March 25, 2011

John P. Nolan

Senior Assistant Chief Accountant

C/o Babette Cooper

United States Securities and Exchange Commission

Washington, D.C. 2054

| | Re: | Las Vegas Railway Express, Inc. |

| | | Form 10-Q for Fiscal Quarter Ended |

| | | December 31, 2010 |

| | | File No. 333-144973 |

Dear Ms. Cooper:

In response to your letter dated March 15, 2011, here are the answers as follows:

Form 10-Q as of December 31. 2010

Note 3 -Notes Payable, page 10

| 1. | We note you recognized a $238,374 gain on the extinguishment of debt. Per ASC 470-50-40-3, when a company has an early extinguishment of debt through exchange of equity, the price of the extinguished debt shall be determined by the value of the equity issued or the value of the debt - whichever is more clearly evident. Please tell us why you believe the value of your common stock issued was considered to be more evident than the value of the debt extinguished, Further, please provide us with the calculations you used to calculate the gain on extinguishment of debt. |

Response:

The debt was exchanged for collateral. No shares were exchanged; therefore ASC 470-50-40-3 did not apply in the extinguishment of the debt. We applied ASC 470-50-40-2 “A difference between the reacquisition price and the net carrying amount of the extinguished debt shall be recognized currently in income of the period of extinguishment as losses or gains and identified as a separate item. Gains and losses shall not be amortized to future periods.”

6650 Via Austi Parkway, Suite 170 * Las Vegas, NV 89119

Tel: (702) 583-6698 Fax: (702) 297-8310

Page 1 of 5

The collateral on the debt were the notes in the Loan Portfolio that had initially been acquired from South Lake Capital. The loan portfolio had been written off in a prior period. The carrying value of the notes ($400,000) and accrued interest ($27,444) was offset by $189,070.27 in unamortized debt discount. The warrants that created the debt discount had already been converted to shares and were not part of the surrender of the notes payable.

Management's Discussion and Analysis, page 12

Continuing Operations - Passenger Train Service, page 14

| 2. | We note your disclosure stating the "Company Filed with the SEC to raise capital. It raised $1,269,000...." We did not note any Forms filed with the SEC to raise capital. Please explain why you state you filed with the SEC to raise capital. Please clarify in future filings the meaning of this statement. |

Response:

