| | |

| | One Ridgmar Centre 6500 West Freeway, Suite 800 Fort Worth, Texas 76116 817.989.9000telephone 817.989.9001facsimile www.approachresources.com |

December 28, 2012

Via EDGAR Transmission and FedEx

Via Facsimile Transmittal 703.813.6982

Mr. H. Roger Schwall

Assistant Director

United States Securities and Exchange Commission

Division of Corporation Finance

100 F Street, N.E.

Washington, D.C. 20549

| | Re: | Approach Resources Inc. |

Form 10-K for the Fiscal Year Ended December 31, 2011

Filed March 12, 2012

File No. 001-33801

Dear Mr. Schwall:

This letter sets forth the responses of Approach Resources Inc. (the “Company” or “we,” “us” or “our”) to the comments of the staff (the “Staff”) of the Securities and Exchange Commission (the “Commission”) with regard to our annual report on Form 10-K for the fiscal year ended December 31, 2011 (our “2011 Form 10-K”). The Staff’s comments were provided to the Company in a letter dated December 13, 2012. For the convenience of the Staff, the text of each comment is reproduced in its entirety followed by our response.

Form 10-K for Fiscal Year Ended December 31, 2011

Business, page 1

Proved Undeveloped Reserves page 31

| 1. | The discussion of the changes to your proved undeveloped reserves during 2011 includes only conversion to proved developed status. Item 1203(b) of Regulation S-K requires the disclosure of “...material changes in proved undeveloped reserves that occurred during the year, including proved undeveloped reserves converted into proved developed reserves.” Please amend your document to explain the material changes, if any, to the disclosed proved undeveloped reserves due to extensions and discoveries, acquisition/divestiture, revision as well as the changes due to improved recovery for all three years. |

| Response: | We acknowledge the Staff’s comment and respectfully refer the Staff to our disclosures regarding material changes in proved undeveloped (“PUD”) reserves during the year ended December 31, 2011, on page 31 in our 2011 Form 10-K, including our discussion of the reclassification of 2.2 million barrels of oil equivalent (“MMBoe”) of PUD reserves in the East Texas Basin. In addition, we propose to enhance our disclosure in future filings, beginning with our annual report on Form 10-K for the year ending December 31, 2012 (our “2012 Form 10-K”), by adding information, similar to the additional information provided below, that reconciles our beginning and end of year balances of estimated PUD reserves: |

Mr. H. Roger Schwall

Securities and Exchange Commission

December 28, 2012

Page 2

“As of December 31, 2011, we had 43.4 MMBoe of PUD reserves, compared to 24.9 MMBoe of PUD reserves at December 31, 2010. The 18.5 MMBoe increase in PUD reserves is attributable to 19.8 MMBoe of extensions and discoveries and 4.2 MMBoe of purchases of minerals in place, partially offset by 5.5 MMBoe of revisions to previous estimates of PUD reserves. Extensions and discoveries were primarily due to the development of our Wolffork oil shale resource play in Project Pangea. Purchases of minerals in place were from our 2011 acquisition of a 38% working interest that we didn’t already own in Project Pangea. This acquisition included 4.2 MMBoe of PUD reserves. Downward revisions of 5.5 MMBoe to PUD reserves included 3.3 MMBoe in south Project Pangea and 2.2 MMBoe in the East Texas Basin, that, due to ongoing, low natural gas prices, we presently do not expect to develop before December 31, 2016.”

| 2. | We note your statement, “We have 8.9 MMBoe of PUDs, or approximately 11.6% of our total proved reserves that have been booked for five years or longer.” In part, FASB ASC Section 932-235-20 Glossary presents the definition of “Proved Undeveloped Oil and Gas Reserves” to include “Undrilled locations can be classified as having undeveloped reserves only if adevelopment plan has been adopted indicating that they are scheduled to be drilled within five years, unless the specific circumstances, justify a longer time.” Please explain to us your rationale for maintaining these reserves as PUD when it appears they do not qualify as proved undeveloped reserves. Tell us whether these reserves are included in adevelopment project and, if so, furnish us with a description of this project, e.g. location, size (including current well count, projected well count, surface facilities), total sunk capital, total surface facility (other than drilling/completion) sunk capital, estimated total project capital. Important development project characteristics are described in Questions 108.01 and 131.03 to 131.06 of our ‘Compliance and Disclosure Interpretations (“C&DIs”)’. The “C&DIs” are available at www.sec.gov/divisions/corpfin/guidance/oilandgas-interp.htm. Alternatively, you may remove these claimed PUD reserves from your document. |

| Response: | Substantially all of the PUD reserves that have been booked for five years or longer are associated with our deep, tight sandstone (Canyon Sands) drilling program in Project Pangea (defined below) in the Permian Basin. This tight sandstone reservoir is approximately 7,250 to 8,500 feet deep and lies under approximately 100,000 gross acres across Project Pangea. At December 31, 2011, our development plan for our PUD reserves included development costs of $158.7 million in 2012, $214.8 million in 2013, $102.3 million in 2014, $82.0 million in 2015 and $34.8 million in 2016. |

