1London December 4, 2007 Positioned to Capitalize on Growth in 3G MarketNASDAQ 20th Investor Program

2This presentation contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, regarding InterDigital, Inc.’s (“InterDigital”) current beliefs, plans and expectations as to: (i) future results, projections and trends; (ii) our strategy; (iii) our future growth potential, including the ability to grow our patent portfolio; (iv) future global mobile device sales and market opportunities; (v) growth in our 3G patent licensing program; (vi) our 2G/3G HSDPA/HSUPA modem ASIC development initiatives; (vii) the competitive advantages of our ASIC; and (viii) acquisitions and monetization of patent portfolios, and such statements are subject to the “safe harbor” created by those sections.Words such as “anticipate,” “assume,” “believe,” “continue,” “could,” “drives,” “emerge,” “enable,” “estimate,” “exceed,” “expect,” “expose,” “goal,” “grow,” “increase,” “intend,” “leverage,” “opportunity,” “outlook,” “plan,” “position,” “potential,” “project,” “may,” “recur,” “seek,” “shape,” “should,” “target,” “transition,” graphical timelines representing future events and variations of such words and similar expressions are intended to identify such forward-looking statements. Actual results and events may differ materially from those described in any forward-looking statement as a result of certain risks and uncertainties, including without limitation: (i) the market relevance of our technologies; (ii) changes in the needs, availability, pricing and features of competitive technologies and product offerings as well as those of strategic partners or consumers; (iii) unanticipated technical or resource difficulties or delays related to further development of our technologies and products; (iv) our ability to leverage or enter into new customer agreements, strategic relationships or acquire complimentary patent portfolios on acceptable terms; (v) our ability to enter into additional patent license agreements; (vi) changes in expenses related to our technology offerings and operations; (vii) potential difficulties in the production of our ASIC; (viii) whether we have the appropriate financial assets and/or cash flows; (ix) unfavorable outcomes in patent disputes and the expense of defending our intellectual property rights; (x) changes in the market share and sales performance of our primary licensees, and any delay in receipt of quarterly royalty reports from our licensees; and, (xi) changes or inaccuracies in market projections, as well as other risks and uncertainties, including those detailed from time to time in our Securities and Exchange Commission filings. We undertake no obligation to update any forward looking statement contained herein. This presentation includes various "non-GAAP financial measures" as that term is defined in Regulation G, which are reconciled to GAAP financial measures at the end of this presentation.

