| QUARTERLY REPORT for the period ended 30 September 2013 |

HIGHLIGHTS

FINANCIAL

| - | Cash receipts for the quarter of US$1.4 million |

| - | A closing cash balance for the quarter of US$10.454 million |

OPERATIONAL

| - | In Williams County, North Dakota, the Sail & Anchor 4-13-14HBK well was the first of the North Stockyard infill wells to be successfully completed in the Middle Bakken Formation. The highest recorded 24-hour IP rate was 1,426 BOPD on a 16/64” choke setting. |

| - | Wash-over operations are currently taking place on the second North Stockyard infill well, the Billabong 2-13-14HBK well, to retrieve a cemented drill-string assembly from the hole. Approximately one half of the drill-string has been retrieved. |

| - | The third and fourth North Stockyard infill wells, Coopers 2-15-14HBK and Tooheys 4-15-15HBK wells, have both been drilled. The production liner has been set and cemented in both wells. These two Middle Bakken Formation wells will be fracture stimulated after the drilling of the fifth North Stockyard infill well, Little Creature 1-15-14HBK well, which is currently drilling the lateral at a depth of 13,254 feet. |

| - | In Goshen County, Wyoming, preparations to drill the Bluff #1-11 this fall have begun. OOGC (the subsidiary of CNOOC) has elected to participate for their 33.33% working interest in the drilling of the Bluff well. |

