SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

| o | Preliminary Proxy Statement |

| o | Confidential, for the use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Pursuant to §240.14a-12 |

| | |

| LAS VEGAS RAILWAY EXPRESS, INC. |

(Name of Registrant as Specified In Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| | (5) | Total fee paid: |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-1l (a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

| | (3) | Filing Party: |

| | (4) | Date Filed: |

Las Vegas Railway Express, Inc.

2013

NOTICE OF SPECIAL MEETING

AND

PROXY STATEMENT

_____________________

June 11, 2013

at 9:00 a.m. Pacific Daylight Time

_____________________

6650 Via Austi Parkway, Suite 170

Las Vegas, NV 89119

Las Vegas Railway Express, Inc.

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON June 11, 2013

Notice is hereby given that a Special Meeting of Stockholders (the “Special Meeting”) of Las Vegas Railway Express, Inc. (the “Company”) will be held at the Company’s offices at 6650 Via Austi Parkway, Suite 170, Las Vegas, NV 89119, on Tuesday, June 11, 2013, at 9:00 am local time, to consider the following proposals:

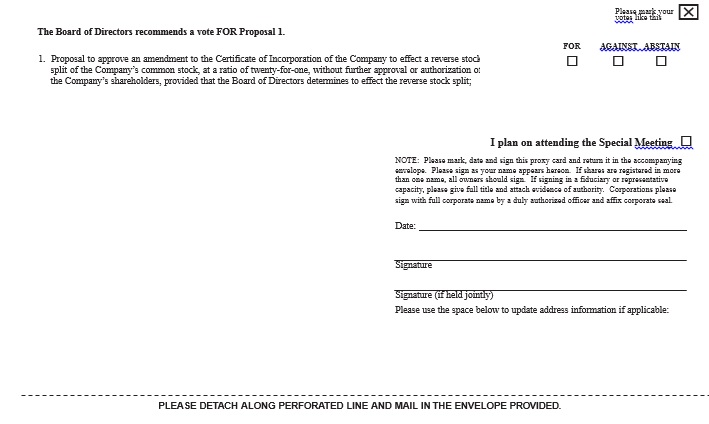

| 1. | To consider and act upon a proposal to approve an amendment to the Certificate of Incorporation of the Company to effect a reverse stock split of the Company’s common stock, at a ratio of twenty-for-one, without further approval or authorization of the Company’s shareholders, provided that the Board of Directors determines to effect the reverse stock split and such amendment is filed with the Secretary of State of Delaware no later than six months from the date of the Special Meeting (the “Reverse Split”); and |

| 2. | To act on such other matters as may properly come before the meeting or any adjournment thereof. |

BECAUSE OF THE SIGNIFICANCE OF THESE PROPOSALS TO THE COMPANY AND ITS STOCKHOLDERS, IT IS VITAL THAT EVERY STOCKHOLDER VOTES AT THE SPECIAL MEETING IN PERSON OR BY PROXY.

These proposals are fully set forth in the accompanying Proxy Statement, which you are urged to read thoroughly. For the reasons set forth in the Proxy Statement, your board of directors recommends a vote "FOR" Proposal 1. The Company intends to mail the Proxy Statement and Proxy card enclosed with this notice on or about May 14, 2013 to all stockholders entitled to vote at the Special Meeting. Only stockholders of record at the close of business on April 26, 2013 will be entitled to attend and vote at the Special Meeting. A list of all stockholders entitled to vote at the Special Meeting will be available at the principal office of the Company during usual business hours, for examination by any stockholder for any purpose germane to the Special Meeting for 10 days prior to the date thereof. Stockholders are cordially invited to attend the Special Meeting. However, whether or not you plan to attend the meeting in person, your shares should be represented and voted. After reading the enclosed Proxy Statement, please sign, date, and return promptly the enclosed Proxy in the accompanying postpaid envelope we have provided for your convenience to ensure that your shares will be represented. Alternatively, you may wish to provide your response by telephone or electronically through the Internet by following the instructions set out on the enclosed Proxy card. If you do attend the meeting and wish to vote your shares personally, you may revoke your Proxy.

| | By Order of the board of directors | |

| | | | |

| | | /s/ John D. McPherson | |

| | | John D. McPherson | |

| | | Chairman of the board of directors | |

WHETHER OR NOT YOU PLAN ON ATTENDING THE MEETING IN PERSON, PLEASE VOTE AS PROMPTLY AS POSSIBLE TO ENSURE THAT YOUR VOTE IS COUNTED.

