UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by the Registrantx |

| Filed by a Party other than the Registrant¨ |

| Check the appropriate box: |

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a–6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a–12 |

| SAMSON OIL & GAS LIMITED |

| (Name of Registrant as Specified In Its Charter) |

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| |

| Payment of Filing Fee (Check the appropriate box): |

| x | No fee required. |

| | |

| ¨ | Fee computed on table below per Exchange Act Rules 14a–6(i)(1) and0–11. |

| | |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0–11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | (5) | Total fee paid: |

| | | |

| | |

| ¨ | Fee paid previously with preliminary materials. |

| | |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule0–11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | Amount Previously Paid: |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | |

| | (3) | Filing Party: |

| | | |

| | (4) | Date Filed: |

| | | |

TABLE OF CONTENTS

SAMSON OIL & GAS LIMITED

(ABN 25 009 069 005)

NOTICE OF ANNUAL GENERAL MEETING

EXPLANATORY MEMORANDUM

PROXY FORM

| Date: | | Thursday, 30 November 2017 |

| | | |

| Time: | | 11.00 am AWST |

| | | |

| Venue: | | Level 1, AMP Building |

| | | 140 St Georges Terrace |

| | | Perth, WA 6000 |

These documents should be read in their entirety. If shareholders are in doubt as to how they should vote, they should seek advice from their accountant, solicitor or other professional adviser prior to voting.

| Notice of Annual General Meeting 2017 |

SAMSON OIL & GAS LIMITED

(ABN 25 009 069 005)

NOTICE OF ANNUAL GENERAL MEETING

NOTICE IS HEREBY GIVEN that the annual general meeting of Samson Oil & Gas Limited will be held at Level 1, AMP Building 140 St Georges Terrace, Perth, Western Australia 6000 on Thursday, 30 November 2017 at 11.00am (Perth, Western Australia time).

AGENDA

ORDINARY BUSINESS

Financial Statements

To receive, consider and discuss the Company’s financial statements for the year ended 30 June 2017 and the reports of the directors and auditors on those statements.

Note:

There is no requirement for Shareholders to approve these reports.

Resolution 1- Re-election of Director

To consider and, if thought fit, to pass the following resolution as an ordinary resolution:

“In accordance with Listing Rule 14.5 and clause 3.6 of the Company's constitution, that Dr. Peter Hill, who retires by rotation and, being eligible, offers himself for re-election, be re-elected as a Director of the Company”.

Resolution 2 – Adoption of Remuneration Report

To consider and, if thought fit, to pass the following resolution as a non-binding resolution:

“That, for the purposes of section 250R(2) of the Corporations Act 2001 and for all other purposes, the Remuneration Report contained in the 2017 Annual Report which accompanied the notice convening this meeting be adopted by shareholders”.

Note:

In accordance with section 250R(2) of the Corporations Act 2001, this resolution is advisory only and does not bind the Directors or the Company.

Voting Exclusion Statement:

The Company will disregard any votes cast on Resolution 2 by or on behalf of any member of the Key Management Personnel, details of whose remuneration are included in the Remuneration Report, or any Closely Related Party of such a member. However, the Company will not disregard any votes cast on Resolution 2 by such a person if the vote is not cast on behalf of such a person and either:

| (a) | the person is acting as proxy and the proxy form specifies how the proxy is to vote on the Resolution; or |

| (b) | the person is the Chairman of the Meeting voting an undirected proxy and their appointment expressly authorises the Chairman to exercise the proxy even though Resolution 2 is connected with the remuneration of the Key Management Personnel of the Company. |

| Notice of Annual General Meeting 2017 |

Resolution 3 – Approval of Additional 10% Placement Facility

To consider and, if thought fit, to pass the following Resolution as a special resolution:

“That for the purposes of ASX Listing Rule 7.1A and for all other purposes, Shareholders approve the issue of Equity Securities up to 10% of the issued capital of the Company (at the time of the issue), calculated in accordance with the formula prescribed in Listing Rule 7.1A.2 for the purpose and on the terms and conditions set out in the Explanatory Memorandum accompanying the notice convening this meeting”.

Voting exclusion statement:

For the purpose of Listing Rule 7.3A.7, and for all other purposes, the Company will disregard any votes cast on this Resolution 3 by any person who may participate in the issue of Equity Securities under the Additional 10% Placement Facility and any person who might obtain a benefit, except a benefit solely in the capacity of a holder of ordinary securities, if the Resolution is passed, and any persons associated with those persons.

However, the Company will not disregard a vote cast on Resolution 3 if:

| a) | it is cast by a person as proxy for a person who is entitled to vote, in accordance with the directions on the proxy form; or |

| b) | it is cast by the person chairing the meeting acting as proxy for a person who is entitled to vote, in accordance with a direction on the proxy form to vote as the proxy decides. |

Resolution 4 – Adoption of New Constitution

To consider and, if thought fit, to pass the following Resolution as aspecial resolution:

“That, for the purposes of sections 136(2) and 648G of the Corporations Act, and for all other purposes, the constitution submitted to this meeting and signed by the Chairman of this meeting for the purpose of identification be adopted as the constitution of the Company in substitution for and to the exclusion of the existing constitution of the Company”.

Resolution 5 – Approval of Future Issue of Shares

To consider and, if thought fit, to pass the following resolution as an ordinary resolution:

“That, for the purpose of Listing Rule 7.1, and for all other purposes, approval is given for the issue of up to 2,000,000,000 Shares, to investors not classified as related parties of the Company, for the purpose and on the terms set out in the explanatory memorandum that accompanied the notice convening this meeting”.

Voting exclusion statement:

The Company will disregard any votes cast on Resolution 5 by any person who may participate in the proposed issue and any person who might obtain a benefit (except a benefit solely in the capacity of a holder of ordinary securities) if the Resolution 5 is passed, and any person associated with those persons.

However, the Company will not disregard a vote cast on Resolution 5 if:

| | a) | the person is acting as proxy for a person who is entitled to vote, in accordance with the directions on the proxy form; or |

| | b) | the person is the Chairman of the Meeting acting as proxy for a person who is entitled to vote, in accordance with a direction on the proxy form to vote as the proxy decides. |

| Notice of Annual General Meeting 2017 |

Resolution 6 - Advisory Vote on named Executive Officer Compensation

In accordance with the requirement of the U.S. Securities Exchange Act of 1934, the compensation paid to the Company’s “named executive officers”, as disclosed in Annexure “A” to the Explanatory Memorandum accompanying the notice convening this meeting, is hereby submitted to an advisory vote of Shareholders.

To consider and, if thought fit, to pass the following resolution as an ordinary resolution:

“That the Shareholders approve, on an advisory basis, the compensation of the Company’s “named executive officers,” as disclosed in Annexure “A” to the Explanatory Memorandum accompanying the notice convening this meeting, including the “Compensation Discussion and Analysis,” compensation tables and narrative disclosed”.

Note:

In accordance with Section 14A of the U.S. Securities Exchange Act of 1934, this resolution is advisory only and does not bind the Directors of the Company.

Resolution 7 - Advisory Vote on the Frequency of Future Advisory Votes on “Named Executive Officer” Compensation

In accordance with the requirements of the U.S. Securities Exchange Act of 1934, the frequency of the required advisory vote on the compensation paid to the Company's “named executive officers”, which vote must be taken every one year, every two years or every three years, as the Shareholders elect, is hereby submitted to an advisory vote of Shareholders, as follows:

“That the Shareholders approve, on an advisory basis, the frequency of the required advisory vote on the compensation paid to the Company’s “named executive officers,” as disclosed in Annexure “A” to the Explanatory Memorandum accompanying the notice convening this meeting”.

Note:

In accordance with Section 14A of the U.S. Securities Exchange Act of 1934, this resolution is advisory only and does not bind the Board or the Company.

