Filed Pursuant to Rule 424(b)(5)

Registration No. 333-161199

PROSPECTUS SUPPLEMENT

(To Prospectus Supplement Dated May 19, 2010 and Prospectus Dated August 21, 2009)

SAMSON OIL & GAS LIMITED

UP TO 123,529,411 ORDINARY SHARES IN THE FORM OF AMERICAN DEPOSITARY SHARES

This supplement to the prospectus supplement dated May 19, 2010 relates to an extension of the Subscription Period (as defined below) from June 10, 2010 to June 30, 2010. In addition, in light of the recent depreciation of the Australian Dollar compared to the U.S. Dollar, we have revised the subscription price for this offering to align it with the price being offered to our ordinary shareholders in Australia and New Zealand under the Share Purchase Plan described below. The original subscription price for this offering was $0.629 per American Depositary Share, which reflected the A$0.034 per share price established for the Share Purchase Plan, converted to U.S. Dollars at the exchange rate in effect on April 27, 2010. The new offer price is $0.567, which reflects the A$0.034 per share price for the Share Purchase Plan, converted to U.S. Dollars at the rate of A$1.00 equals US$0.8344 (the 10-day average exchange rate as of June 9, 2010). In addition, subscribing ADS holders must pay an ADS issuance fee of $0.01 per ADS to The Bank of New York Mellon, our depositary, for a total deposit amount of $0.577 for each new ADS.

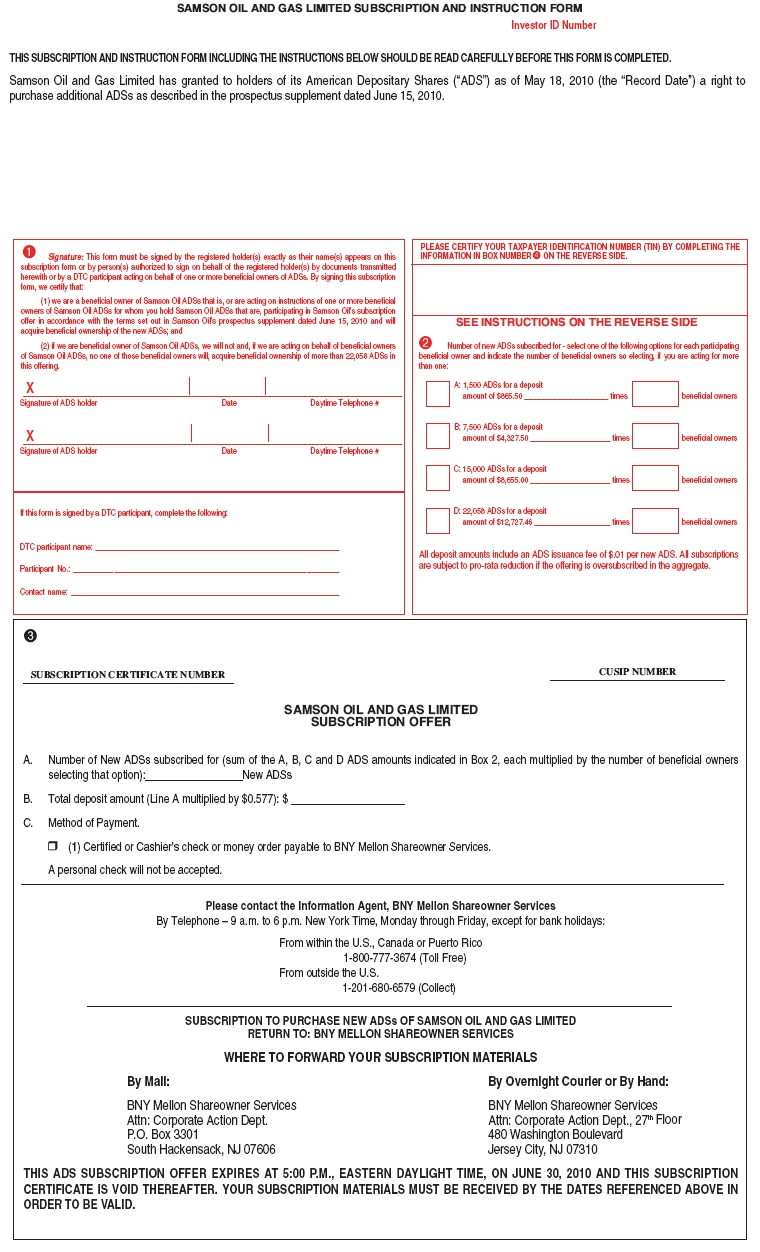

Accordingly, under the terms of this revised offer we are offering to each holder of our American Depositary Shares, or ADSs, the right to purchase up to 22,058 ADSs during the period commencing at 9:00 a.m., Eastern Daylight Time, on May 20, 2010, and ending at 5:00 p.m., Eastern Daylight Time, on June 30, 2010 (the “Subscription Period”). Each ADS holder as of 5:00 p.m., Eastern Daylight Time, on May 18, 2010 (the “Record Date”) will be entitled to participate in this offering. The purchase price is $0.567 per ADS. In addition, subscribing ADS holders must pay an ADS issuance fee of $0.01 per ADS to The Bank of New York Mellon, our depositary, for a total deposit amount of $0.577 for each new ADS. Under the terms of the offering and subject to our right to reduce each holder’s investment in the event of an over-subscription, each holder, regardless of the number of ADSs held, may purchase ADSs in one of four quantities as described below:

| | · | Offer A — $865.50 for 1,500 ADSs, including the ADS issuance fee (representing 30,000 ordinary shares) |

| | · | Offer B — $4,327.50 for 7,500 ADSs, including the ADS issuance fee (representing 150,000 ordinary shares) |

| | · | Offer C — $8,655.00 for 15,000 ADSs, including the ADS issuance fee (representing 300,000 ordinary shares) |

| | · | Offer D — $12,727.46 for 22,058 ADSs, including the ADS issuance fee (representing 441,160 ordinary shares) |

The right to participate in this offering may only be exercised by a holder of our ADSs as of the Record Date. Holders entitled to participate in this offering may only select among the four alternatives described above.

This offering is being conducted concurrently with a Share Purchase Plan being undertaken to all holders of our ordinary shares in Australia and New Zealand. The Share Purchase Plan permits each holder of record of our ordinary shares on the Record Date, regardless of the number of ordinary shares held, to purchase ordinary shares in one of four prescribed quantities. Because they do not directly hold ordinary shares, the holders of our ADSs are not entitled to participate directly in the Share Purchase Plan. Therefore, the purpose of this offering is to afford holders of our ADSs a substantially similar opportunity to purchase our securities as is available to our ordinary shareholders under the Share Purchase Plan.

If subscriptions for ordinary shares in the Share Purchase Plan, together with subscriptions for ADSs in this offering, exceed the maximum number of ordinary shares authorized by our board of directors, we will decrease each participating holder’s subscription amount on a pro rata basis based on the number of shares each holder subscribed for under the subscription form.

There is no minimum number of ADSs required to be sold as a condition to the consummation of this offering.

All subscriptions submitted to the subscription agent for the purchase of ADSs in this offering are irrevocable, even in the event we extend the offering. Our board of directors is making no recommendation regarding your decision to purchase ADSs in this offering. We may elect to terminate the offering at any time prior to the expiration of the Subscription Period. If the offering is cancelled, all subscription payments received by the subscription agent will be returned promptly, without interest.

This is not an underwritten offering. The ADSs are being offered directly by us without the services of an underwriter or selling agent.

Each ADS represents 20 ordinary shares deposited with The Bank of New York Mellon, the depositary. See “Description of American Depositary Shares” beginning on page 24 of the accompanying base prospectus. Our ADSs are listed on the NYSE AMEX under the symbol “SSN.” Our ordinary shares are listed on the Australian Securities Exchange under the symbol “SSN.” On June 14, 2010, the closing price of our ADSs on NYSE AMEX was US$0.60 and the closing price of our ordinary shares on the Australian Securities Exchange was A$0.033 on June 15, 2010. The ADSs being sold in this offering have been approved for trading on the NYSE AMEX.

On June 14, 2010, the aggregate market value of our outstanding ordinary shares held by non-affiliates was US$42,622,163. During the prior twelve calendar month period that ends on, and includes, the date of this prospectus, we have sold pursuant to General Instruction I.B.5 of Form F-3 39,328,000 ordinary shares in the form of 1,966,400 ADSs, for aggregate consideration to us of US$1,236,866.

Investing in our ADSs involves risks. See “Risk Factors” beginning on page S-9 of this prospectus supplement and page 3 of the accompanying base prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying base prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Prospectus Supplement dated June 15, 2010.

