Exhibit 99.1

|

Momentive – Business & Strategy Update Q1 2018 Copyright © 2018 Momentive Performance Materials Inc. All rights reserved. CONFIDENTIAL

|

Forward Looking Statements MPM Holdings Inc. (“Momentive”) Forward-Looking Statements Certain statements in this presentation are forward-looking statements within the meaning of and made pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements related to our transformation and restructuring activities, growth and productivity initiatives, anticipated cost savings, growth, and market recovery, and competitiveness. In addition, our management may from time to time make oral forward-looking statements. All statements, other than statements of historical facts, are forward-looking statements. Forward-looking statements may be identified by the words “believe,” “expect,” “anticipate,” “project,” “plan,” “estimate,” “may,” “will,” “could,” “should,” “seek” or “intend” and similar expressions. Forward-looking statements reflect our current expectations and assumptions regarding our business, the economy and other future events and conditions and are based on currently available financial, economic and competitive data and our current business plans. Actual results could vary materially depending on risks and uncertainties that may affect our operations, markets, services, prices and other factors as discussed in the Risk Factors section of our Annual Report on Form10-K (our “Annual Report”) and our other filings with the Securities and Exchange Commission (the “SEC”). While we believe our assumptions are reasonable, we caution you against relying on any forward-looking statements as it is very difficult to predict the impact of known factors, and it is impossible for us to anticipate all factors that could affect or actual results. Important factors that could cause actual results to differ materially from those in the forward-looking statements include, but are not limited to: a weakening of global economic and financial conditions, interruptions in the supply of or increased cost of raw materials, the impact of work stoppages and other incidents on our operations, changes in governmental regulations or interpretations thereof and related compliance and litigation costs, difficulties with the realization of cost savings in connection with our transformation, and strategic initiatives, including transactions with our affiliate, Hexion Inc., pricing actions by our competitors that could affect our operating margins, our ability to obtain additional financing, and the other factors listed in the Risk Factors section of our Annual Report. For a more detailed discussion of these and other risk factors, see the “Risk Factors” section of our Annual Report. All forward-looking statements are expressly qualified in their entirety by this cautionary notice. The forward-looking statements made by us speak only as of the date on which they are made. Factors or events that could cause our actual results to differ may emerge from time to time. We undertake no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law.Non-GAAP Measures This presentation contains financial measures that are not in accordance with generally accepted accounting principles in the U.S. (“GAAP”), including Segment EBITDA and Segment EBITDA Margin. We have provided reconciliations ofnon-GAAP financial measures to the most directly comparable GAAP financial measures in the appendices to this presentation. Trademarks We own or have rights to various trademarks, service marks and trade names that we use in connection with the operation of our business. This presentation also contains trademarks, service marks and trade names of third parties, including GE (which is used pursuant to our license with GE), which are the property of their respective owners. Market and Industry Data This presentation includes estimates of market share and industry data and forecasts that we obtained from internal company sources and/or industry publications and surveys. We have not independently verified market and industry data provided by third-party sources, nor have we ascertained the underlying economic assumptions relied upon therein. Industry publications and surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, but there can be no assurance as to the accuracy or completeness of included information. Similarly, while we believe our internal estimates with respect to its industry are reliable, the estimates have not been verified by any independent sources. Unless otherwise noted, all information regarding our market share is based on the latest market data currently available to us, and all market share data is based on net sales in the applicable market. Discussions and descriptions of products, product lines, segments, business units, sectors, markets, market shares and similar terms are not intended to constitute market or product definitions for purposes of antitrust, antidumping, trade regulations or other regulatory purposes. Notice to Recipients This presentation shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of these securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. 2 Copyright © 2018 Momentive Performance Materials Inc. All rights reserved. CONFIDENTIAL

|

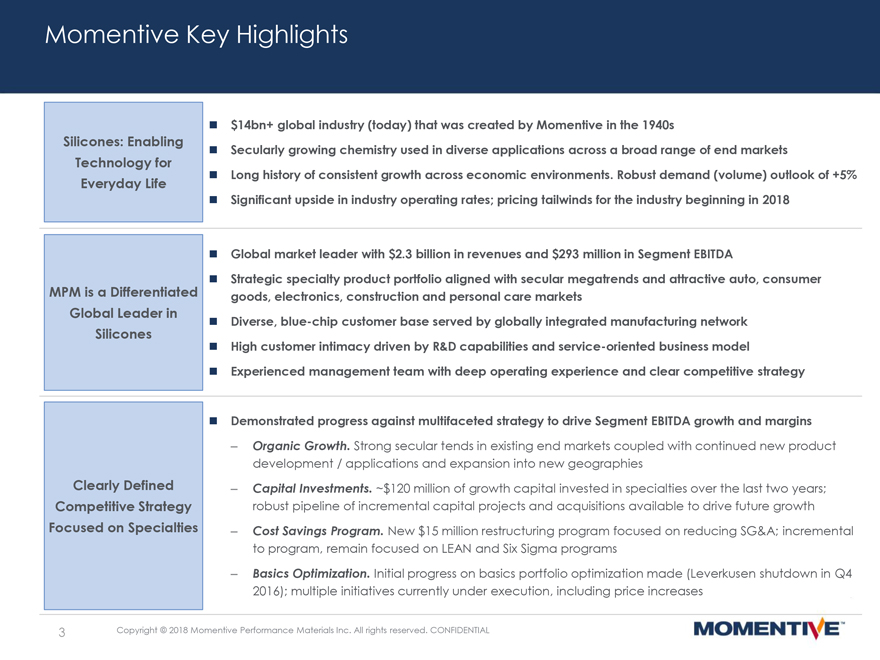

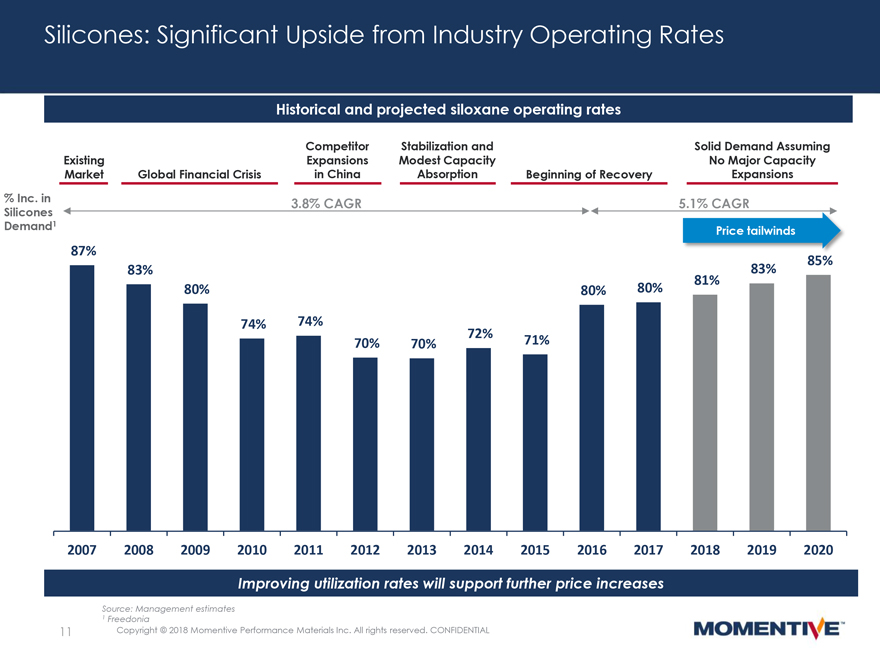

Momentive Key Highlights $14bn+ global industry (today) that was created by Momentive in the 1940s Silicones: Enabling Secularly growing chemistry used in diverse applications across a broad range of end markets Technology for Everyday Life Long history of consistent growth across economic environments. Robust demand (volume) outlook of +5% Significant upside in industry operating rates; pricing tailwinds for the industry beginning in 2018 Global market leader with $2.3 billion in revenues and $293 million in Segment EBITDA Strategic specialty product portfolio aligned with secular megatrends and attractive auto, consumer MPM is a Differentiated goods, electronics, construction and personal care markets Global Leader in Diverse, blue-chip customer base served by globally integrated manufacturing network Silicones High customer intimacy driven by R&D capabilities and service-oriented business model Experienced management team with deep operating experience and clear competitive strategy Demonstrated progress against multifaceted strategy to drive Segment EBITDA growth and margins – Organic Growth. Strong secular tends in existing end markets coupled with continued new product development / applications and expansion into new geographies Clearly Defined – Capital Investments. ~$120 million of growth capital invested in specialties over the last two years; Competitive Strategy robust pipeline of incremental capital projects and acquisitions available to drive future growth Focused on Specialties – Cost Savings Program. New $15 million restructuring program focused on reducing SG&A; incremental to program, remain focused on LEAN and Six Sigma programs – Basics Optimization. Initial progress on basics portfolio optimization made (Leverkusen shutdown in Q4 2016); multiple initiatives currently under execution, including price increases 3Copyright © 2018 Momentive Performance Materials Inc. All rights reserved. CONFIDENTIAL

|

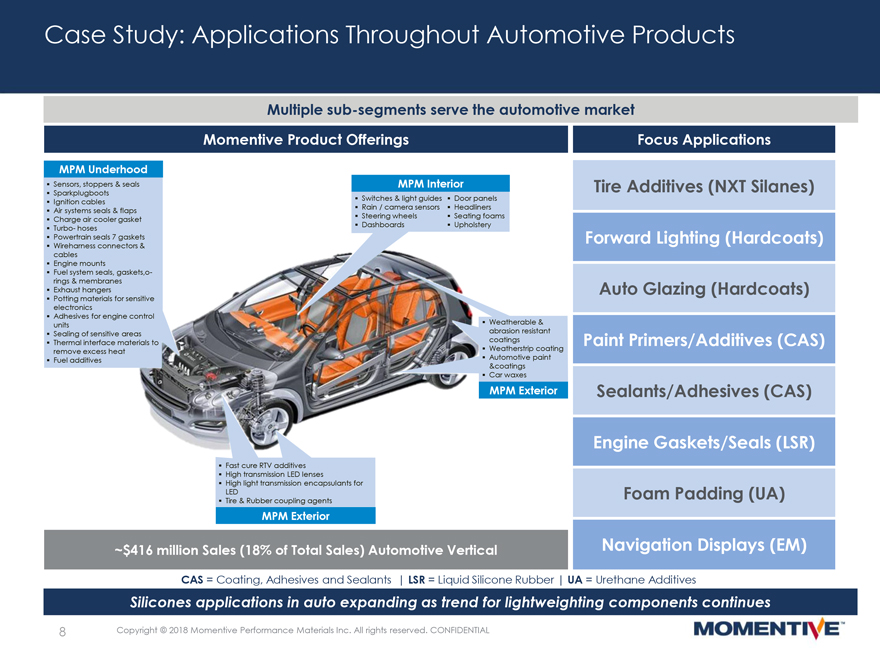

Momentive Key Highlights (cont’d) Since 2015, have grown Segment EBITDA at +23% CAGR and improved margins by >400bps Exited 2017 (Q4) with 10% topline revenue growth, 28% Segment EBITDA growth and 190bps margin Significant Earnings andimprovement Margin Momentum Attractive free cash flow generation profile: low maintenance capex and taxes of approximately$65-75 million and $25 million, respectively, per annum Significant financial flexibility: 4.0x net leverage1 and >$385 million of liquidity Sustainable secular demand growth in specialties (from bothend-market pull and new product initiatives) improving portfolio mix and supported by a strong current orderbook Current contribution from ~$120 million invested in recently completed growth capital projects at less than Robust Outlook with10% ofrun-rate EBITDA potential High Visibility Enacted price increases across the specialty portfolio in Q4 2017 that will flow through in 2018 and beyond New $15 million annual cost savings initiative to follow up successfully completed global restructuring and transformation program Momentive is a Global Leader in Specialty Silicones with Robust Outlook Underpinned by Focused Competitive Strategy and Attractive Industry Fundamentals 1 Defined as total principal value of debt less cash and cash equivalents divided by Segment EBITDA 4Copyright © 2018 Momentive Performance Materials Inc. All rights reserved. CONFIDENTIAL

|

Agenda I. Silicones: Enabling Technology II. Business Overview III. Strategic Growth Plan Update IV. Financial Update V. Summary VI. Appendix 5 Copyright © 2018 Momentive Performance Materials Inc. All rights reserved. CONFIDENTIAL

