Third Quarter 2016 Results November 2, 2016 Exhibit 99.2

Forward-looking statements Third Quarter 2016 Results – November 2016 This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements, other than statements of historical facts, included in this presentation that address activities, events or developments that the Company expects, believes or anticipates will or may occur in the future are forward-looking statements. Without limiting the generality of the foregoing, forward-looking statements contained in this presentation specifically (i) relate to stockholder approval and consummation of the transactions discussed herein, and (ii) include the expectations of management regarding plans, strategies, objectives, anticipated financial and operating results of the Company, including as to the Company’s Wolfcamp shale resource play, estimated resource potential and recoverability of the oil and gas, estimated reserves and drilling locations, capital expenditures, typical well results and well profiles, type curve, and production and operating expenses guidance included in the presentation. These statements are based on certain assumptions made by the Company based on management's experience and technical analyses, current conditions, anticipated future developments and other factors believed to be appropriate and reasonable by management. When used in this presentation, the words “will,” “potential,” “believe,” “intend,” “expect,” “may,” “should,” “anticipate,” “could,” “estimate,” “plan,” “predict,” “project,” “target,” “profile,” “model” or their negatives, other similar expressions or the statements that include those words, are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. Such statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond the control of the Company, which may cause actual results to differ materially from those implied or expressed by the forward-looking statements. In particular, careful consideration should be given to the cautionary statements and risk factors described in the Company's most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. In addition, these risks, uncertainties, assumptions and other important factors include, but are not limited to (1) the inability to complete the transactions discussed in this presentation due to the failure to obtain approval of the Company’s stockholders to certain aspects thereof or other conditions to closing of the initial exchange and/or follow-on exchange offer, (2) the failure to achieve 100% participation in the follow-on exchange offer, (3) a continued decline in commodities prices, (4) the Company’s ability to recognize the anticipated benefits of the transactions, (5) costs related to the transactions, (6) changes in applicable laws or regulations, and (7) other risks and uncertainties indicated from time to time in a definitive proxy statement, including those under “Risk Factors” therein, and other documents filed or to be filed with the SEC by Approach. Any forward-looking statement speaks only as of the date on which such statement is made and the Company undertakes no obligation to correct or update any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by applicable law. The Securities and Exchange Commission (“SEC”) permits oil and gas companies, in their filings with the SEC, to disclose only proved, probable and possible reserves that meet the SEC’s definitions for such terms, and price and cost sensitivities for such reserves, and prohibits disclosure of resources that do not constitute such reserves. The Company uses the terms “estimated ultimate recovery” or “EUR,” reserve or resource “potential,” and other descriptions of volumes of reserves potentially recoverable through additional drilling or recovery techniques that the SEC’s rules may prohibit the Company from including in filings with the SEC. These estimates are by their nature more speculative than estimates of proved, probable and possible reserves and accordingly are subject to substantially greater risk of being actually realized by the Company. EUR estimates, identified drilling locations and resource potential estimates have not been risked by the Company. Actual locations drilled and quantities that may be ultimately recovered from the Company’s interest may differ substantially from the Company’s estimates. There is no commitment by the Company to drill all of the drilling locations that have been attributed these quantities. Factors affecting ultimate recovery include the scope of the Company’s drilling project, which will be directly affected by the availability of capital, drilling and production costs, availability of drilling and completion services and equipment, drilling results, lease expirations, regulatory approval and actual drilling results, as well as geological and mechanical factors. Estimates of unproved reserves, type/decline curves, per well EUR and resource potential may change significantly as development of the Company’s oil and gas assets provides additional data. Type/decline curves, estimated EURs, resource potential, recovery factors and well costs represent Company estimates based on evaluation of petrophysical analysis, core data and well logs, well performance from limited drilling and recompletion results and seismic data, and have not been reviewed by independent engineers. These are presented as hypothetical recoveries if assumptions and estimates regarding recoverable hydrocarbons, recovery factors and costs prove correct. The Company has limited production experience with this project, and accordingly, such estimates may change significantly as results from more wells are evaluated. Estimates of resource potential and EURs do not constitute reserves, but constitute estimates of contingent resources which the SEC has determined are too speculative to include in SEC filings. Unless otherwise noted, IRR estimates are before taxes and assume NYMEX forward-curve oil and gas pricing and Company-generated EUR and decline curve estimates based on Company drilling and completion cost estimates that do not include land, seismic or G&A costs. Cautionary statements regarding oil & gas quantities

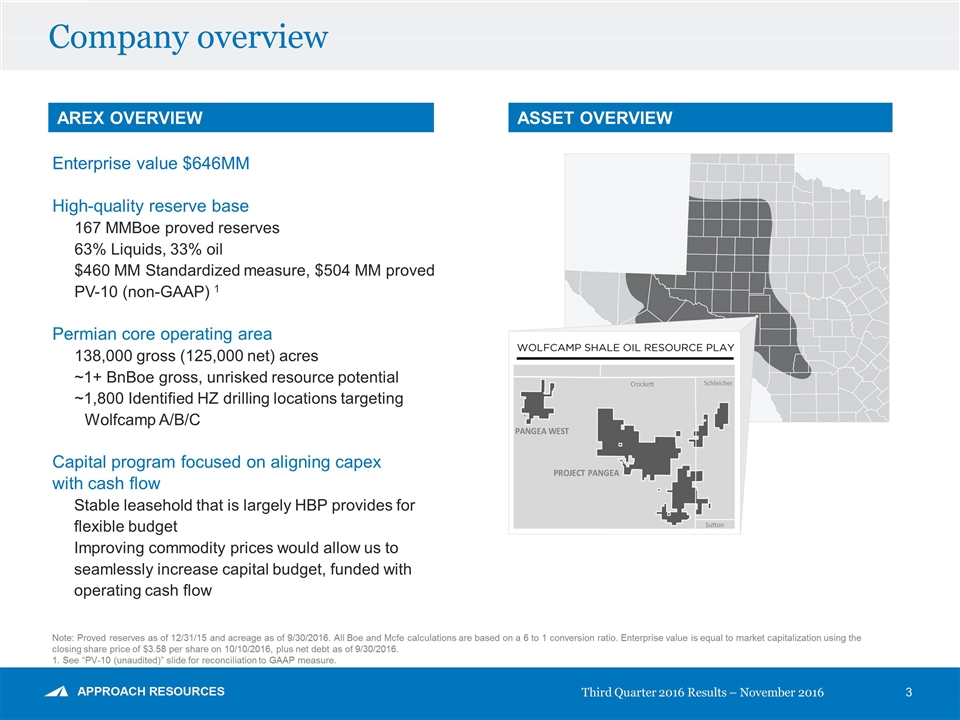

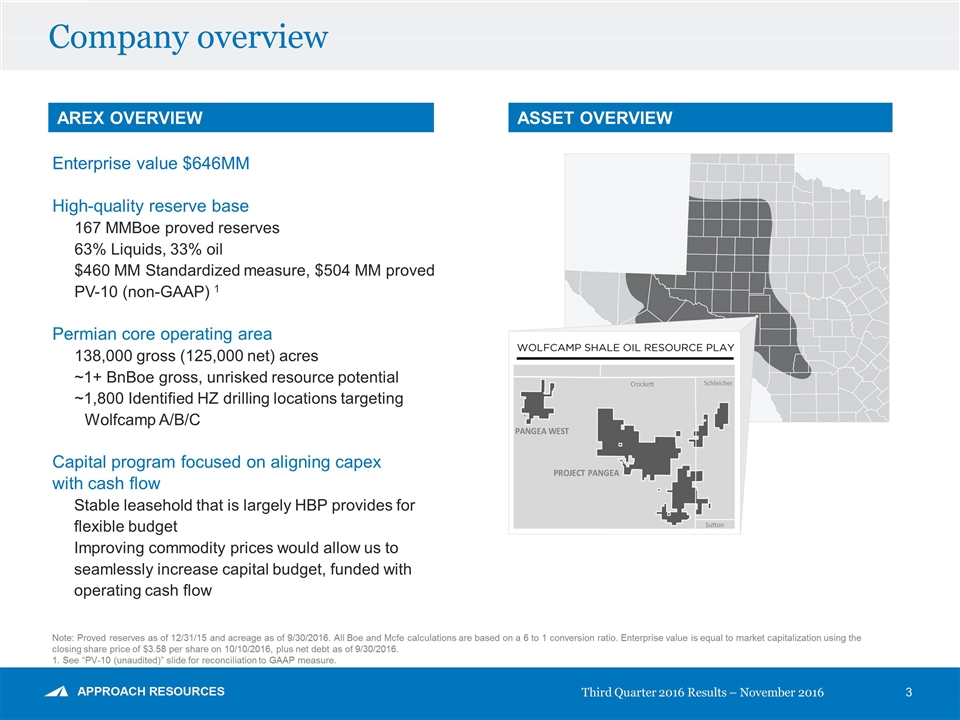

Company overview AREX OVERVIEW ASSET OVERVIEW Enterprise value $646MM High-quality reserve base 167 MMBoe proved reserves 63% Liquids, 33% oil $460 MM Standardized measure, $504 MM proved PV-10 (non-GAAP) 1 Permian core operating area 138,000 gross (125,000 net) acres ~1+ BnBoe gross, unrisked resource potential ~1,800 Identified HZ drilling locations targeting Wolfcamp A/B/C Capital program focused on aligning capex with cash flow Stable leasehold that is largely HBP provides for flexible budget Improving commodity prices would allow us to seamlessly increase capital budget, funded with operating cash flow Note: Proved reserves as of 12/31/15 and acreage as of 9/30/2016. All Boe and Mcfe calculations are based on a 6 to 1 conversion ratio. Enterprise value is equal to market capitalization using the closing share price of $3.58 per share on 10/10/2016, plus net debt as of 9/30/2016. 1. See “PV-10 (unaudited)” slide for reconciliation to GAAP measure. Third Quarter 2016 Results – November 2016

3Q16 Operating highlights OPERATING HIGHLIGHTS Low cost, on time, and on budget 3Q16 LOE of $3.49/Boe is a record low for the Company, down 31% from 3Q15 Completed 3 HZ wells during the quarter (2 in the Baker area, 1 in Pangea West) Wolfcamp A – 1 well and Wolfcamp C – 2 wells Wells completed during the quarter came in below $3.5 MM We plan to drill two wells during 4Q16 but do not plan to bring any new wells on-line until January 2017, and we expect 4Q16 production to average 11.6 MBoe/d Continued Completion Optimization Success Increased completion activity following continued price improvement during the quarter 3Q16 production averaged 12.1 MBoe/d, exceeding previous guidance of 11.9 MBoe/d Average IP for wells completed during 3Q16 was 813 Boe/d (58% oil and 81% liquids), including one short lateral well normalized to a 7,500’ lateral Third Quarter 2016 Results – November 2016

3Q16 Financial highlights FINANCIAL HIGHLIGHTS Preserving cash flow Revenues (pre-hedge) of $23.7 MM, quarterly EBITDAX (non-GAAP)1 of $14.1 MM Operating cash flow of $11.3 MM, capital expenditures of $5.5 MM Remain well-hedged for the balance of 2016, added multiple 2017 natural gas hedges Stable financial position Fall 2016 borrowing base redetermination process currently underway, our lead bank has recommended reaffirmation of the current $325 MM borrowing base2 Current liquidity position is more than adequate to execute on our 2016 plan as we continue to align capex with cash flow, with plans to continue that strategy in 2017 Continued focus on cutting costs & improving margins 3Q16 Operating expenses of $32.2 MM, cash operating expenses (non-GAAP)1 totaled $9.29/Boe, an 11% decrease compared to 3Q15 Net loss of $9.1 MM or $0.22 per diluted share, and adjusted net loss (non-GAAP)1 of $9.6 MM, or $0.23 per diluted share Renegotiated long-term crude oil marketing arrangement that will result in lower oil differentials beginning in fourth quarter 2016 See “Adjusted net loss (unaudited)”, “Cash operating expenses (unaudited)” and “EBITDAX (unaudited)” slides for reconciliation to GAAP measures. There is no assurance that the borrowing base will not be higher or lower than our $325 million borrowing base as of September 30, 2016. Third Quarter 2016 Results – November 2016

Debt-for-equity exchange highlights Third Quarter 2016 Results – November 2016 Large-scale strategic recapitalization anchored by a proven industry investor Reduces debt and interest expense, and increases operating liquidity and financing flexibility Positions Company to resume growth Alliance with a strategic investor enhances access to OFS services if that market tightens in a rising price environment Recapitalization accomplished at a 23% premium to current share price

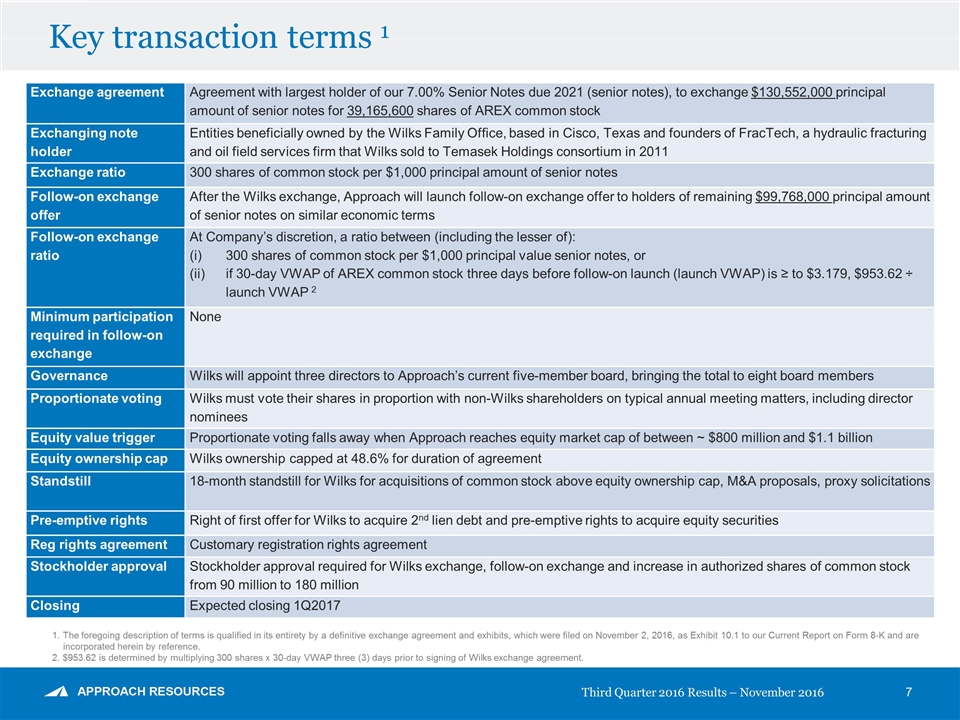

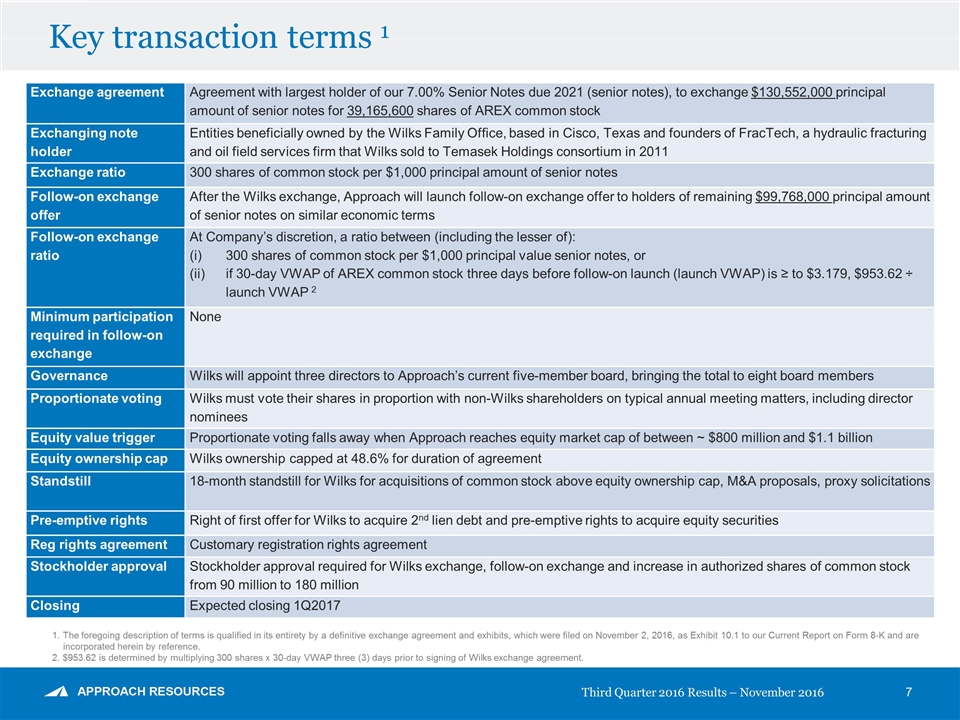

Key transaction terms 1 1. The foregoing description of terms is qualified in its entirety by a definitive exchange agreement and exhibits, which were filed on November 2, 2016, as Exhibit 10.1 to our Current Report on Form 8-K and are incorporated herein by reference. 2. $953.62 is determined by multiplying 300 shares x 30-day VWAP three (3) days prior to signing of Wilks exchange agreement. Exchange agreement Agreement with largest holder of our 7.00% Senior Notes due 2021 (senior notes), to exchange $130,552,000 principal amount of senior notes for 39,165,600 shares of AREX common stock Exchanging note holder Entities beneficially owned by the Wilks Family Office, based in Cisco, Texas and founders of FracTech, a hydraulic fracturing and oil field services firm that Wilks sold to Temasek Holdings consortium in 2011 Exchange ratio 300 shares of common stock per $1,000 principal amount of senior notes Follow-on exchange offer After the Wilks exchange, Approach will launch follow-on exchange offer to holders of remaining $99,768,000 principal amount of senior notes on similar economic terms Follow-on exchange ratio At Company’s discretion, a ratio between (including the lesser of): 300 shares of common stock per $1,000 principal value senior notes, or if 30-day VWAP of AREX common stock three days before follow-on launch (launch VWAP) is ≥ to $3.179, $953.62 ÷ launch VWAP 2 Minimum participation required in follow-on exchange None Governance Wilks will appoint three directors to Approach’s current five-member board, bringing the total to eight board members Proportionate voting Wilks must vote their shares in proportion with non-Wilks shareholders on typical annual meeting matters, including director nominees Equity value trigger Proportionate voting falls away when Approach reaches equity market cap of between ~ $800 million and $1.1 billion Equity ownership cap Wilks ownership capped at 48.6% for duration of agreement Standstill 18-month standstill for Wilks for acquisitions of common stock above equity ownership cap, M&A proposals, proxy solicitations Pre-emptive rights Right of first offer for Wilks to acquire 2nd lien debt and pre-emptive rights to acquire equity securities Reg rights agreement Customary registration rights agreement Stockholder approval Stockholder approval required for Wilks exchange, follow-on exchange and increase in authorized shares of common stock from 90 million to 180 million Closing Expected closing 1Q2017 Third Quarter 2016 Results – November 2016