You may vote “Every Year,” “Every Two Years”, “Every Three Years”, or “Abstain” on Resolution 7. Resolution 7 is non binding, as provided by law. The Board will review the results of the votes and will take them into account in making a determination concerning frequency of future advisory votes on named executive officer compensation.

| Notice of Annual General Meeting 2017 |

PROXIES

In accordance with section 249L of the Corporations Act 2001, members are advised that:

| • | each member has a right to appoint a proxy; |

| • | the proxy need not be a member of the Company; |

| • | a member who is entitled to cast two or more votes may appoint two proxies and may specify the proportion or number of votes each proxy is appointed to exercise. If no proportion or number is specified, then in accordance with clause 15.1 of the Constitution, each proxy may exercise one-half of the votes. |

In accordance with section 250BA of the Corporations Act 2001, the Company specifies the following information for the purposes of receipt of proxy appointments:

| Registered Office: | | Level 16, AMP Building, 140 St Georges Terrace Perth WA 6000 |

| Facsimile Number: | | (08) 9220 9820 (international number: +61 8 9220 9820) |

| Postal Address: | | PO Box 7654, Cloisters Square, Perth, WA 6850 |

Each member entitled to vote at the general meeting has the right to appoint a proxy to attend and vote at the meeting on his behalf. The member may specify the way in which the proxy is to vote on each resolution or may allow the proxy to vote at his discretion.

The instrument appointing the proxy must be received by the Company at the address specified above at least 48 hours before the time notified for the meeting (proxy forms can be lodged by facsimile).

In accordance with regulation 7.11.38 of the Corporations Regulations 2001, the Company’s Directors determine that all Shares that are quoted on the ASX at 11.00am on Tuesday, 28 November 2017 will be taken, for the purposes of determining voting entitlements at the AGM, to be held by the persons registered as holding those Shares at that time.

By Order of the Board

DENIS I RAKICH

Director/Company Secretary

26 October 2017

SAMSON OIL & GAS LIMITED

(ABN 25 009 069 005)

EXPLANATORY MEMORANDUM TO SHAREHOLDERS

This Explanatory Memorandum has been prepared for the information of Shareholders of Samson Oil & Gas Limited in connection with the business to be transacted at the annual general meeting of the Company to be held on Thursday, 30 November 2017.

At that meeting, Shareholders will be asked to consider resolutions:

| • | re-electing a director who retires by rotation; |

| • | adopting the Remuneration Report; |

| • | approving additional 10% placement facility; |

| • | adopting a new Constitution; |

| • | approval of future issue of shares; |

| • | relating to an advisory vote to approve named executive officer compensation; and |

| • | relating to an advisory vote on frequency of future advisory votes. |

The purpose of this Explanatory Memorandum is to provide information that the Board believes to be material to Shareholders in deciding whether or not to pass those resolutions. The Explanatory Memorandum explains the resolutions and identifies the Board’s reasons for putting them to Shareholders. It should be read in conjunction with the accompanying Notice of Meeting.

The following terms and abbreviations used in this Explanatory Memorandum and the accompanying Notice of Meeting have the following meanings:

| AGM or Annual General Meeting | | The annual general meeting of the Company to be held on Thursday, 30 November 2017. |

| | | |

| ASIC | | Australian Securities and Investments Commission. |

| | | |

| ASX | | ASX Limited (ACN 008 624 691), trading as the Australian Securities Exchange. |

| | | |

| ASX Listing Rules or Listing Rules | | The Official Listing Rules of the ASX, as amended from time to time. |

| | | |

| Board | | The board of directors of the Company. |

| | | |

Chairman | | The chairman of the Annual General Meeting. |

| | | |

| Constitution | | The constitution of the Company. |

| Corporations Act | | Corporations Act 2001 (Cth). |

| | | |

| Closely Related Party | | Of a member of the Key Management Personnel means: (i) a spouse or child of the member; (ii) a child of the member’s spouse (iii) a dependant of the member or of the member’s spouse; (iv) anyone else who is one of the member’s family and may be expected to influence the member or be influenced by the member, in the member’s dealing with the entity; (v) a company the member controls; or (vi) a person prescribed by the Corporations Regulations 2001 (Cth.). |

| | | |

| Director | | A director of the Company. |

| | | |

Explanatory Memorandum | | The explanatory memorandum that accompanies this Notice of Meeting. |

| | | |

| Equity Security | | Has the meaning given to that term in the Listing Rules. |

| | | |

| Key Management Personnel | | Has the same meaning as in the accounting standards and broadly includes those persons having authority and responsibility for planning, directing and controlling the activities of the Company, directly or indirectly, including any director (whether executive or otherwise) of the Company. |

| | | |

| Notice of Meeting | | The notice convening the Annual General Meeting which accompanies this Explanatory Memorandum. |

| | | |

Option | | An option to subscribe for a Share. |

| | | |

| Remuneration Report | | The annual remuneration report included in the Company’s annual report for the year ended 30 June 2017. |

| | | |

| Samson or Company | | Samson Oil & Gas Limited (ABN 25 009 069 005). |

| | | |

| Samson Shares or Shares | | Fully paid ordinary shares in the Company. |

| | | |

| Shareholder | | A registered holder of a Share. |

| 3. | Annual financial statements |

The Corporations Act requires the annual financial report, directors’ report and the auditor’s report (Annual Financial Statements) to be received and considered at the Annual General Meeting. The Annual Financial Statements for the period ended 30 June 2017 are included in the Company’s annual financial report, a copy of which will be made available on request.

There is no requirement for Shareholders to approve these reports and no vote will be taken on the Annual Financial Statements. However, Shareholders attending the Annual General Meeting will be given a reasonable opportunity to ask questions about, or make comments on, the Annual Financial Statements and the management of the Company.

| 4. | Resolution 1 – Re-election of P. Hill as a Director |

In accordance with clause 3.6(a) of the Constitution, at each annual general meeting one-third of the Directors (excluding the Managing Director) must retire from office. Each Director so retiring is entitled to offer him or himself for re-election as a Director at the annual general meeting which coincides with his retirement. In addition, ASX Listing Rule 14.5 provides that an entity must hold an election of directors at each annual general meeting.

The Directors to retire are those who have been in office for 3 years since their appointment or last re-appointment or who have been longest in office since their appointment or last re-appointment or, if the Directors have been in office for an equal length of time, then by agreement.

All current Directors of the Company were elected in general meeting on 27 January 2016, and Mr. Gregory Channon was re-elected as a Director at the Company’s 2016 AGM. Since no Directors have been in office for 3 years the Directors to retire are those who have been longest in office. If 2 or more Directors have been in office for the same period, those Directors may agree which of them will retire. Accordingly, by agreement between the Directors (other than Mr. Channon), Dr. Hill will retire by rotation at the AGM and, being eligible, seeks re-election as a Director of the Company.

Dr. Hill has over 40 years of experience in the international oil and natural gas industry. He commenced his career in 1972 and spent 22 years in senior positions at British Petroleum including Chief Geologist, Chief of Staff for BP Exploration, President of BP Venezuela and Regional Director for Central and South America. Dr. Hill then worked as Vice President of Exploration at Ranger Oil Ltd. in England (1994-1995), Managing Director Exploration and Production at Deminex GMBH Oil in Germany (1995-1997), Technical Director/Chief Operating Officer at Hardy Oil & Gas plc (1998-2000), President and Chief Executive Officer at Harvest Natural Resources, Inc. (2000-2005), Director/Chairman at Austral Pacific Energy Ltd. (2006-2008), independent advisor to Palo Alto Investors (January 2008 to December 2009), Non-Executive Chairman at Toreador Resources Corporation (January 2009 to April 2011), Director of Midstates Petroleum Company, Inc. (April 2013 to March 2015), and interim President and Chief Executive Officer of Midstates Petroleum Company, Inc. (March 2014 to March 2015). Dr. Hill has a B.Sc. (Honors) in Geology and a Ph.D. He has provided advisory and consultancy roles to hedge funds, banks, and companies involved in the upstream oil and gas sector. Held non-executive board positions, Chairman, and been involved in international negotiations at government level.

