SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

[x] Filed by the Registrant

[ ] Filed by a Party other than the Registrant

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[x] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material Pursuant to Section 240.14a -11(c) or Section 240.14a -12

Revett Minerals Inc.

(Name of Registrant as Specified in Its Charter)

Commission File Number:

Not Applicable

(Name of Persons Filing Proxy Statement If Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[x] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

| | 1) | Title of each class of securities to which transaction applies: |

| | | |

| | | |

| | 2) | Aggregate number of securities to which transaction applies: |

| | | |

| | | |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | | |

| | 4) | Proposed maximum aggregate value of transaction: |

| | | |

| [ ] | Fee paid previously with preliminary materials. |

| | |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | | |

| | | |

| | 2) | Form, Schedule or Registration Statement No.: |

| | | |

| | | |

| | 3) | Filing Party: |

| | | |

| | | |

| | 4) | Date Filed: |

REVETT MINERALS INC.

NOTICE OF THE ANNUAL AND SPECIAL MEETING

OF SHAREHOLDERS

NOTICE is hereby given that the annual and special meeting (the “Meeting”) of the shareholders of Revett Minerals Inc. (the “Company”) will be held at the Cambridge Suites Hotel, 15 Richmond Street East, Toronto, Ontario, M5C 1N2 on June 16, 2009 at 10:00 a.m. (Eastern Daylight Time), for the following purposes:

| | 1. | To receive the financial statements of the Company for the financial year ended December 31, 2008 and the report of the auditors thereon. |

| | | |

| | 2. | To elect directors. |

| | | |

| | 3. | To appoint auditors and to authorize the directors to fix their remuneration. |

| | | |

| | 4. | To consider, and if deemed desirable, to approve, confirm and ratify an amendment to the Company’s equity incentive plan to increase the maximum number of common shares of the Company that may be reserved for issuance upon the exercise of the options duly granted under the Company’s equity incentive plan, as more particularly described in the Management Information Circular. |

| | | |

| | 5. | To transact such further and other business as may properly come before the Meeting or any adjournment or adjournments thereof. |

A shareholder wishing to be represented by proxy at the Meeting or any adjournment thereof must deposit his or her duly executed form of proxy with the Company’s transfer agent and registrar, Computershare Investor Services Inc., 9th Floor, 100 University Avenue, Toronto, Ontario, M5J 2Y1, Attention: Proxy Department, or by facsimile to (416) 263-9524 or 1-866-249-7775 not later than 5:00 p.m. (Eastern Daylight Time) on June 12, 2009 or, if the Meeting is adjourned, 48 hours (excluding Saturdays and holidays) before any adjournment of the Meeting. A shareholder may also vote by telephone or via the Internet by following the instructions on the form of proxy. If a shareholder votes by telephone or via the Internet, completion or return of the proxy form is not needed. The directors of the Company have fixed the close of business on May 12, 2009 as the record date for the determination of the shareholders of the Company entitled to receive notice of the Meeting.

A Management Information Circular and form of proxy accompany this Notice.

DATED the 7th day of May, 2009.

By Order of the Board

/s/ Ken Eickerman

Kenneth Eickerman

Chief Financial Officer and

Secretary

REVETT MINERALS INC.

MANAGEMENT INFORMATION CIRCULAR

PART ONE - VOTING INFORMATION

SOLICITATION OF PROXIES

This Management Information Circular (the “Circular”) is furnished in connection with the solicitation by management of Revett Minerals Inc. (the “Company”) of proxies to be used at the annual and special meeting of shareholders of the Company (the “Meeting”) to be held on June 16, 2009, at the time and place and for the purposes set forth in the accompanying Notice of Meeting (the “Notice”).It is expected that the solicitation will be primarily by mail, but proxies may also be solicited personally or by telephone by the directors, officers and employees of the Company who will not receive any additional compensation for such services. The cost of solicitation by management will be borne by the Company.

APPOINTMENT AND REVOCATION OF PROXIES

The persons named in the enclosed form of proxy are directors and officers of the Company.A shareholder desiring to appoint some other person (who need not be a shareholder) to represent the shareholder at the Meeting may do soeither by inserting such person’s name in the blank space provided in the applicable form of proxy or by completing another proper form of proxy and, in either case, depositing his or her duly executed form of proxy with the Company’s transfer agent and registrar, Computershare Investor Services Inc., 9th Floor, 100 University Avenue, Toronto, Ontario, M5J 2Y1, Attention: Proxy Department, or by facsimile to (416) 263-9524 or 1-866-249-7775 not later than 5:00 p.m. (Eastern Daylight Time) on June 12, 2009 or, if the Meeting is adjourned, 48 hours (excluding Saturdays and holidays) before any adjournment of the Meeting. You may also vote by telephone or via the Internet by following the instructions on the form of proxy. If you vote by telephone or via the Internet, do not complete or return the proxy form.

In addition to revocation in any other manner permitted by law, a proxy may be revoked by instrument in writing executed by the shareholder or by his attorney authorized in writing and deposited either at the registered office of the Company at any time up to and including the last business day preceding the day of the Meeting, or any adjournment thereof, at which the proxy is to be used or with the Chairman of the Meeting on the day of the Meeting, or adjournment thereof, and upon either of such deposits the proxy is revoked.

EXERCISE OF DISCRETION BY PROXIES

The person named in the enclosed form of proxy will vote or withhold from voting the common shares in respect of which he is appointed in accordance with the direction of the shareholder appointing him. If the shareholder specifies a choice with respect to any matter to be acted upon, the shares will be voted accordingly. In the absence of any direction to the contrary, all common shares represented by proxy will be voted; (i)FOR the election of directors; (ii)FOR the appointment of auditors and authorizing the directors to fix the remuneration of the auditors; and (iii)FOR the approval of the resolution amending the Company’s equity incentive plan.

The enclosed form of proxy confers discretionary authority upon the person named therein with respect to amendments or variations to matters identified in the Notice and with respect to other matters which may properly come before the Meeting. At the time of printing of this Circular, management of the Company knows of no such amendments, variations or other matters to come before the Meeting. However, if any

2.

such amendment, variation or other matter properly comes before the Meeting, it is the intention of the person named in the accompanying form of proxy to vote on such other business in accordance with his best judgment.

NON-REGISTERED HOLDERS

Only registered shareholders of the Company or the persons they appoint as their proxies are permitted to vote at the Meeting. However, in many cases, common shares of the Company beneficially owned by a person (a “Non-Registered Holder”) are registered either: (i) in the name of an intermediary (an “Intermediary”) with whom the Non-Registered Holder deals in respect of the common shares of the Company (Intermediaries include, among others, banks, trust companies, securities dealers or brokers and trustees or administrators of self-administered RRSPs, RRIFs, RESPs and similar plans); or (ii) in the name of a clearing agency (such as The Canadian Depository for Securities Limited (“CDS”)) of which the Intermediary is a participant. In accordance with the requirements of National Instrument 54-101, the Company will have distributed copies of the Notice, this Circular, the form of proxy and the Company’s financial statements for the financial year ended December 31, 2008 (which includes management’s discussion and analysis) (collectively, the “meetingmaterials”) to the clearing agencies and Intermediaries for onward distribution to Non-Registered Holders.

Non-Registered Holders who have not waived the right to receive meeting materials will receive either a voting instruction form or, less frequently, a form of proxy. The purpose of these forms is to permit Non-Registered Holders to direct the voting of the shares they beneficially own. Non-Registered Holders should follow the procedures set out below, depending on which type of form they receive.

| | (a) | Voting Instruction Form. In most cases, a Non-Registered Holder will receive, as part of the meeting materials, a voting instruction form. If the Non-Registered Holder does not wish to attend and vote at the meeting in person (or have another person attend and vote on the Holder’s behalf), the voting instruction form must be completed, signed and returned in accordance with the directions on the form. Voting instruction forms in some cases permit the completion of the voting instruction form by telephone or through the Internet. If a Non-Registered Holder wishes to attend and vote at the meeting in person (or have another person attend and vote on the Holder’s behalf), the Non-Registered Holder must complete, sign and return the voting instruction form in accordance with the directions provided and a form of proxy giving the right to attend and vote will be forwarded to the Non-Registered Holder. |

| | | |

| | (b) | Form of Proxy. Less frequently, a Non-Registered Holder will receive, as part of the meeting materials, a form of proxy that has already been signed by the Intermediary (typically by a facsimile, stamped signature) which is restricted as to the number of shares beneficially owned by the Non-Registered Holder but which is otherwise uncompleted. If the Non-Registered Holder does not wish to attend and vote at the meeting in person (or have another person attend and vote on the Holder’s behalf), the Non-Registered Holder must complete the form of proxy and deposit it with the Secretary of the Company c/o Computershare Investor Services Inc., Attention: Proxy Department, 9th Floor, 100 University Avenue, Toronto, Ontario, M5J 2Y1 or by facsimile to (416) 263-9524 or 1-866-249-7775 or vote by telephone or Internet as described above. If a Non-Registered Holder wishes to attend and vote at the meeting in person (or have another person attend and vote on the Holder’s behalf), the Non-Registered Holder must strike out the names of the persons named in the proxy and insert the Non-Registered Holder’s (or such other person’s) name in the blank space provided. |

3.

