UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | |

¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material under Rule 14a-12 |

| | | | |

| NIMIN ENERGY CORP. |

| (Name of Registrant as Specified in its Charter) |

| | | | |

| Payment of Filing Fee (Check the appropriate box): |

| |

| ¨ | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | | | |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | | | |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | | | |

| | (5) | | Total fee paid: |

| | |

| | | | |

| | | | |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| x | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: $14,354 |

| | | | |

| | (2) | | Form, Schedule or Registration Statement No.: Schedule 14A Preliminary Proxy Statement |

| | | | |

| | (3) | | Filing party: NiMin Energy Corp. |

| | | | |

| | (4) | | Date Filed: May 9, 2012 |

| | | | |

ANNUAL AND SPECIAL MEETING

OF SHAREHOLDERS

TO BE HELD ON JUNE 26, 2012

NOTICE OF ANNUAL AND SPECIAL MEETING AND

MANAGEMENT INFORMATION CIRCULAR

REGARDING THE SALE OF SUBSTANTIALLY ALL OF THE ASSETS

AND THE WINDING UP OF NIMIN ENERGY CORP.

TO BE HELD AT

FESS PARKER’S DOUBLETREE RESORT

633 EAST CABRILLO BOULEVARD

SANTA BARBARA, CALIFORNIA U.S.A. 93103

AT 9:00 A.M. PDT (LOCAL TIME)

DATED MAY 23, 2012

|

FOR THE REASONS SET OUT HEREIN, THE BOARD OF DIRECTORS OF NIMIN ENERGY CORP. UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE FOR THE SALE RESOLUTION AND THE WINDING UP RESOLUTION, AMONG OTHER MATTERS TO BE CONSIDERED AT THE ANNUAL AND SPECIAL MEETING. |

These materials are important and require your immediate attention. They require shareholders of NiMin Energy Corp. to make important decisions. Please carefully read this management information circular and its appendices, as it contains detailed information relating to, among other things, the sale of substantially all of the assets and winding up of NiMin Energy Corp. If you are in doubt as to how to make these decisions, please consult your financial, legal or other professional advisors.

THE SALE OF ASSETS AND THE WINDING UP HAVE NOT BEEN APPROVED OR DISAPPROVED BY ANY SECURITIES REGULATORY AUTHORITY, NOR HAS ANY SECURITIES REGULATORY AUTHORITY PASSED UPON THE FAIRNESS OR MERITS OF THE SALE OF ASSETS AND THE WINDING UP OR UPON THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED IN THIS DOCUMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

May 23, 2012

Dear Shareholder:

You are invited to attend the annual and special meeting (the “Meeting”) of the holders (“Shareholders”) of common shares (“Common Shares”) of NiMin Energy Corp. (“NiMin” or the “Corporation”) to be held at Fess Parker’s DoubleTree Resort, 633 East Cabrillo Boulevard, Santa Barbara, California U.S.A. 93103 on June 26, 2012 at 9:00 A.M. PDT (local time) for the purposes set forth in the accompanying Notice of Annual and Special Meeting of Shareholders.

At the Meeting, in addition to annual items of business, Shareholders will be asked to consider and vote on special resolutions approving: (a) the proposed sale of all or substantially all of the Corporation’s assets (the “Sale of Assets”) including those assets held by NiMin’s wholly-owned subsidiary, Legacy Energy, Inc. (“Legacy”), pursuant to purchase and sale agreements in respect of its Wyoming based assets and California based assets (collectively, the “Purchase and Sale Agreements”), for a total cash consideration of US$125,250,000, subject to deduction and adjustment in certain circumstances (the “Sale Transactions”); and (b) the subsequent complete liquidation and dissolution of the Corporation (the “Winding Up”).

The sale of substantially all of the Corporation’s assets pursuant to the Purchase and Sale Agreements is the result of a broad review of strategic alternatives by the board of directors of the Corporation (the “Board”). Aimed at maximizing Shareholder value, the strategic review process was initiated to help close the gap between the value of NiMin’s underlying assets – including the Corporation’s reserves, production and operations – and the trading level of the Common Shares. Macquarie Capital (U.S.A.) Inc. has been serving as NiMin’s financial advisor in connection with the strategic review.

The Board expects that, after completion of the Sale Transactions and the liquidation and dissolution of Legacy, pursuant to the Winding Up, Shareholders will receive between $1.01 to $1.05 in cash per Common Share based upon 69,834,396 Common Shares issued and outstanding, which amount shall be paid in one or more instalments. The amount of the payment(s) shall be determined by the Board after repaying the Corporation’s bank debt and other obligations and reviewing potential tax and other liabilities of the Corporation, including costs of the Sale Transactions and the subsequent winding up of Legacy and the Corporation. The Board is not currently aware of any material items that could give rise to unforeseen tax liabilities or other liabilities or costs which would materially reduce the amount of the cash available for distribution to Shareholders, but there is no assurance this will remain the case. As soon as practical after closing of the Sale Transactions, NiMin shall distribute, in one or more instalments, as much as possible of the net cash received from the Sale of Assets, in excess of a reasonable reserve for remaining costs and liabilities in an amount determined by the Board in their discretion, acting reasonably.

The Common Shares currently trade on the Toronto Stock Exchange (the “TSX”). If the Sale Transactions are completed, according to the TSX’s rules, the Corporation will be deemed to have gone through a Change in Business (as such term is defined in the TSX Company Manual). The Corporation will be required to meet the original listing requirements of TSX in order to remain listed. The Corporation does not expect to meet the original listing requirements as the Corporation will cease to be engaged in an ongoing business. As a result, the Corporation will take the appropriate steps following closing of the Sale Transactions to voluntarily delist from the TSX. In an effort to maintain liquidity in the Common Shares, the Board may apply to transfer the Corporation’s listing to NEX, a separate board of the TSX Venture Exchange that provides a trading forum for

listed companies that have low levels of business activity or have ceased to carry on an active business; however, no assurance can be provided that a NEX listing will be obtained. The Corporation expects that as a result of delisting from the TSX, it may no longer be eligible to be quoted on OTCQX.

The completion of the Sale Transactions and the Winding Up (subsequent to a liquidating distribution by Legacy to the Corporation once all obligations have been accounted for) and the distribution of all available cash are subject to, among other conditions, the approval of the Shareholders at the Meeting. The Sale Transactions are expected to close on or around June 29, 2012. The Sale Transactions are not conditional upon the approval of the Winding Up by the Shareholders at the Meeting.

If the Sale of Assets and the Winding Up are approved by the Shareholders, the Corporation will provide instructions to the Shareholders describing the procedures to be followed to effect the cash distributions.

For the Sale of Assets and the Winding Up to proceed, each of the Sale of Assets and the Winding Up must be approved by way of a special resolution by at least 66 2/3% of the votes cast by the Shareholders present in person or represented by proxy at the Meeting. In addition, such matters must be approved by a majority of the votes cast by the Shareholders, excluding those votes cast by persons who are to be excluded pursuant to Multilateral Instrument 61-101 –Protection of Minority Security Holders in Special Transactions.

The Board retained CC Natural Resource Partners, LLC (“CCNRP”) to, among other things, provide an opinion (the “CCNRP Fairness Opinion”) upon the fairness, from a financial point of view, of the consideration to be received pursuant to the Sale Transactions.CCNRP has provided the Board with its opinion that, as of April 13, 2012, the consideration to be received by the Corporation pursuant to the Sale Transactions is fair to the Corporation from a financial point of view.

The Board has carefully reviewed the CCNRP Fairness Opinion, as well as other relevant matters, and has unanimously concluded that the Sale of Assets and the Winding Up, in its opinion, are fair to the Shareholders, are in the best interests of the Corporation and the Shareholders, and should be placed before the Shareholders for their approval. The Board unanimously recommends that Shareholders vote in favour of the Sale of Assets and the Winding Up.