His extensive experience in management, corporate leadership, non-executive directorship and consulting, combined with technical expertise, has provided the skills necessary to lead, build teams and deliver business success. The career path to date is a proven track record of significant value creation for all stakeholders served. The key ingredient is to develop a solid strategic position based on quality assets and the highest principles of governance, openness and honest discussion. Dr. Hill also advised Massachusetts Institute of Technology (MIT) and their start-up companies. Gradiant and FastCap, were initiated by MIT post-graduates/faculty and have patents that offer decisive break-through technologies in the energy space. Preserving founder equity and introducing specific clients are key roles that assist the development and value growth of the ventures.

Dr. Hill is the non-executive Chairman of Triangle Petroleum Corporation.

Dr. Hill was elected as a director of the Company on 27 January 2016.

| 5. | Resolution 2 – Adoption of Remuneration Report |

The Corporations Act prescribes certain disclosure requirements for listed companies which include requiring that the Directors of the Company include a remuneration report in the Company’s annual report. The Corporations Act also requires that the Directors put a resolution to Shareholders each year that the remuneration report be adopted.

The Remuneration Report is set out within the Company’s 2017 Annual Report.

The Remuneration Report:

| • | outlines the Board’s policy for determining the nature and amount of remuneration for directors and executives of the Company; |

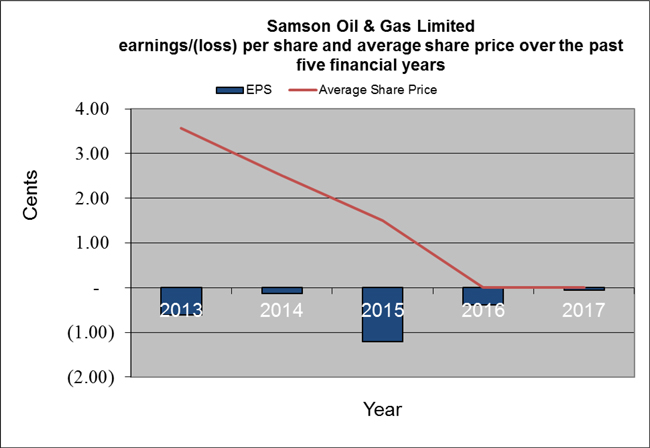

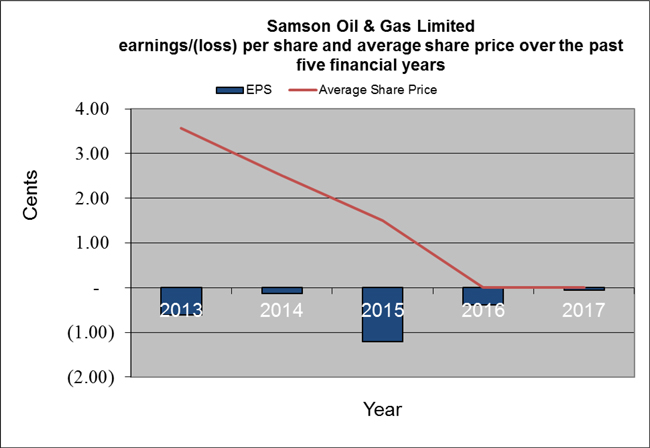

| • | discusses the relationship between the Board’s remuneration policy and the Company’s performance; |

| • | details and explains any performance condition applicable to the remuneration of a director or executive; |

| • | details the remuneration of each director (including options) and executive of the Company for the year; and |

| • | summarises the terms of any contract under which any director or executive is engaged, including the period of notice required to terminate the contract and any termination payments provided for under the contract. |

The vote on the resolution is advisory only and does not bind the Directors or the Company, nor does it affect the remuneration already paid or payable to the Directors or the executives. The Chairman of the AGM will allow reasonable opportunity for Shareholders to ask questions about, or comment on the Remuneration Report at the AGM. However, the Corporations Act provides that if the resolution to approve the Remuneration Report receives a “no” vote of 25% or more of votes cast at the Annual General Meeting, the Company’s subsequent Remuneration Report must explain the Board’s proposed action in response or, if the Board does not propose any action, the Board’s reasons for not making any changes. The Board will take into account the outcome of the vote when considering the remuneration policy, even if it receives less than a 25% “no” vote.

In addition, sections 250U and 250V of the Corporations Act sets out a “two strikes” re-election process pursuant to which:

| (a) | if, at a subsequent annual general meeting (Later Annual General Meeting), at least 25% of the votes cast on a resolution that the remuneration report be adopted are against the adoption of that remuneration report; |

| (b) | at the immediately preceding annual general meeting (Earlier Annual General Meeting), at least 25% of the votes cast on a resolution that the remuneration report be adopted were against the adoption of that remuneration report; and |

| (c) | a resolution was not put to the vote at the Earlier Annual General Meeting under an earlier application of section 250V of the Corporations Act, |

then the Company must put to vote at the Later Annual General Meeting a resolution requiring Shareholders to vote on whether the Company must hold another general meeting (Spill Meeting) to consider the appointment of all of the Directors at the time the Directors Report was approved by the Board who must stand for re-appointment (other than the Managing Director) (Spill Resolution). The Spill Resolution may be passed as an ordinary resolution.

If the Spill Resolution is passed, the Spill Meeting must be held within 90 days after the Spill Resolution is passed. All of the Company’s Directors who were Directors at the time when the resolution to make the Directors’ Report was passed (excluding the Managing Director of the Company who may, in accordance with the ASX Listing Rules, continue to hold office indefinitely without being re-elected to the office) cease to hold office immediately before the end the Spill Meeting and may stand for re-election at the Spill Meeting.

At the Company’s 2016 annual general meeting, less than 25% of the eligible votes cast in respect of the 2016 remuneration report were cast against the adoption of the 2016 remuneration report. Accordingly, a Spill Resolution will not be put to the AGM even if 25% or more of the votes are cast against Resolution 2.

Section 250R(4) of the Corporations Act prohibits any votes on this Resolution being cast by any member of the Key Management Personnel whose remuneration details are disclosed in the Remuneration Report or any Closely Related Party of such a member. However, an exception to this prohibition exists to enable the Chairman to vote Shareholders’ undirected proxy votes. In this regard, you should note that if you appoint the Chairman as your proxy and you indicate on the proxy form that you do not wish to specify how the Chairman should vote on resolution 2, the Chairman will cast your votes in favour of Resolution 2.

If you wish to appoint the Chairman as your proxy but do NOT want your votes cast in favour of Resolution 2, you must indicate your voting intention by ticking the box marked either ‘against’ or ‘abstain’ opposite Resolution 2 on the Proxy Form.

| 6. | Resolution 3 – Approval of Additional 10% Placement Facility |

General

ASX Listing Rule 7.1A enables eligible entities to issue Equity Securities up to 10% of its issued ordinary share capital through placements over a 12 month period after the AGM (Additional 10% Placement Facility). The Additional 10% Placement Facility is in addition to the Company’s 15% placement capacity under Listing Rule 7.1.

For the purposes of Listing Rule 7.1A an eligible entity is one that, as at the date of the relevant annual general meeting:

| (a) | is not included in the A&P/ASX300 Index; and |

| (b) | has a market capitalisation of less than $300 million. |

The Company is an eligible entity as at the time of this Notice of Meeting and is expected to be an eligible entity as at the time of the Annual General Meeting.

The Company is now seeking shareholder approval by way of a special resolution to have the ability to issue Equity Securities under the Additional 10% Placement Facility. The exact number of Equity Securities to be issued under the Additional 10% Placement Facility will be determined in accordance with the formula prescribed in ASX Listing Rule 7.1A.2 (as set out below).

The effect of shareholders approving Resolution 3 will be to allow the Company to issue Equity Securities under Listing Rule 7.1A in addition to the Company’s 15% placement capacity under Listing Rule 7.1.

Resolution 3 is a special resolution, and accordingly at least 75% of votes cast by shareholders eligible to vote at the Annual General Meeting must be in favour of Resolution 3 for it to be passed.

Regulatory Requirements

In compliance with the information requirements of Listing Rule 7.3A, Shareholders are advised of the following information:

Equity securities issued under the Additional 10% Placement Facility must be in the same class as an existing class of quoted Equity Securities of the Company. As at the date of this Notice of Meeting, the Company has on issue one class of quoted Equity Securities, being Shares.