|

SILICONES: ENABLING TECHNOLOGY 6

|

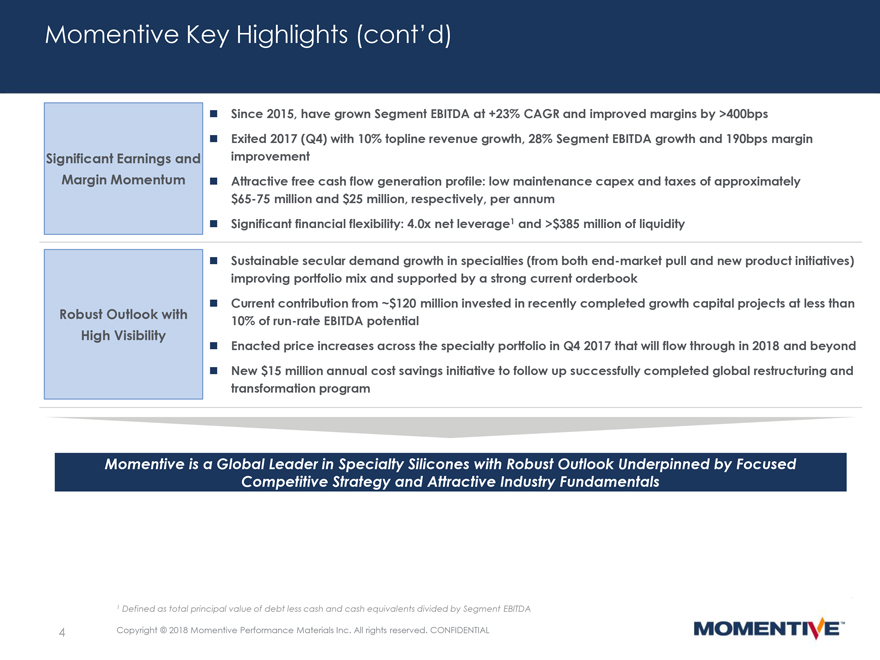

Silicones: Enabling Technology for Everyday Life Unique Properties… …Used in Diverse Applications …Globally Used in a variety of applications2016 Revenue by End Market12016 Demand by Geography1 across diversified end markets, RoW covering a spectrum ofOtherConstruction 8% properties:23%20% $1.1North America Heat and chemical resistant $4.028% Weather and water resistanceChemical Long-term elasticity9%Electrical &Asia$6.3 ElectronicPacific Insulation 19%44%$2.9 Health & Western AdherencePersonal Care Europe 12%Transportation 20% Thermal stability 17% 2016: $14.2 billion Used in everyday life Global Silicones Sales1,2 Others 22% 32% 4% 4% 11% 14% 13% 1 The Freedonia Group, Inc. (“Freedonia”) 2 Based on 2016 data 7 Copyright © 2018 Momentive Performance Materials Inc. All rights reserved. CONFIDENTIAL

|

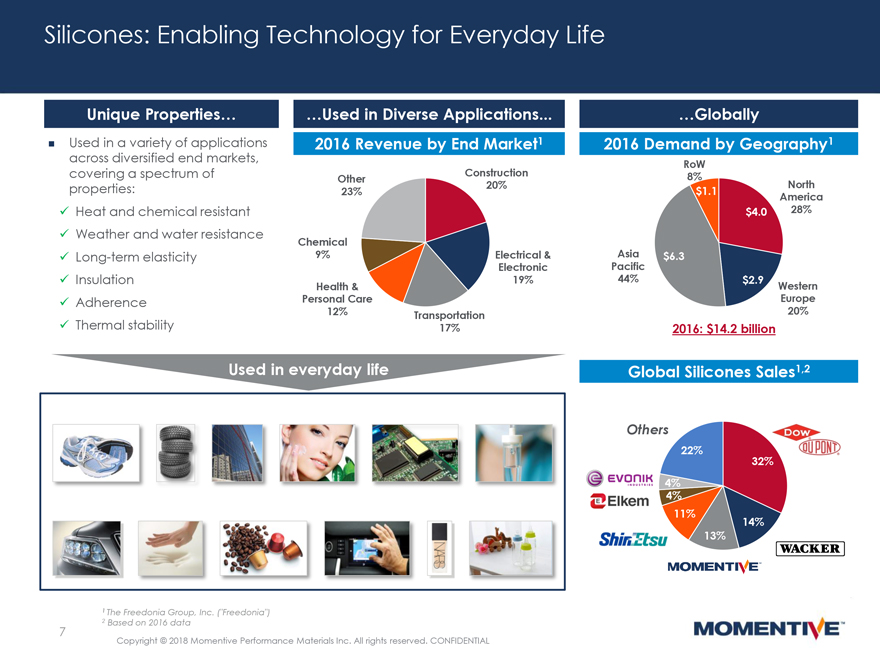

Case Study: Applications Throughout Automotive Products Multiplesub-segments serve the automotive market Momentive Product Offerings Focus Applications MPM Underhood Sensors, stoppers & seals MPM Interior Tire Additives (NXT Silanes) Sparkplugboots Ignition cables Switches & light guides Door panels Air systems seals & flaps Rain / camera sensors Headliners Charge air cooler gasket Steering wheels Seating foams Turbo- hoses Dashboards Upholstery Powertrain seals 7 gaskets Forward Lighting (Hardcoats) Wireharness connectors & cables Engine mounts Fuel system seals,gaskets,o- rings & membranes Exhaust hangers Auto Glazing (Hardcoats) Potting materials for sensitive electronics Adhesives for engine control units Weatherable & Sealing of sensitive areas abrasion resistant Thermal interface materials to coatingsPaint Primers/Additives (CAS) remove excess heat Weatherstrip coating Fuel additives Automotive paint &coatings Car waxes MPM ExteriorSealants/Adhesives (CAS) Engine Gaskets/Seals (LSR) Fast cure RTV additives High transmission LED lenses High light transmission encapsulants for LED Foam Padding (UA) Tire & Rubber coupling agents MPM Exterior ~$416 million Sales (18% of Total Sales) Automotive VerticalNavigation Displays (EM) CAS = Coating, Adhesives and Sealants | LSR = Liquid Silicone Rubber | UA = Urethane Additives Silicones applications in auto expanding as trend for lightweighting components continues 8Copyright © 2018 Momentive Performance Materials Inc. All rights reserved. CONFIDENTIAL

|

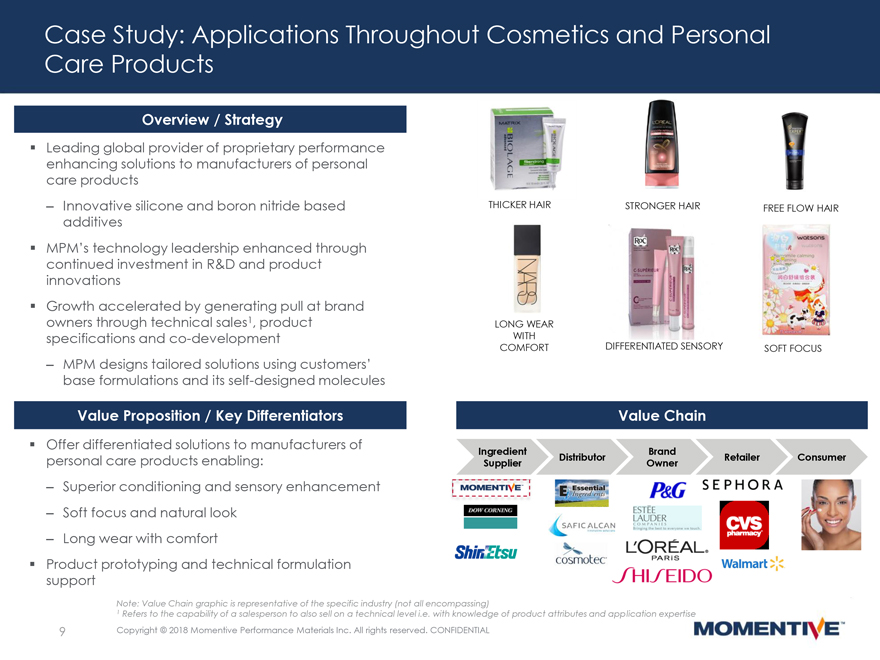

Case Study: Applications Throughout Cosmetics and Personal Care Products Overview / Strategy Leading global provider of proprietary performance enhancing solutions to manufacturers of personal care products –Innovative silicone and boron nitride basedTHICKER HAIR STRONGER HAIR FREE FLOW HAIR additives MPM’s technology leadership enhanced through continued investment in R&D and product innovations Growth accelerated by generating pull at brand owners through technical sales1, productLONG WEAR specifications andco-developmentWITH COMFORTDIFFERENTIATED SENSORYSOFT FOCUS –MPM designs tailored solutions using customers’ base formulations and its self-designed molecules Value Proposition / Key Differentiators Value Chain Offer differentiated solutions to manufacturers ofIngredient Brand personal care products enabling:SupplierDistributorOwnerRetailerConsumer –Superior conditioning and sensory enhancement –Soft focus and natural look –Long wear with comfort Product prototyping and technical formulation support Note: Value Chain graphic is representative of the specific industry (not all encompassing) 1 Refers to the capability of a salesperson to also sell on a technical level i.e. with knowledge of product attributes and application expertise 9Copyright © 2018 Momentive Performance Materials Inc. All rights reserved. CONFIDENTIAL

|

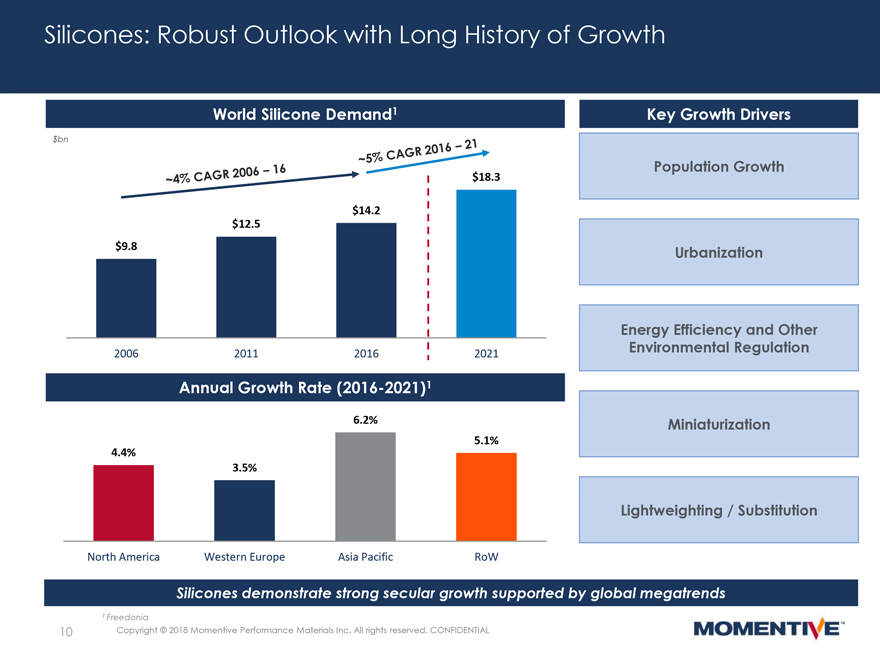

Silicones: Robust Outlook with Long History of Growth World Silicone Demand1 Key Growth Drivers $bn Population Growth $18.3 $14.2 $12.5 $9.8 Urbanization Energy Efficiency and Other 2006201120162021Environmental Regulation Annual Growth Rate (2016-2021)1 6.2% Miniaturization 5.1% 4.4% 3.5% Lightweighting / Substitution North AmericaWestern EuropeAsia PacificRoW Silicones demonstrate strong secular growth supported by global megatrends 1 Freedonia 10Copyright © 2018 Momentive Performance Materials Inc. All rights reserved. CONFIDENTIAL

|

Silicones: Robust Outlook with Long History of Growth World Silicone Demand1 Key Growth Drivers $bn Population Growth $18.3 $14.2 $12.5 $9.8 Urbanization Energy Efficiency and Other 2006201120162021Environmental Regulation Annual Growth Rate (2016-2021)1 6.2% Miniaturization 5.1% 4.4% 3.5% Lightweighting / Substitution North AmericaWestern EuropeAsia PacificRoW Silicones demonstrate strong secular growth supported by global megatrends 1 Freedonia 10Copyright © 2018 Momentive Performance Materials Inc. All rights reserved. CONFIDENTIAL

