| QUARTERLY REPORT for the period ended 30 September 2012 |

0B

HIGHLIGHTS

FINANCIAL

| - | Cash receipts from debtors for the quarter was US$2.1 million |

| - | A closing cash balance for the quarter of US$10.529 million |

OPERATIONAL

| - | Production from the Niobrara Formation in the Defender US33 #2-29H well in Goshen County, WY has been sporadic due to the chemistry of the Niobrara oil which has an unusually high concentration of paraffin and asphaltene (11.74%). Samson, following consultation with industry experts, has designed a chemical treatment program to maintain these compounds in solution. This treatment program will require a change to the bottom hole configuration and a workover rig is scheduled to arrive on location in November to run this completion. Prior to the paraffin and asphaltene plugging, the well had established a consistent production rate of approximately 75 BOPD while maintaining a high fluid level in the wellbore. The go-forward plan is to increase the pump rate to lower the fluid level and thus increase the production rate. |

| - | The last frac stage in the Spirit of America US34 #2-29 exploration well in Goshen County, WY is scheduled to occur in the coming quarter following a wellbore cleanout and tubing retrieval operation. |

| - | The Australia II 12KA 6 #1-29H and the Gretel II 12KA 3 #1-30H wells in Roosevelt County, MT are currently being worked over to improve production performance from the middle member of the Bakken Formation. Workover operations should be completed by early-November. |

| - | The Abercrombie #1-10H (SSN 0.75% W.I.) well has produced a cumulative 29,000 barrels of oil while producing at an average rate of approximately 160 BOPD and 310 Mcf/D during the quarter. |

| - | The Riva Ridge 6-7-33-56H (SSN 0.76% W.I.) is producing at an average rate of approximately 138 BOPD and 15 Mcf/D during the quarter. |

| - | Samson received approval from the Montana Oil and Gas Commission for a 1280 acre north-south orientated spacing unit in sections 2 and 35 in T27-28N R53E (Roosevelt County, MT) to drill the Prairie Falcon well, located just to the south of the Gretel II well and east of Continental’s Abercrombie 1-10H well. |

| - | Greater than 50% of the 77 square mile South Prairie 3-D seismic survey has been acquired on the eastern flank of the Williston Basin in North Dakota. The acquisition should be completed by the second week of November. |

| - | Samson is currently applying for permits to drill in-fill locations in North Stockyard Field for both the Bakken & Three-Forks Formations, and is finalizing an acreage swap which will allow the northern 3 sections to be operated by Samson (with around 60% working interest) so that the infill development of that area can proceed in the first quarter of 2013. This transaction will not affect Samson existing production and will be a cashless exercise. |

| SAMSON OIL & GAS LIMITED |

| September 2012 Quarterly Report |

LAND

| - | Samson’s current land position in the Hawk Springs projects stands at 19,800 net acres. |

| - | Samson’s current land position in the Roosevelt Project is 45,000 gross acres (30,000 net acres) with Samson’s partner in the project, Fort Peck Energy Company, holding 15,000 net acres. |

| - | Samson has an average working interest of 32% in 3,303 acres in the North Stockyard Oil Field. |

| - | Samson’s current land position in the Rock Springs West Project consists of 4,520 acres (100% working interest) in Greens Canyon and 6,400 acres (25% working interest) in Flaming Gorge. |

| - | Samson has a 25% working interest in 23,879 net acres in the South Prairie Project, North Dakota. |

| - | Samson’s current land position in Lea County, NM consists of 480 acres (27% working interest). |

DRILLING PROGRAMME 2012-2013

Roosevelt Project, Roosevelt County, Montana

Mississippian Bakken Formation,Williston Basin

Prairie Falcon #1-35H

Samson 66.7% Working Interest

Samson has obtained approval from the Montana Oil and Gas Commission for a 1280 acre north-south orientated (stand-up) spacing unit in sections 2 and 35 in T27-28N R53E to drill the Prairie Falcon well, located just to the south of the Gretel II well and east of Continental’s Abercrombie 1-10H well. Samson is waiting on the results of two other adjacent wells, which should help define the productive extension of the Elm Coulee Bakken fairway onto the Fort Peck Indian Reservation. If economic results are obtained from the offsetting wells, Samson will move ahead with the drilling of the Prairie Falcon well.