The issue price of Equity Securities issued under the Additional 10% Placement Facility must not be lower than 75% of the volume weighted average price for securities in the same class calculated over the 15 trading days on which trades in that class were conducted immediately before:

| (i) | the date on which the Equity Securities are issued; or |

| (ii) | the date on which the price of Equity Securities is agreed, provided that the issue is thereafter completed within 5 business days. |

As at the date of this Notice of Meeting, the Company has 3,283,000,444 Shares on issue. Accordingly, if Shareholders approve Resolution 3, the Company will have the capacity to issue approximately 328,300,044 Equity Securities under the Additional 10% Placement Facility in accordance with Listing Rule 7.1A.

The precise number of Equity Securities that the Company will have capacity to issue under Listing Rule 7.1A will be calculated at the date of issue of the Equity Securities in accordance with the following formula:

(A x D) – E

| A | is the number of fully paid shares on issue 12 months before the date of issue or agreement: |

| (A) | plus the number of fully paid shares issued in the 12 months under an exception in Listing Rule 7.2; |

| (B) | plus the number of partly paid shares that became fully paid in the 12 months; |

| (C) | plus the number of fully paid shares issued in the 12 months with approval of holders of shares under Listing Rule 7.1 and 7.4; |

| (D) | less the number of fully paid shares cancelled in the 12 months. |

Note that A is has the same meaning in Listing Rule 7.1 when calculating an entity's 15% placement capacity.

| E | is the number of Equity Securities issued or agreed to be issued under Listing Rule 7.1A.2 in the 12 months before the date of the issue or agreement to issue that are not issued with the approval of shareholders under Listing Rule 7.1 or 7.4. |

If Resolution 3 is approved by Shareholders and the Company issues Equity Securities under the Additional 10% Placement Facility, existing Shareholders' voting power in the Company will be diluted as shown in the table below. There is a risk that:

| (i) | the market price for the Company's Equity Securities may be significantly lower on the date of the issue of the Equity Securities than on the date of the Annual General Meeting; and |

| (ii) | the Equity Securities may be issued at a price that is at a discount to the market price for the Company's Equity Securities on the issue date or the Equity Securities are issued as part of consideration for the acquisition of a new asset, which may have an effect on the amount of funds raised by the issue of the Equity Securities. |

The below table shows the dilution of existing Shareholders on the basis of the current market price of Shares and the current number of ordinary securities for variable "A" calculated in accordance with the formula in Listing Rule 7.1A(2) as at the date of this Notice of Meeting.

The table also shows:

| (i) | two examples where variable “A” has increased, by 50% and 100%. Variable “A” is based on the number of ordinary securities the Company has on issue. The number of ordinary securities on issue may increase as a result of issues of ordinary securities that do not require Shareholder approval (for example, a pro rata entitlements issue or scrip issued under a takeover offer) or future specific placements under Listing Rule 7.1 that are approved at a future Shareholders’ meeting; and |

| (ii) | two examples of where the issue price of ordinary securities has decreased by 50% and increased by 50% as against the current market price. |

Variable “A” in Listing

Rule 7.1A.2 | | Dilution |

$0.0015 50% decrease

in Issue Price | $0.003 Issue Price | $0.006 100% increase

in Issue Price |

Current Variable A 3,283,000,444 Shares | Shares issued (10% Voting

Dilution) | 328,330,444

New Shares | 328,330,444

New Shares | 328,330,444

New Shares |

Funds raised | $492,450 | $984,900 | $1,969,800 |

50% increase in current

Variable A 4,924,500,666 Shares | Shares issued

(10% Voting

Dilution) | 492,450,066

New Shares | 492,450,066

New Shares | 492,450,066

New Shares |

Funds raised | $738,675 | $1,477,350 | $2,954,700 |

100% increase in current

Variable A 6,566,000,888 Shares | Shares issued

(10% Voting

Dilution) | 656,600,089

New Shares | 656,600,089

New Shares | 656,600,089

New Shares |

Funds raised | $984,900 | $1,969,800 | $3,939,600 |

The table has been prepared on the following assumptions:

| 1. | Variable A is 3,283,000,444 being the number of ordinary securities on issue at the date of this Notice of Meeting. |

| 2. | The Company issues the maximum number of Equity Securities available under the Additional 10% Placement Facility. |

| 3. | No Options are exercised into Shares before the date of issue of the Equity Securities; |

| 4. | The 10% voting dilution reflects the aggregate percentage dilution against the issued share capital at the time of issue. This is why the voting dilution is shown in each example as 10%. |

| 5. | The table does not show an example of dilution that may be caused to a particular Shareholder by reason of placements under the Additional 10% Placement Facility, based on that Shareholder’s holding at the date of the Meeting. All Shareholders should consider the dilution caused to their own shareholding depending on their specific circumstances. |

| 6. | The table shows only the effect of issues of Equity Securities under Listing Rule 7.1A, not under the 15% placement capacity under Listing Rule 7.1. |

| 7. | The issue of Equity Securities under the Additional 10% Placement Facility consists only of Shares. |

| 8. | The issue price is $0.003, being the closing price of the Shares on ASX on 18 October 2017. |

If Shareholders approve Resolution 3, the Company will have a mandate to issue Equity Securities under the Additional 10% Placement Facility under Listing Rule 7.1A from the date of the Annual General Meeting until the earlier of the following to occur:

| (i) | the date that is 12 months after the date of the Annual General Meeting; and |

| (ii) | the date of the approval by Shareholders of a transaction under Listing Rule 11.1.2 (a significant change to the nature or scale of activities) or 11.2 (disposal of main undertaking), (the Additional 10% Placement Period). |

The Company will only issue and allot Equity Securities during the Additional 10% Placement Period.The approval will cease to be valid in the event that Shareholders approve a transaction under Listing Rule 11.1.2 or 11.2.

The Company may seek to issue the Equity Securities for the following purposes:

| (i) | non-cash consideration for the acquisition of the new assets and investments. In such circumstances the Company will provide a valuation of the non-cash consideration as required by Listing Rule 7.1A.3; or |

| | | |

| | (ii) | cash consideration. In such circumstances, the Company intends to use the funds raised towards an acquisition of new assets or investments (including expense associated with such acquisition), continued exploration and development programs and to provide additional of the Company’s current assets and/or general working capital. |

The Company will provide further information at the time of issue of any Equity Securities under the Additional 10% Placement Facility in compliance with its disclosure obligations under Listing Rules 7.1A.4 and 3.10.5A.

The Company’s allocation policy is dependent on the prevailing market conditions at the time of any proposed issue pursuant to the Additional 10% Placement Facility. The identity of the allottees of Equity Securities will be determined on a case-by-case basis having regard to the factors including but not limited to the following:

| (i) | the methods of raising funds that are available to the Company, including but not limited to, rights issue or other issues in which existing security holders can participate; |

| (ii) | the effect of the issue of the Equity Securities on the control of the Company; |

| (iii) | the financial situation and solvency of the Company; and |

| (iv) | advice from corporate, financial and broking advisers (if applicable). |

The allottees under the Additional 10% Placement Facility have not been determined as at the date of this Notice of Meeting but may include existing substantial Shareholders and/or new Shareholders who are not related parties or associates of a related party of the Company.

Further, if the Company is successful in acquiring new oil and gas assets or investments, it is likely that the allottees under the 10% Placement Facility will be the vendors of the new oil and gas assets or investments.

| (f) | Previous issues of Equity Securities under Listing Rule 7.1A |

The Company has not previously obtained Shareholder approval under Listing Rule 7.1A and accordingly has not issued any Equity Securities pursuant to Listing Rule 7.1A in the 12 months preceding the date of the Annual General Meeting.

| (g) | Voting exclusion statement |

A voting exclusion statement for Resolution 3 is included in the Notice of Meeting preceding this Explanatory Memorandum.

At the date of the Notice of Meeting, the Company has not approached any particular existing security holder or an identifiable class of existing security holders to participate in the issue of the Equity Securities. No existing Shareholder's votes will therefore be excluded for this purpose.