The attached management information circular / proxy statement of the Corporation (the “Circular”) sets forth information about the background to and details of the Sale Transactions, the terms of the Winding Up and the Meeting. The Circular also requests Shareholder approval of: (i) certain annual meeting matters including the election of the Board, the advisory vote on executive compensation, and the appointment of the Corporation’s auditor for the ensuing year; (ii) the unallocated option entitlements under the Corporation’s stock option plan pursuant to TSX requirements; (iii) the Sale of Assets; (iv) the Winding Up; and (v) the advisory vote on compensation payable to the Corporation’s executives as a result of the Sale Transactions.

Please give this material your careful consideration, and, if you require assistance, consult your financial, income tax or other professional advisor.

Shareholder participation in the affairs of NiMin is important. To be represented at the Meeting, Shareholders must either attend the Meeting in person (if a registered Shareholder) or complete and sign the enclosed form of proxy and forward it so as to reach or be deposited with Computershare Trust Company of Canada, 100 University Avenue, Toronto, Ontario M5J 2Y1, not later than forty-eight (48) hours (excluding Saturdays, Sundays and holidays) prior to the time set for the Meeting or any adjournment thereof.

If you have any questions or require additional information with regards to the voting of Common Shares, please contact our proxy solicitation agent, Georgeson Shareholder Communications Canada, Inc., toll-free within North America at 1-888-605-8414 or Email: askus@georgeson.com.

On behalf of the Board and management, we thank you for your support as a Shareholder.

|

| Yours truly, |

|

(signed) “Clarence Cottman III” |

| Clarence Cottman III |

| Chairman and Chief Executive Officer |

| NiMin Energy Corp. |

Neither the United States Securities and Exchange Commission nor any state securities regulatory agency has approved or disapproved the Sale of Assets or the Winding Up, passed upon the merits or fairness of the Sale of Assets or the Winding Up or passed upon the adequacy or accuracy of the disclosure in these materials. Any representation to the contrary is a criminal offense.

The attached Circular is dated May 23, 2012 and is first being mailed to Shareholders on or about May 25, 2012.

NIMIN ENERGY CORP.

NOTICE OF ANNUAL AND SPECIAL MEETING OF COMMON

SHAREHOLDERS OF NIMIN ENERGY CORP.

Notice is hereby given that the annual and special meeting (the “Meeting”) of holders of common shares (“Shareholders”) of NiMin Energy Corp. (the “Corporation”) will be held at Fess Parker’s DoubleTree Resort, 633 East Cabrillo Boulevard, Santa Barbara, California U.S.A. 93103 at 9:00 A.M. PDT (local time), on June 26, 2012 for the following purposes:

| 1. | To receive the consolidated audited financial statements of the Corporation for the financial year ended December 31, 2011; |

| 2. | To fix the board of directors of the Corporation at five (5) members; |

| 3. | To elect the board of directors of the Corporation for the ensuing year; |

| 4. | To appoint KPMG LLP, as the auditors of the Corporation for the ensuing year and to authorize the board of directors to fix their remuneration; |

| 5. | To consider and, if thought advisable, to pass, with or without variation, an ordinary resolution approving the unallocated option entitlements under the Corporation’s stock option plan, all as more particularly described in the Management Information Circular / Proxy Statement accompanying this Notice (the “Circular”); |

| 6. | To consider, and if thought advisable, to pass, with or without variation, a non-binding advisory vote on executive compensation; |

| 7. | To consider, and if thought advisable, to pass, with or without variation, a non-binding advisory vote on the frequency of future advisory votes on executive compensation; |

| 8. | To consider, and if thought advisable, to pass, with or without variation, a special resolution (the “Sale Resolution”), the full text of which is set forth in Appendix “C” to the accompanying Circular, approving the sale of all or substantially all of the assets of the Corporation (the “Sale of Assets”) in accordance with theBusiness Corporations Act(Alberta) (the “ABCA”) as contemplated in the Purchase and Sale Agreements (as such term is defined in the Circular); |

| 9. | To consider, and if thought advisable, to pass, with or without variation, a special resolution (the “Winding Up Resolution”), the full text of which is set forth in Appendix “D” to the accompanying Circular, approving the voluntary liquidation and dissolution of the Corporation pursuant to the ABCA and the distribution to Shareholders of the net proceeds of the Sale of Assets (less the settlement of obligations of the Corporation’s wholly-owned subsidiary, Legacy Energy, Inc.) and cash on hand, as part of such liquidation and dissolution after satisfaction of all liabilities of the Corporation, by way of a reduction of the stated capital of the common shares of the Corporation; |

| 10. | To consider, and if thought advisable, to pass, with or without variation, a non-binding advisory vote approving certain executive compensation payable under a change of control pursuant to the sale of substantially all of the assets of the Corporation; and |

| 11. | To transact such other business as may be properly brought before the Meeting or any adjournment thereof. |

Accompanying this Notice are: (a) a letter to Shareholders; (b) the Circular; (c) a form of proxy (or a voting instruction form if you hold common shares through a broker or other intermediary); and (d) the Corporation’s annual report to Shareholders on Form 10-K for the year ended December 31, 2011. The nature of the business to be transacted at the Meeting is described in further detail in the accompanying Circular, including the appendices thereto.

In order for the Sale Resolution and the Winding Up Resolution to be adopted, each resolution must be approved by at least 66 2/3% of the votes cast by the Shareholders present in person or represented by proxy at the Meeting. In addition, such matters must be approved by a majority of the votes cast by the Shareholders, excluding those votes cast by persons who are to be excluded pursuant to Multilateral Instrument 61-101 –Protection of Minority Security Holders in Special Transactions.

The board of directors of the Corporation has established the date of record for the Meeting as the close of business on May 22, 2012 (the “Record Date”). Only Shareholders of record at the close of business on the Record Date will be entitled to receive notice of the Meeting or any adjourned meeting and to vote at the Meeting. Shareholders who are unable to attend the Meeting in person are requested to date and execute the enclosed instrument of proxy and return it in the envelope provided for that purpose.

Shareholders will also be asked to cast non-binding advisory votes for each of the following items: (i) executive compensation; (ii) the frequency of future advisory votes on executive compensation; and (iii) approving certain executive compensation payable under a change of control pursuant to the sale of substantially all of the assets of the Corporation.

Pursuant to Section 191 of the ABCA, registered Shareholders are entitled to exercise rights of dissent in respect of the proposed Sale of Assets and, if the Sale of Assets becomes effective, to be paid the fair value for such holder’s shares. Shareholders wishing to dissent with respect to the Sale of Assets must send a written objection to the Corporation, addressed to the Chief Executive Officer of the Corporation at Suite 100, 1160 Eugenia Place, Carpinteria, California, U.S.A. 93013, at or prior to the time of the Meeting in order to be effective. Failure to strictly comply with the requirements set forth in Section 191 of the ABCA may result in the loss of any right of dissent. Persons who are beneficial owners of common shares of the Corporation registered in the name of a broker, custodian, nominee or other intermediary who wish to dissent should be aware that only the registered Shareholders are entitled to dissent. Accordingly, a beneficial owner of common shares of the Corporation desiring to exercise this right must make arrangements for the common shares of the Corporation beneficially owned by such person to be registered in his, her or its name prior to the time the written objection to the special resolution to approve the Sale of Assets is required to be received by the Corporation or, alternatively, make arrangements for the registered holder of his, her or its shares to dissent on his, her or its behalf. See “Information Regarding the Sale of Assets – Rights of Dissent to the Sale of Assets” in the Circular for a description of a Shareholder’s right to dissent to the Sale of Assets.

Dated this 23rd day of May, 2012.

| | |

| BY ORDER OF THE BOARD OF DIRECTORS |

|

(signed) “Clarence Cottman III” |

| Clarence Cottman III, Chief Executive Officer |

It is desirable that as many common shares as possible be represented at the Meeting. If you do not expect to attend and would like your common shares represented, please complete the enclosed instrument of proxy and return same as soon as possible in the envelope provided for that purpose. All instruments of proxy, to be valid, must be deposited at the office of the Registrar and Transfer Agent of the Corporation, Computershare Trust Company of Canada, 100 University Avenue, Toronto, Ontario, M5J 2Y1, not later than forty-eight (48) hours (excluding Saturdays, Sundays and holidays) prior to the Meeting or any adjournment thereof. Late instruments of proxy may be accepted or rejected by the Chairman of the Meeting in his sole discretion and the Chairman of the Meeting is under no obligation to accept or reject any particular late instruments of proxy.