|

Silicones: Competitive Landscape Overview Momentive and Competitor Participation along the Silicones Value Chain / Strong presenceLow / Moderate presence CyclicalCommodity Specialty, CommoditySiliconesNon-Cyclical Silicones Raw materialUpstream Downstream Silicon MetalSiloxane Silicones Electronic Sealants &SpecialtyUrethane Materials /Silanes CoatingsElastomersFluidsAdditivesSilicones as % of1 Siloxane High LowRevenue EBITDA content Momentive has access to raw materials at near 92%90% producer economics in Asia Competitor 1 6%2N/A Competitor 2 42%36% Competitor 3Competitor 3 15%18%3 Competitor 4 42%29% Competitor 5 4%2N/A Momentive is strategically focused on downstream specialty silicones Source: Management estimates, company financials, competitor published information, Freedonia 1 Financials shown as average of last three calendar years based on publicly filed information for Momentive, Competitor 2, Competitor 3 and Competitor 4; financials exclude impact from silicon metal; EBITDA excludes unallocated corporate expenses 2 Based on 2016 sales and market share data according to information published by Freedonia 123 Represents silicones as % of EBIT Copyright © 2018 Momentive Performance Materials Inc. All rights reserved. CONFIDENTIAL

|

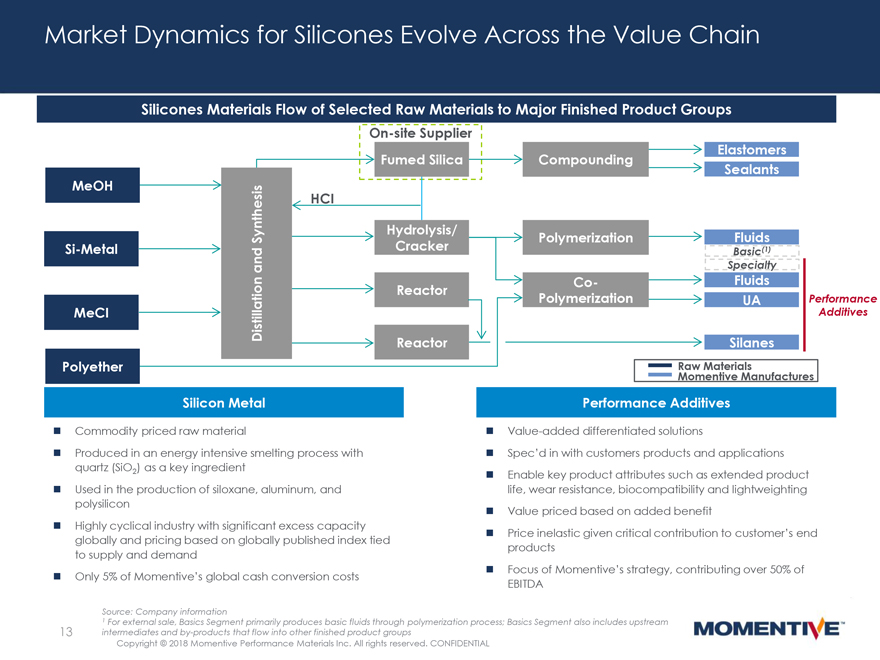

Market Dynamics for Silicones Evolve Across the Value Chain Silicones Materials Flow of Selected Raw Materials to Major Finished Product GroupsOn-site Supplier Elastomers Fumed Silica CompoundingSealants MeOH HCI SynthesisHydrolysis/ PolymerizationFluidsSi-Metal Cracker Basic(1) and Specialty Co-Fluids Reactor PolymerizationUAPerformance MeCIDistillation Additives Reactor Silanes Polyether Raw Materials Momentive Manufactures Silicon Metal Performance Additives Commoditypriced raw material Value-added differentiated solutions Produced in an energy intensive smelting process with Spec’d in with customers products and applications quartz (SiO2 ) as a key ingredient Enable key product attributes such as extended product Used in the production of siloxane, aluminum, and life, wear resistance, biocompatibility and lightweighting polysilicon Value priced based on added benefit Highly cyclical industry with significant excess capacity globally and pricing based on globally published index tied Price inelastic given critical contribution to customer’s end to supply and demand products Only 5% of Momentive’s global cash conversion costs Focus of Momentive’s strategy, contributing over 50% of EBITDA Source: Company information 1 For external sale, Basics Segment primarily produces basic fluids through polymerization process; Basics Segment also includes upstream 13intermediates andby-products that flow into other finished product groups Copyright © 2018 Momentive Performance Materials Inc. All rights reserved. CONFIDENTIAL

|

BUSINESS OVERVIEW 14

|

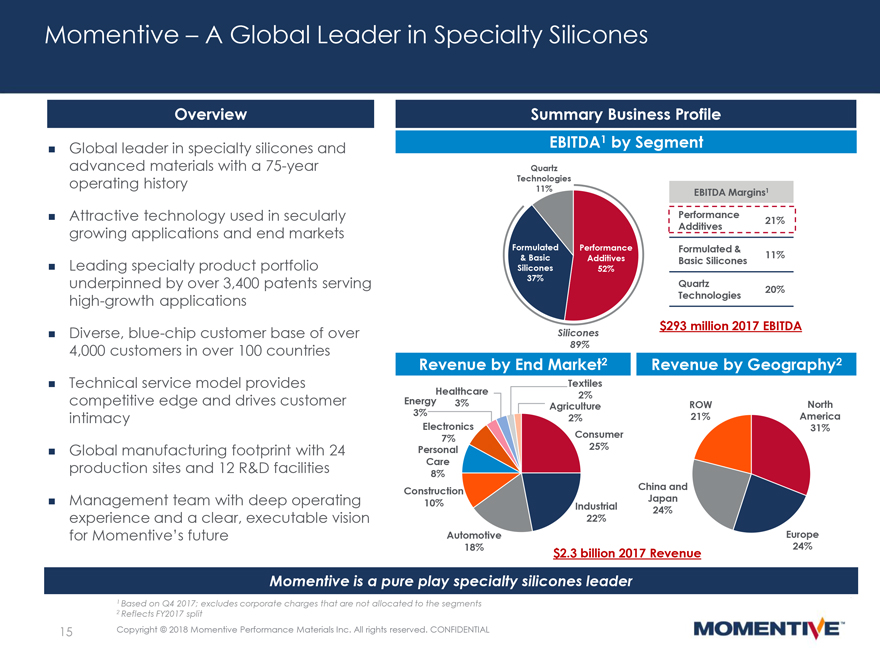

Momentive – A Global Leader in Specialty Silicones Overview Summary Business Profile Global leader in specialty silicones and EBITDA1 by Segment advanced materials with a75-year Quartz operating history Technologies 11% EBITDA Margins1 Attractive technology used in secularly Performance21% growing applications and end markets Additives FormulatedPerformanceFormulated & Leading specialty product portfolio & BasicAdditivesBasic Silicones11% Silicones52% underpinned by over 3,400 patents serving 37% Quartz20% high-growth applications Technologies Diverse, blue-chip customer base of over $293 million 2017 EBITDA Silicones 4,000 customers in over 100 countries 89% Revenue by End Market2Revenue by Geography2 Technical service model provides Textiles competitive edge and drives customerEnergyHealthcare 3%Agriculture 2%ROWNorth intimacy3% 2%21%America Electronics 31% 7% Consumer Global manufacturing footprint with 24Personal 25% production sites and 12 R&D facilitiesCare 8% Construction China and Management team with deep operating10% IndustrialJapan experience and a clear, executable vision 22%24% for Momentive’s futureAutomotive Europe 18% 24% $2.3 billion 2017 Revenue Momentive is a pure play specialty silicones leader 1 Based on Q4 2017; excludes corporate charges that are not allocated to the segments 2 Reflects FY2017 split 15Copyright © 2018 Momentive Performance Materials Inc. All rights reserved. CONFIDENTIAL

|

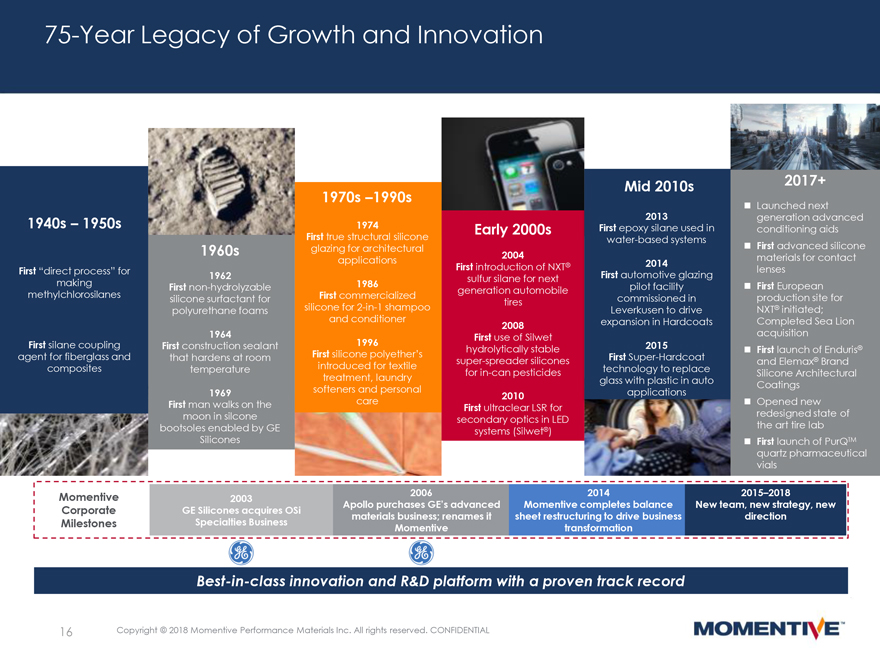

75-Year Legacy of Growth and Innovation Mid 2010s 2017+ 1970s –1990s Launched next 2013 generation advanced 1940s – 1950s 1974Early 2000sFirst epoxy silane used inconditioning aids First true structural silicone water-based systems 1960sglazing for architectural First advanced silicone applications 20042014 materials for contact First “direct process” for First introduction of NXT®First automotive glazinglenses 1962 sulfur silane for next making Firstnon-hydrolyzable1986generation automobilepilot facility First European methylchlorosilanessilicone surfactant forFirst commercialized tirescommissioned inproduction site for polyurethane foamssilicone for2-in-1 shampoo Leverkusen to driveNXT® initiated; and conditioner 2008expansion in HardcoatsCompleted Sea Lion 1964 First use of Silwet acquisition First silane couplingFirst construction sealant1996hydrolytically stable2015 First launch of Enduris® agent for fiberglass andthat hardens at roomFirst silicone polyether’ssuper-spreader siliconesFirst Super-Hardcoatand Elemax® Brand compositestemperatureintroduced for textileforin-can pesticidestechnology to replaceSilicone Architectural treatment, laundry glass with plastic in autoCoatings 1969softeners and personal 2010applications First man walks on thecareFirst ultraclear LSR for Opened new moon in silcone secondary optics in LED redesigned state of bootsoles enabled by GE systems (Silwet®) the art tire lab Silicones First launch of PurQTM quartz pharmaceutical vials Momentive20032006 20142015–2018 CorporateGE Silicones acquires OSiApollo purchases GE’s advancedMomentive completes balanceNew team, new strategy, new materials business; renames itsheet restructuring to drive businessdirection MilestonesSpecialties BusinessMomentivetransformation Best-in-class innovation and R&D platform with a proven track record 16Copyright © 2018 Momentive Performance Materials Inc. All rights reserved. CONFIDENTIAL