As supported by the DeGolyer and MacNaughton reserve report set forth in Exhibit 99.1 of our 2011 Form 10-K, our tight sands PUD reserves have a high degree of technical certainty. Each year, we review the specific circumstances for our PUD reserves, validate the technical and economic merits of these reserves and revise these estimated reserves accordingly. Importantly, PUD reserves that no longer maintain technical or economic merit or that are no longer in our five year development plan are not included in the PUD reserves in the reserve report for that year. For example, as part of determining the Company’s future investment for PUD reserves at year end 2011, we terminated drilling plans for certain PUD reserves the East Texas Basin due to low natural gas prices. As a result, at December 31, 2011, we reclassified 2.2 MMBoe of PUD reserves in the East Texas Basin as probable undeveloped reserves. In addition, we wrote off 3.3 MMBoe of PUD reserves in south Project Pangea because these reserves no longer maintained economic merit.

Mr. H. Roger Schwall

Securities and Exchange Commission

December 28, 2012

Page 3

We have demonstrated a long and committed track record of drilling our deep, tight sandstone reserves in Project Pangea. As of December 31, 2011, we had drilled and completed more than 500 tight sands wells in the Permian Basin since 2004. According to IHS, this makes us the second most active driller of tight sands (Canyon Sands) wells in West Texas since we began drilling in the area in 2004.

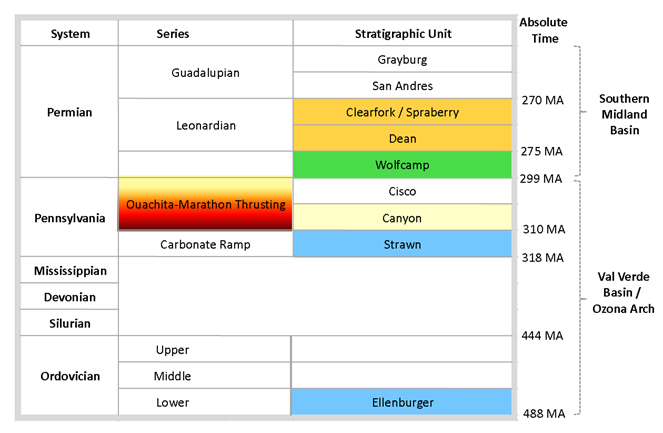

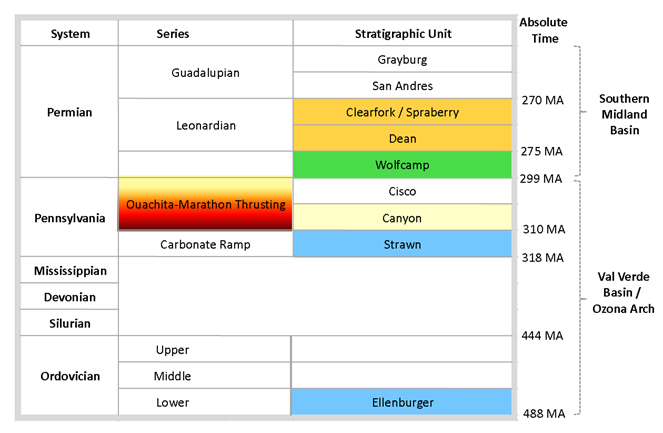

In the process of drilling hundreds of these tight sands wells, we collected log data that indicated the presence of hydrocarbons in the Clearfork, Dean and Wolfcamp Shale formations above the tight sands. In 2009 and 2010, we performed a detailed geological and petrophysical evaluation of the Clearfork, Dean and Wolfcamp formations using logs, 3-D seismic, whole core data and regional mapping. What we discovered was a hydrocarbon column with combined gross pay thickness of approximately 2,500 feetabove our tight sands reservoir that had the potential for multi-zone, commercial development along with the tight sands. The column is made up of three, stacked pay zones: the Clearfork, Dean and Wolfcamp Shale formations. The stratigraphic chart enclosed with this letter asSchedule 1 illustrates the stacked pay zones under our acreage. We sometimes refer to the zones above the tight sands reservoir together as the “Wolffork” formation.