If you have any questions or require additional information with regards to the voting of your shares, please contact Georgeson Shareholder Communications Canada, Inc., toll-free within North America at 1-888-605-8414 or Email: askus@georgeson.com.

TABLE OF CONTENTS

NIMIN ENERGY CORP.

Annual and Special Meeting of the Shareholders of

Common Shares of NiMin Energy Corp.

to be held on June 26, 2012

MANAGEMENT INFORMATION CIRCULAR / PROXY STATEMENT

INTRODUCTION

This Management Information Circular / Proxy Statement (the “Circular”) is provided in connection with the solicitation of proxies by management and the board of directors of NiMin Energy Corp. (the “Corporation”) for use at the annual and special meeting (the “Meeting”) of the holders of common shares (“Shareholders”) of the Corporation to be held at Fess Parker’s DoubleTree Resort, 633 East Cabrillo Boulevard, Santa Barbara, California U.S.A. 93103 on June 26, 2012 at 9:00 A.M. PDT (local time), and at all postponements or adjournments thereof, for the purposes set forth in the Notice accompanying this Circular. See “Glossary of Terms” for capitalized terms not otherwise defined.

A copy of the Corporation’s Annual Information Form / Annual Report on Form 10-K for the fiscal year ended December 31, 2011, as amended from time to time, and filed with the SEC, will be provided, free of charge, to any Shareholder upon written request addressed to NiMin Energy Corp., 1160 Eugenia Place, Suite 100, Carpinteria, California U.S.A. 93013.

NOTICE TO SHAREHOLDERS OUTSIDE OF CANADA

The Corporation is a corporation established under the laws of the Province of Alberta, Canada. The solicitation of proxies in connection with the approval of the matters described in the Notice accompanying this Circular involve securities of a Canadian issuer and are being effected in accordance with Canadian corporate and securities laws and this Circular contains information required by the U.S. securities laws to be included in a proxy statement. Shareholders should be aware that the requirements under Canadian laws may differ from requirements under corporate and securities laws relating to corporations in other jurisdictions.

The enforcement by investors of civil liabilities under U.S. federal securities laws or the securities laws of other jurisdictions outside Canada may be affected adversely by the fact that the Corporation is incorporated under the laws of the Province of Alberta. A Shareholder may not be able to sue the Corporation or its officers or directors in a Canadian court for violations of U.S. or other foreign securities laws. It may be difficult to compel the Corporation to subject itself to a judgment of a court outside Canada.

THE SALE OF ASSETS AND THE WINDING UP HAVE NOT BEEN APPROVED OR DISAPPROVED BY ANY SECURITIES REGULATORY AUTHORITY, NOR HAS ANY SECURITIES REGULATORY AUTHORITY PASSED UPON THE FAIRNESS OR MERITS OF THE SALE OF ASSETS AND THE WINDING UP OR UPON THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED IN THIS DOCUMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Certain information concerning tax consequences of the Sale of Assets and the Winding Up for Shareholders who are not resident in Canada is set forth in “Canadian Federal Income Tax Considerations – Non-residents of Canada” and “United States Income Tax Considerations – Certain U.S. Federal Income Tax Consequences of the Winding Up – Taxation of Non-United StatesShareholders”. Shareholders should be aware that the Sale of Assets and the Winding Up may have tax consequences both in Canada and in their jurisdiction of residence. Such consequences may not be described fully herein and Shareholders are encouraged to consult with their financial, legal and tax advisors regarding specific tax consequences.

- 1 -

FORWARD-LOOKING STATEMENTS

This Circular contains certain statements or disclosures that may constitute forward-looking statements or information (“forward-looking statements”) under applicable securities laws. All statements and disclosures, other than those of historical fact, which address activities, events, outcomes, results or developments that management or the directors of the Corporation, anticipate or expect may or will occur in the future (in whole or in part) should be considered forward-looking statements. In some cases, forward-looking statements can be identified by terms such as “forecast”, “future”, “may”, “will”, “expect”, “anticipate”, “believe”, “potential”, “enable”, “plan”, “continue”, “contemplate”, “pro forma” or other comparable terminology.

Forward-looking statements presented in such statements or disclosures may, among other things, relate to: the structure and effects of the Sale of Assets and the Winding Up, the anticipated benefits and Shareholder value resulting from the Sale of Assets and the Winding Up, the timing and completion of the Sale of Assets and the Winding Up, the liabilities and obligations of Legacy and NiMin, cash distributions, estimated costs of the Sale of Assets and the Winding Up, anticipated income taxes, plans and objectives of management in connection with the Sale of Assets and the Winding Up and operations until closing of the Sale of Assets and the Winding Up, final costs of the Sale of Assets and the Winding Up, the nature and results of operations until closing of the Sale of Assets and the Winding Up, forecast business results and anticipated financial performance.

Various assumptions or factors are applied in drawing conclusions or making the forecasts or projections set out in forward-looking statements. Those assumptions and factors are based on information currently available to the Corporation, including information obtained from third party industry analysts and other third party sources. In some instances, material assumptions and factors are presented or discussed elsewhere in this Circular in connection with the statements or disclosure containing the forward-looking statements. Shareholders are cautioned that the following list of material factors and assumptions is not exhaustive. The factors and assumptions include, but are not limited to:

| | • | | the approval of the Sale of Assets and the Winding Up by Shareholders; |

| | • | | the receipt of all regulatory approvals and all other third party consents, including the consents required under the Purchase and Sale Agreements to complete the Sale Transactions; |

| | • | | no unforeseen changes in the legislative and operating framework for the business of the Corporation or the Purchasers, as applicable; |

| | • | | no significant adverse changes in economic conditions that influence the demand for oil and natural gas products; |

| | • | | anticipated compliance with governmental regulations and assumptions with respect to changes in regulations; |

| | • | | no significant adverse changes pursuant to the terms of the Purchase and Sale Agreements; |

| | • | | continued compliance with all terms and conditions of the Purchase and Sale Agreements; |

| | • | | assumptions made in the discussion of risk factors discussed herein. See “Risk Factors”; and |

| | • | | no significant event occurring outside the ordinary course of business such as a natural disaster or other calamity. |

The forward-looking statements in statements or disclosures in this Circular are based (in whole or in part) upon factors which may cause actual results, performance or achievements of the Corporation to differ materially from those contemplated (whether expressly or by implication) in the forward-looking statements. Those factors are based on information currently available to the Corporation including information obtained by the Corporation from third-party industry analysts and other third party sources. Actual results or outcomes may differ materially from those predicted by such statements or disclosures. While the Corporation does not know what impact any of

- 2 -

those differences may have, its business, results of operations, financial condition and its credit stability may be materially adversely affected. Factors that could cause actual results, performance, achievements or outcomes to differ materially from the results expressed or implied by forward-looking statements include, among other things:

| | • | | the failure to complete the Sale of Assets and the Winding Up; |

| | • | | the payment by NiMin of the $5 million termination fee to the Wyoming Purchaser in the event that such fee becomes payable pursuant to the Wyoming Purchase and Sale Agreement; |

| | • | | the failure to realize the anticipated benefits of the Sale of Assets and the Winding Up; |

| | • | | the risks that the Sale of Assets and the Winding Up will not receive all requisite consents, including the consents required under the Purchase and Sale Agreements, and Shareholder and regulatory approvals; |

| | • | | the risks associated with general economic conditions in the geographic areas where the Corporation and Legacy operate; |

| | • | | the risks of changes in market demand for oil and natural gas products that the Corporation derives revenue from; |

| | • | | the risks associated with legislative and regulatory developments or changes that may affect costs, taxes, revenues, the speed and degree of competition entering the market, global capital markets activity and general economic conditions in geographic areas where the Corporation and its subsidiary operate, timing and extent of changes in prevailing interest rates, currency exchange rates, changes in counterparty risk and the impact of accounting standards issued by Canadian standard setters; and |

| | • | | the risk factors discussed herein. See “Risk Factors”. |

The Corporation cautions Shareholders that the above list of risk factors is not exhaustive. Other factors which could cause actual results, performance, achievements or outcomes of to differ materially from those contemplated (whether expressly or by implication) in the statements or disclosure containing forward-looking statements are disclosed in the Corporation’s publicly filed disclosure documents, including those disclosed under “Risk Factors” in its Annual Information Form/Annual Report on Form 10-K as amended from time to time and those disclosed under “Risk Factors” in this Circular.