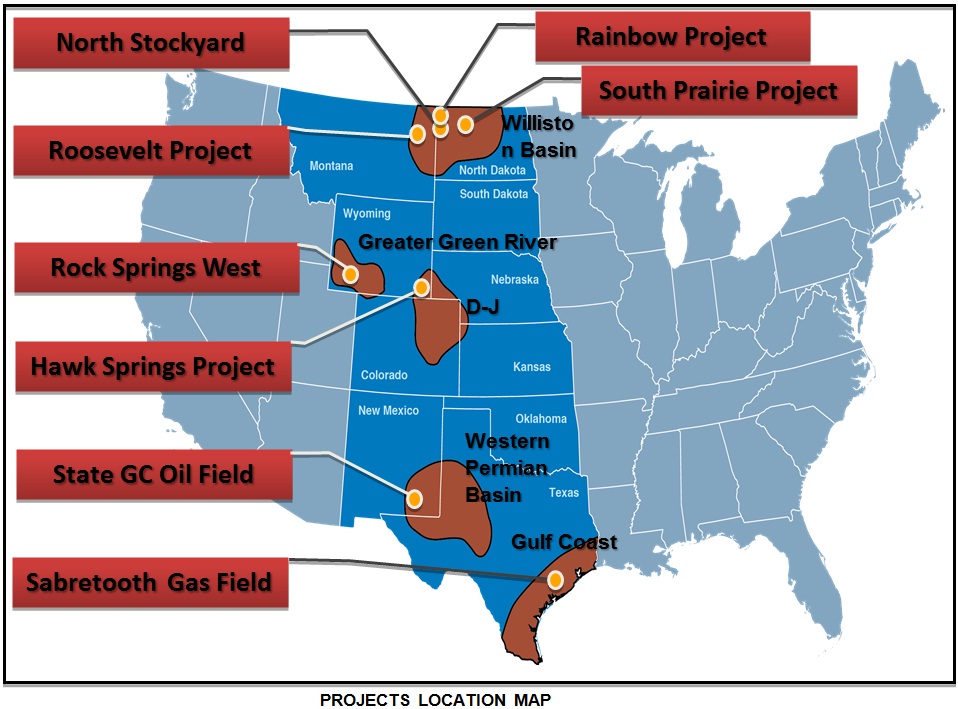

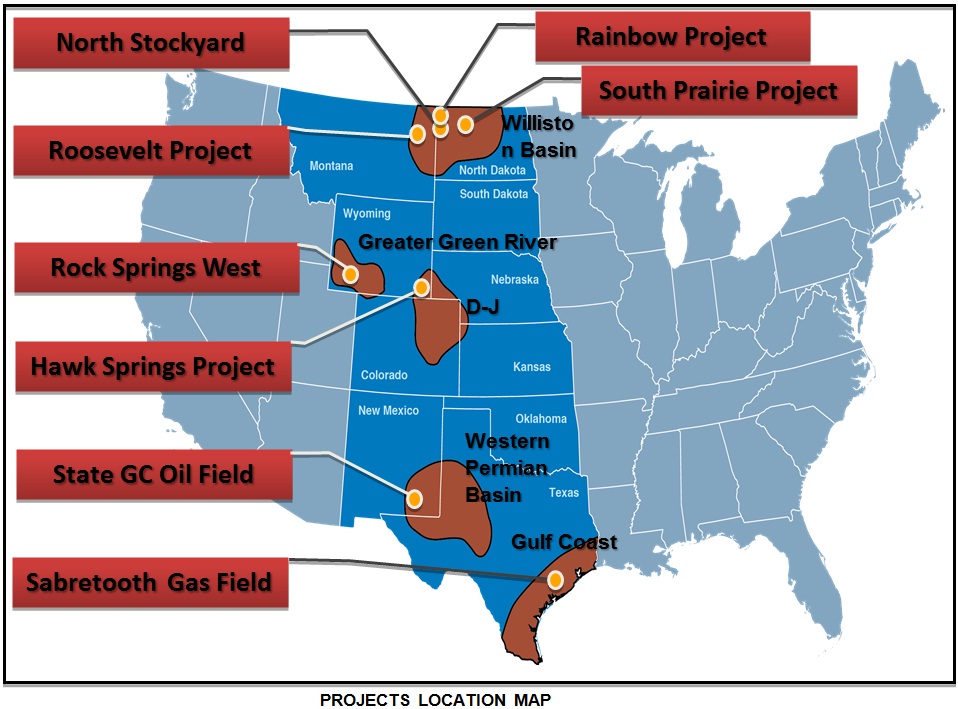

LAND

| - | Samson’s current land position in the Hawk Springs Project, Wyoming stands at 19,247 net acres. |

| - | Samson’s current land position in the Roosevelt Project, Montana, is 30,000 net acres |

| - | Samson has 531 net acres in both the Bakken and Three Forks pools within North Stockyard Oil- field, Williams County, North Dakota. |

| - | Samson recently acquired 950 net acres with the ability to acquire a further 274 net acres in the Bakken pool within its new Rainbow Project in Williams County, North Dakota. |

| - | Samson’s current land position in the Green River Basin, Wyoming is in two areas, Rock Springs West Project, consists of 3,187 net acres (100% working interest) in Greens Canyon and 6,400 acres (25% working interest) in Flaming Gorge. |

| - | Samson has 6,500 net acres in the South Prairie Project, North Dakota. |

| - | Samson’s current land position in Lea County, New Mexico, consists of 130 net acres. |

Samson Oil & Gas Limited Level 16, AMP Building, 140 St Georges Terrace, Perth WA 6000 T: +618 9220 9830F: +618 9220 9820ABN: 25 009 069 005ASX: SSN | Samson Oil & Gas USA 1131, 17th Street, Suite 710, Denver Colorado 80202 T: +1 303 295 0344F: +1 303 295 1961NYSE: SSN |

SAMSON OIL & GAS LIMITED

September 2013 Quarterly Report

DRILLING PROGRAMME FALL 2013

North Stockyard Oilfield, Williams County, North Dakota

Mississippian Bakken Formation, Williston Basin

Bakken infill wells

Samson ~25% Working Interest

The Billabong 2-13-14HBK well was drilled in the Middle Bakken Formation but upon cementing the 4 ½ inch production liner, the bottom of the drill string became cemented in the hole. Wash-over operations are currently taking place to retrieve the cemented drill-string assembly from the hole so that the well can be completed.

