Filed Pursuant to Rule 424(b)(5)

Registration No. 333-183327

PROSPECTUS SUPPLEMENT

(To Prospectus Dated November 6, 2012)

SAMSON OIL & GAS LIMITED

Up to 704,943,953 Ordinary Shares

Up to 35,247,198 American Depositary Shares representing Ordinary Shares

Up to 281,977,581 Warrants to purchase Ordinary Shares

Up to 281,977,581 Ordinary Shares issuable upon the exercise of Warrants

Up to 14,098,879 American Depositary Shares representing Ordinary Shares issuable upon the exercise of Warrants

_____________________________________

We are granting, at no charge, nontransferable pro rata subscription rights to the holders of our ordinary shares and holders of our American Depositary Shares, or ADSs, to purchase ordinary shares or ADSs and warrants. Every three ordinary shares owned of record at 5:00p.m. Perth time on April 8, 2013 entitles its holder to purchase one ordinary share, and 0.4 warrants will be included at no charge with each ordinary share purchased. Each warrant will entitle its holder to purchase one ordinary share. The offering price per ordinary share and warrant is A$0.025, which is $0.026 based on the exchange rate for April 2, 2013 as published by the Australian Reserve Bank. The warrants are exercisable upon issuance and will expire at 5:00 p.m. Perth time on March 31, 2017.

For ADS holders, since each ADS represents 20 ordinary shares deposited with The Bank of New York Mellon, the depositary, every three ADSs owned of record at 5:00 p.m. New York City time on April 8, 2013 entitles its holder to purchase one additional ADS for the U.S. dollar equivalent of A$0.50, which is $0.52 based on the exchange rate for April 2, 2013. The actual ADS purchase price will be established based on the exchange rate on or about May 6, 2013.Eight warrants for ordinary shares will be included at no charge with each ADS purchased in the rights offering. ADS holders must exercise 20 warrants in order to purchase one ADS, so that the cumulative exercise price to receive 20 ordinary shares which could be exchanged for one ADS would be A$0.38 per ordinary share, which is $0.79 per ADS based on the exchange rate for April 2, 2013 as published by the Australian Reserve Bank.In addition, an issuance fee per ADS will be payable by holders to the depositary upon exercise of warrants, which fee is tentatively set as $0.01 per ADS, but may change.

Each ordinary share holder or ADS holder who elects to participate in this rights offering may also apply to oversubscribe for any ADSs or warrants that are not subscribed for by the other ordinary shareholders or ADS holders in this rights offering, subject to rounding and other adjustments. However, the board of directors reserves the right to authorize the issuance of oversubscription ordinary shares, ADSs and warrants at their discretion, and there is no guarantee that holders will receive oversubscription ordinary shares, ADSs or warrants for which they have applied. If holders do not receive all of the oversubscription ordinary shares, ADSs or warrants for which they applied, all oversubscription funds included with subscription forms will be returned to each holder.

The ordinary shares subscription rights will expire at the close of business on April 30, 2013. The depositary has determined that the ADS subscription period will expire at 5:00 p.m. New York City time on April 24, 2013. If you would like to exercise your subscription rights, you must do so before the applicable date and time; however, we may extend the period for exercising the subscription rights, in our sole discretion. Subscription rights that are not exercised by the expiration date of this rights offering will expire and will have no value. Any exercise of subscription rights is irrevocable by the holder. We may, however, elect to terminate this rights offering at any time prior to its consummation.

If you are an ADS holder, you must deposit $0.57 for every ADS that you would like to purchase, also referred to as the deposit amount, which represents approximately 110% of the current estimated subscription price of $0.52 per ADS to account for possible exchange rate fluctuations and the depositary’s issuance fee of $0.01 per ADS. The deposit amount has been translated into U.S. dollars using an exchange rate of $1.0457 per Australian dollar (the Reserve Bank of Australia’s published 4:00 p.m. buying rate on April 2, 2013). If the actual U.S. dollar price (which will be the subscription price of A$0.50 per ADS translated into U.S. dollars at the exchange rate in effect on or about May 6, 2013) plus the issuance fee is less than the deposit amount, then the ADS rights agent will refund the excess amount to the subscribing rights holders. If the actual U.S. dollar price plus the issuance fee exceeds the deposit amount, the subscribing rights holders will have to pay the deficiency.

There is no minimum subscription amount that must be received in order to close this rights offering. If this rights offering is fully subscribed, we expect to receive approximately $18,213,997 in net proceeds from the rights offer.

Our ADSs are currently traded on the NYSE MKT and our ordinary shares are traded on the Australian Securities Exchange (ASX) under the symbol “SSN” We expect that the ADSs sold in this rights offering, including those that may be issued upon exercise of the warrants, will be traded on the NYSE MKT, and the ordinary shares will be traded on the ASX. There can be no assurance, however, that the NYSE MKT will grant our application to list the additional ADSs sold in this rights offering or those issuable upon exercise of the warrants. The ordinary shares and warrants will be quoted on the ASX. The closing price of our ADSs on April 2, 2013 was $0.54 and the closing price of our ordinary shares was A$0.023.

_____________________________________

Exercising your subscription rights and investing in our ordinary shares or the ADSs and our warrants involves risks. See “Risk Factors” beginning on page S-10 of this prospectus supplement and on page 3 of the accompanying prospectus.

_____________________________________

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying base prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

_____________________________________

The date of this prospectus supplement is April 3, 2013

TABLE OF CONTENTS

Prospectus

Appendices

ABOUT THIS PROSPECTUS

We are providing information to you about this rights offering in two parts. The first part is this prospectus supplement, which provides the specific details regarding this rights offering and also adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference into that prospectus. The second part is the accompanying prospectus, which provides more general information. Generally, when we refer to this “prospectus,” we are referring to both documents combined.

Some of the information in the base prospectus may not apply to this offering. If information in this prospectus supplement is inconsistent with the accompanying prospectus, you should rely on this prospectus supplement.

You should rely on the information contained or incorporated by reference into this prospectus supplement and the accompanying prospectus. We have not authorized anyone to provide you with any information that is different. If you receive any information that is different, you should not rely on it.

You should not assume that the information contained in this prospectus supplement or the accompanying prospectus is accurate as of any date other than their respective dates, or that the information contained in any document incorporated by reference in this prospectus is accurate as of any date other than the date on which that document was filed with the Securities and Exchange Commission, or SEC.

We will also file an Australian prospectus and a copy of this prospectus supplement with the ASX.

As used in this prospectus supplement, “Samson,” “we,” “our,” “Company” and “us” refer to Samson Oil & Gas Limited and its subsidiaries, unless stated otherwise or the context requires otherwise.

Currency and Exchange Rate

References in this prospectus supplement to “$” are to United States dollars. Australian dollars are indicated “A$”.

The rate of exchange on April 2, 2013 as reported by the Reserve Bank of Australia for the conversion of Australian dollars into United States dollars was A$1.00 equals $1.0457 and the conversion of United States dollars into Australian dollars was $1.00 equals A$0.96.

Notice to Non-U.S. Investors in Other Jurisdictions

The distribution of this prospectus supplement, and the exercise of the rights granted to ADS holders, may be restricted by law in certain jurisdictions. Any failure to comply with applicable restrictions may constitute a violation of the securities laws of such jurisdictions. In particular, due to restrictions under the securities laws of certain countries, ADS holders resident in such countries may not exercise the rights offered hereby. Non-U.S. ADS holders who wish to exercise any of the rights must inform themselves about and observe any such restrictions. This prospectus supplement does not constitute an offer of our ADSs or warrants, or an invitation to exercise any of the rights, in any jurisdiction in which such offer or invitation would be unlawful. We do not accept any responsibility for violations of local restrictions by any person, whether or not a prospective participant in the rights offering.

Notice to shareholders with registered addresses in Australia or New Zealand

This prospectus supplement is not a disclosure document under Chapter 6D of the Australian Corporations Act, has not been lodged with the Australian Securities and Investments Commission and does not purport to include the information required of a disclosure document under Chapter 6D of the Australian Corporations Act. It will be lodged with the Australian Securities Exchange for information purposes only.