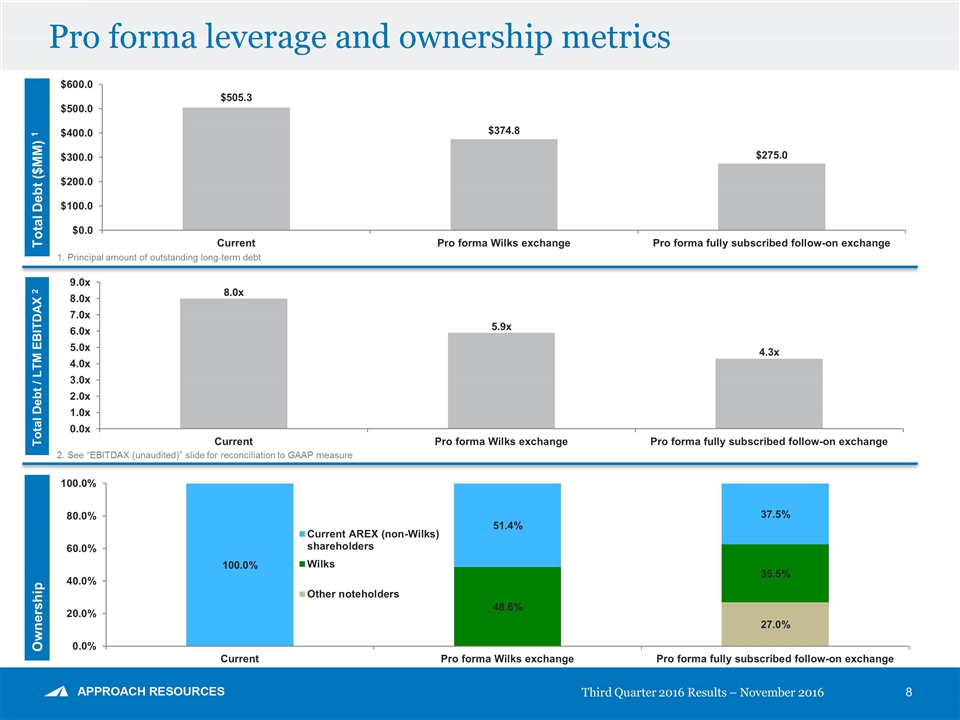

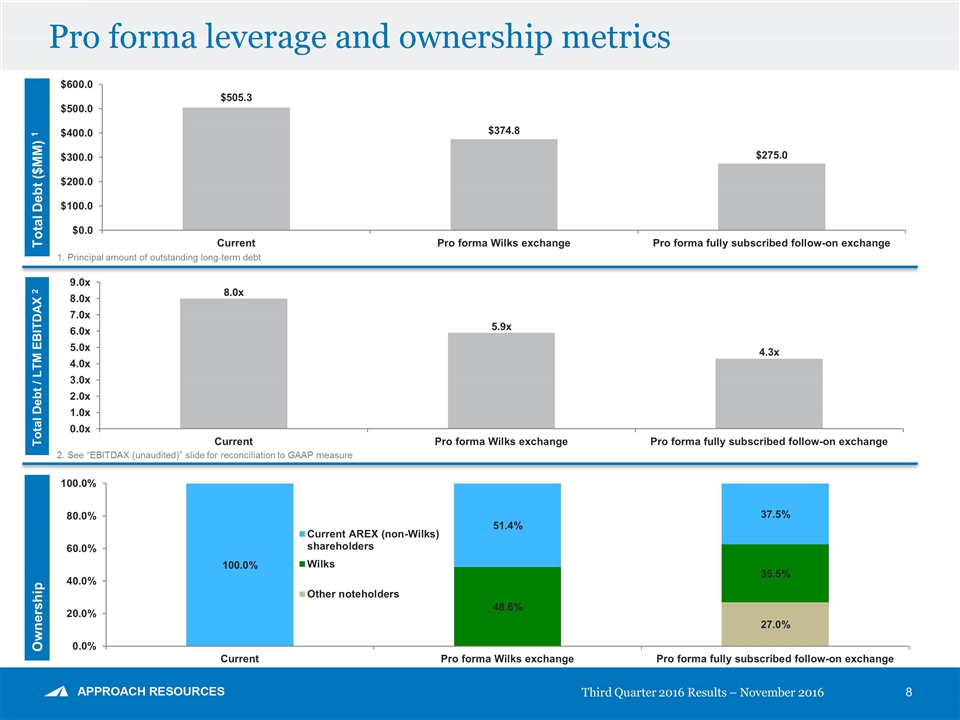

Pro forma leverage and ownership metrics Third Quarter 2016 Results – November 2016 Total Debt ($MM) 1 Ownership Total Debt / LTM EBITDAX 2 1. Principal amount of outstanding long-term debt 2. See “EBITDAX (unaudited)” slide for reconciliation to GAAP measure

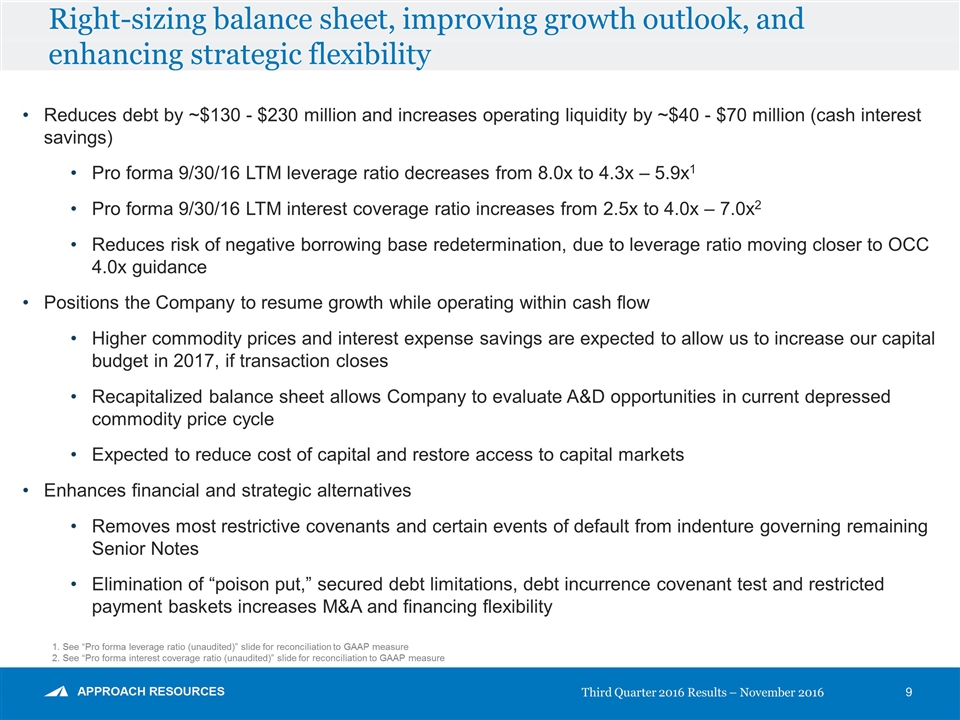

Right-sizing balance sheet, improving growth outlook, and enhancing strategic flexibility Third Quarter 2016 Results – November 2016 Reduces debt by ~$130 - $230 million and increases operating liquidity by ~$40 - $70 million (cash interest savings) Pro forma 9/30/16 LTM leverage ratio decreases from 8.0x to 4.3x – 5.9x1 Pro forma 9/30/16 LTM interest coverage ratio increases from 2.5x to 4.0x – 7.0x2 Reduces risk of negative borrowing base redetermination, due to leverage ratio moving closer to OCC 4.0x guidance Positions the Company to resume growth while operating within cash flow Higher commodity prices and interest expense savings are expected to allow us to increase our capital budget in 2017, if transaction closes Recapitalized balance sheet allows Company to evaluate A&D opportunities in current depressed commodity price cycle Expected to reduce cost of capital and restore access to capital markets Enhances financial and strategic alternatives Removes most restrictive covenants and certain events of default from indenture governing remaining Senior Notes Elimination of “poison put,” secured debt limitations, debt incurrence covenant test and restricted payment baskets increases M&A and financing flexibility 1. See “Pro forma leverage ratio (unaudited)” slide for reconciliation to GAAP measure 2. See “Pro forma interest coverage ratio (unaudited)” slide for reconciliation to GAAP measure

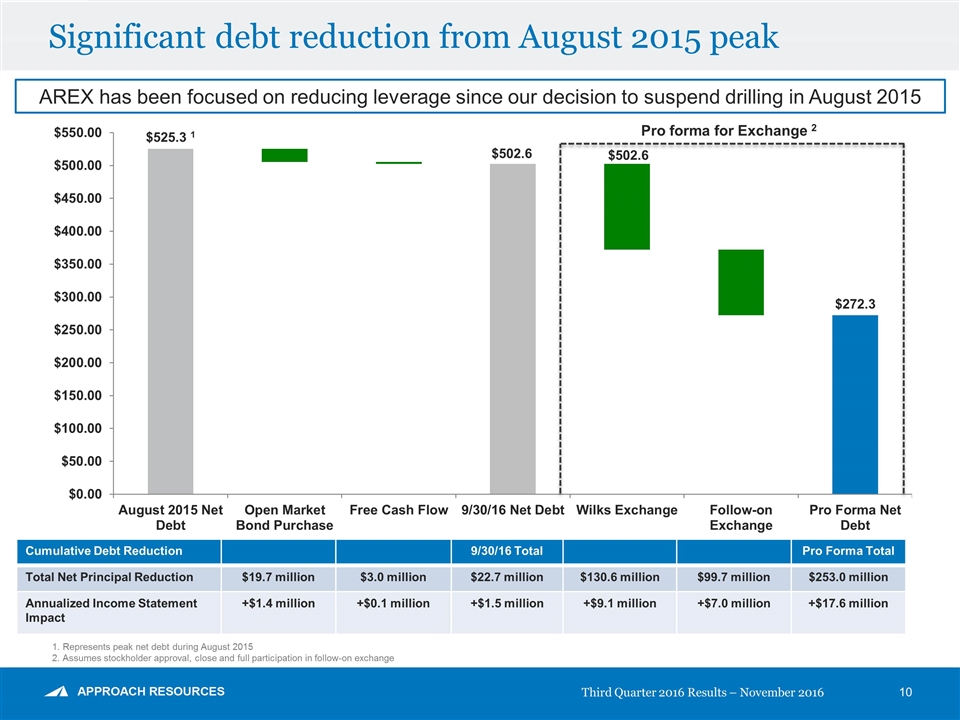

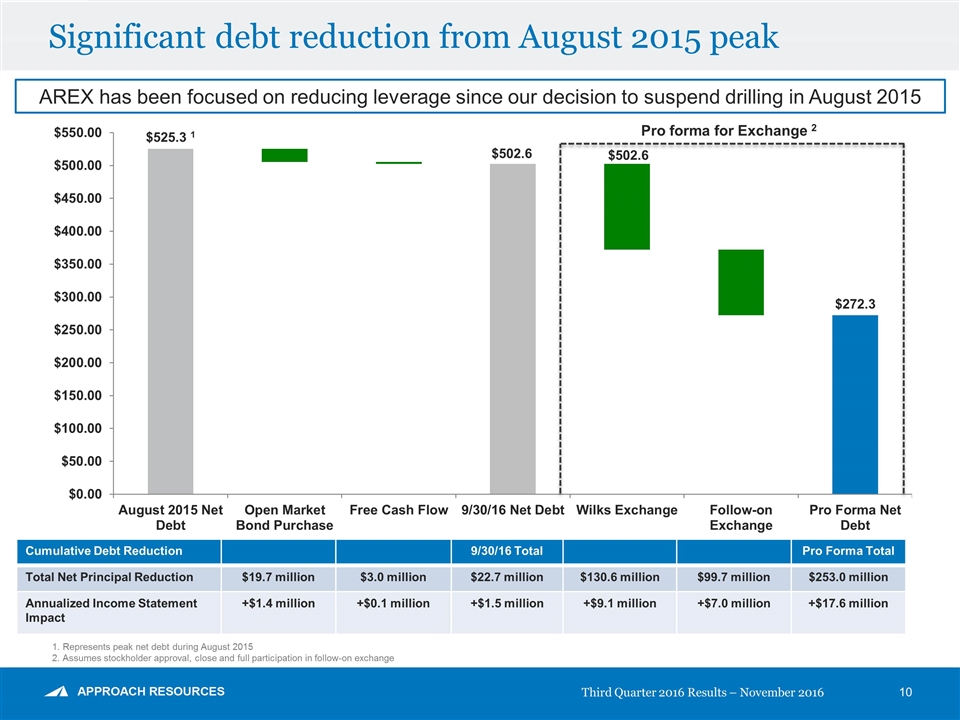

Significant debt reduction from August 2015 peak AREX has been focused on reducing leverage since our decision to suspend drilling in August 2015 Cumulative Debt Reduction 9/30/16 Total Pro Forma Total Total Net Principal Reduction $19.7 million $3.0 million $22.7 million $130.6 million $99.7 million $253.0 million Annualized Income Statement Impact +$1.4 million +$0.1 million +$1.5 million +$9.1 million +$7.0 million +$17.6 million 1. Represents peak net debt during August 2015 2. Assumes stockholder approval, close and full participation in follow-on exchange Pro forma for Exchange 2 Third Quarter 2016 Results – November 2016

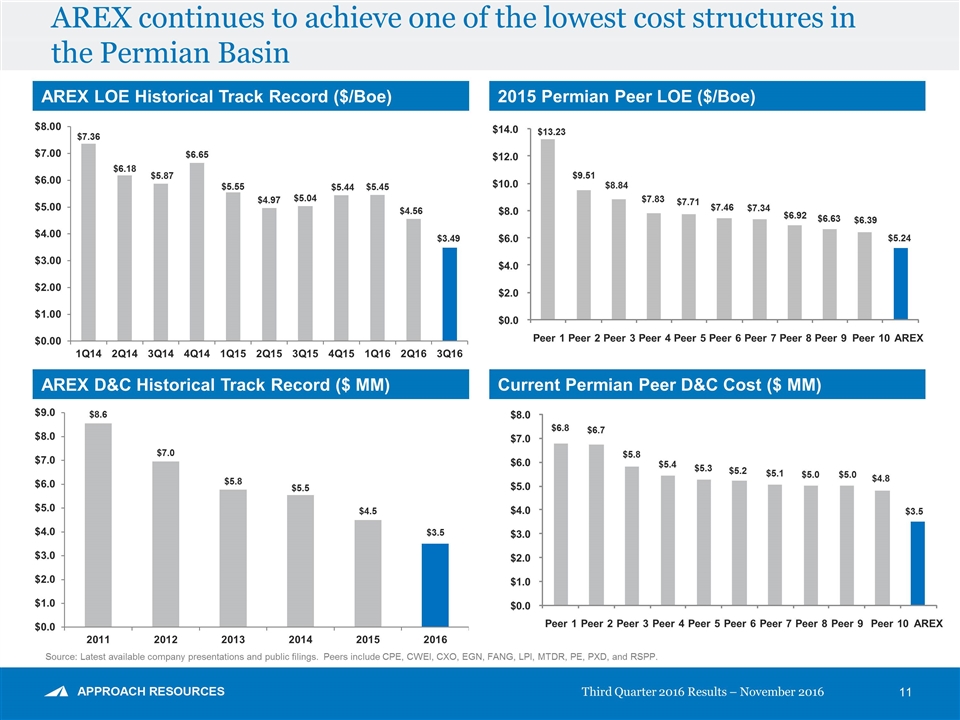

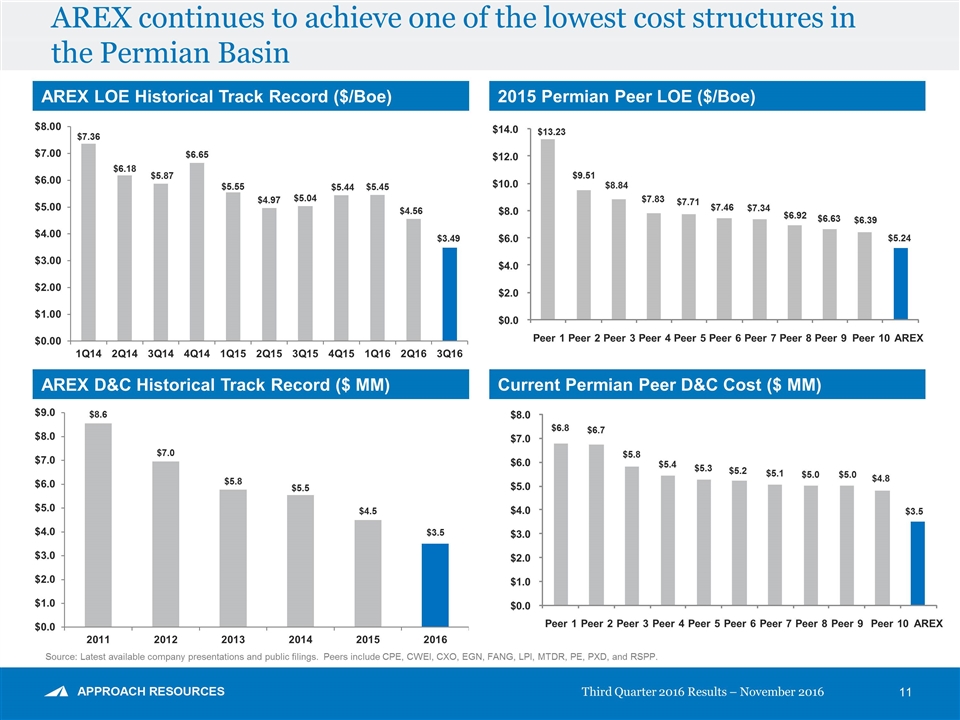

AREX LOE Historical Track Record ($/Boe) 2015 Permian Peer LOE ($/Boe) AREX D&C Historical Track Record ($ MM) Source: Latest available company presentations and public filings. Peers include CPE, CWEI, CXO, EGN, FANG, LPI, MTDR, PE, PXD, and RSPP. AREX continues to achieve one of the lowest cost structures in the Permian Basin $13.23 $9.51 $8.84 $7.83 $7.71 $7.46 $7.34 $6.92 $6.63 $6.39 $5.24 $0.0 $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 $14.0 Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 AREX Current Permian Peer D&C Cost ($ MM) $6.8 $6.7 $5.8 $5.4 $5.3 $5.2 $5.1 $5.0 $5.0 $4.8 $3.5 $0.0 $1.0 $2.0 $3.0 $4.0 $5.0 $6.0 $7.0 $8.0 Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 AREX