TABLE OF CONTENTS

Prospectus Supplement

| | Page |

| | |

| About This Prospectus | 1 |

| Forward-Looking Statements | 2 |

| Summary Description Of The Offering | 3 |

| Timetable | 5 |

| Risk Factors | 9 |

| Capitalization | 14 |

| Use Of Proceeds | 16 |

| The Offering | 17 |

| Certain United States Federal Tax Consequences | 22 |

| Plan Of Distribution | 25 |

| Legal Matters | 26 |

| Where You Can Find More Information | 26 |

Prospectus

| | Page |

| | |

| Documents Incorporated By Reference | 1 |

| Where You Can Find More Information | 1 |

| Forward-Looking Statements | 2 |

| Prospectus Supplement | 2 |

| Risk Factors | 2 |

| Our Business | 11 |

| Our Properties | 12 |

| Ratio Of Earnings To Fixed Charges | 14 |

| Reasons For The Offering And Use Of Proceeds | 14 |

| Market Information | 14 |

| Plan Of Distribution | 17 |

| Description Of Ordinary Shares | 18 |

| Description Of American Depositary Shares | 21 |

| Description Of Debt Securities | 26 |

| Description of Warrants | 32 |

| Description of Rights to Purchase Ordinary Shares | 33 |

| Legal Matters | 34 |

| Experts | 34 |

| Limitation of Liability and Indemnification | 34 |

Appendix

| | Page |

| | |

| Appendix A: Subscription Form | A-1 |

ABOUT THIS PROSPECTUS

We are providing information to you about this offering in two parts. The first part is this prospectus supplement, which provides the specific details regarding this offering and also adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference. The second part is the accompanying prospectus, which provides more general information. Generally, when we refer to this “prospectus,” we are referring to both documents combined.

Some of the information in the base prospectus may not apply to this offering. If information in this prospectus supplement is inconsistent with the accompanying prospectus, you should rely on this prospectus supplement.

You should rely on the information contained or incorporated by reference in this prospectus supplement and the accompanying prospectus. We have not authorized anyone to provide you with any information that is different. If you receive any information that is different, you should not rely on it.

You should not assume that the information contained in this prospectus supplement or the accompanying prospectus is accurate as of any date other than their respective dates, or that the information contained in any document incorporated by reference in this prospectus is accurate as of any date other than the date on which that document was filed with the Securities and Exchange Commission, or SEC.

As used in this prospectus supplement, “Samson,” “we,” “our,” “Company” and “us” refer to Samson Oil & Gas Limited and its subsidiaries, unless stated otherwise or the context requires otherwise.

Currency and Exchange Rate

References in this prospectus supplement to “$,” “USD” and “US$” are to United States dollars. Australian dollars are indicated “AUD” and “A$”.

The rate of exchange on June 15, 2010, as reported by the Reserve Bank of Australia for the conversion of Australian dollars into United States dollars was A$1.00 equals US$0.8564 and the conversion of United States dollars into Australian dollars was US$1.00 equals A$1.1676.

Notice to Non-U.S. Investors in Other Jurisdictions

The distribution of this prospectus supplement, and the purchase of ADSs, may be restricted by law in certain jurisdictions. Any failure to comply with applicable restrictions may constitute a violation of the securities laws of such jurisdictions. In particular, due to restrictions under the securities laws of certain countries, ADS holders residing in such countries may not purchase ADSs hereby. Persons into whose possession this prospectus supplement comes or who wish to exercise any of the rights must inform themselves about and observe any such restrictions. This prospectus supplement does not constitute an offer to subscribe to purchase our ADSs, in any jurisdiction in which such offer or invitation would be unlawful. We do not accept any responsibility for any violation by any person, whether or not a prospective participant in the offering, of any such restrictions.

FORWARD-LOOKING STATEMENTS

This prospectus supplement contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934. These statements include but are not limited to management’s comments regarding business strategy, exploration and development drilling prospects and activities and our use of proceeds plan described herein.

In this prospectus supplement, the use of words such as “anticipate,” “continue,” “estimate,” “expect,” “likely,” “may,” “will,” “project,” “should,” “believe” and similar expressions are intended to identify uncertainties. While we believe that the expectations reflected in those forward-looking statements are reasonable, we cannot assure you that these expectations will prove to be correct. Our actual results could differ materially from those anticipated in these forward-looking statements. The differences between actual results and those predicted by the forward looking statements could be material. These differences may be attributed to the factors described herein under the heading “Risk Factors” starting on page S-9 of this prospectus supplement and starting on page 3 of the accompanying prospectus or other factors not listed there, including, without limitation, the following:

| | · | deviations in and volatility of the market prices of both crude oil and natural gas; |

| | · | our entrance into transactions in derivative instruments; |

| | · | the timing, effects and success of our acquisitions, dispositions and exploration and development activities; |

| | · | uncertainties in the estimation of proved reserves and in the projection of future rates of production; |

| | · | timing, amount, and marketability of production; |

| | · | third party curtailment, processing plant or pipeline capacity constraints beyond our control; |

| | · | our ability to find, acquire, market, develop and produce new properties; |

| | · | the strength and financial resources of our competitors; |

| | · | changes in the legal and/or regulatory environment and/or changes in accounting standards; |

| | · | policies and practices or related interpretations by auditors or regulatory entities; |

| | · | unanticipated recovery or production problems, including cratering, explosions, fires; |

| | · | uncontrollable flows of oil, gas or well fluids; and |

| | · | our ability to comply with the covenants under our loan facility, meet our capital raising targets and follow our use of proceeds plan described herein. |

Many of these factors are beyond our ability to control or predict. Neither these factors nor those included in the “Risk Factors” section of this prospectus supplement are intended to represent a complete list of the factors that may affect us.

SUMMARY DESCRIPTION OF THE OFFERING

The following summary highlights selected information from this prospectus supplement and the documents incorporated by reference herein and does not contain all of the information that may be important to you. You should carefully read this prospectus supplement and all of the information incorporated by reference herein.

| Issuer | | Samson Oil & Gas Limited. |

| | | |

| Offer | | Under the terms of the offering and subject to our right to reduce each holder’s investment in the event of an over-subscription, each holder on the Record Date, regardless of the number of ADSs held, may purchase ADSs in one of four quantities as described below: · Offer A — $865.50 for 1,500 ADSs, including the ADS issuance fee (representing 30,000 ordinary shares) · Offer B — $4,327.50 for 7,500 ADSs, including the ADS issuance fee (representing 150,000 ordinary shares) · Offer C — $8,655.00 for 15,000 ADSs, including the ADS issuance fee (representing 300,000 ordinary shares) · Offer D — $12,727.46 for 22,058 ADSs, including the ADS issuance fee (representing 441,160 ordinary shares) Each ADS holder at 5:00 p.m., Eastern Daylight Time, on May 18, 2010 will be entitled to participate in this offering. The purchase price is $0.567 per ADS. In addition, subscribing ADS holders must pay an ADS issuance fee of $0.01 per ADS to The Bank of New York Mellon, our depositary, for a total deposit amount of $0.577 for each new ADS. |

| | | |

| Share Purchase Plan | | This offering is being conducted concurrently with a Share Purchase Plan being undertaken to all holders of our ordinary shares in Australia and New Zealand. The Share Purchase Plan, which is being conducted pursuant to Australian Securities and Investments Commission Class Order 09/425 and in accordance with Australian Securities Exchange Listing Rule 7.2, Exception 15, permits each holder of record of our ordinary shares on May 18, 2010, regardless of the number of ordinary shares held, to purchase ordinary shares in one of four prescribed quantities. Because they do not directly hold ordinary shares, the holders of our ADSs are not entitled to participate in the Share Purchase Plan. Therefore, the purpose of this offering is to afford holders of our ADSs a substantially similar opportunity to purchase our securities as is available to our ordinary shareholders under the Share Purchase Plan. |

| | | |

| Shares Outstanding Prior to the Offering | | 1,439,742,734 |

| | | |

| Shares Outstanding After Completion of this Offering and the Share Purchase Plan | | 1,563,721,145 |

| | | |

| Record Date | | 5:00 p.m., Eastern Daylight Time, on May 18, 2010. |

| Subscription Period | | ADS holders may purchase ADSs during the period commencing at 9:00 a.m., Eastern Daylight Time, on May 20, 2010, and ending at 5:00 p.m., Eastern Daylight Time, on June 30, 2010 (the “Subscription Period”), unless otherwise extended by us. Holders who would like to purchase ADSs must do so before such date and time. We may extend the period for purchasing ADSs, in our sole discretion. We will announce any extension no later than 1:00 p.m., Eastern Daylight Time, on the business day immediately following the previously scheduled expiration date. See “The Offering — Extensions, Amendments and Termination.” |