|

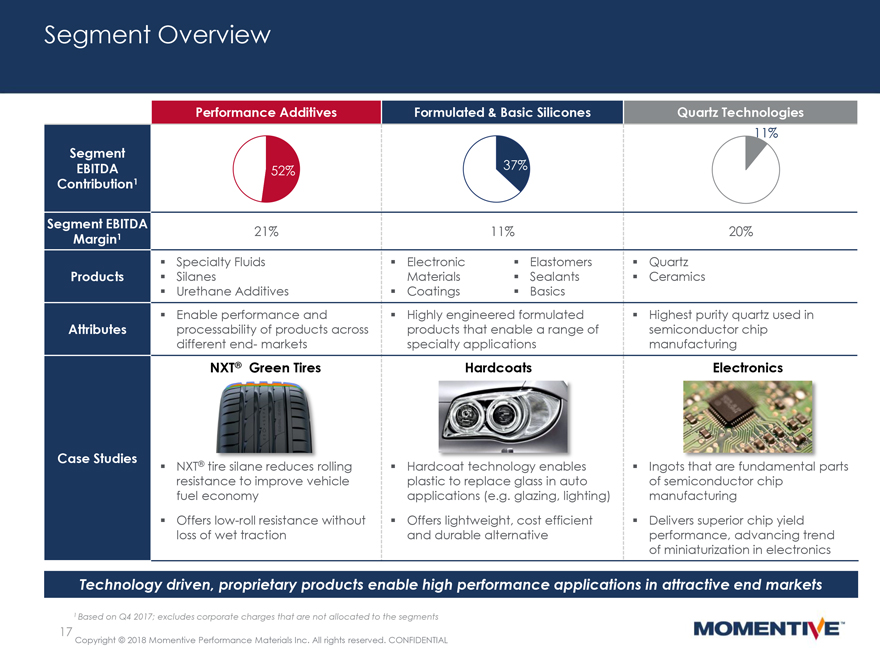

Segment Overview Performance Additives Formulated & Basic Silicones Quartz Technologies 11% Segment EBITDA 52% 37% Contribution1 Segment EBITDA Margin1 21% 11% 20% Specialty Fluids Electronic Elastomers Quartz Products SilanesMaterials Sealants Ceramics Urethane Additives Coatings Basics Enable performance and Highly engineered formulated Highest purity quartz used in Attributes processability of products acrossproducts that enable a range of semiconductor chip differentend- marketsspecialty applications manufacturing NXT® Green TiresHardcoats Electronics Case Studies NXT® tire silane reduces rolling Hardcoat technology enables Ingots that are fundamental parts resistance to improve vehicleplastic to replace glass in auto of semiconductor chip fuel economyapplications (e.g. glazing, lighting) manufacturing Offerslow-roll resistance without Offers lightweight, cost efficient Delivers superior chip yield loss of wet tractionand durable alternative performance, advancing trend of miniaturization in electronics Technology driven, proprietary products enable high performance applications in attractive end markets 1 Based on Q4 2017; excludes corporate charges that are not allocated to the segments 17 Copyright © 2018 Momentive Performance Materials Inc. All rights reserved. CONFIDENTIAL

|

Strategically Aligned with Secular Megatrends Megatrends Key Verticals1MomentiveSilicone Sales byProjectedEnd- Selected Momentive Revenue2End Market2,3Market CAGR3,4 Products Sealants Consumer$592MM Infant Care Products $1.9bn4—5% PopulationGoods(25%) Seating / Upholstery Growth Release Coatings NXT® Tire $416MM Auto LED Lighting Automotive $2.8bn8—9% (18%) Automotive Hardcoats Urbanization $241MM Adhesives / Sealants Construction $2.8bn5—6% Roof Coating (10%) Clear Coating Energy Efficiency and Other Tailored Conditioning EnvironmentalPersonal$192MM$1.2bn4—5% Hair Repair RegulationCare(8%) Sensory Enhancement Inputs Advanced Thermal Miniaturization Management $164MM Solutions Electronics $2.7bn4—5% (7%) Optically Clear Bonding for Display Applications Lightweighting / Substitution $60MM Contact Lens Healthcare $0.5bn6% Wound Care (3%) Biomedical Tubing Momentive is well positioned to benefit from industry megatrends ¹ Does not include industrialend-market as such market is broadly defined without specific market statistics or growth drivers 2 Financials based on 2017 3 Sources: Freedonia and Grand View Research, Inc. 4 For the period of 2016-2021 for Consumer goods, Construction, Personal care, Electronics and Healthcare, and for the period of 2016– 2025 for Automotive 18Copyright © 2018 Momentive Performance Materials Inc. All rights reserved. CONFIDENTIAL

|

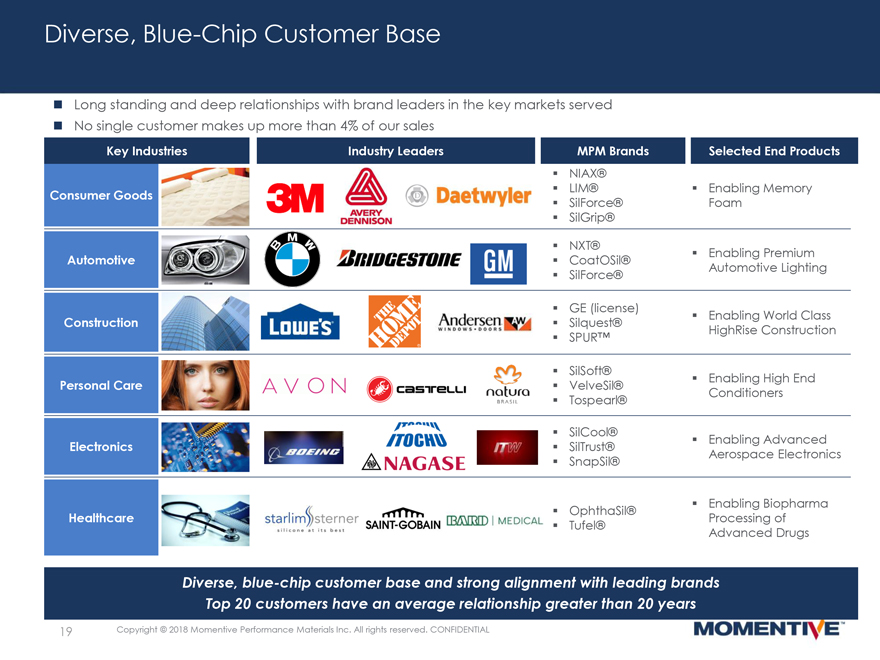

Diverse, Blue-Chip Customer Base Long standing and deep relationships with brand leaders in the key markets served No single customer makes up more than 4% of our sales Key IndustriesIndustry LeadersMPM Brands Selected End Products NIAX® Consumer Goods LIM® Enabling Memory SilForce® Foam SilGrip® NXT® Automotive CoatOSil® Enabling Premium SilForce® Automotive Lighting GE (license) Construction Silquest® Enabling World Class SPUR™ HighRise Construction SilSoft® Personal Care VelveSil® Enabling High End Tospearl® Conditioners SilCool® Electronics SilTrust® Enabling Advanced SnapSil® Aerospace Electronics OphthaSil® Enabling Biopharma Healthcare Processing of Tufel® Advanced Drugs Diverse, blue-chip customer base and strong alignment with leading brands Top 20 customers have an average relationship greater than 20 years 19Copyright © 2018 Momentive Performance Materials Inc. All rights reserved. CONFIDENTIAL

|

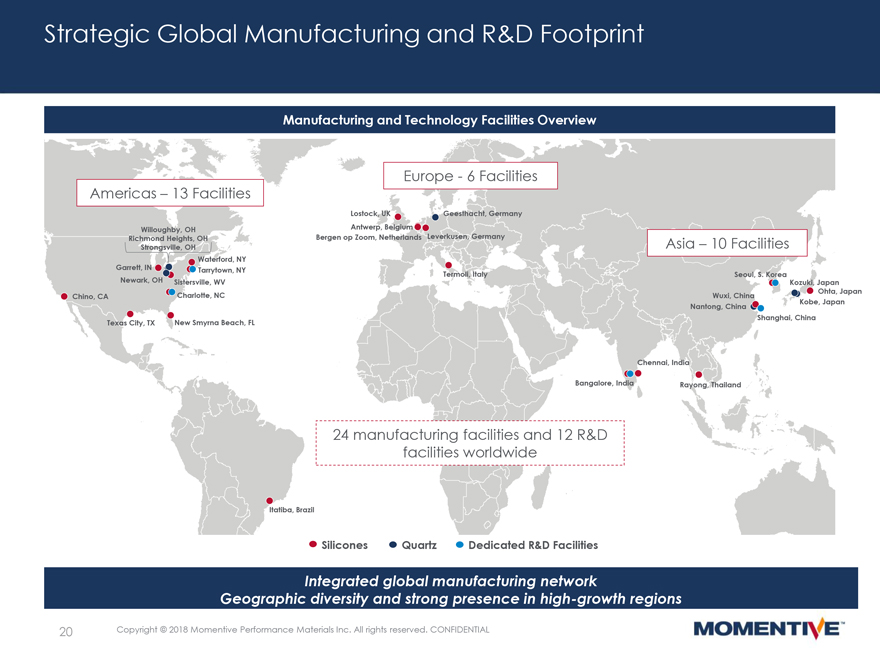

Strategic Global Manufacturing and R&D Footprint Manufacturing and Technology Facilities Overview Europe—6 Facilities Americas – 13 Facilities Lostock, UK Geesthacht, Germany Willoughby, OH Antwerp, Belgium Richmond Heights, OH Bergen op Zoom, Netherlands Leverkusen, Germany Asia – 10 Facilities Strongsville, OH Waterford, NY Garrett, IN Tarrytown, NY Termoli, Italy Seoul, S. Korea Newark, OH Sistersville, WV Kozuki, Japan Ohta, Japan Chino, CA Charlotte, NC Wuxi, China Kobe, Japan Nantong, China Shanghai, China Texas City, TX New Smyrna Beach, FL Chennai, India Bangalore, India Rayong, Thailand 24 manufacturing facilities and 12 R&D facilities worldwide Itatiba, Brazil Silicones Quartz Dedicated R&D Facilities Integrated global manufacturing network Geographic diversity and strong presence in high-growth regions 20 Copyright © 2018 Momentive Performance Materials Inc. All rights reserved. CONFIDENTIAL

|

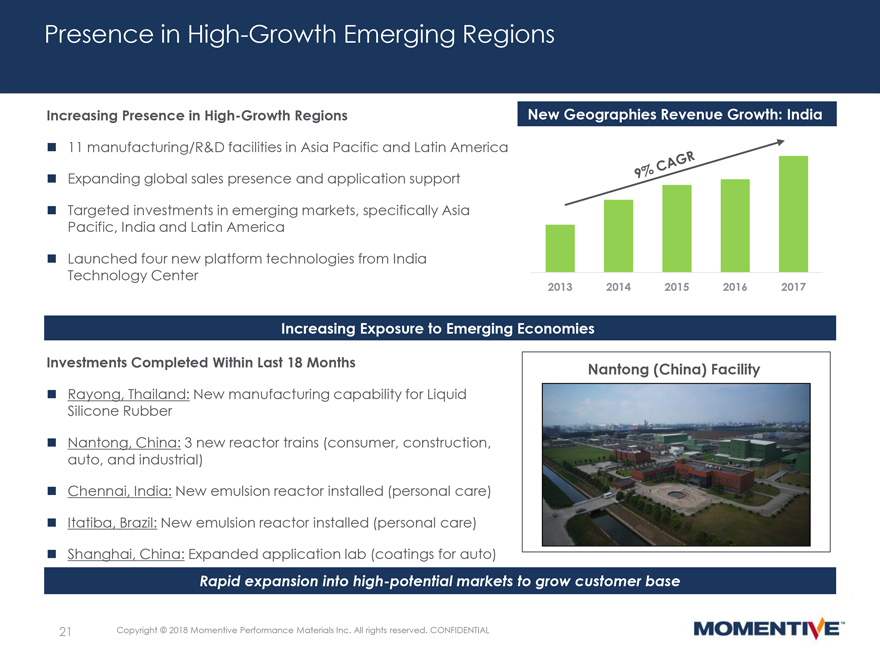

Presence in High-Growth Emerging Regions Increasing Presence in High-Growth Regions New Geographies Revenue Growth: India 11 manufacturing/R&D facilities in Asia Pacific and Latin America Expanding global sales presence and application support Targeted investments in emerging markets, specifically Asia Pacific, India and Latin America Launched four new platform technologies from India Technology Center 20132014201520162017 Increasing Exposure to Emerging Economies Investments Completed Within Last 18 Months Nantong (China) Facility Rayong, Thailand: New manufacturing capability for Liquid Silicone Rubber Nantong, China: 3 new reactor trains (consumer, construction, auto, and industrial) Chennai, India: New emulsion reactor installed (personal care) Itatiba, Brazil: New emulsion reactor installed (personal care) Shanghai, China: Expanded application lab (coatings for auto) Rapid expansion into high-potential markets to grow customer base 21Copyright © 2018 Momentive Performance Materials Inc. All rights reserved. CONFIDENTIAL