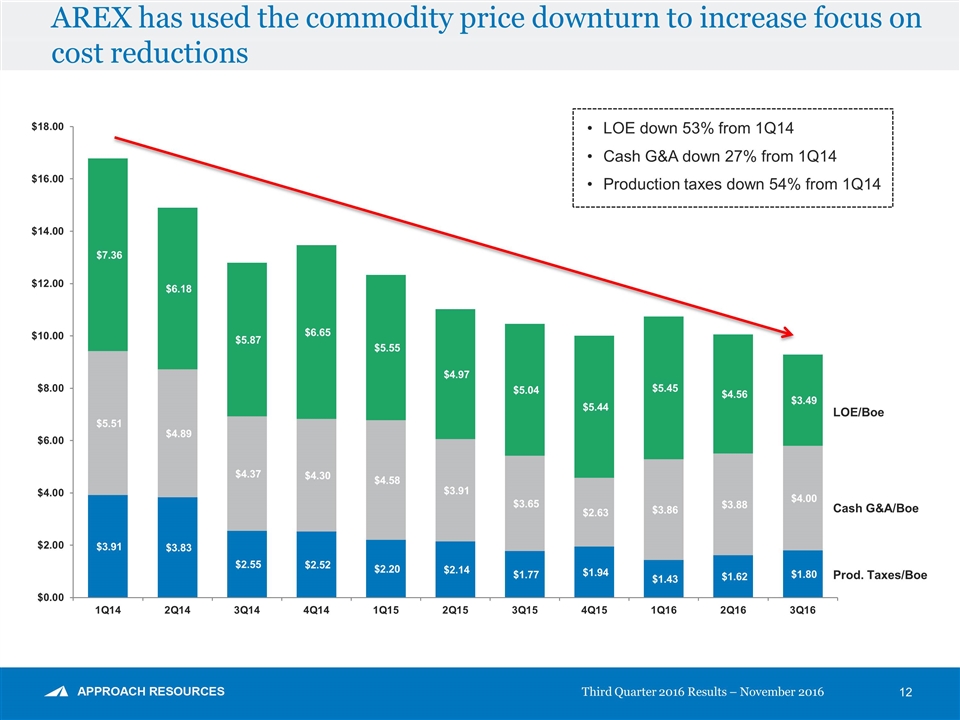

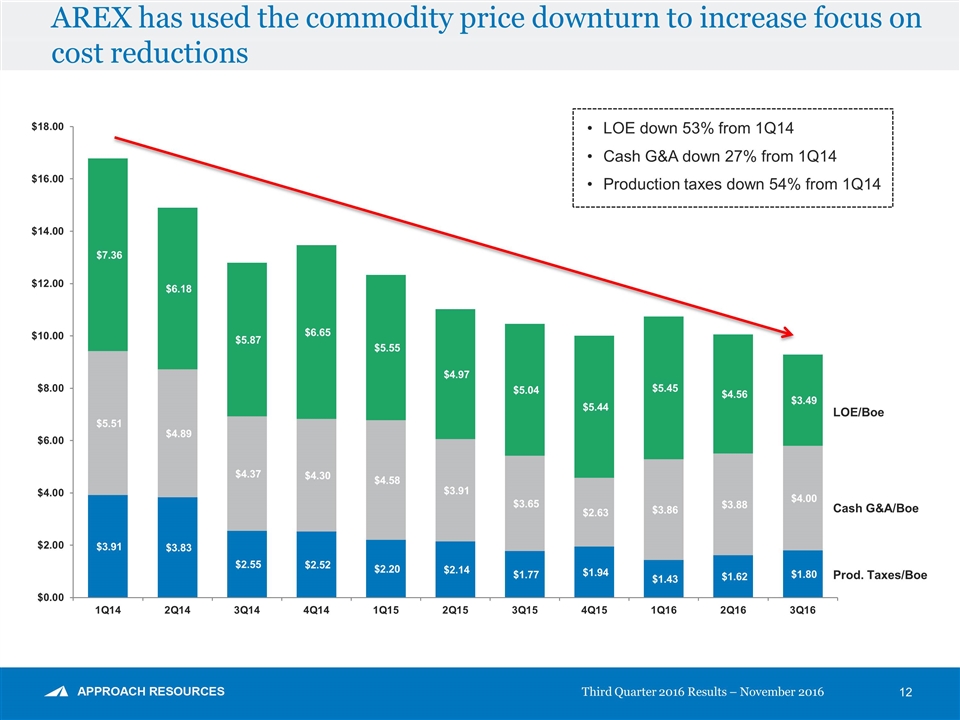

AREX has used the commodity price downturn to increase focus on cost reductions LOE/Boe Prod. Taxes/Boe Cash G&A/Boe LOE down 53% from 1Q14 Cash G&A down 27% from 1Q14 Production taxes down 54% from 1Q14

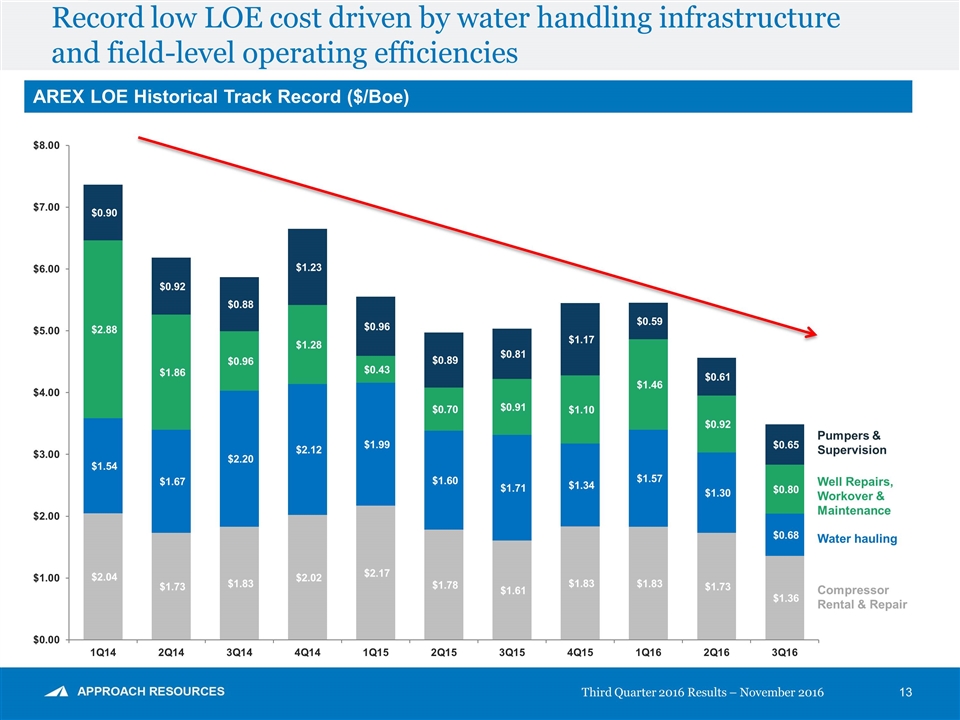

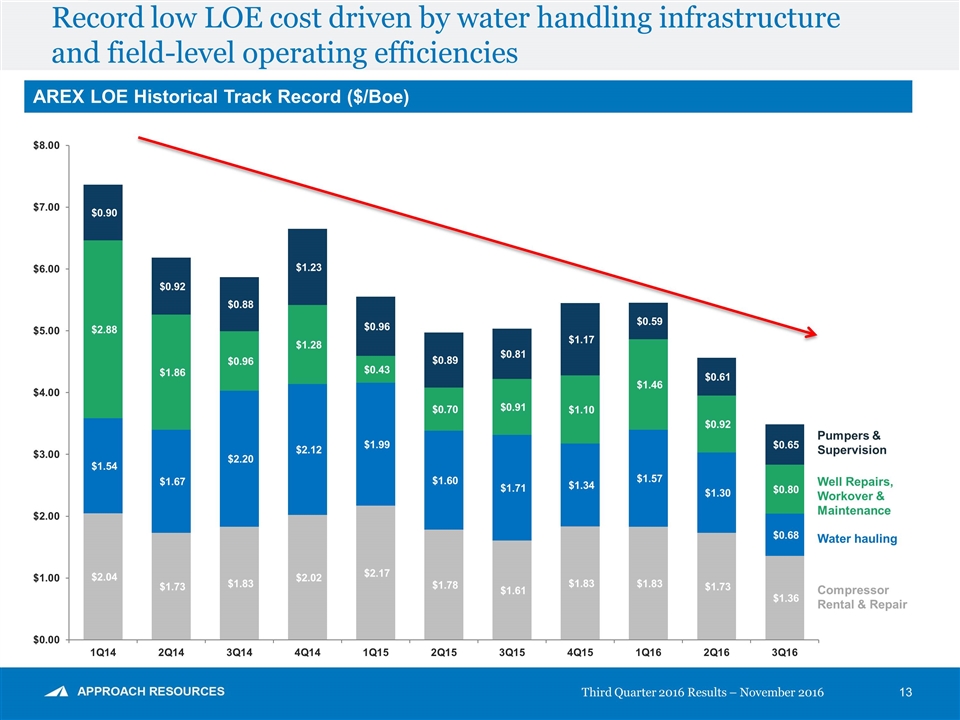

Record low LOE cost driven by water handling infrastructure and field-level operating efficiencies AREX LOE Historical Track Record ($/Boe) Water hauling Compressor Rental & Repair Well Repairs, Workover & Maintenance Pumpers & Supervision Third Quarter 2016 Results – November 2016

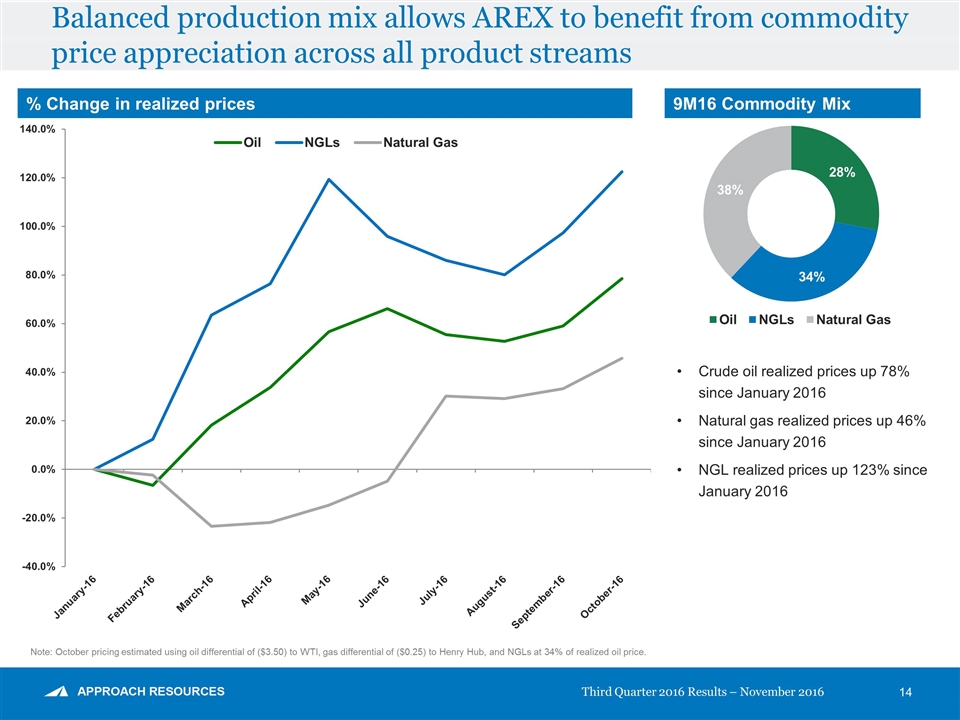

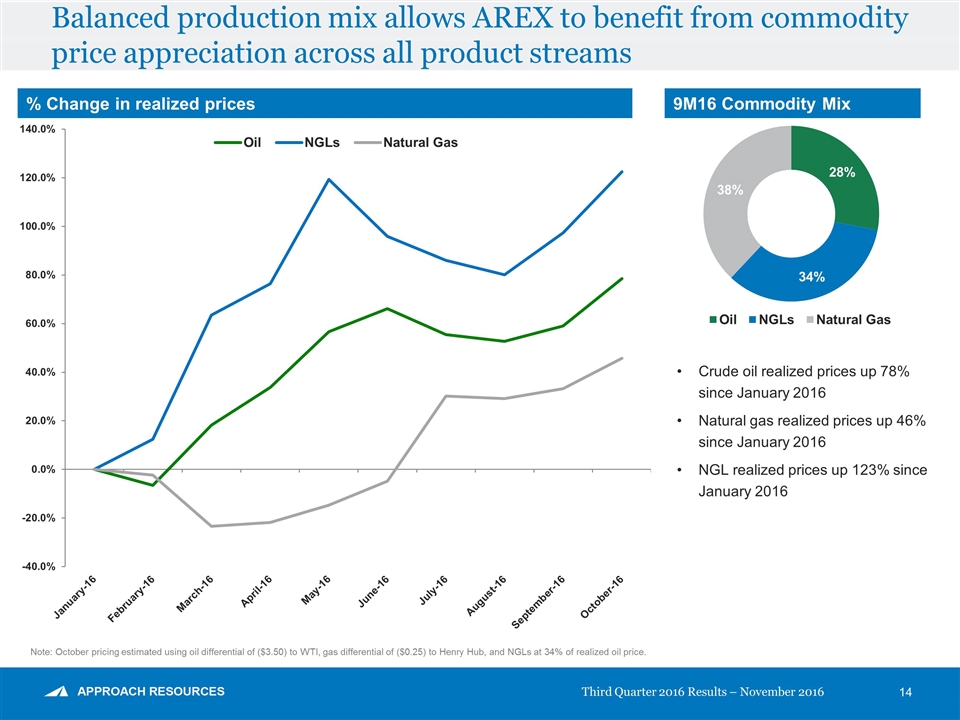

Balanced production mix allows AREX to benefit from commodity price appreciation across all product streams 9M16 Commodity Mix Crude oil realized prices up 78% since January 2016 Natural gas realized prices up 46% since January 2016 NGL realized prices up 123% since January 2016 Note: October pricing estimated using oil differential of ($3.50) to WTI, gas differential of ($0.25) to Henry Hub, and NGLs at 34% of realized oil price. % Change in realized prices

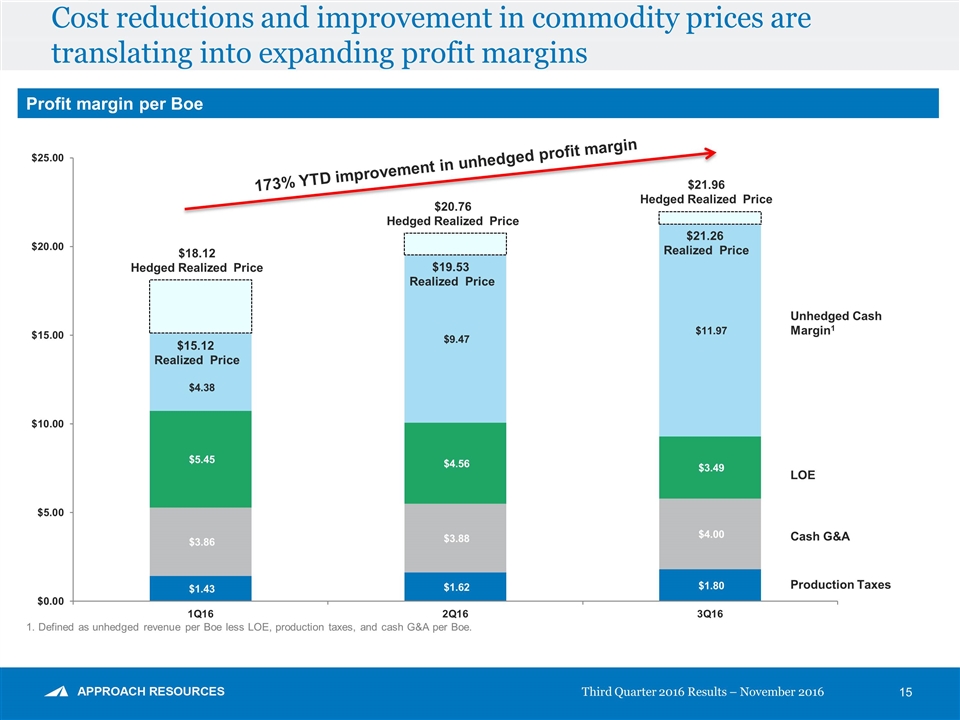

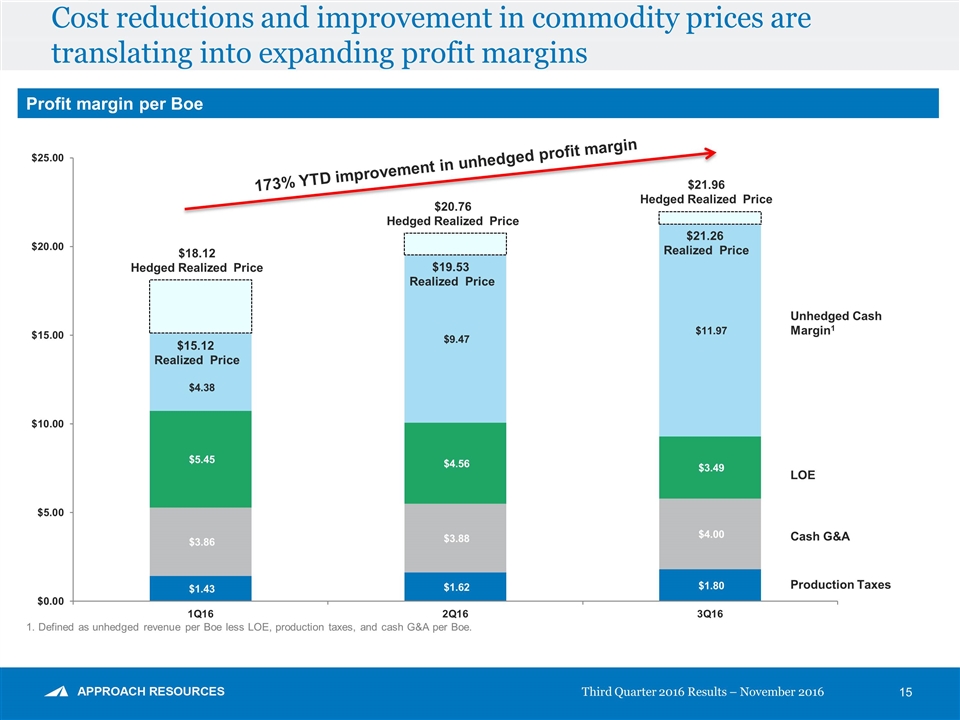

Cost reductions and improvement in commodity prices are translating into expanding profit margins Profit margin per Boe Unhedged Cash Margin1 LOE Production Taxes Cash G&A $15.12 Realized Price $18.12 Hedged Realized Price $19.53 Realized Price $20.76 Hedged Realized Price $21.26 Realized Price $21.96 Hedged Realized Price 173% YTD improvement in unhedged profit margin 1. Defined as unhedged revenue per Boe less LOE, production taxes, and cash G&A per Boe.