| | | |

| Maximum Offering Size | | Our board of directors has approved the sale in this offering and the Share Purchase Plan of up to 123,529,411 ordinary shares in the aggregate (including ordinary shares to be issued to The Bank of New York Mellon and represented by ADSs in the United States). Accordingly, unless the board of directors decides to increase the maximum size of the offering, the aggregate gross funds received in this offering and the Share Purchase Plan will not exceed A$4.2 million. If subscriptions for shares in the Share Purchase Plan, together with subscriptions for ADSs in this offering, exceed the maximum number of ordinary shares authorized by our board of directors, we will decrease each participating holder’s subscription amount on a pro rata basis based on the number of shares each holder subscribed for under the subscription form. For example, if the aggregate subscriptions in this offering and the Share Purchase Plan exceed the maximum authorized amount by 10%, each investor’s subscribed amount will be reduced by 10%. In that event, we will return any excess payments by mail without interest or deduction promptly after the expiration of the Subscription Period. Fractional ADSs resulting from the foregoing pro rata decrease will be eliminated by rounding down to the nearest whole ADS. Upon the expiration of the Subscription Period, we will promptly announce if the offering has been oversubscribed, thereby requiring the Company to decrease the subscriptions on a pro rata basis. |

| | | |

| Right to Modify or Revoke the Subscription form | | Once a purchaser delivers an executed subscription form to the subscription agent, such agreement may not be revoked, changed or otherwise modified by the purchaser. ADS holders who have previously subscribed at the original subscription price of $0.639 will have their purchases adjusted to reflect the new subscription price and will receive a refund. |

| | | |

| Undelivered Subscription Form | | Any subscription form not delivered prior to the expiration of the Subscription Period will have no force and effect. |

| | | |

Procedures to Purchase ADSs | | If you are a registered owner of ADSs, you should send your properly completed and signed subscription form and payment by hand delivery, first class mail or courier service to the subscription agent. Payments submitted in connection with this offering must be made in full, in United States currency, in immediately available funds, by certified bank check or bank draft payable to BNY Mellon Shareowner Services, drawn upon a United States bank. You may not remit personal checks of any type. |

| | | |

| | | If you are a beneficial owner of ADSs and wish to participate in the offering but are not a registered holder of the ADSs, you should timely contact the financial intermediary through which you hold ADSs to arrange for receipt of a subscription form. You are urged to consult your financial intermediary without delay in case your financial intermediary is unable to act immediately. Subscriptions may be entered only by the registered holder or a DTC participant acting on behalf of a beneficial owner. We provide more information on how to purchase ADSs in this offering under “The Offering.” |

| Use of Proceeds | | If this offering and the Share Purchase Plan are subscribed, in the aggregate, to the size currently authorized by our board of directors, we estimate that the combined gross proceeds will be approximately A$4.2 million (US$3.6 million) before deducting approximately US$200,000 in fees and expenses relating to this offering and other expenses relating to the Share Purchase Plan. We intend to use the net proceeds we receive from these offerings for our ongoing development and exploration activities, and for general corporate and working capital purposes. Specifically, we intend to use these funds to drill additional wells in our acreage in the Bakken Field in North Dakota. |

| | | |

| Risk Factors | | See “Risk Factors” beginning on page S-9 of this prospectus supplement and page 3 of the accompanying prospectus for a discussion of certain risk factors that holders should consider before exercising subscription rights and investing in our securities. |

| | | |

| Subscription Agent | | The Bank of New York Mellon. |

| | | |

| Information Agent | | BNY Mellon Shareowner Services. |

| | | |

| Delivery of ADSs | | The ADSs are expected to be delivered to each purchaser (by DWAC delivery to the financial intermediary through which it holds the ADSs or by direct registration of ADSs on an un-certificated basis in the name of the purchaser, confirmed by a statement sent by first class mail if it is a holder registered directly with the depositary) on or around July 7, 2010. |

| | | |

| Listing | | The ADSs being offered have been approved for trading on the NYSE AMEX. Our ADSs are currently traded on the NYSE AMEX under the symbol “SSN.” The closing price of our ADSs on June 14, 2010 was $0.60 per ADS. |

| | | |

| ADS Holder Helpline | | 1-800-777-3674 |

TIMETABLE

The timetable below lists certain important dates relating to the offering. All future dates are expected and subject to change. No assurance can be given that the issuance and delivery of the ADSs will not be delayed.

| Announcement of offering | | May 3, 2010 |

| | | |

| Announcement of extension of Subscription Period and adjustment to U.S. deposit amount | | June 10, 2010 |

| | | |

| Record date | | 5:00 p.m., Eastern Daylight Time, on May 18, 2010 |

| | | |

| Subscription Period commences | | 9:00 a.m., Eastern Daylight Time, on May 20, 2010 |

| | | |

| Subscription Period ends | | 5:00 p.m., Eastern Daylight Time, on June 30, 2010 |

| | | |

| Expected date for issuance and delivery of the ADSs | | On or around July 7, 2010 |

COMPANY OVERVIEW

The following summary provides an overview of certain information about Samson and may not contain all the information that is important to you. This summary is qualified in its entirety by and should be read together with the information contained in other parts of this prospectus supplement, the base prospectus and the documents we incorporate by reference. You should carefully read this entire prospectus supplement and the documents that we incorporate by reference before making a decision about whether to invest in our securities.

Samson Oil & Gas Limited

Our principal business is the exploration and development of oil and natural gas properties in the United States, primarily focused on the Rocky Mountain region. Currently, we have six material oil and gas properties, five of which are producing. We also own interests in the DJ Basin in Goshen County, Wyoming. We do not operate any of our material, producing properties; rather, we own a working interest in each property and have entered into operating agreements with third parties under which the oil and gas are produced and sold. The following table sets forth a summary of certain information about our material properties; for a detailed description of each property, please see “Item 4. Information about the Company – Section D. Property, Plants and Equipment” in our Annual Report on Form 20-F for the year ended June 30, 2009:

| | | Samson Proved Reserves at June 30, 2009 | | | | |

| Property and Location | | Oil bbls | | | Gas mmcf | | | Working Interest percentage | |

| Jonah Field, Green River Basin, Wyoming | | | 37,100 | | | | 5,604 | | | | 21.0 | |

| Look Out Wash Field, Green River Basin, Wyoming | | | 2,900 | | | | 3,161 | | | | 18.2 | |

| State GC Oil and Gas Field, New Mexico | | | 85,500 | | | | 95 | | | | 37.0 | |

| North Stockyard, Williston Basin, North Dakota | | | 46,900 | | | | 32 | | | | 34.5 | |

| Davis Bintliff, Brazoria County, Texas | | | 7,700 | | | | 642 | | | | 9.375 | |

Each of the properties listed above is operated by a third party operator who conducts all activities at these properties pursuant to the terms of joint operating agreements. Consequently, operating results with respect to those properties are beyond our control.

In addition to the material properties listed above, we are undertaking development activities at certain other properties. Over the last several months, we have engaged in discussions with various industry partners concerning potential exploration and development of the Niobrara Formation in Goshen County in southeastern Wyoming. These discussions have resulted in an offer to purchase a portion of our interest at a substantial premium over our original purchase price for the acreage. While we have not made any final determination to sell a portion of our interest at this time, such a sale could provide additional working capital that would then be available to drill several new wells, to pay down debt or for other purposes. It is, however, our intent to retain a significant interest in the project in any event.

In addition to the foregoing, we intend to continue to pursue the acquisition of oil and gas properties and pursue other strategic opportunities in our industry.

2010 Share Placement and U.S. Offering

In May 2010, we completed a share placement which resulted in the sale of 123,529,412 ordinary shares at a price of A$0.034 cents per share. This amount includes an offering in the United States of 1,966,400 ADSs representing 39,328,000 ordinary shares. The purchase price in the United States was US$0.6365 per ADS, which includes a fee of US $0.0075 per ADS payable to the depositary. The ADSs issued in the U.S. were issued pursuant to an effective shelf registration statement and prospectus supplement dated April 30, 2010. The aggregate gross proceeds from the share placement and the U.S. offering were approximately A$4.2 million, or US$3.9 million.

Samson Loan Facility

On May 26, 2006, our wholly–owned subsidiary, Samson Oil and Gas USA, Inc. (“Samson USA”) entered into a convertible loan agreement (the “Loan Facility”) with Macquarie Bank Limited, pursuant to which Samson USA agreed to incur and secure senior convertible loans in an aggregate principal amount of US$21 million (the “Loans”) for the purpose of financing the purchase of the Jonah and Look Out Wash Fields. We repaid US$1,000,000 of this loan at June 30, 2006 and an additional US$2,940,000 in May 2008.

The Loan Facility was restructured in September 2009. The restructured facility contains additional covenants with respect to EBITDA, crude oil production and natural gas production. The first test date for these additional covenants was on March 31, 2010 and the Company was in compliance with all of the covenants on such date. In connection with the restructured Loan Facility, the Company is also required to maintain a reserve–to–debt ratio of at least 1.2:1 from December 31, 2009 and for each quarter date thereafter. The Company was in compliance with this covenant as of December 31, 2009 and March 31, 2010.