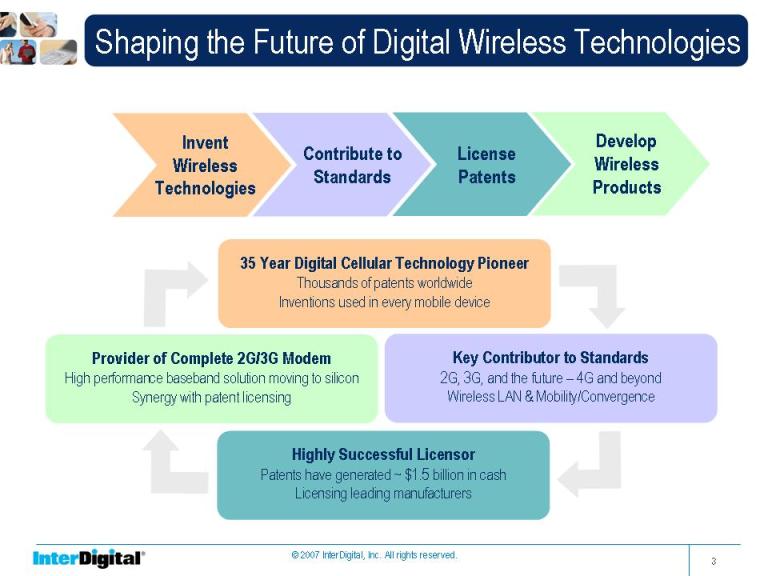

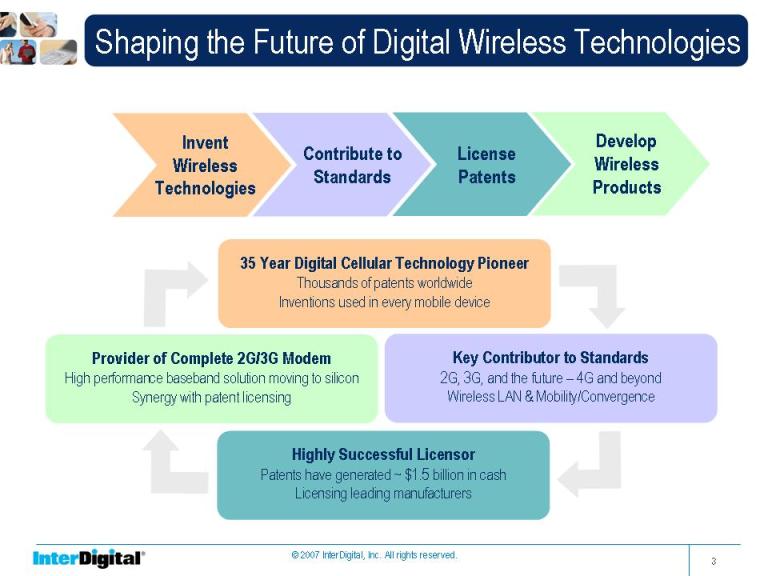

3 Shaping the Future of Digital Wireless Technologies (Gp:) InventWirelessTechnologies(Gp:) Contribute toStandards(Gp:) LicensePatents(Gp:) DevelopWirelessProducts(Gp:) 35 Year Digital Cellular Technology PioneerThousands of patents worldwideInventions used in every mobile device(Gp:) Key Contributor to Standards2G, 3G, and the future – 4G and beyondWireless LAN & Mobility/Convergence(Gp:) Provider of Complete 2G/3G ModemHigh performance baseband solution moving to siliconSynergy with patent licensing(Gp:) Highly Successful LicensorPatents have generated ~ $1.5 billion in cashLicensing leading manufacturers

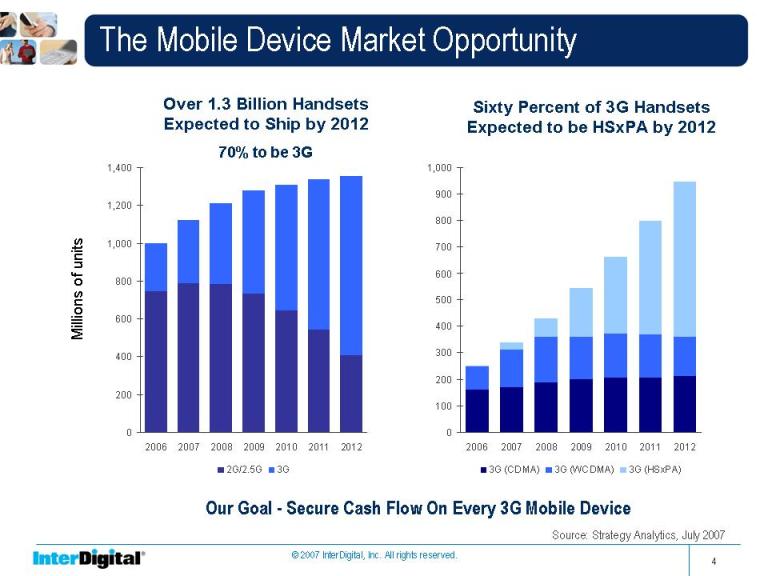

4 The Mobile Device Market Opportunity Over 1.3 Billion Handsets Expected to Ship by 2012 70% to be 3G Sixty Percent of 3G Handsets Expected to be HSxPA by 2012Our Goal - Secure Cash Flow On Every 3G Mobile DeviceMillions of unitsSource: Strategy Analytics, July 2007