Las Vegas Railway Express, Inc.

6650 Via Austi Parkway, Suite 170

Las Vegas, NV 89119

702-583-6715

______________________

PROXY STATEMENT

_______________________

This Proxy Statement is furnished in connection with the solicitation of proxies by the board of directors of Las Vegas Railway Express, Inc. (the “Company”) to be voted at the Special Meeting of Stockholders (“Special Meeting”) which will be held at the Company’s offices at 6650 Via Austi Parkway, Suite 170, Las Vegas, NV 89119, on Tuesday, June 11, 2013, at 9:00 am local time, and at any postponements or adjournments thereof. The proxy materials will be furnished to stockholders on or about May 14, 2013.

REVOCABILITY OF PROXY AND SOLICITATION

Any stockholder executing a proxy that is solicited hereby has the power to revoke it prior to the voting of the proxy. Revocation may be made by attending the Special Meeting and voting the shares of stock in person, or by delivering to the Secretary of the Company at the principal office of the Company prior to the Special Meeting a written notice of revocation or a later-dated, properly executed proxy. Solicitation of proxies may be made by directors, officers and other employees of the Company by personal interview, telephone, facsimile transmittal or electronic communications. No additional compensation will be paid for any such services. This solicitation of proxies is being made by the Company which will bear all costs associated with the mailing of this proxy statement and the solicitation of proxies.

RECORD DATE

Stockholders of record at the close of business on April 26, 2013, will be entitled to receive notice of, attend and vote at the meeting.

INFORMATION ABOUT THE SPECIAL MEETING AND VOTING

Why am I receiving these materials?

The Company has delivered printed versions of these materials to you by mail, in connection with the Company’s solicitation of proxies for use at the Special Meeting. These materials describe the proposals on which the Company would like you to vote and also give you information on these proposals so that you can make an informed decision.

What is included in these materials?

These materials include:

| · | this Proxy Statement for the Special Meeting; |

| · | the proxy card or vote instruction form for the Special Meeting. |

What is the proxy card?

The proxy card enables you to appoint Michael Barron, our Chief Executive Officer, President and Director, as your representative at the Special Meeting. By completing and returning a proxy card, you are authorizing this individual to vote your shares at the Special Meeting in accordance with your instructions on the proxy card. This way, your shares will be voted whether or not you attend the Special Meeting.

What is the purpose of the Special Meeting?

At our Special Meeting, stockholders will act upon the matters outlined in the Notice of Special Meeting on the cover page of this Proxy Statement, namely (i) to consider and act upon a proposal to approve an amendment to the Certificate of Incorporation of the Company to effect a reverse stock split of the Company’s common stock, at a ratio of twenty-for-one, without further approval or authorization of the Company’s shareholders, provided that the Board of Directors determines to effect the reverse stock split and such amendment is filed with the Secretary of State of Delaware no later than six months from the date of the Special Meeting .

What constitutes a quorum?

The presence at the meeting, in person or by proxy, of the holders of a majority of the number of shares of common stock issued and outstanding on the record date will constitute a quorum permitting the meeting to conduct its business. As of the record date, there are 159,111,882 shares of the Company’s common stock issued and outstanding. Thus, the presence of the holders of common stock representing at least 79,555,942 votes will be required to establish a quorum.

What vote is required to pass the proposal(s)?

The affirmative vote of a majority of the issued and outstanding shares of common stock entitled to vote at the Special Meeting is required to approve Proposal 1. Accordingly, shares which abstain from voting as to such matter, and shares held in "street name" by brokers or nominees who indicate on their proxies that they do not have discretionary authority to vote such shares as to such matter, will have the effect of a vote against Proposal 1.