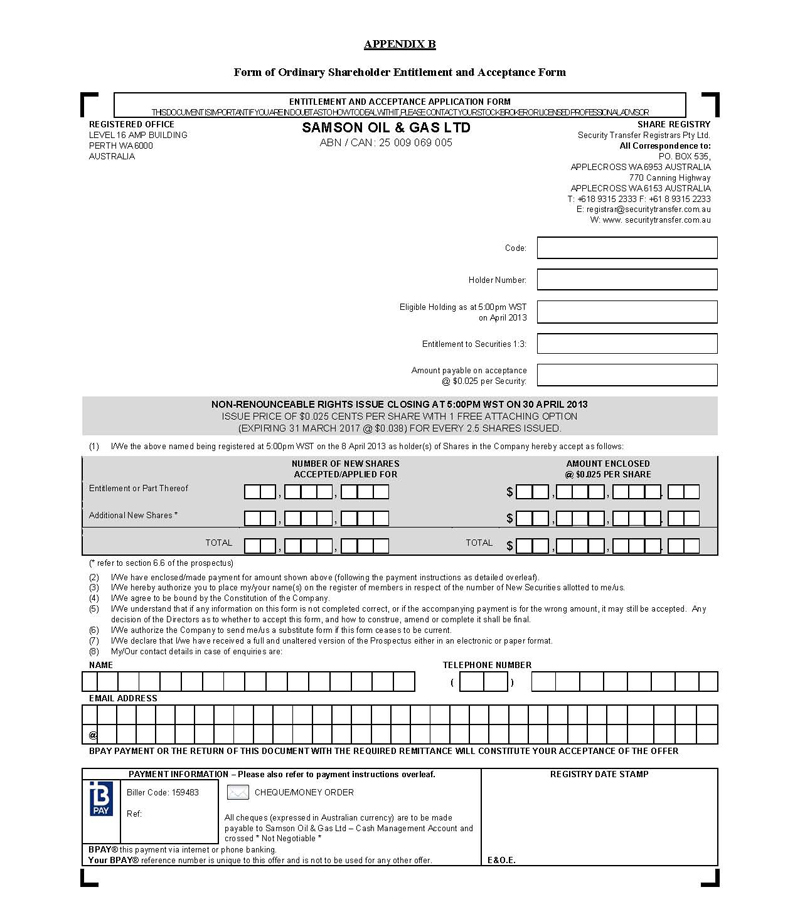

A separate prospectus (“Australian Prospectus”) will be issued in Australia for the rights offering being conducted by the Company to ordinary shareholders in Australia and New Zealand. Shareholders with a registered address in either Australia or New Zealand will receive a copy of the Australian Prospectus and should apply for shares and warrants under the offering using the application forms attached to the Australian Prospectus.

FORWARD-LOOKING STATEMENTS

Written forward–looking statements may appear in documents filed with the Securities and Exchange Commission (“SEC”), including this prospectus supplement, documents incorporated by reference, reports to shareholders and other communications.

The U.S. Private Securities Litigation Reform Act of 1995 provides a “safe harbor” for forward–looking information to encourage companies to provide prospective information about themselves without fear of litigation so long as the information is identified as forward looking and is accompanied by meaningful cautionary statements identifying important factors that could cause actual results to differ materially from those projected in the information. Samson relies on this safe harbor in making forward–looking statements.

Forward–looking statements appear in a number of places in this prospectus supplement and include but are not limited to management’s comments regarding business strategy, exploration and development drilling prospects and activities at our oil and gas properties, oil and gas pipeline availability and capacity, natural gas and oil reserves and production, meeting our capital raising targets and following any use of proceeds plans, our ability to and methods by which we may raise additional capital, production and future operating results.

In this quarterly report, the use of words such as “anticipate,” “continue,” “estimate,” “expect,” “likely,” “may,” “will,” “project,” “should,” “believe” and similar expressions are intended to identify uncertainties. While we believe that the expectations reflected in those forward–looking statements are reasonable, we cannot assure you that these expectations will prove to be correct. Our actual results could differ materially from those anticipated in these forward–looking statements. The differences between actual results and those predicted by the forward-looking statements could be material. Forward-looking statements are based upon our expectations relating to, among other things:

| · | our future financial position, including cash flow, anticipated liquidity and debt levels; |

| · | the timing, effects and success of our exploration and development activities, and acquisitions and dispositions |

| · | oil and natural gas prices and demand; |

| · | uncertainties in the estimation of proved reserves and in the projection of future rates of production; |

| · | timing, amount, and marketability of production; |

| · | third party operational curtailment, processing plant or pipeline capacity constraints beyond our control; |

| · | our ability to find, acquire, market, develop and produce new properties; |

| · | declines in the values of our properties that may result in write-downs; |

| · | effectiveness of management strategies and decisions; |

| · | the strength and financial resources of our competitors; |

| · | our entrance into transactions in commodity derivative instruments; |

| · | the receipt of governmental permits and other approvals relating to our operations; |

| · | unanticipated recovery or production problems, including cratering, explosions, fires; and |

| · | uncontrollable flows of oil, gas or well fluids. |

Many of these factors are beyond our ability to control or predict. Neither these factors nor those included in the “Risk Factors” section of this prospectus supplement represent a complete list of the factors that may affect us. We do not undertake to update the forward–looking statements made in this report.

SUMMARY

The following summary provides an overview of certain information about Samson and may not contain all the information that is important to you. This summary is qualified in its entirety by, and should be read together with, the information contained in other parts of this prospectus supplement including “Risk Factors” and the documents we incorporate by reference. You should carefully read this entire prospectus supplement and the documents that we incorporate by reference before making a decision about whether to exercise your subscription rights and invest in our securities.

Samson Oil & Gas Limited

Our principal business is the exploration and development of oil and natural gas properties in the United States, primarily focused on the Rocky Mountain region. Our business strategy is to create a competitive and sustainable rate of return to shareholders by exploring for, acquiring and developing oil and natural gas resources in the United States. Our primary financial goal is to profitably develop our oil properties while maintaining a strong balance sheet, and specifically to focus on the exploration, exploitation and development of our two major oil plays – the Niobrara in Wyoming and the Bakken in North Dakota and Montana. We are in the early stages of these two shale oil exploration efforts: a Niobrara play in Goshen County, Wyoming, our Hawk Springs Project, and a Bakken play in Roosevelt County, Montana–our Roosevelt Project.

Why We Are Conducting this Rights Offer

We are conducting the offering in order to raise additional equity capital, to improve and strengthen our financial position and to increase our financial flexibility. In particular, we plan to use the proceeds from the offering to conduct development of our North Stockyard project in Williams County, North Dakota. See “Liquidity, Capital Resources and Capital Expenditures” in “Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our most recent Quarterly Report on Form 10-Q filed on February 11, 2013 as amended on February 12, 2013, for a description of capital needed to cover the drilling costs. In authorizing the offering, our board of directors also considered:

| · | current and prospective economic and financial market conditions; |

| · | our future needs for additional capital, liquidity and financial flexibility; |

| · | alternatives available for raising equity capital or conducting a offering; |

| · | historical and current trading prices for our ordinary shares; |

| · | the size and timing of the offering; |

| · | the dilution to our current stockholders; and |

| · | the fact that the offering could potentially increase the public float for our ordinary shares. |

Company Information

We are a company limited by shares, incorporated on April 6, 1979 under the laws of Australia. Our registered office is located at Level 16, AMP Building, 140 St Georges Terrace, Perth, Western Australia 6000 and our telephone number at that office is 618-9220-9830. Our principal office in the United States is located at 1331 17th Street, Suite 710, Denver, Colorado 80202 and our telephone number at that office is 303-295-0344. Our website is http://www.samsonoilandgas.com. Information contained on our website is not incorporated by reference into this prospectus supplement, and you should not consider information on our website to be part of this prospectus.

We were initially listed on the Australian Stock Exchange on April 17, 1980 using the name “Samson Exploration NL”. On January 12, 2005, we changed our name to Samson Oil and Gas NL. On February 10, 2006, we changed our name again to Samson Oil & Gas Limited.

On January 7, 2008, we began trading our ADSs on the American Stock Exchange. Our initial registration statement on Form 20-F was declared effective by the SEC on January 4, 2008.

SUMMARY DESCRIPTION OF THE RIGHTS OFFERING

The following summary highlights selected information from this prospectus supplement and the documents incorporated by reference herein and does not contain all of the information that may be important to you. You should carefully read this prospectus supplement and all of the information incorporated by reference herein.

| Issuer | Samson Oil & Gas Limited |

| | |

| Subscription Rights | We are granting, at no charge, nontransferable pro rata subscription rights to the holders of our ordinary shares and holders of our American Depositary Shares, or ADSs, to purchase ordinary shares, ADSs and warrants. Every three ordinary shares owned of record at 5:00p.m. Perth time on April 8, 2013 entitles its holder to purchase one ordinary share, and 0.4 warrants will be included at no charge with each ordinary share purchased. Each warrant will entitle its holder to purchase one ordinary share (so that 20 warrants will be required to purchase one ADS) at a cash exercise price of A$0.038 per ordinary share, subject to adjustment, which is $0.79 for each ADS based on the exchange rate for April 2, 2013 as published by the Australian Reserve Bank. The offering price per ordinary share and warrant is A$0.025, which is $0.026 based on the exchange rate for April 2, 2013 as published by the Australian Reserve Bank. The warrants are exercisable upon issuance and will expire at 5:00p.m. Perth time on March 31, 2017. For ADS holders, each ADSs represents 20 ordinary shares deposited with The Bank of New York Mellon, the depositary, and each ADS owned of record at 5:00p.m. New York City time on April 8, 2013, entitles its holder to purchase one additional ADS for the U.S. dollar equivalent of A$0.50, which is $0.52 based on the exchange rate for April 2, 2013, and eight warrants for ordinary shares will be included at no charge with each ADS purchased. The actual ADS purchase price will be established based on the exchange rate on May 6, 2013. A subscriber of the ADSs must deposit $0.57 per ADS requested for purchase upon the exercise of each right. This deposit amount represents approximately 110% of the current estimated subscription price per ADS. The amount over and above the estimated subscription price is to increase the likelihood that the ADS rights agent will have sufficient funds to pay the actual subscription price in light of a possible appreciation of the Australian dollar against the U.S. dollar between the date hereof and the date of the issuance of the ADSs and to pay the depositary’s issuance fee of US$0.01 per new ADS. If the actual U.S. dollar price plus the issuance fee is less than the deposit amount, the ADS rights agent will refund such excess U.S. dollar amount to the subscribing rights holder without interest. If there is a deficiency, the ADS rights agent will not deliver the ADSs to such subscribing rights holder until it has received payment of the deficiency. The ADS rights agent may sell a portion of the new ADSs to cover the deficiency if not paid within 14 days from notice of the deficiency. |