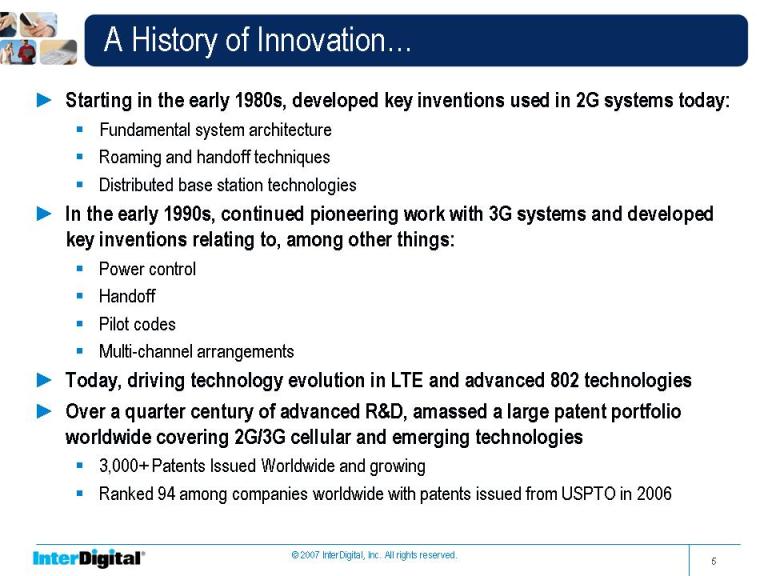

5 Title:A History of Innovation… Body:Starting in the early 1980s, developed key inventions used in 2G systems today:Fundamental system architectureRoaming and handoff techniquesDistributed base station technologiesIn the early 1990s, continued pioneering work with 3G systems and developed key inventions relating to, among other things:Power controlHandoffPilot codesMulti-channel arrangementsToday, driving technology evolution in LTE and advanced 802 technologiesOver a quarter century of advanced R&D, amassed a large patent portfolio worldwide covering 2G/3G cellular and emerging technologies3,000+ Patents Issued Worldwide and growingRanked 94 among companies worldwide with patents issued from USPTO in 2006

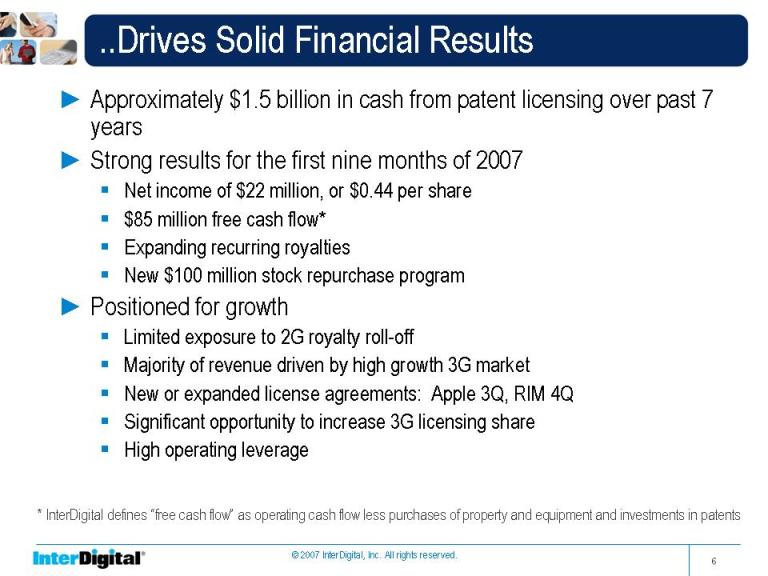

6.Drives Solid Financial ResultsBody:Approximately $1.5 billion in cash from patent licensing over past 7 yearsStrong results for the first nine months of 2007Net income of $22 million, or $0.44 per share$85 million free cash flow*Expanding recurring royaltiesNew $100 million stock repurchase programPositioned for growthLimited exposure to 2G royalty roll-offMajority of revenue driven by high growth 3G marketNew or expanded license agreements: Apple 3Q, RIM 4QSignificant opportunity to increase 3G licensing shareHigh operating leverage* InterDigital defines “free cash flow” as operating cash flow less purchases of property and equipment and investments in patents