The shallowest reservoir in the Wolffork, the Clearfork formation, is approximately 1,400 feet thick and is a siltstone, shale and carbonate reservoir across our acreage. The Dean formation is a siltstone, shale and carbonate reservoir approximately 150 feet thick across our acreage. Most importantly, the Wolfcamp Shale is a source rock located in the oil-to-wet gas window across our acreage. The Wolfcamp Shale is naturally fractured and has gross pay thickness of approximately 1,000 feet across our acreage position. We have attempted to undertake a prudent and measured approach to the testing and development of this formation in conjunction with the development of the other zones above and below the Wolfcamp Shale, including our legacy tight sands reserves.

In late 2010 and early 2011, we began a pilot program to test the Wolfcamp Shale with horizontal wells and to test the multiple zones in the Wolffork column with a combination of new vertical wells and recompletions of wells previously drilled to the tight sands. Since 2010, we have drilled and completed 35 horizontal wells targeting the Wolfcamp Shale and 41 vertical wells targeting the multiple Wolffork formations. We also have recompleted 26 tight sands wells uphole in the Wolffork zones. Although we believe our horizontal wells, vertical wells and recompletions confirm the presence of the Wolfcamp Shale and Wolffork formations across most of our acreage, we are continuing to advance our understanding of reservoir drainage, wellbore communication and optimal reservoir development of the multiple zones in Project Pangea, including the Wolfcamp, Wolffork and deeper tight sands.

We currently believe that optimal development of the multiple target zones under our acreage may entail a combination of (1) drilling new horizontal wells targeting the Wolfcamp Shale, (2) drilling new, comingled vertical wells targeting the deeper tight sands and shallower Wolffork formations, and (3) recompleting existing tight sands wells to comingle tight sands production with uphole Wolffork production. As such, the PUD reserves that have been booked for five years or longer may have additional reserves above the initial target, the tight sands. Our objective in our core operating area in Project Pangea is to maximize wellbore utility and reservoir potential using the most efficient development model and reservoir management techniques. We have directed our focus to understanding optimal development across our entire acreage position through our Wolfcamp and Wolffork delineation and pilot programs, which we expect to complete during 2013. Understanding the most optimal wellbore utility for all reservoirs in Project Pangea, including our deeper tight sands reservoirs, will allow us not only to maximize reservoir potential, but prevent waste and minimize surface impact and use of other critical resources such as fresh water for fracture stimulation.

Mr. H. Roger Schwall

Securities and Exchange Commission

December 28, 2012

Page 4

We respectfully submit that the specific circumstances set forth above, including the technical certainty of recovery, the Company’s level of ongoing, significant development activities in Project Pangea, our track record of development activity in Project Pangea, and the need to optimize development of multi-zone reservoir potential, clearly justify the recognition of the PUD reserves in question.

We also note your question of whether the PUD reserves in question are included in a development project. We have described our historical and current drilling program in detail above. Based on the stage of our tight sands reservoir development and the integrated development of multiple zones and associated facilities with a common ownership across our acreage position, and other factors, we consider the PUD reserves as being included in a development project as defined in Regulation S-X, Rule 4-10(a)(8). As noted above and at page 26 of our 2011 Form 10-K, we refer to this project as “Project Pangea.”

As of December 31, 2011, Project Pangea spanned approximately 145,000 net, primarily contiguous acres in Crockett and Schleicher Counties, Texas in the southern Midland Basin of the greater Permian Basin. At December 31, 2011, we owned interests in approximately 626 net wells, all of which we operate. As disclosed on page 27 of our 2011 Form 10-K, at December 31, 2011, we had identified 2,955 potential drilling and recompletion locations targeting the Wolfcamp, Wolffork and tight sands formations. Project Pangea is connected by over 100 miles of gathering and flow lines, nine compression and dehydration sites, one amine facility, 11 frac pits, water transfer facilities, and hundreds of tank batteries and artificial lifts. We also are in the process of building an oil comingling facility and LAC unit to connect to a 38-mile oil pipeline. We estimate total, sunk costs for Project Pangea to be $656 million. We estimate total, sunk infrastructure costs (other than drilling and completion) to be $21 million. As of December 31, 2011, estimated future development costs totaled $626 million.