| Record Date | The close of business on April 8, 2013. Due to time zone differences, the record date will be 5:00p.m. in Perth on April 8, 2013 for ordinary shareholders and 5:00p.m. in New York City on April 8, 2013 for ADS holders. |

| | |

| Expiration Date of the Rights Offer | The ordinary shares subscription rights will expire at the close of business on April 30, 2013. The depositary has determined that the ADS subscription period will expire at 5:00 p.m. New York City time on April 24, 2013. If you would like to exercise your subscription rights, you must do so before the applicable date and time; however, we may extend the period for exercising the subscription rights, in our sole discretion. Subscription rights that are not exercised by the expiration date of this rights offering will expire and will have no value. Any exercise of subscription rights is irrevocable by the holder. We may, however, elect to terminate this rights offering at any time prior to its consummation. We will announce any extension no later than 11:00 a.m., Denver time, on the business day immediately following the previously scheduled expiration date. See “The Rights Offering—Extensions, Amendments and Termination.” |

| No Minimum Subscription Amount | There is no minimum subscription amount that must be received in order to close this rights offering. |

| | |

| Warrants | 0.4 warrants will be included at no charge with each ordinary share purchased. Each warrant will entitle its holder to purchase one ordinary share at a cash exercise price of A$0.038, per ordinary share, subject to adjustment. Warrants will be uncertificated, transferable and application will be made to the ASX for quotation of the warrants. The warrants are exercisable upon issuance and will expire at 5:00p.m. Perth time on March 31, 2017. For ADS holders, eight warrants for ordinary shares will be included at no charge with each ADS purchased in the rights offering. ADS holders must exercise 20 warrants in order to purchase one ADS, so that the cumulative exercise price to receive 20 ordinary shares, which could be exchanged for one ADS, would be $0.79 based on the exchange rate for April 2, 2013 as published by the Australian Reserve Bank.In addition, an issuance fee per ADS will be payable by its holder to the depositary upon exercise of warrants, which fee is tentatively set as $0.01, but may change.ADS holders may only exercise warrants by contacting us directly, see “The Rights Offering—Exercise of Warrants.” |

| | |

| Expiration Date to Exercise Warrants | 5:00 p.m., Perth, Australia time, March 31, 2017. |

| | |

| Oversubscription Privilege | Each ADS holder or ordinary shareholder will be entitled to oversubscribe for any ADSs or ordinary shares, as applicable, and warrants that are not subscribed for by the other holders in the rights offering, subject to rounding and other adjustments. Applications for oversubscription securities must be made together with initial subscriptions. |

| | |

| | Our board of directors reserves the right to issue oversubscription securities at its discretion, and there is no guarantee that holders will receive oversubscription securities for which they have applied. If holders do not receive all of the oversubscription securities for which they applied, the oversubscription funds will be returned to the holder. |

| | |

| No Revocation or Change of Exercise | Once a security holder exercises any subscription or oversubscription rights, that exercise may not be revoked or changed by the holder. |

| | |

| Unexercised Subscription Rights | Subscription rights that are not exercised prior to the expiration date of this rights offering will be null and void and will have no value. |

| | |

| Exercise of Subscription Rights | Holders of ordinary shares or ADSs may exercise all or only part of the holder’s subscription rights. |

| | For ADS holders, subscriptions and full payment of the ADS deposit amount must be received by the rights agent by 5:00p.m. New York City time on April 24, 2013. For ordinary shareholders, subscriptions and full payment of the ordinary shares subscription amount must be received by the ordinary shares registrar by 5:00p.m. Perth time on April 30, 2013. If you are a beneficial owner of ADSs and wish to participate in the rights offering but are neither a DTC participant nor a registered holder of the ADSs, you should timely contact the financial intermediary through which you hold ADS rights to arrange for their exercise and to arrange for payment of the deposit amount. You are urged to consult your financial intermediary without delay in case your financial intermediary is unable to act immediately. |

