broker, trustee or nominee how to vote your shares.

If you are an ADS holder and your ADSs are held in a brokerage account or by another nominee, this U.S. Proxy Statement and the other proxy materials are being forwarded to you together with a voting instruction card by your broker or nominee (who received the proxy materials from the depositary). As the beneficial owner of the ADSs, you have the right to direct your broker or nominee, and hence the depositary, how to vote the ordinary shares underlying your ADSs. You are also invited to attend the Annual General Meeting in person as provided below.

Attending the Annual General Meeting

All beneficial owners and all holders of record of ordinary shares or ADSs as of the record date (or the ADS record date, as applicable), or their duly appointed proxies, may attend the Annual General Meeting. If you are a beneficial owner of ordinary shares holding your shares through a broker or nominee (i.e., in street name) or you are an ADS holder or beneficial owner of ADSs, you may be asked to provide proof of your share ownership on the record date (or the ADS record date, as applicable), such as a current account statement, a copy of the voting instruction card provided by your broker, trustee or nominee or the depositary, or other similar evidence, in order to be admitted to the meeting.

Voting in Person at the Annual General Meeting

Ordinary shares held in your name as the shareholder of record may be voted in person at the Annual General Meeting. Ordinary shares held beneficially in street name may be voted in person only if you obtain a legal proxy from the broker, trustee or nominee that holds your shares giving you the right to vote the shares. Even if you plan to attend the Annual General Meeting, we recommend that you also submit your proxy or voting instructions prior to the meeting as described below so that your vote will be counted if you later decide not to attend the meeting. ADS holders will not be able to vote in person at the Annual General Meeting unless they receive a proxy from the depositary (the sole record holder of ADSs). Instructions for obtaining a proxy from the depositary are included in the material that the depositary sends to ADS holders.

Voting Without Attending the Annual General Meeting

Whether you hold shares directly as an ordinary shareholder of record or beneficially in street name, you may direct how your shares are voted without attending the Annual General Meeting. Ordinary shareholders of record may complete and return the enclosed proxy form or may appoint another proxy to vote their shares, as described in the Notice of Annual General Meeting. Beneficial owners of ordinary shares and holders of ADSs may direct how your shares are voted without attending the Annual General Meeting by following the instructions in the voting instruction card provided by your broker, trustee, or depositary, as applicable. The Chairman has stated that he intends to vote all shares in respect of which he has been appointed proxy but without direction as to how to vote the shares in favor of all resolutions considered at the meeting. Accordingly, shareholders who do not wish their shares to be voted by the Chairman as proxy in favor of the resolutions expected to be considered should either direct the Chairman how they wish their shares to be voted, appoint another proxy to vote their shares in accordance with the directions on the proxy form, or attend the Annual General Meeting in person to vote their shares.

Revocation of Proxies

Holders of ordinary shares can revoke their proxy at any time before it is voted at the Annual General Meeting by either:

| | · | Submitting another timely, later dated proxy by mail; |

| | · | Delivering timely written notice of revocation to our Secretary; or |

| | · | Attending the Annual General Meeting and voting in person. |

If your ordinary shares are held beneficially in street name or you are an ADS holder, you may revoke your proxy by following the instructions provided by your broker, trustee, nominee or depositary, as applicable.

Absence of Appraisal Rights

We are incorporated under the laws of Australia and, accordingly, are subject to the Australian Corporations Act (the “Corporations Act”). Under the Corporations Act, our shareholders are not entitled to appraisal rights with respect to any of the proposals to be acted upon at the Annual General Meeting.

RESOLUTIONS TO BE VOTED ON

Note: The exact text of each resolution is set forth in the Notice of Annual General Meeting: Agenda.

Resolution 1—Re-election of Nicholas Ong as a Director.

The Board has nominated Nicholas Ong to stand for re-election at the Annual General Meeting. Clause 12.7 of our constitution requires that a person appointed as a Director during the period shall hold office only until the next general meeting and is then eligible for re-election. Under our constitution, the number of directors on the Board is determined by a resolution of the Board, but will not be fewer than three directors.

The Board currently consists of four directors: Mr. Greg Channon, Dr. Peter Hill, Mr. Nicholas Ong, and managing director Mr. Terence Barr.

You may vote “For,” “Against” or “Abstain” on Resolution 1. Members of the Board are elected by a simple majority of votes cast on the ordinary resolution, either in person or by proxy. There is no minimum number of votes required to pass an ordinary resolution electing a director. Neither broker non–votes nor abstentions will affect the outcome of the resolution.