7 Leading Brands License Our 3G PatentsAll trademarks are the sole property of their respective owners.30 - 35% of WCDMA and cdma2000® mobile devices licensed

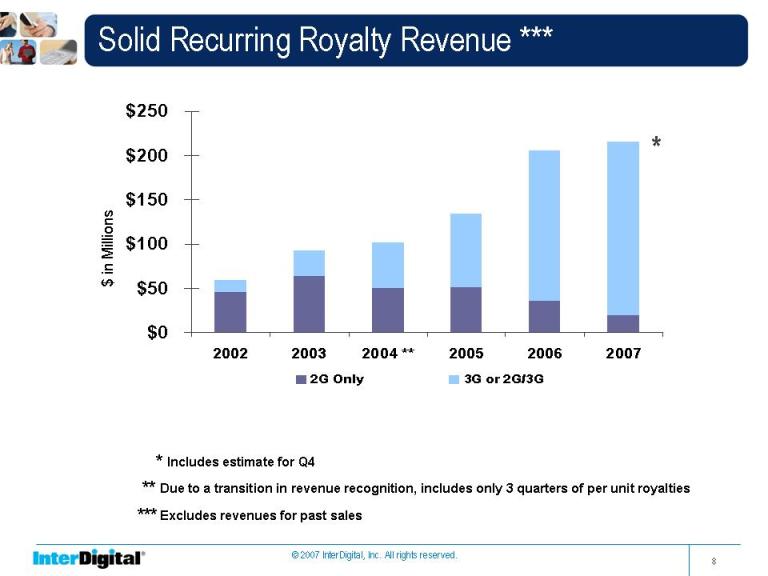

8 Solid Recurring Royalty Revenue *** *** Excludes revenues for past sales $ in Millions ** Due to a transition in revenue recognition, includes only 3 quarters of per unit royalties *Includes estimate for Q4

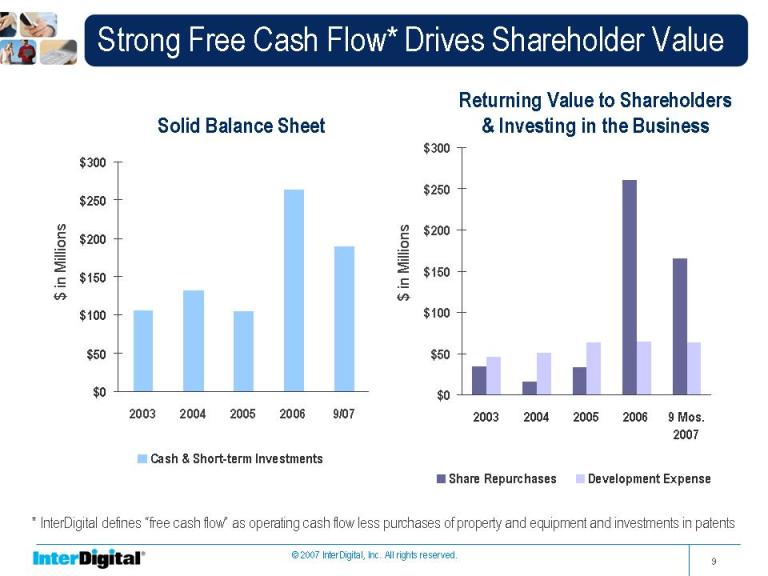

9 Strong Free Cash Flow* Drives Shareholder Value Solid Balance Sheet$ in Millions$ in MillionsReturning Value to Shareholders& Investing in the BusinessInterDigital defines “free cash flow” as operating cash flow less purchases of property and equipment and investments in patents