What is the difference between a stockholder of record and a beneficial owner of shares held in street name?

Most of our stockholders hold their shares in an account at a brokerage firm, bank or other nominee holder, rather than holding share certificates in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially in street name.

Stockholder of Record

If on April 26, 2013, your shares were registered directly in your name with our transfer agent, Empire Stock Transfer, you are considered a stockholder of record with respect to those shares, and the Notice of Special Meeting and Proxy Statement was sent directly to you by the Company. As the stockholder of record, you have the right to direct the voting of your shares by returning the proxy card to us. Whether or not you plan to attend the Special Meeting, if you do not vote over the Internet, please complete, date, sign and return a proxy card to ensure that your vote is counted.

Beneficial Owner of Shares Held in Street Name

If on April 26, 2013, your shares were held in an account at a brokerage firm, bank, broker-dealer, or other nominee holder, then you are considered the beneficial owner of shares held in “street name,” and the Notice of Special Meeting & Proxy Statement was forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Special Meeting. As the beneficial owner, you have the right to direct that organization on how to vote the shares held in your account. However, since you are not the stockholder of record, you may not vote these shares in person at the Special Meeting unless you receive a valid proxy from the organization.

How do I vote?

Shareholders of Record. If you are a stockholder of record, you may vote by any of the following methods:

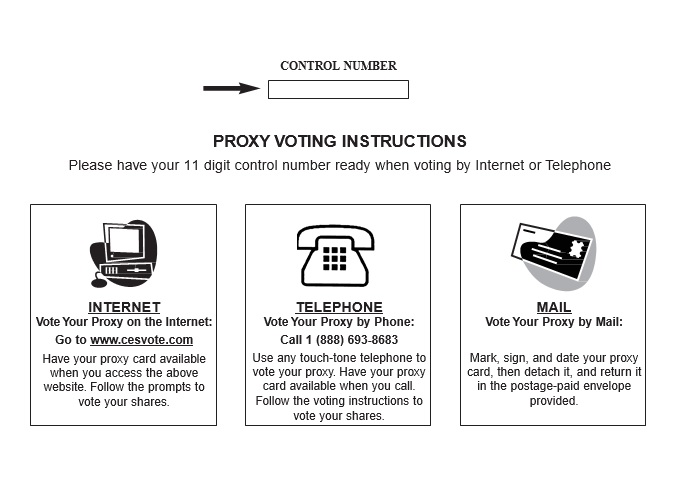

| · | Via the Internet. You may vote by proxy via the Internet by following the instructions provided on the enclosed Proxy Card. |

| · | By Telephone. You may vote by calling the toll free number found on the Proxy Card. |

| · | By Mail. You may vote by completing, signing, dating and returning your proxy card in the pre-addressed, postage-paid envelope provided. |

| · | In Person. You may attend and vote at the Special Meeting. The Company will give you a ballot when you arrive. |

Beneficial Owners of Shares Held in Street Name. If you are a beneficial owner of shares held in street name, you may vote by any of the following methods:

| · | Via the Internet. You may vote by proxy via the Internet by following the instructions provided on the enclosed Proxy Card. |

| · | By Telephone. You may vote by proxy by calling the toll free number found on the vote instruction form. |

| · | By Mail. You may vote by proxy by filling out the vote instruction form and returning it in the pre-addressed, postage-paid envelope provided. |

| · | In Person. If you are a beneficial owner of shares held in street name and you wish to vote in person at the Special Meeting, you must obtain a legal proxy from the organization that holds your shares. |

Abstentions and broker non-votes

While the inspectors of election will treat shares represented by Proxies that reflect abstentions or include "broker non-votes" as shares that are present and entitled to vote for purposes of determining the presence of a quorum, abstentions or "broker non-votes" do not constitute a vote "for" or "against" any matter and thus will be disregarded in any calculation of "votes cast." However, abstentions and "broker non-votes" will have the effect of a negative vote if an item requires the approval of a majority of a quorum or of a specified proportion of all issued and outstanding shares.