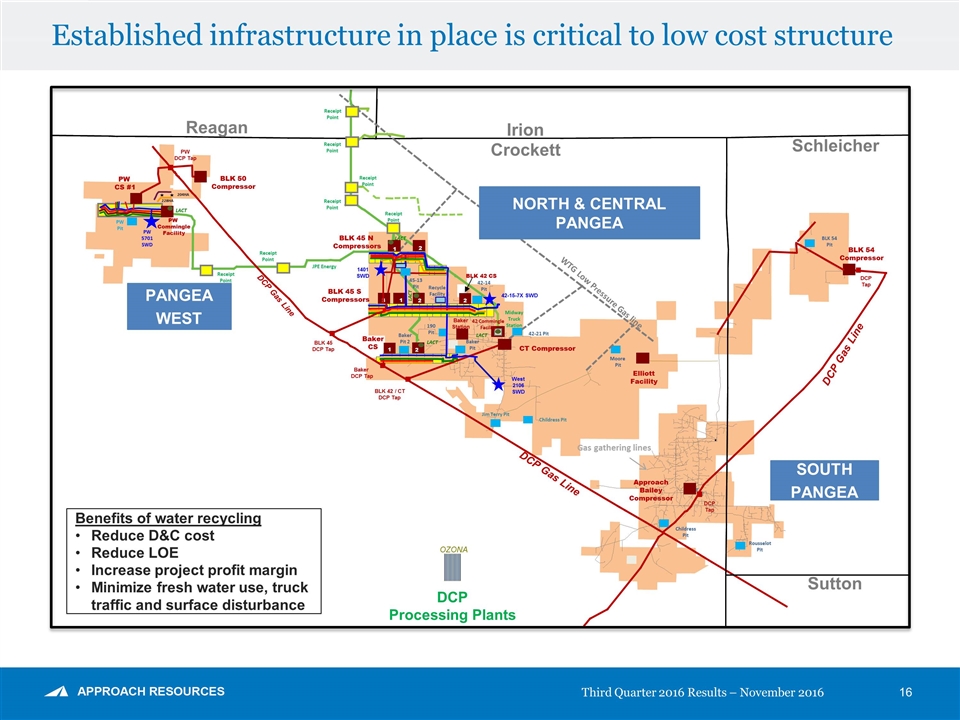

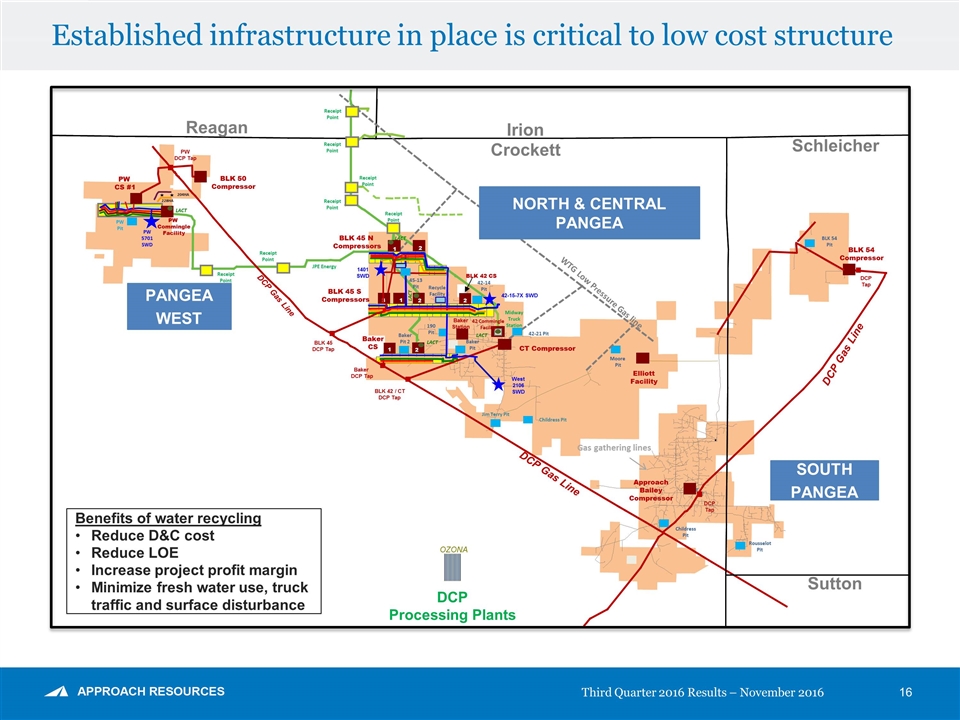

Established infrastructure in place is critical to low cost structure Benefits of water recycling Reduce D&C cost Reduce LOE Increase project profit margin Minimize fresh water use, truck traffic and surface disturbance BLK 54 Compressor OZONA 42-14 Pit PW Pit Jim Terry Pit Childress Pit PW 5701 SWD Receipt Point Midway Truck Station DCP Gas Line BLK 45 DCP Tap DCP Gas Line Gas gathering lines WTG Low Pressure Gas line DCP Processing Plants 1401 SWD West 2106 SWD 42-15-7X SWD Approach Bailey Compressor Schleicher Crockett Irion Reagan Sutton NORTH & CENTRAL PANGEA PANGEA WEST SOUTH PANGEA PW DCP Tap PW CS #1 PW Commingle Facility Receipt Point Receipt Point Receipt Point Receipt Point Receipt Point Receipt Point DCP Tap BLK 45 S Compressors BLK 42 CS 45-13 Pit 190 Pit Baker CS Baker Pit 2 BLK 45 N Compressors BLK 54 Pit Baker Pit Baker Station DCP Gas Line CT Compressor 42-21 Pit LACT LACT 42 Commingle Facility LACT 3 1 2 2 1 2 2 1 Moore Pit LACT Rousselot Pit Childress Pit Recycle Facility Elliott Facility BLK 50 Compressor JPE Energy Baker DCP Tap BLK 42 / CT DCP Tap DCP Tap LACT 204HA 228HA Third Quarter 2016 Results – November 2016

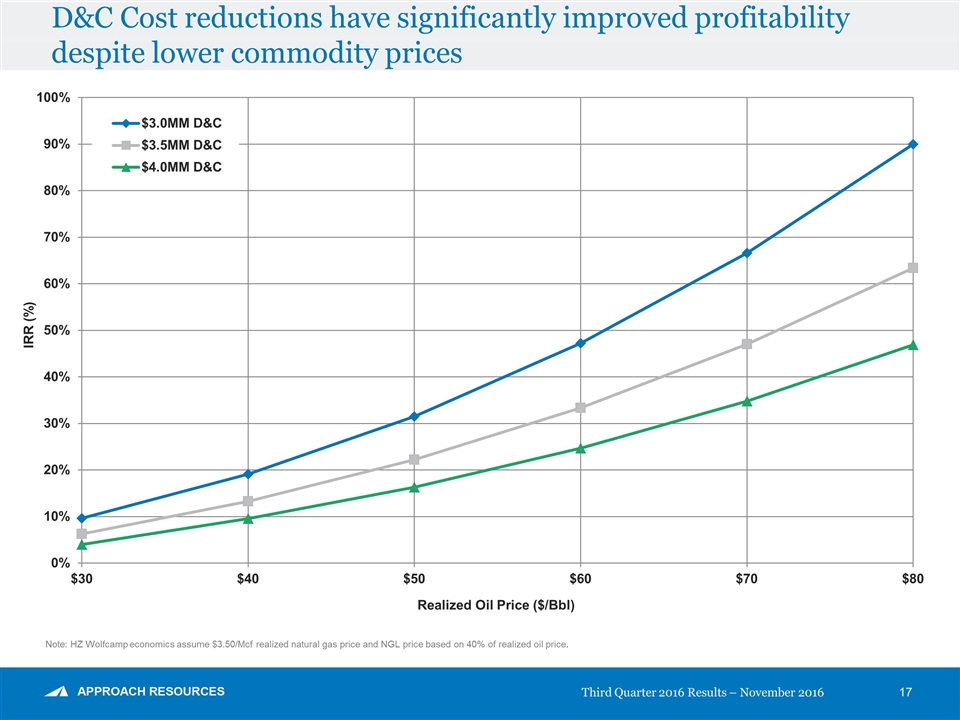

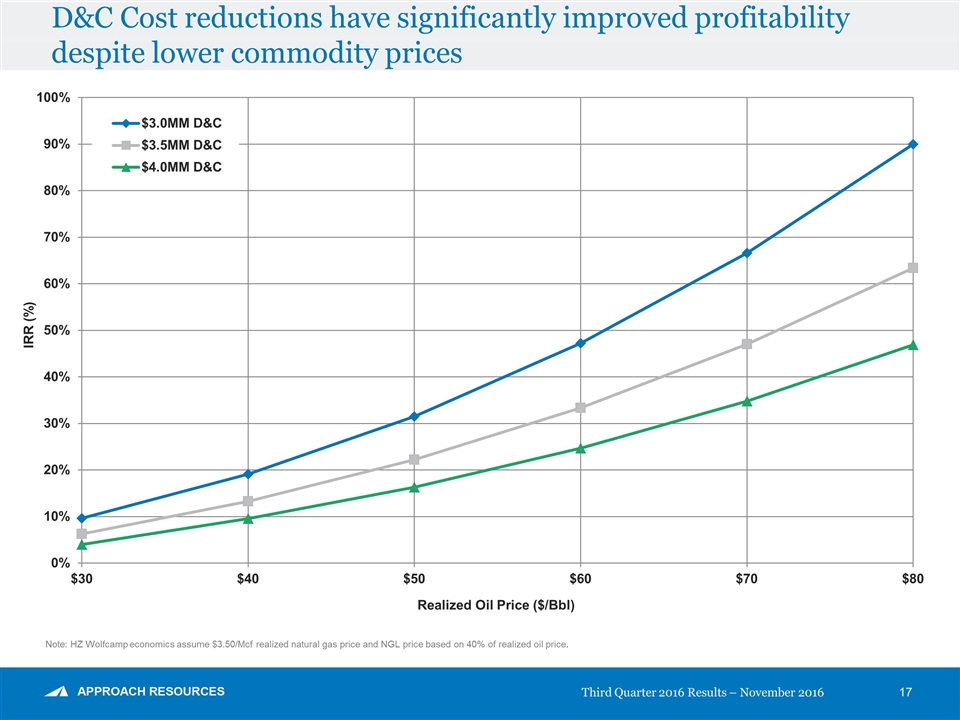

D&C Cost reductions have significantly improved profitability despite lower commodity prices Third Quarter 2016 Results – November 2016 Note: HZ Wolfcamp economics assume $3.50/Mcf realized natural gas price and NGL price based on 40% of realized oil price.

Appendix

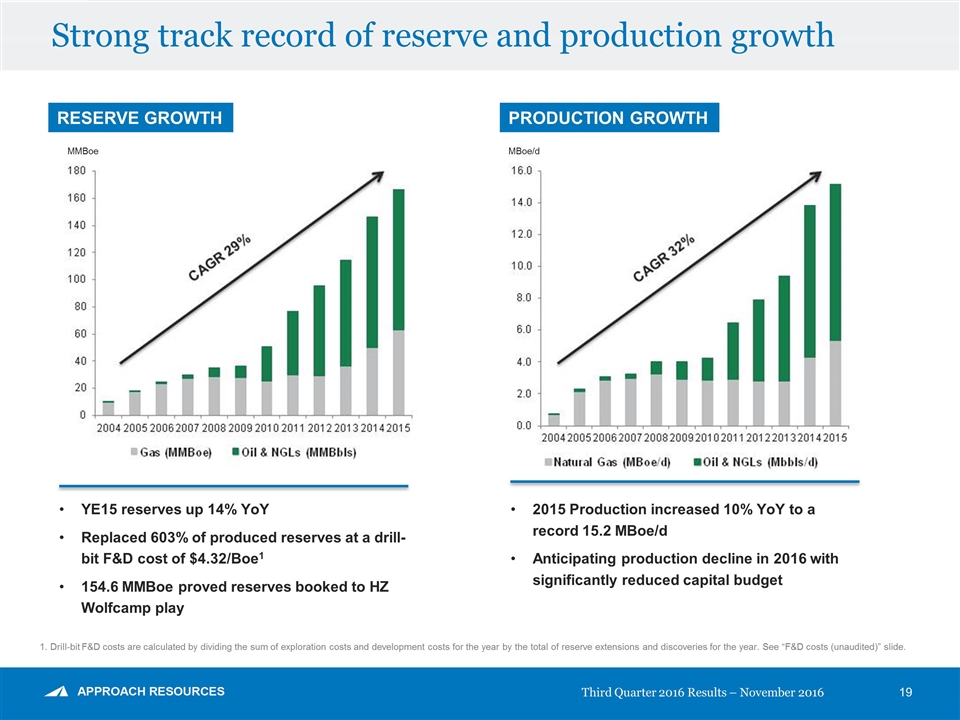

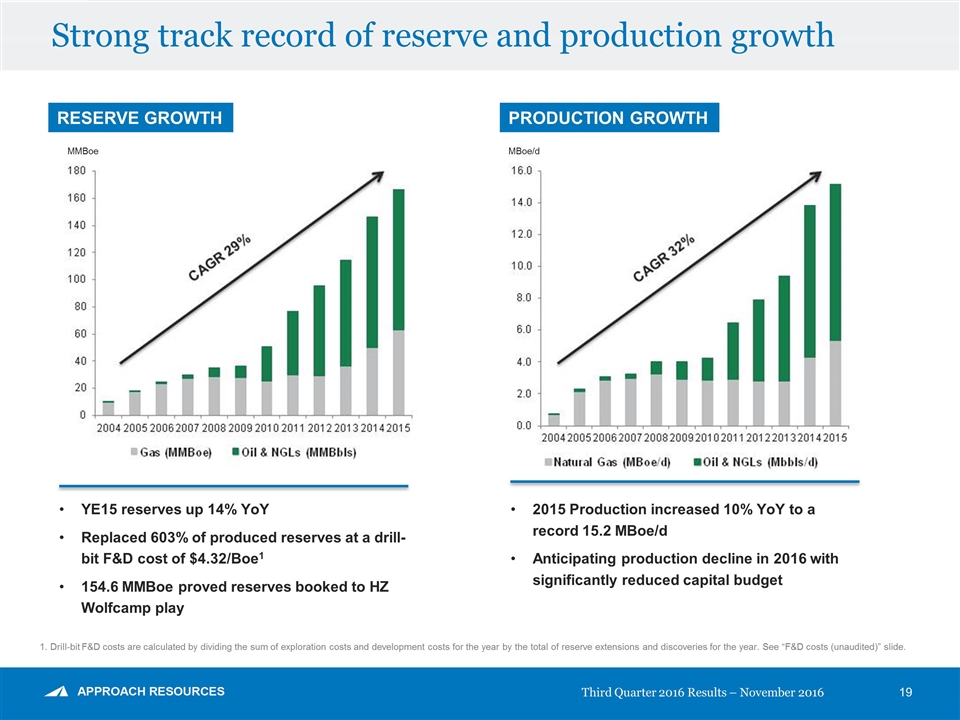

Strong track record of reserve and production growth RESERVE GROWTH CAGR 29% YE15 reserves up 14% YoY Replaced 603% of produced reserves at a drill-bit F&D cost of $4.32/Boe1 154.6 MMBoe proved reserves booked to HZ Wolfcamp play MMBoe PRODUCTION GROWTH CAGR 32% 2015 Production increased 10% YoY to a record 15.2 MBoe/d Anticipating production decline in 2016 with significantly reduced capital budget MBoe/d 1. Drill-bit F&D costs are calculated by dividing the sum of exploration costs and development costs for the year by the total of reserve extensions and discoveries for the year. See “F&D costs (unaudited)” slide. Third Quarter 2016 Results – November 2016