In November 2009, we repaid an additional US$4,473,573 with a portion of the proceeds from our rights offering completed in October 2009. In line with the restructured facility we have also repaid $200,000 per month from January 1, 2010 for a total of $1,000,000 this calendar year. Despite this repayment the Loan Facility remains fully drawn down and no further funds are available. As part of the terms of the Loan Facility, Macquarie holds a security interest in all of our assets. As a result, we must obtain permission from Macquarie to dispose of any properties or to acquire any properties if additional debt will be involved in the acquisition.

Recent Financial and Operational Results

We are incorporated under the laws of Australia. Our annual and interim financial statements are prepared on a historical cost basis in accordance with International Financial Reporting Standards, or IFRS, and the Australian Accounting Standards. IFRS differs in significant respects from accounting principles generally accepted in the United States, or US GAAP. The financial information included in our Annual Report on Form 20-F and our Form 6-K filed with the SEC on December 12, 2009, March 18, 2010 and April 30, 2010, respectively, each of which is incorporated by reference in this prospectus, has been prepared in accordance with IFRS, and except where otherwise indicated, is presented in U.S. dollars.

For the 6 months ended December 31, 2009, our revenue was US$2,186,628, an increase from the previous half year of $1,190,519. As of March 31, 2010, the Company’s cash receipts from customers and debtors were US$2,916,000 and cash reserves were US$3,289,000.

| | | Production and Revenue | |

| | | Gas Mcf | | | Gas USD | | | Oil Bbls | | | Oil USD | | | Total USD Revenue* | |

| December 2009 | | | 169,177 | | | | 700,578 | | | | 5,493 | | | | 403,820 | | | | 1,104,398 | |

| March 2010 | | | 165,811 | | | | 859,059 | | | | 6,231 | | | | 446,305 | | | | 1,305,364 | |

*In some cases revenue is yet to be received and is therefore an estimate.

| | | Average commodity prices | |

| | | Gas USD/Mcf | | | Oil USD/Bbl | |

| December 2009 Quarter | | $ | 4.19 | | | $ | 73.50 | |

| March 2010 Quarter | | $ | 5.18 | | | $ | 71.63 | |

Company Information

We are a company limited by shares, incorporated on April 6, 1979 under the laws of Australia. Our registered office is located at Level 36, Exchange Plaza, 2 The Esplanade, Perth, Western Australia 6000 and our telephone number at that office is 618-9220-9830. Our principal office in the United States is located at 1726 Cole Blvd, Suite 210, Lakewood, Colorado 80401 and our telephone number at that office is 303-295-0344. Our website is http://www.samsonoilandgas.com .. Information contained on our website is not incorporated by reference into this prospectus supplement, and you should not consider information on our website to be part of this prospectus.

RISK FACTORS

Investing in our securities involves risks. You should carefully consider the following information about these risks, together with the other information incorporated by reference into this prospectus supplement, and the information discussed under the caption “Risk Factors” on page 3 of the accompanying prospectus before investing in our securities. These risks could materially and adversely affect our business, financial condition, liquidity and results of operations and the market price of the ordinary shares as represented by ADSs.

Risks Related to Our Company and Our Industry

For a full description of the risk associated with our business, please see the risk factors included in the accompanying base prospectus beginning on page 3 and in our Annual Report on Form 20-F for the year ended June 30, 2009, which is incorporated by reference in this prospectus supplement.

While we are in currently in compliance with the covenants in our loan facility, our lender has put restrictions on us that may affect our ability to successfully operate our business.

On May 26, 2006, our wholly–owned subsidiary, Samson Oil and Gas USA, Inc. (“Samson USA”) entered into a convertible loan agreement (the “Loan Facility”) with Macquarie Bank Limited, pursuant to which Samson USA agreed to issue senior convertible loans in an aggregate principal amount of $21 million for the purpose of financing the purchase of the Jonah and Look Out Wash Fields. As of March 31, 2010, the outstanding principal amount owed to Macquarie is approximately $11.9 million. We have guaranteed the Loan Facility, which is secured by substantially all of our assets and the assets of Samson USA.

On October 6, 2009, we closed two concurrent rights offerings to holders of our ordinary shares in Australia and our American Depositary shares in the United States (the “Rights Offering”). We used a portion of the net proceeds of the Rights Offering to pay down the Loan Facility. This payment reestablished our compliance with the terms of the Loan Facility. Prior to the Rights Offering, we had been in violation of the reserve to debt ratio covenant as of December 31, 2008, March 31, 2009, and June 30, 2009. On March 25, 2009, Macquarie granted us a waiver of the December 31, 2008 violation. In connection with this waiver, we were required to enter into additional hedging transactions for our anticipated production of natural gas, priced at the Colorado Interstate Gas and Henry Hub price points, and with reference to our anticipated oil production, priced at WTI price points. Our violations of the reserve to debt ratio covenant as of March 31 and June 30, 2009, were waived on September 3, 2009, as part of a restructuring of the Loan Facility and the anticipated closing of the Rights Offering. As a result, the Loan Facility now includes additional covenants with respect to EBITDA, crude oil production, and natural gas production. In particular, we are required to maintain a PDP reserve–to–debt ratio of at least 1.2:1 from December 31, 2009 and for each quarter end thereafter. From January 1, 2010, we are also required to repay $200,000 of the principal outstanding each month.

While we believe that we will be able to remain in compliance with the restructured Loan Facility for the foreseeable future, there is no assurance that we will be able to do so. Some of the covenants in the Loan Facility may be affected by changes in market prices for oil or natural gas, which are entirely out of our control, or by the results of our drilling program, which cannot be predicted with any certainty. If we do violate any of these covenants in the future, we may not be able to obtain a waiver from Macquarie on acceptable terms. If we elect to seek alternative financing arrangements, we may not be able to obtain such financing on terms acceptable to us.

If oil or natural gas prices decrease or exploration and development efforts are unsuccessful, we may be required to take further writedowns.

In the past, we have been required to write down the carrying value of our oil and gas properties and other assets. There is a risk that we will be required to take additional writedowns in the future, which would reduce our earnings and stockholders’ equity. A writedown could occur when oil and natural gas prices are low or if we have substantial downward adjustments to our estimated proved reserves, increases in our estimates of development costs or deterioration in our exploration and development results.

We review our oil and gas properties for impairment at December 31 and June 30 each year or whenever events and circumstances indicate that the carrying value may not be recoverable. Once incurred, a writedown of oil and gas properties is not reversible at a later date even if gas or oil prices increase. Given the complexities associated with oil and gas reserve estimates and the history of price volatility in the oil and gas markets, events may arise that would require us to record an impairment of the recorded carrying values associated with our oil and gas properties.

We recorded impairment expense for the six months ended June 30, 2009 of $1,007,159, primarily in relation to the North Stockyard Field in North Dakota and the Highlight Field in Wyoming, which amount is in addition to the $20,699,022 impairment expense (primarily based on the deterioration of oil and natural gas prices) recognized for the six months ended December 31, 2008. The impairment recognized for the six months ended December 31, 2008 was primarily in relation to the carrying value of our Lookout Wash and Jonah fields. Drilling results in the North Stockyard field and oil and natural gas prices have improved since that time, so we do not expect to record any additional impairment in the near future, but there can be no assurance that subsequent changes in oil and gas prices or drilling results will not make it appropriate to do so.

Risks Related to the Offering and Our Securities

The subscription price determined for this offering is not an indication of our value or the value of our ordinary shares as represented by ADSs.

The subscription price for this offering was set by our board of directors and reflects the A$0.034 per share price established for the Share Purchase Plan, converted to US Dollars at the 10-day trailing average exchange rate in effect on June 9, 2010, with the addition of the $0.01 per ADS fee to be paid to The Bank of New York Mellon. The A$0.034 price was set by our board of directors on April 28, 2010. Our board of directors considered a number of factors in establishing the subscription price, including the historic and then current market price of the ordinary shares, our business prospects, our recent and anticipated operating results, general conditions in the securities markets, our need for capital, alternatives available to us for raising capital, the amount of proceeds desired, the pricing of similar transactions, the liquidity of our securities and the level of risk to our investors.

The subscription price does not necessarily bear any relationship to the results of our past operations, cash flows, net income, or financial condition, the book value of our assets, or any other established criteria for value, nor does the trading history of our ADSs accurately predict its future market performance. Because of the manner in which we have established the subscription price, the trading price of our ADSs may be below the subscription prices even at the closing of the offering. On June 14, 2010, the last reported sales price for our ADSs on the NYSE AMEX was US$0.60 per share. Holders should not consider the subscription prices to be an indication of our present or future value or the present or future value or market price of any of our securities.