Brokers holding shares of record for customers generally are not entitled to vote on “non-routine” matters, unless they receive voting instructions from their customers. As used herein, “uninstructed shares” means shares held by a broker who has not received voting instructions from its customers on a proposal. A “broker non-vote” occurs when a nominee holding uninstructed shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that non-routine matter.

What happens if I do not give specific voting instructions?

Shareholders of Record. If you are a stockholder of record and you:

| · | indicate when voting on the Internet or by telephone that you wish to vote as recommended by the board of directors, or |

| · | sign and return a proxy card without giving specific voting instructions, |

then the proxy holders will vote your shares in the manner recommended by the board of directors on all matters presented in this proxy statement and as the proxy holders may determine in their discretion with respect to any other matters properly presented for a vote at the Special Meeting.

Beneficial Owners of Shares Held in Street Name. If you are a beneficial owner of shares held in street name and do not provide the organization that holds your shares with specific voting instructions, under the rules of various national and regional securities exchanges, the organization that holds your shares may generally vote on routine matters.

What are the board’s recommendations?

The board’s recommendation is set forth together with the description of each item in this Proxy Statement. In summary, the board recommends a vote:

| · | for the proposal to approve an amendment to the Certificate of Incorporation of the Company to effect a reverse stock split of the Company’s common stock, at a ratio of twenty-for-one, without further approval or authorization of the Company’s shareholders, provided that the Board of Directors determines to effect the reverse stock split and such amendment is filed with the Secretary of State of Delaware no later than six months from the date of the Special Meeting;; |

With respect to any other matter that properly comes before the meeting, the proxy holders will vote as recommended by the board of directors or, if no recommendation is given, in their own discretion.

Dissenters’ Right of Appraisal

Holders of shares of our common stock do not have appraisal rights under Delaware law or under the governing documents of the Company in connection with this solicitation.

How are Proxy materials delivered to households?

Only one copy of this Proxy Statement will be delivered to an address where two or more stockholders reside with the same last name or who otherwise reasonably appear to be members of the same family based on the stockholders’ prior express or implied consent.

We will deliver promptly upon written or oral request a separate copy of the Proxy Statement upon such request. If you share an address with at least one other stockholder, currently receive one copy of the Proxy Statement at your residence, and would like to receive a separate copy the Proxy Statement for future stockholder meetings of the Company, please specify such request in writing and send such written request to Las Vegas Railway Express, Inc., 6650 Via Austi Parkway, Suite 170, Las Vegas, NV 89119; Attention: Corporate Secretary.

How much stock is owned by 5% stockholders, directors, and executive officers?

The following table sets forth the number of shares known to be beneficially owned by all persons who own at least 5% of the Company's outstanding common stock, the Company's directors, the executive officers, and the directors and executive officers as a group as of April 26, 2013, unless otherwise noted. Unless otherwise indicated, the stockholders listed in the table have sole voting and investment power with respect to the shares indicated.

| | | common stock Beneficially Owned(2) | | Percentage of Common | |

| Name of Beneficial Owner (1) | | | Stock (3) | |

| | | | | | | | |

| John D. McPherson, Chairman (5) | | | 1,100,000 | | | 0.7 | % |

| Michael A. Barron, CEO and President (6) | | | 25,654,502 | | | 15.1 | % |

| Thomas Mulligan (8) | | | 1,000,000 | | | 0.6 | % |

| Gilbert H. Lamphere, Director (4) | | | 18,971,981 | | | 11.6 | % |

| John Marino, Director (7) | | | 2,100,000 | | | 1.3 | % |

| Wanda Witoslawski, CFO and Treasurer | | | 2,728,571 | | | 1.7 | % |

| John M. B. O’Connor | | | 500,000 | | | 0.3 | % |

| | | | | | | | |

| Officers and Directors as a group (7 persons) | | | 52,055,054 | | | 31.6 | % |