Hawk Springs Project, Goshen County, Wyoming

Wildcat (Exploratory) Permo-Penn Hartville Formation, Northern D-J Basin

Bluff Federal #1-12

Samson will most likely have a 50% Working Interest

A better understanding of the Permian section has been achieved from the well data obtained in the Spirit of America US34 #2-29 well. From that data, several of the upper Permian zones calculate to be hydrocarbon bearing whereas the deepest zone, the 9500’ sand, calculates to contain formation water or is “wet”. The SOA #2 prospect depended on the 9500’ sand to be stratigraphically trapped (i.e. a sand pinch-out). The fact that this zone appears to be wet most likely means the sand does not pinch-out or trap at this particular prospect as the seismic data would indicate, but instead persists over a much larger area, requiring a structural closure to trap hydrocarbons in the reservoir. This 9500’ sand has also been mapped as a four-way dip structural closure just a few miles away and more than 2,000’ shallower at the Bluff Federal prospect. The excellent reservoir properties seen at this level in the SOA #2 well has allowed Samson to high-grade the Bluff Federal prospect, which is currently being prepared to be drilled next year.

South Prairie Project, North Dakota

Mississippian Mission Canyon Formation,Williston Basin

Samson 25% Working Interest

After the 3-D seismic survey has been acquired and processed, the data will then be interpreted in the 1st quarter of 2013. After the data has been evaluated and prospects are defined, the first potential well could be drilled as early as the end of the 1st quarter of 2013.

| SAMSON OIL & GAS LIMITED |

| September 2012 Quarterly Report |

North Stockyard Oilfield, Williams County, North Dakota

Mississippian Bakken Formation,Williston Basin

Bakken & Three Forks infill wells

Samson various working interests

A transaction is being undertaken that will see Samson swap its equity in the undrilled acreage in the southern three Sections of this holding for the same acres in the northern three Sections. Samson’s equity in the current production will be unaffected by this transaction. The swap is aimed at allowing Samson to operate the northern three Sections and develop the considerable potential in a timely manner. Based on current industry practice and evidenced by offset production it is economically feasible to drill both the Bakken Formation and the underlying Three Forks Formation at a 160 acre density. Accordingly Samson has identified 10 infill development wells that can be drilled between the existing Bakken wells, 4 in the Bakken formation and 6 in the Three Forks Formation. The wells would be drilled from pads that would accommodate multiple well heads. The infill development drilling is tentatively planned to commence in the first quarter of 2013.