Non-Registered Holders should follow the instructions on the forms they receive and contact their Intermediaries promptly if they need assistance.

VOTING SHARES

The authorized capital of the Company consists of an unlimited number of common shares and an unlimited number of preferred shares, issuable in series. As of May 7, 2009, the Company had outstanding an aggregate of 109,014,696 common shares, each carrying the right to one vote per share. As of May 7, 2009, no preferred shares of the Company were outstanding.

The record date for the determination of shareholders entitled to receive notice of the Meeting has been fixed as May 12, 2009. In accordance with the provisions of theCanada Business Corporations Act, the Company will prepare a list of holders of common shares on such record date. Each holder of common shares named in the list will be entitled to one vote per common share shown opposite his name on the list at the Meeting.

A quorum for the transaction of business at the Meeting is the presence of two shareholders of the Company, present in person or represented by proxy.

PRINCIPAL HOLDERS OF VOTING SECURITIES

As at the date hereof, the following table sets forth the only persons or companies who, to the knowledge of the directors and senior officers of the Company, beneficially own or exercise control or direction over 10% or more of the votes attached to the common shares of the Company.

| Name | Number of Common Shares | Percentage of Common Shares |

| Silver Wheaton Corp.(1) | 17,898,458 | 16.42% |

| | | |

| Note: | |

| | |

| (1) | Silver Wheaton Corp. also owns warrants exercisable into an additional 3,645,000 common shares of the Company. |

PART TWO - BUSINESS OF THE MEETING

ANNUAL FINANCIAL STATEMENTS

The financial statements of the Company for the financial year ended December 31, 2008 and the auditors’ report thereon will be placed before the shareholders of the Company at the Meeting.

ELECTION OF DIRECTORS

The articles of the Company provide that the Company shall have not more than 20 directors to be elected annually. Four directors will be elected at the Meeting. Each director will hold office until the next annual meeting or until a successor is duly elected or appointed, unless his office is earlier vacated in accordance with the Company’s by-laws.

The following table and the notes thereto disclose (i) the name of each person proposed to be nominated by management for election as a director; (ii) all other positions and offices with the Company now held by him; (iii) his principal occupation; (iv) his period of service as a director of the Company; and (v) the approximate number of common shares of the Company beneficially owned by him or over which he exercises, directly or indirectly, control or direction as at May 7, 2009. Proxies in favour of management nominees will be votedFOR the election of the proposed nominees in the absence of directions to the

4.

contrary from the shareholders appointing them. Management does not contemplate that any of the nominees will be unable to serve as a director, but if that should occur for any reason prior to the Meeting, the person named in the enclosed form of proxy reserves the right to vote for another nominee in his discretion. All of the nominees except for Tony Alford currently serve as directors of the Company and their terms of office are to expire upon the termination of the Meeting. The information below as to the number of common shares of the Company owned by nominees for election as directors is not within the knowledge of management and has been furnished by the nominees themselves.

| Name | Office Held | Principal Occupation | Date FirstElected/Appointed | No. of Shares |

JOHN G. SHANAHAN

New York, U.S.A. | President and Chief Executive Officer and Director | President and CEO of the Company | December 2004 | 530,003(2) |

TONY L. ALFORD

North Carolina, U.S.A. | Proposed Director | President of PBA Consultants, Inc. | N/A | 8,269,247(3) |

DAVID R. LEWIS

Ontario, Canada | Director | Semi-retired Financial and Management Consultant | August 2004 | Nil(4) |

| TIMOTHY R. LINDSEY Texas, U.S.A. | Chairman of the Board and Director | Lindsey Energy & Natural Resources | April 2009 | 1,000,000(5) |

| Notes: | |

| | |

| (1) | Reference is made to “Committees of the Board” below. |

| | |

| (2) | Mr. Shanahan also holds options to purchase 25,000 common shares of the Company at an exercise price of US$0.75 per share exercisable until January 25, 2010, options to purchase 150,000 common shares of the Company at an exercise price of Cdn$0.76 per share exercisable until April 27, 2010 and warrants to purchase 300,002 common shares of the Company at an exercise price of US0.10 per share exercisable until February 12, 2011. |

| | |

| (3) | Mr. Alford also holds warrants to purchase 1,381,000 common shares of the Company, of which 106,000 are at an exercise price of US$1.00 per share exercisable until September 30, 2010 and 1,275,000 are at an exercise price of US$0.10 per share exercisable until February 12, 2011. |

| | |

| (4) | Mr. Lewis holds options to purchase 25,000 common shares of the Company at an exercise price of US$0.75 per share exercisable until January 25, 2010 and options to purchase 150,000 common shares of the Company at an exercise price of Cdn$0.76 per share exercisable until April 27, 2010. |

| | |

| (5) | Mr. Lindsey also holds warrants to purchase 750,000 common shares of the Company at an exercise price of US$0.10 per share exercisable until February 12, 2011. |

Except as noted below, each proposed nominee has been engaged for more than five years in his present principal occupation.

John G. Shanahan -President, Chief Executive Officer and Director. Mr. Shanahan became President and Chief Executive Officer of the Company on October 1, 2008. He was formerly a director of EuroZinc Mining Corporation, a position he held between May 2004 and October 2006. He has held various senior management positions in the mining and resource industry including commodities trader with Barclays Capital, senior vice president of Rothschild Inc.; marketing manager for Pasminco Ltd and Australian Mining and Smelting Ltd. Mr. Shanahan holds a bachelor of commerce degree from the University of Melbourne, a graduate diploma in Systems Analysis and Design from the Royal Melbourne Institute of Technology, and an MBA degree from the Columbia School of Business.

5.

Tony L. Alford-Director. Mr. Alford is the Founder and President of PBA Consultants, Inc., since April 1996, a consulting firm specializing in tax savings and cost reduction services, for many of the fortune 500 companies across the USA. Mr. Alford is also the Founder and CEO of Alford & Associates Inc., since 1993, a company which makes investments in real estate investment properties and natural resource companies. Mr. Alford attended Elon College in North Carolina and Liberty University, in Virginia where he studied business management and marketing. He currently serves as a board member for Wachovia Bank of NC, a Wells Fargo Company and several non profit organizations.

David R. Lewis -Director. Mr. Lewis has over thirty-five years of corporate finance related business experience and has served as chairman of the Company’s audit committee since August 2004. Mr. Lewis is currently a semi-retired independent management and financial consultant. During the past five years Mr. Lewis has served in the following capacities: a director and chairman of the audit committee of Holloman Energy Corporation (OTC Bulletin Board:HENC) (from October 2007 to January 2009); chief financial officer of Aurelian Resources Inc. (TSX:ARU) (from May 2004 to August 2007), chief financial officer of Starfield Resources Inc. (TSX:SRU) (from May 2006 to July 2007); chief financial officer of Kahn Resources Inc. (TSX:KRI) (from June 2005 to December 2006) and chief financial officer of Fibre Optic Systems Technology Inc. (TSXV:FOX) (from August 2004 to April 2006). Mr. Lewis also was a director of Khan Resources Inc. from June 2005 to January 2006. Mr. Lewis obtained a Chartered Accountant designation in 1974 while with Coopers & Lybrand in Toronto and he obtained a bachelor of engineering degree in metallurgy from Dalhousie University in 1969.