The Board recommends Shareholders vote in favor of Resolution 1.

Resolution 2—Re-election of Gregory Channon as a Director.

The Board has nominated Gregory Channon to stand for re-election at the Annual General Meeting. In accordance with clause 12.3 of our Constitution, a Director must not hold office without re-election past the third annual general meeting following the Director’s appointment of last election or for more than three years (whichever is the longer). Under our constitution, the number of directors on the Board is determined by a resolution of the Board, but will not be fewer than three directors.

The Board currently consists of four directors: Mr. Greg Channon, Dr. Peter Hill, Mr. Nicholas Ong, and managing director Mr. Terence Barr.

You may vote “For,” “Against” or “Abstain” on Resolution 2. Members of the Board are elected by a simple majority of votes cast on the ordinary resolution, either in person or by proxy. There is no minimum number of votes required to pass an ordinary resolution electing a director. Neither broker non–votes nor abstentions will affect the outcome of the resolution.

The Board recommends Shareholders vote in favor of Resolution 2.

Board of Directors

The following table sets forth certain information regarding the composition of the Board:

| Name | | Age | | Position | | Director

Since | | Current Term

to Expire (Year

Eligible for

Reelection) |

| Nominees | | | | | | | | |

| Nicholas Ong | | 41 | | Director | | 2019 | | 2019 |

| Greg Channon | | 55 | | Director | | 2016 | | 2019 |

| | | | | | | | | |

| Other Directors | | | | | | | | |

| Terence Barr | | 70 | | Director | | 2005 | | N/A |

| Peter Hill | | 72 | | Director | | 2016 | | 2020 |

| | | | | | | | | |

Dr. Peter Hill, 72, has over 45 years of experience in the oil industry. He commenced his career in 1972 and spent 22 years in senior positions at British Petroleum including Chief Geologist, Chief of Staff for BP Exploration, President of BP Venezuela and Regional Director for Central and South America. Dr. Hill then worked as Vice President of Exploration at Ranger Oil Ltd. in England (1994-1995), Managing Director Exploration and Production at Deminex GmbH Oil in Germany (1995-1997), Technical Director/Chief Operating Officer at Hardy Oil & Gas plc (1998-2000), President and Chief Executive Officer at Harvest Natural Resources, Inc. (2000-2005), Director/Chairman at Austral Pacific Energy Ltd. (2006-2008), independent advisor to Palo Alto Investors (January 2008 to December 2009), Non-Executive Chairman at Toreador Resources Corporation (January 2009 to April 2011), Director of Midstates Petroleum Company, Inc. (April 2013 to March 2015), and interim President and Chief Executive Officer of Midstates Petroleum Company, Inc. (March 2014 to March 2015). Dr. Hill has served as a Non-Executive director of Triangle Petroleum Corporation since November 2009 and as Chairman of the Board since April 2012. From April 2012 to February 2013, Dr. Hill served as Triangle Petroleum Corporation’s Executive Chairman, having served previously as Chief Executive Officer of Triangle since November 2009 and President and Chief Executive Officer of Triangle from November 2009 until May 2011. Dr. Hill has a B.Sc. (Honors) in Geology and a Ph.D. Dr. Hill’s qualifications to sit on the Board of Directors include significant public company governance experience, significant experience as an exploration geologist and over 20 years of general management experience. Dr. Hill was Non-executive Director of Triangle from 2012 to 2016. Dr. Hill was the interim CEO of Pardus Oil and Gas through 2016 and 2017.

Key Attributes, Experience and Skills: Dr. Hill has provided advisory and consultancy roles to hedge funds, banks, and companies involved in the upstream oil and gas sector. He has also held non-executive board positions and been involved in international negotiations at government level. His extensive experience in management, corporate leadership, non-executive directorship and consulting, combined with technical expertise, has provided the skills necessary to lead, build teams and deliver business success. His career path to date is a proven track record of significant value creation for all stakeholders served. The Board has determined that Dr. Hill is currently an independent director under NYSE American rules.

Other Public Company Board Service: Benton Oil and Gas / Harvest Natural Resources from 2000 to 2006; Austral Pacific from 2006 to 2008.

Recent Past Public Company Board Service: Torreador Resources from January 2009 to April 2011; Midstates Petroleum from April 2013 to March 2015; Triangle Petroleum Corporation from November, 2009 to 2017.

In light of the foregoing, our Board has concluded that Dr. Hill is well–qualified to serve as a director of the Company.