PROJECTS

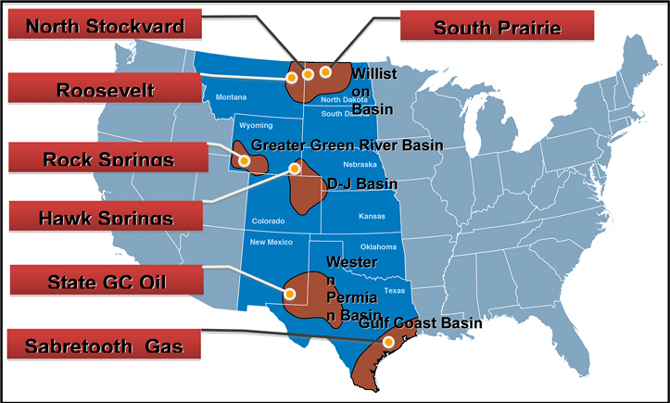

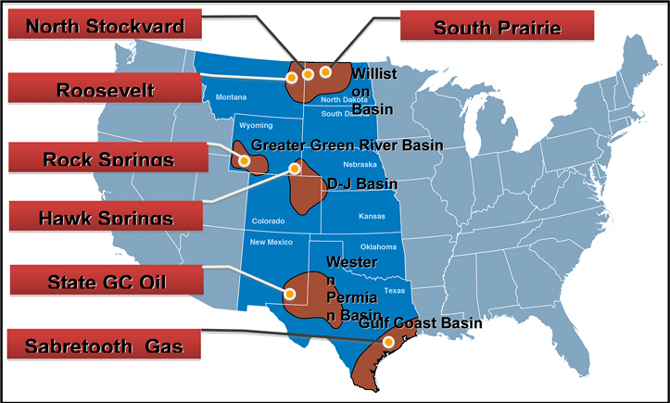

PROJECT LOCATION MAP

Roosevelt Project, Roosevelt County, Montana

Mississippian Bakken Formation,Williston Basin

Samson 100% working interest in Australia II & Gretel II wells, 66.7% in any subsequent drillingSamson has an interest in approximately 45,000 gross acres (30,000 net acres) in the Roosevelt Project with Fort Peck Energy Co. (FPEC) having the remaining 15,000 net acres. Samson’s first Bakken appraisal (exploratory) well in the Roosevelt project area on the Ft. Peck Indian Reservation was drilled in December 2011, the Australia II 12 KA 6 well. This well was drilled to a total measured depth of 14,972 feet with the horizontal lateral remaining within the target zone for the entire lateral length. Oil and gas shows were returned during the drilling of this well. Approximately 3,425 barrels of oil have been produced. It is currently being worked over for mechanical repairs and should be back on production soon. Samson’s second Bakken appraisal (exploratory) well, the Gretel II 12 KA 3, was drilled in January 2012 and fracture stimulated in March 2012. It appears that this well was drilled on the north side of the Brockton Fault zone, which is believed to be the western edge of the continuous Bakken oil. The Gretel II has produced oil, but with a high water cut. This well is currently shut-in and awaiting mechanical repairs. Samson currently has a third permitted exploratory well in this project – the Prairie Falcon. The drilling location of this well is south of the Brockton Fault zone and is north of the Abercrombie 1-10H well, with initial production of 630 BOPD. Samson is waiting on the results of two other nearby wells, which should help define the productive extension of the Elm Coulee Bakken fairway onto the Fort Peck Indian Reservation. If economic results are obtained from the offsetting wells, Samson will move ahead with the drilling of the Prairie Falcon well. Samson is currently looking for a joint venture participant to help drill the Prairie Falcon well and continue to develop its leasehold on the Fort Peck Indian Reservation.

| SAMSON OIL & GAS LIMITED |

| September 2012 Quarterly Report |

Abercrombie 1-10H well, Richland County, Montana

Mississippian Bakken Formation,Williston Basin

Samson 0.75% working interest

The Abercrombie #1-10H (SSN 0.75% W.I.) well has produced a cumulative 29,000 barrels of oil while producing at an average rate of approximately 160 BOPD and 310 Mcf/D during the quarter.

Riva Ridge 6-7-33-56H well, Sheridan County, Montana

Mississippian Bakken Formation,Williston Basin

Samson 0.76% working interest

The Riva Ridge 6-7-33-56H well has been fracked and is now on production. It is producing at an average rate of approximately 138 BOPD and 15 Mcf/D during the quarter.

South Prairie Project, North Dakota

Mississippian Mission Canyon Formation,Williston Basin

Samson 25% working interest

Samson has recently acquired a 25% working interest in 23,879 net acres, which is located on the eastern flank of the Williston Basin in North Dakota. Potential reservoirs include the Mississippian Mission Canyon Formation and the Devonian Nisku Formation. Several leads were initially identified using 2-D seismic and well-control mapping. These leads will be verified with a 77 square mile 3-D seismic survey, which is now being acquired. The seismic data will then be processed and interpreted in the 1st quarter of 2013. After the data has been evaluated, the first well could potentially be drilled as early as the end of the 1st quarter of 2013.

North Stockyard Oilfield, Williams County, North Dakota

Mississippian Bakken Formation, Williston Basin

Samson various working interests

Samson has seven producing wells in the North Stockyard Field. These wells are located in Williams County, North Dakota, in Township 154N Range 99W.

| 1. | The Harstad #1-15H well (34.5% working interest) was down for 33 days during the quarter due to pump rod failure and as a result averaged 19 BOPD for the quarter from the Mississippian Bluell Formation. After the workover, the well has been averaging 35 BOPD. The well has cumulative gross production of 99 MSTB and 82 MMcf. |

| 2. | The Leonard #1-23H well (10% working interest, 37.5% after non-consent penalty) was down for 44 days during the quarter for multiple workovers. As a result, the well averaged 25 BOPD and 33 Mcf/D during the quarter. After the workover, the well has been averaging 51 BOPD and 62 Mcfd. To date, the Leonard #1-23H well has produced approximately 99 MSTB and 102 MMcf. |

| 3. | The Gene #1-22H well (30.6% working interest) produced at an average daily rate of 110 BOPD and 90 Mcf/D during the quarter. The cumulative production to date is approximately 131 MSTB and 144 MMcf. |