Timothy R. Lindsey –Director and Chairman of the Board. Mr. Lindsey has over thirty-years of technical and executive leadership in exploration, production and business development in the U.S., Canada, Africa, Europe, Latin America, the CIS and Asia-Pacific. From March 2005 to the present, Mr Lindsey has been a Principal of Lindsey Energy and Natural Resources, an independent consulting firm specializing in energy and mining industry issues. He is the Founder of Canadian Sahara Energy, Inc. since 2008, a private company with exploration and production interest in Tunisia and Libya; a director since 2008 of Rock Energy Resources, Inc. (RCKE.OB), a publicly-traded company in the United States; a director since 2006 of Daybreak Oil and Gas, Inc. (DBRM.OB), a publicly-traded company in the United States; and a director since 2006 of Challenger Energy Corporation (TSXV.CHQ), a Calgary-based public company. He was a Vice President and then a Senior Vice President of Exploration, from 2003 to 2005 of The Houston Exploration Company (THX.NYSE) and held a number of senior management roles in both domestic and international exploration and business development with Marathon Oil Company (MRO:NYSE) from 1975 to 2003. Mr. Lindsey received a bachelor of science in geology from the Eastern Washington University (Cheney, Washington) in 1973 and completed graduate studies-economic geology at the University of Montana (Missoula, Montana) in 1975. In addition, Mr. Lindsey completed the Advance Executive Program from the Kellogg School of Management, Northwestern University, in 1990. He is a current member of the American Association of Petroleum Geologists, the Rocky Mountain Association of Geologists, the Houston Geological Association, and the Montana Mining Association.

On February 27, 2009, Challenger Energy Corporation obtained an order for protection under theCompanies’ Creditors Arrangement Act. On March 9, 2009, Challenger announced that it had received notice from NYSE Alternext that it had filed a delisting application with the Securities and Exchange Commission in response to Challenger’s announcement of the order under theCompanies’ Creditors Arrangement Act.

Committees of the Board of Directors

The Company’s board of directors has an audit committee, a compensation committee, an environmental and safety committee and a governance and nominating committee. The current members of the audit committee include the chair of the committee, David R. Lewis (independent), Daniel Tellechea

6.

(independent) and John W.W. Hick (independent). See Part Five - Audit Committee Information. The current members of the compensation committee include the chair of the committee, John W. W. Hick (independent), Timothy R. Lindsey (independent) and Daniel Tellechea (independent). See Part Six - Statement of Corporate Governance Practices. The current members of the environmental and safety committee include the chair of the committee, Timothy R. Lindsey (independent), John W.W. Hick (independent) and William Orchow (not independent). See Part Six - Statement of Corporate Governance Practices. The current members of the governance and nominating committee include the chair of the committee, Daniel Tellechea (independent), John W.W. Hick (independent) and John G. Shanahan (not independent). See Part Six - Statement of Corporate Governance Practices.

Upon the election of the proposed nominees to the board of directors of the Company, the proposed constitution of the committees will be as follows: The audit committee will consist of the chair of the committee, David Lewis (independent), Timothy R. Lindsey (independent) and Tony Alford (independent). The compensation committee will consist of the chair of the committee, Timothy R. Lindsey (independent), David Lewis (independent) and Tony Alford (independent). The environmental and safety committee will consist of the chair of the committee, John G. Shanahan (not independent) and Timothy R. Lindsey (independent). The governance and nominating committee will consist of the chair of the committee, Tony Alford (independent), David Lewis (independent) and John G. Shanahan (not independent). See Part Five - Audit Committee Information and Part Six - Statement of Corporate Governance Practices, respectively.

APPOINTMENT OF AUDITORS

Proxies received in favour of management will be voted in favour of the appointment of KPMG LLP, Chartered Accountants, as auditors of the Company to hold office until the next annual meeting of shareholders and the authorization of the directors to fix their remuneration unless the shareholder has specified in the proxy that his shares are to be withheld from voting in respect thereof. KPMG LLP was first appointed as auditors of the Company on August 24, 2004. In order to be effective, the appointment of KPMG LLP must be approved by a majority of the votes cast at the Meeting by shareholders voting in person or by proxy.

APPROVAL OF AMENDMENT TO EQUITY INCENTIVE PLAN

Shareholders are being asked to pass a resolution to approve an amendment to the Company’s equity incentive plan (the “Plan”) to increase the maximum number of common shares reserved for issuance upon the exercise of options from 8,000,000 (less that number of common shares reserved for issuance pursuant to stock options granted under Revett Silver’s equity incentive plan) to 18,000,000 (being 16.5% of the number of issued and outstanding common shares of the Company as of May 7, 2009). The Plan was adopted at the time of the Company’s initial public offering in early 2005. For the material provisions of the Plan and any amendments thereto, see “Compensation Discussion and Analysis – Elements of Compensation – Option-Based Awards (Equity Incentive Plan)”.

The Plan provides for the issuance of stock options, stock appreciation rights and common shares in satisfaction of amounts owing for services. The Plan may be administered by either the board of directors or by a committee established by the board of directors. Eligible participants under the Plan include employees, officers, directors and consultants of the Company and its subsidiaries.

A total of 223,685 common shares have been issued under the Plan in satisfaction of amounts owing for services and options for the purchase of a total of 7,555,000 common shares (being 7% of the number of issued and outstanding common shares of the Company as of May 7, 2009) have been granted and are outstanding as of May 7, 2009. Of the 7,555,000, options for the purchase of a total of 1,065,000 shares

7.

are outstanding under Revett Silver’s equity incentive plan, resulting in 221,315 additional common shares being available for grant under the Plan as of May 7, 2009.

Since options that are exercised over time do not replenish the number of common shares of the Company reserved under the Plan, the Company wishes to reserve an additional 10,000,000 common shares under the Plan. Immediately following the amendment, a total of 10,221,315 options will be available for grant under the Plan (being 9.5% of the number of issued and outstanding common shares of the Company as of May 7, 2009). By approving the Plan Resolution below, the remaining reserve outstanding under the Revett Silver’s equity incentive plan will be transferred to the Plan.

The board of directors of the Company has determined that the Plan Resolution is in the best interests of shareholders and the Company as the ability to award stock options is necessary and vital to the Company’s ability to attract and retain qualified personnel. The board of directors of the Company therefore unanimously recommends that shareholders voteFOR the Plan Resolution. The Plan Resolution requires the approval of a simple majority of the votes cast at the Meeting, in person or by proxy, in order to be adopted. The amendment must also receive the approval of the TSX in order to be effective.

In the absence of instructions to the contrary, the common shares represented by a properly executed form of proxy in favour of the persons designated by management of the Company will be votedFOR the Plan Resolution, as it may be amended or varied at the Meeting.

TEXT OF THE PLAN RESOLUTION

BE IT RESOLVED THAT:

| (a) | that the amendment to the Revett Minerals Inc. (the “Company”) equity incentive plan (the “Plan”) to increase the number of common shares of the Company reserved for issuance upon exercise of options issued pursuant to the Plan from 8,000,000 (less that number of common shares reserved for issuance pursuant to stock options granted under Revett Silver’s equity incentive plan) to 18,000,000 be and is hereby approved; |

| | |

| (b) | that the amendment to delete the following existing sentence in section 5.1 of the Plan be and is hereby approved: |

| | |

| “The total number of shares issued under this Plan, together with the total number of shares issued under any other Share Compensation Arrangement, shall not exceed 8,000,000 Common Shares (less that number of shares reserved for issuance pursuant to stock options granted under Revett Silver Company’s equity incentive plan) or such greater number of Common Shares as may be determined by the Board and approved by any relevant stock exchange or other regulatory authority and, if required, by the shareholders of the Corporation.” |

| | |

| (c) | that the amendment to the Plan inserting the following sentence in section 5.1 be and is hereby approved: |

| | |

| “The total number of shares issued under this Plan, together with the total number of shares issued under any other Share Compensation Arrangement, shall not exceed 18,000,000 Common Shares or such greater number of Common Shares as may be determined by the Board and approved by any relevant stock exchange or other regulatory authority and, if required, by the shareholders of the Corporation.”; and |

| | |

| (d) | any officer or director of the Company is hereby authorized and directed for and on behalf of the Company to execute and deliver or cause to be executed and delivered, all such documents, |

8.

agreements and instruments as are necessary or desirable to give effect to the foregoing resolution, and to perform or cause to be performed all such other acts and things as in such person’s opinion may be necessary or desirable to give full effect to the foregoing resolution and the matters authorized thereby, such determination to be conclusively evidenced by the execution and delivery of such document, agreement or instrument or doing any such act or thing.