The Coopers 2-15-14HBK and Tooheys 4-15-15HBK wells have both been drilled. The production liner has been set and cemented in both wells. These two Middle Bakken Formation wells will be fracture stimulated after the drilling of the Little Creature 1-15-14HBK well which is currently being drilled. The Blackdog 3-13-14H well will be drilled following the Little Creature 1-15-14HBK well.

Hawk Springs Project, Goshen County, Wyoming

Wildcat (Exploratory) Permo-Penn Hartville Formation, Northern D-J Basin

Bluff #1-11 well

Samson 41.67% BPO Working Interest in the 1st Bluff Prospect well

Preparations to drill the Bluff prospect this fall have begun. The well will test a four-way dip structural closure in the Permian and Pennsylvanian age rocks to a depth of approximately 8,000 feet. The well will be located three miles to the northwest of the Spirit of America US34 #2-29 well (SOA #2) and more than 2000’ shallower in depth. The excellent reservoir properties and oil shows seen in the SOA #2 well has allowed Samson to validate the 3-D seismic data and consequently high-grade the Bluff prospect.

South Prairie Project, North Dakota

Mississippian Mission Canyon Formation,Williston Basin

Pubco Prospect

Samson 25% Working Interest

A new understanding of the timing of hydrocarbon migration with respect to formation of the Glenburn structural closures has been achieved from the drilling of the Matson #3-1 well such that three new prospects located along the Prairie Salt edge appear more favorable for drilling. One of these prospects, named Pubco, may be drilled before year end. The joint-venture is currently evaluating a new 2-D seismic line to help confirm counter-regional dip at the eastern edge of the South Prairie 3-D seismic survey which is necessary for closing the 4-way structural trap.

PROJECTS

North Stockyard Oilfield, Williams County, North Dakota

Mississippian Bakken Formation, Williston Basin

PRODUCING WELLS

Samson has eight producing wells in the North Stockyard Oilfield. These wells are located in Williams County, North Dakota, in Township 154N Range 99W. All of the wells experienced downtime during the quarter due mostly to production problems and closure of wells to mitigate detrimental interference effects from off-set well completions.

The Harstad #1-15H well (34.5% working interest) was down for 38 days during the quarter and averaged 33 BOPD from the Mississippian Bluell Formation. The well has cumulative gross oil production of 101.6 MSTB.

The Leonard #1-23H well (10% working interest, 37.5% after non-consent penalty) was down for 1.6 days during the quarter. The well averaged 38 BOPD and 38 Mscf/D during the quarter. To date, the Leonard #1-23H well has produced approximately 111 MSTB and 115 MMscf.

SAMSON OIL & GAS LIMITED

September 2013 Quarterly Report

The Gene #1-22H well (30.6% working interest) was down for approximately 30 days during the quarter mostly due to electrical and downhole problems. The well produced at an average daily rate of 100 BOPD and 115 Mscf/D during the quarter. The cumulative production to date is approximately 155 MSTB and 168 MMscf.

The Gary #1-24H (37% working interest) well was down for 35 days during the quarter mostly due to planned shutin periods while completing the offset wells. The well averaged 70 BOPD and 76 Mscf/D during the quarter. The cumulative production to date is approximately 151 MSTB and 244 MMscf.

The Rodney #1-14H (27% working interest) well was down for 32 days during the quarter due to planned shutin periods while completing the offset wells. The well produced at an average daily rate of 51 BOPD and 80 Mscf/D during the quarter. The cumulative production to date is approximately 119 MSTB and 169 MMscf.

The Earl #1-13H (32% working interest) well was down for 43 days during the quarter due to planned shutin periods while completing the offset wells. The well produced at an average daily rate of 40 BOPD and 49 Mscf/D. Cumulative production to date is approximately 188 MSTB and 272 MMscf.