| 4. | The Gary #1-24H (37% working interest) well was down for 13 days during the quarter due to pump rod failure. As a result, the well averaged 80 BOPD and 122 Mcf/D during the quarter. The cumulative production to date is approximately 129 MSTB and 210 MMcf. |

| 5. | The Rodney #1-14H (27% working interest) well produced at an average daily rate of 97 BOPD and 183 Mcf/D during the quarter. The cumulative production to date is approximately 96 MSTB and 132 MMcf. |

| 6. | Earl #1-13H (32% working interest) well was down for 33 days during the quarter due to tubing failure and as a result produced at an average daily rate of 140 BOPD and 222 Mcf/D during the quarter. Cumulative production to date is approximately 145 MSTB and 200 MMcf. |

| SAMSON OIL & GAS LIMITED |

| September 2012 Quarterly Report |

| 7. | The Everett #1-15H (26% working interest) well was the sixth Bakken well drilled in the North Stockyard Field. The Everett well produced at an average daily rate of 170 BOPD and 244 Mcf/D during the quarter. Cumulative production to date is approximately 70 MSTB and 96 MMcf. |

Sabretooth Gas Field, Brazoria County Texas

Oligocene Vicksburg Formation, Gulf Coast Basin

Samson 12.5% Working Interest

Production for the Davis Bintliff #1 well has held steady at an average rate of 2.6 MMcf/D and 28 BOPD for the quarter. The well was choked-back from a 10/64” choke (where it was making 4.3 Mmcf/D) to an 8/64” choke (where it is now making 2.6 Mmcf/D) during the quarter due to depressed gas prices. Cumulative production to date is approximately 5 Bscf and 59 MBO.

State GC Oil and Gas Field Lea County New Mexico

Permian Bone Spring Formation, Western Permian Basin

Samson 27% Working Interest

The State GC oil and gas field is located in Lea County, New Mexico, and includes two wells, which produced at an average rate of 44 BOPD and 77 Mcf/D.

10B

Hawk Springs Project, Goshen County, Wyoming

Cretaceous Niobrara Formation & Permo-Penn Project, Northern D-J Basin

Samson 100% to 37.5% Working Interest

Production from the Niobrara Formation in the Defender US33 #2-29H well in Goshen County, WY has been sporadic due to the chemistry of the Niobrara oil, which has an unusually high concentration of paraffin and asphaltene (11.74%). Samson, following consultation with industry experts, has designed a chemical treatment program to maintain these compounds in solution. This treatment program will require a change to the bottom hole configuration and a workover rig is scheduled to arrive on location in November to run this completion. Prior to the paraffin and asphaltene plugging, the well had established a consistent production rate of approximately 75 BOPD while maintaining a high fluid level in the wellbore. The go-forward plan is to increase the pump rate to lower the fluid level and thus increase the production rate.

Two stages of a three stage completion have taken place on the Spirit of America US34 #2-29 Permo-Penn exploration well. Most recently, Frac Stage #3 took place, which included 7’ of log pay from 9247-9254’, 7’ of log pay from 9225-9232’, and 8’ of log pay from 9167-9175’. The stimulation included 37,000 pounds of proppant. The initial shut-in pressure (ISIP) after fracking measured 4,238 psi. After 45 minutes the pressure bled down to 4163 psi and 70 bbls were flowed back before the well was shut-in with 3761 psi of pressure. During flowback operations 177 bbls of fluid was recovered before the wellbore plugged with salt. A coil tubing unit was used to drill out the salt plugs, however hot water was subsequently required to clear the plugs, and the plugging is consistent as the salt is precipitating out of the formation water as a result of a pressure drop and temperature cooling. This can be treated with an appropriate salt inhibitor to prevent the salt from precipitating out of the water. To date approximately 253 bbls of load water have been recovered out of approximately 1600 bbls that were pumped into the well. A workover rig will be required to remove the tubing and reset the retrievable bridge plug and packer in attempt to make a completion in the best zone, the 9300’ sand (Frac Stage #2). This final frac stage is scheduled to occur in the coming quarter following this workover operation. Samson has mapped numerous similar prospects within its 3-D seismic area that will allow for follow-up to this well: the next being the Bluff Federal #1-12 well which is 2,000 feet shallower than the Spirit of America well and is located within a 4-way structural closure.

Samson has two contiguous areas in the Hawk Springs Project. One of the areas is a joint venture with a private company and is subject to the Halliburton Joint Venture (HJV).