Terence Barr, 70, was appointed President, Chief Executive Officer, and Managing Director of Samson on January 25, 2005. Mr. Barr is a petroleum geologist with over 40 years of experience, including 11 years with Santos. In recent years, Mr. Barr has specialized in tight gas exploration, drilling and completion, and is considered an expert in this field. Prior to joining Samson, Mr. Barr was employed as Managing Director by Ausam Resources from 1999 to 2003 and was the owner of Barco Exploration from 2003 to 2005. The Board has determined that Mr. Barr does not qualify as an independent director under NYSE American rules due to Mr. Barr’s role as the Company’s Chief Executive Officer.

Key Attributes, Experience and Skills: Mr. Barr brings to the Board, among his other skills and qualifications, significant experience in the oil and natural gas industry that he gained while serving as an executive for the Company, Ausam Resources, and Barco Exploration. With over 40 years of experience, he is considered an expert in the oil and natural gas field.

Other Public Company Board Service: None.

Recent Past Public Company Board Service: None.

In light of the foregoing, our Board has concluded that Mr. Barr is well qualified to serve as a director of the Company and as its Managing Director.

Nicholas Ong, 41, was appointed Company Secretary and Director of Samson on May 21, 2019 and July 22, 2019 respectively. Mr. Ong is the Managing Director of Minerva Corporate Pty Limited. He is also a director of Vonex Ltd, Helios Energy Ltd, Black Star Petroleum Ltd, and White Cliff Minerals Ltd, and acts as company secretary for White Cliff Minerals Ltd, Beroni Group Ltd and Love Group Ltd.. From 2011 to 2016, Mr. Ong was a commercial director at Excelsior Gold Ltd., a public exploration and mining firm. Mr. Ong is a Fellow member of the Governance Institute of Australia and holds a Master of Business Administration from the University of Western Australia and a Bachelor of Commerce from Murdoch University. He also holds graduate diplomas of Applied Finance and Investments and Applied Corporate Governance from the Securities Institute of Australia and the Governance Institute of Australia, respectively. Mr. Ong was a principal adviser at the Australian Securities Exchange in Perth (“ASX”).

Key Attributes, Experience and Skills: Mr. Ong has extensive corporate experience within the petroleum services, petroleum and mineral production, and exploration industries. Mr. Ong has significant experience in the management of public companies listed on the ASX and has extensive knowledge of the ASX Listing Rules and Corporations Act within Australia.

Other Public Company Board Service: Mr. Ong is a director of Vonex Ltd (ASX: VN8), an Australian public company in the telecommunications industry, Helios Energy Ltd (ASX: HE8), an Australian public company in the oil and gas industry, Black Star Petroleum Ltd (ASX: BSP), an Australian public company in the petroleum industry, and White Cliff Minerals Ltd (ASX: WCN), an Australian public company in the mineral exploration and development industry, listed on the ASX.

Recent Past Public Company Board Service: Mr. Ong was a director of Arrow Minerals Ltd, CoAssets Ltd, Auroch Minerals Limited, Fraser Range Metals Group Limited, Tianmei Beverage Group Corp Ltd, Bojun Agriculture Holdings Limited and Jiajiafu Modern Agriculture Limited.In light of the foregoing, our Board has concluded that Mr. Ong is well qualified to serve as a director of the Company.

Greg Channon, 56, is a geologist with 33 years of global oil and gas experience in a variety of technical and leadership roles. During his career, Mr. Channon has worked with a range of exploration and production companies, including Santos, Fletcher Challenge Energy, Shell, Swift Energy and Brightoil. Mr. Channon has lived and worked in Australia, New Zealand, USA, Hong Kong, China, and Africa. In the United States, he has worked in Appalachia, Colorado, California, and Texas. He has sat on the Board of Directors of companies listed on the ASX, TSX and HKSE. In February 2009, Mr. Channon joined Brightoil Petroleum Holdings Limited in Hong Kong, as the Upstream CEO. Upon returning to Australia in December 2011, Mr. Channon consulted with a number of small start-ups, both in Australia and Canada. From July 2014 to December 2016 he was Chief Executive Officer of Pathfinder Energy Pty Ltd. He is currently the Executive Chairman of RL Energy Pty Ltd. He is also a non-executive Director of Ruby Lloyd Pty Ltd (a privately held company).

Key Attributes, Experience and Skills: During his career, Mr. Channon has gained a vast range of diverse oil and gas expertise, including exploration, operations, development, production, economics and commercial negotiations, and IPO start-ups. The Board has determined that Mr. Channon is an independent director under NYSE American rules.