The Everett #1-15H (26% working interest) well was down for 17 days during the quarter due to a rod failure and scheduled maintenance. The Everett well produced at an average daily rate of 102 BOPD and 92 Mscf/D during the quarter. Cumulative production to date is approximately 100 MSTB and 134 MMscf.

The Sail & Anchor 4-13-14HBK well was successfully drilled and completed to a total depth of 18,050 feet (MD) in the Middle Bakken Formation. The highest 24-hour production rate recorded during the flowback was 1,426 BOPD on a 16/64” choke setting. The well produced without artificial lift during the quarter and a rod pump will be installed when the flowing tubing pressure drops to a level where artificial lift is appropriate.

Rainbow Project, Williams County, North Dakota

Mississippian Bakken Formation, Williston Basin

Samson acquired in two tranches, a net 1,225 acres in two 1,280 acre drilling units located in the Rainbow Project, Williams County, North Dakota. The Rainbow Project is located in Sections 17, 18, 19 and 20 in T158N R99W.

The acquisition involved an acreage trade by the parties and a future carry of the vendor by Samson in the initial drilling program on the Rainbow Project. Samson transferred 160 net acres from its 1,200 acre undeveloped acreage holding in North Stockyard and the vendor will fund its share (between 7.5% and 8.5%) of the North Stockyard initial infill program. Samson will acquire 950 net acres in the Rainbow Project from the vendor for this acreage trade and will provide a $1 million carry (10%) to the vendor, for the first development well to be drilled in the Rainbow Project. Samson will have the ability, subject to the vendor acquiring additional acres, to acquire a further 274 acres by carrying the vendor for $0.7 million in the second well in the project.

Samson has assessed the project based on offset well data and understands that the project will support 16 wells, 8 in the middle Bakken and 8 in the first bench of the Three Forks. These wells would be expected to be configured as north-south orientated 10,000 foot horizontals.

In the western drilling unit of the acquired acreage, Samson will hold a 52% working interest. In the eastern drilling unit, Samson’s interest will initially be 23% but with the option to increase it to 44% in the second tranche.

Other interest holders owning an interest in the Rainbow Project include Hess, Halcón and Continental.

SAMSON OIL & GAS LIMITED

September 2013 Quarterly Report

Roosevelt Project, Roosevelt County, Montana

Mississippian Bakken Formation,Williston Basin

Samson 100% working interest in Australia II & Gretel II wells, 66.7% in any subsequent drilling

Samson has an interest in approximately 45,000 gross acres (30,000 net acres) in the Roosevelt Project with Fort Peck Energy Co. (FPEC) having the remaining 15,000 net acres.

Samson entered into a sale agreement to sell its interests in the Roosevelt Project for $13.533 million in cash subject only to the completion of specified due diligence by the buyer. The transaction was scheduled to close on July 31st, but was terminated because the buyer was unable to produce sufficient funds in time for the closing. Samson is currently in the process of negotiating the sale of its Roosevelt Project with other buyers along with the previous potential buyer who was not able to close on time.

The Abercrombie #1-10H (SSN 2.82% W.I.) well has produced a cumulative 52,581 barrels of oil and 119,590 Mscf while producing at an average rate of approximately 48 BOPD and 135 Mscf/D during the quarter.

The Riva Ridge 6-7-33-56H (SSN 0.76% W.I.) well has produced a cumulative 23,803 barrels of oil and 6,529 Mscf while producing at an average rate of approximately 40 BOPD and 21 Mscf/D during the quarter.