Harrod Oilfield, Campbell County, Wyoming

Pennsylvanian Minnelusa Formation, Powder River Basin

Samson 25% working interest

The Harrod 4-2 well has been producing steadily and has averaged 6.5 BOPD for the quarter.

| SAMSON OIL & GAS LIMITED |

| September 2012 Quarterly Report |

Pierce 44-27 Oilfield, Campbell County, Wyoming

Permo-Pennsylvanian Minnelusa Formation, Powder River Basin

Samson 100% working interest

The Pierce 44-27 Unit well has been producing at a steady rate of 12 BOPD during the quarter.

24B

PRODUCTION

Estimated net production by Project for the September 2012 quarter is as follows

| | | OIL – Bbls | | | GAS - Mcf | | | BOE | |

| North Stockyard | | | 13,235 | | | | 14,515 | | | | 15,655 | |

| Hawk Springs | | | 522 | | | | - | | | | 522 | |

| Roosevelt | | | 1,309 | | | | - | | | | 1,309 | |

| Other | | | 3,818 | | | | 26,845 | | | | 8,292 | |

| Total | | | 18,884 | | | | 41,360 | | | | 25,778 | |

Estimated daily net production by Project for the September 2012 quarter is as follows:

| | | OIL – Bbls | | | GAS - Mcf | | | BOE | |

| North Stockyard | | | 147 | | | | 161 | | | | 174 | |

| Hawk Springs | | | 5 | | | | - | | | | 5 | |

| Roosevelt | | | 15 | | | | - | | | | 15 | |

| Other | | | 42 | | | | 298 | | | | 92 | |

| Total | | | 209 | | | | 459 | | | | 286 | |

Estimated net production and revenue:

| | | OIL Bbls | | | OIL US$ | | | Gas Mcf | | | GAS US$ | | | TOTAL US$ | |

| June 2012 Quarter | | | 20,146 | | | | 1,614,215 | | | | 44,870 | | | | 155,078 | | | | 1,769,296 | |

| September 2012 Quarter | | | 18,884 | | | | 1,490,575 | | | | 41,360 | | | | 153,019 | | | | 1,643,594 | |

Average commodity prices:

| | | GAS

US$/Mcf | | | OIL US$/Bbl | |

| June 2012 Quarter | | $ | 3.46 | | | $ | 80.13 | |

| September 2012 Quarter | | $ | 3.70 | | | $ | 78.93 | |

In some cases revenue is yet to be received and is therefore an estimate.

25BFINANCIAL

Frontier Rig 24

This drilling rig has an expected completion date of mid-December 2012 and will be placed on a reduced standby rate for approximately one month prior to being mobilized to North Dakota to commence the infill development program in the North Stockyard field as detailed earlier in this report. The number of wells that will be drilled in that program has yet to be determined and will be dependent on regulatory approvals, final formal agreement of the acreage swap arrangement, the election of Samson as the Operator, and capital availability.

Treasury management

Given that Samson’s business is conducted in the US, the Directors determined that the company’s cash balance should be maintained largely in that currency. In order to diversify the deposit risk, a treasury management policy was adopted such that the cash was distributed as follows:

| SAMSON OIL & GAS LIMITED |

| September 2012 Quarterly Report |

| Bank of the West (Samson’s trading bank) | | US$ | 4,404,734 | |

| Bank of New York Mellon | | US$ | 17,946 | |

| National Australia Bank | | US$ | 35,018 | |

| National Australia Bank | | A$ | 5,802,226 | |

Foreign Exchange Rates

The closing A$:US$ exchange rate on 30 September 2012 was 1.0464. The average A$:US$ exchange rate for the quarter was 1.03848.

The Company’s cash position at 30 September 2012 was as follows:

| | | | | | US$ (‘000’s) | |

| Cash at bank and on deposit | | | : | | | | 10,529 | |

| For and on behalf of the Board of | For further information please contact |

| SAMSON OIL & GAS LIMITED | Denis Rakich, Company Secretary, on 08 9220 9882 |

| TERRY BARR | Information contained in this report relating to hydrocarbon reserves was compiled by the Managing Director of Samson Oil & Gas Ltd., T M Barr a Geologist who holds an Associateship in Applied Geology and is a fellow of the Australian Institute of Mining and Metallurgy who has 30 years relevant experience in the oil & gas industry. |