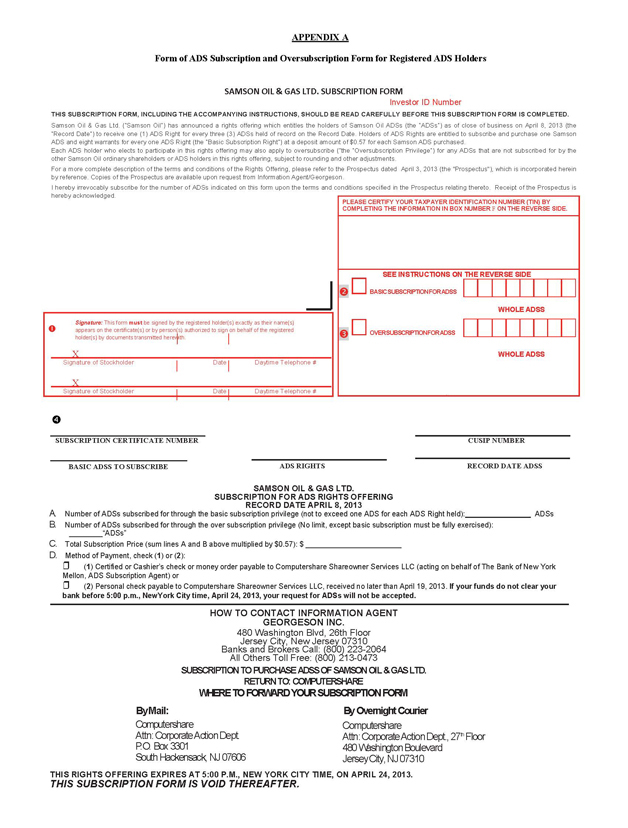

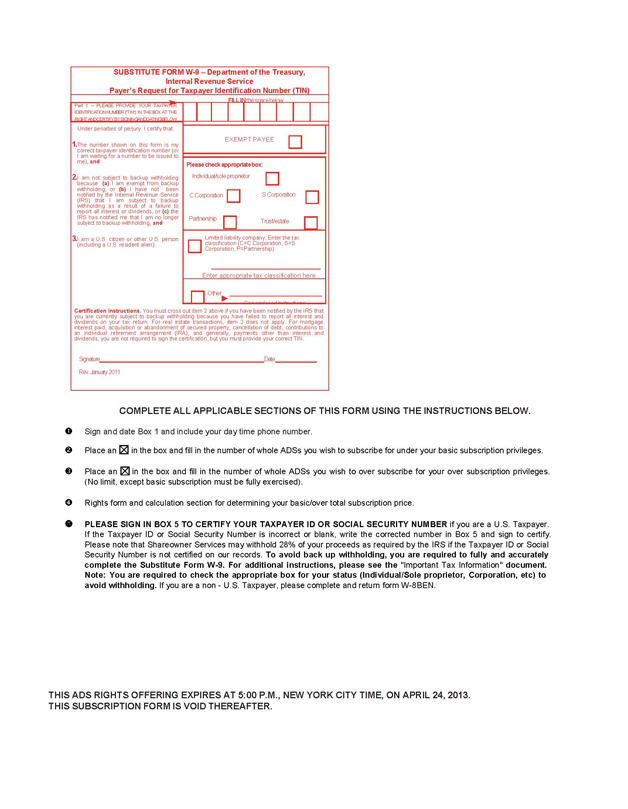

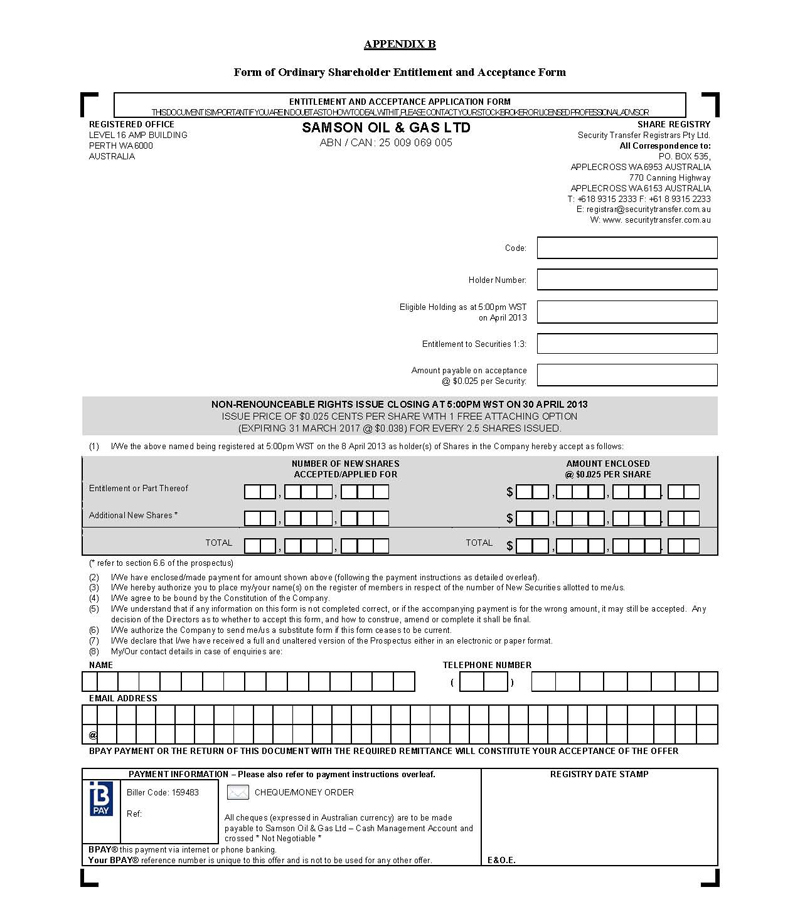

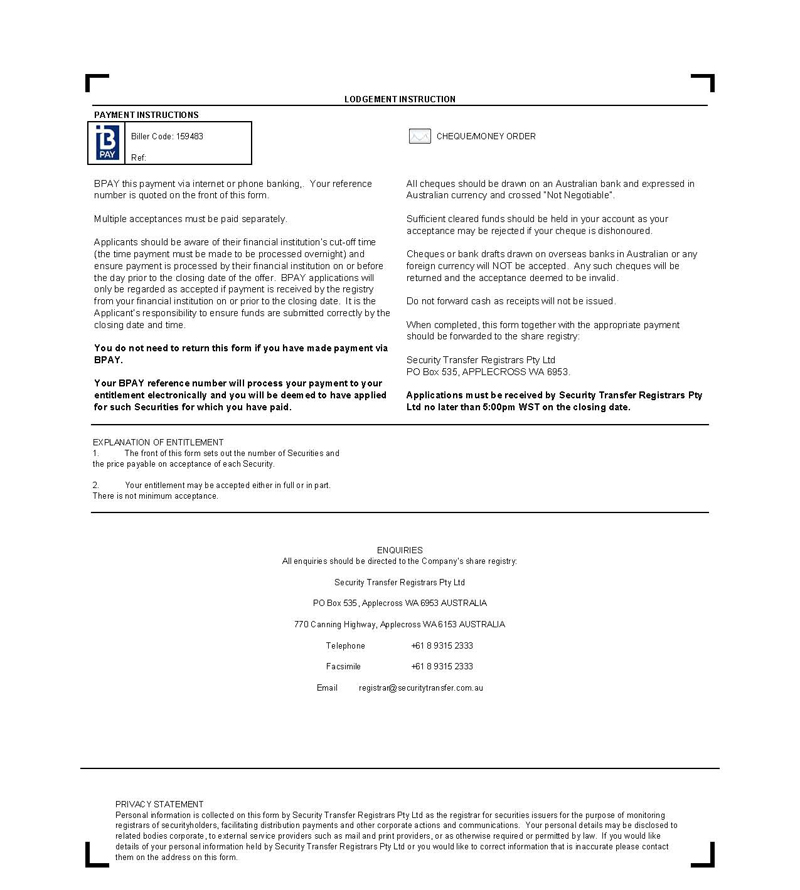

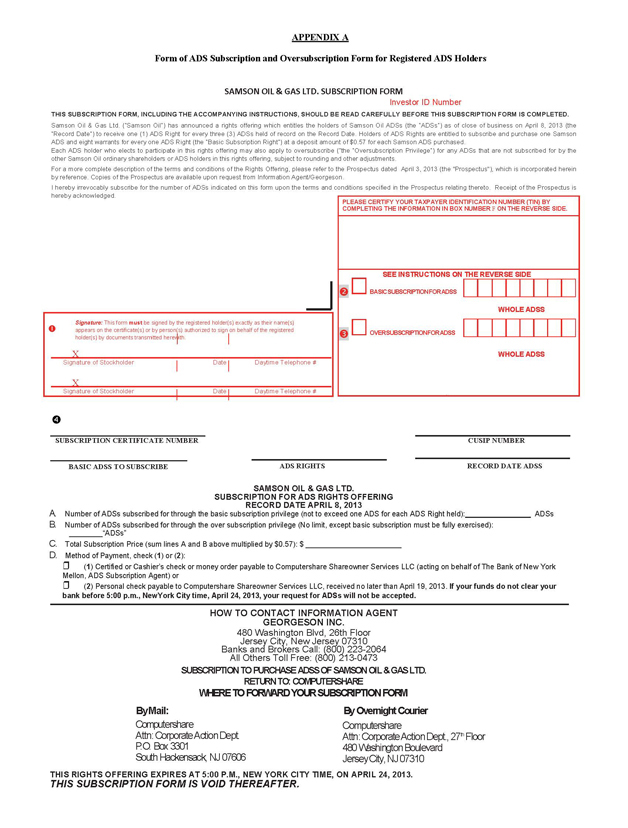

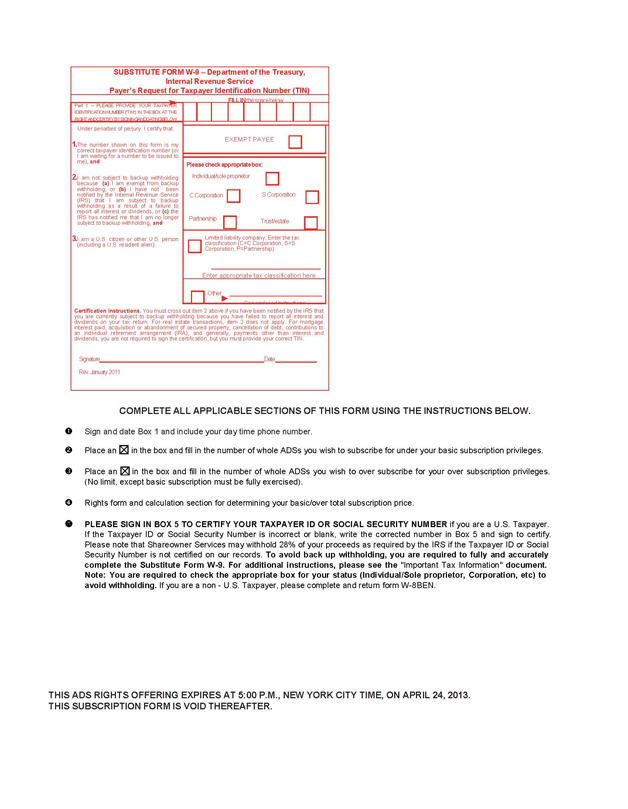

| | If you are a bank or broker for beneficial holders, the ADS subscription rights will be credited to the book-entry system of the Depository Trust Company, or DTC, for further credit to the accounts of persons who held ADSs on the record date at DTC. If you are an ADS holder registered directly with the depositary, you will be sent a subscription form. The ADS subscription form for registered holders is attached to this prospectus supplement as Appendix A. The ordinary shareholder subscription form is attached to this prospectus supplement as Appendix B. |

| | We provide more information on how to exercise your rights under “The Rights Offering.” |

| | |

| | |

| Use of Proceeds | There is no minimum subscription amount that must be received in order to close this rights offering. If the rights offering is subscribed for the maximum $18,428,997, we estimate that the net proceeds from this rights offering will be approximately $18,213,997, after deducting estimated expenses relating to the rights offering. We intend to use the net proceeds to conduct development of our North Stockyard project in Williams County, North Dakota. See “Use of Proceeds.” |

| | |

| Risk Factors | See “Risk Factors” beginning on page S-9 of this prospectus supplement and page 3 of the accompanying prospectus for a discussion of certain risk factors that ADS holders and ordinary shareholders should consider before exercising subscription rights and investing in our securities. |

| | |

| ADS Rights Agent | The Bank of New York Mellon |

| | |

| ADS Information Agent | Georgeson Inc. If you have any questions about how to participate in this rights offering, bank and brokers may call 800-223-2064 and all others may call 800-213-0473. |

| | |

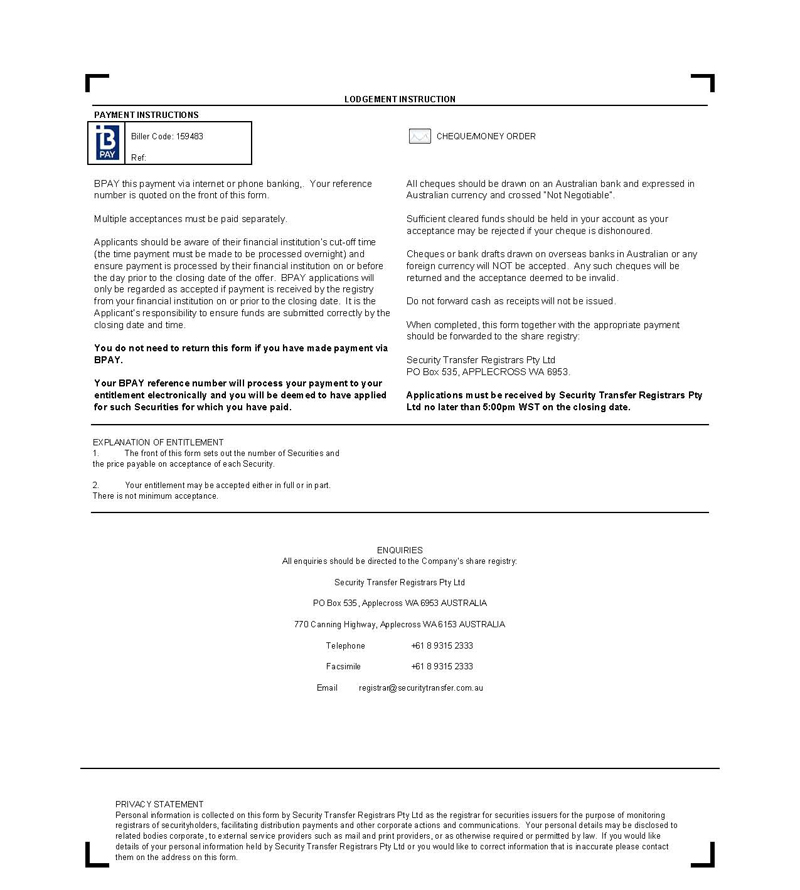

| Ordinary Shares and Warrants Registrar | Security Transfer Registrars Pty Ltd., who may be reached at +618- 9315-2333 |

| | |

Delivery of ADSs | The ADSs are expected to be delivered to each subscriber (by credit to its book-entry account at the financial intermediary through which it holds the rights or by direct registration of ADSs on an uncertificated basis in the name of the holder if it is a holder registered directly with the depositary) on or around May 6, 2013. This date may be changed in our sole discretion. |