SAMSON OIL & GAS LIMITED

September 2013 Quarterly Report

South Prairie Project, North Dakota

Mississippian Mission Canyon Formation,Williston Basin

Samson 25% working interest

Samson has a 25% working interest in 25,590 net acres, which is located on the eastern flank of the Williston Basin in North Dakota. The target reservoir for the project is the Mississippian Mission Canyon Formation. Seventy-six square miles of 3-D seismic data have been shot and processed. The data has been interpreted and the first prospect has been drilled. The Matson #3-1 well was and plugged and abandoned, and based on the technical analysis of this result, the forward program will show a preference for structural closures that exist along the salt edge rather than those created by dissolution events further interior to the salt edge. The joint venture is focusing on developing three structural closure prospects (Pubco, Deering, and Birch) along the Prairie Salt edge in the South Prairie 3-D project. The joint venture is currently evaluating a new 2-D seismic line to help confirm counter-regional dip over the Pubco Prospect at the eastern edge of the South Prairie 3-D seismic survey. The counter-regional dip is necessary for creating a 4-way structural trap.

Sabretooth Gas Field, Brazoria County Texas

Oligocene Vicksburg Formation, Gulf Coast Basin

Samson 9.375% Working Interest

Production for the Davis Bintliff #1 well averaged 4.0 MMscf/D and 39 BOPD for the quarter. Cumulative production to date is approximately 6.0 Bscf and 69 MSTB.

State GC Oil and Gas Field Lea County New Mexico

Permian Bone Spring Formation, Western Permian Basin

Samson 27% Working Interest

The State GC oil and gas field is located in Lea County, New Mexico, and includes two wells, which produced at an average rate of 33 BOPD and 31 Mscf/D during the quarter.

10B

Hawk Springs Project, Goshen County, Wyoming

Cretaceous Niobrara Formation & Permo-Penn Project, Northern D-J Basin

Samson currently has a 100% to 37.5% Working Interest

Samson has two contiguous areas in the Hawk Springs Project. One of the areas is a joint venture with a private company and is subject to the Halliburton Joint Venture (HJV).

The Defender US33 #2-29H well is pumped on timer for about 4 hours per day. The well produced 487 bbls of oil during the quarter.

The Spirit of America (SOA) US34 #2-29 intersected two excellent quality Permian age reservoirs, the 9,300 ft. sand, which appears to be oil saturated and the 9,500 ft. sand which is water saturated. Integrating the well data to the 3-D seismic shows that an amplitude anomaly (lithology/porosity indicator) is associated with the 9500’ sand indicating a thick and porous reservoir exists everywhere the amplitude is mapped. However, the reason for the lack of oil saturation in the 9500’ sand, after further examination of the 3D seismic, is that a leak point can be established by a fortuitous juxtaposition of another porous reservoir across a fault that intersects the amplitude anomaly. This arrangement in the SOA prospect is unique in the project area and therefore re-establishes the prospectivity of the remaining two dozen prospects in the project since these prospects are not affected by any recognized faulting.

As a result of this analysis, the strategy is to drill the Bluff Prospect this fall, which relies on a four way dip structural closure. The Bluff Prospect will be drilled vertically to a depth of approximately 8,000 feet to test multiple targets in the Permian and Pennsylvanian sections.

Harrod Oilfield, Campbell County, Wyoming

Pennsylvanian Minnelusa Formation, Powder River Basin

Samson 25% working interest

The Harrod 4-2 well has produced an average of 0.4 bopd during the quarter.

SAMSON OIL & GAS LIMITED

September 2013 Quarterly Report

Pierce 44-27 Oilfield, Campbell County, Wyoming

Permo-Pennsylvanian Minnelusa Formation, Powder River Basin

Samson 100% working interest

The Pierce 44-27 Unit well produced an average of 8.8 BOPD during the quarter.