The forward-looking statements contained in this analysis are expressly qualified by this cautionary statement. The Corporation is not obligated to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable laws. Because of the risks, uncertainties and assumptions contained herein, readers should not place undue reliance on forward-looking statements or disclosures. The foregoing statements expressly qualify any forward-looking statements contained herein.

GENERAL DISCLOSURE INFORMATION

Unless otherwise stated, the information contained in this Circular is given as at May 23, 2012. No person has been authorized to give information or to make any representations in connection with matters to be considered at the Meeting other than those contained in this Circular and, if given or made, any such information or representations should not be relied upon in making a decision as to how to vote on the matters to be considered at the Meeting or be considered to have been authorized by the Corporation, or the directors or officers thereof.

Unless otherwise indicated or the context otherwise requires, all dollar amounts in this Circular are in United States dollars.

Aggregated figures in graphs, charts and tables contained in this Circular may not add due to rounding. Historical statistical data and/or historical returns do not necessarily indicate future performance. The Corporation has not

- 3 -

independently verified any of the data from third party sources referred to in this Circular or ascertained the underlying assumptions relied upon by such sources. Words importing the singular number only include the plural and vice versa, and words importing any gender include all genders.

Shareholders should not construe the contents of this Circular as legal, tax or financial advice and should consult with their own professional advisors as to the relevant legal, tax, financial or other matters in connection with the Meeting, the Sale of Assets and the Winding Up.

Abbreviations

| | | | | | |

Oil and Natural Gas Liquids | | Natural Gas |

| bbl | | barrel | | mcf | | thousand cubic feet |

| Mbbl | | thousand barrels | | MMcf | | million cubic feet |

| NGLs | | natural gas liquids | | MMbtu | | million British thermal units |

| | | |

Other | | | | | | |

| API | | American Petroleum Institute | | | | |

| BOE | | barrel of oil equivalent | | | | |

| MMBOE | | million barrels of oil equivalent | | | | |

| BOE/d | | barrels of oil equivalent per day | | | | |

| M$ | | thousands of dollars | | | | |

In this Circular and its appendices and schedules, the calculation of barrels of oil equivalent (BOE) is calculated at a conversion rate of six thousand cubic feet (6 mcf) of natural gas for one barrel (bbl) of oil based on an energy equivalency conversion method. BOEs may be misleading particularly if used in isolation. A BOE conversion ratio of 6 mcf: 1 bbl is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead.

- 4 -

GLOSSARY OF TERMS

All capitalized terms used in this Circular but not otherwise defined herein have the meanings set forth under this “Glossary of Terms”.

“ABCA” means theBusiness Corporations Act (Alberta) as in effect at the relevant time;

“ACB” has the meaning ascribed thereto under the heading “Canadian Federal Income Tax Considerations”;

“Advisory Resolutions” means, collectively, the non-binding resolutions of the Shareholders for each of the following items: (i) executive compensation; (ii) the frequency of future advisory votes on executive compensation; and (iii) approving certain executive compensation payable under a change of control pursuant to the sale of substantially all of the assets of the Corporation;

“Aggregate Purchase Price” means cash consideration of $125,250,000, subject to deduction and adjustment in accordance with the provisions of the Purchase and Sale Agreements;

“allowable capital loss” has the meaning ascribed thereto under the heading “Canadian Federal Income Tax Considerations- Residents of Canada – Taxation of Capital Gains and Losses”;

“Annual Information Form” means the Annual Report of the Corporation for the fiscal year ended December 31, 2011 pursuant to section 13 or 15(d) of the Securities Exchange Act of 1934 on Form 10-K, as amended from time to time;

“Beneficial Shareholder” means a Shareholder who holds their Common Shares through their broker, intermediary, trustee or other person, or who otherwise does not hold their Common Shares in their own name;

“Board” means the board of directors of the Corporation;

“California Assets” means Legacy’s right, title and interest in and to the Pleito Creek Field located along the south side of the San Joaquin basin in Kern County, California and certain other miscellaneous assets, as set out in the California Purchase and Sale Agreement;

“California Effective Time” means 7:00 A.M. local time where the California Assets are located on April 1, 2012, if the transactions contemplated by the California Purchase and Sale Agreement are consummated in accordance with the terms and provisions thereof;

“California Purchase and Sale Agreement” means the purchase and sale agreement dated April 26, 2012 by and among the Corporation, Legacy and the California Purchaser, pursuant to which the California Purchaser shall acquire the California Assets, attached hereto as Appendix “H”;

“California Purchase Price” means cash consideration of $27,200,000, subject to deduction and adjustment in accordance with the provisions of the California Purchase and Sale Agreement;

“California Purchaser” means Southern San Joaquin Production, LCC, a Delaware limited liability company;

“California Sale” means the purchase by and sale and conveyance of the California Assets to the California Purchaser pursuant to the terms and conditions of the California Purchase and Sale Agreement;

- 5 -

“CCNRP” means CC Natural Resource Partners, LLC;

“CCNRP Fairness Opinion” means the fairness opinion dated April 13, 2012 received by the Board from CCNRP stating that the consideration to be received pursuant to the Sale Transactions is fair to the Corporation from a financial point of view, a copy of which is attached to this Circular as Appendix “E”;

“Circular” means the Notice and this management information circular / proxy statement for the Meeting, including all appendices hereto;

“Code” means the Internal Revenue Code of 1986, as amended;

“Common Shares” means the common shares in the capital of the Corporation;

“Corporation” or “NiMin” means NiMin Energy Corp., a corporation incorporated pursuant to the laws of the Province of Alberta, Canada;

“CMD” means combined miscible drive technology;

“CRA” means the Canada Revenue Agency;

“DGCL” means Delaware General Corporation Law;

“Dissent Payment” has the meaning ascribed thereto under the heading “Canadian Federal Income Tax Considerations”;

“Dissent Rights” means the rights of dissent of registered Shareholders pursuant to section 191 of the ABCA in respect of the Sale Resolution;

“Dissenting Holder” has the meaning ascribed thereto under the heading “Canadian Federal Income Tax Considerations”;

“Dissenting Shareholder” means a registered Shareholder who has validly exercised its Dissent Rights and has not withdrawn or been deemed to have withdrawn such exercise of Dissent Rights, but only in respect of the Common Shares in respect of which Dissent Rights are validly exercised by such holder;

“Distributions” means the cash distributions that Shareholders will receive from the Corporation pursuant to the Winding Up following the completion of the Sale of Assets and provision of the Legacy Liquidation Distribution Amount to the Corporation and settlement of the Corporation’s obligations and liabilities;

“Escrow Agreement” means that certain escrow agreement to be entered into pursuant to the California Purchase and Sale Agreement among Legacy, the California Purchaser and the escrow agent;

“Escrowed Funds” means an amount of $3,000,000 deposited in escrow pursuant to the terms and conditions of the Escrow Agreement;

“Georgeson” means Georgeson Shareholder Communications Canada, Inc.;

“Holder” means a Shareholder as described under the heading “Canadian Federal Income Tax Considerations”;

“IRS” means Internal Revenue Service;

- 6 -

“Legacy” means Legacy Energy, Inc., a wholly-owned subsidiary of the Corporation, incorporated pursuant to the laws of the State of Delaware;

“Legacy Board” means the board of directors of Legacy;

“Legacy Dissolution” means the liquidation and dissolution of Legacy pursuant to the DGCL;