PART THREE – REPORT ON EXECUTIVE COMPENSATION

COMPENSATION DISCUSSION AND ANALYSIS

Composition and Mandate of the Compensation Committee

The compensation committee currently consists of John W. W. Hick (chair), Timothy R. Lindsey and Daniel Tellechea, each of whom is independent.

Upon the election of the proposed nominees to the board of directors of the Company, it is proposed that the compensation committee will consist of Timothy R. Lindsey (chair), David Lewis and Tony Alford, each of whom is independent.

The compensation committee assists the board in fulfilling the following responsibilities:

To review and make recommendations to the board with respect to salary and incentive compensation, including bonuses and stock option awards and other benefits, direct or indirect, and any employment agreements and/or change of control packages for senior management as well as compensation for the directors;

To make recommendations to the board with respect to general salary guidelines for the Company;

To administer the Company’s compensation plans, including stock option plans, and outside director compensation plans, as adopted by the board from time to time;

To review the Company’s policies in respect of benefits and perquisites;

To ensure that the Company’s compensation practice and philosophies are consistent with the objective of enhancing shareholder value and attracting and retaining qualified senior executives of the Company; and

to oversee the administration of succession planning.

Compensation Philosophy

The Company’s executive compensation philosophy has been designed with the following objectives:

| | (i) | to attract and retain the best possible executive talent; |

| | | |

| | (ii) | to provide an economic framework to motivate these executives to achieve goals consistent with our business strategy; |

| | | |

| | (iii) | to provide a connection between executive and shareholder interests through stock option plans; |

9.

| | (iv) | to be competitive within the Company’s peer group of mining companies; and |

| | | |

| | (v) | to provide a compensation package that recognizes an executive’s individual results and contributions to the Company’s relative and absolute performance. |

Elements of Compensation

The key elements to the Company’s executive compensation philosophy are salary, cash bonus awards and incentive stock options. Salaries are based on the position held, the executive officer’s experience, performance, and the market for executive talent, the latter of which provides a comparison of salaries for similar positions at other mining companies. Where appropriate, the board of directors also considers other performance measures, such as safety, environmental awareness and improvements in relations with the Company’s shareholders, employees, the public and government regulators. Typically, the principal executive officer of the Company makes recommendations to the committee concerning individual salary levels, bonuses, equity based incentives and other forms of compensation for all of the executive officers other than himself, which are then reviewed and submitted to the full board for approval. The compensation committee makes its own recommendation concerning the principal executive officer’s salary, bonus and other types of compensation. The other executive officers play no role with respect to their compensation other than to meet with the compensation committee to establish agreed upon goals and objectives that are determinative of their respective bonuses.

These goals and objectives are established at the beginning of each fiscal year. The board of directors has traditionally maintained salary compensation at levels roughly in line with those of other companies within the Company’s peer group. Beginning in 2006 and continuing in 2008, the compensation committee surveyed the compensation paid to other executives within a peer group of companies comprised of Chariot Resources Ltd., First Majestic Silver Corp., Fronterra Copper Corporation, Mines Management, Inc., and Sabina Silver Corp. in order to establish compensation packages that were both competitive and appropriate to the Company’s situation.

Salary Compensation

At the beginning of 2008, the base salaries of the Named Executive Officers who were then part of senior management were increased by approximately 10% over their base salaries in 2007. With the resignation of William Orchow as chief executive officer on October 1, 2008, John G. Shanahan was appointed as chief executive officer on an interim basis with compensation at a rate of US$30,000 per month. In December 2008, when the outlook for the Company looked precarious, Mr. Shanahan voluntarily took a reduction of his monthly compensation to US$20,000 per month and the Named Executive Officers who were then part of senior management voluntarily took a 20% reduction in base salary. As of April 1, 2009, the Company and Mr. Shanahan, through Shanahan Partners LLC, have entered into a new contract with a term ending on December 31, 2009 and compensation payable at a rate of US$20,000 per month. Mr. Shanahan does not receive employee benefits.

Incentive Compensation

Executive officers of the Company are eligible to receive option awards and cash bonuses. Option awards, whose value is a function of increases or decreases in the Company’s share price, are intended to provide incentives to attain longer term growth and performance objectives and enhance shareholder value. Cash bonuses are intended to reflect shorter term (usually annual) accomplishments.

During the year ended December 31, 2008, the compensation committee and the board continued to modify and improve the formula-driven bonus plan for the Company’s senior management that was first developed in 2006. This plan established the executive’s potential cash bonus at the beginning of the year (expressed as a percentage of the executive’s base salary) and the evaluation is based upon certain

10.

performance criteria using a weighted average approach. The criteria established for each of the Named Executive Officers who were part of senior management at December 31, 2008 is described below. The specific criteria and the individual weighting may change from year to year based upon the executive’s specific role with the Company, but include a combination of goals relating to the Company’s overall financial performance and the specific, individual goals that have been set for the executive, plus a discretionary element established by the board on the recommendation of the compensation committee.

| Name(1) | Kenneth | Carson Rife | Douglas | Douglas |

| | Eickerman | | Ward | Miller |

| Objective | | | | |

| Stock price performance | 15% | 5% | 5% | 5% |

| Cash flow and profitability | 15% | 20% | 15% | 20% |

| Financing | 10% | N/A | 10% | N/A |

| Safety performance | 5% | 20% | 5% | 20% |

| Rock Creek permitting | 0% | 20% | N/A | 20% |

| Investor/public relations | 10% | 10% | 10% | 10% |

| Strategy and positioning | 10% | 10% | 40% | 10% |

| Corporate Governance | 20% | N/A | N/A | N/A |

| Discretionary | 15% | 15% | 15% | 15% |

| | | |

| Notes: | |

| | |

| (1) | Mr. Shanahan, through his company, Shanahan Partners LLC, is a party to a consultancy services agreement with the Company which does not provide for an award of bonuses to Mr. Shanahan. |

The cash flow and profitability objectives are measured against internal cash flow and profitability budgets, mine throughput targets, and metal price assumptions. The safety performance objective is measured by the lost time accident rate in the current year versus the prior year. The Rock Creek permitting and investor/public relations objectives are inherently more difficult to measure and necessarily involve subjective determinations of the Company’s relationships with the governmental permitting agencies, local stakeholders and elected officials, the tone and quality of the Company’s press coverage, the Company’s relationship with its shareholders and its progress in meeting its goal of increasing the retail ownership of its common shares. The strategy and positioning objective is likewise less susceptible to measurement, and involves an assessment of management’s ability to develop and implement a business strategy that will increase shareholder value and position the Company to take advantage of opportunities in the mining industry. The corporate governance objective is measured by management’s ability to develop and implement financial control, governance and oversight procedures that comply with applicable law and ensure the integrity of its reported financial and non-financial information.

No cash bonuses were awarded to the Named Executive Officers for the financial year ended December 31, 2008. During 2008, the compensation committee and the board also did not award any stock options to any of the Named Executive Officers or directors. Subsequent to December 31, 2008, four of the Named Executive Officers (Messrs Eickerman, Rife, Ward and Miller) received an aggregate of 700,000 stock options. In future years, the compensation committee will likely emphasize both cash bonuses and stock option awards in fashioning executive compensation.

11.

The number of options granted to a Named Executive Officer is determined based on the level of responsibility and performance of the Named Executive Officer. When considering new grants of options, consideration is given to the number and value of previous option awards.