Delivery of Ordinary Shares and Warrants | The ordinary shares and warrants are expected to be delivered to each subscriber by book-entry account only with Security Transfer Registrars Pty Ltd, and be available for trading on or about May 9, 2013. Security Transfer Registrars Pty Ltd will thereafter mail transaction confirmation statements to holders |

| Listing | We expect that ADSs being sold in this rights offering, including the ADSs to be issued upon exercise of the warrants, will be traded on the NYSE MKT. There can be no assurances, however, that the NYSE MKT will grant our application to list the additional ADSs sold in this rights offering or those exercisable upon exercise of the warrants. We will apply to have the ordinary shares and warrants listed for quotation on the ASX. |

Timetable

The timetable below lists certain important dates relating to the rights offering. All future dates are expected and subject to change. No assurance can be given that the issuance, delivery and trading of the securities will not be delayed.

| Announcement of rights offering | March 21, 2013 |

| | |

| Record date | April 8, 2013 |

| | |

| Subscription period commences | April 9, 2013 |

| | |

ADS subscription period ends / Expiration date of rights offer for ADS holders Ordinary shares subscription period ends / Expiration date of rights offer for ordinary shareholders | April 24, 2013 April 30, 2013 |

| | |

| Expected date for trading commencement of the securities | May 9, 2013 |

| | |

| Expiration date for exercising warrants | March 31, 2017 |

RISK FACTORS

An investment in our securities involves significant risk. You should consider carefully the risks and uncertainties described below together with all other information in our filings with the SEC that are contained or incorporated by reference in this prospectus supplement and the accompanying prospectus before you decide to invest in our securities. The risk factors set forth below, in addition to all such other information that is contained or incorporated by reference in this prospectus supplement and the accompanying prospectus supersede the risk factors contained in our prior filings with the SEC. Prospective investors should review all of these risk factors before making an investment decision. If any of these risks or uncertainties actually occurs, our business, financial condition or results of operations could be materially adversely affected. Additional risks and uncertainties of which we are unaware or that we currently believe are immaterial could also materially adversely affect our business, financial condition or results of operations. In any case, the trading price of our common stock could decline, and you could lose all or part of your investment. See also “Cautionary Statement Regarding Forward-Looking Statements.”

Risks Related To Our Business, Operations and Industry

Estimates as to the need to make contractual commitments to obtain necessary equipment may not be accurate.

Because we are required to obtain drilling rigs and other equipment necessary to conduct our exploration and development programs from third parties, and the quality of such rigs and equipment is important to the success of those drilling programs, we may elect to make long term contractual commitments to ensure the availability of such equipment. We are required to estimate the future need for, availability of, and reasonable pricing for, such rigs and equipment based on anticipated demand, which in turn depends on future oil and gas prices, the success of other companies’ drilling efforts and other economic factors. If our estimates are not accurate, rigs or other equipment may not be available at the times and places required to commence our drilling programs, or we may commit to the use of rigs or equipment that we cannot fully utilize. Unavailable rigs and equipment could delay scheduled drilling programs and adversely affect results of operations, while unused rigs and equipment could impair cash flow and diminish capital resources. In particular, since January 21, 2013, we have been contracting for the use of a newly manufactured drilling rig for 18 months at a cost of $26,000 per day but we cannot use that rig until we obtain new capital to finance the North Stockyard Field drilling program for which the rig was contracted. There is no assurance that we will be able to obtain the financing needed to commence the planned drilling program in a timely manner and thereby avoid paying a $5 million cancellation fee for this drilling rig. Correspondingly, there is no assurance that we will be able to obtain high quality drilling rigs and equipment in the future when we need them if we fail to make long term commitments for such rigs and equipment in advance.

Inadequate liquidity could materially and adversely affect our business operations.

If our exploration efforts are unsuccessful, it may be more difficult for us to adequately access the capital markets or obtain financing. Our efforts to improve our liquidity position would then be challenging. Various factors may require us to have greater liquidity and capital resources than we currently anticipate needing.

If our exploration efforts are unsuccessful, or we are unable to raise enough capital to conduct the North Stockyard drilling program, then our commitment of the $26,000 in daily rental payments for the new drilling rig, and the potential $5 million early termination fee, could significantly impair our liquidity. In such an event, it may also be more difficult for us to adequately access the capital markets or obtain additional financing. Our efforts to improve our liquidity position would then be challenging. In addition, various factors may require us to have greater liquidity and capital resources than we currently anticipate needing.

We depend on successful exploration, development and acquisitions to maintain reserves and revenue in the future.

In general, the volume of production from natural gas and oil properties declines as reserves are depleted, with the rate of decline depending on reservoir characteristics. Our future oil and natural gas production is highly dependent upon our level of success in finding or acquiring additional reserves that are economically feasible and in developing existing proved reserves. To the extent that cash flow from operations is reduced and external sources of capital become limited or unavailable, our ability to make the necessary capital investment to maintain or expand our asset base of natural gas and oil reserves would be impaired.

We recorded an impairment on the carrying value of our oil and gas assets during the fiscal year ended June 30, 2012, and may again in the future record additional impairments.

We recognized an impairment expense for the twelve months ended June 30, 2012 of $635,464, primarily in relation to the Davis Bintliff well. We also recognized impairment expense related to the asset retirement obligation for the exploratory wells drilled this year - Australia II, Gretel II and Spirit of America I. Subsequent adverse changes in oil and gas prices or drilling results may result in us being unable to recover the carrying value of our long-lived assets, and make it appropriate to recognize more impairments in future periods. Such impairments could materially and adversely affect our results of operations.

Drilling results in emerging plays, such as our Hawk Springs and Roosevelt Projects, are subject to heightened risks.

Part of our strategy is to pursue acquisition, exploration and development activities in emerging plays such as our Hawk Springs Project and Roosevelt Project. Our drilling results in these areas are more uncertain than drilling results in areas that are developed and producing. Because emerging plays have limited or no production history, we have access to little if any past drilling results in those areas to help predict the results of our own exploratory drilling. In addition, part of our strategy to maximize recoveries from such new projects may involve the drilling of horizontal wells and/or using completion techniques that have proven to be successful in other similar formations. Both of the two Roosevelt project wells drilled in the fiscal year 2012 have failed to deliver positive results to date, so $24.7 million of previously capitalized exploration expenditure has been written off as exploration expenditure. In addition, one well in the Hawk Springs project well was drilled unsuccessfully, and $4.9 million in expenditure in relation to this well was written off as a dry hole costs. If future drilling success rates or production are less than anticipated, the value of our position in affected areas will decline, our results of operations, financial condition and liquidity will be adversely impacted and we could incur material write-downs of unevaluated properties.

Oil and natural gas prices are extremely volatile, and decreases in prices have in the past and could in the future adversely affect our profitability, financial condition, cash flows, access to capital and ability to grow.

Our revenues, profitability and future rate of growth depend principally upon the market prices of oil and natural gas, which fluctuate widely. The markets for these commodities are unpredictable and even relatively modest drops in prices can significantly affect our financial results and impede our growth. Sustained declines in oil and gas prices may adversely affect our financial condition, liquidity and results of operations. For example, if the price of oil and natural gas were to have been 20% lower in the years ended June 30, 2012 and 2011, the net profit we reported for June 30, 2011 would have decreased by 1.24% and the net loss would have increased by 20% for the year ended June 30, 2012.

Factors that can cause market prices of oil and natural gas to fluctuate include:

| · | national and international financial market conditions; |

| · | uncertainty in capital and commodities markets; |

| · | the level of consumer product demand; |

| · | U.S. and foreign governmental regulations; |

| · | the price and availability of alternative fuels; |

| · | political and economic conditions in oil producing countries, particularly those in the Middle East, including actions by the Organization of Petroleum Exporting Countries; |

| · | the foreign supply of oil and natural gas; |

| · | the price of oil and gas imports, consumer preferences; and |

| · | overall U.S. and foreign economic conditions. |

We cannot predict future oil and gas prices. At various times, excess domestic and imported supplies have depressed oil and gas prices. Additionally, the location of our producing wells may limit our ability to take advantage of spikes in regional demand and resulting increases in price. While increased demand would normally be expected to increase the prices we receive for our oil and natural gas, other factors, such as the recent sharp downturn in worldwide economic activity, may dampen or even reverse any such positive impact on prices.

Lower oil and natural gas prices may not only decrease our revenues, but also may reduce the amount of oil and natural gas that we can produce economically. Such a reduction may result in substantial downward adjustments to our estimated proved reserves and require write–downs of our properties. If this occurs, or if our estimates of development costs increase, our production data factors change or our exploration results do not meet expectations, accounting rules may require us to write down the carrying value of our oil and natural gas properties to fair value, as a non–cash charge to earnings.