| 3. | The three year aggregate rate for development of your PUD reserves is 37%. Please tell us the plans you will employ to develop these PUD reserves within five years of initial booking. Tell us the figures, if any, for your PUD reserves scheduled for development beyond five years after initial booking. |

| Response: | We note your comment that the three-year aggregate rate for development of our PUD reserves is 37% and respectfully submit that the aggregate percentage of our PUD reserves converted to proved developed reserves is not indicative of future rates or trends. |

Our historical PUD reserve conversion ratios were 6%, 23%, 2%, 14% and 14% for the years 2011, 2010, 2009, 2008 and 2007, respectively. Our 2009 ratio was lower than 2010 and our historical average as a result of the severe decline in oil, NGL and natural gas prices during 2008 and 2009, which was unmatched by a corresponding drop in drilling and service costs. As a result of the sharp decline in commodity prices and high drilling and service costs, we released the two rigs we had running in Project Pangea in April 2009 and significantly reduced our total, annual capital expenditures from $100 million in 2008 to $29 million in 2009.

Mr. H. Roger Schwall

Securities and Exchange Commission

December 28, 2012

Page 5

During 2010, we resumed drilling in Project Pangea. Total capital expenditures related to Project Pangea were $77.4 million in 2010. In addition, as discussed in detail above, in late 2010, we began a pilot program to test the Wolfcamp Shale and Wolffork resource plays in Project Pangea. The Wolfcamp Shale play presented a unique exploration opportunity due to its significant resource potential. As a result of this discovery, much of our focus during 2011 was directed to horizontal and vertical pilot programs testing the Wolfcamp Shale and Wolffork formations, as well as the optimal development, reservoir management and comingling techniques for the Wolfcamp, Wolffork and the deeper tight sandstones reservoir. This activity necessarily slowed our rate of tight sands PUD reserves development. Following the discovery of the Wolfcamp Shale and our pilot Wolffork programs, we increased drilling 2012 and have announced a further increase in drilling for 2013 to capture the PUD reserves opportunities presented by our 2010 discovery and to ensure our legacy tight sands PUD development program is fully optimized.

All PUD reserves included in our 2011 Form 10-K had a development plan scheduling them to be drilled before the end of 2016. At December 31, 2011, we estimated future development costs relating to the development for our PUD reserves to be $158.7 million in 2012, $214.8 million in 2013, $102.3 million in 2014, $82.0 million in 2015 and $34.8 million in 2016.

Undeveloped Acreage Expirations, page 34

| 4. | We note that over 60% of your undeveloped acreage is due to expire by year-end 2014. Here, or in another appropriate location, indicate the amount of PUD reserves associated with these properties and discuss what steps, if any you are taking to address this acreage expiry. If these quantities are material, provide a risk factor addressing this situation as well. |

| Response: | As noted in the Staff’s comment above, at December 31, 2011, approximately 60,000 net acres, or 60%, of our undeveloped acreage was due to expire by year-end 2014. Approximately 3.1 MMBoe of PUD reserves, or 4% of total proved reserves at December 31, 2011, are associated with these properties. We are continually engaged in a combination of drilling and development and discussions with mineral lessors for lease extensions, renewals, new drilling and development units and new leases to address the expiration of undeveloped acreage that occurs in the normal course of our business. |

We acknowledge the Staff’s request for a risk factor addressing acreage expirations and associated PUD reserves and respectfully refer the Staff to our risk factors “Our identified potential drilling locations are scheduled to be drilled over many years, making them susceptible to uncertainties that could prevent them from being drilled or delay their drilling. In certain instances, this could prevent drilling and production before the expiration date of leases for such locations;” “We have leases and options for undeveloped acreage that may expire in the near future;” and “If gas prices remain low or decline further, or if oil and NGL prices decline, we may be required to write down the carrying values of our properties. Current SEC rules also could require us to write down our proved undeveloped reserves in the future,” on pages 20, 21 and 22 of our 2011 Form 10-K.