“Legacy Liquidation Distribution Amount” means the amount Legacy distributes to the Corporation as its sole shareholder pursuant to the liquidation and distribution of Legacy, such amount to include the net proceeds from the Sale Transactions less obligations, liabilities and any contingency reserves of Legacy;

“Legacy Plan of Dissolution” means the plan of dissolution to be conducted to liquidate and dissolve Legacy in accordance with the DGCL;

“Macquarie Capital” means Macquarie Capital (USA) Inc.;

“Management Designees” means the persons named in the instrument of proxy accompanying the Notice and Circular;

“Meeting” means the annual and special meeting of Shareholders to be held at 9:00 A.M. PDT (local time) on June 26, 2012 at Fess Parker’s DoubleTree Resort, 633 East Cabrillo Boulevard, Santa Barbara, California U.S.A. 93103 to consider, among other things, the approval of the Sale of Assets, the Winding Up, the unallocated option entitlements under the Stock Option Plan, the Advisory Resolutions, and other annual meeting matters, including any adjournment or postponement thereof;

“MI 61-101” means Multilateral Instrument 61-101 –Protection of Minority Security Holders in Special Transactions;

“Named Executive Officers” has the meaning ascribed thereto under the heading “Statement of Executive Compensation – Compensation Discussion and Analysis – Summary Compensation”;

“NEX” means the NEX board of the TSXV;

“Non-resident Holder” has the meaning ascribed thereto under the heading “Canadian Federal Income Tax Considerations – Non-residents of Canada”;

“Notice” means the notice of annual and special meeting of holders of Common Shares, dated May 23, 2012 enclosed with this Circular;

“Options” has the meaning ascribed thereto under the heading “Compensation of Executive Officers – Compensation Discussion and Analysis – Stock Option Plan”;

“Part XIII Tax” has the meaning ascribed thereto under the heading “Canadian Federal Income Tax Considerations”;

“Preconsolidated Shares” means the Common Shares prior to consolidation of one (1) new Common Share for each three (3) existing common shares in September 2009;

“Proposed Amendments” has the meaning ascribed thereto under the heading “Canadian Federal Income Tax Considerations”;

- 7 -

“PUC” has the meaning ascribed thereto under the heading “Canadian Federal Income Tax Considerations”;

“Purchase and Sale Agreements” means, collectively, the California Purchase and Sale Agreement and the Wyoming Purchase and Sale Agreement;

“Purchasers” means, collectively, the Wyoming Purchaser and the California Purchaser;

“Record Date” means May 22, 2012;

“Registrar” means the Registrar of Corporations or a Deputy Registrar of Corporations, as the case may be, appointed pursuant to Section 263 of the ABCA;

“Resident Holder” has the meaning ascribed thereto under the heading “Canadian Federal Income Tax Considerations – Residents of Canada”;

“Sale of Assets” means the sale of all or substantially all of the assets of the Corporation and including those assets held by Legacy, including the sale of the Wyoming Assets and the California Assets pursuant to the Purchase and Sale Agreements;

“Sale Resolution” means the special resolution of the Shareholders concerning the Sale of Assets to be considered at the Meeting, substantially in the form set forth in Appendix “C” to this Circular;

“Sale Transactions” means the transactions by which the Wyoming Sale and the California Sale will be effected on and subject to the terms and conditions of the California Purchase and Sale Agreement and the Wyoming Purchase and Sale Agreement, as included in the Sale Resolution;

“SEC” means the United States Securities and Exchange Commission;

“SEDAR” means the System for Electronic Document Analysis and Retrieval of the Canadian Securities Administrators;

“Senior Loan” means a senior secured loan entered into by Legacy and guaranteed by the Corporation on June 30, 2010, as amended on May 18, 2012, in the amount of $36,000,000 from a U.S. based institutional private lender, subject to an original issuer discount of seven point five percent (7.5%), a commitment fee of one percent (1%), a placement fee of one percent (1%) and a transaction fee of three percent (3%);

“Shareholders” means the holders of the Common Shares;

“Stock Option Plan” means the Common Share incentive option plan of the Corporation;

“Stock Option Plan Resolution” means the ordinary resolution of the Shareholders concerning the approval of the unallocated option entitlements under the Stock Option Plan pursuant to requirements of the TSX;

“Support Agreement” means the voting support agreement entered into by directors and executive officers of NiMin pursuant to the Wyoming Purchase and Sale Agreement;

“Tax” or “Taxes” means: (i) all country, federal, local, municipal, foreign and other taxes, assessments, duties or similar charges of any kind whatsoever, including all income, corporate franchise, income, sales, use, ad valorem, receipts, value added, profits, license, withholding, payroll, employment, social security, excise, premium, property, customs, net worth, capitalizations, transfer, stamp, documentation, social security, alternative, minimum, occupation, recapture and other taxes charges of any kind whatever, whether disputed or

- 8 -

not, including all interest, penalties and additions imposed with respect to such amounts, and all amounts payable pursuant to any agreement or arrangement with respect to Taxes; and (ii) any liability for the payment of any amount of the type described in clause (i) of this definition as a result of being a member of an affiliated, consolidated, combined or unitary group for any period, as a result of any tax sharing or tax allocation agreement, arrangement or understanding, or as a result of being liable for another person’s taxes as a transferee or successor, by contract or otherwise;

“Tax Act” means theIncome Tax Act(Canada) and the regulations promulgated thereunder, as amended;

“Tax Return” or “Tax Returns” means all returns, declarations of estimated tax payments, reports, estimates, information returns and statements, including any related or supporting information with respect to any of the foregoing, filed or to be filed with any Taxing Authority in connection with the determination, assessment, collection or administration of any Taxes, including any amendments thereto;

“taxable capital gain” has the meaning ascribed thereto under the heading “Canadian Federal Income Tax Considerations – Residents of Canada – Taxation of Capital Gains and Losses”;

“Taxing Authority” means any domestic, foreign, federal, national or municipal or other local governmental entity, any subdivision, agency, commission or authority thereof or any quasi-government body exercising tax regulation authority;

“Transfer Agent” means the Corporation’s registrar and transfer agent, Computershare Trust Company of Canada;

“Treasury Regulations” means final and temporary regulations now or hereafter promulgated by the U.S. Department of Treasury pursuant to 26 U.S.C. Section 1501 et seq.;

“Treaty” has the meaning ascribed thereto under the heading “Canadian Federal Income Tax Considerations – Non-residents of Canada – Taxation of Dividends”;

“TSX” means the Toronto Stock Exchange;

“TSXV” means the TSX Venture Exchange;

“Winding Up” means the proposed voluntary liquidation and dissolution of the Corporation pursuant to the ABCA and the distribution to Shareholders of the Legacy Liquidation Distribution Amount and cash on hand, less any reserves and payments made in respect of the Corporation’s ongoing costs and liabilities, by way of a reduction of stated capital in one or more instalments as part of such liquidation and dissolution;

“Winding Up Resolution” means the special resolution of the Shareholders concerning the Winding Up to be considered at the Meeting, substantially in the form set forth in Appendix “D” to this Circular;

“Wyoming Assets” means Legacy’s right, title and interest in and to the Ferguson Ranch Field, Hunt Field, Willow Draw Field and Sheep Point Field, all located on the western margin of the Big Horn Basin, and certain other miscellaneous assets, as set out in the Wyoming Purchase and Sale Agreement;

“Wyoming Effective Time” means 7:00 A.M. local time where the Wyoming Assets are located on April 1, 2012, if the transactions contemplated by the Wyoming Purchase and Sale Agreement are consummated in accordance with the terms and provisions thereof;

- 9 -

“Wyoming Purchase and Sale Agreement” means the purchase and sale agreement dated April 24, 2012 by and among the Corporation, Legacy, and the Wyoming Purchaser, pursuant to which the Wyoming Purchaser shall acquire the Wyoming Assets, as attached hereto as Appendix “G”;

“Wyoming Purchase Price” means cash consideration of $98,050,000, subject to deduction and adjustment in accordance with the provisions of the Wyoming Purchase and Sale Agreement;

“Wyoming Purchaser” means BreitBurn Operating L.P., a Delaware limited partnership and wholly-owned subsidiary of BreitBurn Energy Partners L.P.; and

“Wyoming Sale” means the purchase by and sale and conveyance of the Wyoming Assets to the Wyoming Purchaser pursuant to the terms and conditions of the Wyoming Purchase and Sale Agreement.