Reserve estimates are imprecise and subject to revision.

Estimates of oil and natural gas reserves are projections based on available geologic, geophysical, production and engineering data. There are uncertainties inherent in the manner of producing, and the interpretation of, this data as well as in the projection of future rates of production and the timing of development expenditures. Estimates of economically recoverable oil and natural gas reserves and future net cash flows necessarily depend upon a number of factors including:

| · | the quality and quantity of available data; |

| · | the interpretation of that data; |

| · | the ability of Samson to access the capital required to develop proved undeveloped locations; |

| · | the accuracy of various mandated economic assumptions; and |

| · | the judgment of the engineers preparing the estimate. |

Actual future production, natural gas and oil prices, revenues, taxes, development expenditures, operating expenses and quantities of recoverable natural gas and oil reserves will likely vary from our estimates. Any significant variance could materially affect the quantities and value of our reserves. Our reserves may also be susceptible to drainage by operators on adjacent properties. We are required to adjust our estimates of proved reserves to reflect production history, results of exploration and development and prevailing gas and oil prices. These reserve reports are necessarily imprecise and may significantly vary depending on the judgment of the reservoir engineering consulting firm.

Investors should not construe the present value of future net cash flows as the current market value of the estimated oil and natural gas reserves attributable to our properties. The estimated discounted future net cash flows from proved reserves are based on prices and costs as of the date of the estimate, in accordance with applicable regulations, even though actual future prices and costs may be materially higher or lower. Factors that will affect actual future net cash flows include:

| · | the amount and timing of actual production; |

| · | the price for which that oil and gas production can be sold; |

| · | supply and demand for oil and natural gas; |

| · | curtailments or increases in consumption by natural gas and oil purchasers; and |

| · | changes in government regulations or taxation. |

As a result of these and other factors, we will be required to periodically reassess the amount of our reserves, which reassessment may require us to recognize a write–down of our oil and gas properties, as occurred at June 30, 2010 and June 30, 2012.

We operate only a small percentage of our proved properties, and for those properties we do operate, there is no guarantee we will be successful operators.

The business activities at all of our material producing properties are conducted through joint operating agreements under which we own partial non–operating interests in the properties. As a result, we do not have control over normal operating procedures, expenditures, or future development of those properties, including our interests in North Stockyard and State GC properties. Consequently, the operating results with respect to those properties are beyond our control. The failure of an operator of our wells to perform operations adequately, or an operator’s breach of the applicable agreements, could reduce our production and revenues. In addition, the success and timing of our drilling and development activities on properties operated by others depends upon a number of factors outside of our control, including the operator’s timing and amount of capital expenditures, expertise and financial resources, the participation of other owners in drilling wells, and the appropriate use of technology. Since we do not have a majority interest in most of these properties, we may not be in a position to remove the operator in the event of poor performance. Further, significant cost overruns of an operation in any one of these projects may require us to increase our capital expenditure budget and could result in some wells becoming uneconomic.

We are the operators of the Hawk Springs and Roosevelt Projects. Although we are not subject to the risks of depending on third-party operators, there is a risk that we will not be able to operate these properties successfully ourselves.

Petroleum exploration and development involves substantial business risks.

The business of exploring for and developing oil and gas properties involves a high degree of business and financial risk, and thus a substantial risk of investment loss that even a combination of experience, knowledge and careful evaluation may not be able to overcome. In addition, oil and gas drilling and production activities may be shortened, delayed or canceled as a result of a variety of factors, many of which are beyond our control. These factors include:

| · | unexpected drilling conditions; |

| · | unexpected abnormal pressure or irregularities in formations; |

| · | equipment failures or accidents; |

| · | adverse changes in prices; |

| · | ability to fund capital necessary to develop exploration properties and producing properties; |

| · | shortages in experienced labor; and |

| · | shortages or delays in the delivery of equipment, including equipment needed for drilling, fracture stimulating and completing wells. |

Acquisition and completion decisions generally are based on subjective judgments and assumptions that are speculative. It is impossible to predict with certainty the production potential of a particular property or well. Furthermore, the successful completion of a well does not ensure a profitable return on the investment. A variety of geological, operational, or market–related factors, including, but not limited to, unusual or unexpected geological formations, pressures, equipment failures or accidents, fires, explosions, blowouts, cratering, pollution and other environmental risks, shortages or delays in the viability of drilling rigs and the delivery of equipment, loss of circulation of drilling fluids or other conditions may substantially delay or prevent completion of any well or otherwise prevent a property or well from being profitable. A productive well may become uneconomic if water or other substances are encountered that impair or prevent the production of oil or natural gas from the well.

A significant portion of our producing properties are located in the Rocky Mountain region and are vulnerable to extreme seasonal weather, environmental regulation and production constraints.

A significant portion of our operating properties are located in the Rocky Mountain region. As a result, the success of our operations and our profitability may be disproportionately exposed to the impact of adverse conditions unique to that region. Such conditions can include extreme seasonal weather, which could limit our ability to access our properties or otherwise delay or curtail our operations. Also, there could be delays or interruptions of production from existing or planned new wells by significant governmental regulation, transportation capacity constraints, curtailment of production, interruption of transportation, or fluctuations in prices of oil and natural gas produced from the wells in the region.

In addition, some of the properties we intend to develop for production are located on federal lands where drilling and other related activities cannot be conducted during certain times of the year due to environmental considerations. This could adversely affect our ability to operate in those areas and may intensify competition during certain times for drilling rigs, oil field equipment, services, supplies and qualified personnel, which may lead to periodic shortages. These constraints and the resulting shortages or high costs could delay our operations and materially increase our operating and capital costs, particularly if our exploration or development activities on federal lands, or our production from federal lands increases.

The marketability of our production depends upon the availability, operation and capacity of gas gathering systems and the availability of interstate pipelines and processing facilities, all of which are owned by third parties.

The unavailability or lack of capacity of these systems and facilities, which result from factors beyond our control, could result in the shut–in of producing wells or the delay or discontinuance of development plans for properties. We currently own an interest in several wells that are capable of producing but may have their production curtailed from time to time at some point in the future pending gas sales contract negotiations, as well as construction of gas gathering systems, pipelines, and processing facilities.

Operations on the Fort Peck Indian Reservation in Montana are subject to various federal and tribal regulations and laws, any of which may increase our costs and delay our operations.

Various federal agencies within the U.S. Department of the Interior, along with the Fort Peck Assiniboine and Sioux Tribes, promulgate and enforce regulations pertaining to operations on the Fort Peck Indian Reservation. In addition, the Fort Peck Assiniboine and Sioux Tribes are a sovereign nation having the right to enforce laws and regulations independent from federal, state and local statutes and regulations. These tribal laws and regulations include various taxes, fees and other conditions that apply to lessees, operators and contractors conducting operations on Native American tribal lands. Lessees and operators conducting operations on tribal lands are generally subject to the Native American tribal court system. One or more of these factors may increase our costs of doing business in connection with our Roosevelt Project and may have an adverse impact on our ability to effectively transport products within the Fort Peck Indian Reservation or to conduct our operations on such lands.

Our business involves significant operating risks that could adversely affect our production and could be expensive to remedy. We do not have insurance to cover all of the risks that we may face.

Our operations are subject to all the risks normally incident to the operation and development of oil and natural gas properties and the drilling of oil and natural gas wells, including:

| · | cratering and explosions; |

| · | pipe failures and ruptures; |

| · | pipeline accidents and failures; |

| · | mechanical and operational problems that affect production; |

| · | formations with abnormal pressures; |

| · | uncontrollable flows of oil, natural gas, brine or well fluids; |

| · | releases of contaminants into the environment; and |

| · | failure of subcontractors to perform or supply goods or services or personnel shortages. |

These industry operating risks can result in injury or loss of life, severe damage to or destruction of property, damage to natural resources and equipment, pollution or other environmental damage, clean–up responsibilities, regulatory investigation and penalties, and suspension of operations, any of which could result in substantial losses. In addition, maintenance activities undertaken to reduce operational risks can be costly and can require exploration, exploitation and development operations to be curtailed while those activities are being completed. We may also be subject to damage claims by other oil and gas companies.

We do not maintain insurance in amounts that cover all of the losses to which we may be subject, and some risks, such as pollution and environmental risks, are not generally fully insurable. Our insurance policies and contractual rights to indemnity may not adequately cover our losses, and we do not have access to insurance coverage or rights to indemnity for all risks. If a significant accident or other event occurs and is not fully covered by insurance or contractual indemnity, it could adversely affect our financial position and results of operations.

Competition in the oil and natural gas industry is intense, which may adversely affect our ability to succeed.

The oil and natural gas industry is highly competitive, and we compete with other companies that are significantly larger and have greater resources. Many of these companies not only explore for and produce oil and natural gas, but also carry on refining operations and market petroleum and other products on a regional, national or worldwide basis. These companies may be able to pay higher prices for productive oil and natural gas properties and exploratory prospects or define, evaluate, bid for and purchase a greater number of properties and prospects than our financial or human resources permit. In addition, these competitors may have a greater ability to continue exploration activities during periods of low oil and natural gas market prices. Our larger competitors may also be able to absorb the burden of present and future federal, state, local and other laws and regulations more easily than we can. Our ability to acquire additional properties and to discover reserves in the future will be dependent upon our ability to evaluate and select suitable properties and to consummate transactions in this highly competitive environment.