Option-Based Awards (Equity Incentive Plan)

The Company has a Plan which was adopted at the time of the Company’s initial public offering in early 2005, and amended with the approval of the shareholders in 2007 as described in (d) and (k) below. The Plan provides for the issuance of stock options, stock appreciation rights and common shares in satisfaction of amounts owing for services. The Plan may be administered by either the board of directors or by a committee established by the board of directors. The material provisions of the Plan are as follows:

| | (a) | Eligible participants under the Plan include employees, officers, directors and consultants of the Company and its subsidiaries; |

| | | |

| | (b) | A maximum of 8,000,000 common shares (representing approximately 7.3% of the issued and outstanding common shares of the Company as of May 7, 2009), less that number of shares reserved for issuance pursuant to stock options granted under Revett Silver’s equity incentive plan, are available for issuance under the Plan; |

| | | |

| | (c) | The maximum number of common shares in respect of which grants may be made to any one individual, together with any common shares reserved for issuance to such individual under any other stock option plan arrangements, may not exceed 5% of the issued and outstanding common shares of the Company; |

| | | |

| | (d) | The Plan was amended in 2007 to adopt two limitations on grants to insiders. The first limitation is that the number of common shares of the Company in respect of which grants may be made to insiders under all share compensation arrangements may not exceed 10% of the issued and outstanding shares of the Company and the second limitation is that the issuance of common shares to insiders, within a one year period, under all share compensation arrangements, may not exceed 10% of the issued and outstanding common shares of the Company; |

| | | |

| | (e) | The purchase price of common shares reserved for issuance pursuant to options granted is determined by the board of directors of the Company, taking into account any applicable rules of the Toronto Stock Exchange, but in no event shall such price be less than the closing price of the common shares on the Toronto Stock Exchange on the trading date immediately preceding the date of grant; |

| | | |

| | (f) | A stock appreciation right may be granted at the time an option is granted or any time during the term of an option. Upon exercising a stock appreciation right, the related option is cancelled to the extent unexercised, and the holder is entitled to receive payment of an amount equal to the difference between the then current market price and the exercise price. Payment of the appreciated value of the common shares may be made by the Company at the discretion of the board of directors, solely in cash, common shares of the Company, or a combination thereof. Upon exercising an option, any related stock appreciation right is cancelled. No stock appreciation rights have been granted to date; |

| | | |

| | (g) | Options vest at such times as the board of directors may determine at the time of grant, provided that the board or committee may, in their discretion, subsequent to the time of grant, permit an optionee to exercise any or all unvested options; |

12.

| | (h) | Options must have a maximum term of 10 years from the date of grant; |

| | | | |

| | (i) | The Plan provides that each option agreement shall specify the effect of termination of employment on the exerciseability of options. For the options granted to date by the Company, the option agreements provide that in the event of the termination of an optionee’s position for cause, or if the optionee resigns his or her position for other than good reason (as defined), unexercised options will terminate on the date of such termination and if an optionee’s employment is terminated for reasons other than for cause or for death or disability, or if an optionee resigns for good reason (as defined), unexercised options may be exercised not later than one year after such termination, but in no event after the expiry date; |

| | | | |

| | (j) | Options are non-assignable otherwise than by will or the laws of descent and distribution; and |

| | | | |

| | (k) | On June 19, 2007, the shareholders of the Company approved an amendment to the Plan that clarified the nature of amendments that may be made to the Plan with and without obtaining shareholder approval. |

| | | | |

| | | The board of directors of the Company may at any time, subject to the provisions of below, amend, suspend or terminate the Plan, or any portion thereof, or awards or grants made thereunder provided that no change in any award or grant previously made may be made which would impair the rights of the optionee or grantee thereunder without the consent of the affected optionee or grantee. Without limiting the generality of the foregoing, the board or directors of the Company may make the following types of amendments to the Plan or awards or grants made thereunder without shareholder approval: |

| | | | |

| | | (i) | amendments of a ministerial nature including, without limiting the generality of the foregoing, any amendment for the purpose of curing any ambiguity, error or omission in the Plan or to correct or supplement any provision of the Plan that is inconsistent with any other provision of the Plan; |

| | | | |

| | | (ii) | amendments necessary to comply with the provisions of applicable law (including, without limitation, the rules, regulations and policies of the Toronto Stock Exchange); |

| | | | |

| | | (iii) | amendments respecting administration of the Plan; |

| | | | |

| | | (iv) | any amendment to the vesting provisions of the Plan or any option; |

| | | | |

| | | (v) | any amendment to the early termination provisions of the Plan or any option, whether or not such option is held by an insider, provided such amendment does not entail an extension beyond the original expiry date; |

| | | | |

| | | (vi) | any amendment to the termination provisions of the Plan or any option, other than an amendment extending the term of an option, provided any such amendment does not entail an extension of the expiry date of such option beyond its original expiry date; |

| | | | |

| | | (vii) | the addition or modification of any form of financial assistance by the Company; |

13.

| | (viii) | the addition or modification of a cashless exercise feature, payable in cash or common shares, whether or not there is a full deduction of the number of underlying common shares from the Plan reserve; and |

| | | |

| | (ix) | any other amendments, whether fundamental or otherwise, not requiring shareholder approval under applicable law (including without limitation, the rules, regulations and policies of the Toronto Stock Exchange). |

Shareholder approval will be required for the following types of amendments to the Plan or awards or grants made thereunder:

| | (i) | increases to the number of common shares issuable under the Plan, including an increase to a fixed maximum number of common shares or a change from a fixed maximum number of common shares to a fixed maximum percentage; |

| | | |

| | (ii) | any amendment which reduces the exercise price of an option or a cancellation and re-grant at a lower price less than three months after the related cancellation; |

| | | |

| | (iii) | any amendment extending the term of an option beyond its original expiry date; |

| | | |

| | (iv) | any amendment broadening any limits imposed on non-employee director participation under the Plan; |

| | | |

| | (v) | any amendment respecting transferability or assignability of awards or options under the Plan, other than for normal estate settlement purposes; and |

| | | |

| | (vi) | amendments required to be approved by shareholders under applicable law (including, without limitation, the rules, regulations and polices of the Toronto Stock Exchange). |

Revett Silver

Revett Silver has an equity incentive plan which provides for the issuance of stock options and stock appreciation rights and awards of restricted common shares. As at the date hereof, options for the purchase of a total of 1,065,000 Class B common shares of Revett Silver are outstanding. Of these stock options, 280,000 options have an exercise price of US$0.75 and expire between June and October 2009 and 785,000 options have an exercise price of US$0.75 and expire on December 6, 2009. The Class B common shares of Revett Silver are exchangeable, under certain circumstances, into common shares of the Company pursuant to the terms of Revett Silver’s articles. Revett Silver does not intend to issue additional options under this plan and any stock options will be granted by the Company under the Plan. Payment of the exercise price may be made in cash or shares of Revett Silver valued at their fair market value on the date of exercise as determined by the board. Revett Silver may advance a loan to the holder of an option solely for the purpose of enabling the holder to exercise the option. Any such loan shall provide for the payment of interest on terms then prevailing and shall be secured by a pledge of the shares issued.

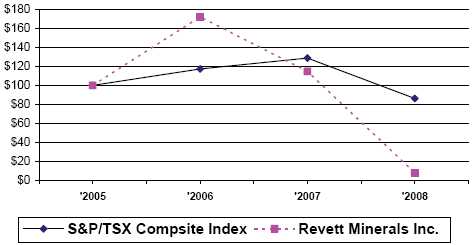

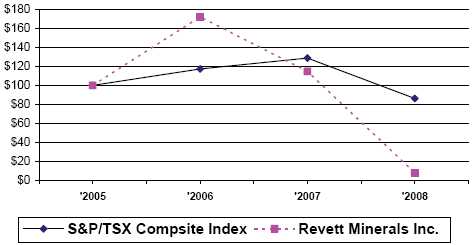

Share Price Performance Graph

The common shares of the Company have been listed on the Toronto Stock Exchange under the symbol “RVM” since 2005. The following graph shows the percentage change in cumulative shareholder return for the Company’s last three financial years on common shares compared to the cumulative total return of the S&P/TSX Composite Index, assuming that Can$100 was invested on December 31, 2005.

14.

The total compensation of the Named Executive Officers is not consistent with the trend shown in the Company’s share price performance in that the total compensation of Named Executive Officers increased in 2007 despite a decline in share price performance. However, with the exception of Mr. Shanahan (who was not a Named Executive Officer prior to October 1, 2008) and Mr. Miller, the total compensation of the Named Executive Officers was lower in 2008 than in 2007 and no bonuses were awarded in 2008.