|

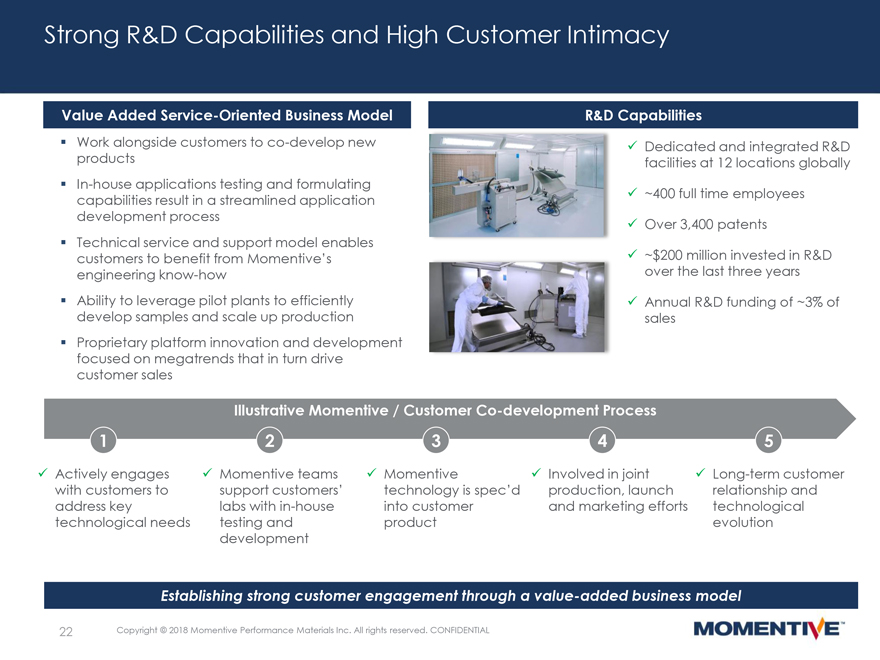

Strong R&D Capabilities and High Customer Intimacy Value Added Service-Oriented Business Model R&D Capabilities Work alongside customers toco-develop new Dedicated and integrated R&D products facilities at 12 locations globallyIn-house applications testing and formulating capabilities result in a streamlined application ~400 full time employees development process Over 3,400 patents Technical service and support model enables customers to benefit from Momentive’s ~$200 million invested in R&D engineeringknow-how over the last three years Ability to leverage pilot plants to efficiently Annual R&D funding of ~3% of develop samples and scale up production sales Proprietary platform innovation and development focused on megatrends that in turn drive customer sales Illustrative Momentive / CustomerCo-development Process 1234 5 Actively engages Momentive teams Momentive Involved in joint Long-term customer with customers tosupport customers’technology is spec’dproduction, launch relationship and address keylabs within-houseinto customerand marketing effortstechnological technological needstesting andproduct evolution development Establishing strong customer engagement through a value-added business model 22Copyright © 2018 Momentive Performance Materials Inc. All rights reserved. CONFIDENTIAL

|

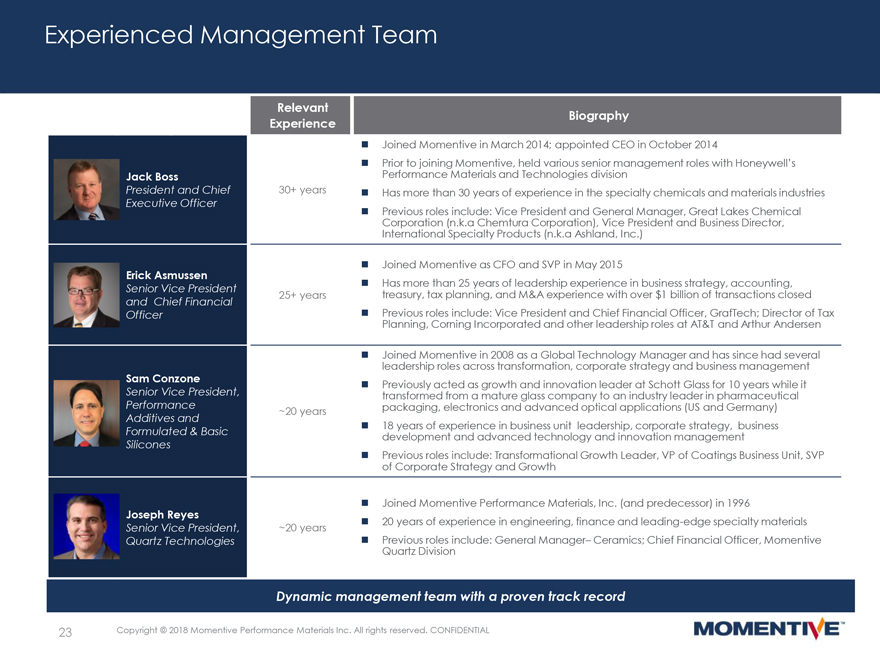

Experienced Management Team Relevant Experience Biography Joined Momentive in March 2014; appointed CEO in October 2014 Prior to joining Momentive, held various senior management roles with Honeywell’s Jack Boss Performance Materials and Technologies division President and Chief30+years Has more than 30 years of experience in the specialty chemicals and materials industries Executive Officer Previous roles include: Vice President and General Manager, Great Lakes Chemical Corporation (n.k.a Chemtura Corporation), Vice President and Business Director, International Specialty Products (n.k.a Ashland, Inc.) Joined Momentive as CFO and SVP in May 2015 Erick Asmussen Senior Vice President Has more than 25 years of leadership experience in business strategy, accounting, and Chief Financial25+years treasury, tax planning, and M&A experience with over $1 billion of transactions closed Officer Previous roles include: Vice President and Chief Financial Officer, GrafTech; Director of Tax Planning, Corning Incorporated and other leadership roles at AT&T and Arthur Andersen Joined Momentive in 2008 as a Global Technology Manager and has since had several leadership roles across transformation, corporate strategy and business management Sam Conzone Previously acted as growth and innovation leader at Schott Glass for 10 years while it Senior Vice President, transformed from a mature glass company to an industry leader in pharmaceutical Performance~20years packaging, electronics and advanced optical applications (US and Germany) Additives and Formulated & Basic 18 years of experience in business unit leadership, corporate strategy, business Silicones development and advanced technology and innovation management Previous roles include: Transformational Growth Leader, VP of Coatings Business Unit, SVP of Corporate Strategy and Growth Joined Momentive Performance Materials, Inc. (and predecessor) in 1996 Joseph Reyes Senior Vice President,~20 years 20 years of experience in engineering, finance and leading-edge specialty materials Quartz Technologies Previous roles include: General Manager– Ceramics; Chief Financial Officer, Momentive Quartz Division Dynamic management team with a proven track record 23Copyright © 2018 Momentive Performance Materials Inc. All rights reserved. CONFIDENTIAL

|

STRATEGIC GROWTH PLAN UPDATE 24

|

Momentive Strategic Growth Pillars Leading Global Market Position in Core Growth Markets Aligned with Global Megatrends Momentive Strategic ApproachMomentive EBITDA Margin Evolution 1 Organic Growth 18 – 20% + Silicones market remains strong with growth at historic levels of 4–5% Expansion into new geographies with a focus on high- growth emerging markets Development of new products and applications 2 13.9% Growth Projects / Acquisitions 12.6% ~$120 million of growth capital invested in 2016 and 2017 which benefit in 2018 and beyond10.7% Increasing growth EBITDA growth from integration of Sea Lion acquisition from high-margin 8.5% specialty products 3Cost Savings Programs Cost savings initiatives $15 million restructuring program launched in March Reducing exposure 2018 as a second phase of cost reductions to basic silicones Continuous improvement and LEAN manufacturing Price increases 4 Accretive capital Formulated & Basics Optimization projects Structural reduction of siloxane capacity FY 2015A FY 2016A FY 2017A Q4 2017AMedium Increase in prices across basics portfolio Term Investments to optimize remaining basics production Target 25Copyright © 2018 Momentive Performance Materials Inc. All rights reserved. CONFIDENTIAL

|

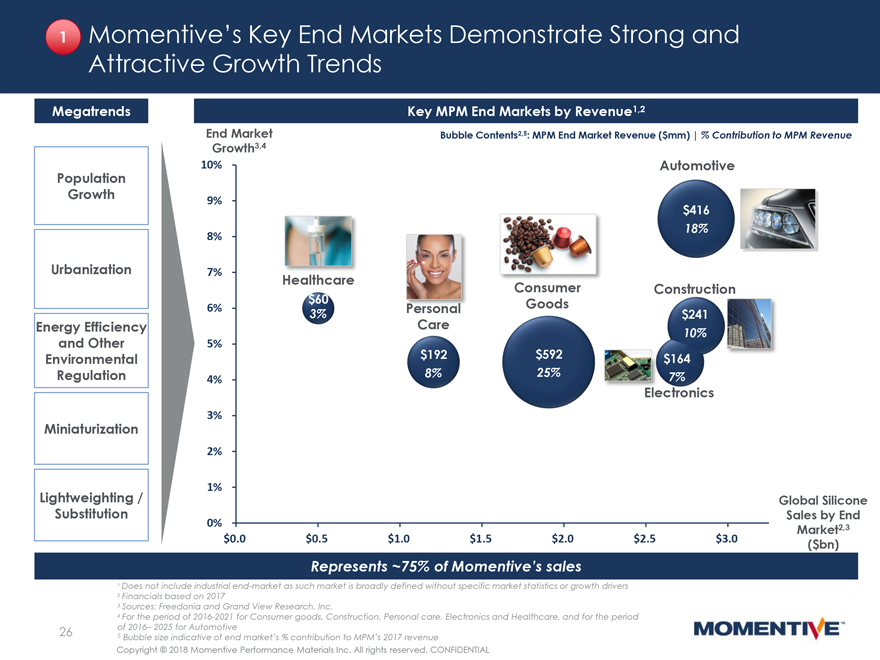

1 Momentive’s Key End Markets Demonstrate Strong and Attractive Growth Trends Megatrends Key MPM End Markets by Revenue1,2 End Market Bubble Contents2,5: MPM End Market Revenue ($mm) | % Contribution to MPM Revenue Growth3,4 10% Automotive Population Growth9% $416 18% 8% Urbanization7% Healthcare ConsumerConstruction $60 Goods 6%3% $241 Energy Efficiency Care 10% and Other5% Environmental $192$592 $164 Regulation4% 8%25% 7% Electronics 3% Miniaturization 2% 1% Lightweighting / Global Silicone Substitution Sales by End 0% Market2,3 $0.0$0.5$1.0$1.5$2.0$2.5$3.0($bn) Represents ~75% of Momentive’s sales ¹ Does not include industrialend-market as such market is broadly defined without specific market statistics or growth drivers 2 Financials based on 2017 3 Sources: Freedonia and Grand View Research, Inc. 4 For the period of 2016-2021 for Consumer goods, Construction, Personal care, Electronics and Healthcare, and for the period 26of 2016– 2025 for Automotive 5 Bubble size indicative of end market’s % contribution to MPM’s 2017 revenue Copyright © 2018 Momentive Performance Materials Inc. All rights reserved. CONFIDENTIAL

|

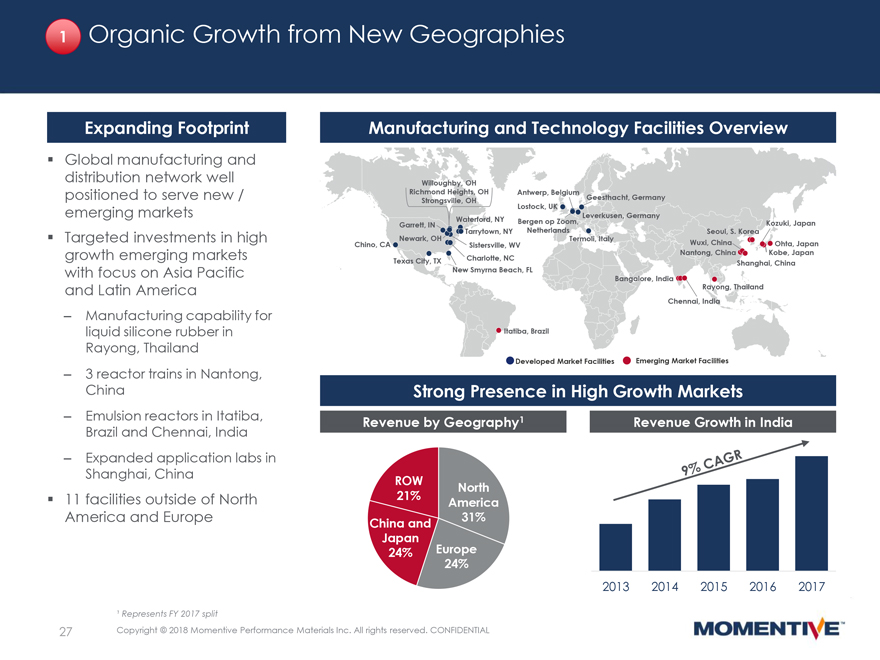

1 Organic Growth from New Geographies Expanding FootprintManufacturing and Technology Facilities Overview Global manufacturing and distribution network well Willoughby, OH positioned to serve new /Richmond Strongsville, Heights, OH OHAntwerp, Belgium Geesthacht, Germany emerging markets Lostock, UK Leverkusen, Germany Garrett, INWaterford, NYBergen op Zoom, Kozuki, Japan NYNetherlands Seoul, S. Korea Targeted investments in highNewark, OHTarrytown,Termoli, Italy Chino, CA Sistersville, WV Wuxi, ChinaOhta, Japan growth emerging markets Charlotte, Nantong, ChinaKobe, Japan Texas City, TXNC Shanghai, China with focus on Asia Pacific New Smyrna Beach, FLBangalore, India and Latin America Rayong, Thailand Chennai, India –Manufacturing capability for liquid silicone rubber in Itatiba, Brazil Rayong, Thailand Developed Market FacilitiesEmerging Market Facilities –3 reactor trains in Nantong, China Strong Presence in High Growth Markets –Emulsion reactors in Itatiba,Revenue by Geography1 Revenue Growth in India Brazil and Chennai, India –Expanded application labs in Shanghai, ChinaROW North 11 facilities outside of North21%America America and EuropeChina and31% Japan 24%Europe 24% 20132014201520162017 ¹ Represents FY 2017 split 27Copyright © 2018 Momentive Performance Materials Inc. All rights reserved. CONFIDENTIAL