Other Public Company Board Service: Statesman Resources Limited (January 2007 – present)

Recent Past Public Company Board Service: New Standard Energy (June 2014 – April 2015), Sirocco Energy Limited (December 2011 – May 2015), Brightoil Petroleum (Holdings) Limited (February 2009 – December 2011)

In light of the foregoing, our Board has concluded that Mr. Channon is well-qualified to serve as a director of the Company.

Resolution 3—Adoption of Remuneration Report.

We are asking our shareholders to approve, on an advisory basis under Australian rules, our Remuneration Report as set forth in our 2019 ASX Annual Report. The Remuneration Report was filed with the Australian Stock Exchange on October 29, 2019, and is attached to this U.S. Proxy Statement asExhibit A. The Remuneration Report:

| | · | explains the Company’s remuneration policy and the process for determining the remuneration of its Directors and executive officers; |

| | · | Address the relationship between the Company’s remuneration policy and the Company’s performance; and |

| | · | sets out the remuneration details for each Director and executive officer named in the Remuneration Report for the financial year ended June 30, 2019. |

Shareholders will be asked to vote on the following ordinary resolution:

“That, for the purposes of section 250R(2) of the Corporations Act 2001 and for all other purposes, the Remuneration Report contained in the 2019 Annual Report which accompanied the notice convening this meeting be adopted by shareholders.”

The vote on the resolution is advisory under Australian rules and does not bind the directors or the Company, nor does it affect the remuneration already paid or payable to the directors or the senior executives. However, the Corporations Act provides that if the resolution to approve the Remuneration Report receives a “no” vote of 25% or more of votes cast at the Annual General Meeting, the Company’s subsequent Remuneration Report must explain the Board’s proposed action in response or, if the Board does not propose any action, the Board’s reasons for not making any changes. The Board will take into account the outcome of the vote when considering the remuneration policy, even if it receives less than a 25% “no” vote.

In addition, sections 250U and 250V of the Corporations Act sets out a “two strikes” re-election process. Under the “two strikes” re-election process, if the Company’s Remuneration Report receives a “No” vote of 25% or more of all votes cast at two consecutive annual general meetings, a resolution (“Spill Resolution”) must be put to the second annual general meeting, requiring shareholders to vote on whether the Company must hold another general meeting (known as the “Spill Meeting”) to consider the appointment of all of the Directors at the time the Directors’ Report was approved by the Board who must stand for re-appointment (other than the Managing Director).

If the Spill Resolution is approved at the annual general meeting by a simple majority of 50% or more of the eligible votes cast, the spill meeting must be held within 90 days of the Spill Resolution being passed (unless none of the Directors, other than the Managing Director, stand for reappointment).

At the Company’s 2018 annual general meeting, less than 25% of the eligible votes cast in respect of the 2018 Remuneration Report were cast against the adoption of the 2018 Remuneration Report. Accordingly, a Spill Resolution will not be put tothe annual general meeting even if 25% or more of the votes are cast against Resolution 3.

Section 250R(4) of the Corporations Act prohibits any votes on this Resolution being cast by any member of the Key Management Personnel, where “Key Management Personnel” broadly means those persons who have authority and responsibility for planning, directing, and controlling the activities of the Company, directly or indirectly, including any director of the Company, whose remuneration details are disclosed in the Remuneration Report or any closely related party’s (for example, a spouse or child of the Key Management Personnel, a child of the Key Management Personnel’s spouse, a dependent of the Key Management Personnel or the Key Management Personnel’s spouse) details are disclosed in the Remuneration Report. However, an exception to this prohibition exists to enable the Chairman to vote shareholders’ undirected proxy votes. In this regard, you should note that if you appoint the Chairman as your proxy and you indicate on the proxy form that you do not wish to specify how the Chairman should vote on resolution 3, the Chairman will cast your votes in favor of Resolution 3.

If you wish to appoint the Chairman as your proxy but do NOT want your votes cast in favour of Resolution 3, you must indicate your voting intention by ticking the box marked either ‘against’ or ‘abstain’ opposite Resolution 3 on the Proxy Form.