| Managing Director |

| |

| 29 October 2012 |

| |

| SAMSON OIL & GAS LIMITED |

| September 2012 Quarterly Report |

Rule 5.3

Appendix 5B

Mining exploration entity quarterly report

Introduced 01/07/96 Origin Appendix 8 Amended 01/07/97, 01/07/98, 30/09/01, 01/06/10, 17/12/10

| Name of entity |

| Samson Oil and Gas Limited |

| ABN | | Quarter ended (“current quarter”) |

| 25 009 069 005 | | 30 September 2012 |

Consolidated statement of cash flows

| | Current quarter | Year to date |

Cash flows related to operating activities | $US’000 | (3.months) |

| | | $US’000 |

| 1.1 | Receipts from product sales and related debtors | 2,072 | 2,072 |

| 1.2 | Payments for (a) exploration & evaluation (b) development (c) production (d) administration | (9,072) (95) (708) (1,193) | (9,072) (95) (708) (1,193) |

| 1.3 | Dividends received | - | - |

| 1.4 | Interest and other items of a similar nature received | 87 | 87 |

| 1.5 | Interest and other costs of finance paid | - | - |

| 1.6 | Income taxes paid | - | - |

| 1.7 | Other (provide details if material) | - | - |

| | | | |

| | Net Operating Cash Flows | (8,909) | (8,909) |

| | | | |

| | Cash flows related to investing activities | | |

| 1.8 | Payment for purchases of: (a) prospects (b) equity investments (c) other fixed assets | - - (7) | - - (7) |

| 1.9 | Proceeds from sale of: (a) prospects (b) equity investments (c) other fixed assets | - - | - - - |

| 1.10 | Loans to other entities | - | - |

| 1.11 | Loans repaid by other entities | - | - |

| 1.12 | Other (provide details if material) | - | - |

| | | | |

| | Net investing cash flows | (7) | (7) |

| 1.13 | Total operating and investing cash flows (carried forward) | (8,916) | (8,916) |

| SAMSON OIL & GAS LIMITED |

| September 2012 Quarterly Report |

| 1.13 | Total operating and investing cash flows (brought forward) | (8,916) | (8,916) |

| | | | |

| | Cash flows related to financing activities | | |

| 1.14 | Proceeds from issues of shares, options, etc. | 445 | 445 |

| 1.15 | Proceeds from sale of forfeited shares | - | - |

| 1.16 | Proceeds from borrowings | - | - |

| 1.17 | Repayment of borrowings | - | - |

| 1.18 | Dividends paid | - | - |

| 1.19 | Other (provide details if material) | - | - |

| | | | |

| | Net financing cash flows | 445 | 445 |

| | | | |

| | Net increase (decrease) in cash held | (8,471) | (8,471) |

| | | | |

| 1.20 | Cash at beginning of quarter/year to date | 18,845 | 18,845 |

| 1.21 | Exchange rate adjustments to item 1.20 | 155 | 155 |

| 1.22 | Cash at end of quarter | 10,529 | 10,529 |

Payments to directors of the entity and associates of the directors

Payments to related entities of the entity and associates of the related entities

| | Current quarter |

| | $US'000 |

| | | |

| 1.23 | Aggregate amount of payments to the parties included in item 1.2 | 180 |

| | | - |

| 1.24 | Aggregate amount of loans to the parties included in item 1.10 | |

| | |

| 1.25 | Explanation necessary for an understanding of the transactions |

| | Monies paid to Directors for salary and fees |

| | |

Non-cash financing and investing activities

| 2.1 | Details of financing and investing transactions which have had a material effect on consolidated assets and liabilities but did not involve cash flows |

| | |

| | |

| | |

| 2.2 | Details of outlays made by other entities to establish or increase their share in projects in which the reporting entity has an interest |

| | |

| | |

| | |

| SAMSON OIL & GAS LIMITED |

| September 2012 Quarterly Report |

Financing facilities available

Add notes as necessary for an understanding of the position.