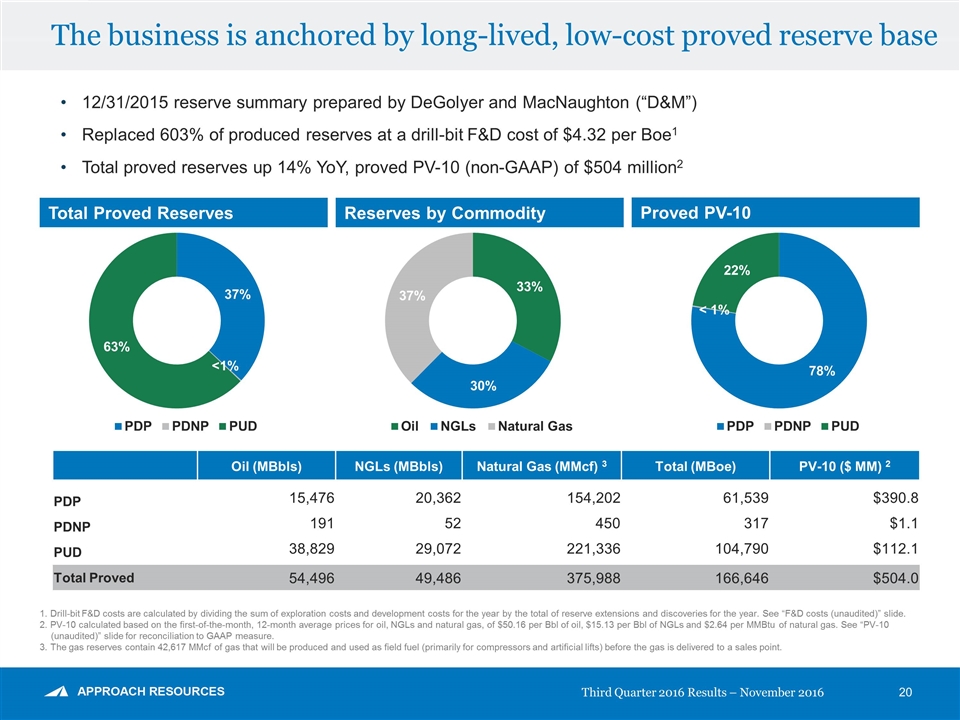

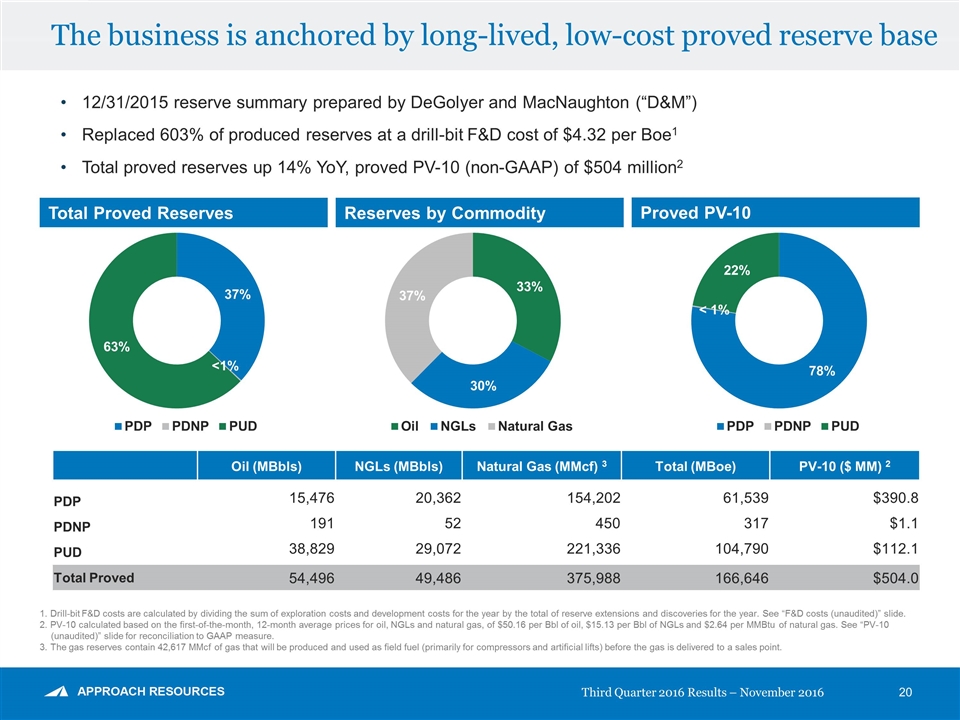

The business is anchored by long-lived, low-cost proved reserve base 12/31/2015 reserve summary prepared by DeGolyer and MacNaughton (“D&M”) Replaced 603% of produced reserves at a drill-bit F&D cost of $4.32 per Boe1 Total proved reserves up 14% YoY, proved PV-10 (non-GAAP) of $504 million2 Oil (MBbls) NGLs (MBbls) Natural Gas (MMcf) 3 Total (MBoe) PV-10 ($ MM) 2 PDP 15,476 20,362 154,202 61,539 $390.8 PDNP 191 52 450 317 $1.1 PUD 38,829 29,072 221,336 104,790 $112.1 Total Proved 54,496 49,486 375,988 166,646 $504.0 Total Proved Reserves Reserves by Commodity Proved PV-10 1. Drill-bit F&D costs are calculated by dividing the sum of exploration costs and development costs for the year by the total of reserve extensions and discoveries for the year. See “F&D costs (unaudited)” slide. 2. PV-10 calculated based on the first-of-the-month, 12-month average prices for oil, NGLs and natural gas, of $50.16 per Bbl of oil, $15.13 per Bbl of NGLs and $2.64 per MMBtu of natural gas. See “PV-10 (unaudited)” slide for reconciliation to GAAP measure. 3. The gas reserves contain 42,617 MMcf of gas that will be produced and used as field fuel (primarily for compressors and artificial lifts) before the gas is delivered to a sales point.

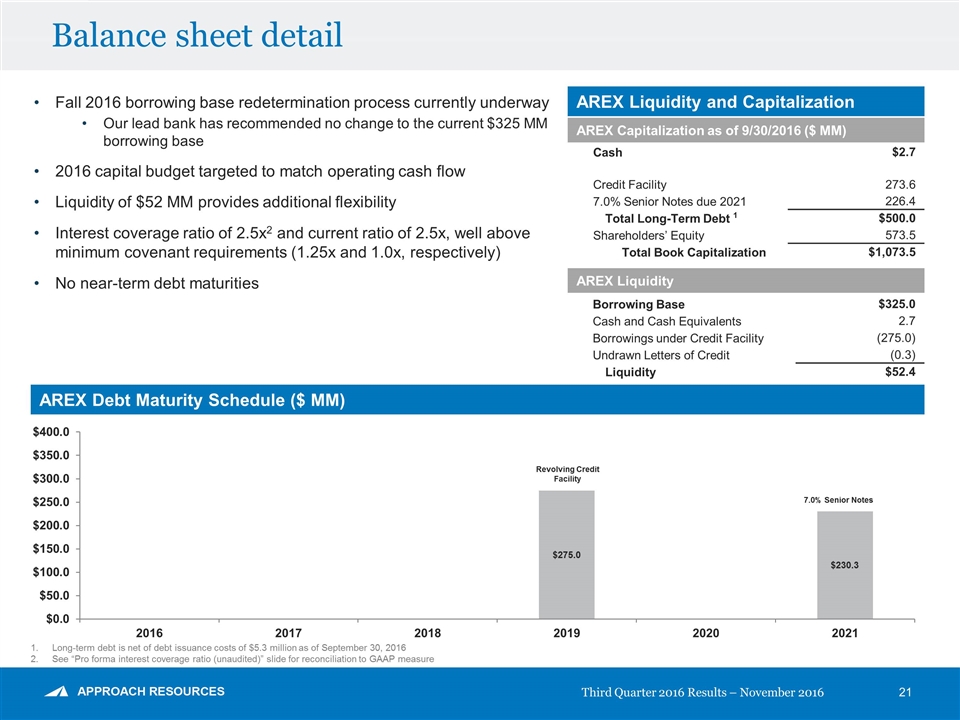

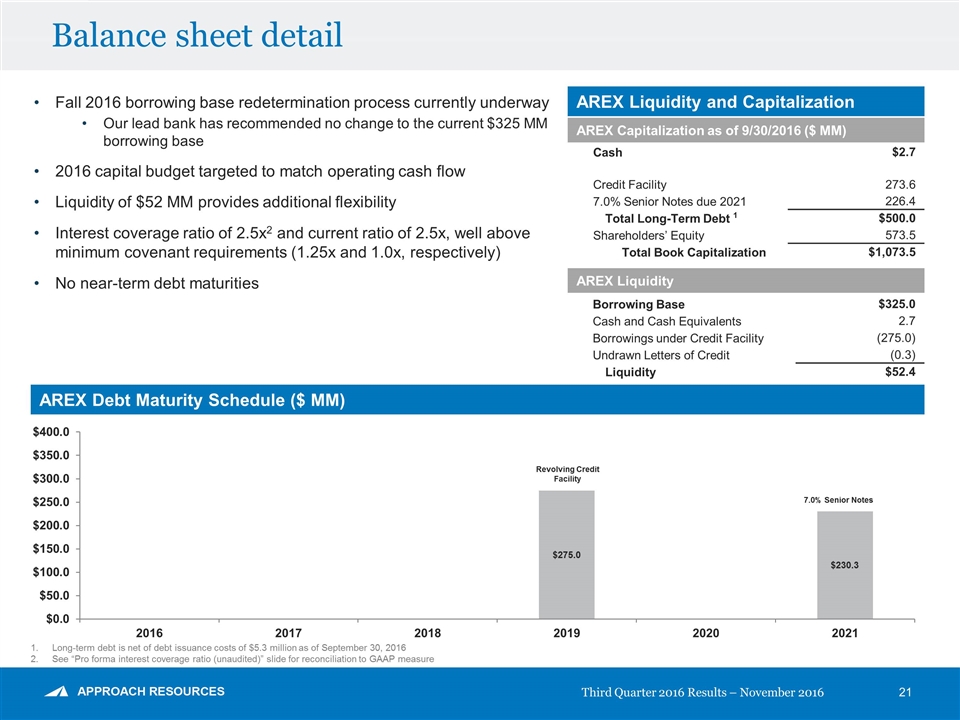

Balance sheet detail AREX Liquidity and Capitalization Fall 2016 borrowing base redetermination process currently underway Our lead bank has recommended no change to the current $325 MM borrowing base 2016 capital budget targeted to match operating cash flow Liquidity of $52 MM provides additional flexibility Interest coverage ratio of 2.5x2 and current ratio of 2.5x, well above minimum covenant requirements (1.25x and 1.0x, respectively) No near-term debt maturities AREX Debt Maturity Schedule ($ MM) AREX Capitalization as of 9/30/2016 ($ MM) Cash $2.7 Credit Facility 273.6 7.0% Senior Notes due 2021 226.4 Total Long-Term Debt 1 $500.0 Shareholders’ Equity 573.5 Total Book Capitalization $1,073.5 AREX Liquidity Borrowing Base $325.0 Cash and Cash Equivalents 2.7 Borrowings under Credit Facility (275.0) Undrawn Letters of Credit (0.3) Liquidity $52.4 7.0% Senior Notes Long-term debt is net of debt issuance costs of $5.3 million as of September 30, 2016 See “Pro forma interest coverage ratio (unaudited)” slide for reconciliation to GAAP measure Revolving Credit Facility

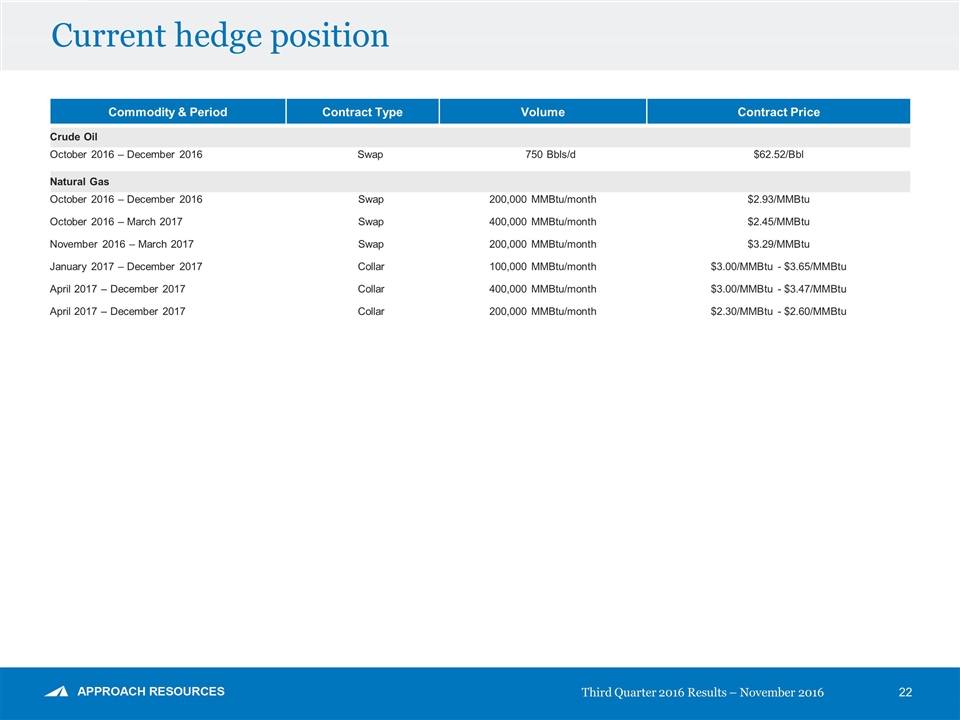

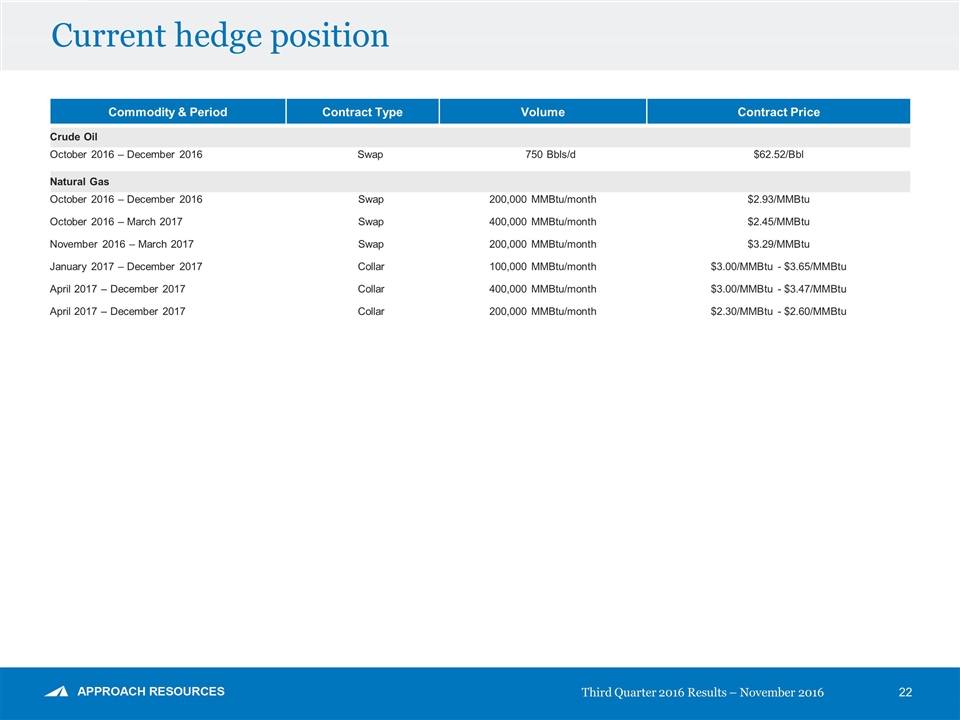

Current hedge position Commodity & Period Contract Type Volume Contract Price Crude Oil October 2016 – December 2016 Swap 750 Bbls/d $62.52/Bbl Natural Gas October 2016 – December 2016 Swap 200,000 MMBtu/month $2.93/MMBtu October 2016 – March 2017 Swap 400,000 MMBtu/month $2.45/MMBtu November 2016 – March 2017 Swap 200,000 MMBtu/month $3.29/MMBtu January 2017 – December 2017 Collar 100,000 MMBtu/month $3.00/MMBtu - $3.65/MMBtu April 2017 – December 2017 Collar 400,000 MMBtu/month $3.00/MMBtu - $3.47/MMBtu April 2017 – December 2017 Collar 200,000 MMBtu/month $2.30/MMBtu - $2.60/MMBtu

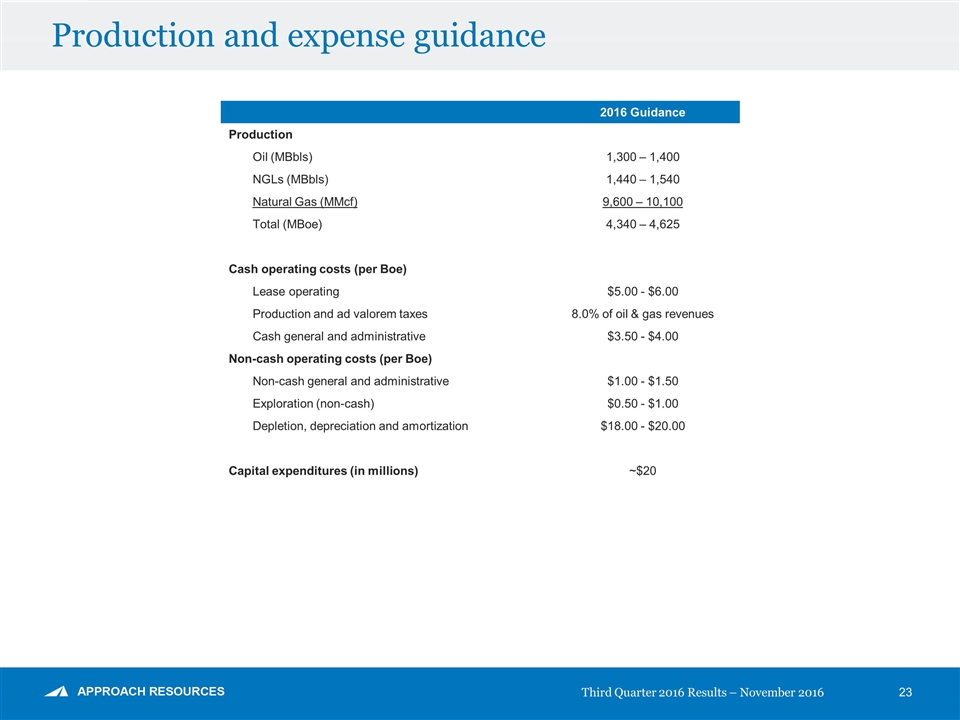

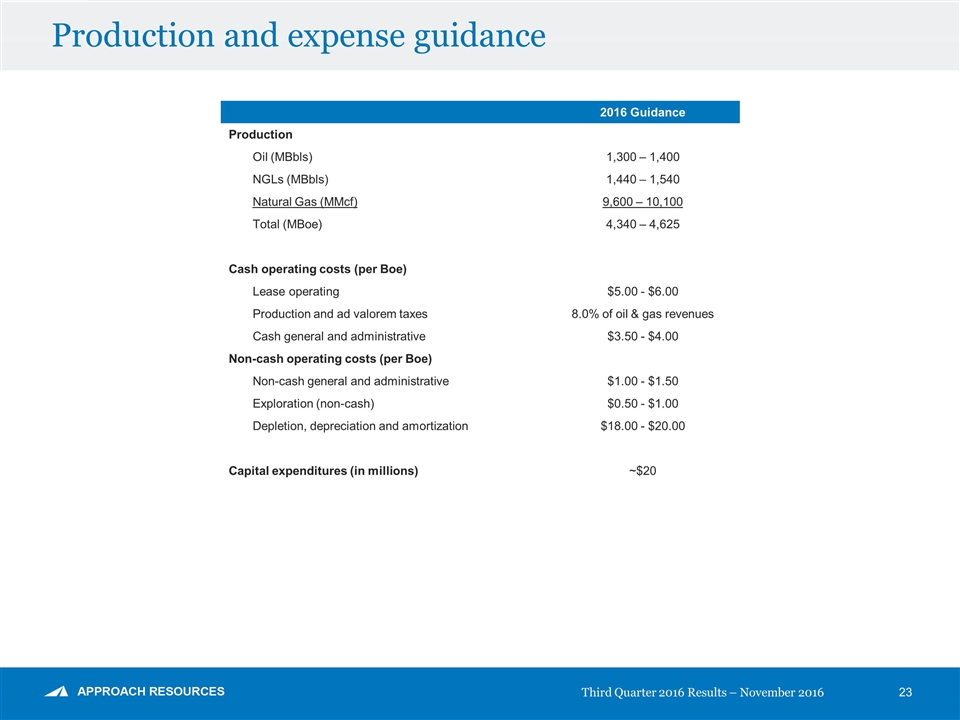

Production and expense guidance 2016 Guidance Production Oil (MBbls) 1,300 – 1,400 NGLs (MBbls) 1,440 – 1,540 Natural Gas (MMcf) 9,600 – 10,100 Total (MBoe) 4,340 – 4,625 Cash operating costs (per Boe) Lease operating $5.00 - $6.00 Production and ad valorem taxes 8.0% of oil & gas revenues Cash general and administrative $3.50 - $4.00 Non-cash operating costs (per Boe) Non-cash general and administrative $1.00 - $1.50 Exploration (non-cash) $0.50 - $1.00 Depletion, depreciation and amortization $18.00 - $20.00 Capital expenditures (in millions) ~$20