|

1 Organic Growth from New Products and Customer Collaboration Case Study: Pharmaceutical Vials Case Study: Consumer Sealants Leveraging expertise in high purity quartz tubing Lowe’s established an innovation collaboration with MPM to compete in consumer sealants Newly established manufacturing process for converting tubes into vials MPM actively participated in product development cycle Key collaboration benefits: Customer demand driven by the need to prevent degradation and preserve stability of biopharma drugs –Shortened development & commercialization cycle Launched PurQTM product portfolio in Q2 2017 –Surety of placement prior to committing investment –Research and marketing collaboration Large and attractive market opportunity –Period of exclusivity with MPM as the sole supplier Existing – Tubing forNew PurQTM ConstructionDelivery SystemCoatings SemiconductorPharmaceutical Vials Innovative Solutions and Close Customer Collaboration Drive Business Performance 28 Copyright © 2018 Momentive Performance Materials Inc. All rights reserved. CONFIDENTIAL

|

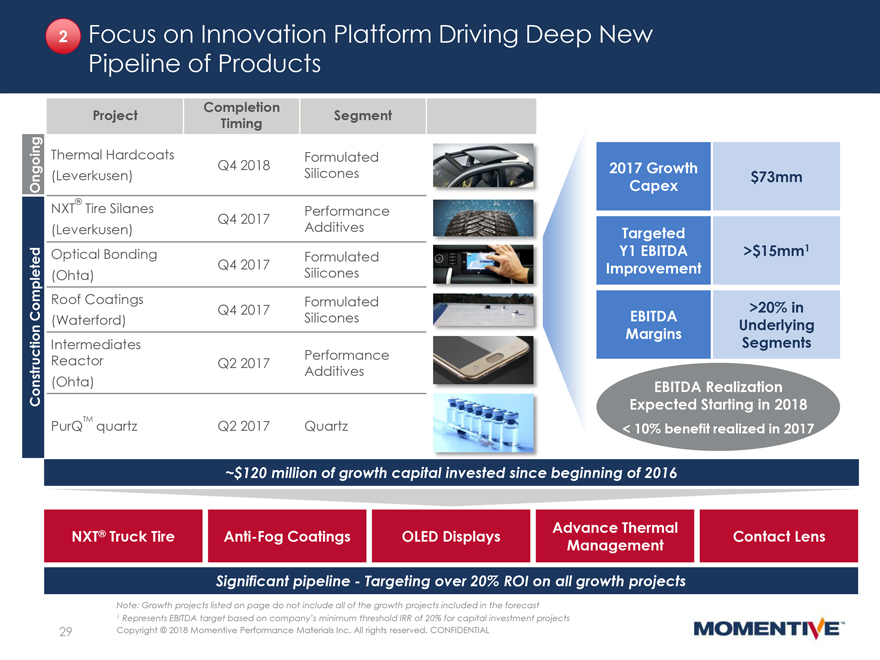

2 Focus on Innovation Platform Driving Deep New Pipeline of Products Completion Project Segment Timing Thermal Hardcoats Formulated (Leverkusen)Q4 2018Silicones 2017 Growth$73mm Ongoing Capex NXT® Tire Silanes Performance Q4 2017 (Leverkusen) Additives Targeted Optical Bonding Formulated Y1 EBITDA>$15mm1 (Ohta)Q4 2017Silicones Improvement CompletedRoof CoatingsQ4 2017Formulated >20% in (Waterford) Silicones EBITDAUnderlying Margins Intermediates Segments ReactorQ2 2017Performance Additives Construction(Ohta) EBITDA Realization Expected Starting in 2018 PurQTM quartzQ2 2017Quartz < 10% benefit realized in 2017 ~$120 million of growth capital invested since beginning of 2016 Advance Thermal NXT® TruckTireAnti-Fog CoatingsOLED Displays Contact Lens Management Significant pipeline—Targeting over 20% ROI on all growth projects Note: Growth projects listed on page do not include all of the growth projects included in the forecast 1 Represents EBITDA target based on company’s minimum threshold IRR of 20% for capital investment projects 29Copyright © 2018 Momentive Performance Materials Inc. All rights reserved. CONFIDENTIAL

|

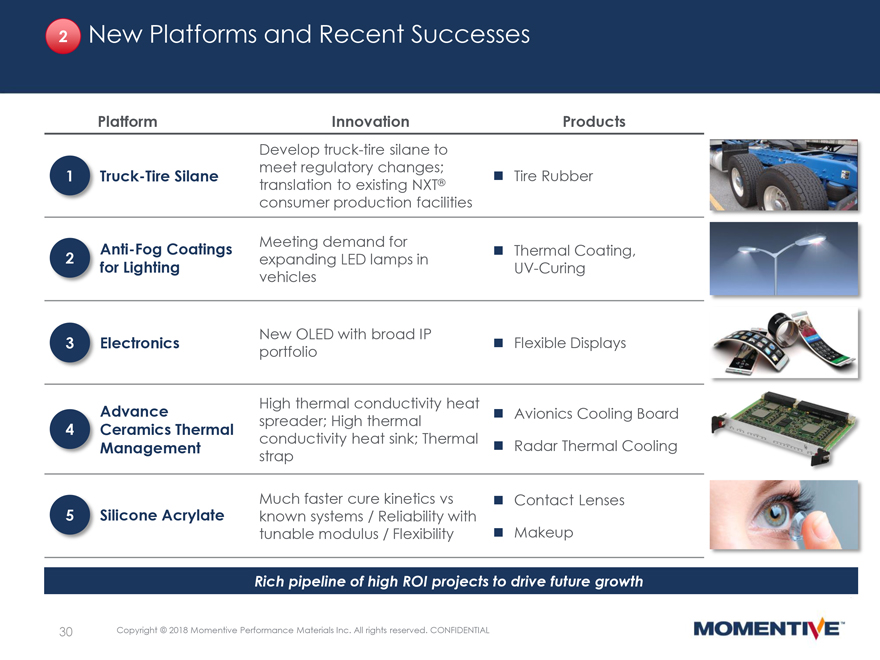

2 New Platforms and Recent Successes PlatformInnovation Products Develop truck-tire silane to meet regulatory changes; 1Truck-Tire Silane Tire Rubber translation to existing NXT® consumer production facilitiesAnti-Fog CoatingsMeeting demand for Thermal Coating, 2 expanding LED lamps in for LightingUV-Curing vehicles New OLED with broad IP 3Electronics Flexible Displays portfolio High thermal conductivity heat Advance Avionics Cooling Board 4Ceramics Thermalspreader; High thermal conductivity heat sink; Thermal Management Radar Thermal Cooling strap Much faster cure kinetics vs Contact Lenses 5Silicone Acrylateknown systems / Reliability with tunable modulus / Flexibility Makeup Rich pipeline of high ROI projects to drive future growth 30Copyright © 2018 Momentive Performance Materials Inc. All rights reserved. CONFIDENTIAL

|

3 Earnings and Margin Momentum Driven by Successful Cost Management Phase I (completed): Phase II: Global Restructuring and Transformation 2018 Restructuring Initiatives Global restructuring program Restructuring initiatives –Restructuring without impact on growth –Consists primarily of additional SG&A cost or consumer facing functions reductions –$30 million savings from position –Implementation expected in early 2018 eliminations and productivity gains –$15 million estimatedrun-rate cost –$5 million savings from structural cost reductions with ~$8 million to be realized actions in Quartz in 2018 Transformation at Leverkusen, Germany –Net cash cost of ~$5–10 million after –Ceased production of siloxane and working capital reductions instead source requirements externally Continued active evaluation of additional–Re-focus efforts on value added specialty structural and SG&A cost-saving chemical operations (e.g. NXT® and opportunities coatings) –Generates $10 million annual savings ~$45 million incremental savings ~$15 million estimated savings ~$60 million in Total Savings Drives Near Term EBITDA Performance Source: Company estimates 31Copyright © 2018 Momentive Performance Materials Inc. All rights reserved. CONFIDENTIAL

|

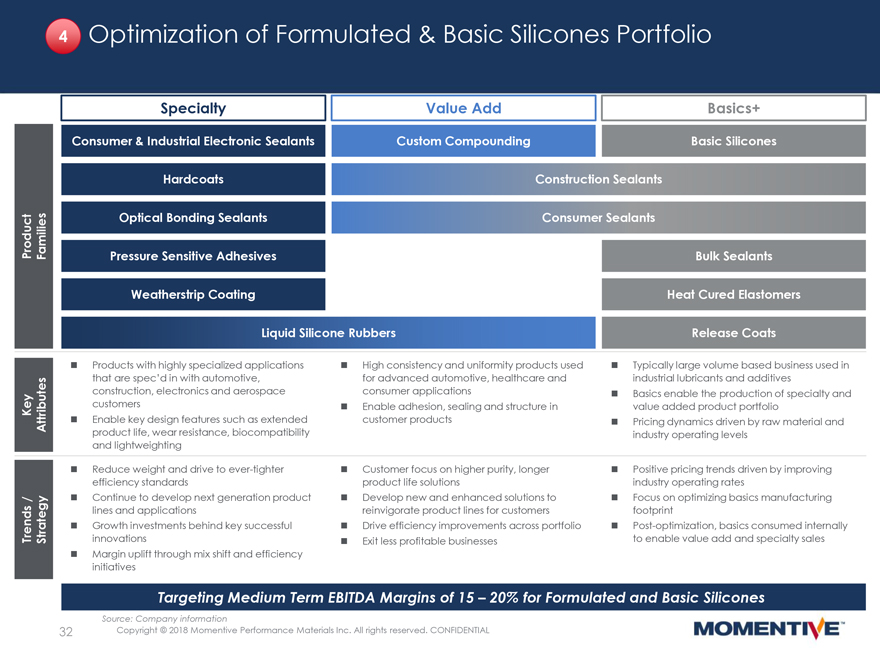

4 Optimization of Formulated & Basic Silicones Portfolio Specialty Value Add Basics+ Consumer & Industrial Electronic Sealants Custom Compounding Basic Silicones Hardcoats Construction Sealants Optical Bonding Sealants Consumer Sealants Product Families Pressure Sensitive Adhesives Bulk Sealants Weatherstrip Coating Heat Cured Elastomers Liquid Silicone Rubbers Release Coats Products with highly specialized applications High consistency and uniformity products used Typically large volume based business used in that are spec’d in with automotive, for advanced automotive, healthcare and industrial lubricants and additives construction, electronics and aerospace consumer applications Basics enable the production of specialty and customers Enable adhesion, sealing and structure in value added product portfolio Key Attributes Enable key design features such as extended customer products Pricing dynamics driven by raw material and product life, wear resistance, biocompatibility industry operating levels and lightweighting Reduce weight and drive to ever-tighter Customer focus on higher purity, longer Positive pricing trends driven by improving efficiency standards product life solutions industry operating rates / Continue to develop next generation product Develop new and enhanced solutions to Focus on optimizing basics manufacturing lines and applications reinvigorate product lines for customers footprint Trends Strategy Growth investments behind key successful Drive efficiency improvements across portfolio Post-optimization, basics consumed internally innovations Exit less profitable businesses to enable value add and specialty sales Margin uplift through mix shift and efficiency initiatives Targeting Medium Term EBITDA Margins of 15 – 20% for Formulated and Basic Silicones Source: Company information 32Copyright © 2018 Momentive Performance Materials Inc. All rights reserved. CONFIDENTIAL