| Total | | | 52,055,054 | | | 31.6 | % |

| | (1) | The address of each of the beneficial owners is 6650 Via Austi Parkway, Suite 170, Las Vegas Nevada 89119, except as indicated. |

| | (2) | In computing the number of shares beneficially owned by a person and the percentage ownership of that person, shares of common stock subject to options held by that person that are currently exercisable, or become exercisable within 60 days are deemed outstanding. However, such shares are not deemed outstanding for purposes of computing the percentage ownership of any other person. |

| | (3) | Based on 159,111,882 shares outstanding as of April 26, 2013. |

| | (4) | The address is 220 East 42nd St., 29th Floor, New York, NY 10017. Common stock beneficially owned: 19,102,207 shares (including 4,471,981 shares issuable upon exercise of warrants) |

| | (5) | Common stock beneficially owned: 1,100,000 shares (including 500,000 shares issuable upon exercise of warrants) |

| | (6) | Common stock beneficially owned: 25,654,502 shares (including 9,887,921 shares issuable upon exercise of warrants, 1,000,000 shares issuable upon exercise of options, and 6,552,295 owned by the Allegheny Nevada Holdings Corporation, of which Michael Barron is the sole owner and controlling shareholder) |

| | (7) | Common stock beneficially owned: 2,100,000 shares (including 500,000 shares issuable upon exercise of warrants and 600,000 shares issued to Transportation Management Services, Inc.) |

| | (8) | Common stock beneficially owned: 1,000,000 shares (including 500,000 shares issuable upon exercise of warrants) |

There are no arrangements known to the Company, including any pledge by any person of securities of the Company, the operation of which may at a subsequent date result in a change in control of the Company.

ACTIONS TO BE TAKEN AT THE MEETING

REVERSE STOCK SPLIT OF THE COMMON STOCK OF THE COMPANY

Our board of directors has adopted resolutions (1) declaring that submitting an amendment to the Company’s Certificate of Incorporation to effect a reverse stock split of our issued and outstanding common stock, as described below, was advisable and (2) directing that a proposal to approve the Reverse Stock Split be submitted to the holders of our common stock for their approval.

At the Special Meeting, the board of directors proposes that the shareholders approve an amendment to the Certificate of Incorporation of the Company to effect a reverse stock split of the Company’s common stock, at a ratio of twenty-for-one, without further approval or authorization of the Company’s shareholders, provided that the Board of Directors determines to effect the reverse stock split and such amendment is filed with the Secretary of State of Delaware no later than six months from the date of the Special Meeting (the “Reverse Split”).

Background and Reasons for the Reverse Stock Split; Potential Consequences of the Reverse Stock Split

If the Reverse Split is approved by shareholders and implemented, the number of issued and outstanding shares of common stock will decrease while the number of authorized shares of the Company’s common stock will not change. As a result, the number of shares of common stock remaining available for issuance will increase. Our board of directors is submitting the Reverse Stock Split to our stockholders for approval with the primary intent of providing the Company with enough unissued shares so (i) the Company has the ability, if necessary, to issue shares of the Company’s common stock to holders of convertible securities of the Company, should such holders convert and/or exercise their convertible securities, and (ii) the Company would have the flexibility to issue additional shares of the Company’s common stock should it be required to do so pursuant to any future equity based financing and/or fundraising agreements. Please note, there can be no assurance of the occurrence of either (i) the conversion of any convertible securities of the Company held by holders of such securities, or (ii) any future financing and/or fundraising.

The Company does not currently have any proposal or arrangement to issue any of its authorized but unissued shares of common stock, except that, the Company intends to seek equity financing of up to approximately $150,000,000 following the Reverse Split, for capital expenditures necessary to implement the Company’s business plan and for working capital. The Company has no formal or informal agreement or understanding with respect to any financing, and there is no assurance any such financing will be available on terms acceptable to the Company, or at all.