Currency fluctuations may adversely affect the price of our ADSs relative to the price of our ordinary shares.

The price of our ordinary shares is quoted in Australian dollars and the price of our ADSs is quoted in U.S. dollars. Movements in the Australian dollar/U.S. dollar exchange rate may adversely affect the U.S. dollar price of our ADSs and the U.S. dollar equivalent of the price of our ordinary shares. If the Australian dollar weakens against the U.S. dollar, the U.S. dollar price of the ADSs could decline correspondingly, even if the price of our ordinary shares in Australian dollars increases or remains unchanged. In the unlikely event that dividends are payable, we will likely calculate and pay any cash dividends in Australian dollars and, as a result, exchange rate movements will affect the U.S. dollar amount of any dividends holders of our ADSs will receive from our depositary. While we would ordinarily expect such variances to be adjusted by inter-market arbitrage activity that accounts for the differences in currency values, there can be no assurance that such activity will in fact be an efficient offset to this risk.

The prices of our ordinary shares and ADSs have been and will likely continue to be volatile.

The trading prices of our ordinary shares on the ASX and of our ADSs on the NYSE Amex have been, and likely will continue to be, volatile. Other natural resource companies have experienced similar volatility and we expect that results of exploration activities, the price of oil and natural gas, future operating results, market conditions for natural resource shares in general, and other factors beyond our control, could have a significant, adverse impact on the market price of our ordinary shares and ADSs. Volatility creates opportunities for arbitrage trading between the ASX and NYSE Amex markets, which may artificially inflate or deflate the price of our securities.

Our ADS holders are not shareholders and do not have shareholder rights.

The Bank of New York Mellon, as depositary, executes and delivers our ADSs on our behalf. ADSs may be evidenced by a certificate evidencing a specific number of ADSs. Our ADS holders will not be treated as shareholders and do not have the rights of shareholders which are described in “Description of Ordinary Shares” in the accompanying base prospectus. The depositary will be the holder of the ordinary shares underlying our ADSs. Holders of our ADSs will have ADS holder rights. A deposit agreement among us, the depositary and our ADS holders sets out ADS holder rights as well as the rights and obligations of the depositary. New York law governs the deposit agreement and the ADSs. For a description of ADS holder rights, see “Description of American Depositary Shares” in the accompanying base prospectus.

Our ADS holders do not have the right to receive notices of general meetings or to attend and vote at our general meetings of shareholders. Our ADS holders may instruct the depositary to vote the ordinary shares underlying their ADSs, but only if we ask the depositary to ask for their instructions. If we do not ask the depository to ask for the instructions, our ADS holders are not entitled to receive our notices of general meeting or to exercise their right to vote. On the other hand, ADS holders can exercise their right to vote the ordinary shares underlying their ADSs by withdrawing the ordinary shares. While it is possible that our ADS holders would not know about the meeting enough in advance to withdraw the ordinary shares, announcements of our shareholder meetings are made by press release and copies of the announcement are routinely filed with the SEC on Form 6-K . If we do ask the depositary to seek our ADS holders’ instructions, the depositary will notify our ADS holders of the upcoming vote and arrange to deliver our voting materials and form of notice to them. The depositary will try, as far as practicable, subject to Australian law and the provisions of the depositary agreement, to vote the ordinary shares as our ADS holders instruct. The depositary will not vote or attempt to exercise the right to vote other than in accordance with the instructions of the ADS holders. We cannot assure our ADS holders that they will receive the voting materials in time to ensure that they can instruct the depositary to vote their shares. In addition, there may be other circumstances in which our ADS holders may not be able to exercise voting rights.

Similarly, while our ADS holders would generally receive the same dividends or other distributions as holders of our ordinary shares, their rights are not identical. Dividends and other distributions payable with respect to our ordinary shares generally will be paid directly to those holders. By contrast, any dividends or distributions payable with respect to ordinary shares that are held as ADSs will be paid to the depositary, which has agreed to pay to our ADS holders the cash dividends or other distributions it or the custodian receives on shares or other deposited securities, after deducting its fees and expenses. Our ADS holders will receive these distributions in proportion to the number of ordinary shares their ADSs represent. In addition, there may be certain circumstances in which the depositary may not pay to our ADS holders amounts distributed by us as a dividend or distribution, such as when it is unlawful or impractical to do so.

Once you deliver your subscription form, you may not cancel, amend or otherwise modify the subscription form, if you no longer desire to invest in us, and you could be committed to buying shares above the current market price, even if we decide to extend the expiration date of the Subscription Period.

Even if circumstances arise after you have subscribed to purchase the ADSs that eliminate your interest in investing in our securities, including if the public trading market price of our ADSs declines before the Subscription Period ends, you will be required to purchase the ADSs for which you subscribed.

We may, in our discretion, extend the expiration date of the Subscription Period. If you subscribe to purchase the ADSs and, afterwards, the public trading market price of our ADSs decreases below the aggregate subscription price — including during any potential extension of time — you may suffer a loss on your investment.

If we cancel this offering, neither we nor the subscription agent will have any obligation to you except for the obligation to return your subscription payments.

We may withdraw or terminate this offering for any reason or no reason at any time. In either case, neither we nor the subscription agent will have any obligation with respect to the ADSs you purchase except to return, without interest or deduction, any subscription payments we or the subscription agent received from you.

If you do not act promptly and follow subscription instructions, your subscription may be rejected.

ADS holders who desire to participate in this offering must act promptly to ensure that all required forms, instructions and payments are actually received by the subscription agent prior to the expiration date of this offering. If you are a beneficial owner of ADSs and you wish to purchase shares in this offering, you must act promptly to ensure that your broker, custodian bank or other nominee acts for you and that all required forms and payments are actually received by your broker, custodian bank or other nominee in sufficient time to deliver such forms and payments to the subscription agent. With respect to exercises of the subscription rights, we shall not be responsible if your broker, custodian or nominee fails to ensure that all required forms and payments are actually received by the subscription agent prior to the expiration date.

If you fail to complete and sign the required subscription form, or if you send an incorrect payment amount, or if you otherwise fail to follow the subscription procedures that apply with respect to the purchase of ADSs in this offering, the subscription agent may, depending on the circumstances, reject your subscription or accept it only to the extent that you have fully complied with its terms. Neither we nor our subscription agent undertakes to contact you concerning an incomplete or incorrect subscription form or payment, nor are we under any obligation to correct such forms or payment. We have the sole discretion to determine whether you and/or your broker, custodian or bank or other nominee properly follows the subscription procedures.

We may be or become a passive foreign investment company, or a PFIC, for U.S. federal income tax purposes, which could result in negative tax consequences to the holders of our securities.

Potential investors in our ADSs should consider the risk that we could be now, or could in the future become, a “passive foreign investment company” for U.S. federal income tax purposes. Although we do not believe we were a PFIC for the 2009 fiscal year, the tests for determining PFIC status depend upon a number of factors. Some of these factors are beyond our control and may be subject to uncertainties, so we cannot be certain of our PFIC status. We have not undertaken a formal study as to whether we are a PFIC, and we do not intend to do so in the foreseeable future. Moreover, we do not undertake an obligation to determine our PFIC status, or to advise investors in our securities as to our PFIC status, for any taxable year.

If we were determined to be a PFIC for any year, holders of our ADSs who are U.S. persons for U.S. federal income tax purposes (a “U.S. holder”) whose holding period for such ADSs includes part of a year in which we are a PFIC generally will be subject to a special adverse tax regime imposed on “excess distributions” of a PFIC. This regime will apply irrespective of whether we are still a PFIC in the year the “excess distribution” is made or received. “Excess distributions” for this purpose would include not only specified distributions received on our ADSs but also gains by a U.S. holder on a sale or other transfer of the ADSs (including certain transfers that would otherwise be tax–free or tax-deferred). Under the PFIC rules, excess distributions would be allocated ratably to the U.S. holder’s holding period. The portion of any excess distributions allocated to the current year would be includible by the U.S. holder as ordinary income in the current year. The portion of any excess distributions allocated to prior years would be taxed to such holder at the highest marginal rate applicable to ordinary income for each year (regardless of the holder’s actual marginal rate for that year and without reduction by any losses or loss carryforwards) and would be subject to interest charges to reflect the value of the U.S. income tax deferral.

In certain cases, U.S. holders may make elections to mitigate the adverse tax rules that apply to PFICs (the “mark–to–market” and “qualified electing fund” “QEF” elections), but these elections may accelerate the recognition of taxable income and could result in the recognition of ordinary income. We have never received a request from a holder of our ADSs for the annual information required to make a QEF election and we have not decided whether we would provide such information if a request were to be made. Additional adverse tax rules will apply to U.S. holders for any year in which we are a PFIC and own or dispose of shares in another corporation that is itself a PFIC. Special adverse rules that impact certain estate planning goals could apply to our ADSs if we are a PFIC.