- 10 -

SUMMARY

The following is a summary of certain information contained elsewhere in this Circular. It is not, and is not intended to be, complete. This is a summary only and is qualified in its entirety by the more detailed information appearing elsewhere in this Circular and the attached Appendices.Shareholders are urged to review carefully this Circular, including the Appendices.Certain capitalized terms used in this Circular have the meanings set forth in the “Glossary of Terms”.

The Meeting

The Meeting will be held at Fess Parker’s DoubleTree Resort, 633 East Cabrillo Boulevard, Santa Barbara, California U.S.A. 93103 on June 26, 2012 at 9:00 A.M. PDT (local time) for the purposes set forth in the Notice accompanying this Circular. The business of the Meeting will be to consider and vote on the annual meeting matters, the Stock Option Plan Resolution, the Sale Resolution, the Winding Up Resolution, the Advisory Resolutions and any other business that may properly come before the Meeting and any adjournments or postponements thereof. See “Particulars of Matters to be Acted Upon”.

The Record Date and Quorum

The Record Date for determining the Shareholders entitled to receive notice of and to vote at the Meeting is the close of business on May 22, 2012.

A Shareholder is entitled to receive notice of, and to vote at, the Meeting if such Shareholder owned Common Shares at the close of business on May 22, 2012, which is set as the Record Date for the Meeting. A Shareholder of record will have one (1) vote for each Common Share at the close of business on the Record Date. At the close of business on the Record Date, there were 69,834,396 Common Shares outstanding and entitled to vote at the Meeting. Pursuant to By-Law No. 1 of the Corporation, a quorum for the transaction of business at the Meeting shall consist of at least two (2) persons holding or representing by proxy not less than five percent (5%) of the outstanding shares of the Corporation entitled to vote at the Meeting. Thus, 3,491,712 Common Shares must be represented by proxy or by Shareholders present and entitled to vote at the Meeting to constitute a quorum. For U.S. purposes, the proxies do not contain provisions for broker non-votes and abstentions other than the withhold vote for certain annual meeting matters. In the absence of directions on a properly executed proxy, such Common Share will be voted in favour of the matters set out herein.

See “Voting Shares – Registered Shareholders”.

Overview of the Sale Transactions

On April 25, 2012, the Corporation announced that the Board had concluded its review of strategic alternatives commenced on November 21, 2011 whereby the Board unanimously determined that the Sale of Assets and the Winding Up is the best alternative for generating maximum value for Shareholders.

See “Information Regarding the Sale of Assets – Reasons for the Sale of Assets”.

As a result of the strategic process, NiMin and Legacy entered into the Wyoming Purchase and Sale Agreement for the sale of the Wyoming Assets, for a total cash consideration of approximately $98 million, subject to adjustments as set out therein. The Wyoming Purchase and Sale Agreement prohibits NiMin and Legacy from soliciting or initiating any discussion regarding a business combination or asset sale involving the Wyoming Assets and provides for a $5 million termination fee in certain circumstances, including if Shareholders do not approve the Sale Resolution. The Wyoming Sale is subject to customary closing conditions, including approval by Shareholders.

See “Information Regarding the Sale of Assets – Wyoming Purchase and Sale Agreement”.

- 11 -

On April 27, 2012, the Corporation announced that it and Legacy entered into the California Purchase and Sale Agreement for the sale of the California Assets for a total cash consideration of approximately $27 million, subject to adjustments as set out therein. The sale of the California Assets is subject to customary closing conditions, including approval by Shareholders.

See “Information Regarding the Sale of Assets – California Purchase and Sale Agreement”.

The combined gross proceeds from the sale of the California Assets and the Wyoming Assets is approximately $125 million, subject to adjustment pursuant to the applicable agreement.

Wyoming Purchase and Sale Agreement

Purchase Price

The total consideration for the purchase, sale and conveyance of the Wyoming Assets, as more specifically described in the Wyoming Purchase and Sale Agreement, is the sum of $98,050,000 in cash, subject to adjustments, including increases to the Wyoming Purchase Price for title benefits and certain paid taxes and proceeds from sales of hydrocarbons produced and saved prior to the Wyoming Effective Time and decreases to the Wyoming Purchase Price for allocated values of those assets comprising the Wyoming Assets not conveyed at closing due to failure to obtain a consent or preferential right, title and environmental defects, certain taxes, unpaid taxes and proceeds from sales of hydrocarbons produced and saved after the Wyoming Effective Time.

Representations, Warranties

The Wyoming Purchase and Sale Agreement contains a number of customary mutual representations and warranties of Legacy and NiMin to the Wyoming Purchaser and of the Wyoming Purchaser to Legacy and NiMin, relating to, among other things: existence, legal power, no conflict, authorization, enforceability, broker’s and finder’s fees, no bankruptcy and no claims.

The Wyoming Purchase and Sale Agreement contains additional representations and warranties of Legacy and NiMin to the Wyoming Purchaser, relating to, among other things: royalties, taxes, absence of material breach or material default under material contracts, conveyance free and clear of liens and encumbrances, no well imbalances, no conflict with constating documents, no consents required to enter into the Wyoming Purchase and Sale Agreement or consummate the transactions contemplated thereby (except as set forth in the Wyoming Purchase and Sale Agreement), compliance with laws, permits, no wells required to be plugged and abandoned (except as set forth in the Wyoming Purchase and Sale Agreement), disclosed authorities for expenditures and other commitments in excess of $50,000 per item, status of Legacy, material compliance with environmental laws, disclosed payout allocation of rights pertaining to any wells and funds held in suspense required to be transferred at closing.

Additionally, the Wyoming Purchase and Sale Agreement also contains further representations and warranties of the Wyoming Purchaser to Legacy and NiMin, relating to, among other things: qualification to own and operate the Wyoming Assets; acquisition of the Wyoming Assets for the Wyoming Purchaser’s own account; sufficient financial resources; satisfaction with due diligence investigation; and no consents required to be made by the Wyoming Purchaser in connection with its performance of the Wyoming Purchase and Sale Agreement.

Conditions to Completion of the Wyoming Sale

| | • | | Conditions Precedent for the benefit of Legacy and the Corporation |

| | • | | The representations and warranties of the Wyoming Purchaser shall be true and correct in all material respects on the closing date of the Wyoming Sale; |

- 12 -

| | • | | The Wyoming Purchaser shall have performed, in all material respects, the obligations, covenants and agreements contained in the Wyoming Purchase and Sale Agreement to be performed or complied with by it at or prior to the closing of the Wyoming Sale; |

| | • | | No suit, action or other proceeding shall be pending or threatened; |

| | • | | The Wyoming Purchaser shall have delivered to Legacy the Wyoming Purchase Price pursuant to the Wyoming Purchase and Sale Agreement; |

| | • | | The Wyoming Purchaser shall have executed, acknowledged and delivered, as appropriate, to Legacy all closing documents as required under the Wyoming Purchase and Sale Agreement (including an officer’s certificate and assignment); and |

| | • | | Shareholder approval shall have been obtained. |

| | • | | Conditions Precedent for the benefit of the Wyoming Purchaser |

| | • | | The representations and warranties of Legacy and NiMin shall be true and correct in all material respects on the closing date of the Wyoming Sale; |

| | • | | Legacy and NiMin shall have performed, in all material respects, the obligations, covenants and agreements contained in the Wyoming Purchase and Sale Agreement to be performed or complied with by it at or prior to the closing of the Wyoming Sale; |

| | • | | No suit, action or other proceeding shall be pending or threatened; |

| | • | | Legacy and NiMin shall have executed, acknowledged and delivered, as appropriate, to the Wyoming Purchaser all closing documents as required under the Wyoming Purchase and Sale Agreement (including an assignment, letters to purchasers of production, officer’s certificate, certificate of non-foreign status of Legacy, change of operator forms, releases relating to security, if any, affecting the Wyoming Assets, and financial statements); and |

| | • | | Shareholder approval shall have been obtained. |

Covenants Regarding the Wyoming Assets

Covenants are provided by the parties in reference to: operations after the Wyoming Effective Time; limitations on the operational obligations and liabilities of Legacy; the Meeting; required approvals; the operation of the Wyoming Assets after the closing of the Wyoming Sale; casualty loss, operatorship, records, administrative duties and other obligations, no-shop provisions and support agreement.