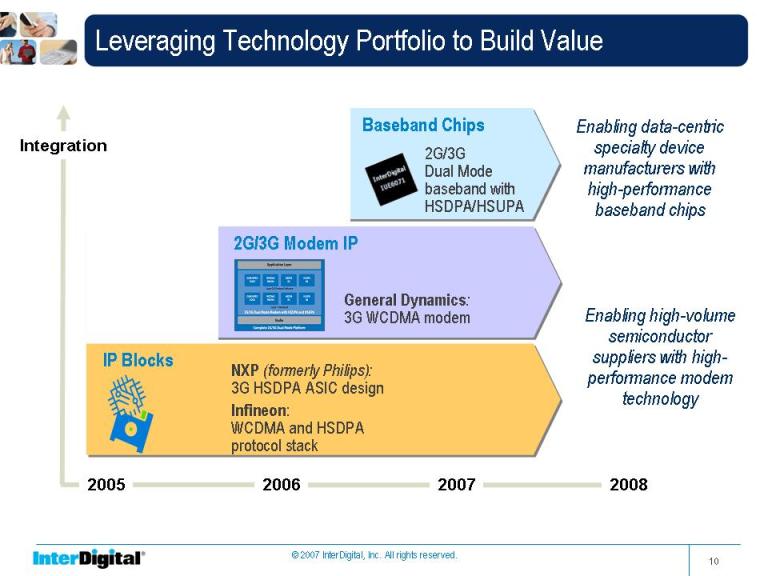

10 Leveraging Technology Portfolio to Build Value20052006200720082G/3G Modem IPGeneral Dynamics: 3G WCDMA modemBaseband Chips 2G/3GDual Mode baseband with HSDPA/HSUPAIntegrationIP BlocksNXP (formerly Philips): 3G HSDPA ASIC designInfineon: WCDMA and HSDPA protocol stackEnabling high-volume semiconductor suppliers with high-performance modem technologyEnabling data-centric specialty device manufacturers with high-performance baseband chips

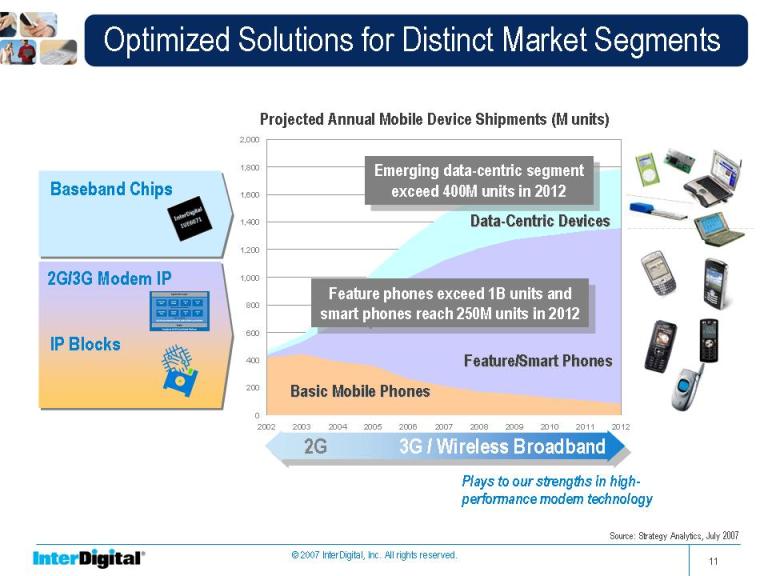

112G 3G / Wireless BroadbandBasic Mobile PhonesFeature/Smart PhonesData-Centric DevicesProjected Annual Mobile Device Shipments (M units) Emerging data-centric segment exceed 400M units in 2012Feature phones exceed 1B units and smart phones reach 250M units in 2012Plays to our strengths in high- performance modem technologySource: Strategy Analytics, July 2007Optimized Solutions for Distinct Market Segments2G/3G Modem IPBaseband Chips IP Blocks