CAPITALIZATION

The following table sets forth our capitalization as of March 31, 2010:

| | 2. | on an as adjusted basis to give effect to the Australian share placement and U.S. offering completed in April 2010, the issuance of 123,529,412 ordinary shares (including 39,328,000 ordinary shares represented by ADSs in the United States) and the receipt by us of US$3.9 million in gross proceeds; and |

| | 3. | on an as adjusted basis to give effect to (i) the matters described in paragraph (2) above and (ii) the completion of this offering and the concurrent Share Purchase Plan in Australia for the maximum gross proceeds of A$4.2 million (US$3.6 million), after deducting the estimated aggregate offering expenses of US$200,000 payable by us. |

The table below does not reflect any shares issued as a result of the exercise of options from March 31, 2010 through the date hereof. You should read this table together with our financial statements and the related notes set forth in our Form 20-F for the year ended June 30, 2009, and the unaudited financial statements for the periods ended December 31, 2009 and March 31, 2010, as filed on our Form 6-K on March 18, 2010 and April 30, 2010, respectively, each of which is incorporated by reference into this prospectus supplement.

| | | As of March 31, 2010 | |

| | | (1) | | | (2) | | | (3) | |

| | | Actual | | | As Adjusted | | | As Adjusted | |

| | | (in thousands) | |

| Long-term borrowings | | $ | 11,986 | | | | 11,986 | | | | 11,986 | |

| Shareholders’ equity: | | | | | | | | | | | | |

Ordinary shares, no par value, 1,295,194,853 shares issued and outstanding (actual); 1,418,724,265 shares issued and outstanding (as adjusted column (2)); 1,542,253,676 shares issued and outstanding (as adjusted column (3)) | | | 66,284 | | | | 70,184 | | | | 73,584 | |

| Additional paid-in capital | | - | | | | - | | | | - | |

| Retained earnings | | | (57,980 | ) | | | (57,980 | ) | | | (57,980 | ) |

| Accumulated other comprehensive income | | | 4,284 | | | | 4,284 | | | | 4,284 | |

| Total shareholders’ equity | | | 12,588 | | | | 16,488 | | | | 19,888 | |

| Total capitalization | | $ | 24,574 | | | | 28,474 | | | | 31,874 | |

MARKET PRICE INFORMATION FOR OUR AMERICAN DEPOSITARY SHARES

Our ADSs, each representing 20 ordinary shares, have been listed on the NYSE Amex since January 7, 2008, under the symbol “SSN.” For the year ended June 30, 2009, the trading price ranged from $3.49 to $0.30 per ADS. The following table provides the high and low trading prices for our ADSs on the NYSE AMEX and the ASX for (1) the years 2008 and 2009, (2) each of the fiscal quarters for the last two years, and (3) each of the past six months (December 1, 2009 through May 31, 2010).

| | | NYSE AMEX Sales Price (USD) | | | ASX Sales Price (AUD) | |

| | | High | | | Low | | | High | | | Low | |

| Annual High and Low | | | | | | | | | | | | |

| Year 2008 (from January 7) | | | 10.76 | | | | 0.37 | | | | 0.28 | | | | 0.01 | |

| Year 2009 (from June 30) | | | 0.85 | | | | 0.19 | | | | 0.04 | | | | 0.01 | |

| | | | | | | | | | | | | | | | | |

| Quarterly High and Low | | | | | | | | | | | | | | | | |

| First Quarter 2010 | | | 0.57 | | | | 0.23 | | | | 0.03 | | | | 0.01 | |

| Fourth Quarter 2009 | | | 0.48 | | | | 0.19 | | | | 0.02 | | | | 0.01 | |

| Third Quarter 2009 | | | 0.85 | | | | 0.36 | | | | 0.04 | | | | 0.02 | |

| Second Quarter 2009 | | | 0.73 | | | | 0.30 | | | | 0.04 | | | | 0.03 | |

| First Quarter 2009 | | | 0.74 | | | | 0.30 | | | | 0.04 | | | | 0.02 | |

| Fourth Quarter 2008 | | | 1.30 | | | | 0.37 | | | | 0.08 | | | | 0.01 | |

| Third Quarter 2008 | | | 3.49 | | | | 1.02 | | | | 0.19 | | | | 0.08 | |

| Second Quarter 2008 | | | 6.51 | | | | 2.70 | | | | 0.28 | | | | 0.12 | |

| | | | | | | | | | | | | | | | | |

| Monthly High and Low | | | | | | | | | | | | | | | | |

| December 2009 | | | 0.24 | | | | 0.19 | | | | 0.01 | | | | 0.01 | |

| January 2010 | | | 0.30 | | | | 0.23 | | | | 0.02 | | | | 0.01 | |

| February 2010 | | | 0.48 | | | | 0.26 | | | | 0.03 | | | | 0.01 | |

| March 2010 | | | 0.57 | | | | 0.43 | | | | 0.03 | | | | 0.02 | |

| April 2010 | | | 0.83 | | | | 0.48 | | | | 0.04 | | | | 0.03 | |

| May 2010 | | | 0.74 | | | | 0.54 | | | | 0.04 | | | | 0.03 | |

USE OF PROCEEDS

If this offering and the Share Purchase Plan are subscribed, in the aggregate, to the maximum amount currently authorized by our board of directors, we estimate that the combined gross proceeds will be approximately A$4.2 million (US$3.6 million) before deducting approximately US$200,000 in fees and expenses relating to this offering and other expenses relating to the Share Purchase Plan. We intend to use the net proceeds we receive from these offerings for our ongoing development and exploration activities, and for general corporate and working capital purposes. Specifically, we intend to use these funds to drill additional wells in our acreage in the Bakken Field in North Dakota.

Although we have estimated the particular use for the net proceeds of this offering and the Share Purchase Plan, our management will have broad discretion to allocate the net proceeds from this offering and the Share Purchase Plan for any purpose, and investors will be relying on the judgment of our management with regard to the use of these net proceeds.

THE OFFERING

We are offering to holders of our American Depositary Shares, or ADSs, the right to purchase up to 22,058 ADSs during the period commencing at 9:00 a.m., Eastern Daylight Time, on May 20, 2010, and ending at 5:00 p.m., Eastern Daylight Time, on June 30, 2010 (the “Subscription Period”). Each ADS holder as of 5:00 p.m., Eastern Daylight Time, on May 18, 2010 (the “Record Date”) will be entitled to participate in this offering. The purchase price is $0.567 per ADS. In addition, subscribing ADS holders must pay an ADS issuance fee of $0.01 per ADS to The Bank of New York Mellon, our depositary, for a total deposit amount of $0.577 for each new ADS. Under the terms of the offering and subject to our right to reduce each holder’s investment in the event of an over-subscription, each holder, regardless of the number of ADSs held, may purchase ADSs in one of four quantities as described below:

| | · | Offer A — $865.50 for 1,500 ADSs, including the ADS issuance fee (representing 30,000 ordinary shares) |

| | · | Offer B — $4,327.50 for 7,500 ADSs, including the ADS issuance fee (representing 150,000 ordinary shares) |

| | · | Offer C — $8,655.00 for 15,000 ADSs, including the ADS issuance fee (representing 300,000 ordinary shares) |

| | · | Offer D — $12,727.46 for 22,058 ADSs, including the ADS issuance fee (representing 441,160 ordinary shares) |

The right to participate in this offering may only be exercised by a holder of our ADSs as of the Record Date. Holders entitled to participate in this offering may only select among the four alternatives described above.

The subscription price for this offering was set by our board of directors and reflects the A$0.034 per share price established for the Share Purchase Plan, converted to US Dollars at the 10-day trailing average exchange rate in effect on June 9, 2010, with the addition of the $0.01 per ADS fee to be paid to The Bank of New York Mellon. The A$0.034 price was set by our board of directors on April 28, 2010. Our board of directors considered a number of factors in establishing the subscription price, including the historic and then current market price of the ordinary shares, our business prospects, our recent and anticipated operating results, general conditions in the securities markets, our need for capital, alternatives available to us for raising capital, the amount of proceeds desired, the pricing of similar transactions, the liquidity of our securities and the level of risk to our investors.

The Share Purchase Plan

This offering is being conducted concurrently with a Share Purchase Plan being undertaken to all holders of our ordinary shares. The Share Purchase Plan, which is being conducted pursuant to Australian Securities and Investments Commission Class Order 09/425 and in accordance with Australian Securities Exchange Listing Rule 7.2, Exception 15, permits each holder of record of our ordinary shares on May 18, 2010, regardless of the number of ordinary shares held, to purchase ordinary shares in one of four prescribed quantities. Because they do not directly hold ordinary shares, the holders of our ADSs are not entitled to participate in the Share Purchase Plan. Therefore, the purpose of this offering is to afford holders of our ADSs a substantially similar opportunity to purchase our securities as is available to our ordinary shareholders under the Share Purchase Plan.