Operations after Wyoming Effective Time

From and after the date of the Wyoming Purchase and Sale Agreement until closing of the Wyoming Sale, Legacy has agreed to operate the Wyoming Assets in the ordinary manner consistent with past practice. The Wyoming Purchaser shall reimburse Legacy a monthly fee of $51,000 per month during this time for administrative overhead expenses incurred by Legacy in order to operate the Wyoming Assets accordingly.

No-Shop

Legacy and NiMin are prohibited from soliciting or initiating any discussion regarding a business combination or asset sale involving the Wyoming Assets and the Wyoming Purchase and Sale Agreement provides for a $5 million termination fee in certain circumstances, including if Shareholders do not approve the Sale Resolution and if an Acquisition Proposal that constitutes a Superior Proposal (as defined in the Wyoming Purchase and Sale Agreement) is accepted or approved.

- 13 -

Survival

The representations, warranties, covenants and obligations of Legacy under the Wyoming Purchase and Sale Agreement shall not survive the closing. The representations, warranties, covenants and obligations of NiMin shall survive the closing for ninety (90) days only. Any claims for breach of representation or warranty properly raised prior to the expiration of such representation or warranty shall survive until such claim and the payment and the indemnity with respect thereto are resolved.

Termination Events

The Wyoming Purchase and Sale Agreement may be terminated at any time at or prior to the closing of the Wyoming Sale, upon certain termination events including the following:

| | • | | by mutual written consent of the parties; |

| | • | | by Legacy or the Wyoming Purchaser if the closing has not occurred before June 29, 2012; |

| | • | | by either party if any governmental authority shall have issued an order, judgment or decree or taken any other action challenging, delaying, restraining, enjoining, prohibiting or invalidating the consummation of any of the transactions contemplated by the Wyoming Purchase and Sale Agreement; |

| | • | | by either party if the aggregate amount of all Wyoming Purchase Price adjustments with respect to uncured title defects plus environmental defect values exceeds fifteen percent (15%) of the Wyoming Purchase Price; |

| | • | | by the Wyoming Purchaser if Shareholder approval for the Sale Resolution is not obtained or if Legacy accepts, approves, recommends or enters into an agreement to implement an Acquisition Proposal (as defined in the Wyoming Purchase and Sale Agreement), in which case Legacy shall within one business day after termination, pay to the Wyoming Purchaser a fee of $5,000,000; and |

| | • | | by Legacy if NiMin, Legacy or the Board, as applicable, accepts, approves, recommends or enters into an agreement to implement an Acquisition Proposal (as defined in the Wyoming Purchase and Sale Agreement) that constitutes a Superior Proposal (as defined in the Wyoming Purchase and Sale Agreement) and concurrently therewith Legacy pays to the Wyoming Purchaser a fee of $5,000,000, provided that NiMin and Legacy have complied with no-shop obligations pursuant to the Wyoming Purchase and Sale Agreement. |

Indemnification

The Wyoming Purchase and Sale Agreement sets out certain indemnifications in favour of Legacy from claims relating to or arising out of certain assumed obligations and any breach by the Wyoming Purchaser relating to any of the Wyoming Purchaser’s representations and warranties and certain indemnifications in favour of the Wyoming Purchaser for breach by Legacy of Legacy’s representations and warranties non-environmental and environmental claims.

Governing Law

The Wyoming Purchase and Sale Agreement shall be governed and construed in accordance with the laws of the State of Wyoming, with the parties agreeing to venue in Park County, Wyoming.

See “Information Regarding the Sale of Assets – Wyoming Purchase and Sale Agreement”.

- 14 -

Support Agreement

Pursuant to the Wyoming Purchase and Sale Agreement, certain support agreements executed by directors and executive officers of the Corporation (“Support Securityholders”) were delivered to the Wyoming Purchaser, whereby the Support Securityholders agreed to vote or cause to be voted at the Meeting an aggregate of 5.13% of the issued and outstanding Common Shares, and any Common Shares resulting from the exercise of Options to purchase an aggregate of 3,925,000 additional Common Shares between the date of the support agreement and closing of the Wyoming Sale, in favour of the Sale Resolution.

See “Information Regarding the Sale of Assets – Support Agreement”.

California Purchase Asset Sale Agreement

Purchase Price

The total consideration for the purchase, sale and conveyance of the California Assets, as more specifically described in the California Purchase and Sale Agreement, is the sum of $27,200,000 in cash, subject to adjustments, including increases to the California Purchase Price for certain taxes and allocation of expenses and revenues and decreases to the California Purchase Price for allocated values of those assets comprising the California Assets not conveyed at closing due to an unresolved preferential right of consent, title defects, environmental defects, certain taxes and allocation of expenses and revenues.

Representations, Warranties

The California Purchase and Sale Agreement contains a number of customary mutual representations and warranties of Legacy and NiMin to the California Purchaser and of the California Purchaser to Legacy and NiMin, relating to, among other things: existence, legal power, no conflict, authorization, enforceability, broker’s and finder’s fees, no bankruptcy and no claims.

The California Purchase and Sale Agreement contains additional representations and warranties of Legacy and NiMin to the California Purchaser, relating to, among other things: royalties, taxes, absence of material breach or material default under any material contracts, conveyance free and clear of liens and encumbrances, no preferential rights or consents affecting California Assets, compliance with laws, permits, no take or pay or calls on production, sufficient rights to operate, current commitments and employees.

Additionally, the California Purchase and Sale Agreement also contains further representations and warranties of the California Purchaser to Legacy and NiMin, relating to, among other things: qualification to own and operate the California Assets; acquisition of the California Assets for the California Purchaser’s own account; sufficient financial resources; satisfaction with due diligence investigation; and no consents required to be made by the California Purchaser in connection with its performance of the California Purchase and Sale Agreement.

Conditions to Completion of the California Sale

| | • | | Conditions Precedent for the benefit of Legacy and the Corporation |

| | • | | The representations and warranties of the California Purchaser shall be true and correct in all material respects on the closing date of the California Sale; |

| | • | | The California Purchaser shall have performed all material obligations, covenants and agreements contained in the California Purchase and Sale Agreement to be performed or complied with by it at or prior to the closing of the California Sale; |

| | • | | No suit, action or other proceeding shall be pending or threatened; |

| | • | | The California Purchaser shall have delivered to Legacy the California Purchase Price pursuant to the California Purchase and Sale Agreement; |

- 15 -

| | • | | The California Purchaser shall have executed, acknowledged and delivered, as appropriate, to Legacy all closing documents as required under the California Purchase and Sale Agreement (including the California Purchase Price, net of adjustments and less an indemnity escrow amount, deliver to an escrow agent an indemnity escrow amount and possession of the California Assets); |

| | • | | All appropriate consents have been obtained and preferential rights exercised or elapsed; |

| | • | | Shareholder approval shall have been obtained; |

| | • | | Holders of not more than ten percent (10%) of the issued and outstanding Common Shares have exercised rights of dissent in connection with the California Sale; and |

| | • | | Legacy shall have received evidence that any approval required in connection with the sale of the California Assets to the California Purchaser have been obtained as contemplated pursuant to required approvals under the California Purchase and Sale Agreement. |

| | • | | Conditions Precedent for the benefit of the California Purchaser |

| | • | | The representations and warranties of Legacy and NiMin shall be true and correct in all material respects on the closing date of the California Sale; |

| | • | | Legacy and NiMin shall have performed all material obligations, covenants and agreements contained in the California Purchase and Sale Agreement to be performed or complied with by it at or prior to the closing of the California Sale; |

| | • | | No suit, action or other proceeding shall be pending or threatened; |

| | • | | Legacy shall have executed, acknowledged and delivered, as appropriate, to the California Purchaser all closing documents as required under the California Purchase and Sale Agreement (including an assignment, the Escrow Agreement, affidavit of non-foreign status, withholding certificate, change of operator forms and releases from employees) and delivered to the California Purchaser possession of the California Assets; |

| | • | | Shareholder approval shall have been obtained; and |

| | • | | The California Purchaser shall have received evidence that any approval required in connection with the sale of the California Assets to the California Purchaser have been obtained as contemplated pursuant to required approvals under the California Purchase and Sale Agreement. |

Covenants Regarding the California Assets

Covenants are provided by the parties in reference to: operations after the California Effective Time; limitations on the operational obligations and liabilities of Legacy; the Meeting; required approvals, the operation of the California Assets after the closing of the California Sale; casualty loss; operatorship; and personnel.