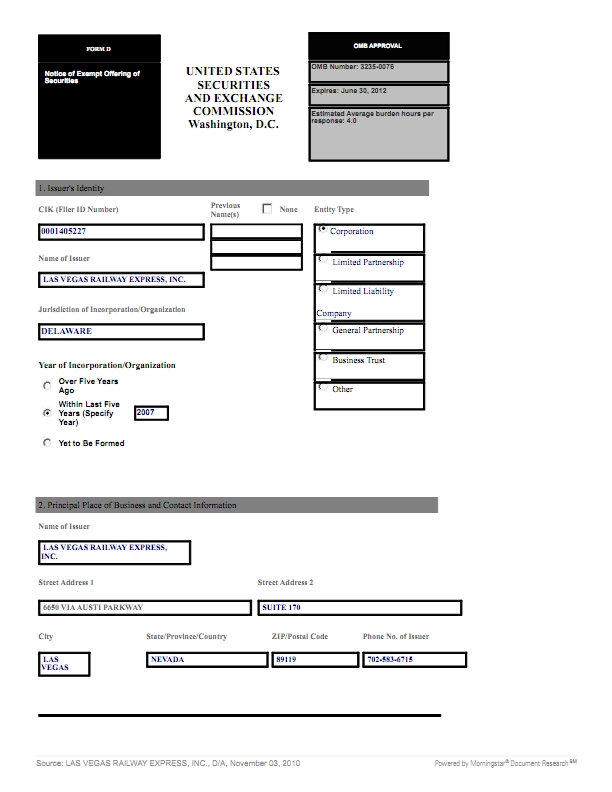

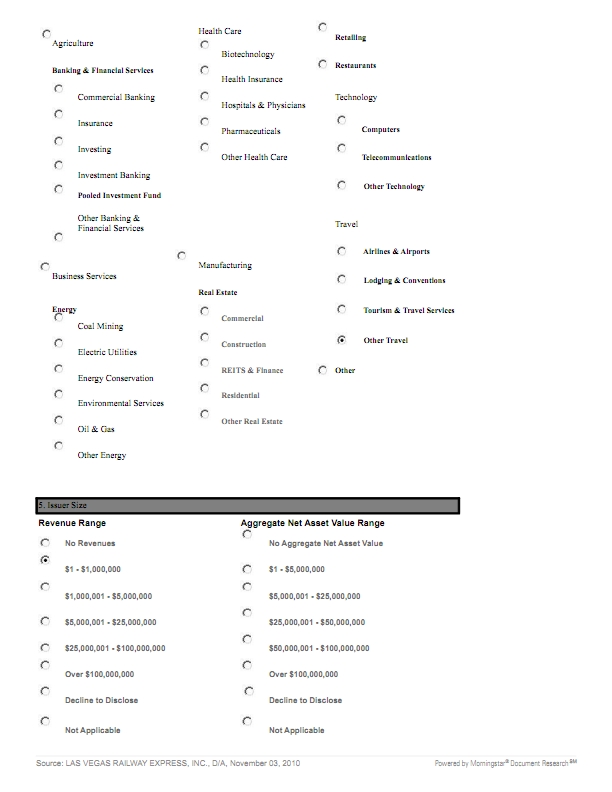

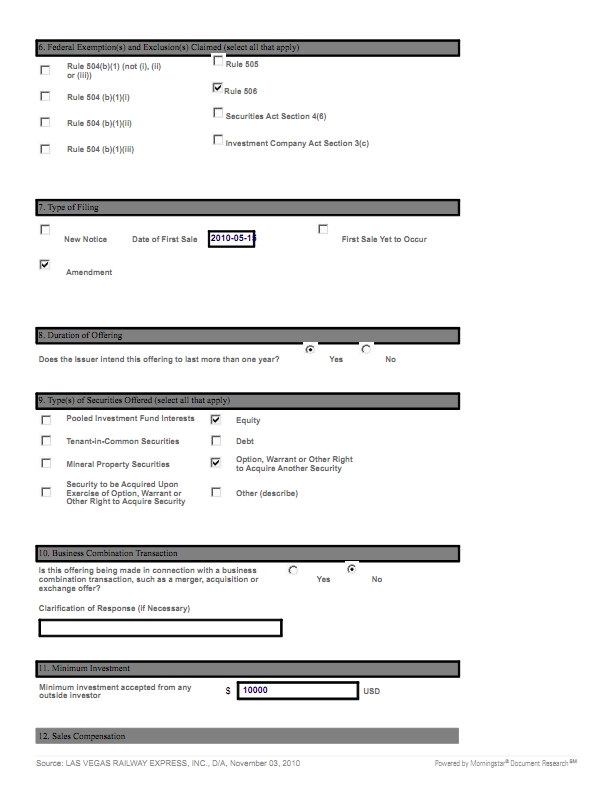

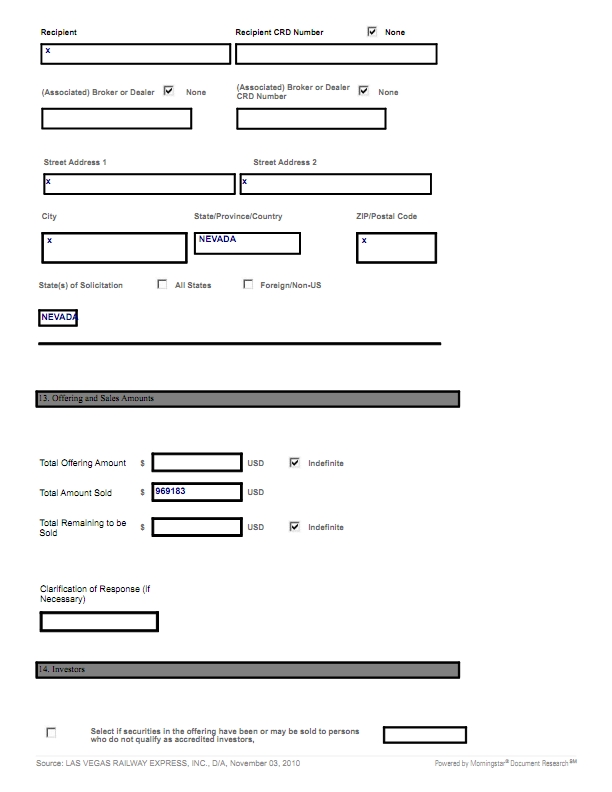

The Company filed with the SEC on November 3, 2010.