COMPENSATION OF NAMED EXECUTIVE OFFICERS

With the exception of compensation paid to the firm through which the services of the chief executive officer are provided, the Named Executive Officers are paid by Revett Silver and not the Company. The following table sets out the compensation for services in all capacities to the Company and Revett Silver in respect of (a) the Company’s chief executive officer and chief financial officer; (b) the most highly compensated individuals, other than the chief executive officer and chief financial officer and whose total compensation for the financial year ended December 31, 2008 exceeded Can$150,000; and (c) one individual who was the chief executive officer until October 1, 2008 and one individual who was the chief financial officer until December 15, 2008. The compensation paid to such individuals (collectively, the “Named Executive Officers”) is set out, in each case, for services rendered during the financial year ended December 31, 2008, December 31, 2007 and December 31, 2006.

15.

Name and

Principal

Position |

Year |

Salary

(US$) |

Share-

based

awards

(US$) |

Option-

based

awards

(US$)(1) | Non-Equity

Incentive Plan

Compensation |

Pension

Value

(US$) |

All

Other

Compen-

sation

(US$) |

Total

Compen-

sation

(US$) |

Annual

Incentive

Plans

(US$) | Long-

Term

Incentive

Plans

(US$) |

| (a) | (b) | (c) | (d) | (e) | (f1) | (f2) | (g) | (h) | (i) |

John G. Shanahan

Chief Executive Officer, President and Director | 2008

2007

2006 | 80,000(2)

Nil

Nil | Nil

Nil

Nil | Nil

79,500(4)

50,625(4) | Nil

Nil

Nil | Nil

Nil

Nil | Nil

Nil

Nil | 206,000(3)

49,000(3)

52,000(3) | 286,000

128,500

102,625 |

Kenneth Eickerman,

Chief Financial Officer and Secretary | 2008

2007

2006

| 101,716(5)

98,500

94,000

| Nil

Nil

Nil

| Nil

21,200

13,500

| Nil

15,000

20,000

| Nil

Nil

Nil

| Nil

Nil

Nil

| Nil

Nil

Nil

| 101,716

134,700

127,500

|

Carson Rife

Vice President of Operations | 2008

2007

2006 | 188,231

175,000

130,000 | Nil

Nil

Nil | Nil

53,000

25,312 | Nil

52,500

52,500 | Nil

Nil

Nil | Nil

Nil

Nil | 1,398(6)

1,398(6)

1,075(6) | 189,629

281,898

208,887 |

Douglas Ward

Vice President of Corporate Development | 2008

2007

2006 | 157,333

150,000

125,000 | Nil

Nil

Nil | Nil

31,800

20,250 | Nil

45,000

45,900 | Nil

Nil

Nil | Nil

Nil

Nil | Nil

Nil

Nil | 157,333

226,800

191,150 |

| Douglas Miller General Manager of the Troy Mine | 2008

2007

2006 | 138,833

119,000

95,000 | Nil

Nil

Nil | Nil

Nil

16,875 | Nil

1,500

1,000 | Nil

Nil

Nil | Nil

Nil

Nil | Nil

Nil

Nil | 138,833

120,000

111,875 |

William Orchow

Former Chief Executive Officer | 2008

2007

2006

| 201,875(7)

250,000

195,000

| 100,000(7)

Nil

Nil

| Nil

79,500

50,625

| Nil

90,000

97,500

| Nil

Nil

Nil

| Nil

Nil

Nil

| 761,250(7)

Nil

Nil

| 1,063,125

419,500

335,625

|

Scott Brunsdon

Former Chief Financial Officer | 2008

2007

2006 | 186,833(8)

175,000

135,000 | Nil

Nil

Nil | Nil

53,000

33,750 | Nil

59,100

59,100 | Nil

Nil

Nil | Nil

Nil

Nil | 300,833

Nil

Nil | 487,666

287,100

227,850 |

| | | |

| Notes: | |

| | |

| (1) | The amounts in this column are calculated using the Black-Scholes option pricing model using the following weighted average assumptions: risk-free interest rate of 2.23% to 2.84% (2007 – 4.22%; 2006 – 4.57%), expected life of four years, volatility - 71% (2007 – 71.6%; 2006 – 70%) and expected dividends of Nil. |

| | |

| (2) | Mr. Shanahan was appointed interim president and chief executive officer of the Company effective October 1, 2008. Before the signing of a new consultancy services agreement dated as of April 1, 2009 with the Company, through Shanahan Partners LLC, for the provision of his services as president and chief executive officer to the Company, Mr. Shanahan voluntarily reduced his rate of compensation from US$30,000 per month to US$20,000 per month |

16.

| commencing December 1, 2008. Under the agreement, Shanahan Partners LLC receives consulting fees instead of a salary. |

| | |

| (3) | Until October 1, 2008, Mr. Shanahan received compensation from the Company only in his capacity as a director and chairman of the board of the Company. Mr. Shanahan received compensation for his services as a director for the financial year ended December 31, 2008 in the amount of US$66,000 for attendance at board and committee meetings, annual retainer and for serving as the chairman of the board. Additional compensation in the amount of US$140,000 was paid to Mr. Shanahan for providing services as a member of a special committee formed to consider strategic alternatives for the Company. Since October 1, 2008, Mr. Shanahan does not receive any compensation in his capacity as a director of the Company. |

| | |

| (4) | These options have subsequently been cancelled at the request of and with the consent of Mr. Shanahan. |

| | |

| (5) | Mr. Eickerman was appointed Chief Financial Officer and Secretary effective December 15, 2008. |

| | |

| (6) | Amounts shown for Mr. Rife under “All Other Compensation” consist of automobile expense allowance. |

| | |

| (7) | Mr. Orchow joined Revett Silver as the president and chief operating officer in September 2003 and was appointed chief executive officer and president of Revett Silver in March 2004. Mr. Orchow was the chief executive officer and president of the Company from August 25, 2004 until his resignation on October 1, 2008. Upon the resignation of Mr. Orchow as chief executive officer of the Company on October 1, 2008, he was entitled to receive an amount equal to three times his then base salary of US$285,000. Mr. Orchow agreed to accept US$100,000 of such amount in the form of common shares of the Company issued based on the volume weighted average trading price of the common shares of the Company for the five trading days immediately preceding October 1, 2008 (pursuant to which 207,995 common shares were issued to him). Of the balance of US$755,000, Mr. Orchow received US$605,000 in 2008 and agreed to receive US$150,000 in 2009 pursuant to a consulting arrangement. Mr. Orchow also received fees of US$6,250 for serving as a director of the Company following his resignation as an officer of the Company. |

| | |

| (8) | Upon the resignation of Mr. Brunsdon as chief financial officer of the Company on December 15, 2008, he was entitled to receive an amount equal to one and a half times his then base salary ofUS$190,000 plus an amount for accrued vacation. Mr. Brunsdon received such amount in 2008. |

INCENTIVE PLAN AWARDS

The following table sets forth certain information, in relation to the Named Executive Officers, regarding option-based awards and share-based awards outstanding as of December 31, 2008.

| | Option-Based Awards | Share-Based Awards |

Name |

Number of

Securities

Underlying

Unexercised

Options

(#) |

Option

Exercise

Price |

Option

Expiration

Date |

Value of

Unexercised

In-the-

Money

Options

(US$)(1) | Number of

Shares or

Units of

Shares

That Have

not Vested

(#) | Market or

Payout Value

of Share-

Based Awards

That Have not

Vested

(US$) |

| (a) | (b) | (c) | (d) | (e) | (f) | (g) |

John G. Shanahan

| 25,000

150,000

150,000(2)

150,000(2) | US$0.75

Cdn$0.76

Cdn$1.10

Cdn$1.11 | Jan 25 2010

Apr 27 2010

Oct 10 2011

Jan 10 2012 |

Nil

|

Nil

|

Nil

|

Ken Eickerman

| 75,000

25,000

40,000 | Cdn$0.55

Cdn$1.10

Cdn$1.11 | Jul 19 2010

Oct 4 2011

Jan 10 2012 |

Nil

|

Nil

|

Nil

|

Carson Rife

| 75,000

75,000

100,000 | US$0.75

Cdn$1.10

Cdn$1.11 | Dec 6 2009

Oct 4 2011

Jan 10 2012 |

Nil

|

Nil

|

Nil

|

Doug Ward

| 75,000

60,000

60,000 | US$0.75

Cdn$1.10

Cnd$1.11 | Dec 6 2009

Oct 4 2011

Jan 10 2012 |

Nil

|

Nil

|

Nil

|

Douglas Miller

| 100,000

75,000

50,000 | US$0.75

US$0.75

Cdn$1.10 | Oct 8 2009

Dec 6 2009

Oct 4 2011 |

Nil

|

Nil

|

Nil

|

17.