We are subject to complex environmental federal, state, local and other laws and regulations that could adversely affect the cost, manner or feasibility of doing business.

Our exploration, development, and production operations are regulated extensively at the federal, state and local levels. Environmental and other governmental laws and regulations have increased the costs to plan, design, drill, install, operate and abandon oil and natural gas wells. Under these laws and regulations, we also could be held liable for personal injuries, property damage and other damages. Failure to comply with these laws and regulations may result in the suspension or termination of operations and subject us to administrative, civil and criminal penalties. Moreover, public interest in environmental protection has increased in recent years, and environmental organizations have opposed, with some success, certain drilling projects.

The environmental laws and regulations to which we are subject:

| 1. | require applying for and receiving permits before drilling commences; |

| 2. | restrict the types, quantities and concentration of substances that can be released into the environment in connection with drilling and production activities; |

| 3. | limit or prohibit drilling activities on certain lands lying within wilderness, wetlands, and other protected areas; and |

| 4. | impose substantial liabilities for pollution resulting from our operations. |

We may be required to prepare an environmental impact statement (“EIS”) to obtain the permits necessary to proceed with the development of certain oil and gas properties. There can be no assurance that we will obtain all necessary permits and, if obtained, that the costs associated with completing the EIS and obtaining such permits will not exceed those that previously had been estimated. It is possible that the costs and delays associated with compliance with such requirements could cause us to delay or abandon the further development of certain properties.

Changes in environmental laws and regulations occur frequently, and any changes that result in more stringent or costly waste handling, storage, transportation, disposal or cleanup requirements could require us to make significant expenditures to maintain compliance, and may otherwise have a material adverse effect on our earnings, results of operations, competitive position or financial condition. For example, because of its potential effect on drinking water, hydraulic fracturing currently is the subject of regulatory scrutiny, negative press, and legislative changes in some states. Hydraulic fracturing is a process that creates a fracture extending from a well bore into a rock formation to enable oil or natural gas to move more easily through the rock pores to a production well. Hydraulic fractures typically are created through the injection of water, sand and chemicals into the rock formation. Legislative and regulatory efforts may render permitting and compliance requirements more stringent for hydraulic fracturing, which may limit or prohibit use of the process. While none of our properties are expected to be subject to any such changes, there is no assurance that this will remain the case.

Over the years, we have owned or leased numerous properties for oil and gas activities upon which petroleum hydrocarbons or other materials may have been released by us or predecessor property owners or lessees who were not under our control. Under applicable environmental laws and regulations, including CERCLA, RCRA and analogous state laws, we could be held strictly liable for the removal or remediation of any such previously released contaminants at such locations, in some cases regardless of whether we were responsible for the release or whether the operations were standard in the industry at the time they were performed.

Our operations also are subject to wildlife-protection laws and regulations. For example, seven oil companies recently were charged with killing migratory birds in North Dakota, where we conduct some of our operations. Reserve pits are used during oil and gas drilling operations. During the clean up phase of a reserve pit, the Migratory Bird Treaty Act requires companies to cover the pit with a net if it is open for more than 90 days. The maximum penalty for each charge under the Migratory Bird Treaty Act is six months in prison and a $15,000 fine.

In April 2012, the EPA issued regulations specifically applicable to the oil and gas industry that will require operators to capture 95 percent of the volatile organic compounds (“VOC”) emissions from natural gas wells that are hydraulically fractured. The reduction in VOC emissions will be accomplished primarily through the use of “reduced emissions completion” or “green completion” to capture natural gas that would otherwise escape into the air. EPA also issued regulations that set requirements for VOC emissions from several types of equipment, including storage tanks, compressors, dehydrators, and valves and sweetening units at gas processing plants. The adoption of these regulations, or the adoption of any other laws or regulations restricting or reducing these emissions, will increase our operating costs.

Another regulatory development that may impact our operations is the EPA’s notice of finding and determination that emissions of carbon dioxide, methane and other greenhouse gases (“GHGs”) present an endangerment to human health and the environment, which allows the EPA to begin regulating emissions of GHGs under existing provisions of the federal Clean Air Act. The EPA has begun to implement GHG-related reporting and permitting rules. Similarly, the U.S. Congress has considered, and may in the future consider, “cap and trade” legislation that would establish an economy-wide cap on emissions of GHGs in the United States and would require most sources of GHG emissions to obtain GHG emission “allowances” corresponding to their annual emissions of GHGs. Any laws or regulations that may be adopted to restrict or reduce emissions of GHGs would be likely to increase our operating costs and could even have an adverse effect on demand for our production.

We depend on key members of our management team.

The loss of key members of our management team could reduce our competitiveness and prospects for future success. We do not have any “key man” insurance policies for our Chief Executive Officer, or any other executive. Our exploratory drilling success and the success of other activities integral to our operations will depend, in part, on our ability to attract and retain experienced management professionals. Competition for these professionals is extremely intense.

Shortages of qualified operational personnel or field equipment and services could affect our ability to execute our plans on a timely basis, increase our costs and adversely affect our results of operations.

The demand for qualified and experienced field personnel to drill wells and conduct field operations, geologists, geophysicists, engineers and other professionals in the oil and natural gas industry can fluctuate significantly, often in correlation with oil and natural gas prices, causing periodic shortages. From time to time, there have also been shortages of drilling rigs and other field equipment, as demand for rigs and equipment has increased with the number of wells being drilled. These factors can also result in significant increases in costs for equipment, services and personnel. For example, we have recently experienced an increase in drilling, completion and other costs associated with certain oil wells. Higher oil and natural gas prices generally stimulate increased demand and result in increased prices for drilling rigs, crews and associated supplies, equipment and services. We have sometimes experienced some difficulty in obtaining drilling rigs, experienced crews and related services and may continue to experience these difficulties in the future. In addition, the cost of drilling rigs and related services has increased significantly over the past several years. If shortages persist or prices continue to increase, our profit margin, cash flow and operating results could be adversely affected and our ability to conduct our operations in accordance with current plans and budgets could be restricted.

Risks Related to The Offering and Our Securities

The prices of our ordinary shares and ADSs have been and will likely continue to be volatile.

The trading prices of our ordinary shares on the ASX and of our ADSs on the NYSE MKT have been, and likely will continue to be, volatile. Other natural resource companies have experienced similar volatility for their shares, leading us to expect that the results of exploration activities, the price of oil and natural gas, future operating results, market conditions for natural resource shares in general, and other factors beyond our control, could have a significant, adverse or positive impact on the market price of our ordinary shares and ADSs. We also believe that this volatility creates opportunities for arbitrage trading between the ASX and NYSE MKT markets. While we recognize that arbitrage trading is an appropriate market mechanism to eliminate the differences between different trading markets resulting from the combination of volatile stock prices and inter-market inefficiencies, some of our shareholders may not be in a position to take advantage of the potential profits available to arbitrageurs in such cases.

Currency fluctuations may adversely affect the price of our ADSs relative to the price of our ordinary shares.

The price of our ordinary shares is quoted in Australian dollars and the price of our ADSs is quoted in U.S. dollars. Movements in the Australian dollar/U.S. dollar exchange rate may adversely affect the U.S. dollar price of our ADSs and the U.S. dollar equivalent of the price of our ordinary shares. During the year ended June 30, 2012, the Australian dollar, as a general trend, appreciated significantly against the U.S. dollar though remains volatile. If the Australian dollar weakens against the U.S. dollar, the U.S. dollar price of the ADSs could decline correspondingly, even if the price of our ordinary shares in Australian dollars increases or remains unchanged. In the unlikely event that dividends are payable, we will likely calculate and pay any cash dividends in Australian dollars and, as a result, exchange rate movements will affect the U.S. dollar amount of any dividends holders of our ADSs will receive from the Bank of New York Mellon, our depositary. While we would ordinarily expect such variances to be adjusted by inter-market arbitrage activity that accounts for the differences in currency values, there can be no assurance that such activity will in fact be an efficient offset to this risk.

We may issue shares of blank check preferred stock in the future that may adversely impact rights of holders of our ordinary shares and ADSs.

Our corporate Constitution authorizes us to issue an unlimited amount of “blank check” preferred stock. Accordingly, our board of directors will have the authority to fix and determine the relative rights and preferences of preferred shares, as well as the authority to issue such shares, without further shareholder approval. As a result, our board of directors could authorize the issuance of a series of preferred stock that would grant to holders preferred rights to our assets upon liquidation, the right to receive dividends before dividends are declared to holders of our common stock, and the right to the redemption of such preferred shares, together with a premium, prior to the redemption of the common stock. To the extent that we do issue such additional shares of preferred stock, the rights of ordinary share and ADS holders could be impaired thereby, including, without limitation, dilution of their ownership interests in us. In addition, shares of preferred stock could be issued with terms calculated to delay or prevent a change in control or make removal of management more difficult, which may not be in the interest of holders of ordinary shares or ADSs.

We report as a U.S. domestic issuer, which means increased compliance costs notwithstanding continued eligibility for certain NYSE MKT rule waivers.