Mr. H. Roger Schwall

Securities and Exchange Commission

December 28, 2012

Page 6

Management’s Discussion and Analysis of Financial Condition and Results of Operations, page 40

Working Interest Acquisition, page 41

| 5. | Here you disclose this February, 2011 acquisition’s cost at $71 million while the 2011 “Property acquisition costs” on page F-26 are just under $42 million. Please correct this inconsistency or reconcile the difference to us. |

| Response: | We note that in making this comment you reviewed the disclosure in the section titled “Working Interest Acquisition” on page 41 of Management’s Discussion and Analysis of Financial Condition and Results of Operations as well as the disclosure made on page F-26 in Note 9 to the Consolidated Financial Statements in our 2011 Form 10-K. In addition to the information reviewed by the Staff, we respectfully refer the Staff to Note 2, “Working Interest Acquisitions,” to the Consolidated Financial Statements on pages F-15 and F-16. Note 2 disclosed the purchase price allocation reconciliation to the $70.8 million paid for the 38% Working Interest Acquisition disclosed on page 41. The $19.4 million allocated to “Mineral interests in oil and gas properties” disclosed in Note 2 is included in the $42 million of “Property acquisition costs” referenced on page F-26. However, the $51.4 million allocated to “Wells, equipment and related facilities” disclosed in Note 2 is included in the $234 million of “Development costs” disclosed on page F-26. |

Notes to Consolidated Financial Statements

Note 10 – Disclosures About Oil and Gas Producing Activities, page F-26

Proved Reserves, page F-26

| 1. | Please revise your disclosure to separately present proved undeveloped reserves as of the beginning and end of each year. Refer to FASB ASC 932-235-50-4. |

| Response: | We acknowledge that the disclosure of proved undeveloped reserves is not separately presented in Note 10 to the Consolidated Financial Statements, although such amounts are calculable by the reader from the information presented in the Oil and Gas Reserve Quantities table on F-27 of our 2011 Form 10-K. We also note that the exact quantities of proved undeveloped reserves at December 31, 2011, are presented on page 28 of our 2011 Form 10-K; the quantities of proved undeveloped reserves at December 31, 2010, are presented on page 30 of our annual report on Form 10-K for the year ended December 31, 2010; and the quantities of proved undeveloped reserves at December 31, 2009, are presented on page 7 of our annual report on Form 10-K for the year ended December 31, 2009. The proved undeveloped reserve information is both calculable from the information presented in Note 10 to the Consolidated Financial Statements and is available to the public in other locations in our public filings. However, we propose to enhance future filings, beginning with our 2012 Form 10-K, by separately providing proved undeveloped reserve quantities as of the beginning and end of each year in the footnotes to the Consolidated Financial Statements. |

Standardized Measure of Discounted Future Net Cash Flows Relating to Proved Reserves. Page F-28

| 2. | We note the disclosure per page F-28 of your filing stating that the standardized measure of discounted future net cash flows and the changes in standardized measure of discountedfuture net cash flows were prepared in accordance with 2010 and 2009 provisions of FASB |

Mr. H. Roger Schwall

Securities and Exchange Commission

December 28, 2012

Page 7

| | ASC 932 and SFAS 69. Please tell us about any differences in the preparation of the standardized measure for the periods presented in your filing. Please note that the amendments to FASB ASC 932 pursuant to ASU 2010-03 were effective for annual reporting periods ending on or after December 31, 2009. |

| Response: | As disclosed on page 43 of Management’s Discussion and Analysis of Financial Condition and Results of Operations in our 2011 Form 10-K in the section titled “Proved Reserves,” we adopted the amendments to FASB ASC 932 pursuant to ASU 2010-03 effective December 31, 2009. There are no differences in the preparation of the standardized measure for the periods presented on page F-28 in the footnotes to the Consolidated Financial Statements of our 2011 Form 10-K. Future cash inflows were computed by applying the average of the closing price on the first day of each month for the respective 12- month periods, to estimate future production. In all future filings, beginning with our 2012 Form 10-K, we will clarify that all periods presented in the “Standardized Measure of Discounted Future Net Cash Flows Relating to Proved Reserves” are consistently prepared in accordance FASB ASC 932. |

Closing

In addition, pursuant to the Staff’s letter, we acknowledge the following:

| | • | | the Company is responsible for the adequacy and accuracy of the disclosure in the filing; |

| | • | | Staff comments or changes to disclosure in response to Staff comments do not foreclose the Commission from taking any action with respect to the filing; and |

| | • | | The Company may not assert staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

Please direct any questions or additional comments regarding this letter to the undersigned at (817) 989-9000.

|

| Sincerely, |

|

| /s/ Steven P. Smart |

Steven P. Smart |

Executive Vice President and Chief Financial Officer |

Enclosure

| cc: | Ethan Horowitz, Branch Chief |

Svitlana Sweat, Staff Accountant

J. Ross Craft, President and Chief Executive Officer

Wesley P. Williams, Thompson & Knight LLP

Schedule 1