In these circumstances (and in accordance with the note set out in ASX Listing Rule 14.11.1 relating to ASX Listing Rules 7.1 and 7.1A), for a person’s vote to be excluded, it must be known that that person will participate in the proposed issue. Where it is not known who will participate in the proposed issue (as is the case in respect of any Equity Securities issued under the Additional 10% Placement Facility), Shareholders must consider the proposal on the basis that they may or may not get a benefit and that it is possible that their holding will be diluted, and there is no reason to exclude their votes.

No existing Shareholder's votes will therefore be excluded under the voting exclusion in the Notice of Annual General Meeting.

Board Recommendation

The Board believes that the Additional 10% Placement Facility is beneficial for the Company as it will give the Company the flexibility to issue further securities representing up to 10% of the Company’s share capital during the next 12 months. Accordingly, the Board unanimously recommends that Shareholders approve Resolution 3.

| 7. | Resolution 4 – Adoption of New Constitution. |

Background

The Company’s existing Constitution was adopted on 9 December 2005. The Constitution has not been subject to a comprehensive review or update since that date and the Directors considered it appropriate to review the Constitution to ensure it reflects the current provisions of the Corporations Act and the ASX Listing Rules.

The Board recommends that the Company’s existing Constitution be replaced to address specific matters that the Board considers to be in the best interests of the Company, and to promote the efficient running of the Company which should be of long term benefit to the Company and its Shareholders.

In light of the number of changes being proposed to various parts of the existing Constitution and the fact that some of these changes are of a non-substantive nature, the Board has decided that it is most appropriate to adopt a new constitution rather than approving numerous amendments to the existing Constitution.

It is not practical to list all the changes to the Constitution in this statement and Shareholders are invited to contact the Company if they have any queries or concerns. However, the proposed changes that the Board considers more significant for shareholders are described below. In the discussion below, references to clauses are to clauses in the proposed new Constitution, unless stated otherwise.

A copy of the proposed new Constitution can be obtained prior to the AGM by contacting the Company. A copy of the new Constitution will also be available for inspection at the AGM.

Regulatory requirements

Under section 136(2) of the Corporations Act, a company may modify or repeal its constitution or a provision of its constitution by a special resolution of its shareholders.

If the resolution is passed, the new Constitution will take effect immediately.

Material changes to the Constitution

The material changes to the existing Constitution are outlined below.

Issue and transfer of Shares

Consistent with the existing Constitution, the new Constitution provides that the Company may issue preference shares. The terms of the preference shares continue to be on standard terms compliant with the requirements of the Corporations Act and the ASX Listing Rules. The main change proposed in the new Constitution is to permit the issue of preference shares on terms which allow conversion into ordinary shares.

Directors

The new Constitution provides that the minimum number of directors of the Company will be three, consistent with the Company’s obligations under the Corporations Act. The existing Constitution contemplated there being a minimum number greater than three, which has been removed in the new Constitution.

The existing Constitution does not stipulate any maximum number of directors of the Company. It is proposed to introduce a maximum of 8 (not including alternate directors) under the new Constitution.

Under the new Constitution, Directors will be required to retire no later than the third annual general meeting following their last election or appointment. Under the existing Constitution, one third of the Directors are required to retire at each annual general meeting. The new provision reflects common director rotation provisions amongst listed companies and is in line with the relevant Listing Rules.

Dividends

Following amendments to the Corporations Act, companies are no longer restricted to paying dividends out of profits. Accordingly, the new Constitution removes the requirement for dividends to be paid out of the profits of the Company.

The new Constitution provides that directors may determine that a dividend is payable and fix the amount, time and method of payment.

The new Constitution expands on the methods which dividends can be paid to include electronic funds transfer and any other means determined by the directors. This provides a more secure, convenient and cost effective payment method for both the Company and its shareholders.

Proportional Takeovers

| (e) | Inclusion of proportional takeover provisions |

The Corporations Act permits a company to include in its constitution provisions prohibiting the registration of a transfer of securities resulting from a proportional takeover bid, unless the relevant shareholders in general meeting approve the bid.

It is a requirement of the Corporations Act that such provisions in a company’s constitution apply for a maximum period of three years, unless earlier renewed. In the case of the Company, the existing Constitution does not contain any such provisions.

The Board has resolved to include proportional takeover provisions in the new Constitution and accordingly, a special resolution is being put to shareholders under section 648G of the Corporations Act (together with the special resolution being put to shareholders under section 136(2) of the Corporations Act in relation to the new Constitution as a whole) to insert the proportional takeover provisions which are contained in clause 9 of the new Constitution.

If approved by shareholders at the AGM, clause 9 will operate for three years from the date of the meeting, unless renewed earlier. The effect of clause 9, if approved, will be that where a proportional takeover bid is made for shares in the Company (i.e. a bid is made for a specified proportion, but not all, of each holder’s bid class securities), the Board must convene a meeting of holders of the relevant shares to vote on a resolution to approve that bid. The meeting must be held, and the resolution voted on, at least 15 days before the offer period under the bid closes. To be passed, the resolution must be approved by a majority of votes at the meeting, excluding votes by the bidder and its associates. However, the Corporations Act also provides that, if the meeting is not held within the time required, then a resolution to approve the proportional takeover bid will be deemed to have been passed.

If the resolution to approve the proportional takeover bid is passed or deemed to have been passed, the transfer of shares resulting from acceptance of an offer under that bid will be permitted, and the transfers registered, subject to the Corporations Act and the new Constitution of the Company. If the resolution is rejected, the registration of any transfer of shares resulting from an offer under the proportional takeover bid will be prohibited, and the bid deemed to be withdrawn.

Clause 9 will not apply to full takeover bids.

In the Board’s view, the relevant shareholders (that is, shareholders other than the bidder and its associates) should have the opportunity to vote on a proposed proportional takeover bid. A proportional takeover bid for the Company may enable control of the Company to be acquired by a party holding less than a majority interest. As a result, the relevant shareholders may not have the opportunity to dispose of all their shares, and risk being part of a minority interest in the Company or suffering loss if the takeover bid causes a decrease in the market price of the shares or makes the shares less attractive and, accordingly, more difficult to sell. Clause 9 would only permit this to occur with the approval of a majority of the relevant shareholders.

For the relevant shareholders, the potential advantages of clause 9 are that it will provide them with the opportunity to consider, discuss in a meeting called specifically for the purpose, and vote on whether a proportional takeover bid should be approved. This affords the relevant shareholders an opportunity to have a say in the future ownership and control of the Company and help the shareholders avoid being locked into a minority.

The Board believes this will encourage any proportional takeover bid to be structured so as to be attractive to at least a majority of the relevant shareholders. It may also discourage the making of a proportional takeover bid that might be considered opportunistic. Finally, knowing the view of a majority of the relevant shareholders may help each individual shareholder to assess the likely outcome of the proportional takeover bid and decide whether or not to accept an offer under the bid.

On the other hand, a potential disadvantage for the relevant shareholders arising from clause 9 is that proportional takeover bids may be discouraged by the further procedural steps that the clause will entail and, accordingly, this may reduce any takeover speculation element in the price of the Company’s Shares. Shareholders may be denied an opportunity to sell a portion of their shares at an attractive price where the majority rejects an offer from persons seeking control of the Company.

The Company’s directors do not consider that there are any advantages or disadvantages specific to the directors in relation to the proposed clause 9. The Board will continue to remain free to make a recommendation to shareholders as to whether a proportional takeover bid should be accepted.

As at the date of this Notice of Meeting, none of the directors are aware of any proposal by a person to acquire, or to increase the extent of, a substantial interest in the Company.

General meetings

The new Constitution removes express references as to who may demand a poll, as this is codified in the Corporations Act and the Constitution would otherwise require amendment if there are future legislative changes. Currently, the relevant section of the Corporations Act dealing with the calling of a poll (section 250L) reflects the position in the existing Constitution in that a poll may be demanded by:

| (i) | at least 5 members entitled to vote on the resolution; or |

| (ii) | members with at least 5% of the votes that may be cast on the resolution on a poll; or |

| (g) | Conduct of the chairman |

The new Constitution contains new provisions which expressly provide that the chairman of a general meeting has charge of the meeting and outlines specific powers of the chair including their ability to require attendees to comply with security arrangements before they are admitted to the meeting, and adjourn or cancel the meeting if in their opinion the meeting has become so unruly or disorderly that it cannot be conducted in a proper and orderly manner.