Operations After California Effective Time

From and after the date of the California Purchase and Sale Agreement until closing of the California Sale, Legacy has agreed to operate the California Assets in the ordinary manner consistent with past practice. The California Purchaser shall reimburse Legacy a monthly fee of $80,000 per month during this time for administrative overhead expenses incurred by Legacy in order to operate the California Assets accordingly.

Survival

The representations, warranties, covenants and obligations of Legacy under the California Purchase and Sale Agreement shall survive closing for sixty (60) days only, provided NiMin shall be responsible for such representations, warranties, covenants and obligations after such sixty (60) day period until six (6) months from

- 16 -

closing of the California Sale. Any claim for indemnification or breach of representation or warranty properly raised prior to the expiration of such representation or warranty shall survive until such claim and the payment and the indemnity with respect thereto are resolved, provided, that in no event shall Legacy’s and/or NiMin’s liability for any such claims exceed in the aggregate $3,000,000 deposited pursuant to the Escrow Agreement.

Termination Events

The California Purchase and Sale Agreement may be terminated at any time at or prior to the closing of the California Sale, upon certain termination events including the following:

| | • | | by mutual written consent of the parties; |

| | • | | by Legacy on the closing date of the California Sale if Legacy’s conditions to close have not been satisfied in all material respect by the California Purchaser or waived by Legacy in writing by the closing date; |

| | • | | by the California Purchaser on the closing date of the California Sale if the California Purchaser’s conditions to close have not been satisfied in all material respect by Legacy and NiMin or waived by the California Purchaser in writing by the closing date; |

| | • | | by either party if the closing of the California Sale shall not have occurred on or before July 20, 2012; |

| | • | | by either party if any governmental authority shall have issued an order, judgment or decree or taken any other action challenging, delaying, restraining, enjoining, prohibiting or invalidating the consummation of any of the transactions contemplated by the California Purchase and Sale Agreement; and |

| | • | | by either party if the aggregate amount of all California Purchase Price adjustments with respect to uncured title defects plus environmental defect values exceeds fifteen percent (15%) of the California Purchase Price. |

Indemnification

The California Purchase and Sale Agreement sets out certain indemnifications in favour of Legacy from claims relating to or arising out of certain assumed obligations and certain indemnifications in favour of the California Purchaser relating to or arising out of retained obligations.

Escrow

At the closing of the California Sale, the California Purchaser shall pay to an escrow agent $3,000,000 in accordance with terms of the California Purchase and Sale Agreement and the Escrow Agreement. Any indemnity payment that Legacy or NiMin is obligated to make to the California Purchaser shall be paid by way of the escrowed funds in accordance with the terms of the Escrow Agreement.

Governing Law

The California Purchase and Sale Agreement shall be governed and construed in accordance with the laws of the State of California, with the parties agreeing to venue in Los Angeles County, California.

See“Information Regarding the Sale of Assets – California Purchase and Sale Agreement”.

Stock Exchange Listing

The Common Shares currently trade on the TSX. If the Sale Transactions are completed, according to TSX’s rules, the Corporation will be deemed to have gone through a Change in Business (as such term is defined in the

- 17 -

TSX Company Manual). The Corporation will be required to meet the continued listing requirements of TSX in order to remain listed. The Corporation does not expect to meet the original listing requirements as the Corporation will cease to be engaged in an ongoing business. As a result, the Corporation will take the appropriate steps following closing of the Sale Transactions to voluntarily delist from the TSX. In an effort to maintain liquidity in the Common Shares, the Board may apply to transfer the Corporation’s listing to NEX, a separate board of the TSXV that provides a trading forum for listed companies that have low levels of business activity or have ceased to carry on an active business; however, no assurance can be provided that a NEX listing will be obtained. The Corporation expects that as a result of delisting from the TSX, it may no longer be eligible to be quoted on OTCQX.

See “Information Regarding the Sale of Assets – Stock Exchange Listing”.

Winding Up including Distribution of Cash

The Corporation will proceed to close the Sale of Assets, including the closing of the Sale Transactions, and undertake the Winding Up upon receipt of all required regulatory and Shareholder approvals. After the payment of the liabilities of NiMin and Legacy which are currently estimated to be between approximately $51.8 million to $54.4 million, NiMin intends to distribute the net proceeds of the liquidation and dissolution of both corporations to Shareholders in one or more distribution instalments. Upon completion of the Sale of Assets, and the satisfaction of the liabilities of NiMin and Legacy, the net proceeds available for distribution are currently estimated to be between $71.0 million to $73.6 million. Although management of the Corporation believes that the estimates of the liabilities and net proceeds for the foregoing distribution are reasonable based on information currently available to the Corporation, the actual amounts of such liabilities and resulting net proceeds available for distribution may differ materially from such estimates, thereby affecting the amount of cash available to be distributed to Shareholders. The Board is not currently aware of any material items that could give rise to unforeseen tax liabilities or other liabilities or costs which would materially reduce the amount of cash available for distribution to Shareholders, but there is no assurance this will remain the case. See “Information Regarding the Liquidation and Dissolution of the Corporation”.

Recommendation of the Board

After consideration of various factors described in the section entitled “Information Regarding the Sale of Assets – Reasons for the Sale of Assets”, including the CCNRP Fairness Opinion and other relevant matters, the Board unanimously determined that the Sale Transactions are fair to the Shareholders and are in the best interests of the Corporation and the Shareholders. The Board unanimously recommends that Shareholders vote FOR the special resolution to approve the Sale of Assets on the terms and conditions set forth in the Purchase and Sale Agreements, and FOR the special resolution to approve the Winding Up, and other matters relating thereto, all as set forth in this Circular.

In considering the recommendation of the Board with respect to the Sale Resolution, Shareholders should be aware that certain of the Corporation’s executive officers have interests in the Sale Transactions that are different from, or in addition to, that of Shareholders, including the receipt of severance packages. The Board was aware of and considered these interests, to the extent such interests existed at the time, among other matters, in evaluating and negotiating the Purchase and Sale Agreements and in recommending the Sale Resolution be approved by the Shareholders. See “Interests of Certain Persons and Companies in Matters to be Acted Upon”.

See “Information Regarding the Sale of Assets – Reasons for the Sale of Assets”.

- 18 -

CCNRP Fairness Opinion

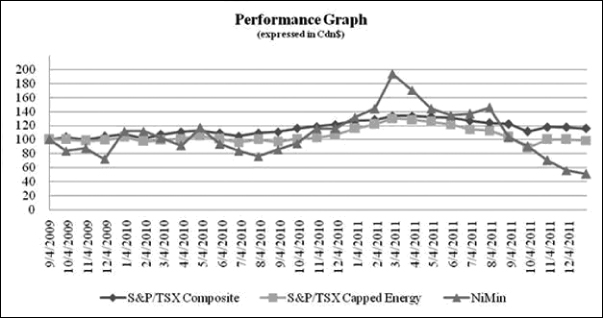

CCNRP has delivered the CCNRP Fairness Opinion to the Board stating that, as of April 13, 2012 and subject to the limitations and assumptions set forth therein, the consideration to be received pursuant to the Sale Transactions is fair to the Corporation from a financial point of view.