Subscription Period

ADS holders may purchase new ADSs during the period commencing at 9:00 a.m., Eastern Daylight Time, on May 20, 2010 and ending at 5:00 p.m., Eastern Daylight Time, on June 30, 2010. Any subscription forms not delivered prior to the expiration of the Subscription Period will have no force and effect.

Once a holder exercises any subscription rights, that exercise may not be revoked or changed.

Subscription forms and full payment of the deposit amount must be received by the subscription agent prior to 5:00 p.m., Eastern Daylight Time, on June 30, 2010. If you have any questions regarding participation procedures, you may call the information agent at 1-800-777-3674.

Maximum Offering Size

Our board of directors has approved the sale in this offering and the Share Purchase Plan of up to 123,529,411 ordinary shares in the aggregate (including ordinary shares to be issued to The Bank of New York Mellon and represented by ADSs in the United States). Accordingly, the aggregate gross funds received in this offering and the Share Purchase Plan will not exceed A$4.2 million.

We may elect to increase the maximum size of the offering and/or the Share Purchase Plan at any time, however , under applicable rules of the Australian Securities Exchange, we may not issue more than 431,157,220 shares (30% of our outstanding shares as of May 19, 2010) in the aggregate in connection with this offering and/or the Share Purchase Plan without obtaining the approval of our shareholders.

If subscriptions for shares in the Share Purchase Plan, together with subscriptions for ADSs in this offering, exceed the maximum number of ordinary shares authorized by our board of directors, we will decrease each participating holder’s subscription amount on a pro rata basis based on the number of shares each holder subscribed for under the subscription form. For example, if the aggregate subscriptions in this offering and the Share Purchase Plan exceed the maximum authorized amount by 10%, each investor’s subscribed amount will be reduced by 10%. In that event, we will return any excess payments by mail without interest or deduction promptly after the expiration of the Subscription Period. Fractional ADSs resulting from the foregoing pro rata decrease will be eliminated by rounding down to the nearest whole new ADS. Upon the expiration of the Subscription Period, we will promptly announce if the offering has been oversubscribed, thereby requiring the Company to decrease the subscriptions on a pro rata basis.

Underwriting Arrangements

We have not employed any brokers, dealers or underwriters in connection with the solicitation of exercise of subscription rights pursuant to this prospectus supplement, and, except as described herein, no other commissions, fees or discounts will be paid in connection with this offering. Certain of our employees may solicit responses from the record holders in connection with this offering, but such employees will not receive any commissions or compensation for such services other than their normal employment compensation.

Pursuant to an agreement between Patersons Securities Limited (“Patersons”) and us dated May 4, 2010, Patersons was engaged as lead manager and underwriter to the Share Purchase Plan in Australia. As of June 10, 2010, this agreement was terminated without penalty to the Company or Patersons and the Share Purchase Plan in Australia will proceed as a non-underwritten offering.

Subscription Agent

The Bank of New York Mellon, in its capacity as depositary for ADS holders, will act as ADS subscription agent. Ordinary shares will be issued and deposited with a custodian for The Bank of New York Mellon. As soon as practicable after it receives notice of the deposit of ordinary shares, The Bank of New York Mellon will deliver new ADSs to participating ADS holders.

Information Agent

BNY Mellon Shareowner Services will act as information agent.

ADS Holder Helpline

If you have any questions about how to participate in this offering, you may call BNY Mellon Shareowner Services at 1-800-777-3674. This helpline is available from 9:00 a.m. to 6:00 p.m., Eastern Daylight Time, Monday to Friday. You may also call us at 303-524-3360 during business hours.

Please note that the helpline will only be able to provide you with information contained in the prospectus supplement, and will not be able to give advice on the merits of this offering or to provide financial advice.

Record Date

ADS holders as of 5:00 p.m., Eastern Daylight Time, on May 18, 2010 may participate in this offering.

Listing

The ADSs being offered have been approved for trading on the NYSE AMEX. Our ADSs are currently traded on the NYSE AMEX under the symbol “SSN.” The closing price of our ADSs on June 14, 2010 was $0.60 per ADS.

Extensions, Amendments and Termination

Your subscription form, together with full payment of the deposit amount, must be received by the subscription agent on or prior to the expiration of the Subscription Period pursuant to the instructions below.

We may extend the Subscription Period for purchase of ADSs in our sole discretion. We will extend the Subscription Period as required by applicable law, and may choose to extend it if we decide to give investors more time to participate in this offering. If we elect to extend the previously scheduled expiration date of this offering, we will issue a press release announcing such extension no later than 1:00 p.m., Eastern Daylight Time, on the business day immediately following the previously scheduled expiration date.

We reserve the right, in our sole discretion, to amend the terms of this offering. In the event of a material change in this offering, we will extend the duration of this offering if necessary to ensure that at least five business days remain in this offering following notice of the material change.

We reserve the right to cancel or terminate this offering, in whole or in part, in our sole discretion at any time prior to the time that this offering expires for any reason or no reason. In the case we terminate this offering, all funds included with your subscription form will be returned to you.

If you do not deliver your subscription form by 5:00 p.m., Eastern Daylight Time, on June 30, 2010, the scheduled expiration date of this offering, your subscription form will have no force and effect.

We will not be obligated to honor your subscription form if the subscription agent receives the documents or the payment relating to your purchase after the conclusion of the Subscription Period, regardless of when you transmitted the documents.

Restrictions on Participation in this Offering by Certain ADS Holders

The distribution of this prospectus supplement, and the purchase of ADSs, may be restricted by law in certain jurisdictions. Any failure to comply with applicable restrictions may constitute a violation of the securities laws of such jurisdictions. In particular, due to restrictions under the securities laws of certain countries, ADS holders residing in such countries may not exercise rights. Persons into whose possession this prospectus supplement comes or who wish to exercise any of the rights must inform themselves about and observe any such restrictions. This prospectus supplement does not constitute an offer of our ordinary shares or ADSs, or an invitation to exercise any of the subscription rights, in any jurisdiction in which such offer or invitation would be unlawful. We do not accept any responsibility for any violation by any person, whether or not a prospective participant in the offering, of any such restrictions.

Timetable

The timetable below lists certain important dates relating to the offering. All future dates are expected and subject to change. No assurance can be given that the issuance and delivery of the ADSs will not be delayed.

| | Announcement of offering | | May 3, 2010 |

| | | | |

| | Announcement of extension of Subscription Period and adjustment to U.S. deposit amount | | June 10, 2010 |

| | | | |

| | Record date | | 5:00 p.m., Eastern Daylight Time, on May 18, 2010 |

| | | | |

| | Subscription Period commences | | 9:00 a.m., Eastern Daylight Time, on May 20, 2010 |

| | | | |

| | Subscription Period ends | | 5:00 p.m., Eastern Daylight Time, on June 30, 2010 |

| | | | |

| | Expected date for issuance and delivery of the ADSs | | On or around July 7, 2010 |

Subscription Procedures

You may purchase ADSs during the Subscription Period as follows:

Subscription by registered holders.

If you are a holder of ADSs registered directly with The Bank of New York Mellon, you will receive a subscription form. You may purchase ADSs by delivering to the subscription agent a properly completed subscription form and delivering payment to the subscription agent. Payment must be made by certified check or bank draft payable to BNY Mellon Shareowner Services. A form of the subscription form is attached hereto as Appendix A, and registered holders will be sent their subscription forms by first class mail as promptly as practicable after the record date.

The properly completed subscription form and payment should be delivered to:

| | By Mail: | By Overnight Courier or By Hand : |

| | | |

| | The Bank of New York Mellon | The Bank of New York Mellon |

| | c/o BNY Mellon Shareowner Services | c/o BNY Mellon Shareowner Services |

| | Attn: Corporate Action Department | 480 Washington Boulevard |

| | P.O. Box 3301 | Attn: Corporate Action |

| | South Hackensack, NJ 07606 | Department – 27th Floor |

| | | Jersey City, NJ 07310 |

The subscription agent must receive the subscription form and payment on or before the end of the Subscription Period. Deposit in the mail will not constitute delivery to the subscription agent . The subscription agent has discretion to refuse to accept any improperly completed or unexecuted subscription form.

You will elect the method of delivering the subscription form and paying the purchase amount to the subscription agent and you will bear any risk associated with it. If you send the subscription form and payment by mail, you should use registered mail, properly insured, with return receipt requested, and allow sufficient time to ensure delivery to the subscription agent before the end of the Subscription Period.

Subscription by beneficial owners.