PRODUCTION

Estimated net production by Project for the September 2013 quarter is as follows:

| | OIL – Bbls | GAS - Mscf | BOE |

| North Stockyard | 10,134* | 3,255 | 10,676 |

| Hawk Springs | 99 | - | 99 |

| Roosevelt | - | - | - |

| Other | 2,403 | 34,727 | 8,190 |

| Total | 12,636 | 37,982 | 18,965 |

*Includes 11 days of production from Sail & Anchor

Estimated daily net production by Project for the September 2013 quarter is as follows:

| | OIL – Bbls | GAS - Mscf | BOE |

| North Stockyard | 112 | 37 | 118 |

| Hawk Springs | 1 | - | 1 |

| Roosevelt | - | - | - |

| Other | 27 | 386 | 91 |

| Total | 140 | 423 | 210 |

Estimated net production and revenue:

| | OIL Bbls | OIL US$ | Gas Mscf | GAS US$ | TOTAL US$ |

| June 2013 Quarter | 13,462 | 1,146,000 | 42,161 | 148,000 | 1,294,000 |

| September 2013 Quarter | 12,636 | 1,254,650 | 37,982 | 117,330 | 1,371,980 |

Average commodity prices:

| | GAS US$/Mscf | OIL US$/Bbl |

| June 2013 Quarter | $3.51 | $85.12 |

| Sept 2013 Quarter | $3.09 | $99.29 |

In some cases revenue is yet to be received and is therefore an estimate.

RESERVES

In August 2013, Samson divested half its equity position in the undeveloped acreage in the North Stockyard project to Slawson Exploration Company Inc. for $5.562 million in cash and other consideration while retaining our full interest in the currently producing wells in the North Stockyard field. As a consequence of the transaction the rig contract with Frontier was also terminated, with no penalty payment. Slawson are now the operator of the project going forward for the development of the undeveloped acreage.

Along with the undeveloped acreage, we have also transferred 25% working interest in the drilled but not yet completed Billabong and Sail and Anchor wells. The cash portion of the purchase price is subject to the delivery of a useable well bore in Billabong, valued in the agreement at $0.9 million and other customary post closing adjustments.

SAMSON OIL & GAS LIMITED

September 2013 Quarterly Report

Following the partial sale of North Stockyard Samson has reassessed its reserves as at June 30, 2013 to account for this sale:

| PROVED | PROBABLE | TOTAL |

| MBOE | NPV10Million | MBOE | NPV10Million | MBOE | NPV10Million |

| 1,545.8 | $34.110 | 1,474.0 | $20.104 | 3,019.8 | $54.214 |

FINANCIAL

Rights Offering Shortfall

During the quarter, in accordance with ASX Listing Rules, Samson issued 318,452,166 ordinary shares to investors in the US and Australia. The placement was completed at A$0.025 per share to raise A$7.9/US$7.3million. The placement also included 127,380,866 transferable options to subscribe for ordinary shares at an exercise price of A$0.038 per share, with an expiry date of 31 March 2017.

Treasury management

In order to diversify the deposit risk, a treasury management policy was adopted such that the cash was distributed as follows:

Bank of the West (Samson’s trading bank) US$2,565,598

Bank of New York Mellon US$17,946

National Australia Bank A $8,455,275

Foreign Exchange Rates

The closing A$:US$ exchange rate on 30 September 2013 was 0.9309. The average A$:US$ exchange rate for the quarter was 0.9165.

The Company’s cash position at 30 September 2013 was as follows:

| | | US$ (‘000’s) |

| Cash at bank and on deposit | : | 10,455 |

For and on behalf of the Board of SAMSON OIL & GAS LIMITED | For further information please contact

Denis Rakich, Company Secretary, on 08 9220 9882 |

TERRY BARR Managing Director 31 October 2013 | | Information contained in this report relating to hydrocarbon reserves was compiled by the Managing Director of Samson Oil & Gas Ltd., T M Barr a Geologist who holds an Associateship in Applied Geology and is a fellow of the Australian Institute of Mining and Metallurgy who has 30 years relevant experience in the oil & gas industry. | |