On July 1, 2011, we commenced reporting as a U.S. domestic issuer instead of as a “foreign private issuer” as we had in prior years. Accordingly, we are now required to comply with the reporting and other requirements imposed by U.S. securities laws on U.S. domestic issuers, which are more extensive than those applicable to foreign private issuers. We are also required to prepare financial statements in accordance with U.S. GAAP in addition to our financial statements prepared in accordance with IFRS pursuant to ASX requirements. Generating two separate sets of financial statements is a substantial burden that imposes significant administrative and accounting costs on us. As a result of becoming a U.S. domestic issuer, the legal, accounting, regulatory and compliance costs to us under U.S. securities laws are significantly higher than those that were incurred by us as a foreign private issuer.

Even though Samson is now a “domestic issuer” for SEC reporting requirements, we remain a “foreign based entity” for purposes of Section 110 of the NYSE MKT Company Guide. This permits us to apply to the NYSE MKT to have certain of its listing criteria relaxed and receive exemptions from rules applicable to corporations incorporated in the United States. We currently are relying on one Section 110 exemption received in connection with our stock option plan, and is described in more detail in “Item 6—Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities—Market Information.” While we have no current plans to seek additional Section 110 relief from NYSE MKT, there can be no assurance that we will not do so in the future.

We do not expect to pay dividends in the foreseeable future. As a result, holders of our ordinary shares and ADSs must rely on appreciation for any return on their investment.

We do not anticipate paying cash dividends on our ordinary shares in the foreseeable future. Accordingly, holders of our ordinary shares and ADSs will have to rely on capital appreciation, if any, to earn a return on their investment in our ordinary shares.

The trading prices of our ADSs may be adversely affected by short selling.

“Short selling” is the sale of a security that the seller does not own, including a sale that is completed by the seller’s delivery of a “borrowed” security (i.e. the short seller’s promise to deliver the security). Short sellers make a short sale because they believe that they will be able to buy the stock at a lower price than their sales price. Significant amounts of short selling, or the perception that a significant amount of short sales could occur, could depress the market price of our ADSs. The price decline could be exacerbated if sufficient “naked short selling” occurs, which is the practice by which short sellers place short sell orders for shares without first borrowing the shares to be sold, or without having first adequately located such shares and arranged for a firm contract to borrow such shares prior to the delivery date set to close the sale. The result is an artificial deluge into the market of shares for sale – shares that the seller does not own and has not even borrowed. Although there are regulations in the United States designed to address abusive short selling, the regulations may not be adequately structured or enforced.

We may be deemed to be a passive foreign investment company (a “PFIC”) for U.S. federal income tax purposes. If we are or we become a PFIC, it could have adverse tax consequences to holders of our ordinary shares, ADSs, or warrants.

Potential investors in our ordinary shares, ADSs, or warrants should consider the risk that we could be now, or could in the future become, a PFIC for U.S. federal income tax purposes. We do not believe that we were a PFIC for the taxable year ended June 30, 2012, and do not expect to be a PFIC in the foreseeable future. However, the tests for determining PFIC status depend upon a number of factors, some of which are beyond our control and subject to uncertainties, and accordingly we cannot be certain of our PFIC status for the current, or any other, taxable year. We do not undertake an obligation to determine our PFIC status, or to advise investors in our securities as to our PFIC status, for any taxable year.

If we were to be a PFIC for any year, holders of our ordinary shares or ADSs who are U.S. persons for U.S. federal income tax purposes (“U.S. holders”) whose holding period for such ordinary shares or ADSs includes part of a year in which we are a PFIC generally will be subject to a special, highly adverse, tax regime imposed on “excess distributions” made by us. This regime will continue to apply irrespective of whether we are still a PFIC in the year an “excess distribution” is made or received. “Excess distributions” for this purpose would include certain distributions received on our ordinary shares or ADSs. In addition, gains by a U.S. holder on a sale or other transfer of our ordinary shares or ADSs (including certain transfers that would otherwise be tax-free) would be treated in the same manner as excess distributions. Under the PFIC rules, excess distributions (including gains treated as excess distributions) would be allocated ratably to each day in the U.S. holder’s holding period of the ordinary shares or ADSs with respect to which the excess distribution is made or received. For this purpose, the holding period of an ordinary share or ADS received upon exercise of a warrant will, under Proposed Treasury Regulations, include the holding period of the warrant. The portion of any excess distributions allocated to the current year or prior years before the first day of the first taxable year beginning after December 31, 1986 in which we became a PFIC would be includible by the U.S. holder as ordinary income in the current year. The portion of any excess distributions allocated to prior taxable years in which we were a PFIC would be taxed to such U.S. holder at the highest marginal rate applicable to ordinary income for each such year (regardless of the U.S. holder’s actual marginal rate for that year and without reduction by any losses or loss carryforwards), and any such tax owing would be subject to interest charges. In addition, dividends received from us will not be “qualified dividend income” if we are a PFIC in the year of payment, or were a PFIC in the year preceding the year of payment, and will be subject to taxation at ordinary income rates.

In certain cases, U.S. holders may make elections to mitigate the adverse tax rules that apply to PFICs (the “mark-to-market” and “qualified electing fund” or “QEF” elections), but these elections may also accelerate the recognition of taxable income and could result in the recognition of ordinary income. These elections cannot generally be made with respect to warrants. We have never received a request from a holder of our ordinary shares or ADSs for the annual information required to make a QEF election and we have not decided whether we would provide such information if such a request were to be received. Additional adverse tax rules would apply to U.S. holders for any year in which we are a PFIC and own or dispose of shares in another corporation that is itself a PFIC. Special adverse rules that impact certain estate planning goals could apply to our ordinary shares or ADSs if we are a PFIC.

The market price of our ordinary shares and ADSs could be adversely affected by sales of substantial amounts of shares in the public markets or the issuance of additional shares in future including in connection with acquisitions.

Sales of a substantial number of our ordinary shares in the public market, either directly or indirectly as the sale of ADSs, or the perception that such sales may occur, could cause the market price of our ordinary shares (and ADSs) to decline. In addition, the sale of these shares in the public market, or the possibility of such sales, could impair our ability to raise capital through the sale of additional shares or other securities. As of June 30, 2012, we had granted options to purchase an aggregate of approximately 67,500,000 million shares of our ordinary shares to certain of our directors and employees. These option holders, subject to compliance with applicable securities laws, are permitted to sell shares they own or acquire upon the exercise of options in the public market.

In addition, in the future, we may issue ordinary shares or ADSs including in connection with acquisitions of assets or businesses. If we use our shares for this purpose, the issuances could have a dilutive effect on the market value of our ordinary shares, depending on market conditions at the time of an acquisition, the price we pay, the value of the business or assets acquired, our success in exploiting the properties or integrating the businesses we acquire and other factors.

Our ADS holders are not shareholders and do not have shareholder rights.

The Bank of New York Mellon, as depositary, executes and delivers our ADSs on our behalf. Each ADS is represented by a certificate evidencing a specific number of ADSs. Our ADS holders arenot required to be treated as shareholders and do not have the rights of shareholders. The depositary is the holder of the ordinary shares underlying our ADSs. Holders of our ADSs have ADS holder rights. A deposit agreement among us, the depositary and our ADS holders sets out ADS holder rights as well as the rights and obligations of the depositary. New York law governs the deposit agreement and the ADSs.

Our ADS holders do not have the right to receive notices of general meetings or to attend and vote at our general meetings of shareholders. Our practice is to give ADS holders notices of general meetings and to enable them to vote at our general meetings of shareholders, but we are not obligated to continue to do so. Our ADS holders may instruct the depositary to vote the ordinary shares underlying their ADSs, but only when we ask the depositary to ask for their instructions. Although our practice is to have the depositary ask for the instructions of ADS holders, we are not obligated to do so, and if we do not, our ADS holders would not be able to exercise their right to vote. ADS holders can exercise their right to vote the ordinary shares underlying their ADSs by withdrawing the ordinary shares. However it is possible that our ADS holders would not know about the meeting enough in advance to withdraw the ordinary shares.

When we do ask the depositary to seek our ADS holders’ instructions, the depositary notifies our ADS holders of the upcoming vote and arranges to deliver our voting materials and form of notice to them. The depositary then tries, as far as practicable, subject to Australian law and the provisions of the depositary agreement, to vote the ordinary shares as our ADS holders instruct. The depositary does not vote or attempt to exercise the right to vote other than in accordance with the instructions of the ADS holders. We cannot assure our ADS holders that they will receive the voting materials in time to ensure that they can instruct the depositary to vote their shares. In addition, there may be other circumstances in which our ADS holders may not be able to exercise voting rights.

Similarly, while our ADS holders would generally receive the same dividends or other distributions as holders of our ordinary shares, their rights are not identical. Dividends and other distributions payable with respect to our ordinary shares generally will be paid directly to those holders. By contrast, any dividends or distributions payable with respect to ordinary shares that are held as ADSs will be paid to the depositary, which has agreed to pay to our ADS holders the cash dividends or other distributions it or the custodian receives on shares or other deposited securities, after deducting its fees and expenses. Our ADS holders will receive these distributions in proportion to the number of ordinary shares their ADSs represent. In addition, while it is unlikely there may be circumstances in which the depositary may not pay to our ADS holders the same amounts distributed by us as a dividend or distribution, such as when it is unlawful or impractical to do so. See the next risk factor below.

There are circumstances where it may be unlawful or impractical to make distributions to the holders of our ADSs.

Our depositary, The Bank of New York Mellon, has agreed to pay to our ADS holders the cash dividends or other distributions it or the custodian receives on shares or other deposited securities, after deducting its fees and expenses. Our ADS holders will receive these distributions in proportion to the number of ordinary shares their ADSs represent.