| | Option-Based Awards | Share-Based Awards |

Name |

Number of

Securities

Underlying

Unexercised

Options

(#) |

Option

Exercise

Price |

Option

Expiration

Date |

Value of

Unexercised

In-the-

Money

Options

(US$)(1) | Number of

Shares or

Units of

Shares

That Have

not Vested

(#) | Market or

Payout Value

of Share-

Based Awards

That Have not

Vested

(US$) |

| (a) | (b) | (c) | (d) | (e) | (f) | (g) |

William Orchow

| 300,000

150,000

150,000 | US$0.75

Cdn$1.10

Cdn$1.11 | Dec 6 2009

Oct 4 2011

Jan 10 2012 |

Nil

|

Nil

|

Nil

|

Scott Brunsdon

| 150,000

100,000

100,000 | US$0.75

Cdn$1.10

Cdn$1.11 | Dec 6 2009

Oct 4 2011

Jan 10 2012 |

Nil

|

Nil

|

Nil

|

| | | |

| Notes: | |

| (1) | Calculated using the closing price of the common shares of the Company on the Toronto Stock Exchange on December 31, 2008 of Cdn$0.08 and subtracting the exercise price of stock options. |

| | |

| (2) | These options have subsequently been cancelled at the request of and with the consent of Mr. Shanahan. |

The following table sets forth certain information, in relation to the Named Executive Officers, regarding the value vested or earned of incentive plan awards for the financial year ended December 31, 2008.

Name | Option-Based

Awards –

Value Vested

During the Year

(US$) | Share-Based

Awards –

Value Vested

During the Year

(US$) | Non-Equity Incentive

Plan Compensation –

Value Earned During

the Year

(US$) |

| (a) | (b) | (c) | (d) |

| John G. Shanahan | Nil | Nil | Nil |

| Ken Eickerman | Nil | Nil | Nil |

| Carson Rife | Nil | Nil | Nil |

| Doug Ward | Nil | Nil | Nil |

| Douglas Miller | Nil | Nil | Nil |

| William Orchow | Nil | Nil | Nil |

| Scott Brunsdon | Nil | Nil | Nil |

EQUITY COMPENSATION PLAN INFORMATION

The following table provides information as of December 31, 2008 with respect to shares of the Company and its subsidiary, Revett Silver that may be issued under all equity compensation plans.

18.

Plan Category |

Number of securities to

be issued upon exercise

of outstanding options

(a) |

Weighted-average

exercise price of

outstanding options

(b) | Number of securities

remaining available for

future issuance under

equity compensation plans

(excluding securities

reflected in (a))

(c) |

| Equity compensationplans approved bysecurity holders(1) | 3,740,000 | Cdn$1.01 | 2,801,315 |

| Equity compensationplans not approved bysecurity holders(2) | Nil | Nil | Nil |

| Total | 3,740,000 | Cdn$1.01 | 2,801,315 |

| | | |

| Notes: | |

| | |

| (1) | Reference is made to “Part Three - Report on Executive Compensation - Compensation Discussion and Analysis – Elements of Compensation – Option-Based Awards (Equity Incentive Plan)” above for a description of the Plan. |

| | |

| (2) | Reference is made to “Part Three - Report on Executive Compensation - Compensation Discussion and Analysis – Elements of Compensation – Revett Silver” above for a description of the Revett Silver’s equity incentive plan. |

TERMINATION AND CHANGE OF CONTROL BENEFITS

Each of the Named Executive Officers in the Summary Compensation Table has entered into an employment agreement with Revett Silver except for Mr. Shanahan, who, through Shanahan Partners LLC, has a consultancy services agreement with the Company. Unless otherwise noted, each agreement provides for severance payments in the event the executive officer’s employment is terminated without cause, upon the occurrence of a Change of Control (defined as a person or entity acquiring beneficial ownership of 25% or more of the voting shares or as a result of a contested election of directors, the persons who were directors before such election cease to constitute a majority of the board), or other than for Good Reason (defined as a substantial alteration in the nature and status of the employee’s responsibilities or reduction in duties, salary or benefits following a Change of Control, or if a satisfactory employment agreement with a successor to the Company is not concluded or the business is sold following a Change of Control and, for Messrs. Rife and Ward, includes a relocation of office by more than 50 miles).

| 1. | Mr. John G. Shanahan, president and chief executive officer, through Shanahan Partners LLC, entered into a consultancy services agreement with the Company on October 1, 2008 which has since expired, and subsequently entered into another consultancy services agreement dated as of April 1, 2009 which is set to remain in force until December 31, 2009, or such longer period as may be agreed to. Pursuant to the new agreement, Mr. Shanahan’s firm currently receives monthly compensation of US$20,000. Upon the occurrence of a Change of Control (defined as a person acquiring securities to affect materially the control of the Company (40% of the voting shares) or consolidation, merger or arrangement or the sale of all or substantially all of the assets to another person), Mr. Shanahan’s firm is entitled to a payment of US$300,000 within 10 days of the Change of Control. If the agreement is not extended beyond December 31, 2009 or a new agreement providing for his direct employment is not entered into commencing January 1, 2010, the Company must pay an amount equal to six (6) months of the base fee (i.e. US$120,000) within 10 days. If the agreement is terminated by the Company without Cause (defined as any act or omission of the firm or Mr. Shanahan which would permit an employer, without notice or payment in lieu of notice, to terminate the employee), Mr. Shanahan is entitled to receive |

19.

| severance equal to six (6) months of the base fee (i.e. US$120,000), provided that if such termination occurs after a Change of Control, no severance is payable. Mr. Shanahan’s firm may terminate the agreement by giving two weeks notice to the Company. As an independent consultant, Mr. Shanahan is not entitled to participate, in his capacity of CEO, in any of the Company’s benefit plans. |

| | |

| 2. | Mr. Kenneth Eickerman, chief financial officer and secretary, entered into an employment agreement with Revett Silver on May 30, 2007. If Mr. Eickerman’s employment is terminated other than for cause, he is entitled to 12 months of salary, payable in one lump sum, and to a continuation of benefits for 12 months. If his employment is terminated following a Change of Control or for Good Reason, he is entitled to 24 months of salary and to a continuation of benefits for 12 months. Mr. Eickerman may terminate the agreement unilaterally upon one month’s notice. |

| | |

| 3. | Mr. Carson Rife, vice-president operations, entered into an employment agreement with Revett Silver on February 1, 2004. If Mr. Rife’s employment is terminated other than for cause, he is entitled to 18 months of salary, payable in one lump sum, and to a continuation of benefits for 12 months. If his employment is terminated following a Change of Control or for Good Reason, he is entitled to 36 months of salary and to a continuation of benefits for 12 months. Mr. Rife may terminate the agreement unilaterally upon one month’s notice. |

| | |

| 4. | Mr. Doug Ward, vice-president corporate development, entered into an employment agreement with Revett Silver on May 1, 2004. If Mr. Ward’s employment is terminated other than for cause, he is entitled to 18 months of salary, payable in one lump sum, and to a continuation of benefits for 12 months. If his employment is terminated following a Change of Control or for Good Reason, he is entitled to 36 months of salary and to a continuation of benefits for 12 months. Mr. Ward may terminate the agreement unilaterally upon one month’s notice. |

| | |

| 5. | Mr. Douglas Miller, general manager of Troy Unit, entered into an employment agreement with Revett Silver on April 1, 2004. If Mr. Miller’s employment is terminated other than for cause, he is entitled to 12 months of salary, payable in one lump sum, and to a continuation of benefits for 12 months. If his employment is terminated following a Change of Control or for Good Reason, he is entitled to 24 months of salary and to a continuation of benefits for 12 months. Mr. Miller may terminate the agreement unilaterally upon one month’s notice. |

| | |

| 6. | Mr. William Orchow, former president and chief executive officer, entered into an employment agreement with Revett Silver on January 1, 2004. Mr. Orchow received severance in accordance with the terms of his employment pursuant as described under “Compensation of Named Executive Officers” above upon his resignation on October 1, 2008. |

| | |

| 7. | Mr. Scott Brunsdon, former chief financial officer and secretary, entered into an employment agreement with Revett Silver on June 15, 2004. Mr. Brunsdon received severance in accordance with the terms of his employment pursuant as described under “Compensation of Named Executive Officers” above upon his resignation on December 15, 2008. |

PART FOUR – REPORT ON DIRECTOR COMPENSATION

DIRECTOR COMPENSATION TABLE

The following table sets out all amounts of compensation provided to the directors of the Company for the financial year ended December 31, 2008.