Other amendments

There are a number of other differences between the existing and new Constitutions that are not summarised or referred to above because they do not materially alter the effect of the existing Constitution for shareholders. These include changes:

| (a) | to update provisions to reflect the current position under the Corporations Act, Listing Rules and other applicable rules; |

| (b) | of a drafting, procedural or administrative nature; |

| (c) | to remove outdated and redundant provisions; and |

| (d) | to update names and definitions to reflect current terminology, although where possible the defined terms in the Corporations Act are relied on. |

In addition, where appropriate, the new Constitution removes duplication of existing requirements under the Corporations Act or the Listing Rules, which would otherwise require amendments if there are future legislative or regulatory changes.

Board Recommendation

The Board unanimously recommends that Shareholders approve Resolution 4.

| 8. | Resolution 5 – Approval of Future Issue of Shares. |

Background

Resolution 5 seeks Shareholder approval for the issue of up to 2,000,000,000 Shares, at a price of no less than $0.0012 per Share, to investors not classified as related parties of the Company under the ASX Listing Rules. If the new Constitution is approved pursuant to Resolution 4, the Company may instead issue 2,000,000,000 preference shares, convertible to Shares at a 1-to-1 ratio, at a price of no less than $0.0012 per preference share.

The purpose of Resolution 5 is to enable the Company to raise additional capital by means of an equity placement or placements in order to ensure compliance with the continued listing requirements of the NYSE American Stock Exchange and assist with the Company’s funding needs and other corporate activities without utilising the Company's 15% placement capacity under Listing Rule 7.1 or the Additional 10% Placement Capacity (in the event Resolution 3 is approved by Shareholders).

Listing Rule 7.1

Listing Rule 7.1 provides that, unless an exemption applies, a company must not, without prior approval of shareholders, issue or agree to issue securities if the securities will in themselves or when aggregated with any securities issued by the company during the previous 12 months, exceed 15% of the number of ordinary securities on issue at the commencement of that 12-month period.

Resolution 5

If Shareholders do not approve Resolution 5 and the Company seeks to raise further funds through an issue of equity securities exceeding its 15% placement capacity (and, if Resolution 3 is approved by Shareholders, the Additional 10% Placement Facility), it would need to call another general meeting to approve that issue.

Under Australian law, if a single investor (or group of associated investors) would acquire a voting power in the Company of more than 20% as a result of a placement, the Company must obtain an independent expert’s report stating whether the acquisition is fair and reasonable to the other Shareholders, and the acquisition must be approved by an ordinary resolution of Shareholders on which. no votes are cast by the acquirer or its associates. It is unknown at this stage whether the Shares the subject of Resolution 5 will be issued to a single investor (or group of associated investors) and hence whether this additional approval will be required.

If Shareholders approve Resolutions 3 and 5, the Company will be authorized to issue 2,000,000,000 Shares at a price of no less than A$0.0012 per ordinary share plus Shares representing an additional 10% of the expanded capital. However, even if Shareholders approve both Resolutions 3 and 5, the Company may choose to forego the issuance of the 2,000,000,000 Shares, at a price of no less than A$0.0012 per Share in reliance on Resolution 5 and instead utilise the Additional 10% Placement Capacity and the existing 15% placement capacity on terms the Board deems reasonable.

Information requirements for Resolution 5

In compliance with the information requirements of Listing Rule 7.3, Shareholders are advised of the following information in relation to Resolution 5:

| (1) | The maximum number of Shares to be issued will be up to 2,000,000,000. The issue could comprise 2,000,000,000 fully paid ordinary shares or, if thenew Constitution is approved pursuant to Resolution 4, the Company might instead issue 2,000,000,000 preference shares, convertible to ordinary shares at a 1-to-1 ratio, at a price of no less than $0.0012 per share. |

| (2) | The shares will be issued by no later than three months after the date of the AGM. |

The issue price will be at least 80% of the volume-weighted average market price for Shares, calculated over the last five days on which sales in Shares are recorded on the ASX before the day on which the issue is made or, if there is a prospectus, product disclosure statement or offer information statement relating to the issue, over the last five days on which sales of Shares are recorded before the date on which the prospectus, product disclosure statement or offer information statement is signed. In the event the Company issues preference shares, such shares will beconvertible to Shares at a 1-to-1 ratio.

| (3) | The Shares will be issued to professional and/or sophisticated investors that are not related parties of the Company. |

| (4) | The Shares will be either: |

| a. | fully paid ordinary shares in the capital of the Company and will upon issue rank equally in all respects with the existing Shares. The Company will apply to ASX for official quotation of such Shares; or |

| b. | preference shares issued in accordance with the Company’s Constitution (if thenew Constitution is approved pursuant to Resolution 4) whichwill beconvertible to Shares at a 1-to-1 ratio. |

| (5) | Funds raised from the issue of Shares will be used to ensure compliance with the continued listing requirements of the NYSE American Stock Exchange, for exploration and development of the Foreman Butte Project and general working capital. |

| (6) | The Directors have not yet determined the final issue date (if any) of the Shares the subject of Resolution 5. However, any issue of Shares will occur by no later than three months after the date of the AGM, and the Shares may be issued progressively. |

| (7) | A voting exclusion statement for Resolution 5 is included in the Notice of Meeting. |

Board Recommendation

The Board unanimously recommends Shareholders vote in favour of Resolution 5.

| 9. | Resolution 6 - Advisory Vote on “Named Executive Officer” Compensation |

The advisory vote being put to Shareholders is for US regulatory purposes only and is not a requirement of either the Corporations Act or the ASX Listing Rules. An explanation of the resolution is set out in Annexure "A".

Board Recommendation

The Board unanimously recommends that you vote in favour of Resolution 6.

| 10. | Resolution 7 – Advisory Vote on the Frequency of Future Advisory Votes on Named Executive Officer Compensation |

The advisory vote being put to Shareholders is for US regulatory purposes only and is not a requirement of either the Corporations Act or the ASX Listing Rules. An explanation of the resolution is set out in Annexure "A".

Board Recommendation

The Board unanimously recommends that you vote to hold an advisory vote on named executive officer compensation “Every Year.”

| 11. | Action to be taken by Shareholders |

Shareholders should read this Explanatory Memorandum carefully before deciding how to vote on the resolutions set out in the Notice of Meeting.

Attached to the Notice of Meeting is a proxy form for use by Shareholders. All Shareholders are invited and encouraged to attend the AGM or, if they are unable to attend in person, to complete, sign and return the proxy form to the Company in accordance with the instructions contained in the proxy form and the Notice of Meeting. Lodgment of a proxy form will not preclude a Shareholder from attending and voting at the AGM in person.

ANNEXURE “A”

SCHEDULE 14A PROXY STATEMENT

pursuant to the U.S. Securities Exchange Act of 1934

GENERAL INFORMATION

Proxy Solicitation

This proxy statement, in the form mandated by the U.S. Securities and Exchange Commission (the “SEC”) under United States securities laws (this “U.S. Proxy Statement”), is being furnished by the Board of Directors (the “Board”) of Samson Oil & Gas Limited, an Australian corporation (“we,” “us,” “Samson” or the “Company”), in connection with our solicitation of proxies for Samson’s annual general meeting of shareholders to be held at Level 1, AMP Building, 140 St. Georges Terrace, Perth, Western Australia 6000 on Thursday, November 30, 2017 at 11:00 a.m. Western Australian Standard Time, and at any adjournments or postponements thereof (the “Annual General Meeting”). The information contained in this U.S. Proxy Statement supplements the information provided to holders of ordinary shares in the Notice of Annual General Meeting and the accompanying Explanatory Memorandum to Shareholders (“Explanatory Memorandum”) and proxy form.