|

4 Transformation of the Basics Segment to Drive Profitable Growth Key Optimization Initiatives Germany Transformation 2016 Structural shutdowns of siloxane capacity Strategic actions to significantly improve profitability while ensuring sustainable critical supply Restructuring of Leverkusen (Germany) operations completed in Q4 2016 Internal sourcing and long-term offtake agreement ensures required supply of intermediates Raising prices across basic silicones Benefiting from tight supply/demand conditions to successfully pass through price increases Higher operating rates in basic silicones manufacturingShut Down Siloxane Production and Expand Specialty Capacity Investments to improve production assets Leveraging capital structure, plant stability, and First phase in global transformation continuous improvement to drive sustained efficiency Decouple Leverkusen specialties from Assessing and implementing further opportunities acrosssiloxane and shut down of siloxane platform to:capacity –Optimize supply and production globally Expand NXT® production capacity –Focus on site and product line profitability –Further expand capacity for specialty applications Restructuring of Germany operations generated ~$10 million of annual EBITDA improvement 33Copyright © 2018 Momentive Performance Materials Inc. All rights reserved. CONFIDENTIAL

|

FINANCIAL UPDATE 34

|

Solid Track Record of Segment EBITDA Growth… LTM Segment EBITDA ($mm) $293 $267$274$275 $238 $214 $194 $189 $183 Q4’15Q1’16Q2’16Q3’16Q4’16Q1’17Q2’17Q3’17Q4’17 Robust Earnings Driven by Revenue Growth and Cost Savings Initiatives 35Copyright © 2018 Momentive Performance Materials Inc. All rights reserved. CONFIDENTIAL

|

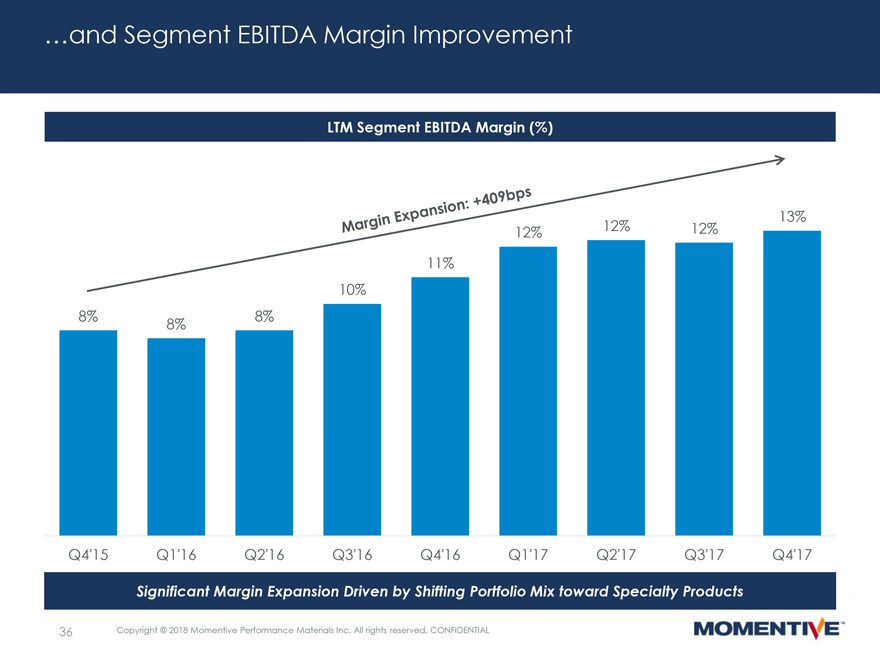

…and Segment EBITDA Margin Improvement LTM Segment EBITDA Margin (%) 12% 13% 12% 12% 11% 10% 8% 8% 8% Q4’15Q1’16Q2’16Q3’16Q4’16Q1’17Q2’17Q3’17Q4’17 Significant Margin Expansion Driven by Shifting Portfolio Mix toward Specialty Products 36Copyright © 2018 Momentive Performance Materials Inc. All rights reserved. CONFIDENTIAL

|

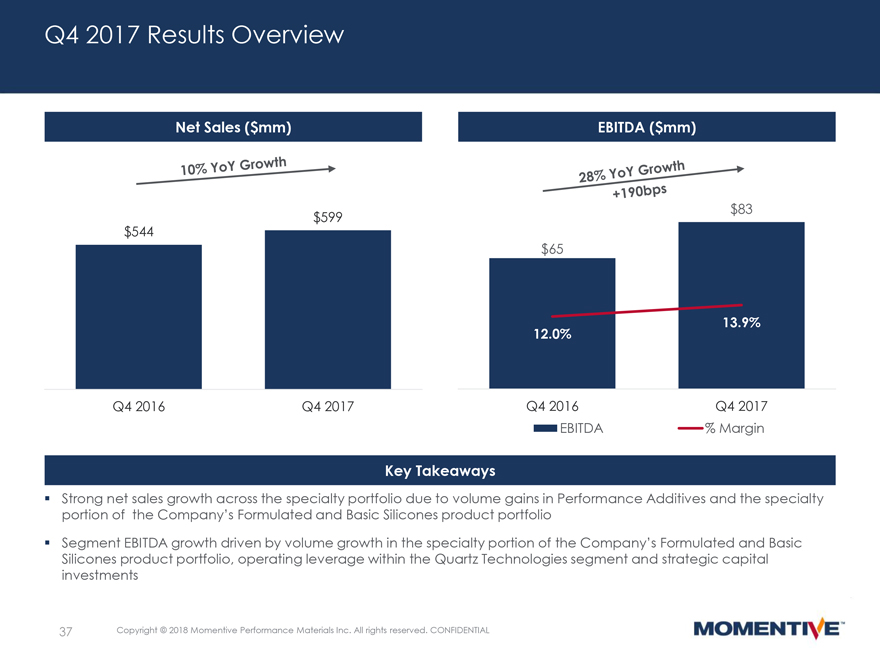

Q4 2017 Results Overview Net Sales ($mm) EBITDA ($mm) $599 $83 $544 $65 13.9% 12.0% Q4 2016 Q4 2017 Q4 2016 Q4 2017 EBITDA % Margin Key Takeaways Strong net sales growth across the specialty portfolio due to volume gains in Performance Additives and the specialty portion of the Company’s Formulated and Basic Silicones product portfolio Segment EBITDA growth driven by volume growth in the specialty portion of the Company’s Formulated and Basic Silicones product portfolio, operating leverage within the Quartz Technologies segment and strategic capital investments 37 Copyright © 2018 Momentive Performance Materials Inc. All rights reserved. CONFIDENTIAL

|

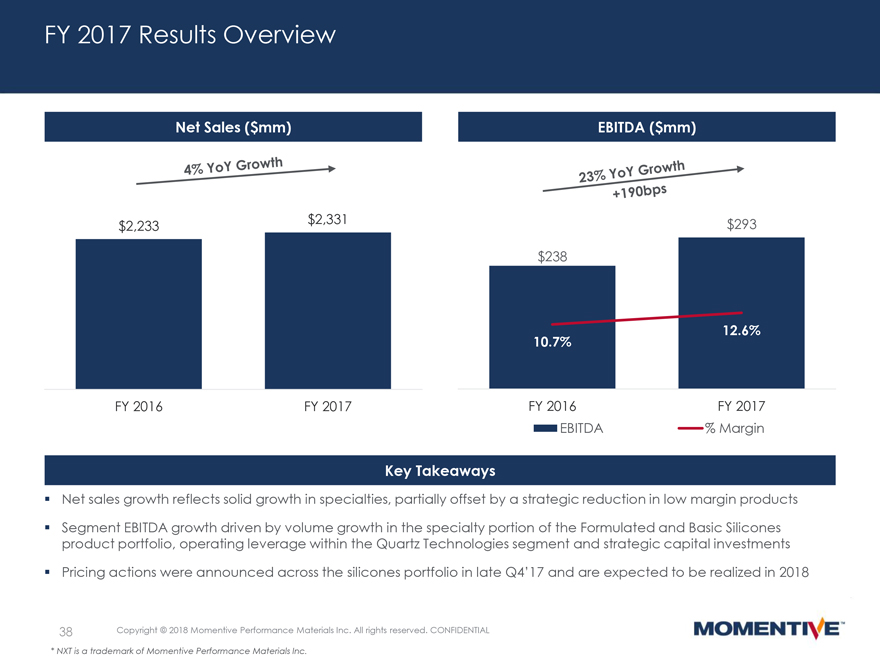

FY 2017 Results Overview Net Sales ($mm) EBITDA ($mm) $2,233$2,331 $293 $238 12.6% 10.7% FY 2016FY 2017FY 2016FY 2017 EBITDA% Margin Key Takeaways Net sales growth reflects solid growth in specialties, partially offset by a strategic reduction in low margin products Segment EBITDA growth driven by volume growth in the specialty portion of the Formulated and Basic Silicones product portfolio, operating leverage within the Quartz Technologies segment and strategic capital investments Pricing actions were announced across the silicones portfolio in late Q4’17 and are expected to be realized in 2018 38Copyright © 2018 Momentive Performance Materials Inc. All rights reserved. CONFIDENTIAL * NXT is a trademark of Momentive Performance Materials Inc.

|

Capital Expenditures Update Summary Over the last several years, Momentive has made significant capital investments to accelerate and facilitate the growth of its specialty product portfolio and to enhance its global manufacturing network — Robust capital allocation framework and process. Focus on 20%+ ROI opportunities More than 20 discrete growth projects since beginning of 2016 representing total growth capex spend of ~$120mm, of which ~80% have been deployed Current portfolio of projects is at less than 10% of estimatedrun-rate EBITDA levels providing significant near-term earnings visibility and upside —Notably, in FY 2015-2017, Momentive invested ~$35 million to globalize and double its NXT Silane production capacity. This production expansion has commissioned and will ramp up production and product qualification over the first half of FY 2018 —NXT is a leading additive for green tire applications. Over the last several years, NXT revenues have grown at over 20% CAGR Momentive has significant flexibility over its capital expenditures. Annual maintenance requirements of $65-75 million per annum Annual Capital Expenditure ($mm) $161 $115$117 $125 $107 73 $96 $81 2946 45 41 22$65-75 32 664974867188802012201320142015201620172018ERun-Rate Maintenance Maintenance & EHSGrowth & Productivity 39 Copyright © 2018 Momentive Performance Materials Inc. All rights reserved. CONFIDENTIAL

|

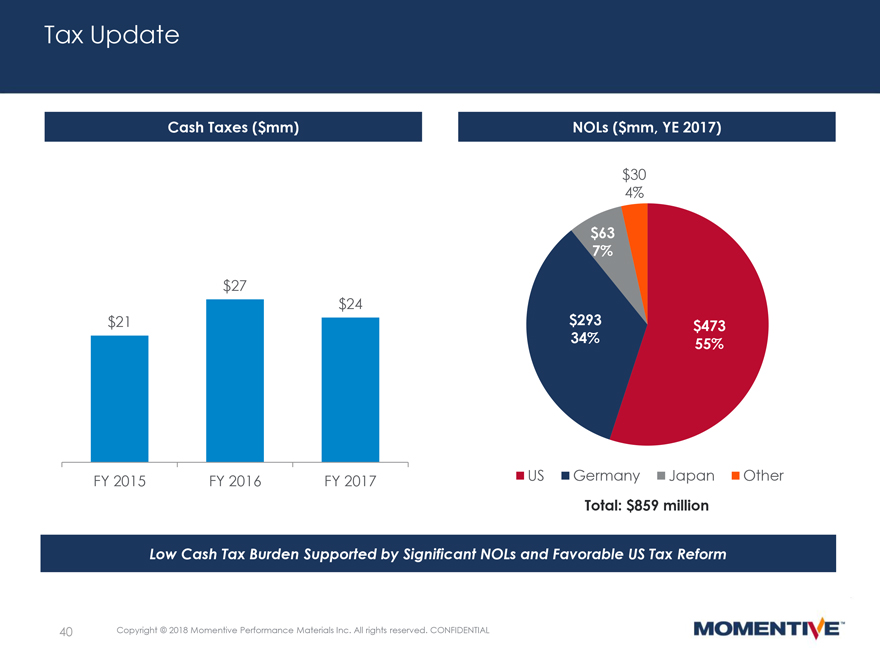

Tax Update Cash Taxes ($mm) NOLs ($mm, YE 2017) $30 4% $63 7% $27 $24 $21 $293$473 34%55% FY 2015FY 2016FY 2017USGermanyJapanOther Total: $859 million Low Cash Tax Burden Supported by Significant NOLs and Favorable US Tax Reform 40Copyright © 2018 Momentive Performance Materials Inc. All rights reserved. CONFIDENTIAL