Possible Anti-Takeover Effects of Reverse Split

By increasing the number of authorized but unissued shares of common stock, the Reverse Split could, under certain circumstances, have an anti-takeover effect, although this is not the intent of the Board of Directors. For example, it may be possible for the Board of Directors to delay or impede a takeover or transfer of control of the Company by causing such additional authorized but unissued shares to be issued to holders who might side with the Board of Directors in opposing a takeover bid that the Board of Directors determines is not in the best interests of the Company or its stockholders. The Reverse Split therefore may have the effect of discouraging unsolicited takeover attempts. By potentially discouraging initiation of any such unsolicited takeover attempts the Reverse Split may limit the opportunity for the Company’s stockholders to dispose of their shares at the higher price generally available in takeover attempts or that may be available under a merger proposal. The Reverse Split may have the effect of permitting the Company’s current management, including the current Board of Directors, to retain its position, and place it in a better position to resist changes that stockholders may wish to make if they are dissatisfied with the conduct of the Company’s business. However, the Board of Directors is not aware of any attempt to take control of the Company and the Board of Directors has not approved the Reverse Split with the intent that it be utilized as a type of anti-takeover device.

Information With Respect to the Reverse Split

Shareholders should recognize that if the Reverse Split should take effect, they will own a fewer number of shares than they currently own (a number equal to the number of shares owned immediately prior to the Reverse Split divided by twenty). While we expect that the Reverse Split will result in an increase in the per share price of our common stock, the Reverse Split may not increase the per share price of our common stock in proportion to the reduction in the number of shares of our common stock outstanding. It also may not result in a permanent increase in the per share price, which depends on many factors, including our performance, prospects and other factors that may be unrelated to the number of shares outstanding. The history of similar reverse splits for companies in similar circumstances is varied. Furthermore, the liquidity of our common stock could be adversely affected by the reduced number of shares that would be outstanding after the Reverse Split. Consequently, there can be no assurance that the Reverse Split will result in an increase in our share price.

In addition, the Reverse Split will likely increase the number of shareholders who own “odd lots” (stockholdings in amounts of less than 100 shares). Shareholders who hold odd lots typically will experience an increase in the cost of selling their shares, as well as possible greater difficulty in effecting such sales.

The Reverse Split will be realized simultaneously and in the same ratio for all shares of the common stock. All holders of common stock will be affected uniformly by the Reverse Split, which will have no effect on the proportionate holdings of any of our shareholders, except for possible changes due to the treatment of fractional shares resulting from the Reverse Split. In lieu of issuing fractional shares, the Company will round up in the event a shareholder would be entitled to receive less than one share of common stock. In addition, the split will not affect any holder of common stock’s proportionate voting power (subject to the treatment of fractional shares), and all shares of common stock will remain fully paid and non-assessable.

The authorized capital stock of the Company consists of 200,000,000 shares of common stock, having a par value of $.0001 per share. There will be no change in the number of authorized capital stock or the par value of the common stock as a result of the Reverse Split. Our issued and outstanding securities as of April 26, 2013 are as follows:

| | · | 159,111,882 shares of common stock. |

| | | |

| | · | $2,425,000 in principal amount of convertible notes and debentures convertible into 48,500,000 shares of common stock. |

| | | |

| | · | Warrants to purchase 81,856,842 shares of common stock at a weighted average exercise price of $0.11. |

| | | |

| | · | Options to purchase 2,000,000 shares of common stock at a weighted average exercise price of $0.50. |

Based on the number of shares currently issued and outstanding, immediately following the Reverse Split the Company would have approximately 7,955,594 shares of common stock issued and outstanding (without giving effect to rounding for fractional shares) based upon a ratio for the Reverse Split of 20-for-1.

The Board of Directors will determine the actual time of filing of the Certificate of Amendment. The Reverse Split will be effective upon the filing of a Certificate of Amendment to the Certificate of Incorporation with the Secretary of State of the State of Delaware.

The Board reserves the right, notwithstanding shareholder approval and without further action by shareholders, to elect not to proceed with the Reverse Split if the Board determines that the Reverse Split is no longer in the best interests of the Company and its shareholders.