Section 250R(4) of the Corporations Act prohibits any votes on this Resolution being cast by senior executives (or their associates) whose remuneration details are disclosed in the Remuneration Report. However, the Company will not disregard any votes cast on Resolution 3 if the person casting the vote is acting as proxy, the proxy form specifies how the proxy is to vote on the resolution, and the vote is not cast on behalf of a person who is otherwise excluded from voting on this resolution as described above. Additionally, an exception to the prohibition exists to enable the Chairman to vote shareholders’ undirected proxy votes. In this regard, you should note that if you appoint the Chairman as your proxy and you indicate on the proxy form that you do not wish to specify how the Chairman should vote on Resolution 3, the Chairman will cast your votes in favor of Resolution 3.If you wish to appoint the Chairman as your proxy but do NOT want your votes cast in favor of Resolution 3, you must indicate your voting intention by checking the box marked either ‘against’ or ‘abstain’ opposite Resolution 3 on the proxy form.

The Chairman of the annual general meeting will allow reasonable opportunity for shareholders to ask questions about, or comment on the Remuneration Report at the meeting. Shareholders should note that prices specified in the Remuneration Report are in Australian Dollars unless otherwise indicated.

You may vote “For,” “Against” or “Abstain” on Resolution 3. Resolution 3 is passed by a simple majority of votes cast on the resolution, either in person or by proxy.There is no minimum number of votes required to pass the resolution. The vote on Resolution 3 is non–binding, as provided by Australian law. The Board does not make a recommendation on this vote but will review the results of the votes and will take them into account in making a determination concerning the Remuneration Report.

Resolution 4 —Advisory vote on “named executive officer” compensation.

In accordance with the requirements of the U.S. Securities Exchange Act of 1934, the compensation paid to the Company’s “named executive officers,” as disclosed in this Annexure “A” U.S. Proxy Statement, including the Compensation Discussion and Analysis, compensation tables and narrative discussion in the “Executive Compensation” section of this U.S. Proxy Statement, is hereby submitted to an advisory vote of shareholders, as follows:

“That the Shareholders approve, on an advisory basis, the compensation of the Company’s “named executive officers,” as disclosed in Annexure “A” to the Explanatory Memorandum accompanying the notice convening this meeting, including the “Compensation Discussion and Analysis,” compensation tables and narrative disclosed.”

Our “named executive officers” are:

1. Terence M. Barr, Managing Director, Chief Executive Officer and President

2. Robyn Lamont, Chief Financial Officer*

3. Janna Blanter, Chief Financial Officer*

4. Mark Ulmer, Vice President–Engineering and Operations

*Robyn Lamont and Janna Blanter resigned on February 28, 2019 and September 30, 2019, respectively, and are no longer executive officers, however, they remain “named executive officers” pursuant to Item 402(m) of Regulation S-K.

In accordance with Section 14A of the U.S. Securities Exchange Act of 1934, this resolution is advisory only and does not bind the Board. The Board will review the results of the votes and will take them into account in making a determination concerning named executive officer compensation. Currently, the Companyholds an advisory vote onexecutive compensation on an annual basis.

You may vote “For,” “Against” or “Abstain” on the advisory vote. The advisory vote is passed by a simple majority of votes cast on the resolution, either in person or by proxy. There is no minimum number of votes required to pass the resolution. Neither broker non–votes nor abstentions will affect the outcome of the resolution.

The Board unanimously recommends that you vote to approve Resolution 4.

AUDIT COMMITTEE MATTERS

Audit Committee Pre–Approval Policy

The charter of the Audit Committee includes certain procedures regarding the pre-approval of all engagement letters and fees for all auditing services and permitted non-audit services performed by the independent auditors, subject to any exception under Section 10A of the Securities Exchange Act of 1934, as amended, and the rules promulgated thereunder (the “Exchange Act”). Pre-approval authority may be delegated to an Audit Committee member or a subcommittee comprised of members of the Audit Committee, and any such member or subcommittee shall report any decisions to the full Audit Committee at its next scheduled meeting. All services were approved by the Audit Committee pursuant to its pre–approval policies as in effect as of the relevant times.

Representatives of the Company’s Australian auditor, RSM Australian Partners (“RSM”), will be present at the Annual General Meeting and will be available to respond to appropriate questions. Representatives of the Company’s U.S. auditor, Moss Adams LLP, are not expected to be present at the Annual General Meeting.

Fees Paid to Principal Accountants

| | | Fiscal Year Ended

June 30, | |

| | | 2019 | | | 2018 | |

| Audit fees | | $ | 225,350 | | | $ | 232,500 | |

| Audit–related fees | | $ | - | | | $ | - | |

| Tax fees | | $ | - | | | $ | - | |

| All other fees(1) | | $ | - | | | $ | - | |

| Total | | $ | 225,350 | | | $ | 232,500 | |

(1) All other fees in fiscal year 2019 includes services in connection with our internal controls. All services were approved by the Audit Committee.