If your ADSs are held in the name of a broker, dealer, custodian bank or other nominee, then your broker, dealer, custodian bank or other nominee is the record holder of the ADSs you own. You will not receive a subscription form directly from the subscription agent. Instead, The Bank of New York Mellon will distribute a subscription form to your broker, dealer, custodian bank or other nominee and such party will transmit the materials to you. Each such record holder will collect subscription instructions from the underlying beneficial owners and deliver the subscription form, together with payment, to The Bank of New York Mellon.

If you wish to purchase ADS through this offering, you should promptly contact your broker, dealer, custodian bank or other nominee as record holder of your ADSs. We will ask your record holder to notify you of this offering. However, if you are not contacted by your broker, dealer, custodian bank or other nominee, you should promptly initiate contact with that intermediary. In order to ensure that they have sufficient time to transmit your subscription instructions, your broker, dealer, custodian bank or other nominee may establish a deadline for you to submit instructions that is prior to 5:00 p.m., Eastern Daylight Time, on June 30, 2010, which we established as the expiration of this offering.

Brokers, dealers, custodian banks or other nominees may not purchase ADSs in connection with this offering, except upon the instruction of beneficial owners of our ADSs as of the record date. Subscription forms may be submitted only by a requested holder of ADSs or by a DTC participant acting on behalf of a beneficial owner.

Delivery of ADSs

The ADSs are expected to be delivered to each purchaser (by DWAC delivery to the financial intermediary through which it holds the ADSs or by direct registration of ADSs on an un-certificated basis in the name of the purchaser, confirmed by a statement sent by first class mail if it is a holder registered directly with the depositary) on or around July 7, 2010.

No Recommendation

Whether to participate in this offering must be made according to each investor’s evaluation of its own best interests and after considering all of the information in this prospectus supplement and the accompanying prospectus, including (1) the risk factors under the caption “Risk Factors” in this prospectus supplement and the accompanying prospectus, and (2) all of the other information incorporated by reference in this prospectus supplement and the accompanying prospectus. Our board of directors has not made any recommendation to ADS holders regarding whether they should purchase the ADSs.

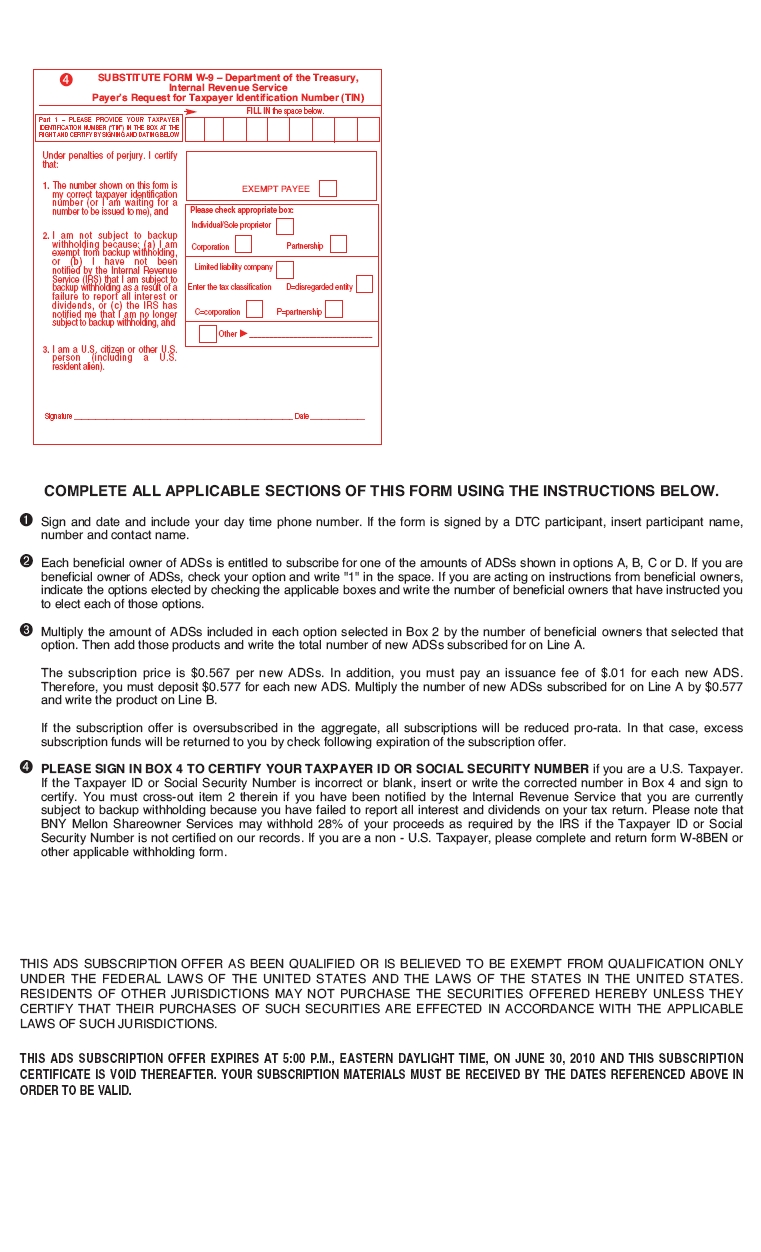

CERTAIN UNITED STATES FEDERAL TAX CONSEQUENCES

The following is a general summary of the material U.S. federal income tax consequences of the ownership and disposition of ADSs. This summary addresses only U.S. federal income tax considerations of U.S. holders (as defined below) of ADSs that purchase ADSs, and who in each case hold such ADSs as capital assets for U.S. federal income tax purposes.

This summary is based on U.S. tax laws including the Internal Revenue Code of 1986, as amended (the “Code”), Treasury regulations promulgated thereunder, rulings, judicial decisions, administrative pronouncements, and the U.S.-Australia income tax treaty, as amended (the “Treaty”), all as of the date hereof, and all of which are subject to change or changes in interpretation, possibly with retroactive effect. In addition, this summary is based in part upon the assumption that each obligation in the deposit agreement relating to the ADSs and any related agreement will be performed in accordance with its terms.

This summary does not address all aspects of U.S. federal income taxation that may apply to holders that are subject to special tax rules, including: certain U.S. expatriates; insurance companies; tax-exempt entities; banks and other financial institutions; persons subject to the alternative minimum tax; regulated investment companies; securities broker-dealers or dealers; traders in securities who elect to apply a mark-to-market method of accounting; persons that own (directly, indirectly or by attribution) 10 percent or more of our outstanding share capital or voting stock; partnerships or other pass-through entities or a person who is an investor in such an entity; persons holding their ADSs as part of a straddle, hedging or conversion transaction; persons who acquire our ADSs pursuant to the exercise of employee stock options or otherwise as compensation; and, persons whose functional currency is not the U.S. dollar. Such holders may be subject to U.S. federal income tax consequences different from those set forth below.

As used herein, the term “U.S. holder” means a beneficial owner of ADSs that is (a) an individual citizen or resident of the United States for U.S. federal income tax purposes; (b) a corporation (or other entity taxable as a corporation for U.S. federal income tax purposes) created or organized in or under the laws of the United States or any state thereof or the District of Columbia; (c) an estate the income of which is subject to U.S. federal income taxation regardless of its source; or (d) a trust if a court within the United States can exercise primary supervision over the administration of the trust and one or more U.S. persons are authorized to control all substantial decisions of the trust. If a partnership (including for this purpose any entity treated as a partnership for U.S. federal income tax purposes) holds ADSs, the tax treatment of a partner generally will depend upon the status of the partner and the activities of the partnership. If a U.S. holder is a partner in a partnership that holds ADSs, such holder is urged to consult its own tax advisor regarding the specific tax consequences of the ownership and disposition of ADSs.

Any holder of our ADSs who is not a U.S. holder should consult with the holder’s own tax advisor with regard to the U.S., federal, state, local and foreign tax consequences of purchasing the ADSs and the related matters discussed herein.

U.S. holders should consult their own tax advisors regarding the specific U.S. federal, state and local tax consequences of the ownership and disposition of ADSs in light of their particular circumstances as well as any consequences arising under the laws of any other taxing jurisdiction. In particular, U.S. holders are urged to consult their own tax advisors regarding whether they are eligible for benefits under the Treaty.

For U.S. federal income tax purposes, a U.S. holder of ADSs generally will be treated as owning the underlying shares represented by those ADSs. Therefore, deposits or withdrawals by a U.S. holder of shares for ADSs or of ADSs for shares will not be subject to U.S. federal income tax. This summary (except where otherwise expressly noted) applies equally to U.S. holders of ordinary shares and U.S. holders of ADSs.

This summary assumes that we are not and will not become a controlled foreign corporation for purposes of the Code and, except as otherwise indicated, that we are not and will not become a passive foreign investment company.

U.S. taxation of ADSs

Taxation of dividends