20.

Name(1) |

Fees

Earned

(US$) |

Share-

based

awards

(US$) |

Option-

based

awards

(US$) | Non-equity

incentive

plan

compensation

(US$) |

Pension

Value

(US$) |

All Other

Compen-

sation

(US$) |

Total

(US$) |

| (a) | (b) | (c) | (d) | (e) | (f) | (g) | (h) |

| John W. W. Hick | 53,000 | Nil | Nil | Nil | Nil | 65,000(2) | 118,000 |

| David R. Lewis | 58,000 | Nil | Nil | Nil | Nil | 65,000(2) | 123,000 |

| Daniel Tellechea | 52,000 | Nil | Nil | Nil | Nil | Nil | 52,000 |

| Louis P. Gignac(3) | 53,000 | Nil | Nil | Nil | Nil | Nil | 53,000 |

| | | |

| Notes: | |

| | |

| (1) | This director compensation table does not include information for John G. Shanahan and William Orchow, each of whom is a director and a Named Executive Officer. The compensation paid to Mr. Shanahan and Mr. Orchow for their services as a director for the financial year ended December 31, 2008 has been reflected in the Summary Compensation Table for Named Executive Officers. |

| | |

| (2) | These amounts were paid for services as a member of a special committee formed to consider strategic alternatives for the Company. |

| | |

| (3) | Mr. Gignac resigned from the board of directors of the Company effective April 14, 2009. |

During the fiscal year ended December 31, 2008, the directors, except for directors that are executive officers of the Company, received an attendance fee of US$2,000 for each board meeting attended and a fee of US$1,000 for each committee meeting attended. Directors who are not executive officers of the Company received an annual retainer of US$25,000 payable at the option of the director in cash or shares of the Company. The chairman of the board received an additional US$15,000 per annum. The chairman of the audit committee received an additional US$10,000 per annum and the chairman of each of the other committees received an additional US5,000 per annum. Directors are also reimbursed for travel expenses incurred in connection with attendance at meetings of the board of directors or any committee of the board.

For 2009, attendance fees will be accrued and a decision will be made no later than the end of the year to either pay them or to have the accrual carried forward until the following year.

21.

DIRECTOR OPTION-BASED AND SHARE-BASED AWARDS

The following table sets forth certain information, in relation to the directors, regarding option-based and share-based awards outstanding as of December 31, 2008.

| | Option-Based Awards | Share-Based Awards |

Name |

Number of

Securities

Underlying

Unexercised

Options

(#) |

Option

Exercise

Price

|

Option

Expiration

Date |

Value of

Unexercised

In-the-

Money

Options

(US$)(1) |

Number of

Shares or

Units of

Shares

That Have

not Vested

(#) |

Market or

Payout Value

of Share-

Based Awards

That Have not

Vested

(US$) |

| (a) | (b) | (c) | (d) | (e) | (f) | (g) |

John W.W. Hick

| 25,000

150,000

150,000

150,000 | US$0.75

Cdn$0.76

Cdn$1.10

Cdn$1.11 | Jan 25 2010

Apr 27 2010

Oct 4 2011

Jan 10 2012 |

Nil

|

Nil

|

Nil

|

David R. Lewis

| 25,000

150,000

150,000(2)

150,000(2) | US$0.75

Cdn$0.76

Cdn$1.10

Cdn$1.11 | Jan 25 2010

Apr 27 2010

Oct 4 2011

Jan 10 2012 |

Nil

|

Nil

|

Nil

|

Daniel Tellechea

| 25,000

150,000

150,000

150,000 | US$0.75

Cdn$0.76

Cdn$1.10

Cdn$1.11 | Jan 25 2010

Apr 27 2010

Oct 4 2011

Jan 10 2012 |

Nil

|

Nil

|

Nil

|

| Louis P. Gignac(3) | 210,000 | Cdn$0.84 | Nov 19 2012 | Nil | Nil | Nil |

| | | |

| Notes: | |

| | |

(1) | Calculated using the closing price of the common shares of the Company on the Toronto Stock Exchange on December 31, 2008 of Cdn$0.08 and subtracting the exercise price of stock options. |

| | |

| (2) | These options have subsequently been cancelled at the request of and with the consent of Mr. Lewis. |

| | |

| (3) | Mr. Gignac resigned from the board of directors of the Company effective April 14, 2009. |

OPTION-BASED AND SHARE-BASED AWARDS VESTED DURING 2008

The following table sets forth certain information, in relation to the directors, regarding the value vested or earned of incentive plan awards for the financial year ended December 31, 2008.

Name | Option-Based

Awards –

Value Vested

During the Year

(US$) | Share-Based

Awards –

Value Vested

During the Year

(US$) | Non-Equity Incentive

Plan Compensation –

Value Earned During

the Year

(US$) |

| (a) | (b) | (c) | (d) |

| John W.W. Hick | Nil | Nil | Nil |

| David R. Lewis | Nil | Nil | Nil |

| Daniel Tellechea | Nil | Nil | Nil |

| Louis P. Gignac(1) | Nil | Nil | Nil |

| | | |

| Notes: | |

| | |

| (1) | Mr. Gignac resigned from the board of directors of the Company effective April 14, 2009. |

22.

Indebtedness of Officers and Directors

There is no indebtedness of any officer or director, or any associate of any such director or officer, to the Company or any of its subsidiaries.

PART FIVE - AUDIT COMMITTEE INFORMATION

Additional Information on the audit committee of the board of directors of the Company can be found in the Company’s Form 10-K, which is filed on SEDAR atwww.sedar.com. A copy of this document can also be obtained from the Company as set out below under “Additional Information.”

PART SIX - STATEMENT OF CORPORATE GOVERNANCE PRACTICES

The following describes the Company’s approach to corporate governance as well as the current and proposed composition of the board.

The Board of Directors

The Company’s board currently consists of six directors, four of whom are independent. The independent directors are Messrs. John W.W. Hick, David Lewis, Timothy R. Lindsey and Daniel Tellechea.

Mr. Orchow is not considered independent of management of the Company because, during the past three years, he was the president and chief executive officer of the Company. Mr. Shanahan is not considered independent of management of the Company because he is the president and chief executive officer of the Company.

Messrs. John W.W. Hick, Daniel Tellechea and William Orchow will not be standing for re-election at the Meeting. At the Meeting, it will be proposed that Mr. Tony Alford will be elected to the board, along with three current board members, Messrs. David Lewis, Timothy R. Lindsey and John G. Shanahan, who will be standing for re-election at the Meeting. For the reasons stated above, Mr. Shanahan will be the only director of the Company who is not independent.

The following directors or proposed directors are also directors of other reporting issuers (or equivalent), as indicated beside their names:

| Name | Issuer |

| John W.W. Hick | Aeroquest International Limited (TSX:AQL) |

| | Carpathian Gold Inc. (TSX:CPN) |

| | First Uranium Corporation (TSX:FIU) |

| | Hudson Resources Inc. (TSXV:HUD) |

| | Marengo Mining Limited (TSX:MRN) |

| | Silver Eagle Mines Inc. (TSX:SEG) |

| Timothy R. Lindsey | Challenger Energy Corporation (TSXV.CHQ) |

| | Daybreak Oil and Gas, Inc. (DBRM.OB) |

| | Rock Energy Resources, Inc. (RCKE.OB) |

| William Orchow | Goldrich Mining Company (OTC Bulletin Board:LITS) |

23.

| Name | Issuer |

| Daniel Tellechea | Silver Eagle Mines Inc. (TSX:SEG) |

At most regularly scheduled meetings of the board of directors, the independent directors make time available to meet independent of management. In the financial year ended December 31, 2008, nine board meetings were held and the board met independent of management at five of those meetings.