|

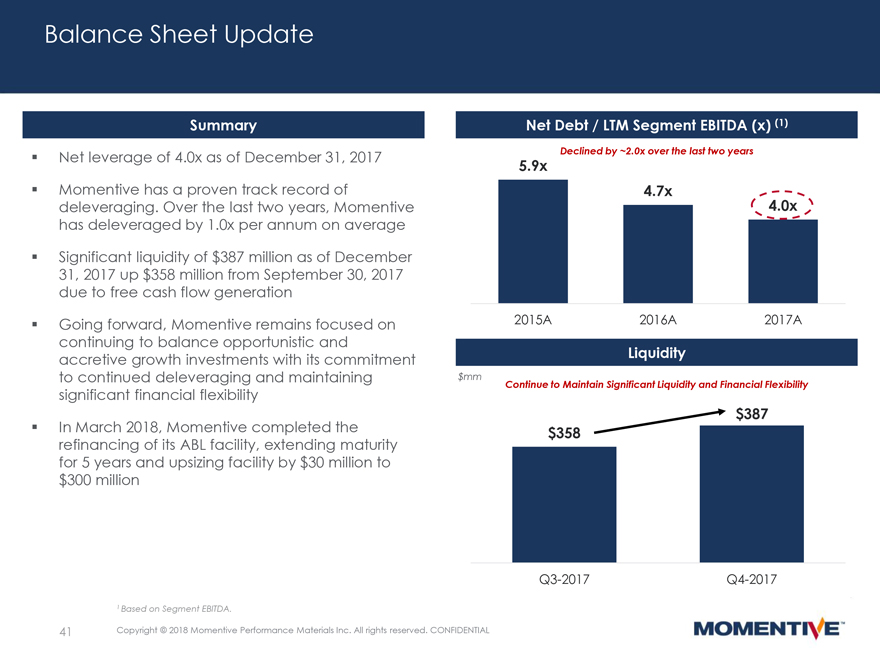

Balance Sheet Update Summary Net Debt / LTM Segment EBITDA (x) (1) Net leverage of 4.0x as of December 31, 2017 Declined by ~2.0x over the last two years 5.9x Momentive has a proven track record of 4.7x deleveraging. Over the last two years, Momentive 4.0x has deleveraged by 1.0x per annum on average Significant liquidity of $387 million as of December 31, 2017 up $358 million from September 30, 2017 due to free cash flow generation Going forward, Momentive remains focused on 2015A2016A2017A continuing to balance opportunistic and accretive growth investments with its commitment Liquidity to continued deleveraging and maintaining$mmContinue to Maintain Significant Liquidity and Financial Flexibility significant financial flexibility $387 In March 2018, Momentive completed the $358 refinancing of its ABL facility, extending maturity for 5 years and upsizing facility by $30 million to $300million Q3-2017Q4-2017 1 Based on Segment EBITDA. 41Copyright © 2018 Momentive Performance Materials Inc. All rights reserved. CONFIDENTIAL

|

SUMMARY 42

|

Momentive – Summary Takeaways Silicones: Enabling Technology for Everyday Life 1 Robust Outlook with MPM is a Differentiated Global High Visibility 5 2 Leader in Silicones 4 3 Significant Earnings and Clearly Defined Competitive Strategy Margin Momentum Focused on Specialties 43 Copyright © 2018 Momentive Performance Materials Inc. All rights reserved. CONFIDENTIAL

|

APPENDIX

|

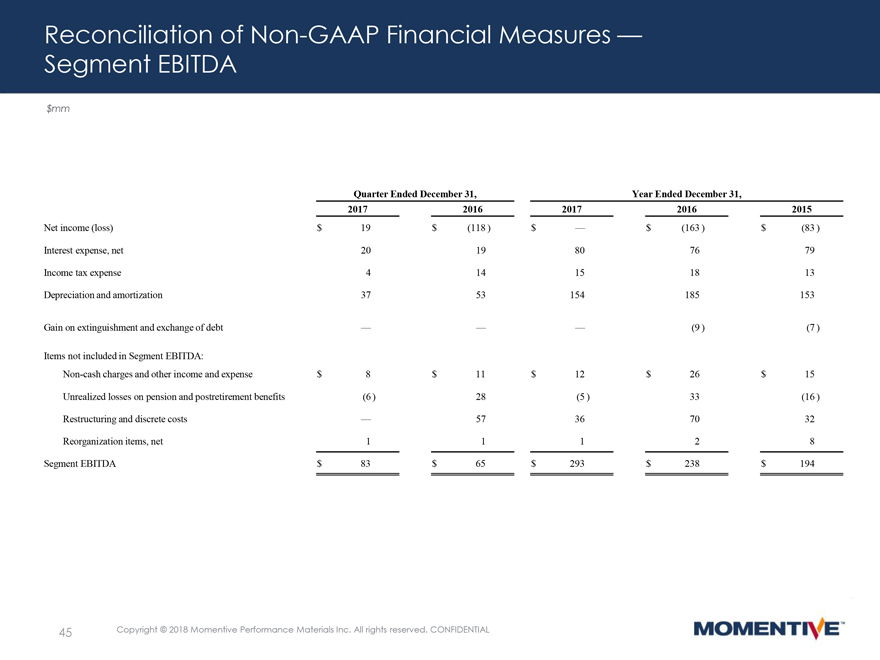

Reconciliation ofNon-GAAP Financial Measures — Segment EBITDA $mm Quarter Ended December 31, Year Ended December 31, 2017 20162017 20162015 Net income (loss)$19$(118 )$ —$(163 )$ (83 ) Interest expense, net 20 1980 7679 Income tax expense 4 1415 1813 Depreciation and amortization 37 53154 185153 Gain on extinguishment and exchange of debt — —— (9 )(7 ) Items not included in SegmentEBITDA: Non-cash charges and other income and expense$8$11$ 12$26$ 15 Unrealized losses on pension and postretirement benefits (6 ) 28(5 ) 33(16 ) Restructuring and discrete costs — 5736 7032 Reorganization items, net 1 11 28 Segment EBITDA$83$65$ 293$238$ 194 45Copyright © 2018 Momentive Performance Materials Inc. All rights reserved. CONFIDENTIAL

|

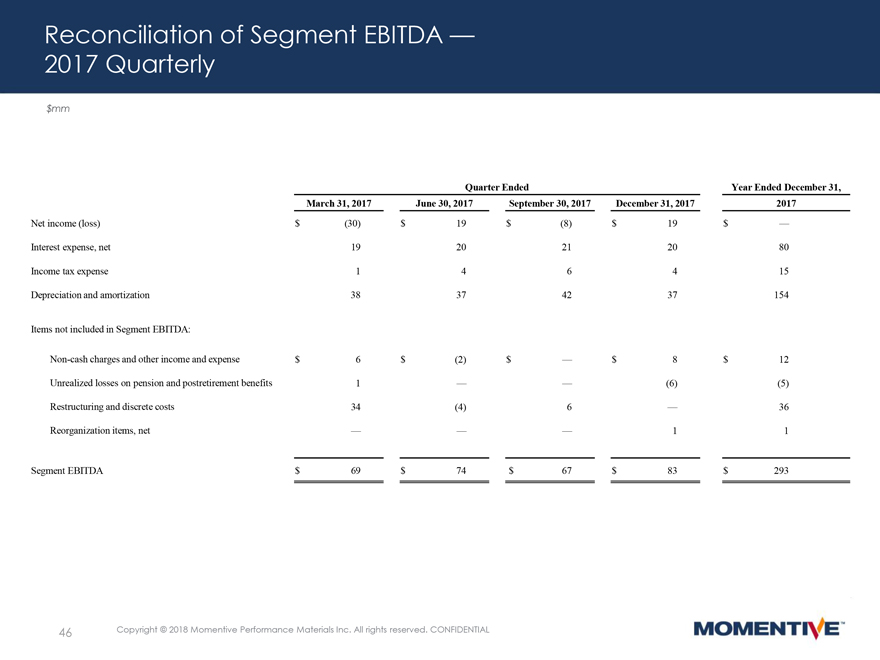

Reconciliation of Segment EBITDA — 2017 Quarterly $mm Quarter Ended Year Ended December 31, March 31, 2017June 30, 2017September 30, 2017December 31, 2017 2017 Net income (loss)$(30)$19$(8)$19$— Interest expense, net 19 20 21 20 80 Income tax expense 1 4 6 4 15 Depreciation and amortization 38 37 42 37 154 Items not included in SegmentEBITDA: Non-cash charges and other income and expense$6$(2)$—$8$12 Unrealized losses on pension and postretirement benefits 1 — — (6) (5) Restructuring and discrete costs 34 (4) 6 — 36 Reorganization items, net — — — 1 1 Segment EBITDA$69$74$67$83$293 46Copyright © 2018 Momentive Performance Materials Inc. All rights reserved. CONFIDENTIAL

|

Reconciliation ofNon-GAAP Financial Measures — Net Debt $mm Year Ended December 31, 2017 2016 2015 Cash (net of restricted)$173$224$217 1st Lien Notes$1,100$1,100$1,100 2nd Lien Notes 202 202 231 Foreign Local Debt 36 36 36 Debt$1,338$1,338$1,367 Net debt$1,165$1,114$1,150 LTM Segment EBITDA$293$238$194 Net Leverage 4.0 x 4.7 x 5.9 x 1 1st Lien Notes and 2nd Lien Notes are shown at principal value and exclude the impact of unamortized debt discount 47Copyright © 2018 Momentive Performance Materials Inc. All rights reserved. CONFIDENTIAL

|

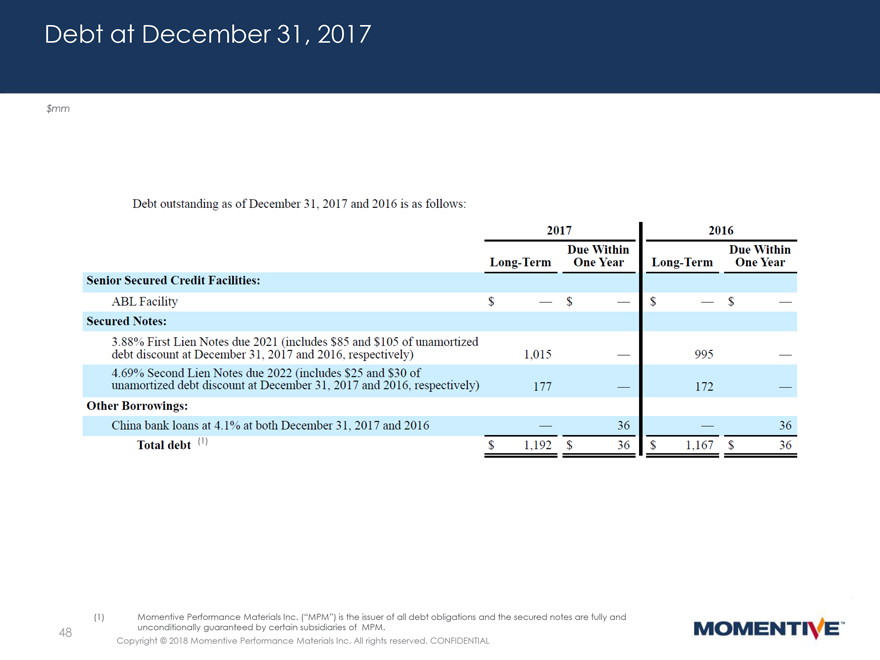

Debt at December 31, 2017 $mm (1) (1) Momentive Performance Materials Inc. (“MPM”) is the issuer of all debt obligations and the secured notes are fully and 48 unconditionally guaranteed by certain subsidiaries of MPM. Copyright © 2018 Momentive Performance Materials Inc. All rights reserved. CONFIDENTIAL

|

Copyright © 2018 Momentive Performance Materials Inc. All rights reserved. CONFIDENTIAL