| | | Amount available | Amount used |

| | | $US’000 | $US’000 |

| 3.1 | Loan facilities | - | - |

| | | | |

| 3.2 | Credit standby arrangements | - | - |

| | | | |

Estimated cash outflows for next quarter

| | | $US’000 |

| 4.1 | Exploration and evaluation | 1,500 |

| | | |

| 4.2 | Development | 1,100 |

| | | |

| 4.3 | Production | 340 |

| | | |

| 4.4 | Administration | 1,912 |

| | | |

| | Total | 4,852 |

Reconciliation of cash

| Reconciliation of cash at the end of the quarter (as shown in the consolidated statement of cash flows) to the related items in the accounts is as follows. | Current

quarter $US’000 | Previous quarter

$US’000 |

| 5.1 | Cash on hand and at bank | 5,162 | 3,188 |

| | | | |

| 5.2 | Deposits at call | 5,367 | 15,657 |

| | | | |

| 5.3 | Bank overdraft | - | - |

| | | | |

| 5.4 | Other (provide details) | - | - |

| | | | |

| | Total: cash at end of quarter(item 1.22) | 10,529 | 18,845 |

Changes in interests in mining tenements

| | | Tenement reference | Nature of interest (note (2)) | Interest at beginning of quarter | Interest at end of quarter |

| 6.1 | Interests in mining tenements relinquished, reduced or lapsed | | | | |

| 6.2 | Interests in mining tenements acquired or increased | | | | |

| SAMSON OIL & GAS LIMITED |

| September 2012 Quarterly Report |

Issued and quoted securities at end of current quarter – all reference to option exercise price is in AUSTRALIAN DOLLARS

Description includes rate of interest and any redemption or conversion rights together with prices and dates.

| | Total number | Number quoted | Issue price per

security (see

note 3)

(Australian

cents) | Amount paid up

per security (see

note 3) (Australian

cents) |

| 7.1 | Preference +securities(description) | | | | |

| 7.2 | Changes during quarter (a) Increases through issues (b) Decreases through returns of capital, buy-backs, redemptions | | | | |

| 7.3 | +Ordinary securities | 1,799,873,156 | 1,799,873,156 | | |

| 7.4 | Changes during quarter (a) Increases through issues (b) Decreases through returns of capital, buy-backs | 27,983,189 | | 1.5c | |

| 7.5 | +Convertible debt securities(description) | | | | |

| 7.6 | Changes during quarter (a) Increases through issues (b) Decreases through securities matured, converted | | | | |

| SAMSON OIL & GAS LIMITED |

| September 2012 Quarterly Report |

| 7.7 | Options(description and conversion factor) | 5,379,077 2,000,000 196,637,641 1,000,000 29,000,000 31,500,000 4,000,000 4,000,000 | - - 196,637,641 - - - - - | Exercise price 30c 25c 1.5c 20c 8c 8c 16.4c 15.5c | Expiry date 10.10.2012 11.05.2013 31.12.2012 20.11.2013 31.10.2014 31.12.2014 31.12.2014 31.10.2015 |

| 7.8 | Issued during quarter | - | - | - | - |

| 7.9 | Exercised during quarter | 27,983,189 | | 1.5c | 31.12.2012 |

| 7.10 | Expired during quarter | - | - | - | - |

| 7.11 | Debentures (totals only) | | | | |

| 7.12 | Unsecured notes (totals only) | | | | |

Compliance statement

| 1 | This statement has been prepared under accounting policies which comply with accounting standards as defined in the Corporations Act or other standards acceptable to ASX (see note 5). |

| 2 | This statement does give a true and fair view of the matters disclosed. |

Sign here: ............................................................ Date: 29 October 2012

(Company secretary)

Print name: Denis Rakich

Notes

| 1 | The quarterly report provides a basis for informing the market how the entity’s activities have been financed for the past quarter and the effect on its cash position. An entity wanting to disclose additional information is encouraged to do so, in a note or notes attached to this report. |

| 2 | The “Nature of interest” (items 6.1 and 6.2) includes options in respect of interests in mining tenements acquired, exercised or lapsed during the reporting period. If the entity is involved in a joint venture agreement and there are conditions precedent which will change its percentage interest in a mining tenement, it should disclose the change of percentage interest and conditions precedent in the list required for items 6.1 and 6.2. |

| 3 | Issued and quoted securities The issue price and amount paid up is not required in items 7.1 and 7.3 for fully paid securities. |

| 4 | The definitions in, and provisions of,AASB 6: Exploration for and Evaluation of Mineral Resourcesand AASB 107: Statement of Cash Flows apply to this report. |

| 5 | Accounting Standards ASX will accept, for example, the use of International Financial Reporting Standards for foreign entities. If the standards used do not address a topic, the Australian standard on that topic (if any) must be complied with. |

== == == == ==