SAMSON OIL & GAS LIMITED

September 2013 Quarterly Report

Rule 5.3

Appendix 5B

Mining exploration entity quarterly report

Introduced 01/07/96 Origin Appendix 8 Amended 01/07/97, 01/07/98, 30/09/01, 01/06/10, 17/12/10

| Name of entity |

| Samson Oil and Gas Limited |

| ABN | | Quarter ended (“current quarter”) |

| 25 009 069 005 | | 30 September 2013 |

Consolidated statement of cash flows

Cash flows related to operating activities | Current quarter $US’000 | Year to date (3.months) $US’000 |

| 1.1 | Receipts from product sales and related debtors | 1,396 | 1,396 |

| 1.2 | Payments for (a) exploration & evaluation (b) development (c) production (d) administration | (202) (11,885) (51) (1,322) - | (202) (11,885) (51) (1,322) |

| | Dividends received | | - |

| | Interest and other items of a similar nature received | 12 | 12 |

| | Interest and other costs of finance paid | - | - |

| | Income tax (payment) refund | - | - |

| | Other (provide details if material) | - | - |

| | Net Operating Cash Flows | (12,052) | (12,052) |

| | Cash flows related to investing activities | | |

| | Payment for purchases of: (a) prospects (b) equity investments (c) other fixed assets | - - - | - - - |

SAMSON OIL & GAS LIMITED

September 2013 Quarterly Report

| | Proceeds from sale of: (a) prospects (b) equity investments (c) other fixed assets | 2,640 - - - | 2,640 - - |

| | Loans to other entities | | - |

| | Loans repaid by other entities | - | - |

| | Other (provide details if material) | - | - |

| | Net investing cash flows | 2,640 | 2,640) |

| | Total operating and investing cash flows (carried forward) | (9,412) | (9,412) |

| | Total operating and investing cash flows (brought forward) | (9,412) | (9,412) |

| | Cash flows related to financing activities | | |

| | Proceeds from issues of shares, options, etc. | 6,811 | 6,811 |

| | Proceeds from sale of forfeited shares | - | - |

| | Proceeds from borrowings | - | - |

| | Repayment of borrowings | - | - |

| | Dividends paid | - | - |

| | Other (provide details if material) | - | - |

| | Net financing cash flows | 6,811 | 6,811 |

SAMSON OIL & GAS LIMITED

September 2013 Quarterly Report

| | Net increase (decrease) in cash held | (2,601) | (2,601) |

| | Cash at beginning of quarter/year to date | 13,349 | 13,349 |

| | Exchange rate adjustments to item 1.20 | (293) | (293) |

| Cash at end of quarter | 10,455 | 10,455 |

Payments to directors of the entity and associates of the directors

Payments to related entities of the entity and associates of the related entities

| | Current quarter $US'000 |

1.23 | Aggregate amount of payments to the parties included in item 1.2 | 201 |

1.24 | Aggregate amount of loans to the parties included in item 1.10 | - |

1.25 | Explanation necessary for an understanding of the transactions |

| Monies paid to Directors for salary and fees |

Non-cash financing and investing activities

| 2.1 | Details of financing and investing transactions which have had a material effect on consolidated assets and liabilities but did not involve cash flows |

| | |

| 2.2 | Details of outlays made by other entities to establish or increase their share in projects in which the reporting entity has an interest |

| | |

Financing facilities available

Add notes as necessary for an understanding of the position.

| | | Amount available $US’000 | Amount used $US’000 |

| 3.1 | Loan facilities | - | - |

| Credit standby arrangements | - | - |

SAMSON OIL & GAS LIMITED

September 2013 Quarterly Report

Estimated cash outflows for next quarter

| | | $US’000 |

| 4.1 | Exploration and evaluation | 375 |

| Development | 1,500 |

| Production | 393 |

| Administration | 1,500 |

| | Total | 3,768 |

Reconciliation of cash

| Reconciliation of cash at the end of the quarter (as shown in the consolidated statement of cash flows) to the related items in the accounts is as follows. | Current quarter $US’000 | Previous quarter $US’000 |