FORM D/A was filed on November 3, 2010 as an amendment to a previous filed FORM D. Said filing is attached as Exhibit A.

Exhibits 31.1 and 31.2

| 3. | We note multiple differences between the language of your certifications and the language required by Item 601(b)(31) of Regulation S-K. We issued a comment on this matter as it pertained to the certifications included in your Form 10-Q for the period ending September 30, 2010. Please tell us why you have not corrected these wording differences. Also, please confirm with us in writing that you will revise all future certifications accordingly and provide us with a copy of your proposed certifications. |

Response:

We erroneously did not correct the template for the December 31, 2010 quarterly report. The only deviation we noted from Regulation S-K 601 Exhibit 31 regarding Rule 13a-14(a) and 15d-15(a) was the additional disclosure of point 6. We will remove that disclosure in future filings.

6650 Via Austi Parkway, Suite 170 * Las Vegas, NV 89119

Tel: (702) 583-6698 Fax: (702) 297-8310

Page 2 of 5

Exhibit 31.1

Section 302 Certification of Chief Executive Officer

I, Michael Barron, certify that:

1. I have reviewed this quarterly report on Form 10-Q of Las Vegas Railway Express, Inc.

2. Based on my knowledge, this quarterly report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this quarterly report;

3. Based on my knowledge, the financial statements, and other financial information included in this quarterly report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this quarterly report;

4. The registrant's other certifying officers and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-14 and 15d-14) for the registrant and have:

| | a) designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared; |

| | b) designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles; |

| | c) evaluated the effectiveness of the registrant's disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and |

| | d) disclosed in this report any change in the registrant's internal control over financial reporting that occurred during the registrant's most recent fiscal quarter (the registrant's fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant's internal control over financial reporting. |

5. The registrant's other certifying officers and I have disclosed, based on our most recent evaluation, to the registrant's auditors and the audit committee of registrant's board of directors (or persons performing the equivalent functions):

| | a) all significant deficiencies in the design or operation of internal controls which could adversely affect the registrant's ability to record, process, summarize and report financial data and have identified for the registrant's auditors any material weaknesses in internal controls; and |

| | b) any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal controls. |

Date: November 12, 2010

/s/ Michael A. Barron

Michael A. Barron

Chief Executive Officer

6650 Via Austi Parkway, Suite 170 * Las Vegas, NV 89119

Tel: (702) 583-6698 Fax: (702) 297-8310

Page 3 of 5

Exhibit 31.2

Section 302 Certification of Chief Financial Officer

I, John M. Zilliken, certify that:

1. I have reviewed this quarterly report on Form 10-Q of Las Vegas Railway Express, Inc.

2. Based on my knowledge, this quarterly report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this quarterly report;

3. Based on my knowledge, the financial statements, and other financial information included in this quarterly report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this quarterly report;

4. The registrant's other certifying officers and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-14 and 15d-14) for the registrant and have:

| | a) designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared; |

| | b) designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles; |

| | c) evaluated the effectiveness of the registrant's disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and |

| | d) disclosed in this report any change in the registrant's internal control over financial reporting that occurred during the registrant's most recent fiscal quarter (the registrant's fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant's internal control over financial reporting. |

5. The registrant's other certifying officers and I have disclosed, based on our most recent evaluation, to the registrant's auditors and the audit committee of registrant's board of directors (or persons performing the equivalent functions):

| | a) all significant deficiencies in the design or operation of internal controls which could adversely affect the registrant's ability to record, process, summarize and report financial data and have identified for the registrant's auditors any material weaknesses in internal controls; and |

| | b) any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal controls. |

Date: November 12, 2010

/s/ John M. Zilliken

John M. Zilliken

Chief Financial Officer

6650 Via Austi Parkway, Suite 170 * Las Vegas, NV 89119

Tel: (702) 583-6698 Fax: (702) 297-8310

Page 4 of 5

If you have any questions, please feel free to contact me at (702) 583-6715.

Sincerely,

/s/ Michael A. Barron

Michael A. Barron

Chief Executive Officer

6650 Via Austi Parkway, Suite 170 * Las Vegas, NV 89119

Tel: (702) 583-6698 Fax: (702) 297-8310

Page 5 of 5