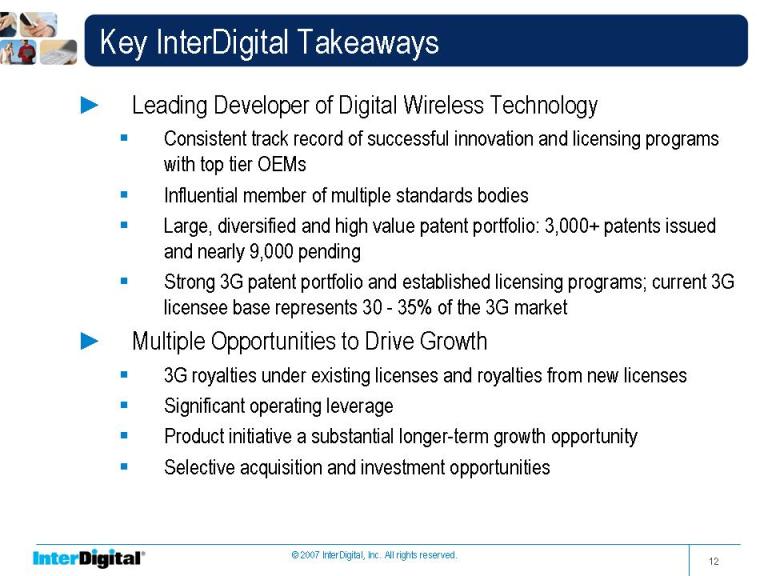

12 Key InterDigital TakeawaysLeading Developer of Digital Wireless TechnologyConsistent track record of successful innovation and licensing programs with top tier OEMsInfluential member of multiple standards bodiesLarge, diversified and high value patent portfolio: 3,000+ patents issued and nearly 9,000 pendingStrong 3G patent portfolio and established licensing programs; current 3G licensee base represents 30 - 35% of the 3G marketMultiple Opportunities to Drive Growth3G royalties under existing licenses and royalties from new licensesSignificant operating leverageProduct initiative a substantial longer-term growth opportunitySelective acquisition and investment opportunities

13 3G Revenue Growth Potential$950 $700 $475$240$1.00$1,425 $1,050 $700$350$1.50$1,900 $1,425 $950$475$2.00Potential Annual Revenue per 3G device in 2012($ millions) 25% 50% 75% 100%Patent position drives market penetration Product drives value per deviceToday we derive cash flow on 30 - 35% of 3G mobile devices sold

14 London December 4, 2007 Positioned to Capitalize on Growth in 3G Market NASDAQ 20th Investor Program

16 Licensees as of November 2007

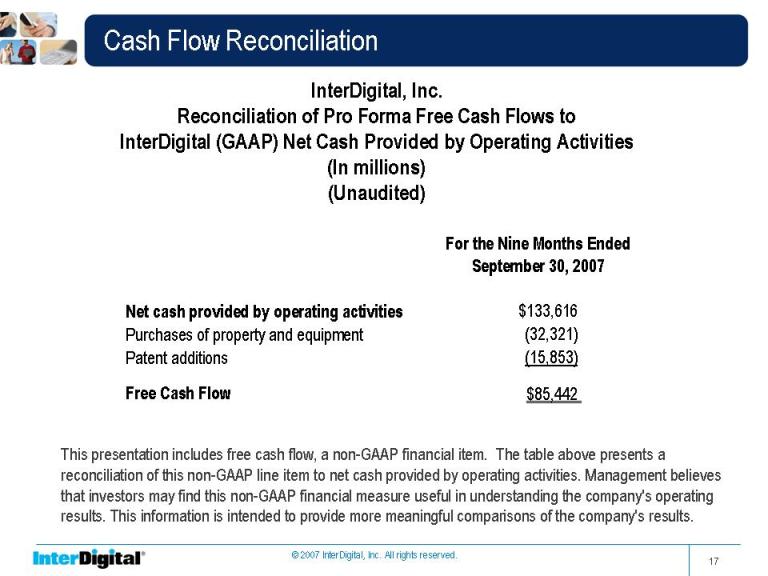

17 Cash Flow Reconciliation This presentation includes free cash flow, a non-GAAP financial item. The table above presents a reconciliation of this non-GAAP line item to net cash provided by operating activities. Management believes that investors may find this non-GAAP financial measure useful in understanding the company's operating results. This information is intended to provide more meaningful comparisons of the company's results. InterDigital, Inc. Reconciliation of Pro Forma Free Cash Flows to InterDigital (GAAP) Net Cash Provided by Operating Activities (In millions) (Unaudited)