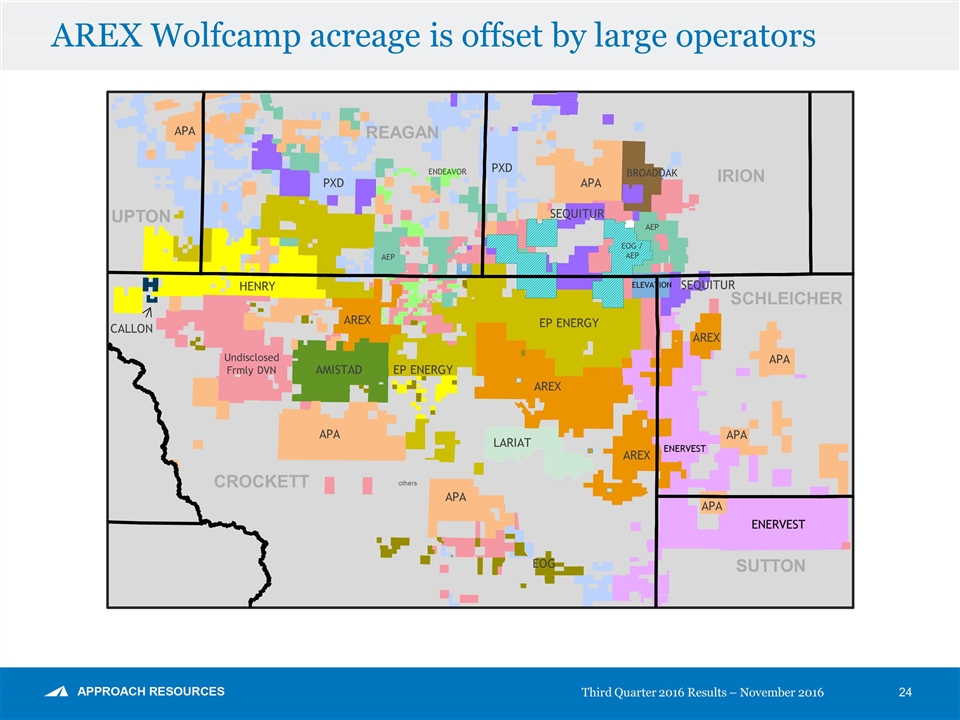

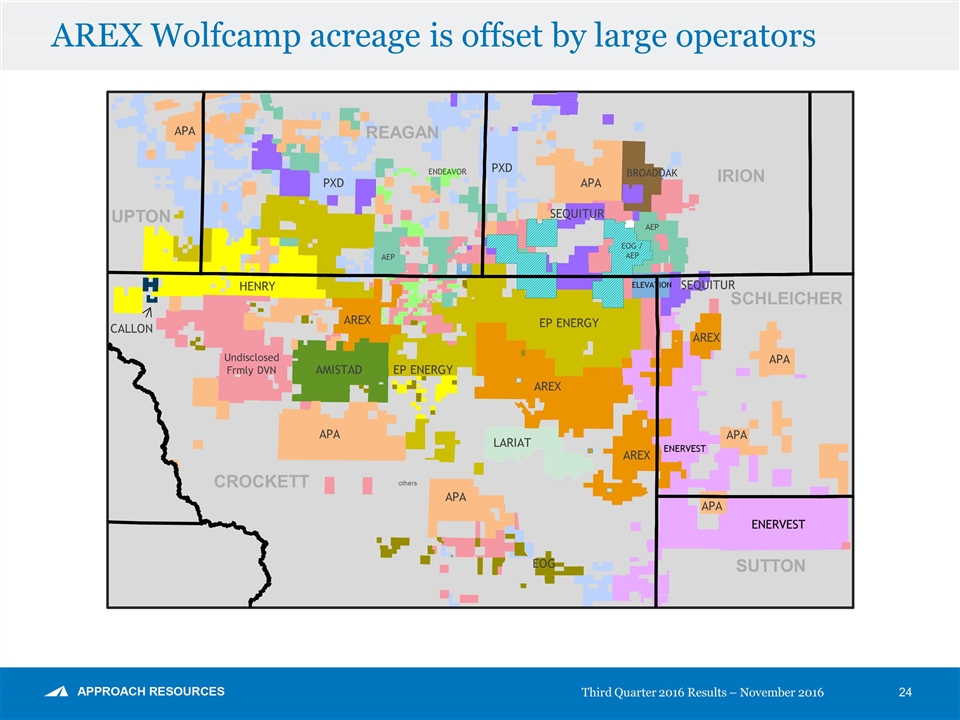

AREX Wolfcamp acreage is offset by large operators AREX AMISTAD HENRY ENERVEST EP ENERGY others APA PXD APA APA Undisclosed Frmly DVN ELEVATION PXD APA APA APA EOG ENERVEST EOG / AEP AEP BROADOAK ENDEAVOR APA EP ENERGY SEQUITUR SEQUITUR LARIAT AREX AREX AREX AEP CALLON UPTON CROCKETT REAGAN IRION SCHLEICHER SUTTON Third Quarter 2016 Results – November 2016

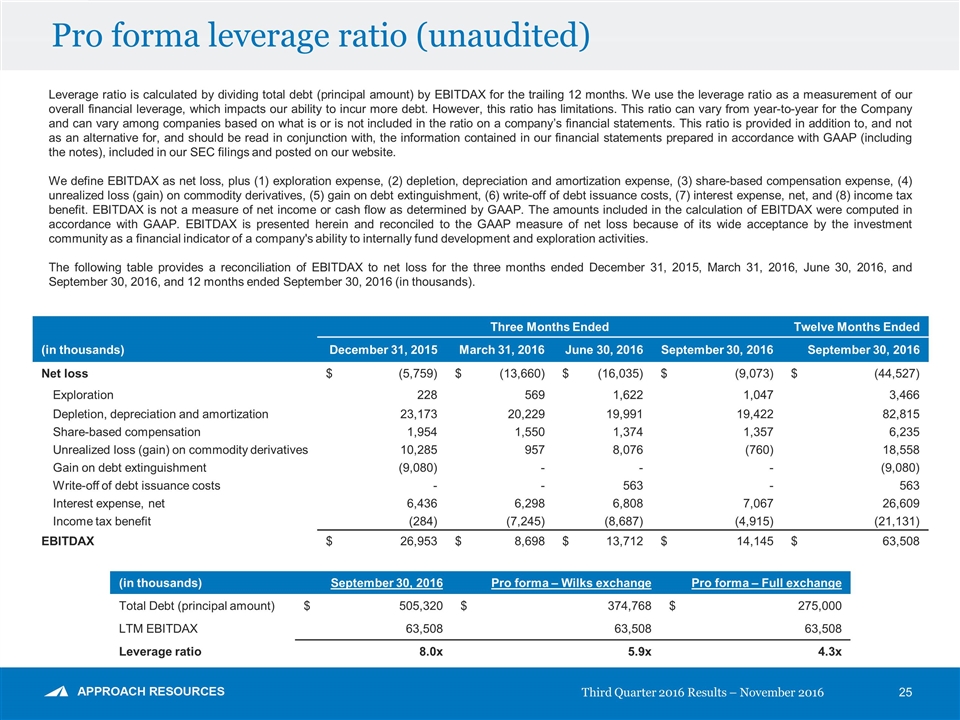

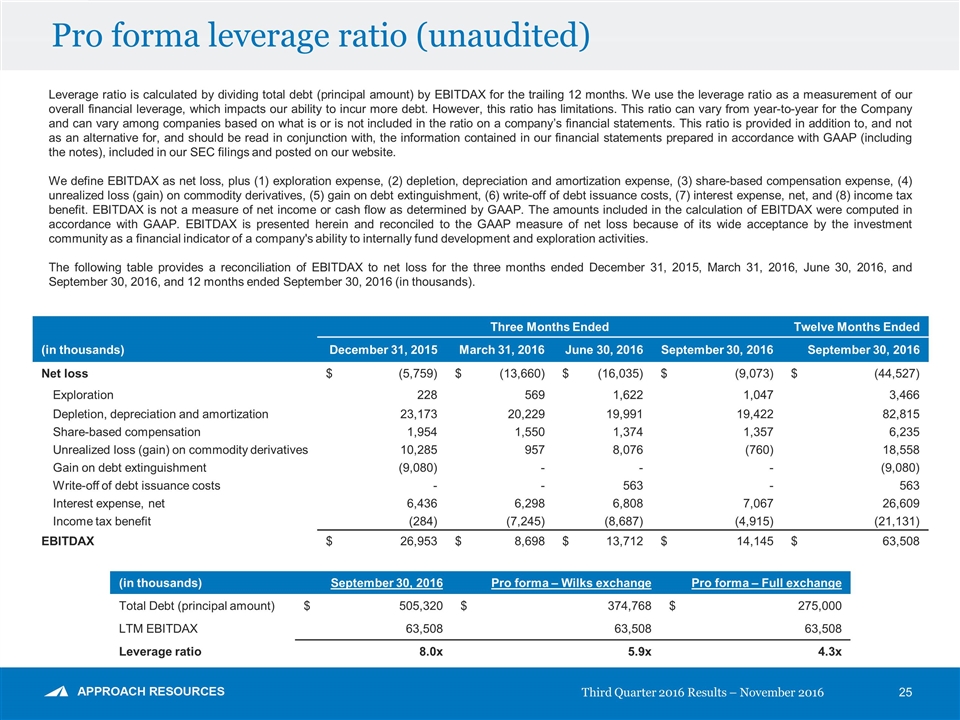

Pro forma leverage ratio (unaudited) Leverage ratio is calculated by dividing total debt (principal amount) by EBITDAX for the trailing 12 months. We use the leverage ratio as a measurement of our overall financial leverage, which impacts our ability to incur more debt. However, this ratio has limitations. This ratio can vary from year-to-year for the Company and can vary among companies based on what is or is not included in the ratio on a company’s financial statements. This ratio is provided in addition to, and not as an alternative for, and should be read in conjunction with, the information contained in our financial statements prepared in accordance with GAAP (including the notes), included in our SEC filings and posted on our website. We define EBITDAX as net loss, plus (1) exploration expense, (2) depletion, depreciation and amortization expense, (3) share-based compensation expense, (4) unrealized loss (gain) on commodity derivatives, (5) gain on debt extinguishment, (6) write-off of debt issuance costs, (7) interest expense, net, and (8) income tax benefit. EBITDAX is not a measure of net income or cash flow as determined by GAAP. The amounts included in the calculation of EBITDAX were computed in accordance with GAAP. EBITDAX is presented herein and reconciled to the GAAP measure of net loss because of its wide acceptance by the investment community as a financial indicator of a company's ability to internally fund development and exploration activities. The following table provides a reconciliation of EBITDAX to net loss for the three months ended December 31, 2015, March 31, 2016, June 30, 2016, and September 30, 2016, and 12 months ended September 30, 2016 (in thousands). (in thousands) September 30, 2016 Pro forma – Wilks exchange Pro forma – Full exchange Total Debt (principal amount) $ 505,320 $ 374,768 $ 275,000 LTM EBITDAX 63,508 63,508 63,508 Leverage ratio 8.0x 5.9x 4.3x Three Months Ended Twelve Months Ended (in thousands) December 31, 2015 March 31, 2016 June 30, 2016 September 30, 2016 September 30, 2016 Net loss $ (5,759) $ (13,660) $ (16,035) $ (9,073) $ (44,527) Exploration 228 569 1,622 1,047 3,466 Depletion, depreciation and amortization 23,173 20,229 19,991 19,422 82,815 Share-based compensation 1,954 1,550 1,374 1,357 6,235 Unrealized loss (gain) on commodity derivatives 10,285 957 8,076 (760) 18,558 Gain on debt extinguishment (9,080) - - - (9,080) Write-off of debt issuance costs - - 563 - 563 Interest expense, net 6,436 6,298 6,808 7,067 26,609 Income tax benefit (284) (7,245) (8,687) (4,915) (21,131) EBITDAX $ 26,953 $ 8,698 $ 13,712 $ 14,145 $ 63,508

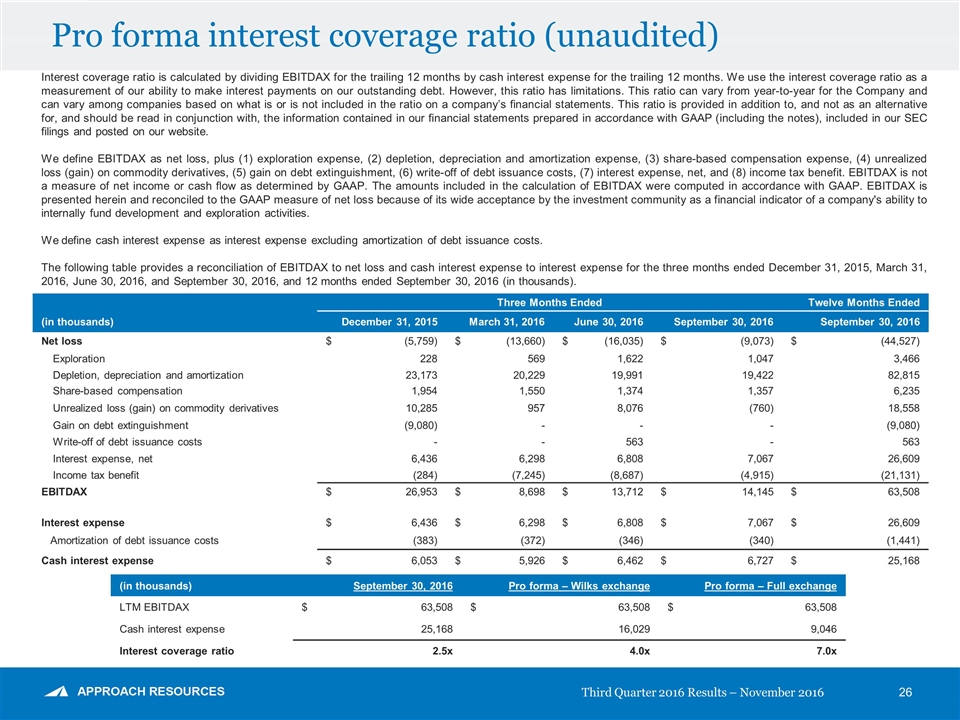

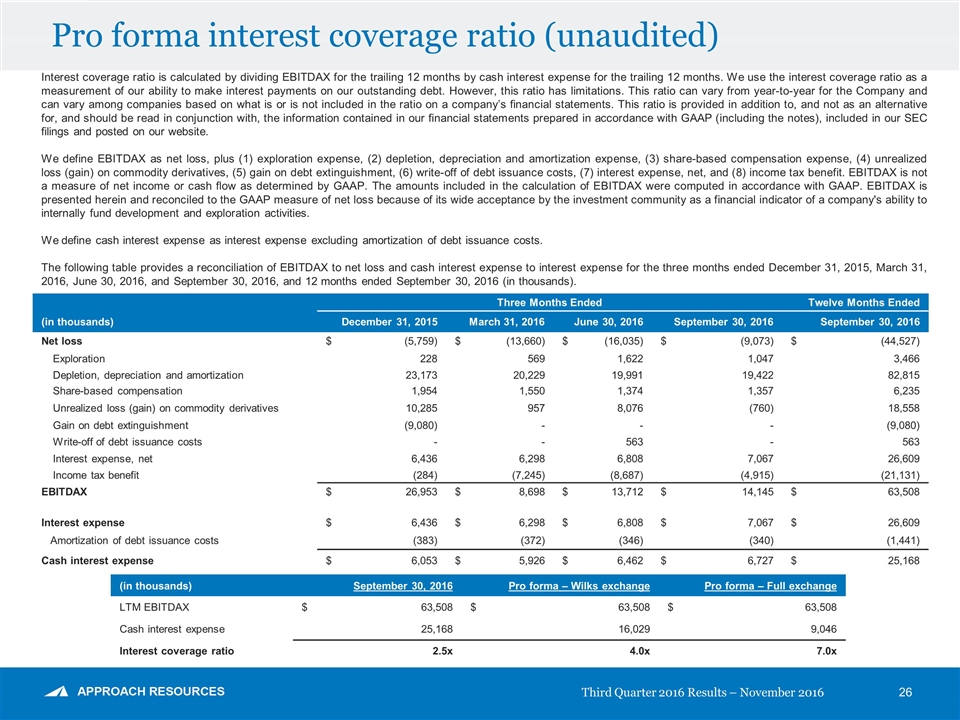

Pro forma interest coverage ratio (unaudited) Interest coverage ratio is calculated by dividing EBITDAX for the trailing 12 months by cash interest expense for the trailing 12 months. We use the interest coverage ratio as a measurement of our ability to make interest payments on our outstanding debt. However, this ratio has limitations. This ratio can vary from year-to-year for the Company and can vary among companies based on what is or is not included in the ratio on a company’s financial statements. This ratio is provided in addition to, and not as an alternative for, and should be read in conjunction with, the information contained in our financial statements prepared in accordance with GAAP (including the notes), included in our SEC filings and posted on our website. We define EBITDAX as net loss, plus (1) exploration expense, (2) depletion, depreciation and amortization expense, (3) share-based compensation expense, (4) unrealized loss (gain) on commodity derivatives, (5) gain on debt extinguishment, (6) write-off of debt issuance costs, (7) interest expense, net, and (8) income tax benefit. EBITDAX is not a measure of net income or cash flow as determined by GAAP. The amounts included in the calculation of EBITDAX were computed in accordance with GAAP. EBITDAX is presented herein and reconciled to the GAAP measure of net loss because of its wide acceptance by the investment community as a financial indicator of a company's ability to internally fund development and exploration activities. We define cash interest expense as interest expense excluding amortization of debt issuance costs. The following table provides a reconciliation of EBITDAX to net loss and cash interest expense to interest expense for the three months ended December 31, 2015, March 31, 2016, June 30, 2016, and September 30, 2016, and 12 months ended September 30, 2016 (in thousands). Three Months Ended Twelve Months Ended (in thousands) December 31, 2015 March 31, 2016 June 30, 2016 September 30, 2016 September 30, 2016 Net loss $ (5,759) $ (13,660) $ (16,035) $ (9,073) $ (44,527) Exploration 228 569 1,622 1,047 3,466 Depletion, depreciation and amortization 23,173 20,229 19,991 19,422 82,815 Share-based compensation 1,954 1,550 1,374 1,357 6,235 Unrealized loss (gain) on commodity derivatives 10,285 957 8,076 (760) 18,558 Gain on debt extinguishment (9,080) - - - (9,080) Write-off of debt issuance costs - - 563 - 563 Interest expense, net 6,436 6,298 6,808 7,067 26,609 Income tax benefit (284) (7,245) (8,687) (4,915) (21,131) EBITDAX $ 26,953 $ 8,698 $ 13,712 $ 14,145 $ 63,508 Interest expense $ 6,436 $ 6,298 $ 6,808 $ 7,067 $ 26,609 Amortization of debt issuance costs (383) (372) (346) (340) (1,441) Cash interest expense $ 6,053 $ 5,926 $ 6,462 $ 6,727 $ 25,168 (in thousands) September 30, 2016 Pro forma – Wilks exchange Pro forma – Full exchange LTM EBITDAX $ 63,508 $ 63,508 $ 63,508 Cash interest expense 25,168 16,029 9,046 Interest coverage ratio 2.5x 4.0x 7.0x