If the Reverse Split proposal is approved by the Company’s stockholders, and if the Board of Directors in its discretion still believes at that time the Reverse Split is in the best interests of the Company and its stockholders after the Board of Directors votes in favor of effecting the Reverse Split, the Reverse Split will be implemented by filing a Certificate of Amendment to the Company’s Certificate of Incorporation with the Secretary of State of the State of Delaware, substantially in the form of Appendix A hereto, and the Reverse Split will become effective on the date of the filing (the “Effective Date”). We will obtain a new CUSIP number for the new common stock effective at the time of the Reverse Split. Stockholders who held shares of the Company’s common stock as of the close of business on the Effective Date (“Record Holders”) will be notified as soon as practicable after the Effective Date that the Reverse Split has been effected. The Company’s transfer agent will act as its exchange agent (the “Exchange Agent”) to act for the Record Holders in implementing the exchange of their certificates. As soon as practicable after the Effective Date, Record Holders will be notified and requested to surrender their certificates representing shares of pre-split common stock (“Old common stock”) to the Exchange Agent in exchange for certificates representing post-split common stock (“New common stock”). Any fractional shares resulting from the Reverse Split will be rounded up to the nearest whole number. At the Effective Date, each lot of 20 shares of Old common stock issued and outstanding immediately prior to the effective time will, automatically and without any further action on the part of our shareholders, be combined into and become one share of New common stock, subject to the treatment for fractional shares described above, and each certificate which, immediately prior to the effective time represented Old common stock, will be deemed cancelled and, for all corporate purposes, will be deemed to evidence ownership of New common stock.

As soon as practicable after the Effective Date, a letter of transmittal will be sent to shareholders of record as of the Effective Date for purposes of surrendering to the transfer agent certificates representing Old common stock in exchange for certificates representing New common stock shares in accordance with the procedures set forth in the letter of transmittal. No new certificates will be issued to a shareholder until such shareholder has surrendered such shareholder’s outstanding certificate(s), together with the properly completed and executed letter of transmittal, to the Exchange Agent. From and after the Effective Date, any certificates representing Old common stock which are submitted for transfer, whether pursuant to a sale, other disposition or otherwise, will be exchanged for certificates representing New common stock. SHAREHOLDERS SHOULD NOT DESTROY ANY STOCK CERTIFICATE(S) AND SHOULD NOT SUBMIT ANY CERTIFICATE(S) UNTIL REQUESTED TO DO SO.

The number of shares which will result in fractional interests cannot be precisely predicted as the Company cannot determine in advance the number of stockholders whose total holdings are not evenly divisible by the exchange ratio. It is not anticipated that a substantial number of shares will be required to be issued.

Principal Effects of the Reverse Split

General

The Reverse Split will affect all holders of our common stock uniformly and will not change the proportionate equity interests of such shareholders, nor will the respective voting rights and other rights of holders of our common stock be altered, except for possible changes due to the treatment of fractional shares resulting from the Reverse Split,

Accounting Matters

The Reverse Split will not affect total shareholders’ equity on our balance sheet. As a result of the Reverse Split, the stated capital component attributable to our common stock will be reduced to an amount equal to one-twentieth of its present amount, and the additional paid-in capital component will be increased by the amount by which the shareholder’s equity is reduced. The per share net loss and net book value per share of our common stock will be increased as a result of the Reverse Split because there will be fewer shares of our common stock outstanding.

No Appraisal Rights

Under the General Corporation Law of the State of Delaware, shareholders will not be entitled to exercise appraisal rights in connection with the Reverse Split, and the Company will not independently provide shareholders with any such right.