In addition to solicitation by mail, certain of our directors, officers and employees may, to the extent permitted by Australian law, solicit proxies by telephone, personal contact, or other means of communication. They will not receive any additional compensation for these activities. Also, brokers, banks and other persons holding ordinary shares or American Depositary Shares (“ADSs”) representing ownership of ordinary shares on behalf of beneficial owners will be requested to solicit proxies or authorizations from beneficial owners. To the extent permitted by Australian law, we will bear all costs incurred in connection with the preparation, assembly and mailing of the proxy materials and the solicitation of proxies and will reimburse brokers, banks and other nominees, fiduciaries and custodians for reasonable expenses incurred by them in forwarding proxy materials to beneficial owners of our ordinary shares or ADSs.

This U.S. Proxy Statement and accompanying proxy materials are expected to be first sent to our ordinary shareholders on or about October 6, 2017, and are also available at http://www.samsonoilandgas.com.

Business of the Annual General Meeting

At the Annual General Meeting, shareholders will:

| · | Receive, consider and discuss the Company’s financial statements for the year ended June 30, 2017 and the reports of the directors and auditors on those statements. |

| · | Be asked to consider resolutions to: |

| | o | Approve the re-election of Dr. Peter Hill; |

| | o | Approve the adoption of the Remuneration Report, which is attached asExhibit A; |

| | | |

| | o | Approval of additional 10% placement facility; |

| | o | Adoption of a new Constitution, which is attached asExhibit B; |

| | o | Approval of the future issuance of up to $2,000,000,000 ordinary shares; |

| | o | Approve, on an advisory basis, named executive officer compensation; and |

| | o | Approve, on an advisory basis, the frequency of future advisory votes on named executive officer compensation. |

The matters described in this U.S. Proxy Statement constitute the only business that the Board intends to present or is informed that others will present at the meeting. The proxy does, however, confer discretionary authority upon the Chairman of the Annual General Meeting to vote on any other business that may properly come before the meeting.

Shareholders Entitled to Vote

October 2, 2017 has been fixed as the record date for the determination of holders of ordinary shares entitled to vote at the Annual General Meeting, however ordinary shareholders voting by proxy must return their proxy form to the Company at least 48 hours prior to the Annual General Meeting in order for their votes to be counted. Each ordinary share is entitled to one vote. Votes may not be cumulated.

3,283,000,444 ordinary shares, no par value, were issued and outstanding as of September 22, 2017, of which 2,300,658,200 were held in the form of 11,503,291 ADSs. Each ADS represents 200 ordinary shares.

Under our constitution, the quorum for a meeting of holders of ordinary shares is two holders of ordinary shares.

For purposes of determining the number of shares that have been cast for a resolution, a vote of “Abstain” does not increase the number of shares needed to achieve a majority vote. Abstentions are treated as if the shares so voted are not present at the vote on such resolution.

Each ADS holder may vote the ordinary shares underlying their ADSs in accordance with the deposit agreement among us, the depositary and the ADS holders (the “Deposit Agreement”). ADS holders should read “Differences between ADS Holders and Ordinary Shareholders” directly below.

Differences between ADS Holders and Ordinary Shareholders

The Bank of New York Mellon, as depositary, executes and delivers ADSs on our behalf. We are requesting the depositary, which holds the ordinary shares underlying the ADSs, to seek ADS holders’ instructions as to voting for the Annual General Meeting. As a result, ADS holders may instruct the depositary to vote the ordinary shares underlying their ADSs. The depositary establishes the ADS record date. The depositary has set the ADS record date for the Annual General Meeting as October 2, 2017.

Because we have asked the depositary to seek the instructions of ADS holders, the depositary will notify ADS holders of the upcoming vote and arrange to deliver our voting materials and form of notice to them. The depositary then tries, as far as practicable, subject to Australian law and the terms of the Deposit Agreement, to vote the ordinary shares as our ADS holders instruct. The depositary does not vote or attempt to exercise the right to vote other than in accordance with the instructions of the ADS holders. We cannot guarantee that ADS holders will receive this U.S. Proxy Statement and the other proxy materials from the depositary in time to permit them to instruct the depositary to vote their shares. In addition, there may be other circumstances in which ADS holders may not be able to exercise voting rights. Furthermore, ADS holders can exercise their right to vote the ordinary shares underlying their ADSs by exchanging their ADSs for ordinary shares. However, even though we are subject to U.S. domestic issuer proxy rules and announcements of our shareholder meetings are made by press release and filed with the SEC, ADS holders may not know about the meeting early enough to exchange their ADSs for ordinary shares.

ADS holders are not required to be treated as holders of ordinary shares and do not have the rights of holders of ordinary shares. The Deposit Agreement sets out ADS holder rights as well as the rights and obligations of the depositary. New York State law governs the Deposit Agreement and the ADSs.

Differences between Holding Shares of Record and as a Beneficial Owner

If your ordinary shares are registered directly in your name with our transfer agent, Security Transfer Registrars Pty Ltd, you are considered, with respect to those shares, the shareholder of record, and we are sending this U.S. Proxy Statement and the other proxy materials directly to you. As the shareholder of record, you have the right to grant your voting proxy directly to the named proxy holder or to vote in person at the meeting. We have enclosed a proxy form for you to use.

Most holders of ordinary shares hold their ordinary shares through a broker or other nominee rather than directly in their own name. If your ordinary shares are held in a brokerage account or by another nominee, you are considered the beneficial owner of the ordinary shares even though they are held in “street name,” and these proxy materials should be forwarded to you by the broker, trustee or nominee together with a voting instruction card. As the beneficial owner, you have the right to direct your broker, trustee or nominee how to vote and you are also invited to attend the Annual General Meeting. Since a beneficial owner is not the shareholder of record, you may not vote these shares in person at the meeting unless you obtain a “legal proxy” from the broker, trustee or nominee that holds your shares, giving you the right to vote the shares at the meeting. Your broker, trustee or nominee has enclosed or provided voting instructions for you to use in directing the broker, trustee or nominee how to vote your shares.

If you are an ADS holder and your ADSs are held in a brokerage account or by another nominee, this U.S. Proxy Statement and the other proxy materials are being forwarded to you together with a voting instruction card by your broker or nominee (who received the proxy materials from the depositary). As the beneficial owner of the ADSs, you have the right to direct your broker or nominee, and hence the depositary, how to vote the ordinary shares underlying your ADSs. You are also invited to attend the Annual General Meeting in person as provided below.

Attending the Annual General Meeting

All holders of record of ordinary shares and all ADS holders as of the record date, or their duly appointed proxies, may attend the Annual General Meeting. If you are a beneficial owner of ordinary shares holding your shares through a broker or nominee (i.e., in street name) or you are an ADS holder, you may be asked to provide proof of your share ownership on the record date, such as a current account statement, a copy of the voting instruction card provided by your broker, trustee or nominee or the depositary, or other similar evidence, in order to be admitted to the meeting.

Voting in Person at the Annual General Meeting

Ordinary shares held in your name as the shareholder of record may be voted in person at the Annual General Meeting. Ordinary shares held beneficially in street name may be voted in person only if you obtain a legal proxy from the broker, trustee or nominee that holds your shares giving you the right to vote the shares. Even if you plan to attend the Annual General Meeting, we recommend that you also submit your proxy or voting instructions prior to the meeting as described below so that your vote will be counted if you later decide not to attend the meeting. ADS holders will not be able to vote in person at the Annual General Meeting unless they receive a proxy from the depositary (the sole record holder of ADSs). Instructions for obtaining a proxy from the depositary are included in the material that the depositary sends to ADS holders.

Voting Without Attending the Annual General Meeting

Whether you hold shares directly as an ordinary shareholder of record or beneficially in street name, you may direct how your shares are voted without attending the Annual General Meeting. Ordinary shareholders of record may complete and return the enclosed proxy form or may appoint another proxy to vote their shares, as described in the Notice of Annual General Meeting. Beneficial owners of ordinary shares and holders of ADSs may direct how your shares are voted without attending the Annual General Meeting by following the instructions in the voting instruction card provided by your broker, trustee, or depositary, as applicable. The Chairman has stated that he intends to vote all shares in respect of which he has been appointed proxy but without direction as to how to vote the shares in favor of all resolutions considered at the meeting. Accordingly, shareholders who do not wish their shares to be voted by the Chairman as proxy in favor of the resolutions expected to be considered should either direct the Chairman how they wish their shares to be voted, appoint another proxy to vote their shares in accordance with the directions on the proxy form, or attend the Annual General Meeting in person to vote their shares.