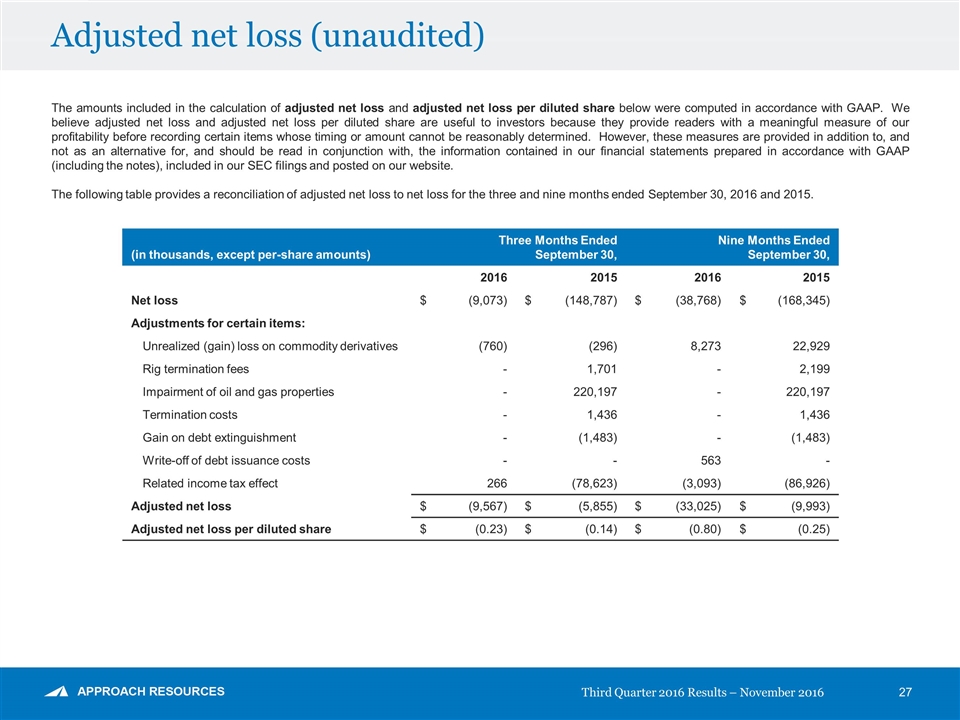

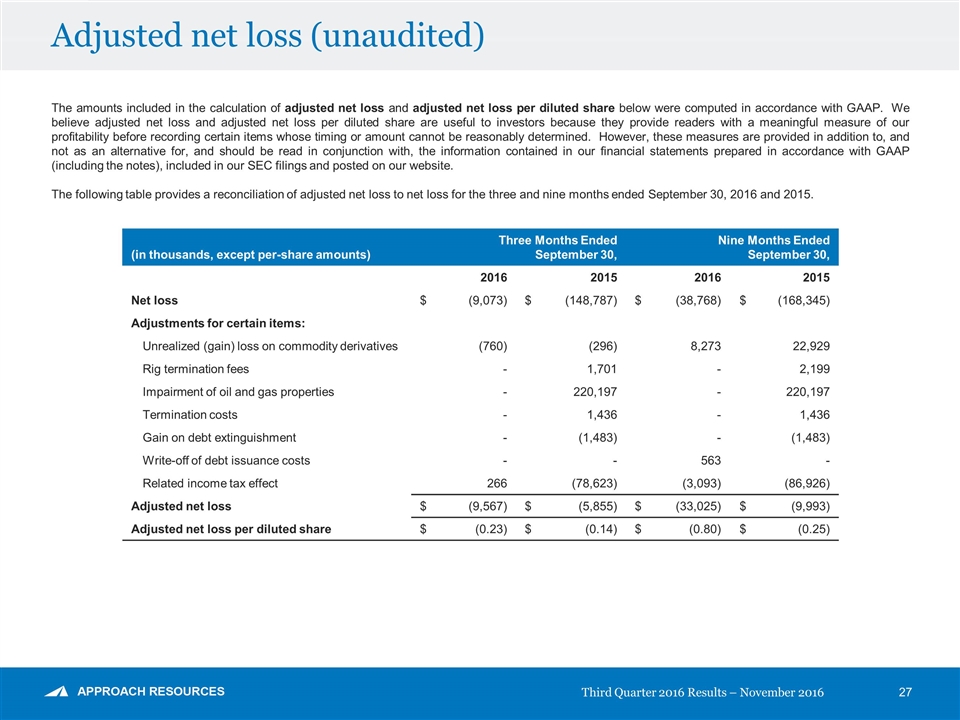

Adjusted net loss (unaudited) (in thousands, except per-share amounts) Three Months Ended September 30, Nine Months Ended September 30, 2016 2015 2016 2015 Net loss $ (9,073) $ (148,787) $ (38,768) $ (168,345) Adjustments for certain items: Unrealized (gain) loss on commodity derivatives (760) (296) 8,273 22,929 Rig termination fees - 1,701 - 2,199 Impairment of oil and gas properties - 220,197 - 220,197 Termination costs - 1,436 - 1,436 Gain on debt extinguishment - (1,483) - (1,483) Write-off of debt issuance costs - - 563 - Related income tax effect 266 (78,623) (3,093) (86,926) Adjusted net loss $ (9,567) $ (5,855) $ (33,025) $ (9,993) Adjusted net loss per diluted share $ (0.23) $ (0.14) $ (0.80) $ (0.25) The amounts included in the calculation of adjusted net loss and adjusted net loss per diluted share below were computed in accordance with GAAP. We believe adjusted net loss and adjusted net loss per diluted share are useful to investors because they provide readers with a meaningful measure of our profitability before recording certain items whose timing or amount cannot be reasonably determined. However, these measures are provided in addition to, and not as an alternative for, and should be read in conjunction with, the information contained in our financial statements prepared in accordance with GAAP (including the notes), included in our SEC filings and posted on our website. The following table provides a reconciliation of adjusted net loss to net loss for the three and nine months ended September 30, 2016 and 2015.

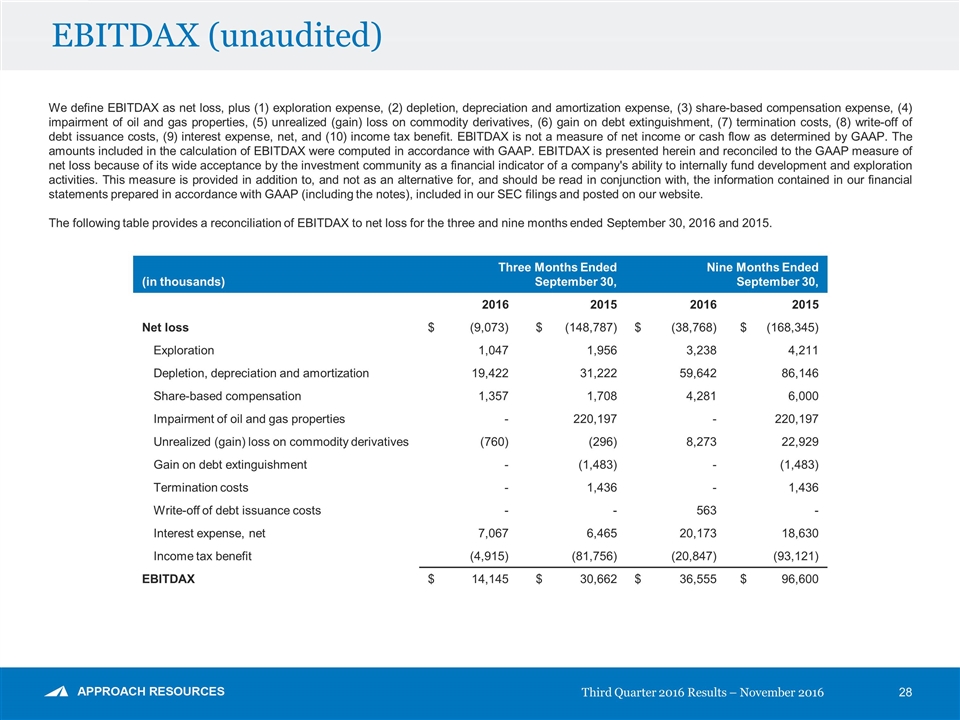

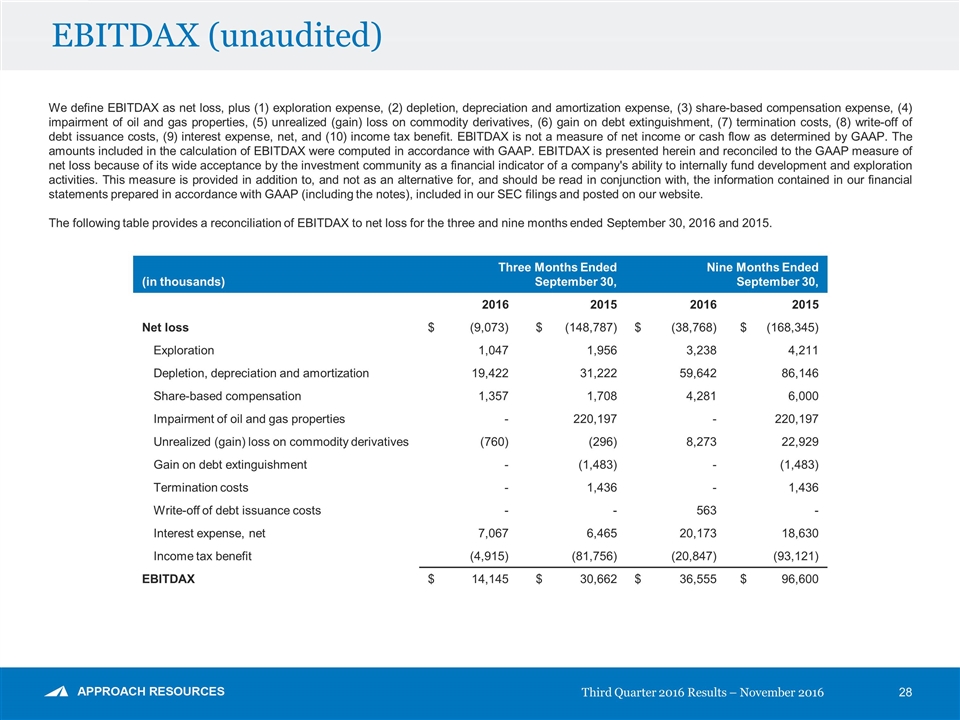

EBITDAX (unaudited) We define EBITDAX as net loss, plus (1) exploration expense, (2) depletion, depreciation and amortization expense, (3) share-based compensation expense, (4) impairment of oil and gas properties, (5) unrealized (gain) loss on commodity derivatives, (6) gain on debt extinguishment, (7) termination costs, (8) write-off of debt issuance costs, (9) interest expense, net, and (10) income tax benefit. EBITDAX is not a measure of net income or cash flow as determined by GAAP. The amounts included in the calculation of EBITDAX were computed in accordance with GAAP. EBITDAX is presented herein and reconciled to the GAAP measure of net loss because of its wide acceptance by the investment community as a financial indicator of a company's ability to internally fund development and exploration activities. This measure is provided in addition to, and not as an alternative for, and should be read in conjunction with, the information contained in our financial statements prepared in accordance with GAAP (including the notes), included in our SEC filings and posted on our website. The following table provides a reconciliation of EBITDAX to net loss for the three and nine months ended September 30, 2016 and 2015. (in thousands) Three Months Ended September 30, Nine Months Ended September 30, 2016 2015 2016 2015 Net loss $ (9,073) $ (148,787) $ (38,768) $ (168,345) Exploration 1,047 1,956 3,238 4,211 Depletion, depreciation and amortization 19,422 31,222 59,642 86,146 Share-based compensation 1,357 1,708 4,281 6,000 Impairment of oil and gas properties - 220,197 - 220,197 Unrealized (gain) loss on commodity derivatives (760) (296) 8,273 22,929 Gain on debt extinguishment - (1,483) - (1,483) Termination costs - 1,436 - 1,436 Write-off of debt issuance costs - - 563 - Interest expense, net 7,067 6,465 20,173 18,630 Income tax benefit (4,915) (81,756) (20,847) (93,121) EBITDAX $ 14,145 $ 30,662 $ 36,555 $ 96,600

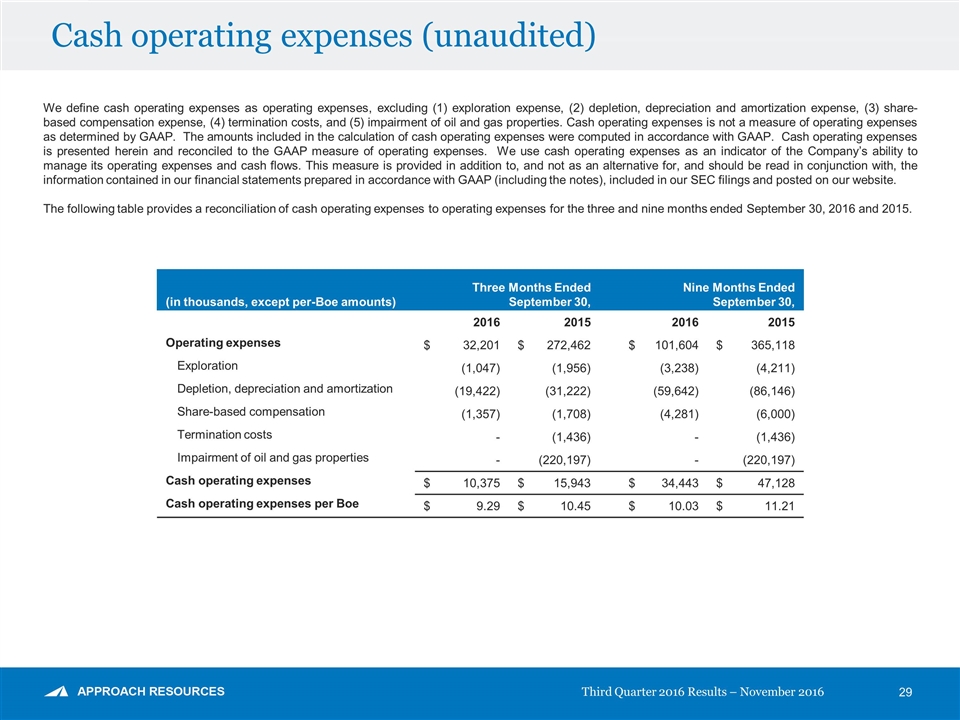

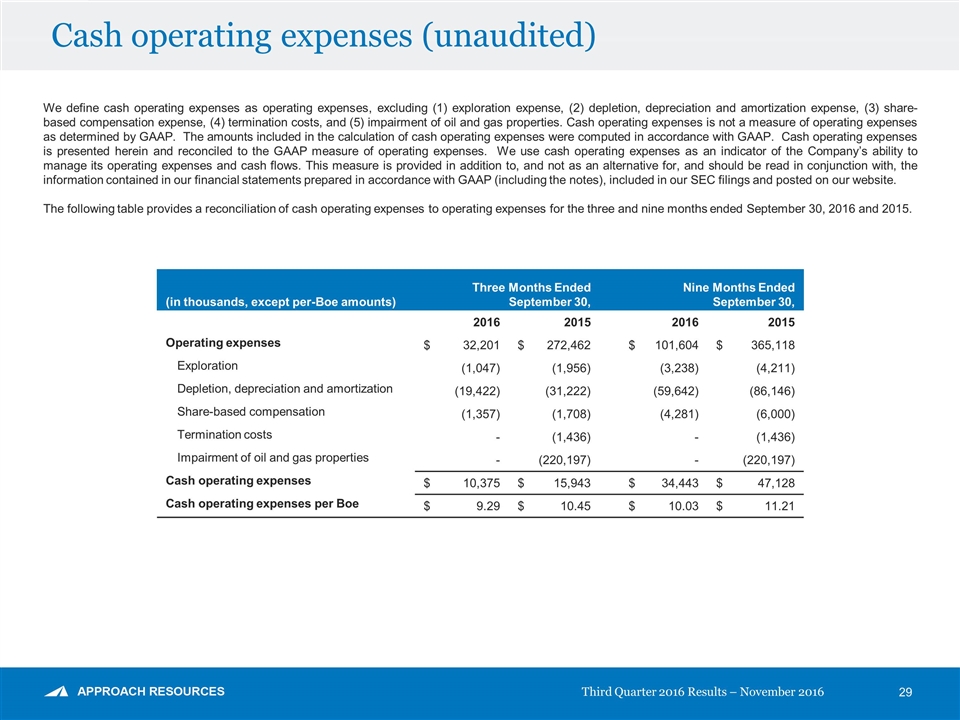

Cash operating expenses (unaudited) We define cash operating expenses as operating expenses, excluding (1) exploration expense, (2) depletion, depreciation and amortization expense, (3) share-based compensation expense, (4) termination costs, and (5) impairment of oil and gas properties. Cash operating expenses is not a measure of operating expenses as determined by GAAP. The amounts included in the calculation of cash operating expenses were computed in accordance with GAAP. Cash operating expenses is presented herein and reconciled to the GAAP measure of operating expenses. We use cash operating expenses as an indicator of the Company’s ability to manage its operating expenses and cash flows. This measure is provided in addition to, and not as an alternative for, and should be read in conjunction with, the information contained in our financial statements prepared in accordance with GAAP (including the notes), included in our SEC filings and posted on our website. The following table provides a reconciliation of cash operating expenses to operating expenses for the three and nine months ended September 30, 2016 and 2015. (in thousands, except per-Boe amounts) Three Months Ended September 30, Nine Months Ended September 30, 2016 2015 2016 2015 Operating expenses $ 32,201 $ 272,462 $ 101,604 $ 365,118 Exploration (1,047) (1,956) (3,238) (4,211) Depletion, depreciation and amortization (19,422) (31,222) (59,642) (86,146) Share-based compensation (1,357) (1,708) (4,281) (6,000) Termination costs - (1,436) - (1,436) Impairment of oil and gas properties - (220,197) - (220,197) Cash operating expenses $ 10,375 $ 15,943 $ 34,443 $ 47,128 Cash operating expenses per Boe $ 9.29 $ 10.45 $ 10.03 $ 11.21