Our auditor for the years ended June 30, 2019 and June 30, 2018 was Moss Adams LLP.

Audit Committee Report

Our management is responsible for the preparation of our financial statements and our independent auditor, Moss Adams LLP (“Moss Adams”), is responsible for auditing our annual financial statements and expressing an opinion as to whether they are presented fairly, in all material respects, in conformity with accounting principles generally accepted in the United States (“US GAAP”). The Audit Committee is responsible for, among other things, reviewing and selecting our independent auditor, reviewing our annual and interim financial statements and pre–approving all engagement letters and fees for auditing services.

In the performance of its oversight function in connection with our financial statements as of and for the fiscal year ended June 30, 2019, the Audit Committee has:

| | · | Reviewed and discussed the audited financial statements with management and Moss Adams. The Audit Committee’s review included a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments and the clarity of disclosures in the financial statements; |

| | · | Discussed with Moss Adams the matters required to be discussed by Statement on Auditing Standards No. 61, as amended, of the Auditing Standards Board of the American Institute of Certified Public Accountants, as adopted by the Public Company Accounting Oversight Board in Rule 3200T; |

| | · | Received the written disclosures and the letter from Moss Adams regarding its communications with the Audit Committee concerning independence as required by the Public Company Accounting Oversight Board and discussed Moss Adams’s independence with Moss Adams; and |

| | · | Reviewed and approved the services provided by Moss Adams. |

Based upon the reports and discussions described above, and subject to the limitations on the roles and responsibilities of the Audit Committee referred to in its charter, the Audit Committee recommended to the Board, and the Board approved, that the Company’s audited financial statements be included in our Annual Report on Form 10-K for the fiscal year ended June 30, 2019, as filed with the Securities and Exchange Commission on October 15, 2019.

AUDIT COMMITTEE:

Greg Channon

Peter Hill

ORDINARY SHARE OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

This section sets forth information regarding the beneficial ownership of our ordinary shares, including ordinary shares held by means of American Depositary Shares (“ADSs”), by certain holders of our ordinary shares and by our executive officers and directors. Beneficial ownership has been determined in accordance with applicable SEC rules.

As of October 22, 2019, the Company was aware of one beneficial owner of more than 5% of the Company’s ordinary shares, as set forth in the table below. All information concerning security ownership of certain beneficial owners is based upon filings made by such persons with the SEC or upon information provided by such persons to us.

| | | Ordinary Shares

Beneficially Owned | |

| Name | | Amount of

Ordinary

Shares | | | Percent of

Total

Ordinary

Shares | |

| Robert E. Mead(1) | | | 219,773,000 | | | | 6.69 | % |

(1) Based on a Form 13G/A filing made by the shareholder on April 19, 2017, which listed the shareholder as owning 1,098,865 ADSs, with each ADS representing 200 ordinary shares. The shareholder’s address is 3653 Maplewood Ave., Dallas, TX 75205.

The following table sets forth information regarding beneficial ownership of our ordinary shares by our executive officers and directors as of October 22, 2019. Except as otherwise indicated, (i) the address of the persons listed below is c/o Samson Oil & Gas Limited, 1331 17th Street, Suite 710, Denver, CO 80202 and (ii) the persons listed below, to our knowledge, have sole voting and investment power with respect to all shares of ordinary shares shown as beneficially owned by them, subject to the application of community property laws where applicable. To the Company’s knowledge, none of the ordinary shares held by our executive officers and directors have been pledged as security as of that date. Beneficial ownership representing less than 1% is denoted with an asterisk.

As of October 22, 2019, there were 328,300,044 ordinary shares outstanding.

| | | Ordinary Shares

Beneficially Owned | |

| Name | | Amount of

Ordinary

Shares | | | Percent of

Total

Ordinary

Shares | |

| Directors and officers | | | | | | | | |

| Terence Barr(1) | | | 8,484,097 | | | | 2.6 | % |

| Janna Blanter(2) * | | | - | | | | - | % |

| Greg Channon(3) | | | 2,910,500 | | | | 0.8 | % |

| Tristan Farel(4) | | | - | | | | - | % |

| Peter Hill(5) | | | 3,529,120 | | | | 1.1 | % |

| Robyn Lamont(6) ** | | | 4,526,118 | | | | 1.4 | % |

| Denis Rakich(7)*** | | | 2,571,740 | | | | 0.8 | % |

| Nicholas Ong(8) | | | - | | | | - | % |

| Mark Ulmer(9) | | | 9,026,420 | | | | 2.7 | % |

| | | | | | | | | |

| Current Directors and Current Executive Officers as a group (six persons) | | | 23,950,137 | | | | 7.2 | % |

* Ms. Janna Blanter resigned on September 30, 2019 and is no longer an executive officer, however, she remains a “named executive officer” pursuant to Item 402(m) of Regulation S-K.