Revocation of Proxies

Holders of ordinary shares can revoke their proxy at any time before it is voted at the Annual General Meeting by either:

| · | Submitting another timely, later–dated proxy by mail; |

| · | Delivering timely written notice of revocation to our Secretary; or |

| · | Attending the Annual General Meeting and voting in person. |

If your ordinary shares are held beneficially in street name or you are an ADS holder, you may revoke your proxy by following the instructions provided by your broker, trustee, nominee or depositary, as applicable.

Absence of Appraisal Rights

We are incorporated under the laws of Australia and, accordingly, are subject to the Australian Corporations Act (the “Corporations Act”). Under the Corporations Act, our shareholders are not entitled to appraisal rights with respect to any of the proposals to be acted upon at the Annual General Meeting.

RESOLUTIONS TO BE VOTED ON

Note: The exact text of each resolution is set forth in the Notice of Annual General Meeting: Agenda.

Resolution 1—Re-election of Director.

The Board has nominated Dr. Peter Hill to stand for re-election at the Annual General Meeting. Directors whose terms of office will not expire at the Annual General Meeting will continue in office for the remainder of their respective terms. Under our constitution, the number of directors on the Board is determined by a resolution of the Board, but will not be fewer than three directors.

In accordance with Rule 3.6(a) of our constitution, at each Annual General Meeting, one-third of the directors (excluding the managing director) must retire from office. Each director, assuming he or she is still eligible, is entitled to offer himself or herself for re-election as a director at the Annual General Meeting which coincides with his or her retirement. The Board currently consists of four directors: Mr. Channon; Dr. Peter Hill, Mr. Denis Rakich, and managing director Mr. Terence Barr.

You may vote “For,” “Against” or “Abstain” on Resolution 1. Members of the Board are elected by a simple majority of votes cast on the ordinary resolution, either in person or by proxy. There is no minimum number of votes required to pass an ordinary resolution electing a director. Neither broker non–votes nor abstentions will affect the outcome of the resolution.

The Board recommends Shareholders vote in favor of Resolution 1.

Board of Directors

The following table sets forth certain information regarding the composition of the Board:

Name | | Age | | Position | | Director

Since | | Current Term

to Expire (Year

Eligible for

Reelection) |

| Nominees | | | | | | | | |

| Peter Hill | | 70 | | Director | | 2016 | | 2017 |

| | | | | | | | | |

| Other Directors | | | | | | | | |

| Terence Barr | | 68 | | Director | | 2005 | | N/A |

| Denis Rakich | | 64 | | Director | | 2016 | | 2018 |

| Greg Channon | | 54 | | Director | | 2016 | | 2019 |

Dr. Peter Hill, 70, has over 40 years of experience in the oil industry. He commenced his career in 1972 and spent 22 years in senior positions at British Petroleum including Chief Geologist, Chief of Staff for BP Exploration, President of BP Venezuela and Regional Director for Central and South America. Dr. Hill then worked as Vice President of Exploration at Ranger Oil Ltd. in England (1994-1995), Managing Director Exploration and Production at Deminex GMBH Oil in Germany (1995-1997), Technical Director/Chief Operating Officer at Hardy Oil & Gas plc (1998-2000), President and Chief Executive Officer at Harvest Natural Resources, Inc. (2000-2005), Director/Chairman at Austral Pacific Energy Ltd. (2006-2008), independent advisor to Palo Alto Investors (January 2008 to December 2009), Non-Executive Chairman at Toreador Resources Corporation (January 2009 to April 2011), Director of Midstates Petroleum Company, Inc. (April 2013 to March 2015), and interim President and Chief Executive Officer of Midstates Petroleum Company, Inc. (March 2014 to March 2015). Dr. Hill has served as a director of Triangle Petroleum Corporation since November 2009 and as Chairman of the Board since April 2012. From April 2012 to February 2013, Dr. Hill served as Triangle Petroleum Corporation’s Executive Chairman, having served previously as Chief Executive Officer of Triangle since November 2009 and President and Chief Executive Officer of Triangle from November 2009 until May 2011. Dr. Hill has a B.Sc. (Honors) in Geology and a Ph.D. Dr. Hill’s qualifications to sit on the Board of Directors include significant public company governance experience, significant experience as an exploration geologist and over 20 years of general management experience.

Key Attributes, Experience and Skills: Dr. Hill has provided advisory and consultancy roles to hedge funds, banks, and companies involved in the upstream oil and gas sector. He has also held non-executive board positions, Chairman, and been involved in international negotiations at government level. His extensive experience in management, corporate leadership, non-executive directorship and consulting, combined with technical expertise, has provided the skills necessary to lead, build teams and deliver business success. His career path to date is a proven track record of significant value creation for all stakeholders served. The Board has determined that Dr. Hill is currently and, if re-elected to the Board would qualify as an independent director under NYSE American rules.

Other Public Company Board Service: Benton Oil and Gas / Harvest Natural Resources from 2000 to 2006; Austral Pacific from 2006 to 2008.

Recent Past Public Company Board Service: Torreador Resources from January 2009 to April 2011; Midstates Petroleum from April 2013 to March 2015; Triangle Petroleum Corporation from November, 2009 to present.

Terence Barr, 68, was appointed Managing Director, Chief Executive Officer and President of the Company in January 2005. Mr. Barr is a petroleum geologist with over 40 years of experience, including 11 years with Santos. In recent years, he has specialized in tight gas exploration, drilling, and completion, and is considered an expert in this field. Prior to joining the Company, Mr. Barr was employed as Managing Director by Ausam Resources from 1999 to 2003 and was the owner of Barco Exploration from 2003 to 2005. The Board has determined that Mr. Barr does not qualify as an independent director under NYSE American rules due to Mr. Barr’s role as the Company’s Chief Executive Officer.

Key Attributes, Experience and Skills: Mr. Barr brings to the Board, among his other skills and qualifications, significant experience in the oil and natural gas industry that he gained while serving as an executive for the Company, Ausam Resources, and Barco Exploration. With over 40 years of experience, he is considered an expert in the oil and natural gas field. In light of the foregoing, our Board has concluded that Mr. Barr is well–qualified to serve as a director of the Company and as its Managing Director.

Other Public Company Board Service: None.

Recent Past Public Company Board Service: None.

Denis Rakich, 64, was appointed Company Secretary of Samson Oil & Gas Limited on June 18, 1998. In this role, Mr. Rakich is responsible for the legal, financial and corporate management of the Company.

Key Attributes, Experience and Skills: Mr. Rakich is an accountant with extensive corporate experience within the petroleum services, petroleum and mineral production and exploration industries. Mr. Rakich has had over 30 years’ experience in the management of public companies listed on the ASX with extensive knowledge of the ASX Listing Rules and Corporations Act within Australia. He is a member of the Australian Society of Accountants. The Board has determined that Mr. Rakich does not qualify as an independent director under NYSE American rules due to Mr. Rakich’s role as the Company’s Secretary.

Other Public Company Board Service: Mr. Rakich is a Director and Company Secretary for Ausgold Ltd. (ASX: AUC), an Australian public company in the resources sector. He is also Director and Company Secretary of Fortune Minerals Limited, a private Australian company.

Recent Past Public Company Board Service: Mr. Rakich has served as an officer or director the following ASX listed public companies:

| · | Marymia Exploration N.L. – Director / Company Secretary (1988 – November 2001) |

| · | Reliance Mining Limited – Director / Company Secretary (February 2003 – August 2004) |

| · | Senex Energy Ltd (formerly Victoria Petroleum N.L.) – Company Secretary (June 1988 – June 2010) |

| · | A-Cap Resources Limited – Company Secretary (2010 – July 2015) |