| 5.1 | Cash on hand and at bank | 5,688 | 8,372 |

| 5.2 | Deposits at call | 4,767 | 4,977 |

| Bank overdraft | - | - |

| Other (provide details) | - | - |

| | Total: cash at end of quarter(item 1.22) | 10,455 | 13,349 |

Changes in interests in mining tenements

| | | Tenement reference | Nature of interest (note (2)) | Interest at beginning of quarter | Interest at end of quarter |

| 6.1 | Interests in mining tenements relinquished, reduced or lapsed | | | | |

| Interests in mining tenements acquired or increased | | | | |

SAMSON OIL & GAS LIMITED

September 2013 Quarterly Report

Issued and quoted securities at end of current quarter – all reference to option exercise price is in AUSTRALIAN DOLLARS

Description includes rate of interest and any redemption or conversion rights together with prices and dates.

| | Total number | Number quoted | Issue price per security (see note 3) (cents) | Amount paid up per security (see note 3) (cents) |

| 7.1 | Preference +securities (description) | | | | |

| 7.2 | Changes during quarter (a) Increases through issues (b) Decreases through returns of capital, buy-backs, redemptions | | | | |

| 7.3 | +Ordinary securities | 2,547,627,193 | 2,547,627,193 | | |

| 7.4 | Changes during quarter (a) Increases through issues (b) Decreases through returns of capital, buy-backs | 318,452,166 9,864 | 318,452,166 9,864 | 2.5c 3.8c | |

| 7.5 | +Convertible debt securities(description) | | | | |

| 7.6 | Changes during quarter (a) Increases through issues (b) Decreases through securities matured, converted | | | | |

| 7.7 | Options (description and conversion factor) | 1,000,000 29,000,000 31,500,000 4,000,000 4,000,000 229,678,528 | - - - - - - | Exercise price 20c 8c 8c 16.4c 15.5c 3.8c | Expiry date 20.11.2013 31.10.2014 31.12.2014 31.12.2014 31.10.2015 31.03.2017 |

| 7.8 | Issued during quarter | 132,380,866 | 132,380,866 | 3.8c | 31.03.2017 |

| 7.9 | Exercised during quarter | 9,864 | 9,864 | 3.8c | |

| 7.10 | Expired during quarter | | | | |

| 7.11 | Debentures (totals only) | | | | |

| 7.12 | Unsecured notes (totals only) | NIL | NIL | | |

SAMSON OIL & GAS LIMITED

September 2013 Quarterly Report

Compliance statement

| 1 | This statement has been prepared under accounting policies which comply with accounting standards as defined in the Corporations Act or other standards acceptable to ASX (see note 5). |

| 2 | This statement does give a true and fair view of the matters disclosed. |

| Sign here: | |  | | Date: 31 October 2013 |

| | | (Company secretary) | | |

| | | | | |

| Print name: | | Denis Rakich | | |

Notes

| 1 | The quarterly report provides a basis for informing the market how the entity’s activities have been financed for the past quarter and the effect on its cash position. An entity wanting to disclose additional information is encouraged to do so, in a note or notes attached to this report. |

| 2 | The “Nature of interest” (items 6.1 and 6.2) includes options in respect of interests in mining tenements acquired, exercised or lapsed during the reporting period. If the entity is involved in a joint venture agreement and there are conditions precedent which will change its percentage interest in a mining tenement, it should disclose the change of percentage interest and conditions precedent in the list required for items 6.1 and 6.2. |

| 3 | Issued and quoted securities The issue price and amount paid up is not required in items 7.1 and 7.3 for fully paid securities. |

| 4 | The definitions in, and provisions of,AASB 6: Exploration for and Evaluation of Mineral Resourcesand AASB 107: Statement of Cash Flows apply to this report. |

| 5 | Accounting Standards ASX will accept, for example, the use of International Financial Reporting Standards for foreign entities. If the standards used do not address a topic, the Australian standard on that topic (if any) must be complied with. |

== == == == ==