**Ms. Robyn Lamont resigned on February 28, 2019 and is no longer an executive officer, however, she remains a “named executive officer” pursuant to Item 402(m) of Regulation S-K.

***Denis Rakich resigned on July 22, 2019 and is no longer an executive officer, however, he remains a “named executive officer” pursuant to Item 402(m) of Regulation S-K.

(1) Consists of (a) 60,000,000 options to purchase ordinary shares which vested Nov. 17, 2017 and are deemed beneficially owned; (b) 24,358,966 ordinary shares; and (c) 2,410 ADSs (482,000 ordinary shares). Mr. Barr exercises sole voting and sole investment control over (a) 16,511,385 ordinary shares held by the Terence M. Barr Superannuation Fund (the “Fund”); and (b) 7,834,621 ordinary shares held by Barr Super Pty, Ltd. William G. Dartnell is trustee of the Fund. Mr. Barr is a beneficiary of the Fund and the sole owner of Barr Super Pty Ltd. Mr. Barr exercises shared voting power and shared investment power over (a) 12,960 ordinary shares and (b) 2,410 ADS (482,000 ordinary shares), each of which are held jointly with his spouse, Mrs. Laurel Barr.

(2) Ms. Blanter had no options to purchase ordinary shares.

(3) Consists of (a) 24,000,000 options to purchase ordinary shares which vested Nov. 17, 2017 and are deemed beneficially owned; and (b) 5,105,000 ordinary shares. 1125474 Channon Superannuation Fund (the "Fund") is the record owner of the securities set forth herein. Asgard Capital Management Limited is trustee of the Fund. Mr. Channon is a beneficiary of the Fund and exercises sole voting and sole investment control over the securities.

(4) Mr. Farel had no options to purchase ordinary shares.

(5) Consists of (a) 30,000,000 options to purchase ordinary shares which vested Nov. 17, 2017 and are deemed beneficially owned; and (b) 5,291,200 ordinary shares.

(6) Consists of (a) 37,000,000 options to purchase ordinary shares which vested Nov. 16, 2017 and are deemed beneficially owned; (b) 7,750,378 ordinary shares; and (c) 2,554 ADSs (510,800 ordinary shares).

(7) Consists of (a) 24,000,000 options to purchase ordinary shares which vested Nov. 17, 2017 and are deemed beneficially owned; and (b) 1,717,400 ordinary shares.

(8) Mr. Ong had no options to purchase ordinary shares.

(9) Consists of (a) 48,000,000 options to purchase ordinary shares which vested Nov. 16, 2017 and are deemed beneficially owned; and (b) 211,321 ADSs (42,246,200 ordinary shares).

EXECUTIVE COMPENSATION

Executive Officers of the Company

The following table sets forth certain information with respect to our executive officers as of October 16, 2019.

| Name | | Age | | Position |

| Terence Barr | | 70 | | Chief Executive Officer |

| Tristan Farel | | 49 | | Chief Financial Officer |

| Nicholas Ong | | 41 | | Secretary |

| Mark Ulmer | | 48 | | Vice President – Engineering and Operations |

Terence Barr. Mr. Barr was appointed President, Chief Executive Officer, and Managing Director of Samson on January 25, 2005. Mr. Barr is a petroleum geologist with over 40 years of experience, including 11 years with Santos. In recent years, Mr. Barr has specialized in tight gas exploration, drilling and completion. Prior to joining Samson, Mr. Barr was employed as Managing Director by Ausam Resources from 1999 to 2003 and was the owner of Barco Exploration from 2003 to 2005.