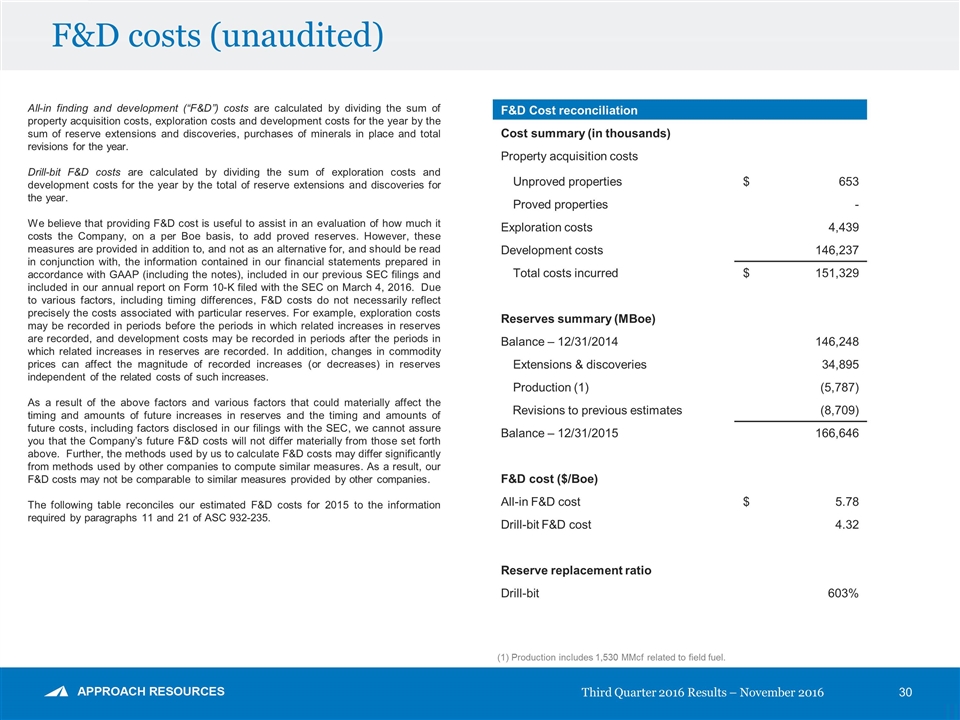

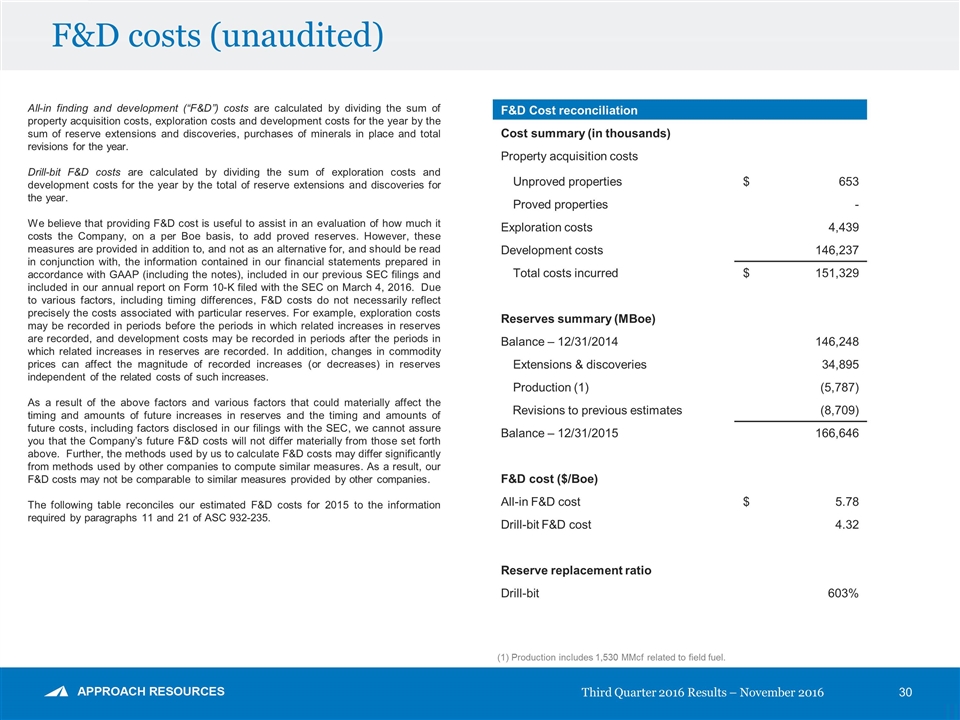

F&D costs (unaudited) F&D Cost reconciliation Cost summary (in thousands) Property acquisition costs Unproved properties $ 653 Proved properties - Exploration costs 4,439 Development costs 146,237 Total costs incurred $ 151,329 Reserves summary (MBoe) Balance – 12/31/2014 146,248 Extensions & discoveries 34,895 Production (1) (5,787) Revisions to previous estimates (8,709) Balance – 12/31/2015 166,646 F&D cost ($/Boe) All-in F&D cost $ 5.78 Drill-bit F&D cost 4.32 Reserve replacement ratio Drill-bit 603% All-in finding and development (“F&D”) costs are calculated by dividing the sum of property acquisition costs, exploration costs and development costs for the year by the sum of reserve extensions and discoveries, purchases of minerals in place and total revisions for the year. Drill-bit F&D costs are calculated by dividing the sum of exploration costs and development costs for the year by the total of reserve extensions and discoveries for the year. We believe that providing F&D cost is useful to assist in an evaluation of how much it costs the Company, on a per Boe basis, to add proved reserves. However, these measures are provided in addition to, and not as an alternative for, and should be read in conjunction with, the information contained in our financial statements prepared in accordance with GAAP (including the notes), included in our previous SEC filings and included in our annual report on Form 10-K filed with the SEC on March 4, 2016. Due to various factors, including timing differences, F&D costs do not necessarily reflect precisely the costs associated with particular reserves. For example, exploration costs may be recorded in periods before the periods in which related increases in reserves are recorded, and development costs may be recorded in periods after the periods in which related increases in reserves are recorded. In addition, changes in commodity prices can affect the magnitude of recorded increases (or decreases) in reserves independent of the related costs of such increases. As a result of the above factors and various factors that could materially affect the timing and amounts of future increases in reserves and the timing and amounts of future costs, including factors disclosed in our filings with the SEC, we cannot assure you that the Company’s future F&D costs will not differ materially from those set forth above. Further, the methods used by us to calculate F&D costs may differ significantly from methods used by other companies to compute similar measures. As a result, our F&D costs may not be comparable to similar measures provided by other companies. The following table reconciles our estimated F&D costs for 2015 to the information required by paragraphs 11 and 21 of ASC 932-235. (1) Production includes 1,530 MMcf related to field fuel.

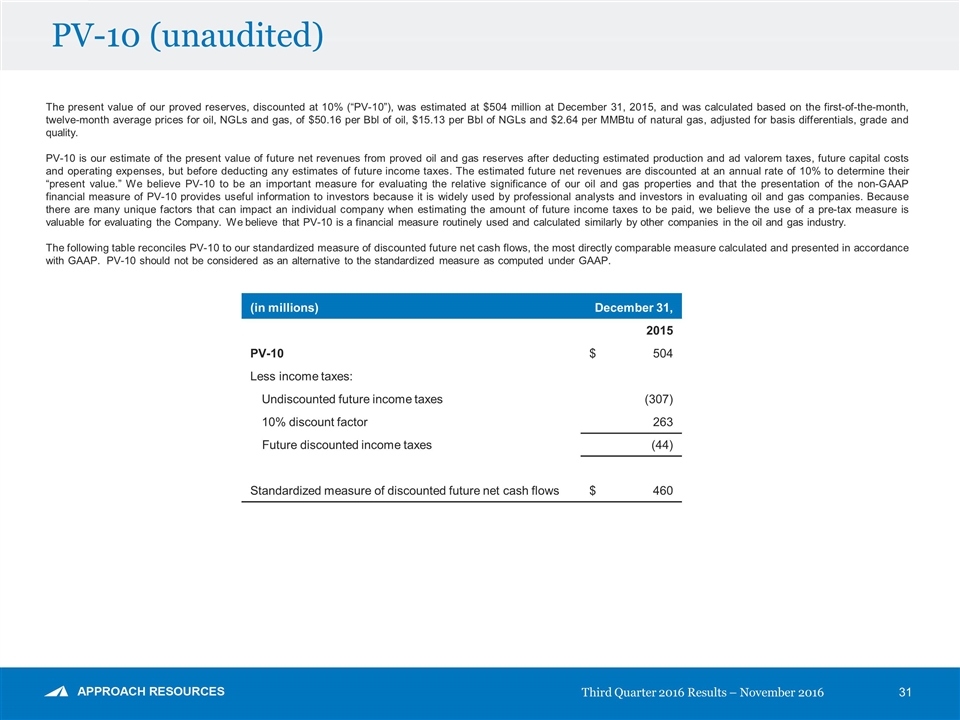

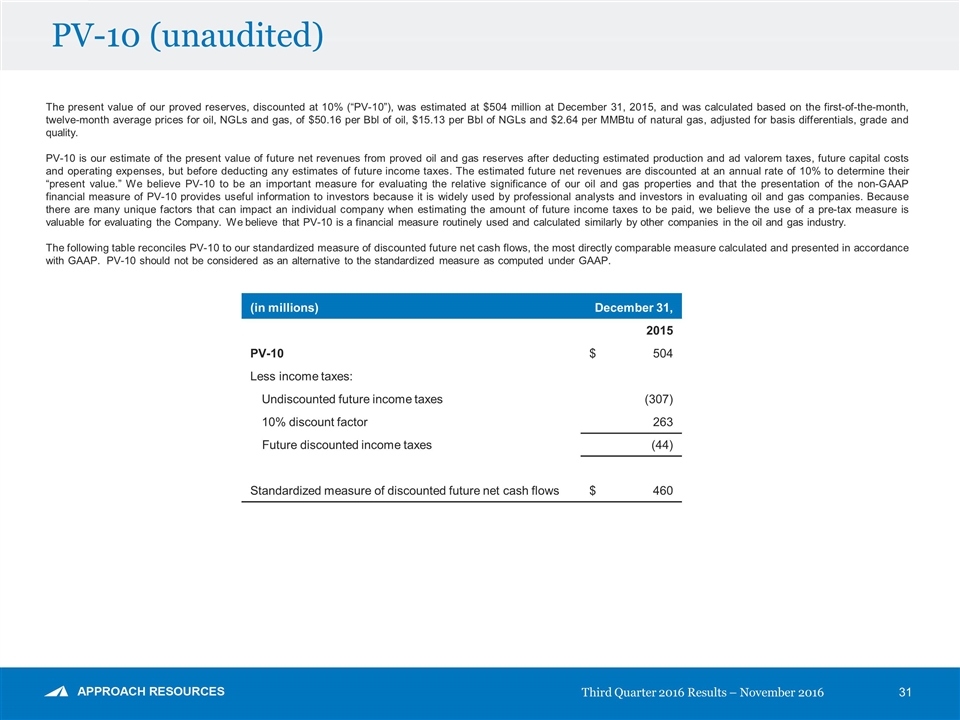

PV-10 (unaudited) The present value of our proved reserves, discounted at 10% (“PV-10”), was estimated at $504 million at December 31, 2015, and was calculated based on the first-of-the-month, twelve-month average prices for oil, NGLs and gas, of $50.16 per Bbl of oil, $15.13 per Bbl of NGLs and $2.64 per MMBtu of natural gas, adjusted for basis differentials, grade and quality. PV-10 is our estimate of the present value of future net revenues from proved oil and gas reserves after deducting estimated production and ad valorem taxes, future capital costs and operating expenses, but before deducting any estimates of future income taxes. The estimated future net revenues are discounted at an annual rate of 10% to determine their “present value.” We believe PV-10 to be an important measure for evaluating the relative significance of our oil and gas properties and that the presentation of the non-GAAP financial measure of PV-10 provides useful information to investors because it is widely used by professional analysts and investors in evaluating oil and gas companies. Because there are many unique factors that can impact an individual company when estimating the amount of future income taxes to be paid, we believe the use of a pre-tax measure is valuable for evaluating the Company. We believe that PV-10 is a financial measure routinely used and calculated similarly by other companies in the oil and gas industry. The following table reconciles PV-10 to our standardized measure of discounted future net cash flows, the most directly comparable measure calculated and presented in accordance with GAAP. PV-10 should not be considered as an alternative to the standardized measure as computed under GAAP. (in millions) December 31, 2015 PV-10 $ 504 Less income taxes: Undiscounted future income taxes (307) 10% discount factor 263 Future discounted income taxes (44) Standardized measure of discounted future net cash flows $ 460

Disclosure THIS PRESENTATION IS NEITHER AN OFFER TO PURCHASE NOR A SOLICITATION TO BUY ANY OF THE EXISTING SENIOR NOTES NOR IS IT A SOLICITATION FOR ACCEPTANCE OF THE EXCHANGE OFFER OR THE FOLLOW-ON EXCHANGE. THE COMPANY IS MAKING THE EXCHANGE OFFER AND THE FOLLOW-ON EXCHANGE OFFER ONLY BY, AND PURSUANT TO THE TERMS OF, THE OFFERS TO EXCHANGE AND LETTERS OF TRANSMITTAL. THE EXCHANGE OFFER AND THE FOLLOW-ON EXCHANGE OFFER ARE NOT BEING MADE IN ANY JURISDICTION IN WHICH THE MAKING OR ACCEPTANCE THEREOF WOULD NOT BE IN COMPLIANCE WITH THE SECURITIES, BLUE SKY OR OTHER LAWS OF SUCH JURISDICTION. NONE OF THE COMPANY, ANY INFORMATION AGENT OR ANY EXCHANGE AGENT FOR THE EXCHANGE OFFER OR THE FOLLOW-ON EXCHANGE OFFER MAKES ANY RECOMMENDATION IN CONNECTION WITH SUCH EXCHANGE OFFERS. THIS PRESENTATION IS NEITHER AN OFFER TO SELL NOR A SOLICITATION OF AN OFFER TO BUY ANY OF THESE SECURITIES AND SHALL NOT CONSTITUTE AN OFFER, SOLICITATION OR SALE IN ANY JURISDICTION IN WHICH SUCH OFFER, SOLICITATION OR SALE IS UNLAWFUL. Additional Information and Where to Find It In connection with the exchange transactions, the Company intends to file a definitive proxy statement with the SEC. The definitive proxy statement and other relevant documents will be sent or given to the stockholders of the Company and will contain important information about the exchange transactions and related matters. The Company’s stockholders and other interested persons are advised to read, when available, the definitive proxy statement in connection with the Company’s solicitation of proxies for the meeting of stockholders to be held to approve certain aspects of the exchange transactions because these materials will contain important information about the exchange transactions. The definitive proxy statement will be mailed to the Company stockholders as of a record date to be established for voting on the exchange transactions. Stockholders will also be able to obtain copies of the definitive proxy statement once it is available, without charge, at the SEC’s website at www.sec.gov or by directing a request to: Approach Resources Inc., One Ridgmar Centre, 6500 West Freeway, Suite 800, Fort Worth, Texas 76116, Attention: Investor Relations, (817) 989-9000. Participants in Solicitation The Company and its directors and officers may be deemed participants in the solicitation of proxies of the Company’s stockholders in connection with the exchange transactions. The Company stockholders and other interested persons may obtain, without charge, more detailed information regarding the directors and officers of the Company in the Company’s proxy statement for its 2016 Annual Meeting of Stockholders, which was filed with the SEC on April 20, 2016. Information regarding the persons who may, under the SEC rules, be deemed participants in the solicitation of proxies to the Company stockholders in connection with the exchange transactions will be set forth in the definitive proxy statement for the exchange transactions when available. Additional information regarding the interests of participants in the solicitation of proxies in connection with the exchange transactions will be included in the definitive proxy statement that the Company intends to file with the SEC. NO OFFER OR SOLICITATION

Contact information Suzanne Ogle Vice President – Investor Relations & Corporate Communications 817.989.9000 ir@approachresources.com www.approachresources.com