Certain U.S. Federal Income Tax Consequences

The discussion below is only a summary of certain U.S. federal income tax consequences of the Reverse Split generally applicable to beneficial holders of shares of our common stock and does not purport to be a complete discussion of all possible tax consequences. This summary addresses only those shareholders who hold their Old common stock shares as “capital assets” as defined in the Internal Revenue Code of 1986, as amended (the “Code”). This discussion does not address all U.S. federal income tax considerations that may be relevant to particular shareholders in light of their individual circumstances or to shareholders that are subject to special rules, such as financial institutions, tax-exempt organizations, insurance companies, dealers in securities, and foreign shareholders. The following summary is based upon the provisions of the Code, applicable Treasury Regulations thereunder, judicial decisions and current administrative rulings, as of the date hereof, all of which are subject to change, possibly on a retroactive basis. Tax consequences under state, local, foreign, and other laws are not addressed herein. Each shareholder should consult his, her or its own tax advisor as to the particular facts and circumstances that may be unique to such shareholder and also as to any estate, gift, state, local or foreign tax considerations arising out of the Reverse Split.

| | | | |

| | | Ÿ | The Reverse Split will qualify as a recapitalization for U.S. federal income tax purposes. As a result: |

| | | Ÿ | Shareholders should not recognize any gain or loss as a result of the Reverse Split. |

| | | Ÿ | The aggregate basis of a shareholder’s pre-Reverse Split shares will become the aggregate basis of the shares held by such shareholder immediately after the Reverse Split. |

| | | Ÿ | The holding period of the shares owned immediately after the Reverse Split will include the shareholder’s holding period before the Reverse Split. |

The above discussion is not intended or written to be used, and cannot be used by any person, for the purpose of avoiding U.S. Federal tax penalties. It was written solely in connection with the proposed reverse split of our common stock.

RECOMMENDATION OF THE BOARD FOR PROPOSAL NO. 1:

THE BOARD RECOMMENDS A VOTE FOR THE REVERSE SPLIT.

The board of directors knows of no other business which will be presented at the Special Meeting. If any other matters properly come before the meeting, the persons named in the enclosed Proxy, or their substitutes, will vote the shares represented thereby in accordance with their judgment on such matters.

The proxies being solicited hereby are being solicited by the Company. The Company will bear the entire cost of solicitation of proxies, including preparation, assembly, printing and mailing of the Notice, the Proxy Statement, the Proxy card and establishment of the Internet site hosting the proxy material. Copies of solicitation materials will be furnished to banks, brokerage houses, fiduciaries and custodians holding in their names shares of common stock beneficially owned by others to forward to such beneficial owners. Officers and regular employees of the Company may, but without compensation other than their regular compensation, solicit proxies by further mailing or personal conversations, or by telephone, telex, facsimile or electronic means. We will, upon request, reimburse brokerage firms and others for their reasonable expenses in forwarding solicitation material to the beneficial owners of stock.

| | By Order of the board of directors, | |

| | | |

| | | |

| | /s/ John D. McPherson | |

| | John D. McPherson | |

| | Chairman of the board of directors | |

Appendix A

Certificate of Amendment

of

Certificate of Incorporation

of

Las Vegas Railway Express, Inc.

Under Section 242 of the Delaware General Corporation Law

Las Vegas Railway Express, Inc., a corporation organized and existing under the laws of the State of Delaware (the “Corporation”) hereby certifies as follows:

1. The Certificate of Incorporation of the Corporation is hereby amended by changing Article 4 so that, as amended, said Article 4 shall be and read as follows:

| | The total number shares of stock, which this corporation is authorized to issue is 200,000,000 shares of common stock with a par value of $0.0001. Effective _______, 2013, each twenty (20) shares of the Corporation’s common stock, par value $0.0001 per share, shall be converted and reclassified into one (1) share of the Corporation’s common stock, par value $0.0001 per share. |

| | Any fractional shares resulting from such conversion will be rounded up to the nearest whole number. |

2. The foregoing amendment has been duly adopted in accordance with the provisions of Section 242 of the General Corporation law of the State of Delaware by the vote of a majority of each class of outstanding stock of the Corporation entitled to vote thereon.

IN WITNESS WHEREOF, I have signed this Certificate this ____ day of __________, 2013.

| | |

| Michael Barron | |

| Chief Executive Officer | |

| | |