Tristan Farel.Mr. Farel was appointed Chief Financial Officer of Samson on October 1, 2019. Mr. Farel has 18 years of accounting and reporting experience, holding various executive and senior management positions with both public and private companies in the United States, Canada, and Australia. Mr. Farel has experience in the areas of financial analysis, SEC reporting, International Financial Reporting Standards (IFRS) reporting, due diligence and integration in connection with mergers and acquisitions and consolidations, purchase accounting, scheduling and organizing external audits, tax scheduling, and developing capital and operating budgets. Mr. Farel also worked for five years in public accounting as an auditor. Mr. Farel has held the positions of Chief Financial Officer of PetroShale, Inc. from 2013 to 2014, Chief Financial Officer of New Frontier Energy, Inc. from 2010 to 2016, and Chief Financial Officer of Arete Industries, Inc. from 2015 to 2019. Mr. Farel has also held the positions of Financial Reporting Manager for Resolute Energy Corporation (2006-2010) and Audit Manager for Hein & Associates (2001-2006). Mr. Farel has a Bachelor of Science in Business Administration, with an emphasis in Accounting, from the University of Colorado at Boulder, and has been active in the Council of Petroleum Accountants Society, the Colorado Society of Certified Public Accountants and the American Institute of Certified Public Accountants.

Nicholas Ong. Mr. Ong was appointed Company Secretary and Director of Samson on May 21, 2019 and July 22, 2019 respectively. Mr. Ong is the Managing Director of Minerva Corporate Pty Limited. He is also a director of Vonex Ltd, Helios Energy Ltd, Black Star Petroleum Ltd, and White Cliff Minerals Ltd, and acts as company secretary for White Cliff Minerals Ltd, Beroni Group Ltd and Love Group Ltd. From 2011 to 2016, Mr. Ong was a commercial director at Excelsior Gold Ltd., a public exploration and mining firm. Mr. Ong is a Fellow member of the Governance Institute of Australia and holds a Master of Business Administration from the University of Western Australia and a Bachelor of Commerce from Murdoch University. He also holds graduate diplomas of Applied Finance and Investments and Applied Corporate Governance from the Securities Institute of Australia and the Governance Institute of Australia, respectively. Mr. Ong was a principal adviser at the Australian Securities Exchange in Perth (“ASX”).

Mark Ulmer. Mr. Ulmer was appointed Samson’s Vice President of Engineering and Operations on April 1, 2016. He is a petroleum engineer with more than twenty-two years of experience in the oil and gas industry. Mr. Ulmer founded Ulmer Energy, LLC, in 2007, and Ulmer Consulting, LLC, in 2010, and he has founded a variety of other oil-and-gas related companies since that time including an operating entity, a midstream company, two oilfield services companies, and an investment vehicle. Mr. Ulmer earned his Bachelor of Science in Petroleum Engineering in 1994 and a Bachelor of Science in Mechanical Engineering in 1997, both from the Colorado School of Mines. His various graduate degrees, which include an MBA, an MS in Finance, and a Certificate in Entrepreneurial Studies, are from the University of Colorado. He is also a Professional Engineer in Petroleum licensed in Colorado. Mr. Ulmer was Chief Operating Officer for Versa Energy, LLC, in 2013-2014, and he is currently on the Advisory Board for McElvain Energy Fund 2011, LLC.

Leadership Changes

On February 28, 2019, Robyn Lamont, the former Chief Financial Officer of Samson, resigned and, on March 1, 2019, Ms. Janna Blanter was appointed Chief Financial Officer of Samson. On September 30, 2019, Ms. Janna Blanter resigned and Mr. Tristan Farel was appointed Chief Financial Officer of Samson on October 1, 2019. Former Company Secretary, Mr. Denis Rakich, resigned July 22, 2019 and Mr. Nicholas Ong was appointed as his replacement.

Executive Officer Compensation in Fiscal Year Ended June 30, 2019

Summary Compensation Table

The following table summarizes the total compensation paid to or earned by our principal executive officer, and our two other highest paid executive officers, other than the principal executive officer, who were serving as executive officers as of June 30, 2019 (the “named executive officers”). Ms. Lamont is included pursuant to Rule 402(m)(2)(iii) of Regulation S-K.

Name and

Principal Position | | Fiscal

Year

Ended

June 30 | | | Salary

($) | | | Accrued

Bonus

($) | | | Stock

Awards

($) | | | Option

Awards

($) | | | Non-Equity

Incentive Plan

Compensation

($) | | | All Other

Compensation

($)(1)(2) | | | Total

($)(1) | |

| Terence M. Barr | | 2018 | | | 325,000 | | | – | | | | – | | | | 65,995 | | | – | | | 20,231 | | | 411,226 | |

Managing Director, Chief Executive

Officer and President | | 2019 | | | 300,000 | | | – | | | | – | | | | – | | | – | | | 24,615 | | | 324,614 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Janna Blanter* | | 2018 | | | – | | | – | | | | – | | | | – | | | – | | | – | | | – | |